Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2014

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

|

Commission File No. 333-173172

| ||

| MOXIAN CHINA, INC. | ||

| (Exact Name of Registrant as Specified in its Charter) |

| Nevada | 27-3729742 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

| Room

2313-2315 , Block B, Zhongshen Garden, Caitian South Road, Futian District, Shenzhen Guangdong Province, China 518101 |

Tel: +86 (0)755-66803251 | |

| (Address of Principal Executive Offices and Zip Code) | Registrant’s Telephone Number, Including Area Code) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: Common Stock, par value $.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

The aggregate market value of the voting common equity held by non-affiliates based upon the price at which Common Stock was last sold as of March 31, 2014, the last business day of the registrant’s most recently completed second fiscal quarter was approximately $17,491.

As of December 31, 2014, the number of shares of the registrant’s common stock outstanding was 198,300,000.

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2014

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

| PART I | ||

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 14 |

| Item 1B. | Unresolved Staff Comments | 15 |

| Item 2. | Properties | 15 |

| Item 3. | Legal Proceedings | 15 |

| Item 4. | Mine Safety Disclosure | 15 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 15 |

| Item 6. | Selected Financial Data | 17 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 19 |

| Item 8. | Financial Statements and Supplementary Data | 19 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 19 |

| Item 9A. | Controls and Procedures | 19 |

| Item 9B. | Other Information | 21 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 21 |

| Item 11. | Executive Compensation | 24 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 25 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 26 |

| Item 14. | Principal Accountant Fees and Services | 26 |

| PART IV | ||

| Item 15. | Exhibits and Financial Statement Schedules | 27 |

| SIGNATURES | 29 |

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; |

| ● | Changes or developments in laws, regulations or taxes in our industry; |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; |

| ● | Competition in our industry; |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| ● | Changes in our business strategy, capital improvements or development plans; |

| ● | The availability of additional capital to support capital improvements and development; and |

| ● | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations. |

| ● | Uncertainties with respect to the PRC legal system could adversely affect us. |

| ● | Our contractual arrangements with our affiliated entity may not be as effective in providing operational control as direct ownership. |

| ● | The uncertainties of the development of internet and social media industry in China may have negative effect on us. |

| ● |

Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

|

●

|

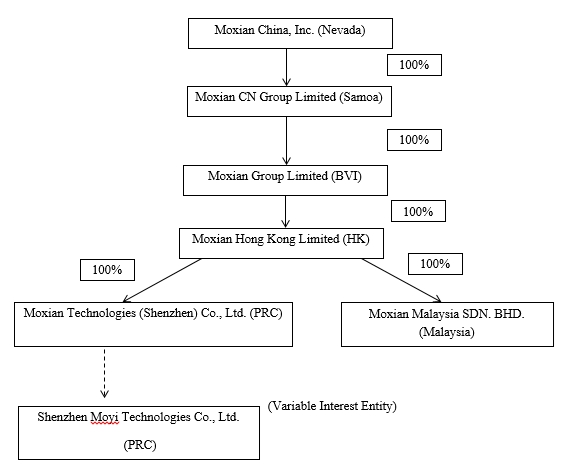

The “Company,” “we,” “us,” or “our,” “Moxian” are references to the combined business of the (i) Moxian China, Inc., a company incorporated under the laws of Nevada; (ii) Moxian CN Group Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian CN Samoa”); (iii) Moxian Group Limited, a company incorporated under the laws of British Virgin Islands (“Moxian BVI”), (iv) Moxian (Hong Kong) Limited, a limited liability company incorporated under the laws of Hong Kong (“Moxian HK”), (v) Moxian Technologies (Shenzhen) Co., Ltd. (“Moxian Shenzhen”), (vi) Moxian Malaysia SDN BHD (“Moxian Malaysia”), and (vii) Shenzhen Moyi Technologies Co. Ltd., a contractually controlled affiliate of Moxian Shenzhen formed under the laws of People’s Republic of China (“Moyi”). |

|

●

|

“REBL” refers to Rebel Group, Inc. (“Rebel”) and its wholly-owned subsidiary, Moxian Intellectual Property Limited under the laws of Samoa (“Moxian Samoa”), and before the License and Acquisition Agreement, Moxian BVI, Moxian HK, Moxian Shenzhen, and Moxian Malaysia. |

|

● |

“Common Stock” refers to the common stock, par value $.001, of the Company; |

| ● |

“HK” refers to the Hong Kong; |

| 3 |

|

● |

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; |

|

● |

“Securities Act” refers to the Securities Act of 1933, as amended; and |

|

● |

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Unless otherwise noted, all currency figures in this filing are in U.S. dollars.

References to "yuan" or "RMB" are to Chinese yuan (also known as the renminbi). According to the currency exchange website www.xe.com, as of December 29, 2014, US$1.00 = 6.2214 yuan; 1 yuan= US$0.1607.

References to “HKD” or “HKD $” are to Hong Kong Dollar. According to the currency exchange website www.xe.com, as of December 29, 2014, US$1.00 = HKD 7.75828; 1 HKD = US$0.12889.

References to “MYR” or “RM” are to Malaysian Ringgit. According to the currency exchange website www.xe.com, as of December 29, 2014, US$1.00 = MYR 3.50666; 1 MYR = US$0.28517.

PART I

Introduction

Moxian China, Inc. (“Moxian China,” the “Company,” “we,” “our,” or “us”), formerly SECURE NetCheckIn Inc., previously engaged in the business of offering a cloud-based scheduling and notification product targeted to urgent care facilities and medical offices to increase the satisfaction of patients in scheduling and timing of appointments. On February 21, 2014, we entered into a License and Acquisition Agreement with REBL (the “License and Acquisition Agreement”), whereby we (i) acquired all the equity interests of Moxian BVI, and (ii) obtained the license to use the intellectual property rights (as define below) of REBL. Pursuant to the License and Acquisition Agreement, REBL agreed to sell, convey, and transfer 100% of the equity interests of Moxian BVI to Moxian CN Samoa, a newly incorporated wholly-owned subsidiary of the Company, in consideration of an aggregate of $1,000,000 in cash. As a result, Moxian BVI, together with its subsidiaries, Moxian HK, Moxian Shenzhen, and Moxian Malaysia, became the Company’s subsidiaries. Under the License and Acquisition Agreement, REBL also agreed to grant us the exclusive right to use REBL’s intellectual property rights (collectively, the “IP Rights”) in Mainland China, Malaysia, and other countries and regions where REBL conducts its business (the “Licensed Territory”), and the exclusive right to solicit, promote, distribute and sell REBL products and services in the Licensed Territory for five years (the “License”). In exchange for such License, the Company agreed to pay to REBL: (i) $1,000,000 as a license maintenance royalty each year commencing from the second year from the date of the agreement; and (ii) 3% of the gross profit of distribution and sale of REBL products and services as an earned royalty. Pursuant to the License and Acquisition Agreement, the Company has the right to acquire the new IP Rights that are developed by REBL relating to the development Moxian Platform, which is an integrated platform for online-offline shopping, entertainment, and social platform (the “Moxian Business”)and sub-license such rights to a third party. The Company also has the obligation to develop the social media market in the Licensed Territory of REBL products and services related to the business related to Moxian Business. Since the acquisition of Moxian BVI and the grant of the License from REBL, we changed our business to develop and explore the social media business, and distributing, selling, and promoting the products and services of REBL mainly in the China and Malaysia regions.

