Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED COMMUNITY BANKS INC | t81222_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - UNITED COMMUNITY BANKS INC | t81222_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - UNITED COMMUNITY BANKS INC | t81222_ex2-1.htm |

JANUARY 27, 2015 Announcing Merger Agreement with MoneyTree Corporation (and its wholly-owned subsidiary bank, First National Bank)

2 2 Forward Looking Statements and Non Forward Looking Statements and Non - - GAAP Measures GAAP Measures Forward Looking Statements This presentation may contain statements that constitute “forward-looking statements”within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “believe”, “estimate”, “expect”, “intend”, “anticipate”and similar expressions and variations thereof identify certain of such forward-looking statements, which speak only as of the dates which they were made. United Community Banks, Inc. (the “Company”) undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those indicated in the forward- looking statements as a result of various factors. Readers are cautioned not to place undue reliance on these forward-looking statements and are referred to the Company’s periodic filings with the Securities and Exchange Commission for a summary of certain factors that may impact the Company’s results of operations and financial condition. Non-GAAP Measures This presentation also contains financial measures determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). Such non-GAAP financial measures include the following: tangible book value and tangible book value per share. Management uses these non-GAAP financial measures because we believe they are useful for evaluating our operations and performance over periods of time, as well as in managing and evaluating our business and in discussions about our operations and performance. Management believes these non-GAAP financial measures provide users of our financial information with a meaningful measure for assessing our financial results and credit trends, as well as for comparison to financial results for priorperiods. These non-GAAP financial measures should not be considered as a substitute for financial measures determined in accordance with GAAP and may not be comparable to other similarly titled financial measures used by other companies.

3 3 Additional Information Additional Information Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving the Company and MoneyTree Corporation (“MoneyTree”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, the Company will file with the SEC a registration statement on Form S-4 that will include a proxy statement/prospectus for the shareholders of MoneyTree. The Company also plans to file other documents with the SEC regarding the proposed merger transaction with MoneyTree. MoneyTree will mail the final proxy statement/prospectus to its shareholders. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLEBECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement/prospectus, as well as other filings containing information about the Company and MoneyTree, will be available without charge, at the SEC’s website (http://www.sec.gov). Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus can also be obtained, when available, without charge, from the Company’s website (http://www.ucbi.com). Participants in the Merger Solicitation The Company and MoneyTree, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in thesolicitation of proxies from the shareholders of MoneyTree in respect of the proposed merger transaction. Information regarding the directors and executive officers of the Company is set forth in the Company’s Form 10-K for the year ended December 31, 2013, definitive proxy statement for the Company’s 2014 annual meeting of shareholders, as filed with the SEC on March 24, 2014, and other documents subsequently filed by the Company with the SEC. Information regarding the directors and executive officers of MoneyTree who may be deemed participants in the solicitation of the shareholders of MoneyTree in connection with the proposed transaction will be included in the proxy statement/prospectus for MoneyTree’s special meeting of shareholders, which will be filed by the Company with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the proposed merger transaction filed with the SEC when they become available.

