Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Summit Materials, LLC | Financial_Report.xls |

| EX-21 - EX-21 - Summit Materials, LLC | d840621dex21.htm |

| EX-95.1 - EX-95.1 - Summit Materials, LLC | d840621dex951.htm |

| EX-32.1 - EX-32.1 - Summit Materials, LLC | d840621dex321.htm |

| EX-12.1 - EX-12.1 - Summit Materials, LLC | d840621dex121.htm |

| EX-32.2 - EX-32.2 - Summit Materials, LLC | d840621dex322.htm |

| EX-99.1 - EX-99.1 - Summit Materials, LLC | d840621dex991.htm |

| EX-31.1 - EX-31.1 - Summit Materials, LLC | d840621dex311.htm |

| EX-31.2 - EX-31.2 - Summit Materials, LLC | d840621dex312.htm |

| EX-10.18 - EX-10.18 - Summit Materials, LLC | d840621dex1018.htm |

| EX-10.19 - EX-10.19 - Summit Materials, LLC | d840621dex1019.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 27, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-187556

SUMMIT MATERIALS, LLC

(Exact name of registrant as specified in its charter)

| Delaware | 24-4138486 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1550 Wynkoop Street, 3rd Floor Denver, Colorado |

80202 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (303) 893-0012

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of February 23, 2015, 100% of the registrant’s outstanding limited liability company interests were held by Summit Materials Intermediate Holdings, LLC.

Table of Contents

| PART | ITEM | PAGE | ||||||

| I |

1 | 4 | ||||||

| 1A | 16 | |||||||

| 1B | 24 | |||||||

| 2 | 24 | |||||||

| 3 | 29 | |||||||

| 4 | 29 | |||||||

| II |

5 | 29 | ||||||

| 6 | 29 | |||||||

| 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

31 | ||||||

| 7A | 61 | |||||||

| 8 | 62 | |||||||

| 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

102 | ||||||

| 9A | 102 | |||||||

| 9B | 103 | |||||||

| III |

10 | 103 | ||||||

| 11 | 106 | |||||||

| 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

120 | ||||||

| 13 | Certain Relationships and Related Transactions, and Director Independence |

122 | ||||||

| 14 | 123 | |||||||

| IV |

15 | 124 | ||||||

2

Table of Contents

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (this “report”) contains “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “trends,” “plans,” “estimates,” “projects” or “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions. All non-historical statements such as those relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the effect of known factors, and it is impossible to anticipate all factors that could affect our actual results.

Some of the important factors that could cause actual results to differ materially from our expectations are disclosed under “Risk Factors” and elsewhere in this report. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

CERTAIN DEFINITIONS

As used in this report, unless otherwise noted or the context otherwise requires:

| • | “We,” “our,” “us,” and “the Company” refer to Summit Materials, LLC and its subsidiaries as a combined entity; |

| • | “Summit Holdings” refers only to Summit Materials Holdings L.P., our indirect parent entity; |

| • | “Summit Materials” refers only to Summit Materials, LLC and not its subsidiaries; |

| • | “Finance Corp.” refers only to Summit Materials Finance Corp., a wholly-owned indirect subsidiary of Summit Materials; |

| • | “Cornejo” refers collectively to Cornejo & Sons, L.L.C., C&S Group, Inc., Concrete Materials Company of Kansas, LLC and Cornejo Materials, Inc.; |

| • | “Harper Contracting” refers collectively to substantially all the assets of Harper Contracting, Inc., Harper Sand and Gravel, Inc., Harper Excavating, Inc., Harper Ready Mix Company, Inc. and Harper Investments, Inc.; |

| • | “Altaview Concrete” refers collectively to Altaview Concrete, LLC, Peak Construction Materials, LLC, Peak Management, L.C. and Wasatch Concrete Pumping, LLC; |

| • | “RK Hall” refers collectively to R.K. Hall Construction, Ltd., RHMB Capital, L.L.C., Hall Materials, Ltd., B&H Contracting, L.P., RKH Capital, L.L.C. and SCS Materials, L.P.; |

| • | “B&B” refers collectively to B&B Resources, Inc., Valley Ready Mix, Inc. and Salt Lake Sand & Gravel, Inc.; |

| • | “Industrial Asphalt” refers collectively to Industrial Asphalt, LLC, Asphalt Paving Company of Austin, LLC, KBDJ, L.P. and all the assets of Apache Materials Transport, Inc.; |

| • | “Ramming Paving” refers collectively to J.D. Ramming Paving Co., LLC, RTI Hot Mix, LLC, RTI Equipment Co., LLC and Ramming Transportation Co., LLC; |

| • | “Norris” refers to Norris Quarries, LLC; |

| • | “Kay & Kay” refers to certain assets of Kay & Kay Contracting, LLC; |

| • | “Sandco” refers to certain assets of Sandco Inc.; |

| • | “Lafarge” refers to Lafarge North America, Inc.; |

| • | “Westroc” refers to Westroc, LLC; |

| • | “Alleyton” refers collectively to Alleyton Resource Company, LLC, Alcomat, LLC and Alleyton Services Company, LLC, the surviving entities from the acquisition of Alleyton Resource Corporation, Colorado Gulf, LP and certain assets of Barten Shephard Investments, LP; |

| • | “Troy Vines” refers to Troy Vines, Incorporated; |

3

Table of Contents

| • | “Buckhorn Materials” refers to Buckhorn Materials, LLC, which is the surviving entity from the acquisition of Buckhorn Materials LLC and Construction Materials Group LLC; |

| • | “Canyon Redi-Mix” refers collectively to Canyon Redi-Mix, Inc. and CRM Mixers LP; |

| • | “Mainland” refers to Mainland Sand & Gravel ULC, which is the surviving entity from the acquisition of Rock Head Holdings Ltd., B.I.M. Holdings Ltd., Carlson Ventures Ltd., Mainland Sand and Gravel Ltd. and Jamieson Quarries Ltd.; |

| • | “Southwest Ready Mix” refers to Southwest Ready Mix, LLC; |

| • | “Colorado County S&G” refers to Colorado County Sand & Gravel Co., L.L.C., which is the surviving entity from the acquisition of Colorado County Sand & Gravel Co., L.L.C, M & M Gravel Sales, Inc., Marek Materials Co. Operating, Ltd. and Marek Materials Co., L.L.C.; |

| • | “Concrete Supply” refers to Concrete Supply of Topeka, Inc., Penny’s Concrete and Ready Mix, L.L.C. and Builders Choice Concrete Company of Missouri, L.L.C.; |

| • | “Blackstone” refers to investment funds associated with or designated by The Blackstone Group L.P. and its affiliates; |

| • | “Silverhawk” refers to certain investment funds affiliated with Silverhawk Summit, L.P.; and |

| • | “Sponsors” refers to Blackstone and Silverhawk. |

Unless otherwise stated or the context otherwise requires, all references to years refer to our fiscal year.

| Item 1. | BUSINESS. |

Overview

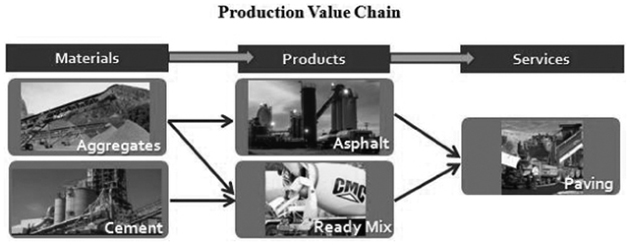

We are one of the fastest growing construction materials companies in the United States, with a 197% increase in revenue between the year ended December 31, 2010 and the year ended December 27, 2014, as compared to an average increase of approximately 38% in revenue reported by our competitors over the same period. Our materials include aggregates, which we supply across the country, with a focus on Texas, Kansas, Kentucky, Utah and Missouri, and cement, which we supply primarily in Missouri, Iowa and Illinois. Within our markets, we offer customers a single-source provider for construction materials and related downstream products through our vertical integration. In addition to supplying aggregates to customers, we use our materials internally to produce ready-mixed concrete and asphalt paving mix, which may be sold externally or used in our paving and related services businesses. Our vertical integration creates opportunities to increase aggregates volumes and optimize margin at each stage of production and enables us to provide customers with efficiency gains, convenience and reliability, which we believe gives us a competitive advantage.

