Attached files

| file | filename |

|---|---|

| 8-K - CIRRUS LOGIC, INC. 8-K - CIRRUS LOGIC, INC. | a51027803.htm |

| EX-99.1 - EXHIBIT 99.1 - CIRRUS LOGIC, INC. | a51027803ex99_1.htm |

Exhibit 99.2

January 28 2015 Cirrus

Logic Letter to Shareholders Q3 FY15 CIRRUS LOGIC, INC. 800 WEST SIXTH

STREET, AUSTIN, TEXAS 78701

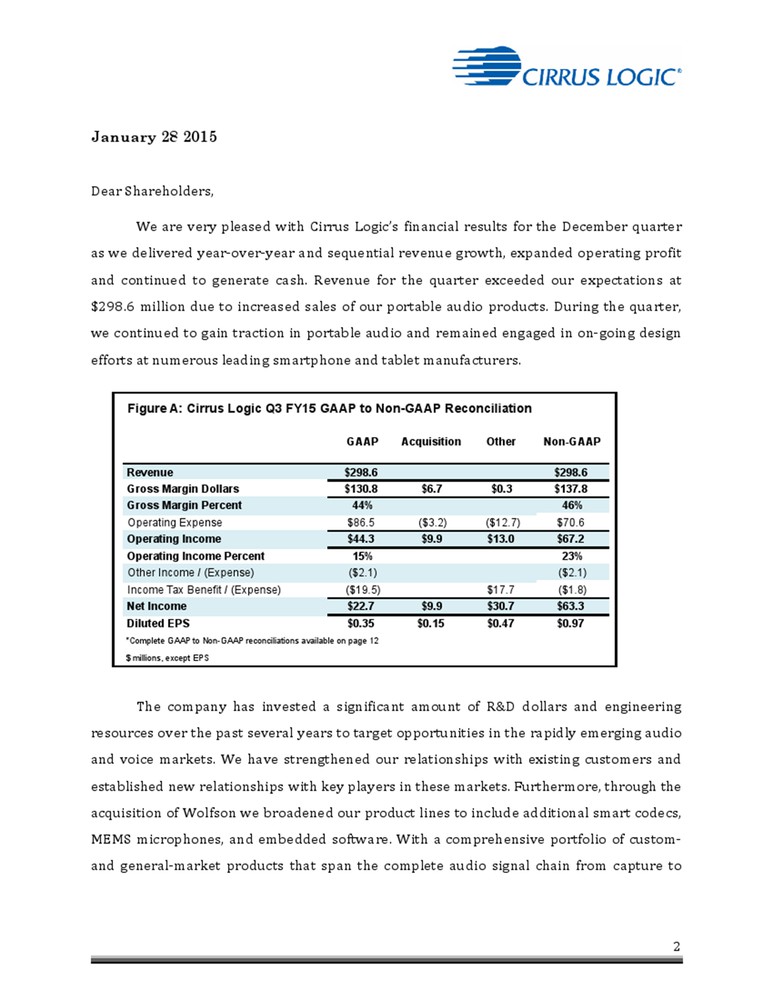

Dear Shareholders, We are

very pleased with Cirrus Logic’s financial results for the December

quarter as we delivered year-over-year and sequential revenue growth,

expanded operating profit and continued to generate cash. Revenue for

the quarter exceeded our expectations at $298.6 million due to increased

sales of our portable audio products. During the quarter, we continued

to gain traction in portable audio and remained engaged in on-going

design efforts at numerous leading smartphone and tablet manufacturers.

The company has invested a significant amount of R&D dollars and

engineering resources over the past several years to target

opportunities in the rapidly emerging audio and voice markets. We have

strengthened our relationships with existing customers and established

new relationships with key players in these markets. Furthermore,

through the acquisition of Wolfson we broadened our product lines to

include additional smart codecs, MEMS microphones, and embedded

software. With a comprehensive portfolio of custom-and general-market

products that span the complete audio signal chain from capture to

Figure A: Cirrus Logic Q3 FY15 GAAP to Non-GAAP Reconciliation GAAP

Acquisitions Other Non-GAAP Revenue Gross Margin Dollars Gross Margin

Percent Operating Expense Operating Income Operating Income Percent

Other Income/(Expense) Income Tax Benefit /(Expense) Net Income Diluted

EPS *Complete GAAP to Non-GAPP reconciliations available on page 12 $

millions, except EPS $298.6 $298.6 $130.8 $6.7 $0.3 $137.8 44% 46% $86.5

($3.2) ($12.7) $70.6 $44.3 $9.9 $13.0 $67.2 15% 23% ($2.1) ($2.1)

