Attached files

| file | filename |

|---|---|

| EX-31.2 - RULE 13A-14(A) CERTIFICATION - China Tianfeihong Wine Inc | tfhw10q122914ex31_2.htm |

| EX-32 - RULE 13A-14(B) CERTIFICATION - China Tianfeihong Wine Inc | tfhw10q122914ex32.htm |

| EXCEL - IDEA: XBRL DOCUMENT - China Tianfeihong Wine Inc | Financial_Report.xls |

| EX-31.1 - RULE 13A-14(A) CERTIFICATION - China Tianfeihong Wine Inc | tfhw10q122914ex31_1.htm |

U. S. Securities and Exchange Commission

Washington, D. C. 20549

FORM 10-Q

[x] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended November 30, 2014

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File No. 0-54843

CHINA TIANFEIHONG WINE, INC.

(Name of Registrant in its Charter)

| Delaware | 99-0360626 | |

| (State of Other Jursidiction of incorporation or organization) | (I.R.S. Employer I.D. No.) |

1849 Licheng Middle Avenue, Longqiao Street, Chengxiang District

Putian City, Fujian Province, P.R. China 351100

(Address of Principal Executive Offices)

Issuer's Telephone Number: 86-0594-6258386

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes [x] No [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes [ ] No [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company [x]

APPLICABLE ONLY TO CORPORATE ISSUERS: Indicate the number of shares outstanding of each of the Registrant's classes of common stock, as of the latest practicable date:

January 8, 2015

Common Voting Stock: 34,396,680

CHINA TIANFEIHONG WINE, INC.

QUARTERLY report on Form 10-Q

for the fiscal QUARTER ended NOVEMBER 30, 2014

| Page No | ||

| Part I | Financial Information | |

| Item 1. | Financial Statements (unaudited): | |

| Consolidated Balance Sheets – November 30, 2014 and August 31, 2014 | 1 | |

| Consolidated Statements of Income and Other Comprehensive Income - for the Three Month Periods Ended November 30, 2014 and 2013 | 2 | |

| Consolidated Statements of Changes in Stockholders’ Equity – for the Three Months Ended November 30, 2014 | 3 | |

| Consolidated Statements of Cash Flows – for the Three Months Ended November 30, 2014 and 2013 | 4 | |

| Notes to Consolidated Financial Statements | 5 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Item 3 | Quantitative and Qualitative Disclosures about Market Risk | 26 |

| Item 4. | Controls and Procedures | 26 |

| Part II | Other Information | |

| Item 1. | Legal Proceedings | 28 |

| Items 1A. | Risk Factors | 28 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 28 |

| Item 3. | Defaults upon Senior Securities | 28 |

| Item 4. | Mine Safety Disclosures | 28 |

| Item 5. | Other Information | 28 |

| Item 6. | Exhibits | 28 |

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN U.S.$)

| November 30, | August 31, | |||||||

| 2014 | 2014 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 5,865,101 | $ | 5,229,261 | ||||

| Accounts receivable | 1,556,605 | 431,940 | ||||||

| Inventory, net | 972,599 | 375,750 | ||||||

| Prepaid income taxes | — | 50,348 | ||||||

| Prepaid expenses | 28,508 | 40,625 | ||||||

| Total current assets | 8,422,813 | 6,127,924 | ||||||

| Fixed assets, net | 36,312 | 48,113 | ||||||

| Total Assets | $ | 8,459,125 | $ | 6,176,037 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 2,408,543 | $ | 682,030 | ||||

| Taxes payable | 97,798 | 19,465 | ||||||

| Loans from stockholder | 62,152 | 24,339 | ||||||

| Accrued liabilities and other payables | 64,851 | 72,981 | ||||||

| Total current liabilities | 2,633,344 | 798,815 | ||||||

| Stockholders’ equity: | ||||||||

| Common stock, $0.0006 par value per share, 80,000,000 shares authorized; 34,396,680 shares issued and outstanding as of November 30, 2014 and August 31, 2014 | 20,638 | 20,638 | ||||||

| Additional paid-in capital | 726,548 | 726,548 | ||||||

| Statutory reserve fund | 462,194 | 420,406 | ||||||

| Retained earnings | 4,241,376 | 3,865,318 | ||||||

| Other comprehensive income | 211,920 | 203,702 | ||||||

| Stockholders’ equity before noncontrolling interests | 5,662,676 | 5,236,612 | ||||||

| Noncontrolling interests | 163,105 | 140,610 | ||||||

| Total stockholders’ equity | 5,825,781 | 5,377,222 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 8,459,125 | $ | 6,176,037 | ||||

See accompanying notes to the consolidated financial statements.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

| Three Months ended November 30, | ||||||||

| 2014 | 2013 | |||||||

| Revenue | $ | 3,136,386 | $ | 1,932,378 | ||||

| Cost of goods sold | (2,095,040 | ) | (1,311,260 | ) | ||||

| Gross profit | 1,041,346 | 621,118 | ||||||

| Operating expenses | ||||||||

| Selling and marketing | 387,331 | 197,537 | ||||||

| General and administrative | 72,925 | 47,273 | ||||||

Total operating expenses | 460,256 | 244,810 | ||||||

| Income from operations | 581,090 | 376,308 | ||||||

| Interest income | 5,117 | 3,502 | ||||||

| Income before provision for income taxes | 586,207 | 379,810 | ||||||

| Provision for income taxes | 146,555 | 94,625 | ||||||

| Net income | 439,652 | 285,185 | ||||||

| Noncontrolling interests | (21,806 | ) | (9,375 | ) | ||||

| Net income attributable to common stockholders | $ | 417,846 | $ | 275,810 | ||||

| Earnings per common share, basic and diluted | $ | 0.01 | $ | 0.01 | ||||

| Weighted average shares outstanding, basic and diluted | 34,396,680 | 32,000,000 | ||||||

| Comprehensive income : | ||||||||

| Net income | $ | 439,652 | $ | 285,185 | ||||

| Foreign currency translation adjustment | 8,907 | 32,756 | ||||||

| Comprehensive income | 448,559 | 317,941 | ||||||

| Comprehensive income attributable to noncontrolling interests | (22,495 | ) | (9,390 | ) | ||||

| Comprehensive income attributable to common stockholders | $ | 426,064 | $ | 308,551 | ||||

See accompanying notes to the consolidated financial statements.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 (UNAUDITED) (IN U.S.$)

| Common Stock | Additional Paid-in Capital | Statutory Reserve Fund | Retained Earnings | Other Comprehensive Income | Noncontrolling Interests | Total | ||||||||||||||||||||||

| Balance, August 31, 2014 | $ | 20,638 | $ | 726,548 | $ | 420,406 | $ | 3,865,318 | $ | 203,702 | $ | 140,610 | $ | 5,377,222 | ||||||||||||||

| Net income | — | — | — | 417,846 | — | 21,806 | 439,652 | |||||||||||||||||||||

| Appropriation for statutory reserve | — | — | 41,788 | (41,788 | ) | — | — | — | ||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | 8,218 | 689 | 8,907 | |||||||||||||||||||||

| Balance, November 30, 2014 - Unaudited | $ | 20,638 | $ | 726,548 | $ | 462,194 | $ | 4,241,376 | $ | 211,920 | $ | 163,105 | $ | 5,825,781 | ||||||||||||||

