Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Water Works Company, Inc. | d842703d8k.htm |

| EX-99.1 - EX-99.1 - American Water Works Company, Inc. | d842703dex991.htm |

NYSE: AWK

2015 Guidance Call

December 15, 2014

Exhibit 99.2 |

NYSE: AWK

Ed Vallejo

Vice President of Investor Relations |

| NYSE:

AWK www.amwater.com

3

December 2014

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements in this presentation including, without limitation, American

Water’s estimate of 2015 earnings per share from continuous operations,

continued investments, long term earnings per share growth, are forward-looking statements

within

the

meaning

of

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-

looking

statements

are

predictions

based

on

American

Water’s

current

expectations

and

assumptions

regarding

future

events.

Actual

results

could

differ

materially

because

of

factors

such

as

the

decisions

of

governmental

and

regulatory

bodies,

including

decisions

to

raise

or

lower

rates;

the

timeliness

of

regulatory

commissions’

actions

concerning

rates;

changes

in

laws,

governmental

regulations

and

policies,

including

environmental,

health

and

water

quality,

and

public

utility

regulations

and

policies;

the

outcome

of

litigation

and

government

action

related

to

the

Freedom

Industries

chemical

spill

in

West

Virginia;

weather

conditions,

patterns

or

events,

including

drought

or

abnormally

high

rainfall,

strong

winds

and

coastal,

intercoastal

flooding

and

cooler

than

normal

temperatures;

changes

in

customer

demand

for,

and

patterns

of

use

of,

water,

such

as

may

result

from

conservation

efforts;

American

Water’s

ability

to

appropriately

maintain

current

infrastructure

and

manage

the

expansion

of

its

business;

its

ability

to

obtain

permits

and

other

approvals

for

projects;

changes

in

its

capital

requirements;

its

ability

to

control

operating

expenses

and

to

achieve

efficiencies

in

its

operations;

its

ability

to

obtain

adequate

and

cost-effective

supplies

of

chemicals,

electricity,

fuel,

water

and

other

raw

materials

that

are

needed

for

its

operations;

its

ability

to

successfully

acquire

and

integrate

water

and

wastewater

systems

that

are

complementary

to

its

operations;

its

ability

to

successfully

expand

its

business,

including

concession

arrangements

and

agreements

for

the

provision

of

water

services

to

facilitate

hydraulic

fracking

in

shale

regions;

cost

overruns

relating

to

improvements

or

the

expansion

of

its

operations;

changes

in

general

economic,

business

and

financial

market

conditions;

access

to

sufficient

capital

on

satisfactory

terms;

fluctuations

in

interest

rates;

the

effect

of

restrictive

covenants

or

changes

to

credit

ratings

on

its

current

or

future

debt

that

could

increase

its

financing

costs

or

affect

its

ability

to

borrow,

make

payments

on

debt

or

pay

dividends;

fluctuations

in

the

value

of

benefit

plan

assets

and

liabilities

that

could

increase

financing

costs

and

funding

requirements;

migration

of

customers

into

or

out

of

its

service

territories;

difficulty

in

obtaining

insurance

at

acceptable

rate

s and

on

acceptable

terms

and

conditions;

its

ability

to

retain

and

attract

qualified

employees;

labor

actions

including

work

stoppages

and

strikes;

the

incurrence

of

impairment

charges;

and

civil

disturbance,

terrorist

threats

or

acts,

or

public

apprehension

about

future

disturbances

or

terrorist

threats

or

acts.

For

further

information

regarding

risks

and

uncertainties

associated

with

American

Water’s

business,

please

refer

to

American

Water’s

annual

and

quarterly

SEC

filings.

American

Water

does

not

undertake

to

update

its

forward-looking

statements. |

NYSE: AWK

www.amwater.com

4

December 2014

Today’s Agenda and Speakers:

Strategy

Overview:

Susan Story

Regulated

Operations:

Walter Lynch

Market Based

Operations:

Sharon Cameron

2015 Earnings

Guidance:

Linda Sullivan |

NYSE: AWK

Strategy Overview

Susan Story

President and Chief Executive Officer |

NYSE: AWK

www.amwater.com

6

December 2014

American Water: The Premier Water Services Provider

in North America

The largest publicly traded water and wastewater

service provider in the United States

~ $9.5 Billion Market Capitalization

Our Business lines:

Regulated Business

o

~90% of Total Revenues

o

Provide water and wastewater services

in 16 U.S. states

o

3.2 million customer connections, 12

million people served

Market Based Business

o

~ 10 % of Total Revenues (Reg. like

risk profile)

o

Provide services to 43 states and parts

of Canada

o

2 million people served |

NYSE: AWK

www.amwater.com

December 2014

7

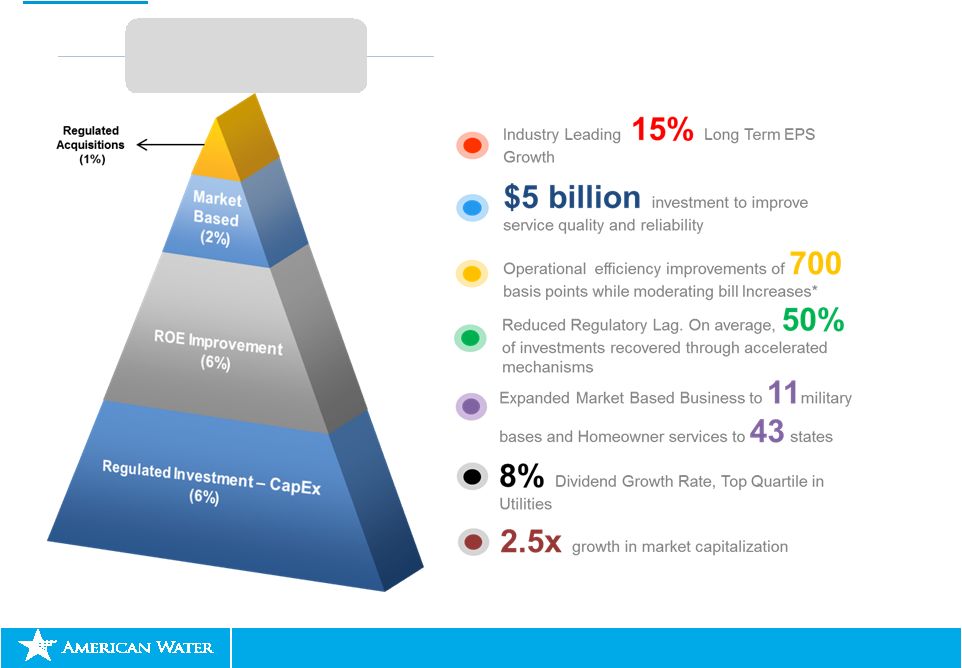

Our Past: Strong performance over the past 5 years (2010–2014)

2010-2014

~15% EPS Growth

*O&M Efficiency ratio comparison of 2010 vs LTM Sep 2014

**Source: Thomson Reuters, Time Period: 2009 –

2013 Dividend Paid CAGR

Peer companies include: AWR, WTR, CWT, ATO, GAS, WGL, GXP, WR, OGE, AEE, POR, LNT,

