Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy15q1.htm |

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy15q1xex991.htm |

|

Q1 FY 2015 Earnings

Prepared Comments and Slides

February 19, 2015

Michael Iburg

Investor Relations

Phone: 408-333-0233

miburg@Brocade.com

Kristy Campbell

Media Relations

Phone: 408-333-4221

kcampbel@Brocade.com

NASDAQ: BRCD

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Prepared comments provided by Michael Iburg, Investor Relations

Thank you for your interest in Brocade’s Q1 Fiscal 2015 earnings presentation, which includes prepared remarks, safe harbor, slides, and a press release detailing fiscal first quarter 2015 results. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and has been made available on the Brocade Investor Relations website at www.brcd.com. The press release will be issued subsequently via Marketwired.

© 2015 Brocade Communications Systems, Inc. Page 2 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 3 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Today’s prepared comments include remarks by Lloyd Carney, Brocade CEO, regarding the company’s quarterly results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at

2:30 p.m. PT on February 19 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2015 Brocade Communications Systems, Inc. Page 4 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Prepared comments provided by Lloyd Carney, CEO

© 2015 Brocade Communications Systems, Inc. Page 5 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

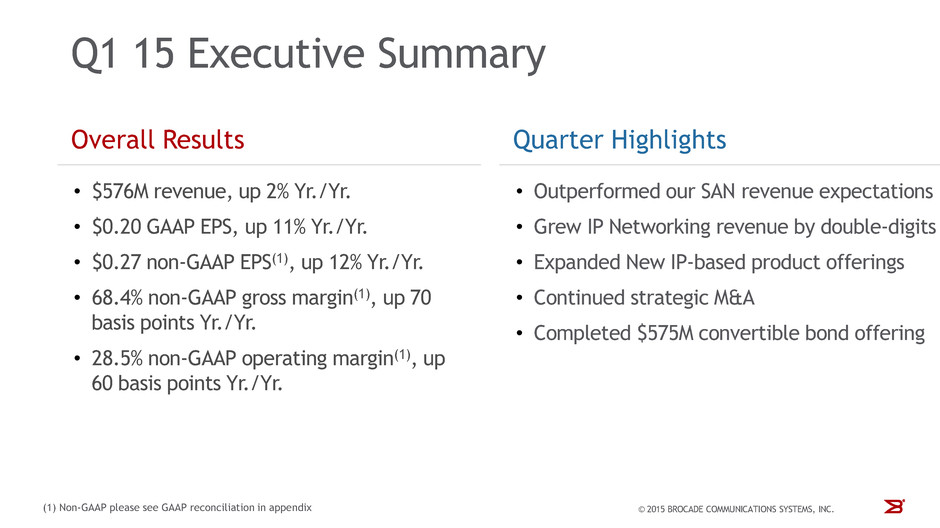

Brocade continued to execute well across a number of key metrics in Q1. We outperformed our SAN expectations for the quarter and achieved double-digit growth in our IP Networking business over the same period a year ago, resulting in increased profitability.

We have a clear strategic vision that has three essential components: expanding our presence in the data center, building a portfolio of open, software-driven solutions for both storage networking and IP networking, and executing within a financial model that delivers shareholder value and enables us to invest prudently in our future growth.

We continue to extend our leadership in New IP-based technologies. We are delivering on an aggressive product roadmap, recently announcing several innovative products to enable increasingly open, agile, and user-centric networks.

We are leveraging our strong financial position to make thoughtful, strategic acquisitions that add value to our technology portfolio. Earlier this month, we announced our intent to acquire the virtual application delivery controller business from Riverbed. This acquisition enhances our position in this rapidly growing market and expands the capability of our software offerings.

During the quarter, we completed a $575 million convertible notes offering, which reduces the interest rate on our debt and provides additional resources to meet our financial objectives and drive our strategic vision. The demand for these notes was high and a clear recognition by the market of the company’s financial strength and business direction.