On February 17, 2014, the Company incorporated Moxian CN Group Limited (“Moxian CN Samoa”) under the laws of Independent State of Samoa.

Moxian BVI was incorporated on July 3, 2012 under the laws of British Virgin Islands. Moxian HK was incorporated on January 18, 2013 and became Moxian BVI’s subsidiary since February 14, 2013.

Moxian HK is currently engaged in the business of online social media and will launch its business in China and Malaysia.

Moxian Shenzhen was invested and wholly owned by Moxian HK. Moxian Shenzhen was incorporated on April 8, 2013 and is engaged in the business of internet technology, computer software, commercial information consulting, etc.

Moxian Malaysia was incorporated on March 1, 2013 and became Moxian HK’s subsidiary since April 2, 2013. Moxian Malaysia is conducting its business in IT Services and Media Advertising industry.

On July 15, 2014, Moxian Shenzhen entered into a series of agreements with Shenzhen Moyi Technologies Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moyi”), and its shareholders which permit us to operate Moyi and the right to purchase all of its equity interests from its shareholders as summarized below (the “Moyi Agreements”).

| 4 |

Moyi, which is owned solely by Chinese shareholders, is granted an Internet Content Provider license (“ICP License”). Businesses in China that are engaged in the business of Internet information services, including online advertisement and e-commerce services, are required to obtain an ICP Permit. Due to Chinese regulatory restrictions on foreign investments in the Internet sector, we operate our marketing platform and conduct our business through Moyi pursuant to the Moyi Agreements. Under the Moyi Agreements, Moyi will be treated as a variable interest entity in which the Company does not have direct or controlling equity interest but the historical financial results of such entity will be consolidated in our financial statements in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). The Moyi Agreements include:

Exclusive Business Cooperation Agreement. Pursuant to the Exclusive Business Cooperation Agreement, dated July 15, 2014, between Moxian Shenzhen and Moyi, Moxian Shenzhen has the exclusive right to provide to Moyi technical and systems support, marketing consulting services, training for technical personnel and technical consulting services. As payment for these services, Moyi has agreed to pay Moxian Shenzhen a service fee equal to 100% Moyi’s pre-tax profit. The initial term of this agreement is 10 years and the term can be renewed upon expiration by Moxian Shenzhen’s discretion. The agreement can be terminated by Moxian Shenzhen by a 30-day written notice or by Moyi upon Moxian Shenzhen’s gross negligence or fraudulent action.

Loan Agreement. Pursuant to the Loan Agreement, dated July 15, 2014, by and among Moxian Shenzhen and Zhang Guohui and Guan Fensheng (collectively, the “Moyi Shareholders”), who collectively own 100% equity interests of Moyi, Moxian Shenzhen provided a loan in the amount of RMB 1 million (or $161,651) (the “Loan”) to the Moyi Shareholders for a term of 10 years. The Moyi Shareholders can only use the Loan as working capital of Moyi. Moxian Shenzhen shall have the right to purchase a part or all of Moyi’s equity interests from the Moyi Shareholders.

Share Pledge Agreement. Pursuant to the Share Pledge Agreement, dated July 15, 2014, among Moxian Shenzhen and the Moyi Shareholders, the Moyi Shareholders pledged all of their equity interests in Moyi to Moxian Shenzhen to ensure the performance of Moyi’s obligations under the Exclusive Business Cooperation Agreement. The Moyi Shareholders also agreed not to transfer, dispose of their equity interest in Moyi without the prior written consent of Moxian Shenzhen.

Power of Attorney. Pursuant to the power of attorney dated July 15, 2014, the Moyi Shareholders irrevocably entrusted to Moxian Shenzhen the following rights: (1) the right to attend shareholder meetings of Moyi; and (2) all the rights to exercise its voting power of Moyi on for an indefinite period of time.

Exclusive Option Agreement. Pursuant to the Exclusive Option Agreement dated July 15, 2014 between Moxian Shenzhen and the Moyi Shareholders, Moxian Shenzhen or its designee has an exclusive option to purchase from the Moyi Shareholders, to the extent permitted under the laws of the People’s Republic of China, all or part of their 100% equity interest in Moyi in one or more installments in consideration of RMB10 (or $1.62) per share or the appraised price as required by the laws of PRC. Other than Moxian Shenzhen and its designee, other third party has no right to purchase any equity interest of Moyi from the Moyi Shareholders.

| 5 |

The following diagram sets forth the structure of the Company as of the date of this Report:

Our web site address is www.moxianchina.com. Information contained on our web site is not part of this Annual Report on Form 10-K or our other filings with the Securities and Exchange Commission (“SEC”).

Our Business

General Development and Plan of Operations

Moxian is a social network that integrates social media and business into one single platform. We utilize our website as a social media platform to promote our clients’ business and assist our clients to find consumers online and bring them into real-world stores. In Moxian, our registered consumer users can share photos, post messages in their timeline, and most importantly, interact with our merchant clients to receive up-to-date offers or deals through both the web and mobile applications. We believe that through the Moxian Platform, merchants and retailers can increase their in-store sales by attracting more consumers through online advertisements and promotions.

We believe that Moxian Platform provides significant opportunities for our merchant clients to promote and market their businesses. We offer different types of products for our merchant clients to advertise through our website, www.moxian.com, and enable them to leverage our combination of reach, social context and engagement. Therefore, we believe that we enable our merchant clients to maximize the growth of their businesses. In addition, we also offer useful tools that enable consumer users to connect, share, discover, and communicate with each other and our consumer users can maximize the value of using our website through obtaining rewards and buying deals from our merchant clients.

