Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ancestry.com LLC | d878652d8k.htm |

February 24, 2015

Business Update

Exhibit 99.1 |

| Safe

Harbor Slide 2

This presentation has been prepared by Ancestry.com LLC (the “Company”) for the

exclusive use of the party to whom the Company delivers this presentation (such party, together with its

subsidiaries and affiliates, the “Recipient”). Although the Company believes the

information is accurate in all material respects, the Company does not make any representation or

warranty, either express or implied, as to the accuracy, completeness or reliability of the

information contained in this presentation. Any estimates or projections contained in this

presentation as to events that may occur in the future (including projections of future

financial performance and forward-looking statements) are based upon the reasonable judgment of

the Company.

The presentation may include certain forward-looking statements provided by the Company.

Any such statements and projections reflect various estimates and assumptions by the

Company concerning anticipated results. No representations or warranties are made by the

Company as to the accuracy of any such statements. Whether or not any such forward-looking

statements are in fact achieved will depend upon future events, some of which are not within

the control of the Company. Information concerning factors that could cause events or

results to differ materially from those projected in the forward-looking statements is

contained under the caption “risk factors” in our form 10-k for the year ended December 31, 2014

(the “Annual Report”) and in discussions in other of our securities and exchange

commission filings. Statements contained herein describing documents and agreements are summaries

only and the Annual Report summaries are qualified in their entirety by such documents and

agreements. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the

past or future. The Company expressly disclaims any and all liability relating to or resulting

from the use of this presentation. In addition, the information contained in this presentation

is as of the date hereof, and the Company has no obligation to update such information,

including in the event that such information becomes inaccurate.

This presentation has been prepared solely for informational purposes only. The Recipient

should not construe the contents of this presentation as legal, tax, accounting or investment

advice or a recommendation. The Recipient should consult its own counsel and tax and financial

advisors as to legal and related matters concerning the matters described herein, and, by

accepting this presentation, the Recipient confirms that it is not relying upon the

information contained herein to make any decision. This presentation does not purport to be all-inclusive

or to contain all of the information that the Recipient may require.

We present Non-GAAP Revenues, Adjusted EBITDA, and Free Cash Flow as non-U.S. GAAP

financial measures in various places throughout this presentation. We believe Non-GAAP

Revenues, Adjusted EBITDA, and Free Cash Flow are useful to investors as supplemental measures

to evaluate the overall operating performance of our business. Non-GAAP Revenues,

Adjusted EBITDA, and Free Cash Flow are financial data that are not calculated in accordance

with U.S. GAAP. We prepare Non-GAAP Revenues, Adjusted EBITDA, and Free Cash Flow to

eliminate the impact of items that we do not consider indicative of our core operating

performance. We encourage you to evaluate these adjustments and the reasons we consider them

appropriate, as well as the material limitations on non-U.S. GAAP measures. A

reconciliation of these measures to the applicable GAAP measure can be found in our Annual Report.

Our combined results for the year ended December 31 2012 represent the addition of our

predecessor financials for the period from January 1, 2012 to December 28, 2012 and our

successor financials for the period from December 29, 2012 to December 31, 2012. This

combination does not comply with U.S. GAAP or with the rules for pro forma presentation, but is

presented as we believe the presentation is useful to the reader for comparison with the prior