© 2015 Brocade Communications Systems, Inc. Page 6 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

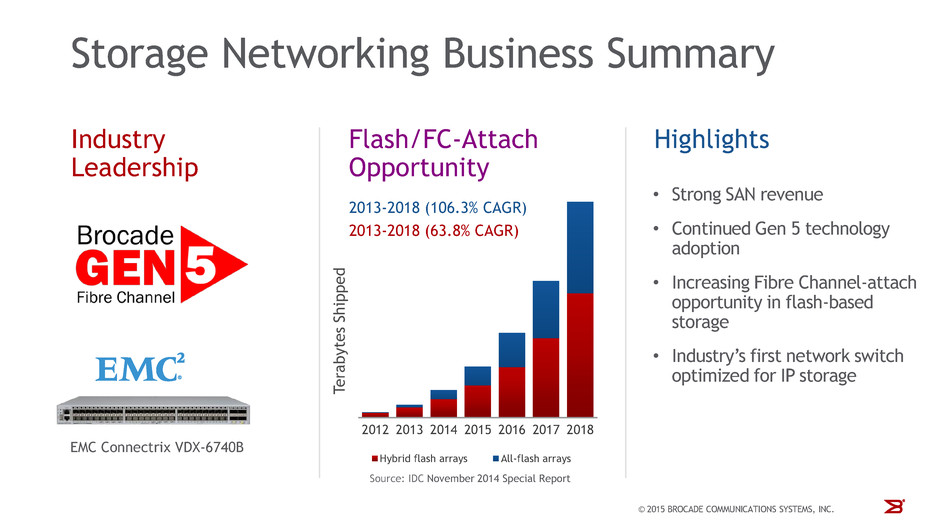

Q1 15 was one of the best quarters in Brocade history for SAN revenue. A key driver of our performance continues to be the strong adoption of our industry-leading Gen 5 Fibre Channel portfolio. With the rapid migration to high-density server virtualization, Fibre Channel technology offers tremendous advantages, providing highly-deterministic, reliable, low-latency performance.

In addition, with the exponential growth of storage capacity in the data center, we continue to see an opportunity to leverage our differentiated storage networking solution to deliver the most reliable and easy-to-scale data center storage fabrics. The adoption of new technologies, such as all-flash arrays and hybrid flash arrays, is growing at a faster rate than many leading analysts had predicted. The network truly matters in these high performance deployments and Fibre Channel continues to be the best network protocol to attach these technologies.

While block storage is served more efficiently with Fibre Channel, we see increasing interest in dedicated IP-based Flash storage for unstructured data, creating an emerging use case for our IP Storage product line. With our extensive expertise in mission-critical storage networking, and an industry-leading portfolio of Ethernet fabric solutions and storage network management tools, this is a natural fit for Brocade.

We were pleased to announce an expanded OEM relationship with EMC for the industry’s first IP-based storage networking switch, the EMC Connectrix VDX-6740B. This solution leverages the Brocade VDX®switch and Brocade VCS fabric technology to provide the reliability, performance, and scalability that customers expect from their storage network.

© 2015 Brocade Communications Systems, Inc. Page 7 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

