Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - Spectrum Brands Holdings, Inc. | hrg-12312014x10xqdec31quar.htm |

| 8-K - 8-K - Spectrum Brands Holdings, Inc. | hrg-12312014x10xqpressrele.htm |

1st Quarter Conference Call February 6th, 2015

Agenda Quarterly Overview & Operating Highlights Omar Asali, President and Director Financial Highlights Tom Williams, Chief Financial Officer (NYSE: HRG) 2

Safe Harbor Disclaimer 3 Limitations on the Use of Information. This company overview has been prepared by Harbinger Group Inc. (the “Company” or “HGI”) solely for informational purposes, and not for the purpose of updating any information or forecast with respect to the Company or any of its affiliates or any other purpose. This information is subject to change without notice and should not be relied upon for any purpose. Neither the Company nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information. In furnishing this information and making any oral statements, neither the Company nor any of its affiliates undertakes any obligation to provide the recipient with access to any additional information or to update or correct such information. The information herein or in any oral statements (if any) are prepared as of the date hereof or as of such earlier dates as presented herein; neither the delivery of this document nor any other oral statements regarding the affairs of Company or its affiliates shall create any implication that the information contained herein or the affairs of the Company or its affiliates have not changed since the date hereof or after the dates presented herein (as applicable); that such information is correct as of any time subsequent to its date; or that such information is an indication regarding the performance of the Company or any of its affiliates since the time of the Company’s or such affiliates latest public filings or disclosure. These materials and any related oral statements are not all- inclusive and shall not be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Special Note Regarding Forward-Looking Statements. This document contains, and certain oral statements made by our representatives from time to time may contain, forward-looking statements, including those statements regarding expected dividends from our subsidiaries, capital needs of our subsidiaries and potential acquisitions, expectations with respect to foreign exchange rates and commodity prices and expectations regarding our common stock buyback program, for which the manner of purchase, the number of shares to be purchased and the timing of purchases will be based on the price of HGI's common stock, general business and market conditions and applicable legal requirements, and is subject to the discretion of HGI's management. Generally, forward- looking statements include information concerning possible or assumed future distributions from subsidiaries, other actions, events, results, strategies and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will” “could,” “might,” or “continues” or similar expressions. Such forward-looking statements are subject to risks and uncertainties that could cause actual results, events and developments to differ materially from those set forth in or implied by such statements. These statements are based on the beliefs and assumptions of HGI's management and the management of HGI's subsidiaries (including target businesses). Factors that could cause actual results, events and developments to differ include, without limitation: the ability of HGI's subsidiaries (including, target businesses following their acquisition) to generate sufficient net income and cash flows to make upstream cash distributions; the decision of HGI subsidiaries' boards to make upstream cash distributions, which is subject to numerous factors such as restrictions contained in applicable financing agreements, state and regulatory restrictions and other relevant consideration as determined by the applicable board; HGI's liquidity, which may be impacted by a variety of factors, including the capital needs of HGI's current and future subsidiaries; capital market conditions; commodity market conditions; foreign exchange rates; HGI's and its subsidiaries' ability to identify any suitable future acquisition opportunities, efficiencies/cost avoidance, cost savings, income and margins, growth, economies of scale, combined operations, future economic performance, conditions to, and the timetable for, completing the integration of financial reporting of acquired or target businesses with HGI or HGI subsidiaries; completing future acquisitions and dispositions; litigation; potential and contingent liabilities; management's plans; changes in regulations, taxes and the those forward looking statements included under the caption “Risk Factors” in HGI's most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. HGI does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operation results. Non-U.S. GAAP Measures. Management believes that certain non-U.S. GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Reconciliations of such measures to the most comparable U.S. GAAP measures are included herein. We exclude the impact of foreign currency loses of $37 million and the net investment gains on the measure of revenue growth of the quarter, which is based on a non-GAAP financial measure. While these adjustments are an integral part of the overall performance of the business, macroeconomic factors and volatility caused by portfolio repositioning and derivative movements can overshadow the underlying performance. We believe this measure assists in understanding the trends in our business. Our Consumer Products segment uses Adjusted EBITDA-Consumer Products, a non-U.S. GAAP financial measure. Management believes that Adjusted EBITDA-Consumer Products is significant to gaining an understanding of Spectrum Brands' results as it is frequently used by the financial community to provide insight into an organization's operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation and amortization can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA-Consumer Products can also be a useful measure of our Consumer Product segment's ability to service debt and is one of the measures used for determining Spectrum Brand's debt covenant compliance. Adjusted EBITDA-Consumer Products excludes certain items that are unusual in nature or not comparable from period to period. Our Insurance segment uses Insurance AOI, a non-U.S. GAAP financial measure frequently used throughout the insurance industry. Adjusted Operating Income is calculated by adjusting the reported insurance segment operating income to eliminate the impact of net investment gains, excluding gains and losses on derivatives and including net other-than-temporary impairment losses recognized in operations, the effect of changes in the rates used to discount the FIA embedded derivative liability and the impact of certain litigation reserves. While these adjustments are an integral part of the overall performance of our Insurance Segment, market conditions impacting these items can overshadow the underlying performance of the business. Accordingly, we believe using a measure which excludes their impact is effective in analyzing the trends of our Insurance segment's operations. Our Energy segment uses Adjusted EBITDA-Energy, a non-U.S. GAAP financial measure. Management believes that Adjusted EBITDA-Energy is significant to gaining an understanding of the Compass'/HGI Partnership's results as it is frequently used by the financial community and management to provide insight into an organization's operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation and amortization can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA-Energy excludes certain items that are unusual in nature or not comparable from period to period such as accretion of discount on asset retirement obligations, non-cash changes in the fair value of derivatives, non-cash write-downs of assets, and stock-based compensation. While management believes that non-U.S. GAAP measurements are useful supplemental information, such adjusted results are not intended to replace U.S. GAAP financial results and should be read in conjunction with those U.S. GAAP results. By accepting this document, each recipient agrees to and acknowledges the foregoing terms and conditions.