See accompanying notes to the consolidated financial statements.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

| Three Months Ended November 30, | ||||||||

| 2014 | 2013 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 439,652 | $ | 275,810 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 11,904 | 10,591 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| (Increase) decrease in accounts receivable | (1,124,665 | ) | 22,570 | |||||

| (Increase) decrease in inventory | (596,849 | ) | 26,654 | |||||

| Decrease in prepaid income tax | 50,348 | — | ||||||

| Decrease in prepaid expenses | 12,117 | — | ||||||

| Decrease in advances to suppliers | — | 15,037 | ||||||

| Increase (decrease) in accounts payable | 1,726,513 | (59,126 | ) | |||||

| Increase in taxes payable | 78,333 | 13,600 | ||||||

| (Decrease) in accrued liabilities and other payables | (8,130 | ) | (35 | ) | ||||

| Net cash provided by operating activities | 589,223 | 305,101 | ||||||

| Cash flows from financing activities: | ||||||||

| Proceeds from stockholder loans | 37,630 | — | ||||||

| Net cash provided by financing activities | 37,630 | — | ||||||

| Effect of exchange rate changes on cash | 8,987 | 21,413 | ||||||

| Net change in cash | 635,840 | 326,514 | ||||||

| Cash, beginning | 5,229,261 | 3,994,502 | ||||||

| Cash, end | $ | 5,865,101 | $ | 4,321,016 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for: | ||||||||

| Interest | $ | — | $ | — | ||||

| Income taxes | $ | 53,967 | $ | 89,645 | ||||

See accompanying notes to the consolidated financial statements.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

1. ORGANIZATION

China Tianfeihong Wine, Inc. (the “Company”), formerly known as Zenitech Corporation, was incorporated under the laws of the State of Delaware on July 28, 2005. Since its inception until the closing of the reverse acquisition transaction, the Company was a development-stage company in the business of developing, manufacturing, distributing and marketing of environmentally friendly floral sleeves and wrappers for the floriculture industry.

On August 1, 2013, the Company filed a certificate of amendment to its articles of incorporation to change its name from “Zenitech Corporation” to “China Tianfeihong Wine Inc. ” (the “Name Change”) and to effect a 1 for 6 reverse stock split (the “Reverse Split”) of its outstanding shares of common stock. The Name Change and the Reserve Split were effective on August 12, 2013. Upon the effectiveness of the Reverse Split, the number of outstanding shares of the Company’s common stock decreased from 14,380,266 to 2,396,680 shares. The number of authorized shares of common stock remained at 80,000,000 shares.

On December 30, 2013, the Company completed a reverse acquisition transaction through a share exchange with the stockholders of Fanwei Hengchang Co., Ltd (BVI) (“Fanwei Hengchang”), whereby the Company acquired 100% of the outstanding shares of Fanwei Hengchang in exchange for the issuance of 32,000,000 shares of the Company’s common stock, representing 93.03% of the issued and outstanding shares of common stock. As a result of the reverse acquisition, Fanwei Hengchang became the Company’s wholly-owned subsidiary and the former Fanwei Hengchang’s stockholders became our controlling stockholders. The share exchange transaction was treated as a reverse acquisition, with Fanwei Hengchang as the acquirer and the Company as the acquired party for accounting purposes. Unless the context suggests otherwise, when we refer in this report to the business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Fanwei Hengchang and its consolidated subsidiaries and variable interest entity.

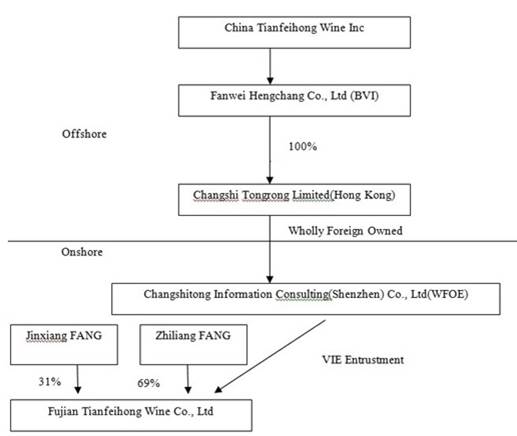

As a result of the acquisition of Fanwei Hengchang, the Company now indirectly owns all of the issued and outstanding capital stock of Changshi Tongrong Limited (Hong Kong) (“Changshi Tongrong”), which in turn owns all of the issued and outstanding capital stock of Changshitong Consulting (Shenzhen) Co. Ltd (“Changshitong Consulting”). In addition, the Company effectively and substantially controls Fujian Tianfeihong Wine Co., Ltd (“Fujian Tianfeihong”) through a series of agreements with Changshitong Consulting.

Subsequent to the closing of the Share Exchange Agreement, the Company conducts operations through its controlled consolidated affiliate, Fujian Tianfeihong. Fujian Tianfeihong is primarily engaged in distributing fruit wine, including green plum wine, loquat wine, olive wine and pomegranate wine, to supermarkets and liquor stores in the People’s Republic of China (“PRC”).

On November 26, 2013, prior to the reverse acquisition transaction, Changshitong Consulting and Fujian Tianfeihong and its shareholders Jinxiang Fang and Zhiliang Fang entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Fujian Tianfeihong became Changshitong Consulting’s contractually controlled affiliate. The VIE Agreements included:

Exclusive Technical Service and Business Consulting Agreement: Pursuant to the Exclusive Technical Service and Business Consulting Agreement, Changshitong Consulting (“WFOE”) is to provide technical support and consulting services to Fujian Tianfeihong in exchange for (i) 95% of the total annual net profit of Fujian Tianfeihong plus (ii) RMB10,000 per month (U.S.$1,627). The Agreement has an unlimited term and only can be terminated upon written agreement of both parties.

Proxy Agreement: Pursuant to the Proxy Agreement, Zhiliang Fang and Jinxiang Fang, each authorize Changshitong Consulting to designate someone to exercise their entire stockholder decision rights with respect to Fujian Tianfeihong. The Agreement has an unlimited term and can only be terminated upon written agreement of both parties.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

1. ORGANIZATION (continued)

Call Option Agreement: A Call Option Agreement among Zhiliang Fang and Jinxiang Fang (together referred to as “Fujian Tianfeihong Shareholders”), and Changshitong Consulting under which they have granted to Changshitong Consulting the irrevocable right and option to acquire all of the equity interests in Fujian Tianfeihong to the extent permitted by PRC law. If PRC law limits the percentage of Fujian Tianfeihong that Changshitong Consulting may purchase at any time, then Changshitong Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00 (US$0.16) or the minimum price required by PRC laws if at that time there is any PRC laws regulating the minimum price. The Fujian Tianfeihong Stockholders agreed to refrain from taking certain actions which might harm the value of Fujian Tianfeihong or Changshitong Consulting’s option. This Agreement remains effective until all equity interests under the Agreement have been transferred to Changshitong Consulting or its designated entities or natural persons.

