Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - GRACO INC | d873526dex32.htm |

| EX-21 - EX-21 - GRACO INC | d873526dex21.htm |

| EX-24 - EX-24 - GRACO INC | d873526dex24.htm |

| EX-23 - EX-23 - GRACO INC | d873526dex23.htm |

| EX-31.2 - EX-31.2 - GRACO INC | d873526dex312.htm |

| EXCEL - IDEA: XBRL DOCUMENT - GRACO INC | Financial_Report.xls |

| EX-31.1 - EX-31.1 - GRACO INC | d873526dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| for the fiscal year ended December 26, 2014, or |

| [ ] | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| for the transition period from to . |

Commission File No. 001-09249

Graco Inc.

(Exact name of Registrant as specified in its charter)

| Minnesota |

41-0285640 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

88 –11th Avenue Northeast

Minneapolis, MN 55413

(Address of principal executive offices) (Zip Code)

(612) 623-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $1.00 per share

Shares registered on the New York Stock Exchange.

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer” and “accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer X Accelerated filer Non-accelerated filer Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act).

Yes No X

The aggregate market value of 59,350,426 shares of common stock held by non-affiliates of the registrant was $4,615,089,158 as of June 27, 2014.

58,991,622 shares of common stock were outstanding as of February 3, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s definitive Proxy Statement for its Annual Meeting of Shareholders to be held on April 24, 2015, are incorporated by reference into Part III, as specifically set forth in said Part III.

Table of Contents

ON FORM 10-K

| Page | ||||||

| Part I |

||||||

| Item 1 |

3 | |||||

| Item 1A |

6 | |||||

| Item 1B |

9 | |||||

| Item 2 |

9 | |||||

| Item 3 |

11 | |||||

| Item 4 |

11 | |||||

| 12 | ||||||

| Part II |

||||||

| Item 5 |

14 | |||||

| Item 6 |

15 | |||||

| Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 | ||||

| Item 7A |

27 | |||||

| Item 8 |

29 | |||||

| Management’s Report on Internal Control Over Financial Reporting |

29 | |||||

| 30 | ||||||

| 32 | ||||||

| 32 | ||||||

| 33 | ||||||

| 34 | ||||||

| 35 | ||||||

| Item 9 |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

58 | ||||

| Item 9A |

58 | |||||

| Item 9B |

58 | |||||

| Part III |

||||||

| Item 10 |

59 | |||||

| Item 11 |

59 | |||||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

59 | ||||

| Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

59 | ||||

| Item 14 |

59 | |||||

| Part IV |

||||||

| Item 15 |

60 | |||||

| 63 | ||||||

| ACCESS TO REPORTS |

| Investors may obtain access free of charge to the Graco Inc. Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, other reports and amendments to the reports by visiting the Graco website at www.graco.com. These reports will be available as soon as reasonably practicable following electronic filing with, or furnishing to, the Securities and Exchange Commission. |

2

Table of Contents

PART I

Graco Inc., together with its subsidiaries (“Graco,” “us,” “we,” or “our Company”), is a multi-national manufacturing company. We design, manufacture and market equipment to pump, meter, mix and dispense a wide variety of fluids and coatings. Our equipment is used in the construction, automotive, industrial, mining, oil and natural gas, process, public works and other industries.

We classify our business into three reportable segments, each with a worldwide focus: Industrial, Contractor and Lubrication (more details below). Financial information concerning these segments is set forth in Part II, Item 7, Results of Operations and Note B to the Consolidated Financial Statements of this Form 10-K.

Each segments sells its products in North, Central and South America (the “Americas”), Europe, Middle East and Africa (“EMEA”), and Asia Pacific. Sales in the Americas represent approximately 56 percent of our Company’s total sales. Sales in EMEA represent approximately 25 percent. Sales in Asia Pacific represent approximately 19 percent. Part II, Item 7, Results of Operations and Note B to the Consolidated Financial Statements of this Form 10-K contain financial information about these geographic markets. We provide marketing and product design in each of these geographic regions. Our Company also provides application assistance to distributors and employs sales personnel in each of these geographic regions.

We specialize in providing equipment solutions for difficult-to-handle materials with high viscosities, abrasive or corrosive properties and multiple component materials that require precise ratio control. We aim to serve niche markets, providing high customer value through product differentiation. Our products enable customers to reduce their use of labor, material and energy, improve quality and achieve environmental compliance. We have particularly strong manufacturing and engineering capabilities.

We make significant investments in developing innovative, high quality products. We strive to grow into new geographic markets by strategically adding commercial resources and third party distribution in growing and emerging markets. We have grown our third party distribution to have specialized experience in particular end user applications. We leverage our product technologies for new applications and industries. We make targeted acquisitions, completing three acquisitions in fiscal year 2014 and three acquisitions in early fiscal year 2015. Together, these comprise our long-term growth strategies, which we coordinate and drive across our geographic regions.

Graco Inc. is a Minnesota corporation and was incorporated in 1926. For more information about our Company and our products, services and solutions, visit our website at www.graco.com. The information on the website is not part of this report nor any other report filed or furnished to the Securities and Exchange Commission (“SEC”).

Manufacturing and Distribution

We manufacture a majority of our products in the United States. We manufacture some of our products in Switzerland (Industrial segment), the United Kingdom (Industrial segment), the People’s Republic of China (“P.R.C.”) (all segments), Belgium (all segments), and Romania (Industrial segment). Our manufacturing is aligned with our business segments and is co-located with product development to accelerate technology improvements and improve our cost structure. We perform critical machining, assembly and testing in-house for most of our products to control quality, improve response time and maximize cost-effectiveness. We make our products in focused factories and product cells. We source raw materials and components from suppliers around the world.

For all segments, we primarily sell our equipment through third party distributors worldwide, positioned throughout our geographic regions. We also sell to selective retailers. We primarily distribute our products from our warehouses to distributors or retailers, who sell our products to end users. Outside of the United States, our subsidiaries located in Australia, Belgium, Japan, Italy, Korea, Mexico, the P.R.C., Switzerland and the United Kingdom distribute our Company’s products. Operations in Maasmechelen, Belgium; St. Gallen, Switzerland; Shanghai, P.R.C.; and Montevideo, Uruguay reinforce our commitment to their regions.

During 2014, manufacturing capacity met business demand. Production requirements in the immediate future are expected to be met through existing facilities, the installation of new automatic and semi-automatic machine tools, efficiency and productivity improvements, the use of leased space and available subcontract services.

For more details on our facilities, see Item 2, Properties.

Product Development

Our primary product development efforts are carried out in facilities located in Minneapolis, Anoka and Rogers, Minnesota; North Canton, Ohio; St. Gallen, Switzerland; Suzhou, P.R.C.; and Brighouse, United Kingdom. The product development and engineering

3

Table of Contents

groups focus on new product design, product improvements, new applications for existing products and technologies for their specific customer base. Our product development efforts focus on bringing new and supplemental return-on-investment value to end users of our products. Total product development expenditures for all segments were $54 million in 2014, $51 million in 2013, and $49 million in 2012.

Our Company consistently makes significant investments in new products, and in 2014 we invested $54 million, or 4.4 percent of sales, in our product development activities. Our product development activities are focused both on upgrades to our current product lines to provide features and benefits that will provide a return-on-investment to our end user customers and development of products that will reach into new industries and applications to incrementally grow our sales. Sales of products that refresh and upgrade our product lines are measured and compared to planned results. Sales of products that provide entry into new industries and applications are also measured, with additional focus on commercial resources and activities to build specialized third party distribution and market acceptance by end users.

