Attached files

| file | filename |

|---|---|

| EX-4.1 - EX-4.1 - Asante Solutions, Inc. | d795546dex41.htm |

| EX-3.1 - EX-3.1 - Asante Solutions, Inc. | d795546dex31.htm |

| EX-5.1 - EX-5.1 - Asante Solutions, Inc. | d795546dex51.htm |

| EX-4.2.1 - EX-4.2.1 - Asante Solutions, Inc. | d795546dex421.htm |

| EX-23.3 - EX-23.3 - Asante Solutions, Inc. | d795546dex233.htm |

| EX-23.1 - EX-23.1 - Asante Solutions, Inc. | d795546dex231.htm |

| EX-10.15 - EX-10.15 - Asante Solutions, Inc. | d795546dex1015.htm |

| EX-10.17 - EX-10.17 - Asante Solutions, Inc. | d795546dex1017.htm |

| EX-10.16 - EX-10.16 - Asante Solutions, Inc. | d795546dex1016.htm |

| EX-10.18 - EX-10.18 - Asante Solutions, Inc. | d795546dex1018.htm |

| EX-10.19 - EX-10.19 - Asante Solutions, Inc. | d795546dex1019.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 23, 2015.

Registration No. 333-201164

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Asante Solutions, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 3841 | 20-8090774 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

352 East Java Drive

Sunnyvale, CA 94089

(408) 716-5600

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

David Thrower

President and Chief Executive Officer

Asante Solutions, Inc.

352 East Java Drive

Sunnyvale, CA 94089

(408) 716-5600

(Names, address, including zip code, and telephone number, including area code, of agents for service)

Please send copies of all communications to:

| Richard A. Kline Rezwan D. Pavri Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, California 94025 (650) 752-3100 |

Donald J. Murray Brian K. Rosenzweig Covington & Burling LLP 620 Eighth Avenue New York, New York 10018 (212) 841-1000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||

| Common stock, $0.001 par value per share |

$60,375,000 | $7,016 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes offering price of the additional shares that the underwriters have the option to purchase. |

| (2) | The registrant previously paid $5,229 of the total registration fee in connection with the initial filing of this registration statement on December 19, 2014. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

(Subject to Completion, dated January 23, 2015)

PRELIMINARY PROSPECTUS

3,500,000 Shares

Common Stock

We are offering 3,500,000 shares of our common stock. This is our initial public offering, and no public market currently exists for our shares. We anticipate that the initial public offering price will be between $13.00 and $15.00 per share.

Prior to this offering, there has been no public market for our common stock. We have applied to have our common stock listed on The NASDAQ Global Market under the symbol “PUMP”.

Certain existing stockholders have agreed to purchase $17.1 million of our common stock in a private placement that will close concurrently with this offering at a price per share equal to the public offering price. The sale of such shares will not be registered under the Securities Act of 1933, as amended. Based on the midpoint of the estimated price range listed above, we would sell 1,221,428 shares of common stock in this concurrent private placement. The underwriters will serve as placement agents for the concurrent private placement and receive the same discount on shares purchased by the private placement participants as they will on shares sold to the public in this offering.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk Factors” beginning on page 16 of this prospectus.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us from this offering, before expenses |

$ | $ | ||||||

| Proceeds to us from this offering and the concurrent private placement, before expenses |

$ | $ | ||||||

|

|

||||||||

| (1) We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting.” |

| |||||||

We have granted the underwriters an option for a period of 30 days after the date of the underwriting agreement relating to this offering to purchase up to an additional 525,000 shares of common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock sold in this offering to investors on or about , 2015. The closing of this offering is not conditioned upon the closing of the concurrent private placement.

| Leerink Partners | Cowen and Company |

| Wells Fargo Securities | Oppenheimer & Co. |

The date of this prospectus is , 2015

Table of Contents

|

|

The SHORTEST Step to PUMPING IS A SNAP

READY SNAP GO

ASANTE SNAP

Table of Contents

| Page | ||||

| 1 | ||||

| 16 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 56 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

58 | |||

| 75 | ||||

| 102 | ||||

| 110 | ||||

| 120 | ||||

| 125 | ||||

| 129 | ||||

| 134 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders of Our Common Stock |

136 | |||

| 140 | ||||

| 145 | ||||

| 145 | ||||

| 145 | ||||

| F-1 | ||||

We and the underwriters have not authorized anyone to provide any information or make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or the underwriters or to which we or the underwriters have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

For investors outside of the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

i

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider before deciding whether to purchase shares of our common stock. You should read this entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before making an investment decision. Unless expressly indicated or the context requires otherwise, the terms “Asante,” “company,” “we,” “us,” and “our” in this prospectus refer to Asante Solutions, Inc., a Delaware corporation, and, where appropriate, its wholly-owned subsidiaries.

Overview

We are a medical device company with the mission of improving and simplifying the management of diabetes for patients and healthcare practitioners. Our first commercial product, the Asante Snap™ Insulin Pump System, or the Snap system, is the first and only pump featuring a modular design with pre-filled insulin cartridges and disposable pump bodies, intended to be used for up to a week, which are utilized in combination with a slim, lightweight controller intended to be used for four years. The modular design is enabled by several technological innovations including an innovative pump drive mechanism. Traditional insulin pumps require users to fill the pump’s reservoir multiple times per week from a vial of insulin with a syringe-type system, which is time consuming and cumbersome. The Snap system’s cartridges are pre-filled with 300 units of insulin and slide directly into the disposable pump body. The Snap system’s modular design enables a novel, consumer-oriented business model with free trials, $99 upgrades and lower upfront costs. The Snap system’s use of pre-filled insulin cartridges and its novel interface enable a pump that is simple to learn, set-up and use. As a result, based on independent market research, our own research and analysis and our limited commercial experience to date, we believe that the Snap system is an attractive choice as a first pump for individuals initiating insulin pump therapy, as well as for existing pumpers seeking greater ease of use. In January 2013, we received regulatory clearance, which we refer to as 510(k) clearance, from the U.S. Food and Drug Administration, or the FDA, to market the Snap system. Currently, the Snap system is only approved for use by adults over the age of 21 and has 510(k) clearance for use only with Humalog insulin cartridges which represent approximately 50% of the pre-filled insulin cartridge market. We initiated a limited launch in the second quarter of 2013 and intend to use the proceeds of this offering to accelerate commercialization of the Snap system in the United States.

