Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Post Holdings, Inc. | form8-kxstrikerannouncement.htm |

| EX-99.1 - EXHIBIT 99.1 - PRESS RELEASE - Post Holdings, Inc. | strikeracqannouncementpr.htm |

Post Holdings, Inc. Post Holdings, Inc. to Acquire MOM Brands Company January 26, 2015

Certain matters discussed in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on Post’s current expectations of Post and are subject to uncertainty and changes in circumstances. These forward-looking statements include, among others, statements regarding expected synergies and benefits of the acquisition of MOM Brands Company (“MOM Brands”), expectations about future business plans, prospective performance and opportunities, regulatory approvals and the expecting timing of the completion of the MOM Brands transaction. These forward-looking statements may be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “should” or similar words. There is no assurance that the acquisition of MOM Brands will be consummated, and there are a number of risks and uncertainties that that could cause actual results to differ materially from the forward-looking statements made herein. These risks and uncertainties include risks relating to Post’s ability to obtain financing of the acquisition and access to capital and otherwise to complete the acquisition; the timing to consummate the acquisition of MOM Brands; the ability and timing to obtain required regulatory approvals, including antitrust approvals, and satisfy other closing conditions; Post’s ability to realize the synergies contemplated by the acquisition of MOM Brands; Post’s ability to promptly and effectively integrate the MOM Brands business; our high leverage and substantial debt, including covenants that restrict the operation of our business; our ability to service outstanding debt or obtain additional financing, including secured or unsecured debt; our ability to continue to compete in our product markets and our ability to retain market position; our ability to identify and complete acquisitions, manage growth and integrate acquisitions; changes in our cost structure, management, financing and business operations; significant volatility in the costs of certain raw materials, commodities, packaging or energy used to manufacture our products; our ability to maintain competitive pricing, introduce new products or successfully manage costs; our ability to successfully implement business strategies to reduce costs; impairment in the carrying value of goodwill or other intangibles; the loss or bankruptcy of a significant customer; allegations that products cause injury or illness, product recalls and product liability claims and other litigation; our ability to anticipate and respond to changes in consumer preferences and trends; changes in economic conditions and consumer demand for our products; disruptions in the U.S. and global capital and credit markets; labor strikes, work stoppages or unionization efforts; legal and regulatory factors, including changes in advertising and labeling laws, food safety and laws and regulations governing animal feeding operations; our ability to comply with increased regulatory scrutiny related to certain of our products and / or international sales; the ultimate impact litigation may have on us, including the lawsuit (to which Michael Foods is a party) alleging violations of federal and state antitrust laws in the egg industry; our reliance on third party manufacturers for certain of our products; disruptions or inefficiencies in supply chain; our ability to recognize the expected benefits of the closing of the Modesto, California manufacturing facility; fluctuations in foreign currency exchange rates; consolidations among the retail grocery and foodservice industries; change in estimates in critical accounting judgments and changes to or new laws and regulations affecting our business; losses or increased funding and expenses related to qualified pension plans; loss of key employees; our ability to protect our intellectual property; changes in weather conditions, natural disasters, disease outbreaks and other events beyond our control; our ability to successfully operate international operations in compliance with applicable laws and regulations; our ability to satisfy the requirements of Section 404 of the Sarbanes- Oxley Act of 2002, including with respect to acquired businesses; business disruptions caused by information technology failures and / or technology hacking; and other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements represent the Company’s judgment as of the date of this presentation. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company disclaims, however, any intent or obligation to update these forward-looking statements. 1 Forward-Looking Statements This presentation does not constitute an offer to sell or the solicitation of an offer to buy any security.

Prospective Financial Information The prospective financial information provided in this presentation regarding Post’s and MOM Brands’ future performance, including Post’s expected Adjusted EBITDA for fiscal 2015 and specific dollar amounts and other plans, expectations, estimates and similar statements, represents Post management’s estimates as of the date of this presentation only and are qualified by, and subject to, the assumptions and the other information set forth on the slide captioned “Forward-Looking Statements.” The estimated 2015 Adjusted EBITDA and the dollar amounts and other plans, expectations, estimates and similar statements contained in this presentation are based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to business, economic and competitive uncertainties and contingencies, many of which are beyond our control, are based upon specific assumptions with respect to future business decisions, some of which will change and are necessarily speculative in nature. It can be expected that some or all of the assumptions of the estimates furnished by us will not materialize or will vary significantly from actual results. Accordingly, the information set forth herein is only an estimate of what management believes is realizable as of the date hereof, and actual results will vary from the estimates set forth herein. Investors should also recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put the estimated 2015 Adjusted EBITDA and other prospective financial information in context and not to place undue reliance on it. The estimated fiscal 2015 Adjusted EBITDA is not prepared with a view toward compliance with published guidelines of the American Institute of Certified Public Accountants, and neither our independent registered public accounting firms nor any other independent expert or outside party compiles or examines these estimates and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto. The estimated 2015 Adjusted EBITDA is stated as a high and low range, which is intended to provide a sensitivity analysis as variables are changed but it is not intended to represent that actual results could not fall outside of the estimated ranges. Any failure to successfully implement our operating strategy or the occurrence of any of the events or circumstances set forth under “Forward- Looking Statements” could result in the actual operating results being different than the estimates set forth herein, and such differences may be adverse and material. Market and Industry Data This presentation includes industry and trade association data, forecasts and information that was prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other independent sources available to the Company. Some data also are based on Post’s good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third-party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. Post has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions on which such data are based. Post’s market share data is based on information from Nielsen Expanded All Outlets Combined (“xAOC”). 2 Additional Information