Moxian principally operates in Malaysia and China. We launched Moxian Platform in Malaysia and in China in June 2013 and July 2014, respectively, and we currently have limited revenues from our operations. The Company has incurred substantially more losses than its revenues to date. The Company plans to expand to Eastern and Southeastern Asian countries and districts, such as Singapore, Malaysia, Indonesia, Philippine, India, Thailand, Brunei, Vietnam, Taiwan during 2015 to 2016.

| 6 |

Our Users

Users of Moxian consist of the following two categories:

| ● | Merchant clients – we provide our merchant clients with both free and paid accounts. For free accounts, merchant clients can obtain a Do It Yourself webpage for business promotion activities only. For paid accounts, after the merchant clients purchase one of our MO-Tube packages (as described below), they are allowed to issue MO-Points to our consumer users, post the contents of their products and services at MO-Promo e-catalog sites, promote their products and services on a mobile directory listing, display advertisements on Moxian main page and on the timeline of their web pages. |

| ● | Consumer users, or MO-Pals in the language of Moxian website – Moxian offers free service for MO-Pals. MO-Pals can sign up a Moxian account for free, invite friends and family members, meet new groups, share stories, photos and videos, send micro-blog messages, play online games and earn MO-Points from Moxian and its affiliated merchants. |

Our Products

MO-Promo Platform

Moxian designed and developed a social marketing platform, branded as “MO-Promo,” which serves as an online sale promotion website for our clients’ businesses. It is a social marketing platform which consists of the following components: (a) Social Customer Relationship Management (“SCRM”) system, (b) MO-Points, (c) online games, (d) a social networking website known as MO-Zone and (d) Social Loyalty Program that rewards MO-Pal as users or customers who are using MO-Points. Moxian’s registered consumer users can access the online stores by visiting “MO-Promo” at www.moxianchina.com. In Mo-Promo, they can be rewarded with MO-Points for free by playing games and wining prizes that are sponsored by Moxian and client merchants. In this way, the registered consumer users are encouraged to visit our website and the online stores. Our merchant clients can also advertise, run marketing campaigns, and learn about their customers through our MO-Promo Platform. Below are the detailed descriptions of Mo-Promo Platform.

SCRM System

The SCRM system enables our merchant clients to interact with their consumers and better understand their needs and preferences. SCRM combines the work of people including market researchers, PR staff, marketing teams, and sales teams. It is a platform for merchants to connect to their business partners and existing/prospective consumers (our subscribers). Our SCRM system allows merchant clients to find insights into a brand's overall visibility through interactions and communications of consumer users in Moxian so that they can identify opportunities for engagement, assess competitor’s activities, and be alerted to any negative feedback from consumers on their products. Our SCRM monitoring tools can be used to obtain quantitative and qualitative responses to advertising campaigns for promotions, identify opportunities to improve a brand, uncover significant unmet customer needs, and identify people who may be highly predisposed to purchasing a brand or a product. Our SCRM system also provides information about emerging trends and consumers’ opinions on specific topics, brands or products.

MO-Points

MO-Points are the electronic points in the Moxian Social Loyalty Program. Registered users can use MO-Points to (i) play games, which must be activated with MO-Points, to win prizes at our Incentive Games Center, and (ii) claim rewards or gifts from Moxian or Moxian’s merchant clients. There are multiple ways of earning MO-Points. Registered users can receive MO-Points by: (i) playing our online games, (ii) making purchases at our merchant clients’ stores, or (iii) referring friends or family to Moxian’s merchant clients (including sharing photos, submitting comments and sending messages). MO-Points cannot be transferred, gifted, resold or exchanged for cash.

Moxian currently provides 500 MO-Points to its merchant clients for no charge (the “Trial MO-Points”) when they first sign up for Moxian’s service packages. The merchant clients may use them to promote their businesses by granting free Mo-Points to those users who purchase their products and services from such merchants’ offline stores. We believe Mo-Points create an incentive to consumers to make purchases and provide positive feedback about their experience and products and services to other consumers. If a merchant client gives out all the Trial MO-Points and it decides to continue marketing itself by utilizing the MO-Promo Platform, such merchant will need to pay for the full Moxian’s service packages, which offer MO-Points ranging from 3000 to 10,000 points.

Social Loyalty Program

The Moxian Social Loyalty Program is a system which encourages registered consumer users to spend MO-Points and return to the MO-Promo Platform. We encourage our users to return to Moxian through rewarding users with reward prizes for “spending” MO-Points in our Incentive Game Center. We believe that spending MO-Points can lead to consumers seeking additional MO-Points by making purchases from our merchant clients and thereby creating customer and brand loyalty. Merchants can also promote specific products by providing reward points solely for purchases of those products. These promotions provide a low cost method for small to medium business owners with limited resources to increase their revenue by rewarding their frequent customers for their purchases.

| 7 |

Online Games

Our online games consist of two categories: (i) Incentive Game Center (“Incentive Game Center”) such as MO-Bid, MO-Grab, MO-Chess that encourages users to play to win prizes, which are either sponsored by Moxian or its merchant clients; and (ii) other online games, known as MO-Puzzle games, which enables users to play for fun and earn MO-Points. The online games are part of the social media platform which attract consumer users to visit our website.

MO-Zone

MO-Zone permits Moxian users to share photos, write posts and diaries, exchange information, watch video clips, and communicate with each other. Every user can customize MO-Zone to their preferences. It is also the social networking site where Moxian users can share their shopping experiences.

Moxian Advertisements

Merchant clients can advertise their products or services through posting banner ads or other advertisements on the Moxian website. In addition, the clients can create their own Moxian page. On their page, they can specify content to which a user is directed if he or she clicks on the page. They can present their products and services on the page, and post any discount information or any activities in the physical stores regarding their products or services. Merchant clients can further engage their intended audiences by incorporating social context with their marketing messages. Social context includes actions a user’s friends have taken, such as visible history when the user’s friend has visited a merchant’s web page. With the social context, the merchants can highlight the interactions of a user’s friends with a brand or product.

Moxian Mobile Applications

Moxian mobile applications provide consumer users another approach to experience our website. Moxian currently provides its platform on both Apple-based products (iOS) and Android-based products. They can be downloaded for free in the Apple Store and Google Play. Our mobile application allows users to redeem points, use social media features such as checking in to the application, sharing photos, a shortcut to the MO-Promo platform, and allows use of our MO-Points to purchase or bid items at the MO-Promo platform.

Our Primary Benefits to Merchants

We believe that the most significant feature of Moxian is that we develop insights into social conversations and behaviors, levels of engagement, influence, and activities of our registered users, or MO-Pals. We analyze the profiles of MO-Pals. Each time a MO-Pal redeems MO-Points, a message will appear in the user’s timeline page. Therefore, we can record the occurrence and analyze the data, including age, gender, marital status, and race. The MO-Pal’s preference in buying different brands of products is also recorded in their social profile, as well as their direct communications with their contacts. Because we provide merchant clients with the information we collect, our clients tailor their message to a select audience to market their products and services more effectively.

