Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PEABODY ENERGY CORP | btu_8-kx20150224.htm |

J.P. Morgan Global High Yield & Leveraged Finance Conference February 24, 2015 Michael C. Crews Executive Vice President and Chief Financial Officer Exhibit 99.1

Statement on Forward-Looking Information Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. The company uses words such as “anticipate,” “believe,” “expect,” “may,” “forecast,” “project,” “should,” “estimate,” “plan,” “outlook,” “target,” “likely,” “will,” “to be” or other similar words to identify forward-looking statements. These forward-looking statements are based on numerous assumptions that the company believes are reasonable, but they are open to a wide range of uncertainties and business risks that may cause actual results to differ materially from expectations as of February 24, 2015. These factors are difficult to accurately predict and may be beyond the company’s control. The company does not undertake to update its forward-looking statements. Factors that could affect the company’s results include, but are not limited to: supply and demand for our coal products; price volatility and customer procurement practices, particularly in international seaborne products and in the company’s trading and brokerage businesses; impact of alternative energy sources, including natural gas and renewables; global steel demand and the downstream impact on metallurgical coal prices; impact of weather and natural disasters on demand and production; reductions and/or deferrals of purchases by major customers and ability to renew sales contracts; credit and performance risks associated with customers, suppliers, contract miners, co-shippers, and trading, banks and other financial counterparties; geologic, equipment, permitting, site access, operational risks and new technologies related to mining; transportation availability, performance and costs; availability, timing of delivery and costs of key supplies, capital equipment or commodities such as diesel fuel, steel, explosives and tires; impact of take-or-pay agreements for rail and port commitments for the delivery of coal; successful implementation of business strategies; negotiation of labor contracts, employee relations and workforce availability; changes in postretirement benefit and pension obligations and their related funding requirements; replacement and development of coal reserves; maintenance of adequate liquidity, excluding the cost, availability, access to capital and financial markets; ability to appropriately secure our obligations for land reclamation, federal and state workers’ compensation, federal coal leases and other obligations related to the company’s operations; effects of changes in interest rates and currency exchange rates (primarily the Australian dollar); effects of acquisitions or divestitures; economic strength and political stability of countries in which the company has operations or serves customers; legislation, regulations and court decisions or other government actions, including, but not limited to, new environmental and mine safety requirements; changes in income tax regulations, sales-related royalties, or other regulatory taxes and changes in derivative laws and regulations; litigation, including claims not yet asserted; terrorist attached or security threats, including cypersecurity threats; impacts of pandemic and illnesses; and other risks detailed in the company’s reports filed with the United States Securities and Exchange Commission (SEC). Adjusted EBITDA is defined as (loss) income from continuing operations before deducting net interest expense; income taxes; asset retirement obligation expenses; depreciation, depletion, and amortization; asset impairment and mine closure costs; charges for the settlement of claims and litigation related to previously divested operations; and changes in deferred tax asset valuation allowance and amortization of basis difference related to equity affiliates. Adjusted EBITDA, which is not calculated identically by all companies, is not a substitute for operating income, net income or cash flow as determined in accordance with United States GAAP. Management uses Adjusted EBITDA as the primary metric to measure segment operating performance and also believes it is useful to investors in comparing the company’s current results with those of prior and future periods and in evaluating the company’s operating performance without regard to its capital structure or the cost basis of its assets. Adjusted (Loss) Income from Continuing Operations and Adjusted Diluted EPS are defined as (loss) income from continuing operations and diluted earnings per share from continuing operations, respectively, excluding the impacts of asset impairment and mine closure costs and charges for the settlement of claims and litigation related to previously divested operations, net of tax, and the remeasurement of foreign income tax accounts on the company’s income tax provision. The company calculates income tax benefits related to asset impairment and mine closure costs and charges for the settlement of claims and litigation related to previously divested operations based on the enacted tax rate in the jurisdiction in which they have been or will be realized, adjusted for the estimated recoverability of those benefits. Management has included these measures because, in the opinion of management, excluding those foregoing items is useful in comparing the company’s current results with those of prior and future periods. Management also believes that excluding the impact of the remeasurement of foreign income tax accounts represents a meaningful indicator of the company's ongoing effective tax rate. 2

Peabody Taking Aggressive Action to Combat Near-Term Headwinds 3 Sculpting a Stronger, More Competitive Company for All Markets ● Global coal markets remain challenged; Peabody continues to control the controllable in response to extended downturn ● Building on successes in safety, cost control and productivity improvements; Exercising continued capital discipline ● Taking proactive steps to preserve cash and liquidity in the near term and advance a competitive long-term platform

Global Coal Markets 4 Shanghai

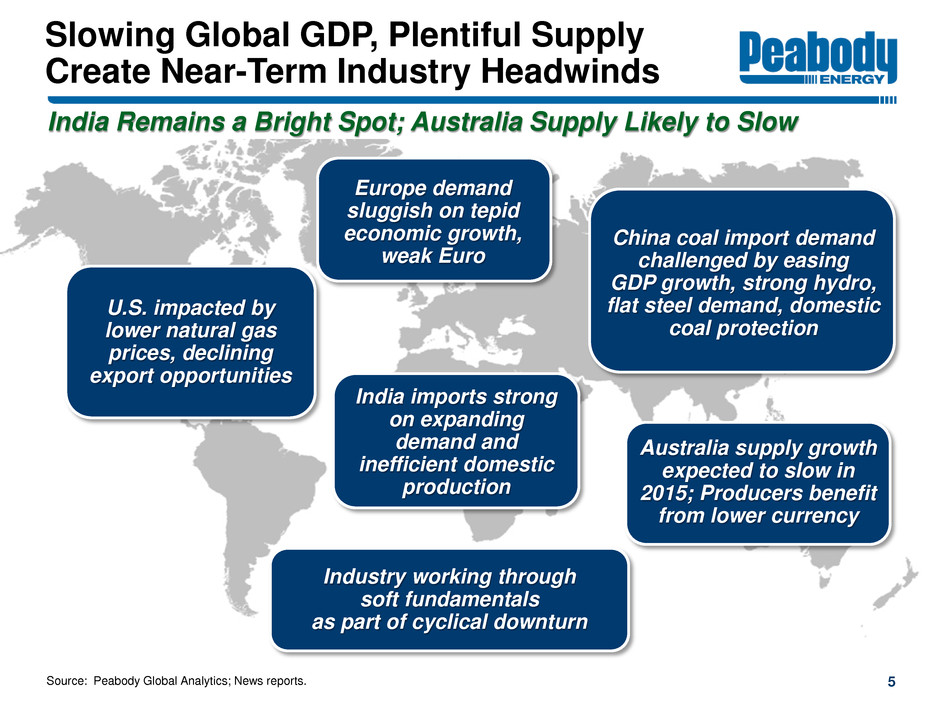

Slowing Global GDP, Plentiful Supply Create Near-Term Industry Headwinds 5 Australia supply growth expected to slow in 2015; Producers benefit from lower currency China coal import demand challenged by easing GDP growth, strong hydro, flat steel demand, domestic coal protection Source: Peabody Global Analytics; News reports. India imports strong on expanding demand and inefficient domestic production U.S. impacted by lower natural gas prices, declining export opportunities Europe demand sluggish on tepid economic growth, weak Euro India Remains a Bright Spot; Australia Supply Likely to Slow Industry working through soft fundamentals as part of cyclical downturn

