Attached files

| file | filename |

|---|---|

| S-1/A - AMENDMENT NO. 3 TO FORM S-1 - BOX INC | d642425ds1a.htm |

| EX-10.3 - EX-10.3 - BOX INC | d642425dex103.htm |

| EX-10.9 - EX-10.9 - BOX INC | d642425dex109.htm |

| EX-5.1 - EX-5.1 - BOX INC | d642425dex51.htm |

| EX-10.5 - EX-10.5 - BOX INC | d642425dex105.htm |

| EX-10.2 - EX-10.2 - BOX INC | d642425dex102.htm |

| EX-10.8 - EX-10.8 - BOX INC | d642425dex108.htm |

| EX-3.2 - EX-3.2 - BOX INC | d642425dex32.htm |

| EX-10.10 - EX-10.10 - BOX INC | d642425dex1010.htm |

| EX-3.4 - EX-3.4 - BOX INC | d642425dex34.htm |

| EX-1.1 - EX-1.1 - BOX INC | d642425dex11.htm |

| EX-10.4 - EX-10.4 - BOX INC | d642425dex104.htm |

| EX-23.1 - EX-23.1 - BOX INC | d642425dex231.htm |

| EX-10.12 - EX-10.12 - BOX INC | d642425dex1012.htm |

| EX-10.11 - EX-10.11 - BOX INC | d642425dex1011.htm |

| EX-10.19 - EX-10.19 - BOX INC | d642425dex1019.htm |

Exhibit 10.18

OFFICE LEASE

KILROY REALTY

CROSSING/900

REDWOOD CITY PARTNERS, LLC,

a Delaware limited liability company,

as Landlord,

and

BOX, INC.,

a Delaware corporation,

as Tenant.

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 |

PREMISES, BUILDINGS, PROJECT, AND COMMON AREAS | 9 | ||||

| ARTICLE 2 |

LEASE TERM; OPTION TERMS | 18 | ||||

| ARTICLE 3 |

BASE RENT | 22 | ||||

| ARTICLE 4 |

ADDITIONAL RENT | 24 | ||||

| ARTICLE 5 |

USE OF PREMISES | 36 | ||||

| ARTICLE 6 |

SERVICES AND UTILITIES | 41 | ||||

| ARTICLE 7 |

REPAIRS | 45 | ||||

| ARTICLE 8 |

ADDITIONS AND ALTERATIONS | 47 | ||||

| ARTICLE 9 |

COVENANT AGAINST LIENS | 50 | ||||

| ARTICLE 10 |

INDEMNIFICATION AND INSURANCE | 51 | ||||

| ARTICLE 11 |

DAMAGE AND DESTRUCTION | 56 | ||||

| ARTICLE 12 |

NONWAIVER | 59 | ||||

| ARTICLE 13 |

CONDEMNATION | 60 | ||||

| ARTICLE 14 |

ASSIGNMENT AND SUBLETTING | 60 | ||||

| ARTICLE 15 |

SURRENDER OF PREMISES; OWNERSHIP AND REMOVAL OF TRADE FIXTURES | 67 | ||||

| ARTICLE 16 |

HOLDING OVER | 67 | ||||

| ARTICLE 17 |

ESTOPPEL CERTIFICATES; FINANCIAL STATEMENTS | 68 | ||||

| ARTICLE 18 |

SUBORDINATION | 69 | ||||

| ARTICLE 19 |

DEFAULTS; REMEDIES | 70 | ||||

| ARTICLE 20 |

COVENANT OF QUIET ENJOYMENT | 73 | ||||

| ARTICLE 21 |

LETTER OF CREDIT | 73 | ||||

| ARTICLE 22 |

EMERGENCY GENERATOR | 80 | ||||

| ARTICLE 23 |

SIGNS | 81 | ||||

(i)

| ARTICLE 24 |

COMPLIANCE WITH LAW | 84 | ||||

| ARTICLE 25 |

LATE CHARGES | 85 | ||||

| ARTICLE 26 |

LANDLORD’S RIGHT TO CURE DEFAULT; PAYMENTS BY TENANT | 86 | ||||

| ARTICLE 27 |

ENTRY BY LANDLORD | 86 | ||||

| ARTICLE 28 |

TENANT PARKING | 87 | ||||

| ARTICLE 29 |

MISCELLANEOUS PROVISIONS | 89 | ||||

EXHIBITS AND SCHEDULES

| EXHIBIT A-1 |

OUTLINE OF PREMISES |

|||||

| EXHIBIT A-2 |

OUTLINE OF OFFSITE PROJECT |

|||||

| EXHIBIT A-3 |

OUTLINE OF TERRACE |

|||||

| EXHIBIT B |

WORK LETTER |

|||||

| SCHEDULE 1 TO WORK LETTER |

BASE BUILDING PLANS | |||||

| SCHEDULE 2 TO WORK LETTER |

BASE BUILDING DEFINITION | |||||

| SCHEDULE 3 TO WORK LETTER |

DELIVERY CONDITION | |||||

| SCHEDULE 4 TO WORK LETTER |

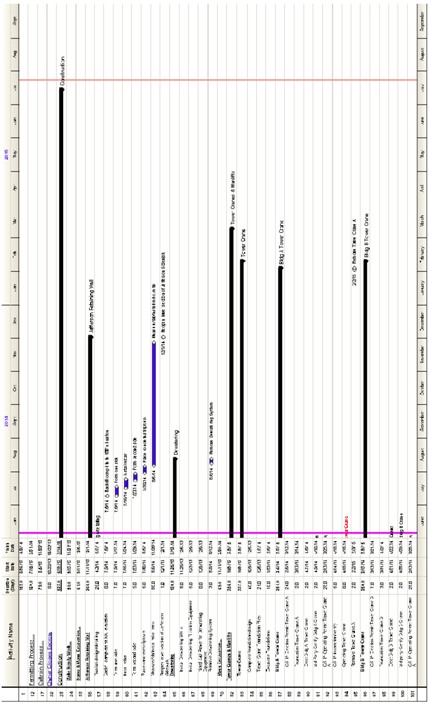

CONSTRUCTION SCHEDULE | |||||

| EXHIBIT C |

NOTICE OF LEASE TERM DATES |

|||||

| EXHIBIT D |

RULES AND REGULATIONS |

|||||

| EXHIBIT E |

FORM OF TENANT’S ESTOPPEL CERTIFICATE |

|||||

| EXHIBIT F-1 |

FORM OF LETTER OF CREDIT |

|||||

| EXHIBIT F-2 |

EXAMPLE CALCULATION OF L-C BURNDOWN |

|||||

| EXHIBIT G-1 |

DEPICTION AND GENERAL LOCATIONS OF TENANT’S SIGNAGE |

|||||

| EXHIBIT G-2 |

GENERAL LOCATIONS OF LANDLORD’S SIGNAGE |

|||||

| EXHIBIT H |

MARKET RENT DETERMINATION FACTORS |

|||||

| EXHIBIT I |

VISITOR PARKING AREA |

|||||

(ii)

TABLE OF CONTENTS

| Page | ||

| Abatement Amount |

23 | |

| Abatement Condition |

23 | |

| Abatement Event |

44 | |

| Abatement Notice |

44 | |

| Accountant |

35 | |

| Additional Allowance |

Exhibit B | |

| Additional Monthly Base Rent |

Exhibit B | |

| Additional Rent |

24 | |

| Advocate Arbitrators |

20 | |

| Alterations |

47 | |

| Amendment |

Exhibit B | |

| Appealable Tax Expenses |

31 | |

| Appeals Notice |

31 | |

| Applicable Laws |

85 | |

| Approved Working Drawings |

Exhibit B | |

| Arbitration Agreement |

20 | |

| Architect |

119 | |

| Audit Period |

35 | |

| Bank |

74 | |

| Bank Credit Threat |

75 | |

| Bank Prime Loan |

85 | |

| Bankruptcy Code |

75 | |

| Base Building |

48, Exhibit B | |

| Base Building Code |

Exhibit B | |

| Base Building Plans |

Exhibit B | |

| Base Building Punch List Items |

Exhibit B | |

| Base Rent |

23 | |

| Base, Shell and Core |

Exhibit B | |

| Briefs |

21 | |

| Brokers |

93 | |

| BS/BS Exception |

45 | |

| Building |

Summary | |

| Building A |

Summary | |

| Building A Delivery Condition Termination Date |

Exhibit B | |

| Building A Delivery Failure Termination Notice |

Exhibit B | |

| Building A First Rent Abatement Delivery Condition Date |

Exhibit B | |

| Building A Late Delivery Date Abatements |

Exhibit B | |

| Building A Lease Commencement Date |

Summary | |

| Building A Lease Year |

18 | |

| Building A Premises |

Summary | |

| Building A Second Rent Abatement Delivery Condition Date |

Exhibit B | |

| Building A Termination Effective Date |

Exhibit B | |

| Building B |

Summary | |

| Building B Delivery Condition Termination Date |

Exhibit B |

(iii)

