Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MOSAIC CO | a8-kmarketmosaicdecember20.htm |

Michael R. Rahm Vice President, Market and Strategic Analysis Andy J. Jung Director, Market and Strategic Analysis Josh Paula Market Analyst Lead Mathew Philippi Market Analyst Market Mosaic is a newsletter published for our customers, suppliers and stakeholders by the Market and Strategic Analysis group of The Mosaic Company. Some issues assess the near term outlook for agricultural and plant nutrient markets while others take an in-depth look at a topic of special interest to our readers. The final issue of this year highlights our picks for the top five market developments in 2014 as well as the top five factors to watch in 2015. Review and Outlook – continued inside As 2014 draws to a close, we took a look back at developments that moved agricultural commodity, phosphate (P) and potash (K) markets this year. We also took a peek ahead at 2015 and identified key factors to watch next year. This issue highlights our top five picks in each category. Top Five Market Developments in 2014 1 - The Drop in Agricultural Commodity Prices Prices for most agricultural commodities declined significantly in response to another block-buster harvest and large projected stock build this year. Futures prices have staged a strong rally since the end of September, but 2015 new crop prices still are trading off from levels of the last two years as farmers make post-harvest decisions about next year’s crop. Global grain and oilseed production this year topped last year’s record-shattering harvest thanks to ideal growing conditions, particularly in the U.S. Corn Belt. U.S. Department of Agriculture (USDA) estimates released on December 10 now indicate that global output will exceed 3.0 billion tonnes for the first time in 2014/15, up 0.9% or 26 million tonnes from 2013/14. Recall, however, that the global harvest took a giant step up in 2013/14 - jumping 8.6% or 237 million tonnes from the year before. Global grain and oilseed inventories are projected to climb to higher levels despite strong demand growth. In fact, the latest USDA statistics show that global stockpiles at the end of the 2014/15 crop year are projected to increase 43 million tonnes to 625 million or 21.2% of projected use. That is the biggest stockpile since 1999/00, but stocks as a percentage of use are down from 29.0% at the end of 1999/00 and are just 100 basis points greater than the five-year average. Market Mosaic December 2014 ® 3.0 4.0 5.0 6.0 7.0 S O N D J F M A M J J A $ BU New Crop Corn Prices Daily Close of the New Crop Contract (Sep 1 - Aug 31) 2013 2014 2015 Source: CME 9 10 11 12 13 14 S O N D J F M A M J J A $ BU New Crop Soy b ea n Prices Daily Close of the New Crop Contract (Sep 1 - Aug 31) 2013 2014 2015 Source: CME

Two characteristics of this year’s projected stock build are worth noting. First, corn and soybeans account for virtually all of the projected net increase. Soybean stocks are expected to jump 35% or 23 million tonnes to 90 million and corn inventories are projected to increase 11% or 19 million tonnes to 192 million by the end of the 2014/15 crop year. Second, the United States accounts for the biggest chunk of the projected gain due to a record harvest this fall. U.S. grain and oilseed inventories are forecast to increase 30 million tonnes or nearly three-fourths of the projected increase in global stocks. U.S. corn inventories are projected to climb 19 million tonnes by the end of the 2014/15 crop year – equal to the entire global build. U.S. soybean inventories are expected to increase nine million tonnes and account for almost 40% of the projected jump in global stocks. 