Since our first acquisition more than five years ago, we have rapidly become a major participant in the U.S. construction materials industry. We believe that, by volume, we are a top 10 aggregates supplier, a top 25 cement producer and a major producer of ready-mixed concrete and asphalt paving mix. Our revenue in 2014 was $1.2 billion with a net loss of $6.3 million. Our proven and probable aggregates reserves were 2.1 billion tons as of December 27, 2014. In 2014, we sold 25.4 million tons of aggregates, 1.0 million tons of cement, 2.8 million cubic yards of ready-mixed concrete and 4.3 million tons of asphalt paving mix across our more than 200 sites and plants.

The rapid growth we have achieved over the last five years has been due in large part to our acquisitions, which we funded with equity commitments that our Sponsors and certain other investors made to Summit Holdings together with debt financing. During this period, we witnessed a cyclical decline and slow recovery in the private construction market and nominal growth in public infrastructure spending. However, the private construction market is beginning to rebound, which we believe signals the outset of a strong growth period in our industry and end markets. We believe we are well positioned to capitalize on this anticipated recovery in order to grow our business and reduce our leverage over time. As of December 27, 2014, our total indebtedness was approximately $1,064.9 million.

The private construction market includes residential and nonresidential new construction and the repair and remodel market. According to the National Association of Home Builders, the number of total housing starts in the United States, a leading indicator for our residential business, is expected to grow 57% from 2013 to 2016. In addition, the Portland Cement Association (“PCA”) projects that spending in private nonresidential construction will grow 26% over the same period. The private construction market represented 56% of our revenue in 2014.

4

Table of Contents

Public infrastructure, which includes spending by federal, state and local governments for roads, highways, bridges, airports and other public infrastructure projects, has been a relatively stable portion of government budgets providing consistent demand to our industry and is projected by the PCA to grow approximately 3% from 2013 to 2016. With the nation’s infrastructure aging, we expect U.S. infrastructure spending to grow over the long term, and we believe we are well positioned to capitalize on any such increase. Despite this projected growth, we do not believe it will be consistent across the United States, but will instead be concentrated in certain regions. The public infrastructure market represented 44% of our revenue in 2014.

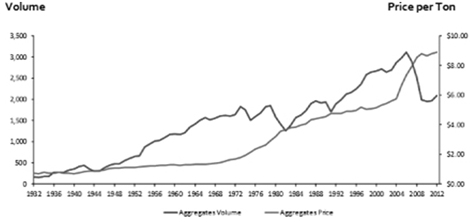

In addition to the anticipated growth in our end markets, we expect higher volume and pricing in our core product categories. The PCA estimates that cement consumption will increase approximately 30% from 2013 to 2016, reflecting rising demand in the major end markets. At the same time, we believe that cement pricing will be driven higher by tightening production capacity in the United States, where the PCA projects consumption will exceed domestic cement capacity by 2017 driven by both increasing demand and by other capacity constraints arising from the U.S. Environmental Protection Agency’s (“EPA”) National Emission Standards for Hazardous Air Pollutants (“NESHAP”) regulation for Portland Cement Plants (“PC-MACT”), with which compliance is generally required in 2015. Favorable market dynamics can also be seen in aggregates, where volumes decreased from 3.1 billion tons in 2006 to an estimated 2.1 billion tons in 2013, a 34% decline that has been offset by growth in the average price per ton, which increased from $7.37 in 2006 to an estimated $8.94 in 2013, a 21% increase, according to the U.S. Geological Survey. Consistent with these market trends, our cement and aggregates average pricing increased 6% and 2%, respectively, from the year ended December 31, 2010 to the year ended December 27, 2014.

Historically, we have sought to supplement organic growth potential with acquisitions, by strategically targeting attractive, new markets or expanding in existing markets. We consider population trends, employment rates, competitive landscape, private construction outlook, public funding and various other factors prior to entering a new market. In addition to analyzing macroeconomic data, we seek to establish a top position in our local markets, which we believe supports our achieving sustainable organic growth and attractive returns. This positioning provides local economies of scale and synergies, which benefit our pricing, costs and profitability. We believe that each of our operating companies has a top three market share position in its local market.

Our acquisition strategy to date has helped us to achieve scale and rapid growth, and we believe that significant opportunities remain for growth through acquisition. We estimate that approximately 65% of the U.S. construction materials market is privately owned. From this group, our senior management team maintains contact with over 300 private companies. These long-standing relationships, cultivated over decades, have been the primary source for our past acquisitions and, we believe, will be a key driver of our future growth. We believe the value proposition we offer to potential sellers has made us a buyer of choice and has enabled us to largely avoid competitive auctions and instead negotiate directly with sellers at attractive valuations.

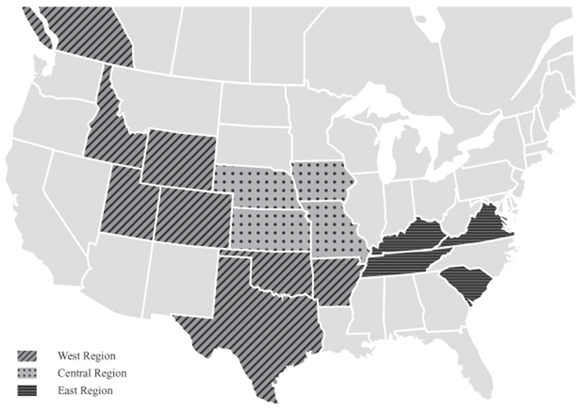

Our Regional Platforms

We currently operate across 17 U.S. states and in British Columbia, Canada through our three regional platforms that make up our operating segments: West; Central; and East. Each of our operating businesses has its own management team that, in turn, reports to a regional president who is responsible for overseeing the operating businesses, developing growth opportunities, implementing best practices and integrating acquired businesses. Acquisitions are an important element of our strategy, as we seek to enhance value through increased scale and cost savings within local markets.

| • | West Region: Our West region includes operations in Texas, the Mountain states of Utah, Colorado, Idaho and Wyoming and in British Columbia, Canada where we supply aggregates, ready-mixed concrete, asphalt paving mix and paving and related services. As of December 27, 2014, the West region controlled approximately 0.7 billion tons of proven and probable aggregates reserves and $362.4 million of hard assets. During the year ended December 27, 2014, approximately 55% of our revenue was generated in the West region. In 2014, we continued to expand the West region, with significant growth in Texas through key acquisitions as well as the establishment of a new platform in British Columbia, Canada with our September acquisition of Mainland. |

| • | Central Region: Our Central region extends across the Midwestern United States, most notably in Kansas, Missouri, Nebraska, Iowa and Illinois, where we supply aggregates, cement, ready-mixed concrete, asphalt paving mix and paving and related services. As of December 27, 2014, the Central region controlled approximately 0.9 billion tons of proven and probable aggregates reserves, approximately 0.4 billion of which serve its cement business, and $539.9 million of hard assets. During the year ended December 27, 2014, approximately 33% of our revenue was generated in the Central region. |