| Building B Delivery Failure Termination Notice |

Exhibit B | |

| Building B First Rent Abatement Delivery Condition Date |

Exhibit B | |

| Building B Late Delivery Date Abatements |

Exhibit B | |

| Building B Lease Commencement Date |

Summary | |

| Building B Premises |

Summary | |

| Building B Second Rent Abatement Delivery Condition Date |

Exhibit B | |

| Building B Termination Effective Date |

Exhibit B | |

| Building Common Areas, |

10 | |

| Building Hours |

41 | |

| Building Structure |

45 | |

| Building Systems |

45 | |

| Buildings |

Summary | |

| Burn Down Date |

78 | |

| Cafeteria |

39 | |

| Cafeteria Facilities |

39 | |

| Casualty |

56 | |

| Child Care Facility |

37 | |

| Child Care Provider |

37 | |

| Child Care Users |

37 | |

| Code |

Exhibit B | |

| CofO |

Exhibit B | |

| CofO Item |

Exhibit B | |

| Common Areas |

10 | |

| Comparable Area |

Exhibit H | |

| Comparable Buildings |

171 | |

| Comparable Term |

Exhibit H | |

| Comparable Transactions |

Exhibit H | |

| Concessions |

Exhibit H | |

| Construction Covenant |

114 | |

| Construction Drawings |

Exhibit B | |

| Construction Period |

53 | |

| Contemplated Effective Date |

63 | |

| Contemplated Transfer Space |

63 | |

| Contract |

Exhibit B | |

| Contractor |

Exhibit B | |

| Control, |

66 | |

| Controlled Account |

79 | |

| Controlled Account Agreement |

79 | |

| Controlled Account Deposit |

79 | |

| Controlled Bank |

79 | |

| Coordination Fee |

Exhibit B | |

| Cosmetic Alterations |

48 | |

| Cost Pool |

32 | |

| Damage Termination Date |

59 | |

| Damage Termination Notice |

59 | |

| Delay Notice |

Exhibit B |

(iv)

| Delivery Condition |

Exhibit B | |

| Delivery Date |

Exhibit B | |

| Direct Expenses |

24 | |

| Economic Terms |

12 | |

| Electronic Project Sign |

83 | |

| Emergency |

47 | |

| Energy Disclosure Information |

101 | |

| Energy Disclosure Requirements |

101 | |

| Engineers |

Exhibit B | |

| Environmental Laws |

97 | |

| Environmental Permits |

97 | |

| Estimate |

34 | |

| Estimate Statement |

34 | |

| Estimated Construction Dates |

Exhibit B | |

| Estimated Direct Expenses |

34 | |

| Excess |

33 | |

| Exercise Notice |

19 | |

| Expense Year |

24 | |

| FDIC |

77 | |

| Final Condition |

Exhibit B | |

| Final Condition Date |

Exhibit B | |

| Final Costs |

Exhibit B | |

| Final Retention |

Exhibit B | |

| Final Space Plan |

Exhibit B | |

| Final Working Drawings |

Exhibit B | |

| First Offer Notice |

12 | |

| First Offer Space |

12 | |

| First Offer Term |

13 | |

| First Rebuttals |

21 | |

| Fitness Center |

40 | |

| Fitness Center Provider |

40 | |

| Fitness Center Users |

40 | |

| Fixed Period |

77 | |

| Force Majeure |

92 | |

| Force Majeure Delay |

Exhibit B | |

| Generator |

80 | |

| Generator Area |

80 | |

| Hazardous Material(s) |

96 | |

| Holidays |

41 | |

| Hunter Storm |

13 | |

| HVAC |

41 | |

| Identification Requirements |

96 | |

| Improvement Allowance |

Exhibit B | |

| Improvement Allowance Items |

Exhibit B | |

| Improvements |

Exhibit B | |

| Initial L-Cs |

73 |

(v)

| Intention to Transfer Notice |

63 | |

| Interest Rate |

85 | |

| Intervening Lease |

15 | |

| KRC |

13 | |

| Landlord |

Summary | |

| Landlord Caused Delay |

Exhibit B | |

| Landlord Parties |

51, 52 | |

| Landlord Rent Abatement Acceleration Election |

23 | |

| Landlord Repair Notice |

57 | |

| Landlord Response Notice |

19 | |

| Landlord Use Rights |

17 | |

| Landlord’s Twelve Month Warranty |

9 | |

| Landlord’s Event Use Rights |

17 | |

| Landlord’s Initial Statement |

22 | |

| Landlord’s Option Rent Calculation |

19 | |

| Landlord’s Project Costs |

52 | |

| Landlord’s Repair Estimate Notice |

57 | |

| Late Payment Notice |

85 | |

| L-C |

73 | |

| L-C Amount |

73 | |

| L-C Burn Down Amount |

78 | |

| LC Expiration Date |

75 | |

| L-C Reduction Conditions |

78 | |

| Lease |

Summary | |

| Lease Commencement Date |

18 | |

| Lease Commencement Date Delay |

Exhibit B | |

| Lease Expiration Date |

18 | |

| Lease Term |

18 | |

| Lines |

96 | |

| Lobbies |

11 | |

| Lobby |

11 | |

| Management Fee Percentage |

29 | |

| Market Rent |

Exhibit H | |

| Merger Notice |

84 | |

| Net Equivalent Lease Rate |

Exhibit H | |

| net operating cashflow |

78 | |

| Net Worth |

66 | |

| Neutral Arbitrator |

20 | |

| Notices |

92 | |

| Objectionable Content |

84 | |

| Objectionable Name |

82 | |

| Office Space Leasing Requirement |

11 | |

| Offsite First Offer Notice |

14 | |

| Offsite First Offer Space |

14 | |

| Offsite Landlord |

14 | |

| Offsite Project |

14 |

(vi)

| Offsite Superior Right Holders |

14 | |

| Operating Expenses |

25 | |

| Option Rent |

19 | |

| Option Term |

19 | |

| Original Improvements |

54 | |

| Original Tenant |

12 | |

| OSHPD |

38 | |

| Outside Agreement Date |

19 | |

| Outside Restoration Date |

58 | |

| Over-Allowance Amount |

Exhibit B | |

| Parking Covenant |

88 | |

| Penetrating Work |

102 | |

| Permitted Chemicals |

97 | |

| Permitted Occupants |

66 | |

| Permitted Signage |

82 | |

| Permitted Transferee |

65 | |

| Permitted Transferee Assignee |

66 | |

| Permitted Use |

Summary | |

| Premises |

9 | |

| Project |

10 | |

| Project Common Areas |

10 | |

| Proposition 13 |

30 | |

| Receivership |

77 | |

| Reduction Date |

78 | |

| Reminder Notice |

47 | |

| Renewal Allowance |

Exhibit H | |

| Renovations |

95 | |

| Rent Abatement Period |

23 | |

| Rent |

24 | |

| Restricted Common Area Modifications |

11 | |

| Restricted Party |

84 | |

| Retail Space |

Summary | |

| Rooftop Equipment |

99 | |

| Rules and Regulations |

36 | |

| Ruling |

22 | |

| Second Rebuttals |

21 | |

| Secured Areas |

87 | |

| Security Deposit Laws |

76 | |

| Security Holder |

69 | |

| Sensor Areas |

100 | |

| Six Month Period |

64 | |

| SNDA |

69 | |

| Specialty Improvements |

50 | |

| Statement |

33 | |

| Subject Space |

61 | |

| Substantial Completion of the Improvements |

Exhibit B |

(vii)

| Substitution Notice |

84 | |

| Summary |

Summary | |

| Tax Expenses |

30 | |

| TCCs |

9 | |

| Tenant |

Summary | |

| Tenant Construction Delay |

Exhibit B | |

| Tenant Damage |

9 | |

| Tenant Energy Use Disclosure |

102 | |

| Tenant Parties |

51 | |

| Tenant Rent Abatement Acceleration Election |

24 | |

| Tenant’s Agents |

Exhibit B | |

| Tenant’s Exercise Period |

12 | |

| Tenant’s Initial Statement |

22 | |

| Tenant’s Offsite Exercise Period |

14 | |

| Tenant’s Rebuttal Statement |

22 | |

| Tenant’s Security System |

43 | |

| Tenant’s Share |

32 | |

| Tenant’s Signage |

82 | |

| Terrace |

16 | |

| Terrace Users |

17 | |

| Third Party Contractor |

56 | |

| Transfer |

64 | |

| Transfer Costs |

63 | |

| Transfer Notice |

61 | |

| Transfer Premium |

63 | |

| Transferee |

61 | |

| Transfers |

61 | |

| Underlying Documents |

26 | |

| Unused L-C Proceeds |

77 | |

| Water Sensors |

100 | |

| Wellness Center |

37 | |

| Wellness Center Provider |

38 | |

| Wellness Center Users |

37 | |

| Work Letter |

9 |

(viii)

CROSSING/900

OFFICE LEASE

This Office Lease (the “Lease”), dated as of the date set forth in Section 1 of the Summary of Basic Lease Information (the “Summary”), below, is made by and between REDWOOD CITY PARTNERS, LLC, a Delaware limited liability company (“Landlord”), and BOX, INC., a Delaware corporation (“Tenant”).