2 - The Tightening of the Global Potash Market Following the steep drop during the last half of 2013, potash prices increased throughout 2014 in response to a steady tightening of the global supply and demand balance. And it is worth noting that fundamentals had tightened far ahead of the recent halt in production and potential loss of Uralkali’s Solikamsk 2 mine in Russia. On the demand side of the ledger, global muriate of potash (MOP) shipments surged 8% or 4.5 million tonnes to a record 58.2 million tonnes KCl this year. The Big Six potash consuming regions – namely China, North America, Brazil, India, Indonesia and Malaysia – account for roughly two-thirds of global shipments and are expected to account for 80% of the projected increase in global shipments this year. On the supply side of the ledger, demand growth was met by a combination of increases in output as well as large drawdowns of producer inventories. In the former Soviet Union (FSU), producers ramped up production. Uralkali recently reported that it expects to produce about 12.0 million tonnes KCl this year, up 2.0 million tonnes from 2013 despite the halt in production at its 2.5 million tonne Solikamsk 2 mine in late November. Belaruskali reported that production during the first half of the year was up 20% or nearly 1.0 million tonnes at 5.2 million and recently guided that production likely would exceed 10.0 million tonnes for the entire year, up from 7.1 million tonnes last year. In North America, producers utilized large inventories to fill orders. Statistics collected by the International Plant Nutrition Institute (IPNI) showed that stocks held by North American producers at both on- and off-site warehouses peaked at 3.19 million tonnes KCl on January 31, 2014 before plunging 54% or 1.71 million tonnes during the next eight months to just 1.48 million tonnes on September 30, 2014. Producer stocks were 47% less than a year earlier and 23% less than the seven-year Olympic average for this date. North American production for the first three-quarters of the year was off 2% or 280,000 tonnes KCl due largely to extended downtime at Agrium’s Vanscoy mine as well as less output from Mosaic’s smaller U.S. operations. “...the world is just one crop disaster from a food crisis and just one additional bumper crop from a farm crisis.” - Dr. Michael R. Rahm 2.0 2.2 2.4 2.6 2.8 3.0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Bil Tonnes Source: USDA Production Domestic Use Crop Year Beginning In Global Grain and Oilseed Production and Use 15% 17% 19% 21% 23% 25% 27% 29% 300 350 400 450 500 550 600 650 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 S/U Ratio Mil Tonnes Source: USDA Global Grain and Oilseed E nding S tock s Ending Stocks Stocks/Use Ratio Crop Year Beginning In $ 300 $ 350 $ 400 $ 450 $ 500 $ 550 $ 600 $ 650 10 11 12 13 14 $ Tonne M OP Price f ob M idw est Terminal cnf Braz il Source: FMB and Green Markets

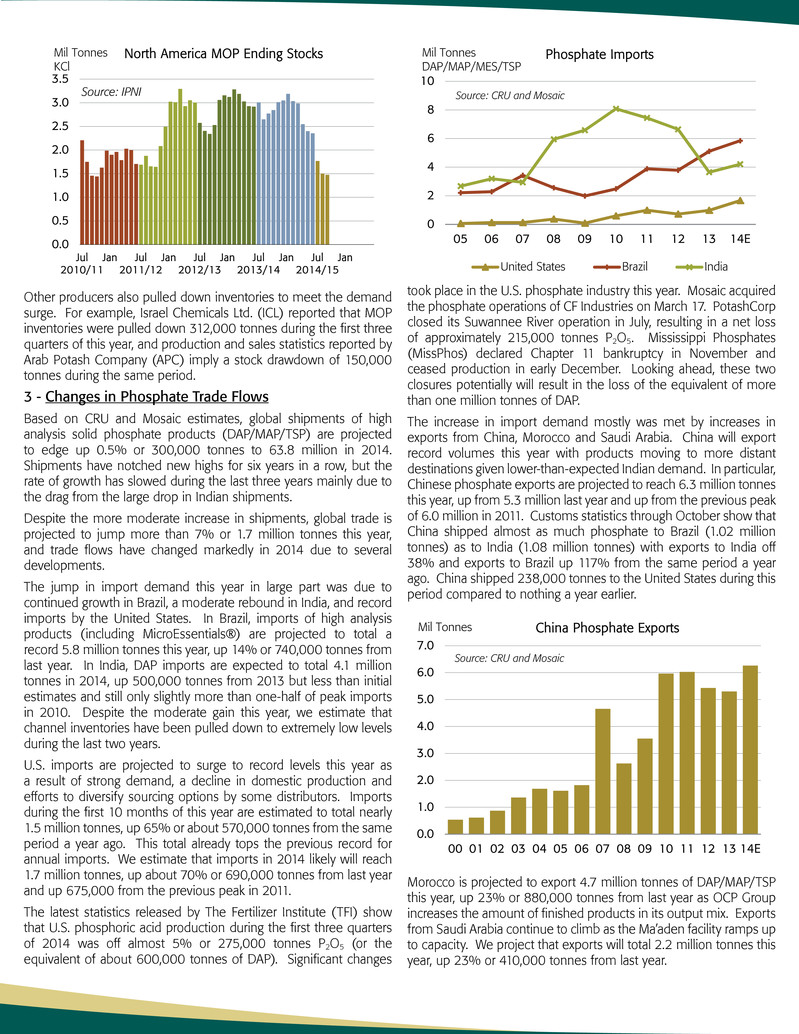

Other producers also pulled down inventories to meet the demand surge. For example, Israel Chemicals Ltd. (ICL) reported that MOP inventories were pulled down 312,000 tonnes during the first three quarters of this year, and production and sales statistics reported by Arab Potash Company (APC) imply a stock drawdown of 150,000 tonnes during the same period. 3 - Changes in Phosphate Trade Flows Based on CRU and Mosaic estimates, global shipments of high analysis solid phosphate products (DAP/MAP/TSP) are projected to edge up 0.5% or 300,000 tonnes to 63.8 million in 2014. Shipments have notched new highs for six years in a row, but the rate of growth has slowed during the last three years mainly due to the drag from the large drop in Indian shipments. Despite the more moderate increase in shipments, global trade is projected to jump more than 7% or 1.7 million tonnes this year, and trade flows have changed markedly in 2014 due to several developments. The jump in import demand this year in large part was due to continued growth in Brazil, a moderate rebound in India, and record imports by the United States. In Brazil, imports of high analysis products (including MicroEssentials®) are projected to total a record 5.8 million tonnes this year, up 14% or 740,000 tonnes from last year. In India, DAP imports are expected to total 4.1 million tonnes in 2014, up 500,000 tonnes from 2013 but less than initial estimates and still only slightly more than one-half of peak imports in 2010. Despite the moderate gain this year, we estimate that channel inventories have been pulled down to extremely low levels during the last two years. U.S. imports are projected to surge to record levels this year as a result of strong demand, a decline in domestic production and efforts to diversify sourcing options by some