Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SPDR GOLD TRUST | Financial_Report.xls |

| EX-32.1 - EX-32.1 - SPDR GOLD TRUST | d847025dex321.htm |

| EX-31.1 - EX-31.1 - SPDR GOLD TRUST | d847025dex311.htm |

| EX-31.2 - EX-31.2 - SPDR GOLD TRUST | d847025dex312.htm |

| EX-32.2 - EX-32.2 - SPDR GOLD TRUST | d847025dex322.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended December 31, 2014 |

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission file number: 001-32356

SPDR® GOLD TRUST

SPONSORED BY WORLD GOLD TRUST SERVICES, LLC

(Exact Name of Registrant as Specified in Its Charter)

| New York | 81-6124035 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

c/o World Gold Trust Services, LLC

510 Madison Avenue, 9th Floor

New York, New York 10022

(Address of Principal Executive Offices)

(212) 317-3800

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of February 4, 2015 the Registrant had 257,000,000 Shares outstanding.

Table of Contents

INDEX

i

Table of Contents

SPDR® GOLD TRUST

PART I - FINANCIAL INFORMATION:

| Item 1. | Financial Statements (Unaudited) |

Unaudited Statements of Financial Condition

at December 31, 2014 and September 30, 2014

| (Amounts in 000’s of US$ except for share data) | Dec-31, 2014(4) |

Sep-30, 2014(1) |

||||||

| ASSETS |

||||||||

| Investment in Gold (cost at December 31, 2014: $28,274,774) |

$ | 27,464,292 | $ | 30,250,898 | (2) | |||

|

|

|

|

|

|||||

| Total Assets |

$ | 27,464,292 | $ | 30,250,898 | ||||

|

|

|

|

|

|||||

| LIABILITIES |

||||||||

| Gold payable |

$ | 126,717 | $ | 140,368 | ||||

| Accounts payable to related parties and other vendors |

5,705 | 9,588 | ||||||

| Accounts payable |

3,757 | 315 | ||||||

| Accrued expenses |

3,558 | 3,758 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

139,737 | 154,029 | ||||||

| Redeemable Shares: |

||||||||

| Shares at redemption value to investors |

— | 30,096,869 | ||||||

|

|

|

|

|

|||||

| Net Assets |

27,324,555 | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities, Redeemable Shares & Shareholders’ Equity |

$ | 30,250,898 | ||||||

|

|

|

|||||||

| Shares issued and outstanding(3) |

237,200,000 | 257,300,000 | ||||||

| Net asset value per Share |

$ | 115.20 | ||||||

| (1) | Represents audited statement of financial condition as of September 30, 2014 prior to adoption of provisions for an investment company for accounting purposes. |

| (2) | Investment in Gold is held at the lower of average cost or market value. The average cost of Investment in Gold at September 30, 2014 is $30,728,152. |

| (3) | Authorized share capital is unlimited and the par value of the Shares is $0.00. |

| (4) | For accounting purposes, effective October 1, 2014, the Trust has adopted the financial presentation provisions for an investment company. Please refer to Note 2.2. |

See notes to the unaudited financial statements

1

Table of Contents

SPDR® GOLD TRUST

Unaudited Schedule of Investment(1)

December 31, 2014

(All balances in 000’s)

| Ounces of gold |

Cost | Fair Value | % of Net Assets |

|||||||||||||

| Investment in Gold |

22,901.2 | $ | 28,274,774 | $ | 27,464,292 | 100.51% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Investments |

$ | 28,274,774 | $ | 27,464,292 | 100.51% | |||||||||||

| Liabilities in excess of other assets |

(139,737 | ) | (0.51)% | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net Assets |

$ | 27,324,555 | 100.00% | |||||||||||||

|

|

|

|

|

|||||||||||||

| (1) | For accounting purposes, effective October 1, 2014, the Trust has adopted the financial presentation provisions for an investment company. Disclosure of a schedule of investments is required for investment companies. Please refer to Note 2.2. |

See notes to the unaudited financial statements.

2

Table of Contents

SPDR® GOLD TRUST

Unaudited Statements of Operations

For the three months ended December 31, 2014 and 2013

| (Amounts in 000’s of US$, except per share data) | Three Months Ended Dec-31, 2014(1) |

Three Months Ended Dec-31, 2013 |

||||||

| REVENUES |

||||||||

| Proceeds from sales of gold to pay expenses |

$ | — | $ | 37,989 | ||||

| Cost of gold sold to pay expenses |

— | (36,789 | ) | |||||

|

|

|

|

|

|||||

| Gain on gold sold to pay expenses |

— | 1,200 | ||||||

| Gain on gold distributed for the redemption of shares |

— | 135,907 | ||||||

| Unrealized gain/(loss) on investment in gold |

— | (603,341 | ) | |||||

|

|

|

|

|

|||||

| Total gain/(loss) on gold |

— | (466,234 | ) | |||||

|

|

|

|

|

|||||

| EXPENSES |

||||||||

| Custody fees |

4,910 | 5,980 | ||||||

| Trustee fees |

504 | 504 | ||||||

| Sponsor fees |

10,928 | 13,245 | ||||||

| Marketing agent fees |

10,928 | 13,245 | ||||||

| Other expenses |

4,415 | 2,346 | ||||||

|

|

|

|

|

|||||

| Total expenses |

31,685 | 35,320 | ||||||

|

|

|

|

|

|||||

| Fees waived |

(3,148 | ) | — | |||||

|

|

|

|

|

|||||

| Net expenses |

28,537 | 35,320 | ||||||

|

|

|

|

|

|||||

| Net investment loss |

(28,537 | ) | ||||||

|

|

|

|||||||

| Net realized and change in unrealized gain/(loss) on investment in gold |

||||||||

| Net realized gain/(loss) from investment in gold sold to pay expenses |

(899 | ) | — | |||||

| Net realized gain/(loss) from gold distributed for the redemption of shares |

(106,862 | ) | — | |||||

| Net change in unrealized appreciation/(depreciation) on investment in gold |

(333,228 | ) | — | |||||

|

|

|

|

|

|||||

| Net realized and change in unrealized gain/(loss) on investment in gold |

(440,989 | ) | — | |||||

|

|

|

|

|

|||||

| Net income/(loss) |

$ | (469,526 | ) | $ | (501,554 | ) | ||

|

|

|

|

|

|||||

| Net income/(loss) per share |

$ | (1.76 | ) | |||||

|

|

|

|||||||

| Weighted average number of shares |

285,051 | |||||||

|

|

|

|||||||

| (1) | For accounting purposes, effective October 1, 2014, the Trust has adopted the financial presentation provisions for an investment company. Please refer to Note 2.2. |