periods. |

Ancestry

Refresher •

Our mission is to help everyone

discover, preserve and share their

family history

•

More than 2 million subscribers

•

Clear Category Leader . . . we

created the category

•

Great Business Model

•

Revenue of $620 and $225 million of

Adj. EBITDA before one-time items

•

Clear growth thesis

3 |

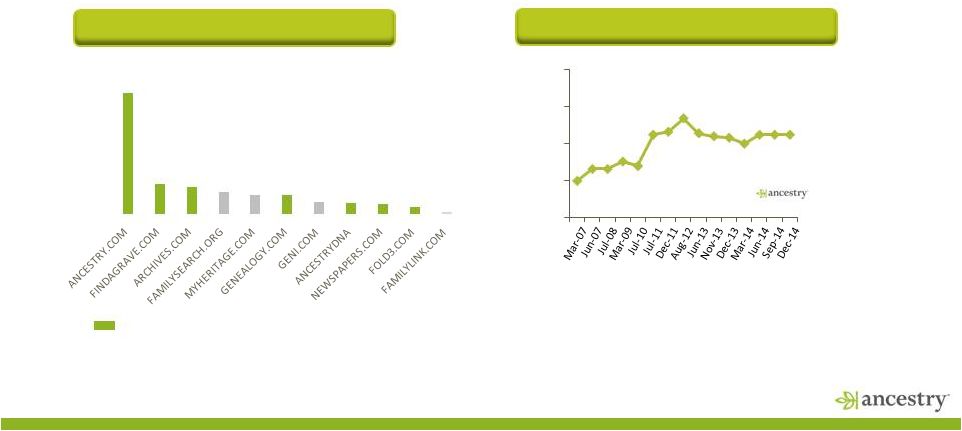

Competitive Position

4

A clear category leader with tremendous brand awareness

US Monthly Unique Visitors

(# of Monthly Unique Visitors in millions)

Ancestry owned websites

Source: Compete US data as of December 2014

Notes: MyHeritage acquired Geni in November 2012

Unaided Brand Awareness

8.2

2.1

1.8

1.5

1.3

1.3

0.8

0.7

0.7

0.4

0.1

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

25%

33%

33%

38%

35%

56%

58%

67%

57%

55%

54%

50%

56%

56%

56%

0%

25%

50%

75%

100%

* Other websites had less than 2% unaided brand awareness

Source:

For

March

2007

through

August

2012,

data

from

studies

by

Ipsos

conducted

on

our

behalf. For

June 2013 through December 2014, data from studies by Millward Brown Optimor conducted on our

behalf. Each of Ipsos and Millward Brown Optimor may have used different

methodologies. |

Poised

for Growth in 2015 •

Improving subscriber growth trends entering 2015

•

Return to Adj. EBITDA growth exiting 2014; revenue

to follow

•

2014 was a year of investment; 2015 is about

execution:

o

Content drives retention, deepens the moat and drives growth

o

Expansion into DNA creates stand alone value, and fuels

profitable subscriber growth

o

International expansion into Germany and Mexico expands

global footprint

o

New product features and tools enhance customer experience

o

Multiple complementary brands/product opportunities with

solid Adj. EBITDA contribution

5 |

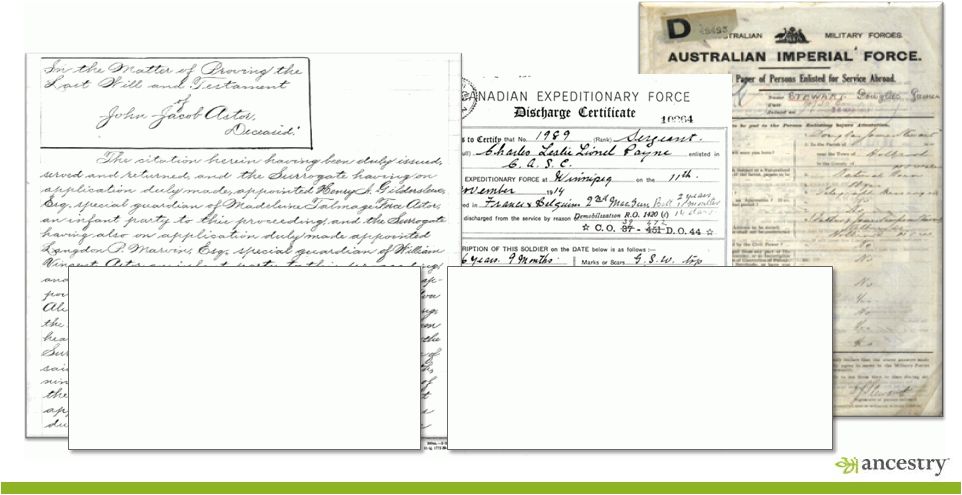

US Probate

Project World War One

AUS

CA

Growth Through New Content

6

•

170M Images, 73M principal records

•

49 of 50 states represented

•

3 year digitization effort ending in 2015

•

Records from early-1800’s to mid-1900’s

•

Developing new product experience to support

multi-image records and guided tour

•

Marketing launch is Labor Day, September 2015

•

375,000 records and 12.3 million images describing

all the servicemen and women serving in the AIF in

World War One

•

640,000 records and 32 million images describing all

the Canadian servicemen serving in World War One |

Deep

Content Relationships Contractually

Exclusive

–

exclusive publishing rights from

archive or institution for an

extended period of time

Digitization

Barrier

–

archives

reluctant to digitize again, or

digitized utilizing proprietary

unique technology

User

Generated

–

user

contributed content including

trees, photos, stories and

documents

Commoditized

–

currently

distributed across commercial

competitors or with minimal

barriers to acquire

* Includes key 2015 content releases

7

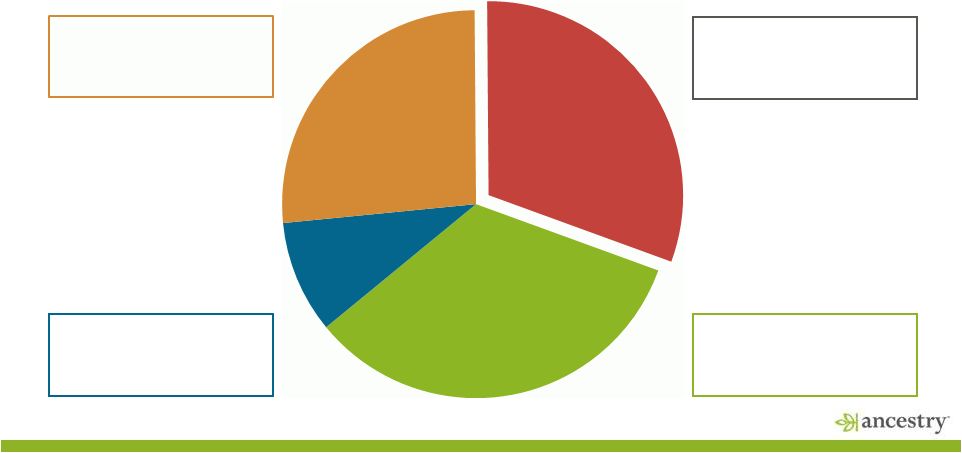

Contractually

Exclusive

34%

Digitization

Barrier

9%

User

Generated

26%

Commoditized

31% |

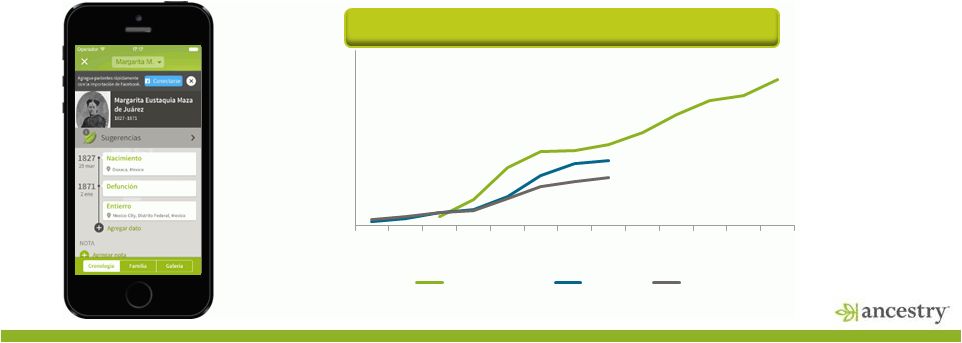

DNA

Expansion Drives Growth 8

•

Market expanding opportunity . . . DNA Touches Everyone

•

10% of kit purchasers become incremental subscribers

•

Database is growing fast, leading to more discoveries

0

100000

200000

300000

400000

500000

600000

700000

800000

Jan-12

Jul-12

Jan-13

Jul-13

Jan-14

Jul-14

Jan-15

DNA Database Sample Size |

•

31% of Ancestry subscribers located outside the U.S.

