Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - KIRBY CORP | ex31_2.htm |

| EX-32 - EXHIBIT 32 - KIRBY CORP | ex32.htm |

| EX-3.2 - EXHIBIT 3.2 - KIRBY CORP | ex3_2.htm |

| EX-21.1 - EXHIBIT 21.1 - KIRBY CORP | ex21_1.htm |

| EX-10.9 - EXHIBIT 10.9 - KIRBY CORP | ex10_9.htm |

| EX-23.1 - EXHIBIT 23.1 - KIRBY CORP | ex23_1.htm |

| EX-10.8 - EXHIBIT 10.8 - KIRBY CORP | ex10_8.htm |

| EX-10.14 - EXHIBIT 10.14 - KIRBY CORP | ex10_14.htm |

| EX-10.10 - EXHIBIT 10.10 - KIRBY CORP | ex10_10.htm |

| EXCEL - IDEA: XBRL DOCUMENT - KIRBY CORP | Financial_Report.xls |

| 10-K - KIRBY CORPORATION 10-K 12-31-2014 - KIRBY CORP | form10k.htm |

| EX-31.1 - EXHIBIT 31.1 - KIRBY CORP | ex31_1.htm |

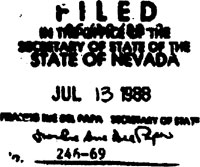

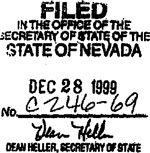

| ARTICLES OF INCORPORATION | ||||

| OF | ||||

| KIRBY JAMAICA, INC. | ||||

| FILED AT THE REQUEST OF | ||||

| C T Corporation 3 years | ||||

| P. O. Box 807 | ||||

| Dallas, Texas 75221 | ||||

| January 31, 1969 | ||||

| (date) | ||||

|

||||

| JOHN KOONTZ.Secretary of State | ||||

|

||||

| (by) deputy secretary of state | ||||

| No. | 246-69 |

| Filing Fee $ | 150.00 | |||

|

324 |

ARTICLES OF INCORPORATION

OF

KIRBY JAMAICA, INC.

FIRST: The name of the corporation is KIRBY JAMAICA, INC.

SECOND: Its principal office in the State of Nevada is located at One East First Street, Reno, Washoe County, Nevada. The name and address of its resident agent is The Corporation Trust Company of Nevada, One East First Street, Reno, Nevada.

THIRD: The Corporation may engage in any lawful activity including, by way of partial enumeration and not by way of limitation, the following:

To enter into, maintain, operate or carry on in any or all of its branches the business of exploring for, producing, developing, mining, processing, refining, treating, handling, marketing or dealing in, petroleum, oil, natural gas, asphalt, bituminous rock, sulphur and any and all other minerals, whether similar or dissimilar, and any and all products or by-products which may be derived from such substances, or any of them; and for all or any of such purposes to acquire, own, lease, operate or otherwise deal in or with oil or gas wells, tanks, storage facilities, gathering systems, pipelines, processing plants, mines, samplers, refineries, smelters, crushers, mills, wharves, watercraft, aircraft, tank cars, communication systems, machinery, equipment and any and all other kinds and types

of real or personal property that may in anywise be deemed necessary, convenient or advisable in connection with the carrying on of such business or any branch thereof.

To purchase, or otherwise acquire, or invest in, own, mortgage, pledge, sell, assign, transfer, or otherwise dispose of, in whole or in part, oil, gas and mineral leases and interests therein, fee lands, mineral interests in lands, mining claims, applications or options to acquire oil, gas or mineral leases, royalty interests, overriding royalty interests, net profits interests, production payments and any other interest in lands or any interest created by contract or otherwise which entitles the owner or owners thereof to participate in any way in, or obtain any advantage from, the production or sale of oil, gas or other minerals whether similar or dissimilar.

To transport oil, gas and other similar and dissimilar minerals, as well as any and all refinements and by-products thereof, and also any and all types and kinds of equipment, supplies, materials, machinery, goods, wares, and merchandise and property, and to buy, exchange, construct, contract for, lease and in any and all other ways acquire, take, hold, and own any and all required easements, transportation equipment and facilities, including gathering lines and pipelines, and to manage, maintain and operate the same, and to sell, mortgage, lease or otherwise dispose of the same.

To engage in the business of drilling, boring and sinking wells for the extraction and production of petroleum, gas and any other useful or valuable substances or products either for itself or for others through any type of contracts

or arrangements deemed beneficial to the corporation, and to manufacture, acquire, own, use, maintain and operate drilling rigs, derricks, drills, bits, casing, pipe, explosives and any articles, materials, machinery, equipment and property used for or in connection with the said business of the corporation.

To lay, construct, purchase or otherwise acquire, own, lease, develop, improve, maintain and operate a pipe line or pipe lines; to transport by means of such pipe line or pipe lines, natural gas, manufactured gas, combinations of natural gas and manufactured gas, petroleum, refined petroleum products, and all kinds of products and by-products of gas and oil whether purchased, produced or sold by the corporation or by others; and to sell, convey or otherwise dispose of such pipe line or pipe lines.

To conduct and engage in a scientific business, including prospecting, exploring and computing by electric, physical, mechanical and other means for the discovery and location in, upon or above the earth, and the detecting of oil, gas, rock, minerals and objects of every kind; and the conducting of research and scientific tests and experiments.

To engage in the business of managing, supervising and operating all types of oil, gas and mineral properties; to negotiate and consummate, for itself or for others, leases and contracts with respect to all such property; to enter into contracts and arrangements, either as principal or as agent, for the operation, conduct and improvement of any property managed, supervised or operated by the corporation; to furnish financial, management and other services to others; to purchase or otherwise acquire, own, use, improve,

maintain, sell, lease, or otherwise dispose of any articles, materials, machinery, equipment and property used for or in connection with the business of the corporation; and to engage in and conduct, or authorize, license, and permit others to engage in and conduct, any business, or activity incident, necessary, advisable, or advantageous to the ownership of oil, gas and other mineral properties managed, supervised or operated by the corporation.

To guarantee the payment of the principal of and interest upon notes, debentures, bonds, or other evidences of indebtedness, of any kind or character of any corporation, joint stock company, syndicate, association, firm, trust or person whatsoever.

To engage in any lawful activity and to manufacture purchase or otherwise acquire, invest in, own, mortgage, pledge, sell, assign and transfer or otherwise dispose of, trade, deal in and deal with goods, wares and merchandise and personal property of every class and description.

To hold, purchase and convey real and personal estate and to mortgage or lease any such real and personal estate with its franchises and to take the sane by devise or bequest.

To acquire, and pay for in cash, stock or bonds of this corporation or otherwise, the good will, rights, assets and property, and to undertake or assume the whole or any part of the obligations or liabilities of any person, firm, association or corporation.

To acquire, hold, use, sell, assign, lease, grant licenses in respect of, mortgage or otherwise dispose of letters patent of the United States or any foreign country

patent rights, licenses and privileges, inventions, improvements and processes, copyrights, trade-marks and trade names, relating to or useful in connection with any business of this corporation.

The objects and purposes specified in the foregoing clauses shall except where otherwise expressed, be in nowise limited or restricted by reference to, or inference from, the terms of any other clause in these articles of incorporation, but the objects and purposes specified in each of the foregoing clauses of this article shall be regarded as independent objects and purposes.

