Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - VALSPAR CORP | Financial_Report.xls |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - VALSPAR CORP | valspar144409s1_ex23-1.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - VALSPAR CORP | valspar144409s1_ex31-2.htm |

| EX-32.1 - CERTIFICATION OF CEO/CFO PURSUANT TO SECTION 906 - VALSPAR CORP | valspar144409s1_ex32-1.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - VALSPAR CORP | valspar144409s1_ex31-1.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - VALSPAR CORP | valspar144409s1_ex21-1.htm |

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

|

||

|

WASHINGTON, D.C. 20549

|

||

|

FORM 10-K

|

||

|

(Mark One)

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2014 |

| or | |

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________________ to ___________________ |

Commission File Number 1-3011

|

THE VALSPAR CORPORATION

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Delaware

|

36-2443580

|

|

(State of incorporation)

|

(I.R.S. Employer Identification No.)

|

|

901 3rd Avenue South

|

|

|

Minneapolis, Minnesota

|

55402

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (612) 851-7000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on which Registered

|

|

Common Stock, $.50 Par Value

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Act). o Yes x No

The aggregate market value of the voting stock held by persons other than officers, directors and more than 10% stockholders of the registrant as of April 25, 2014 was approximately $4.1 billion based on the closing sales price of $72.71 per share as reported on the New York Stock Exchange. As of December 9, 2014, 81,939,836 shares of Common Stock, $0.50 par value per share (net of 36,502,788 shares in treasury), were outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

Portions of The Valspar Corporation’s definitive Proxy Statement (the “Proxy Statement”), to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year ended October 31, 2014, are incorporated by reference into Part III to the extent described in this report.

(This page has been left blank intentionally.)

|

Page

|

|||

|

1

|

|||

|

3

|

|||

|

6

|

|||

|

6

|

|||

|

7

|

|||

|

7

|

|||

|

8

|

|||

|

10

|

|||

|

11

|

|||

|

23

|

|||

|

24

|

|||

|

53

|

|||

|

53

|

|||

|

53

|

|||

|

53

|

|||

|

53

|

|||

|

53

|

|||

|

53

|

|||

|

53

|

|||

|

54

|

|||

|

56

|

|||

(This page has been left blank intentionally.)

|

BUSINESS

|

BUSINESS & PRODUCT OVERVIEW

The Valspar Corporation is a global leader in the paints and coatings industry. We develop, manufacture and distribute a broad range of coatings, paints and related products and we operate our business in two reportable segments: Coatings and Paints. Net sales in the Coatings and Paints segments in 2014 were $2,511.1 million and $1,786.4 million, respectively. We have grown our business organically by using new technologies to provide high quality products with superior value and performance. Our global growth has also been fueled by our well-executed integration of acquisitions that have expanded our scale, technology platforms and portfolio of respected brands.

The Valspar Corporation is a Delaware corporation founded in 1806. Our principal executive offices are located at 901 3rd Avenue South, Minneapolis, Minnesota 55402, and our telephone number at that address is (612) 851-7000. Our corporate website address is www.valsparglobal.com. The information on our website is not part of this filing.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, are made available free of charge on our website as soon as reasonably practicable after we electronically file such materials with, or furnish such materials to, the Securities and Exchange Commission. You may access these documents on the “Investors” page of our website referred to above.

Coatings Segment

Our Coatings segment includes our industrial product lines and our packaging product line. We offer a broad range of decorative and protective coatings for metal, wood and plastic, primarily for sale to original equipment manufacturing (OEM) customers in Asia, Australia, Europe, North America and South America. Products within our Coatings segment include primers, top coats, varnishes, sprays, stains, fillers and other coatings for a wide range of manufacturing industries, including agricultural and construction equipment, appliances, building products, furniture, metal fabrication, metal packaging and transportation. We use a variety of technologies to provide value to our customers. These technologies include electrodeposition, powder, solvent-based, waterborne and UV cured coatings. We also provide a wide range of technical, manufacturing and formulation services for our customers.

Our industrial product lines include general industrial, coil and wood coatings. Our general industrial product line provides customers a single source for powder, liquid and electrodeposition coatings technologies for a wide variety of industries, including agricultural and construction equipment, pipe, lawn and garden, appliance, transportation and marine shipping containers. Our coil product line produces coatings applied to metal coils used to manufacture pre-engineered buildings and building components, other metal building and architectural products and appliances. Our wood product line supplies decorative and protective coatings for wood furniture, building products, cabinets and floors. We also provide color design and technical service to our customers. We supply our industrial products throughout the world.

Our packaging product line includes coatings for the interior and exterior of packaging containers, principally metal food containers and beverage cans. We also produce coatings for aerosol and paint cans, crowns for glass bottles, plastic packaging and bottle closures. We believe we are the world’s largest supplier of metal packaging coatings. We supply our packaging products throughout the world.

Paints Segment

Our Paints segment includes our consumer paints and automotive paint refinish product lines. We offer a wide variety of paints, primers, topcoats and aerosol spray paints through retailers, distribution networks and company-owned stores.

Our consumer paints product line comprises the largest part of our Paints segment. We offer a broad portfolio of interior and exterior decorative paints, stains, primers, varnishes and specialty decorative products, such as enamels, aerosols and faux finishes, used in both the do-it-yourself and professional markets. In the U.S. and Canada, we offer our branded products and private-label brands through more than 10,000 points of sale. The primary distribution channels for these products are home centers, hardware stores, distributors and independent dealers. In China, we sell branded consumer paints primarily through distributors and exclusive retailers. In Australia and New Zealand, we sell branded consumer paints through independent dealers, hardware chains, home centers and Valspar company-owned stores. In the U.K. and Ireland, we sell branded products primarily through a large home center customer.

We develop highly customized merchandising and marketing support programs for our consumer paint customers, enabling them to differentiate their paint departments from their competitors’ through customer service, paint tinting technology, product and color selection assistance and in-store displays. Our primary brands include VALSPAR and CABOT in the U.S., HUARUN in China, WATTYL, SOLVER and VALSPAR in Australia and New Zealand and VALSPAR and PLASTI-KOTE in the U.K. and Ireland.

Our automotive product line includes refinish paints and aerosol spray paints sold through automotive refinish distributors, body shops, automotive supply distributors and automotive supply retailers. We distribute these products under the DE BEER, VALSPAR, OCTORAL and HOUSE OF KOLOR brands in many countries around the world.

| 1 |

Other and Administrative

In addition to the main product lines within our Coatings and Paints segments, we manufacture and sell specialty polymers and colorants. The specialty polymers and colorants are manufactured for internal use and for external sale to other coatings manufacturers. We also sell furniture protection plans and furniture care and repair products under the Guardsman brand.

COMPETITION

All aspects of the coatings and paints business are highly competitive. Some of our competitors are larger and have greater financial resources than we have.

Competition in our Coatings segment is based on formulating products for specific customer applications, meeting customer delivery and application requirements, new technology offerings and pricing. As one of the world’s largest industrial coatings manufacturers, we can provide coatings solutions globally and are committed to developing new technologies.

Competition in our Paints segment is based on factors such as consumer brand recognition, product quality, distribution and price. In this segment, we support our brand awareness through advertising and highly customized merchandising and marketing support programs provided to our customers.