We developed the Snap system to be a full-featured pump that is easy to use and that addresses several barriers to adoption for patients who have resisted insulin pump therapy in favor of multiple daily injections using a syringe or insulin pen. These barriers include complexity of pump set up, complexity of ongoing pump use, high out-of-pocket cost of pump acquisition, inability to try the pump before purchasing and the need to make a four-year commitment to therapy consistent with payor reimbursement cycles. Our solution addresses these concerns both through product features of the Snap system and a novel, consumer-oriented business model enabled by the Snap system’s modular design, including:

| • | Pre-filled insulin cartridges, auto-priming and intuitive user interface increases ease of use. A key feature of the Snap system is the pre-filled insulin cartridge, which saves pump set-up steps and allows users to simply change insulin cartridges approximately once a week instead of having to use a vial and syringe to fill the pump reservoir two to three times per week as is necessary with insulin pumps currently available, which we refer to as traditional pumps. We believe that this saves as many as 120 steps and as much as 25 minutes per week, as well as reduces the potential for troublesome air bubbles. The Snap system also incorporates a technology that allows for auto-priming, whereby, without user intervention, the infusion tubing is automatically and rapidly filled with insulin every time a new cartridge is inserted. In addition, the disposable pump body, which contains a fresh battery, is replaced every week, eliminating the need to change or charge a battery. Our marketing literature and |

1

Table of Contents

| advertising campaigns highlight the short set-up time with a tagline of “Less prep time. More life time.” The Snap system is also slim and lightweight, weighing 25% less than the leading traditional pump, and has an intuitive user interface. |

| • | Modular design enables novel business model with free trials, $99 upgrades and lower upfront costs. Instead of pump candidates generally needing to make a purchase commitment by simply looking at demo pumps in the healthcare provider’s office, patients can actually wear the Snap system and pump insulin for up to 28 days at no cost to them or their payor. In our limited commercial experience, over a twelve month period, 207 out of our 350 trial users, or approximately 59%, purchased the Snap system after the free trial period. Additionally, we offer patients the ability to upgrade their controller—the electronic pump component designed to be used for four years—any time there is a significant Asante product release for $99 per upgrade. We believe that this will differentiate us in a marketplace where major innovations can occur and should occur more rapidly than the standard four-year reimbursement cycle. Finally, the upfront cost for the Snap system is expected to be approximately $1,000 when sold directly, in comparison to traditional pumps, which have upfront costs typically ranging from $4,000 to $6,000. We believe that the significantly lower upfront cost relative to traditional pumps is attractive to patients who often have out-of-pocket insurance co-pays of approximately 20% of the costs. |

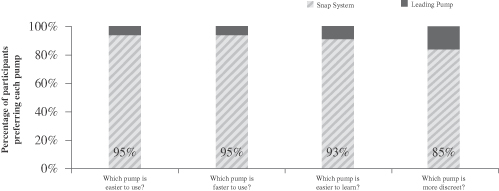

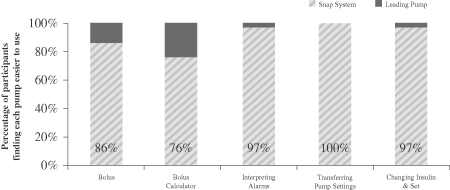

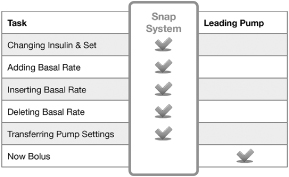

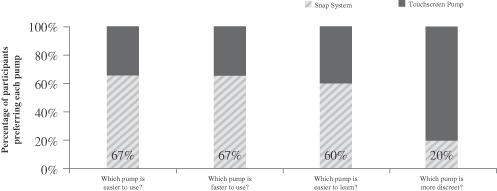

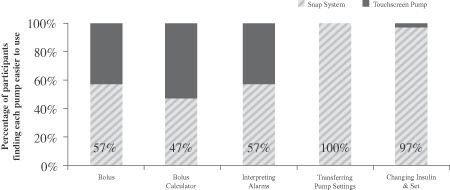

Following receipt of FDA 510(k) clearance, we conducted three market research studies to test our go-to-market hypotheses in 2013 prior to our domestic product launch and a fourth market research study in 2014. One of the studies was a comparative study designed to understand the interaction between devices and the people who use them, or a comparative human factors study, which was initiated in 2013 and expanded in 2014 by Human Factors MD, an independent third-party market research firm. This study compared the Snap system to the market-leading (Medtronic) pump using 58 subjects that were managing their diabetes with multiple daily injections. Participants used both the Snap system and the market-leading pump over a four-hour period in a laboratory setting to perform common tasks and simulate a “day in the life” of a pump user. Study subjects found using the Snap system to be faster and easier to learn than the market-leading pump. When given a choice, 97% of the participants preferred the Snap system to the leading competitor. The same study demonstrated that exposure to the Snap system nearly doubled patient preference for pump therapy over multiple daily injections. Our other two pre-launch market research studies, one of which was conducted in the United States and one of which was conducted in the United Kingdom, compared the Snap system to traditional insulin pumps using subjects that were already managing their diabetes through insulin pump therapy using a traditional pump system. The U.K. study enrolled 19 participants and found that 35% of the participants preferred the Snap system to their current pump after wearing the Snap system for four weeks. The U.S. study enrolled 34 participants, 29 of whom were also diabetes educators, and found that 45% of the subjects said they were more likely to choose the Snap system as their next insulin pump after wearing the Snap System for four weeks. Further, the diabetes educator participants said that the Snap system would be a good choice for 57% of their patients.

In late 2014, Human Factors MD conducted an additional study to compare the Snap system to the Tandem t:slim pump with a touchscreen using 30 subjects that were managing their diabetes with multiple daily injections. Participants used both the Snap system and the Tandem t:slim pump over approximately a four-hour period in a laboratory setting to perform common tasks and simulate a “day in the life” of a pump user. Study subjects found the Snap system to be faster and easier to use. Further, participants rated both pumps on the System Usability Scale, or SUS, a validated scale that has become a standard in system usability. Based on the SUS, participants rated the Snap system as more usable than the Tandem t:slim pump. Overall, 60% of the participants preferred the Snap system over the Tandem t:slim pump (although preference for the Snap system was not statistically significant, which means that this result could have occurred by chance rather than based on actual participant preference).