MO-Tube Packages

We provide the basic features of MO-Promo Platform for all merchant clients for free. Such free packages include the basic SCRM features with 500 Trial MO-Points offered. In order to make use of all the MO-Promo features, merchant clients will have to purchase MO-Tube packages at various prices. Under our MO-Tube packages, the merchant clients can make use of the full SCRM features, advertise on our websites, and conduct online activities to their targeted customers with the goal of increasing offline sales.

After subscribing for the MO-Tube packages, the merchant clients will have access to more detailed data from consumer users who have made a purchase. In addition, MO-Points are allocated to our clients based on the MO-Tube package subscribed for. As an incentive to boost subscriptions, Moxian bundles these packages with offline advertising opportunities with our business partners in offline media such as roadside billboard and magazines.

Value for Our Merchant Clients

We are dedicated to creating value for our merchant clients. By purchasing the MO-Tube service packages, we believe our clients are able to leverage our MO-Promo platform for their advertising and marketing needs targeted towards their current clients and potential clients. We believe we offer our clients a unique combination of interaction with consumer users, targeting the right customers, learning the users’ preference in their purchase, and engaging the users with innovative promotion methods.

| ● | Interaction. We offer our consumer users a platform to interact with their friends and discover new products and services. While doing so, our merchant clients are able to communicate with these users through this platform, running promotions such as giving out prizes and discounts. |

| 8 |

| ● | Targeted Consumer Users. Our merchants can target users on Moxian based on users’ interests and personal information which users have chosen to share with us on Moxian. Because consumer users can be attracted by advertisements and promotional campaigns that are targeted to them, the promotional campaigns targeted at either first time customers or returning customers can generate more revenues for our merchant clients. |

| ● | Purchasing Preference. We are a strong believer in “word of mouth” marketing and Moxian can assist our consumer users to express their purchasing preferences. We allow consumer users to show their history of visiting the merchants’ Moxian page in their own timeline. This allows messages to be communicated to their friends who may be potential customers to our merchant clients’ outlets or stores and promote their business. In addition, when a consumer user redeems MO-Points at our merchant’s outlet, the redemption of MO-Points automatically subscribes the consumer to a news feed of the merchant’s business site on the consumer user’s homepage (MO-Zone). |

| ● | Engagement. We encourage constant interaction between merchants and their consumers. Moxian offers a platform for both merchants and consumers to be actively involved. Further, merchants not only can engage with existing customers, but also potential customers who can be introduced to the merchants in the process of such engagement. Our platform encourages innovative methods for our merchants, such as promotional campaigns, sharing of information, discovering new products/services, or polling to understand the needs of customers. |

We believe that the MO-Promo platform offers a significant opportunity and financial incentives for our merchant clients to sign up for our website and purchase MO-Tube Packages. In addition, we believe we create value for our merchant clients through MO-Zone. When a promotional campaign is started by a merchant, subscribed users’ login/homepage on MO-Zone receive notifications which we believe allows merchant clients to maximize their revenues through the interaction and engagement with consumer users.

Social Media Marketing Services

In order to better serve our clients and subscribers, we, through MO-Promo and other Moxian applications, also provide various consulting and management services to small and medium-sized businesses, including:

| ● | We provide social media consulting services, with a consultant will be assigned to each client; |

| ● | We publish interactive content for merchant clients in the social communities of their respective industries; |

| ● | We design and customize social webpages for merchant clients, including running feedback, adding coupons or promotions and embedding clients’ product videos and images in clients’ social websites; |

| ● | We manage marketing campaigns on our clients’ social webpages; and |

| ● | We provide analysis and statistics for visitors to clients’ social webpages and hold free strategy sessions to assist clients on generating more traffic on their social webpages. |

Marketing Strategy

Referral marketing is an increasingly popular method for marketers to add new revenue streams or to streamline sales processes with business partners. Moxian has two types of referral programs where different marketers assist us to broaden our client base. The first one is referrals by MO-Pals. MO-Pals (our subscribers) can refer other users to earn extra free MO-Points. We believe this motivates our subscribers to visit our merchants’ social webpages or online/offline stores, which can stimulate sales of our merchants’ products and services. In addition, we believe referrals among MO-Pals can increase Moxian’s user information database, which enables us to provide more accurate analysis and statistics regarding consumer behavior and preferences for our merchants.

Second, we utilize sales representatives who target those who are interested in building Moxian business in a region, such as Malaysia and Singapore, where they represent Moxian for referring merchant clients to us. Moxian usually pays 30% of the purchase price of the sold products or services that are paid by first-time consumers as referral fees. Sales representatives are not entitled to any referral fees from a transaction by repeat consumers in our merchants’ stores.

We believe there are two advantages of our marketing strategy. First, we believe sending our sales representatives to visit potential merchant clients helps the Company to identify and establish relationship with prospective customers through in-person communication. Once the prospective customer are identified, Moxian’s internal sales teams can focus their efforts on those activities required to close the deal and make the sale, rather than devoting time to acquiring and developing the lead, as would typically be the case with other types of marketing programs. Second, referrals of new users by our subscribers to our merchant clients’ stores incur no cost to the Company, because it is the merchant clients that grant free MO-Points to the referring subscribers. In addition, with the MO-Points that are granted in consideration of the referral, we believe that subscribers are more likely to return to our merchant clients’ stores to purchase their products or services with the granted MO-Points. As a result, we believe referral programs can create higher number of returning customers than other types of marketing programs.

| 9 |

Other methods of promoting Moxian include online ads, event campaigns, and print media such as local-based booklet magazines, cross social media marketing, which is an integrated marketing strategy with digital channels, social media and website or blog, with a role for e-mail marketing and online forms.

Customers

Moxian’s customers include retail merchants, manufacturers, shopping mall operators, transportation, telecommunication providers, software developers, online e-commerce operators, payment providers, and news media. As of December 25, 2014, we had 244 paying merchant clients and a total of 17,741 merchant clients (with 16,800 in China and 941 in Malaysia) that are using our platform on a trial basis.

Industry

Moxian is seeking to build an Online-to-Offline (“O2O”) platform model. It is widely believed that O2O platforms can substantially enhance marketing and commerce performance for brands and retailers compared to traditional digital marketing approaches. O2O refers to any and all activities that originate online and eventually result in a shopper going to a physical store. Forrester Research predicts that by 2016, more than half of the $3.5 trillion spent in the US retail offline will be influenced by the web (Forrester’s US Cross-Channel Retail Forecast, 2011 To 2016).