FOURTH: The amount of the total authorized capital stock of the corporation is One Million Dollars ($1,000,000.00) consisting of one million (1,000,000) shares of common stock of the par value of One Dollar ($1.00) each.

No stockholder of this corporation shall by reason of his holding shares of any class have any preemptive or preferential right to purchase or subscribe to any shares of any class of this corporation, now or hereafter to be authorized, or any notes, debentures, bonds, or other securities convertible into or carrying options or warrants to purchase shares of any class, now or hereafter to be authorized, whether or not the issuance of any such shares, or such notes, debentures, bonds or other securities, would adversely affect the dividend or voting rights of such stockholder, other than such rights, if any, as the Board of Directors, in its discretion from time to time may grant, and at such price as the Board of Directors in its discretion may fix; and the Board of Directors may issue shares

of any class of this corporation, or any notes, debentures, bonds, or other securities convertible into or carrying options or warrants to purchase shares of any class, without offering any such shares of any class either in whole or in part, to the existing stockholders of any class.

FIFTH: The governing board of this corporation shall be known as directors, and the number of directors may from time to time be increased or decreased in such manner as shall be provided by the by-laws of this corporation, provided that the number of directors shall not be reduced to less than three (3), except that in cases where all the shares of the corporation are owned beneficially and of record by either one or two stockholders, the number of directors may be less than three (3) but not less than the number of stockholders.

The names and post office addresses of the first board of directors, which shall be three (3) in number, are as follows:

| NAME | POST OFFICE ADDRESS | ||||||

| Jeff Montgomery | 1200 | First City National Bank Bldg. Houston, Texas | |||||

| Warren F. Johnston | 1200 | First City National Bank Bldg. Houston, Texas | |||||

| Paul W. pond | 1200 | First City National Bank Bldg. Houston, Texas | |||||

SIXTH: The capital shall not be subject to assessment to pay the debts of the corporation.

SEVENTH: The name and post office address of each of the incorporators signing the articles of incorporation are as follows:

| NAME | POST OFFICE ADDRESS | |||||

| D. R. Allen | Republic National Bank Building Dallas, Texas | |||||

| H. C. Broadt | Republic National Bank Building Dallas, Texas | |||||

| T. R. Bohannon | Republic National Bank Building Dallas, Texas | |||||

EIGHTH: The Corporation is to have perpetual existence.

NINTH: In furtherance, and not in limitation of the powers conferred by statute, the board of directors is expressly authorized:

Subject to the by-laws, if any, adopted by the stockholders, to make, alter or amend the by-laws of the corporation.

To fix the amount to be reserved as working capital over and above its capital stock paid in, to authorize and cause to be executed mortgages and liens upon the real and personal property of this corporation.

By resolution passed by a majority of the whole board, to designate one or more committees, each committee to consist of two or more of the directors of the corporation, which, to the extent provided in the resolution or in the by-laws of the corporation, shall have and may exercise the powers of the board of directors in the management of the business and affairs of the corporation, and may authorize the seal of the corporation to be affixed to all papers which may require it. Such committee or committees shall have such name or names as may be stated in the by-laws of the corporation or as may be determined from time to time by resolution adopted by the board of directors.

When and as authorized by the affirmative vote of

stockholders holding stock entitling them to exercise a majority of the voting power given at a stockholder’s meeting called for that purpose, or when authorized by the written consent of the holders of a majority of the voting stock issued and outstanding, the board of directors shall have power and authority at any meeting to sell, lease or exchange all of the property and assets of the corporation, including its good will, and its corporate franchises, upon such terms and conditions as its board of directors deem expedient and for the best Interests of the corporation. No vote or consent of the stockholders, however, shall be required for a transfer of assets by way of mortgage or in trust or in pledge to secure indebtedness of the corporation.

TENTH: Meetings of stockholders and directors may be held outside the State of Nevada in the manner provided for by the by-laws. The books of the corporation may be kept (subject to any provision contained in the statutes) outside the State of Nevada at such place or places as may be designated from time to time by the board of directors or in the by-laws of the corporation.

ELEVENTH: No contract or other transaction between the corporation and any other corporation and no other act of the corporation shall, in the absence of fraud, be invalidated or in any way affected by the fact that any of the directors of the corporation are pecuniarily or otherwise interested in such contract, transaction or other act, or are directors or officers of such other corporation. Any director of the corporation, individually, or any firm or

association of which any such director may be a member, may be a party to, or may be pecuniarily or otherwise interested, in, any contract or transaction of the corporation, provided that the fact that he individually or such firm or association is so interested shall be disclosed or shall have been known to the Board of Directors or a majority of such members thereof as shall be present at any meeting of the Board of Directors at which action upon any such contract or transaction shall be taken; and any director of the corporation who is a director or officer of such other corporation or who is so interested may be counted in determining the existence of a quorum at any meeting of the Board of Directors which shall authorize any such contract or transaction, and may vote thereat to authorize any such contract or transaction with like force and effect as if he were not such director or officer of such other corporation or not so interested, every director of the corporation being hereby relieved from any disability which might other wise prevent him from carrying out transactions with or contracting with the corporation for the benefit of himself or any firm, corporation, association, trust or organization in which or with which he may be in anywise interested or connected.

TWELFTH: All of this corporation’s directors and officers and former directors and officers and all persons who may have served at this corporation’s request as a director or officer of another corporation in which this corporation owns shares of capital stock or of which this

corporation is a creditor, shall be indemnified against expenses actually and necessarily incurred by them in connection with the defense of any action, suit or proceeding in which they, or any of them, are made parties, or a party, by reason of being or having been directors or officers or a director or officer of this corporation [ILLEGIBLE], of such other corporation, except in relation to matters as to which any such director or officer or for [ILLEGIBLE] or director or officer or person shall be adjudged in such action, suit or proceeding to be liable for negligence or misconjust. The foregoing right to indemnity shall Include reimbursement of amounts and expenses paid or incurred in settlement of any such action, suite or proceeding if settlement thereof or a plea of nolo contendere (or other plea of substantially the same Import and effect) in the opinion of counsel for this corporation appears to be in the interest of this corporation. Such indemnification shall not be deemed exclusive of any other rights to which those indemnified may be entitled by law or under any by-laws, agreement, vote of stockholders or otherwise.

THIRTEENTH: This corporation reserves the right to amend, alter, change or repeal any provision contained in the articles of incorporation, in the manner now or hereafter prescribed by statute, or by the articles of Incorporation, and all rights conferred upon stockholders herein are granted subject to this reservation.

WE, THE UNDERSIGNED, being each of the incorporators hereinbefore named, for the purpose of forming a corporation pursuant to the General Corporation Law of the State of Nevada, do make and file these articles of

incorporation, hereby declaring; and certifying that the facts herein stated are true, and accordingly have here-unto set our hands this 29th day of January, 1969.

|

|

| D. R. Allen | |

|

|

| H. C. Broadt | |

|

|

| T. R. Bohannon |

| STATE OF TEXAS | X | |

| SS: | ||

| COUNTY OF DALLAS | X |

On this 29th day of January, 1969, before me, the undersigned, a Notary Public in and for the county and state aforesaid, personally appeared D. R. Allen, H. C. Broadt end T. R. Bohannon, known to me to be the persons described in and who executed the foregoing instrument and who acknowledged to me that they executed the same freely and voluntarily and for the uses and purposes therein mentioned.