RAW MATERIALS

We obtain raw materials from a number of suppliers. The raw materials are derived from petrochemicals, minerals and metals. Our most significant raw materials include solvents, titanium dioxide and epoxy and other resins. Historically, these materials have been generally available on the open market, with pricing and availability subject to fluctuation. Most of the raw materials used in production are purchased from outside sources. We have made, and plan to continue to make, supply arrangements to meet our current and future usage requirements. We manage sourcing of critical raw materials by establishing contracts, buying from multiple sources and identifying alternative or lower cost materials or technology, when possible. We have active initiatives to find lower cost materials, reformulate products with lower cost and more environmentally friendly raw materials and qualify multiple and local sources of supply, including suppliers from Asia and other lower cost regions of the world.

INTELLECTUAL PROPERTY

Our practice is to seek patent protection for our products and manufacturing processes when appropriate. We also license some patented technology from third parties. Nevertheless, our business is not materially dependent upon licenses or similar rights or on any single patent or group of related patents. Although we believe our patent rights are valuable, our knowledge and trade secret information regarding our manufacturing processes and materials have also been important in maintaining our competitive position. We require certain employees to sign confidentiality agreements relating to proprietary information.

While we make efforts to protect our trade secret information, others may independently develop or otherwise acquire substantially equivalent proprietary information or techniques or inappropriately gain access to our proprietary technology or disclose this technology. Any of these factors could adversely impact the value of our proprietary trade secret information and harm our business.

SEASONALITY AND WORKING CAPITAL ITEMS

Our sales volume is traditionally lowest during the first quarter of the fiscal year (November, December and January), and highest in the third quarter of the fiscal year (May, June and July), primarily due to weather and the buying cycle in our Coatings and Paints segments. When sales are lowest, we build inventory, financed by internally generated funds and short-term and long-term debt facilities discussed in Note 9 of Notes to Consolidated Financial Statements.

SIGNIFICANT CUSTOMERS

In 2014, our sales to Lowe’s Companies, Inc. exceeded 10% of consolidated net sales. Our ten largest customers accounted for approximately 33% of consolidated net sales. Our five largest customers in the Paints segment accounted for approximately 55% of our net sales in the segment. Our five largest customers in the Coatings segment accounted for approximately 17% of our net sales in the segment.

BACKLOG AND GOVERNMENT CONTRACTS

We have no significant backlog of orders and generally are able to fill orders on a current basis. No material portion of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the government.

RESEARCH AND DEVELOPMENT

The base technologies that support our products’ performance and applications have been developed and optimized over many years. Our on-going applied science and development efforts are focused on delivering premium, differentiated coatings solutions that meet or exceed market needs for improved performance, consistent quality and customer value. We work closely with our customers to build a deep understanding of their challenges and objectives and to foster innovation in the products and services that we provide.

Research and development costs for fiscal 2014 were $134.1 million, or 3.0% of net sales, compared to $128.3 million, or 3.1% of net sales, for fiscal 2013 and $123.4 million, or 3.1% of net sales, for fiscal 2012.

| 2 |

ENVIRONMENTAL COMPLIANCE

We undertake to comply with applicable environmental regulations. Capital expenditures for this purpose were not material in fiscal 2014, and we do not expect such expenditures will be material in fiscal 2015.

EMPLOYEES

We employ approximately 10,500 people globally, approximately 330 of whom are subject to collective bargaining agreements in the U.S. We believe our relationship with our union employees is good.

FOREIGN OPERATIONS AND EXPORT SALES

Our foreign operations are conducted primarily through majority-owned subsidiaries and, to a limited extent, through joint ventures. Revenues from foreign subsidiaries and operations comprised approximately 46% of our total consolidated net sales in 2014.

In addition to our manufacturing plants in the U.S., we have manufacturing plants in Australia, Brazil, Canada, China, France, Germany, India, Ireland, Italy, Malaysia, Mexico, The Netherlands, New Zealand, Poland, Singapore, South Africa, Switzerland, the United Kingdom and Vietnam. We also have joint ventures in Japan, South Africa, Switzerland and Vietnam and sales offices in other countries.

During fiscal 2014, export sales from the U.S. represented 3.2% of our business.

|

RISK FACTORS

|

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and any investment in us.

Deterioration of economic conditions could harm our business.

Our business may be adversely affected by changes in national or global economic conditions, including inflation, interest rates, access to and the functioning of capital markets, consumer spending rates, energy availability and costs (including fuel surcharges) and the effects of governmental initiatives to manage economic conditions. Deterioration of national or global economic conditions may reduce demand for our products and overall growth of the paints and coatings industry.

Volatility in financial markets and the deterioration of national or global economic conditions could impact our operations as follows:

|

•

|

the financial stability of our customers and suppliers may be compromised, which could result in additional bad debts for us or non-performance by suppliers;

|

|

•

|

it may become more costly or difficult to obtain financing to fund operations or investment opportunities, or to refinance our debt in the future; and

|

|

•

|

the value of our investments in debt and equity securities may decline, including our assets held in pension plans.

|

At various times, we utilize hedges and other derivative financial instruments to reduce our exposure to various interest rate risks, which qualify for hedge accounting for financial reporting purposes. Volatile fluctuations in market conditions could cause these instruments to become ineffective, which could require any gains or losses associated with these instruments to be reported in our earnings each period.

Fluctuations in the availability and prices of raw materials could negatively impact our financial results.

We purchase the raw materials needed to manufacture our products from a number of suppliers. Most of our raw materials are derived from petroleum, minerals and metals. Under normal market conditions, these materials are generally available from one or more suppliers on the open market. From time to time, however, the availability and costs of raw materials may fluctuate significantly, which could impair our ability to procure necessary materials, or increase the cost of manufacturing our products. As a result, our raw material costs can be volatile, and we have experienced disruptions in supplies of certain raw materials at various times. These disruptions could affect our ability to manufacture products ordered by our customers, which could negatively impact sales.

When raw material costs increase, our profit margins are reduced unless and until we are able to pass along the increases to our customers through higher prices. If raw material costs increase and if we are unable to pass along, or are delayed in passing along, those increases to our customers, we will experience profit margin reductions.

Many of our customers are in cyclical industries, which may affect the demand for our products.

Many of our customers are in businesses or industries that are cyclical and sensitive to changes in general economic conditions. As a result, the demand for our products depends, in part, upon economic cycles affecting our customers’ businesses or industries and general economic conditions. Downward economic cycles affecting the industries of our customers and the deterioration of global economic conditions may reduce our sales and profitability.

| 3 |

The industries in which we operate are highly competitive, and some of our competitors are larger than we are and may have greater financial resources than we do.

All aspects of the paints and coatings business are highly competitive. We face strong competitors in all areas of our business. Any increase in competition may cause us to lose market share or compel us to reduce prices to remain competitive, which could result in reduced margins for our products. Competitive pressures may not only impair our margins but may also impact our revenues and our growth. Many of our competitors are larger than we are and may have greater financial resources than we do. Competition with these companies could curtail price increases or require price reductions or increased spending on marketing, sales and research and development, any of which could adversely affect our results of operations.

