Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT - JONES LANG LASALLE INC | exhibit991fourthquarter201.htm |

| 8-K - 8-K - JONES LANG LASALLE INC | q42014earningrelease-form8k.htm |

Supplemental Information Fourth-Quarter Earnings Call 2014

Market & Financial Overview

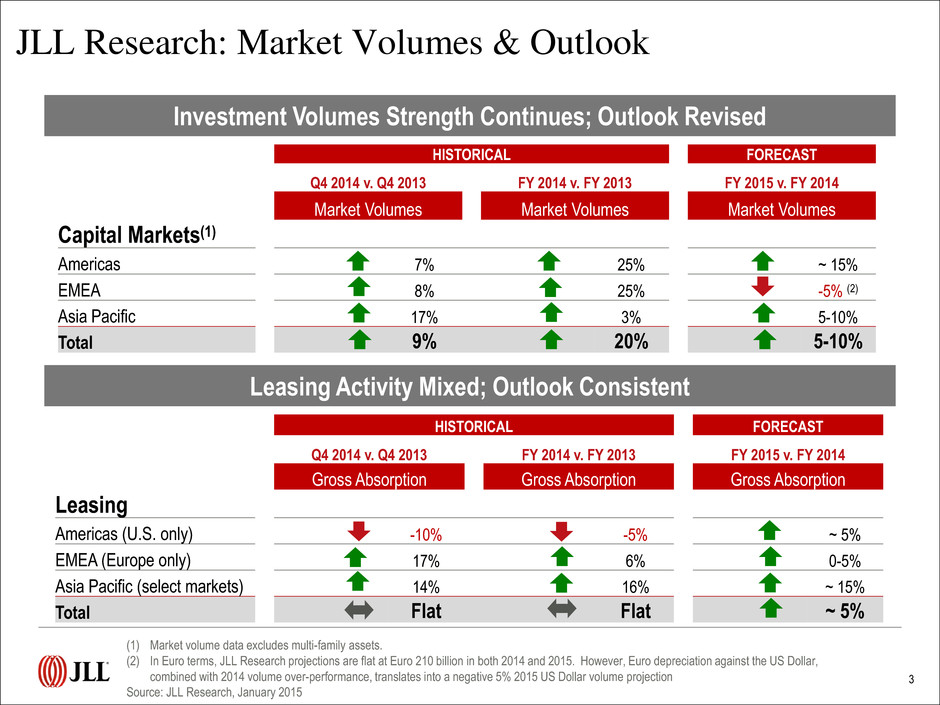

JLL Research: Market Volumes & Outlook Leasing Activity Mixed; Outlook Consistent Investment Volumes Strength Continues; Outlook Revised 3 HISTORICAL FORECAST Q4 2014 v. Q4 2013 FY 2014 v. FY 2013 FY 2015 v. FY 2014 Market Volumes Market Volumes Market Volumes Capital Markets(1) Americas 7% 25% ~ 15% EMEA 8% 25% -5% (2) Asia Pacific 17% 3% 5-10% Total 9% 20% 5-10% HISTORICAL FORECAST Q4 2014 v. Q4 2013 FY 2014 v. FY 2013 FY 2015 v. FY 2014 Gross Absorption Gross Absorption Gross Absorption Leasing Americas (U.S. only) -10% -5% ~ 5% EMEA (Europe only) 17% 6% 0-5% Asia Pacific (select markets) 14% 16% ~ 15% Total Flat Flat ~ 5% (1) Market volume data excludes multi-family assets. (2) In Euro terms, JLL Research projections are flat at Euro 210 billion in both 2014 and 2015. However, Euro depreciation against the US Dollar, combined with 2014 volume over-performance, translates into a negative 5% 2015 US Dollar volume projection Source: JLL Research, January 2015