Business Segments

Industrial Segment

The Industrial segment is our largest segment and represents approximately 59 percent of our total sales in 2014. It includes the Applied Fluid Technologies division, Industrial Products division and Process division. The Industrial segment makes products for industrial customers that manufacture their own products (such as appliances, vehicles, airplanes and furniture).

Most Industrial segment equipment is sold worldwide through specialized third party distributors, integrators, design centers, original equipment manufacturers and material suppliers. Some products are sold directly to end users. We work with material suppliers to develop or adapt our equipment for use with specialized and hard-to-handle materials. Distributors promote and sell the equipment, hold inventory, provide product application expertise and offer on-site service, technical support and integration capabilities. Integrators implement large individual installations in manufacturing plants where products and services from a number of different manufacturers are aggregated into a single system. Design centers engineer systems for their customers using our products. Original equipment manufacturers incorporate our Company’s Industrial segment products into systems and assemblies that they then supply to their customers.

Applied Fluid Technologies

The Applied Fluid Technologies division designs and sells equipment for use by industrial customers and specialty contractors. This equipment includes two component proportioning systems that are used to spray polyurethane foam (spray foam) and polyurea coatings. Spray foam is commonly used for insulating building walls, roofs, water heaters, refrigerators, hot tubs and other items. Polyurea coatings are applied on storage tanks, pipes, roofs, truck beds, concrete and other items. We offer a complete line of pumps and proportioning equipment that sprays specialty coatings on a variety of surfaces for protection and fireproofing. This division also manufactures vapor-abrasive blasting equipment, as well as equipment that pumps, meters, mixes and dispenses sealant, adhesive and composite materials. Our advanced composite equipment includes gel coat equipment, chop and wet-out systems, resin transfer molding systems and applicators. This equipment bonds, molds, seals, vacuum encapsulates, and laminates parts and devices in a wide variety of industrial applications.

Industrial Products

The Industrial Products division makes finishing equipment that applies paint and other coatings to products such as motor vehicles, appliances, furniture and other industrial and consumer products. A majority of this division’s business is outside of North America.

This division’s products include liquid finishing equipment that applies liquids on wood, metals and plastics. This equipment includes paint circulating and paint supply pumps, paint circulating advanced control systems, plural component coating proportioners, various accessories to filter, transport, agitate and regulate fluid, and spare parts such as spray tips, seals and filter screens. We also offer a variety of applicators that use different methods of atomizing and spraying the paint or other coatings depending on the viscosity of the fluid, the type of finish desired, and the need to maximize transfer efficiency, minimize overspray and minimize the release of volatile organic compounds into the air. Manufacturers in the automotive, automotive feeder, commercial and recreational vehicle, military and utility vehicle, aerospace, farm, construction, wood and general metals industries use our liquid finishing products.

We make powder finishing products that coat powder finishing on metals. These products are sold under the Gema® trademark. Gema powder systems coat window frames, metallic furniture, automotive components and sheet metal. Primary end users of our Gema powder finishing products include manufacturers in the construction, home appliance, automotive component and custom coater industries. We strive to provide innovative production solutions in powder coating for end users in emerging and developed markets.

4

Table of Contents

Process

Our Process division makes pumps of various technologies that move chemicals, water, waste water, petroleum, food and other fluids. Manufacturers and processors in the food and beverage, dairy, pharmaceutical, cosmetic, oil and gas, electronics, waste water, mining and ceramics industries use these pumps. This division makes environmental monitoring and remediation equipment that is used to conduct ground water sampling and ground water remediation, and for landfill liquid and gas management.

In 2014, we acquired the stock of Alco Valves Group. Alco Valves Group is based in the United Kingdom and manufactures high pressure valves used in the oil and natural gas industry. Subsequent to the 2014 fiscal year-end, we acquired High Pressure Equipment (HiP) company with facilities in the United States and the United Kingdom. HiP manufactures valves, fittings and other flow control equipment for use in ultra-high pressure environments such as the oil and natural gas industry. Also subsequent to the 2014 fiscal year-end, we purchased the White Knight Fluid Handling business, which is based in the United States and makes pumps that are used in a variety of chemical applications.

Contractor Segment

The Contractor segment generated approximately 31 percent of our Company’s 2014 total sales. Through this segment, we offer sprayers that apply paint to walls and other structures. We offer several models of professional grade handheld paint sprayers. We also make sprayers that apply texture to walls and ceilings, and sprayers that apply highly viscous coatings to roofs. Contractor equipment also includes sprayers that apply markings on roads, parking lots, fields, bike paths, crosswalks and floors.

This segment’s end users are primarily professional painters in the construction and maintenance industries, tradesmen and do-it-yourselfers. Contractor products are marketed and sold in all major geographic areas. We continue to add distributors throughout the world that specialize in the sale of Contractor products. Throughout the world, we are pursuing a broad strategy of converting contractors accustomed to manually applying paint and other coatings by brush-and-roller to spray technology.

Our Contractor products are distributed primarily through distributor outlets whose main products are paint and other coatings. Contractor products are also sold through general equipment distributors outside of North America. Certain sprayers and accessories are distributed globally through the home center channel.

Lubrication Segment

The Lubrication segment represented approximately 10 percent of our Company’s sales during 2014. The bulk of the Lubrication segment’s sales comes from North America.

Through the Lubrication segment, we offer equipment for use in vehicle servicing. We supply pumps, hose reels, meters, valves and accessories for use by fast oil change facilities, service garages, fleet service centers, automobile dealerships, auto parts stores, truck builders and heavy equipment service centers.

We offer systems, components and accessories for the automatic lubrication of industrial and commercial equipment, compressors, turbines and on- and off-road vehicles. We offer products that automatically lubricate bearings, gears and generators, and products that evacuate and dispense lubricants. Industries served include gas transmission and petrochemical, pulp and paper, mining and construction, agricultural equipment, food and beverage, material handling, metal manufacturing, wind energy and oil and gas exploration.

Raw Materials

The primary materials and components in our products are steel of various alloys, sizes and hardness; specialty stainless steel and aluminum bar stock, tubing and castings; tungsten carbide; electric and gas motors; injection molded plastics; sheet metal; forgings; powdered metal; hoses; and electronic components. The materials and components that we use are generally adequately available through multiple sources of supply. To manage cost, we source significant amounts of materials and components from outside the United States, primarily in the Asia Pacific region.

In 2014, our raw material and purchased component availability was strong, and our costs were fairly stable. We experienced price decreases in copper and rubber commodities, but had some significant increases in stainless steel, aluminum, plastics and chrome.

We endeavor to address fluctuations in the price and availability of various materials and components through adjustable surcharges and credits, close management of current suppliers, price negotiations and an intensive search for new suppliers. We have performed risk assessments of our key suppliers, and we factor the risks identified into our commodity plans.

5

Table of Contents

Intellectual Property

We own a number of patents across our segments and have patent applications pending both in the United States and in other countries, license our patents to others, and are a licensee of patents owned by others. In our opinion, our business is not materially dependent upon any one or more of these patents or licenses. Our Company also owns a number of trademarks in the United States and foreign countries, including registered trademarks for “GRACO,” “Gema,” several forms of a capital “G,” and various product trademarks that are material to our business, inasmuch as they identify Graco and our products to our customers.

Competition

We encounter a wide variety of competitors that vary by product, industry and geographic area. Each of our segments generally has several competitors. Our competitors are both U.S. and foreign companies and range in size. We believe that our ability to compete depends upon product quality, product reliability, innovation, design, customer support and service, personal relationships, specialized engineering and competitive pricing. Although no competitor duplicates all of our products, some competitors are larger than our Company, both in terms of sales of directly competing products and in terms of total sales and financial resources. We also face competitors with different cost structures and expectations of profitability and these companies may offer competitive products at lower prices. We may have to refresh our product line and continue development of our distribution channel to stay competitive. We are also facing competitors who illegally sell counterfeits of our products or otherwise infringe on our intellectual property rights. We may have to increase our intellectual property enforcement activities.