See notes to the unaudited financial statements

3

Table of Contents

SPDR® GOLD TRUST

Unaudited Statements of Cash Flows

For the three months ended December 31, 2014 and 2013

| (Amounts in 000’s of US$) | Three Months Ended Dec-31, 2014 |

Three Months Ended Dec-31, 2013 |

||||||

| INCREASE / DECREASE IN CASH FROM OPERATIONS: |

||||||||

| Cash proceeds received from sales of gold |

$ | 29,178 | $ | 37,989 | ||||

| Cash expenses paid |

(29,178 | ) | (37,989 | ) | ||||

|

|

|

|

|

|||||

| Increase/(Decrease) in cash resulting from operations |

0 | 0 | ||||||

| Cash and cash equivalents at beginning of period |

0 | 0 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 0 | $ | 0 | ||||

|

|

|

|

|

|||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH FINANCING ACTIVITIES: |

||||||||

| Value of gold received for creation of shares — net of gold receivable |

$ | 986,305 | $ | 827,161 | ||||

|

|

|

|

|

|||||

| Value of gold distributed for redemption of shares — net of gold payable |

$ | 3,289,093 | $ | 4,775,052 | ||||

|

|

|

|

|

|||||

| (Amount in 000’s of US$) | Three Months Ended Dec-31, 2014 |

Three Months Ended Dec-31, 2013 |

||||||

| RECONCILIATION OF NET INCOME/(LOSS) TO NET CASH PROVIDED BY OPERATING ACTIVITIES |

||||||||

| Net Income/(Loss) |

$ | (469,526 | ) | $ | (501,554 | ) | ||

| Adjustments to reconcile net income/(loss) to net cash provided by operating activities |

||||||||

| Proceeds from sales of gold to pay expenses |

29,178 | — | ||||||

| Net realized (gain)/loss from investment in gold sold to pay expenses |

899 | — | ||||||

| Net realized (gain)/loss from gold distributed for the redemption of shares |

106,862 | — | ||||||

| Net change in unrealized (appreciation)/depreciation on investment in gold |

333,228 | — | ||||||

| (Increase)/Decrease in investment in gold |

— | 4,746,235 | ||||||

| — | ||||||||

| Increase/(Decrease) in gold payable |

— | 78,072 | ||||||

| Increase/(Decrease) in liabilities |

(641 | ) | (2,669 | ) | ||||

| Increase/(Decrease) in redeemable shares |

||||||||

| Creations |

— | 827,161 | ||||||

| Redemptions |

— | (5,147,245 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

See notes to the unaudited financial statements

4

Table of Contents

SPDR® GOLD TRUST

Unaudited Statement of Changes in Net Assets

For the three months ended December 31, 2014 and year ended September 30, 2014

| (Amounts in 000’s of US$) | Three Months Ended Dec-31, 2014(3) |

Year Ended Sep-30, 2014(2) |

||||||

| Net Assets - Opening Balance(1) |

$ | 30,096,869 | $ | (2,979,854 | ) | |||

| Creations |

986,305 | — | ||||||

| Redemptions |

(3,289,093 | ) | — | |||||

| Net investment loss |

(28,537 | ) | — | |||||

| Net realized gain/(loss) from investment in gold sold to pay expenses |

(899 | ) | — | |||||

| Net realized gain/(loss) from gold distributed for the redemption of shares |

(106,862 | ) | — | |||||

| Net change in unrealized appreciation/(depreciation) on investment in gold |

(333,228 | ) | — | |||||

| Net income/(loss) |

— | (230,386 | ) | |||||

| Adjustment of Redeemable Shares to redemption value |

— | 3,210,240 | ||||||

|

|

|

|

|

|||||

| Net Assets - Closing Balance |

$ | 27,324,555 | $ | — | ||||

|

|

|

|

|

|||||

| (1) | The Trust reclassified redeemable capital shares as of September 30, 2014 into net assets as part of its transition to investment company accounting effective October 1, 2014. Please refer to Note 2.2. The opening balance for the year ended September 30, 2014 represents Shareholders’ Deficit. |

| (2) | Represents audited statement of changes in shareholders’ equity/(deficit) for the year ended September 30, 2014. |

| (3) | For accounting purposes, effective October 1, 2014, the Trust has adopted the financial presentation provisions for an investment company. Please refer to Note 2.2. |

See notes to the unaudited financial statements

5

Table of Contents

SPDR® GOLD TRUST

Notes to the Unaudited Financial Statements

| 1. | Organization |

The SPDR® Gold Trust (the “Trust”) is an investment trust formed on November 12, 2004 (“Date of Inception”) under New York law pursuant to a trust indenture. The fiscal year end for the Trust is September 30th. The Trust holds gold and is expected from time to time to issue shares (“Shares”) (in minimum denominations of 100,000 Shares, also referred to as “Baskets”) in exchange for deposits of gold and to distribute gold in connection with redemption of Baskets. The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the Trust’s expenses.

The Shares trade on the NYSE Arca, Inc. (“NYSE Arca”) under the symbol “GLD”, providing investors with an efficient means to obtain market exposure to the price of gold bullion. The Shares are eligible for margin accounts. The Shares are also listed on the Mexican Stock Exchange (Bolsa Mexicana de Valores), the Singapore Exchange Securities Trading Limited, the Stock Exchange of Hong Kong Limited and the Tokyo Stock Exchange.

BNY Mellon Asset Servicing, a division of The Bank of New York Mellon (the Trustee) does not actively manage the gold held by the Trust. This means that the Trustee does not sell gold at times when its price is high, or acquire gold at low prices in the expectation of future price increases. It also means that the Trustee does not make use of any of the hedging techniques available to professional gold investors to attempt to reduce the risk of losses resulting from price decreases. Any losses sustained by the Trust will adversely affect the value of the Shares.

Effective October 1, 2014, the Trust has adopted the financial presentation provisions appropriate to an investment company for accounting purposes and follows the accounting and reporting guidance under the Financial Accounting Standards Board (the “FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (“Topic 946”), but is not registered, and is not required to be registered, under the Investment Company Act of 1940, as amended (the “Investment Company Act”). Please refer to Note 2.2 Investment Company Status.