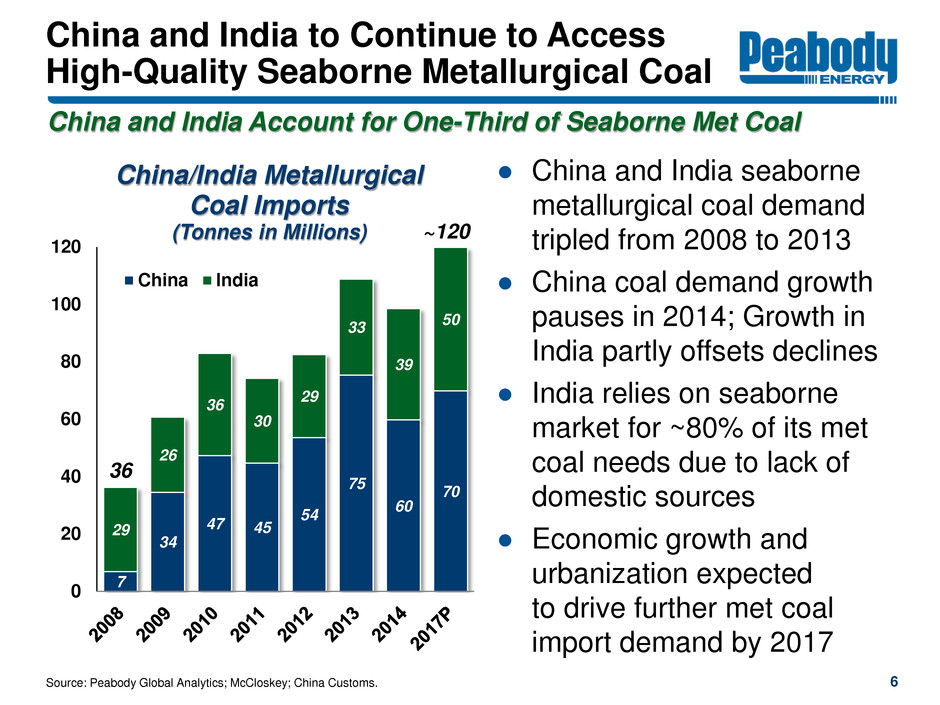

China and India to Continue to Access High-Quality Seaborne Metallurgical Coal Source: Peabody Global Analytics; McCloskey; China Customs. 6 7 34 47 45 54 75 60 70 29 26 36 30 29 33 39 50 0 20 40 60 80 100 120 China/India Metallurgical Coal Imports (Tonnes in Millions) China India ● China and India seaborne metallurgical coal demand tripled from 2008 to 2013 ● China coal demand growth pauses in 2014; Growth in India partly offsets declines ● India relies on seaborne market for ~80% of its met coal needs due to lack of domestic sources ● Economic growth and urbanization expected to drive further met coal import demand by 2017 China and India Account for One-Third of Seaborne Met Coal 36 ~120

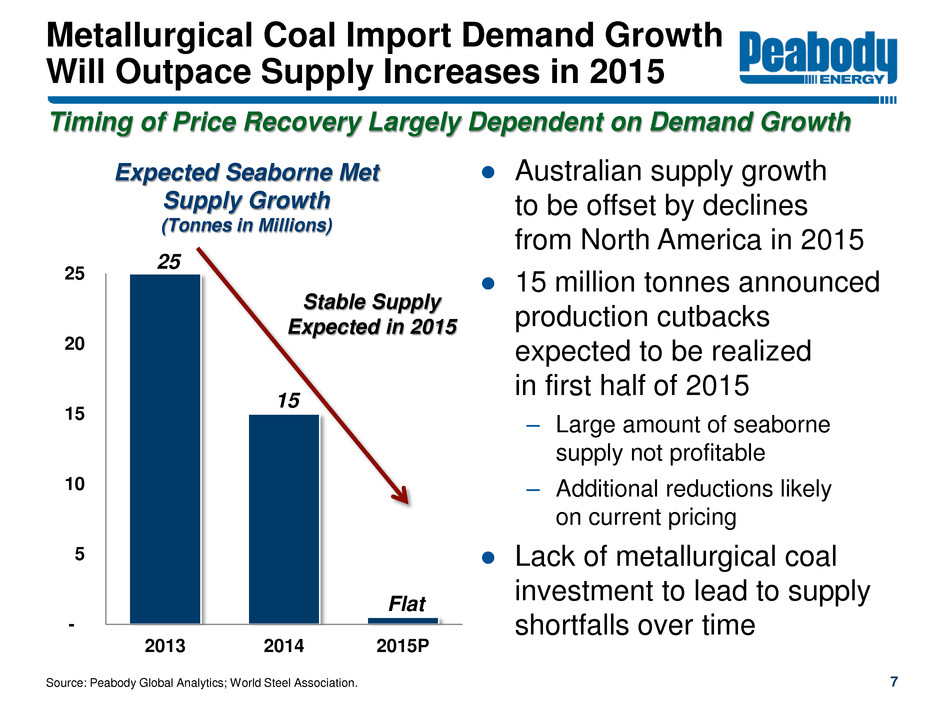

Metallurgical Coal Import Demand Growth Will Outpace Supply Increases in 2015 Source: Peabody Global Analytics; World Steel Association. 7 ● Australian supply growth to be offset by declines from North America in 2015 ● 15 million tonnes announced production cutbacks expected to be realized in first half of 2015 – Large amount of seaborne supply not profitable – Additional reductions likely on current pricing ● Lack of metallurgical coal investment to lead to supply shortfalls over time 25 15 Flat - 5 10 15 20 25 2013 2014 2015P Expected Seaborne Met Supply Growth (Tonnes in Millions) Stable Supply Expected in 2015 Timing of Price Recovery Largely Dependent on Demand Growth

Thermal Seaborne Fundamentals: Rising Demand Strains Against Strong Supply 8 ● 2014 marked by oversupply as producers increased volumes to lower unit costs, leveraged weaker currencies ● 2015 supply growth to be partly offset by drop in U.S. exports ● Prices also influenced by recent oil moves ● 2014 China coal imports slow on strong hydro growth, new coal quality restrictions; Recent imports soft ● India imports boosted by strong demand, ongoing domestic shortfalls ● Global seaborne thermal demand is expected to be ~950 million tonnes in 2015 Thermal Coal Demand Thermal Coal Supply Source: Peabody Global Analytics.