distributors. Imports during the first 10 months of this year are estimated to total nearly 1.5 million tonnes, up 65% or about 570,000 tonnes from the same period a year ago. This total already tops the previous record for annual imports. We estimate that imports in 2014 likely will reach 1.7 million tonnes, up about 70% or 690,000 tonnes from last year and up 675,000 from the previous peak in 2011. The latest statistics released by The Fertilizer Institute (TFI) show that U.S. phosphoric acid production during the first three quarters of 2014 was off almost 5% or 275,000 tonnes P2O5 (or the equivalent of about 600,000 tonnes of DAP). Significant changes took place in the U.S. phosphate industry this year. Mosaic acquired the phosphate operations of CF Industries on March 17. PotashCorp closed its Suwannee River operation in July, resulting in a net loss of approximately 215,000 tonnes P2O5. Mississippi Phosphates (MissPhos) declared Chapter 11 bankruptcy in November and ceased production in early December. Looking ahead, these two closures potentially will result in the loss of the equivalent of more than one million tonnes of DAP. The increase in import demand mostly was met by increases in exports from China, Morocco and Saudi Arabia. China will export record volumes this year with products moving to more distant destinations given lower-than-expected Indian demand. In particular, Chinese phosphate exports are projected to reach 6.3 million tonnes this year, up from 5.3 million last year and up from the previous peak of 6.0 million in 2011. Customs statistics through October show that China shipped almost as much phosphate to Brazil (1.02 million tonnes) as to India (1.08 million tonnes) with exports to India off 38% and exports to Brazil up 117% from the same period a year ago. China shipped 238,000 tonnes to the United States during this period compared to nothing a year earlier. Morocco is projected to export 4.7 million tonnes of DAP/MAP/TSP this year, up 23% or 880,000 tonnes from last year as OCP Group increases the amount of finished products in its output mix. Exports from Saudi Arabia continue to climb as the Ma’aden facility ramps up to capacity. We project that exports will total 2.2 million tonnes this year, up 23% or 410,000 tonnes from last year. 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 Jul 2010/11 Jan Jul 2011/12 Jan Jul 2012/13 Jan Jul 2013/14 Jan Jul 2014/15 Jan Mil Tonnes KCl North America MOP Ending Stocks Source: IPNI 0.0 1.0 2.0 3.0 4.0 5.0 6 .0 7 .0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E China Phosp hate Ex p ortsMil Tonnes Source: CRU and Mosaic 0 2 4 6 8 10 05 06 07 08 09 10 11 12 13 14E Phosp hate I mp orts United States Brazil India Mil Tonnes DAP/MAP/MES/TSP Source: CRU and Mosaic

4 - Transportation/Logistics Issues and Shipping Delays Moving P&K products from mines and chemical plants to customers seems like a straightforward task, but several developments this year have resulted in long shipping delays and have frustrated and harmed both producers and distributors. For example, Atlantic storms that produced 30-foot swells shut down exports from the large Jorf Lasfar complex in Morocco for several weeks during the first quarter and helped to ignite the jump in phosphate prices earlier this year. In North America, rail car and power shortages delayed potash shipments from Saskatchewan mines, causing production curtailments due to full warehouses at one end of the supply chain and stock-outs and missed sales at the other end. Some of these issues such as the shut-down of the Jorf Lasfar port were due to Mother Nature while others such as delayed rail shipments in North America largely are the result of structural changes taking place in the industry. In North America, the demand for rail services is increasing at a rapid rate due to the growth in container, oil, ethanol, coal and grain shipments. At the same time, railroads have implemented new business models that seek more ratable performance over time. As a result, railroads are struggling to keep up with trend growth let alone meet peak seasonal demands in these sectors. Many analysts expect that it may take several years for rail service supply to catch up with demand. Producers and distributors are beginning to adjust to these structural changes. For example, many North American distributors began to fill potash bins for fall application immediately after the spring season due to concerns about railroad performance. And distributors are purchasing P&K products now for spring application due to the below average fall season and implications for an especially strong peak season next spring. 