SUMMARY OF BASIC LEASE INFORMATION

| TERMS OF LEASE | DESCRIPTION | |

| 1. Date: |

September 15, 2014. | |

| 2. Premises: (Article 1) |

||

| 2.1 Buildings: |

That certain six (6) story office building (“Building A”) to be located at 900 Jefferson Avenue, Redwood City, California, and that certain four (4) story office building (“Building B”), each of which also include a ground floor below the storied levels described of above, to be located at 900 Middlefield Avenue, Redwood City, California. Landlord and Tenant hereby agree that Building A contains a total of 226,197 rentable square feet of space, and Building B contains a total of 113,015 rentable square feet of space. The term “Building” as used in this Lease shall refer to Building A or Building B, and the term “Buildings” shall refer to both Building A and Building B. | |

| 2.2 Premises: |

A stipulated total of 334,212 rentable square feet of space, consisting of the entirety of Building A (the “Building A Premises”), as further depicted on Exhibit A-1 to the Lease, and the entirety of Building B (the “Building B Premises”), as further depicted on Exhibit A-1 to the Lease, excluding the stipulated 5,000 rentable square feet of retail space (the “Retail Space”) on the ground floor of Building B, in the approximate location shown on Exhibit A-1 attached hereto. | |

1

| The Building A Premises shall consist of a stipulated total of 226,197 rentable square feet, as follows:

Ground Floor: 12,560 rentable square feet Floor 1: 36,177 rentable square feet Floor 2: 35,492 rentable square feet Floor 3: 35,492 rentable square feet Floor 4: 35,492 rentable square feet Floor 5: 35,492 rentable square feet Floor 6: 35,492 rentable square feet

The Building B Premises shall consist of a stipulated total of 108,015 rentable square feet, as follows:

Ground Floor: 5,715 rentable square feet Floor 1: 25,575 rentable square feet Floor 2: 25,575 rentable square feet Floor 3: 25,575 rentable square feet Floor 4: 25,575 rentable square feet | ||

| 2.3 Project: |

The Buildings and the Common Areas shall be the components of an office project known as Crossing/900, as further set forth in Section 1.1.2 of this Lease. | |

| 3. Lease Term (Article 2): |

||

| 3.1 Length of Term: |

Approximately eleven (11) years and six (6) months from the Building B Lease Commencement Date (as that term is defined in Section 3.2.2 of this Summary below). | |

| 3.2 Lease Commencement Dates: |

Landlord and Tenant hereby acknowledge that Landlord shall be constructing the Base Building, as that term is defined in Section 1 of Exhibit B, attached hereto, with respect to each Building and delivering the same to Tenant in the Delivery Condition, as that term is defined in Section 1 of Exhibit B. | |

| 3.2.1 Building A Lease Commencement Date: |

The “Building A Lease Commencement Date” shall be the latest to occur of: (i) July 1, | |

2

| 2015, (ii) the date that occurs six (6) months following the Delivery Date (as that term is defined in Section 1.2 of Exhibit B), with respect to the Building A Premises, and (iii) the applicable Final Condition Date (as that term is defined in Section 1.3 of Exhibit B). | ||

| 3.2.2 Building B Lease Commencement Date: |

The “Building B Lease Commencement Date” shall be the latest to occur of: (i) January 1, 2017, (ii) the date that occurs six (6) months following the Delivery Date, with respect to the Building B Premises, and (iii) the applicable Final Condition Date. | |

| 3.3 Lease Expiration Date: |

The last day of the one hundred thirty-eighth (138th) full calendar month following the Building B Commencement Date; subject to extension of the Lease Expiration Date by Tenant’s exercise of one or both of the extension options granted under Section 2.2 of this Lease below. | |

| 3.4 Option Term(s): |

Two (2) five (5)-year option(s) to renew, as more particularly set forth in Section 2.2 of this Lease. | |

| 4. Base Rent (Article 3): |

||

| 4.1 Building A Premises: |

||

| Period During Lease Term |

Annual Base Rent* |

Monthly Installment of Base Rent* |

Monthly Rental Rate per Rentable Square Foot |

|||||||||

| Building A Lease |

||||||||||||

| Building A Lease Year 1 | $ | 11,807,483.40 | $ | 983,956.95 | $ | 4.35 | * | |||||

| Building A Lease Year 2 |

$ | 12,161,707.92 | $ | 1,013,475.66 | $ | 4.48 | ||||||

| Building A Lease Year 3 |

$ | 12,526,559.16 | $ | 1,043,879.93 | $ | 4.61 | ||||||

| Building A Lease Year 4 |

$ | 12,902,355.96 | $ | 1,075,196.33 | $ | 4.75 | ||||||

| Building A Lease Year 5 |

$ | 13,289,426.64 | $ | 1,107,452.22 | $ | 4.90 | ||||||

| Building A Lease Year 6 |

$ | 13,688,109.48 | $ | 1,140,675.79 | $ | 5.04 | ||||||

| Building A Lease Year 7 |

$ | 14,098,752.72 | $ | 1,174,896.06 | $ | 5.19 | ||||||

| Building A Lease Year 8 |

$ | 14,521,715.28 | $ | 1,210,142.94 | $ | 5.35 | ||||||

3

| Building A Lease Year 9 |

$ | 14,957,366.76 | $ | 1,246,447.23 | $ | 5.51 | ||||||

| Building A Lease Year 10 |

$ | 15,406,087.80 | $ | 1,283,840.65 | $ | 5.68 | ||||||

| Building A Lease Year 11 |

$ | 15,868,270.44 | $ | 1,322,355.87 | $ | 5.85 | ||||||

| Building A Lease Year 12 |

$ | 16,344,318.60 | $ | 1,362,026.55 | $ | 6.02 | ||||||

| Building A Lease Year 13 – |

$ | 16,834,648.20 | $ | 1,402,887.35 | $ | 6.20 |

| * | Subject to the Abatement Amount (as defined in Section 3.2 below). |

The initial Monthly Installment of Base Rent amount was calculated by multiplying the initial Monthly Rental Rate per Rentable Square Foot amount by the number of rentable square feet of space in the Building A Premises, and the initial Annual Base Rent amount was calculated by multiplying the initial Monthly Installment of Base Rent amount by twelve (12). In all subsequent Base Rent payment periods during the Lease Term commencing on the first (1st) day of Building A Lease Year 2, the calculation of each Monthly Installment of Base Rent amount reflects an annual increase of three percent (3%) and each Annual Base Rent amount was calculated by multiplying the corresponding Monthly Installment of Base Rent amount by twelve (12).

4.2 Building B Premises:

| Period During Lease Term |

Annual Base Rent |

Monthly Installment of Base Rent |

Monthly Rental Rate per Rentable Square Foot |

|||||||||

| Building B Lease |

||||||||||||

| Building A Lease Year 2 |

$ | 5,807,534.52 | $ | 483,961.21 | $ | 4.48 | ||||||

| Building A Lease Year 3 |

$ | 5,981,760.60 | $ | 498,480.05 | $ | 4.61 | ||||||

| Building A Lease Year 4 |

$ | 6,161,213.40 | $ | 513,434.45 | $ | 4.75 | ||||||

| Building A Lease Year 5 |

$ | 6,346,049.76 | $ | 528,837.48 | $ | 4.90 | ||||||

| Building A Lease Year 6 |

$ | 6,536,431.20 | $ | 544,702.60 | $ | 5.04 | ||||||

| Building A Lease Year 7 |

$ | 6,732,524.16 | $ | 561,043.68 | $ | 5.19 | ||||||

| Building A Lease Year 8 |

$ | 6,934,499.88 | $ | 577,874.99 | $ | 5.35 | ||||||

| Building A Lease Year 9 |

$ | 7,142,534.88 | $ | 595,211.24 | $ | 5.51 | ||||||

| Building A Lease Year 10 |

$ | 7,356,810.96 | $ | 613,067.58 | $ | 5.68 | ||||||

| Building A Lease Year 11 |

$ | 7,577,515.32 | $ | 631,459.61 | $ | 5.85 | ||||||

| Building A Lease Year 12 |

$ | 7,804,840.80 | $ | 650,403.40 | $ | 6.02 | ||||||

| Building A Lease Year 13 |

$ | 8,038,986.00 | $ | 669,915.50 | $ | 6.20 | ||||||

4

The initial Monthly Installment of Base Rent amount was calculated by multiplying the initial Monthly Rental Rate per Rentable Square Foot amount by the number of rentable square feet of space in the Building B Premises, and the initial Annual Base Rent amount was calculated by multiplying the initial Monthly Installment of Base Rent amount by twelve (12). In all subsequent Base Rent payment periods during the Lease Term commencing on the first (1st) day of Building A Lease Year 2, the calculation of each Monthly Installment of Base Rent amount reflects an annual increase of three percent (3%) and each Annual Base Rent amount was calculated by multiplying the corresponding Monthly Installment of Base Rent amount by twelve (12).