Our limited launch in the second quarter of 2013 was designed to provide us with early real-world commercial experience while we worked to significantly reduce our cost of goods and expand our addressable market. Our direct cost per disposable pump body was reduced by 70% from 2012 to May 2014 and by an

2

Table of Contents

additional 70% from May 2014 to July 2014 through process optimization and manufacturing transfer to an off-shore contractor. The first commercial-ready disposable pump bodies from our China-based contract manufacturer were ready in volume in July 2014. In parallel, we have been working to expand our addressable market opportunity through the filing of separate 510(k) applications with the FDA for use of the Snap system with pediatrics (ages 10 through 21), which we submitted and the FDA accepted for review in the first quarter of 2015, and for a modified pump body designed to accommodate a Novolog pre-filled insulin cartridge which we plan to submit to the FDA in 2015; as currently, the Snap system has 510(k) clearance for use only with Humalog cartridges. The pediatric population represents a significant portion of the installed base of pumpers and a significant future opportunity for us. Even after we receive FDA clearance for a modified pump body designed to accommodate a Novolog pre-filled insulin cartridge, we will not be able to launch the sale of the Snap system for use with Novolog until we receive new infusion sets that are designed to work with Novolog pre-filled insulin cartridges from our manufacturer, Unomedical A/S. Novolog, produced by Novo Nordisk, an affiliate of one of our greater than 5% stockholders, and Humalog, produced by Eli Lilly, each have approximately half of the rapid-acting pre-filled insulin cartridge market. Both Humalog and Novolog are similar types of rapid-acting insulin that are often prescribed interchangeably, though physician preference, perceived differences in efficacy and brand loyalty may lead patients to opt to use only one of these insulin therapies. Additionally, physicians and diabetes educators may be reluctant to recommend the Snap system to patients until we receive FDA approval for use with Novolog pre-filled insulin cartridges due to the perceived additional administrative burden for physicians and diabetes educators of needing to determine which patients are Humalog users before recommending the Snap system.

We have initiated our launch of MySnap™, which provides aesthetic enhancements to the current Snap system, with a color screen and options for user customization of the color and aesthetic features of the pump controller. Our product development strategy also includes designing additional features including wireless communication capabilities, integrating with continuous glucose monitoring systems and blood glucose monitoring systems, creating partnerships with open source data companies to allow end-user and professional application development and additional aesthetic enhancements. In furtherance of these strategies, in August 2014, we entered into a memorandum of understanding related to the development and commercialization of a smartphone application with Dexcom, a manufacturer of continuous glucose monitoring systems. Under the terms of this arrangement, we will integrate data from the Snap system with Dexcom’s G5 sensor data into Dexcom’s smartphone application to allow users to simultaneously access continuous glucose monitoring and pump data as they manage their glucose levels.

The Market Opportunity

Diabetes is a chronic, life-threatening disease that is characterized by the body’s inability to properly metabolize glucose. Management of glucose is regulated by insulin. Insulin is a hormone that allows cells in the body to absorb glucose from blood and convert it into energy. Diabetes occurs when the pancreas does not produce enough insulin or the body cannot effectively use the insulin it produces. As a result, a person with diabetes cannot utilize glucose properly and it continues to accumulate in the blood. If not closely monitored and properly treated, diabetes can lead to serious medical complications, including damage to various tissues and organs, seizures, coma and death.

Diabetes impacts an estimated 347 million people worldwide and approximately 30 million people in the United States. In 2014, approximately 6.5 million people in the United States require daily administration of insulin, which includes approximately 1.7 million people with Type 1 diabetes and approximately 4.8 million people with Type 2 diabetes. Throughout this prospectus, we refer to the combination of people with Type 1 diabetes and people with Type 2 diabetes who are insulin dependent as “people with insulin-dependent diabetes.”

The two primary therapies practiced by people with insulin-dependent diabetes are insulin injections and insulin pumps, each of which is designed to supplement or replace the insulin-producing function of the

3

Table of Contents

pancreas. Multiple daily injection therapy, or MDI therapy, involves the use of syringes or insulin pens to inject insulin into the person’s body up to six times per day. Insulin pumps are used to perform what is often referred to as continuous subcutaneous insulin infusion, or insulin pump therapy, and typically use a programmable device and an infusion set to administer insulin into the person’s body.

The U.S. insulin pump market is expected to be approximately $1.4 billion in 2014. Close Concerns estimates that the compound annual growth rate will be 8.6% over the next four years, growing the market to $1.9 billion in 2018. According to the American Association of Diabetes Educators, insulin pump therapy is considered the “gold standard” of care for people with insulin-dependent diabetes. Notwithstanding the potential advantages of insulin pump therapy, we believe that only 28% of the U.S. Type 1 diabetes population (or approximately 470,000 people) use an insulin pump. Approximately 2% of the U.S. Type 2 diabetes population on insulin (or approximately 100,000 people) use an insulin pump.

We believe that the adoption of insulin pump therapy has been limited by the perceived shortcomings of the insulin pumps that are currently available, which we refer to as traditional pumps, and the barriers created by the business models of insulin pump companies. These product shortcomings and barriers to pump adoption include:

| • | Time-consuming and difficult pump set-up, as users need to fill the pump’s reservoir and change out the insulin multiple times per week; |

| • | Difficult to learn, teach and use; |

| • | Limited or no opportunity to try before purchasing; |

| • | Limited product upgrade opportunities. Most insurance companies will only pay for a new insulin pump once every four years, which generally means most patients use the same pump, features and technology for that entire time period, despite advancements that may be made; and |

| • | High upfront cost of pump acquisition which is split between the patient and the payor. |

By addressing these issues, there is a meaningful opportunity to not only motivate eligible MDI patients to adopt pump therapy, but also to address the concerns and unmet needs of traditional insulin pump users.

Our Solution

Our Snap system is a full-featured pump that we believe is an attractive choice as an initial pump for individuals starting insulin pump therapy, as well as for existing pumpers seeking greater ease of use. The Snap system is the first and only modular pump that uses a pre-filled insulin cartridge. We are employing a novel, consumer-oriented business model, enabled by the Snap system’s modular design that deviates from traditional insulin pump company business practices. We believe that the key elements of our business model and differentiated product features of the Snap system include:

Consumer-Oriented Business Model

| • | Free trial. We believe that we are the only pump manufacturer that offers patients a free trial program as an integral part of its strategy. Instead of simply viewing various demo pumps in the healthcare provider’s office, patients can use the Snap system to pump insulin for up to 28 days at no cost to them or to payors. We believe that this will reduce some of the barriers to starting on a pump, since traditional pumps cost approximately $1,000 out-of-pocket to the patient just to get started, and many patients do not know if they will actually prefer pumping over MDI therapy. Our ability to offer the free trial program is directly related to the Snap system’s modular design as the disposable pump bodies are simply discarded and we are able to cost-effectively reuse the returned trial controllers by performing a simple test on the electronics. Other manufacturers may offer 30-day return policies, but |