Share Pledge Agreement: A Share Pledge Agreement among Zhiliang Fang and Jinxiang Fang, Fujian Tianfeihong, and Changshitong Consulting under which the Fujian Tianfeihong Shareholders agree to pledge all of their equity in Fujian Tianfeihong to Changshitong Consulting to guarantee Fujian Tianfeihong’s and its stockholders’ performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement. This Agreement remains effective until the obligations under the Exclusive Technical Service and Business Consulting Agreement, Call Option Agreement and Proxy Agreement have been fulfilled or terminated.

The VIE Agreements with the Company’s Chinese affiliate and its stockholders, which relate to critical aspects of the Company’s operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law.

As a result of the entry into the foregoing agreements, the Company has a corporate structure which is set forth as follows:

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF ACCOUNTING AND PRESENTATION

The accompanying consolidated financial statements have been prepared on the accrual basis of accounting. The unaudited consolidated financial statements for the three month periods ended November 30, 2014 and 2013 include China Tianfeihong Wine, Inc., Fanwei Hengchang, Changshi Tongrong and its wholly owned subsidiary, Changshitong Consulting and its VIE, Fujian Tianfeihong. All significant intercompany accounts and transactions have been eliminated in consolidation.

The unaudited interim consolidated financial statements of the Company as of November 30, 2014 and for the three months periods ended November 30, 2014 and 2013, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the Securities and Exchange Commission (the “SEC”) which apply to interim financial statements. Accordingly, they do not include all of the information and footnotes normally required by accounting principles generally accepted in the United States of America for annual financial statements. In the opinion of management, such information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The interim consolidated financial information should be read in conjunction with the consolidated financial statements and the notes thereto, included in the Company’s Form 10-K filed with the SEC. The results of operations for the three months ended November 30, 2014 are not necessarily indicative of the results to be expected for future quarters or for the year ending August 31, 2015.

All consolidated financial statements and notes to the consolidated financial statements are presented in United States dollars (“US Dollar” or “US$” or “$”).

VARIABLE INTEREST ENTITY

Pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810, “Consolidation” (“ASC 810”), the Company is required to include in its consolidated financial statements the financial statements of its variable interest entities (“VIEs”). ASC 810 requires a VIE to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual returns. VIEs are those entities in which a company, through contractual arrangements, bears the risk of, and enjoys the rewards normally associated with ownership of the entity, and therefore the company is the primary beneficiary of the entity.

Under ASC 810, a reporting entity has a controlling financial interest in a VIE, and must consolidate that VIE, if the reporting entity has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affect the VIE’s economic performance; and (b) the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the VIE. The reporting entity’s determination of whether it has this power is not affected by the existence of kick-out rights or participating rights, unless a single enterprise, including its related parties and de facto agents, have the unilateral ability to exercise those rights. Fujian Tianfeihong’s actual stockholders do not hold any kick-out rights that affect the consolidation determination.

Through the VIE agreements disclosed in Note 1, the Company is deemed the primary beneficiary of Fujian Tianfeihong. Accordingly, the results of Fujian Tianfeihong have been included in the accompanying consolidated financial statements. Fujian Tianfeihong has no assets that are collateral for or restricted solely to settle their obligations. The creditors of Fujian Tianfeihong do not have recourse to the Company’s general credit.

The following financial balances of Fujian Tianfeihong have been included in the accompanying consolidated financial statements.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

VARIABLE INTEREST ENTITY (continued)

| November 30, 2014 | August 31, 2014 | |||||||||

| (Unaudited) | ||||||||||

| TOTAL ASSETS(1) | $ | 8,458,755 | $ | 6,175,646 | ||||||

| TOTAL LIABILITIES(1) | $ | 2,627,782 | $ | 781,126 | ||||||

(1) Total assets and liabilities of the VIE are reported net of intercompany balances that have been eliminated with the VIE consolidation.

| Three Months Ended November 30, | ||||||||

| 2014 | 2013 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Revenue | $ | 3,136,386 | $ | 1,932,378 | ||||

| Net income (2) | $ | 436,129 | $ | 275,810 | ||||

(2) Under the Exclusive Technical Service and Business Consulting Agreement, 95% of the net income is to be remitted to WFOE.

| Three Months Ended November 30, | ||||||||||||

| 2014 | 2013 | |||||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Net cash provided by operating activities | $ | 584,370 | $ | 305,101 | ||||||||

| Net cash provided by financing activities | 37,630 | — | ||||||||||

| Effect of exchange rate changes on cash | 13,859 | 21,413 | ||||||||||

| Net increase in cash | $ | 635,859 | $ | 326,514 | ||||||||

The Company believes that Changshitong Consulting’s contractual agreements with Fujian Tianfeihong are in compliance with PRC law and are legally enforceable. The stockholders of Fujian Tianfeihong are also the senior management of the Company and therefore the Company believes that they have no current interest in seeking to act contrary to the contractual arrangements. However, Fujian Tianfeihong and its stockholders may fail to take certain actions required for the Company’s business or to follow the Company’s instructions despite their contractual obligations to do so. Furthermore, if Fujian Tianfeihong or its stockholders do not act in the best interests of the Company under the contractual arrangements and any dispute relating to these contractual arrangements remains unresolved, the Company will have to enforce its rights under these contractual arrangements through PRC law and courts and therefore will be subject to uncertainties in the PRC legal system.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

VARIABLE INTEREST ENTITY (continued)

All of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. As a result, uncertainties in the PRC legal system could limit the Company’s ability to enforce these contractual arrangements, which may make it difficult to exert effective control over Fujian Tianfeihong, and its ability to conduct the Company’s business may be adversely affected.

USE OF ESTIMATES

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

FOREIGN CURRENCY TRANSLATION

Almost all Company assets are located in the PRC. The functional currency for the majority of the Company’s operations is the Renminbi (“RMB”). The Company uses the United States Dollar (“US Dollar” or “US$” or “$”) for financial reporting purposes. The financial statements of the Company have been translated into US Dollars in accordance with FASB ASC 830, “Foreign Currency Matters.”

All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. Statements of income amounts have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of the Company’s consolidated financial statements are recorded as other comprehensive income (loss).

The exchange rates used to translate amounts in RMB into US dollars for the purposes of preparing the consolidated financial statements are as follows:

| November 30, 2014 | August 31, 2014 | |||||||

| Consolidated balance sheet items, except for stockholders’ equity, as of the periods end | 0.1629 | 0.1625 | ||||||

| For the three months ended November 30, | ||||||||

| 2014 | 2013 | |||||||

| Amounts included in the statements of income, statement of changes in stockholders’

equity and statements of cash flows for the periods | 0.1627 | 0.1628 | ||||||

For the three months ended November 30, 2014 and 2013, foreign currency translation adjustments of $8,907 and $32,756, respectively, have been reported as other comprehensive income (loss). Other comprehensive income (loss) of the Company consists entirely of foreign currency translation adjustments. Pursuant to ASC 740-30-25-17, “Exceptions to Comprehensive Recognition of Deferred Income Taxes,” the Company does not recognize deferred U.S. taxes related to the undistributed earnings of its foreign subsidiaries and, accordingly, recognizes no income tax expense or benefit from foreign currency translation adjustments.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

FOREIGN CURRENCY TRANSLATION (continued)

Although government regulations now allow convertibility of the RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that the RMB could be converted into US dollars at that rate or any other rate.