The statements of financial condition at December 31, 2014 and September 30, 2014, the statements of operations and of cash flows for the three months ended December 31, 2014 and 2013 and the statement of changes in net assets for the three months ended December 31, 2014 and the statement of changes in shareholders’ equity for year ended September 30, 2014 have been prepared on behalf of the Trust without audit. In the opinion of management of the sponsor of the Trust, World Gold Trust Services, LLC (the “Sponsor”), all adjustments (which include normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows as of and for the three months ended December 31, 2014 and for all periods presented have been made.

These financial statements should be read in conjunction with the financial statements and notes thereto included in the Trust’s Annual Report on Form 10-K for the fiscal year ended September 30, 2014. The results of operations for the three months ended December 31, 2014 are not necessarily indicative of the operating results for the full fiscal year.

| 2. | Significant Accounting Policies |

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires those responsible for preparing financial statements to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Trust.

| 2.1. | Basis of Accounting |

The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

| 2.2. | Investment Company Status |

In June 2013, the FASB issued Accounting Standards Update 2013-08, Investment Companies – Amendments to the Scope, Measurement, and Disclosure Requirements (“ASU 2013-08”). ASU 2013-08 is an update to Topic 946 that provides guidance to assess whether an entity is an investment company, and establishes additional measurement and disclosure requirements for an investment company. ASU 2013-08 is effective for interim and annual periods beginning after December 15, 2013 and is required to be applied prospectively. The Sponsor concluded that the Trust meets the definition of an investment company. As a result, effective October 1, 2014, the Trust qualifies as an investment company solely for accounting purposes pursuant to the accounting and reporting guidance under Topic 946, but is not registered, and is not required to be registered, under the Investment Company Act.

6

Table of Contents

As a result of the prospective application of ASU 2013-08, certain disclosures required by Topic 946 are only presented for periods beginning October 1, 2014. Financial statements and disclosures for periods prior to October 1, 2014 will continue to be presented in their previously reported form, however certain captions have been changed. The primary changes to the financial statements resulting from the adoption of ASU 2013-08 and corresponding application of Topic 946 include:

| • | Reporting of investment in gold at fair value on the Unaudited Statement of Financial Condition, which was previously reported at the lower of average cost or market value; |

| • | Recognition of the net change in unrealized appreciation/depreciation on investment in gold within the Unaudited Statements of Operations, which was previously reported as an “Adjustment of redeemable shares to redemption value” on the Audited Statement of Changes in Shareholders’ Deficit; |

| • | Shares of the Trust are classified as Net Assets on the Unaudited Statement of Financial Condition, which was previously classified as “Shares at redemption value to investors.” An adjustment was recorded as of October 1, 2014 to reclassify the balance of Shares at redemption value to investors at September 30, 2014 into Net Assets as follows (all balances in 000’s): |

| Balance at September 30, 2014 |

Transition Adjustment |

ASU 2013-08 Balance at October 1, 2014 |

||||||||||

| Shares at redemption value to investors |

$ | 30,096,869 | $ | (30,096,869 | ) | $ | — | |||||

| Net Assets |

— | 30,096,869 | 30,096,869 | |||||||||

| • | The addition of a Schedule of Investments and a Financial Highlights note to the financial statements. |

ASU 2013-08 prescribes that an entity that qualifies as an investment company as a result of an assessment of its status shall account for the effect of the change in status prospectively from the date of the change in status and shall recognize any impact as a cumulative effect adjustment to the net asset value at the beginning of the period. No cumulative effect adjustment to net asset value was required to be recorded as a result of the Trusts adoption of ASU 2013-08 because the fair value of gold bullion held by the Trust was lower than the cost of gold held by Trust at September 30, 2014, and therefore, there was no accumulated shareholders’ equity or (deficit).

| 2.3. | Fair Value Measurement |

FASB Accounting Standards Codification 820, “Fair Value Measurements and Disclosures” (“ASC 820”), provides a single definition of fair value, a hierarchy for measuring fair value and expanded disclosures about fair value adjustments.

Various inputs are used in determining the fair value of the Trust’s assets or liabilities. These inputs are categorized into three broad levels. Level 1 includes unadjusted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market based inputs (including prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include management’s own assumptions in determining the fair value of investments. The Trust does not hold any derivative instruments, and its assets only consist of allocated gold bullion and gold receivable; representing gold covered by contractually binding orders for the creation of Shares where the gold has not yet been transferred to the Trust’s account and, from time to time, cash, which is used to pay expenses.

The following table summarizes the inputs used as of December 31, 2014 in determining the Trust’s investments at fair value for purposes of ASC 820:

| Level 1 | Level 2 | Level 3 | ||||||||||

| Investment in Gold |

$ | 27,464,292 | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 27,464,292 | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

In determining the net asset value (“NAV”) of the Trust, the Trustee values the gold held by the Trust on the basis of the price of an ounce of gold as set by the afternoon session of the twice daily fix of the price of an ounce of gold which starts at 3:00 PM London, England time and is performed by the four members of the London gold fix. The Trustee determines the NAV of the Trust on each day the NYSE Arca is open for regular trading, at the earlier of the London PM fix for the day or 12:00 PM New York time. If no London PM fix is made on a particular evaluation day or if the London PM fix has not been announced by 12:00 PM New York time on a particular evaluation day, the next most recent London gold price fix (AM or PM) is used in the determination of the NAV of the Trust, unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for such determination.

7

Table of Contents

While we believe that the London PM fix is an appropriate indicator of the value of gold, there are other indicators that are available that could be different than the London PM fix. The use of such an alternative indicator could result in materially different fair value pricing of the gold in the Trust which could result in market adjustments or redemption value adjustments of the outstanding redeemable Shares. There can be no assurance that a future change, if any, in the London PM fix will not have a material effect on the Trust’s operations.

Once the value of the gold has been determined, the Trustee subtracts all estimated accrued fees (other than the fees to be computed by reference to the value of the adjusted net asset value (“ANAV”) of the Trust or custody fees computed by reference to the value of gold held in the Trust), expenses and other liabilities of the Trust from the total value of the gold and all other assets of the Trust (other than any amounts credited to the Trust’s reserve account, if established). The resulting figure is the ANAV of the Trust. The ANAV of the Trust is used to compute the fees of the Trustee, the Sponsor and the Marketing Agent.