Selected Business Wins and Expansions 4 Americas EMEA Asia Pacific - Capital One, 14M sf - Porsche, 286K sf - Ryder Systems, 600 locations - 353 North Clark, Chicago - Hyatt U.S. Hotel Portfolio, $490M - Industrial Portfolio, Mexico, $302M - Duke Realty, Cincinnati, 2.2M sf - Hyatt HQ, Chicago, 235K sf - Mitsubishi (MUTB), New York, 93K sf - HSBC Tower, London, $1.8B - PalaisQuartier, Frankfurt, €800M - Residential JV, London, £429M - Promenade Mall, Bucharest, €148M - Retail/Leisure Portfolio, Italy, €290M - The Park, Ireland, 500K sf - Union Investment, Frankfurt, 237K sf - Le Prestige Mall, Jeddah, 172K sf - Flipkart, Bangalore, 3M sf - Volkswagen, Beijing, 215K sf - PwC, Manila, 232K sf - Sunshine Insurance, Beijing, 1.3M sf - Tencent, Chengdu, 2.3M sf - Australia Dept. of Defense, 400 properties - Unilever, Bangkok, 194K sf - Birkenhead Point, Sydney, AUD 310M - Suntown Plaza, Shanghai Multi-Regional Crédit Agricole CIB, 30 countries BBVA, Asia, EMEA, Mexico

Prime Offices – Projected Changes in Values, 2015 5 + 10-20% + 5-10% + 0-5% - 0-5% - 5-10% Tokyo Capital Values Rental Values *New York – Midtown, London – West End, Paris - CBD. Nominal rates in local currency. Source: JLL Research, January 2015 Sydney, Beijing, Dubai, Boston Chicago, Los Angeles, New York* San Francisco, London* Hong Kong, Paris*, Madrid Toronto, Washington DC, Mexico City Singapore, Stockholm, Seoul, Shanghai Frankfurt, Brussels Beijing, London*, Sydney Dubai, Boston, Chicago, Los Angeles New York*, San Francisco, Seoul Toronto, Frankfurt, Washington DC Mexico City, Paris*, Shanghai, Brussels Stockholm, Hong Kong, Singapore Mumbai, Sao Paulo Tokyo, Madrid Mumbai, Sao Paulo Moscow Moscow