The value of the RMB against the US dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. Any significant revaluation of the RMB may materially affect the Company’s financial condition in terms of US dollar reporting.

CHANGE OF FISCAL YEAR END DATE

On December 30, 2013, the Board of Directors of the Company approved changing the fiscal year-end of the Company from December 31 to August 31 as a result of the Fanwei Hengchang Acquisition.

REVENUE RECOGNITION

Revenues are primarily derived from selling fruit wines to contract distributors and retail establishments. The Company’s revenue recognition policies comply with FASB ASC 605 “Revenue Recognition.” The Company recognizes product revenue when the following fundamental criteria are met: (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred, (iii) the price to the customer is fixed or determinable and (iv) collection of the resulting accounts receivable is reasonably assured. The Company recognizes revenue for product sales upon transfer of title to the customer. Customer purchase orders and/or contracts are generally used to determine the existence of an arrangement. Shipping documents and the completion of any customer acceptance requirements, when applicable, are used to verify product delivery. The Company assesses whether a price is fixed or determinable based upon the payment terms associated with the transaction and whether the sales price is subject to refund or adjustment.

The Company has no product returns or sales discounts and allowances because goods delivered and accepted by customers are normally not returnable.

The Company recognizes gift sample products as cost of goods sold in compliance with ASC 605-50-S99. As such, when the Company gives a customer a free product, the expense associated with this free product at the time of sale is classified as cost of goods sold.

SHIPPING COSTS

Shipping costs incurred by the Company are recorded in selling and marketing expenses. Shipping costs for the three months ended November 30, 2014 and 2013 were $133,642 and $84,994, respectively.

CASH AND CASH EQUIVALENTS

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

ACCOUNTS RECEIVABLE

Accounts receivable are recorded at the contract amount after deduction of trade discounts and allowances, if any, and do not bear interest. The allowance for doubtful accounts, when necessary, is the Company’s best estimate of the amount of probable credit losses of accounts receivable. The Company determines the allowance based on historical write-off experience, customer specific facts and economic conditions.

Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company does not have any off-balance-sheet credit exposure related to its customers. As of November 30, 2014 and August 31, 2014, the Company considers accounts receivable of $1,556,605 and $431,940, respectively, fully collectible. For the periods presented, the Company did not write off any accounts receivable as bad debts.

INVENTORY

Inventory, comprised principally of bottled wine, is valued at the lower of cost or market value. The value of inventory is determined using the first-in, first-out method.

The Company periodically estimates an inventory allowance for estimated unmarketable inventory. Inventory amounts are reported net of such allowances, if any. There were no allowances for inventory as of November 30, 2014 and August 31, 2014.

FAIR VALUE OF FINANCIAL INSTRUMENTS

FASB ASC 820, “Fair Value Measurement,” defines fair value as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity.

IMPAIRMENT OF LONG-LIVED ASSETS

The Company applies FASB ASC 360, “Property, Plant and Equipment,” which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company may recognize the impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to those assets. No impairment of long-lived assets was recognized for the periods presented.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

FIXED ASSETS

Fixed assets are recorded at cost, less accumulated depreciation. Cost includes the price paid to acquire the asset, and any expenditures that substantially increase the asset’s value or extends the useful life of an existing asset. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the periods benefited. Maintenance and repairs are generally expensed as incurred. The estimated useful lives for fixed asset categories are as follows:

Computers and equipment 3 years

Motor vehicles 4 years

Fixture and furniture 5 years

INCOME TAXES

The Company accounts for income taxes in accordance with FASB ASC 740, “Income Taxes” (“ASC 740”), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent the future tax consequences for those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. As of November 30, 2014 and August 31, 2014, the Company had no deferred tax assets or liabilities.

ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with tax positions. As of November 30, 2014 and August 31, 2014, the Company does not have accruals for uncertain tax positions.

The income tax laws of various jurisdictions in which the Company and its subsidiaries operate are summarized as follows:

United States

The Company is subject to United States tax at graduated rates from 15% to 35%. No provision for income taxes in the United States has been made as the Company had no U.S. taxable income for the three months ended November 30, 2014 and 2013 because it is the Company's intention to indefinitely reinvest such earnings in its foreign subsidiaries. If such earnings were distributed, the Company would be subject to additional U.S. income tax expense. Determination of the amount of unrecognized deferred income tax liability related to these earnings is not practicable.

PRC

Changshitong Consulting and its VIE, Fujian Tianfeihong are subject to an Enterprise Income Tax at 25% and file their own tax returns. Consolidated tax returns are not permitted in China.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

INCOME TAXES (continued)

BVI

Fanwei Hengchang is incorporated in the BVI and is governed by the income tax laws of the BVI. According to the current BVI income tax law, the applicable income tax rate for the Company is 0%.

Hong Kong

Changshi Tongrong is incorporated in Hong Kong. Pursuant to the income tax laws of Hong Kong, the Company is not subject to tax on non-Hong Kong source income.

Advertising Costs

Advertising costs are charged to operations when incurred. For the three months ended November 30, 2014 and 2013, advertising expense was $154,565 and $41,026, respectively.

Statutory Reserve Fund

Pursuant to the corporate law of the PRC, the Company is required to transfer 10% of its net income, as determined under PRC accounting rules and regulations, to a statutory reserve fund until such reserve balance reaches 50% of the Company’s registered capital. The statutory reserve fund is non-distributable other than during liquidation and can be used to fund previous years’ losses, if any, and may be utilized for business expansion or used to increase registered capital, provided that the remaining reserve balance after use is not less than 25% of registered capital. For the three months ended November 30, 2014 and 2013, a statutory reserve of $41,788 and $29,012 was required to be allocated by the Company, respectively.

NOTE 3. RECENTLY ISSUED ACCOUNTING STANDARDS

In August 2014, the FASB issued authoritative guidance that requires an entity’s management to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going concern and requires additional disclosures if certain criteria are met. This guidance is effective for fiscal periods ending after December 15, 2016, with early adoption permitted. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

In June 2014, the FASB issued Accounting Standards Update No. 2014-12, Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period (ASU 2014-12). ASU 2014-12 requires that a performance target that affects vesting and could be achieved after the requisite service period be treated as a performance condition. A reporting entity should apply existing guidance in Accounting Standards Codification (ASC) 718, Compensation—Stock Compensation, as it relates to such awards. ASU 2014-12 is effective for us in our first quarter of fiscal 2017 with early adoption permitted using either of two methods: (i) prospective to all awards granted or modified after the effective date; or (ii) retrospective to all awards with performance targets that are outstanding as of the beginning of the earliest annual period presented in the financial statements and to all new or modified awards thereafter, with the cumulative effect of applying ASU 2014-12 as an adjustment to the opening retained earnings balance as of the beginning of the earliest annual period presented in the financial statements. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 3. RECENTLY ISSUED ACCOUNTING STANDARDS (continued)

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers”, which supersedes the revenue recognition requirements in ASC 605, “Revenue Recognition”. The core principle of this updated guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The new rule also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. This guidance is effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. Companies are permitted to adopt this new rule following either a full or modified retrospective approach. Early adoption is not permitted. The Company has not yet determined the potential impacts of this updated authoritative guidance on its consolidated financial statements.