Use of Non-GAAP Measures for MOM Brands Post has presented in this release an estimated range of MOM Brands’ adjusted EBITDA for MOM Brands’ fiscal year ended December 27, 2014. Adjusted EBITDA is a non-GAAP measure which represents earnings before interest, taxes, depreciation, amortization and other adjustments. MOM Brands uses adjusted EBITDA as a measurement of financial results and as an indication of the relative strength of operating performance. Post management’s estimated range of MOM Brands’ adjusted EBITDA is based on the financial statements that were prepared by MOM Brands current management. The information in this release has been prepared based only upon information available as of the date hereof, and has not been prepared with a view toward compliance with published guidelines of the Securities and Exchange Commission or the guidelines of the American Institute of Certified Public Accountants for the preparation or presentation of financial information. The financial statements referred to above have not been audited or reviewed by Post’s or MOM Brands’ independent auditors or any other accounting firm. The results reflected in audited financial statements may vary from the information provided in this press release. The financial data for MOM Brands reflects performance under current management and may not be indicative of the operating results that can be obtained under Post’s cost structure. Post has not provided a quantitative reconciliation of this non-GAAP financial measure included in this press release to the most comparable financial measure or measures calculated and presented in accordance with GAAP due primarily to the timing of the closing of MOM Brands’ financial procedures for their fiscal year ended December 27, 2014 and the difficulty in forecasting and quantifying the exact amount of the items excluded from adjusted EBITDA that will be included in the comparable GAAP financial measures such that it is not practicable to produce such reconciliations for this financial information without unreasonable effort. Use of Non-GAAP Measures for Post While the Company reports financial results in accordance with accounting principles generally accepted in the U.S., this presentation includes the forecast non-GAAP measure Adjusted EBITDA for Post, which is not in accordance with or a substitute for GAAP measures. Post considers Adjusted EBITDA an important supplemental measure of performance and ability to service debt. Adjusted EBITDA is often used to assess performance because it allows comparison of operating performance on a consistent basis across periods by removing the effects of various items. Adjusted EBITDA has various limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of results as reported under GAAP. Post has not provided a quantitative reconciliation of the forecast non-GAAP financial measures included in this presentation to the most comparable financial measure or measures calculated and presented in accordance with GAAP due primarily to the difficulty in forecasting and quantifying the exact amount of the items excluded from Adjusted EBITDA that will be included in the comparable GAAP financial measures such that it is not practicable to produce such reconciliations for this financial information without unreasonable effort. 3 Additional Information (Cont’d)