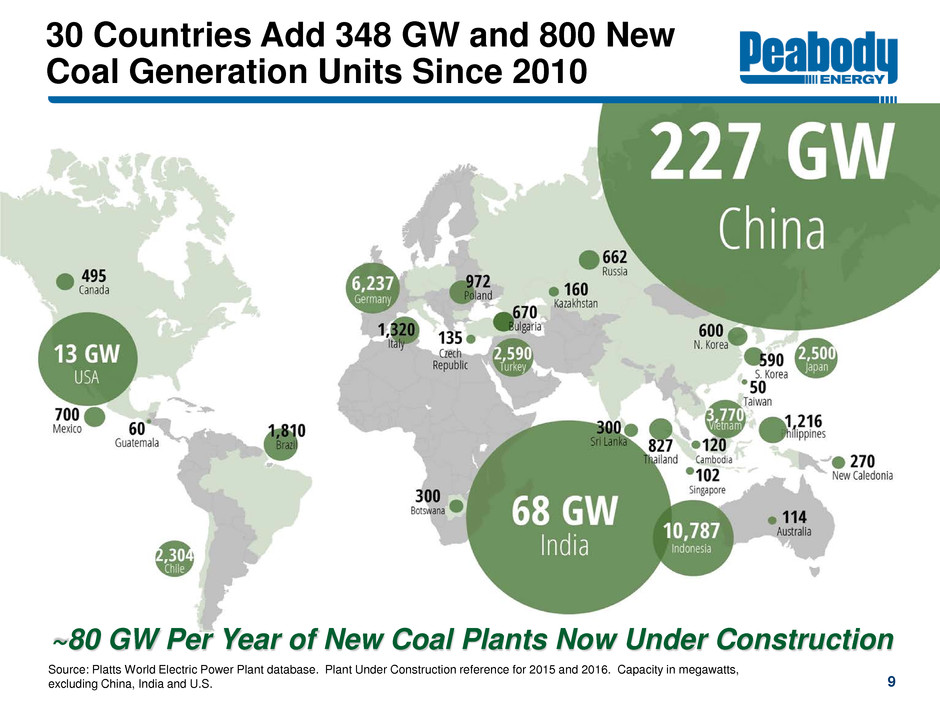

30 Countries Add 348 GW and 800 New Coal Generation Units Since 2010 Source: Platts World Electric Power Plant database. Plant Under Construction reference for 2015 and 2016. Capacity in megawatts, excluding China, India and U.S. ~80 GW Per Year of New Coal Plants Now Under Construction 9

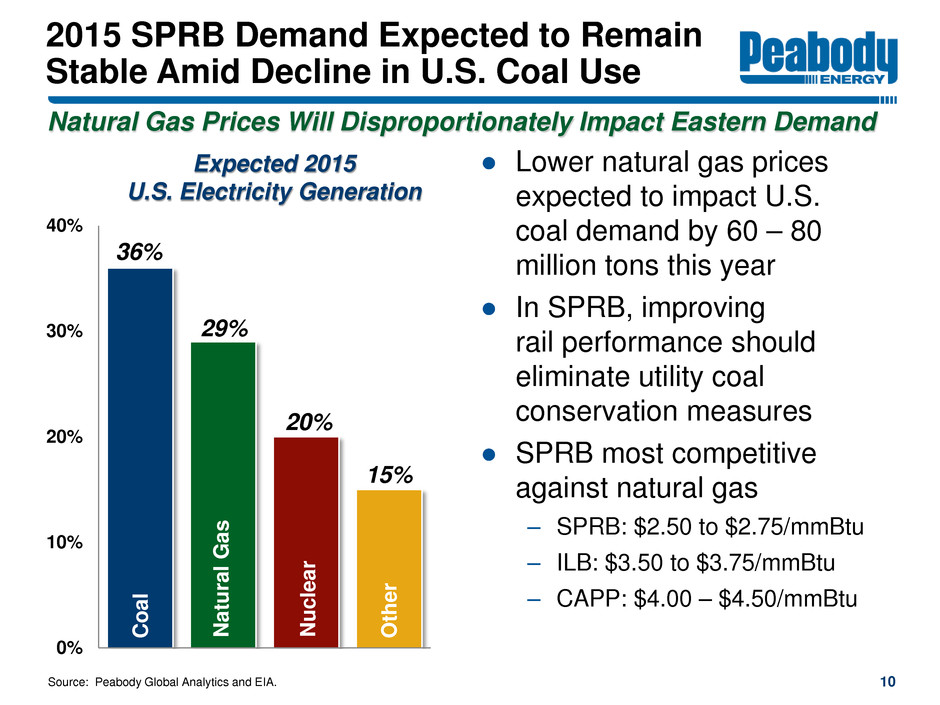

2015 SPRB Demand Expected to Remain Stable Amid Decline in U.S. Coal Use Source: Peabody Global Analytics and EIA. 10 36% 29% 20% 15% 0% 10% 20% 30% 40% ● Lower natural gas prices expected to impact U.S. coal demand by 60 – 80 million tons this year ● In SPRB, improving rail performance should eliminate utility coal conservation measures ● SPRB most competitive against natural gas – SPRB: $2.50 to $2.75/mmBtu – ILB: $3.50 to $3.75/mmBtu – CAPP: $4.00 – $4.50/mmBtu Expected 2015 U.S. Electricity Generation Na tu ral G as N uclea r O th er C oa l Natural Gas Prices Will Disproportionately Impact Eastern Demand

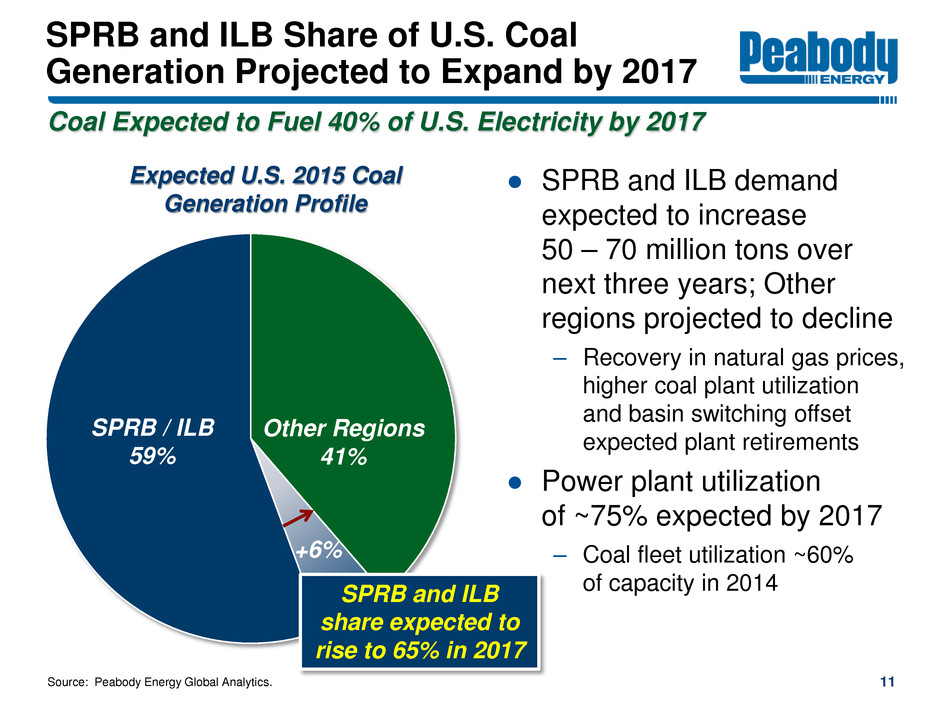

SPRB and ILB Share of U.S. Coal Generation Projected to Expand by 2017 11 Coal Expected to Fuel 40% of U.S. Electricity by 2017 Source: Peabody Energy Global Analytics. Other Regions 41% SPRB / ILB 59% ● SPRB and ILB demand expected to increase 50 – 70 million tons over next three years; Other regions projected to decline – Recovery in natural gas prices, higher coal plant utilization and basin switching offset expected plant retirements ● Power plant utilization of ~75% expected by 2017 – Coal fleet utilization ~60% of capacity in 2014 SPRB and ILB share expected to rise to 65% in 2017 Expected U.S. 2015 Coal Generation Profile +6%