IN WITNESS WHEREOF, I have hereunto set my hand and affixed my official seal the day and year in this certificate first above written.

|

|

| Notary Public | |

|

|

| (Seal) |

| CERTIFICATE OF AMENDMENT TO | ||||

| ARTICLES OF INCORPORATION OF |

||||

| KIRBY JAMAICA, INC. | ||||

|

||||

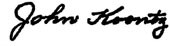

| FILED AT THE REOUEST OF | ||||

| Woodbum, Formon, Wedge, Blakey, Foloon & Hug | ||||

| Attorneys-at law | ||||

| One East First Street, Rano, Nevada 89501 | ||||

| June 7, 1992 | ||||

| (date) | ||||

|

||||

| JOHN KOONTZ Secretary of State | ||||

|

||||

| (by) deputy secretary of state | ||||

| No | 246-69 |

| Filing Fee $ | 15.00 | |||

|

324 |

|

CERTIFICATE OF AMENDMENT OF ARTICLES OF INCORPORATION OF KIRBY JAMAICA, INC. |

|

| Kirby Jamaica, Inc., a corporation organized under the laws of the State of Nevada, by its President and Assistant Secretary does hereby certify: | ||

| 1. That the Board of Directors of said corporation, at a meeting duly convened and held on the 2nd day of June, 1972, passed a resolution declaring that it is advisable and in the best interest of the Corporation that its Articles of Incorporation be amended as follows: | ||

| “RESOLVED, that Article First of said Articles of Incorporation be amended to read as follows: | ||

| “FIRST: The name of the corporation is Kirby Petroleum Co. of Jamaica.” | ||

| 2. That the number of shares outstanding and entitled to vote on an amendment to the Articles of Incorporation is 1,000 shares; that the said change by amendment has been consented to and authorized by the written consent of the shareholder holding at least a majority of each class of stock outstanding and entitled to vote thereon. | ||

| IN WITNESS WHEREOF, the said Kirby Jamaica, Inc. has caused this certificate to be signed by its President and its Assistant Secretary and its corporate seal to be hereto affixed this 2nd day of June, 1972. | ||

| KIRBY JAMAICA, INC. | ||

| By |  |

|

| Warren F. Johnston, President | ||

| By |  |

|

| Myron H. Newman, Assistant Secretary | ||

| STATE OF TEXAS | ) |

| COUNTY OF HARRIS | ) |

On this 2nd day of June, 1972, personally appeared before me, [ILLEGIBLE], a Notary Public in and for the county and state aforesaid, WARREN F. JOHNSTON and [ILLEGIBLE] known to me to be respectively the President and Assistant Secretary of KIRBY JAMAICA, INC., a corporation organized and existing under the laws of the State of Nevada, who executed the foregoing instrument on behalf of said corporation, and upon oath, did depose and say that he, the said WARREN F. JOHNSTON, is the President and that he, the said [ILLEGIBLE], is the Assistant Secretary of said corporation; that they are acquainted with the seal of said corporation and that the seal affixed to said instrument is the corporate seal of said corporation; that the signatures to said instrument were made by officers of said corporation as indicated after said signatures; and that the said corporation executed the said instrument freely and voluntarily and for the uses and purposes therein mentioned.

IN WITNESS WHEREOF, I have hereunto set my hand and affixed my official seal at my office in the County of Harris in the State of Texas, the day and year in this certificate first above written.

|

|

| Notary Public in and for | |

| Harris County, Texas |

My Commission Expires:

June 1, 1973

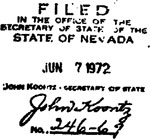

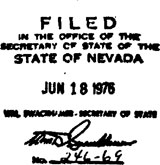

| CERTIFICATE OF AMENDMENT TO | ||||

| ARTICLES OF INCORPORATION | ||||

| OF | ||||

| KIRBY PETROLEUM CO. OF JAMAICA | ||||

| FILED AT THE REQUEST OF | ||||

| CT Corporation System | |||||||

| P.O. Box 807 | |||||||

| Dallas, Texas 75221 | |||||||

| January 20, 1975 | |||||||

| (date) | |||||||

|

|||||||

| Wm. D. SWACKHAMER, Secretary of State | |||||||

| (by) deputy secretary of state | |||||||

| No | 246-69 | ||||||

| Filing Fee $ | 20.00 | ||||||

|

324 | ||||||

CERTIFICATE OF AMENDMENT

OF

ARTICLES OF INCORPORATION

KIRBY PETROLEUM CO. OF JAMAICA, a corporation organized under the laws of the State of Nevada, by its president and ASST secretary, does hereby certify:

1. That the board of directors of said corporation at a meeting duly convened and held on the 14th day of November, 1974, passed a resolution declaring that the following change and amendment in the Articles of Incorporation is advisable.

RESOLVED that Article First of said Articles of Incorporation be amended to read as follows:

“First: The name of the corporation is KIRBY EXPLORATION COMPANY”.

2. That the number of shares of the corporation outstanding and entitled to vote on an amendment to the Articles of Incorporation is one thousand (1,000); that the said change and amendment has been consented to and authorized by the written consent of stockholders holding at least a majority of each class of stock outstanding and entitled to vote thereon.

IN WITNESS WHEREOF, the said KIRBY PETROLEUM CO. OF JAMAICA has caused this certificate to be signed by its president and its ASST secretary and its corporate seal to be hereto affixed this 18 day of November, 1974.

| KIRBY PETROLEUM CO. OF JAMAICA | ||

| By |  |

|

| President | ||

| By |  |

|

| Asst Secretary | ||

(SEAL)

| STATE OF TEXAS | ) |

| ) ss: | |

| COUNTY OF ILLEGIBLE | ) |

On [ILLEGIBLE] 18, 1774 personally appeared before me, a Notary Public, [ILLEGIBLE] and [ILLEGIBLE] who acknowledged that they executed the above instrument.

|

|

| (Notary Public) |

(SEAL)

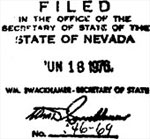

| CERTIFICATE OF AMENDMENT | ||

| TO | ||

| ARTICLES OF INCORPORATION | ||

| OF | ||

| KIRBY EXPLORATION COMPANY | ||

| FILED AT THE REQUEST OF | ||

| Woodbum, Formon, Wedge, Blakey, Folsom & Hug | ||

| Attorneys-at-Low | ||

| One East First Street, Rena, Nevada 89501 |

| JUN 13 1976 | ||||

| (date) | ||||

|

||||

| Wm. D. SWACKHAMER, Secretary of State | ||||

| (by) deputy secretary of state | ||||

| No | 246-69 |

| Filing Fees $ | 450.00 | |||

|

324 |

| CERTIFICATE OF AMENDMENT OF ARTICLES OF INCORPORATION |

|

KIRBY EXPLORATION COMPANY, a corporation organized under the laws of the State of Nevada, by its president and secretary, does hereby certify:

1. That the board of directors of said corporation by unanimous consent dated the 23rd day of March, 1976, passed a resolution declaring that the following changes and amendments in the Articles of Incorporation are advisable:

| RESOLVED, that Article Fourth of the Articles of Incorporation of this corporation be amended to read as follows: | |

| “FOURTH: The amount of the total authorized capital stock of the corporation is Four Million (4,000,000) shares of common Stock of the per value of $1.00 per share. | |

| “No stockholder of this corporation shall by reason of his holding shares of any class have any preemptive or preferential right to purchase or subscribe to any shares of any class of this corporation, now or hereafter to be authorized, or any notes, debentures, bonds or other securities convertible into or carrying options or warrants to purchase shares of any class, now or hereafter to be authorized, whether or not the issuance of any such shares, or such notes, debentures, bonds or other securities, would adversely affect the dividend or voting rights of such stockholder other than such rights, if any, as the Board of Directors in its discretion from time to time may grant, and at such price as the Board of Directors in its discretion may fix; and the Board of Directors may cause to be issued shares of any class of this corporation, or any notes, debentures, bonds or other securities convertible into or carrying options or warrants to purchase shares of any class without offering any such shares or other securities either in whole or in part to the existing stockholders of any class.” |

| RESOLVED, that the first paragraph of Article Fifth of the Articles of Incorporation of this corporation be amended to read as follows: | |

| “FIFTH: The members of the governing board shall be styled directors and the number thereof shall be not less than three (3) nor more than fifteen (15), the exact number to be fixed as provided by the by-laws of the corporation, provided, that the number so fixed as provided by the by-laws may be increased or decreased within the limit above specified from time to time as provided by the by-laws.” | |

| RESOLVED, that Article Twelfth of the Articles of Incorporation of this corporation be amended to read as follows: | |

| “TWELFTH: 1. The corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contandere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and that, with respect to any criminal action or proceeding, ha had reasonable cause to believe that his conduct was unlawful. | |

| “2. The corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with the defense or settlement of such action or suit if he acted in good |

| faith and in a manner which he reasonably believed to be in or not opposed to the best interest, of the corporation, but no indemnification shall be made in respect of any claim, issue or matter as to which such person has been adjudged to be liable for gross negligence or misconduct in the performance of his duty to the corporation unless and only to the extent that the court in which such action or suit was brought determines upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper. | |

| “3. To the extent that a director, officer, employee or agent of the corporation has been successful on the merits or otherwise in defense of any action suit or proceeding referred to in sections 1 and 2 of this Article Twelfth, or in defense of any claim, issue or matter therein, he shall be indemnified by the corporation against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with such defense. | |

| “4. Expenses incurred in defending a civil or criminal action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding as authorized by the Board of Directors in the specific case upon receipt of an undertaking by or on behalf of the director, officer, employee or agent to repay such amount unless it is ultimately determined that he is entitled to be indemnified by the corporation as authorized in this Article Twelfth. | |

| “5. The indemnification provided by this Article Twelfth: | |

| “(a) Does not exclude any other rights to which a person seeking indemnification may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office; and | |

| “(b) Shall continue as to a person who has caused to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such a person. | |

| “6. The corporation may purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against him and incurred by him in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify him against such liability under the provisions of this Article Twelfth.” |

2. That the number of shares of the corporation outstanding and entitled to vote on an amendment to the Articles of Incorporation is 1,000; that the number of shares voted for the amendment was 1,000; that the number of shares voted against the amendment was 0.

IN WITNESS WHEREOF, KIRBY EXPLORATION COMPANY has caused this certificate to be signed by its president and its secretary and its corporate seal to be hereto affixed this 23rd day of March, 1976.

| KIRBY EXPLORATION COMPANY | ||

| By |  |

|

| President | ||

| By |  |

|

| Secretary | ||

| (SEAL) | |

| STATE OF TEXAS | )( |

| )( | |

| COUNTY OF HARRIS | )( |

BEFORE ME, the undersigned, a Notary Public in and for said County and State, on this day personally appeared Robert R. Hillery and Myron H. Newman, who, being by me first duly sworn, declared that they are the president and secretary, respectively, of Kirby Exploration Company, that they signed the foregoing document as president and secretary, respectively, of the corporation, and that they executed the same as the act of such corporation for the purposes and consideration therein expressed, and in the capacity therein stated.

GIVEN UNDER MY HAND AND SEAL OF OFFICE this 23rd day of March, 1976.

|

|

| Notary Public in and for | |

| County, Texas |

My Commission Expires: June 1, 1977

| RESTATED | ||||

| ARTICLES OF INCORPORATION | ||||

| OF | ||||

| KIRBY EXPLORATION COMPANY | ||||

| FILED AT THE REQUEST OF | ||||

| Woodbum, Forman, Wedge, Blokey, Folsom & Hug | ||||

| Attorneys-of-Law | ||||

| One East First Street, Reno, Nevada 89501 | ||||

| JUN 18 [ILLEGIBLE] | ||||

| (date) | ||||

|

||||

| Wm. D. SWACKHAMER, Secretary of State | ||||

| (by) deputy secretary of state | ||||

| No | 246-69 |

| Filing Fee $ | 50.00 | ||

|

324 | ||

|

RESTATED ARTICLES OF INCORPORATION OF KIRBY EXPLORATION COMPANY |

|

FIRST: The name of the corporation is KIRBY EXPLORATION COMPANY.

SECOND: Its principal office in the State of Nevada is Located at One East First Street, Reno, Washoe County, Nevada. The name and address of its resident agent is The Corporation Trust Company of Nevada, One East First Street, Reno, Nevada.

THIRD: The corporation may engage in any lawful activity including, by way of partial enumeration and not by way of limitation, the following:

To enter into, maintain, operate or carry on in any or all of its branches the business of exploring for, producing, developing, mining, processing, refining, treating, handling, marketing or dealing in, petroleum, oil, natural gas, asphalt, bituminous rock, sulphur and any and all other minerals, whether similar or dissimilar, and any and all products or by-products which may be derived from such substances, or any of them; and for all or any of such purposes to acquire, own, lease, operate or otherwise deal in or with oil or gas wells, tanks, storage facilities, gathering systems, pipelines, processing plants, mines, samplers, refineries, smelters, crushers, mills, wharves, watercraft, aircraft, tank cars, communication systems, machinery, equipment and any and all other kinds and types of real or personal property that may in anywise be deemed necessary, convenient or advisable in connection with the carrying on of such business or any branch thereof.

To purchase, or otherwise acquire, or invest in, own, mortgage, pledge, sell, assign, transfer or otherwise dispose of, in whole or in part, oil, gas and mineral leases and interests therein, fee lands, mineral interests in lands, mining claims, applications or options to acquire oil, gas or mineral leases, royalty interests, overriding royalty interests, net profits interests, production payments and any other interest in lands or any interest created by contract or otherwise which entitles the owner or owners thereof to participate in any way in, or obtain any advantage from, the production or sale of oil, gas or other minerals whether similar or dissimilar.

To transport oil, gas and other similar and dissimilar minerals, as well as any and all refinements and by-products thereof, and also any and all types and kinds of equipment, supplies, materials, machinery, goods, wares, and merchandise and property, and to buy, exchange, construct, contract for, lease and in any and all other ways acquire, take, hold and own any and all required easements, transportation equipment and facilities, including gathering lines and pipelines, and to manage, maintain and operate the same, and to sell, mortgage, lease or otherwise dispose of the same.