($19.5) $17.7 ($1.8) $22.7 $9.9 $30.7 $63.3 $0.35 $0.15 $0.47 $0.97

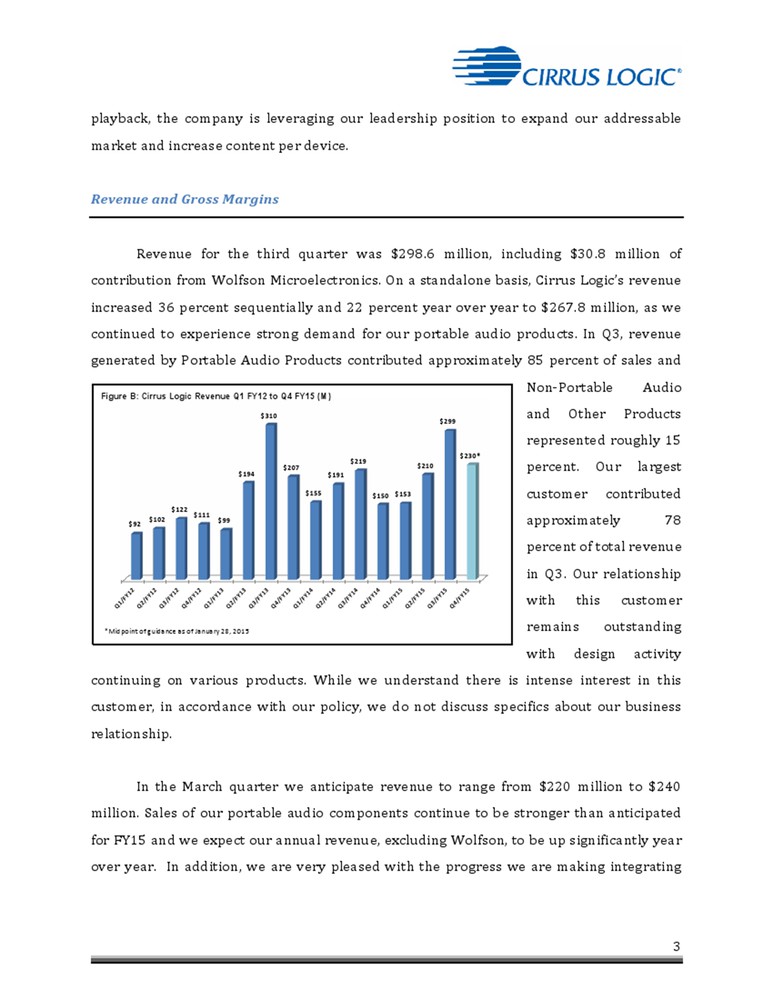

playback, the company is leveraging our leadership position to expand our addressable market and increase content per device. Revenue and Gross Margins Revenue for the third quarter was $298.6 million, including $30.8 million of contribution from Wolfson Microelectronics. On a standalone basis, Cirrus Logic’s revenue increased 36 percent sequentially and 22 percent year over year to $267.8 million, as we continued to experience strong demand for our portable audio products. In Q3, revenue generated by Portable Audio Products contributed approximately 85 percent of sales and Non-Portable Audio and Other Products represented roughly 15 percent. Our largest customer contributed approximately 78 percent of total revenue in Q3. Our relationship with this customer remains outstanding with design activity continuing on various products. While we understand there is intense interest in this customer, in accordance with our policy, we do not discuss specifics about our business relationship. In the March quarter we anticipate revenue to range from $220 million to $240 million. Sales of our portable audio components continue to be stronger than anticipated for FY15 and we expect our annual revenue, excluding Wolfson, to be up significantly year over year. In addition, we are very pleased with the progress we are making integrating Figure B: Cirrus Logic Revenue Q1 FY12 to Q4 FY15 (M) $92 $102 $122 $111 $99 $194 $310 $207 $155 $191 $219 $150 $153 $210 $299 $230* *Mid point of guidance as of January 28, 2015 Q1/FY12 Q2/FY12 Q3/FY12 Q4/FY12 Q1/FY13 Q2/FY13 Q3/FY13 Q4/FY13 Q1/FY14 Q2/FY14 Q3/FY14 Q4/FY14 Q1/FY15 Q2/FY15 Q3/FY15 Q4/FY15

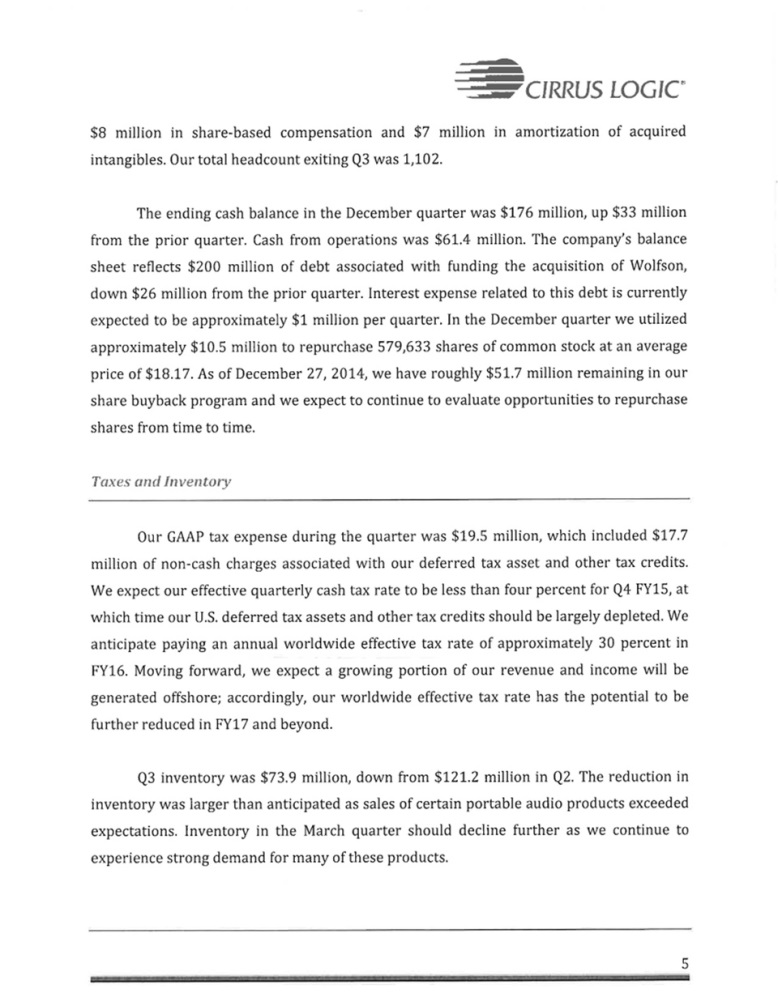

Wolfson. This business should grow significantly in the March quarter on both a year-over-year and a sequential basis as their smart codec share expands at existing customers. GAAP gross margin for the December quarter was 43.8 percent and non-GAAP gross margin was 46.2 percent. GAAP gross margins reflect roughly 230 basis points of costs related to accounting requirements associated with the fair value write up of inventory acquired through the Wolfson transaction and a seasonally higher mix of portable products. In the March quarter, we expect gross margin to range from 45 percent to 47 percent as the inventory related charges are essentially behind us. Our long-term gross margin expectations remain in the mid-40 percent range. Operating Profit and Cash Operating profit in the December quarter was 15 percent GAAP and 23 percent on a non-GAAP basis. GAAP operating expenses were $86.5 million and non-GAAP operating expenses were $70.6 million, inclusive of a full quarter of Wolfson costs. GAAP operating expenses contain approximately $7.5 million in share-based compensation and $5.2 million in amortization of acquired intangibles. These expenses also reflect $3.2 million in costs associated with the acquisition of Wolfson, including $2.6 million in share-based compensation. In the March quarter R&D and SG&A expenses should range from $88 million to $92 million, including Figure C: Cirrus Logic GAAP R&D and SG&A Expenses/Headcount Q1 FY12 to Q4 FY15 $M 90 80 70 60 50 40 30 20 10 0 Q1/FY12 Q2/FY12 Q3/FY12 Q4/FY12 Q1/FY13 Q2/FY13 Q3/FY13 Q4/FY13 Q1/FY14 Q2/FY14 Q3/FY14 Q4/FY14 Q1/FY15 Q2/FY15 Q3/FY15 Q4/FY15 *Mid point guidance as of January 28, 2015 **Operating expense and headcount Increase reflects acquisition of Wolfson Microelectronics ($ millions, except headcount) 594 623 635 667 698 644 637 652 665 678 735 752 739 1,099** 1,102 R&D Headcount SG&A OpEx*

