Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED FEBRUARY 6, 2015 - COMMUNICATIONS SYSTEMS INC | csi150440_8k.htm |

Infrastructure and Services for Global Communications NASDAQ: JCS 1 Communications Systems, Inc. Infrastructure and Services for Global Communications NASDAQ: JCS February 2015

Infrastructure and Services for Global Communications NASDAQ: JCS 2 Safe Harbor This presentation includes certain forward -looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Communication s Systems’current expectations or beliefs and are subject to uncertainty and changes in circumstances. Act ual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive or regulatory factors, and other risks and uncertainties affecting the operation of Communications Systems’business. These risks, uncertainties and contingencies are indicated from time t o time in the Company ’s filings with the Securities and Exchange Commission. The information set forth he rein should be read in light of such risks. Further, investors should keep in mind that the Company’s financial results in any particular period may not be indicative of future results. Communications Systems is under no obligation to, and expressly disclaims any obligation to, update or alter its forward -looking statements, whether as a result of new information, futu re events, changes in assumptions or otherwise.

Infrastructure and Services for Global Communications NASDAQ: JCS 3 Business Overview A business in transformation »The Facts »The Situation »The Resolution » Established business c. 1969 » NASDAQ since 1981 » Credible brands » Product portfolio focused on Network Equipment and Services » Solid balance sheet, no goodwill and attractive dividend » Recent difficult operating performance » Thinly traded < 10,000 shares per day » Breakthrough products in growth markets » Taking advantage of substantial operating improvement opportunities Investment thesis, significant potential for breakout value change

Infrastructure and Services for Global Communications NASDAQ: JCS 4 Business Overview CSI consists of three technology-driven businesses $65.1 $44.3 $9.8 CSI Sales Breakdown ($ in millions; TTM at September 30, 2014) Total: $119.2 » Suttle – Innovative solutions for gigabit broadband deployments – Blue-chip telecom client base – Rising revenues and increasing margins – Benefitting from increased broadband demand » Transition Networks – Industry Leader in Mixed Media solutions – Stabilizing global revenues – Solid product GM’s >43% – Investing in R&D for future growth, ~11% of Sales » JDL Technologies – Wide range of IT services and network support – Strong presence in South Florida – Historically lumpy revenues – Pursuing new verticals to grow business and reduce period-to-period revenue volatility

Infrastructure and Services for Global Communications NASDAQ: JCS 5 Suttle Delivering innovative solutions for Gigabit broadband deployments » Solutions for fiber and copper networks meet high-speed demands for application diversity – Brownfield and greenfield – SFU, MDU and MTU » Key brands recently launched -FutureLink™and MediaMAX™ – High-speed connectivity on any medium (fiber, copper, power line, wireless) • OSP and premise applications • Optimized wireless connectivity – Incorporate best available technology, leverage existing infrastructure, and future-proof the network $ in millions Gross margin % Sales Growth and Margin Expansion Quality ManagementSolutions from the Central Office to the Premises Central Office Cabinet Tower MDU Pole Pedestal SFU

Infrastructure and Services for Global Communications NASDAQ: JCS 6 » Strong end-user demand for higher speeds and greater device connectivityhas been driving clients’copper and fiber network expansion programs. Suttle Strategic innovation partner to blue-chip client base Customer Engagement Model Blue-Chip Client Base Deployment of Broadband Networks Suttle Sales by Customer Group ($ in millions; TTM at 9/30/14) Telecom carriers represent 85% of total sales ($65.1)

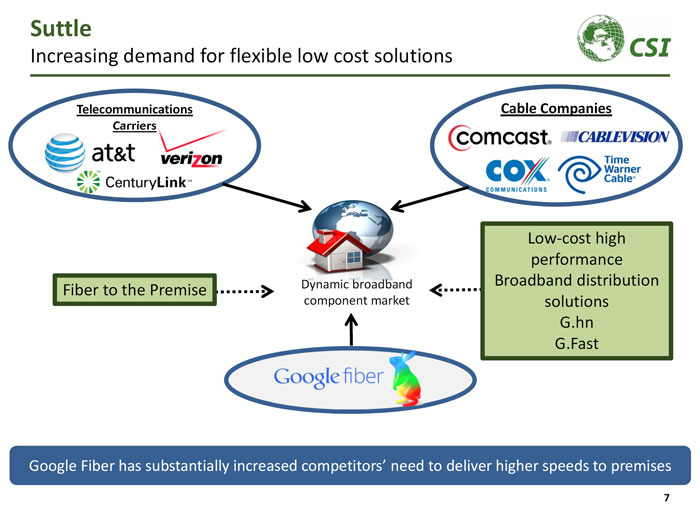

Infrastructure and Services for Global Communications NASDAQ: JCS 7 Suttle Increasing demand for flexible low cost solutions Telecommunications Carriers Cable Companies Fiber to the Premise Low-cost high performance Broadband distribution solutions G.hn G.Fast Google Fiber has substantially increased competitors’need to deliver higher speeds to premises Dynamic broadband component market