4

Table of Contents

| they still require a high upfront payment and the patient may be delayed or have difficulty getting reimbursed for the out-of-pocket cost of returning a pump due to often complex, protracted interactions with pump companies, payors and/or distributors. In contrast, patients taking advantage of our free trial period do not incur any out-of-pocket costs to begin using the Snap system and do not have to involve pump companies, third-party payors or distributors in an attempt to be reimbursed for out-of-pocket costs should they decide during the free trial period that they do not want to continue using the Snap system. |

| • | $99 upgrade program. The modular design of the Snap system allows us to offer a program through which patients can upgrade their controller for only $99 any time there is a significant Asante product release. We believe this will differentiate us in a marketplace where major innovations can and should occur more quickly than the standard four-year reimbursement cycle. We believe this difficult-to-replicate upgrade program will increase the Snap system’s attractiveness and increase patient loyalty. It will also mitigate patient and provider concerns that they will have to function without a major competitive or technological innovation for multiple years as they know that during our future upgrade cycles they will be able to obtain our latest technology for only $99. |

| • | Lower cost to start pumping. The upfront cost for the Snap system is expected to be approximately $1,000 when sold directly in comparison to traditional tubed pumps, which have upfront costs typically ranging from $4,000 to $6,000. We believe the significantly lower cost relative to traditional tubed pumps will be attractive to patients who often pay approximately 20% of the costs out-of-pocket. We believe that patients will view paying approximately $200 for the Snap system to be less of a barrier than paying approximately $1,000 for a traditional tubed pump, whether for MDI patients evaluating switching to pump therapy or existing pump users contemplating switching pumps. |

Differentiated Patient Experience

| • | Easy set-up with pre-filled insulin cartridge and auto-priming. The Snap system uses cartridges pre-filled with 300 units of insulin, thus eliminating the need to transfer insulin from a vial into a pump reservoir. Users simply insert the pre-filled cartridge into the pump body, and when the tubing connector is attached to the pump body, the infusion-set tubing is automatically primed. |

| • | Less frequent set-up. Most traditional pumps recommend changing insulin, reservoir and tubing every two to three days. Each time, the user needs to repeat the process of filling the reservoir with insulin from a vial and priming the pump, a combined process which may take up to 26 minutes per week. With the Snap system, the user changes the insulin and tubing approximately once a week and switches the infusion site two to three times per week. |

| • | Easy to learn and teach with intuitive user interface. In a comparative study conducted by an independent third-party market research firm, the Snap system was considered easier to use than the market-leading pump on delivering a bolus, using the bolus calculator, managing basal rates, changing insulin and other tasks. The user interface is designed to provide an on screen label describing the function of each of the control buttons, never forcing the user to remember or guess at their function. |

| • | Slim and lightweight. The Snap system is slim and 25% lighter than the market-leading pump. Weighing approximately three ounces, the Snap system is the lightest tubed insulin pump available on the market. |

| • | Integrated battery. Traditional pumps require the user to monitor battery levels and either replace or recharge the battery on a frequent basis. The Snap system’s innovative modular design means that the battery is housed within the disposable pump body and that each new disposable pump body contains a new battery. End users never need to change or charge a battery with the Snap system, nor purchase one separately. |

5

Table of Contents

| • | Novel safety features. The Snap system has additional safety features such as a drop-detector alarm, a wet-pump alarm and advanced optical-occlusion detection not found on other commercial pumps. |

| • | Customizable design. Our new MySnap pump allows users to go to the Asante Snap website, www.snappump.com, and choose their personalized color combination for the controller which is then manufactured to order. |

Risks Affecting Us

Our business is subject to numerous risks and uncertainties, including those highlighted in “Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | We have incurred significant operating losses in the past, and we may not be able to achieve or maintain profitability and if we are unable to raise additional funds or improve operating results, we may not be able to continue as a going concern; |

| • | Currently, we derive our revenue from sales of the Snap system, and any factors that negatively affect the sales of this product may harm our business, financial condition and results of operations; |

| • | The failure of the Snap system to achieve and maintain market acceptance could result in sales being below our expectations, which would harm our business, financial condition and results of operations; |

| • | The medical device industry is very competitive, and if we fail to successfully compete, our business and results of operations could be harmed; |

| • | If we or our potential customers fail to secure or retain adequate insurance coverage or are unable to receive reimbursement for the Snap system by third-party payors, our business, financial condition and results of operations could be harmed; |

| • | Our ability to sell our products is highly dependent on our ability to expand and maintain quality sales, marketing and clinical infrastructure; |

| • | Our sales and marketing efforts are substantially affected by the actions of independent distributors who are free to market products that compete with the Snap system and to alter the sales price of the Snap system. If we are unable to maintain or expand our network of independent distributors, our sales may be impacted; |

| • | If important assumptions about the potential market for our products are inaccurate, or if we have failed to understand what people with insulin-dependent diabetes are seeking in an insulin pump, our business and results of operations may be harmed; |

| • | While the total available market to address insulin-dependent diabetes is large, our products are currently available for use only in a small portion of the overall market. If we are unable to obtain necessary approvals and deploy our products for use broadly to address the total available insulin-dependent market, our business, results of operations and future growth rates may be harmed; |

| • | We have a material weakness in our internal control over financial reporting. If this material weakness persists or if we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired; and |

| • | The safety and efficacy of our products is not supported by long-term clinical data, which could limit sales, and our products could cause unforeseen negative effects. |

6

Table of Contents

Concurrent Private Placement

Certain existing stockholders have agreed to purchase $17.1 million of our common stock in a private placement that will close concurrently with this offering at a price per share equal to the public offering price. The underwriters will serve as placement agents for the concurrent private placement and receive the same discount on shares purchased by the private placement participants as they will on shares sold to the public in this offering.

Corporate Information

Our principal executive offices are located at 352 East Java Drive, Sunnyvale, California 94089 and our telephone number is (408) 716-5600. Our corporate website address is www.asantesolutions.com and our product website address is www.snappump.com. Information contained on, or that can be accessed through, our corporate and product websites is not incorporated by reference into this prospectus, and you should not consider information on our corporate or product websites to be part of this prospectus. We were incorporated in 2006 as a Delaware corporation under the name M2 Group Holdings, Inc. and changed our name to Asante Solutions, Inc. in April 2010.