Environmental Protection

Our compliance with federal, state and local environmental laws and regulations did not have a material effect upon our capital expenditures, earnings or competitive position during the fiscal year ended December 26, 2014.

Employees

As of December 26, 2014, we employed approximately 3,100 persons, excluding the employees of the held separate Liquid Finishing businesses (see below). Of this total, approximately 1,050 were employees based outside the United States, and 900 were hourly factory workers in the United States. None of our Company’s United States employees are covered by a collective bargaining agreement. Various national industry-wide labor agreements apply to certain employees in various countries outside the United States. Compliance with such agreements has no material effect on our Company or our operations.

Acquisition and Planned Divestiture of ITW Liquid Finishing Businesses

In April 2012, we purchased the finishing businesses of Illinois Tool Works Inc. (“ITW”). The acquisition included powder finishing and liquid finishing equipment operations, technologies and brands (separately, the “Powder Finishing” and “Liquid Finishing” businesses). Results of the Powder Finishing businesses have been included in the Industrial segment since the date of acquisition. In March 2012, the United States Federal Trade Commission (“FTC”) issued an order for our Company to hold the Liquid Finishing assets separate from our other businesses. In May 2012, the FTC issued a proposed decision and order that required us to sell the held separate Liquid Finishing business assets no later than 180 days from the date the order becomes final. The FTC approved a final decision and order that became effective on October 9, 2014.

Pursuant to the final order, Graco must sell the Liquid Finishing business assets within 180 days of the effective date. On October 8, 2014, the Company announced it had signed a definitive agreement to sell the Liquid Finishing business assets for $590 million cash, subject to regulatory approval and other customary closing conditions. The sale transaction is expected to close in the first half of 2015. Graco will continue to hold the Liquid Finishing businesses separate and maintain them as viable and competitive until the sale process is complete.

Growth Strategies and Acquisitions – Our growth strategies may not provide the return on investment desired if we are not successful in implementation of these strategies.

Making acquisitions, investing in new products, expanding geographically and targeting new industries are among our growth strategies. We may not obtain the return on investment desired if we are not successful in implementing these growth strategies. Suitable acquisitions must be located, completed and effectively integrated into or added to our existing businesses or corporate structure for this growth strategy to be successful. We may not be able to obtain financing at a reasonable cost. We may be unsuccessful in acquiring and effectively integrating into or adding businesses to our current operations or corporate structure. We

6

Table of Contents

may not realize projected efficiencies and cost-savings from the businesses we acquire. We cannot predict how customers, competitors, suppliers and employees will react to the acquisitions that we make. If acquired businesses do not meet performance expectations, assets acquired could be subject to impairment. We make significant investments in developing products that have innovative features and differentiated technology in their industries and in niche markets. We are adding to the geographies in which we do business with third party distributors. We cannot predict whether and when we will be able to realize the expected financial results and accretive effect of the acquisitions that we make, the new products that we develop and the channel expansions that we make.

Divestiture - Our acquisition of the finishing businesses of ITW includes a requirement that we divest the acquired Liquid Finishing businesses, which has not been completed and remains subject to FTC approval.

In April 2012, we completed our purchase of the finishing businesses of ITW. The acquisition included Powder Finishing and Liquid Finishing equipment operations, technologies and brands. Results of the Powder Finishing businesses have been included in the Industrial segment since the date of acquisition. Pursuant to a March 2012 order, the Liquid Finishing businesses were to be held separate from the rest of Graco’s businesses while the FTC considered a settlement with Graco and determined which portions of the Liquid Finishing business Graco must divest. The FTC approved a final decision and order on October 6, 2014, which became effective on October 9, 2014. Pursuant to the final order, Graco must sell the Liquid Finishing business assets within 180 days of the effective date. On October 8, 2014, the Company announced it had signed a definitive agreement to sell the Liquid Finishing business assets for $590 million cash, subject to regulatory approval and other customary closing conditions. The sale transaction is expected to close in the first half of 2015. Nonetheless, we cannot be certain to what extent or when the required regulatory approval of a buyer and terms of the sale will be obtained, or whether the Company will be able to complete a divestiture in a time frame that is satisfactory to the FTC. Graco will continue to hold the Liquid Finishing businesses separate and maintain them as viable and competitive until the sale process is complete.

Economic Environment – Demand for our products depends on the level of commercial and industrial activity worldwide.

An economic downturn or financial market turmoil may depress demand for our equipment in all major geographies and markets. If our distributors and original equipment manufacturers are unable to purchase our products because of unavailable credit or unfavorable credit terms or are simply unwilling to purchase our products, our net sales and earnings will be adversely affected. An economic downturn may affect our ability to satisfy the financial covenants in the terms of our financing arrangements.

Currency – Changes in currency translation rates could adversely impact our revenue and earnings.

Changes in exchange rates will impact our reported sales and earnings. A majority of our manufacturing and cost structure is based in the United States. In addition, decreased value of local currency may make it difficult for some of our distributors to purchase products.

Changes in Laws and Regulations – Changes may impact how we can do business and the cost of doing business around the world.

The speed and frequency of implementation and the complexity of new or revised laws and regulations globally appear to be increasing. In addition, as our business grows and/or geographically expands, we may become subject to laws and regulations previously inapplicable to our business. These laws and regulations increase our costs of doing business, may affect the manner in which our products will be produced or delivered and may impact our long-term ability to provide returns to our shareholders.

Anti-Corruption Laws – We may incur costs and suffer damages if our employees, agents, distributors or suppliers violate anti-bribery, anti-corruption or trade laws and regulations.

Bribery, corruption and trade laws and regulations, and enforcement thereof, is increasing in frequency, complexity and severity on a global basis. If our internal controls and compliance program do not adequately prevent or deter our employees, agents, distributors, suppliers and other third parties with whom we do business from violating anti-corruption laws, we may incur defense costs, fines, penalties and reputational damage.

Intellectual Property – Demand for our products may be affected by new entrants who copy our products and/or infringe on our intellectual property.

From time to time, we have been faced with instances where competitors have infringed or improperly used our intellectual property and/or taken advantage of our design and development efforts. The ability to protect and enforce intellectual property rights varies across jurisdictions. Competitors who copy our products are becoming more prevalent in Asia. If we are unable to effectively meet these challenges, they could adversely affect our revenues and profits and hamper our ability to grow.

7

Table of Contents

Foreign Operations – Conducting business internationally exposes our Company to risks that could harm our business.

In 2014, approximately 53 percent of our sales were generated by customers located outside the United States. We are increasing our presence in advancing economies. Operating and selling outside of the United States exposes us to certain risks that could adversely impact our sales volume, rate of growth or profitability. These risks include: complying with foreign legal and regulatory requirements, international trade factors (export controls, trade sanctions, duties, tariff barriers and other restrictions), protection of our proprietary technology in certain countries, potentially burdensome taxes, potential difficulties staffing and managing local operations, and changes in exchange rates.

Competition – Our success depends upon our ability to develop, market and sell new products that meet our customers’ needs, and anticipate industry changes.

Our profitability will be affected if we do not develop new products and technologies that meet our customers’ needs. Our ability to develop, market and sell products that meet our customers’ needs depends upon a number of factors, including anticipating the features and products that our customers will need in the future, identifying and entering into new markets, and training our distributors. Changes in industries in which we participate, including consolidation of competitors and customers, could affect our success. Price competition and competitor strategies could affect our success.

Suppliers – Risks associated with foreign sourcing, supply interruption, delays in raw material or component delivery, supply shortages and counterfeit components may adversely affect our production or profitability.