Quarterly Overview & Operating Highlights Omar Asali

HGI Summary Consolidated 1st quarter results solid, consistent with our expectations Macro-economic headwinds are challenging certain areas of the business —Commodity prices —Foreign exchange rates —Low interest rates —Low GDP growth rates Successfully managing through leadership transitions Continue to believe that attractive, cash flow positive M&A opportunities are available We remain well-positioned to continue delivering growth in free cash flow and book value for the foreseeable future Solid consolidated financial and operational performance in the first fiscal quarter of 2015 5

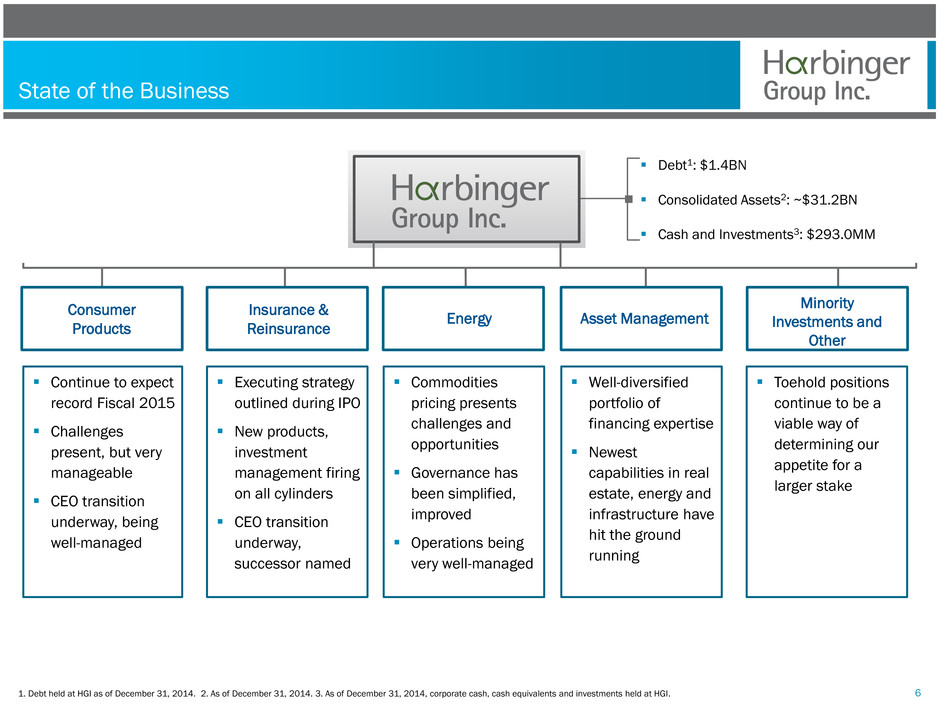

State of the Business 6 Consumer Products Asset Management Energy Minority Investments and Other Insurance & Reinsurance Continue to expect record Fiscal 2015 Challenges present, but very manageable CEO transition underway, being well-managed 1. Debt held at HGI as of December 31, 2014. 2. As of December 31, 2014. 3. As of December 31, 2014, corporate cash, cash equivalents and investments held at HGI. Debt1: $1.4BN Consolidated Assets2: ~$31.2BN Cash and Investments3: $293.0MM Executing strategy outlined during IPO New products, investment management firing on all cylinders CEO transition underway, successor named Commodities pricing presents challenges and opportunities Governance has been simplified, improved Operations being very well-managed Well-diversified portfolio of financing expertise Newest capabilities in real estate, energy and infrastructure have hit the ground running Toehold positions continue to be a viable way of determining our appetite for a larger stake

Consumer Products Reaffirmed outlook for 6th consecutive year of record financial performance Business fundamentals strong, near-term challenges manageable Very active M&A deal pipeline —Tell Manufacturing, adding commercial locksets to existing consumer business —P&G’s European pet food business, including well-known IAMS and Eukanuba brands —Salix Animal, world’s largest vertically integrated dog treat company Robust platform for future growth via: —New products, enhanced features, new retailing partners —Distribution and market-share gains —Expansion of e-commerce Spectrum’s share price increased 5.7% in the first fiscal quarter, outperforming the S&P 500, NASDAQ and Dow averages over the same time period 7

Consumer Products First quarter growth: —Revenue increased low single-digits (adjusting for currency and port delays) —Growth in Adjusted EBITDA (adjusting for currency impacts) Momentum in key lines of the business —Record first quarter for Home and Garden product line —Home Appliances grew more than 3% —Hardware and Home Improvement up year-over-year as well (adjusting for currency impacts and port delays) Significant cost improvement savings realized during the quarter —Provides capital to invest in new products —Enhances competitiveness in key categories, such as batteries Expecting record fiscal year for revenue, Adjusted EBITDA, and free cash flow in 2015 Spectrum brands has multiple opportunities to continue building book value for its shareholders 8

Insurance Products FGL’s investment portfolio continues to perform very well: —Average yield on assets purchased: 5.2% —Average yield on portfolio: 4.83%, up 19 bps from 1Q14 Maintaining average NAIC rating of approximately 1.5 GAAP book value up 25% to $1.7 billion Book value excluding AOCI up 8% to $1.3 billion Fixed annuity sales at FGL increased 115% vs. 1Q14 and 42% vs. 4Q14 —Sales of products launched this past year accounting for more than half of new growth Our Insurance Segment is very healthy, well-managed and positioned for ongoing growth 9 Note: GAAP book value and book value excluding AOCI reflect FGL’s results only

Energy Products Recent performance impacted by severe decline in commodity prices —Our average sales prices: oil down 29%, gas liquids down 37% Acquiring full interest in Compass was the right move for HGI —Simplified governance accelerated response to unfavorable trends —The gain recorded this quarter largely offsets the non-cash impairment Focus on managing the business optimally, weathering the current storm —Production ahead of expectations —Operating efficiencies continuing under strong leadership, improved governance —Recompletion program generating attractive returns in challenging environment Compass to de-lever to maintain balance sheet flexibility —Appetite for targeted acquisitions on a cash-flow accretive basis remains high Our Energy Segment is comprised of long- lived, lower-decline rate and lower geologic-risk conventional oil and gas assets 10

Asset Management Contributions from newest businesses driving revenue growth, improved profitability —EIC, CorAmerica have closed on their initial investments, poised for longer-term growth Salus’ asset-based lending model well-positioned in current environment — Increasing opportunities to provide liquidity to middle-market operators in retail, other attractive verticals —Continues to expand portfolio with minimum impairments and full preservation of capital Five Island well-positioned to capitalize on market opportunities in high-yield space Diversified lending platform that provides synergistic opportunities for investing across our business 11