$8 million in share-based compensation and $7 million in amortization of acquired intangibles. Our total headcount exiting Q3 was 1,102. The ending cash balance in the December quarter was $176 million, up $33 million from the prior quarter. Cash from operations was $61.4 million. The company’s balance sheet reflects $200 million of debt associated with funding the acquisition of Wolfson, down $26 million from the prior quarter. Interest expense related to this debt is currently expected to be approximately $1 million per quarter. In the December quarter we utilized approximately $10.5 million to repurchase 579,633 shares of common stock at an average price of $18.17. As of December 27, 2014, we have roughly $51.7 million remaining in our share buyback program and we expect to continue to evaluate opportunities to repurchase shares from time to time. Taxes and Inventory Our GAAP tax expense during the quarter was $19.5 million, which included $17.7 million of non-cash charges associated with our deferred tax asset and other tax credits. We expect our effective quarterly cash tax rate to be less than four percent for Q4 FY15, at which time our U.S. deferred tax assets and other tax credits should be largely depleted. We anticipate paying an annual worldwide effective tax rate of approximately 30 percent in FY16. Moving forward, we expect a growing portion of our revenue and income will be generated offshore; accordingly, our worldwide effective tax rate has the potential to be further reduced in FY17 and beyond. Q3 inventory was $73.9 million, down from $121.2 million in Q2. The reduction in inventory was larger than anticipated as sales of certain portable audio products exceeded expectations. Inventory in the March quarter should decline further as we continue to experience strong demand for many of these products.

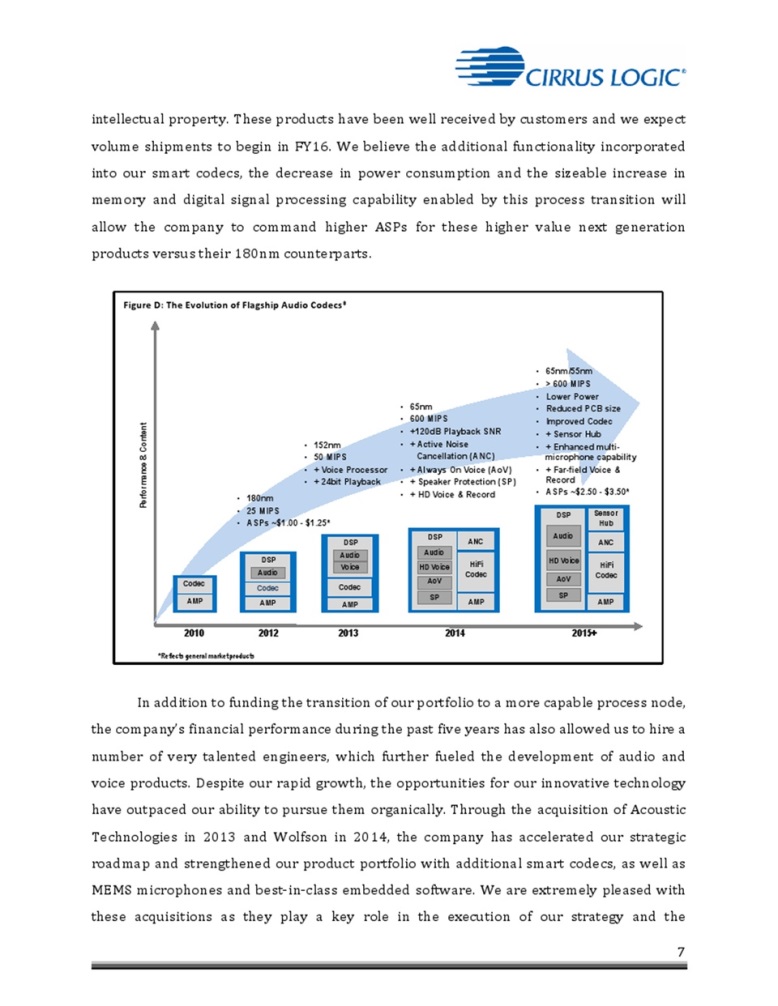

Company Strategy Cirrus Logic has been a premier supplier of high-fidelity audio components for many years. Our strategy of providing innovative solutions to leaders in fast growing markets where our technology is viewed as an important feature in the end product has been a key factor in our success. Recently, we have experienced a substantial increase in demand across the mobile handset market for advanced audio and voice technology that helps to differentiate our customers’ products. In 2012, we began shipping devices in high volume that moved beyond the traditional functionality found in high-fidelity audio components and incorporated advanced signal processing in the form of active noise cancellation. As a result, we increased the value of our products and significantly expanded our SAM to include handsets that differentiate on voice as well as audio use cases. We have continued to pursue a strategy of increasing content with our customers by providing the very best hardware, software and associated signal processing algorithms that focus on the audio and voice experience in mobile applications. For example, our new 55nm smart codecs integrate the functionality of several discrete components, including codecs, audio and voice DSPs, and class-D amplifiers, into one device with complex digital signal processing capabilities and programmable DSPs. With a robust product roadmap that features new audio and voice technologies such as enhanced multi-microphone capability and always on voice activation, we believe the continued implementation of this strategy has positioned Cirrus Logic extremely well for growth in FY16 and subsequent years. Delivering outstanding performance utilizing advanced audio and voice processing technology such as active noise cancellation required a significant investment and the sustained efforts of Cirrus Logic’s best engineers across both the analog and digital domains. We initially developed components that incorporated some of these advanced features in 180nm; however, this process node limited what we could achieve in terms of signal processing capabilities, power consumption and die size. As a result, we began a multi year process to transition a large portion of our product portfolio to 55nm, which required a considerable amount of effort, including the fundamental redesign of our analog