In April 2014, the FASB issued ASU 2014-08, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360), Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity”, which amends the requirements for reporting discontinued operations. Under ASU 2014-08, a disposal of a component of an entity or a group of components of an entity is required to be reported in discontinued operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity's operations and financial results when the component or group of components meets the criteria to be classified as held for sale or when the component or group of components is disposed of by sale or other than by sale. In addition, this ASU requires additional disclosures about both discontinued operations and the disposal of an individually significant component of an entity that does not qualify for discontinued operations presentation in the financial statements. The guidance is effective for annual and interim periods beginning after December 15, 2014, with early adoption permitted. This accounting standard update is not expected to have a material impact on the Company’s consolidated financial statements.

In July 2013, FASB issued ASU No. 2013-11, Presentation of an Unrecognized Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists. This ASU requires an unrecognized tax benefit to be presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward. An exception exists to the extent that a net operating loss carryforward, a similar tax loss, or a tax credit carryforward is not available at the reporting date under the tax law of the applicable jurisdiction to settle any additional income taxes that would result from the disallowance of a tax position or the tax of the applicable jurisdiction does not require the entity to use, and entity does not intend to use, the deferred tax asset for such a purpose, the unrecognized tax benefit should be presented in the financial statements as a liability and should not be combined with deferred tax assets. ASU No. 2013-11 is effective for fiscal years and interim periods beginning after December 15, 2013 and did not have a material impact on the Company's consolidated financial statements.

NOTE 4. FAIR VALUE OF FINANCIAL INSTRUMENTS

FASB ASC 820, “Fair Value Measurement,” specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

| Level 1 Inputs - | Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access. | |

| Level 2 Inputs - | Inputs other than the quoted prices in active markets that are observable either directly or indirectly. | |

| Level 3 Inputs - | Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements. |

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 4. FAIR VALUE OF FINANCIAL INSTRUMENTS (continued)

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurements. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. As of November 30, 2014 and August 31, 2014, none of the Company’s assets and liabilities were required to be reported at fair value on a recurring basis. Carrying values of non-derivative financial instruments, including cash, accounts receivable, prepaid expenses, accounts payable and accrued liabilities, approximate their fair values due to the short term nature of these financial instruments. There were no changes in methods or assumptions during the periods presented.

NOTE 5. FIXED ASSETS

Fixed assets are summarized as follows:

| November 30, 2014 | August 31, 2014 | |||||||

| (Unaudited) | ||||||||

| Computers and equipment | $ | 24,678 | $ | 24,618 | ||||

| Motor vehicles | 148,870 | 148,504 | ||||||

| Fixture and furniture | 13,912 | 13,878 | ||||||

| 187,460 | 187,000 | |||||||

| Less: Accumulated depreciation | (151,148 | ) | (138,887 | ) | ||||

| Fixed assets, net | $ | 36,312 | $ | 48,113 | ||||

For the three months ended November 30, 2014 and 2013, depreciation expense was $11,904 and $10,591 respectively.

NOTE 6. ACCRUED LIABILITIES AND OTHER PAYABLES

Accrued liabilities and other payables consist of the following:

| November 30, 2014 | August 31, 2014 | |||||||

| (Unaudited) | ||||||||

| Accrued payroll | $ | 9,272 | $ | 9,250 | ||||

| Professional fees | 28,546 | 47,941 | ||||||

| Other | 27,033 | 15,790 | ||||||

| Accrued liabilities and other payables | $ | 64,851 | $ | 72,981 | ||||

NOTE 7. LEASES

The Company leases office space under an eight-year operating lease from an unrelated third party, expiring on June 30, 2017. This lease has a renewal option. This lease requires the Company to pay the total rent in advance for one year of RMB 264,000 (US$43,006). The monthly rent charge was increased from RMB 22,000 (USD $3,579) to RMB 25,000 (USD $4,068) commencing July 2014.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 7. LEASES (continued)

The minimum future rentals under this lease as of November 30, 2014 are as follows:

| Period Ending | ||||||

| August 31, | Amount | |||||

| 2015 | $ | 8,145 | ||||

| 2016 | 48,870 | |||||

| 2017 | 40,725 | |||||

| $ | 97,740 | |||||

Rent expense for the three months ended November 30, 2014 and 2013 was $12,204 and $15,037, respectively.

NOTE 8. INCOME TAXES

The provision for income taxes consisted of the following:

| For the three month ended November 30, | ||||||||||

| 2014 | 2013 | |||||||||

| (Unaudited) | (Unaudited) | |||||||||

| Current | $ | 146,555 | $ | 94,625 | ||||||

| Deferred | — | — | ||||||||

| $ | 146,555 | $ | 94,625 | |||||||

The Company is required to file income tax returns in both the PRC and the United States. PRC tax filings for the tax year ended December 31, 2013 were examined by the PRC tax authorities in May 2014. The tax filings were accepted and no adjustments were proposed by the PRC tax authorities.

The Company did not generate any income in the United States or otherwise have any U.S. taxable income. The Company does not believe that it has any U.S. federal income tax liabilities with respect to any transactions that the Company or any of its subsidiaries may have engaged in through November 30, 2014. However, there can be no assurance that the IRS will agree with this position, and therefore the Company ultimately could be liable for U.S. federal income taxes, interest and penalties (See Note 10).

NOTE 9. RELATED PARTY TRANSACTIONS

The majority stockholder loans money to the Company, primarily to meet the non-RMB cash requirements. The loans are non-interest bearing and due on demand. The balance of $62,152 and $24,339 at November 30, 2014 and August 31, 2014, respectively, represents professional and legal fees incurred in the U.S. paid by this stockholder. The balance is reflected as loans from stockholder on the consolidated balance sheet.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 10. CONTINGENCIES

The Company did not file its U.S. federal income tax returns, including, without limitation, information returns on Internal Revenue Service (“IRS”) Form 5471, “Information Return of U.S. Persons with Respect to Certain Foreign Corporations” for the fiscal year ended December 31, 2013. In addition, the Company did not file with the U.S. Internal Revenue Service the information report for the year ended December 31, 2013 concerning its interest in foreign bank accounts on Form TDF 90-22.1, “Report of Foreign Bank and Financial Accounts” (“FBAR”). Not complying with the FBAR reporting and recordkeeping requirements will subject the Company to civil penalties up to $10,000 for each of its foreign bank accounts. The Company has not determined the amount of any penalties that may be assessed at this time and believes that penalties, if any, that may be assessed would not be material to the consolidated financial statements.

NOTE 11. CONCENTRATION OF CREDIT AND BUSINESS RISKS

Substantially all of the Company’s assets and bank accounts are in banks located in the PRC and are not covered by protection similar to that provided by the FDIC on funds held in United States banks.