Infrastructure and Services for Global Communications NASDAQ: JCS 8 Suttle Evolving solutions 2015 Launch Programs •Burial/Aerial Terminals •Fiber Panels/Frames •Fiber Termination •Pushable-Pullable Fiber •G.hn Wireless Endpoints •G.Fast Gateways Target New Products > 25% 2014 New Product Releases •Fiber Terminals •Building Entrance Terminals •Premise Distribution-Tool- less High Speed Copper Connectivity •HPNA/G.hn Endpoints New Products > 30% Legacy Premise Product Platforms •Structured Cabling Systems •Voice Connectivity •DSL Filtering A powerful transformation of the product portfolio in line with market needs

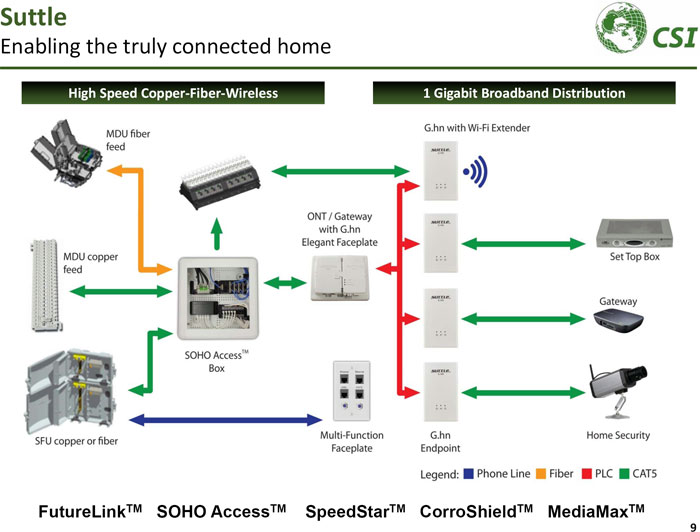

Infrastructure and Services for Global Communications NASDAQ: JCS 9 Suttle Enabling the truly connected home 1 Gigabit Broadband DistributionHigh Speed Copper-Fiber-Wireless FutureLink TM SOHO Access TM SpeedStar TM CorroShield TM MediaMax TM

Infrastructure and Services for Global Communications NASDAQ: JCS 10 Transition Networks Participating in the Enterprise evolution to Fiber, Ethernet connectivity Large addressable market, attractive growth Current Serviceable Market Total Addressable Market Opportunity Total Copper Switch Ports Over 1.2 BILLION Copper Switch Ports in Service Solutions for Enterprise networks evolution – Diversified customer base; Federal, Enterprise, Service Provider, Industrial – Established Tier 1 channels

Infrastructure and Services for Global Communications NASDAQ: JCS 11 Transition Networks Reposition core products to expand market opportunity » Take share, expand total addressable market – Re-focus efforts around core business – Expand thought leadership in conversion technologies » Better, faster, cheaper – Operational focus on cost, delivery, service – Innovations to make network migrations cost effective, seamless Introduce innovations based around core ION technologies Fiber-to-the-Desk ‒ Fiber extension cord ‒ Legacy data center, desk evolution 2.5/5 Gbps Networks ‒ >2x bandwidth over embedded Cat 5e/6 cable infrastructure ‒ Enable WiFi AP’s, Small Cells Smart Connectivity ‒ Wireless near field, Personal Area Network (PAN) mgmt. & control ‒ Inventory, report, work flow Smart SFP ‒ Embedded Carrier Ethernet ‒ VDSL, G.FAST, for Enterprise & Utility applications Relaunch existing ION conversion platform ION Platform Complete Mixed Media Delivery Solutions

Infrastructure and Services for Global Communications NASDAQ: JCS 12 Transition Networks Enter carrier market with TDM/ISDN over IP innovations Large addressable, valuable embedded baseSolutions for the evolving network ~75 MILLION LINES TDM, ISDN, Serial » Significant embedded legacy infrastructure » Addressable global market for Liberator™ >$100 MILLION Growing @ 15% per annum Flexible, comprehensive solution for large emerging market opportunity Liberator™