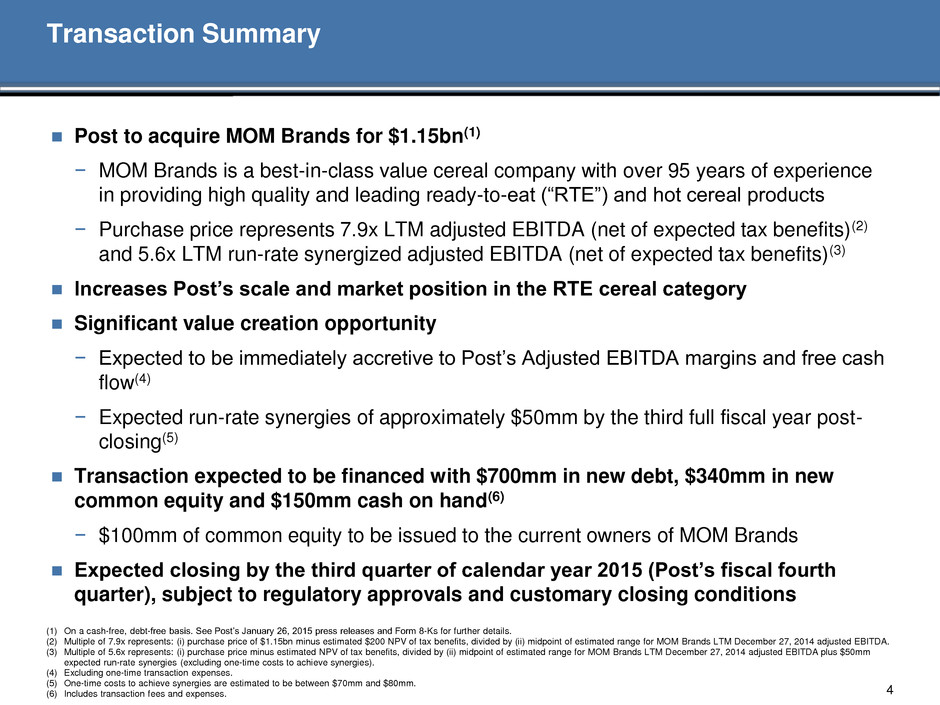

Transaction Summary 4 Post to acquire MOM Brands for $1.15bn(1) − MOM Brands is a best-in-class value cereal company with over 95 years of experience in providing high quality and leading ready-to-eat (“RTE”) and hot cereal products − Purchase price represents 7.9x LTM adjusted EBITDA (net of expected tax benefits)(2) and 5.6x LTM run-rate synergized adjusted EBITDA (net of expected tax benefits)(3) Increases Post’s scale and market position in the RTE cereal category Significant value creation opportunity − Expected to be immediately accretive to Post’s Adjusted EBITDA margins and free cash flow(4) − Expected run-rate synergies of approximately $50mm by the third full fiscal year post- closing(5) Transaction expected to be financed with $700mm in new debt, $340mm in new common equity and $150mm cash on hand(6) − $100mm of common equity to be issued to the current owners of MOM Brands Expected closing by the third quarter of calendar year 2015 (Post’s fiscal fourth quarter), subject to regulatory approvals and customary closing conditions (1) On a cash-free, debt-free basis. See Post’s January 26, 2015 press releases and Form 8-Ks for further details. (2) Multiple of 7.9x represents: (i) purchase price of $1.15bn minus estimated $200 NPV of tax benefits, divided by (ii) midpoint of estimated range for MOM Brands LTM December 27, 2014 adjusted EBITDA. (3) Multiple of 5.6x represents: (i) purchase price minus estimated NPV of tax benefits, divided by (ii) midpoint of estimated range for MOM Brands LTM December 27, 2014 adjusted EBITDA plus $50mm expected run-rate synergies (excluding one-time costs to achieve synergies). (4) Excluding one-time transaction expenses. (5) One-time costs to achieve synergies are estimated to be between $70mm and $80mm. (6) Includes transaction fees and expenses.

Compelling Strategic and Financial Rationale 5 Consistent with Post’s M&A Strategy Execute value-enhancing M&A Add diversity to platform through M&A Add scale to core RTE cereal to gain efficiency and fortify market position Strengthens Post’s Competitive Position Expected to increase Post’s scale and market position in the RTE cereal category Expected to make Post / MOM Brands the leader in the RTE cereal value segment(1) and the growing RTE cereal bagged segment Highly Synergistic Combination Significant synergy potential via manufacturing, distribution, procurement, SG&A / corporate overhead efficiencies and rationalization Expected run-rate synergies of approximately $50mm by the third full fiscal year post-closing(2) Broadens Post’s Product Portfolio Expected to significantly increase presence in the growing bagged and hot cereal segments(3) Pro forma for the combination, Post / MOM Brands expected to have 16 of the top 50 RTE cereal brands; MOM Brands currently owns 9 of the top 50 RTE cereal brands(3) Post / MOM Brands will own a diverse portfolio of complementary RTE cereal and hot cereal products Significant Value Creation Opportunity Expected to strengthen Post’s long-term growth potential and is expected to be immediately accretive to Post’s Adjusted EBITDA margins and free cash flow(4) Substantial cash flow generation potential enables Post to reduce leverage and fund growth over the long-term $200mm in expected tax benefits arising from the transaction and from the significant capital investments that MOM Brands has made in the preceding 5 years(5) (1) Value segment defined as MOM Brands (Bags and Boxes), Private Label (Bags and Boxes) and Post Bags. (2) One-time costs to achieve synergies are estimated to be between $70mm and $80mm. (3) ACNielsen xAOC, 52 weeks ended December 27, 2014. U.S. data only. (4) Excluding one-time transaction expenses. (5) Based on Post management’s NPV estimate of tax benefits.

