Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - INTERPACE BIOSCIENCES, INC. | pdi8kajanuary162015.htm |

| EX-99.3 - EXHIBIT 99.3 - INTERPACE BIOSCIENCES, INC. | exhibit993rp.htm |

| EX-23.1 - EXHIBIT 23.1 - INTERPACE BIOSCIENCES, INC. | exhibit231rp.htm |

| EX-99.1 - EXHIBIT 99.1 - INTERPACE BIOSCIENCES, INC. | exhibit991rp.htm |

| EX-23.2 - EXHIBIT 23.2 - INTERPACE BIOSCIENCES, INC. | exhibit232rp_alpern.htm |

Exhibit 99.2

Financial Statements (Unaudited)

RedPath Integrated Pathology, Inc.

As of September 30, 2014 and for the Nine Months Ended September 30, 2014 and 2013

1

RedPath Integrated Pathology, Inc.

Financial Statements (Unaudited)

As of September 30, 2014 and for the Nine Months Ended September 30, 2014 and 2013

Contents | ||

Condensed Balance Sheet (Unaudited) | 3 | |

Condensed Statements of Operations (Unaudited) | 4 | |

Statements of Stockholders’ Deficit (Unaudited) | 5 | |

Condensed Statements of Cash Flows (Unaudited) | 6 | |

Notes to Financial Statements (Unaudited) | 7 | |

2

RedPath Integrated Pathology, Inc.

Condensed Balance Sheet (Unaudited)

(in thousands)

The accompanying notes are an integral part of these financial statements.

3

RedPath Integrated Pathology, Inc.

Condensed Statements of Operations (Unaudited)

For The Nine Months Ended September 30, 2014 and 2013

(in thousands)

The accompanying notes are an integral part of these financial statements.

4

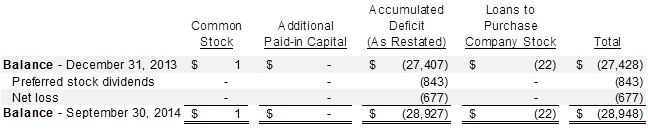

RedPath Integrated Pathology, Inc.

Statements of Stockholders’ Deficit

For the Nine Month Periods Ended September 30, 2014 and 2013

(in thousands)

The accompanying notes are an integral part of these financial statements.

5

RedPath Integrated Pathology, Inc.

Condensed Statement of Cash Flows (Unaudited)

For The Nine Months Ended September 30, 2014 and 2013

(in thousands)

The accompanying notes are an integral part of these financial statements.

6

RedPath Integrated Pathology, Inc.

Notes to Financial Statements

(in thousands, except share amounts)

Note 1 - Summary of Significant Accounting Policies

A. | Business |

RedPath Integrated Pathology, Inc. (the Company), a Delaware corporation, was formed on August 6, 2004. The Company is a pathology services company whose mission is to facilitate superior disease diagnosis through integrated molecular analysis. The Company operates one lab in Pittsburgh, Pennsylvania.

B. | Use of Estimates |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates used in preparing these financial statements include those assumed in computing the provision for third-party payor contractual adjustments and allowance for uncollected accounts. It is at least reasonably possible that the significant estimates used will change within the next year and these changes could be material.

C. | Cash and Cash Equivalents |

The Company considers all highly liquid investments with original maturities of three months or less to be cash equivalents. At times, the Company’s cash and cash equivalents may be in excess of the Federal Deposit Insurance Corporation insurance limits. The Company does not believe it is exposed to any significant credit risk.

D. | Accounts Receivable and Net Service Revenue |

The Company’s revenue is generated from providing diagnostic services using the patented PathFinder test. The Company’s services are fulfilled upon completion of the test, review, and release of the test results by the Company, and then subsequently billing the third-party payor or hospital. The Company recognizes revenue related to billings for Medicare, Medicare Advantage, and hospitals on an accrual basis, net of contractual adjustment, when there is a predictable pattern of collectability. These contractual adjustments represent the difference between the list prices and the reimbursement rate set by Medicare and Medicare Advantage, or the amounts billed to hospitals, which approximates the Medicare rate. Upon ultimate collection, the amount received from Medicare, Medicare Advantage and hospitals with a predictable pattern of payment is compared to the previous estimates and the contractual allowance is adjusted accordingly. Any amounts not collected are charged to bad debt expense. Until a contract has been negotiated with a commercial insurance carrier or governmental program, the PathFinder test may or may not be covered by these entities existing reimbursement policies. In addition, patients do not enter into direct agreements with the Company that commit them to pay any portion of the cost of the tests in the event that their insurance declines to reimburse the Company. In the absence of an agreement with the patient or other clearly enforceable legal right to demand payment, the related revenue is only recognized upon the earlier of payment notification, if applicable, or cash receipt. Accordingly, the Company recognizes revenue from commercial insurance carriers when payment is received.

