Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAESARS ENTERTAINMENT OPERATING COMPANY, INC. | d861421d8k.htm |

| Exhibit 99.1

|

Privileged & Confidential Subject to FRE 408 – For Settlement Purposes Only

Response To Banks

January 2015

|

|

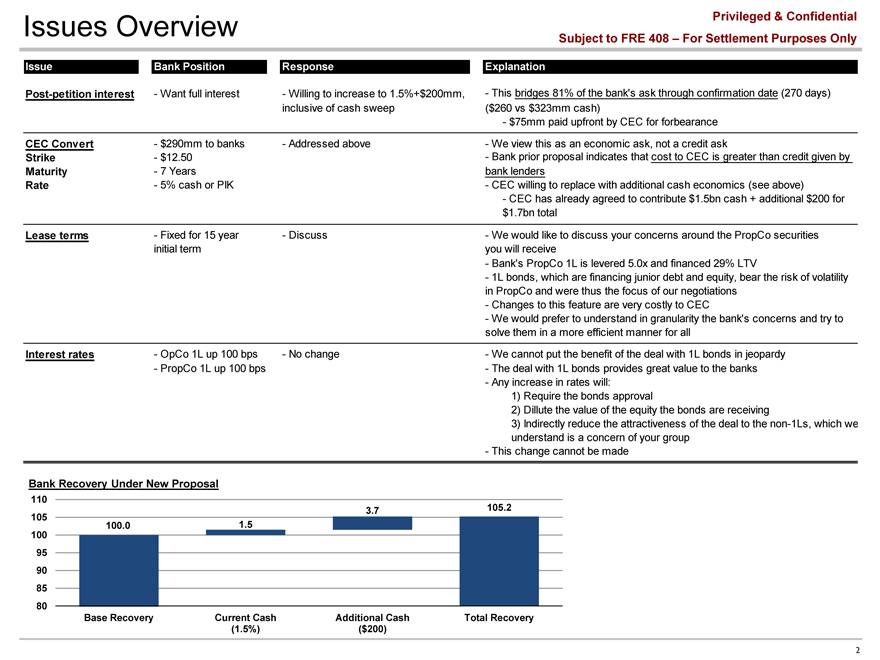

Issues Overview

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

Issue Bank Position Response Explanation

Post-petition interest—Want full interest—Willing to increase to 1.5%+$200mm,—This bridges 81% of the bank’s ask through confirmation date (270 days)

inclusive of cash sweep($260 vs $323mm cash)

—$75mm paid upfront by CEC for forbearance

CEC Convert—$ 290mm to banks—Addressed above—We view this as an economic ask, not a credit ask

Strike—$ 12.50—Bank prior proposal indicates that cost to CEC is greater than credit given by

Maturity—7 Years bank lenders

Rate—5% cash or PIK—CEC willing to replace with additional cash economics (see above)

—CEC has already agreed to contribute $1.5bn cash + additional $200 for

$1.7bn total

Lease terms—Fixed for 15 year—Discuss—We would like to discuss your concerns around the PropCo securities

initial term you will receive

—Bank’s PropCo 1L is levered 5.0x and financed 29% LTV

—1L bonds, which are financing junior debt and equity, bear the risk of volatility

in PropCo and were thus the focus of our negotiations

—Changes to this feature are very costly to CEC

—We would prefer to understand in granularity the bank’s concerns and try to

solve them in a more efficient manner for all

Interest rates—OpCo 1L up 100 bps—No change—We cannot put the benefit of the deal with 1L bonds in jeopardy

—PropCo 1L up 100 bps—The deal with 1L bonds provides great value to the banks

—Any increase in rates will:

1) Require the bonds approval

2) Dillute the value of the equity the bonds are receiving

3) Indirectly reduce the attractiveness of the deal to the non-1Ls, which we

understand is a concern of your group

—This change cannot be made

Bank Recovery Under New Proposal

110

105 3.7 105.2

100.0 1.5

100

95

90

85

80

Base Recovery Current Cash Additional Cash Total Recovery

(1.5%)($200)