Financial Highlights Tom Williams

1Q Revenue Highlights Consolidated revenues of $1.44 billion at HGI Currency-neutral revenue growth of 4.1% at HGI as compared to the Fiscal 2014 Quarter (excluding the impact of net investment gains in Insurance) 13 REVENUES (in millions) $1,101 $1,105 1Q14 1Q15 +0.4% 1Q14 1Q15 Note: each segment is presented on its own scale and is not intended to offer a comparison to any other segment; Corporate & Other segment not shown (revenue of $0 and $21 million in 1Q14 and 1Q15, respectively) Consumer Products1 Insurance (16.7%) $36 $34 1Q14 1Q15 (3.4%) $5 $8 1Q14 1Q15 Energy2 Asset Management +77.8% Business remains fundamentally strong Organic growth in small appliances, electronic personal care, and home and garden products Battery sales affected by promotions, inventory reductions at key retailer Strong net investment gains in year ago quarter suppressed revenue growth $903 million in annuity sales this quarter, providing pipeline for future growth Natural production declines, lower oil and natural gas commodity prices Offset by contributions from full interest in Compass as of October 31st Contributions from newest capabilities in infrastructure, energy and real estate lending Salus had $792 million of loans outstanding 1. Growth rate shown excluding impact of $37.4 million in unfavorable foreign exchange. 2. Reflects 74.4% proportional interest in Compass Production GP, LLC through October 31, 2014 3. Presents Insurance Segment revenue excluding $141.9 and $52.0 of net investment gains in 1Q14 and 1Q15, respectively 1Q14 1Q15 As reported Excluding net Investment gains3 $231 $259 12.2% $373 $311 Unfavorable impact from foreign exchange

Significant Items Impacting Results Acquisition of full interest in Compass venture triggered a gain to Other Income this quarter Subsequent application of ceiling test limitation triggered a non-cash impairment to Energy’s Operating Income this quarter 14 Acquisition of full interest in Compass: —After the change in control, we re-measured our basis to fair market value based on: —Comparable transactions —Estimated cash flows using NYMEX futures —Resulted in $141.2 million gain to Other Income this quarter Non-cash Energy charge this quarter: —Required ceiling test limitation under the full cost method of accounting uses historical prices —Triggered $190.0 million in non-cash impairments to oil & gas properties Non-cash Corporate & Other charge this quarter: —$60.2 million impairment to goodwill and intangible assets of Frederick’s of Hollywood —Business in the midst of a turnaround plan