To determine the Trust’s NAV, the Trustee subtracts from the ANAV of the Trust the amount of estimated accrued but unpaid fees computed by reference to the value of the ANAV of the Trust and computed by reference to the value of the gold held in the Trust (i.e. the fees of the Trustee, the Sponsor, the Marketing Agent and the Custodian). The Trustee determines the NAV per Share by dividing the NAV of the Trust by the number of Shares outstanding as of the close of trading on NYSE Arca.

| 2.4. | Investment in Gold |

Effective December 22, 2014, HSBC Bank plc (the “Custodian”) has taken over custodial responsibilities of the Trust. Prior to December 22, 2014, HSBC Bank USA, N.A. was the Custodian. Gold is held by the Custodian, on behalf of the Trust. Beginning October 1, 2014, the gold held by the Trust is reported at fair value on the Statements of Financial Condition. Prior to October 1, 2014, the gold held by the Trust was reported at the lower of cost or market, using the average cost method.

8

Table of Contents

| 2.5. | Gold Receivable |

Gold receivable represents the quantity of gold covered by contractually binding orders for the creation of Shares where the gold has not yet been transferred to the Trust’s account. Generally, ownership of the gold is transferred within three business days of the trade date.

| (Amounts in 000’s of US$) | Dec-31, 2014 |

Sep-30, 2014 |

||||||

| Gold receivable |

$ | — | $ | — | ||||

| 2.6. | Gold Payable |

Gold payable represents the quantity of gold covered by contractually binding orders for the redemption of Shares where the gold has not yet been transferred out of the Trust’s account. Generally, ownership of the gold is transferred within three business days of the trade date.

| (Amounts in 000’s of US$) | Dec-31, 2014 |

Sep-30, 2014 |

||||||

| Gold payable |

$ | 126,717 | $ | 140,368 | ||||

| 2.7. | Creations and Redemptions of Shares |

The Trust creates and redeems Shares from time to time, but only in one or more Baskets (a Basket equals a block of 100,000 Shares). The Trust issues Shares in Baskets to certain authorized participants (“Authorized Participants”) on an ongoing basis. The creation and redemption of Baskets is only made in exchange for the delivery to the Trust or the distribution by the Trust of the amount of gold and any cash represented by the Baskets being created or redeemed, the amount of which will be based on the combined net asset value of the number of Shares included in the Baskets being created or redeemed determined on the day the order to create or redeem Baskets is properly received.

As the Shares of the Trust are redeemable in Baskets at the option of the Authorized Participants, the Trust has classified the Shares as Redeemable Shares on the Statement of Financial Condition as of September 30, 2014 and as Net Assets as of December 31, 2014. The Trust records the redemption value, which represents its maximum obligation, as Redeemable Shares with the difference from cost as an offsetting amount to Shareholders’ Equity. Changes in the Shares for the three months ended December 31, 2014 and for the year ended September 30, 2014, are as follows:

| (All amounts are in 000’s) | Three Months Ended Dec-31, 2014 |

Year Ended Sep-30, 2014 |

||||||

| Activity in Number of Shares Issued and Outstanding: |

||||||||

| Creations |

8,500 | 47,200 | ||||||

| Redemptions |

(28,600 | ) | (91,500 | ) | ||||

|

|

|

|

|

|||||

| Net increase/(decrease) Shares Issued and Outstanding |

(20,100 | ) | (44,300 | ) | ||||

|

|

|

|

|

|||||

| (Amounts in 000’s of US$) | Three Months Ended Dec-31, 2014 |

Year Ended Sep-30, 2014 |

||||||

| Activity in Value of Shares Issued and Outstanding: |

||||||||

| Creations |

$ | 986,305 | $ | 5,893,107 | ||||

| Redemptions |

(3,289,093 | ) | (11,209,535 | ) | ||||

|

|

|

|

|

|||||

| Net increase/(decrease) Shares Issued and Outstanding |

$ | (2,302,788 | ) | $ | (5,316,428 | ) | ||

|

|

|

|

|

|||||

9

Table of Contents

| 2.8. | Revenue Recognition Policy |

The Trustee will, at the direction of the Sponsor or in its own discretion, sell the Trust’s gold as necessary to pay the Trust’s expenses. When selling gold to pay expenses, the Trustee will endeavor to sell the smallest amount of gold needed to pay expenses in order to minimize the Trust’s holdings of assets other than gold. Unless otherwise directed by the Sponsor, when selling gold, the Trustee will endeavor to sell at the price established by the London Fix at 3:00 PM London time (“London PM Fix”). The Trustee will place orders with dealers (which may include the Custodian) through which the Trustee expects to receive the most favorable price and execution of orders. The Custodian may be the purchaser of such gold only if the sale transaction is made at the next London gold price fix (either AM or PM) following the sale order. A gain or loss is recognized based on the difference between the selling price and the average cost of the gold sold, and such amounts are reported as net realized gain/(loss) from investment in gold sold to pay expenses on the Statement of Operations.

During the three month period ended December 31, 2014, the fair value of gold contributed amounted to $986,304,506. The total cost and fair value of gold distributed and sold was $3,439,682,822 and $3,331,921,637, respectively, resulting in a net realized loss of $107,761,185.

During the three month period ended December 31, 2013, the fair value of gold contributed amounted to $827,161,237. The total cost and fair value of gold distributed and sold was $4,970,055,276 and $5,107,362,151, respectively, resulting in a net realized gain of $137,106,875.

10

Table of Contents

| 2.9. | Income Taxes |

The Trust is classified as a “grantor trust” for US federal income tax purposes. As a result, the Trust itself will not be subject to US federal income tax. Instead, the Trust’s income and expenses will “flow through” to the Shareholders, and the Trustee will report the Trust’s proceeds, income, deductions, gains, and losses to the Internal Revenue Service on that basis. The Sponsor of the Trust has evaluated whether or not there are uncertain tax positions that require financial statement recognition and has determined that no reserves for uncertain tax positions are required as of December 31, 2014 or September 30, 2014.

The Sponsor evaluates tax positions taken or expected to be taken in the course of preparing the Trust’s tax returns to determine whether the tax positions are “more-likely-than-not” to be sustained by the applicable tax authority. Tax positions not deemed to meet that threshold would be recorded as an expense in the current year. The Trust is required to analyze all open tax years. Open tax years are those years that are open for examination by the relevant income taxing authority. As of December 31, 2014, 2013, 2012 and 2011 tax years remain open for examination. There are no examinations in progress at period end.

| 3. | Related Parties – Sponsor and Trustee |

Fees are paid to the Sponsor as compensation for services performed under the Trust Indenture and for services performed in connection with maintaining the Trust’s website and marketing the Shares. The Sponsor’s fee is payable monthly in arrears and is accrued daily at an annual rate equal to 0.15% of the ANAV of the Trust, subject to reduction as described below. The Sponsor will receive reimbursement from the Trust for all of its disbursements and expenses incurred in connection with the Trust.