| 5. Operating Expenses and Tax Expenses (Article4): |

This is a TRIPLE NET lease and as such, the provisions contained in this Lease are intended to pass on to Tenant and reimburse Landlord for the costs and expenses reasonably associated with this Lease and the Project, and Tenant’s operation therefrom. To the extent such costs and expenses payable by Tenant cannot be charged directly to, and paid by, Tenant, such costs and expenses shall be paid by Landlord but reimbursed by Tenant as Additional Rent. | |

| 6. Tenant’s Share (Article4): |

100% (which was calculated by dividing the number of square feet of space in the Premises by the number of rentable square feet of space in the Project, excluding the Retail Space). | |

| 7. Permitted Use (Article5): |

Tenant shall use the Premises solely for general office, research and development, and other incidental uses to the extent all such uses are consistent with first-class office buildings (including those occupied by technology-oriented office space users) in the market in which the Project is located (the “Permitted Use”); provided, however, that notwithstanding anything to the contrary set forth hereinabove, and as more particularly set forth in the Lease, Tenant shall be responsible for operating and maintaining the Premises pursuant to, and in no event may Tenant’s Permitted Use violate, (A) Landlord’s Rules and Regulations, as that term is set forth in Section 5.2 of this Lease, subject to the limitations on modifications to the Rules and Regulations set forth in Section 5.2 of this Lease, (B) all Applicable Laws, as that term is set forth in Article 24 of | |

5

| this Lease, and (C) the Underlying Documents (as that term is defined in Section 4.2.4 of this Lease). | ||

| 8. Letter of Credit (Article 21): |

$25,000,000, subject to reduction as set forth in Article 21 below, and subject to increase as set forth in Section 2.1 of the Work Letter attached hereto as Exhibit B. | |

| 9. Parking Passes (Article 28): |

Three (3) passes per each 1,000 rentable square feet of the Premises (i.e., one thousand three (1,003) unreserved parking passes for the entire initial Premises), subject to the TCCs of Article 28 of the Lease. | |

| 10. Address of Tenant (Section 29.18): |

Box, Inc. 4440 El Camino Real Los Altos, California 94022 Attention: Peter McGoff, Esq. Telephone Number: (650) 209-3407 E-mail: pete@box.com

with copies to:

Box, Inc. 4440 El Camino Real Los Altos, California 94022 Attention: Telephone Number: E-mail:

and

Reed Smith LLP 101 Second Street, Suite 1800 San Francisco, California 94105 Attention: Charles H. Seaman, Esq. Telephone: (415) 543-8700 E-mail: cseaman@reedsmith.com

(Prior to the Building A Lease Commencement Date) | |

| and |

Box, Inc. 900 Jefferson Avenue Redwood City, California Attention: Peter McGoff, Esq. | |

6

| Telephone Number: (650) 209-3407 E-mail: pete@box.com

with copies to:

Reed Smith LLP 101 Second Street, Suite 1800 San Francisco, California 94105 Attention: Charles H. Seaman, Esq. Telephone: (415) 543-8700 E-mail: cseaman@reedsmith.com

(After the Building A Lease Commencement Date) | ||

| 11. Address of Landlord (Section 29.18): |

Redwood City Partners, LLC c/o Kilroy Realty Corporation 12200 West Olympic Boulevard, Suite 200 Los Angeles, California 90064 Attention: Legal Department

with copies to:

Kilroy Realty Corporation 12200 West Olympic Boulevard, Suite 200 Los Angeles, California 90064 Attention: Mr. John Fucci

and

Kilroy Realty Corporation 100 First Street Office of the Building, Suite 250 San Francisco, California 94105 Attention: Regional Vice-President, Northern California

and

Allen Matkins Leck Gamble Mallory & Natsis LLP 1901 Avenue of the Stars, Suite 1800 Los Angeles, California 90067 Attention: Anton N. Natsis, Esq. | |

7

| 12. Broker(s) (Section 29.24):

Representing Tenant:

Cornish & Carey Commercial Newmark Knight Frank |

Representing Landlord:

Cassidy Turley | |

| 13. Improvement Allowance (Section 2 of Exhibit B): |

An amount equal to $70.00 per rentable square foot of the Premises for a total of $23,394,840.00, subject to increase by the Additional Allowance as defined in Section 2.1 of the Work Letter. | |

8

ARTICLE 1

PREMISES, BUILDINGS, PROJECT, AND COMMON AREAS

1.1 Premises, Buildings, Project and Common Areas.

1.1.1 The Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the premises set forth in Section 2.2 of the Summary (the “Premises”). The outline of the Premises is set forth in Exhibit A-1 attached hereto, and each floor or floors of the Premises has the number of rentable square feet as set forth in Section 2.2 of the Summary. The parties hereto agree that the lease of the Premises is upon and subject to the terms, covenants and conditions (the “TCCs”) herein set forth, and each of Landlord and Tenant covenants as a material part of the consideration for this Lease to keep and perform each and all of such TCCs by it to be kept and performed and that this Lease is made upon the condition of such performance. The parties hereto hereby acknowledge that the purpose of Exhibit A-1 is to show the approximate location of the Building A Premises in Building A, only, and the approximate location of the Building B Premises in Building B, only, and such Exhibit is not meant to constitute an agreement, representation or warranty as to the construction of the Premises, the precise area thereof or the specific location of the Common Areas, as that term is defined in Section 1.1.3, below, or the elements thereof or of the accessways to the Premises or the Project, as that term is defined in Section 1.1.2, below. Except as specifically set forth in this Lease and in the Work Letter attached hereto as Exhibit B (the “Work Letter”), Tenant shall accept the Premises in its existing “as-is” condition and Landlord shall not be obligated to provide or pay for any improvement work or services related to the improvement of the Premises. Tenant also acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty regarding the condition of the Premises, the Buildings or the Project or with respect to the suitability of any of the foregoing for the conduct of Tenant’s business, except as specifically set forth in this Lease and the Work Letter. The taking of possession of any portion of the Premises by Tenant shall conclusively establish that such portion of the Premises and associated elements of the Building in which such portion of the Premises is situated, were at such time in good and sanitary order, condition and repair (subject, however, to any Base Building Punchlist Items (as that term is defined in Section 1.3 of the Work Letter). Notwithstanding the foregoing, upon the applicable Lease Commencement Date, each Base Building, as that term is defined in Section 8.2 of this Lease, shall be in good working condition and repair and in compliance with Applicable Laws, to the extent required to allow the legal occupancy of the Premises for the Permitted Use, and the Base Building Plans (as defined in, and required by, Section 1.1 of the Work Letter), and Landlord hereby covenants that each Base Building shall remain in good working condition for a period of twelve (12) months following the applicable Final Condition Date applicable to such Building pursuant to the TCCs of this Section 1.1.1. Landlord shall, at Landlord’s sole cost and expense (which shall not be deemed an Operating Expense, as that term is defined in Section 4.2.4), repair or replace any failed or inoperable portion of such Base Building during such twelve (12) month period (“Landlord’s Twelve Month Warranty”), provided that the need to repair or replace was not caused by the misuse, misconduct, damage, destruction, omissions, and/or negligence (collectively, “Tenant Damage”) of Tenant, its subtenants and/or assignees, if any, or any company which it acquired, sold or merged with Tenant, or any Tenant Parties, as that term is

9

defined in Section 10.1, below, or by any modifications, Alterations, as that term is defined in Section 8.1 below, or improvements (including the Improvements, as that term is defined in Section 2.1 of the Work Letter) constructed by or on behalf of Tenant. Landlord’s Twelve Month Warranty shall not be deemed to require Landlord to replace any portion of any Base Building, as opposed to repair such portion of such Base Building, unless prudent commercial property management practices dictate replacement rather than repair of the item in question. To the extent repairs which Landlord is required to make pursuant to this Section 1.1.1 are necessitated in part by Tenant Damage and not covered by Landlord’s insurance, then Tenant shall reimburse Landlord for an equitable proportion of the cost of such repair. If it is determined that either Base Building (or any portion thereof) was not in good working condition and repair as of the applicable Final Condition Date, Landlord shall not be liable to Tenant for any damages, but Landlord, at no cost to Tenant, shall promptly commence such work or take such other action as may be necessary to place the same in good working condition and repair, and shall thereafter diligently pursue the same to completion; and Landlord shall repair any damage to the Original Improvements arising in connection with Landlord’s work.

1.1.2 The Buildings and the Project. The Premises is a part of the Buildings set forth in Section 2.1 of the Summary. The Buildings are the principle components of an office project to be known as “Crossing/900.” The term “Project,” as used in this Lease, shall mean (i) the Buildings and the Common Areas, and (ii) the land (which is improved with landscaping, parking structures and/or other facilities and improvements) upon which the Buildings and the Common Areas are located.