The Asante Solutions design logo, “Asante Solutions” and our other registered and common law trade names, trademarks and service marks are the property of Asante Solutions, Inc. This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | Being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| • | Not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act, for an extended period of time; |

| • | Reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | Exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended, or the Securities Act, which such fifth anniversary will occur in 2020. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

7

Table of Contents

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

See “Risk Factors—Risks Related to Our Common Stock and this Offering—We are an “emerging growth company” and we do not know whether the reduced disclosure requirements and relief from certain other significant obligations that are applicable to emerging growth companies will make our common stock less attractive to investors” for certain risks related to our status as an emerging growth company.

8

Table of Contents

THE OFFERING

| Common stock offered by us |

3,500,000 shares |

| Common stock sold by us in the concurrent private placement |

Concurrently with this offering, certain of our existing stockholders will purchase from us in a private placement an aggregate of $17.1 million of common stock at a price per share equal to the initial public offering price. Based on an assumed initial public offering price of $14.00 per share, which is the midpoint of the price range set forth on the cover of this prospectus, this would be equal to 1,221,428 shares of common stock. A $1.00 increase in the assumed initial public offering price of $14.00 per share would decrease the aggregate number of shares that will be issued in the concurrent private placement by 81,428 shares. A $1.00 decrease in the assumed public offering price of $14.00 per share would increase the aggregate number of shares that will be issued in the concurrent private placement by 93,956 shares. We will receive the net proceeds after payment of placement agent fees and commissions with respect to the shares that are sold in the concurrent private placement. The sale of these shares to certain existing stockholders will not be registered in this offering and will be subject to a lock-up of at least 180 days. We refer to the private placement of these shares of common stock as the “concurrent private placement.” |

| Common stock to be outstanding after this offering and the concurrent private placement |

11,949,813 shares |

| Option to purchase additional shares |

We have granted the underwriters an option, which is exercisable within 30 days from the date of this prospectus, to purchase an aggregate of up to an additional 525,000 shares of common stock. See “Underwriting” for more information. |

| Use of Proceeds |

We estimate that our net proceeds from the sale of our common stock that we are offering and the concurrent private placement will be approximately $59.0 million (or approximately $65.8 million if the option to purchase additional shares is exercised in full), assuming an initial public offering price of $14.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting underwriting discounts and commissions, estimated offering expenses payable by us and placement agent discounts and commissions. |

| We intend to use a majority of the net proceeds we receive from this offering and the concurrent private placement to accelerate commercialization of the Snap system, including by adding to our salesforce, filing future 510(k) applications with the FDA and initiating product launches. We intend to use the remainder of the net proceeds from this offering and the concurrent private placement for general corporate purposes, including working capital, operating |

9

Table of Contents

| expenses and capital expenditures. We also may use a portion of the net proceeds to acquire complementary businesses, products, services or technologies. However, we do not have agreements or commitments for any specific acquisitions at this time. See “Use of Proceeds” for additional information. |

| Risk Factors |

You should read the “Risk Factors” section of this prospectus and other information in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Concentration of Ownership |

Upon completion of this offering and the concurrent private placement, our executive officers, directors and holders of 5% or more of our common stock will beneficially own, in the aggregate, approximately 74.9% of the outstanding shares of our common stock. |

Proposed NASDAQ Global Market trading symbol

| PUMP |

The number of shares of our common stock that will be outstanding after this offering and the concurrent private placement is based on 7,228,385 shares outstanding as of September 30, 2014, which includes:

| • | 6,347,619 shares outstanding as of September 30, 2014 (including the automatic conversion of 5,884,452 outstanding shares of convertible preferred stock into common stock); and |

| • | 880,766 shares of common stock, on an as-converted basis, issuable upon the cash exercise of warrants to purchase 880,766 shares of Series A-3 convertible preferred stock outstanding as of September 30, 2014, each with an exercise price of $0.13 per share, which would terminate upon this offering in accordance with their terms, if not exercised prior to the offering. |

The number of shares of our common stock to be outstanding after the completion of this offering and the concurrent private placement excludes:

| • | 783,176 shares of our common stock issuable upon the exercise of options to purchase shares of our common stock outstanding as of September 30, 2014, with a weighted-average exercise price of $3.54; |

| • | 738,819 shares of our common stock issuable upon the exercise of options to purchase shares of our common stock granted after September 30, 2014, with an exercise price of $4.81 per share; |

| • | 5,647 shares of our common stock issuable upon the exercise of options to purchase shares of our common stock granted after September 30, 2014 and to be effective on the date of the completion of this offering at an exercise price per share equal to the initial public offering price; |

| • | 7,838 shares of our common stock, on an as-converted basis, issuable upon the exercise of warrants to purchase shares of our Series A-1 convertible preferred stock outstanding as of September 30, 2014, with a weighted-average exercise price of $63.74 per share, 3,560 of which expired after September 30, 2014 and 4,278 of which are expected to remain outstanding after this offering unless exercised prior to this offering pursuant to their terms; |

| • | 46,152 shares of our common stock, on an as-converted basis, issuable upon the exercise of warrants to purchase shares of our Series A-3 convertible preferred stock issued after September 30, 2014 with an exercise price of $13.00 per share, which are expected to remain outstanding after this offering unless exercised prior to this offering pursuant to their terms; |

| • | 1,463,377 shares of our common stock reserved for future issuance under our 2015 Stock Option and Incentive Plan (which excludes the 738,819 shares referenced in the second bullet point of this |

10

Table of Contents

| paragraph and includes the 5,647 shares referenced in the third bullet point of this paragraph) which contains provisions that automatically increase its share reserve each year and includes 530,753 shares of common stock that were reserved under our 2007 Stock Plan (which excludes the 738,819 shares referenced in the second bullet point of this paragraph); and |

| • | 186,525 shares of our common stock reserved for issuance under our 2015 Employee Stock Purchase Plan, which will become effective upon the completion of this offering and contains provisions that automatically increase its share reserve each year. |

Unless otherwise indicated, other than in our consolidated financial statements, all information in this prospectus assumes:

| • | A one-for-thirteen reverse split of our common stock and convertible preferred stock that was effected on January 21, 2015; |

| • | The filing and effectiveness of our amended and restated certificate of incorporation and the effectiveness of our amended and restated bylaws, each of which is expected to occur immediately prior to the completion of this offering; |

| • | The automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 5,884,452 shares of our common stock, the conversion of which will occur immediately prior to the completion of this offering; and |

| • | No exercise of the underwriters’ option to purchase additional shares. |

11

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our historical consolidated financial data. We have derived the summary consolidated statement of operations data for the years ended December 31, 2012 and 2013 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated statement of operations data for the nine months ended September 30, 2013 and 2014 and our consolidated balance sheet data as of September 30, 2014 from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited interim consolidated financial statements reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for the fair presentation of the financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future and the results in the nine months ended September 30, 2014 are not necessarily indicative of results to be expected for the full year or any other period. The following summary financial and other data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||||||

| (In thousands, except share and per share data) | ||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||

| Revenue |

$ | — | $ | 292 | $ | 135 | $ | 964 | ||||||||

| Cost of revenue(1) |

— | 8,280 | 5,874 | 7,031 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross loss |