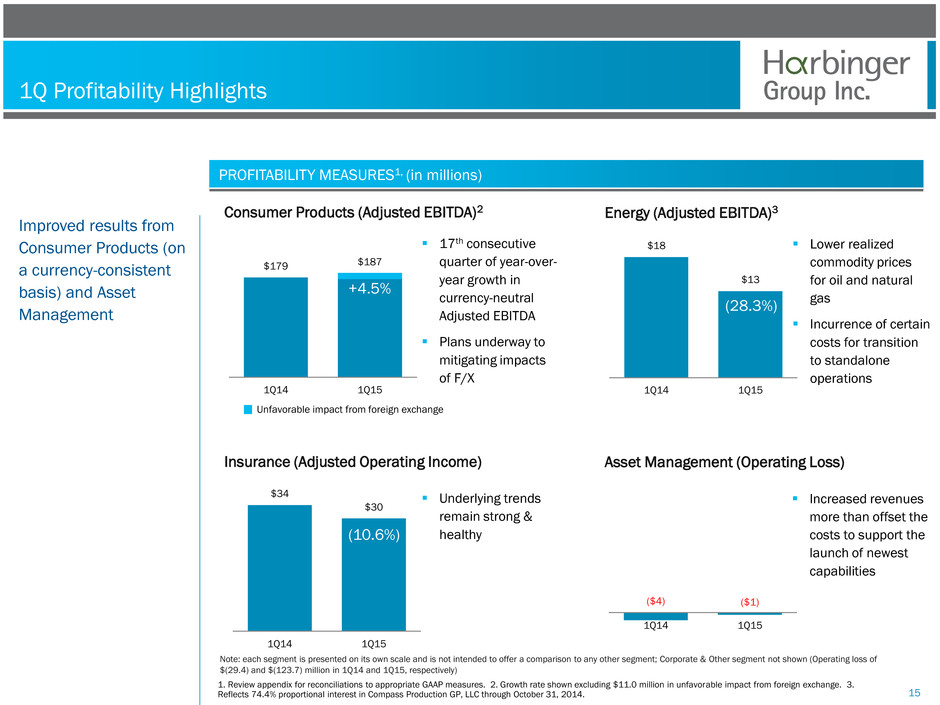

1Q Profitability Highlights Improved results from Consumer Products (on a currency-consistent basis) and Asset Management 15 PROFITABILITY MEASURES1, (in millions) $179 $187 1Q14 1Q15 $34 $30 1Q14 1Q15 Consumer Products (Adjusted EBITDA)2 Insurance (Adjusted Operating Income) $18 $13 1Q14 1Q15 ($4) ($1) 1Q14 1Q15 Energy (Adjusted EBITDA)3 Asset Management (Operating Loss) 17th consecutive quarter of year-over- year growth in currency-neutral Adjusted EBITDA Plans underway to mitigating impacts of F/X Underlying trends remain strong & healthy Lower realized commodity prices for oil and natural gas Incurrence of certain costs for transition to standalone operations Note: each segment is presented on its own scale and is not intended to offer a comparison to any other segment; Corporate & Other segment not shown (Operating loss of $(29.4) and $(123.7) million in 1Q14 and 1Q15, respectively) 1. Review appendix for reconciliations to appropriate GAAP measures. 2. Growth rate shown excluding $11.0 million in unfavorable impact from foreign exchange. 3. Reflects 74.4% proportional interest in Compass Production GP, LLC through October 31, 2014. +4.5% (28.3%) (10.6%) Increased revenues more than offset the costs to support the launch of newest capabilities Unfavorable impact from foreign exchange

Capital Structure Update HGI received $22 million in dividends from subsidiaries this quarter —Expect approximately $81 million in total dividends for Fiscal 2015 —Compass expected to use its cash flow for deleveraging over the next three quarters Corporate cash and investments: $293 million —Decrease of $224 million from 4th quarter balance due principally to: —$119 million acquisition of EXCO’s interest in Compass —Ongoing stock buyback program —Traditional investment activities at HGI Funding —One-time compensation payment Acquired 1.5 million shares of HGI in the quarter under existing buyback authorization —Average price of $12.96, or approximately $19 million —Since the program’s inception, 6.7 million shares acquired at average price of $12.69 —$15.5 million remained available for use after December 31st Our capital structure is strong and we are well- positioned to continue growing Activity in stock buyback program continued during the quarter 16