The O2O platform model has been recognized as a trillion dollar opportunity (http://techcrunch.com/2010/08/07/why-online2offline-commerce-is-a-trillion-dollar-opportunity/). According to official statistics, China’s O2O market reached 98.7 billion yuan (approx. US$9 billion) in 2011. Industry analysts anticipate that the China O2O market will quadruple to 418 billion yuan (approx. US$67 billion) in 2016 (http://www.prnewswire.com/news-releases/chinas-o2o-market-the-path-to-success-is-not-uni-directional-201906281.html). Moxian is able to capture a share in this market by offering its platform to merchants. Our platform allows users to be aware of their interested merchants’ on-going promotion so as to attract them to purchase offline.

We anticipate that we will face challenges coming from the pioneers of the e-commerce industry both in Asia and overseas majors trying to expand into Asia. However, we believe our business model is capable in obtaining a significant market share. Our market is not restricted to China as compared to other potential competitors. We will be targeting a number of Asian countries which can result in a bigger market share.

Competition

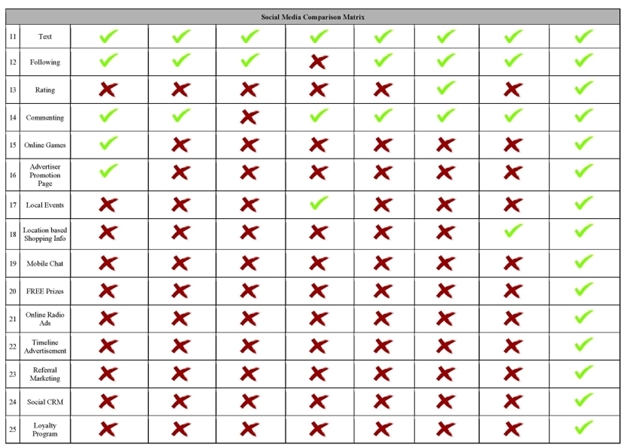

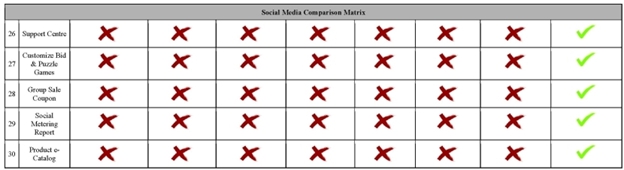

Although major global social network platform providers have the advantage of an existing user base, we believe Moxian has a unique social business model and social media features that can enable us to stand out among the competition. Other major social network platforms usually focus on personal photo sharing, video sharing, chat features, group chatting, micro-blogging, following groups’ online activities, rating and commenting on products and services. What we believe makes Moxian stand out is that our merchant clients have: (i) their own promotion webpages, (ii) local event programs for their customer users, (iii) location-based promotion information, (iv) mobile chat applications, (v) give-away free prizes for consumer users, (vi) timeline advertising on Moxian’s social webpage, (vii) a social customer relationship management system for merchants, (viii) social loyalty program, and (ix) customized online games to promote merchants’ brand and group sales promotions.

Our competitors are the major players in the social networking industry such as Facebook, Google, Twitter, Myspace, Linkedin, YouTube, and Foursquare. Below is the table of comparison between Moxian’s services and its competitors’ services.

| 10 |

Our Strategy

In order for us to compete in the social media and the O2O market, our strategies include:

Expand our user base. We are dedicated to attracting more users and our goal is to retain existing and acquire new subscribers by providing more real-time deals, delivering high quality customer service and expanding the number and categories of deals we offer. We continue to focus on growing our user base across Asia in large markets such as China and Malaysia. We intend to grow our user base by continuing our marketing efforts and enhancing our products, including mobile apps, in order to make Moxian more accessible and useful. We continue to develop a variety of activities to attract more loyal users by give-away prizes, offline events sponsored by our partners, sales promotions and rewards programs. In addition, we adopt the word-of-mouth and referral marketing strategy to increase users’ sign-ups in Moxian.

| 11 |

Increase the number and variety of our products. We focus on product development that we believe will create engaging interactions between our consumer users and merchant clients, across the web, and on mobile devices. We continue to invest significantly in improving our core products such as MO-Promo, MO-Zone, and MO-Points and develop other new products to increase the varieties of our products.

Generate sticky content. In order to attract more users, we intend to develop content on our website in order to attract users’ attention for longer viewing time and for them to return to our website. We plan to tailor the contents based on our analysis of the users and generate such contents that are favorable to our consumer users.

Cooperate with more branded businesses. In order to develop Moxian’s reputation, we intend to develop more merchant clients who have established their brand in local and global markets. Our merchant expansion efforts are focused on providing merchants with a positive experience by offering placement of their deals to our website at a lower cost and high quality customer service and tools to manage deals more effectively.

Regulation

Because we are launching in Malaysia and China first, the following discussions about regulations that govern Moxian’s operations will focus on Malaysia and China.

With respect to collecting information via user registration and consumption of MO-Points data, we will have to comply with The Personal Data Protection Act in Malaysia (“PDPA”). Non-compliance of such rules may result in a fine in the amount of MYR100,000 to MYR 500,000. Directors of Moxian Malaysia may also be personally liable for the Company’s violation of The Personal Data Protection Act in Malaysia. We have taken the following steps to ensure the compliance of PDPA: (i) our Privacy Policy has been drafted to be in compliance with PDPA; (ii) we have registered as “Data Users” with the Commission of Personal Data Protection in Malaysia; (iii) we trained and ensured our staff to be aware of PDPA and the protection of personal data; and (iv) we are the in the process of engaging a counsel in Malaysia to ensure our ongoing compliance with PDPA.

In the PRC, we will have to comply with laws and regulations relating to the distribution of Internet content in China such as obtaining an Internet Content Provider license (an “ICP License”) and our data usage policy has to be in accordance with Regulations of The People’s Republic of China for Safety Protection of Computer Information System. Due to the Chinese government’s restrictions on foreign investment in the Internet sector, we cannot apply or directly own an ICP License. Therefore, we entered into a series of contractual agreements with Moyi, a Chinese domestic company, in July 2014, so that we can operate and distribute Internet content in China with the ICP License held by Moyi. Noncompliance with such rules in China may result in the shutdown of our website.

Our website is maintained through a server in Hong Kong. Therefore, our data usage policy and regular terms of service for both our users and merchants must to comply with the applicable rules and regulations in Hong Kong, SAR. As information from our merchants and consumer users are preserved in Hong Kong, we will need to comply with the Hong Kong Personal Data (Privacy) Ordinance (Cap 486). Non-compliance of such rules in Hong Kong may result in a fines of up to HKD $500,000. Directors of Moxian Hong Kong may also be personally liable for the Company’s violation of Hong Kong Personal Data (Privacy) Ordinance.