Industry sources estimate that the ten largest coatings manufacturers represent more than half of the world’s coatings sales. Our larger competitors may have more resources to finance acquisitions or internal growth in this competitive environment and may have more resources or capabilities to conduct business with large suppliers or large customers in our industry. Finally, many of our larger competitors operate businesses in addition to paints and coatings and so may be better able to compete during coatings industry downturns.

We have a significant amount of debt.

Our total long-term and short-term debt was $1,556.4 million at October 31, 2014. Our debt categorized as short-term was $606.4 million at October 31, 2014. Our level of debt may have important consequences. For example, it:

|

•

|

may require us to dedicate a material portion of our cash flows from operations to make payments on our indebtedness, thereby reducing our ability to fund working capital, capital expenditures or other general corporate purposes;

|

|

•

|

could make us less attractive to prospective or existing customers or less able to fund potential acquisitions; and

|

|

•

|

may limit our flexibility to adjust to changing business and market conditions and make us more vulnerable to a downturn in general economic conditions as compared to a competitor that may have less indebtedness.

|

Acquisitions are an important part of our growth strategy, and future acquisitions may not be available or successful.

Acquisitions have historically contributed significantly to the growth of our company. As part of our growth strategy, we intend to continue to pursue acquisitions of complementary businesses and products. If we are not able to identify and complete future acquisitions, our growth may be negatively affected. Even if we are successful in completing future acquisitions, we may experience:

|

•

|

difficulties in assimilating acquired companies and products into our existing business;

|

|

•

|

delays in realizing the benefits from the acquired companies or products;

|

|

•

|

difficulties due to lack of or limited prior experience in any new markets we may enter;

|

|

•

|

unforeseen claims and liabilities, including unexpected environmental exposures or product liability;

|

|

•

|

unforeseen adjustments, charges and write-offs;

|

|

•

|

unexpected losses of customers of, or suppliers to, acquired businesses;

|

|

•

|

difficulties in conforming the acquired business’ standards, processes, procedures and controls with our operations;

|

|

•

|

variability in financial information arising from the application of purchase price accounting;

|

|

•

|

difficulties in retaining key employees of the acquired businesses; and

|

|

•

|

challenges arising from the increased geographic diversity and complexity of our operations.

|

Any of these factors may make it more difficult to repay our debt or have an adverse effect on results of operations. In addition, an acquisition could materially impair our operating results by causing us to incur debt or requiring us to amortize acquisition-related costs or the cost of acquired assets.

We derive a substantial portion of our revenues from foreign markets, which subjects us to additional business risks.

We conduct a substantial portion of our business outside of the U.S. We currently have production facilities, research and development facilities, and administrative and sales offices located outside the U.S., including facilities and offices located in Australia, Brazil, Canada, China, Finland, France, Germany, Greece, India, Indonesia, Ireland, Italy, Japan, Malaysia, Mexico, The Netherlands, New Zealand, Poland, Russia, Singapore, South Africa, South Korea, Spain, Switzerland, the United Arab Emirates, the United Kingdom and Vietnam. In 2014, revenues from products sold outside the U.S. accounted for approximately 46% of our consolidated net sales.

| 4 |

We expect sales in international markets to represent a significant portion of our consolidated net sales. Notwithstanding the benefits of geographic diversification, our ability to achieve and maintain profitable

growth in international markets is subject to risks related to the differing legal, political, social and regulatory requirements and economic conditions

of many jurisdictions. Risks inherent in international operations include the following:

|

•

|

agreements may be difficult to enforce, and receivables may be difficult to collect or have longer payment cycles;

|

|

•

|

foreign countries may impose additional withholding taxes or otherwise tax our foreign income or adopt other restrictions on foreign trade or investment, including currency exchange controls;

|

|

•

|

foreign operations may experience labor disputes and difficulties in attracting and retaining key employees;

|

|

•

|

transportation and other shipping costs may increase;

|

|

•

|

foreign governments may nationalize private enterprises;

|

|

•

|

unexpected adverse changes may occur in export duties, quotas and tariffs and difficulties in obtaining export licenses;

|

|

•

|

intellectual property rights may be more difficult to enforce;

|

|

•

|

fluctuations in exchange rates may affect product demand and may adversely affect the profitability in U.S. dollars of products and services we provide in international markets where payment for our products and services is made in the local currency;

|

|

•

|

our business and profitability in a particular country could be affected by political or economic changes or terrorist activities and responses to such activities;

|

|

•

|

unexpected adverse changes in foreign laws or regulatory requirements may occur; and

|

|

•

|

compliance with a variety of foreign laws and regulations may be burdensome.

|

Fluctuations in foreign currency exchange rates could affect our financial results.

We earn revenues, pay expenses, own assets and incur liabilities in countries using currencies other than the U.S. dollar. Because our consolidated financial statements are presented in U.S. dollars, we translate revenues and expenses into U.S. dollars at the average exchange rate during each reporting period, as well as assets and liabilities into U.S. dollars at exchange rates in effect at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against other major currencies will affect our net revenues, operating income and the value of balance sheet items denominated in foreign currencies. We do not use derivative financial instruments to hedge our exposure to translation gains and losses. Fluctuations in foreign currency exchange rates, particularly the strengthening of the U.S. dollar against major currencies, could materially affect our financial results.

We have certain key customers, and the loss of key customers could negatively affect our business.

Our relationships with certain key customers are important to us. From 2012 through 2014, sales to our largest customer exceeded 10% of our consolidated net sales. In 2014, our ten largest customers accounted for approximately 33% of our consolidated net sales. Our five largest customers in the Paints segment accounted for approximately 55% of our net sales in the segment. Although we sell various types of products through various channels of distribution, we believe that the loss of a substantial portion of net sales to our largest customers could have a material adverse impact on us.

If the reputation of our company or one or more of its key brands is damaged, it could harm our business.

Our reputation is one of the foundations of our relationships with key customers and other stakeholders. If we are unable to effectively manage real or perceived issues that negatively affect our reputation, our ability to conduct our business could be impaired, and our financial results could suffer. As we continue to invest in advertising and promotion for our key brands, our financial success is becoming more dependent on the success of our brands. The success of these brands could suffer if our marketing plans or product initiatives do not have the desired effect on a brand’s image, reputation or ability to attract customers. Further, our growth and results could be harmed if the reputation of our company or a key brand is damaged due to real or perceived quality issues, product recalls, regulatory enforcement or actions or customer claims and litigation.

Technology changes, and our ability to protect our technology, could affect our business.

Our product and application technology is supported by underlying chemistry that has been developed over many years. Ongoing research and development efforts focus on improving our internally developed and acquired technology and formulating changes to improve the performance, profitability and cost competitiveness of our products. If our competitors develop new technology, or if our customers’ technology requirements change, and we are not able to develop competitive technology, our business and financial results could suffer. Further, although we seek to protect our proprietary technology and information

| 5 |

through

confidentiality and trade secret protection programs and practices, patents, cybersecurity measures and other means, if we

were unable to protect our material proprietary technology or information, our business and financial results could

suffer.

Interruption, failure or compromise of our information systems could adversely affect our business.