•

New market opportunities…starting with Mexico and Germany

•

2014 international revenues surpassed $130 million

International Growth by Geo Since Launch

(1)

(1)

Represents billings data from the respective geographies.

(2)

The UK website launched in 2002. Billings data unavailable for the first two years.

(3)

AU and CA sites were launched in 2006.

(2)

(3)

(3)

We’re a Global Business Today and Expanding

9

Year

1

Year

2

Year

3

Year

4

Year

5

Year

6

Year

7

Year

8

Year

9

Year

10

Year

11

Year

12

Year

13

United Kingdom

Australia

Canada |

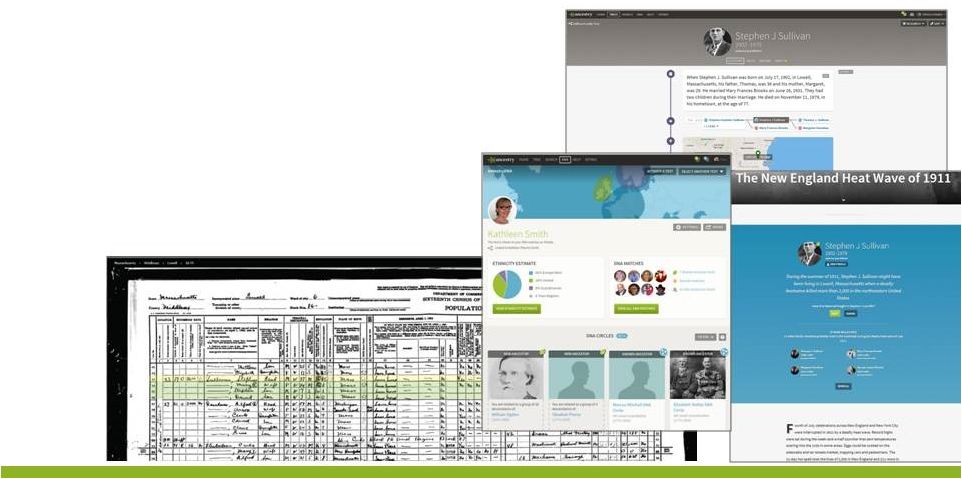

Great

Product Experience Drives Growth •