1Q 2015 Sum of the Parts Valuation (Dilutive) without AOCI As of the close of the first quarter, the estimated net value of our assets and liabilities was $17.06 per share of diluted common stock, an all- time record for a quarterly close. This represents an increase of 8.4% from Fiscal 2014 year-end. Shares of HGI were $14.16 at December 31st, 2014, an increase of nearly 8% in the quarter. SUM OF THE PARTS VALUATION – ESTIMATED VALUE VS. COMMON STOCK PRICE ($) $13.08 $6.68 $0.87 $2.04 $0.33 $1.03 -$6.97 $17.06 $14.16 Difference of $2.90 or 17.0% Discount Spectrum Brands1 Insurance Segment2 Total Estimated Value8 Common Stock Price9 HGI Funding LLC4 HGI Asset Mgmt Holdings LLC5 Cash6 Debt & Other Liabilities7 HGI Energy Holdings LLC3 17 1. The valuation of HGI’s interest in Spectrum Brands (NYSE: SPB) is based on the volume weighted average closing price (“VWAP”) of SPB shares for the 20 day trading period of $95.08 through December 31, 2014 multiplied by the 27,756,905 SPB shares owned by HGI. 2. The valuation of HGI’s interest in the insurance segment reflects the sum of the per-share-value of its interests in (i) Fidelity & Guaranty Life (NYSE: FGL) based on the VWAP of FGL shares for the 20-day trading period of $25.06 through December 31, 2014 multiplied by the 47,000,000 shares owned by HGI (or $5.84 per share); and (ii) of the $6.43 per share book value of the Insurance segment, Front Street Re (Holdings) Ltd. represents a net book value of $170.5 million, or $0.84 per share. 3. The valuation of HGI Energy Holdings LLC reflects its net book of value as of December 31, 2014. 4. The valuation of HGI Funding LLC reflects its net book value as of December 31, 2014 (which includes 3,396,885 SPB shares and the market value of other securities owned by HGI Funding). 5. The valuation of HGI Asset Management Holdings LLC, reflects its net book of value as of December 31, 2014. 6. Total cash consists of cash at HGI as of December 31, 2014. 7. Debt and other liabilities includes the face value of all liabilities at HGI as of December 31, 2014. 8. Per share amount for each of the above mentioned assets and liabilities is calculated by dividing the total valuation of such asset or liability by the 201,755,393 shares of HGI common stock (NYSE: HRG) outstanding as of December 31, 2014, which amount does gives effect to dilution for the vesting of all outstanding restricted shares (4,876,469). 9. The closing price for HGI’s shares of common stock December 31, 2014. Note: Book value as reflected above is not necessarily indicative of market value