We rely on information systems to run most aspects of our business, including sales and distribution of products, purchases of raw materials and supplies, accounting for purchase and sale transactions, manufacturing processes, billing and collections and managing data and records for employees and other parties. Our business may be adversely affected if these systems are interrupted, damaged or compromised or if they fail for any extended period of time due to user errors, programming errors, computer viruses, security breaches or other problems. Information security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of cyber attackers. Although we strive to have appropriate security controls in place, prevention of security breaches cannot be assured, particularly as cyber threats continue to evolve. We may be required to expend additional resources to continue to enhance our security measures or to investigate and remediate any security vulnerabilities. In addition, third-party service providers manage a portion of our information systems, and we are subject to risk as a result of interruption, failure or security breaches of those systems. The consequences of these risks could adversely impact our results of operations and cash flows.

Numerous laws and regulations affect our business.

We are subject to numerous laws and regulations that control the manufacturing, marketing, sale, use and disposal of our products. These laws and regulations include health, safety, product liability, environmental and labeling requirements applicable to our products and business.

Environmental laws and regulations control, among other things, the discharge of pollutants into the air and water, the handling, use, treatment, storage and clean-up of hazardous and non-hazardous wastes, the investigation and remediation of soil and groundwater affected by hazardous substances, or otherwise relating to environmental protection and various health and safety matters. These environmental laws and regulations impose strict, retroactive and joint and several liability for the costs of, and damages resulting from, cleaning up current sites, past spills, disposals and other releases of hazardous substances. Violations of these laws and regulations can also result in fines and penalties. We are currently undertaking remedial activities at a number of our facilities and properties, and have received notices under the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, or analogous state laws, of liability or potential liability in connection with the disposal of material from our operations or former operations. Pursuant to health, safety, product liability and labeling laws and regulations, we have also been subject to various governmental enforcement actions and litigation by individuals relating to the sale or use of or exposure to our products or materials used or contained in our products, including claims for property damage or personal injury claimed to have been caused by our products or materials used or contained in our products.

We are subject to the risk that adverse decisions relating to our compliance with existing laws and regulations and new laws or regulations, or changes in existing laws or regulations or their interpretation could limit our ability to generate revenues, increase our compliance costs and expand our potential liability for enforcement actions by governmental authorities and litigation by individuals.

In addition, our customers’ or consumers’ perceptions about the acceptability or potential environmental or health effects of certain substances could require us to invest additional amounts to develop products that exclude those substances. If we are unable to develop products that exclude those substances when and if required by our customers, we may experience reduced sales and profitability.

|

UNRESOLVED STAFF COMMENTS

|

Not applicable.

|

PROPERTIES

|

We lease our principal offices located in Minneapolis, Minnesota. Our North American manufacturing operations are conducted at 23 locations (22 owned; 1 leased) in the U.S., Canada and Mexico. The total combined square footage for our principal offices and manufacturing operations in North America is approximately 4,528,000. Asia Pacific manufacturing operations are conducted at 13 locations (11 owned; 2 leased) in Australia, China, Malaysia, New Zealand, Singapore and Vietnam, with a total combined square footage of approximately 2,071,000. European manufacturing operations are conducted at 12 locations (10 owned; 2 leased) in France, Germany, Ireland, Italy, The Netherlands, Poland, Switzerland and the United Kingdom, with a total combined square footage of approximately 1,408,000. In South America, we own two manufacturing facilities in Brazil with square footage of approximately 471,000. In India, we own one manufacturing facility with square footage of approximately 113,000. In South Africa, we own one manufacturing facility with square footage of approximately 96,000.

| 6 |

Shown below is a breakdown of the approximate square footage of principal facilities by region as of October 31, 2014:

|

Region

|

Approximate

Square Footage Owned |

Approximate

Square Footage Leased |

Total

|

|||||||||

|

North America

|

4,060,000 | 468,000 | 4,528,000 | |||||||||

|

Asia Pacific

|

1,968,000 | 103,000 | 2,071,000 | |||||||||

|

Europe

|

1,298,000 | 110,000 | 1,408,000 | |||||||||

|

Other

|

680,000 | — | 680,000 | |||||||||

|

Total

|

8,006,000 | 681,000 | 8,687,000 | |||||||||

Set forth below is a breakdown of the approximate square footage of principal facilities by business segment:

|

Business Segment

|

Approximate

Square Footage |

|||

|

Coatings

|

4,903,000 | |||

|

Paints

|

3,021,000 | |||

|

Other and Administrative

|

763,000 | |||

|

Total

|

8,687,000 | |||

We believe our properties are well maintained, in good operating condition and adequate for the purposes for which they are being used. Operating capacity of our manufacturing properties varies by product line, but additional production capacity is available for most product lines by increasing the number of days and/or shifts worked.

|

LEGAL PROCEEDINGS

|

Environmental Matters

We are involved in various claims relating to environmental matters at a number of current and former plant sites and waste management sites. We engage or participate in remedial and other environmental compliance activities at certain of these sites. At other sites, we have been named as a potentially responsible party (“PRP”) under federal and state environmental laws for site remediation. We analyze each individual site, considering the number of parties involved, the level of our potential liability or contribution relative to the other parties, the nature and magnitude of the hazardous wastes involved, the method and extent of remediation, the potential insurance coverage, the estimated legal and consulting expense with respect to each site and the time period over which any costs would likely be incurred. Based on the above analysis, we estimate the clean-up costs and related claims for each site. The estimates are based in part on discussion with other PRPs, governmental agencies and engineering firms.

We accrue appropriate reserves for potential environmental liabilities when the amount of the costs that will be incurred can be reasonably determined. Accruals are reviewed and adjusted as additional information becomes available. While uncertainties exist with respect to the amounts and timing of our ultimate environmental liabilities, we believe it is neither probable nor reasonably possible that such liabilities, individually or in the aggregate, will have a material adverse effect on our financial condition, results of operations or cash flows.

Other Legal Matters

We are involved in a variety of legal claims and proceedings relating to personal injury, product liability, warranties, customer contracts, employment, trade practices, environmental and other legal matters that arise in the normal course of business. These claims and proceedings include cases where we are one of a number of defendants in proceedings alleging that the plaintiffs suffered injuries or contracted diseases from exposure to chemicals or other ingredients used in the production of some of our products or waste disposal. We are also subject to claims related to the performance of our products. We believe these claims and proceedings are in the ordinary course for a business of the type and size in which we are engaged. While we are unable to predict the ultimate outcome of these claims and proceedings, we believe it is neither probable nor reasonably possible that the costs and liabilities of such matters, individually or in the aggregate, will have a material adverse effect on our financial condition, results of operations or cash flows.

|

MINE SAFETY DISCLOSURES

|

Not applicable.

| 7 |

EXECUTIVE OFFICERS OF THE REGISTRANT

The names and ages of all of our executive officers, all of whom are approved by the Board of Directors for re-election in February of each year, and the positions held by them are as listed below. There are no family relationships between any of the officers or between any officer and director.

|

Name

|

Age

|

Position

|

||

|

Gary E. Hendrickson

|

58

|

Chairman since June 2012, Chief Executive Officer since June 2011 and President since February 2008

|

||

|

James L. Muehlbauer

|

53

|

Executive Vice President and Chief Financial and Administrative Officer since March 2013

|

||

|

Rolf Engh

|

61

|

Executive Vice President since July 2005, General Counsel and Secretary since April 1993

|

||

|

Anthony L. Blaine

|

47

|

Senior Vice President, Human Resources since January 2007

|

||

|

Cynthia A. Arnold

|

57

|

Senior Vice President and Chief Technology Officer since January 2011

|

The foregoing executive officers have served in the stated capacity for the registrant during the past five years, except for the following:

Mr. Hendrickson was also Chief Operating Officer from February 2008 to June 2011.