We are sourcing an increasing percentage of our materials and components from suppliers outside the United States, and from suppliers within the United States who engage in foreign sourcing. Long lead times or supply interruptions associated with a global supply base may reduce our flexibility and make it more difficult to respond promptly to fluctuations in demand or respond quickly to product quality problems. Changes in exchange rates between the U.S. dollar and other currencies and fluctuations in the price of commodities may impact the manufacturing costs of our products and affect our profitability. Protective tariffs, unpredictable changes in duty rates, and trade regulation changes may make certain foreign-sourced parts no longer competitively priced. Long supply chains may be disrupted by environmental events or other political factors. Raw materials may become limited in availability from certain regions. Port labor disputes may delay shipments. We source a large volume and a variety of electronic components, which exposes us to an increased risk of counterfeit components entering our supply chain. If counterfeit components unknowingly become part of our products, we may need to stop delivery and rebuild our products. We may be subject to warranty claims and may need to recall products.

Security Breaches – Intrusion into our information systems may impact our business.

Security breaches or intrusion into our information systems, and the breakdown, interruption in or inadequate upgrading or maintenance of our information processing software, hardware or networks may adversely affect our business. Security breaches or intrusion into the systems or data of the third parties with whom we conduct business may also harm our business.

Political Instability – Uncertainty surrounding political leadership may limit our growth opportunities.

Domestic political instability, including government shut downs, may limit our ability to grow our business. International political instability may prevent us from expanding our business into certain geographies and may also limit our ability to grow our business. Terrorist activities and civil disturbances may harm our business.

Legal Proceedings – Costs associated with claims, litigation, administrative proceedings and regulatory reviews, and potentially adverse outcomes, may affect our profitability.

As our Company grows, we are at an increased risk of being a target in litigation, administrative proceedings and regulatory reviews. The cost of defending such matters appears to be increasing, particularly in the United States. We may also need to pursue claims or litigation to protect our interests. Such costs may adversely affect our Company’s profitability. Our businesses expose us to potential toxic tort, product liability and commercial claims. Successful claims against the Company may adversely affect our results.

Major Customers – Our Contractor segment depends on a few large customers for a significant portion of its sales. Significant declines in the level of purchases by these customers could reduce our sales and impact segment profitability.

Our Contractor segment derives a significant amount of revenue from a few large customers. Substantial decreases in purchases by these customers, difficulty in collecting amounts due or the loss of their business would adversely affect the profitability of this segment. The business of these customers is dependent upon the economic vitality of the construction and home maintenance markets. If these markets decline, the business of our customers could be adversely affected and their purchases of our equipment could decrease.

8

Table of Contents

Variable Industries – Our success may be affected by variations in the construction and automotive industries.

Our business may be affected by fluctuations in residential, commercial and institutional building and remodeling activity. Changes in construction materials and techniques may also impact our business. Our business may also be affected by fluctuations of activity in the automotive industry.

Natural Disasters – Our operations are at risk of damage or destruction by natural disasters or fire.

The loss of, or substantial damage to, one of our facilities could make it difficult to supply our customers with product and provide our employees with work. Flooding, tornadoes, typhoons, unusually heavy precipitation, earthquakes or fire could adversely impact our operations.

Item 1B. Unresolved Staff Comments

None.

Our facilities are in satisfactory condition, suitable for their respective uses, and are generally adequate to meet current needs. A description of our principal facilities as of February 17, 2015, is set forth in the chart below. Facilities are used by all segments, unless otherwise noted.

| Facility |

Owned or |

Square Footage |

Facility Activities | |||||

|

North America

| ||||||||

| Dunnville, Ontario, Canada

|

Leased | 3,200 | Manufacturing for Industrial segment | |||||

| Guelph, Ontario, Canada | Leased | 3,300 | Warehouse and office for Industrial segment

| |||||

| Tlalnepantla, State of Mexico, Mexico | Leased | 4,000 | Manufacturing, warehouse and office for Industrial segment

| |||||

| San Leandro, California, United States | Leased | 12,100 | Manufacturing, warehouse and office for Industrial segment

| |||||

| Indianapolis, Indiana, United States | Owned | 63,500 | Warehouse, office, product development and application laboratory for Industrial segment | |||||

| Dexter, Michigan, United States | Leased | 31,300 | Manufacturing, warehouse, office and product development for Industrial segment

| |||||

| Minneapolis, Minnesota, United States | Owned | 142,000 | Corporate office; office and product development for Industrial segment

| |||||

| Minneapolis, Minnesota, United States | Owned | 42,000 | Corporate office

| |||||

| Minneapolis, Minnesota, United States | Owned | 405,000 | Manufacturing, warehouse and office for Industrial segment

| |||||

| Minneapolis, Minnesota, United States | Owned | 86,700 | Warehouse and assembly for Industrial segment

| |||||

| Anoka, Minnesota, United States | Owned | 207,000 | Manufacturing, warehouse, office and product development for Lubrication segment | |||||

| Rogers, Minnesota, United States | Owned | 333,000 | Manufacturing, office and product development for Contractor segment

| |||||

9

Table of Contents

| Rogers, Minnesota, United States | Leased | 227,100 | Warehouse and office

| |||||

| North Canton, Ohio, United States | Owned | 132,000 | Manufacturing, warehouse, office, product development and application laboratory for Industrial segment

| |||||

| Erie, Pennsylvania, United States | Leased | 43,000 | Manufacturing, warehouse, office and product development for Industrial segment

| |||||

| Sioux Falls, South Dakota, United States | Owned | 149,000 | Manufacturing and office for Industrial and Contractor segment spray guns and accessories

| |||||

| Houston, Texas, United States

|

Leased | 4,500 | Warehouse and office for Industrial segment

| |||||

| Kamas, Utah, United States

|

Leased | 20,000 | Manufacturing and office for Industrial segment

| |||||

| Chesapeake, Virginia, United States

|

Leased | 9,600 | Manufacturing and office for Industrial segment

| |||||

| Chesapeake, Virginia, United States

|

Leased | 3,300 | Warehouse for Industrial segment

| |||||

| South America

| ||||||||

| Porto Alegre, Rio Grande do Sul, Brazil

|

Leased | 4,000 | Manufacturing, office and product development for Industrial segment | |||||

| Porto Alegre, Rio Grande do Sul, Brazil

|

Leased | 2,900 | Manufacturing and warehouse for Industrial segment

| |||||

| Uruguay Free Zone, Montevideo, Uruguay

|

Leased | 1,800 | Office

| |||||

| Europe

| ||||||||

| Maasmechelen, Belgium | Owned | 175,000 | Warehouse, office and assembly; European training, testing and education center

| |||||

| Valence, France

|

Leased | 3,900 | Office for Industrial segment

| |||||

| Rödermark, Germany

|

Leased | 8,600 | Warehouse and office for Industrial segment

| |||||

| Milan, Italy

|

Leased | 7,500 | Office and warehouse for Industrial segment

| |||||

| Sibiu, Romania

|

Leased | 31,000 | Manufacturing for Industrial segment

| |||||

| St. Gallen, Switzerland

|

Owned | 78,000 | Manufacturing, warehouse, office, product development and application laboratory for Industrial segment

| |||||

| St. Gallen, Switzerland

|

Leased | 9,000 | Manufacturing for Industrial segment

| |||||

| Poole, Dorset, United Kingdom

|

Leased | 3,500 | Office and warehouse for Industrial segment | |||||

| Denton, Manchester, United Kingdom | Leased | 2,500 | Manufacturing, warehouse and office for Industrial segment

| |||||

10

Table of Contents

| Stoke-on-Trent, Staffordshire, United Kingdom | Leased | 7,300 | Manufacturing, warehouse, office and product development for Industrial segment

| |||||

| Brighouse, West Yorkshire, United Kingdom | Leased | 18,000 | Manufacturing, warehouse, office and product development for Industrial segment

| |||||

| Brighouse, West Yorkshire, United Kingdom | Leased | 10,800 | Manufacturing, warehouse and office for Industrial segment

| |||||

| Brighouse, West Yorkshire, United Kingdom | Leased | 6,000 | Warehouse for Industrial segment | |||||

| Asia Pacific

| ||||||||

| Bundoora, Australia | Leased | 2,500 | Office

| |||||

| Derrimut, Australia | Leased | 7,500 | Warehouse

| |||||

| Shanghai, P.R.C. | Leased | 29,400 | Office; Asia Pacific training, testing and education center

| |||||

| Shanghai Waiqaoqiao Pilot Free Trade Zone, P.R.C. | Leased | 30,700 | Warehouse

| |||||

| Shanghai, P.R.C.