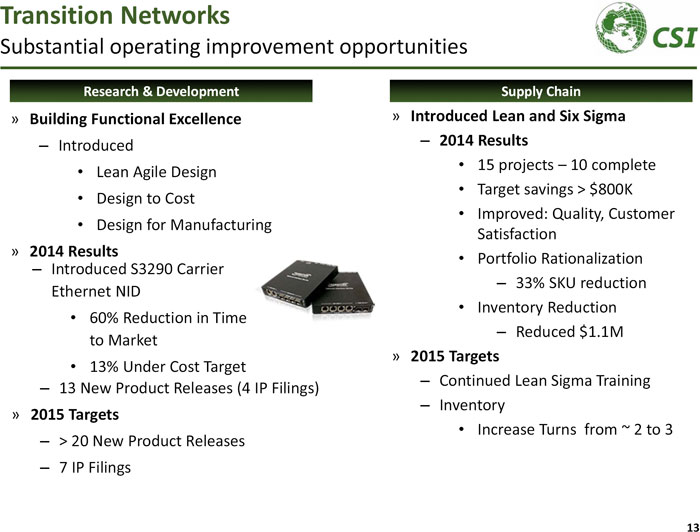

Infrastructure and Services for Global Communications NASDAQ: JCS 13 Transition Networks Substantial operating improvement opportunities » Building Functional Excellence – Introduced • Lean Agile Design • Design to Cost • Design for Manufacturing » 2014 Results » Introduced Lean and Six Sigma – 2014 Results • 15 projects –10 complete • Target savings > $800K • Improved: Quality, Customer Satisfaction • Portfolio Rationalization – 33% SKU reduction • Inventory Reduction – Reduced $1.1M » 2015 Targets – Continued Lean Sigma Training – Inventory • Increase Turns from ~ 2 to 3 – 13 New Product Releases (4 IP Filings) » 2015 Targets – > 20 New Product Releases – 7 IP Filings – Introduced S3290 Carrier Ethernet NID • 60% Reduction in Time to Market • 13% Under Cost Target Research & Development Supply Chain

Infrastructure and Services for Global Communications NASDAQ: JCS 14 JDL Technologies Delivering value-added IT services » Broad portfolio of technology solutions – Managed IT services, a large growing market – Cloud and virtualization services » Historically focused on South Florida region public education market – Volatility in federal and local IT funding has led to inconsistent JDL revenue streams 1 » JDL makes money in years of E-rate funding – 2010-2014 Sales ~$ 72MM Operating Income ~$10MM » E Rate 2015 funds approved for late 2015 Revenues 1 $ in millions » Target new verticals –Health Care » Expand geographic footprint » Broaden portfolio of IT solutions » Build a Monthly Recurring Revenue model (Annuity model) Strategic Direction 1 JDL revenues reflect the conclusion of a large K12 project in 1Q’14

Infrastructure and Services for Global Communications NASDAQ: JCS 15 JDL Technologies Diversifying end-markets and expanding footprint Historical Focus Expanded Growth Strategy Verticals Geography Health Care •HIPAA-Compliant IT services •Data Security •Compliance training Financial •Leveraging data security requirements of Gramm- Leach-Bliley Act Goal: Higher growth and lower volatility in period-to-period revenues Education •K12 to higher Education •Wireless classroom •E-Rate funding initiative Commercial •Diverse range of small commercial enterprises Education •K12 to higher Education •Wireless classroom •E-Rate funding initiative •Private education IT Services Leader in South Florida Expanding Nationally via Managed Services Commercial •Diverse range of commercial enterprises •Leveraging compliance requirements as applicable

Infrastructure and Services for Global Communications NASDAQ: JCS 16 JDL Technologies Focus on Florida Health Care market »Fast growing market opportunity – Health care has 1/3 of data breaches – Violations can carry >$1MM penalties – EMR becoming standard »Value proposition – Medical practices managing in increasingly complex IT environment – Providing HIPPA-compliant solutions is essential »Florida health care profile – Companies with 20-200 users: 4,000 – IT spending per company: $300K JDL Market Opportunity >$200MM with 15% CAGR »Early market success – First to market HIPPA-compliant IT services in Florida – Significant GM % showing continuous quarterly growth Strongly positioned for market success

Infrastructure and Services for Global Communications NASDAQ: JCS 17 » Company cost structure realigned, Office of the Chairman » New management structure in place. >20 Key Industry appointments » Obsolete inventory adjustment, >$3MM 2013/14 » Substantial Lean Operations gains, >$1Million in 2015 » Reinvested in R&D ( >7% ) IP Portfolio developing » All businesses have solid sales plans, >10%CAGR » Significant Tax reduction opportunities exist >400bps » Portfolio options being assessed Well positioned for success Investment thesis, significant potential for breakout value change