1.1.3 Common Areas.

1.1.3.1 In General. Tenant shall have the non-exclusive right to use in common with other tenants in the Project, and subject to the rules and regulations referred to in Article 5 of this Lease, those portions of the Project which are provided, from time to time, for use in common by Landlord, Tenant and any other tenants of the Project (such areas are collectively referred to herein as the “Common Areas”). The Common Areas shall consist of the Project Common Areas and the Building Common Areas (as both of those terms are defined below). The term “Project Common Areas,” as used in this Lease, shall mean the portion of the Project located outside of the Buildings and not reserved for the exclusive use of Landlord or any tenants of the Retail Space. The term “Building Common Areas,” as used in this Lease, shall mean the portions of the Common Areas located within the Buildings and not leased to Tenant or other tenants in the Building, including, with respect to Building A, the shuttle elevators and public lobbies and hallways leading to the exterior of the Building (as opposed to the Lobbies (as that term is defined in Section 1.1.3.2 below)), and with respect to Building B, the ground floor hallway(s) providing access from the Retail Space to the restrooms. The parties acknowledge and agree that the retail tenant and their customers and invitees shall be permitted at all times to access the Common Area restrooms located on the ground floor of Building B (with access controlled by use of a keypad or card access system installed by Landlord as part of Landlord’s construction of the Base Building). Subject to the terms of Sections 1.5 and 1.1.3.2 below, the manner in which the Common Areas are maintained and operated shall be at the reasonable discretion of Landlord (but shall at least be consistent with the manner in which the common areas of the Comparable Buildings, as that term is defined on Exhibit H, attached hereto, are maintained and operated) and the use thereof shall be subject to such Rules and Regulations (as

10

that term is defined in Section 5.2 below), provided that such Rules and Regulations do not unreasonably interfere with the rights granted to Tenant under this Lease and the Permitted Use. Landlord agrees that, if Tenant so elects and appoints a representative, Landlord shall meet and confer with Tenant’s representative on approximately a quarterly basis regarding the manner in which the Common Areas are operated and maintained; provided, however, any suggestions or requests made by Tenant’s representative shall not be binding on Landlord. Landlord reserves the right to close temporarily, make alterations or additions to, or change the location of elements of the Project and the Common Areas; provided that, in connection therewith, Landlord shall perform such closures, alterations, additions or changes in a commercially reasonable manner and, in connection therewith, shall use commercially reasonable efforts to minimize any material interference with Tenant’s use of and access to the Premises and those Common Areas (including parking facilities) necessary for the full use and enjoyment of the Premises. In addition, so long as no parties other than Tenant and/or its “Permitted Transferees,” as that term is defined in Section 14.8, below, are directly leasing from Landlord any portion of the office space within the Building (the “Office Space Leasing Requirement”), then Landlord shall not, except to the extent required by Applicable Law that is not related to the Retail Space, after the initial construction of the Building, materially modify (A) access from or to, the ground floor lobby of the Building, (B) the location of the Retail Space or its access off the Lobby (as that term is defined in Section 1.1.3.2 below) of Building B, (C) the location and access to and from the project parking facilities from the street and the Buildings, or (D) the hardscape, softscape and furniture on the Terrace, as defined in Section 1.5 below (collectively, “Restricted Common Area Modifications”), without first obtaining Tenant’s prior written consent, which may be withheld, conditioned or delayed in Tenant’s reasonable discretion; provided, however, to the extent a Restricted Common Area Modification is required by Applicable Law and is solely related to the Retail Space or the Project parking facilities, then Landlord shall inform Tenant of such Restricted Common Area Modification and Tenant may provide Landlord with comments regarding such Restricted Common Area Modifications but Tenant shall not have the right to approve or disapprove such Restricted Common Area Modifications. Except when and where Tenant’s right of access is specifically excluded in this Lease, Tenant shall have the right of access to the Premises, the Buildings, and the Project parking facility twenty-four (24) hours per day, seven (7) days per week during the Lease Term, as that term is defined in Section 2.1, below.

1.1.3.2 Lobbies. So long as Tenant is satisfying the Office Space Leasing Requirement, the ground floor lobby areas of each Building (as identified on Exhibit A-1 attached hereto) (each a “Lobby”, collectively, the “Lobbies”) shall be deemed to be part of the “Premises” under this Lease, and, notwithstanding any provision to the contrary set forth in this Lease, all of the TCCs of this Lease (except as set forth in this Section 1.1.3.2 below) applicable to the Premises shall apply with respect to the Lobbies, including without limitation, Tenant’s repair and maintenance obligations set forth in Section 7.2 below, and Tenant’s obligations relating to compliance with Applicable Laws set forth in Article 24 below. At anytime that Tenant is no longer satisfying the Office Space Leasing Requirement with respect to a particular Building, the Lobby of such Building shall become Building Common Areas, as well such other areas on each floor as are required for multi-tenant use. Notwithstanding any provision to the contrary set forth in this Lease: (i) Tenant may only use the Lobbies for ingress and egress to and from the exterior of each Building and the elevators, or such other use as permitted by Landlord in its reasonable discretion, and which use is consist

11

with the lobby areas of other Comparable Buildings occupied by a single-tenant office user, (ii) Tenant shall have the right to make Improvements to the Lobbies in accordance with the terms of the Work Letter, (iii) any Alterations (including any Cosmetic Alterations, as that term is defined in Section 8.1 below) made by Tenant to the Lobbies shall require Landlord’s consent, not to be unreasonably withheld, or delayed, and (iv) Landlord and Landlord’s Terrace Users (as defined in Section 1.5 below) shall have the right to enter the Lobbies in order to obtain access to the Terrace during the exercise of Landlord’s Use Rights.

1.2 Stipulation of Rentable Square Feet of Premises and Buildings. For purposes of this Lease, rentable square feet of the Premises shall be deemed as set forth in Section 2.2 of the Summary and the rentable square feet of the Buildings shall be deemed as set forth in Section 2.1 of the Summary. In the event of a recapture by Landlord under Section 14.4 of this Lease below, the rentable square footage shall be revised proportionately on a floor-by-floor basis. Absent such recapture, there shall be no changes to the stipulated rentable area of the Premises and the Buildings.

1.3 Right of First Offer on Retail Space. During the initial Lease Term and any Option Term, Landlord hereby grants to the named Tenant in this Lease (the “Original Tenant”) and its Permitted Transferee Assignee (as defined in Section 14.8 below) a one-time right of first offer with respect to the Retail Space, but only in the event Landlord, in its sole discretion, elects to offer the Retail Space for use as office space (the “First Offer Space”). Tenant’s right of first offer shall be on the TCCs set forth in this Section 1.3.

1.3.1 Procedure for Offer. Subject to the TCCs of this Section 1.3, Landlord shall notify Tenant (the “First Offer Notice”) from time to time when the First Offer Space or any portion thereof will become available for lease to third parties, subject to the rights of any Superior Right Holder. Pursuant to such First Offer Notice, Landlord shall offer to lease to Tenant the then available First Offer Space. The First Offer Notice shall describe the space so offered to Tenant and the base rent, operating expense obligations, measurement of rentable square footage, condition of the base building upon delivery to Tenant, free rent and improvement allowances (collectively, the “Economic Terms”) and other fundamental material economic terms upon which Landlord is willing to lease such space to Tenant.

1.3.2 Procedure for Acceptance. If Tenant wishes to exercise Tenant’s right of first offer with respect to the space described in the First Offer Notice, then within fifteen (15) business days of delivery of the First Offer Notice to Tenant (“Tenant’s Exercise Period”), Tenant shall deliver notice to Landlord of Tenant’s election to exercise its right of first offer with respect to the entire space described in the First Offer Notice on the Material Economic Terms contained in such First Offer Notice. If Tenant does not so notify Landlord within such fifteen (15) business day period, then Landlord shall be free to lease the space described in the First Offer Notice to anyone to whom Landlord desires on any terms Landlord desires; provided, however, Landlord shall not lease such First Offer Space to a third party on Economic Terms less than ninety percent (90%) as favorable to Landlord as the Economic Terms offered in such First Offer Notice to Tenant (as determined using a Net Equivalent Lease Rate, as defined in Exhibit H attached hereto), without first providing Tenant with a new First Offer Notice on such reduced Economic Terms. If Landlord provides such a new First Offer Notice to Tenant, Tenant’s Exercise Period with respect to such new First Offer Notice shall be a period of five (5)

12

business days. Notwithstanding anything to the contrary contained herein, Tenant must elect to exercise its right of first offer, if at all, with respect to all of the space offered by Landlord to Tenant at any particular time, and Tenant may not elect to lease only a portion thereof.

1.3.3 Construction In First Offer Space. Unless otherwise provided in the applicable First Offer Notice, Tenant shall take the First Offer Space in its “as is” condition, and the construction of improvements in the First Offer Space shall comply with the TCCs of Article 8 of this Lease. Any improvement allowance to which Tenant may be entitled shall be as set forth in the First Offer Notice. However, Landlord shall deliver the First Offer Space to Tenant in a broom clean condition, free of personal property.

1.3.4 Amendment to Lease. If Tenant timely exercises Tenant’s right to lease the First Offer Space as set forth herein, then Landlord and Tenant shall within thirty (30) days thereafter execute an amendment to this Lease for such First Offer Space upon the TCCs as set forth in the First Offer Notice and this Section 1.3. Notwithstanding the foregoing, the failure of Landlord and Tenant to execute and deliver such First Offer Space amendment shall not affect an otherwise valid exercise of Tenant’s first offer rights or the parties’ rights and responsibilities in respect thereof. Unless otherwise provide in the applicable First Offer Notice, Tenant shall commence payment of rent for the First Offer Space, and the term of Tenant’s lease of the First Offer Space shall commence, upon the date of delivery of the First Offer Space to Tenant and shall terminate conterminously with Tenant’s lease of the remainder of the Premises on the Lease Expiration Date (as the same may be extended pursuant to Section 2.2 below), or on the date that is five (5) years following the date of the commencement of Tenant’s lease of the First Offer Space, whichever is longer. The length of the term of Tenant’s lease of the First Offer Space shall be referred to herein as the “First Offer Term”.