|

Leased | 27,000 | Office and warehouse for Industrial segment | |||||

| Suzhou, P.R.C. | Owned | 79,000 | Manufacturing, warehouse, office and product development

| |||||

| Yokohama, Japan

|

Leased | 18,500 | Office

| |||||

| Boon Lay Way, Singapore

|

Leased | 2,100 | Warehouse and office for Industrial segment | |||||

| Anyang, South Korea

|

Leased | 5,100 | Office

| |||||

| Gwangjoo, South Korea | Leased | 10,700 | Warehouse | |||||

Our Company is engaged in routine litigation, administrative proceedings and regulatory reviews incident to our business. It is not possible to predict with certainty the outcome of these unresolved matters, but management believes that they will not have a material effect upon our operations or consolidated financial position.

Item 4. Mine Safety Disclosures

Not applicable.

11

Table of Contents

Executive Officers of Our Company

The following are all the executive officers of Graco Inc. as of February 17, 2015:

Patrick J. McHale, 53, is President and Chief Executive Officer, a position he has held since June 2007. He served as Vice President and General Manager, Lubrication Equipment Division from June 2003 to June 2007. He was Vice President, Manufacturing and Distribution Operations from April 2001 to June 2003. He served as Vice President, Contractor Equipment Division from February 2000 to April 2001. From September 1999 to February 2000, he was Vice President, Lubrication Equipment Division. Prior to September 1999, he held various manufacturing management positions in Minneapolis, Minnesota; Plymouth, Michigan; and Sioux Falls, South Dakota. Mr. McHale joined the Company in 1989.

David M. Ahlers, 56, became Vice President, Human Resources and Corporate Communications in April 2010. From September 2008 through March 2010, he served as the Company’s Vice President, Human Resources. Prior to joining Graco, Mr. Ahlers held various human resources positions, including, most recently, Chief Human Resources Officer and Senior Managing Director of GMAC Residential Capital, from August 2003 to August 2008. He joined the Company in 2008.

Caroline M. Chambers, 50, was elected Vice President, Corporate Controller and Information Systems on December 6, 2013. She has also served as the Company’s principal accounting officer since September 2007. From April 2009 to December 2013, she was Vice President and Corporate Controller. She served as Vice President and Controller from December 2006 to April 2009. She was Corporate Controller from October 2005 to December 2006 and Director of Information Systems from July 2003 through September 2005. Prior to becoming Director of Information Systems, she held various management positions in the internal audit and accounting departments. Prior to joining Graco, Ms. Chambers was an auditor with Deloitte & Touche in Minneapolis, Minnesota and Paris, France. Ms. Chambers joined the Company in 1992.

Mark D. Eberlein, 54, is Vice President and General Manager, Process Division, a position he has held since January 2013. From November 2008 to December 2012, he was Director, Business Development, Industrial Products Division. He was Director, Manufacturing Operations, Industrial Products Division from January to October 2008. From 2001 to 2008, he was Manufacturing Operations Manager of a variety of Graco business divisions. Prior to joining Graco, Mr. Eberlein worked as an engineer at Honeywell and at Sheldahl. He joined the Company in 1996.

Karen Park Gallivan, 58, became Vice President, General Counsel and Secretary in September 2005. She was Vice President, Human Resources from January 2003 to September 2005. Prior to joining Graco, she was Vice President of Human Resources and Communications at Syngenta Seeds, Inc. from January 1999 to January 2003. From 1988 through January 1999, she was the general counsel of Novartis Nutrition Corporation. Prior to joining Novartis, Ms. Gallivan was an attorney with the law firm of Rider, Bennett, Egan & Arundel, L.L.P. She joined the Company in 2003.

James A. Graner, 70, became Chief Financial Officer in September 2005, a position he held in conjunction with Treasurer from September 2005 to June 2011. He served as Vice President and Controller from March 1994 to September 2005. He was Treasurer from May 1993 through February 1994. Prior to becoming Treasurer, he held various managerial positions in the treasury, accounting and information systems departments. He joined the Company in 1974. Mr. Graner has announced his intention to retire in 2015.

Dale D. Johnson, 60, became Vice President and General Manager, Contractor Equipment Division in April 2001. From January 2000 through March 2001, he served as President and Chief Operating Officer. From December 1996 to January 2000, he was Vice President, Contractor Equipment Division. Prior to becoming the Director of Marketing, Contractor Equipment Division in June 1996, he held various marketing and sales positions in the Contractor Equipment division and the Industrial Equipment division. He joined the Company in 1976.

Jeffrey P. Johnson, 55, became Vice President and General Manager, EMEA in January 2013. From February 2008 to December 2012 he was Vice President and General Manager, Asia Pacific. He served as Director of Sales and Marketing, Applied Fluid Technologies Division, from June 2006 until February 2008. Prior to joining Graco, he held various sales and marketing positions, including, most recently, President of Johnson Krumwiede Roads, a full-service advertising agency, and European sales manager at General Motors Corp. He joined the Company in 2006.

David M. Lowe, 59, became Executive Vice President, Industrial Products Division in April 2012. From February 2005 to April 2012, he was Vice President and General Manager, Industrial Products Division. He was Vice President and General Manager, European Operations from September 1999 to February 2005. Prior to becoming Vice President, Lubrication Equipment Division in December 1996, he was Treasurer. Mr. Lowe joined the Company in 1995.

Bernard J. Moreau, 54, is Vice President and General Manager, South and Central America, a position he has held since January 2013. From November 2003 to December 2012, he was Sales and Marketing Director, EMEA, Industrial/Automotive Equipment Division. From January 1997 to October 2003, he was Sales Manager, Middle East, Africa and East Europe. Prior to 1997, he

12

Table of Contents

worked in various Graco sales engineering and sales management positions, mainly to support Middle East, Africa and southern Europe territories. He joined the Company in 1985.

Peter J. O’Shea, 50, became Vice President and General Manager, Asia Pacific in January 2013. From January 2012 until December 2012, he was Director of Sales and Marketing, Industrial Products Division, and from 2008 to 2012, he was Director of Sales and Marketing, Industrial Products Division and Applied Fluid Technologies Division. He was Country Manager, Australia - New Zealand from 2005 to 2008, and from 2002 to 2005 he served as Business Development Manager, Australia - New Zealand. Prior to becoming Business Development Manager, Australia - New Zealand, he worked in various Graco sales management positions. Mr. O’Shea joined the Company in 1995.