Financial Information

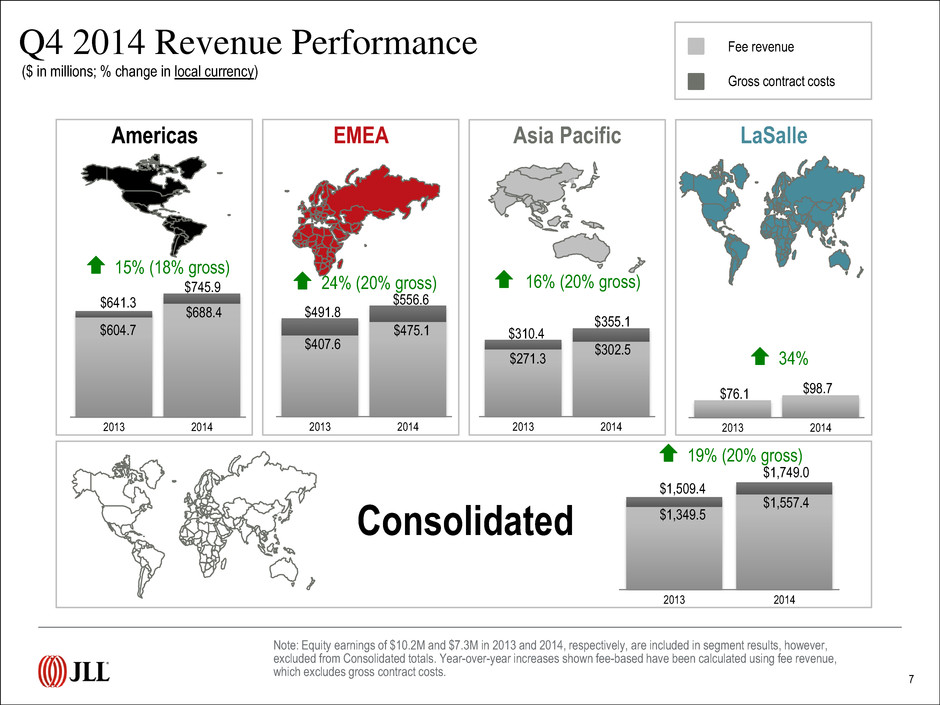

2013 2014 2013 20142013 2014 2013 2014 7 Q4 2014 Revenue Performance Note: Equity earnings of $10.2M and $7.3M in 2013 and 2014, respectively, are included in segment results, however, excluded from Consolidated totals. Year-over-year increases shown fee-based have been calculated using fee revenue, which excludes gross contract costs. Americas EMEA Asia Pacific LaSalle Consolidated ($ in millions; % change in local currency) 15% (18% gross) 24% (20% gross) 16% (20% gross) 19% (20% gross) $641.3 Fee revenue Gross contract costs 2013 2014 34% $745.9 $491.8 $556.6 $310.4 $355.1 $1,509.4 $1,749.0 $604.7 $688.4 $407.6 $475.1 $271.3 $302.5 $76.1 $98.7 $1,349.5 $1,557.4

2013 2014 46% 2013 2014 2013 2014 2013 2014 2013 2014 8 FY 2014 Revenue Performance Note: Equity earnings of $31.3M and $48.3M in 2013 and 2014, respectively, are included in segment results, however, excluded from Consolidated totals. Year-over-year increases shown fee-based have been calculated using fee revenue, which excludes gross contract costs. Americas EMEA Asia Pacific LaSalle Consolidated ($ in millions; % change in local currency) 18% (22% gross) 17% (23% gross) 11% (19% gross) 18% (23% gross) $1,918.6 Fee revenue Gross contract costs $2,319.9 $1,322.6 $1,632.6 $965.8 $1,110.2 $4,461.6 $5,429.6 $1,118.0 $1,316.2 $2,109.5 $1,806.5 $847.7 $909.1 $285.9 $415.1 $4,026.8 $4,701.7

9 Q4 2014 Real Estate Services Revenue ($ in millions; % change in local currency over Q4 2013) Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $345.3 18% $106.9 11% $85.9 34% $538.1 19% Capital Markets & Hotels $94.1 18% $173.2 42% $60.8 5% $328.1 27% Property & Facility Management - Fee $139.0 6% $65.7 14% $101.1 10% $305.8 9% Gross Revenue $195.3 18% $91.6 10% $141.7 16% $428.6 16% Project & Development Services - Fee $69.5 19% $41.2 21% $20.9 18% $131.6 19% Gross Revenue $70.7 20% $96.8 11% $32.9 37% $200.4 18% Ad isory, Consulting & Other $40.2 11% $88.1 21% $33.5 16% $161.8 17% Total RES Operating Fee Revenue $688.1 15% $475.1 24% $302.2 16% $1,465.4 18% Total Gross Revenue $745.6 18% $556.6 20% $354.8 19% $1,657.0 19% Americas EMEA Asia Pacific Total RES

10 FY 2014 Real Estate Services Revenue ($ in millions; % change in local currency over YTD 2013) Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $1,039.5 19% $295.2 9% $205.3 23% $1,540.0 17% Capital Markets & Hotels $266.6 22% $411.8 23% $141.9 (10%) $820.3 15% Property & Facility Management - Fee $454.3 13% $236.9 21% $379.4 14% $1,070.6 15% Gross Revenue $661.9 31% $338.2 38% $523.6 24% $1,523.7 30% Project & Development Services - Fee $222.7 20% $139.6 18% $72.2 11% $434.5 18% Gross Revenue $225.5 21% $354.7 28% $129.1 45% $709.3 29% Ad isory, Consulting & Other $125.6 10% $232.7 13% $109.9 16% $468.2 13% Total RES Operating Fee Revenue $2,108.7 18% $1,316.2 17% $908.7 11% $4,333.6 16% Total Gross Revenue $2,319.1 22% $1,632.6 23% $1,109.8 19% $5,061.5 22% Americas EMEA Asia Pacific Total RES