— | (7,988 | ) | (5,739 | ) | (6,067 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Research and development(1) |

4,147 | 3,762 | 2,868 | 3,429 | ||||||||||||

| Selling, general and administrative(1) |

6,597 | 10,228 | 6,971 | 13,581 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

10,744 | 13,990 | 9,839 | 17,010 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(10,744 | ) | (21,978 | ) | (15,578 | ) | (23,077 | ) | ||||||||

| Interest expense |

(1,656 | ) | (806 | ) | (429 | ) | (351 | ) | ||||||||

| Other income, net |

1 | 510 | 426 | 6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(12,399 | ) | (22,274 | ) | (15,581 | ) | (23,422 | ) | ||||||||

| Extinguishment of convertible preferred stock |

— | — | — | 73,430 | ||||||||||||

| Undistributed earnings allocated to preferred stockholders |

— | — | — | (45,576 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to common stockholders(2) |

$ | (12,399 | ) | $ | (22,274 | ) | $ | (15,581 | ) | $ | 4,432 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share attributable to common stockholders:(2) |

||||||||||||||||

| Basic |

$ | (547.50 | ) | $ | (982.69 | ) | $ | (687.02 | ) | $ | 9.85 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (547.50 | ) | $ | (982.69 | ) | $ | (687.02 | ) | $ | 8.29 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used to compute net income (loss) per share attributable to common stockholder:(2) |

||||||||||||||||

| Basic |

22,647 | 22,666 | 22,679 | 450,103 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

22,647 | 22,666 | 22,679 | 534,778 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(2) |

$ | (5.24 | ) | $ | (4.77 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Shares used to compute pro forma net loss per common share, basic and diluted (unaudited)(2) |

4,348,517 | 4,906,889 | ||||||||||||||

|

|

|

|

|

|||||||||||||

12

Table of Contents

| (1) | Includes stock-based compensation as follows: |

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||||||

| (In thousands) | ||||||||||||||||

| Cost of revenue |

$ | — | $ | 18 | $ | 11 | $ | 44 | ||||||||

| Research and development |

32 | 28 | 19 | 64 | ||||||||||||

| Selling, general and administrative |

112 | 105 | 75 | 257 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total stock-based compensation expense |

$ | 144 | $ | 151 | $ | 105 | $ | 365 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (2) | See Note 12 and Note 13 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the calculations of our basic and diluted net loss per common share, pro forma net loss per common share, and the weighted-average number of shares used in the computation of the per share amounts. |

Our consolidated balance sheet data as of September 30, 2014 is presented on:

| • | An actual basis; |

| • | A pro forma basis, giving effect to (i) the automatic conversion of the outstanding shares of our convertible preferred stock as of September 30, 2014 into 5,884,452 shares of our common stock, (ii) the issuance of an aggregate of 880,766 shares of our common stock upon the cash exercise of the Series A-3 convertible preferred stock warrants outstanding as of September 30, 2014 at an exercise price of $0.13 per share (which warrants will automatically be net exercised immediately prior to this offering if not previously exercised), (iii) the reclassification of the convertible preferred stock warrant liability to stockholders’ equity and (iv) the effectiveness of our amended and restated certificate of incorporation, as if such conversion and effectiveness had occurred on September 30, 2014; and |

| • | A pro forma as adjusted basis, giving effect to (i) the pro forma adjustments set forth above, (ii) the sale and issuance of 3,500,000 shares of our common stock by us in this offering, based upon the assumed initial public offering price of $14.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, (iii) the sale and issuance of 1,221,428 shares of our common stock by us in the concurrent private placement, based upon the assumed initial public offering price of $14.00 per share, which is the midpoint of the price range set forth on the cover of this prospectus after deducting placement agent discounts and commissions and (iv) the elimination of the derivative liability related to investor participation rights from our Series A-3 convertible preferred stock financing. |

The pro forma as adjusted information set forth in the table below is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering that will be determined at pricing.

| As of September 30, 2014(2) | ||||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted(1) |

||||||||||

| (Unaudited) | ||||||||||||

| (In thousands) | ||||||||||||

| Consolidated Balance Sheet Data(2): | ||||||||||||

| Cash and cash equivalents |

$ | 20,191 | $ | 20,306 | $79,279 | |||||||

| Working capital |

19,324 | 19,439 | 79,168 | |||||||||

| Total assets |

25,422 | 25,537 | 84,510 | |||||||||

| Convertible preferred stock warrant liability |

8,931 | — | — | |||||||||

| Derivative liability |

756 | 756 | — | |||||||||

| Convertible preferred stock |

45,701 | — | — | |||||||||

| Total stockholders’ (deficit) equity |

(33,261 | ) | 21,486 | 81,215 | ||||||||

13

Table of Contents

| (1) | Each $1.00 increase (decrease) in the assumed initial public offering price of $14.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase (decrease) our cash and cash equivalents, working capital, total assets and total stockholders’ (deficit) equity by approximately $3.3 million, assuming that the number of shares of our common stock offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and placement agent discounts and commissions payable by us. Each increase (decrease) of 1.0 million shares in the number of shares offered by us would increase (decrease) the amount of our cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $13.0 million, assuming an initial public offering price of $14.00 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and placement agent discounts and commissions payable by us. |

| (2) | This consolidated balance sheet data excludes the effects of the credit agreement we entered into with Square 1 Bank under which we borrowed $12.5 million subsequent to September 30, 2014. |

RECENT DEVELOPMENTS

Our estimated financial results for the three months ended December 31, 2014 presented below are preliminary and are subject to the completion of our quarter-end closing procedures and financial review. The preliminary financial data has been prepared by and is the responsibility of our management. PricewaterhouseCoopers LLP has not audited, reviewed, compiled or performed any procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. These estimates are not a comprehensive statement of our financial results for this period and should not be viewed as a substitute for full interim financial statements prepared in accordance with generally accepted accounting principles. Our actual results may differ from these estimates as a result of the completion of our quarter-end closing procedures, review adjustments and other developments that may arise between now and the time our financial results for this period are finalized, and such changes could be material.