Security

Social media offers important business advantages to companies and organizations. However, it has potential security risks. In order to mitigate these security risks, we have established and enforced social media usage policies. We have deployed strategies such as multilayered security at the gateway and end point, content classification, content filtering, and data loss prevention (“DLP”).

Moxian believes that effective security for social networking must leverage both decentralized and centralized modes of IT security. In other words, Moxian must protect both the network and the users at the end point.

Our centralized security holds the key to safeguard enterprises’ data and network resources. As hackers become more aggressive in their attacks on social media, we continue to set up the use of traditional protection tools such as scanning to verify incoming content and traffic. In addition, we implemented a web security tool and configured our Internet gateway to block malicious inbound traffic such as cross-site scripting exploits and phishing. Moxian also has inbound content filtering, which employs spam blockers and anti-virus applications to block or allow a communication based on analysis of its content.

For outgoing traffic, a DLP solution enables the business to screen content before it leaves the corporate network. It monitors outbound traffic to detect and potentially stop the communication of sensitive information by under protected means. DLP can identify sensitive data at rest, control its usage at user end points, and monitor or block its egress from network perimeters.

Whenever user personal data is processed, Moxian takes utmost care in keeping their data secured. We use a variety of industry-standard security technologies and procedures to help protect their personal data from unauthorized access or disclosure. We store data behind a firewall, a barrier designed to prevent outsiders from accessing our servers. Even though Moxian takes significant steps to ensure that the users and clients’ personal data is not intercepted, accessed, used or disclosed by unauthorized persons, we cannot eliminate security risks entirely particularly where the internet is concerned.

| 12 |

Employees

As of the date of this Report, the Company had over 90 employees, with 12 persons working as management, 35 persons working in the product development and technical department, 10 people working in administration and over 30 people working in the sales and marketing department. The Company considers its employee relations to be good, and to date has not experienced a work stoppage due to a labor dispute.

Intellectual Property

Pursuant to the License and Acquisition Agreement, we obtained a License to utilize the IP Rights of REBL. The following are the intellectual property rights that the Company is permitted to use, the details of which are set forth in the following table:

Trademarks

| Type | Marks | Application No. | Country | Status |

| Trademark |  |

85931344 | United States of America | Pending |

| Trademark |  |

302534274 | Hong Kong | Approved |

| Trademark |  |

13460714 | China | Pending |

| Trademark |  |

13460852 | China | Pending |

| Trademark |  |

10624504 | China | Approved |

| Trademark | 魔线 | 13461178 | China | Pending |

| Trademark |  |

10624435 | China | Approved |

Patents

Moxian Shenzhen submitted an application in China on December 27, 2013 (Patent Application No. 201310734492.2) to patent the marketing and promotional methods utilized by the Moxian Platform. The marketing method to be patented is that online users (such as merchants) may use the statistics and data collected from consumers to promote and market their businesses on the Internet. The primary feature of such marketing method is that it can locate merchants that match consumers’ needs and provide a series of interactive tools for merchants to promote their sales, including, granting rewards points, granting reward prizes, providing online games for consumers to earn rewards points, etc.

Copyright

The copyright application of Moxian’s mascot “Moya” has been submitted by Moxian Shenzhen on December 2, 2013 (Application No. 201330592230.8). Moya is a mascot representing Moxian Platform. Below are some pictures of Moya with different expressions:

|

|

|

|

|

| 13 |

Recent Development

On September 28, 2014, Moxian HK entered into loan agreements with three entities: Moxian China Limited (“MCL”), Ace Keen Limited and Jet Key Limited (collectively, the “Creditors”). Pursuant to the loan agreements, Moxian HK obtained loans in the aggregate amount of $908,048 (the “Moxian HK Loans”). On the same day, Moxian Malaysia also signed three loan agreements with the Creditors, pursuant to which Moxian Malaysia borrowed an aggregate of $2,020,221 from the Creditors (the “Moxian Malaysia Loans”). Also on the same day, Moxian Shenzhen entered into three loan agreements with the Creditors, and borrowed an aggregate of $2,961,460 (the “Moxian Shenzhen Loans”). MCL owns 33.8% of total outstanding shares of the Company. Ace Keen Limited is controlled by Mr. Zhang Guo Hui, who is the holder of 70% of the equity interests in Moyi, our variable interest entity in China. Jet Key Limited is owned and controlled by Ms. Zhang Ying, who is Mr. Zhang Guo Hui’s sister. The terms of Moxian HK Loans, Moxian Malaysia Loan, and Moxian Shenzhen Loans are the same: the term is six months and they are unsecured and bear no interest. The Creditors are negating with the Company and they intend to convert the aforementioned loans into the shares of the Company by the end of December 2015.

On October 31, 2014 and November 30, 2014, Moxian Shenzhen received RMB 630,000 (approximately $102,942) and RMB 90,000 (approximately $14,486), respectively, as loans (the “MCL Shenzhen Loans”) from MCL. The term of such loans is twelve months and they bear no interest. On December 31, 2014, the Company, MCL and Moxian Shenzhen entered into a Loan Agreement, where the Company agreed to issue a convertible promissory note (the “Note”) to MCL for the repayment of the MCL Shenzhen Loans.

On October 31, 2014 and November 30, 2014, Moxian Malaysia received a loan in the amount of RM 118,800 (approximately $34,032) and RM 23,100 (approximately $6,605), respectively, from MCL (the “MCL Malaysia Loans”). The term of such loans is twelve months and they bear no interest. On December 31, 2014, the Company, MCL and Moxian Malaysia entered into a Loan Agreement, where the Company agreed to issue a Note to MCL for the repayment of the MCL Malaysia Loans.

On November 30, 2014, Moxian HK received HKD $500,000 (approximately $64,437) as a loan from MCL (the “MCL HK Loan”). The term of such loan is twelve months and it bears no interest. On December 31, 2014, the Company, MCL and Moxian HK entered into a Loan Agreement, where the Company agreed to issue a Note to MCL for the repayment of the MCL HK Loan.

The Notes issued to MCL by the Company in consideration of the MCL Shenzhen Loans, the MCL Malaysia Loans and the MCL HK Loan are of substantially similar terms. The Notes will be due and payable in one year and bears no interest. Upon consummation of a financing that generates at least $5,000,000 by the Company (“Qualified Financing”), the Notes will automatically convert into shares of the Company’s Common Stock at a conversion price equal to the price of the Company’s securities sold in the Qualified Financing. If no Qualified Financing is consummated prior to the maturity date of Notes and as long as there remains any outstanding principal or interest of the Notes, holders of the Notes shall have the option to convert the Notes within 30 days after the maturity date at a conversion price that is equal to the volume weighted average price of Common Stock during a 20-day trading period prior to the conversion of the Notes.