Sustained Value Creation Steadily increasing sum-of-the-parts value as well as the quarterly close in HGI’s common stock price. SUM OF THE PARTS VALUATION1 – ESTIMATED VALUE VS. HGI’S COMMON STOCK PRICE ($) 18 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Diluted Sum of the Parts Valuation $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Closing Stock Price +35% +77% 1. See page 18 and the Company’s past disclosures for a description of the calculation of its sum of the parts valuation

Questions and Answers

1st Quarter Conference Call February 6th, 2015

Appendix

Reconciliation of Adjusted EBITDA of Consumer Products Segment to U.S. GAAP a. For the three months ended December 30, 2014 and December 30, 2013, respectively. RECONCILIATION OF ADJUSTED EBITDA OF CONSUMER PRODUCTS SEGMENT TO U.S. GAAP NET INCOME (UNAUDITED) 22 ($ in Millions) 2015 2014 Reported net income - Consumer Products segment 50.0$ 54.4$ Add back: Interest expense 44.4 57.0 Income tax expense 20.5 12.7 Tell inventory fair value adjustment 0.8 - Restructuring and related charges 7.4 4.5 Acquisition and integration related charges 8.1 5.5 Other 0.1 - Adjusted EBIT - Consumer Products segment 131.3 134.1 Depreciation and amortization, net of accelerated depreciation Depreciation of properties 18.4 17.9 Amortization of intangibles 20.5 20.2 Stock-based compensation 5.6 6.6 Adjusted EBITDA - Consumer Products segment 175.8$ 178.8$ Fiscal Quarter (a)