Our cement plant, commissioned in 2008, is a highly efficient, technologically advanced, integrated manufacturing and distribution system strategically located near Hannibal, Missouri, 100 miles north of St. Louis along the Mississippi River. We utilize an on-site solid and liquid waste fuel processing facility, which can reduce the plant’s fuel costs by up to 50% and is one of only 12 facilities in the United States with such capabilities. Our cement business primarily serves markets in Missouri, Iowa and Illinois.

| • | East Region: Our East region serves markets in Kentucky, South Carolina, North Carolina, Tennessee and Virginia, where we supply aggregates, asphalt paving mix and paving and related services. As of December 27, 2014, the East region controlled approximately 0.5 billion tons of proven and probable aggregates reserves and $152.8 million of hard assets. During the year ended December 27, 2014, approximately 12% of our revenue was generated in the East region. |

5

Table of Contents

Acquisition History

The following table lists acquisitions we have completed since August 2009:

| Company |

Date of Acquisition |

Region | ||

| Hamm, Inc. | August 25, 2009 | Central | ||

| Hinkle Contracting Company, LLC | February 1, 2010 | East | ||

| Cornejo | April 16, 2010 | Central | ||

| Elmo Greer & Sons, LLC | April 20, 2010 | East | ||

| Continental Cement | May 27, 2010 | Central | ||

| Harshman Construction L.L.C. and Harshman Farms, Inc. | June 15, 2010 | Central | ||

| South Central Kentucky Limestone, LLC | July 23, 2010 | East | ||

| Harper Contracting | August 2, 2010 | West | ||

| Kilgore Pavement Maintenance, LLC and Kilgore Properties, LLC | August 2, 2010 | West | ||

| Con-Agg of MO, L.L.C. | September 15, 2010 | Central | ||

| Altaview Concrete | September 15, 2010 | West | ||

| EnerCrest Products, Inc. | September 28, 2010 | West | ||

| RK Hall | November 30, 2010 | West | ||

| Triple C Concrete, Inc. | January 14, 2011 | West | ||

| Elam Construction, Inc. | March 31, 2011 | West | ||

| Bourbon Limestone Company | May 27, 2011 | East | ||

| Fischer Quarries, L.L.C. | May 27, 2011 | Central | ||

| B&B | June 8, 2011 | West | ||

| Grand Junction Concrete Pipe, Inc. | June 10, 2011 | West | ||

| Industrial Asphalt | August 2, 2011 | West | ||

| Ramming Paving | October 28, 2011 | West | ||

| Norris | February 29, 2012 | Central | ||

| Kay & Kay | October 5, 2012 | East | ||

| Sandco | November 30, 2012 | West | ||

| Lafarge | April 1, 2013 | Central | ||

| Westroc | April 1, 2013 | West | ||

| Alleyton | January 17, 2014 | West | ||

| Troy Vines | March 31, 2014 | West | ||

| Buckhorn Materials | June 9, 2014 | East | ||

| Canyon Redi-Mix | July 29, 2014 | West | ||

| Mainland | September 4, 2014 | West | ||

| Southwest Ready Mix | September 19, 2014 | West | ||

| Colorado County S&G | September 30, 2014 | West | ||

| Concrete Supply | October 3, 2014 | Central |

Our End Markets

Residential Construction. Residential construction includes single family houses and multi-family units such as apartments and condominiums. Demand for residential construction is influenced by employment prospects, new household formation and mortgage interest rates. In recent years, foreclosures have resulted in an oversupply of available houses, which had dampened the demand for new residential construction in many markets in the United States. However, employment prospects have improved, foreclosure rates have stabilized and demand has begun to grow, although the rate of growth is inconsistent across the United States.

Nonresidential Construction. Nonresidential construction encompasses all privately financed construction other than residential structures. Demand for nonresidential construction is driven by population and economic growth. Population growth spurs demand for stores, shopping centers and restaurants. Economic growth creates demand for projects such as hotels, office buildings, warehouses and factories. The supply of nonresidential construction projects is affected by interest rates and the availability of credit to finance these projects.

Public Infrastructure Construction. Public infrastructure construction includes spending by federal, state and local governments for highways, bridges, airports, schools, public buildings and other public infrastructure projects. Public infrastructure spending has historically been more stable than private sector construction. We believe that public infrastructure spending is less sensitive to interest rate changes and economic cycles and often is supported by multi-year federal and state legislation and programs. A significant portion of our revenue is derived from public infrastructure projects. As a result, the supply of federal and state funding for public infrastructure highway construction significantly affects our public infrastructure end-use business.

6

Table of Contents

In the past, public infrastructure sector funding was underpinned by a series of six-year federal highway authorization bills. Federal funds are allocated to the states, which are required to match a portion of the federal funds they receive. Federal highway spending uses funds predominantly from the Federal Highway Trust Fund, which derives its revenue from taxes on diesel fuel, gasoline and other user fees. The dependability of federal funding allows the state departments of transportation to plan for their long term highway construction and maintenance needs.

Funding for the existing federal transportation funding program expired on September 30, 2014 and on August 1, 2014, a Highway Trust Fund extension bill was enacted. This bill provides approximately $10.8 billion of funding, which is expected to last until May 2015. Any additional funding or successor programs have yet to be approved. With the nation’s infrastructure aging, we expect U.S. infrastructure spending to grow over the long term, and we believe we are well positioned to capitalize on any such increase.

Our Industry

The U.S. construction materials industry is composed of four primary sectors: aggregates; cement; ready-mixed concrete; and asphalt paving mix. Each of these materials is widely used in most forms of construction activity. Participants in these sectors typically range from small, privately-held companies focused on a single material, product or market to multinational corporations that offer a wide array of construction materials and services. Competition is constrained in part by the distance materials can be transported efficiently, resulting in predominantly local or regional operations. Due to the lack of product differentiation, competition for all of our products is predominantly based on price and, to a lesser extent, quality of products and service. As a result, the prices we charge our customers are not likely to be materially different from the prices charged by other producers in the same markets. Accordingly, our profitability is generally dependent on the level of demand for our products and our ability to control operating costs.

Transportation infrastructure projects, driven by both state and federal funding programs, represent a significant share of the U.S. construction materials market. In addition to federal funding, highway construction and maintenance funding is also available through state, county and local agencies. Our five largest states by revenue (Texas, Kansas, Kentucky, Utah and Missouri, which represented approximately 34%, 19%, 11%, 10% and 9%, respectively, of our total revenue in 2014) each have funds whose revenue sources are constitutionally protected and may only be spent on transportation projects:

| • | Texas Department of Transportation’s budget from 2014 to 2016 is $25.3 billion. On November 4, 2014, voters in Texas passed a proposition that is expected to provide between $1.2 billion and $1.7 billion of incremental funding annually to the Texas Department of Transportation. The funds must be used for construction, maintenance, rehabilitation and acquiring right-of-way for public roads. |

| • | Kansas has a 10 year $8.2 billion highway bill that was passed in May 2010. |

| • | Kentucky’s biennial highway construction plan has funding of $3.6 billion from July 2014 to June 2016. |

| • | Utah’s transportation investment fund had $3.0 billion committed through 2018. |

| • | Missouri has an estimated $0.7 billion in annual construction funding committed to essential road and bridge programs through 2017. |

Demand for our products is observed to have low elasticity in relation to prices. We believe this is partially explained by the absence of competitive replacement products and relatively low contribution of our products to total construction costs. We do not believe that increases in our products’ prices are likely to affect the decision to undertake a construction project since these costs usually represent a small portion of total construction costs.