Prior to March 2013, Mr. Muehlbauer was Executive Vice President and Chief Financial Officer at Best Buy Co., Inc. since April 2008.

Prior to January 2011, Ms. Arnold was Chief Technology Officer at Sun Chemical Corporation since July 2004.

|

ITEM 5

|

Our Common Stock is listed on the New York Stock Exchange under the trading symbol VAL. The table below sets forth the quarterly high and low market prices of Common Stock for fiscal years 2014 and 2013 as quoted on the New York Stock Exchange.

|

Market Price (high/low)

|

|||||||

|

For the Fiscal Year

|

2014

|

2013

|

|||||

|

First Quarter

|

$

|

73.74–68.18

|

$

|

68.42–55.17

|

|||

|

Second Quarter

|

$

|

76.18–66.94

|

$

|

68.30–58.97

|

|||

|

Third Quarter

|

$

|

82.00–71.78

|

$

|

74.25–62.32

|

|||

|

Fourth Quarter

|

$

|

82.26–72.15

|

$

|

71.32–61.13

|

|||

The quarterly dividend declared November 25, 2014, to be paid on December 19, 2014 to common stockholders of record December 8, 2014, was increased to $0.30 per share. The table below sets forth the quarterly dividends paid for fiscal years 2014 and 2013.

|

Per Share Dividends

|

|||||||

|

For the Fiscal Year

|

2014

|

2013

|

|||||

|

First Quarter

|

$

|

0.26

|

$

|

0.23

|

|||

|

Second Quarter

|

$

|

0.26

|

$

|

0.23

|

|||

|

Third Quarter

|

$

|

0.26

|

$

|

0.23

|

|||

|

Fourth Quarter

|

$

|

0.26

|

$

|

0.23

|

|||

|

$

|

1.04

|

$

|

0.92

|

||||

The number of record holders of our Common Stock at December 9, 2014 was 1,214.

ISSUER PURCHASES OF EQUITY SECURITIES

|

Period

|

Total Number

of Shares

Purchased1

|

Average

Price Paid

per Share

|

Total Number of

Shares Purchased as Part

of Publicly Announced

Plans or Programs1

|

Maximum Number

of Shares that May

Yet be Purchased Under

the Plans or Programs1

|

|||||||||

|

7/26/14 – 8/22/14

|

|||||||||||||

|

Repurchase program

|

308,323

|

$

|

77.33

|

308,323

|

5,871,974

|

||||||||

|

8/23/14 – 9/19/14

|

|||||||||||||

|

Repurchase program

|

297,500

|

$

|

80.34

|

297,500

|

5,574,474

|

||||||||

|

9/20/14 – 10/31/14

|

|||||||||||||

|

Repurchase program

|

555,000

|

$

|

77.76

|

555,000

|

5,019,474

|

||||||||

|

1

|

On December 5, 2012, we received board authorization to repurchase 15,000,000 shares, with no predetermined end date. In fiscal 2014, we repurchased 4,705,081 shares. On November 21, 2014, following the end of fiscal year 2014, the Board approved a new share repurchase program, with no expiration date, authorizing us to purchase up to $1.5 billion of outstanding shares of Common Stock. This new program was effective immediately and replaced the previous repurchase authorization.

|

| 8 |

Stock Performance Graph

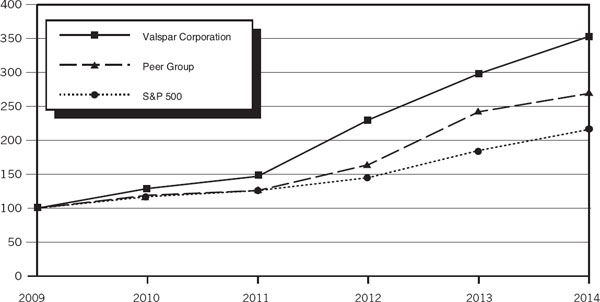

The following graph compares our cumulative total stockholder return for the last five fiscal years with the cumulative total return of the Standard & Poor’s 500 Stock Index and a peer group of companies selected by us on a line-of-business basis. The graph assumes the investment of $100 in our Common Stock, the S&P 500 Index and the peer group at the end of fiscal 2009 and the reinvestment of all dividends.

The companies selected to form the peer group index are: Akzo Nobel N.V.; Ferro Corporation; H.B. Fuller Company; Masco Corporation; Newell Rubbermaid Inc.; PPG Industries, Inc.; RPM International Inc.; and The Sherwin-Williams Company.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

Among The Valspar Corporation, a Peer Group and the S&P 500 Index

|

Cumulative Total Return

|

|||||||||||||||||||

|

Fiscal Year End

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

|||||||||||||

|

Valspar

|

$

|

100

|

$

|

129

|

$

|

147

|

$

|

230

|

$

|

298

|

$

|

353

|

|||||||

|

Peer Group

|

$

|

100

|

$

|

119

|

$

|

126

|

$

|

164

|

$

|

242

|

$

|

269

|

|||||||

|

S&P 500

|

$

|

100

|

$

|

117

|

$

|

126

|

$

|

145

|

$

|

185

|

$

|

216

|

|||||||

Assumes $100 invested on October 30, 2009 in the Common Stock of The Valspar Corporation, the Peer Group and the S&P 500 Index, including reinvestment of dividends.

| 9 |

The following selected financial data has been derived from our audited Consolidated Financial Statements and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements and related Notes included elsewhere in this Form 10-K.

|

Fiscal Years

|

||||||||||||||||||

|

(Dollars in thousands,

except per share amounts)

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||||||||||||

|

Operating Results

|

Net Sales

|

$

|

4,522,424

|

$

|

4,103,776

|

$

|

4,020,851

|

$

|

3,952,954

|

$

|

3,226,687

|

|||||||

|

Cost and Expenses

|

||||||||||||||||||

|

Cost of Sales

|

2,983,378

|

2,745,718

|

2,667,147

|

2,721,146

|

2,155,009

|

|||||||||||||

|

Operating Expense

|

979,137

|

865,634

|

871,434

|

862,160

|

695,601

|

|||||||||||||

|

Impairment of Goodwill and Intangible Assets

|

—

|

—

|

—

|

409,714

|

—

|

|||||||||||||

|

Income (Loss) from Operations

|

559,909

|

492,424

|

482,270

|

(40,066

|

)

|

376,077

|

||||||||||||

|

Interest Expense

|

65,330

|

64,758

|

67,604

|

61,511

|

58,267

|

|||||||||||||

|

Other (Income) Expense – Net

|

2,697

|

3,871

|

(2,558

|

)

|

1,577

|

(1,387

|

)

|

|||||||||||

|

Income (Loss) Before Income Taxes

|

491,882

|

423,795

|

417,224

|

(103,154

|

)

|

319,197

|

||||||||||||

|

Net Income (Loss)