7

For all services performed, the Company considers whether or not the following revenue recognition criteria are met: persuasive evidence of an arrangement exists; delivery has occurred or services have been rendered; the fee is fixed or determinable; and collectability is reasonably assured.

Persuasive evidence of an arrangement exists and delivery is deemed to have occurred upon completion of the test, review, and release of the test results by the Company and then subsequently billing the third-party payor or hospital. The assessment of the fixed or determinable nature of the fees charged for diagnostic testing performed and the collectability of those fees require significant judgment by management. Management believes that these two criteria have been met when there is contracted reimbursement coverage and/or a predictable pattern of collectability with individual third-party payors or hospitals and accordingly, recognizes revenue upon delivery of the test results. In the absence of contracted reimbursement coverage or a predictable pattern of collectability, the Company believes that the fee is fixed or determinable and collectability is reasonably assured only upon request of third-party payer notification of payment or when cash is received, and recognizes revenue at that time.

E. | Property and Equipment |

Property and equipment are recorded at cost. Depreciation is computed using the straight-line method over the estimated useful lives of the related assets and accelerated methods for income tax purposes. Leasehold improvements are amortized over the lesser of their useful lives or the remaining term of the lease.

Internally developed software costs are capitalized and amortized over their expected useful life of three years. Internal and external costs incurred during the preliminary project stage are expensed as incurred, application development stage costs are capitalized, post-implementation and operations stage costs are expensed as incurred, and upgrades and enhancements are either expensed or capitalized based upon the nature of the costs incurred.

Maintenance and repairs which are not considered to extend the useful lives of assets are charged to operations as incurred. Expenditures for additions and improvements are capitalized. Upon disposal, assets and related accumulated depreciation are removed from the Company’s accounts and the resulting gains or losses are reflected in the statements of operations.

F. | Other Assets |

Patent costs incurred are being amortized on a straight-line basis over their estimated useful lives of ten years.

Loan acquisition fees are capitalized and being amortized on a straight-line basis over the term of the related debt.

G. | Stock-based Compensation |

The Company expenses the fair value of employee stock purchase plans, stock option grants and similar awards. The Company recognizes the fair value of share-based compensation awards in the statement of operations on a straight-line basis over the vesting period, which approximates the service period.

8

H. | Research and Development Costs |

The Company expenses research and development costs associated with developing new procedures or significantly improving existing procedures as incurred.

I. | Distinguishment of Liabilities From Equity |

The Company relies on the guidance provided by ASC 480, Distinguishing Liabilities from Equity, to classify certain redeemable and/or convertible instruments, such as the Company’s preferred stock. The Company first determines whether the respective financial instrument should be classified as a liability. The Company will determine the liability classification if the financial instrument is mandatorily redeemable, or if the financial instrument, other than outstanding shares, embodies a conditional obligation that the Company must or may settle by issuing a variable number of its equity shares.

Once the Company determines that the financial instrument should not be classified as a liability, it determines whether the financial instrument should be presented between the liability section and the equity section of the balance sheet (“temporary equity”). The Company will determine temporary equity classification if the redemption of the preferred stock or other financial instrument is outside the control of the Company (i.e. at the option of the holder). Otherwise, the Company accounts for the financial instrument as permanent equity.

Initial Measurement

The Company records temporary equity or permanent equity at issuance at the fair value, or cash received.

Subsequent Measurement

Temporary Equity

At each balance sheet date, the Company reevaluates the classification of its redeemable instruments, as well as the probability of redemption. If the redemption amount is probable or currently redeemable, the Company records the instruments at its redemption value. Upon issuance, the initial carrying amount of a redeemable equity security at its fair value. If the instrument is redeemable currently at the option of the holder, it will be adjusted to its maximum redemption amount at each balance sheet date. If the instrument is not redeemable currently and it is probable that it will become redeemable, it is recorded at its fair value. If it is probable that the instrument will become redeemable it will be recognized immediately at its redemption value. The resulting increases or decreases in the carrying amount of a redeemable instrument will be recognized as adjustments to additional paid in capital.

J. | Income Taxes |

The Company provides for income taxes in accordance with the asset and liability method. Under this method, deferred tax assets and liabilities are recognized for future tax consequences attributable to differences between the carrying amounts of existing assets and liabilities for financial reporting and for income tax reporting. The deferred tax assets or liabilities represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred tax assets are reduced by a valuation allowance when it is more likely than not that some portion or all of the deferred tax assets will not be realized.