The foregoing description of the terms of the Loan Agreements and the Notes is qualified in its entirety by reference to the provisions of the Loan Agreements and the form of the Notes which are included as Exhibits 10.8, 10.9, 10.10 and 4.2 to this Annual Report and are incorporated by reference herein.

Please also see “Item 9A. Controls and Procedure” on page 19 on this Annual Report for the weaknesses in our internal control over financial reporting identified by our management in connection with the MCL Shenzhen Loans, the MCL Malaysia Loans and the MCL HK Loan.

Available Information

The Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the U.S. Securities and Exchange Commission (the “SEC”). The Company is subject to the informational requirements of the Exchange Act and files or furnishes reports, proxy statements, and other information with the SEC. Such reports and other information filed by the Company with the SEC are available via the Company’s website at www.moxian.com when such reports are available on the SEC’s website. The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

Principal Executive Offices

Our principal executive offices are located at Room 2313-2315, Block B, Zhongshen Garden, Caitian South Road, Futian District, Shenzhen Guangdong Province, China 518101. Our principal telephone number at such location is +86 (0)755-66803251.

Disclosure in response to this item is not required of a smaller reporting company.

| 14 |

ITEM 1B. UNRESOLVED STAFF COMMENTS

Disclosure in response to this item is not required of a smaller reporting company.

The Company currently does not own any properties. We are currently renting an office in Shenzhen. The monthly rent is RMB 50,000 (or approximately $8,196). We are also renting an office in Malaysia. The monthly rent for the Malaysia office is RM 20,000 (or approximately $6,700). The Company believes that such office space will be sufficient for its current needs.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. There are currently no legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is not quoted on any exchange. Our common stock was traded under the symbol “SNEC” until December 13, 2013and is currently quoted on the OTCQB under the trading symbol “MOXC.” Our common stock did not trade prior to April 10, 2013. Trading in stocks quoted on the OTCQB is often thin and is characterized by wide fluctuations in trading prices due to many factors that may have little to do with a company’s operations or business prospects. We cannot assure you that there will be a market for our common stock in the future.

OTCQB securities are not listed or traded on the floor of an organized national or regional stock exchange. Instead, OTCQB securities transactions are conducted through a telephone and computer network connecting brokers.

For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. The following quotations reflect the high and low bids for our shares of common stock based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. All prices are split-adjusted to reflect the 60-for-1 stock split in December 2013.

| High | Low | |||||||

| Fiscal Year 2013* | Bid | Bid | ||||||

| First Quarter | $ | - | $ | - | ||||

| Second Quarter | $ | - | $ | - | ||||

| Third Quarter | $ | - | $ | - | ||||

| Fourth Quarter | $ | - | $ | - |

| High | Low | |||||||

| Fiscal Year 2014 | Bid | Bid | ||||||

| First Quarter* | $ | - | $ | - | ||||

| Second Quarter* | $ | - | $ | - | ||||

| Third Quarter* | $ | 5.20 | $ | 3.00 | ||||

| Fourth Quarter | $ | 11.00 | $ | 4.30 | ||||

* The Company’s Common Stock did not trade until April 10, 2014.

As of December 29, 2014, the last sale price reported on the OTCQB for the Company’s Common Stock was approximately $5.50 per share.

Holders

As of September 30, 2014, we had 198,300,000 shares of our common stock par value, $.001 issued and outstanding. There were approximately 119 beneficial owners of our common stock.

| 15 |

Transfer Agent and Registrar

The transfer agent for our capital stock is Island Stock Transfer, located at 15500 Roosevelt Boulevard, Suite 301.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. In addition, the broker-dealer must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the investors’ ability to buy and sell our stock.

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

Unregistered Sales of Equity Securities

On October 31, 2014 and November 30, 2014, Moxian Shenzhen received RMB 630,000 (approximately $102,942) and RMB 90,000 (approximately $14,486), respectively, as loans (the “MCL Shenzhen Loans”) from Moxian China Limited (“MCL”). The term of such loans is twelve months and they bear no interest. On December 31, 2014, the Company, MCL and Moxian Shenzhen entered into a Loan Agreement, where the Company agreed to issue a convertible promissory note (the “Note”) to MCL for the repayment of the MCL Shenzhen Loans.

On October 31, 2014 and November 30, 2014, Moxian Malaysia received a loan in the amount of RM 118,800 (approximately $34,032) and RM 23,100 (approximately $6,605), respectively, from MCL (the “MCL Malaysia Loans”). The term of such loans is twelve months and they bear no interest. On December 31, 2014, the Company, MCL and Moxian Malaysia entered into a Loan Agreement, where the Company agreed to issue a Note to MCL for the repayment of the MCL Malaysia Loans.

On November 30, 2014, Moxian HK received HKD $500,000 (approximately $64,437) as a loan from MCL (the “MCL HK Loan”). The term of such loan is twelve months and it bears no interest. On December 31, 2014 the Company, MCL and Moxian HK entered into a Loan Agreement, where the Company agreed to issue a Note to MCL for the repayment of the MCL HK Loan.

The issuances of the Notes under the Securities Exchange Agreement were exempt from registration under the Securities Act pursuant to Regulation S promulgated thereunder.

Except as disclosed above, all unregistered sales of the Company’s securities have been disclosed on the Company’s current reports on Form 8-K and the Company’s quarterly reports on Form 10-Q.

| 16 |

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the fiscal year ended September 30, 2014.

ITEM 6. SELECTED FINANCIAL DATA

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

The following discussion of our financial condition and results of operations

should be read in conjunction with our unaudited condensed consolidated financial statements and the notes to those financial

statements appearing elsewhere in this Report.

Certain statements in this Report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

The "Company", "we," "us," and "our," refer to (i) Moxian China, Inc., a company incorporated under the laws of Nevada; (ii) Moxian CN Group Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian CN Samoa”); (iii) Moxian Group Limited, a company incorporated under the laws of British Virgin Islands (“Moxian BVI”), (iv) Moxian (Hong Kong) Limited, a limited liability company incorporated under the laws of Hong Kong (“Moxian HK”), (v) Moxian Technologies (Shenzhen) Co., Ltd. (“Moxian Shenzhen”), and (vi) Moxian Malaysia SDN BHD (“Moxian Malaysia”), and (vii) Shenzhen Moyi Technologies Co. Ltd., a contractually controlled affiliate of Moxian Shenzhen formed under the laws of People’s Republic of China (“Moyi”).