intellectual property. These products have been well received by customers and we expect volume shipments to begin in FY16. We believe the additional functionality incorporated into our smart codecs, the decrease in power consumption and the sizeable increase in memory and digital signal processing capability enabled by this process transition will allow the company to command higher ASPs for these higher value next generation products versus their 180nm counterparts. In addition to funding the transition of our portfolio to a more capable process node, the company’s financial performance during the past five years has also allowed us to hire a number of very talented engineers, which further fueled the development of audio and voice products. Despite our rapid growth, the opportunities for our innovative technology have outpaced our ability to pursue them organically. Through the acquisition of Acoustic Technologies in 2013 and Wolfson in 2014, the company has accelerated our strategic roadmap and strengthened our product portfolio with additional smart codecs, as well as MEMS microphones and best-in-class embedded software. We are extremely pleased with these acquisitions as they play a key role in the execution of our strategy and the Figure D: The Evolution of Flagship Audio Codecs* Performace&Content *Reflects general market products Codec AMP DSP Audio Codec AMP DSP Audio Voice Codec AMP DSP Audio HD Voice AoV SP ANC HiFi Codec AMP 2010 2012 2013 2014 180nm 25 MIPS ASPs ~$1.00* 152nm 50 MIPS + Voice Processor + 24bit Playback 65nm 600 MIPS +120dB Playback SNR + Active Noise Cancellation (ANC) + Always On Voice (AoV) + Speaker Protection (SP) + HD Voice & Record 65nm/55nm > 600 MIPS Lower Power Reduced PCB size Improved Codec + Sensor Hub + Enhanced multi-microphone capability + Far-filed Voice & Record ASPs ~$2.50 - $3.50*

realization of our growth and profitability targets. Moreover, we believe Wolfson’s smart codecs are poised to meaningfully expand share with their existing customers, beginning this quarter, and will help the company engage new customers over the next few years. We are very excited about the prospects for Cirrus Logic going forward. Our core competency of analog and digital signal processing is squarely centered on audio and voice applications, a segment that we believe will grow much faster than the overall mobile market. The introduction of new products targeting this market that have been developed by both Cirrus Logic and Wolfson are driving the company’s expectation for growth in FY16. We expect to benefit in FY17 and beyond from further product introductions based on the combined companies' 55nm platform and the cross sale of components such as our highly advanced amplifiers and MEMS microphones into existing customers. In addition, we are investing in wearables, automotive and other applications where voice can deliver a compelling interface to a wide array of devices as we leverage our technology investments in handsets. Summary and Guidance For the March quarter we expect the following results: Revenue to range between $220 million and $240 million; GAAP gross margin to be between 45 percent and 47 percent; and Combined R&D and SG&A expenses to range between $88 million and $92 million, including approximately $8 million in share-based compensation expense and $ 7 million in amortization of acquired intangibles. In summary, Q3 was an excellent quarter for Cirrus Logic as we delivered strong revenue growth and expanded operating profit. With an exceptional customer base and a broad range of industry leading hardware, software algorithms, tools and support we believe Cirrus Logic is positioned extremely well to capitalize on the remarkable growth