As of November 30, 2014 and August 31, 2014, no customer accounted for more than 10% of accounts receivable. There were no major customers which accounted for 10% or more of the total net revenue for the three months ended November 30, 2014 and 2013. The Company extends credit to its customers based upon its assessment of their credit worthiness and generally does not require collateral. Credit losses have not been significant. Four vendors individually accounted for 23%, 29%, 18% and 11% of purchases for the three months ended November 30, 2014.

The Company’s operations may be adversely affected by significant political, economic and social uncertainties in the PRC. Although the PRC government has been pursuing economic reform policies for more than twenty years, no assurance can be given that the PRC government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption or unforeseen circumstances affecting the PRC’s political, economic and social conditions. There is also no guarantee that the PRC government’s pursuit of economic reforms will be consistent and effective or that it will continue.

NOTE 12. CONDENSED FINANCIAL INFORMATION OF REGISTRANT

Under PRC laws and regulations, the Company’s PRC subsidiary and VIE are restricted in their ability to transfer certain of their net assets to the Company in the form of dividend payments, loans or advances. The restricted net assets of the Company’s PRC subsidiary and VIE amounted to $5,662,676 and $5,236,612 as of November 30, 2014 and August 31, 2014, respectively.

In addition, the Company’s operations and revenues are conducted and generated in the PRC; all of the Company’s revenues being earned and currency received are denominated in RMB. RMB is subject to the foreign exchange control regulations in China, and, as a result, the Company may be unable to distribute any dividends outside of China due to PRC foreign exchange control regulations that restrict the Company’s ability to convert RMB into US Dollars.

Schedule I of Article 5-04 of Regulation S-X requires the condensed financial information of the Company to be filed when the restricted net assets of consolidated subsidiaries and VIE’s exceed 25 percent of consolidated net assets as of the end of the most recently completed fiscal year. For purposes of this test, restricted net assets of consolidated subsidiaries and VIEs shall mean that amount of the registrant’s proportionate share of net assets of its consolidated subsidiaries and VIEs (after intercompany eliminations) which as of the end of the most recent fiscal year may not be transferred to the parent company in the form of loans, advances or cash dividends without the consent of a third party. The condensed parent company financial statements have been prepared in accordance with Rule 12-04, Schedule I of Regulation S-X as the restricted net assets of the Company’s PRC subsidiary and VIE exceed 25% of the consolidated net assets of the Company.

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 12. CONDENSED FINANCIAL INFORMATION OF REGISTRANT (continued)

The following condensed financial information of the Company includes the US parent only balance sheets as of November 30, 2014 and August 31, 2014, and the US parent company only statements of operations, and cash flows for the three months ended November 30, 2014 and 2013:

Condensed Balance Sheets

| November 30, 2014 | August 31, 2014 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Investment in subsidiaries and VIEs | $ | 5,662,676 | $ | 5,236,612 | ||||

| TOTAL ASSETS | $ | 5,662,676 | $ | 5,236,612 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Accrued expenses and other payables | $ | — | $ | — | ||||

| Total liabilities | $ | — | $ | — | ||||

| Stockholders’ equity | ||||||||

| Common stock, $0.0006 par value per share, 80,000,000 shares authorized; 34,396,680 shares issued and outstanding as of November 30, 2014 and August 31, 2014 | $ | 20,638 | $ | 20,638 | ||||

| Additional paid-in capital | 726,548 | 726,548 | ||||||

| Retained earnings | 4,915,490 | 4,489,426 | ||||||

| Total stockholders’ equity | 5,662,676 | 5,236,612 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 5,662,676 | $ | 5,236,612 | ||||

Condensed Statements of Operations

| Three Months Ended November 30, | ||||||||

| 2014 | 2013 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Revenues | ||||||||

| Share of earnings from investment in subsidiaries and VIE | $ | 426,064 | $ | 308,551 | ||||

| Operating expenses | ||||||||

| General and administrative | — | — | ||||||

| Net income | $ | 426,064 | $ | 308,551 | ||||

CHINA TIANFEIHONG WINE, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED NOVEMBER 30, 2014 AND 2013 (UNAUDITED) (IN U.S.$)

NOTE 12. CONDENSED FINANCIAL INFORMATION OF REGISTRANT (continued)

Condensed Statements of Cash Flows

| Three Months Ended November 30, | ||||||||

| 2014 | 2013 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 426,064 | $ | 308,551 | ||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities | ||||||||

| Share of earnings from investment in subsidiaries and VIE | (426,064 | ) | (308,551 | ) | ||||

| Net cash (used in) operating activities | — | — | ||||||

| Net increase in cash | — | — | ||||||

| Cash, beginning of year | — | — | ||||||

| Cash, end of year | $ | — | $ | — | ||||

Basis of Presentation

The Company records its investment in its subsidiaries and VIEs under the equity method of accounting. Such investment is presented as “Investment in subsidiaries and VIE” on the condensed balance sheets and shares of the subsidiaries and VIE’s profits are presented as “Share of earnings from investment in subsidiaries and VIE” in the condensed statements of operations.

Certain information and footnote disclosures normally included in financial statements prepared in conformity with accounting principles generally accepted in the United States of America have been condensed or omitted. The parent only financial information has been derived from the Company’s consolidated financial statements and should be read in conjunction with the Company’s consolidated financial statements.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULT OF OPERATIONS

Overview

We conduct our operations through our consolidated affiliate, Fujian Tianfeihong Wine, Co., Ltd. (hereinafter referred to as “Fujian Tianfeihong”). Fujian Tianfeihong, founded in April 2009, is primarily engaged in distributing a wide variety of fruit wine, including green plum wine, loquat wine, olive wine, and pomegranate wine, to supermarkets and liquor stores. The headquarters of Fujian Tianfeihong are located at 1600 Tai'an Block, Licheng Road, Chengxiang District, Putian City, Fujian Province, China.

Our U.S parent corporation was incorporated in the state of Delaware on July 28, 2005. Until its acquisition of Fanwei Hengchang, China Tianfeihong Wine, Inc. was a development stage company without significant assets or any revenue.

On December 30, 2013, we completed a reverse acquisition transaction through a share exchange with the stockholders of Fanwei Hengchang Co., Ltd. (BVI) (“Fanwei Hengchang”), whereby we acquired 100% of the outstanding shares of Fanwei Hengchang in exchange for a total of 32,000,000 shares of our common stock, representing 93.03% of our issued and outstanding shares of common stock. As a result of the reverse acquisition, Fanwei Hengchang became our wholly-owned subsidiary and the former Fanwei Hengchang stockholders became our controlling stockholders. The share exchange transaction was treated as a reverse acquisition, with Fanwei Hengchang as the acquirer and China Tianfeihong Wine, Inc. as the acquired party for accounting purposes. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Fanwei Hengchang and its consolidated subsidiaries and variable interest entity.

As a result of our acquisition of Fanwei Hengchang and its wholly owned subsidiaries, we now own all of the issued and outstanding capital stock of Changshi Tongrong, which in turn owns all of the issued and outstanding capital stock of Changshitong Consulting. In addition, we effectively and substantially control Fujian Tianfeihong (the "VIE") through a series of agreements between Changshitong Consulting and Fujian Tianfeihong and its stockholders. The consolidated group, including the VIE is hereafter referred to as the “Company”.