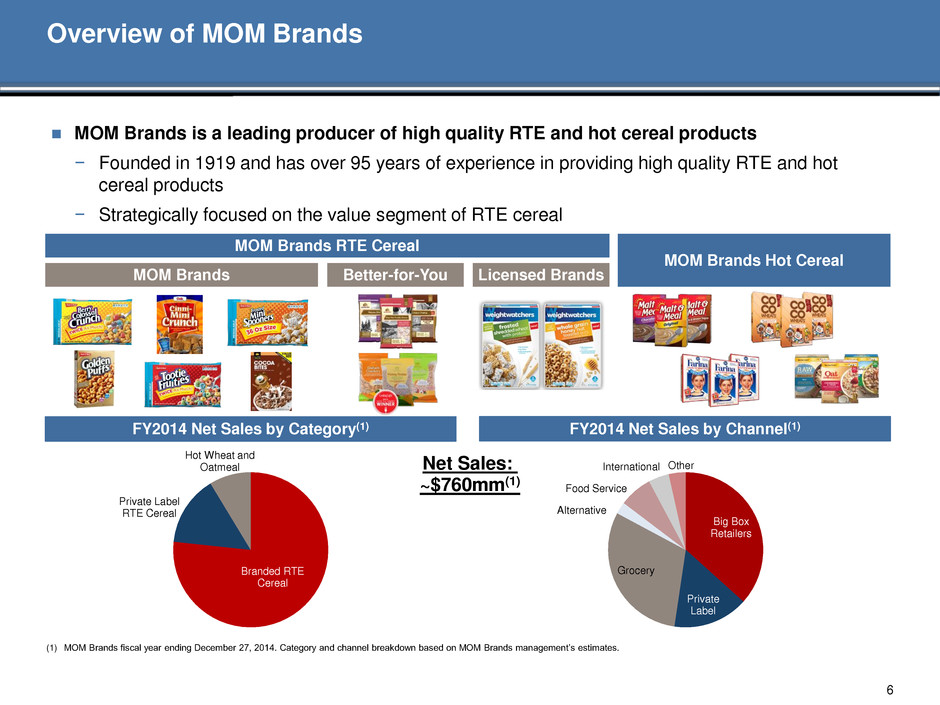

Overview of MOM Brands 6 MOM Brands is a leading producer of high quality RTE and hot cereal products − Founded in 1919 and has over 95 years of experience in providing high quality RTE and hot cereal products − Strategically focused on the value segment of RTE cereal Branded RTE Cereal Private Label RTE Cereal Hot Wheat and Oatmeal Big Box Retailers Private Label Grocery Alternative Food Service International Other Net Sales: ~$760mm(1) MOM Brands RTE Cereal MOM Brands Hot Cereal MOM Brands Better-for-You Licensed Brands FY2014 Net Sales by Category(1) FY2014 Net Sales by Channel(1) (1) MOM Brands fiscal year ending December 27, 2014. Category and channel breakdown based on MOM Brands management’s estimates.

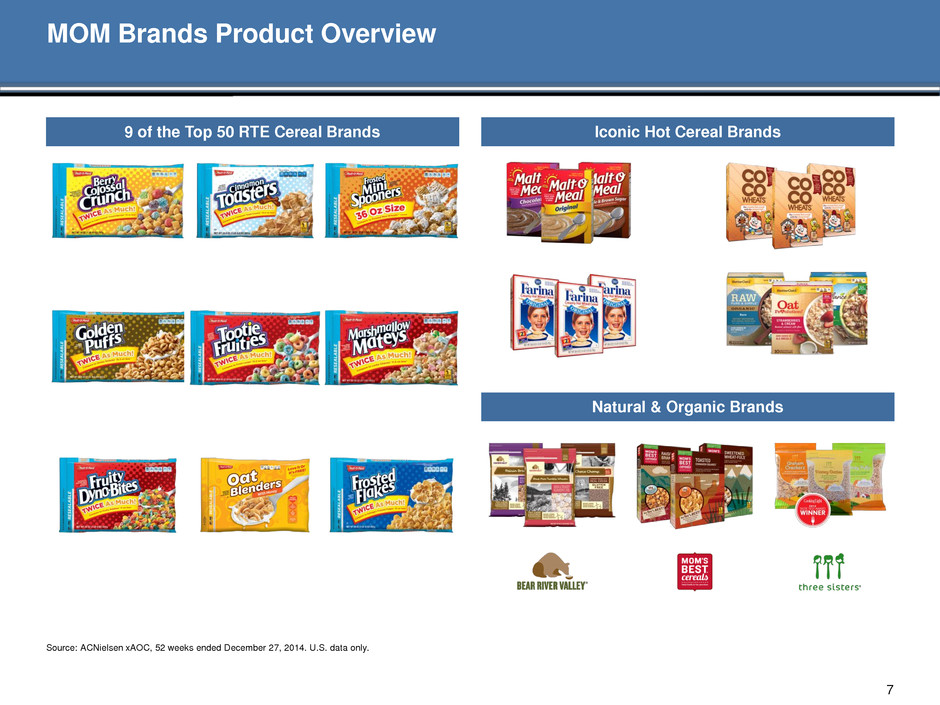

Iconic Hot Cereal Brands Natural & Organic Brands 9 of the Top 50 RTE Cereal Brands MOM Brands Product Overview 7 Source: ACNielsen xAOC, 52 weeks ended December 27, 2014. U.S. data only.