Infrastructure and Services for Global Communications NASDAQ: JCS 18 Strong Financial Profile Solid balance sheet and attractive dividend yield 1 based on 8,653,382 CSI shares outstanding as of 11/1/2014 2 based on CSI’s third quarter ending share price of $11.16 on 9/30/14 Balance Sheet Summary ($ in millions, except share figure) 9/30/2014 Cash, equivalents, investments $32.0 Total assets $102.6 Total long-term debt $0.8 Working capital $60.7 Stockholders’equity $88.1 Cash per share 1 $3.70 Annual Dividend of $0.64 Per Share Equates to a Yield of 5.7% 2 49 Consecutive Quarters of Dividend Payments

Infrastructure and Services for Global Communications NASDAQ: JCS 19 Appendix

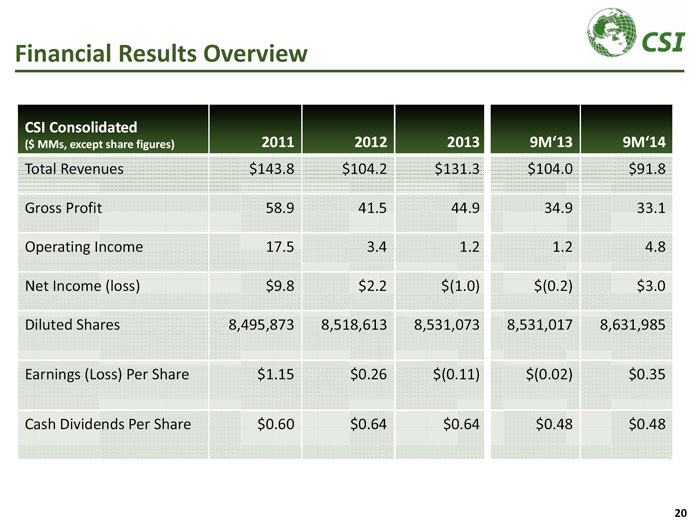

Infrastructure and Services for Global Communications NASDAQ: JCS 20 Financial Results Overview CSI Consolidated ($ MMs, except share figures) 2011 2012 2013 9M‘13 9M‘14 Total Revenues $143.8 $104.2 $131.3 $104.0 $91.8 Gross Profit 58.9 41.5 44.9 34.9 33.1 Operating Income 17.5 3.4 1.2 1.2 4.8 Net Income (loss) $9.8 $2.2 $(1.0) $(0.2) $3.0 Diluted Shares 8,495,873 8,518,613 8,531,073 8,531,017 8,631,985 Earnings (Loss) Per Share $1.15 $0.26 $(0.11) $(0.02) $0.35 Cash Dividends Per Share $0.60 $0.64 $0.64 $0.48 $0.48

Infrastructure and Services for Global Communications NASDAQ: JCS 21 Summary of Segment Results(rounded 000s) Three Months Ended September 30 Nine Months Ended September 30 2014 2013 2014 2013 2013 2012 Sales $ 19,938,000 $ 14,838,000 $ 51,827,000 $ 41,103,000 $ 54,346,000 $ 45,030,000 Gross profit 6,467,000 4,977,000 16,233,000 12,155,000 15,812,000 11,974,000 Operating income 2,824,000 1,688,000 6,093,000 3,510,000 5,457,000 2,603,000 Three Months Ended September 30 Nine Months Ended September 30 2014 2013 1 2014 2013 1 2013 1 2012 Sales $ 11,272,000 $ 10,882,000 $ 32,589,000 $ 32,156,000 $ 43,857,000 $ 53,843,000 Gross profit 4,989,000 5,165,000 15,081,000 16,561,000 22,419,000 27,995,000 Operating loss (43,000) (5,850,000) (977,000) (6,071,000) (3,711,000) 5,888,000 Three Months Ended September 30 Nine Months Ended September 30 2014 2013 2014 2013 2013 2012 Sales $ 2,224,000 $ 18,897,000 $ 7,426,000 $ 30,747,000 $ 33,116,000 $5,377,000 Gross profit 556,000 3,481,000 1,781,000 6,212,000 6,668,000 1,529,000 Operating (loss) income (123,000) 2,467,000 (304,000) 3,803,000 4,039,000 (655,000) 1 Includes goodwill impairment charge of $5,849,853