Fanwei Hengchang was established in the British Virgin Islands on May 29, 2013. It is a holding company whose sole asset is the capital stock of Changshi Tongrong Limited (Hong Kong), a holding company established in Hong Kong on August 10, 2012 whose sole asset is all of the registered equity of Changshitong Information Consulting (Shenzhen) Co., Ltd. (“Changshitong Consulting”). Changshitong Consulting was established by Changshi Tongrong as a wholly foreign owned enterprise (the “WFOE”) in the People's Republic of China (“PRC”) on September 23, 2013.

For accounting purposes, the acquisition of these entities has been treated as a recapitalization with no adjustment to the historical basis of their assets and liabilities. The restructuring has been accounted for using the “as if” pooling method of accounting and the operations have been consolidated as if the restructuring had occurred as of the beginning of the earliest period presented in our consolidated financial statements and the current corporate structure had been in existence throughout the periods covered by our consolidated financial statements.

Contractual Arrangements with our Controlled Consolidated Affiliate and its Stockholders

On November 26, 2013, prior to the reverse acquisition transaction, Changshitong Consulting and Fujian Tianfeihong and its shareholders, Jinxiang Fang and Zhiliang Fang, entered into a series of agreements (the “VIE Agreements”) pursuant to which Fujian Tianfeihong became Changshitong Consulting’s contractually controlled affiliate. The VIE Agreements included:

| (1) | an Exclusive Technical Service and Business Consulting Agreement between Changshitong Consulting and Fujian Tianfeihong pursuant to which Changshitong Consulting is to provide technical support and consulting services to Fujian Tianfeihong in exchange for (i) 95% of the total annual net profit of Fujian Tianfeihong plus (ii) RMB10,000 per month (U.S.$1,627); |

| (2) | a Call Option Agreement among Zhiliang Fang and Jinxiang Fang (together referred to as “Fujian Tianfeihong Stockholders”) and Changshitong Consulting under which the Fujian Tianfeihong Stockholders have granted to Changshitong Consulting the irrevocable right and option to acquire all of the equity interests in Fujian Tianfeihong to the extent permitted by PRC law. If PRC law limits the percentage of Fujian Tianfeihong that Changshitong Consulting may purchase at any time, then Changshitong Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00 (U.S. $0.16) or the minimum price permitted by PRC laws if at that time there are any PRC laws regulating the minimum purchase price. The Fujian Tianfeihong Stockholders agreed to refrain from taking certain actions which might harm the value of Fujian Tianfeihong or Changshitong Consulting’s option; |

| (3) | a Proxy Agreement by Zhiliang Fang, Jinxiang Fang, Changshitong Consulting and Fujian Tianfeihong pursuant to which the Fujian Tianfeihong Stockholders authorize Changshitong Consulting to designate someone to exercise all of their stockholder decision rights with respect to Fujian Tianfeihong; and |

| (4) | a Share Pledge Agreement among Zhiliang Fang and Jinxiang Fang, Fujian Tianfeihong, and Changshitong Consulting under which the Fujian Tianfeihong Stockholders pledge all of their equity in Fujian Tianfeihong to Changshitong Consulting to guarantee Fujian Tianfeihong’s and its stockholders’ performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement. |

The accounting effect of the VIE Agreements between Changshitong Consulting and Fujian Tianfeihong is to cause the balance sheets and financial results of Fujian Tianfeihong to be consolidated with those of Changshitong Consulting, with respect to which Fujian Tianfeihong is now a variable interest entity.

Results of Operations

The following table sets forth key components of our results of operations during three months ended November 30, 2014 and 2013, and the percentage changes between 2014 and 2013.

| November 30, | November 30, | |||||||||||

| 2014 | 2013 | Change | ||||||||||

| (US $) | (US $) | % | ||||||||||

| Revenue | $ | 3,136,386 | $ | 1,932,378 | 62 | % | ||||||

| Cost of Sales | (2,095,040 | ) | (1,311,260 | ) | 60 | % | ||||||

| Gross profit | 1,041,346 | 621,118 | 68 | % | ||||||||

| Selling and marketing expenses | 387,331 | 197,537 | 96 | % | ||||||||

| General and administrative expenses | 72,925 | 47,273 | 54 | % | ||||||||

| Total operating expenses | 460,256 | 244,810 | 88 | % | ||||||||

| Income from operations | 581,090 | 376,308 | 54 | % | ||||||||

| Other income | 5,117 | 3,502 | 46 | % | ||||||||

| Income before provision for income taxes | 586,207 | 379,810 | 54 | % | ||||||||

| Provision for income taxes | 146,555 | 94,625 | 55 | % | ||||||||

| Net income | 439,652 | 285,185 | 54 | % | ||||||||

| Less: Non controlling interests | 21,806 | 9,375 | 133 | % | ||||||||

| Net income attributable to common stockholders | $ | 417,846 | $ | 275,810 | 51 | % | ||||||

| Comprehensive income: | ||||||||||||

| Net income | $ | 439,652 | $ | 285,185 | 54 | % | ||||||

| Foreign currency translation adjustment | 8,907 | 32,756 | (73 | )% | ||||||||

| Total comprehensive income | $ | 448,559 | $ | 317,941 | 41 | % | ||||||

| Less: Comprehensive income attributable to noncontrolling interests | $ | 22,495 | $ | 9,390 | 140 | % | ||||||

| Comprehensive income attributable to common stockholders | $ | 426,064 | $ | 308,551 | 38 | % | ||||||

Sales. Our sales increased to $3,136,386 for the three months ended November 30, 2014 from $1,932,378 for the three months ended November 30, 2013, an increase of 62%. The increase was primarily attributable to our marketing efforts, which yielded a 47% increase in the quantity of cases sold, to 65,300 for three months ended November 30, 2014 from 44,403 for the three months ended November 30, 2013. In addition, the average selling price per case of wine increased to $48.03 for three months ended November 30, 2014 from $43.52 in fiscal year 2013, an increase of 10%. While the factors that caused a drop in sales from fiscal year 2013 to fiscal year 2014 (increased competition, reduced market demand) remain as obstacles to growth, the surge in sales in the recent quarter indicates that our efforts to overcome these obstacles have met with some success.

Gross Profit. Our cost of sales primarily consists of the cost for wine purchases and the VAT surcharge. In addition, to stimulate new distribution channels, Fujian Tianfeihong has been aggressively offering rewards to customers, so that when the customer contracts to purchase a certain amount, we give the customer a certain amount of free goods. These rewards are recorded as an additional cost of sales. Rewards added $200,381 to cost of revenue during the three months ended November 30, 2014 and $132,197 during the three months ended November 30, 2013.

Our unit box purchase price increased by 9% to $28.79 for the three months ended November 30, 2014 from $26.41 for the three months ended November 30, 2013. However, as the rewards expense was smaller relative to sales in the recent quarter, gross margin increased from 32.1% in the three months ended November 30, 2013 to 33.2% in the three months ended November 30, 2014. Due to the increase in revenue and increased gross margin, our gross profit increased to $1,041,346 for the three months ended November 30, 2014 from $621,118 for the three months ended November 30, 2013, representing an increase of 68%.