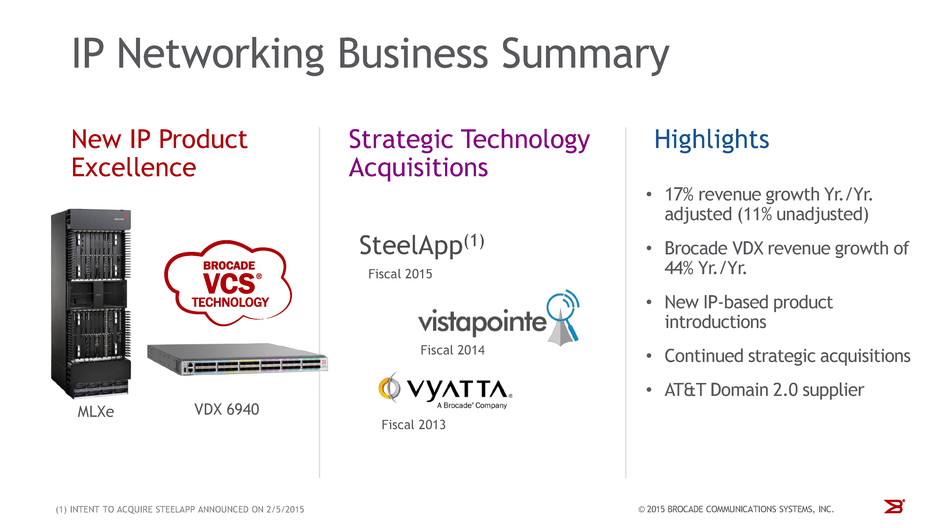

IP Networking revenue grew 17% year-over-year on an adjusted basis. Strength was broad based, with growth across service provider and federal markets. In particular, the Brocade VDX family grew 44% over the prior year, demonstrating our continued strength in data center deployments and execution of our strategy. Brocade offers one of the strongest product portfolios in the industry to support emerging New IP technologies and we continue to expand our capabilities through product innovation and strategic acquisitions.

Our recently launched security products for the Brocade MLXe router enable comprehensive in-flight data privacy for campus, data center, and wide area networks. These enhancements, leveraging wire-speed IPSec and MACsec encryption, allow customers to deploy pervasive data security across their network while offloading their appliances, improving performance, and increasing their overall IT security profile.

We also introduced the Brocade VDX 6940 switch and enhancements to Brocade VCS fabric technology. This expanded offering enables customers to easily scale their network to fit demand, while the addition of SDN and cloud orchestration capabilities allows customers to seamlessly integrate a Brocade VDX network infrastructure with the rest of their open data center ecosystem.

Earlier this month, we announced our intention to acquire the SteelApp division of Riverbed. SteelApp, an early innovator in the rapidly-growing virtual application delivery control (vADC) market, is currently the #3 vendor in the vADC market and is ranked by Gartner as a visionary in this space. This is highly strategic to our software-based networking portfolio, expands our leadership in NFV and New IP architectures, and drives new sales in the data center and service provider markets.

The value of our growing technology portfolio and success in achieving market recognition as an industry leader was underscored in Q1 15 when AT&T selected Brocade for participation in the Domain 2.0 supplier program. This highly selective program seeks the most innovative suppliers to help enable AT&T’s vision of an open, virtualized, customer-centric, cloud-based architecture. Only nine suppliers have been named to the program since its inception and we are very pleased to have been selected to contribute to this visionary initiative.

© 2015 Brocade Communications Systems, Inc. Page 8 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

We achieved solid revenue results in Q1 with broad-based strength across our portfolio of next-generation networking solutions. With a healthy financial position, we are prudently employing our resources to build an industry-leading portfolio of next-generation technologies that will accelerate growth and deliver shareholder value.

© 2015 Brocade Communications Systems, Inc. Page 9 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Prepared comments provided by Dan Fairfax, CFO

© 2015 Brocade Communications Systems, Inc. Page 10 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

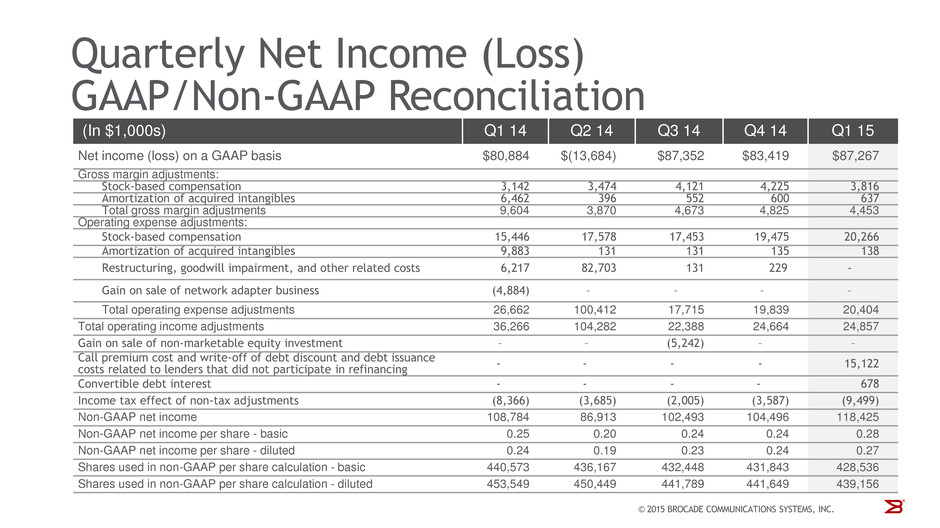

Fiscal Q1 15 followed normal quarterly seasonal patterns, with strong sequential SAN revenue partially offset by lower sequential IP Networking revenue. Fiscal Q1 is typically our strongest SAN quarter as it aligns with the fiscal year-end of certain OEM partners and is usually their strongest storage quarter. IP Networking revenue is typically down sequentially due to lower U.S. Federal sales. The following commentary focuses on year-over-year comparisons.