Greater Plant Utilization Likely to Offset Near-Term Impact from MATS Ruling 12 MATS Ruling EPA Carbon Proposal EPA Carbon Proposal to Face Significant Opposition Source: Peabody Global Analytics and company announcements. ● 60 GW of coal plants to be retired by 2017 ● 245 GW of coal-fueled generation will remain ● PRB and ILB best-positioned as higher utilization and basin switching offset power plant retirements ● Proposal represents major EPA overreach ● Terms are only preliminary; Likely to be challenged and litigated by multiple groups ● Peabody supports advanced coal technology; Strongly opposes rules that punish electricity consumers

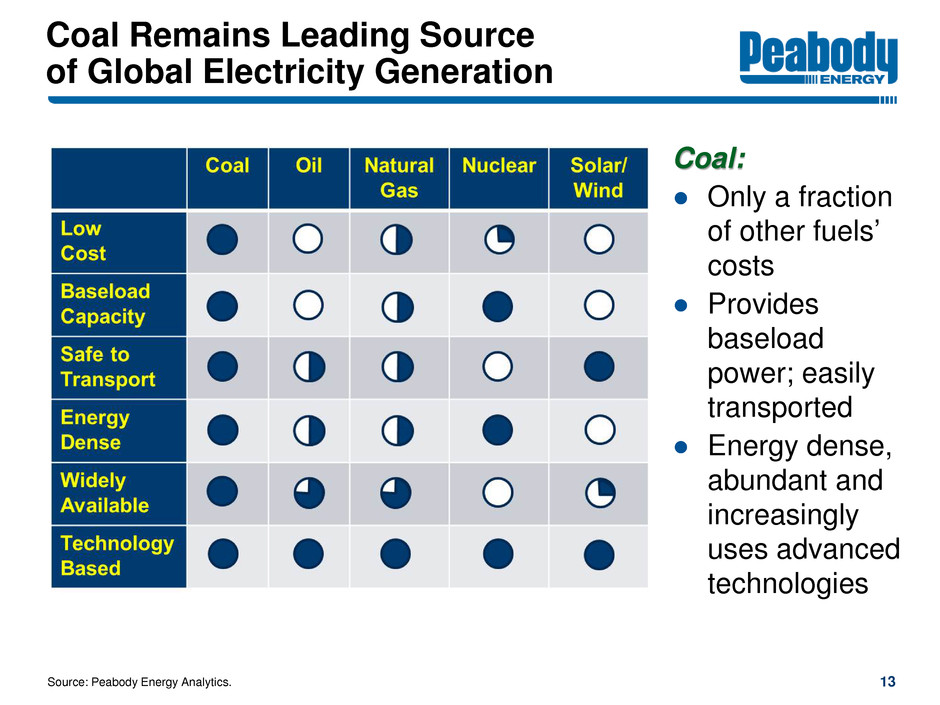

Coal Remains Leading Source of Global Electricity Generation 13 Source: Peabody Energy Analytics. Coal: ● Only a fraction of other fuels’ costs ● Provides baseload power; easily transported ● Energy dense, abundant and increasingly uses advanced technologies

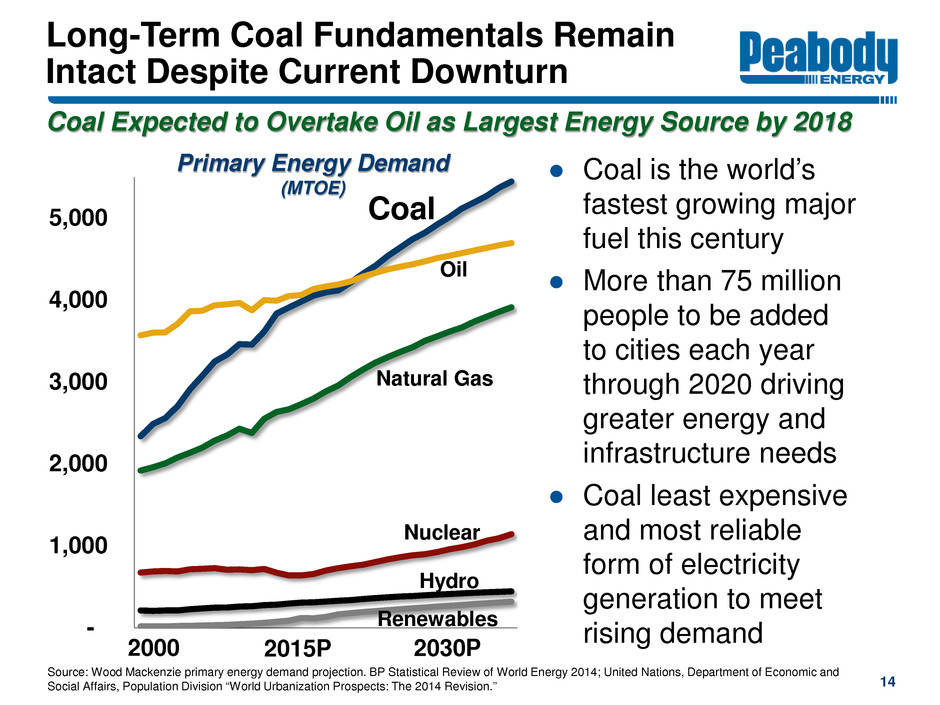

Long-Term Coal Fundamentals Remain Intact Despite Current Downturn 14 Source: Wood Mackenzie. - 1,000 2,000 3,000 4,000 5,000 Renewables Natural Gas Oil Nuclear Hydro Coal 2000 2030P 2015P Source: Wood Mackenzie primary energy demand projection. BP Statistical Review of World Energy 2014; United Nations, Department of Economic and Social Affairs, Population Division “World Urbanization Prospects: The 2014 Revision.” ● Coal is the world’s fastest growing major fuel this century ● More than 75 million people to be added to cities each year through 2020 driving greater energy and infrastructure needs ● Coal least expensive and most reliable form of electricity generation to meet rising demand Primary Energy Demand (MTOE) Coal Expected to Overtake Oil as Largest Energy Source by 2018

Peabody Energy Overview 15 North Antelope Rochelle Mine

Peabody Energy: World’s Largest Private-Sector Coal Company 16 Improve Safety, Productivity and Sustainable Mining Maintain Strong Capital Discipline and Liquidity Pursue Additional Cost Reduction Opportunities Enhance Assets Through Strategic Portfolio Management Continue Global Coal Advocacy Initiatives Our Strategy ● Maintain position in higher-growth, low-cost U.S. basins ● Utilize major Australian metallurgical and thermal coal platform ● Maximize strong global presence serving higher- growth Asian markets Benefits From Depth of Management and Strategic Priorities