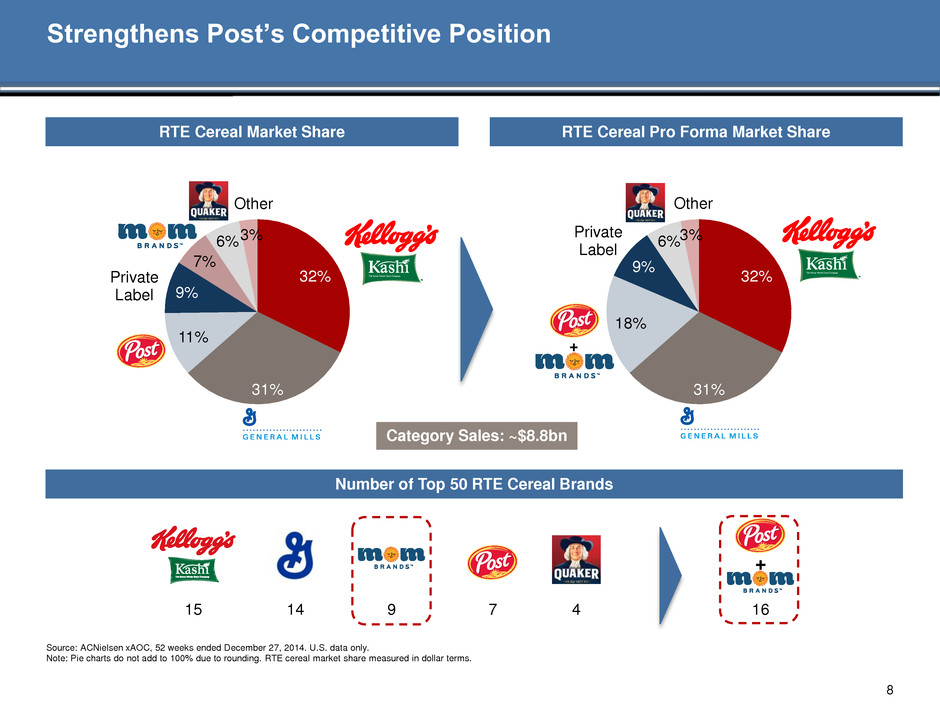

Strengthens Post’s Competitive Position Source: ACNielsen xAOC, 52 weeks ended December 27, 2014. U.S. data only. Note: Pie charts do not add to 100% due to rounding. RTE cereal market share measured in dollar terms. 32% 31% 11% 9% 7% 6% 3% The Seven Whole Grain CompanyPrivate Label Other Category Sales: ~$8.8bn RTE Cereal Market Share RTE Cereal Pro Forma Market Share 32% 31% 18% 9% 6% 3% The Seven Whole Grain Company Private Label Other + 15 4 7 9 14 + 16 Number of Top 50 RTE Cereal Brands 8