• Full-year fee revenue up 18% from 2013 • Revenue growth broad-based with Leasing up 19%, Capital Markets & Hotels up 22%, Property & Facility Management up 13%, and Project & Development Services up 20% compared with 2013 • Adjusted EBITDA margin calculated on a fee revenue basis was 13.0% compared with 12.7% in 2013 Americas Real Estate Services 2014 Highlights Fee Revenue By Geography ($ in millions) 11 Fee Revenue By Service Line 2014 2013 Leasing $ 1,039 $ 878 Capital Markets & Hotels 267 219 Property & Facility Management 454 407 Project & Development Services 223 188 Advisory, Consulting & Other 126 114 Total Operating Revenue $ 2,109 $ 1,806 Adjusted EBITDA $ 275 $ 229 Adjusted EBITDA Margin 13.0% 12.7% United States 92% Brazil 3% Canada 2% Mexico 2% Other Americas 1%

EMEA Real Estate Services 2014 Highlights Fee Revenue By Geography ($ in millions) 12 U.K. 50% Germany 12% France 10% Central Eastern Europe 4% Russia 3% Spain 3% Netherlands 3% Belgium 2% MENA 3% Italy 2% Other EMEA 8% Fee Revenue By Service Line 2014 2013 Leasing $ 295 $ 272 Capital Markets & Hotels 412 333 Property & Facility Management 237 193 Project & Development Services 139 117 Advisory, Consulting & Other 233 204 Total Operating Revenue $ 1,316 $ 1,119 Adjusted EBITDA $ 145 $ 110 Adjusted EBITDA Margin 11.0% 9.8% • Full-year fee revenue up 17% from 2013 • Revenue growth driven by Capital Markets & Hotels, up 23%, and Property & Facility Management, up 21%, compared with 2013 • Adjusted EBITDA margin calculated on a fee revenue basis was 11.0% compared with 9.8% in 2013

Asia Pacific Real Estate Services 2014 Highlights Fee Revenue By Geography ($ in millions) 13 Greater China (inc. Hong Kong) 34% Australia 29% India 11% Japan 9% Singapore 7% Thailand 3% New Zealand 2% Other Asia 6% Fee Revenue By Service Line 2014 2013 Leasing $ 206 $ 173 Capital Markets & Hotels 142 164 Property & Facility Management 379 348 Project & Development Services 72 67 Advisory, Consulting & Other 110 96 Total Operating Revenue $ 909 $ 848 Adjusted EBITDA $ 98 $ 90 Adjusted EBITDA Margin 10.7% 10.6% • Full-year fee revenue up 11% from 2013 • Revenue growth driven by Leasing, up 23%, and Property & Facility Management, up 14%, compared with 2013 • Adjusted EBITDA margin calculated on a fee revenue basis was 10.7% compared with 10.6% in 2013

LaSalle Investment Management Note: AUM data reported on a one-quarter lag. 2014 Highlights Q4 2014 AUM = $53.6 Billion U.K. $18.5 Continental Europe $4.5 North America $13.3 Asia Pacific $5.3 Public Securities $12.0 ($ in millions) ($ in billions) 14 Separate Accounts $29.7 Commingled Funds $11.9 Public Securities $12.0 Revenue 2014 2013 Advisory Fees $ 236 $ 223 Transaction Fees & Other 27 18 Incentive Fees 105 14 Operating Revenue $ 368 $ 255 Equity Earnings 47 31 Total Revenue $ 415 $ 286 Adjusted EBITDA $ 134 $ 70 Adjusted EBITDA Margin 32.3% 24.4% • Successful capital raising with $8.9 billion raised in 2014; a new record for LaSalle • Assets Under Management reach $53.6 billion, up from $47.6 billion a year ago • Continued incentive fee potential in future quarters; magnitude of combined incentive fees and equity earnings expected to moderate from record 2014