Fees are paid to the Trustee, as compensation for services performed under the Trust Indenture. The Trustee’s fee is payable monthly in arrears and is accrued daily at an annual rate equal to 0.02% of the ANAV of the Trust, subject to a minimum fee of $500,000 and a maximum fee of $2 million per year. The Trustee’s fee is subject to modification as determined by the Trustee and the Sponsor in

11

Table of Contents

good faith to account for significant changes in the Trust’s administration or the Trustee’s duties. The Trustee will charge the Trust for its expenses and disbursements incurred in connection with the Trust (including the expenses of the Custodian paid by the Trustee), exclusive of fees of agents for services to be performed by the Trustee, and for any extraordinary services performed by the Trustee for the Trust.

Affiliates of the Trustee may from time to time act as Authorized Participants or purchase or sell gold or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

| 3.1. | Other Vendor Agreements |

Fees are paid to the Custodian under the Allocated Bullion Account Agreement (as amended, the “Allocated Bullion Account Agreement”) as compensation for its custody services. Under the Allocated Bullion Account Agreement, the Custodian’s fee is computed at an annual rate equal to 0.10% of the average daily aggregate value of the first 4.5 million ounces of gold held in the Trust’s allocated gold account (“Trust Allocated Account”) and the Trust’s unallocated gold account (“Trust Unallocated Account”) and 0.06% of the average daily aggregate value of all gold held in the Trust Allocated Account and the Trust Unallocated Account in excess of 4.5 million ounces.

The Custodian and its affiliates may from time to time act as Authorized Participants or purchase or sell gold or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

Fees are paid to the marketing agent for the Trust, State Street Global Markets, LLC (the “Marketing Agent”), by the Trustee from the assets of the Trust as compensation for services performed pursuant to the agreement, as amended, between the Sponsor and the Marketing Agent (the “Marketing Agent Agreement”). The Marketing Agent’s fee is payable monthly in arrears and is accrued daily at an annual rate equal to 0.15% of the ANAV of the Trust, subject to reduction as described below.

The Marketing Agent and its affiliates may from time to time act as Authorized Participants or purchase or sell gold or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

Under the Marketing Agent Agreement, as amended, if at the end of any month, the estimated ordinary expenses of the Trust exceed an amount equal to 0.40% per year of the daily ANAV of the Trust for such month, the Sponsor and the Marketing Agent will waive the amount of such excess from the fees payable to them from the assets of the Trust for such month in equal shares up to the amount of their fees. Investors should be aware that, if the gross value of the Trust assets is less than approximately $1.0 billion, the ordinary expenses of the Trust (including the fees and expenses of the Trustee and the Custodian, printing and mailing costs, legal and audit fees, registration fees and listing fees) will accrue at a rate greater than 0.40% per year of the daily ANAV of the Trust. Additionally, if the Trust incurs unforeseen expenses that cause the total of such ordinary expenses of the Trust to exceed 0.70% per year of the daily ANAV of the Trust those expenses will accrue at a rate greater than 0.40% per year of the daily ANAV of the Trust, even after the Sponsor and the Marketing Agent have completely waived their combined fees of 0.30% per year of the daily ANAV of the Trust.

For the three months ended December 31, 2014, the Sponsor and the Marketing Agent each waived their fees in the amount of $1,573,617 since the Trust’s ordinary expenses exceeded 0.40% per year of the daily ANAV of the Trust. The Sponsor and Marketing Agent did not waive their fees for the three months ended December 31, 2013.

Amounts Payable to Related Parties and Other Vendor Agreements

| (Amounts in 000’s of US$) | Dec-31, 2014 |

Sep-30, 2014 |

||||||

| Payable to Custodian |

$ | 1,621 | $ | 1,748 | ||||

| Payable to Trustee |

170 | 164 | ||||||

| Payable to Sponsor |

1,957 | 3,838 | ||||||

| Payable to Marketing Agent |

1,957 | 3,838 | ||||||

|

|

|

|

|

|||||

| Accounts Payable to Related Parties and Other Vendors |

$ | 5,705 | $ | 9,588 | ||||

|

|

|

|

|

|||||

| 4. | Concentration of Risk |

The Trust’s sole business activity is the investment in gold. Various factors could affect the price of gold: (i) global gold supply and demand, which is influenced by such factors as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries such as China,

12

Table of Contents

Australia, South Africa and the United States; (ii) investors’ expectations with respect to the rate of inflation; (iii) currency exchange rates; (iv) interest rates; (v) investment and trading activities of hedge funds and commodity funds; and (vi) global or regional political, economic or financial events and situations. In addition, there is no assurance that gold will maintain its long-term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately. Each of these events could have a material effect on the Trust’s financial position and results of operations.

| 5. | Indemnification |

The Sponsor and its shareholders, members, directors, officers, employees, affiliates and subsidiaries are indemnified from the Trust and held harmless against certain losses, liabilities or expenses incurred in the performance of its duties under the Trust Indenture without gross negligence, bad faith, willful misconduct, willful malfeasance or reckless disregard of the indemnified party’s obligations and duties under the Trust Indenture. Such indemnity includes payment from the Trust of the costs and expenses incurred in defending against any claim or liability under the Trust Indenture. Under the Trust Indenture, the Sponsor may be able to seek indemnification from the Trust for payments it makes in connection with the Sponsor’s activities under the Trust Indenture to the extent its conduct does not disqualify it from receiving such indemnification under the terms of the Trust Indenture. The Sponsor will also be indemnified from the Trust and held harmless against any loss, liability or expense arising under the Marketing Agent Agreement or any agreement entered into with an Authorized Participant which provides the procedures for the creation and redemption of Baskets and for the delivery of gold and any cash required for creations and redemptions insofar as such loss, liability or expense arises from any untrue statement or alleged untrue statement of a material fact contained in any written statement provided to the Sponsor by the Trustee. Any amounts payable to the Sponsor are secured by a lien on the Trust.