2

|

|

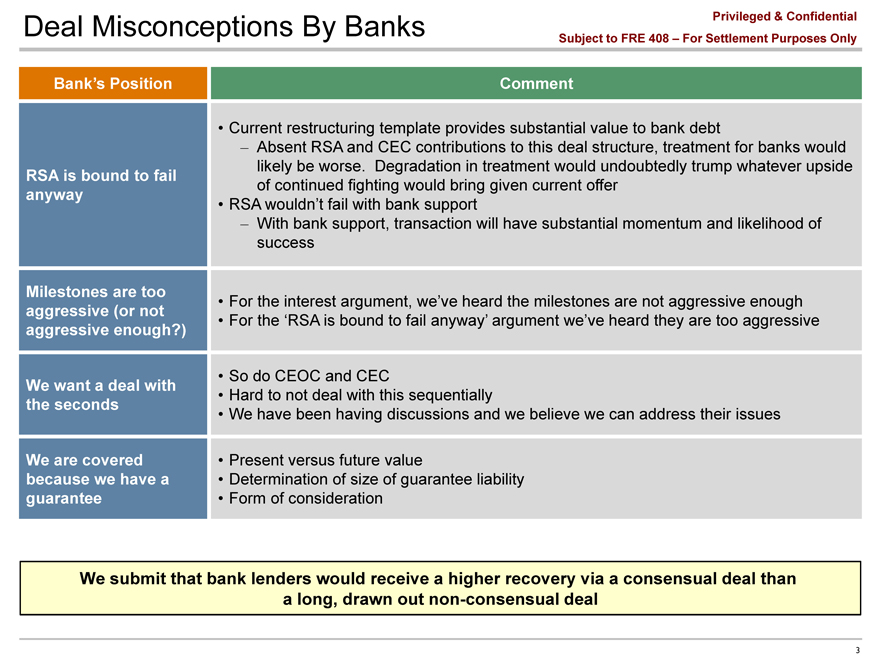

Deal Misconceptions By Banks

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

Bank’s Position Comment

• Current restructuring template provides substantial value to bank debt

– Absent RSA and CEC contributions to this deal structure, treatment for banks would

RSA is bound to fail likely be worse. Degradation in treatment would undoubtedly trump whatever upside

anyway of continued fighting would bring given current offer

• RSA wouldn’t fail with bank support

– With bank support, transaction will have substantial momentum and likelihood of

success

Milestones are too

aggressive (or not • For the interest argument, we’ve heard the milestones are not aggressive enough

aggressive enough?) • For the ‘RSA is bound to fail anyway’ argument we’ve heard they are too aggressive

We want a deal with • So do CEOC and CEC

the seconds • Hard to not deal with this sequentially

• We have been having discussions and we believe we can address their issues

We are covered • Present versus future value

because we have a • Determination of size of guarantee liability

guarantee • Form of consideration

We submit that bank lenders would receive a higher recovery via a consensual deal than a long, drawn out non-consensual deal

3

|

|

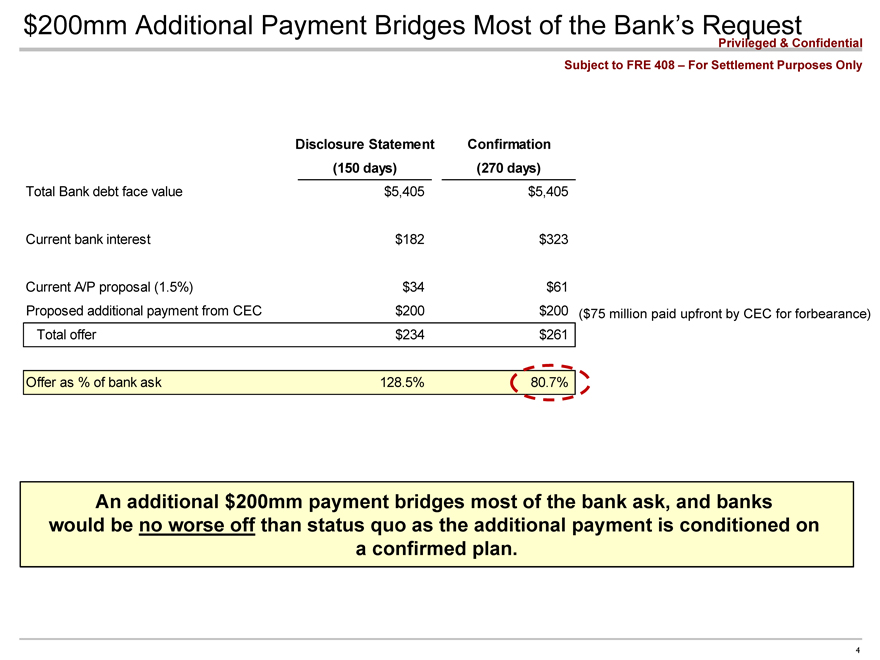

$200mm Additional Payment Bridges Most of the Bank’s Request

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

Disclosure Statement Confirmation

(150 days)(270 days)