Charles L. Rescorla, 63, was elected Vice President, Corporate Manufacturing, Distribution Operations and Corporate Development on December 6, 2013. From June 2011 to December 2013, he was Vice President, Corporate Manufacturing, Information Systems and Distribution Operations. He was Vice President, Manufacturing, Information Systems and Distribution Operations from April 2009 to June 2011. He served as Vice President, Manufacturing and Distribution Operations from September 2005 to April 2009. From June 2003 to September 2005, he was Vice President, Manufacturing/Distribution Operations and Information Systems. From April 2001 until June 2003, he was Vice President and General Manager, Industrial/Automotive Equipment Division. Prior to April 2001, he held various positions in manufacturing and engineering management. Mr. Rescorla joined the Company in 1988.

Christian E. Rothe, 41, became Vice President and Treasurer in June 2011. Prior to joining Graco, he held various positions in business development, accounting and finance, including, most recently, at Gardner Denver, Inc., a manufacturer of highly engineered products, as Vice President, Treasurer from January 2011 to June 2011, Vice President - Finance, Industrial Products Group from October 2008 to January 2011, and Director, Strategic Planning and Development from October 2006 to October 2008. Mr. Rothe joined the Company in 2011.

Mark W. Sheahan, 50, became Vice President and General Manager, Applied Fluid Technologies Division in February 2008. He served as Chief Administrative Officer from September 2005 until February 2008, and was Vice President and Treasurer from December 1998 to September 2005. Prior to becoming Treasurer in December 1996, he was Manager, Treasury Services. He joined the Company in 1995.

Brian J. Zumbolo, 45, became Vice President and General Manager, Lubrication Equipment Division in August 2007. He was Director of Sales and Marketing, Lubrication Equipment and Applied Fluid Technologies, Asia Pacific, from November 2006 through July 2007. From February 2005 to November 2006, he was the Director of Sales and Marketing, High Performance Coatings and Foam, Applied Fluid Technologies Division. Mr. Zumbolo was the Director of Sales and Marketing, Finishing Equipment from May 2004 to February 2005. Prior to May 2004, he held various marketing positions in the Industrial Equipment division. Mr. Zumbolo joined the Company in 1999.

Except as otherwise noted above, the Board of Directors elected or re-elected the above executive officers to their current positions on December 7, 2012, effective January 1, 2013.

13

Table of Contents

PART II

Item 5. Market for the Company’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Graco Common Stock

Graco common stock is traded on the New York Stock Exchange under the ticker symbol “GGG.” As of February 3, 2015, the share price was $71.65 and there were 58,991,622 shares outstanding and 2,788 common shareholders of record, which includes nominees or broker dealers holding stock on behalf of an estimated 78,000 beneficial owners.

High and low sales prices for the Company’s common stock and dividends declared for each quarterly period in the past two years were as follows:

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

|||||||||||||

| 2014 |

||||||||||||||||

| Stock price per share |

||||||||||||||||

| High |

$ | 78.97 | $ | 77.82 | $ | 79.88 | $ | 81.93 | ||||||||

| Low |

65.18 | 70.39 | 72.29 | 67.06 | ||||||||||||

| Dividends declared per share |

0.28 | 0.28 | 0.28 | 0.30 | ||||||||||||

| 2013 |

||||||||||||||||

| Stock price per share |

||||||||||||||||

| High |

$ | 59.81 | $ | 65.43 | $ | 74.70 | $ | 79.66 | ||||||||

| Low |

52.45 | 53.90 | 62.84 | 72.39 | ||||||||||||

| Dividends declared per share |

0.25 | 0.25 | 0.25 | 0.28 | ||||||||||||

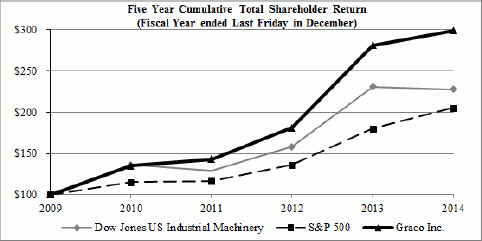

The graph below compares the cumulative total shareholder return on the common stock of the Company for the last five fiscal years with the cumulative total return of the S&P 500 Index and the Dow Jones US Industrial Machinery Index over the same period (assuming the value of the investment in Graco common stock and each index was $100 on December 25, 2009, and all dividends were reinvested).

| 2009 |

2010 |

2011 |

2012 |

2013 |

2014 | |||||||

| Dow Jones US Industrial Machinery |

100 | 136 | 129 | 158 | 231 | 228 | ||||||

| S&P 500 |

100 | 115 | 117 | 136 | 180 | 205 | ||||||

| Graco Inc. |

100 | 135 | 143 | 181 | 281 | 299 |

14

Table of Contents

Issuer Purchases of Equity Securities

On September 14, 2012, the Board of Directors authorized the Company to purchase up to 6,000,000 shares of its outstanding common stock, primarily through open-market transactions. The authorization expires on September 30, 2015.

In addition to shares purchased under the Board authorization, the Company purchases shares of common stock held by employees who wish to tender owned shares to satisfy the exercise price or tax withholding on stock option exercises.

Information on issuer purchases of equity securities follows:

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (at end of period) |

||||||||||||

| Sep 27, 2014 - Oct 24, 2014 |

277,035 | $ | 71.11 | 277,035 | 2,887,377 | |||||||||||

| Oct 25, 2014 - Nov 21, 2014 |

200,000 | $ | 78.52 | 200,000 | 2,687,377 | |||||||||||

| Nov 22, 2014 - Dec 26, 2014 |

230,000 | $ | 79.59 | 230,000 | 2,457,377 | |||||||||||

Item 6. Selected Financial Data

Graco Inc. and Subsidiaries (in thousands, except per share amounts)

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Net sales |

$ | 1,221,130 | $ | 1,104,024 | $ | 1,012,456 | $ | 895,283 | $ | 744,065 | ||||||||||

| Net earnings |

225,573 | 210,822 | 149,126 | 142,328 | 102,840 | |||||||||||||||

| Per common share |

||||||||||||||||||||

| Basic net earnings |

$ | 3.75 | $ | 3.44 | $ | 2.47 | $ | 2.36 | $ | 1.71 | ||||||||||

| Diluted net earnings |

3.65 | 3.36 | 2.42 | 2.32 | 1.69 | |||||||||||||||

| Cash dividends declared |

1.13 | 1.03 | 0.93 | 0.86 | 0.81 | |||||||||||||||

| Total assets |

$ | 1,544,778 | $ | 1,327,228 | $ | 1,321,734 | $ | 874,309 | $ | 530,474 | ||||||||||

| Long-term debt (including current portion) |

615,000 | 408,370 | 556,480 | 300,000 | 70,255 | |||||||||||||||

Net sales in 2012 included $93 million from Powder Finishing operations acquired in April 2012. The Company used long-term borrowings and available cash balances to complete the $668 million purchase of Powder Finishing and Liquid Finishing businesses in 2012.

15

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following Management’s Discussion and Analysis reviews significant factors affecting the Company’s consolidated results of operations, financial condition and liquidity. This discussion should be read in conjunction with our financial statements and the accompanying notes to the financial statements. The discussion is organized in the following sections:

| • | Overview |

| • | Acquisition and Planned Divestiture |

| • | Results of Operations |

| • | Segment Results |

| • | Financial Condition and Cash Flow |

| • | Critical Accounting Estimates |

| • | Recent Accounting Pronouncements |

Overview

Graco designs, manufactures and markets systems and equipment to pump, meter, mix and dispense a wide variety of fluids and coatings. The Company specializes in equipment for applications that involve difficult-to-handle materials with high viscosities, materials with abrasive or corrosive properties and multiple-component materials that require precise ratio control. Graco sells primarily through independent third-party distributors worldwide to industrial and contractor end users. More than half of our sales are outside of the United States. Graco’s business is classified by management into three reportable segments, each responsible for product development, manufacturing, marketing and sales of their products.