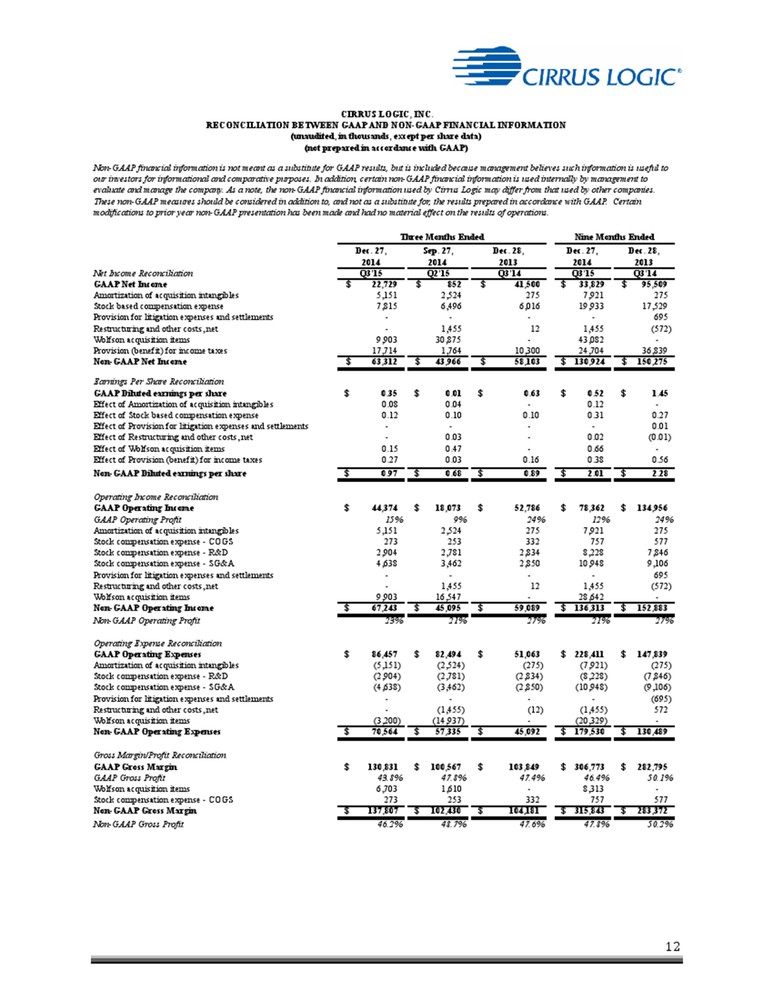

opportunities for high performance audio and voice processing solutions in the coming years. Sincerely, Jason Rhode Thurman Case President and Chief Executive Officer Chief Financial Officer Conference Call Q&A Session Cirrus Logic will host a live Q&A session at 5 p.m. EDT today to answer questions related to its financial results and business outlook. Participants may listen to the conference call on the Cirrus Logic website. Participants who would like to submit a question to be addressed during the call are requested to email investor.relations@cirrus.com. A replay of the webcast can be accessed on the Cirrus Logic website approximately two hours following its completion, or by calling (404) 537-3406, or toll-free at (855) 859-2056 (Access Code: 61707935). Use of Non-GAAP Financial Information This shareholder letter and its attachments include references to non-GAAP financial information, including gross margins, operating expenses, net income, operating profit and income, and diluted earnings per share. A reconciliation of the adjustments to GAAP results is included in the tables below. Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. Safe Harbor Statement Except for historical information contained herein, the matters set forth in this news release contain forward-looking statements, including our future growth expectations, anticipated tax rates, and potential share repurchases, along with estimates of fourth quarter fiscal year 2015 revenue, gross margin, combined research and development and selling, general and administrative expense levels, interest expense, share-based compensation expense and amortization of acquired intangibles. In some cases, forward-looking statements are identified by words such as “expect,” “anticipate,” “target,” “project,” “believe,” “goals,” “opportunity,” “estimates,” “intend,” and variations of these types of words and similar expressions. In addition, any statements that refer to our plans, expectations, strategies or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, but are not limited to, the level of orders and shipments during the fourth quarter fiscal year 2015, as well as customer cancellations of orders, or the failure to place orders consistent with forecasts; and the risk factors listed in our Form 10-K for the year ended March 29, 2014, and in our other filings with the Securities and Exchange Commission, which are available at www.sec.gov. The foregoing information concerning our business outlook represents our outlook as of the date of this news release, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise. Cirrus Logic, Cirrus and Wolfson are registered trademarks of Cirrus Logic, Inc. or its subsidiaries. All other company or product names noted herein may be trademarks of their respective holders. Summary financial data follows:

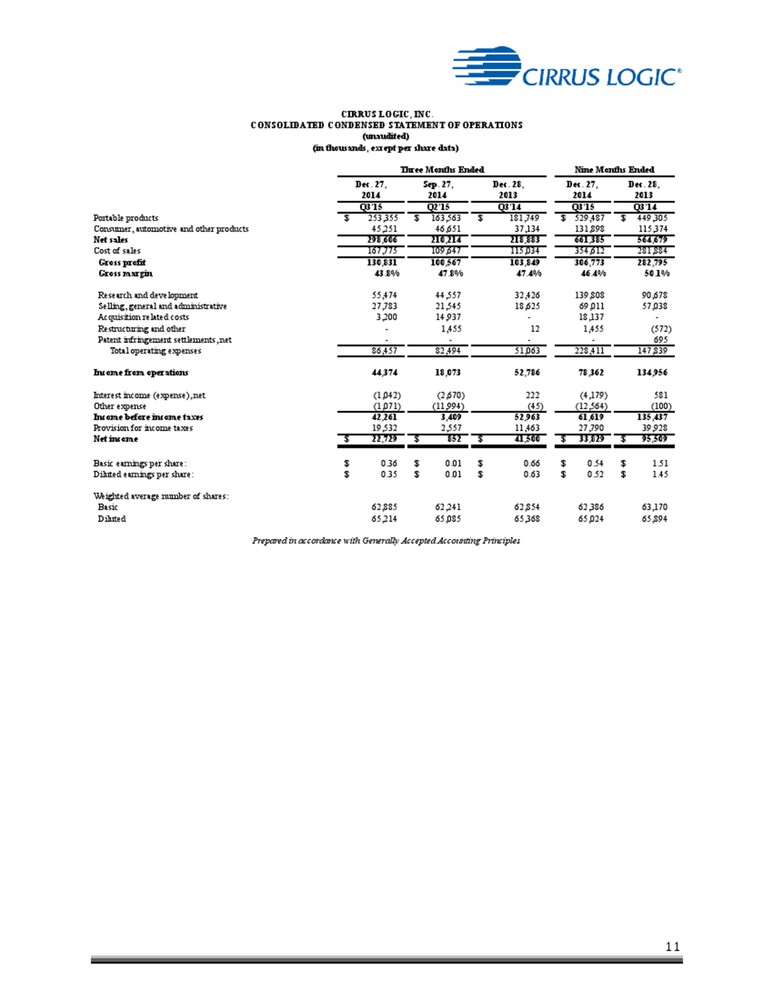

Dec. 27, Sep. 27, Dec. 28, Dec. 27, Dec. 28, 2014 2014 2013 2014 2013 Q3'15 Q2'15 Q3'14 Q3'15 Q3'14 Portable products 253,355 $ 163,563 $ 181,749 $ 529,487 $ 449,305 $ Consumer, automotive and other products 45,251 46,651 37,134 131,898 115,374 CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS (unaudited) (in thousands, except per share data) Three Months Ended Nine Months Ended Net sales 298,606 210,214 218,883 661,385 564,679 Cost of sales 167,775 109,647 115,034 354,612 281,884 Gross profit 130,831 100,567 103,849 306,773 282,795 Gross margin 43.8% 47.8% 47.4% 46.4% 50.1% Research and development 55,474 44,557 32,426 139,808 90,678 Selling, general and administrative 27,783 21,545 18,625 69,011 57,038 Acquisition related costs 3,200 14,937 - 18,137 - Restructuring and other - 1,455 12 1,455 (572) Patent infringement settlements, net - - - - 695 Total operating expenses 86,457 82,494 51,063 228,411 147,839 Income from operations 44,374 18,073 52,786 78,362 134,956 Interest income (expense), net (1,042) (2,670) 222 (4,179) 581 Other expense (1,071) (11,994) (45) (12,564) (100) Income before income taxes 42,261 3,409 52,963 61,619 135,437 Provision for income taxes 19,532 2,557 11,463 27,790 39,928 Net income 22,729 $ 852 $ 41,500 $ 33,829 $ 95,509 $ Basic earnings per share: 0.36 $ 0.01 $ 0.66 $ 0.54 $ 1.51 $ Diluted earnings per share: 0.35 $ 0.01 $ 0.63 $ 0.52 $ 1.45 $ Weighted average number of shares: Basic 62,885 62,241 62,854 62,386 63,170 Diluted 65,214 65,085 65,368 65,024 65,894 Prepared in accordance with Generally Accepted Accounting Principles 11