Solid Balance Sheet Position 2014 Highlights ($ in millions) 15 December Balance Sheet 2014 2013 2012 Cash and Cash Equivalents $ 250 $ 153 $ 152 Short-Term Borrowings 20 25 32 Credit Facility 0 155 169 Net Bank Debt $ (230) $ 27 $ 49 Long-Term Senior Notes 275 275 275 Deferred Business Acquisition Obligations 118 135 214 Total Net Debt $ 163 $ 437 $ 538 (1) Excludes investments in joint venture entities, capitalized leases and tenant improvement allowances that are required to be consolidated under U.S. GAAP (2) Includes deferred business acquisition payments and earn outs paid during the period for transactions closed in prior periods (3) Includes distributions of $62M partially offset by capital contributions of $56M • Investment grade balance sheet; Baa2 (Stable) / BBB (Stable) – In December 2014, Standard & Poor’s raised JLL’s rating to “BBB” • Continued healthy net debt reduction while continuing to invest in the business – Reduced net debt by $274 million • Low cost debt driving reduced interest expense – FY 2014 net interest expense of $28 million down from $35 million for FY 2013 • FY 2014 Investment Spending FY 2014 – Capital Expenditures (1) $130 m – M&A (2) $78 m – Co-Investment (3) $(6) m

Appendix

17 Prime Offices – Capital Value Clock, Q4 2013 v Q4 2014 Based on notional capital values for Grade A space in CBD or equivalent. US positions relate to the overall market. Source: JLL Research, January 2015 Americas EMEA Asia Pacific Q4 2014 Q4 2013 The Jones Lang LaSalle Property Clocks SM Capital value growth slowing Capital value growth accelerating Capital values bottoming out Capital values falling Beijing Hong Kong Singapore Chicago, Toronto Washington DC Mumbai Brussels Shanghai Madrid Tokyo Seoul Sydney, New York Frankfurt Sao Paulo Mexico City Boston, Los Angeles Berlin, Stockholm Houston San Francisco Moscow Dallas Amsterdam London Milan Paris Capital Value growth slowing Capital Value growth accelerating Capital Values bottoming out Capital Values falling Hong Kong, Toronto Singapore, Houston Shanghai, Washington DC, Mexico City London, Stockholm, Seoul Paris Brussels Amsterdam Berlin, Boston, Los Angeles Frankfurt, Chicago Milan Sydney New York, San Francisco Dallas Sao Paulo Moscow Mumbai, Madrid Tokyo, Beijing

18 Prime Offices – Rental Clock, Q4 2013 v Q4 2014 Americas EMEA Asia Pacific Q4 2014 Q4 2013 Based on rents for Grade A space in CBD or equivalent. US positions relate to the overall market. Source: JLL Research, January 2015 The Jones Lang LaSalle Property Clocks SM Rental value growth slowing Rental value growth accelerating Rental values bottoming out Rental values falling Seoul Paris, Milan Beijing Hong Kong Washington DC Shanghai Singapore Mumbai, Istanbul Dubai Tokyo Los Angeles New York Toronto Sao Paulo Mexico City Dallas Houston San Francisco Frankfurt Boston Amsterdam, Johannesburg Berlin, Moscow Brussels, Madrid Sydney, Chicago Stockholm London Rental Value growth slowing Rental Value growth accelerating Rental Values bottoming out Rental Values falling Sao Paulo Boston, Los Angeles Hong Kong Berlin, Frankfurt Brussels, Istanbul Seoul, Washington DC Amsterdam, Madrid, Dubai, Milan Chicago Moscow Paris, Sydney Toronto, Johannesburg Mumbai Mexico City, Shanghai Singapore, Houston San Francisco Dallas Beijing Stockholm, Tokyo London New York

19 Q4 2014 Adjusted EBITDA* Performance Americas EMEA Asia Pacific LaSalle Consolidated * Refer to slide 25 for Reconciliation of GAAP Net Income to Adjusted EBITDA for the three months ended December 31, 2013, and 2014, for details relative to these Adjusted EBITDA calculations. Segment Adjusted EBITDA is calculated by adding the segment’s depreciation and amortization to its reported operating income, which excludes restructuring and acquisition charges. Consolidated Adjusted EBITDA is the sum of the Adjusted EBITDA of the four segments. ($ in millions) 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 $101.0 $124.3 $65.4 $91.1 $45.6 $55.6 $18.5 $26.3 $230.5 $297.4