EDE, SCG, POM, HE, IDA, TE, CMS, UNS, PNM. ** |

NYSE: AWK

www.amwater.com

December 2014

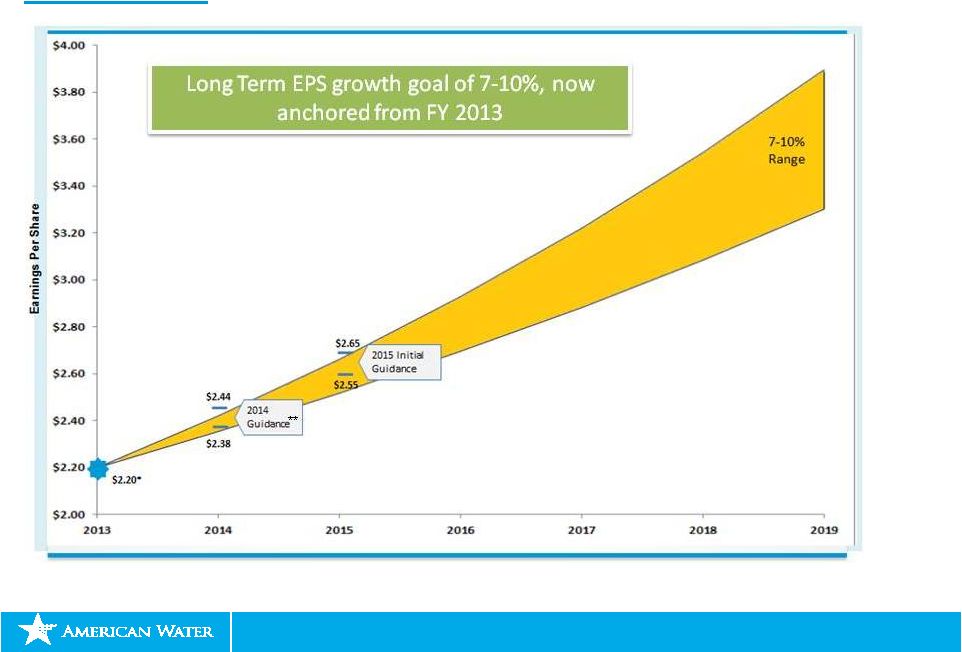

Our Present: FY 2015 Guidance from continuing operations

8

*Adjusted

non-GAAP

measure

excluding

$0.14

EPS

impact

of

debt

tender

offer

in

2013

**Adjusted 2014 guidance excludes Freedom Industries chemical spill EPS

impact of $0.04 in West Virginia |

NYSE: AWK

www.amwater.com

December 2014

9

*Anchored from FY 2013

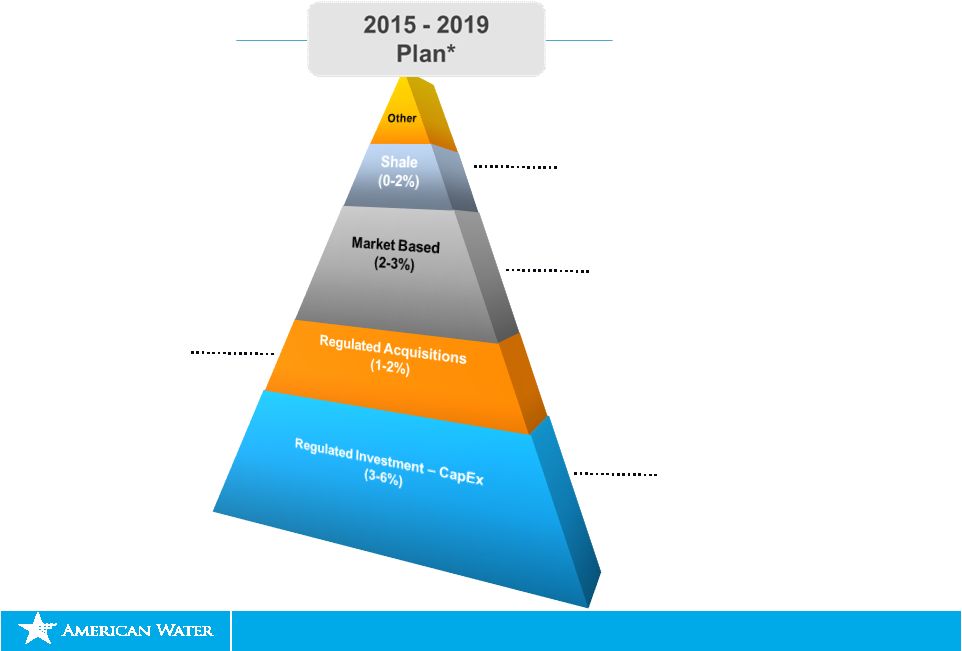

Our Future : Our commitment over the next 5 years |

NYSE: AWK

II. Regulated Operations

Walter Lynch

President and Chief Operating Officer

Regulated Operations |

NYSE: AWK

www.amwater.com

11

December 2014

American Water’s Regulated Presence

Every day we operate and manage:

•

47,000

miles of distribution and

collection mains

•

80

surface water treatment plants

•

500

groundwater treatment plants

•

1,000

groundwater wells

•

100

wastewater treatment facilities

•

87

dams

* Data as of year end 2013

We manage more than 370

individual water systems

across the country*

16 regulated states |

NYSE: AWK

www.amwater.com

12

December 2014

Infrastructure

Investment

Regulated Business: Focus Areas

Efficiency &

Water Energy

Nexus

Growth

Constructive

Regulatory

Frameworks |

NYSE: AWK

www.amwater.com

13

December 2014

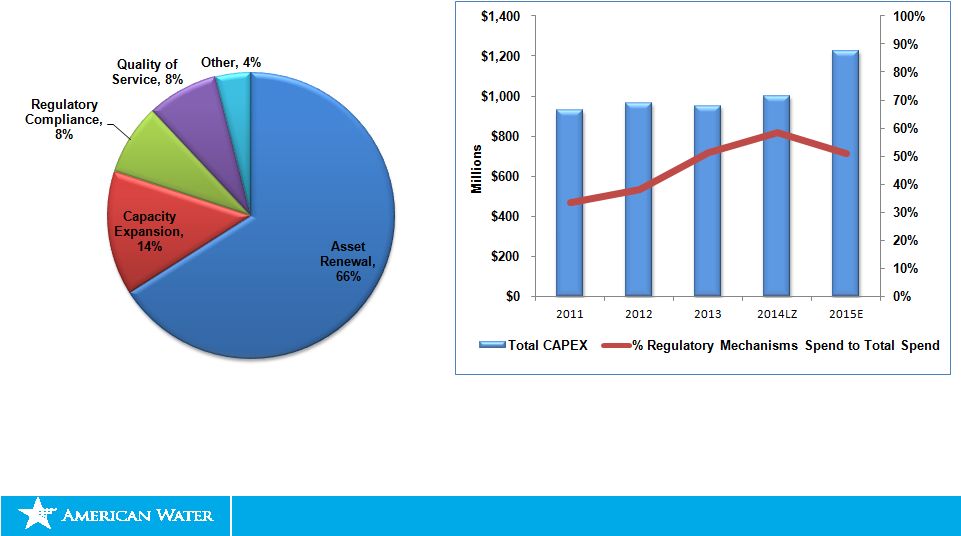

Regulatory Capital Investment of $5.2 billion over next

five years

Note

(1) Regulatory Mechanisms include DSIC, SIC and Future Test Years

Investments covered by Regulatory Mechanisms

2015 –

2019 Average Capital

Expenditures by Purpose |

NYSE: AWK

www.amwater.com

December 2014

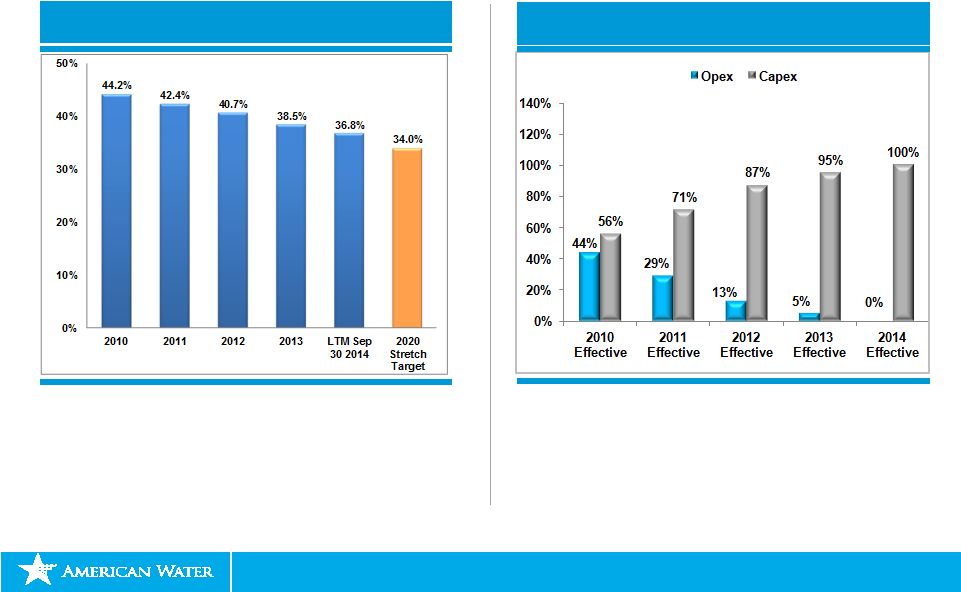

Cost containment and timely return on our investments will

drive added Capital Expenditures

14

Note:

O&M Efficiency Ratio -

Non GAAP Measure –

See appendix for

reconciliation

Incremental Revenue Requirement*

-Increases Attributable to Opex vs. Capex-

Note:

*

Approximation

in

states

where

we

received

black

box

award

**

For

general

rate

cases

effective

in

2014,

the

incremental

revenue

requirement was reduced by 25% due to lower Operating

expenditures.

O&M Efficiency Ratio

Stretch Target of 34% by 2020

** |

NYSE: AWK

III. Market-Based Operations

Sharon Cameron

President, American Water Enterprises |

NYSE: AWK

www.amwater.com

16

December 2014

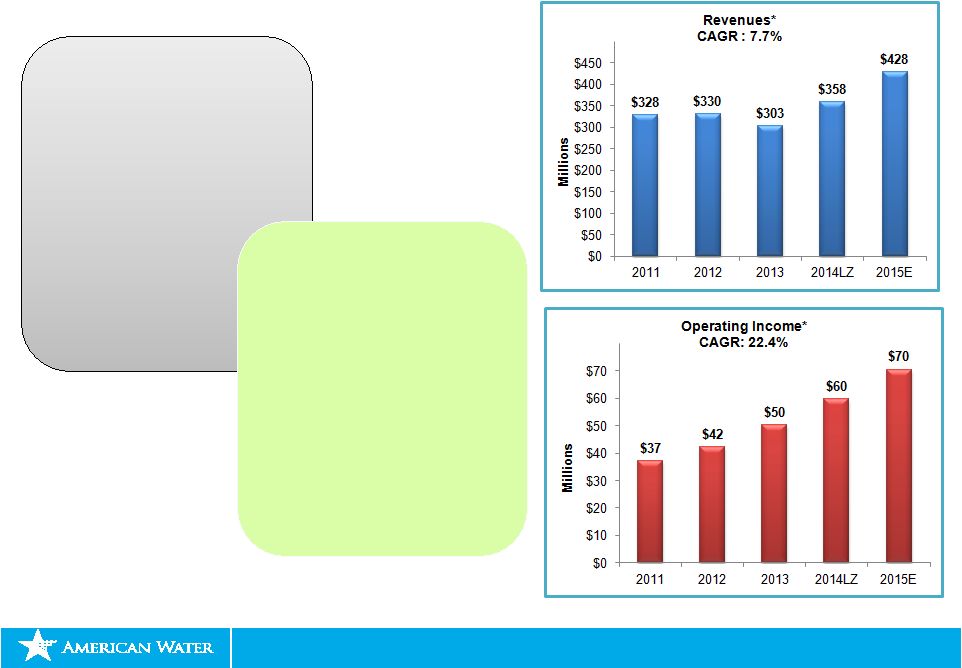

Lines of Business

•

Homeowner Services

(HOS)