Significant core product innovation story

•

It’s becoming easier and more accessible

10 |

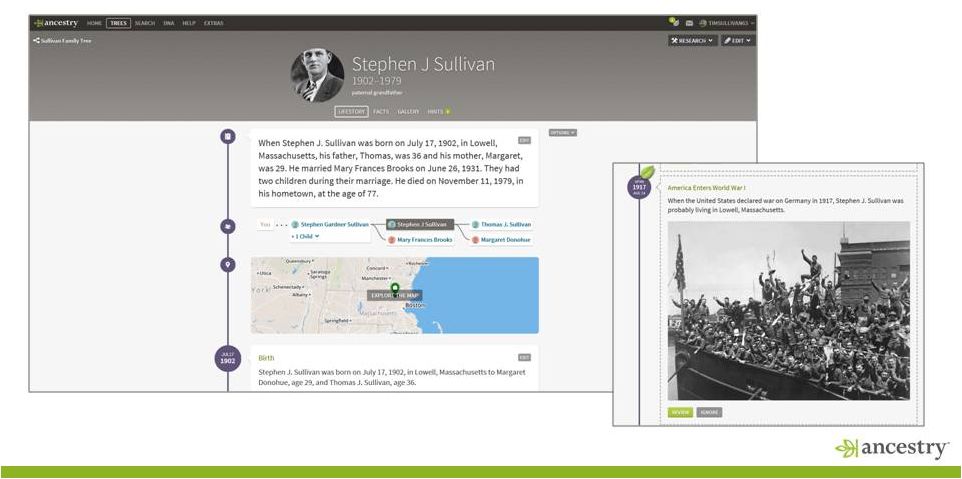

LifeStory

11

Historical Insights |

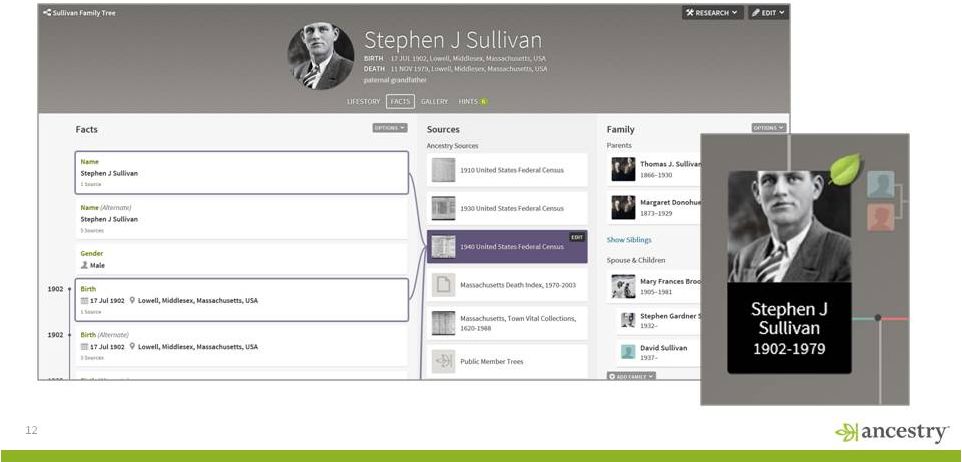

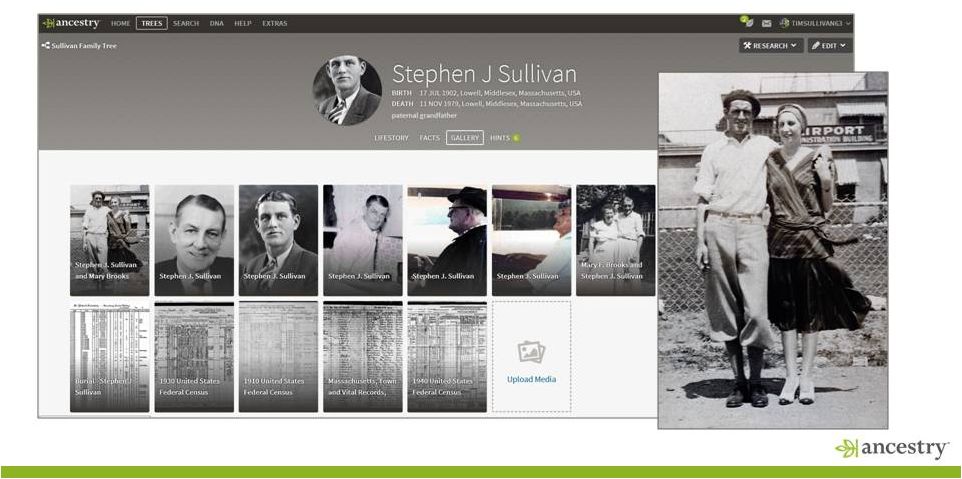

12

Facts and Hints |

Media

Gallery 13 |

Family

history made simple and affordable with access to more than 4.5 billion digital

records The web’s premier collection of original military records.

The official research arm of Ancestry.

Professional genealogists with extensive research and

genealogical experience.

Find historical newspapers from the 1700s–2000s across

the United States and beyond.