Aggregates

Aggregates are key material components used in the production of cement, ready-mixed concrete and asphalt paving mixes for the residential, nonresidential and public infrastructure markets and are also widely used for various applications and products, such as road and building foundations, railroad ballast, erosion control, filtration, roofing granules and in solutions for snow and ice control. Generally extracted from the earth using surface or underground mining methods, aggregates are produced from natural deposits of various materials such as limestone, sand and gravel, granite and trap rock. Once extracted, processed and graded, aggregates are supplied directly to their end use or incorporated for further processing into construction materials and products, such as cement, ready-mixed concrete and asphalt paving mix.

According to the March 2014 U.S. Geological Survey, approximately 1.3 billion tons of crushed stone with a value of approximately $11.9 billion was produced in the United States in 2013, in line with the 1.3 billion tons produced in 2012. Sand and gravel production was approximately 935 million tons in 2013 valued at approximately $6.7 billion, up from 899 million tons produced in 2012. The U.S. aggregate industry is highly fragmented relative to other building product markets, with numerous participants operating in localized markets and the top ten players controlling approximately 30% of the national market in 2013. In February 2014, the U.S. Geological Survey reported that a total of 1,550 companies operating 4,000 quarries and 91 underground mines produced or sold crushed stone in 2013 in the United States.

7

Table of Contents

Transportation costs are a major variable in determining aggregate pricing and marketing radius. The cost of transporting aggregate products from the plant to the market often equates to or exceeds the sale price of the product at the plant. As a result of the high transportation costs and the large quantities of bulk material that have to be shipped, finished products are typically marketed locally. High transportation costs are responsible for the wide dispersion of production sites. Where possible, construction material producers maintain operations adjacent to highly populated areas to reduce transportation costs and enhance margins. However, more recently, rising land values combined with local environmental concerns have been forcing production sites to move further away from the end-use locations.

We believe that the long-term growth of the market for aggregates is predominantly driven by growth in population, employment and households, which in turn affects demand for nonresidential construction, including stores, shopping centers and restaurants and increases transportation infrastructure spending. In recent years, the recession and subsequent slow recovery in the United States has led to a decrease in overall private and public infrastructure construction activity. While short-term demand for aggregates fluctuates with economic cycles, the declines have historically been followed by strong recovery, with each peak establishing a new historical high. In addition, according to the U.S. Geological Survey, during periods of economic decline in which aggregates volumes sold has decreased, prices have historically continued to grow, as illustrated in the following table:

A significant portion of annual demand for aggregates is derived from large public infrastructure and highway construction projects. According to the Montana Contractors’ Association, approximately 38,000 tons of aggregate are required to construct a one mile stretch of a typical four-lane interstate highway. Highways located in markets with significant seasonal temperature variances are particularly vulnerable to freeze-thaw conditions that exert excessive stress on pavement and lead to more rapid surface degradation. Surface maintenance repairs, as well as general highway construction, occur in the warmer months, resulting in a majority of aggregates production and sales in the period from April through November in most states.

Cement

Portland cement, an industry term for the common cement in general use around the world, is made from a combination of limestone, shale, clay, silica and iron ore. It is a fundamental building material consumed in several stages throughout the construction cycle of residential, nonresidential and public infrastructure projects. It is a binding agent that, when mixed with sand or aggregates and water, produces either ready-mixed concrete or mortar and is an important component of other essential construction materials. Cement is sold either in bulk or in bags as branded products, depending on its final user. Few construction projects can take place without utilizing cement somewhere in the design, making it a key ingredient used in the construction industry. The majority of all cement shipments are sent to ready-mixed concrete operators. The remaining shipments are directed to manufacturers of concrete related products such as block and precast. Nearly two-thirds of U.S. consumption occurs between May and November, coinciding with end-market construction activity.

The principal raw materials in cement are a blend of approximately 80% limestone and approximately 10% shale, with the remaining raw materials being clay and iron ore. Generally, the limestone and shale are mined from quarries located on site with the production plant. These core ingredients are blended and crushed into a fine grind and then preheated and ultimately introduced into a kiln heated to about 3,000°F. Under this extreme heat, a chemical transformation occurs uniting the elements to form a new substance with new physical and chemical characteristics. This new substance is called clinker and it is formed into pieces about the size of marbles. The clinker is then cooled and later ground into a fine powder that then is classified as Portland cement.

8

Table of Contents

Cement production in the United States is distributed among 98 production facilities located across 34 states. It is a capital-intensive business with variable costs dominated by raw materials and energy required to fuel the kiln. Building new plants is challenging given the extensive permitting that is required and significant costs. We estimate new plant construction costs in the United States to be approximately $250-300 per ton, not including costs for property or securing raw materials and the required distribution network. Assuming construction costs of $275 per ton, a 1.25 million ton facility, comparable to our cement plant’s potential annual capacity, would cost approximately $343.8 million to construct.

As reported by the PCA in the 2014 United States Cement Industry Annual Yearbook, consumption is down significantly from the industry peak of approximately 141.1 million tons in 2005 to approximately 90.3 million tons in 2013 because of the decline in U.S. construction activity. U.S. cement consumption has at times outpaced domestic production capacity with the shortfall being supplied with imports, primarily from China, Canada, Greece, Mexico and South Korea. The PCA reports that cement imports have declined since their peak of approximately 39.6 million tons in 2006 to approximately 8.0 million tons in 2013, in a manner indicative of the industry’s general response to the current demand downturn. In addition to the reduction in imports, U.S. excess capacity increased from 5% in 2006 to approximately 32% in 2013 according to the PCA. Our cement plant operated above the industry mean at 86% capacity utilization in 2013 as its markets did not suffer the pronounced demand declines seen in states like Florida, California and Arizona.

On December 20, 2012, the EPA signed the PC-MACT, which in most instances requires compliance in 2015. The PCA had estimated that 18 plants could be forced to close due to the inability to meet PC-MACT standards or because the compliance investment required may not be justified on a financial basis. Our cement plant utilizes alternative fuel (hazardous and non-hazardous) as well as coal, natural gas and petroleum coke and, as a result, is subject to the Hazardous Waste Combustor NESHAP (“HWC-MACT”) standards, rather than PC-MACT standards. Any future costs to comply with the existing HWC-MACT standards are not expected to be material.

Ready-Mixed Concrete

Ready-mixed concrete is one of the most versatile and widely used materials in construction today. Its flexible recipe characteristics allow for an end product that can assume almost any color, shape, texture and strength to meet the many requirements of end users that range from bridges, foundations, skyscrapers, pavements, dams, houses, parking garages, water treatment facilities, airports, tunnels, power plants, hospitals and schools. The versatility of ready-mixed concrete gives engineers significant flexibility when designing these projects.

Cement, coarse aggregate, fine aggregate, water and admixtures are the primary ingredients in ready-mixed concrete. The cement and water are combined and a chemical reaction is produced called hydration. This paste or binder represents between 15 to 20% of the volume of the mix that coats each particle of aggregate and serves as the agent that binds the aggregates together, according to the National Ready Mixed Concrete Association (“NRMCA”). The aggregates represent 60 to 75% of the mix by volume, with a small portion of volume (5 to 8%) consisting of entrapped air that is generated by using air entraining admixtures. Once fully hydrated, the workable concrete will then harden and take on the shape of the form in which it was placed.