Peabody Positioned in Low-Cost U.S. Basins, High-Growth Asian Markets ● Strong, stable U.S. operations provide solid cash flow – Gross margin averaged 28% since 2010 ● Largest producer and reserve holder in Powder River Basin – Flagship North Antelope Rochelle Mine world’s largest and most productive coal mine ● Illinois Basin operations strategically located to serve local customer base 17 Australia Platform Gross margins as of Dec. 31, 2014. Excludes DD&A and ARO expense. ● Competitive advantage with mines close to ports; Ports near high-growth regions ● Peabody is largest seaborne low-vol PCI supplier ● Significant potential for future development; Opportunities being evaluated for when market conditions warrant U.S. Platform

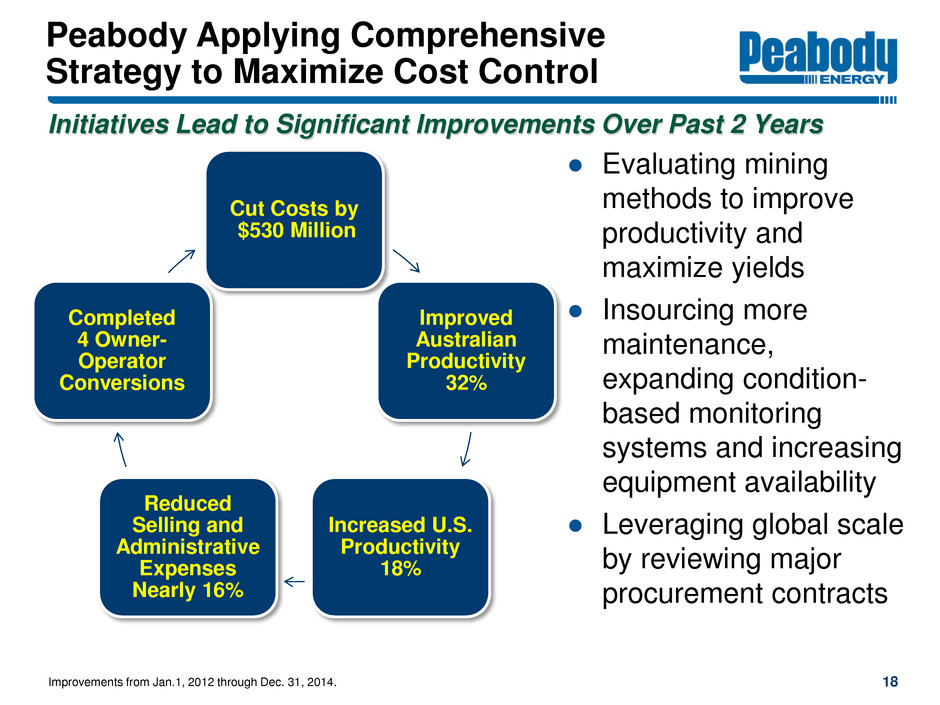

Peabody Applying Comprehensive Strategy to Maximize Cost Control 18 To ta l S av in gs ● Evaluating mining methods to improve productivity and maximize yields ● Insourcing more maintenance, expanding condition- based monitoring systems and increasing equipment availability ● Leveraging global scale by reviewing major procurement contracts Cut Costs by $530 Million Improved Australian Productivity 32% Increased U.S. Productivity 18% Reduced Selling and Administrative Expenses Nearly 16% Completed 4 Owner- Operator Conversions Improvements from Jan.1, 2012 through Dec. 31, 2014. . Initiatives Lead to Significant Improvements Over Past 2 Years

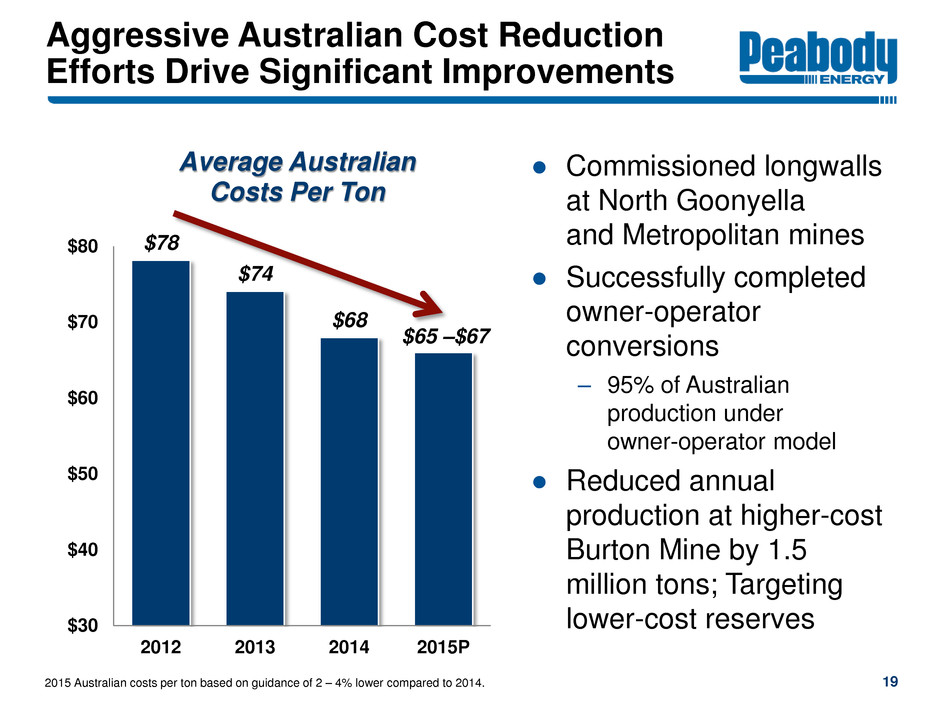

Aggressive Australian Cost Reduction Efforts Drive Significant Improvements ● Commissioned longwalls at North Goonyella and Metropolitan mines ● Successfully completed owner-operator conversions – 95% of Australian production under owner-operator model ● Reduced annual production at higher-cost Burton Mine by 1.5 million tons; Targeting lower-cost reserves 19 $78 $74 $68 $30 $40 $50 $60 $70 $80 2012 2013 2014 2015P Average Australian Costs Per Ton 2015 Australian costs per ton based on guidance of 2 – 4% lower compared to 2014. $65 –$67