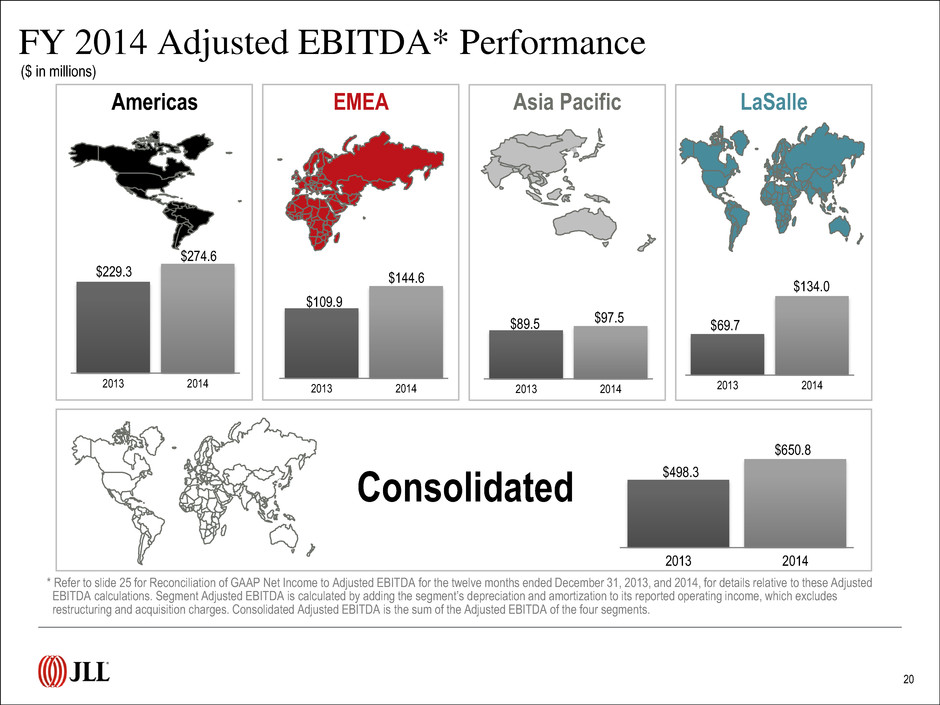

20 FY 2014 Adjusted EBITDA* Performance Americas EMEA Asia Pacific LaSalle Consolidated * Refer to slide 25 for Reconciliation of GAAP Net Income to Adjusted EBITDA for the twelve months ended December 31, 2013, and 2014, for details relative to these Adjusted EBITDA calculations. Segment Adjusted EBITDA is calculated by adding the segment’s depreciation and amortization to its reported operating income, which excludes restructuring and acquisition charges. Consolidated Adjusted EBITDA is the sum of the Adjusted EBITDA of the four segments. ($ in millions) 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 $229.3 $274.6 $109.9 $144.6 $89.5 $97.5 $69.7 $134.0 $498.3 $650.8

21 Q4 2014 Real Estate Services Revenue ($ in millions; % change in USD over Q4 2013) Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $345.3 17% $106.9 3% $85.9 29% $538.1 16% Capital Markets & Hotels $94.1 17% $173.2 34% $60.8 1 0% $328.1 21% Property & Facility Management - Fee $139.0 4% $65.7 8% $101.1 5% $305.8 5% Gross Revenue $195.3 15% $91.6 4% $141.7 10% $428.6 11% Project & Development Services - Fee $69.5 17% $41.2 13% $20.9 12% $131.6 15% Gross Revenue $70.7 19% $96.8 3% $32.9 30% $200.4 12% Advisory, Consulting & Other $40.2 10% $88.1 14% $33.5 15% $161.8 13% Total RES Operating Fee Revenue $688.1 14% $475.1 17% $302.2 11% $1,465.4 14% Total Gross Revenue $745.6 16% $556.6 13% $354.8 14% $1,657.0 15% Americas EMEA Asia Pacific Total RES