The quality of a concrete mix is generally determined by the weight ratio of water to cement. Higher quality concrete is produced by lowering the water-cement ratio as much as possible without sacrificing the workability of the fresh concrete. Specialty admixtures such as high range water reducers can aid in achieving this condition without sacrificing quality.

Other materials commonly used in the production of ready-mixed concrete include fly-ash, a waste by-product from coal burning power plants, silica fume, a waste by-product generated from the manufacture of silicon and ferro-silicon metals, and ground granulated blast furnace slag, a by-product of the iron and steel manufacturing process. All of these products have cemetitious properties that enhance the strength, durability and permeability of the concrete. These materials are available directly from the producer or via specialist distributors who intermediate between the ready-mixed concrete producers and the users.

Given the high weight-to-value ratio, delivery of ready-mixed concrete is typically limited to a one-hour haul from a production plant location and is further limited by a 90 minute window in which newly-mixed concrete must be poured to maintain quality and performance. As a result of the transportation constraints, the ready-mixed concrete market is highly localized, with an estimated 5,500 ready-mixed concrete plants in the United States according to the NRMCA. According to the NRMCA, 300.9 million cubic yards of ready-mixed concrete were produced in 2013, which is a 4% increase from the 289.8 million cubic yards produced in 2012 but a 34% decrease from the industry peak of 458.3 million cubic yards in 2005.

Asphalt Paving Mix

Asphalt paving mix is the most common roadway material used today. It is a versatile and essential building material that has been used to surface 93% of the more than 2.6 million miles of paved roadways in the United States, according to National Asphalt Pavement Association (“NAPA”).

9

Table of Contents

Typically, asphalt paving mix is placed in three distinct layers to create a flexible pavement structure. These layers consist of a base course, an intermediate or binder course, and a surface or wearing course. These layers vary in thicknesses of three to six inches for base mix, two to four inches for intermediate mix and one to two inches for surface mix.

According to NAPA, the components of asphalt paving mix by weight are approximately 95% aggregates and 5% asphalt cement, a petroleum based product that serves as the binder. The ingredients are then metered, mixed and heated to a temperature in excess of 300°F before being placed in a truck and delivered to the jobsite for final placement.

Asphalt pavement is generally 100% recyclable and reusable and is the most reused and recycled pavement material in the United States. Reclaimed asphalt pavement can be incorporated into new pavement at replacement rates in excess of 30% depending upon the mix and the application of the product. We actively engage in the recycling of previously used asphalt pavement and concrete. This material is crushed and repurposed in the construction cycle. Approximately 68.3 million tons of used asphalt is recycled annually by the industry according to a December 2013 National Asphalt Pavement Association survey.

The use of warm mix asphalt (“WMA”) or “green” asphalt is gaining popularity. The immediate benefit to producing WMA is the reduction in energy consumption required by burning fuels to heat traditional hot mix asphalt (“HMA”) to temperatures in excess of 300°F at the production plant. These high production temperatures are needed to allow the asphalt binder to become viscous enough to completely coat the aggregate in the HMA, have good workability during laying and compaction, and durability during traffic exposure. According to the Federal Highway Administration, WMA can reduce the temperature by 50 to 70°F, resulting in lower emissions, fumes and odors generated at the plant and the paving site.

According to NAPA, there are approximately 4,000 asphalt paving mix plants in the United States and an estimated 350.7 million tons of asphalt paving mix was produced in 2013 which was broadly in line with the estimated 360.3 million tons produced in 2012.

Our Operations

We operate our construction materials and products and paving and related services businesses through local operations and marketing teams, which work closely with our end customers to deliver the products and services that meet each customer’s specific needs for a project. We believe that this strong local presence gives us a competitive advantage by keeping our costs low and allowing us to obtain a unique understanding for the evolving needs of our customers.

We have operations in 17 U.S. states and in British Columbia, Canada. Our business in each region is vertically-integrated. We supply aggregates internally for the production of cement, ready-mixed concrete and asphalt paving mix and a significant portion of our asphalt paving mix is used internally by our paving and related services businesses. In the year ended December 27, 2014, approximately 70% of our aggregates production was sold directly to outside customers with the remaining amount being further processed by us and sold as a downstream product. In addition, we operate a municipal waste landfill and a construction and demolition debris landfill in our Central region, and we have liquid asphalt terminal operations in our East region.

Approximately 82% of our asphalt paving mix was installed by our paving and related services businesses in the year ended December 27, 2014. We charge a market price and competitive margin at each stage of the production process in order to optimize profitability across our operations. Our production value chain is illustrated as follows:

10

Table of Contents

Construction Materials

We are a leading provider of construction materials in the markets we serve. Our construction materials operations are composed of aggregates production, including crushed stone and construction sand and gravel, cement and ready-mixed concrete production and asphalt paving mix production.

Our Aggregates Operations

Aggregates Products

We mine limestone, gravel, and other natural resources from 84 crushed stone quarries and 50 sand and gravel deposits throughout the United States and in British Columbia, Canada. Aggregates are produced mainly from blasting hard rock from quarries and then crushing and screening it to various sizes to meet our customers’ needs. The production of aggregates also involves the extraction of sand and gravel, which requires less crushing, but still requires screening for different sizes. Aggregate production utilizes capital intensive heavy equipment which includes the use of loaders, large haul trucks, crushers, screens and other heavy equipment at quarries.

Once extracted, the minerals are processed and/or crushed on site into crushed stone, concrete and masonry sand, specialized sand, pulverized lime or agricultural lime. The minerals are processed to meet customer specifications or to meet industry standard sizes. Crushed stone is used primarily in ready-mixed concrete, asphalt paving mix, and the construction of road base for highways.

Our extensive network of quarries, plants and facilities, located throughout our three regions, enables us to have a nearby operation to meet the needs of customers in each of our markets.

Aggregates Reserves

Our December 27, 2014 estimate of 2.1 billion tons of proven and probable reserves of recoverable stone, and sand and gravel of suitable quality for economic extraction is based on drilling and studies by geologists and engineers, recognizing reasonable economic and operating restraints as to maximum depth of extraction and permit or other restrictions.

Reported proven and probable reserves include only quantities that are owned or under lease, and for which all required zoning and permitting have been obtained. Of the 2.1 billion tons of proven and probable aggregates reserves, 1.1 billion, or 51%, are located on owned land and 1.0 billion are located on leased land.

Aggregates Sales and Marketing

The cost of transportation from each quarry and the proximity of competitors are key factors that determine the effective market area for each quarry. Each quarry location is unique with regards to demand for each product, proximity to competition and distribution network. Each of our aggregates operations is responsible for the sale and marketing of its aggregates products. Approximately 70% of our aggregates production is sold directly to outside customers and the remaining amount is further processed by us and sold as a downstream product. Even though aggregates are a commodity product, we work to optimize pricing depending on the site location, availability of particular product, customer type, project type and haul cost. We sell aggregates to internal downstream operations at market prices.

Aggregates Competition

The U.S. aggregate industry is highly fragmented with numerous participants operating in localized markets. The February 2014 U.S. Geological Survey reported that a total of 1,550 companies operating 4,000 quarries and 91 underground mines produced or sold crushed stone in 2013 in the United States. This fragmentation is a result of the cost of transporting aggregates, which typically limits producers to a market area within approximately 40 miles of their production facilities.