The Sponsor has agreed to indemnify certain parties against certain liabilities and to contribute to payments that such parties may be required to make in respect of those liabilities. The Trustee has agreed to reimburse such parties, solely from and to the extent of the Trust’s assets, for indemnification and contribution amounts due from the Sponsor in respect of such liabilities to the extent the Sponsor has not paid such amounts when due. The Sponsor has agreed that, to the extent the Trustee pays any amount in respect of the reimbursement obligations described in the preceding sentence, the Trustee, for the benefit of the Trust, will be subrogated to and will succeed to the rights of the party so reimbursed against the Sponsor.

| 6. | Financial Highlights |

The Trust is presenting the following financial highlights related to investment performance and operations of a Share outstanding for the three-month period ended December 31, 2014. The net investment loss and total expense ratios have been annualized. The total return at net asset value is based on the change in net asset value of a Share during the period and the total return at market value is based on the change in market value of a Share on the NYSE Arca during the period. An individual investor’s return and ratios may vary based on the timing of capital transactions.

| Three Months Ended December 31, 2014 |

||||

| Net Asset Value |

||||

| Net asset value per Share, beginning of period |

$ | 116.97 | ||

|

|

|

|||

| Net investment income/(loss) |

(0.12 | ) | ||

| Net Realized and Change in Unrealized Gain (Loss) |

(1.65 | ) | ||

|

|

|

|||

| Net Income/(Loss) |

(1.77 | ) | ||

|

|

|

|||

| Net asset value per Share, end of period |

$ | 115.20 | ||

|

|

|

|||

| Market value per Share, beginning of period |

$ | 116.21 | ||

|

|

|

|||

| Market value per Share, end of period |

$ | 113.58 | ||

|

|

|

|||

| Ratio to average net assets |

||||

| Net Investment Loss(1) |

(0.40 | )% | ||

|

|

|

|||

| Gross Expenses(1) |

0.44 | % | ||

|

|

|

|||

| Net expenses(1), (3) |

0.40 | % | ||

|

|

|

|||

| Total Return, at net asset value(2) |

(1.51 | )% | ||

|

|

|

|||

| Total Return, at market value(2) |

(2.26 | )% | ||

|

|

|

|||

13

Table of Contents

| (1) | Percentages are annualized. |

| (2) | Percentages are not annualized. |

| (3) | Net expense ratio reflects fee waivers for the three months ended December 31, 2014. |

| 7. | Subsequent Events |

The Sponsor filed a Definitive Consent Solicitation Statement (the “Consent Solicitation”) with the SEC on June 19, 2014 with respect to a proposal to amend and restate the Trust Indenture of the Trust to (i) implement a unitary fee structure and cap investor ordinary fees at 0.40% of the NAV each year and (ii) permit the Sponsor to compensate its affiliates for providing marketing and other services to the Trust without any additional cost to the Trust. The voting period for the Consent Solicitation has been extended to February 27, 2015.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This information should be read in conjunction with the financial statements and notes included in Item 1 of Part I of this Quarterly Report. The discussion and analysis which follows may contain trend analysis and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 which reflect our current views with respect to future events and financial results. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate” as well as similar words and phrases signify forward-looking statements. SPDR® Gold Trust’s forward-looking statements are not guarantees of future results and conditions and important factors, risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements.

Trust Overview

SPDR® Gold Trust is an investment trust that was formed on November 12, 2004 (Date of Inception). The Trust issues baskets of Shares, or Baskets, in exchange for deposits of gold and distributes gold in connection with the redemption of Baskets. The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the expenses of the Trust’s operations. The Shares are designed to provide investors with a cost effective and convenient way to invest in gold.

As of the date of this quarterly report, Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, Goldman, Sachs & Co., Goldman Sachs Execution & Clearing, L.P., HSBC Securities (USA) Inc., J.P. Morgan Securities Inc., Merrill Lynch Professional Clearing Corp., Morgan Stanley & Co. LLC, RBC Capital Markets LLC, Scotia Capital (USA) Inc., UBS Securities LLC, and Virtu Financial BD LLC are the only Authorized Participants. An updated list of Authorized Participants can be obtained from the Trustee or the Sponsor.

Investing in the Shares does not insulate the investor from certain risks, including price volatility. The following chart illustrates the movement in the price of the Shares and NAV of the Shares against the corresponding gold price (per 1/10 of an oz. of gold) since the day the Shares first began trading on the NYSE:

14

Table of Contents

Share price & NAV v. gold price from November 18, 2004 to December 31, 2014

The divergence of the price of the Shares and NAV of the Shares from the gold price over time reflects the cumulative effect of the Trust expenses that arise if an investment had been held since inception.

Valuation of Gold, Definition of NAV and ANAV

As of the London PM fix on each day that the NYSE Arca is open for regular trading or, if there is no London PM fix on such day or the London PM fix has not been announced by 12:00 PM New York time on such day, as of 12:00 PM New York time on such day (the “Valuation Time”), the Trustee values the gold held by the Trust and determines both the ANAV and the NAV of the Trust.

15

Table of Contents

At the Valuation Time, the Trustee values the Trust’s gold on the basis of that day’s London PM fix or, if no London PM fix is made on such day or has not been announced by the Valuation Time, the next most recent London gold price fix (AM or PM) determined prior to the Valuation Time will be used, unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate as a basis for valuation. In the event the Trustee and the Sponsor determine that the London PM fix or last prior London gold price fix (AM or PM) is not an appropriate basis for valuation of the Trust’s gold, they will identify an alternative basis for such valuation to be employed by the Trustee. While we believe that the London PM fix is an appropriate indicator of the value of gold, there are other indicators that are available that could be different than the London PM fix. The use of such an alternative indicator could result in materially different fair value pricing of the gold in the Trust which could result in different lower of cost or market adjustments or redemption value adjustments of our outstanding redeemable Shares. There can be no assurance that a future change, if any, in the London PM fix will not have a material effect on the Trust’s operations.

Once the value of the gold has been determined, the Trustee subtracts all estimated accrued but unpaid fees (other than the fees to be computed by reference to the value of the ANAV of the Trust or custody fees computed by reference to the value of gold held in the Trust), expenses and other liabilities of the Trust from the total value of the gold and all other assets of the Trust (other than any amounts credited to the Trust’s reserve account, if established). The resulting figure is the ANAV of the Trust. The ANAV of the Trust is used to compute the fees of the Trustee, the Sponsor, and the Marketing Agent.

To determine the Trust’s NAV, the Trustee subtracts from the ANAV of the Trust the amount of estimated accrued but unpaid fees computed by reference to the value of the ANAV of the Trust and computed by reference to the value of the gold held in the Trust (i.e., the fees of the Trustee, the Sponsor, the Marketing Agent and the Custodian). The Trustee determines the NAV per Share by dividing the NAV of the Trust by the number of Shares outstanding as of the close of trading on the NYSE Arca.

Critical Accounting Policy

Valuation of Gold

Effective December 22, 2014, HSBC Bank plc (the “Custodian”) has assumed custodial responsibilities of the Trust. Prior to December 22, 2014, HSBC Bank USA, N.A. was the Custodian. Gold is held by the Custodian, on behalf of the Trust. Beginning October 1, 2014, the gold held by the Trust is reported at fair value on the Statements of Financial Condition. Prior to October 1, 2014, the gold held by the Trust was reported at the lower of cost or market, using the average cost method.