To engage in the business of drilling, boring and sinking wells -for the extraction and production of petroleum, gas and any other useful or valuable substances or products either for itself or for others through any type of contracts or arrangements deemed beneficial to the corporation, and to manufacture, acquire, own, use, maintain and operate drilling rigs, derricks, drills, bits, casing, pipe, explosives and any articles, materials, machinery, equipment and property used for or in connection with the said business of the corporation.

To lay, construct, purchase or otherwise acquire, own, lease, develop, improve, maintain and operate a pipe line or pipe lines; to transport by means of such pipe line or pipe lines, natural gas, manufactured gas, combinations of natural gas and manufactured gas, petroleum, refined petroleum products, and all kinds of products and by-products of gas and oil whether purchased, produced or sold by the corporation or by others; and to sell, convey or otherwise dispose of such pipe line or pipe lines.

To conduct and engage in a scientific business, including prospecting, exploring and computing by electric, physical, mechanical and other means for the discovery and location in, upon or above the earth, and the detecting of oil, gas, rock, minerals and objects of every kind; and the conducting of research and scientific tests and experiments.

To engage in the business of managing, supervising and operating all types of oil, gas and mineral properties; to negotiate and consummate, for itself or for others, leases and contracts with respect to all such property; to enter into contracts and arrangements, either as principal or as agent, for the operation, conduct and improvement of any property managed, supervised or operated by the corporation; to furnish financial, management and other services to others; to purchase or otherwise acquire, own, use, improve, maintain, sell, lease or otherwise dispose of any articles, materials, machinery, equipment and property used for or in connection with the business of the corporation; and to engage in and conduct, or authorize, license and permit others to engage in and conduct any business or activity incident, necessary, advisable or

advantageous to the ownership of oil, gas and other wineral properties managed, supervised or operated by the corporation.

To guarantee the payment of the principal of and interest upon notes, debentures, bonds, or other evidences of indebtedness, of any kind or character, of any corporation, joint stock company, syndicate, association, firm, trust or person whatsoever.

To engage in any lawful activity and to manufacture, purchase or otherwise acquire, invest in, own, mortgage, pledge, sell, assign and transfer or otherwise dispose of, trade, deal in and deal with goods, wares, and merchandise and personal property of every class and description.

To hold, purchase and convey real and personal estate and to mortgage or lease any such real and personal estate with its franchises and to take the same by devise or bequest.

To acquire, and pay for in cash, stock or bonds of this corporation or otherwise, the good will, rights, assets and property, and to undertake or assume the whole or any part of the obligations or liabilities of any person, firm, association or corporation.

To acquire, hold, use, sell, assign, lease, grant licenses in respect of, mortgage or otherwise dispose of letters patent of the United states or any foreign country patent rights, licenses and privileges, inventions, improvements and processes, copyrights, trademarks and trade names, relating to or useful in connection with any business of this corporation.

The objects and purposes specified in the foregoing clauses shall except where otherwise expressed, be in nowise limited or restricted by reference to, or inference from, the

terms of any other clause in these Articles of Incorporation, but the objects and purposes specified in each of the foregoing clauses of this Article shall be regarded as independent objects and purposes.

FOURTH: The amount of the total authorized capital stock of the corporation is Four Million (4,000,000) shares of Common Stock of the par value of $1.00 per share.

No stockholder of this corporation shall by reason of his holding shares of any class have any preemptive or preferential right to purchase or subscribe to any shares of any class of this corporation, now or hereafter to be authorized, or any notes, debentures, bonds or other securities convertible into or carrying options or warrants to purchase shares of any class, now or hereafter to be authorized, whether or not the issuance of any such shares, or such notes, debentures, bonds or other securities, would adversely affect the dividend or voting rights of such stockholder other than such rights, if any, as the Board of Directors in its discretion from time to time may grant, and at such price as the Board of Directors in its discretion may fix; and the Board of Directors may cause to be issued shares of any class of this corporation, or any notes, debentures, bonds or other securities convertible into or carrying options or warrants to purchase shares of any class without offering any such shares or other securities either in whole or in part to the existing stockholders of any class.

FIFTH: The members of the governing board shall be styled directors and the number thereof shall be not less than three (3) nor more than fifteen (15), the exact number to be fixed as provided by the by-laws of the corporation, provided, that the number so fixed as provided by the by-laws may be increased or decreased within the limit above specified from time to time as provided by the by-laws.

The names and post office addresses of the first Board of Directors, which shall be three (3) in number, are as follows:

| NAME | POST OFFICE ADDRESS | |||||

| Jeff Montgomery | 1200 First City National Bank Bldg. Houston, Texas | |||||

| Warren F. Johnston | 1200 First City National Bank Bldg. Houston, Texas | |||||

| Paul W. Pond | 1200 First City National Bank Bldg. Houston, Texas | |||||

SIXTH: The capital shall not be subject to assessment to pay the debts of the corporation.

SEVENTH: The name and post office address of each of the incorporators signing the Articles of Incorporation are as follows :

| NAMe | POST OFFice ADDRESS | |||||

| D. R. Allen | Republic National Bank Building Dallas, Texas | |||||

| H. C. Broadt | Republic National Bank Building Dallas, Texas | |||||

| T. R. Bohannon | Republic National Bank Building Dallas, Texas | |||||

EIGHTH: The corporation is to have perpetual existence.

NINTH: In furtherance, and not in limitation of the powers conferred by statute, the Board of Directors is expressly authorized:

Subject to the by-laws, if any, adopted by the stockholders to make, alter or amend the by-laws of the corporation.

To fix the amount to be reserved as working capital over and above its capital stock paid in, to authorize and cause to be executed mortgages and liens upon the real and personal property of this corporation.

By resolution passed by a majority of the whole Board, to designate one or more committees, each committee to consist of two or more of the Directors of thecorporation which, to the extent provided in the resolution or in the by-laws of the corporation, shall have and may exercise the powers of the Board of Directors in the management of the business and affairs of the corporation, and my authorize the seal of the corporation to be affixed to all papers which may require it. Such committee or committees shall have such name or names as may be stated in the by-laws of the corporation or as may be determined from time to time by resolution adopted by the Board of Directors.

When and as authorized by the affirmative vote of stockholders holding stock entitling them to exercise a majority of the voting power given at a stockholders’ meeting called for that purpose, or when authorized by the written consent of the holders of a majority of the voting stock issued and outstanding, the Board of Directors shall have power and authority at any meeting to sell, lease or exchange all of the property and assets of the corporation, including its

good will, and its corporate franchises, upon such terms and conditions as its Board of Directors deems expedient and for the best interests of the corporation. No vote or consent of the stockholders, however, shall be required for a transfer of assets by way of mortgage or in trust or in pledge to secure indebtedness of the corporation.

TENTH: Meetings of stockholders and Directors may be held outside the State of Nevada in the manner provided for by the by-laws. The books of the corporation may be kept (subject to any provision contained in the statutes) outside the State of Nevada at such place or places as may be designated from time to time by the Board of Directors or in the by-laws of the corporation.