Graco’s key strategies include developing and marketing new products, leveraging products and technologies into additional, growing end user markets, expanding distribution globally and completing strategic acquisitions that provide additional channel and technologies. Long-term financial growth targets accompany these strategies, including our expectation of 10 percent revenue growth and 12 percent consolidated net earnings growth. We continued to develop new products in each operating division including products that are expected to drive incremental sales growth, such as the development of equipment for packaging applications as well as continued refresh and upgrades of existing product lines.

In January 2014, the Company paid $65 million cash to acquire QED Environmental Systems, a manufacturer of fluid management solutions for environmental monitoring and remediation, markets where Graco had little or no previous exposure. Results of operations are included in the Company’s Industrial segment starting from the date of acquisition.

In October 2014, we acquired the stock of Alco Valves Group (“Alco”) for £72 million cash. Alco is a United Kingdom based manufacturer of high quality, high pressure valves used in the oil and natural gas industry and in other industrial processes. Alco’s products and business relationships will enhance Graco’s position in the oil and natural gas industry and complement Graco’s core competencies of designing and manufacturing advanced flow control technologies. Results of Alco operations are included in the Company’s Industrial segment starting from the date of acquisition.

Manufacturing is a key competency of the Company. Our management team in Minneapolis provides strategic manufacturing expertise, and is also responsible for factories not fully aligned with a single division. Our primary manufacturing facilities are in the United States and Switzerland, and our primary distribution facilities are located in the United States, Belgium, Switzerland, United Kingdom, P.R.C., Japan, Korea and Australia.

Acquisition and Planned Divestiture of ITW Liquid Finishing Businesses

In April 2012, we purchased the finishing businesses of ITW. The acquisition included finishing equipment operations, technologies and brands of the Powder Finishing and Liquid Finishing businesses. Results of the Powder Finishing businesses have been included in the Industrial segment since the date of acquisition. In March 2012, the FTC issued an order to hold the Liquid Finishing assets separate from our other businesses. In May 2012, the FTC issued a proposed decision and order that required us to sell the held separate Liquid Finishing business assets no later than 180 days from the date the order becomes final. The FTC approved a final decision and order that became effective on October 9, 2014.

Pursuant to the final order, Graco must sell the Liquid Finishing business assets within 180 days of the effective date. On October 8, 2014, the Company announced it had signed a definitive agreement to sell the Liquid Finishing business assets for $590 million cash, subject to regulatory approval and other customary closing conditions. The sale transaction is expected to close in the first half of 2015, in compliance with the FTC’s final decision and order. Graco will continue to hold the Liquid Finishing businesses separate and maintain them as viable and competitive until the sale process is complete.

16

Table of Contents

Under terms of the hold separate order, the Company does not have the power to direct the activities of the Liquid Finishing businesses that most significantly impact the economic performance of those businesses. Therefore, we have determined that the Liquid Finishing businesses are variable interest entities for which the Company is not the primary beneficiary and that they should not be consolidated. Furthermore, the Company does not have a controlling interest in the Liquid Finishing businesses, nor is it able to exert significant influence over the Liquid Finishing businesses. Consequently, our investment in the shares of the Liquid Finishing businesses has been reflected as a cost-method investment on our Consolidated Balance Sheets as of December 26, 2014 and December 27, 2013, and their results of operations have not been consolidated with those of the Company. As a cost-method investment, income is recognized based on dividends received from current earnings of Liquid Finishing. Dividends of $28 million received in 2014, $28 million received in 2013 and $12 million received in 2012 are included in other expense (income) on the Consolidated Statements of Earnings. We evaluate our cost-method investment for other-than-temporary impairment at each reporting period. As of December 26, 2014, we evaluated our investment in the Liquid Finishing businesses and determined that there was no impairment.

Results of Operations

Net sales, operating earnings, net earnings and earnings per share were as follows (in millions except per share amounts):

| 2014 | 2013 | 2012 | ||||||||||

| Net Sales |

$ | 1,221 | $ | 1,104 | $ | 1,012 | ||||||

| Operating Earnings |

309 | 280 | 225 | |||||||||

| Net Earnings |

226 | 211 | 149 | |||||||||

| Diluted Net Earnings per Common Share |

$ | 3.65 | $ | 3.36 | $ | 2.42 | ||||||

2014 Summary:

| • | Net sales grew by 11 percent, representing growth in all reportable segments and regions, including double digit growth in the Americas. |

| • | Sales from acquired operations totaled $41 million for 2014, contributing 4 percentage points of the growth for the year. |

| • | Changes in currency translation rates reduced sales and net earnings by approximately $3 million and $2 million, respectively. |

| • | Gross profit margin, expressed as a percentage of sales, was 55 percent for the year, slightly lower than 2013 due to the effects of purchase accounting ($2.5 million) and lower margins from acquired operations. |

| • | Investment in new product development was $54 million or 4 percent of sales in 2014. |

| • | Operating expenses increased $30 million over 2013; approximately 75 percent of the increase relates to acquired operations and spending on regional and product growth initiatives. |

| • | Operating earnings were consistent in 2014 and 2013 at 25 percent of sales. |

| • | Other expense (income) included dividends received from the Liquid Finishing businesses that are held separate from the Company’s other businesses. Dividends for 2014 and 2013 were $28 million in each year. |

| • | The effective tax rate was 28 1⁄2 percent, up from 27 percent in 2013. The effective rate was lower in 2013 primarily because it included two years of federal R&D credit as the credit was reinstated in the first quarter of 2013 retroactive to the beginning of 2012. |

| • | Cash flows from operations totaled $241 million, compared to $243 million in the prior year; increases in accounts receivable and inventories were in line with volume growth. |

| • | Long-term debt was $615 million at December 26, 2014, compared to $408 million at December 27, 2013. |

| • | Dividends paid totaled $66 million in 2014. |

| • | The Company repurchased $195 million of its stock in 2014 compared to $68 million in 2013. |

2013 Summary:

| • | Net sales grew by 9 percent, including increases of 11 percent in the Americas, 10 percent in EMEA and 3 percent in Asia Pacific. Sales in the Industrial segment grew by 8 percent; sales in the Contractor segment grew by 15 percent and sales in the Lubrication segment decreased by 1 percent. |

| • | First quarter 2013 sales from Powder Finishing operations acquired in April 2012 contributed approximately 3 percentage points to full-year 2013 sales growth. |

| • | Changes in currency translation rates did not have a significant impact on sales or earnings in 2013. |

| • | Gross profit margin as a percentage of sales increased to 55 percent from 54 percent. The effects of realized price increases and higher production volume offset the unfavorable effect of changes in product mix, including the effect of increased Powder Finishing equipment and Contractor segment sales. In 2012, non-recurring purchase accounting effects reduced gross margin for the year by approximately 1 percentage point. |

| • | Investment in new product development was $51 million or 5 percent of sales in 2013. |

17

Table of Contents

| • | Total operating expenses increased $2 million over 2012, with increases in product development and selling and marketing activities largely offset by decreases in general and administrative expenses, including a $14 million decrease in acquisition and divestiture costs. |

| • | Operating earnings were 25 percent of sales in 2013 as compared to 22 percent in 2012. |

| • | Other expense (income) included dividends received from the Liquid Finishing businesses that are held separate from the Company’s other businesses. Dividends for 2013 and 2012 totaled $28 million and $12 million, respectively. |

| • | The effective tax rate was 27 percent, down from 31 percent in 2012. The lower rate for 2013 reflected the effects of higher after-tax dividend income received from the Liquid Finishing businesses and the federal R&D credit that was renewed in 2013, effective retroactive to the beginning of 2012. There was no R&D credit recognized in 2012. |

| • | Cash flows from operations grew to $243 million compared to $190 million in the prior year, with increases in working capital in line with volume growth. |

| • | Long-term debt was $408 million at December 27, 2013, compared to $556 million at December 28, 2012. |

| • | Dividends paid totaled $61 million in 2013. |

| • | The Company repurchased $68 million of its stock in 2013 compared to $1 million in 2012. |