9

The Company utilizes a two-step approach for recognizing and measuring uncertain tax positions accounted for in accordance with the asset and liability method. The first step is to evaluate the tax position for recognition by determining whether evidence indicates that it is more likely than not that a position will be sustained if examined by a taxing authority. The second step is to measure the tax benefit as the largest amount that is 50% likely of being realized upon settlement with a taxing authority. There were no amounts recorded at September 30, 2014 related to uncertain tax positions.

K. | Taxes on Revenue Producing Transactions |

Taxes assessed by governmental authorities on revenue producing transactions, including sales, value added, excise and use taxes, are recorded on a net basis (excluded from revenue) in the statement of operations.

L. | Reclassifications |

Certain reclassifications have been reflected in the financial statements to conform to the presentation of PDI, Inc. consolidated financial statements.

M. | Subsequent Events |

On October 31, 2014, the Company entered into an Agreement and Plan of Merger to be acquired by PDI, Inc.

Note 2 - Accounts Receivable and Service Fee Revenue

Accounts receivable consisted of the following at September 30, 2014:

Substantially all of the Company’s service revenue is billed to third-party insurance providers and hospitals. Approximately 34% of gross service revenue was concentrated with one payor. This payor accounted for approximately 25% of net accounts receivable September 30, 2014.

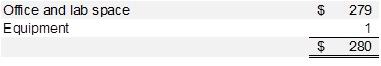

Note 3 - Property and Equipment

Property and equipment consisted of the following at September 30, 2014:

10

Depreciation expense included in cost of laboratory services was approximately $94 in 2014 and approximately $137 in 2013. Depreciation expense included in operating expenses was approximately $76 in 2014 and approximately $113 in 2013.

Note 4 - Other Assets

Other assets consisted of the following at September 30, 2014:

Patent costs relate to patented methods used in the Company’s pathology services. Amortization expense of patent costs, included in costs of laboratory services, amounted to approximately $29 in 2014 and 2013.

Amortization of loan acquisition fees, included in interest expense, amounted to approximately $10 in 2014 and $11 in 2013.

Note 5 - Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following at September 30, 2014:

Note 6 - Income Taxes

The provision for income taxes consisted of Federal income taxes of $39 at September 30, 2014 and $17 at September 30, 2013.

Amounts for deferred tax assets and liabilities are as follows at September 30, 2014:

11

The Company has provided an allowance for the entire amount of the potential deferred tax asset at September 30, 2014, as these assets will not be realized until the Company generates taxable income in the future.

The Company’s deferred tax asset consists primarily of Federal net operating loss carryforwards. The Company has loss carryforwards that may be offset against future taxable income of approximately $8,377 for Federal and state income tax purposes. The loss carryforwards begin to expire in 2029.

Tax years 2010 through 2012 remain open to examination by the Internal Revenue Service and various state taxing authorities.

Note 7 - Leasing Arrangements

The Company leases certain office and lab space and laboratory equipment under operating leases expiring in various years through 2015. Approximate rent expense was allocated evenly between cost of laboratory services and operating expenses and is comprised of the following at September 30, 2014 and 2013:

Monthly rent payments for the Company’s facility amounts to $31. The lease expires in March 2015.

The Company is obligated under a variety of capital leases for equipment acquisitions. The long-term lease obligation represents the present value of the minimum lease payments discounted at rates ranging from 4% to 20%. The capitalized cost of equipment under capital leases is approximately $250 less accumulated depreciation of approximately $97 at September 30, 2014.

Note 8 - Note Payable and Long-term Debt

The Company has a revolving line-of-credit agreement with a bank that provides for maximum borrowings of $3,000. The Company has the ability to request advances based on a formula defined in the line-of-credit agreement. Outstanding borrowings under the line bear interest at the prime rate (3.25% at September 30, 2014) plus 1%, but not less than a minimum interest rate of 5%.

12

In 2014, the line-of-credit agreement was amended to cap the borrowing amount at $1,987 and to extend the maturity date to October 1, 2014. The amendment also added an event of default if the Company fails to execute and close, or fails to make substantial progress towards a merger or sale of substantially all of its assets.

The line of credit is collateralized by substantially all of the Company’s assets. In addition, the line of credit contains certain restrictive covenants that require the Company to maintain certain minimum monthly financial ratios and to achieve certain profit levels at certain interim dates during the year.

The credit agreement with the bank also includes a success fee that is due and payable if the Company consummates a public offering or upon a change in control. The success fee is calculated as a percentage of the maximum borrowings during the term of the agreement plus a fixed amount based upon the sales price as defined in the agreement.