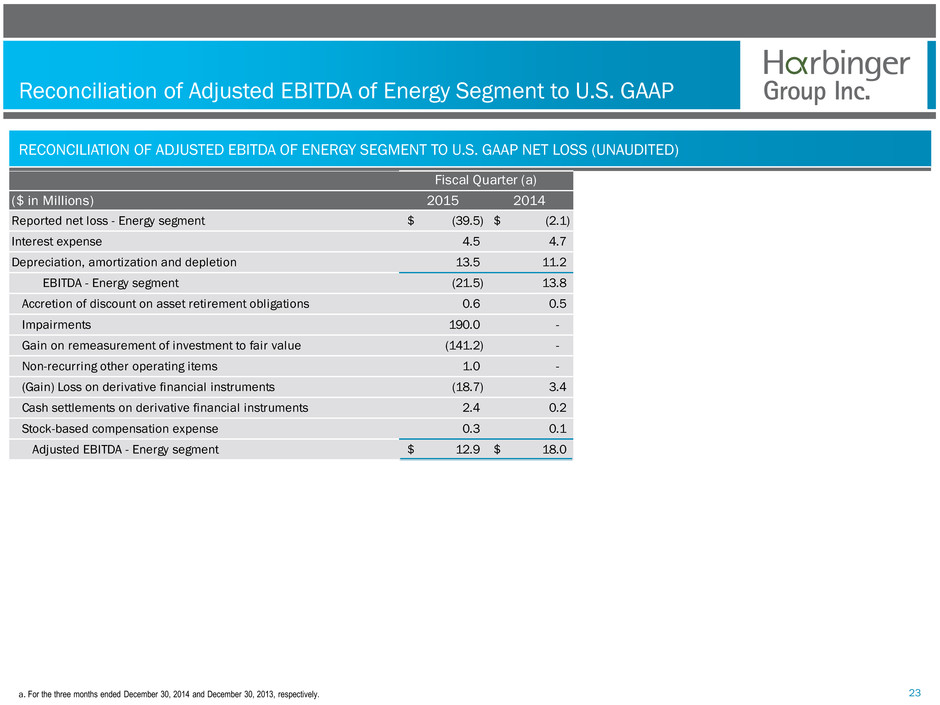

Reconciliation of Adjusted EBITDA of Energy Segment to U.S. GAAP a. For the three months ended December 30, 2014 and December 30, 2013, respectively. RECONCILIATION OF ADJUSTED EBITDA OF ENERGY SEGMENT TO U.S. GAAP NET LOSS (UNAUDITED) 23 ($ in Millions) 2015 2014 Reported net loss - Energy segment (39.5)$ (2.1)$ Interest expense 4.5 4.7 Depreciation, amortization and depletion 13.5 11.2 EBITDA - Energy segment (21.5) 13.8 Accretion of discount on asset retirement obligations 0.6 0.5 Impairments 190.0 - Gain on remeasurement of investment to fair value (141.2) - Non-recurring other operating items 1.0 - (Gain) Loss on derivative financial instruments (18.7) 3.4 Cash settlements on derivative financial instruments 2.4 0.2 Stock-based compensation expense 0.3 0.1 Adjusted EBITDA - Energy segment 12.9$ 18.0$ Fiscal Quarter (a)

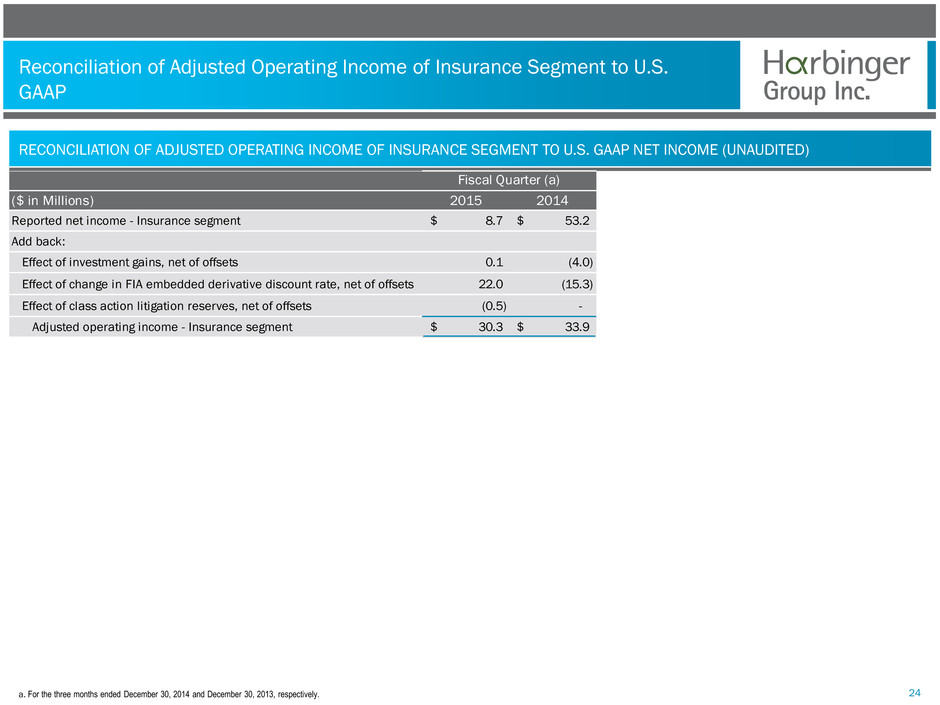

Reconciliation of Adjusted Operating Income of Insurance Segment to U.S. GAAP a. For the three months ended December 30, 2014 and December 30, 2013, respectively. RECONCILIATION OF ADJUSTED OPERATING INCOME OF INSURANCE SEGMENT TO U.S. GAAP NET INCOME (UNAUDITED) 24 ($ in Millions) 2015 2014 Reported net income - Insurance segment 8.7$ 53.2$ Add back: Effect of investment gains, net of offsets 0.1 (4.0) Effect of change in FIA embedded derivative discount rate, net of offsets 22.0 (15.3) Effect of class action litigation reserves, net of offsets (0.5) - Adjusted operating income - Insurance segment 30.3$ 33.9$ Fiscal Quarter (a)