22 YTD 2014 Real Estate Services Revenue ($ in millions; % change in USD over YTD 2013) Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $1,039.5 18% $295.2 9% $205.3 19% $1,540.0 17% Capital Markets & Hotels $266.6 22% $411.8 24% $141.9 (13%) $820.3 15% Property & Facility Management - Fee $454.3 12% $236.9 23% $379.4 9% $1,070.6 13% Gross Revenue $661.9 28% $338.2 41% $523.6 19% $1,523.7 27% Project & Development Services - Fee $222.7 19% $139.6 19% $72.2 7% $434.5 17% Gross Revenue $225.5 19% $354.7 29% $129.1 40% $709.3 28% Advisory, Consulting & Other $125.6 10% $232.7 14% $109.9 14% $468.2 13% Total RES Operating Fee Revenue $2,108.7 17% $1,316.2 18% $908.7 7% $4,333.6 15% Total Gross Revenue $2,319.1 21% $1,632.6 23% $1,109.8 15% $5,061.5 20% Americas EMEA Asia Pacific Total RES

Fee Revenue / Expense Reconciliation Note: Consolidated revenue and fee revenue exclude equity earnings (losses). Restructuring and acquisition charges and intangible amortization related to the King Sturge acquisition are excluded from adjusted operating income margin. • Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue and expense in JLL financial statements have been increasing steadily • Gross accounting requirements increase revenue and costs without corresponding profit • Business managed on a fee revenue basis to focus on margin expansion in the base business 23 ($ in millions) 2014 2013 2014 2013 Revenue $1,749.0 $1,509.4 $5,429.6 $4,461.6 Gross contract costs (191.6) (159.9) (727.9) (434.8) Fee revenue $1,557.4 $1,349.5 $4,701.7 $4,026.8 Operating expenses $1,487.2 $1,313.6 $4,963.9 $4,092.8 Gross contract costs (191.6) (159.9) (727.9) (434.8) Fee-based operating expenses $1,295.6 $1,153.7 $4,236.0 $3,658.0 Operating income $ 261.8 $ 195.8 $ 465.7 $ 368.8 Add: Restructuring and acquisition charges 1.1 3.6 42.5 18.3 King Sturge intangible amortization 0.4 0.6 2.0 2.2 Adjusted operating income $ 263.3 $ 200.0 $ 510.2 $ 389.3 Adjusted operating income margin 16.9% 14.8% 10.9% 9.7% Three Months Twelve Months Ended December 31 Ended December 31