Total Bank debt face value $5,405 $5,405

Current bank interest $182 $323

Current A/P proposal (1.5%) $34 $61

Proposed additional payment from CEC $200 $200

Total offer $234 $261

Offer as % of bank ask 128.5% 80.7%

($75 million paid upfront by CEC for forbearance)

An additional $200mm payment bridges most of the bank ask, and banks would be no worse off than status quo as the additional payment is conditioned on a confirmed plan.

4

|

|

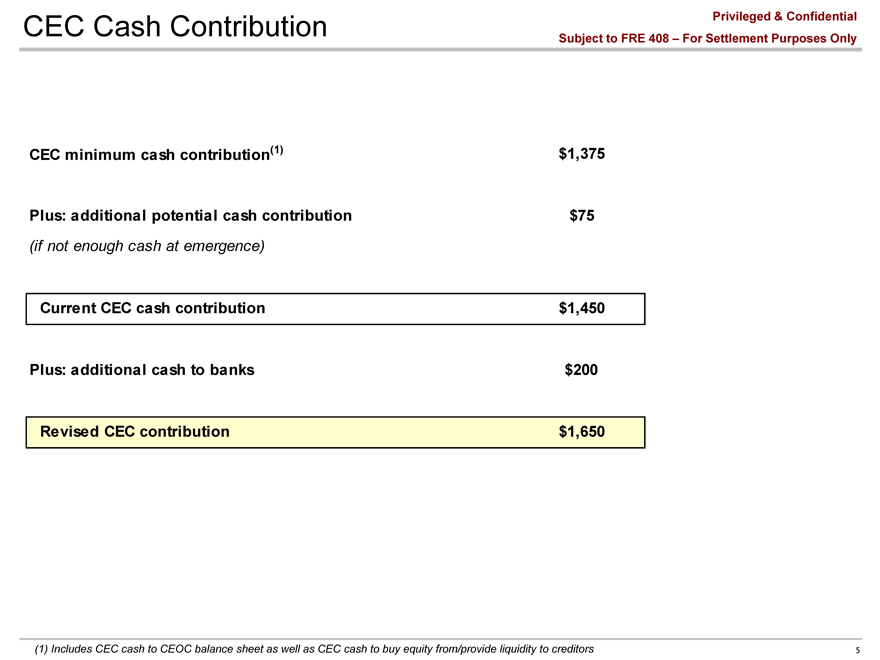

CEC Cash Contribution

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

CEC minimum cash contribution(1) $1,375

Plus: additional potential cash contribution $75

(if not enough cash at emergence)

Current CEC cash contribution $1,450

Plus: additional cash to banks $200

Revised CEC contribution $1,650

Includes CEC cash to CEOC balance sheet as well as CEC cash to buy equity from/provide liquidity to creditors