16

Table of Contents

Results of Operations

In the three months ended December 31, 2014, an additional 8,500,000 Shares (85 Baskets) were created in exchange for 816,766 ounces of gold, 28,600,000 Shares (286 Baskets) were redeemed in exchange for 2,748,635 ounces of gold, and 24,342 ounces of gold were sold to pay expenses.

As at December 31, 2014, the Custodian held 22,901,223 ounces of gold on behalf of the Trust in its vault, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $27,464,291,323 (cost — $28,274,773,121) based on the London PM fix on December 31, 2014. Subcustodians held nil ounces of gold in their vaults on behalf of the Trust and 105,663 ounces of gold were payable by the Trust in connection with the creation and redemption of Baskets.

As at September 30, 2014, the amount of gold owned by the Trust was 24,751,771 ounces, with a market value of $30,110,529,883 (cost — $30,587,784,162), net of gold payable of 115,387 ounces with a market value of $140,368,276, based on the London PM fix on September 30, 2014 (in accordance with the Trust Indenture).

17

Table of Contents

As at September 30, 2014, the Custodian held 24,867,158 ounces of gold in its vault 100% of which is allocated gold in the form of London Good Delivery gold bars including gold payable, with a market value of $30,250,898,159 (cost – $30,728,152,437). Subcustodians held nil ounces of gold in their vaults on behalf of the Trust and 115,387 ounces of gold were payable by the Trust in connection with the creation and redemption of Baskets.

As at August 28, 2014, Inspectorate International Limited concluded the annual full count of the Trust’s gold bullion held by the Custodian. As at October 8, 2014, inspectorate International Limited concluded reconciliation procedures from August 29, 2014 through September 30, 2014. The results can be found on www.spdrgoldshares.com.

Cash Resources and Liquidity

At December 31, 2014 the Trust did not have any cash balances. When selling gold to pay expenses, the Trustee endeavors to sell the exact amount of gold needed to pay expenses in order to minimize the Trust’s holdings of assets other than gold. As a consequence, we expect that the Trust will not record any cash flow from its operations and that its cash balance will be zero at the end of each reporting period.

Analysis of Movements in the Price of Gold

As movements in the price of gold are expected to directly affect the price of the Trust’s Shares, investors should understand what the recent movements in the price of gold have been. Investors, however, should also be aware that past movements in the gold price are not indicators of future movements. This section identifies recent trends in the movements of the gold price.

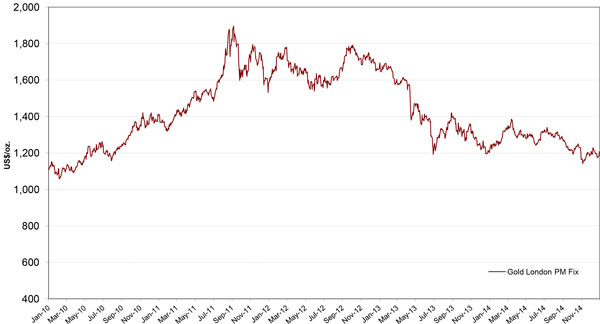

The following chart provides historical background on the price of gold. The chart illustrates movements in the price of gold in US dollars per ounce over the period from January 1, 2010 to December 31, 2014, and is based on the London PM Fix.

18

Table of Contents

Daily gold price - January 1, 2010 to December 31, 2014

The average, high, low and end-of-period gold prices for the three and twelve month periods over the prior three years and for the period from the Date of Inception through December 31, 2014, based on the London PM Fix, were:

| Period |

Average | High | Date | Low | Date | End of period |

Last business day(1) |

|||||||||||||||||||||

| Three months to March 31, 2012 |

$ | 1,690.57 | $ | 1,781.00 | Feb 28, 2012 | $ | 1,598.00 | Jan 03, 2012 | $ | 1,662.50 | Mar 30, 2012 | |||||||||||||||||

| Three months to June 30, 2012 |

$ | 1,609.49 | $ | 1,677.50 | Apr 02, 2012 | $ | 1,540.00 | May 30, 2012 | $ | 1,598.50 | Jun 29, 2012 | |||||||||||||||||

| Three months to September 30, 2012 |

$ | 1,652.00 | $ | 1,784.50 | Sep 21, 2012 | $ | 1,556.25 | Jul 12, 2012 | $ | 1,776.00 | Sep 28, 2012 | |||||||||||||||||

| Three months to December 31, 2012 |

$ | 1,719.96 | (3) | $ | 1,791.75 | Oct 04, 2012 | $ | 1,650.50 | Dec 20, 2012 | $ | 1,664.00 | Dec 31, 2012 | (2) | |||||||||||||||

19

Table of Contents

| Period |

Average | High | Date | Low | Date | End of period |

Last business day(1) |

|||||||||||||||||||||

| Three months to March 31, 2013 |

$ | 1,631.77 | $ | 1,693.75 | Jan 02, 2013 | $ | 1,574.00 | Mar 06, 2013 | $ | 1,598.25 | Mar 28, 2013 | |||||||||||||||||

| Three months to June 30, 2013 |

$ | 1,414.80 | $ | 1,583.50 | Apr 02, 2013 | $ | 1,192.00 | Jun 28, 2013 | $ | 1,192.00 | Jun 28, 2013 | |||||||||||||||||

| Three months to September 30, 2013 |

$ | 1,326.28 | $ | 1,419.50 | Aug 28, 2013 | $ | 1,212.75 | Jul 05, 2013 | $ | 1,326.50 | Sep 30, 2013 | |||||||||||||||||

| Three months to December 31, 2013 |

$ | 1,273.75 | (3) | $ | 1,361.00 | Oct 28, 2013 | $ | 1,195.25 | Dec 20, 2013 | $ | 1,201.50 | Dec 31, 2013 | (2) | |||||||||||||||

| Three months to March 31, 2014 |

$ | 1,293.06 | $ | 1,385.00 | Mar 14, 2014 | $ | 1,221.00 | Jan 08, 2014 | $ | 1,291.75 | Mar 31, 2014 | |||||||||||||||||

| Three months to June 30, 2014 |

$ | 1,288.44 | $ | 1,325.75 | Apr 14, 2014 | $ | 1,242.75 | Jun 03, 2014 | $ | 1,315.00 | Jun 30, 2014 | |||||||||||||||||

| Three months to September 30, 2014 |

$ | 1,281.21 | $ | 1,340.25 | Jul 10, 2014 | $ | 1,213.50 | Sep 22, 2014 | $ | 1,216.50 | Sep 30, 2014 | |||||||||||||||||

| Three months to December 31, 2014 |

$ | 1,200.69 | (3) | $ | 1,250.25 | Oct 21, 2014 | $ | 1,142.00 | Nov 05, 2014 | $ | 1,199.25 | Dec 31, 2014 | (2) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Twelve months ended December 31, 2012 |