1.3.5 Termination of Right of First Offer. Tenant’s rights under this Section 1.3 shall be personal to the Original Tenant and its Permitted Transferee Assignee and may only be exercised by the Original Tenant or its Permitted Transferee Assignee (and not any other assignee, or any sublessee or other transferee of the Original Tenant’s interest in this Lease) if the Original Tenant or its Permitted Transferee Assignee occupies at least fifty percent (50%) of the rentable square footage of the initial Building B Premises leased by Tenant under this Lease (subject to the last sentence of Section 14.4 below). For purposes of this Lease, Tenant shall be deemed to be occupying any portion of the Premises that is not then subleased to a third party (other than a Permitted Transferee). The right of first offer granted herein shall terminate as to particular First Offer Space upon the failure by Tenant to exercise its right of first offer with respect to such First Offer Space as offered by Landlord. Tenant shall not have the right to lease First Offer Space, as provided in this Section 1.3, if, as of the date of the attempted exercise of any right of first offer by Tenant, or, at Landlord’s option, as of the scheduled date of delivery of such First Offer Space to Tenant, Tenant is in monetary or material non-monetary default under this Lease (beyond the expiration of any applicable notice and cure period set forth in this Lease).

1.4 Right of First Offer on the Offsite Project. Commencing upon the date, if at all, that Landlord, or Kilroy Realty Corporation (“KRC”), or HS Middlefield, LLC, a California limited liability company, or Hunter/Storm, LLC, a California limited liability company (collectively, “Hunter Storm”), or any affiliate of either or both of KRC and Hunter Storm (an

13

entity which at any time is controlled by, controls, or is under common control with, KRC or Hunter Storm) (collectively the “Offsite Landlord”), acquires the so-called “library site” located at the southwest corner of Jefferson Avenue and Middlefield Avenue in the City, which is currently owned by the City (the “Offsite Project”), as depicted on Exhibit A-2 attached hereto, and continuing through the initial Lease Term and any Option Term(s), Offsite Landlord grants to Original Tenant and its Permitted Transferee Assignee an on-going right of first offer with respect to any office space constructed at the Offsite Project (the “Offsite First Offer Space”). Neither Landlord nor Offsite Landlord shall have any liability or responsibility to Tenant for any failure or election not to acquire the Offsite Project, but Landlord shall be liable to Tenant for the failure of Offsite Landlord to comply with Tenant’s rights under this Section 1.4. Notwithstanding the foregoing, such right of first offer shall be subordinate to all rights of other tenants under Intervening Leases, as that term is defined in Section 1.4.5, below, such tenants are collectively referred to as the “Offsite Superior Right Holders”. Tenant’s right of first offer shall be on the TCCs set forth in this Section 1.4.

1.4.1 Procedure for Offer. Subject to the TCCs of this Section 1.4, Offsite Landlord shall notify Tenant (the “Offsite First Offer Notice”) from time to time prior to Offsite Landlord entering into a binding agreement with a third party to lease the Offsite First Offer Space or any portion thereof, subject to the rights of any Offsite Superior Right Holder. Pursuant to such Offsite First Offer Notice, Offsite Landlord shall offer to lease to Tenant the then available Offsite First Offer Space. The Offsite First Offer Notice shall describe the space so offered to Tenant, the Economic Terms and other fundamental material economic terms upon which Offsite Landlord is willing to lease such space to Tenant.

1.4.2 Procedure for Acceptance. If Tenant wishes to exercise Tenant’s right of first offer with respect to the space described in the Offsite First Offer Notice, then within fifteen (15) business days of delivery of the Offsite First Offer Notice to Tenant (“Tenant’s Offsite Exercise Period”), Tenant shall deliver notice to Offsite Landlord of Tenant’s election to exercise its right of first offer with respect to the entire space described in the Offsite First Offer Notice on the Economic Terms contained in such Offsite First Offer Notice. If Tenant does not so notify Offsite Landlord within such fifteen (15) business day period, then Offsite Landlord shall be free to lease the space described in the Offsite First Offer Notice to anyone to whom Offsite Landlord desires on any terms Offsite Landlord desires and any such lease shall become an Intervening Lease; provided, however, Offsite Landlord shall not lease such Offsite First Offer Space to a third party on Economic Terms less than ninety percent (90%) as favorable to Offsite Landlord as the Economic Terms offered in such Offsite First Offer Notice to Tenant (as determined using a Net Equivalent Lease Rate, as defined in Exhibit H attached hereto), without first providing Tenant with a new Offsite First Offer Notice on such reduced Economic Terms. If Offsite Landlord provides such a new Offsite First Offer Notice to Tenant, Tenant’s Offsite Exercise Period with respect to such new First Offer Notice shall be a period of ten (10) days. Notwithstanding anything to the contrary contained herein, Tenant must elect to exercise its right of first offer, if at all, with respect to all of the space offered by Offsite Landlord to Tenant at any particular time, and Tenant may not elect to lease only a portion thereof.

1.4.3 Construction In Offsite First Offer Space. Unless otherwise provided in the Offsite First Offer Notice, Tenant shall take the Offsite First Offer Space in its “as is” condition. Any improvement allowance to which Tenant may be entitled shall be as set forth in the Offsite First Offer Notice. However, Offsite Landlord shall deliver the Offsite First Offer Space to Tenant in a broom clean condition, free of personal property.

14

1.4.4 Lease. If Tenant timely exercises Tenant’s right to lease the Offsite First Offer Space as set forth herein, then Offsite Landlord and Tenant shall promptly execute separate lease for such Offsite First Offer Space upon the TCCs as set forth in the Offsite First Offer Notice and this Section 1.4, and the non-business oriented terms of this Lease (including, without limitation, Article 8) given the terms of the Offsite First Offer Notice and the potential nature of the Offsite Project as a multi-tenant office project. Notwithstanding the foregoing, the failure of Offsite Landlord and Tenant to execute and deliver such Offsite First Offer Space lease shall not affect an otherwise valid exercise of Tenant’s first offer rights or the parties’ rights and responsibilities in respect thereof. The rentable square footage of any Offsite First Offer Space leased by Tenant shall be determined by Offsite Landlord in accordance with Offsite Landlord’s then current standard of measurement for the Offsite Project. Unless otherwise provided in the Offsite First Offer Notice, Tenant shall commence payment of rent for the Offsite First Offer Space, and the term of Tenant’s lease of the Offsite First Offer Space shall commence and shall terminate as of the dates set forth in the Offsite First Offer Notice.

1.4.5 Termination of Right of First Offer. Tenant’s rights under this Section 1.4 shall be personal to the Original Tenant and its Permitted Transferee Assignee and may only be exercised by the Original Tenant or its Permitted Transferee Assignee (and not any other assignee, or any sublessee or other transferee of the Original Tenant’s interest in this Lease) if the Original Tenant or its Permitted Transferee Assignee occupies at least fifty percent (50%) of the rentable square footage of the initial Premises leased by Tenant under this Lease (subject to the last sentence of Section 14.4 below). The right of first offer granted herein shall terminate in its entirety upon (i) the transfer or sale of the Offsite Project by the current owner (i.e., the City) to any entity other than Offsite Landlord, (ii) the transfer or sale of the Project other than to an Offsite Landlord, or (iii) following Offsite Landlord’s acquisition of the Offsite Project, the transfer or sale of the Offsite Project (other than to another Offsite Landlord). The right of first offer granted herein shall not terminate as to particular Offsite First Offer Space upon the failure by Tenant to exercise its right of first offer with respect to such Offsite First Offer Space as offered by Offsite Landlord and Offsite Landlord shall re-offer such space to Tenant upon the expiration or earlier termination of any lease (an “Intervening Lease”) entered into by Offsite Landlord prior to the Offsite ROFO Expiration following Tenant’s failure to timely exercise its right to lease the Offsite First Offer Space, subject, however, to Offsite Landlord’s right to renew or expand any such Intervening Lease, provided that such Intervening Lease contains a renewal or expansion right (but irrespective of whether any such renewal or expansion right is exercised strictly in accordance with its terms or pursuant to a lease amendment or a new lease). Tenant shall not have the right to lease Offsite First Offer Space, as provided in this Section 1.4, if, as of the date of the attempted exercise of any right of first offer by Tenant, or, at Offsite Landlord’s option, as of the scheduled date of delivery of such Offsite First Offer Space to Tenant, Tenant is in monetary or material non-monetary default under this Lease (beyond the expiration of any applicable notice and cure period set forth in this Lease).