ELEVENTH: No contract or other transaction between the corporation and any other corporation and no other act of the corporation shall, in the absence of fraud, be invalidated or in any way affected by the fact that any of the Directors of the corporation are pecuniarily or otherwise interested in such contract, transaction or other act, or are directors or officers of such other corporation. Any Director of the corporation, individually, or any firm or association of which any such Director may be a member, may be a party to, or may be pecuniarily or otherwise interested in any contract or transaction of the corporation, provided that the fact that he individually or such firm or association is so interested shall be disclosed or shall have been known to the Board of Directors or a majority of such members thereof as shall be present at any meeting of the Board of Directors at which action upon any such contract or transaction shall be taken; and any Director of the corporation who is a director or

officer of such other corporation or who is so interested may be counted in determining the existence of a quorum at any meeting of the Board of Directors which shall authorize any such contract or transaction, and may vote thereat to authorize any such contract or transaction with like force and effect as if he were not such director or officer of such other corporation or not so interested, every Director of the corporation being hereby relieved from any disability which might otherwise prevent him from carrying out transactions with or contracting with the corporation for the benefit of himself or any firm, corporation, association, trust or organization in which or with which he may be in anywise interested or connected.

TWELFTH: 1. The corporation shall indemnify any person who was or is a party or is threatened. to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, Judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or

upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and that, with respect to any criminal action or proceeding, he had reasonable cause to believe that his conduct was unlawful.

2. The corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with the defense or settlement of such action or suit if he acted in good faith and in a manner which he reasonably believed to be in or not opposed to the beet interests of the corporation, but no indemnification shall be made in respect of any claim, issue or matter as to which such person has been adjudged to be Lieble for gross negligence or misconduct in the performance of his duty to the corporation unless and only to the extent that the court in which such action or suit was brought determines upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

3. To the extent that a director, officer, employee or agent of the corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in sections 1 and 2 of this Article Twelfth, or in defense of any claim, issue or matter therein, he shall be indemnified by the corporation against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with such defense.

4. Expenses incurred in defending a civil or criminal action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding as authorized by the Board of Directors in the specific case upon receipt of an undertaking by or on behalf of the director, officer, employee or agent to repay such amount unless it is ultimately determined that he is entitled to be indemnified by the corporation as authorized in this Article Twelfth.

5. The indemnification provided by this Article Twelfth:

(a) Does not exclude any other rights to which, a person seeking indemnification may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office; and

(b) Shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such a person.

6. The corporation may purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the

request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against him and incurred by him in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify him against such liability under the provisions of this Article Twelfth.

THIRTEENTH: This corporation reserves the right to amend, alter, change or repeal any provision contained in the Articles of Incorporation, in the manner now or hereafter prescribed by statute, or by the Articles of Incorporation, and all rights conferred upon stockholders herein are granted subject to this reservation.

| STATE OF TEXAS | ) | |

| ) | ||

| COUNTY OF HARRIS | ) |

The undersigned, Robert R. Hillery, President of Kirby Exploration Company, and Myron H. Newman, Secretary of Kirby Exploration Company, being duly sworn, depose and say that they have been authorized to execute the foregoing certificate by resolution of the Board of Directors of Kirby Exploration Company adopted on March 27, 1976, and that the foregoing certificate correctly sets forth the text of the Articles of Incorporation of Kirby Exploration Company as amended to date.

|

|

| Robert R. Hillery, President | |

| Kirby Exploration Company | |

|

|

| Myron H. Newman, Secretary | |

| Kirby Exploration Company |

SUBSCRIBED AND SWORN TO before me this 23rd day of March, 1976.

|

|

| Notary Public in and for | |

| Harris County, Texas |

| Filing Fee: $20.00 | ||

| BY: woodburn, Wedge, Blakey | ||

| Jeppson | ||

| One East First st. | ||

| Reno, Nevada 89501 |

|

CERTIFICATE OF AMENDMENT OF THE RESTATED ARTICLES OF INCORPORATION OF KIRBY EXPLORATION COMPANY |

KIRBY EXPLORATION COMPANY, a corporation organized under the laws of the State of Nevada, by its President and Secretary, does hereby certify:

SECTION ONE: The name of the Corporation is KIRBY EXPLORATION COMPANY.

SECTION TWO: That the Board of Directors of said Kirby Exploration Company by unanimous written consent, dated as of the 25th day of March, 1981, adopted a resolution declaring that it would be advisable to amend Article FOURTH of the Restated Articles of Incorporation of Kirby Exploration Company increasing the authorized shares of common capital stock of Kirby Exploration Company from 4,000,000 shares of common capital stock with the par value of One Dollar ($1.00) per share to 40,000,000 shares of common capital stock of the par value of Ten Cents ($0.10) per share, and they therefore called for submission of such resolution to the shareholders at the Annual Meeting to take action thereon.

SECTION THREE: That, pursuant to such call of the Board of Directors, and upon notice given to each shareholders entitled to vote on an amendment to the Restated Articles of Incorporation, an Annual Meeting of the Shareholders of Kirby Exploration Company was held on April 21, 1981, in Houston, Texas. The number of shares of Kirby Exploration Company outstanding and entitled to vote at the time of such meeting was 1,596,946 shares of common stock. The number of shares which voted for such amendment to the Restated Articles of Incorporation was l,044,351 shares of common stock representing 65.4%of the shares entitled to vote and the number of shares of common stock which voted against such amendment was 1,407 shares of common stock representing .09% of the common stock entitled to vote thereon. Such amendment read as follows:

| The first sentence of Article FOURTH of the Restated Articles of Incorporation of Kirby Exploration Company is amended to read as follows: | ||

| “The amount of the total authorized capital stock of the corporation is Forty Million (40,000,000) shares of common stock of the par value of Ten Cents ($.10) per share.” | ||

SECTION FOUR: That upon the filing of such amendment each share of the presently authorized common stock of Kirby Exploration Company of the par value of One Dollar ($1.00) per share will be changed into ten (10) shares of the new common stock of said Kirby Exploration Company of the par value of Ten Cents ($0.10) per share.

IN WITNESS WHEREOF, the said Kirby Exploration Company has caused this instrument to be executed by its President and Secretary, duly authorized, and its corporate seal affixed hereto, this 22nd day of April, 1981.

|

|

| George A. Peterkin, Jr President | |

| (Corporate Seal) |  |

| Henry Gilchrist, Secretary |

| THE STATE OF TEXAS | ) |

| ) | |

| COUNTY OF HARRIS | ) |

BEFORE ME, the undersigned, a Notary Public in and for said County and State, on this day personally appeared GEORGE A. PETERKIN, JR., President of Kirby Exploration Company, the corporation executing the foregoing instrument, and being first duly sworn, acknowledged that he signed the foregoing document in the capacity therein stated and declared that the statements therein contained are true.

IN WITNESS WHEREOF, I have hereunto set my hand and seal this 22nd day of April, 1981.

|

||

| Notary Pub1ic in and for | ||

| Harris County, Texas | ||

| My Commission Expires: | ||

| November 30, 1984 | ||

| THE STATE OF TEXAS: | ) |

| ) | |

| COUNTY OF HARRIS | ) |

BEFORE ME, the undersigned, a Notary Public in and for said County and State, on this day personally appeared HENRY GILCHRIST, Secretary of Kirby Exploration Company, the corporation executing the foregoing instrument, and being first duly sworn, acknowledge that he signed the foregoing instrument in the capacity therein stated and declared that the statements therein contained are true.