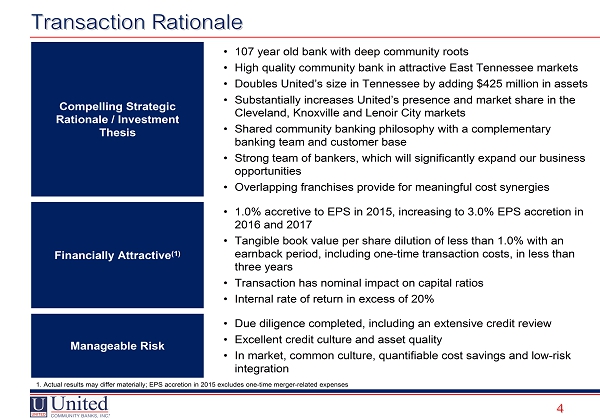

4 4 Transaction Rationale Transaction Rationale Compelling Strategic Rationale / Investment Thesis • 107 year old bank with deep community roots • High quality community bank in attractive East Tennessee markets • Doubles United’s size in Tennessee by adding $425 million in assets • Substantially increases United’s presence and market share in the Cleveland, Knoxville and Lenoir City markets • Shared community banking philosophy with a complementary banking team and customer base • Strong team of bankers, which will significantly expand our business opportunities • Overlapping franchises provide for meaningful cost synergies Financially Attractive (1) • 1.0% accretive to EPS in 2015, increasing to 3.0% EPS accretion in 2016 and 2017 • Tangible book value per share dilution of less than 1.0% with an earnback period, including one-time transaction costs, in less than three years • Transaction has nominal impact on capital ratios • Internal rate of return in excess of 20% Manageable Risk • Due diligence completed, including an extensive credit review • Excellent credit culture and asset quality • In market, common culture, quantifiable cost savings and low-risk integration 1. Actual results may differ materially; EPS accretion in 2015 excludes one-time merger-related expenses

5 5 Transaction Overview Transaction Overview Transaction • Acquisition of MoneyTree Corporation (“MoneyTree”) and its wholly- owned subsidiary bank, First National Bank (“FNB”) Consideration • Option to elect a fixed exchange ratio of 3.5832 shares of United stock or $65.00 in cash per MoneyTree common share, or a combination thereof • Cash / stock election subject to proration based on 80% aggregate stock consideration • $63.59 per MoneyTree share implied value based on United’s closing price of $17.65 on January 27, 2015 • Approximately 2.4 million United shares will be issued (3.9%) pro forma ownership Purchase Price • Approximately $52 million implied aggregate acquisition consideration • Nominal cash liquidation value paid for all stock options outstanding Valuation Multiples • Price / Tangible Book Value (1) • Price / 2014 Earnings Per Share 135% 19.9x Approvals • MoneyTree shareholder approval • Customary regulatory approvals Closing • Expected during the second quarter of 2015 1. Including the conversion of Series C Cumulative Convertible Preferred Stock

6 6 Strengthening Knoxville / East Tennessee Presence Strengthening Knoxville / East Tennessee Presence MoneyTree Source: SNL Financial Market Deposits Share Rank Institution Branches ($000) (%) 1 First Horizon National Corp. 30 2,722,119 18.46 2 SunTrust Banks Inc. 31 2,380,693 16.14 3 Regions Financial Corp. 33 2,163,006 14.67 4 Home Federal Bank of Tennessee 19 1,566,119 10.62 5 BB&T Corp. 18 1,172,900 7.95 6 Pinnacle Financial Partners 5 507,601 3.44 Pro Forma 13 505,978 3.43 7 MoneyTree Corp. 8 318,802 2.16 8 Bank of America Corp. 3 289,269 1.96 9 Twin Cities Finl Svcs Inc. 10 264,854 1.80 10 Clayton Bancorp Inc 5 253,485 1.72 11 United Community Banks Inc. 5 187,176 1.27 12 U.S. Bancorp 18 165,080 1.12 13 Foothills Bank & Trust 3 164,954 1.12 14 Citizens of Grainger Cnty Corp 5 158,559 1.08 15 Capital Bank Finl Corp 9 157,270 1.07 l l Total For Institutions In Market 284 14,747,706 Knoxville MSA (10)