The primary national players are large vertically-integrated companies, including Vulcan Materials Company, Martin Marietta Materials, Inc., CRH plc, Heidelberg, Lafarge North America Inc. and Cemex, S.A.B. de C.V., that have a combined estimated market share of approximately 30%.

Competitors by region include:

| • | West—CRH plc, Heidelberg Cement plc, Martin Marietta, CEMEX, S.A.B. de C.V., Lafarge and various local suppliers. |

| • | Central—Martin Marietta Materials, Inc., CRH plc, Holcim (US) Inc. and various local suppliers. |

| • | East—CRH plc, Heidelberg Cement plc, Vulcan Materials Company and various local suppliers. |

We believe we have a strong competitive advantage in aggregates through our well located reserves in key markets, high quality reserves and our logistic networks. We further share and implement best practices relating to safety, strategy, sales and marketing,

11

Table of Contents

production, and environmental and land management. As a result of our vertical integration and local market knowledge, we have a strong understanding of the needs of our aggregates customers. In addition, our companies have a reputation for responsible environmental stewardship and land restoration, which assists us in obtaining new permits and new reserves.

Our Cement Operations

Cement Products

We operate a highly-efficient, technologically-advanced integrated cement manufacturing and distribution system located near Hannibal, Missouri, 100 miles north of St. Louis along the Mississippi River. We also operate an on-site waste fuel processing facility, which can reduce fuel costs for the plant by up to 50%. Our cement plant is one of only 12 with hazardous waste fuel facilities permitted and operating out of 98 total cement plants in the United States. Our cement plant’s potential capacity is 1.25 million tons per annum. Our cement plant is subject to the HWC-MACT standards. See “—Our Industry—Cement.”

Cement Markets

Cement is a product that is costly to transport. Consequently, the radius within which a typical cement plant is competitive extends for only up to 150 miles from any shipping/distribution point. Cement is distributed to local customers primarily by truck from our Hannibal plant and distribution terminals in St. Louis, Missouri and Bettendorf, Iowa. We also transport cement by inland waterway barges on the Mississippi River to our storage and distribution terminals. In 2014, approximately 8% of our cement sales were delivered by barge. Our location on the Mississippi River extends our market beyond the typical 150 miles, as barge transport is more cost effective than trucking or moving by rail. Our traditional markets include eastern Missouri, southeastern Iowa and central/northwestern Illinois.

Cement Sales and Marketing

Our cement customers are ready-mixed concrete and concrete products producers and contractors within our markets. Sales are made on the basis of competitive prices in each market and, as is customary in the industry, we do not typically enter into long-term sales contracts.

Cement Competition

Construction of cement production facilities is highly capital intensive and requires long lead times to complete engineering design, obtain regulatory permits, acquire equipment and construct a plant. Most U.S. cement producers are owned by large foreign companies operating in multiple international markets. Our largest competitors include Holcim (US) Inc., and Lafarge North America Inc., whose parent companies announced a merger plan in April 2014 that would create the world’s largest cement maker, in addition to Buzzi Unicem USA, Inc. and Eagle Materials Inc. Competitive factors include price, reliability of deliveries, location, quality of cement and support services. With a new cement plant, on-site raw material aggregate supply, a network of cement terminals, and longstanding customer relationships, we believe we are well positioned to serve our customers.

Our Ready-mixed Concrete Operations

Ready-mixed Concrete Products

We believe our West and Central regions are leaders in the supply of ready-mixed concrete in their respective markets. The West region has ready-mixed concrete operations in the Houston and Midland/Odessa, Texas, Salt Lake Valley, Utah, Twin Falls, Idaho and Grand Junction, Colorado markets. Our Central region supplies ready-mixed concrete to the Wichita, Kansas and Columbia, Missouri markets and surrounding areas. We produce ready-mixed concrete by blending aggregates, cement, chemical admixtures in various ratios and water at our concrete production plants.

Our aggregates business serves as the primary source of the raw materials for our concrete production, functioning essentially as a supplier to our ready-mixed concrete operations. Different types of concrete include lightweight concrete, high performance concrete, self-compacting/consolidating concrete and architectural concrete and are used in a variety of activities ranging from building construction to highway paving.

We operated 41 ready-mixed concrete plants and 375 concrete delivery trucks in the West region and 23 ready-mixed concrete plants and 229 concrete delivery trucks in the Central region as of December 27, 2014.

12

Table of Contents

Ready-mixed Concrete Competition

Ready-mixed concrete production requires relatively small amounts of capital to build a concrete batching plant and acquire delivery trucks. As a result, in each local market, we face competition from numerous small producers, as well as other large vertically-integrated companies with facilities in multiple markets. There are approximately 5,500 ready-mixed concrete plants in the United States, and in 2013 the U.S. ready-mixed concrete industry produced approximately 300.9 million cubic yards of ready-mixed concrete according to the NRMCA.

Our ready-mixed concrete operations compete with CEMEX, S.A.B. de C.V. in Texas and CRH plc in Utah and Colorado and various other privately owned competitors in other parts of the West and Central regions.

Competition among ready-mixed concrete suppliers is generally based on product characteristics, delivery times, customer service and price. Product characteristics such as tensile strength, resistance to pressure, durability, set times, ease of placing, aesthetics, workability under various weather and construction conditions as well as environmental effect are the main criteria that our customers consider for selecting their product. Our quality assurance program produces results in excess of design strengths while optimizing material costs. Additionally, we believe our strategic network of locations and superior customer service gives us a competitive advantage relative to other producers.

Our Asphalt Paving Mix Operations

Asphalt Paving Mix Products

Our asphalt paving mix products are produced by first heating carefully measured amounts of aggregates at high temperatures to remove the moisture from the materials in an asphalt paving mix plant. As the aggregates are heated, liquid asphalt is then introduced to coat the aggregates. Depending on the specifications of a particular mix, recycled asphalt may be added to the mix, which lowers the production costs. The aggregates used for production of these products are generally supplied from our quarries or sand and gravel plants. The ingredients are metered, mixed and brought up to a temperature in excess of 300°F before being placed in a truck and delivered to the jobsite for final placement.

As of December 27, 2014, we operated 20 asphalt paving mix plants in the West region, five plants in the Central region and 14 plants in the East region. Approximately 93% of our plants can utilize recycled asphalt pavement.

Asphalt Paving Mix Sales and Marketing

Approximately 82% of the asphalt paving mix we produce is installed by our own paving crews. The rest is sold on a per ton basis to road contractors for the construction of roads, driveways and parking lots, as well as directly to state departments of transportation and local agencies.

Asphalt Paving Mix Competition

According to NAPA, there are approximately 4,000 asphalt paving mix plants in the United States and an estimated 350.7 million tons of asphalt paving mix was produced in 2013. Our asphalt paving mix operations compete with CRH plc and other local suppliers in each of our three regions. Based on availability of internal aggregate supply, quality, operating efficiencies, and location advantages, we believe we are well positioned vis-à-vis our competitors.

Asphalt paving mix is generally applied at high temperatures. Prolonged exposure to air causes the mix to lose temperature and harden. Therefore, delivery is typically within close proximity to the asphalt paving mix plant. Local market demand, proximity to competition, transportation costs and supply of aggregates and liquid asphalt vary widely from market to market. Most of our asphalt operations use a combination of company-owned and hired haulers to deliver materials to job sites.

Asphalt Paving and Related Services

As part of our vertical integration strategy, we provide asphalt paving and related services to both the private and public infrastructure sectors as either a prime or sub-contractor. These services complement our construction materials and products businesses by providing a reliable downstream outlet, in addition to our external distribution channels.