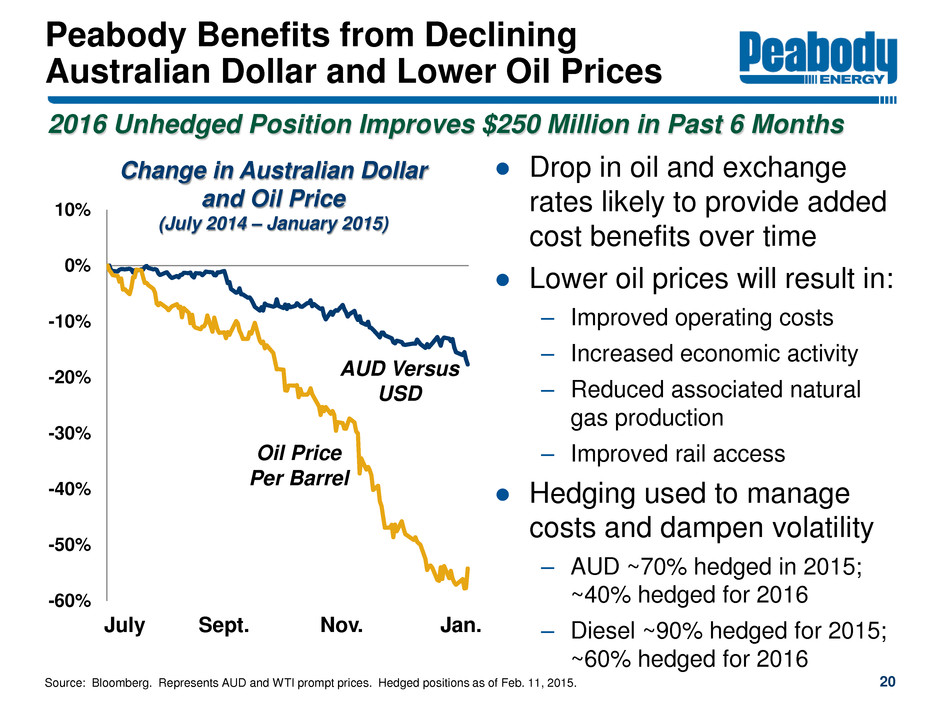

-60% -50% -40% -30% -20% -10% 0% 10% Peabody Benefits from Declining Australian Dollar and Lower Oil Prices ● Drop in oil and exchange rates likely to provide added cost benefits over time ● Lower oil prices will result in: – Improved operating costs – Increased economic activity – Reduced associated natural gas production – Improved rail access ● Hedging used to manage costs and dampen volatility – AUD ~70% hedged in 2015; ~40% hedged for 2016 – Diesel ~90% hedged for 2015; ~60% hedged for 2016 Source: Bloomberg. Represents AUD and WTI prompt prices. Hedged positions as of Feb. 11, 2015. Change in Australian Dollar and Oil Price (July 2014 – January 2015) 4,140 880 20 2016 Unhedged Position Improves $250 Million in Past 6 Months July Sept. Nov. Jan. Oil Price Per Barrel AUD Versus USD

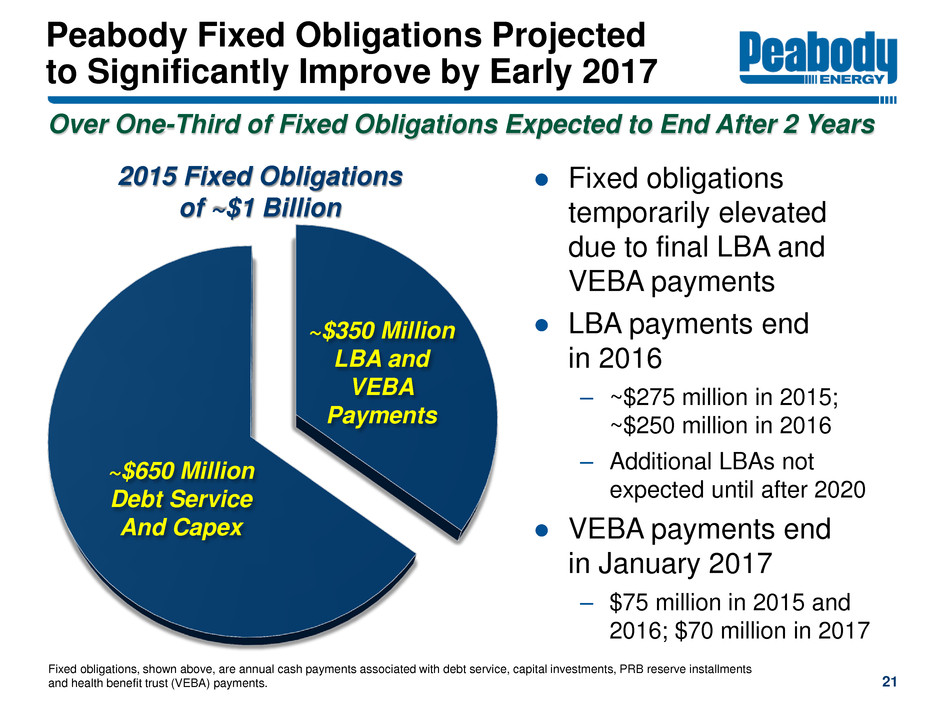

Peabody Fixed Obligations Projected to Significantly Improve by Early 2017 ● Fixed obligations temporarily elevated due to final LBA and VEBA payments ● LBA payments end in 2016 – ~$275 million in 2015; ~$250 million in 2016 – Additional LBAs not expected until after 2020 ● VEBA payments end in January 2017 – $75 million in 2015 and 2016; $70 million in 2017 21 ~$350 Million LBA and VEBA Payments 2015 Fixed Obligations of ~$1 Billion ~$650 Million Debt Service And Capex Fixed obligations, shown above, are annual cash payments associated with debt service, capital investments, PRB reserve installments and health benefit trust (VEBA) payments. 014. Over One-Third of Fixed Obligations Expected to End After 2 Years

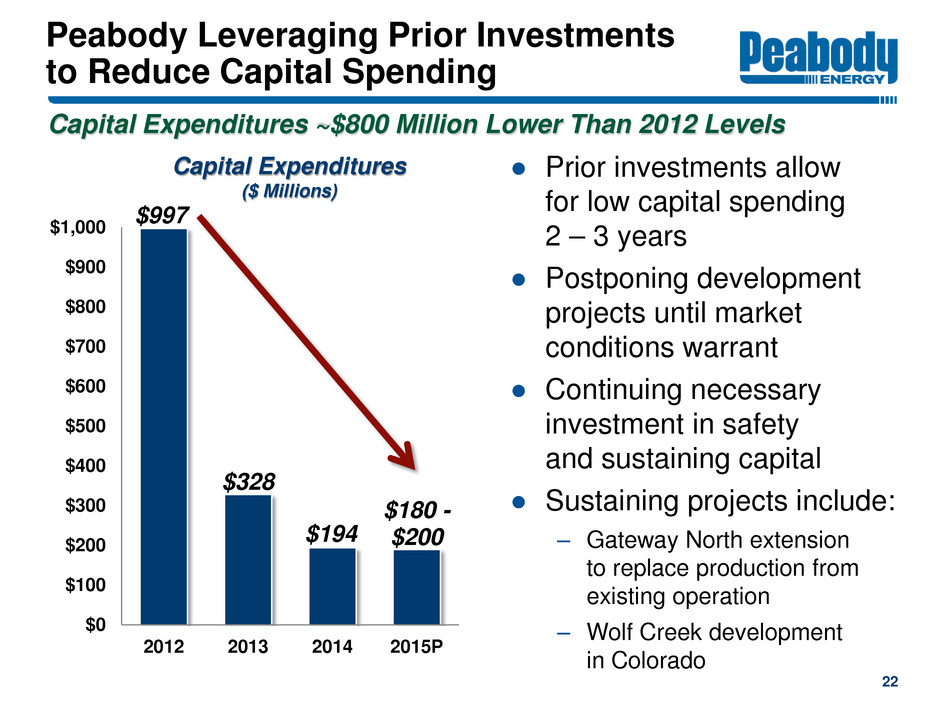

Peabody Leveraging Prior Investments to Reduce Capital Spending ● Prior investments allow for low capital spending 2 – 3 years ● Postponing development projects until market conditions warrant ● Continuing necessary investment in safety and sustaining capital ● Sustaining projects include: – Gateway North extension to replace production from existing operation – Wolf Creek development in Colorado 22 $997 $328 $194 $180 - $200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 2012 2013 2014 2015P Capital Expenditures ($ Millions) 2014. Capital Expenditures ~$800 Million Lower Than 2012 Levels