While complete financial information as of and for such period is not available, based on the information and data currently available, our management preliminarily estimates that for the three months ended December 31, 2014, our revenue will be between $0.5 million and $0.6 million, compared to revenue for the three months ended December 31, 2013 of $0.2 million. The increase in revenue for the three months ended December 31, 2014 is primarily the result of an increase in the number of Snap system patients and resulting sales of Snap system disposable components.

Management preliminarily estimates that for the three months ended December 31, 2014, our gross loss will be between $1.7 million and $2.0 million, compared to $2.2 million for the three months ended December 31, 2013. The decrease in gross loss for the three months ended December 31, 2014 is primarily the result of lower per unit costs due to increased production volumes and the transfer of our disposable pump body manufacturing to a lower-cost third party. Results for both periods include adjustments to inventory to reflect the value at the lower of cost or market and excess manufacturing overhead costs.

In addition, management preliminarily estimates that for the three months ended December 31, 2014, our loss from operations will be between $11.4 million and $11.8 million, compared to $6.4 million for the three months ended December 31, 2013. This includes non-cash stock-based compensation expense of between $1.5 million and $1.7 million for the three months ended December 31, 2014 and $46,000 for the three months ended December 31, 2013. The increase in loss from operations for the three months ended December 31, 2014 is primarily the result of an increase in headcount to support our Snap system development and commercialization activities, the increase in non-cash stock-based compensation expense (due primarily to options granted during the three months ended December 31, 2014) and increased administrative expenses related to the growth in our operations and preparations for becoming a public company.

We had approximately $22.2 million in cash and cash equivalents at December 31, 2014.

14

Table of Contents

These estimated ranges and numbers are preliminary and may change. In addition, these preliminary results of operations for the three months ended December 31, 2014 are not necessarily indicative of the results to be achieved in any future period.

15

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks and uncertainties, together with all of the other information in this prospectus, before deciding whether to purchase shares of our common stock. If any of the following risks materialize, our business, financial condition, results of operations, and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment. For additional information, see “Special Note Regarding Forward-Looking Statements.”

Risks Relating to Our Business and Industry

We have incurred significant operating losses in the past, and we may not be able to achieve or maintain profitability and if we are unable to raise additional funds or improve operating results, we may not be able to continue as a going concern.

Since our incorporation in Delaware in November 2006, we have incurred significant net losses and we had an accumulated deficit of $51.4 million as of September 30, 2014, after giving effect to a $73.4 million gain on extinguishment of our convertible preferred stock related to our February 2014 recapitalization that reduced our accumulated deficit by such amount. Our operations have been primarily financed through sales of our preferred stock, issuances of debt and limited sales of our products. We have incurred significant operating expenses in connection with the development and expansion of our business. Substantially all of our financial resources have been used to fund research and development, preparation for commercial launch of our Snap insulin pump system, or the Snap system, including growing our marketing and salesforce, and assembling a management team.

In the second quarter of 2013, we began to commercially sell the Snap system on a limited basis. We operate at a substantial net loss and expect that we will continue to do so for at least the next several years. You should not rely on the revenue growth during any prior quarterly or annual period as an indication of our future performance.

We expect our costs and expenses to increase significantly in future periods as we continue to expend substantial financial resources on, among other things:

| • | Growing our sales and marketing infrastructure; |

| • | Funding ongoing research and development activities; |

| • | Increasing our manufacturing capabilities; |

| • | Obtaining regulatory clearance or approval to commercialize our products currently under development and to expand the scope of approval for our existing products; and |

| • | General administration, including personnel costs and legal and accounting expenses related to being a public company. |

Any future operating losses and the estimated timing of profitability are highly uncertain, especially given that we only recently began to commercialize the Snap system and have done so thus far on a limited basis. Currently our manufacturing costs, including overhead, exceed the revenue we generate from sales of our Snap system. If we are unable to maintain adequate revenue growth or to manage our expenses, we may continue to incur significant losses in the future and may not be able to achieve or maintain profitability. Any additional operating losses will have an adverse effect on our stockholders’ equity and we may not ever be able to achieve or sustain profitability, earn sufficient revenues and cash flows to continue our operations or continue as a going concern.

Currently, we derive our revenue from sales of the Snap system, and any factors that negatively affect the sales of this product may harm our business, financial condition and results of operations.

The Snap system is our revenue-generating commercial product. We expect to continue to derive our revenue from the sale of the Snap system and pump-related supplies. Currently, our Snap system is exclusively

16

Table of Contents

sold by several independent distributors and we are dependent upon these independent distributors for revenue. Therefore, our ability and our independent distributor’s ability to market and sell the Snap system will be the primary factor in our ability to generate revenue for the foreseeable future.

Sales of the Snap system may be negatively impacted by many factors, including:

| • | The failure of our independent distributors to sell our product and place orders promptly with us; |

| • | Our failure to enter into contracts with third-party payors on a timely basis and on acceptable terms; |

| • | Changes in reimbursement policies or rates for diabetes pump products and technologies, including the Snap system, by third-party payors; |

| • | Our ability to timely procure third-party manufactured pre-filled insulin cartridges or infusion sets; |

| • | Actual or perceived problems with the third-party manufactured pre-filled insulin cartridges or infusion sets necessary for use in the Snap system; |

| • | Negative publicity regarding diabetes pumps in general; |

| • | Failure of physicians or diabetes educators to recommend the Snap system; |

| • | Problems associated with expanding our manufacturing capabilities, or issues arising from the destruction, loss or temporary shutdown of our or our third-party manufacturing facilities; |

| • | Quality, capacity or cost challenges arising from our manufacture of the Snap system or arising from components supplied to us for use in the Snap system; |

| • | Patent or intellectual property infringement or misappropriation claims; and |

| • | Adverse regulatory or legal actions or claims relating to the Snap system or similar products or technologies. |

Any factors that negatively impact sales of our product, or result in sales of this product increasing at a lower rate than expected, would harm our business, financial condition and results of operations.

The failure of the Snap system to achieve and maintain market acceptance could result in sales being below our expectations, which would harm our business, financial condition and results of operations.