•

Contract Operations

•

Military Services Group

(MSG)

•

Municipal/Industrial

(CSG)

“Regulated Like”

•

Capitalizes on AW strengths

•

Strong/consistent margins

•

Controllable risk

•

Growing markets

Market based businesses generate complementary

opportunities for growth

Note:

MBB

segment

also

includes

two

non-regulated

contracts

for

NJ

concessions

which

are

not

included

in

this

presentation

*2011

and

2012

figures

include

Terratec |

NYSE: AWK

www.amwater.com

17

December 2014

Homeowner Services

•

Protect homeowners from unexpected

high repair costs

•

Manage approximately 700k customers

and 1.4m contracts

•

Municipal partnerships

•

New York City

•

Nashville, TN

•

Burlington, IA

•

Orlando, FL

•

Current warranties:

•

Water Line

•

Sewer Line

•

In Home Plumbing

•

In Home Electric

•

HVAC (Test)

Under-penetrated Market Opportunity as large Municipal

Players are Increasingly Open to Partnerships |

NYSE: AWK

www.amwater.com

December 2014

18

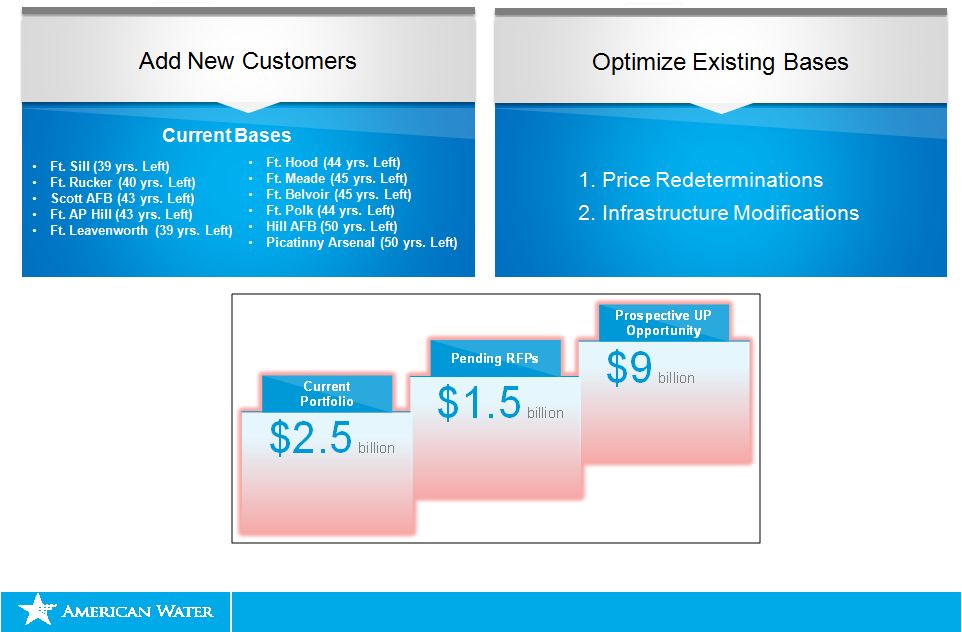

Military Services: Overall Growth Strategy |

NYSE: AWK

IV. 2015 Earnings Guidance: Summary

Linda Sullivan

Senior Vice President

and Chief Financial Officer |

NYSE: AWK

www.amwater.com

20

December 2014

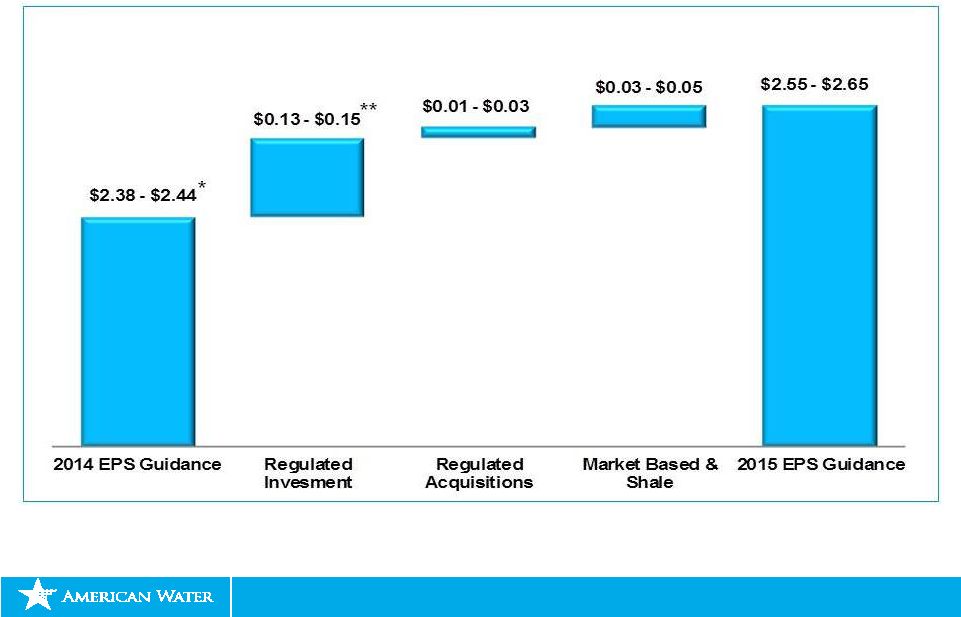

Note:

*Adjusted 2014 guidance excludes $0.04 EPS impact of Freedom industries chemical

spill in West Virginia **Regulated investment category includes $0.02

projected EPS impact due to Freedom industries chemical spill in West Virginia

Earnings guidance for 2015 is $2.55 -

$2.65 per share

(Diluted EPS from continuing operations) |

NYSE: AWK

www.amwater.com

21

December 2014

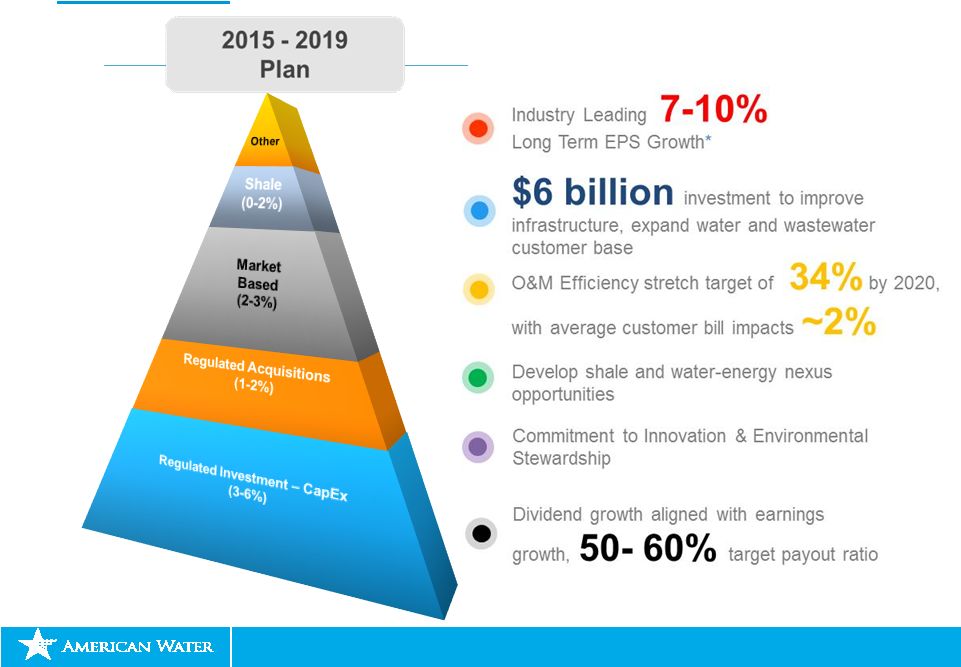

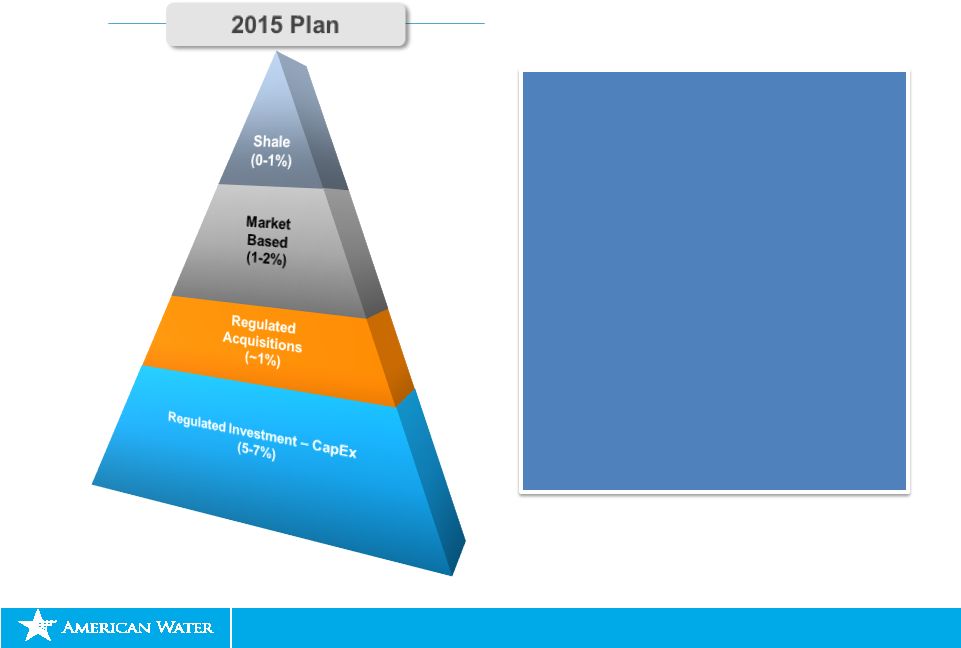

2015 growth largely driven by regulated investment

•

Capital investment of $1. 2

billion in 2015; regulated

investment $1.1 billion

•

Continued growth strategy in

2014; closing of recently

announced acquisitions

expected mid-2015

•

Steady and significant growth

continues in Market Based

•

Shale opportunities developing |

NYSE: AWK

www.amwater.com

22

December 2014