Q1 15 revenue of $576M was up 2% Yr./Yr. driven by increased IP Networking revenue. SAN revenue was approximately flat Yr./Yr. as switch sales grew 8% offset by declines in Director and Server revenues of 2% and 24%, respectively, as customer buying patterns favored fixed configuration platforms in the quarter. IP Networking revenue was up 11% Yr./Yr. primarily due to stronger U.S. Federal sales and better sales execution in both service provider and enterprise markets.

Non-GAAP gross margin was 68.4% in Q1 15, up 70 basis points year-over-year due to higher revenues, lower manufacturing overhead costs, and a mix shift towards higher margin SAN products. Non-GAAP operating margin was 28.5% in Q1 15, up 60 basis points from Q1 14 primarily due to higher revenue and gross margin.

Q1 15 non-GAAP diluted EPS was $0.27, up from $0.24 in Q1 14 primarily due to higher revenue and gross margin.

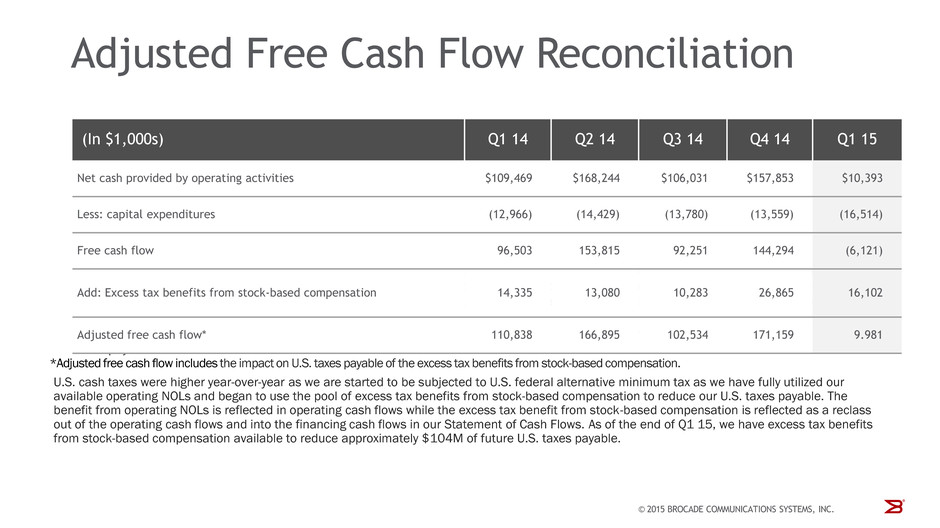

Operating cash flow and adjusted free cash flow were below the forecasted ranges for the quarter due to an increase in DSOs of three days, as well as the impact of the early redemption fee associated with calling the 2020 secured notes prior to maturity.

Inventory turns were relatively flat at 19 times and the cash conversion cycle extended to 16 days, consistent with the increase in DSOs.

The Q1 15 effective non-GAAP tax rate was 23.1%, down 300 basis points year-over-year due to the benefit of the federal R&D tax credit catch-up for calendar 2014 that was approved by the U.S. Congress in Q1 15. Although the R&D tax credit was approved by Congress retroactively for 2014, it has not been approved for 2015.

© 2015 Brocade Communications Systems, Inc. Page 11 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Revenue from our total SAN business, including hardware products and SAN-based support and services, in Q1 15 was $407M, down 1% from Q1 14 primarily due to a 5% decline in support and services revenue attributed to the timing of out-of-warranty repair services.

Our SAN product revenue was $353M in the quarter, essentially flat year-over-year. Switch sales were up 8% Yr./Yr., offset by Director and Server sales, which were down 2% and 24% respectively, as customer buying patterns favored fixed configuration platforms in the quarter. Switch revenue of $177M was a record for the company.