Our business depends on the Snap system reaching and maintaining market acceptance. We must demonstrate to people with insulin-dependent diabetes, as well as their caregivers and healthcare providers, that the Snap system is a suitable alternative to competitive products. To do this, we must distinguish our product from traditional insulin pump products and MDI therapy as well as alternative insulin treatment methodologies. We must educate people with diabetes, their caregivers and healthcare providers, as to the distinct features, ease-of-use, positive lifestyle impact and other perceived benefits of the Snap system as compared to competitive products. If we are not successful in convincing existing and potential customers, as well as physicians and other healthcare providers, of the benefits of the Snap system and if we are not able to achieve the support of caregivers and healthcare providers for the Snap system, our sales may decline or we may fail to increase our sales in line with our expectations.

Our ability to achieve and maintain market acceptance of the Snap system could be prohibitively difficult and negatively impacted by several factors, including, among other things:

| • | Lack of evidence supporting the safety, ease-of-use or other perceived benefits of the Snap system over competitive products or other currently available insulin treatment methodologies; |

| • | Perceived risks associated with the use of the Snap system or similar products or technologies generally; |

| • | Relative pricing of competitive products and therapies to payors and patients; |

17

Table of Contents

| • | Relative insurance coverage of competitive products and therapies; |

| • | The introduction of new competitive products or therapies and a higher rate of acceptance of those products by consumers or healthcare practitioners as compared to the Snap system; |

| • | Actual or perceived difficulty for caregivers, healthcare providers or patients in using the pump or the related software; and |

| • | Results of clinical studies relating to the Snap system or similar competitive products. |

If the Snap system is perceived as more complicated or less effective than traditional insulin therapies by people with insulin-dependent diabetes, their caregivers or healthcare providers, it is possible these potential patients will be unwilling to change their current treatment regimens. Moreover, healthcare providers tend to be slow to change their medical treatment practices because of perceived liability risks arising from the use of new products and the uncertainty of third-party reimbursement. Accordingly, healthcare providers may not recommend the Snap system until there is sufficient evidence to convince them to alter their treatment recommendations, such as receiving endorsements from prominent healthcare providers or other key opinion leaders in the diabetes treatment community that our products are effective in providing insulin therapy.

If the Snap system does not achieve and maintain widespread market acceptance, we may fail to achieve sales at or above our expectations. If our sales do not meet our expectations, we may fail to meet our strategic objectives, and our business, financial condition and results of operations could be harmed.

The medical device industry is very competitive, and if we fail to successfully compete, our business and results of operations could be harmed.

The market for medical devices is intensely competitive, subject to rapid change and highly sensitive to the introduction of new products or technologies, as well as changes in the actions of current industry participants. The Snap system competes directly with several traditional insulin pumps as well as other treatment methods for diabetes. Many of our competitors are major medical device companies that are either publicly traded companies or divisions or subsidiaries of publicly traded companies. Medtronic MiniMed, a division of Medtronic, Inc., has been the market leader for many years and has the majority share of the traditional insulin pump market in the United States. Other existing significant insulin pump suppliers in the United States include Insulet Corporation, Tandem Diabetes Care, Animas Corporation, a division of Johnson & Johnson and Roche Diagnostics, a division of F. Hoffman-La Roche Ltd.

These competitors also enjoy several competitive advantages over us, including:

| • | Larger sales and marketing and product development teams; |

| • | Greater financial resources; |

| • | Developed relationships and contracts with healthcare providers, distributors and third-party payors; |

| • | Established reputation and name recognition among healthcare providers and other important opinion leaders in the diabetes industry; |

| • | Established base of long-time customers; |

| • | Products supported by long-term clinical data; |

| • | Larger and more established distribution networks; |

| • | Greater ability to cross-sell products or provide incentives to healthcare providers to use their products; and |

| • | More experience with performing research and development, conducting clinical trials, manufacturing and obtaining regulatory approval or clearance. |

18

Table of Contents

Furthermore, some of our competitors manufacture and market products with features that we do not currently offer. For instance, Medtronic offers a traditional insulin pump that is integrated with a continuous glucose monitoring, or CGM, system with a recently approved threshold suspend feature. Additionally, Insulet markets an insulin pump with a tubeless delivery system that does not utilize an infusion set.

For these and other reasons, we may not be able to compete effectively for a share of the market. As a result, we may fail to meet our business objectives or forecasted budget, and our business, results of operations and financial condition could be harmed.

If we or our potential customers fail to secure or retain adequate insurance coverage or are unable to receive reimbursement for the Snap system by third-party payors, our business, financial condition and results of operations could be harmed.

We have derived our revenue from sales of the Snap system in the United States, and we expect this trend to continue for the next several years. Typically, third-party payors pay for a substantial portion of the purchase price of the Snap system and its disposable components. These third-party payors include private insurance companies, preferred provider organizations and other managed care providers. Future sales of the Snap system will be diminished unless our customers can rely on third-party payors to pay for all or a large portion of the cost to purchase the Snap system. We are also dependent on insulin cartridge suppliers maintaining adequate payor coverage.

Many third-party payors follow coverage decisions and payment amounts determined by the Centers for Medicare and Medicaid Services, or CMS, which administers the U.S. Medicare program, in setting their coverage and reimbursement policies. Medicare has recently begun to review its reimbursement practices for certain diabetes-related products, which has resulted in a significant reduction in the reimbursement rate for some of those products. As a result, there is uncertainty as to the future Medicare reimbursement rate for our products. In addition, those third-party payors that do not follow the CMS guidelines may adopt different coverage and reimbursement policies for our products, which could also diminish payments for the Snap system. It is possible that some third-party payors will not offer any coverage for our products.

Today, we are completely reliant on distributors to obtain and maintain payor contracts and relationships. We received a DME license in the state of California in the second quarter of 2014. We are in the process of seeking accreditation and additional DME licenses in the states where we seek to distribute the Snap system directly. We currently expect to receive all such licenses and accreditation in the first half of 2015. Once our DME licenses and accreditation have been obtained, we will then target critical payors for direct contracting. There is no guarantee that we will obtain the DME licenses required for additional states in which we plan to sell directly in the first half of 2015 or at all.

We expect to enter into direct contracts with third-party payors; however, we may not succeed in doing so or any such contracts may not enable us to sell our products on a profitable basis. Additionally, our current contracts with distributors or future direct contracts with payors can typically be modified or terminated by the third-party payor or distributor without cause and with little or no notice to us. We anticipate potential delays in attaining approvals from third-party payors to cover the cost of the Snap system because time must be spent complying with administrative procedures and meeting the requirements of third-party payors. Failure to secure or retain adequate insurance coverage or reimbursement for the Snap system by third-party payors, or delays in processing approvals by those payors, could result in the loss of sales, which could harm our business, results of operations and financial condition.