5

|

|

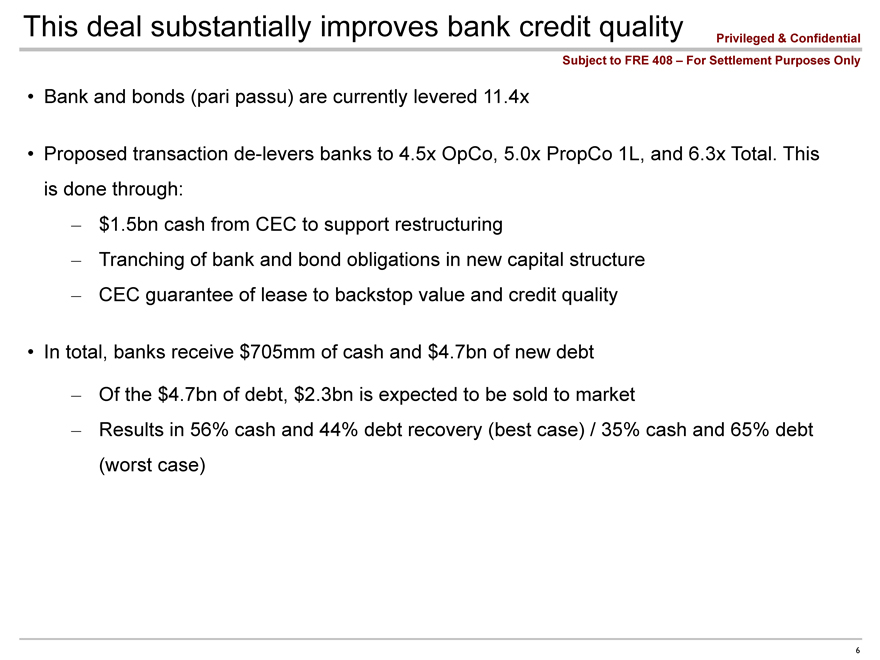

This deal substantially improves bank credit quality

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

Bank and bonds (pari passu) are currently levered 11.4x

Proposed transaction de-levers banks to 4.5x OpCo, 5.0x PropCo 1L, and 6.3x Total. This is done through:

$1.5bn cash from CEC to support restructuring

Tranching of bank and bond obligations in new capital structure

CEC guarantee of lease to backstop value and credit quality

In total, banks receive $705mm of cash and $4.7bn of new debt

Of the $4.7bn of debt, $2.3bn is expected to be sold to market

Results in 56% cash and 44% debt recovery (best case) / 35% cash and 65% debt (worst case)

6

|

|

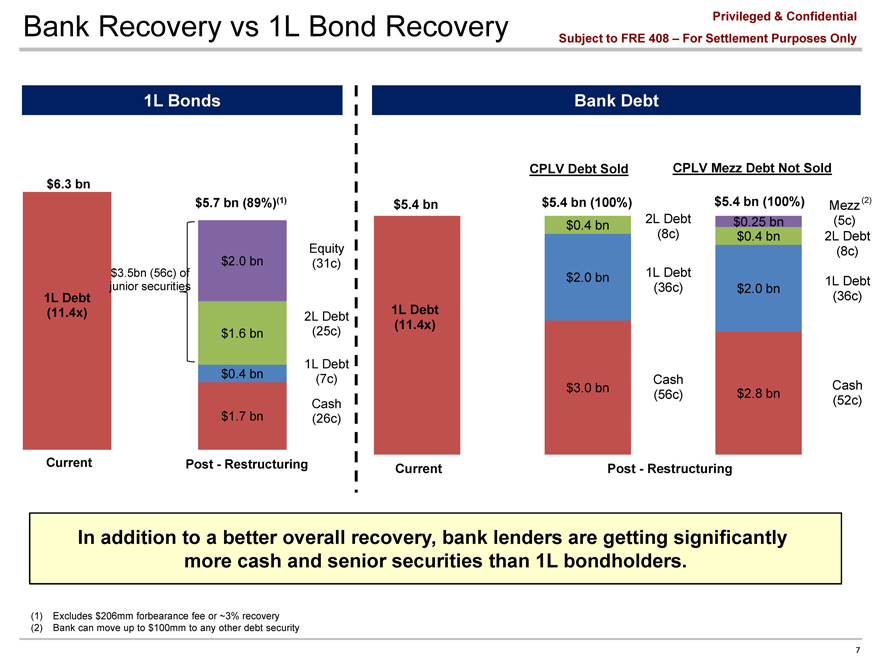

Bank Recovery vs 1L Bond Recovery

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

1L Bonds

$6.3 bn

$5.7 bn (89%)(1)

Equity

$2.0 bn(31c)

$3.5bn (56c) of

junior securities

1L Debt

(11.4x) 2L Debt

$1.6 bn(25c)

1L Debt

$0.4 bn(7c)

Cash

$1.7 bn(26c)

Current Post—Restructuring

Bank Debt

CPLV Debt Sold CPLV Mezz Debt Not Sold

$5.4 bn $5.4 bn (100%) $5.4 bn (100%) Mezz (2)

$0.4 bn 2L Debt $0.25 bn(5c)

(8c) $0.4 bn 2L Debt

(8c)

$2.0 bn 1L Debt 1L Debt

(36c) $2.0 bn(36c)

1L Debt

(11.4x)

$3.0 bn Cash Cash

(56c) $2.8 bn(52c)

Current Post—Restructuring

In addition to a better overall recovery, bank lenders are getting significantly more cash and senior securities than 1L bondholders.