1.4.6 Cooperation. Subject to the TCCs of this Section 1.4.6, Offsite Landlord and Tenant agree to mutually cooperate to work together in connection with Offsite Landlord’s efforts to acquire title to the Offsite Project and Offsite Landlord’s the proposed development of

15

the Offsite Project for the benefit of Offsite Landlord with respect to Offsite Project. All such actions shall be at Offsite Landlord’s sole cost and expense. Offsite Landlord acknowledges and agrees that Tenant shall have no obligation to retain consultants, pursue litigation or perform any other action under this Section 1.4.6 that would require Tenant to incur out of pocket costs. So long as Tenant’s right to lease the Offsite First Offer Space as set forth in this Section 1.4 remains in effect, Tenant and any affiliated entity shall not actively pursue acquisition of the Offsite Project, whether by itself or as an investor or participant with any third-party, nor otherwise actively cooperate with any prospective third-party in connection with the purchase, ground lease, master lease or investment in the Offsite Project. The TCCs of this Section 1.4.6 (and the parties’ respective obligations set forth herein) shall terminate upon the termination of Tenant’s right to lease the Offsite First Offer Space pursuant to Section 1.4.5 above, but shall be suspended during the effective period of a binding agreement between the City and any entity other than Offsite Landlord for the exclusive right to negotiate for the acquisition, ground lease, or master lease of the Offsite Project, or for the acquisition, ground lease, or master lease of the Offsite Project. Notwithstanding the foregoing, Tenant shall have the right, from time to time, to inquire with Landlord in writing as to whether any Offsite Landlord is then using or continuing to use commercially reasonable efforts to pursue the acquisition, ground lease, or master lease, of the Offsite Project, and Landlord shall respond to Tenant, in good faith, within thirty (30) days of receipt of such inquiry, which notice shall (if applicable) provide reasonable detail concerning the steps Offsite Landlord is then engaged in, or anticipating engaging in, to pursue the acquisition, ground lease, or master lease of the Offsite Project. In the event Landlord notifies Tenant that no Offsite Landlord is then pursuing acquisition of the Offsite Project, pursuant to the immediately preceding sentence, then the TCCs of this Section 1.4.6 (and the parties’ respective obligations set forth herein) shall terminate as of the date of Landlord’s notice. Likewise, if Landlord responds to Tenant’s inquiry that it is then using or continuing to use commercially reasonable efforts to pursue the Offsite Project but fails to achieve, within a reasonable period of time, any of the steps detailed in Landlord’s notice, then the TCCs of this Section 1.4.6 (and the parties’ respective obligations set forth herein) shall terminate.

1.5 Terrace. Tenant shall have the right to use, on an exclusive basis, but subject to Landlord Use Rights (as defined hereinbelow), the terrace located between the Buildings with entrances at the first floor level (not the ground floor level) of the Project, shown on Exhibit A-3 attached hereto (collectively, the “Terrace”), which Terrace shall, for purposes of this Lease, be deemed part of the Common Areas. If Landlord recaptures one or more full floors of the Premises pursuant to Section 14.4 below or Tenant otherwise fails to directly lease from Landlord one (1) or more full floors within either Building, Tenant’s use of the Terrace shall be on a non-exclusive basis, however, thereafter, Tenant shall have the right to schedule temporary exclusive use of the Terrace with Landlord from time to time for particular events, subject to the scheduled use of the Terrace by Landlord and other tenants of the Project, as reasonably determined by Landlord on a proportionate basis, taking into consideration the amount of rentable square feet then leased by Tenant at the Project. Tenant’s use of the Terrace shall be subject to such reasonable rules and regulations as may be prescribed by Landlord from time to time. Following the expiration of the Construction Period, Tenant may make Alterations to the Terrace, and may install or place on the Terrace certain furniture, fixtures, plants, graphics, signs or insignias, subject to Landlord’s prior consent, which consent shall not be unreasonably withheld, conditioned or delayed; provided, however, following the termination of Tenant’s exclusive rights to use the Terrace, Tenant shall remove all such furniture, plants, graphics signs

16

or insignia, and other personal property, and repair any damage caused by such removal, the parties acknowledging that Tenant shall not be obligated to remove any Alterations (as defined in Section 8.1 below) installed by Tenant and approved by Landlord. Landlord shall have the right to temporarily close the Terrace or limit access thereto from time to time (i) in connection with Landlord’s maintenance or repair of the Terrace or Buildings and (ii) during Tenant’s period of exclusive use of the Terrance, no more than three (3) events within any twelve (12) month period (but at any time of the day not to exceed twelve (12) hours on any one occasion, not including set up and take down time), for other reasonable purposes, including, without limitation, for events hosted by or on behalf of Landlord at any time (collectively “Landlord Use Rights”, with Landlord’s Use Rights under item (ii) referred to herein as “Landlord’s Event Use Rights”); provided, however, that Landlord shall provide reasonable advance written notice to Tenant of the date(s) and the anticipated period of closure or limited use of the Terrace, and in the case of Landlord’s Event Use Rights, Landlord shall schedule any such use of the Terrace in consultation with Tenant so as to avoid conflicts with any particular pre-planned use of the Terrace by Tenant for an event that does not occur routinely and, to the extent necessary (as reasonably determined by Landlord), shall provide its own security services for such events at its own cost (and not as an element of Direct Expenses). The foregoing limitation on Landlord’s Event Use Rights shall not apply following the termination of Tenant’s exclusive use of the Terrace, and instead, Landlord’s right to use the Terrace for events shall be subject to scheduling and availability as set forth in this Section 1.5 above. So long as Tenant is satisfying the Office Space Leasing Requirement, if Landlord utilizes a security service other than the service generally providing services to the Premises on behalf of Tenant, Tenant shall have the right to approve such supplier of security services employed or engaged in connection with Landlord’s Event Use Rights, which approval shall not be unreasonably withheld, conditioned or delayed. Reasonable advance written notice shall be not less than fifteen (15) days for Landlord’s Event Use Rights. Landlord and Tenant acknowledge and agree that (A) Tenant shall be responsible for supervising and controlling access to the Terrace by Tenant’s employees, officers, directors, shareholders, agents, representatives, contractors and invitees (the “Terrace Users”) and Landlord shall be responsible for supervising and controlling access to the Terrace by Landlord’s Terrace Users; and (B) Landlord is not responsible for supervising and controlling access to the Terrace, except in connection with Landlord’s exercise of Landlord’s Use Rights. Except to the extent arising as a consequence of the negligence or willful misconduct of Landlord: (I) Tenant assumes the risk for any loss, claim, damage or liability arising out of the use or misuse of the Terrace by Tenant’s Terrace Users, and Tenant releases and discharges Landlord from and against any such loss, claim, damage or liability; (II) Tenant further agrees to indemnify, defend and hold Landlord and the Landlord Parties, harmless from and against any and all losses and claims relating to or arising out of the use or misuse of the Terrace by Tenant or Tenant’s Terrace Users (subject, however, to Section 10.3.2.4 below). Except to the extent arising as a consequence of the negligence or willful misconduct of Tenant: (y) Landlord assumes the risk for any loss, claim, damage or liability arising out of the use or misuse of the Terrace by Landlord’s Terrace Users, and Landlord releases and discharges Tenant from and against any such loss, claim, damage or liability; (z) Landlord further agrees to indemnify, defend and hold Tenant and the Tenant Parties, harmless from and against any and all losses and claims relating to or arising out of the use or misuse of the Terrace by Landlord or Landlord’s Terrace Users. Neither party shall have any liability or responsibility to monitor the use, or manner of use, by the Terrace Users of the other party. Tenant’s rights under this Section 1.5 shall be personal to the Original Tenant and its Permitted Transferee Assignee and may only be exercised by the Original Tenant or its Permitted Transferee Assignee and their respective subtenants.

17

ARTICLE 2

LEASE TERM; OPTION TERMS

2.1 Initial Lease Term. The TCCs and provisions of this Lease shall be effective as of the date of this Lease. The term of this Lease (the “Lease Term”) shall be as set forth in Section 3.1 of the Summary, shall commence on the Building A Lease Commencement Date with respect to the Building A Premises and shall commence on the Building B Lease Commencement date with respect to the Building B Premises (the Building A Lease Commencement Date and the Building B Lease Commencement Date may each be referred to herein as the “Lease Commencement Date”), and shall terminate on the date set forth in Section 3.3 of the Summary (the “Lease Expiration Date”) unless this Lease is sooner terminated as hereinafter provided or extended pursuant to Section 2.2 below. Notwithstanding any provision to the contrary set forth in this Lease, Tenant shall have the right to occupy the Premises prior to the applicable Lease Commencement Date for the conduct of its business, provided that (A) a temporary certificate of occupancy or its equivalent shall have been issued by the appropriate governmental authorities for each such portion to be occupied, and (B) all of the TCCs of this Lease shall apply as though the applicable Lease Commencement Date had occurred (although the applicable Lease Commencement Date shall not actually occur until the occurrence of the same pursuant to the TCCs of the second sentence of this Section 2.1) upon such occupancy of a portion of the Premises by Tenant, the parties acknowledging that during any such period of early occupancy Tenant shall be obligated to pay (i) Base Rent, (ii) Tenant’s Share of the annual Direct Expenses and (iii) any other Additional Rent due under this Lease, applicable to the entirety of any floor (including any portion thereof) of the Premises occupied by Tenant prior to the applicable Lease Commencement Date for the conduct of its business, notwithstanding the Rent Abatement set forth in Section 3.2 below. Tenant’s entry into the Premises for the purposes of designing, constructing and installing the Improvements or installing and testing furniture, fixtures, and equipment in the Premises, shall not constitute the conduct of business by Tenant for purposes of the preceding sentence. For purposes of this Lease, the term “Building A Lease Year” shall mean each consecutive twelve (12) calendar month period during the Lease Term; provided, however, that the first Building A Lease Year shall commence on the Building A Lease Commencement Date and end on the last day of the month in which the first anniversary of the Building A Lease Commencement Date occurs (or if the Building A Lease Commencement Date is the first day of a calendar month, then the first Building A Lease Year shall commence on the Building A Lease Commencement Date and end on the day immediately preceding the first anniversary of the Building A Lease Commencement Date), and the second and each succeeding Building A Lease Year shall commence on the first day of the next calendar month; and further provided that the last Building A Lease Year shall end on the Lease Expiration Date. At any time during the Lease Term, Landlord may deliver to Tenant a notice in the form as set forth in Exhibit C, attached hereto, as a confirmation only of the information set forth therein, which Tenant shall execute and return to Landlord within ten (10) business days of receipt thereof, provided that if such notice is not factually correct, then Tenant shall make such changes as are necessary to make such notice factually correct and shall thereafter return such notice to Landlord within said ten (10) business day period.