Dec. 27, Sep. 27, Dec. 28, Dec. 27, Dec. 28, 2014 2014 2013 2014 2013 Net Income Reconciliation Q3'15 Q2'15 Q3'14 Q3'15 Q3'14 GAAP Net Income 22,729 $ 852 $ 41,500 $ 33,829 $ 95,509 $ Amortization of acquisition intangibles 5,151 2,524 275 7,921 275 Stock based compensation expense 7,815 6,496 6,016 19,933 17,529 Non-GAAP financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. Certain modifications to prior year non-GAAP presentation has been made and had no material effect on the results of operations. Three Months Ended Nine Months Ended (not prepared in accordance with GAAP) CIRRUS LOGIC, INC. RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION (unaudited, in thousands, except per share data) Provision for litigation expenses and settlements - - - - 695 Restructuring and other costs, net - 1,455 12 1,455 (572) Wolfson acquisition items 9,903 30,875 - 43,082 - Provision (benefit) for income taxes 17,714 1,764 10,300 24,704 36,839 Non-GAAP Net Income 63,312 $ 43,966 $ 58,103 $ 130,924 $ 150,275 $ Earnings Per Share Reconciliation GAAP Diluted earnings per share 0.35 $ 0.01 $ 0.63 $ 0.52 $ 1.45 $ Effect of Amortization of acquisition intangibles 0.08 0.04 - 0.12 - Effect of Stock based compensation expense 0.12 0.10 0.10 0.31 0.27 Effect of Provision for litigation expenses and settlements - - - - 0.01 Effect of Restructuring and other costs, net - 0.03 - 0.02 (0.01) Effect of Wolfson acquisition items 0.15 0.47 - 0.66 - Effect of Provision (benefit) for income taxes 0.27 0.03 0.16 0.38 0.56 Non-GAAP Diluted earnings per share 0.97 $ 0.68 $ 0.89 $ 2.01 $ 2.28 $ Operating Income Reconciliation GAAP Operating Income 44,374 $ 18,073 $ 52,786 $ 78,362 $ 134,956 $ GAAP Operating Profit 15% 9% 24% 12% 24% Amortization of acquisition intangibles 5,151 2,524 275 7,921 275 Stock compensation expense - COGS 273 253 332 757 577 Stock compensation expense - R&D 2,904 2,781 2,834 8,228 7,846 Stock compensation expense - SG&A 4,638 3,462 2,850 10,948 9,106 Provision for litigation expenses and settlements - - - - 695 Restructuring and other costs, net - 1,455 12 1,455 (572) Wolfson acquisition items 9,903 16,547 - 28,642 - Non-GAAP Operating Income 67,243 $ 45,095 $ 59,089 $ 136,313 $ 152,883 $ Non-GAAP Operating Profit 23% 21% 27% 21% 27% Operating Expense Reconciliation GAAP Operating Expenses 86,457 $ 82,494 $ 51,063 $ 228,411 $ 147,839 $Amortization of acquisition intangibles (5,151) (2,524) (275) (7,921) (275) Stock compensation expense - R&D (2,904) (2,781) (2,834) (8,228) (7,846) Stock compensation expense - SG&A (4,638) (3,462) (2,850) (10,948) (9,106) Provision for litigation expenses and settlements - - - - (695) Restructuring and other costs, net - (1,455) (12) (1,455) 572 Wolfson acquisition items (3,200) (14,937) - (20,329) - Non-GAAP Operating Expenses 70,564 $ 57,335 $ 45,092 $ 179,530 $ 130,489 $ Gross Margin/Profit Reconciliation GAAP Gross Margin 130,831 $ 100,567 $ 103,849 $ 306,773 $ 282,795 $ GAAP Gross Profit 43.8% 47.8% 47.4% 46.4% 50.1% Wolfson acquisition items 6,703 1,610 - 8,313 - Stock compensation expense - COGS 273 253 332 757 577 Non-GAAP Gross Margin 137,807 $ 102,430 $ 104,181 $ 315,843 $ 283,372 $ Non-GAAP Gross Profit 46.2% 48.7% 47.6% 47.8% 50.2% 12