|

345,401

|

289,255

|

292,497

|

(138,601

|

)

|

222,056

|

||||||||||||

|

Net Income as a Percent of Sales

|

7.6

|

%

|

7.0

|

%

|

7.3

|

%

|

N/A

|

6.9

|

%

|

|||||||||

|

Return on Average Equity

|

32.4

|

%

|

24.7

|

%

|

24.0

|

%

|

N/A

|

14.2

|

%

|

|||||||||

|

Per Common Share:

|

||||||||||||||||||

|

Net Income (Loss) – Basic

|

$

|

4.13

|

$

|

3.29

|

$

|

3.20

|

$

|

(1.47

|

)

|

$ | 2.25 | |||||||

|

Net Income (Loss) – Diluted1

|

4.01

|

3.20

|

3.10

|

(1.47

|

)

|

2.20

|

||||||||||||

|

Dividends Paid

|

1.04

|

0.92

|

0.80

|

0.72

|

0.64

|

|||||||||||||

|

Financial Position

|

Total Assets

|

$

|

4,033,951

|

$

|

4,025,509

|

$

|

3,626,836

|

$

|

3,500,151

|

$

|

3,867,936

|

|||||||

|

Working Capital2

|

725,834

|

591,591

|

538,559

|

538,025

|

530,435

|

|||||||||||||

|

Property, Plant and Equipment, Net

|

645,102

|

633,475

|

550,968

|

548,253

|

567,630

|

|||||||||||||

|

Long-Term Debt, Net of Current Portion

|

950,035

|

1,037,392

|

1,012,578

|

679,805

|

943,216

|

|||||||||||||

|

Stockholders’ Equity

|

1,011,091

|

1,122,550

|

1,223,523

|

1,212,550

|

1,630,365

|

|||||||||||||

|

Other Statistics

|

Property, Plant and Equipment

|

|||||||||||||||||

|

Expenditures

|

$

|

121,271

|

$

|

116,749

|

$

|

89,363

|

$

|

66,469

|

$

|

67,732

|

||||||||

|

Depreciation and Amortization

|

||||||||||||||||||

|

Expense

|

100,910

|

88,159

|

93,704

|

97,747

|

81,312

|

|||||||||||||

|

Research and Development

|

||||||||||||||||||

|

Expense

|

134,134

|

128,265

|

123,401

|

120,056

|

105,090

|

|||||||||||||

|

Total Cash Dividends

|

$

|

87,427

|

$

|

81,189

|

$

|

73,351

|

$

|

68,164

|

$

|

63,279

|

||||||||

|

Average Diluted Common Shares Outstanding (000’s)

|

86,046

|

90,526

|

94,380

|

94,310

|

100,866

|

|||||||||||||

|

Number of Stockholders at

|

||||||||||||||||||

|

Year End

|

1,219

|

1,290

|

1,365

|

1,405

|

1,432

|

|||||||||||||

|

Number of Employees at

|

||||||||||||||||||

|

Year End

|

10,513

|

10,702

|

9,755

|

10,020

|

10,180

|

|||||||||||||

|

Market Price Range – Common Stock:

|

||||||||||||||||||

|

High

|

$

|

82.26

|

$

|

74.25

|

$

|

59.81

|

$

|

40.60

|

$

|

33.13

|

||||||||

|

Low

|

66.94

|

55.17

|

33.17

|

27.44

|

25.11

|

|||||||||||||

Reference is made to the Notes to Consolidated Financial Statements for a summary of accounting policies and additional information.

|

1

|

In 2014, 2013, 2012, 2011, and 2010, net income (loss) per common share diluted includes $0.34, $0.32, $0.18, $0.24 and $0.08 per share in restructuring charges, respectively. See Note 18 in Notes to Consolidated Financial Statements for more information on 2014, 2013 and 2012. Net income (loss) per common share diluted for 2011 includes an impairment charge on goodwill and intangible assets of $3.75. In 2013, 2011 and 2010, net income (loss) per common share diluted includes $0.02, $0.09 and $0.03 in acquisition-related charges, respectively. Net income (loss) per common share diluted in 2010 includes gains on sale of certain assets of $0.08. Adjusted net income per common share diluted, excluding the items mentioned above, was $4.35 for 2014, $3.54 for 2013, $3.28 for 2012, and $2.65 for 2011, which includes a dilutive share impact of $0.04, and $2.23 for 2010. See related reconciliation in “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Measures” for more information on 2014 and 2013.

|

|

2

|

We define Working Capital as accounts and notes receivable plus inventory less trade accounts payable.

|

| 10 |

|

ITEM 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is intended to provide a reader of our financial statements with a narrative from the perspective of management on our financial condition, results of operations, liquidity and certain other factors that may affect our future results. Unless otherwise noted, transactions, trends and other factors significantly impacting our financial condition, results of operations and liquidity are discussed in order of magnitude. In addition, unless expressly stated otherwise, the comparisons presented in this MD&A refer to the same period in the prior year. Our MD&A is presented in seven sections:

|

•

|

Overview

|

|

•

|

Results of Operations

|

|

•

|

Financial Condition

|

|

•

|

Non-GAAP Financial Measures

|

|

•

|

Critical Accounting Estimates

|

|

•

|

Off-Balance Sheet Arrangements

|

|

•

|

Forward-Looking Statements

|

Our MD&A should be read in conjunction with the Consolidated Financial Statements and related Notes included in Item 8, Financial Statements and Supplementary Data, of this Form 10-K.

OVERVIEW

The Valspar Corporation is a global leader in the paints and coatings industry. We develop, manufacture and distribute a broad range of coatings, paints and related products and we operate our business in two reportable segments: Coatings and Paints. Our Coatings segment aggregates our industrial product lines and our packaging product line. Our Paints segment aggregates our consumer paints and automotive refinish product lines. See Note 15 in Notes to Consolidated Financial Statements for further information on our reportable segments.

We operate in over 25 countries, and approximately 46% of our total net sales in 2014 was generated outside of the U.S. In the discussions of our operating results, we sometimes refer to the impact of changes in foreign currency exchange rates or the impact of foreign currency exchange rate fluctuations, which are references to the differences between the foreign currency exchange rates we use to convert international operating results from local currencies into U.S. dollars for reporting purposes. The impact of foreign currency exchange rate fluctuations is calculated as the difference between current period activity translated using the current period’s currency exchange rates and the comparable prior-year period’s currency exchange rates. We use this method to calculate the impact of changes in foreign currency exchange rates for all countries where the functional currency is not the U.S. dollar.

We have a 4-4-5 week accounting cycle with the fiscal year ending on the Friday on or immediately preceding October 31. Fiscal year 2014 included 53 weeks while fiscal years 2013 and 2012 both included 52 weeks.