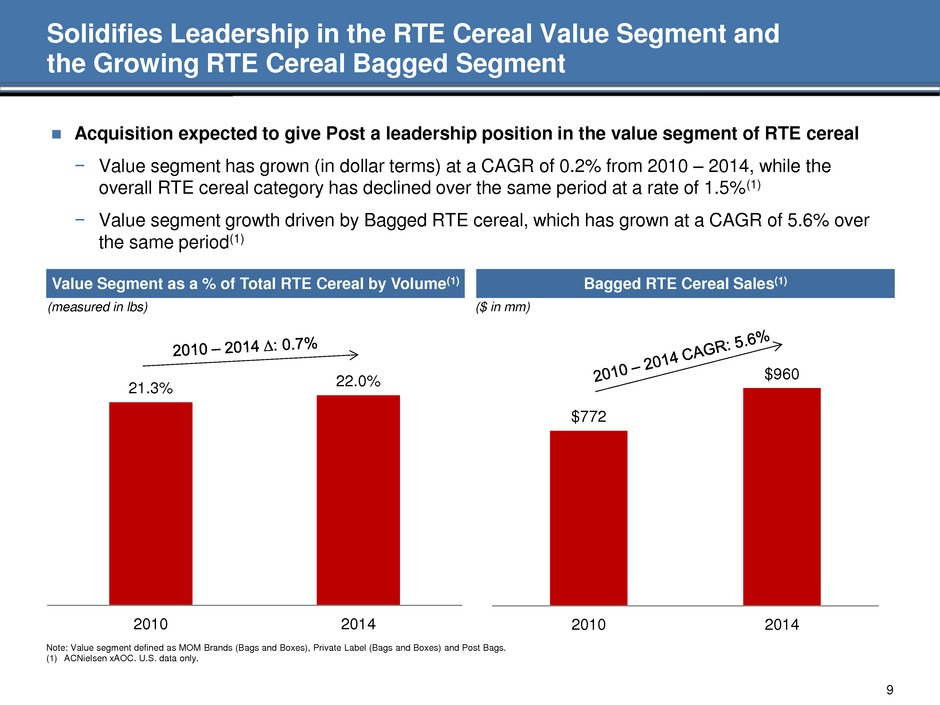

21.3% 22.0% 2010 2014 Solidifies Leadership in the RTE Cereal Value Segment and the Growing RTE Cereal Bagged Segment 9 Acquisition expected to give Post a leadership position in the value segment of RTE cereal − Value segment has grown (in dollar terms) at a CAGR of 0.2% from 2010 – 2014, while the overall RTE cereal category has declined over the same period at a rate of 1.5%(1) − Value segment growth driven by Bagged RTE cereal, which has grown at a CAGR of 5.6% over the same period(1) ($ in mm) Value Segment as a % of Total RTE Cereal by Volume(1) Bagged RTE Cereal Sales(1) $772 $960 2010 2014 Note: Value segment defined as MOM Brands (Bags and Boxes), Private Label (Bags and Boxes) and Post Bags. (1) ACNielsen xAOC. U.S. data only. (measured in lbs)

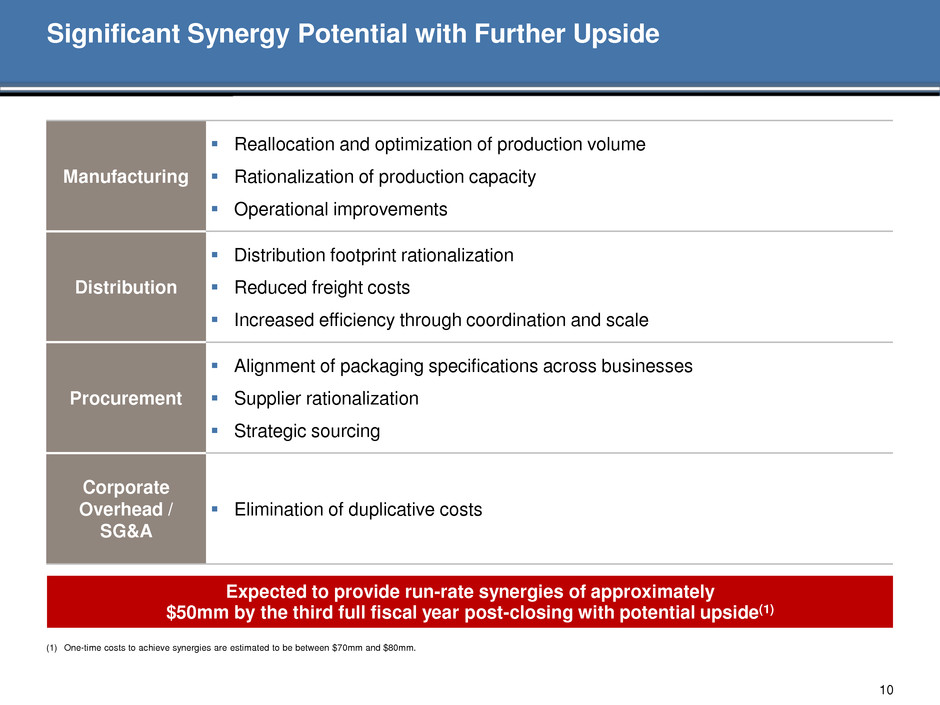

Significant Synergy Potential with Further Upside 10 Manufacturing Reallocation and optimization of production volume Rationalization of production capacity Operational improvements Distribution Distribution footprint rationalization Reduced freight costs Increased efficiency through coordination and scale Procurement Alignment of packaging specifications across businesses Supplier rationalization Strategic sourcing Corporate Overhead / SG&A Elimination of duplicative costs Expected to provide run-rate synergies of approximately $50mm by the third full fiscal year post-closing with potential upside(1) (1) One-time costs to achieve synergies are estimated to be between $70mm and $80mm.