Overview

Moxian China, Inc., formerly known as SECURE NetCheckIn, Inc., engages in the business of providing a social marketing and promotion platform to merchants who desire to promote their businesses through online social media. Our products and services aim to enhance the interaction between users and merchant clients by allowing merchant clients to study consumer behavior through data compiled from our database of users’ activities. We design our products and services to allow our merchant clients to run advertisement campaigns and promotions to target their customers. Our platform is also designed and built to entice users to return and to encourage new consumer users to subscribe our website.

We launched our marketing platform in Malaysia and China in June 2013 and July 2014, respectively. We have generated limited revenues and we have incurred substantially more losses than our revenues to date.

As of September 30, 2013 and September 30, 2014, our accumulated deficits were $209,824 and $5,001,166, respectively. Our stockholders’ equity (deficiency) was ($11,524) and ($4,587,023) as of September 30, 2013 and September 30, 2014, respectively. We have so far generated $56,122 in revenue. Our losses have principally been attributed to operating expenses, administrative and other operating expenses.

Results of Operations

For the year ended September 30, 2014 compared with the year ended September 30, 2013.

Gross Revenues

The Company received sales revenues of $56,122 in the year ended September 30, 2014 compared to nil being generated in the year ended September 30, 2013.

| 17 |

The Company’s sales revenue of $56,122 in the year ended September 30, 2014 comes from paying merchant clients who subscribed to our MO-Promo platform. In our efforts to acquire these subscribers, the costs of $15,514 consist were mainly for printing MO-Point cards and acquiring posters and advertisement placements in newspaper and other media.

Operating Expenses

Operating expenses for the years ended September 30, 2014 and September 30, 2013, were $2,176,963 and $31,411, respectively. The expenses consisted of filing fees, professional fees, payroll and benefits and other general expenses.

We expect that our general and administrative expenses will continue to increase as we incur additional costs to support the growth of our business.

Net Loss

Net loss for the years ended September 30, 2014 and September 30, 2013, were $4,791,342 and $31,441, respectively. Basic and diluted net loss per share amounted to ($0.02) and ($0.00) respectively for the years ended September 30, 2014 and September 30, 2013.

The increase in net loss for the year ended September 30, 2014 was contributed by an impairment of goodwill arising from acquisition.

Liquidity and Capital Resources

At September 30, 2014 we had working capital of ($4,935,692) consisting of cash on hand of $1,770,196 as compared to working capital of ($12,019) and our cash of $28 at September 30, 2013.

Net cash used in operating activities for the year ended September 30, 2014 was $2,106,329 as compared to net cash provided by operating activities of $523 for the year ended September 30, 2013. The cash used in operating activities are mainly for filing fees, professional fees, payroll and benefits and general expenses.

Net cash provided by investing activities for the year ended September 30, 2014 was $667,730 as compared to net cash used in investing activities of $523 for the year ended September 30, 2013. The cash used in investing activities are mainly for the purchases of equipment. The cash provided by investing activities are mainly from the net cash inflow from the acquisition of subsidiaries.

Net cash provided by financing activities for the year ended September 30, 2014 was $3,155,839 as compared to nil for the year ended September 30, 2013. The cash provided by financing activities are mainly from loan borrowings.

Currently, we have limited operating capital. We believe that our current capital and our other existing resources will be sufficient only to provide a limited amount of working capital, and the revenues, if any, generated from our business operations alone may not be sufficient to fund our operations or planned growth.

We will likely require additional capital to continue to operate our business, and to further expand our business. Sources of additional capital through various financing transactions or arrangements with third parties may include equity or debt financing, bank loans or revolving credit facilities. Management has plans to seek additional capital from private equity funds in Asia in the next 12 months. We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means, such as conducting a public offering of our common stock. Our inability to raise additional funds when required may have a negative impact on our operations, business development and financial results.

Critical Accounting Policies and Estimates

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at dates of the financial statements and the reported amounts of revenue and expenses during the periods. Actual results could differ from these estimates. Our significant estimates and assumptions include depreciation and the fair value of our stock, stock-based compensation, debt discount and the valuation allowance relating to the Company’s deferred tax assets.

Recently Issued Accounting Pronouncements

Reference is made to the “Recent Accounting Pronouncements” in Note 2 to the Financial Statements included in this Report for information related to new accounting pronouncement, none of which had a material impact on our consolidated financial statements, and the future adoption of recently issued accounting pronouncements, which we do not expect will have a material impact on our consolidated financial statements.

| 18 |

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive activities and business development. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

As of September 30, 2014, we did not have any off-balance sheet arrangements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company's consolidated financial statements, together with the report of the independent registered public accounting firm thereon and the notes thereto, are presented beginning at page F-1. The Company’s balance sheets as of September 30, 2014 and 2013 and the related statements of operations, changes in stockholders’ deficit and cash flows for the years then ended have been audited by Dominic K.F. Chan & Co. Dominic K.F. Chan & Co is an independent registered public accounting firm. These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and pursuant to Regulation S-K as promulgated by the Securities and Exchange Commission and are included herein pursuant to Part II, Item 8 of this Form 10-K. The financial statements have been prepared assuming the Company will continue as a going concern.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Previous Independent Accountants

On February 19, 2014, our Board of Directors terminated Tarvaran, Askelson& Company LLP (“TA”), as our independent accountant. The reports of TA, on our financial statements for the past two fiscal years contained no adverse opinion or a disclaimer of opinion and were not modified; however, the reports were qualified as to the uncertainty of our ability to continue as a going concern due to our dependence on a successful execution of our plan of operations and ability to raise additional financing, lack of our generation of revenues, and our stockholders’ deficit and negative working capital. The decision to change independent accountants was approved by our Board of Directors on February 19, 2014.

During two most recent fiscal years and through February 14, 2014, we have had no disagreements with TA, on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of TA, would have caused it to make reference to the subject matter of such disagreements in its report on our financial statements for such periods.

During our two most recent fiscal years and through February 19, 2014, there have been no reportable events as defined under Item 304(a)(1)(v) of Regulation S-K.

New Independent Accountants

Our Board of Directors appointed Dominic K.F. Chan & Co. (“Chan”) as our new independent registered public accounting firm effective as of February 19, 2014. During the two most recent fiscal years and through the date of our engagement, we did not consult with Chan regarding either (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements, or (2) any matter that was either the subject of a disagreement or a reportable event as defined in Item 304(a)(1)(v) of Regulation S-K.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosures Control and Procedures

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the company’s principal executive and principal financial officers and effected by the company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

| ● | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company; |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and |

| 19 |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Because of the inherent limitations of internal control, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.