Our asphalt paving and related services businesses bid on both private construction and public infrastructure projects in their respective local markets. We only provide paving and related services operations as a complement to our construction materials operation, which we believe is a major competitive strength. Factors affecting competitiveness in this business segment include price, estimating abilities, knowledge of local markets and conditions, project management, financial strength, reputation for quality and the availability of machinery and equipment.

Contracts with our customers are primarily fixed unit price or fixed price. Under fixed unit price contracts, we provide materials or services at fixed unit prices (for example, dollars per ton of asphalt placed). While the fixed unit price contract shifts the risk of estimating the quantity of units required for a particular project to the customer, any increase in our unit cost over the bid amount, whether due to inflation, inefficiency, errors in our estimates or other factors, is borne by us unless otherwise provided in the contract. Most of our contracts contain escalators for increases in liquid asphalt prices.

13

Table of Contents

Customers

Our business is not dependent on any single customer or a few customers. Therefore, the loss of any single or particular small number of customers would not have a material adverse effect on any individual respective market in which we operate or on us as a whole. No individual customer accounted for more than 10% of our 2014 revenue.

Seasonality

Use and consumption of our products fluctuate due to seasonality. Nearly all of the products used by us, and by our customers, in the private construction or public infrastructure industries are used outdoors. Our highway operations and production and distribution facilities are also located outdoors. Therefore, seasonal changes and other weather-related conditions, in particular extended rainy and cold weather in the spring and fall and major weather events, such as hurricanes, tornadoes, tropical storms and heavy snows, can adversely affect our business and operations through a decline in both the use of our products and demand for our services. In addition, construction materials production and shipment levels follow activity in the construction industry, which typically occurs in the spring, summer and fall. Warmer and drier weather during the second and third quarters of our fiscal year typically result in higher activity and revenue levels during those quarters. The first quarter of our fiscal year has typically lower levels of activity due to weather conditions.

Backlog

Our products are generally delivered upon receipt of orders or requests from customers, or shortly thereafter. Accordingly, the backlog associated with product sales is converted into revenue within a relatively short period of time. Inventory for products is generally maintained in sufficient quantities to meet rapid delivery requirements of customers. Therefore, a period over period increase or decrease of backlog does not necessarily result in an improvement or a deterioration of our business. Our backlog includes only those products and projects for which we have obtained a purchase order or a signed contract with the customer and does not include products purchased and sold or services awarded and provided within the period.

Our paving and related services backlog represents our estimate of revenue that will be realized under the applicable contracts. We generally include a project in backlog at the time it is awarded and funding is in place. Many of our paving and related services are awarded and completed within one year and therefore may not be reflected in our beginning or ending contract backlog. Historically, we have not been materially adversely affected by contract cancellations or modifications. However, in accordance with applicable contract terms, substantially all contracts in our backlog may be cancelled or modified by our customers.

As a vertically-integrated business, approximately 30% of our aggregates sales volume was further processed and sold as a downstream product, such as ready-mixed concrete or asphalt paving mix, or used in our paving and related services business, and approximately 82% of the asphalt paving mix we sold was installed by our own paving crews during the year ended December 27, 2014. The following table sets forth our backlog as of the indicated dates:

| (in thousands) | December 27, 2014 |

December 28, 2013 |

December 29, 2012 |

|||||||||

| Aggregate (in tons) |

4,853 | 5,153 | 3,881 | |||||||||

| Ready-mixed concrete (in cubic yards) |

260 | 138 | 155 | |||||||||

| Asphalt (in tons) |

2,112 | 2,387 | 2,314 | |||||||||

| Construction services (1) |

$ | 301,333 | $ | 359,263 | $ | 288,673 | ||||||

| (1) | The dollar value of the construction services backlog includes the value of the aggregate and asphalt tons and ready-mixed concrete cubic yards in backlog that are expected to be sourced internally. |

Intellectual Property

We do not own or have a license or other rights under any patents that are material to our business.

Employees

As of December 27, 2014 we had approximately 3,990 employees, of whom approximately 78% were hourly workers and the remainder were salaried employees. Because of the seasonal nature of our industry, many of our hourly and certain of our full time employees are subject to seasonal layoffs. The scope of layoffs varies greatly from season to season as they are predominantly a function of the type of projects in process and the weather during the late fall through early spring.

14

Table of Contents

Approximately 6.9% of our hourly employees and approximately 0.3% of our full time salaried employees are union members. We believe we enjoy a satisfactory working relationship with our employees and their unions.

Environmental and Government Regulation

We are subject to federal, state, provincial and local laws and regulations relating to the environment and to health and safety, including noise, discharges to air and water, waste management including the management of hazardous waste used as a fuel substitute at our Hannibal, Missouri cement kiln, remediation of contaminated sites, mine reclamation, operation and closure of landfills and dust control and to zoning, land use and permitting. Our failure to comply with such laws and regulations can result in sanctions such as fines or the cessation of part or all of our operations. From time to time, we may also be required to conduct investigation or remediation activities. There also can be no assurance that our compliance costs associated with such laws and regulations or activities will not be significant.

In addition, our operations require numerous governmental approvals and permits. Environmental operating permits are subject to modification, renewal and revocation and can require us to make capital, maintenance and operational expenditures to comply with the applicable requirements. Stricter laws and regulations, or more stringent interpretations of existing laws or regulations, may impose new liabilities on us, reduce operation hours, require additional investment by us in pollution control equipment or impede our opening new or expanding existing plants or facilities. We regularly monitor and review our operations, procedures and policies for compliance with existing environmental laws and regulations, changes in interpretations of existing laws and enforcement policies, new laws that are adopted, and new requirements that we anticipate will be adopted that could affect our operations.

Multiple permits are required for our operations, including those required to operate our cement plant. Applicable permits may include conditional use permits to allow us to operate in certain areas absent zoning approval and operational permits governing, among other matters, air and water emissions, dust, particulate matter and storm water management and control. In addition, we are often required to obtain bonding for future reclamation costs, most commonly specific to restorative grading and seeding of disturbed surface areas. As of December 27, 2014, we believe we were in substantial compliance with the permitting requirements that are material to the operation of our business.

Like others in our industry, we expend substantial amounts to comply with applicable environmental laws and regulations and permit limitations, which include amounts for pollution control equipment required to monitor and regulate emissions into the environment. Since many of these requirements are likely to be affected by future legislation or rule making by government agencies, and are therefore not quantifiable, it is not possible to accurately predict the aggregate future costs of compliance and their effect on our future results of operations, financial condition or liquidity.

At most of our quarries, we incur reclamation obligations as part of our mining activities. Reclamation methods and requirements can vary depending on the individual site and state regulations. Generally, we are required to grade the mined properties to a certain slope and seed the property to prevent erosion. We record a mining reclamation liability in our consolidated financial statements to reflect the estimated fair value of the cost to reclaim each property including active and closed sites.

Our operations in Kansas include one municipal waste landfill and two construction and demolition debris landfills, one of which has been closed. Among other environmental, health and safety requirements, we are subject to obligations to appropriately close those landfills at the end of their useful lives and provide for appropriate post-closure care. Asset retirement obligations relating to these landfills are recorded in our consolidated financial statements.