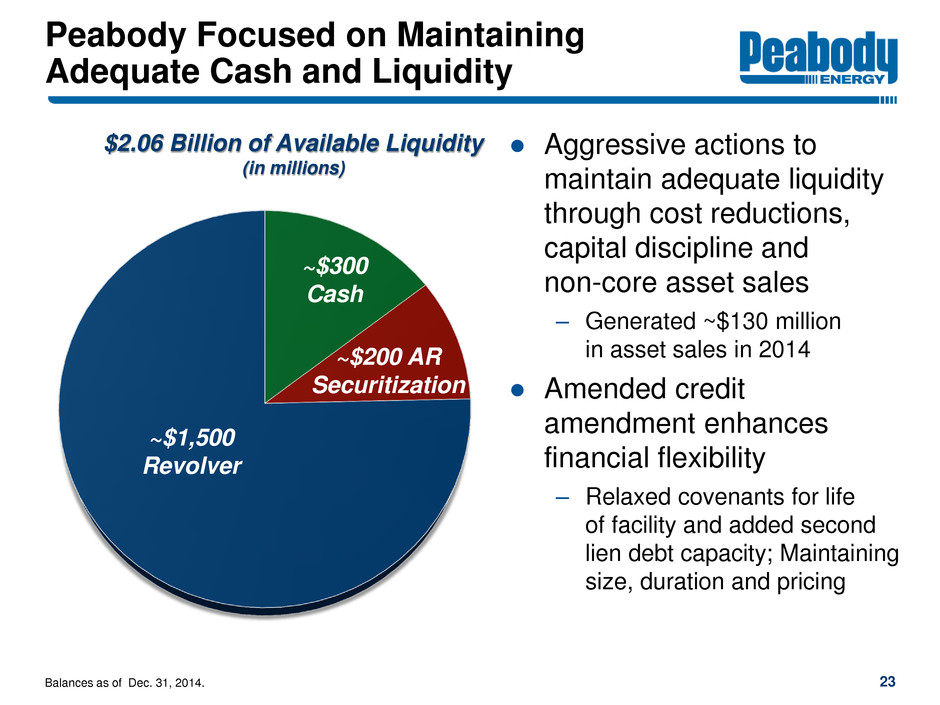

Peabody Focused on Maintaining Adequate Cash and Liquidity ● Aggressive actions to maintain adequate liquidity through cost reductions, capital discipline and non-core asset sales – Generated ~$130 million in asset sales in 2014 ● Amended credit amendment enhances financial flexibility – Relaxed covenants for life of facility and added second lien debt capacity; Maintaining size, duration and pricing Balances as of Dec. 31, 2014. $2.06 Billion of Available Liquidity (in millions) 23 ~$1,500 Revolver ~$200 AR Securitization ~$300 Cash

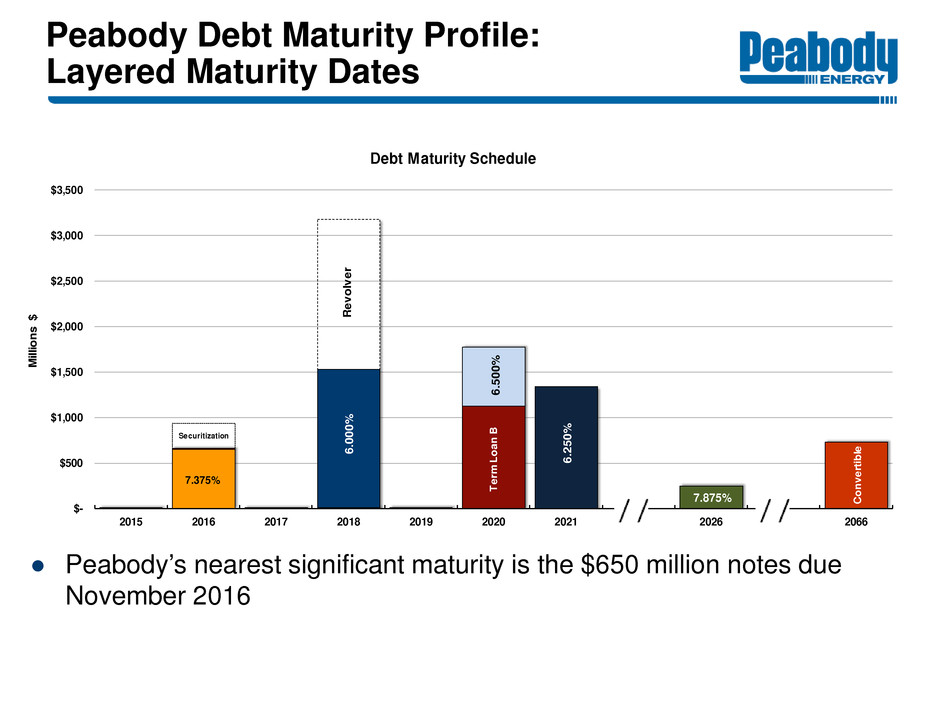

$- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2015 2016 2017 2018 2019 2020 2021 2026 2066 M ill io n s $ Debt Maturity Schedule 7.375% Securitization R ev o lv er 6. 50 0% 6. 25 0% 7.875% C o n ve rt ib le T er m L o an B 6. 00 0% Peabody Debt Maturity Profile: Layered Maturity Dates ● Peabody’s nearest significant maturity is the $650 million notes due November 2016

Peabody Energy: World’s Only Global Pure-Play Coal Investment 25 Global Scope Best-In-Class Operations Competitive Position Major Growth Potential Tier one assets in lowest cost U.S. basins and substantial Australian platform targeting highest-growth Asian regions Active portfolio management and continued efforts to expand upon safety, cost and productivity improvements Well-capitalized platform with strong focus on maintaining adequate levels of cash and liquidity; Cash obligations to decline in 2017 Sizeable asset base with strong pipeline for future development; Significant leverage to improving markets