Long-term debt consisted of the following at September 30, 2014:

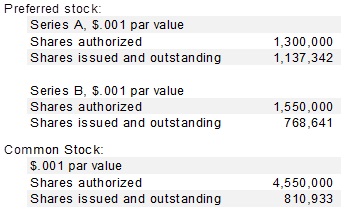

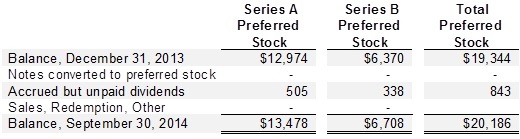

Note 9 - Stockholders’ Deficit and Temporary Equity

Preferred and common stock as of September 30, 2014 is as follows:

The Series B preferred stock has priority over the Series A preferred stock and the common stock with respect to dividends, redemption and liquidation rights, as defined. The Series B liquidation preference is equal to 2 times $7.35 per share plus all accrued and unpaid dividends, whether or not declared. The holders of Series B preferred stock are entitled to dividends at an annual rate of 8% of the original Series B issue price. The dividends accrue whether or not earned or declared and are cumulative.

The Series A preferred stock has priority over common stock with respect to dividends, redemption and liquidation rights, as defined. The Series A liquidation preference is equal to 1.4 times $7.41 per share plus all accrued and unpaid dividends, whether or not declared. The holders of Series A preferred stock are entitled to dividends at an annual rate of 8% of the original Series A issue price. The dividends accrue whether or not earned or declared and are cumulative. A rollforward of the Series A and Series B preferred stock is as follows:

13

The holders of common stock are entitled to receive dividends as declared at the discretion of the Board of Directors. Pursuant to the terms of the preferred stock issuance agreement, cash dividends may not be paid on common shares while Series A and B preferred stock is outstanding.

The holders of Series A and B preferred shares also have the right to convert their shares to common stock under certain qualifying conditions, as defined.

At the option of a majority of the holders of the preferred stock, the Company shall redeem all shares of preferred stock at a redemption price defined in the Company’s Articles of Incorporation beginning on the fifth anniversary of the issuance date of the preferred stock. If funds are not available at the redemption date, the redemption will be completed on a pro-rata basis as funds become available.

Note 10 - Retirement Plan

The Company sponsors a defined contribution 401(k) profit sharing plan, which covers all employees who meet the plan’s eligibility requirements. The plan calls for the Company to match an amount equal to 25% of an employee’s elective deferral, up to 4% of eligible compensation. The plan also allows for discretionary profit sharing contributions. The Company made contributions of approximately $26 and $22 for the nine months ended September 30, 2014 and 2013, respectively.

Note 11 - Settlement Agreement

In June 2012, Medicare commenced a pre-payment audit to determine, among other things, the Company’s adherence to the Date of Service Rule (14 day rule) and to ensure that Medicare claims were properly filed. The audit resulted in the suspension of reimbursement of Medicare claims to the Company. This audit ran concurrently with an investigation of the Company’s business practices by the United States Department of Justice.

The Company and the United States Department of Justice reached a joint settlement with no charges being filed against the Company, and a Settlement Agreement was executed in January 2013.

Under the terms of the Settlement Agreement, the Company agreed not to submit any further claims for reimbursement to Medicare for its PFTG test performed on specimens obtained during the period from October 1, 2010 through September 30, 2012, or to appeal any denials for claims during this time period. In addition, for calendar years 2014 through 2017, the Company agreed to make payments to the United States Department of Justice as follows:

The payments are due during the time period the Company achieves the revenue milestones noted above for each of the four years noted. Once the total of all payments made by the Company reaches $3,000, the Company’s obligation is satisfied with the United States Department of Justice. At September 30, 2014, the Company recorded $2,000 as an accrued settlement liability, which is management’s best estimate of the amount that will be required to be paid under the Settlement Agreement based on its estimate of future revenues.

14

Note 12 - Going Concern

As shown in the accompanying financial statements, the Company has incurred significant accumulated losses since its inception. Additionally, the Company has not been able to generate cash from operations. The accompanying financial statements have been prepared on a basis which assumes that the Company will continue as a going concern and which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business.

Management has initiated the following plans to fund future business activities:

• Obtained additional funding through new debt from existing shareholders (Note 8)

• Extended loan agreement with bank (Note 8)

• Maintained cost reduction activities, including workforce reductions, that began in 2012

• Increased collection efforts on past-due receivables

Management believes that the above initiatives will be sufficient to allow the Company to continue to operate as a going concern. However, there is no assurance that the management plans will mitigate the effects of these conditions and that such plans can be effectively implemented or achieved. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

15