14

Brand Family Complements Growth |

Financial Overview

15 |

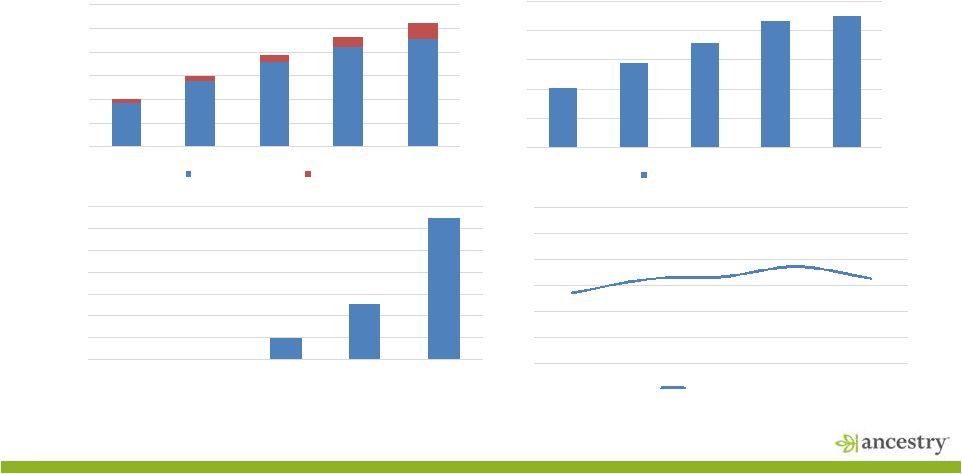

Key

Performance Metrics – 5 Year Trend

16

$100

$200

$300

$400

$500

$600

$700

2010

2011

2012

2013

2014

Non-GAAP Revenue ($MMs)

Subscription

Product

0

100

200

300

400

500

600

700

2010

2011

2012

2013

2014

DNA Database

0

50

100

150

200

250

2010

2011

2012

2013

2014

Adj EBITDA

Adj EBITDA (exc. 1x items)

20%

25%

30%

35%

40%

45%

50%

2010

2011

2012

2013

2014

Adj EBITDA Margin %

Adj EBITDA margin (exc. 1x items)

(1)

Adjusted EBITDA is defined as net income (loss) plus non-cash adjustments to revenue from

purchase accounting; interest expense, net; other (income) expense; income tax expense (benefit); and

non-cash charges, including depreciation, amortization and stock-based compensation

expense. Adjusted EBITDA for the twelve months ended December 31, 2014 also excludes $10.6 million of

accrued interest to be paid on restricted cash held pending resolution of the shareholder

appraisal litigation, professional service fees related to litigation and costs associated with the return-of-

capital distribution paid in February 2014 by our parent company, Holdings LLC. Adjusted EBITDA

for the twelve months ended December 31, 2013 also excludes $5.6 million of professional services

related to litigation, reorganizing our corporate structure, registering our existing Notes

with the SEC, costs associated with the return-of-capital distribution paid in September 2013 by our parent

company, Holdings LLC, and costs related to the settlement of litigation.