All product segments saw strong sequential growth with Directors up 7%, Switches up 10%, and Server products up 9%, consistent with normal seasonal demand.

From a total revenue perspective, including SAN and IP Networking, our channels to market remained relatively stable year-over-year with OEM revenue dropping slightly from 70% to 67% of total revenue, while revenue sold through channel/direct routes increased from 30% to 33%.

© 2015 Brocade Communications Systems, Inc. Page 12 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

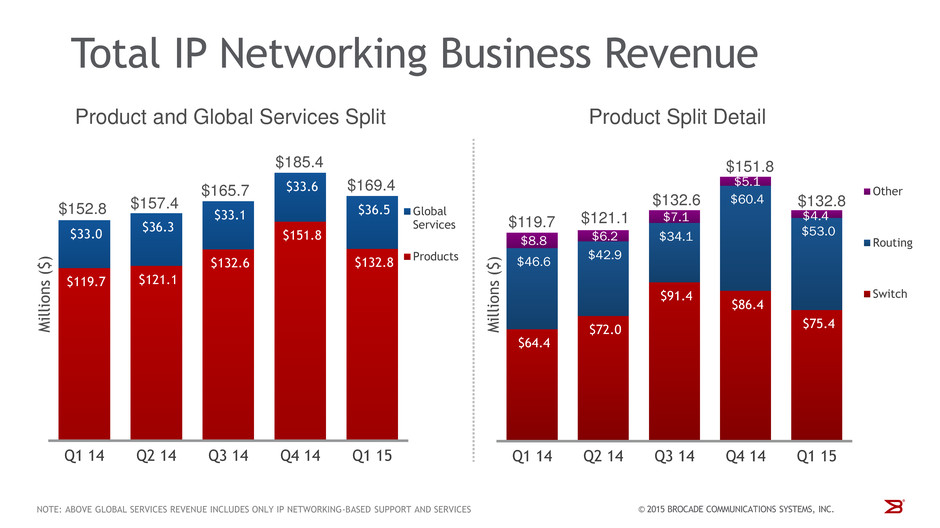

Revenue from our total IP Networking business, including hardware and IP-based support and services, was $169M, up 11% Yr./Yr.

Q1 15 IP Networking product revenue was $133M, up 11% year-over-year. The revenue improvement was broad-based across all geographies and all continuing product lines. Geographically, we saw double digit growth year-over-year in the Americas (up 12%), EMEA (up 20%), and Japan (up 20%), with mid-single digit growth in APAC (up 6%). From a product perspective, we experienced strong year-over-year growth in both switches (up 17%) and routers (up 14%) while only the repositioned Brocade ADX® and discontinued hardware (wireless and network adapter cards) were down year-over-year. Contributing to the strong performance in switches, Brocade VDX revenue was up 44% Yr./Yr. and we shipped our one millionth VDX port in the quarter.

IP-based Global Services revenue was $36.5M, up 11% year-over-year due to the timing of large support renewals.

The split of our IP Networking business based on customer use cases is an important measurement of the progress we are making to grow our data center business. Although it is difficult to identify all end-users and their specific network deployments due to our two-tier distribution channel, we are providing estimates of the split of our IP Networking business. Our data center customers represented approximately 53% of IP Networking revenue in Q1 15, compared to 59% in Q1 14 and 58% in Q4 14. Although the Q1 15 percentage of Data Center IP Networking was lower year-over-year, the absolute dollars were higher in Q1 15 compared to Q1 14. The estimated percentage of revenue coming from data center IP Networking customers may fluctuate quarter-to-quarter due to the timing of large data center customer transactions, minor changes to classification from improved visibility of actual customer deployments, as well as the seasonality of the public sector, including Federal. Other use cases, such as enterprise campus and carrier networks (MAN/WAN) represent the balance of the business.

As an additional breakdown of our IP Networking revenue based on ship-to location, the Americas region (excluding U.S. Federal) was 53% of total IP Networking revenue, a decrease of 1% Yr./Yr. Federal was 10% of total IP Networking revenue, an increase of 2% Yr./Yr. International was 37% of total IP Networking revenue, essentially flat Yr./Yr. as a percentage of total IP Networking revenue.