PeabodyEnergy.com AdvancedEnergyForLife.com

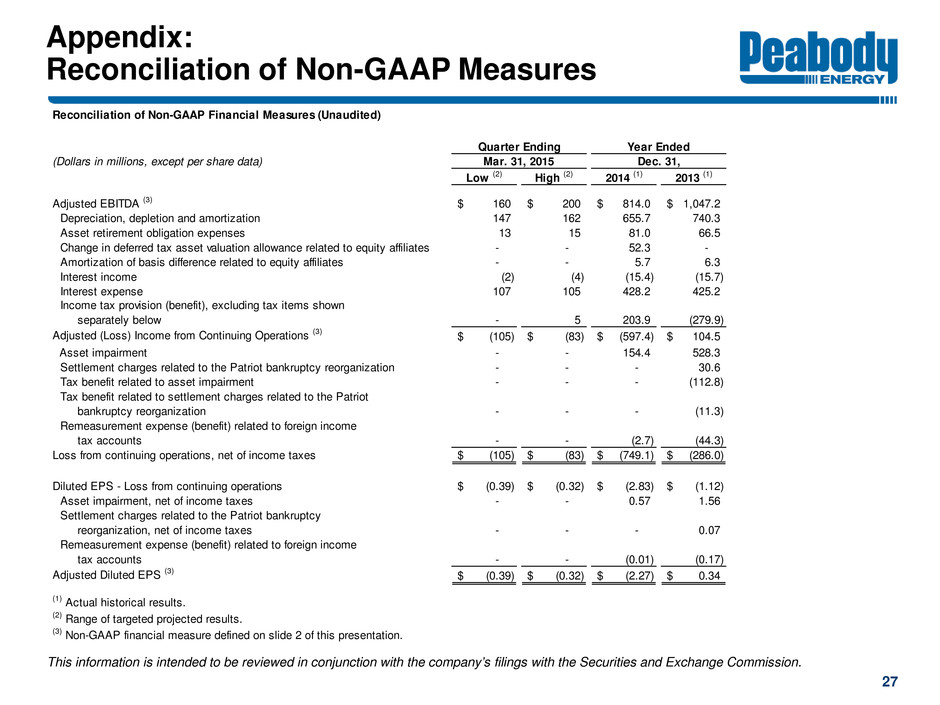

Appendix: Reconciliation of Non-GAAP Measures This information is intended to be reviewed in conjunction with the company’s filings with the Securities and Exchange Commission. 27 (Dollars in millions, except per share data) Low (2) High (2) 2014 (1) 2013 (1) Adjusted EBITDA (3) 160$ 200$ 814.0$ 1,047.2$ Depreciation, depletion and amortization 147 162 655.7 740.3 Asset retirement obligation expenses 13 15 81.0 66.5 Change in deferred tax asset valuation allowance related to equity affiliates - - 52.3 - Amortization of basis difference related to equity affiliates - - 5.7 6.3 Interest income (2) (4) (15.4) (15.7) Interest expense 107 105 428.2 425.2 Income tax provision (benefit), excluding tax items shown separately below - 5 203.9 (279.9) Adjusted (Loss) Income from Continuing Operations (3) (105)$ (83)$ (597.4)$ 104.5$ Asset impairment - - 154.4 528.3 Settlement charges related to the Patriot bankruptcy reorganization - - - 30.6 Tax benefit related to asset impairment - - - (112.8) Tax benefit related to settlement charges related to the Patriot bankruptcy reorganization - - - (11.3) Remeasurement expense (benefit) related to foreign income tax accounts - - (2.7) (44.3) Loss from continuing operations, net of income taxes (105)$ (83)$ (749.1)$ (286.0)$ Diluted EPS - Loss from continuing operations (0.39)$ (0.32)$ (2.83)$ (1.12)$ Asset impairment, net of income taxes - - 0.57 1.56 Settlement charges related to the Patriot bankruptcy reorganization, net of income taxes - - - 0.07 Remeasurement expense (benefit) related to foreign income tax accounts - - (0.01) (0.17) Adjusted Diluted EPS (3) (0.39)$ (0.32)$ (2.27)$ 0.34$ (1) Actual historical results. (2) Range of targeted projected results. (3) Non-GAAP financial measure defined on slide 2 of this presentation. Year Ended Dec. 31, Reconciliation of Non-GAAP Financial Measures (Unaudited) Mar. 31, 2015 Quarter Ending

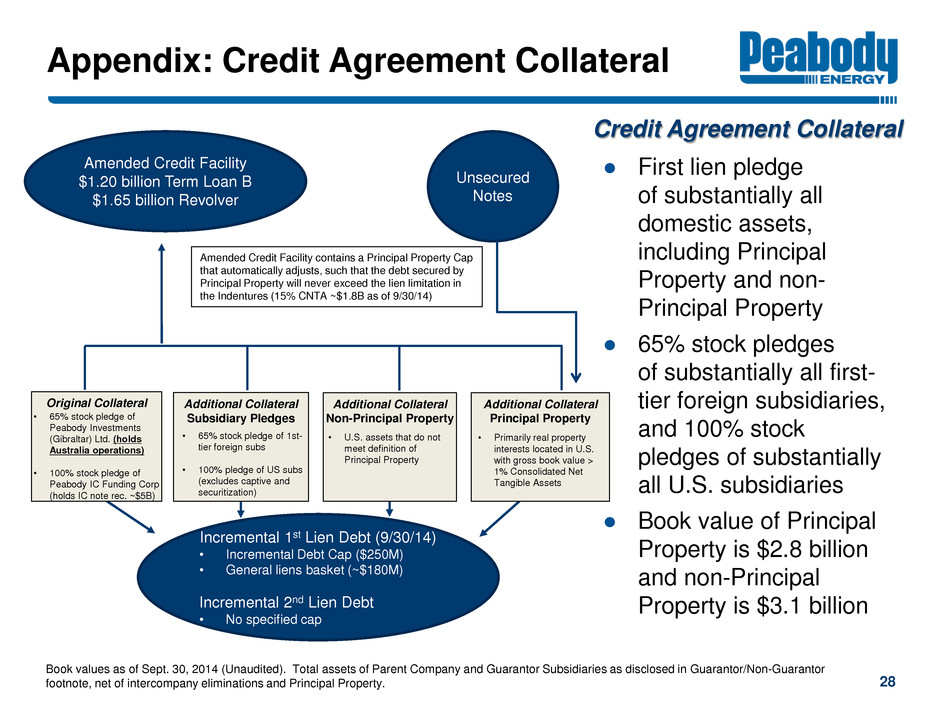

Appendix: Credit Agreement Collateral ● First lien pledge of substantially all domestic assets, including Principal Property and non- Principal Property ● 65% stock pledges of substantially all first- tier foreign subsidiaries, and 100% stock pledges of substantially all U.S. subsidiaries ● Book value of Principal Property is $2.8 billion and non-Principal Property is $3.1 billion 28 Credit Agreement Collateral Book values as of Sept. 30, 2014 (Unaudited). Total assets of Parent Company and Guarantor Subsidiaries as disclosed in Guarantor/Non-Guarantor footnote, net of intercompany eliminations and Principal Property. Additional Collateral Non-Principal Property Amended Credit Facility $1.20 billion Term Loan B $1.65 billion Revolver Unsecured Notes Original Collateral Additional Collateral Subsidiary Pledges • U.S. assets that do not meet definition of Principal Property Additional Collateral Principal Property • 65% stock pledge of 1st- tier foreign subs • 100% pledge of US subs (excludes captive and securitization) • 65% stock pledge of Peabody Investments (Gibraltar) Ltd. (holds Australia operations) • 100% stock pledge of Peabody IC Funding Corp (holds IC note rec. ~$5B) Incremental 1st Lien Debt (9/30/14) • Incremental Debt Cap ($250M) • General liens basket (~$180M) Incremental 2nd Lien Debt • No specified cap • Primarily real property interests located in U.S. with gross book value > 1% Consolidated Net Tangible Assets Amended Credit Facility contains a Principal Property Cap that automatically adjusts, such that the debt secured by Principal Property will never exceed the lien limitation in the Indentures (15% CNTA ~$1.8B as of 9/30/14)