(1) Excludes $206mm forbearance fee or ~3% recovery (2) Bank can move up to $100mm to any other debt security

7

|

|

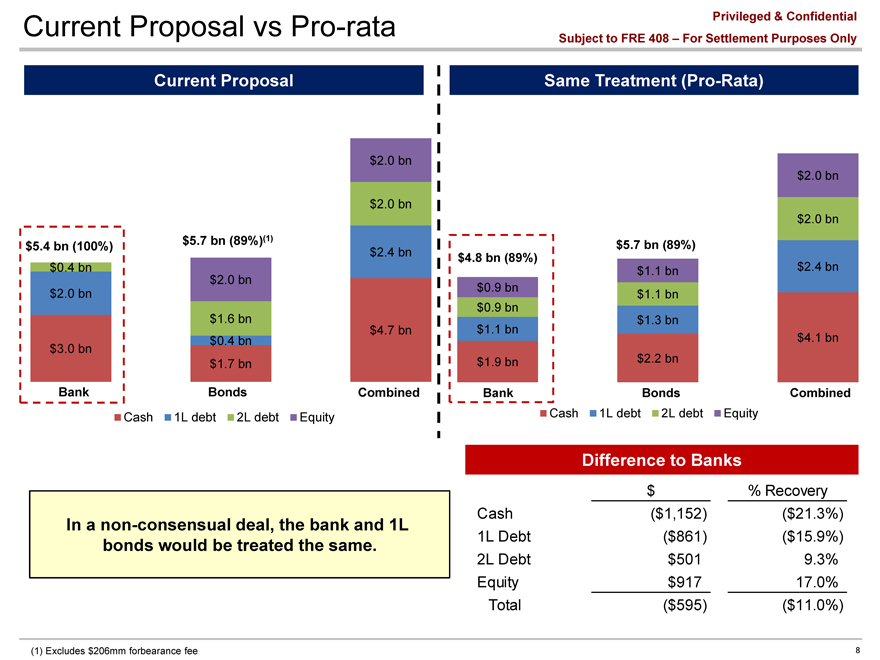

Current Proposal vs Pro-rata

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

Current Proposal

$ 2.0 bn

$ 2.0 bn

$5.4 bn (100%) $5.7 bn (89%)(1)

$ 2.4 bn

$0.4 bn

$2.0 bn

$2.0 bn

$1.6 bn

$ 4.7 bn

$3.0 bn $0.4 bn

$1.7 bn

Bank Bonds Combined

Cash 1L debt 2L debt Equity

Same Treatment (Pro-Rata)

$ 2.0 bn

$ 2.0 bn

$5.7 bn (89%)

$4.8 bn (89%)

$1.1 bn $ 2.4 bn

$0.9 bn $1.1 bn

$0.9 bn

$1.3 bn

$1.1 bn $ 4.1 bn

$1.9 bn $2.2 bn

Bank Bonds Combined

Cash 1L debt 2L debt Equity

In a non-consensual deal, the bank and 1L bonds would be treated the same.

Difference to Banks

$% Recovery

Cash($1,152)($ 21.3%)

1L Debt($861)($ 15.9%)

2L Debt $501 9.3%

Equity $917 17.0%

Total($595)($ 11.0%)