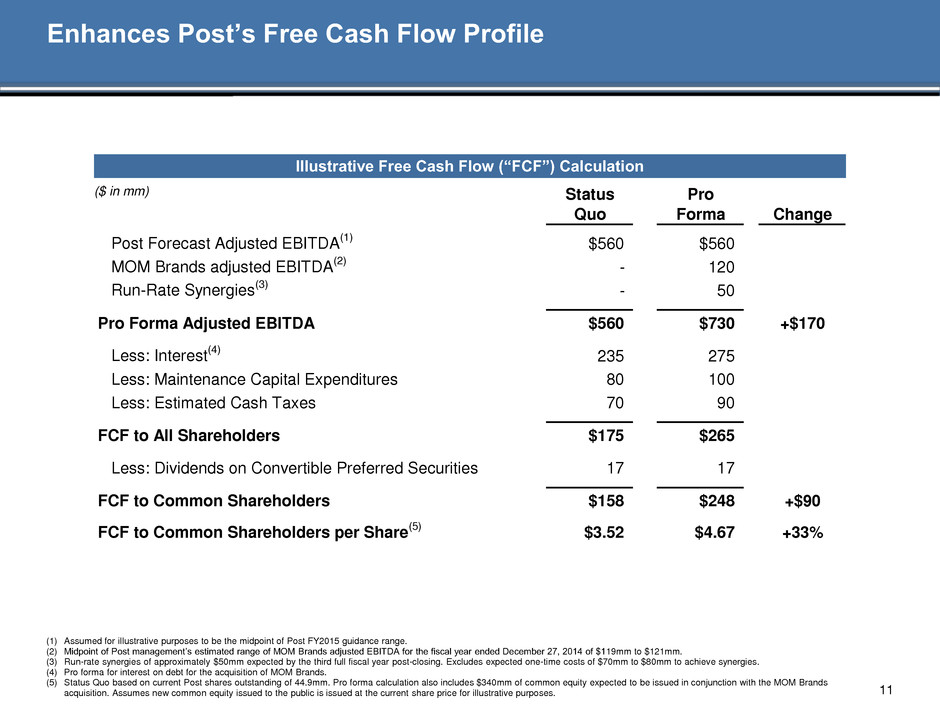

Enhances Post’s Free Cash Flow Profile 11 (1) Assumed for illustrative purposes to be the midpoint of Post FY2015 guidance range. (2) Midpoint of Post management’s estimated range of MOM Brands adjusted EBITDA for the fiscal year ended December 27, 2014 of $119mm to $121mm. (3) Run-rate synergies of approximately $50mm expected by the third full fiscal year post-closing. Excludes expected one-time costs of $70mm to $80mm to achieve synergies. (4) Pro forma for interest on debt for the acquisition of MOM Brands. (5) Status Quo based on current Post shares outstanding of 44.9mm. Pro forma calculation also includes $340mm of common equity expected to be issued in conjunction with the MOM Brands acquisition. Assumes new common equity issued to the public is issued at the current share price for illustrative purposes. Illustrative Free Cash Flow (“FCF”) Calculation ($ in mm) Status Pro Quo Forma Change Post Forecast Adjusted EBITDA (1) $560 $560 MOM Brands adjusted EBITDA (2) - 120 Run-Rate Synergies (3) - 50 Pro Forma Adjusted EBITDA $560 $730 +$170 Less: Interest (4) 235 275 Less: Maintenance Capital Expenditures 80 100 Less: Estimated Cash Taxes 70 90 FCF to All Shareholders $175 $265 Less: Dividends on Convertible Preferred Securities 17 17 FCF to Common Shareholders $158 $248 +$90 FCF to Common Shareholders per Share (5) $3.52 $4.67 +33%