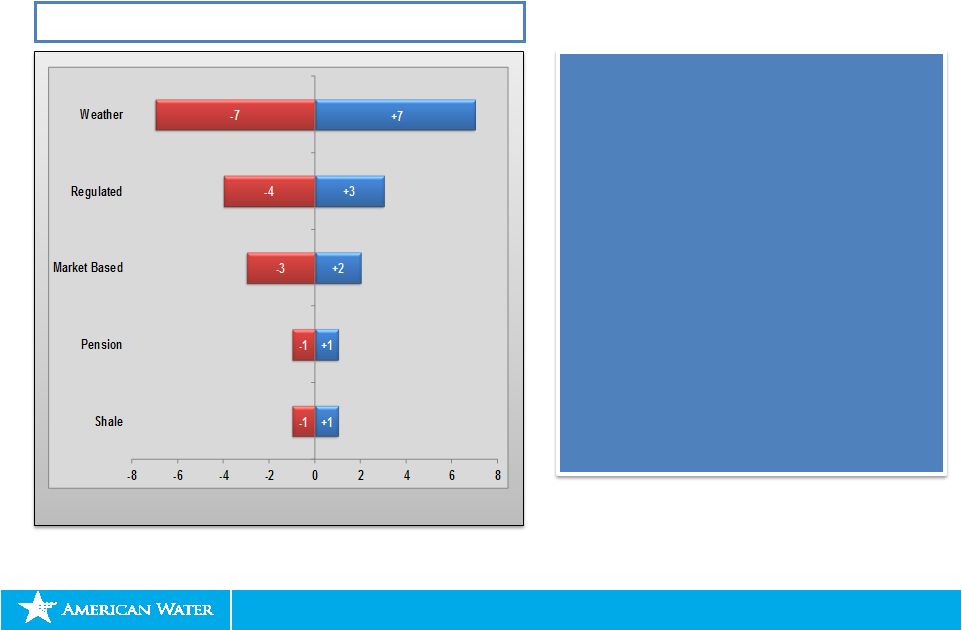

FY 2015 Initial Guidance: $2.55 -

$2.65

Cents per Share variation

2015 Guidance and Major Variables

•

Guidance range includes a certain

amount of variability, with weather

representing the largest variable

•

Guidance range expected to

cover normal weather

variability; weather extremes

outside of the band are not

included

•

Weather impacts will be

quantified and disclosed for

transparency

•

Guidance range includes $5 million

for potential legal costs related to

the WV event |

NYSE: AWK

www.amwater.com

23

December 2014

Drivers:

•

Market demand

•

Environmental Regulations

•

Investment Risk Profile

Drivers:

•

Timing of Acquisitions

•

Legislation

•

Regulatory Treatment

Drivers:

•

Market Penetration rate: HOS

•

Military Award Timing

•

New Regulated Like products

and services

Drivers:

•

Capital Investment

•

Authorized ROE’s

•

Reduction of Regulatory Lag

•

O&M efficiency

•

Consumption Decline

Long Term Plan: Consistent growth drivers with additional regulated

investment upside as we increase capital investment from $5.8B to $6B

*7-10 % Long term EPS growth target anchored from FY 2013

|

NYSE: AWK

www.amwater.com

24

December 2014

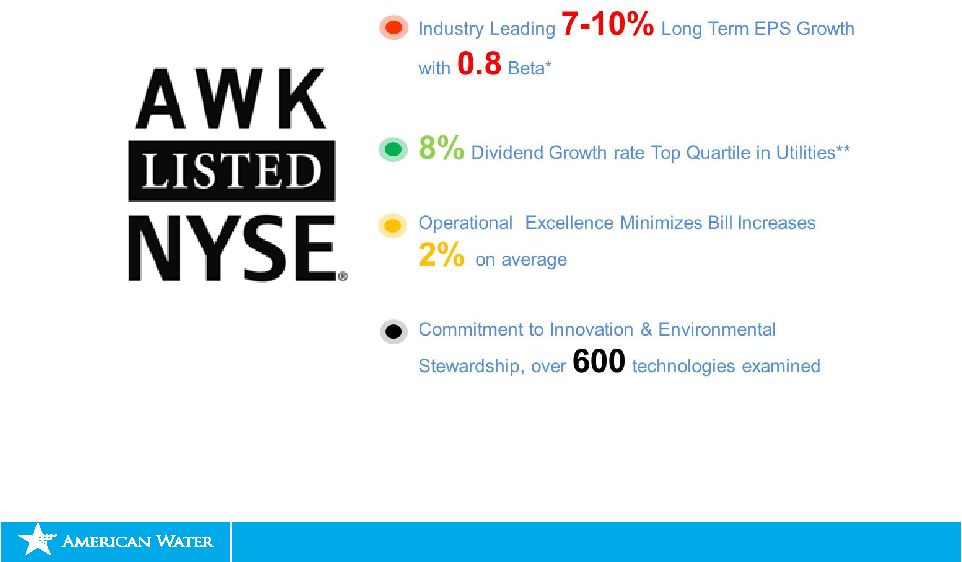

Why American Water is the right investment for you

*Source : Thomson Reuters

**Source: Thomson Reuters, Time Period: 2009 –

2013 Dividend Paid CAGR

Peer companies include: AWR, WTR, CWT, ATO, GAS, WGL, GXP, WR, OGE, AEE, POR, LNT,

EDE, SCG, POM, HE, IDA, TE, CMS, UNS, PNM. |

NYSE: AWK

In Summary

Susan Story

President and Chief Executive Officer |

NYSE: AWK

www.amwater.com

26

December 2014

Our future results are anchored on 5 central themes

with customers at the center of all we do

SAFETY

PEOPLE

TECHNOLOGY &

OPERATIONAL

EFFICIENCY

GROWTH

CUSTOMERS

•

Very satisfied customers

•

Know our customers’

needs and deliver value

•

Proud and engaged people

who are always improving

•

Diverse teams making a

difference

•

Zero accidents and injuries

•

Live healthy

•

Grow existing businesses

•

Buy and build

complementary

businesses

•

Long-term environmental

leadership

•

Industry-leading

operational efficiency,

driven by technology |

NYSE: AWK

www.amwater.com

27

December 2014

Investor Relations Team:

Durgesh Chopra

Director –

Investor Relations

Durgesh.chopra@amwater.com

Ed

Vallejo

Vice President –

Investor Relations

Edward.vallejo@amwater.com

Tel: 856-566-4005

Fax: 856-782-2782 |

NYSE: AWK

Appendix |

NYSE: AWK

www.amwater.com

29

December 2014

Reconciliation Table –

Regulated O&M Efficiency Ratio

Regulated O&M Efficiency Ratio

(A Non-GAAP Unaudited Number)

FY

FY

FY

FY

LTM Ended

Sep

($ in thousands)

2010

2011

2012

2013

2014

Total Operations and Maintenance Expense

$1,290,941

$1,301,794

$1,350,040

$1,312,724

$1,330,605

Less:

Operations and Maintenance Expense –

Market Based Operations

256,633

278,375

276,809

264,253

272,386

Operations and Maintenance Expense –

Other

(61,138)

(69,192)

(56,755)

(56,973)

(53,606)

Total Regulated Operations and Maintenance Expense

$1,095,446

$1,092,611

$1,129,986

$1,105,444

$1,111,825

Less:

Allocation of internal non-O&M costs to Regulated O&M expense

29,414

30,590

35,067

34,635

37,975

Regulated Purchased Water Expense

99,834

99,008

110,173

111,119

119,692

Impact of West Virginia Freedom Industries Chemical Spill

10,302

Estimated impact of weather (mid-point of range)

4,289

(1,514)

(1,762)

Adjusted Regulated Operations and Maintenance Expense (a)

$966,198

$963,013

$980,457

$961,204

$ 945,618

Total Operating Revenues

$2,555,035

$2,666,236

$2,876,889

$2,901,858

$2,986,192

Less:

Operating Revenues –

Market Based Operations

294,723

327,815

330,329

325,463

334,647

Operating Revenues –

Other

(25,344)

(30,470)

(17,874)

(17,523)

(17,594)

Total Regulated Operating Revenues

$2,285,656

$2,368,891

$2,564,434

$2,593,918

$2,669,139

Less:

Regulated Purchased Water expense*

99,834

99,008

110,173

111,119

119,692

Plus:

Impact of West Virginia Freedom Industries Chemical Spill

1,012

Estimated impact of weather (mid-point of range)

(42,885)

15,137

16,785

Adjusted Regulated operating revenues (b)

$2,185,822

$2,269,883

$2,411,376

$2,497,936

$2,567,244

Regulated O&M Efficiency Ratio (a)/(b)

44.2%

42.4%

40.7%

38.5%

36.8%

*Calculation assumes purchased water revenues approximate purchased water

expenses |