(1) Excludes $206mm forbearance fee

8

|

|

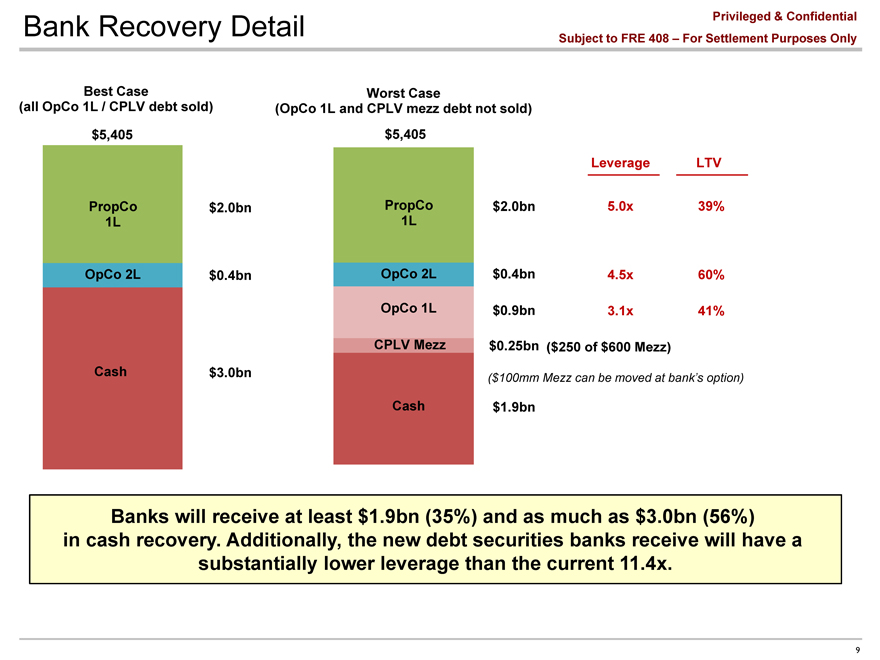

Bank Recovery Detail

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

Best Case

(all OpCo 1L / CPLV debt sold)

$5,405

PropCo $ 2.0bn

1L

OpCo 2L $ 0.4bn

Cash $ 3.0bn

Worst Case

(OpCo 1L and CPLV mezz debt not sold)

$5,405

Leverage LTV

PropCo $2.0bn 5.0x 39%

1L

OpCo 2L $0.4bn 4.5x 60%

OpCo 1L $0.9bn 3.1x 41%

CPLV Mezz $0.25bn ($250 of $600 Mezz)

($100mm Mezz can be moved at bank’s option)

Cash $1.9bn

Banks will receive at least $1.9bn (35%) and as much as $3.0bn (56%) in cash recovery. Additionally, the new debt securities banks receive will have a substantially lower leverage than the current 11.4x.

9

|

|

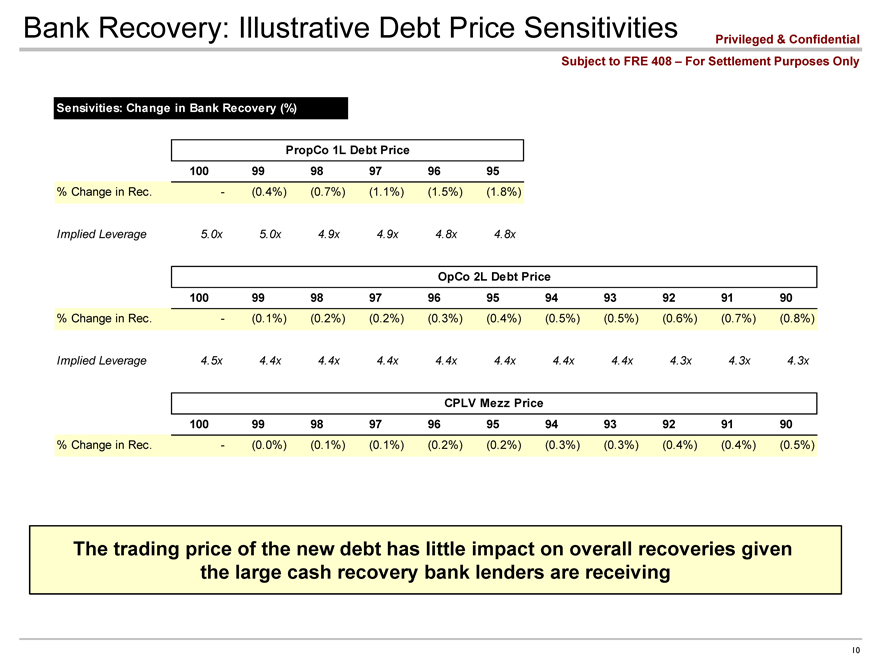

Bank Recovery: Illustrative Debt Price Sensitivities

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

Sensivities: Change in Bank Recovery (%)

PropCo 1L Debt Price

100 99 98 97 96 95

% Change in Rec. -(0.4%)(0.7%)(1.1%)(1.5%)(1.8%)

Implied Leverage 5.0x 5.0x 4.9x 4.9x 4.8x 4.8x

OpCo 2L Debt Price

100 99 98 97 96 95 94 93 92 91 90

% Change in Rec. -(0.1%)(0.2%)(0.2%)(0.3%)(0.4%)(0.5%)(0.5%)(0.6%)(0.7%)(0.8%)