|

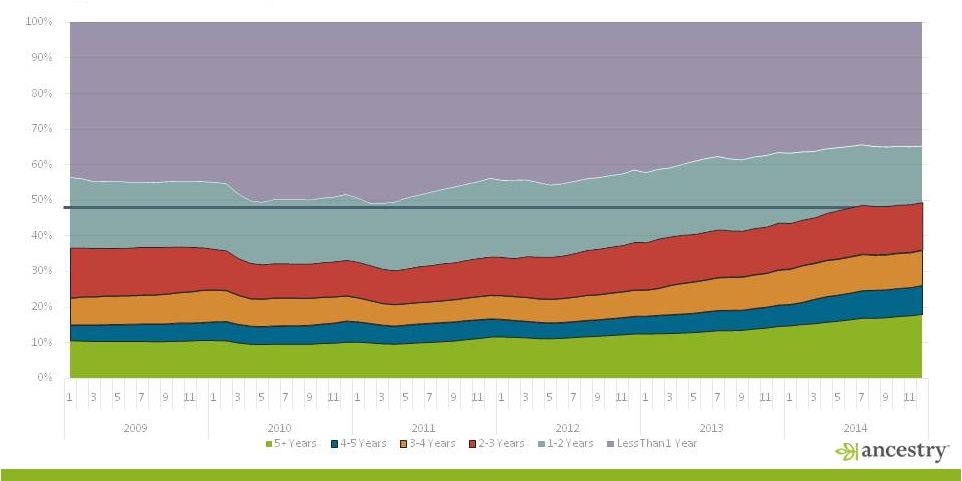

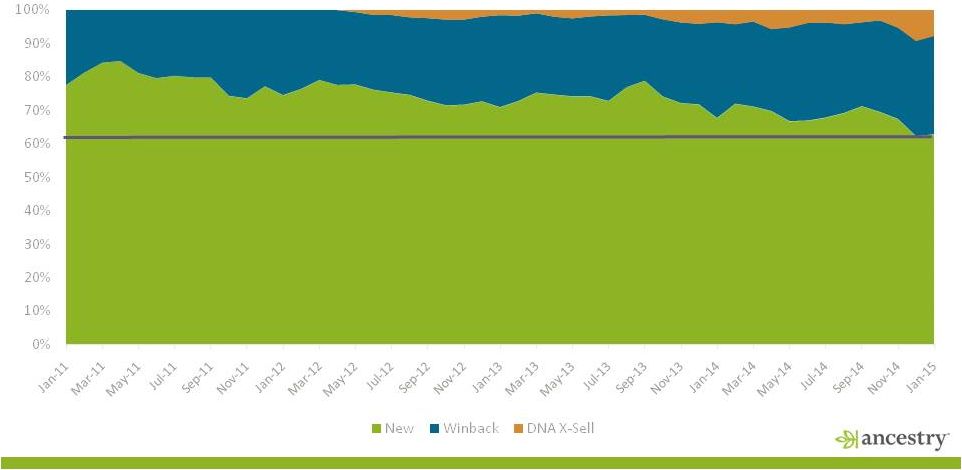

Large

Base of Loyal Subscribers 17 |

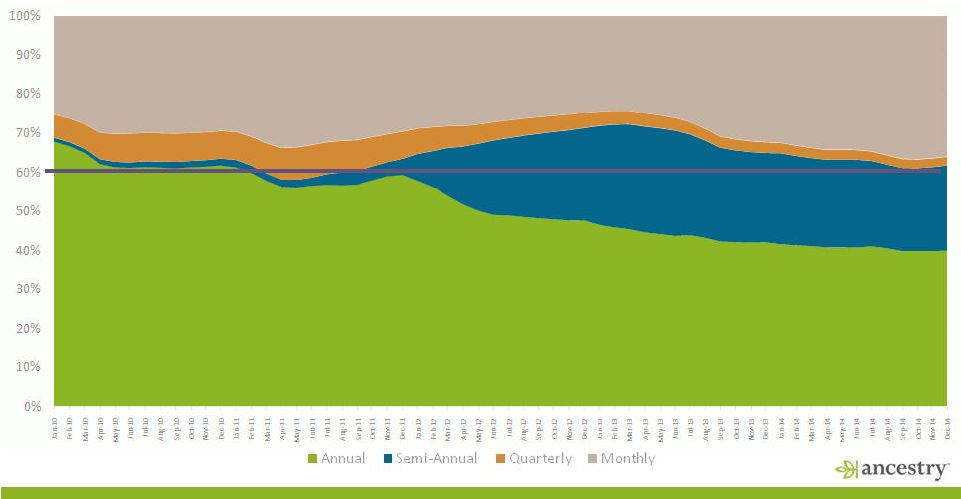

Stable

Subscriber Model Provides Revenue Visibility 18 |

Inventory Duration Mix

19 |

($000’s)