5 - The Oil Price Collapse and Stronger Dollar The collapse of oil prices and appreciation of the U.S. dollar during the last half of this year have both positive and negative implications for the plant nutrient industry. For countries that are large net exporters of agricultural commodities, a weaker local currency generally provides a net benefit to this sector. In Brazil for example, the weaker real increases the local currency cost of dollar-based P&K imports, but the local currency gain from exporting soybeans, soybean products, sugar, coffee and other crops in dollars more than makes up for the higher local currency cost of imported inputs. A similar argument could be made for palm oil exports from Indonesia and Malaysia. The collapse of oil prices also provides a windfall to large petroleum importing countries. India is a good example. Oil is India’s largest import and the nearly 50% drop in oil prices should ease pressure on the government to cut plant nutrient subsidies in order to reduce the budget deficit. Lower energy prices may also provide an economic and political window to reform subsidy policies and promote more balanced and sustainable nutrient use. In fact, the Finance Ministry announced last week that it continues to make progress on the framework for a new urea policy. This could translate into greater financial support for P&K and thus higher demand for these products. A weaker currency also enhances the cost competitiveness of producers who incur large local currency costs. For example, the recent freefall of the ruble boosts profitability of Russian phosphate and potash producers to the extent that the currency weakens at a faster rate than inflation and other cost pressures. Top Five Factors to Watch in 2015 1 - Can Markets Hold Recent Gains? Bulls argue that agricultural commodity prices have bottomed and markets are looking ahead to more positive fundamentals. They see outstanding demand prospects given more moderate grain and oilseed prices. They also expect that the USDA will lower its final 2014 U.S. crop estimates in January, and they remain concerned about the Brazilian harvest due to late first crop planting and implications for lower Safrinha area and yields. They also highlight the positive impact of larger on-farm storage in North America and point out a smattering of bullish developments elsewhere such as the drought in Australia and threats of Russian grain export restrictions. Bears argue that the recent rally likely will prove a dead cat bounce for several reasons. They argue that projected inventories still are ® 70 80 90 100 110 120 130 $20 $40 $60 $80 $100 $120 $140 05 06 07 08 09 10 11 12 13 14 Index$ BBL WTI Oil Price vs. U.S. Dollar Index Nearby WTI Crude Oil U.S. Dollar Index Source: NYMEX and ICE 300 350 400 450 500 550 600 650 700 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 Mil Tonnes Source: USDA and Mosaic G lobal G rain and Oilseed E nding St ock s USDA M osaic ' 15/ 16 R ang e M osaic M edium Scenario Crop Year Beginning In

large even after adjusting for developments described above. They also note that recent weather patterns look a lot like an El Niño event that typically results in above average South American yields and point out that initial forecasts of the Brazil soybean crop are mostly in the 92 to 96 million tonne range, up significantly from the record harvest of 86.7 million tonnes last year. They expect that the strong U.S. dollar eventually will pressure agricultural commodity prices and that something will spook the speculative herd that is building increasingly large net long positions in several agricultural commodities. Agricultural commodity prices can change quickly thanks in large part to Mother Nature as well as other uncontrollable factors such as the recent OPEC decision not to curtail oil output. So, it is no surprise that there is a wide range of potential outcomes in 2015/16. The chart on the previous page illustrates that the world is just one crop disaster from a food crisis and just one additional bumper crop from a farm crisis. It also indicates that a return to trend yield and demand growth will result in a reduction of global inventories. Suffice it to say that markets will focus intently on current macroeconomic developments, Southern Hemisphere crop progress, and 2015 U.S. acreage prospects. 