Our fundamental business objective is to create long-term value for our stockholders. We intend to accomplish this by:

|

•

|

Focusing on Customer Success by delivering coatings products and solutions that add value for our customers;

|

|

•

|

Building Strong Brands and Distribution Partners by investing in brands that are well recognized in the markets in which we operate and building differentiated distribution networks in key markets;

|

|

•

|

Developing Differentiated Technologies by investing in technologies that enhance our competitive position and add value for our customers;

|

|

•

|

Driving Industry-Leading Innovation by developing unique products and services that differentiate us in the marketplace with our customers; and

|

|

•

|

Attracting and Developing the Best People by creating a world class team with deep expertise and stockholder value orientation.

|

In addition to creating value for our shareholders, we are committed to:

|

•

|

Adhering to our values, engaging in ethical business conduct and doing business with integrity;

|

|

•

|

Improving the safety and reducing the environmental footprint of our business and the products we manufacture while also delivering solutions that enable our customers to meet their safety and environmental objectives; and

|

|

•

|

Demonstrating our corporate citizenship by supporting the communities in which we work and live through volunteer efforts and philanthropy.

|

The following discussion of results of operations and financial condition should be read in the context of this overview.

| 11 |

RESULTS OF OPERATIONS

Overview

In North America, many of the markets in which we compete continued to improve. We increased our market share and net sales in Europe and Asia despite challenging economic conditions. In Australia, we gained new business in an improving market.

Raw material costs in our industries remained stable throughout 2013 and 2014. Since our raw material costs average approximately 80% of our cost of goods sold, the efficient use of raw materials is a critical cost component of the products we manufacture.

Net sales in 2014 increased 10.2% to $4,522,424 from $4,103,776 in 2013, primarily due to our acquisition of the Inver Group, new business across all significant product lines and regions and the 53rd week in fiscal year 2014. Our gross profit rate of 34.0% increased from 33.1% in the prior year primarily due to improved productivity, favorable price/cost comparison and leverage from increased volumes. Our operating expenses, as a percentage of net sales, increased to 21.7% from 21.1% last year driven by investments to support our growth initiatives, primarily in the Paints segment, and higher incentive compensation. Net income as a percent of sales of 7.6% increased from 7.0% in the prior year despite higher restructuring charges in 2014.

Restructuring

Fiscal year 2014 restructuring expenses, relating primarily to initiatives that began in fiscal year 2013, included the following: (i) actions in the Paints segment to consolidate manufacturing and distribution operations following the acquisition of Ace Hardware Corporation’s paint manufacturing business, ongoing profit improvement plans in Australia, and other actions in Asia, (ii) actions in our Coatings segment to consolidate manufacturing operations in Europe following the acquisition of the Inver Group, and other actions to rationalize manufacturing operations and lower operating expenses, and (iii) overall initiatives to improve our global cost structure, including non-manufacturing headcount reductions. Most of these restructuring activities were completed in 2014. In the fourth quarter of 2014, we initiated activities to rationalize manufacturing operations in the Coatings segment in the Australia region, which we expect to complete in 2015. Total restructuring charges were $41,139 or $0.34 per share in fiscal year 2014 and $36,433 or $0.32 per share in fiscal year 2013. Included in fiscal year 2014 and 2013 restructuring charges were $11,141 and $6,664 of non-cash pre-tax asset impairment charges, respectively.

See Note 18 in Notes to Consolidated Financial Statements for further information on restructuring. See reconciliation in “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Measures” for more information on the per share impact of restructuring charges.

Financial Results 2014 vs. 2013

The following tables present selected financial data for the years ended October 31, 2014 and October 25, 2013.

|

Net Sales

|

2014

|

2013

|

% Change

|

|||||||

|

Coatings

|

$

|

2,511,088

|

$

|

2,209,492

|

13.7

|

%

|

||||

|

Paints

|

1,786,448

|

1,671,228

|

6.9

|

%

|

||||||

|

Other and Administrative

|

224,888

|

223,056

|

0.8

|

%

|

||||||

|

Consolidated Net Sales

|

$

|

4,522,424

|

$

|

4,103,776

|

10.2

|

%

|

|

•

|

Consolidated Net Sales – Consolidated net sales for the year increased 10.2%, including a positive impact of 4.9% from the fiscal year 2013 acquisitions of the Inver Group and the paint manufacturing business of Ace Hardware (Ace paints), a positive impact of 1.0% from the 53rd week in fiscal year 2014 and a negative impact of 0.7% from foreign currency. The remaining increase in sales of 5.0% was due to new business across all significant product lines and growth of existing business in our consumer product lines.

|

|

•

|

Coatings Segment Net Sales – Our Coatings segment net sales for the year increased 13.7%, including a positive impact of 8.8% from our Inver Group acquisition, a positive impact of 1.1% from the 53rd week in fiscal year 2014 and a negative impact of 0.6% from foreign currency. The remaining increase in sales of 4.4% was due to volume growth driven by new business in all product lines, partially offset by continued weakness in our North America general industrial product line.

|

|

•

|

Paints Segment Net Sales – Our Paints segment net sales for the year increased 6.9%, including a positive impact of 0.8% from the 53rd week in fiscal 2014, a positive impact of 0.5% from our Ace paints acquisition and a negative impact of 1.1% from foreign currency. The remaining increase in sales of 6.7% reflects new business in all regions and growth in our North America home improvement channel.

|

|

•

|

Other and Administrative Net Sales – The Other and Administrative category includes the following product lines: resins, furniture protection plans and colorants. Other and Administrative net sales increased 0.8%, including a positive impact of 1.4% from the 53rd week in fiscal 2014 and a positive impact of 0.5% from foreign currency. The offsetting decrease of 1.1% was primarily due to decreased sales of resins.

|

| 12 |

|

Gross Profit

|

2014

|

2013

|

||||||

|

Consolidated Gross Profit

|

$ | 1,539,046 | $ | 1,358,058 | ||||

|

As a percent of Net Sales

|

34.0 | % | 33.1 | % | ||||

|

•

|

Gross Profit – The gross profit rate increased 0.9 percentage points. This was primarily due to improved productivity, including benefits from completed restructuring actions, favorable price/cost comparison and leverage from increased volumes, partially offset by investments in strategic acquisitions, which had lower initial margins. Restructuring charges of $28,471 or 0.6% of net sales and $21,916 or 0.5% of net sales were included in the 2014 and 2013 periods, respectively. There were no acquisition-related charges in 2014 compared to $513 or 0.01% of net sales in 2013.

|

|

Operating Expenses

|

2014

|

2013

|

||||||

|

Consolidated Operating Expenses1

|

$ | 979,137 | $ | 865,634 | ||||

|

As a percent of Net Sales

|

21.7 | % | 21.1 | % | ||||

|

1

|

Includes research and development, selling, general and administrative, restructuring and acquisition-related costs. For breakout see Consolidated Statements of Operations.

|

|

•

|

Consolidated Operating Expenses (dollars) – Consolidated operating expenses increased $113,503 or 13.1% compared to the prior year primarily due to investments to support our growth initiatives, the effect of our Inver Group acquisition and higher incentive compensation. Restructuring charges of $12,668 or 0.3% of net sales and $14,517 or 0.4% of net sales were included in the 2014 and 2013 periods, respectively. There were no acquisition-related charges in 2014, compared to $1,729 or 0.04% of net sales in 2013.