© 2015 Brocade Communications Systems, Inc. Page 13 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

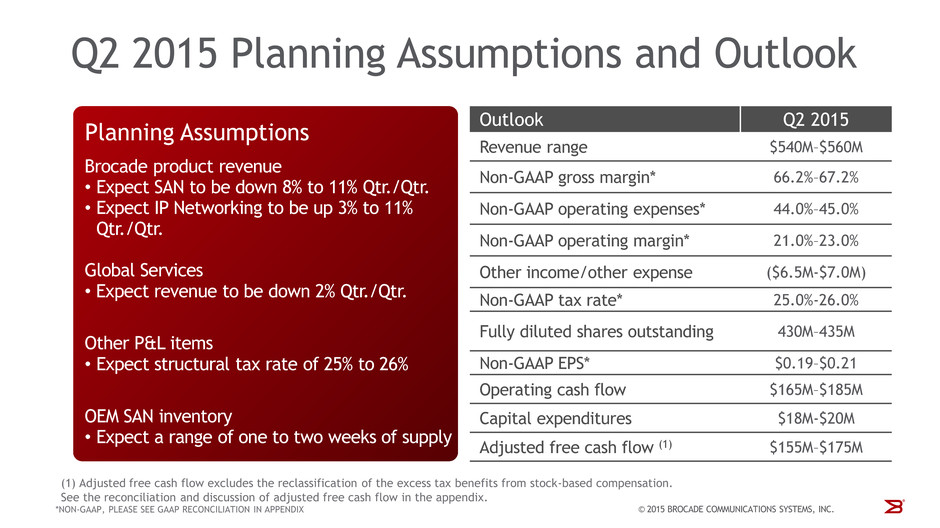

Looking forward to Q2 15, we considered a number of factors, including the following, in setting our outlook:

• | Although we are unsure when the SteelApp transaction will close during the quarter, we have included $2M to $3M of SteelApp revenue and $3M to $4M of additional operating expense in the Q2 15 Outlook shown above. |

• | SteelApp revenue historically included certain license agreements which will not transfer to Brocade at the completion of the acquisition. As a result, the anticipated full-quarter baseline revenue is expected to be in the range of $5M to $7M for 2H FY15. At the same time, we expect incremental operating expenses associated with SteelApp to be approximately $7M per quarter for 2H FY15. |

• | For Q2 15, we expect SAN revenue to be down 8% to 11% Qtr./Qtr. and down 2% to up 1% Yr./Yr. |

• | We expect our Q2 15 IP Networking revenue to be up 3% to 11% Qtr./Qtr. and up 13% to 21% Yr./Yr. |

• | We expect our Global Services revenue to be down 2% Qtr./Qtr. and down 7% Yr./Yr. as Q2 of 2014 included a 14th week of amortized revenue. |

• | We expect Q2 15 non-GAAP gross margin to be between 66.2% to 67.2%, and non-GAAP operating margin to be between 21.0% to 23.0% primarily due to the seasonally lower revenue and increased operating expenses. Although we will be below our FY15-16 operating margin range in fiscal Q2, we will manage our operating expense base to be at the low-end of the target range for fiscal year 2015. |

• | At the end of Q1 15, OEM inventory was approximately 1.3 weeks of supply based on SAN business revenue. We expect inventory to be between one to two weeks in Q2 15. |

© 2015 Brocade Communications Systems, Inc. Page 14 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Prepared comments provided by Steve Coli, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on February 19, Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2015 Brocade Communications Systems, Inc. Page 15 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 16 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 17 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Additional Financial Information:

Q1 14 | Q4 14 | Q1 15 | ||||

GAAP product gross margin | 67.7 | % | 68.3 | % | 69.2 | % |

Non-GAAP product gross margin | 69.4 | % | 68.9 | % | 69.7 | % |

GAAP services gross margin | 57.2 | % | 58.6 | % | 59.3 | % |

Non-GAAP services gross margin | 58.9 | % | 61.0 | % | 61.4 | % |

© 2015 Brocade Communications Systems, Inc. Page 18 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 19 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 20 of 20