IN WITNESS WHEREOF, I have hereunto set my hand and seal this 22nd day of April, 1981.

|

||

| Notary Public in and for | ||

| Harris County, Texas | ||

| My Commission Expires: | ||

| November 30, 1984 |

| FILING FEE: $6,600 By: C T CORPORATION SYSTEM SUITE #1600 ONE FAST FIRST STREET RENO, NEVADA 89501 |

|

CERTIFICATE OF AMENDMENT OF RESTATED ARTICLES OF INCORPORATION OF KIRBY EXPLORATION COMPANY |

KIRBY EXPLORATION COMPANY, a Nevada corporation, by its Vice President and Assistant Secretary does hereby certify:

| I. | The Board of Directors of the Corporation adopted a resolution setting forth the amendments in the Restated Articles of Incorporation hereinafter set forth and declaring their advisability, and called an annual meeting of the shareholders entitled to vote for the consideration of such amendments. | |

| II. | Thereafter, on the 25th day of April, 1984 upon notice given to each stockholder of record entitled to vote on an amendment to the Restated Articles of Incorporation as provided by law, an annual meeting of the stockholders of the Corporation was held, at which meeting 16,733,420 shares of the common stock of the Corporation, being approximately 69.7% of the issued and outstanding common stock of the Corporation, voted in favor of the amendment contained in III.A below, and 13,506,753 shares of common stock of the Corporation, being approximately 56.3% of the issued and outstanding common stock of the Corporation, voted in favor of the amendment contained in III. B below. | |

| III. | The Amended Articles of Incorporation of the Corporation are hereby amended as follows: | |

| A. | Article First of the Amended Articles of Incorporation of the Corporation is hereby amended to read in its entirety as follows: | |

| “FIRST: The name of the corporation is KIRBY EXPLORATION COMPANY, INC.” | ||

| B. | Article Fourth of the Amended Articles of Incorporation of the Corporation is hereby amended to read in its entirety as follows: | |

“FOURTH: 1. The total number of shares of all classes of stock which the corporation shall have authority to issue is 80,000,000, consisting of (1) 20,000,000 shares of Preferred Stock, par value $1.00 per share (“Preferred Stock”), and (2) 60,000,000 shares of Common Stock, par value $0.10 per share (“Common Stock”).

2. The Board of Directors is hereby expressly authorized, by resolution or resolutions from time to time adopted, to provide, out of the unissued shares of Preferred Stock, for the issuance of serial Preferred Stock. Before any shares of any such series are issued, the Board of Directors shall fix and state, and hereby is expressly empowered to fix, by resolution or resolutions, the designations, preferences, and relative, participating, optional or other special rights of the shares of each such series, and the qualifications, limitations or restrictions thereon, including but not limited to, determination of any of the following:

| (a) | the designation of such series, the number of shares to constitute such series and the stated value thereof if different from the par value thereof; |

| (b) | whether the shares of such series shall have voting rights, in addition to any voting rights provided by law, and, if so, the terms of such voting rights, which may be full or limited; |

| (c) | the dividends, if any, payable on such series and at what rates, whether any such dividends shall be cumulative, and, if so, from what dates, the conditions and dates upon which such dividends shall be payable, the preference or relation which such dividends shall bear to the dividends payable on any shares of stock of any other class or any other series of this class; |

| (d) | whether the shares of such series shall be subject to redemption by the corporation, and, if so, prices and other terms and conditions of such redemption; |

| (e) | the amount or amounts payable upon shares of such series upon, and the rights of the holders of such series in, the voluntary or involuntary liquidation, dissolution or winding up of, or upon any distribution of the assets of, the corporation; |

| (f) | whether the shares of such series shall be subject to the operation of a retirement or sinking fund and, if so, the extent to and manner in which any such retirement or sinking fund shall be applied to the purchase or redemption of the shares of such series for retirement or other corporate purposes and the terms and provisions relative to the operation thereof; |

| (g) | whether the shares of such series shall be convertible into, or exchangeable for, shares of stock of any other class or any other series of this class or any other class or classes of securities and, if so, the price or prices or the rate or rates of conversion or exchange and the method, if any, of adjusting the same, and any other terms and conditions of conversion or exchange; |

| (h) | the limitations and restrictions, if any, to be effective while any shares of such series are outstanding upon the payment of dividends or the making of other distributions on, and upon the purchase, redemption or other acquisition by the corporation of, the Common Stock or shares of stock of any other class or any other series of this class; |

| (i) | the conditions or restrictions, if any, upon the creation of indebtedness of the corporation or upon the issue of any additional stock, including additional shares of such series or any other series of this class or of any other class; and |

| (j) | any other powers, preferences and relative, participating, optional and other special rights, and any qualifications, limitations and restrictions thereof. |

The powers, preferences and relative, participating, optional and other special rights of each series of Preferred Stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series at any time outstanding. All shares of any one series of Preferred Stock shall be identical in all respects with all other shares of such series, except that shares of any one series issued at different times may differ as to the dates from which dividends thereof shall be cumulative. The Board of Directors may increase the number of shares of the Preferred Stock designated for any existing series by a resolution adding to such series authorized and unissued shares of the Preferred Stock not designated for any other series. The Board of Directors may decrease the number of shares of Preferred Stock designated for any existing series by a resolution, subtracting from such series unissued shares of the Preferred Stock designated for such series, and the shares so subtracted shall become authorized, unissued and undesignated shares of the Preferred Stock.

3. Each holder of Common Stock shall be entitled to one vote for each share of Common Stock held of record on all matters on which stockholders generally are entitled to vote. Subject to the provisions of law and the rights of the Preferred Stock and any other class or series of stock having a preference as to dividends over the Common Stock then outstanding, dividends may be paid on the Common Stock out of assets legally available for dividends, but only at such times and in such amounts as the Board of Directors shall determine and declare. Upon the dissolution, liquidation or winding up of the corporation, after any preferential amounts to be distributed to the holders of the Preferred Stock and any other class or series of stock having a preference over the Common Stock then outstanding have been paid or declared and set apart for payment, the holders of the Common Stock shall be entitled to receive all the remaining assets of the corporation available for distribution to its stockholders ratably in proportion to the number of shares held by them, respectively.

4. No stockholder of this corporation shall by reason of his holding shares of any class have

any preemptive or preferential right to purchase or subscribe to any shares of any class of this corporation, now or hereafter to be authorized, or any notes, debentures, bonds or other securities convertible into or carrying options or warrants to purchase shares of any class, now or hereafter to be authorized, whether or not the issuance of any shares or such notes, debentures, bonds or other securities, would adversely affect the dividend or voting rights of such stockholder other than such rights, if any, as the Board of Directors in its discretion from time to time may grant, and at such price as the Board of Directors in its discretion may fix; and the Board of Directors may cause to be issued shares of any class of this corporation, or any notes, debentures, bonds or other securities convertible into or carrying options or warrants to purchase shares of any class without offering any such shares or other securities either in whole or in part to the existing stockholders of any class.”