|

|

EBIT2

|

2014

|

2013

|

||||||

|

Coatings

|

$ | 389,390 | $ | 329,886 | ||||

|

As a percent of Net Sales

|

15.5 | % | 14.9 | % | ||||

|

Paints

|

192,222 | 168,395 | ||||||

|

As a percent of Net Sales

|

10.8 | % | 10.1 | % | ||||

|

Other and Administrative

|

(24,400 | ) | (9,728 | ) | ||||

|

As a percent of Net Sales

|

(10.8 | )% | (4.4 | )% | ||||

|

Consolidated EBIT

|

$ | 557,212 | $ | 488,553 | ||||

|

As a percent of Net Sales

|

12.3 | % | 11.9 | % | ||||

|

2

|

EBIT is defined as earnings before interest and taxes.

|

|

•

|

Consolidated EBIT – EBIT for 2014 increased $68,659 or 14.1% from the prior year. Fiscal year 2014 results included restructuring charges of $41,139 or 0.9% of net sales, compared to $36,433 or 0.9% of net sales in fiscal year 2013. There were no acquisition-related charges in fiscal year 2014, compared to charges of $2,242 or 0.1% of net sales in fiscal year 2013. Foreign currency exchange fluctuation had an immaterial effect on Consolidated and segment EBIT.

|

|

•

|

Coatings Segment EBIT – EBIT as a percent of net sales increased 60 basis points from the prior year, primarily due to improved productivity, including the benefits from completed restructuring actions, leverage from higher volumes and a favorable price/cost comparison, partially offset by higher restructuring charges and the effect of the Inver Group acquisition. Restructuring charges for the 2014 and 2013 periods were $28,902 or 1.2% of net sales and $19,492 or 0.9% of net sales, respectively. There were no acquisition-related charges in 2014, compared to $2,242 or 0.1% of net sales in 2013.

|

|

•

|

Paints Segment EBIT – EBIT as a percent of net sales increased 70 basis points from the prior year, primarily due to improved sales mix, productivity, including the benefits from completed restructuring actions, and lower restructuring charges, partially offset by investments to support our growth initiatives. Restructuring charges for 2014 and 2013 periods were $11,934 or 0.7% of net sales and $14,953 or 0.9% of net sales, respectively.

|

|

•

|

Other and Administrative EBIT – Other and Administrative EBIT includes corporate expenses. EBIT as a percent of net sales decreased 640 basis points from the prior year primarily due to higher incentive compensation accruals, partially offset by lower restructuring charges. EBIT included restructuring charges of $303 or 0.1% of net sales and $1,988 or 0.9% of net sales in the 2014 and 2013 periods, respectively.

|

|

Interest Expense

|

2014

|

2013

|

||||||

|

Consolidated Interest Expense

|

$ | 65,330 | $ | 64,758 | ||||

|

•

|

Interest Expense – Interest expense increased slightly in fiscal year 2014 primarily due to a higher average debt balance, partially offset by lower average interest rates.

|

|

Effective Tax Rate

|

2014

|

2013

|

||||||

|

Effective Tax Rate

|

29.8 | % | 31.7 | % | ||||

|

•

|

Effective Tax Rate – The lower 2014 effective tax rate was primarily due to favorable changes in geographical mix of earnings.

|

|

Net Income (Loss)

|

2014

|

2013

|

% Change

|

|||||||||

|

Consolidated Net Income (Loss)

|

$ | 345,401 | $ | 289,255 | 19.4 | % | ||||||

| 13 |

Financial Results 2013 vs. 2012

The following tables present selected financial data for the years ended October 25, 2013 and October 26, 2012.

|

Net Sales

|

2013

|

2012

|

% Change

|

|||||||||

|

Coatings

|

$ | 2,209,492 | $ | 2,175,687 | 1.6 | % | ||||||

|

Paints

|

1,671,228 | 1,604,599 | 4.2 | % | ||||||||

|

Other and Administrative

|

223,056 | 240,565 | (7.3 | )% | ||||||||

|

Consolidated Net Sales

|

$ | 4,103,776 | $ | 4,020,851 | 2.1 | % | ||||||

|

•

|

Consolidated Net Sales – Consolidated net sales for the year increased 2.1%, including a positive impact of 2.4% from acquisitions and a negative impact of 0.5% from foreign currency. The remaining increase in sales of 0.2% was due to new business across all significant product lines and regions. The increase was partially offset by volume declines caused by continued weakness in our global general industrial product line, a weak residential housing market in Australia and lower sales in our China consumer paints product line.

|

|

•

|

Coatings Segment Net Sales – Our Coatings segment net sales for the year increased 1.6%, including a positive impact of 1.4% from acquisitions and a negative impact of 0.6% from foreign currency. The remaining increase in sales of 0.8% was primarily due to volume growth driven by new business in all significant product lines, which was partially offset by continued weakness in our general industrial product line.

|

|

•

|

Paints Segment Net Sales – Our Paints segment net sales for the year increased 4.2%, including a positive impact of 4.2% from acquisitions and a negative impact of 0.3% from foreign currency. The remaining increase in sales of 0.3% reflects new business in our North America consumer paints market, partially offset by declines in international consumer markets due to a weak residential housing market in Australia and lower sales in China.

|

|

•

|

Other and Administrative Net Sales – The Other and Administrative category includes the following product lines: resins, furniture protection plans, colorants and gelcoats. Other and Administrative net sales decreased 7.3%, including a negative impact of 0.1% from foreign currency. The decline was primarily due to our exit from the gelcoat products market in the fourth quarter of 2012.

|

|

Gross Profit

|

2013

|

2012

|

||||||

|

Consolidated Gross Profit

|

$ | 1,358,058 | $ | 1,353,704 | ||||

|

As a percent of Net Sales

|

33.1 | % | 33.7 | % | ||||

|

•

|

Gross Profit – The gross profit rate decreased 0.6% primarily due to investments in strategic acquisitions, which had lower initial margins, changes in certain vendor support programs and higher restructuring charges, partially offset by slightly lower raw material costs. Restructuring charges of $21,916 or 0.5% of net sales and $16,199 or 0.4% of net sales were included in the 2013 and 2012 periods, respectively. Acquisition-related charges were $513, or 0.01% of net sales in 2013. There were no acquisition-related charges included in gross profit in the 2012 period.

|

|

Operating Expenses

|

2013

|

2012

|

||||||

|

Consolidated Operating Expenses1

|

$ | 865,634 | $ | 871,434 | ||||

|

As a percent of Net Sales

|

21.1 | % | 21.7 | % | ||||

|

1

|

Includes research and development, selling, general and administrative, restructuring and acquisition-related costs. For breakout see Consolidated Statements of Operations.

|

|

•

|

Consolidated Operating Expenses (dollars) – Consolidated operating expenses decreased 0.7% compared to the prior year primarily due to changes in certain vendor support programs in our Paints segment and lower incentive compensation, partially offset by investments to support growth initiatives in both our Paints and Coatings segments and higher restructuring charges. Restructuring charges of $14,517 or 0.4% of net sales and $9,646 or 0.2% of net sales were included in the 2013 and 2012 periods, respectively. Acquisition-related charges were $1,729, or 0.04% of net sales in 2013. There were no acquisition-related charges included in operating expenses in the 2012 period.

|

|

EBIT2

|

2013

|

2012

|

||||||

|

Coatings

|

$ | 329,886 | $ | 356,428 | ||||

|

As a percent of Net Sales

|

14.9 | % | 16.4 | % | ||||

|

Paints