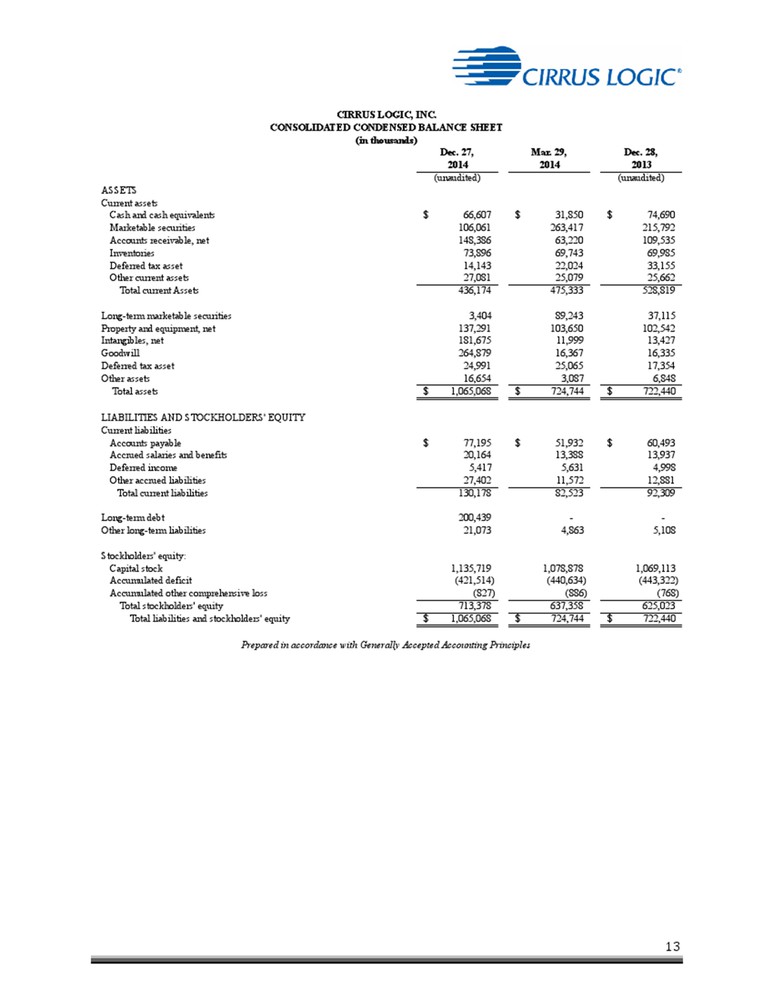

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED BALANCE SHEET Dec. 27, Mar. 29, Dec. 28, 2014 2014 2013 (unaudited) (unaudited) ASSETS Current assets Cash and cash equivalents 66,607 $ 31,850 $ 74,690 $ (in thousands) Marketable securities 106,061 263,417 215,792 Accounts receivable, net 148,386 63,220 109,535 Inventories 73,896 69,743 69,985 Deferred tax asset 14,143 22,024 33,155 Other current assets 27,081 25,079 25,662 Total current Assets 436,174 475,333 528,819 Long-term marketable securities 3,404 89,243 37,115 Property and equipment, net 137,291 103,650 102,542 Intangibles, net 181,675 11,999 13,427 Goodwill 264,879 16,367 16,335 Deferred tax asset 24,991 25,065 17,354 Other assets 16,654 3,087 6,848 Total assets 1,065,068 $ 724,744 $ 722,440 $ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable 77,195 $ 51,932 $ 60,493 $ Accrued salaries and benefits 20,164 13,388 13,937 Deferred income 5,417 5,631 4,998 Other accrued liabilities 27,402 11,572 12,881 Total current liabilities 130,178 82,523 92,309 Long-term debt 200,439 - - Other long-term liabilities 21,073 4,863 5,108 Stockholders' equity: Capital stock 1,135,719 1,078,878 1,069,113 Accumulated deficit (421,514) (440,634) (443,322) Accumulated other comprehensive loss (827) (886) (768) Total stockholders' equity 713,378 637,358 625,023 Total liabilities and stockholders' equity 1,065,068 $ 724,744 $ 722,440 $ Prepared in accordance with Generally Accepted Accounting Principles 13 January 28 2015Dear Shareholders,We are very pleased with Cirrus Logic’s financial results for the December quarter as we delivered year-over-year and sequential revenue growth, expanded operating profit and continued to generate cash. Revenue for the quarter exceeded our expectations at $298.6 million due to increased sales of our portable audio products. During the quarter, we continued to gain traction in portable audio and remained engaged in on-going design efforts at numerous leading smartphone and tablet manufacturers.The company has invested a significant amount of R&D dollars and engineering resources over the past several years to target opportunities in the rapidly emerging audio and voice markets. We have strengthened our relationships with existing customers and established new relationships with key players in these markets. Furthermore, through the acquisition of Wolfson we broadened our product lines to include additional smart codecs, MEMS microphones, and embedded software. With a comprehensive portfolio of custom-and general-market products that span the complete audio signal chain from capture to playback, the company is leveraging our leadership position to expand our addressable market and increase content per device. Revenue and Gross MarginsRevenue for the third quarter was $298.6 million, including $30.8 million of contribution from Wolfson Microelectronics. On a standalone basis, Cirrus Logic’s revenue increased 36 percent sequentially and 22 percent year over year to $267.8 million, as we continued to experience strong demand for our portable audio products. In Q3, revenue generated by Portable Audio Products contributed approximately 85 percent of sales and Non-Portable Audio and Other Products represented roughly 15 percent. Our largest customer contributed approximately 78 percent of total revenue in Q3. Our relationship with this customer remains outstanding with design activity continuing on various products. While we understand there is intense interest in this customer, in accordance with our policy, we do not discuss specifics about our business relationship. In the March quarter we anticipate revenue to range from $220 million to $240 million. Sales of our portable audio components continue to be stronger than anticipated for FY15 and we expect our annual revenue, excluding Wolfson, to be up significantly year over year. In addition, we are very pleased with the progress we are making integrating Wolfson. This business should grow significantly in the March quarter on both a year-over-year and a sequential basis as their smart codec share expands at existing customers.GAAP gross margin for the December quarter was 43.8 percent and non-GAAP gross margin was 46.2 percent. GAAP gross margins reflect roughly 230 basis points of costs related to accounting requirements associated with the fair value write up of inventory acquired through the Wolfson transaction and a seasonally higher mix of portable products. In the March quarter, we expect gross margin to range from 45 percent to 47 percent as the inventory related charges are essentially behind us. Our long-term gross margin expectations remain in the mid-40 percent range. Operating Profit and Cash Operating profit in the December quarter was 15 percent GAAP and 23 percent on a non-GAAP basis. GAAP operating expenses were $86.5 million and non-GAAP operating expenses were $70.6 million, inclusive of a full quarter of Wolfson costs. GAAP operating expenses contain approximately $7.5 million in share-based compensation and $5.2 million in amortization of acquired intangibles. These expenses also reflect $3.2 million in costs associated with the acquisition of Wolfson, including $2.6 million in share-based compensation. In the March quarter R&D and SG&A expenses should range from $88 million to $92 million, including $8 million in share-based compensation and $7 million in amortization of acquired intangibles. Our total headcount exiting Q3 was 1,102.The ending cash balance in the December quarter was $176 million, up $33 million from the prior quarter. Cash from operations was $61.4 million. The company’s balance sheet reflects $200 million of debt associated with funding the acquisition of Wolfson, down $26 million from the prior quarter. Interest expense related to this debt is currently expected to be approximately $1 million per quarter. In the December quarter we utilized approximately $10.5 million to repurchase 579,633 shares of common stock at an average price of $18.17. As of December 27, 2014, we have roughly $51.7 million remaining in our share buyback program and we expect to continue to evaluate opportunities to repurchase shares from time to time. Taxes and Inventory Our GAAP tax expense during the quarter was $19.5 million, which included $17.7 million of non-cash charges associated with our deferred tax asset and other tax credits. We expect our effective quarterly cash tax rate to be roughly five percent for Q4 FY15, at which time our U.S. deferred tax assets and other tax credits should be largely depleted. We anticipate paying an annual worldwide effective tax rate of approximately 30 percent in FY16. Moving forward, we expect a growing portion of our revenue and income will be generated offshore; accordingly, our worldwide effective tax rate has the potential to be further reduced in FY17 and beyond.Q3 inventory was $73.9 million, down from $121.2 million in Q2. The reduction in inventory was larger than anticipated as sales of certain portable audio products exceeded expectations. Inventory in the March quarter should decline further as we continue to experience strong demand for many of these products. Company Strategy Cirrus Logic has been a premier supplier of high-fidelity audio components for many years. Our strategy of providing innovative solutions to leaders in fast growing markets where our technology is viewed as an important feature in the end product has been a key factor in our success. Recently, we have experienced a substantial increase in demand across the mobile handset market for advanced audio and voice technology that helps to differentiate our customers’ products. In 2012, we began shipping devices in high