7 7 Strengthening Key Markets Strengthening Key Markets Loudon County: •United will have #1 market share in Loudon County (Lenoir City), where MoneyTree is concentrated and where United initially entered the market a number of years ago •Loudon County is a strategically important market within the Knoxville MSA and in East Tennessee •Combined resources in this market will result in significant business growth momentum Bradley County: •Bradley County (Cleveland) is one of the most attractive growth markets in East Tennessee •United has had a strong desire to increase its market presence in this market and has been looking for the right opportunity Proj. Pop. Median Change HH Income 2014-2018 2014 County Population (%) ($) Loudon 50,705 5.29 51,749 Bradley 102,680 4.67 38,828 Tennessee 6,531,577 3.79 43,390 United States 317,199,353 3.50 51,579 Market Demographics • Population growth and household income demographics for both Loudon and Bradley Counties compare favorably to those for Tennessee and the US Source: SNL Financial Market Deposits Share Rank Institution Branches ($000) (%) 1 First Horizon National Corp. 4 265,848 18.90 2 First Citizens Bancshares Inc. 3 209,024 14.86 3 Regions Financial Corp. 4 200,879 14.28 4 Bradley County Financial Corp. 5 188,792 13.42 5 BB&T Corp. 3 172,150 12.24 Pro Forma 3 94,699 6.73 6 SunTrust Banks Inc. 2 91,726 6.52 7 CapitalMark Bank & Trust 1 79,108 5.62 8 United Community Banks Inc. 2 68,511 4.87 9 First Security Group Inc. 2 35,341 2.51 10 Educational Svcs of Am Inc. 1 31,284 2.22 11 Athens Bancshares Corporation 2 28,354 2.02 12 MoneyTree Corp. 1 26,188 1.86 13 Andrew Johnson Bancshares Inc. 1 9,695 0.69 Total For Institutions In Market 31 1,406,900 Bradley County Market Deposits Share Rank Institution Branches ($000) (%) Pro Forma 7 355,018 48.26 1 MoneyTree Corp. 5 245,407 33.36 2 BB&T Corp. 3 161,951 22.01 3 United Community Banks Inc. 2 109,611 14.90 4 SunTrust Banks Inc. 1 66,295 9.01 5 Regions Financial Corp. 2 64,683 8.79 6 American Trust Bk of East TN 1 34,710 4.72 7 Capital Bank Finl Corp 2 28,161 3.83 8 First Security Group Inc. 1 18,272 2.48 9 Peoples Bancshares of TN Inc 1 6,584 0.89 Total For Institutions In Market 18 735,674 Loudon County

8 8 • Well-established community banking franchise with 107 years of history • Corporate culture and operating model with exceptional customer service as a cornerstone • One of the largest community banks remaining in East Tennessee • Track record of solid profitability, driven by traditional community banking services • Credit quality that is among the best in Tennessee • 71% core (non-CD) deposits • High-quality management and banking teams and regional leaders with proven performance Franchise Overview Franchise Overview Q4 2014 Performance 1. Including the conversion of Series C Cumulative Convertible Preferred Stock Note: Financial data at the bank level, except equity and shares (holding company level) Source: SNL Financial

9 9 FNB Loan / Deposit Composition FNB Loan / Deposit Composition – – December 31, 2014 December 31, 2014 Loan Composition $253.3 million Deposit Composition $354.4 million Yield: 4.47% Cost: .37% C&D 11 % 1 - 4 Family 35 % Multifamily 5 % CRE - Inc. Prod. 17 % CRE - Own. - Occ. 23 % C&I 6 % Cons. & Other 3% Source: SNL Financial Demand 20 % NOW & Other 4 % MMDA & Savings 47 % Retail 15 % Jumbo 14 %

10 10 Loan Portfolio Review Summary Loan Portfolio Review Summary •Extensive loan file review by a United and independent third party consultant •72% of portfolio reviewed •100% of loans exceeding $300,000 reviewed •100% of loans internally rated Special Mention or Substandard •Loans reviewed were well-underwritten and well-structured and had strong payment and performance characteristics •Internal loan grades were consistent with the reviewers’ratings

11 11 Financial Assumptions and Returns Financial Assumptions and Returns Realistic / Conservative Financial Assumptions (1) • Cost Savings: $4.0 million (~35%+ of non-interest expenses); partially realized in 2015 and 100% in 2016 and thereafter • Credit Mark: ($6.3) million gross or 2.5% of gross loans • Other Marks: ($2.6) million in aggregate including OREO, fixed assets and interest rate marks • Intangibles: $15.0 million Goodwill; $3.7 million CDI • Transaction Costs: $6.0 million, pre-tax Value-Adding Financial Impact (1) • 1.0% accretive to EPS in 2015, increasing to 3.0% EPS accretion in 2016 and 2017 • Tangible book value per share dilution of less than 1.0% with an earnback period, including one-time transaction costs, in less than three years • Transaction has nominal impact on capital ratios • Internal rate of return in excess of 20% 1. Actual results may differ materially; EPS accretion in 2015 excludes one-time merger-related expenses