Impact of Exchange Rates. In preparing our financial statements for inclusion in our SEC filings, we translate from the Chinese Renminbi to U.S. dollars the elements of our balance sheets at the exchange rate on the balance date, except for stockholders’ equity and our statements of income. Accordingly, our year-to-year comparisons may be influenced by changes in the average exchange rate, resulting in increases or decreases that do not reflect actual changes in operating results. The exchange rates used to translate Renminbi into Dollars in the financial statements included in this report were all within 0.25% of each other. (See: Note 2 to The Consolidated Financial Statements: "Summary of Significant Accounting Policies - Foreign Currency Translation"). Accordingly, changes in exchange rates did not have a material impact on the comparison of financial results.

Selling expenses. Our selling expenses increased by 96% to $387,331 for the three months ended November 30, 2014 from $197,537 for the three months ended November 30, 2013, primarily due to an increase of $48,660 in transportation expenses and an increase of $113,539 in marketing expenses related to the increase in sales. Our selling expenses primarily consist of transportation expenses, marketing expenses and expenses incurred for the sales function, such as salaries, travel expenses, entertainment and rent.

General and administrative expenses. Our general and administrative (“G&A”) expenses increased by 54%, to $72,925 for the three months ended November 30, 2014 from $47,273 for three months ended November 30, 2013. Our G&A expenses primarily consist of office expenses, entertainment expenses, travel expenses, depreciation expenses, rent, professional fees, and salaries. The change in G&A expenses occurred in all categories, and was not attributable to any single situation.

Other income. Our other income consisted entirely of interest income earned on our bank balances. Due to the increase in our cash position and a modest increase in prevailing interest rates, interest income increased to $5,117 for the three months ended November 30, 2014 from $3,502 for the three months ended November 30, 2013.

Provision for income tax. Due to the 54% increase in our pre-tax income, our provision for income tax increased to $146,555 for the three months ended November 30, 2014 from $94,625 for the three months ended November 30, 2013, representing a 55% increase. Our effective tax rate was the same as the statutory rate of 25% for the three months ended November 30, 2014 and 2013.

Net income. After deducting income tax, the Company reported net income of $439,652 and $285,185 for the three months ended November 30, 2014 and 2013, respectively. The VIE agreements assign to Changshitong Consulting only 95% of the net profit generated from Fujian Tianfeihong. For that reason, we deducted a “non-controlling interest” of $21,806 and $9,375, respectively, before recognizing net income attributable to the Company’s common stockholders on our Consolidated Statements of Income and Comprehensive Income. After that deduction, our net income attributable to the Company for the three months ended November 30, 2014 was $417,846, an increase of 51% from the net income of $275,810 for the three months ended November 30, 2013.

Foreign Currency Translation Adjustment. Our reporting currency is the U.S. dollar. Our local currency, Renminbi (RMB), is our functional currency. Results of operations and cash flow are translated at average exchange rates during the period being reported upon, and assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of stockholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. RMB is not freely convertible into the currency of other nations. All such exchange transactions must take place through authorized institutions. There is no guarantee the RMB amounts could have been, or could be, converted into US dollars at rates used in translation. For the three months ended November 30, 2014 and 2013, foreign currency translation adjustments of $8,907 and $32,756, respectively, have been reported as other comprehensive income in the consolidated statements of income and other comprehensive income.

Liquidity and Capital Resources

As of November 30, 2014, our working capital totaled $5,789,469, an increase of $460,360 since August 31, 2014. The increase is a little bit more than our net income for the three months ended November 30, 2014, due to the fact that we have very little in fixed or intangible assets on our balance sheet and, accordingly, little depreciation or amortization expense. Cash represented almost 70% of our current assets at November 30, 2014.

Since our operating activities provided $589,223 in cash during the three months ended November 30, 2014, and we have been cash flow positive for the past two years, we believe that our liquid assets are adequate to finance our operations for the foreseeable future.

The following table sets forth a summary of our cash flows for the periods indicated:

Cash Flow

(all amounts in U.S. dollars)

| Three months Ended November 30, 2014 | Three months Ended November 30, 2013 | |||||||

| Net cash provided by operating activities | $ | 589,223 | $ | 305,101 | ||||

| Net cash provided by financing activities | 37,630 | — | ||||||

| Effects of Exchange Rate Change in Cash | 8,987 | 21,413 | ||||||

| Net Increase in Cash | 635,840 | 326,514 | ||||||

| Cash at Beginning of the Period | 5,229,261 | 3,994,502 | ||||||

| Cash at End of the Period | $ | 5,865,101 | $ | 4,321,016 | ||||

Operating activities

Cash provided by operating activities was $589,223 for the three months ended November 30, 2014, as compared to $305,101 for the three months ended November 30, 2013. In both periods, cash provided by operations was more than net income, as we record little depreciation and amortization and control our cash flow by balancing accounts payable against changes in our accounts receivable and inventory.

Investing activities

We did not have any investing activities for the three months ended November 30, 2014 and 2013. The net book value of our fixed assets at November 30, 2014 was $36,312, reflecting the fact that our business activities do not need significant fixed assets. Accordingly, unless we expand our business activities in the future, investing activities should involve similarly insignificant amounts of cash.

Financing activities

Cash provided by financing activities was $37,630 for the three months ended November 30, 2014 which represented a loan from related party. From time to time, we will take modest loans from related parties, primarily to provide the dollars needed to pay expenses incurred by our parent company in the U.S. During the three months ended November 30, 2013, we did not have any financing activities.

Because of our ample cash position and the profitability of our operations, we do not anticipate incurring significant additional debt. Therefore, our liquidity should be adequate to sustain the full implementation of our business plan for the foreseeable future.

Transfer of Cash

All of our sales are generated by Fujian Tianfeihong in the PRC, and 95% of the net income is then assigned to Changshitong Consulting. PRC regulations restrict the ability of our PRC subsidiary, Changshitong Consulting, to make dividend and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of its annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amount of said fund reaches 50% of its registered capital. Allocations to this statutory reserve fund can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

The Chinese government strictly regulates conversion of RMB into foreign currencies. Currently, Fujian Tianfeihong and Changshitong Consulting may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange (“SAFE”), by complying with certain procedural requirements. Pursuant to applicable Chinese laws and regulations, foreign invested enterprises incorporated in China, such as Changshitong Consulting, are required to apply for “Foreign Exchange Registration Certificates.” Currently, conversion within the scope of the “current account” (e.g. remittance of foreign currencies for payment of dividends, trade and service-related foreign exchange transactions, etc.) can be effected without requiring the approval of SAFE, but must be effected through authorized Chinese banks in accordance with regulatory procedures. However, conversion of currency in the “capital account” (e.g. for capital items such as direct investments, loans, securities, etc.) still requires the approval of SAFE. Compliance with those procedural requirements can result in delays in obtaining foreign exchange, which could interfere with offshore activities by the Company, such as acquisitions, offshore investments, or the payment of dividends to the Company’s stockholders.