2010

2011

2012

2013

2014

Non-GAAP Revenues

(A)

300,931

399,661

487,635

561,506

619,544

Adj. EBITDA

100,974

144,807

178,825

217,176

225,405

Less: Cash paid

(received) for income taxes

11,128

3,683

27,156

(40,601)

1,334

Less: Capitalization of content

database costs

13,874

20,408

23,538

22,239

37,566

Less: Purchases of property

and equipment

12,968

13,895

20,776

26,714

21,821

Pre-Interest

Expense

FCF

(B)

63,004

106,821

107,355

208,824

164,684

% Margin [(B)/(A)]

21%

27%

22%

37%

27%

High free cash flow conversion

20

(1)

Adjusted EBITDA is defined as net income (loss) plus non-cash adjustments to revenue from

purchase accounting; interest expense, net; other (income) expense; income tax expense (benefit); and non-cash charges,

including depreciation, amortization and stock-based compensation expense. Adjusted EBITDA

and therefore free cash flow for the twelve months ended December 31, 2014 also exclude $10.6 million of accrued interest

to be paid on restricted cash held pending resolution of the shareholder appraisal litigation,

professional service fees related to litigation and costs associated with the

return-of-capital distribution paid in February 2014 by our parent company,

Holdings LLC. Adjusted EBITDA and therefore free cash flow for the twelve months ended December 31, 2013 also exclude $5.6 million of professional services related to litigation, reorganizing

our corporate structure, registering our existing Notes with the

SEC, costs associated with the return-of-capital distribution paid in September 2013

by our parent company, Holdings LLC, and costs related to the settlement of litigation.

|

Debt

Capitalization Overview 21

$MM

PF Acq.

9/30/2012

12/31/2013

12/31/2014

Cash and Cash Equivalents

$25

$87

$108

Revolver ($50MM Capacity)

–

–

–

Senior Secured Term Loan

670

–

–

Senior Secured Term Loan B-1

–

457

453

Senior Secured Term Loan B-2

–

165

132

11% Senior Unsecured OpCo Notes

300

300

300

Total OpCo Debt

$970

$922

$885

Net OpCo Debt

945

835

777

9.63%/10.38% PIK Toggle HoldCo Notes

–

300

400

Total Holdco Debt

$970

$1,222

$1,285

Net Debt

945

1,135

1,177

Pro Forma Credit Ratios

Senior

Secured

Debt

/

Adj.

EBITDA

3.9x

2.9x

2.6x

Total OpCo Debt / Adj. EBITDA

5.6x

4.2x

3.9x

Net OpCo Debt / Adj. EBITDA

5.5x

3.8x

3.5x

Total HoldCo Debt / Adj. EBITDA

5.6x

5.6x

5.7x

Net Holdco Debt / Adj. EBITDA

5.5x

5.2x

5.2x

LTM Adjusted EBITDA

(1)

$173

$217

$225

(1)

Adjusted EBITDA is defined as net income (loss) plus non-cash adjustments to revenue from

purchase accounting; interest expense, net; other (income) expense; income tax expense (benefit); and

non-cash charges, including depreciation, amortization and stock-based compensation

expense. Adjusted EBITDA for the twelve months ended December 31, 2014 also excludes $10.6 million of

accrued interest to be paid on restricted cash held pending resolution of the shareholder

appraisal litigation, professional service fees related to litigation and costs associated with the return-of-

capital distribution paid in February 2014 by our parent company, Holdings LLC. Adjusted

EBITDA for the twelve months ended December 31, 2013 also excludes $5.6 million of professional services

related to litigation, reorganizing our corporate structure, registering our existing Notes

with the SEC, costs associated with the return-of-capital distribution paid in September 2013 by our parent

company, Holdings LLC, and costs related to the settlement of litigation. |

|