volume that moved beyond the traditional functionality found in high-fidelity audio components and incorporated advanced signal processing in the form of active noise cancellation. As a result, we increased the value of our products and significantly expanded our SAM to include handsets that differentiate on voice as well as audio use cases. We have continued to pursue a strategy of increasing content with our customers by providing the very best hardware, software and associated signal processing algorithms that focus on the audio and voice experience in mobile applications. For example, our new 55nm smart codecs integrate the functionality of several discrete components, including codecs, audio and voice DSPs, and class-D amplifiers, into one device with complex digital signal processing capabilities and programmable DSPs. With a robust product roadmap that features new audio and voice technologies such as enhanced multi-microphone capability and always on voice activation, we believe the continued implementation of this strategy has positioned Cirrus Logic extremely well for growth in FY16 and subsequent years.Delivering outstanding performance utilizing advanced audio and voice processing technology such as active noise cancellation required a significant investment and the sustained efforts of Cirrus Logic’s best engineers across both the analog and digital domains. We initially developed components that incorporated some of these advanced features in 180nm; however, this process node limited what we could achieve in terms of signal processing capabilities, power consumption and die size. As a result, we began a multi year process to transition a large portion of our product portfolio to 55nm, which required a considerable amount of effort, including the fundamental redesign of our analog intellectual property. These products have been well received by customers and we expect volume shipments to begin in FY16. We believe the additional functionality incorporated into our smart codecs, the decrease in power consumption and the sizeable increase in memory and digital signal processing capability enabled by this process transition will allow the company to command higher ASPs for these higher value next generation products versus their 180nm counterparts. In addition to funding the transition of our portfolio to a more capable process node, the company’s financial performance during the past five years has also allowed us to hire a number of very talented engineers, which further fueled the development of audio and voice products. Despite our rapid growth, the opportunities for our innovative technology have outpaced our ability to pursue them organically. Through the acquisition of Acoustic Technologies in 2013 and Wolfson in 2014, the company has accelerated our strategic roadmap and strengthened our product portfolio with additional smart codecs, as well as MEMS microphones and best-in-class embedded software. We are extremely pleased with these acquisitions as they play a key role in the execution of our strategy and the realization of our growth and profitability targets. Moreover, we believe Wolfson’s smart codecs are poised to meaningfully expand share with their existing customers, beginning this quarter, and will help the company engage new customers over the next few years. We are very excited about the prospects for Cirrus Logic going forward. Our core competency of analog and digital signal processing is squarely centered on audio and voice applications, a segment that we believe will grow much faster than the overall mobile market. The introduction of new products targeting this market that have been developed by both Cirrus Logic and Wolfson are driving the company’s expectation for growth in FY16. We expect to benefit in FY17 and beyond from further product introductions based on the combined companies' 55nm platform and the cross sale of components such as our highly advanced amplifiers and MEMS microphones into existing customers. In addition, we are investing in wearables, automotive and other applications where voice can deliver a compelling interface to a wide array of devices as we leverage our technology investments in handsets. Summary and Guidance For the March quarter we expect the following results:Revenue to range between $220 million and $240 million; GAAP gross margin to be between 45 percent and 47 percent; and Combined R&D and SG&A expenses to range between $88 million and $92 million, including approximately $8 million in share-based compensation expense and $ 7 million in amortization of acquired intangibles.In summary, Q3 was an excellent quarter for Cirrus Logic as we delivered strong revenue growth and expanded operating profit. With an exceptional customer base and a broad range of industry leading hardware, software algorithms, tools and support we believe Cirrus Logic is positioned extremely well to capitalize on the remarkable growth opportunities for high performance audio and voice processing solutions in the coming years. Sincerely, Jason Rhode Thurman Case President and Chief Executive Officer Chief Financial Officer Conference Call Q&A Session Cirrus Logic will host a live Q&A session at 5 p.m. EDT today to answer questions related to its financial results and business outlook. Participants may listen to the conference call on the Cirrus Logic website. Participants who would like to submit a question to be addressed during the call are requested to email A replay of the webcast can be accessed on the Cirrus Logic website approximately two hours following its completion, or by calling (404) 537-3406, or toll-free at (855) 859-2056 (Access Code: 61707935).Use of Non-GAAP Financial InformationThis shareholder letter and its attachments include references to non-GAAP financial information, including gross margins, operating expenses, net income, operating profit and income, and diluted earnings per share. A reconciliation of the adjustments to GAAP results is included in the tables below. Non-GAAP financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP.Safe Harbor StatementExcept for historical information contained herein, the matters set forth in this news release contain forward-looking statements, including our future growth expectations, anticipated tax rates, and potential share repurchases, along with estimates of fourth quarter fiscal year 2015 revenue, gross margin, combined research and development and selling, general and administrative expense levels, interest expense, share-based compensation expense and amortization of acquired intangibles. In some cases, forward-looking statements are identified by words such as “expect,” “anticipate,” “target,” “project,” “believe,” “goals,” “opportunity,” “estimates,” “intend,” and variations of these types of words and similar expressions. In addition, any statements that refer to our plans, expectations, strategies or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, but are not limited to, the level of orders and shipments during the fourth quarter fiscal year 2015, as well as customer cancellations of orders, or the failure to place orders consistent with forecasts; and the risk factors listed in our Form 10-K for the year ended March 29, 2014, and in our other filings with the Securities and Exchange Commission, which are available at www.sec.gov. The foregoing information concerning our business outlook represents our outlook as of the date of this news release, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise. Cirrus Logic, Cirrus and Wolfson are registered trademarks of Cirrus Logic, Inc. or its subsidiaries. All other company or product names noted herein may be trademarks of their respective holders.