IN WITNESS WHEREOF, this Certificate of Amendment has been executed by the Vice President and Assistant Secretary of the Corporation as of the 11th day of September, 1984.

|

|

| Vice President | |

|

|

| Assistant Secretary |

| STATE OF TEXAS | [ILLEGIBLE] |

| COUNTY OF HARRIS | [ILLEGIBLE] |

On this 11th day of September, 1984, before me appeared Myron H. illegible to so personally known, who, being by me duly sworn, did say that he is the Vice President of KIRBY EXPLORATION COMPANY, a Nevada corporation, and acknowledged that the statements contained in the foregoing Certificate of Amendment are true and correct.

|

|

| Notary Public |

| My commission expires: |  |

||

| STATE OF TEXAS | [ILLEGIBLE] |

| COUNTY OF HARRIS | [ILLEGIBLE] |

On this 11th day of September, 1984, before me appeared Steve Holcomb, to me personally known, who, being by me duly sworn, did say that he is the Assistant Secretary of KIRBY EXPLORATION COMPANY, a Nevada corporation, and acknowledged that the statements contained in the foregoing Certificate of Amendment are true and correct.

|

|

| Notary Public |

| My commission expires: |  |

||

| FILING FEE: $50.00 | ||

| BY: | PRENTICE HALL CORPORATE SERV | |

| ROOM E | ||

| 502 EAST JOHN STREET | ||

| CARSON CITY, NEVADA 89701 |

|

CERTIFICATE OF AMENDMENT |

KIRBY EXPLORATION COMPANY, INC., a Nevada corporation (the “Corporation”), by its President and Secretary does hereby certify:

| I. | The Board of Directors of the Corporation adopted resolutions setting forth the amendments below in III.A and III.B (the “Amendments”) to the Restated Articles of Incorporation of the Corporation, as amended (the “Restated Articles of Incorporation”), directed that the Amendments be submitted to a vote of the stockholders and called an annual meeting of the stockholders entitled to vote for the consideration of the Amendments. | |

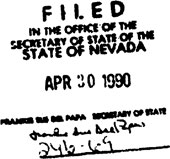

| II. | Thereafter, on the 26th day of April, 1988, upon notice given to each stockholder of record entitled to vote on an amendment to the Restated Articles of incorporation as provided by law, an annual meeting of the stockholders of the Corporation was held, at which meeting 17,684,863 shares of the common stock of the Corporation, being approximately 74.0% of the issued and outstanding common stock of the Corporation, voted in favor of the amendment contained in III.A below, and 17,422,597 shares of common stock of the Corporation, being approximately 72.9% of the issued and outstanding common stock of the Corporation, voted in favor of the amendment contained in III.B below. | |

| III. | The Restated Articles of Incorporation are hereby amended as follows: | |

| A. | Article Twelfth is amended to read in its entirety as follows: | |

| “TWELFTH: 1. The corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including | ||

| attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, has no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, does not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and that, with respect to any criminal action or proceeding, he had reasonable cause to believe that his conduct was unlawful. | ||

| 2. The corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, Joint venture, trust or other enterprise against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense or settlement of the action or suit if he acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation. Indemnification shall not be made for any claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper. | ||

| 3. To the extent that a director, officer, employee or agent of a corporation has been successful on the, merits or otherwise in defense of any action, suit or proceeding referred to in sections 1 and. 2 of this Article Twelfth, or in defense of any claim, issue or matter therein, he must be indemnified by the corporation against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with the defense. |

| 4. Any indemnification under sections 1 and 2 of this Article Twelfth, unless ordered by a court or advanced pursuant to section 5 of this Article Twelfth, must be made by the corporation only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances. The determination muse be made: | |||

| (a) By the stockholders; | |||

| (b) By the board of directors by majority vote of a quorum consisting of directors who were not parties to the act, suit or proceeding; | |||

| (c) If a majority vote of a quorum consisting of directors who were not parties to the act, suit or proceeding so orders, by independent legal counsel in a written opinion; or | |||

| (d) If a quorum consisting of directors who were not parties to the act, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion. | |||

| 5. The expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding must be paid by the corporation as they are incurred and in advance of the final disposition of the action, suit or proceeding upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he is not entitled to be indemnified by the corporation. The provisions of this section 5 of this Article. Twelfth do not affect any rights to advancement of expenses to which corporate personnel other than directors or officers may be entitled under any contract or otherwise by law. | |||

| 6. The indemnification and advancement of expenses provided by this Article Twelfth: | |||

| (a) Does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under these articles of incorporation or any bylaws, agreement, vote of stockholders or disinterested directors or otherwise, for either an action in his official capacity or an action in another capacity while holding his office, except that indemnification, unless ordered by a court pursuant to section 2 of this Article Twelfth or for the advancement of expenses of any director or officer, if a final adjudication establishes that his acts or | |||

| omissions involved intentional misconduct, fraud or a knowing violation of the law and was material to the cause of action. | |||

| (b) Continues for a person who has ceased to be a director, officer, employee or agent and inures to the benefit of the heirs, executors and administrators of such a person. | |||

| 7. The corporation may purchase and maintain insurance or make other financial arrangements on be-half of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee or agent, or arising. out of his status as such, whether or not the corporation has the authority to indemnify him against such liability and expenses. | |||

| 8. The other financial arrangements made by the corporation pursuant to section 7 of this Article Twelfth may include the following: | |||

| (a) The creation of a trust fund. | |||

| (b) The establishment of a program of self-insurance. | |||

| (c) The securing of its obligation of indemnification by granting a security interest or other lien on any assets of the corporation. | |||

| (d) The establishment of a letter of credit, guaranty or surety. | |||

| No financial arrangement made pursuant to this section may provide protection for a person adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable for intentional misconduct, fraud or a knowing violation of law, except with respect to the advancement of expenses or indemnification ordered by a court. | |||

| 9. Any insurance or other financial arrangement made on behalf of a person pursuant to this Article Twelfth may be provided by the corporation or any other person approved by the board of directors, even if all or part of the otter person’s stock or other securities is owned by the corporation. | |||

| 10. In the absence of fraud: | ||||

| (a) The decision of the board of directors as to the propriety of the terms and conditions of any insurance or other financial arrangement made pursuant to this Article Twelfth and the choice of the person to provide the Insurance or other financial arrangement shall be conclusive; and | ||||

| (b) The insurance or other financial arrangement: | ||||

| (1) Is not void or voidable; and | ||||

| (2) Does not subject any director approving it to personal liability for his action, even if a director approving the insurance or other financial arrangement is a beneficiary of the insurance or other financial arrangement.” | ||||

| B. | Article Thirteenth is renumbered as Article Fourteenth and a now Article Thirteenth is added to read in its entirety as follows: | |||

| “THIRTEENTH: No director or officer of the corporation shall be personally liable to the corporation or any of its stockholders for damages for breach of fiduciary duty as a director or officer involving any act or omission of any of such director or officer occurring on or after April 26, 1988, and to the extent permitted under applicable law, occuring prior to April 26, 1988, except, that the foregoing provision shall not eliminate or limit the liability of a director or officer for: | ||||

| (a) acts or omissions which involve intentional misconduct, fraud or a knowing violation of law; or | ||||

| (b) the payments of dividends in violation of Section 78.300 of the Nevada Revised Statutes. | ||||