$ | 1,668.93 | (3) | $ | 1,791.75 | Oct 04, 2012 | $ | 1,540.00 | May 30, 2012 | $ | 1,664.00 | Dec 31, 2012 | (2) | |||||||||||||||

| Twelve months ended December 31, 2013 |

$ | 1,409.55 | (3) | $ | 1,693.75 | Jan 02, 2013 | $ | 1,192.00 | Jun 28, 2013 | $ | 1,201.50 | Dec 31, 2013 | (2) | |||||||||||||||

| Twelve months ended December 31, 2014 |

$ | 1,265.65 | (3) | $ | 1,385.00 | Mar 14, 2014 | $ | 1,142.00 | Nov 05, 2014 | $ | 1,199.25 | Dec 31, 2014 | (2) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| November 12, 2004 to December 31, 2014 |

$ | 1,064.66 | (3) | $ | 1,895.00 | Sep 05, 2011 | $ | 411.10 | Feb 08, 2005 | $ | 1,199.250 | Dec 31, 2014 | (2) | |||||||||||||||

| (1) | The end of period gold price is the London PM Fix on the last business day of the period. This is in accordance with the Trust Indenture and the basis used for calculating the Net Asset Value of the Trust. |

| (2) | There was no London PM Fix on the last business day of December 2012, 2013 and 2014. The London AM Fix on such business days was $1,664.00, $1,201.50 and $1,199.25, respectively. The Net Asset Value of the Trust on December 31, 2012 and December 30, 2013 and December 31, 2014 was calculated using the London AM Fix, in accordance with the Trust Indenture. |

| (3) | There was no London PM Fix for both December 24th and December 31st for the periods ended 2012, 2013 and 2014. For comparative purposes, the average was calculated using the London AM Fix for those business days. Accordingly, the Net Asset Value of the Trust for December 24th and December 31st for the periods ended 2012, 2013 and 2014, was calculated using the London AM Fix. |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk |

The Trust Indenture does not authorize the Trustee to borrow for payment of the Trust’s ordinary expenses. The Trust does not engage in transactions in foreign currencies which could expose the Trust or holders of Shares to any foreign currency related market risk. The Trust does not invest in any derivative financial instruments or long-term debt instruments.

| Item 4. | Controls and Procedures |

Disclosure controls and procedures. Under the supervision and with the participation of the Sponsor, World Gold Trust Services, LLC, including its chief executive officer and chief financial officer, we carried out an evaluation of the effectiveness of the design and operation of the Trust’s disclosure controls and procedures. Based upon that evaluation, our chief executive officer and chief financial officer concluded that the disclosure controls and procedures were effective as of the end of the period covered by this quarterly report.

Internal control over financial reporting. There has been no change in the internal control of the Trust over financial reporting that occurred during our most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the internal control over financial reporting.

20

Table of Contents

| Item 1. | Legal Proceedings |

Not applicable.

| Item 1A. | Risk Factors |

You should carefully consider the factors discussed in Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year ended September 30, 2014, which could materially affect our business, financial condition or future results. The risks described in our Annual Report on Form 10-K are not the only risks facing the Trust. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

| a) | None. |

| b) | Not applicable. |

| c) | As of the date of the formation of the Trust on November 12, 2004, the NAV of the Trust, which represents the value of the gold deposited in the Trust, was $13,081,500, and the NAV per Share was $43.60. Since formation and through December 31, 2014, 9,627 Baskets (962,700,000 Shares) have been created and 7,255 Baskets (725,500,000 Shares) have been redeemed. |

| Period |

Total Number of Shares Redeemed |

Average Ounces of Gold Per Share |

||||||

| 10/01/14 to 10/31/14 |

10,700,000 | .09614 | ||||||

| 11/01/14 to 11/30/14 |

8,600,000 | .09611 | ||||||

| 12/01/14 to 12/31/14 |

9,300,000 | .09607 | ||||||

|

|

|

|

|

|||||

| Total |

28,600,000 | .09611 | ||||||

|

|

|

|

|

|||||

| Item 3. | Defaults Upon Senior Securities |

None.

| Item 4. | Mine Safety Disclosures. |

None.

| Item 5. | Other Information |

None.

| Item 6. | Exhibits |

The exhibits listed on the accompanying Exhibit Index, and such Exhibit Index, are filed or incorporated by reference as a part of this report.

21

Table of Contents

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

| WORLD GOLD TRUST SERVICES, LLC |

| Sponsor of the SPDR® Gold Trust |

| (Registrant) |

| /s/ William Rhind |

| William Rhind |

| Principal Executive Officer |

| /s/ John Adrian Pound |

| John Adrian Pound |

| Principal Financial and Accounting Officer |

Date: February 6, 2015

| * | The Registrant is a trust and the persons are signing in their capacities as officers of World Gold Trust Services, LLC, the Sponsor of the Registrant. |

22

Table of Contents

EXHIBIT INDEX

Pursuant to Item 601 of Regulation S-K

| Exhibit No. |

Description of Exhibit | |

| 31.1 | Certification of Chief Executive Officer pursuant to Rule 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as amended, with respect to the Trust’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. | |

| 31.2 | Certification of Chief Financial Officer pursuant to Rule 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as amended, with respect to the Trust’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. | |

| 32.1 | Certification of Principal Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, with respect to the Trust’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. | |

| 32.2 | Certification of Principal Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, with respect to the Trust’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014. | |

| 101.INS* | XBRL Instance Document | |

| 101.SCH* | XBRL Taxonomy Extension Schema Document | |

| 101.CAL* | XBRL Taxonomy Extension Calculation Linkbase Document | |

| 101.LAB* | XBRL Taxonomy Extension Label Linkbase Document | |

| 101.PRE* | XBRL Taxonomy Extension Presentation Linkbase Document | |

| 101.DEF* | XBRL Taxonomy Extension Definition Linkbase Document | |

| * | Pursuant to Rule 406T of Regulation S-T, these interactive data files are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, are deemed not filed for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, and otherwise are not subject to liability under those sections. |

23