Implied Leverage 4.5x 4.4x 4.4x 4.4x 4.4x 4.4x 4.4x 4.4x 4.3x 4.3x 4.3x

CPLV Mezz Price

100 99 98 97 96 95 94 93 92 91 90

% Change in Rec. -(0.0%)(0.1%)(0.1%)(0.2%)(0.2%)(0.3%)(0.3%)(0.4%)(0.4%)(0.5%)

The trading price of the new debt has little impact on overall recoveries given the large cash recovery bank lenders are receiving

10

|

|

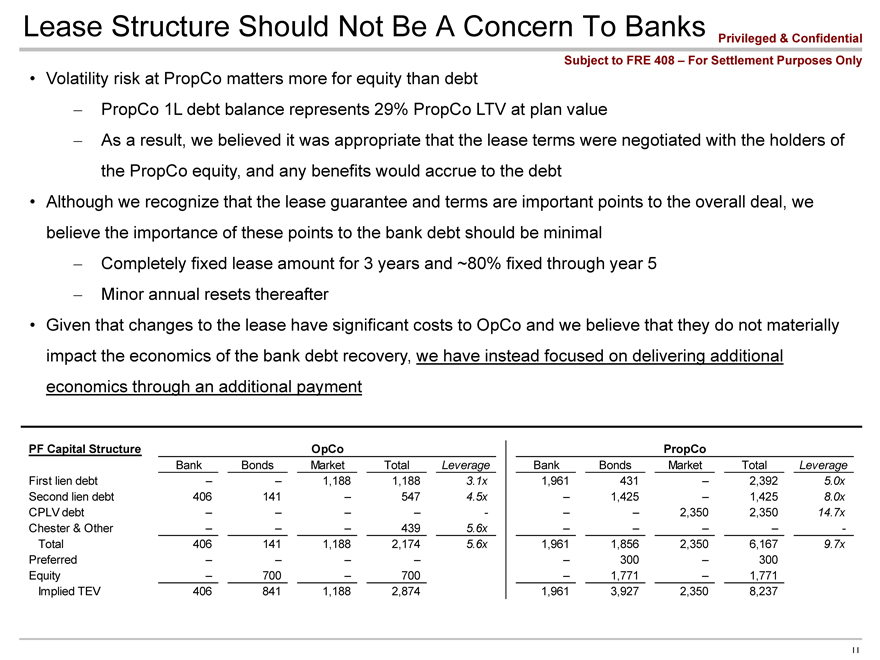

Lease Structure Should Not Be A Concern To Banks

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

Volatility risk at PropCo matters more for equity than debt

– PropCo 1L debt balance represents 29% PropCo LTV at plan value

– As a result, we believed it was appropriate that the lease terms were negotiated with the holders of the PropCo equity, and any benefits would accrue to the debt

Although we recognize that the lease guarantee and terms are important points to the overall deal, we believe the importance of these points to the bank debt should be minimal

– Completely fixed lease amount for 3 years and ~80% fixed through year 5

– Minor annual resets thereafter

Given that changes to the lease have significant costs to OpCo and we believe that they do not materially impact the economics of the bank debt recovery, we have instead focused on delivering additional economics through an additional payment

PF Capital Structure OpCo

Bank Bonds Market Total Leverage

First lien debt – – 1,188 1,188 3.1x

Second lien debt 406 141 – 547 4.5x

CPLV debt – – – – -

Chester & Other – – – 439 5.6x

Total 406 141 1,188 2,174 5.6x

Preferred – – – –

Equity – 700 – 700

Implied TEV 406 841 1,188 2,874

PropCo

Bank Bonds Market Total Leverage

1,961 431 – 2,392 5.0x

– 1,425 – 1,425 8.0x

– – 2,350 2,350 14.7x

– – – – -

1,961 1,856 2,350 6,167 9.7x

– 300 – 300

– 1,771 – 1,771

1,961 3,927 2,350 8,237

11

|

|

Transaction dynamics with non-1L

Privileged & Confidential

Subject to FRE 408 – For Settlement Purposes Only

We are strongly supportive of improved deal dynamics with the non-1L bondholders

We have had conversations with holders throughout this process and remain hopeful a consensual deal is possible

More importantly, we believe a deal with the bank debt will have the greatest impact on facilitating a deal with the non-1Ls

13