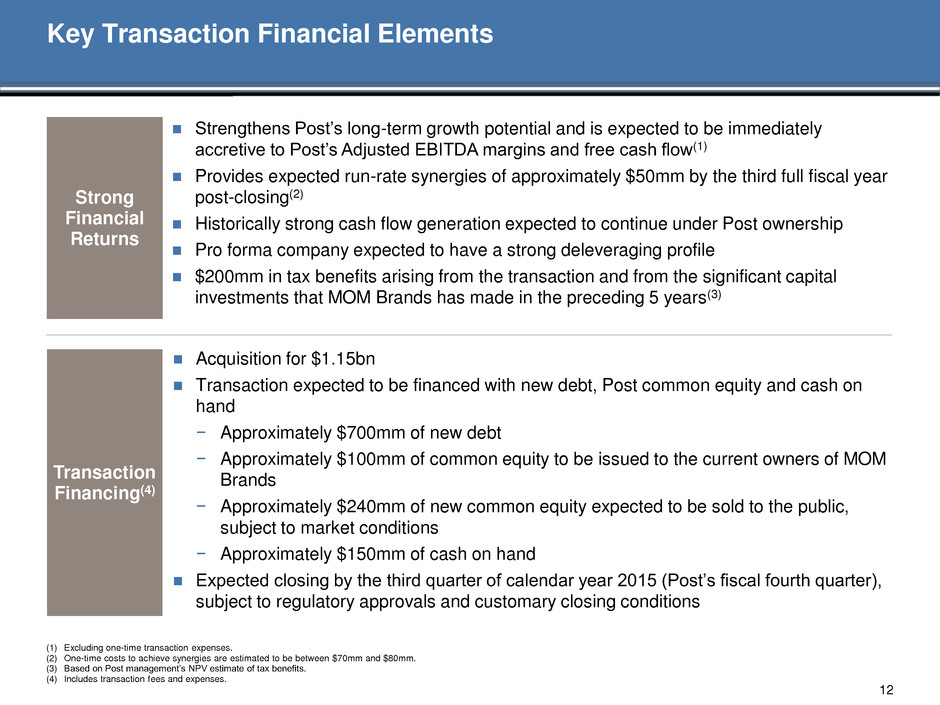

12 Strengthens Post’s long-term growth potential and is expected to be immediately accretive to Post’s Adjusted EBITDA margins and free cash flow(1) Provides expected run-rate synergies of approximately $50mm by the third full fiscal year post-closing(2) Historically strong cash flow generation expected to continue under Post ownership Pro forma company expected to have a strong deleveraging profile $200mm in tax benefits arising from the transaction and from the significant capital investments that MOM Brands has made in the preceding 5 years(3) Transaction Financing(4) Key Transaction Financial Elements Strong Financial Returns Acquisition for $1.15bn Transaction expected to be financed with new debt, Post common equity and cash on hand − Approximately $700mm of new debt − Approximately $100mm of common equity to be issued to the current owners of MOM Brands − Approximately $240mm of new common equity expected to be sold to the public, subject to market conditions − Approximately $150mm of cash on hand Expected closing by the third quarter of calendar year 2015 (Post’s fiscal fourth quarter), subject to regulatory approvals and customary closing conditions (1) Excluding one-time transaction expenses. (2) One-time costs to achieve synergies are estimated to be between $70mm and $80mm. (3) Based on Post management’s NPV estimate of tax benefits. (4) Includes transaction fees and expenses.

13 Update on Post’s Financials Q1 2015 Update(1) Full Year 2015 Guidance(1) The following are preliminary estimates for the fiscal quarter ended December 31, 2014 − Net sales of approximately $1,074mm − Adjusted EBITDA of approximately $126mm to $128mm versus previous guidance of $115mm to $120mm Each of Post’s businesses performed consistent with Post management’s expectations for fiscal Q1 2015 except for Post Foods and Michael Foods which outperformed Post management’s expectations Post management continues to expect fiscal 2015 Adjusted EBITDA to be between $540mm and $580mm, excluding any contribution from the acquisition of MOM Brands − Post management expects progressive improvement in quarterly Adjusted EBITDA throughout fiscal 2015 on a consolidated basis − Expected sequential improvement is primarily driven by recovery at Dymatize, seasonality and cost management initiatives at Post Foods and the timing of commodity cost decreases impacting operating results (1) See Post’s January 26, 2015 press releases and Form 8-Ks for further details.

Key Takeaways 14 Opportunistic transaction, close to home Highly strategic transaction − Expected to increase Post’s scale and market position in the RTE cereal category, solidifying leadership in the value segment − Broadens Post’s product portfolio, significantly increasing presence in the growing bagged and hot cereal segments Attractive valuation − 7.9x LTM adjusted EBITDA (net of expected tax benefits)(1) and 5.6x LTM run-rate synergized adjusted EBITDA (net of expected tax benefits)(2) Resulting in compelling financial impact − Expected to be immediately accretive to Post’s Adjusted EBITDA margins and free cash flow(3) − Significant synergy potential with further upside Post is delivering on earnings expectations − Q1 2015 above the high end of previously announced Adjusted EBITDA guidance − Affirming FY2015 guidance (1) Multiple of 7.9x represents: (i) purchase price of $1.15bn minus estimated $200 NPV of tax benefits, divided by (ii) midpoint of estimated range for MOM Brands LTM December 27, 2014 adjusted EBITDA. (2) Multiple of 5.6x represents: (i) purchase price minus estimated NPV of tax benefits, divided by (ii) midpoint of estimated range for MOM Brands LTM December 27, 2014 adjusted EBITDA plus $50mm expected run-rate synergies (excluding one-time costs to achieve synergies). (3) Excluding one-time transaction expenses.

15 Post Holdings, Inc.