2 - Is P&K Demand at Risk? P&K demand prospects and customer sentiment have improved markedly from just a couple of months ago mostly as a result of the recent rally in crop prices. Higher new crop prices not only have bolstered farm economics but also have calmed the “we-are-headed-to-sub-three-dollar-corn” fears. We summarized other economic and agronomic reasons why we do not expect farmers to slash P&K application rates in our last issue of Market Mosaic. Record nutrient removal during the last two years combined with the widespread use of precision application technologies does not square with the view that P&K levels following this year’s harvest will be adequate to feed next year’s crop. More importantly, recent reports from our sales team indicate that P&K movement this fall was below average not because of widespread and deep cuts in application rates but simply because of the much narrower application window. Finally, recent supply shocks such as the halt in production and potential loss of the Uralkali Solikamsk 2 mine and the shutdown of the MissPhos Pascagoula plant appear to have convinced buyers that there is limited downside risk and it is the right time to position product for the next application season. 3 - Will India Come Through? In the case of phosphate, global shipments are forecast to post another solid gain in 2015. In fact, we expect shipments of these leading solid products will climb from 63.8 million tonnes in 2014 to the 64.5-66.5 million tonne range next year. Our current point estimate of 65.4 is squarely in the middle of the range and represents another 2.5% or 1.6 million tonne increase in shipments next year. Our current forecast banks on India for more than one-half of the projected increase. In particular, we forecast that DAP shipments will rebound from 7.9 million this year to 8.8 million and that imports will increase from 4.1 million tonnes in 2014 to 4.9 million in 2015. Several factors support these forecasts. Farm economics remain profitable given additional increases in minimum support prices (MSP) for major crops and the likelihood of largely unchanged plant nutrient subsidies. In addition, the phosphate distribution channel looks bone dry to us, so virtually all demand will need to ship from domestic plants and import terminals this year. The bottom line is that import economics are expected to work absent a collapse of the rupee, and India likely will have a big import appetite in 2015. China is expected to supply much of the projected rebound in Indian imports next year. We project that Chinese exports will remain at or near the record high level of this year with a larger share moving into India. In addition, recent changes in China’s export tax policy are expected to facilitate a more orderly flow of exports and reduce price volatility, other things equal. China announced on December 16 that the government will do away with low and high tax windows and simply tax DAP and MAP exports at a flat rate of RMB100 or about $16 per tonne throughout the entire year (the announcement included no mention of a value-added tax). In 2014, DAP and MAP exports were taxed at a flat rate of RMB50 per tonne during the low tax window that ran from May 16 to October 15 and at a rate of 15% plus RMB50 per tonne during the high tax period. 