The following table presents net sales by geographic region (in millions):

| 2014 | 2013 | 2012 | ||||||||||

| Americas1 |

$ | 684 | $ | 595 | $ | 536 | ||||||

| EMEA2 |

305 | 283 | 257 | |||||||||

| Asia Pacific |

232 | 226 | 219 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 1,221 | $ | 1,104 | $ | 1,012 | ||||||

|

|

|

|

|

|

|

|||||||

| 1 | North, South and Central America, including the United States. Sales in the United States were $577 million in 2014, $498 million in 2013 and $441 million in 2012. |

| 2 | Europe, Middle East and Africa |

In 2014, sales in the Americas increased by 15 percent in total, with increases of 18 percent in the Industrial segment, 12 percent in the Contractor segment and 13 percent in the Lubrication segment as compared to the prior year. Sales from acquired operations totaled $32 million in the Americas, contributing 6 percentage points of growth. All of the growth from acquisitions is included the Industrial segment. Excluding acquisitions the Industrial segment grew by 7 percent in the region, with strength broadly across industrial end user markets and successful new product launches. The Contractor segment continues to benefit from the recovery of the U.S. housing and construction markets. Sales in the Lubrication segment reflected double digit growth in both vehicle service applications and industrial lubrication customers.

In 2014, sales in EMEA increased by 8 percent (7 percent at consistent translation rates). Sales in the Industrial segment increased by 9 percent (8 percent at consistent translation rates). Sales increased by 5 percent in the Contractor segment (4 percent at consistent translation rates) and decreased by 1 percent in the Lubrication segment (2 percent at consistent translation rates). Growth in EMEA came primarily from the developed economies in the West. The emerging markets increased slightly over 2013, with gains in Eastern Europe and the Middle East, partially offset by declines in Russia.

In 2014, sales in Asia Pacific grew by 3 percent. Sales increased by 3 percent in the Industrial segment (4 percent at consistent translation rates). Sales in the Contractor segment decreased by 3 percent (4 percent at consistent translation rates) and sales in the Lubrication segment decreased by 7 percent (4 percent at consistent translation rates). China grew by 3 1⁄2 percent, with good growth in the automotive industry. However, we continue to see lack of growth in a number of other markets throughout the region and continue to see variability in bookings and billings by country and product line.

In 2013, sales in the Americas increased by 11 percent in total, with increases of 6 percent in the Industrial segment, 22 percent in the Contractor segment and flat in the Lubrication segment as compared to the prior year. The increase in the Americas was led by the Contractor segment, which benefited from growth in U.S. housing starts and construction spending. Increased sales in the Industrial segment were driven by improvement in a variety of general industrial, construction and process-related end-markets. Sales in the Lubrication segment reflected modest demand growth in vehicle service applications and a low rate of investment by industrial lubrication customers.

In 2013, sales in EMEA increased by 10 percent (8 percent at consistent translation rates). Sales in the Industrial segment increased by 12 percent (9 percent at consistent translation rates). Sales increased by 4 percent in the Contractor segment (2 percent at consistent translation rates) and increased by 14 percent in the Lubrication segment (12 percent at consistent translation rates). We saw growth during 2013 in the emerging markets of EMEA, though end-markets in many industries remained weak in Western Europe throughout much of the year.

18

Table of Contents

In 2013, sales in Asia Pacific grew by 3 percent (5 percent at consistent translation rates). Sales increased by 7 percent in the Industrial segment (10 percent at consistent translation rates). Sales in the Contractor segment decreased by 4 percent (3 percent at consistent translation rates) and sales in the Lubrication segment decreased by 13 percent (10 percent at consistent translation rates). Industrial project activity was strong in the fourth quarter, which brought the Industrial segment back to modest growth for the year. However, we saw lack of growth in a number of end user markets throughout Asia Pacific, including shipyards, container manufacturing, heavy machinery, general manufacturing, housing, paint and mining.

The following table presents components of net sales change:

| 2014 | ||||||||||||||||||||||||||||

| Segment | Region | |||||||||||||||||||||||||||

| Industrial | Contractor | Lubrication | Americas | Europe | Asia Pacific | Consolidated | ||||||||||||||||||||||

| Volume and Price |

6 % | 10 % | 9 % | 10 % | 5 % | 2 % | 7 % | |||||||||||||||||||||

| Acquisitions |

6 % | - % | - % | 6 % | 2 % | 2 % | 4 % | |||||||||||||||||||||

| Currency |

- % | - % | (1)% | (1)% | 1 % | (1)% | - % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

12 % | 10 % | 8 % | 15 % | 8 % | 3 % | 11 % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 2013 | ||||||||||||||||||||||||||||

| Segment | Region | |||||||||||||||||||||||||||

| Industrial | Contractor | Lubrication | Americas | Europe | Asia Pacific | Consolidated | ||||||||||||||||||||||

| Volume and Price |

3 % | 14 % | - % | 10 % | 2 % | 1 % | 6 % | |||||||||||||||||||||

| Acquisitions |

5 % | - % | - % | 1 % | 6 % | 4 % | 3 % | |||||||||||||||||||||

| Currency |

- % | 1 % | (1)% | - % | 2 % | (2)% | - % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

8 % | 15 % | (1)% | 11 % | 10 % | 3 % | 9 % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

The following table presents an overview of components of operating earnings as a percentage of net sales:

| 2014 | 2013 | 2012 | ||||||||||

| Net Sales |

100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of products sold |

45.4 | 45.0 | 45.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

54.6 | 55.0 | 54.4 | |||||||||

| Product development |

4.4 | 4.7 | 4.8 | |||||||||

| Selling, marketing and distribution |

16.0 | 16.1 | 16.2 | |||||||||

| General and administrative |

8.9 | 8.9 | 11.2 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating earnings |

25.3 | 25.3 | 22.2 | |||||||||

| Interest expense |

1.5 | 1.6 | 1.9 | |||||||||

| Other expense (income), net |

(2.0) | (2.5) | (1.1) | |||||||||

|

|

|

|

|

|

|

|||||||

| Earnings before income taxes |

25.8 | 26.2 | 21.4 | |||||||||

| Income taxes |

7.3 | 7.1 | 6.7 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Earnings |

18.5 | % | 19.1 | % | 14.7 | % | ||||||

|

|

|

|

|

|

|

|||||||

2014 Compared to 2013

Operating earnings as a percentage of sales were 25 percent in 2014, consistent with 2013. The impact of purchase accounting, acquisition and divestiture costs, and spending on regional and product expansion offset the improvement in operating expense leverage from higher sales.

Gross profit margin as a percentage of sales decreased approximately one-half percentage point from 2013. Acquisitions negatively impacted the margin rate in 2014, decreasing the rate by 0.2 percentage point for purchase accounting, and 0.3 percentage point for lower margins in the acquired businesses. The favorable effect of realized price increases and higher production volume offset the unfavorable effect of changes in product mix.

Operating expenses for 2014 increased $30 million. The increase included $15 million from acquired operations, $8 million from regional and product expansion initiatives and a $2 million increase in divestiture and acquisition costs. Product development spending increased $3 million (including approximately $1 million from acquired operations), and represents 4 percent of sales, down slightly from 2013.

19

Table of Contents

Interest expense was $19 million in 2014, compared to $18 million in 2013. Other expense (income) included dividends received from the Liquid Finishing businesses that are held separate from the Company’s other businesses. These dividends totaled $28 million for the year, consistent with 2013.