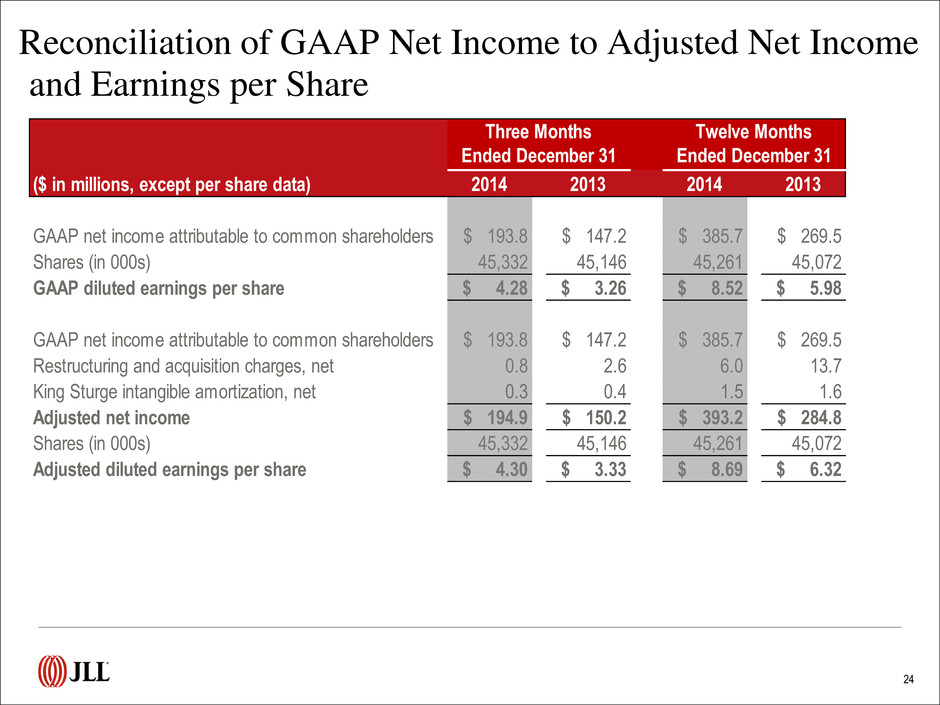

24 Reconciliation of GAAP Net Income to Adjusted Net Income and Earnings per Share ($ in millions, except per share data) 2014 2013 2014 2013 GAAP net income attributable to common shareholders $ 193.8 $ 147.2 $ 385.7 $ 269.5 Shares (in 000s) 45,332 45,146 45,261 45,072 GAAP diluted earnings per share $ 4.28 $ 3.26 $ 8.52 $ 5.98 GAAP net incom attributable to common shareholders $ 193.8 $ 147.2 $ 385.7 $ 269.5 Restructuring and acquisition charges, net 0.8 2.6 6.0 13.7 King Sturge intangible amortization, net 0.3 0.4 1.5 1.6 Adjusted net income $ 194.9 $ 150.2 $ 393.2 $ 284.8 Shares (in 000s) 45,332 45,146 45,261 45,072 Adjusted diluted earnings per share $ 4.30 $ 3.33 $ 8.69 $ 6.32 Three Months Twelve Months Ended December 31 Ended December 31

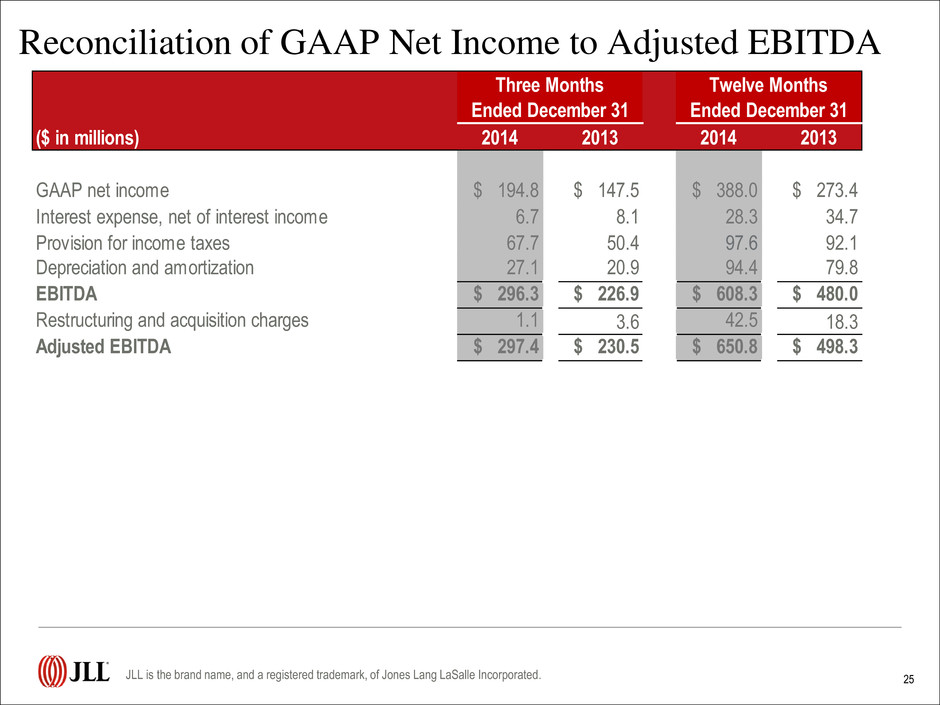

25 Reconciliation of GAAP Net Income to Adjusted EBITDA JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. ($ in millions) 2014 2013 2014 2013 GAAP net income $ 194.8 $ 147.5 $ 388.0 $ 273.4 Interest expense, net of interest income 6.7 8.1 28.3 34.7 Provision for income taxes 67.7 50.4 97.6 92.1 Depreciation and amortization 27.1 20.9 94.4 79.8 EBITDA $ 296.3 $ 226.9 $ 608.3 $ 480.0 Restructuring and acquisition charges 1.1 3.6 42.5 18.3 Adjusted EBITDA $ 297.4 $ 230.5 $ 650.8 $ 498.3 Ended December 31 Ended December 31 Three Months Twelve Months