4 - How Will the Potash Situation Play Out? Potash prospects look increasingly positive as the calendar begins to flip from 2014 to 2015. Global shipments are projected to increase moderately in 2015 with gains in Asia more than offsetting small changes in the Americas. Our analysis indicates that North American output will need to increase significantly next year in order to meet projected demand given that: 1) mines in the FSU and elsewhere already are operating at high rates, 2) North American producers emptied the cupboard in 2014, and 3) at least 2.5 million tonnes from the Solikamsk 2 mine are at risk. Global MOP shipments are projected to inch up further within the 58 to 60 million tonne range next year. Our current forecast of 58.9 million tonnes KCl is up 1.3 % or 0.7 million tonnes from a projected 58.2 million tonnes this year. Customers remain cautious as a result of lower crop values, but moderate potash values, a strong crop price rally this fall, lower but still profitable farm economics, and lean channel inventories in many regions have improved market sentiment and underpin our 2015 shipment forecast. 1 2 3 4 5 6 7 8 9 # # # # # # # # # # # # 2 3 4 5 6 7 8 9 # # # # # 64.5-66.5 30 35 40 45 50 55 60 65 70 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Global Phosphate ShipmentsMil Tonnes DAP/MAP/MES/TSP Source: FRC/CRU and Mosaic

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Northern Promise Joint Venture, the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Northern Promise Joint Venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the future success of current plans for the Northern Promise Joint Venture and any future changes in those plans; difficulties with realization of the benefits of the transactions with CF, including the risks that the acquired assets may not be integrated successfully or that the cost or capital savings from the transactions may not be fully realized or may take longer to realize than expected, or the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of the long term ammonia supply agreements with CF becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, the liabilities Mosaic assumed in the Florida phosphate assets acquisition, or the costs of the Northern Promise Joint Venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. Copyright © 2014. The Mosaic Company. All rights reserved. The Mosaic Company Atria Corporate Center, Suite E490 3033 Campus Drive Plymouth, MN 55441 (800) 918-8270 toll free (763) 577-2700 The large Asian importing countries are expected to account for nearly all of the projected net increase in global shipments next year. Brazilian shipments are expected to level off at about 8.5- 8.7 million tonnes and North American shipments are projected to drop from 9.8 million tonnes this year to 8.6-8.8 million tonnes due to a modest drop in overall potash use as well as a bunching of shipments in 2014. If these forecasts and assumptions are on target, then meeting additional demand of 1.0 million tonnes, replacing the North American, ICL and APC inventory drawdowns of almost 2.2 million tonnes, and making up the potential loss of 2.5 million tonnes from the Solikamsk 2 mine will require 5.7 million tonnes of additional production in 2015 with much of that expected to come from North American producers. 5 - Will Transportation Performance Improve? Recent reports indicate that large swells already have caused minor loading delays in Jorf Lasfar so Mother Nature may have the final say in this matter. In North America, plant nutrients still will have to compete with another record North American crop as well as other commodities for rail cars, power and crews. However, the prospect of fewer oil and fracking sand shipments next year as well as what so far looks like a less severe winter are raising expectations for improved rail performance in North America. In the meantime, producers and distributors are adjusting to recent demand developments and new railroad business models. In addition, the below average fall application season in North America has heightened concerns about railroad capabilities to meet exceptionally strong peak demand next spring. Although there are no official statistics, anecdotal evidence suggests that P&K application this fall was, on average, off 20% to 25% from normal. This, combined with growing confidence that there is limited downside risk, is bringing buyers to the table now and that should help to smooth product flows. ® 58-60 25 30 35 40 45 50 55 60 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14E15F Global Potash ShipmentsMil Tonnes KCl Source: Fertecon and Mosaic