Health and Safety

Our facilities and operations are subject to a variety of worker health and safety requirements, particularly those administered by the federal Occupational Safety and Health Administration (“OSHA”) and Mine Safety and Health Administration (“MSHA”), which may become stricter in the future. Throughout our organization, we strive for a zero-incident safety culture and full compliance with safety regulations. Failure to comply with these requirements can result in sanctions such as fines and penalties and claims for personal injury and property damage. These requirements may also result in increased operating and capital costs in the future. We cannot guarantee that violations of such requirements will not occur, and any violations could result in additional costs.

Worker safety and health matters are overseen by our corporate risk management and safety department as well as operating company level safety managers. We provide leadership and support, comprehensive training, and other tools designed to accomplish health and safety goals, reduce risk, eliminate hazards, and ultimately make our work places safer.

15

Table of Contents

Insurance

Our insurance program is structured using multiple “A” rated insurance carriers, and a variety of deductible amounts. In particular, our workers compensation, general liability and auto liability policies are subject to a $500,000 per occurrence deductible. Losses within these deductibles are accrued for using projections based on past loss history.

We also maintain $50.0 million in combined umbrella insurance. Other policies have smaller deductibles and include property, contractors equipment, contractors pollution and professional, directors and officers, employment practices liability and fiduciary and crime. We also have a separate marine insurance policy for our cement business, which is located adjacent to the Mississippi River and ships cement on the river via barge.

| ITEM 1A. | RISK FACTORS |

Risks Related to Our Industry and Our Business

Industry Risks

Our business depends on activity within the construction industry and the strength of the local economies in which we operate.

We sell most of our construction materials and products and provide all of our paving and related services to the construction industry, so our results are significantly affected by the strength of the construction industry. Demand for our products, particularly in the residential and nonresidential construction markets, could decline if companies and consumers cannot obtain credit for construction projects or if the slow pace of economic activity results in delays or cancellations of capital projects. In addition, federal and state budget issues may continue to hurt the funding available for infrastructure spending, particularly highway construction, which constitutes a significant portion of our business.

Our earnings depend on the strength of the local economies in which we operate because of the high cost to transport our products relative to their price. In recent years, many states have reduced their construction spending due to budget shortfalls resulting from lower tax revenue as well as uncertainty relating to long-term federal highway funding. As a result, there has been a reduction in many states’ investment in infrastructure spending. If economic and construction activity diminishes in one or more areas, particularly in our top revenue-generating markets of Texas, Kansas, Kentucky, Utah and Missouri, our results of operations and liquidity could be materially adversely affected, and there is no assurance that reduced levels of construction activity will not continue to affect our business in the future.

Our business is cyclical and requires significant working capital to fund operations.

Our business is cyclical and requires that we maintain significant working capital to fund our operations. Our ability to generate sufficient cash flow depends on future performance, which will be subject to general economic conditions, industry cycles and financial, business and other factors affecting our operations, many of which are beyond our control. If we are unable to generate sufficient cash to operate our business and service our outstanding debt and other obligations, we may be required, among other things, to further reduce or delay planned capital or operating expenditures, sell assets or take other measures, including the restructuring of all or a portion of our debt, which may only be available, if at all, on unsatisfactory terms.

Weather can materially affect our business, and we are subject to seasonality.

Nearly all of the products we sell and the services we provide are used or performed outdoors. Therefore, seasonal changes and other weather-related conditions can adversely affect our business and operations through a decline in both the use and production of our products and demand for our services. Adverse weather conditions such as extended rainy and cold weather in the spring and fall can reduce demand for our products and reduce sales or render our contracting operations less efficient. Major weather events such as hurricanes, tornadoes, tropical storms and heavy snows with quick rainy melts could adversely affect sales in the near term.

Construction materials production and shipment levels follow activity in the construction industry, which typically occurs in the spring, summer and fall. Warmer and drier weather during the second and third quarters of our fiscal year typically result in higher activity and revenue levels during those quarters. The first quarter of our fiscal year has typically lower levels of activity due to the weather conditions. Our second quarter varies greatly with spring rains and wide temperature variations. A cool wet spring increases drying time on projects, which can delay sales in the second quarter, while a warm dry spring may enable earlier project startup.

Our industry is capital intensive and we have significant fixed and semi-fixed costs. Therefore, our earnings are sensitive to changes in volume.

The property and machinery needed to produce our products can be very expensive. Therefore, we need to spend a substantial amount of capital to purchase and maintain the equipment necessary to operate our business. Although we believe that our current

16

Table of Contents

cash balance, along with our projected internal cash flows and our available financing resources, will provide sufficient cash to support our currently anticipated operating and capital needs, if we are unable to generate sufficient cash to purchase and maintain the property and machinery necessary to operate our business, we may be required to reduce or delay planned capital expenditures or incur additional debt. In addition, given the level of fixed and semi-fixed costs within our business, particularly at our cement production facility, decreases in volumes could negatively affect our financial position, results of operations and liquidity.

Within our local markets, we operate in a highly competitive industry.

The U.S. construction aggregates industry is highly fragmented with a large number of independent local producers in a number of our markets. Additionally, in most markets, we compete against large private and public infrastructure companies, some of which are also vertically-integrated. Therefore, there is intense competition in a number of the markets in which we operate. This significant competition could lead to lower prices, lower sales volumes and higher costs in some markets, negatively affecting our financial position, results of operations and liquidity. Further, the lack of availability of skilled labor, such as truck drivers, may require us to increase compensation or reduce deliveries, which could negatively affect our financial position, results of operations and liquidity.

Growth Risks

The success of our business depends, in part, on our ability to execute on our acquisition strategy, to successfully integrate acquisitions and to retain key employees of our acquired businesses.

A significant portion of our historical growth has occurred through acquisitions and we will likely enter into acquisitions in the future. We are presently evaluating, and we expect to continue to evaluate on an ongoing basis, possible acquisition transactions. We are presently engaged, and at any time in the future we may be engaged, in discussions or negotiations with respect to possible acquisitions. We regularly make, and we expect to continue to make, non-binding acquisition proposals, and we may enter into letters of intent, in each case allowing us to conduct due diligence on a confidential basis. To successfully acquire a significant target, we may need to raise additional equity capital and indebtedness. There can be no assurance that we will enter into definitive agreements with respect to any contemplated transactions or that they will be completed. Our growth has placed, and will continue to place, significant demands on our management and operational and financial resources. Acquisitions involve risks that the businesses acquired will not perform as expected and that business judgments concerning the value, strengths and weaknesses of businesses acquired will prove incorrect.

Acquisitions may require integration of the acquired companies’ sales and marketing, distribution, engineering, purchasing, finance and administrative organizations. We may not be able to integrate successfully any business we may acquire or have acquired into our existing business and any acquired businesses may not be profitable or as profitable as we had expected. Our inability to complete the integration of new businesses in a timely and orderly manner could increase costs and lower profits. Factors affecting the successful integration of acquired businesses include, but are not limited to, the following:

| • | We may become liable for certain liabilities of any acquired business, whether or not known to us. These risks could include, among others, tax liabilities, product liabilities, environmental liabilities and liabilities for employment practices, and they could be significant. |

| • | Substantial attention from our senior management and the management of the acquired business may be required, which could decrease the time that they have to service and attract customers. |

| • | We may not effectively utilize new equipment that we acquire through acquisitions or otherwise at utilization and rental rates consistent with that of our existing equipment. |

| • | The complete integration of acquired companies depends, to a certain extent, on the full implementation of our financial systems and policies. |

| • | We may actively pursue a number of opportunities simultaneously and we may encounter unforeseen expenses, complications and delays, including difficulties in employing sufficient staff and maintaining operational and management oversight. |