18

2.2 Option Terms.

2.2.1 Option Right. Landlord hereby grants the Original Tenant and its Permitted Transferee Assignee, two (2) options to extend the Lease Term for the entire Premises, each by a period of five (5) years (each, an “Option Term”). Such option shall be exercisable only by Notice (as that term is defined in Section 29.18 of this Lease) delivered by Tenant to Landlord as provided below, provided that, as of the date of delivery of such Notice, Tenant is not then in monetary or material non-monetary default under this Lease beyond any applicable notice and cure period. Upon the proper exercise of such option to extend, the Lease Term (including the Lease Expiration Date), as it applies to the entire Premises, shall be extended for a period of five (5) years. The rights contained in this Section 2.2 shall only be exercised by the Original Tenant or any Permitted Transferee Assignee (and not any other assignee, sublessee or other transferee of the Original Tenant’s interest in this Lease) if Original Tenant and/or its Permitted Transferee Assignee is in occupancy of at least sixty-seven percent (67%) of the rentable square footage of the initial Premises leased by Tenant under this Lease (subject to the last sentence of Section 14.4 below).

2.2.2 Option Rent. The Rent payable by Tenant during the Option Term (the “Option Rent”) shall be equal to the Market Rent, and determined pursuant to, Exhibit H attached hereto. The calculation of the Market Rent shall be derived from a review of, and comparison to, the Net Equivalent Lease Rates of the Comparable Transactions, as those terms are defined in Exhibit H.

2.2.3 Exercise of Option. The option contained in this Section 2.2 shall be exercised by Tenant, if at all, only in the manner set forth in this Section 2.2. Tenant shall deliver notice (the “Exercise Notice”) to Landlord not more than eighteen (18) months nor less than fifteen (15) months prior to the expiration of the then Lease Term, stating that Tenant is exercising its option. If Tenant delivers the Exercise Notice, Landlord shall deliver notice (the “Landlord Response Notice”) to Tenant on or before the date which is thirty (30) days after Landlord’s receipt of the Exercise Notice, setting forth Landlord’s good faith calculation of the Market Rent (the “Landlord’s Option Rent Calculation”). Within fifteen (15) business days of its receipt of the Landlord Response Notice, Tenant may, at its option, accept the Market Rent contained in the Landlord’s Option Rent Calculation. If Tenant does not affirmatively accept or Tenant rejects the Market Rent specified in the Landlord’s Option Rent Calculation, the parties shall follow the procedure set forth in Section 2.2.4 below, and the Market Rent shall be determined in accordance with the TCCs of Section 2.2.4 below.

2.2.4 Determination of Market Rent. In the event Tenant timely exercises its option to extend the Lease but rejects Landlord’s Option Rent Calculation set forth in the Landlord Response Notice pursuant to Section 2.2.3, above, then Landlord and Tenant shall attempt to agree upon the Option Rent using good-faith efforts. If Landlord and Tenant fail to reach agreement upon the Option Rent applicable to the Option Term on or before the date that is ninety (90) days prior to the expiration of the initial Lease Term in the case of the first Option Term and the date that is ninety (90) days prior to the expiration of the first Option Term in the case of the second Option Term (each an “Outside Agreement Date”), then the Market Rent (and therefore, the Option Rent) shall be determined by arbitration pursuant to the TCCs of this Section 2.2.4. Each party shall make a separate best and final determination of the Option Rent,

19

within five (5) days following the applicable Outside Agreement Date and supply a copy of such determination to the other party, and both such determinations shall be submitted to arbitration in accordance with Section 2.2.4.1 through Section 2.2.4.4, below. Notwithstanding the foregoing, either party may, but notice delivered to the other within two (2) business days after receipt of the other party’s best and final determination of the Option Rent, accept the other party’s Option Rent determination; and, in such case, the accepted determination shall be the Option Rent for the applicable Option Term and no arbitration shall be required under this Section 2.2.4.

2.2.4.1 Landlord and Tenant shall each appoint one arbitrator who shall by profession be a MAI appraiser who shall have been active over the ten (10) year period ending on the date of such appointment in the appraising first class office properties in the vicinity of the Project. The determination of the arbitrators shall be limited solely to the issue area of whether Landlord’s or Tenant’s submitted Option Rent is the closest to the actual Option Rent as determined by the arbitrators, taking into account the requirements of Section 2.2.2 of this Lease. Each such arbitrator shall be appointed within fifteen (15) days after the Outside Agreement Date. Landlord and Tenant may consult with their selected arbitrators prior to appointment and may select an arbitrator who is favorable to their respective positions (including an arbitrator who has previously represented Landlord and/or Tenant, as applicable). The arbitrators so selected by Landlord and Tenant shall be deemed “Advocate Arbitrators.”

2.2.4.2 The two Advocate Arbitrators so appointed shall be specifically required pursuant to an engagement letter within ten (10) days of the date of the appointment of the last appointed Advocate Arbitrator to agree upon and appoint a third arbitrator (“Neutral Arbitrator”) who shall be qualified under the same criteria set forth hereinabove for qualification of the two Advocate Arbitrators except that (i) the Neutral Arbitrator may be a licensed real estate broker or real estate lawyer who shall have been active over the ten (10) year period ending on the date of such appointment in the leasing of first class office properties in the vicinity of the Project, (ii) neither Landlord nor Tenant (or such party’s Advocate Arbitrator) may, directly or indirectly, consult with the Neutral Arbitrator prior or subsequent to his or her appearance, and (iii) the Neutral Arbitrator cannot be someone who has represented Landlord or Tenant (or any affiliate of Landlord or Tenant) during the five (5) year period prior to such appointment. The Neutral Arbitrator shall be retained via an engagement letter jointly prepared by Landlord’s counsel and Tenant’s counsel.

2.2.4.3 Within ten (10) days following the appointment of the Neutral Arbitrator, Landlord and Tenant shall enter into an arbitration agreement (the “Arbitration Agreement”) which shall set forth the following:

2.2.4.3.1 Each of Landlord’s and Tenant’s best and final and binding determination of the Option Rent exchanged by the parties pursuant to Section 2.2.4, above;

2.2.4.3.2 An agreement to be signed by the Neutral Arbitrator, the form of which agreement shall be attached as an exhibit to the Arbitration Agreement, whereby the Neutral Arbitrator shall agree to undertake the arbitration and render a decision in accordance with the TCCs of this Lease, as modified by the Arbitration Agreement, and shall require the Neutral Arbitrator to demonstrate to the reasonable satisfaction of the parties that the Neutral Arbitrator has no conflicts of interest with either Landlord or Tenant;

20

2.2.4.3.3 Instructions to be followed by the Neutral Arbitrator when conducting such arbitration;

2.2.4.3.4 That Landlord and Tenant shall each have the right to submit to the Neutral Arbitrator (with a copy to the other party), on or before the date that occurs fifteen (15) days following the appointment of the Neutral Arbitrator, an advocate statement (and any other information such party deems relevant) prepared by or on behalf of Landlord or Tenant, as the case may be, in support of Landlord’s or Tenant’s respective determination of Option Rent (the “Briefs”);

2.2.4.3.5 That within five (5) business days following the exchange of Briefs, Landlord and Tenant shall each have the right to provide the Neutral Arbitrator (with a copy to the other party) with a written rebuttal to the other party’s Brief (the “First Rebuttals”); provided, however, such First Rebuttals shall be limited to the facts and arguments raised in the other party’s Brief and shall identify clearly which argument or fact of the other party’s Brief is intended to be rebutted;

2.2.4.3.6 That within five (5) business days following the parties’ receipt of each other’s First Rebuttal, Landlord and Tenant, as applicable, shall each have the right to provide the Neutral Arbitrator (with a copy to the other party) with a written rebuttal to the other party’s First Rebuttal (the “Second Rebuttals”); provided, however, such Second Rebuttals shall be limited to the facts and arguments raised in the other party’s First Rebuttal and shall identify clearly which argument or fact of the other party’s First Rebuttal is intended to be rebutted;

2.2.4.3.7 The date, time and location of the arbitration, which shall be mutually and reasonably agreed upon by Landlord and Tenant, taking into consideration the schedules of the Neutral Arbitrator, the Advocate Arbitrators, Landlord and Tenant, and each party’s applicable consultants, which date shall in any event be within forty-five (45) days following the appointment of the Neutral Arbitrator;

2.2.4.3.8 That no discovery shall take place in connection with the arbitration, other than to verify the factual information that is presented by Landlord or Tenant;