Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - AEOLUS PHARMACEUTICALS, INC. | exh32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - AEOLUS PHARMACEUTICALS, INC. | exh31_1.htm |

| EX-23.1 - EXHIBT 23.1 - AEOLUS PHARMACEUTICALS, INC. | exh23_1.htm |

| EX-31.2 - EXHIBIT 31.2 - AEOLUS PHARMACEUTICALS, INC. | exh31_2.htm |

| EX-21.1 - EXHIBIT 21.1 - AEOLUS PHARMACEUTICALS, INC. | exh21_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

____________

FORM 10-K

____________

(MARK ONE)

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to__________

Commission File Number 0-50481

____________

AEOLUS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

____________

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

56-1953785

(I.R.S. Employer

Identification No.)

|

|

26361 Crown Valley Parkway, Suite 150

Mission Viejo, California

(Address of principal executive offices)

|

92691

(Zip Code)

|

|

Registrant’s telephone number, including area code: 949-481-9825

|

|

|

Securities registered pursuant to Section 12(b) of the Act: None

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.01 par value per share

(Title of class)

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ýNo ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ýNo ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ý

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ¨No ý

The aggregate market value of the voting common stock held by non-affiliates of the registrant based upon the average of the bid and asked price on the OTC Bulletin Board as of March 31, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $33,637,517. Shares of common stock held by each executive officer and director and by each other stockholder who owned 10% or more of the outstanding common stock as of such date have been excluded in that such stockholder might be deemed to be an affiliate of the registrant. This determination of affiliate status might not be conclusive for other purposes.

As of December 22, 2014, the registrant had 135,850,068 outstanding shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Information Statement to be filed pursuant to Regulation 14C in connection with the registrant’s Written Consent in Lieu of the 2014 Annual Meeting of Stockholders (the “Information Statement”) are incorporated herein by reference into Part III hereof.

AEOLUS PHARMACEUTICALS, INC.

ANNUAL REPORT ON FORM 10-K

Table of Contents

| Page | ||

|

PART I

|

1

|

|

|

Item 1. Business.

|

1

|

|

|

Item 1A. Risk Factors.

|

35

|

|

|

Item 1B. Unresolved Staff Comments.

|

52

|

|

|

Item 2. Properties.

|

52

|

|

|

Item 3. Legal Proceedings.

|

52

|

|

|

Item 4. Mine Safety Disclosures.

|

52

|

|

|

PART II

|

52

|

|

|

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

52

|

|

|

Item 6. Selected Financial Data.

|

53

|

|

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

54

|

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

|

61

|

|

|

Item 8. Financial Statements and Supplementary Data.

|

62

|

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

81

|

|

|

Item 9A. Controls and Procedures.

|

81

|

|

|

Item 9B. Other Information.

|

83

|

|

|

PART III

|

83

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance.

|

83

|

|

|

Item 11. Executive Compensation.

|

83

|

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

83

|

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence.

|

85

|

|

|

Item 14. Principal Accounting Fees and Services.

|

85

|

|

|

PART IV

|

85

|

|

|

Item 15. Exhibits and Financial Statement Schedules.

|

85

|

PART I

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that relate to future events or our future financial performance. You can identify forward-looking statements by terminology such as “may,” “might,” “will,” “could,” “should,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential” or “continue” or the negative of these terms or other comparable terminology. Our actual results might differ materially from any forward-looking statement due to various risks, uncertainties and contingencies, including but not limited to those identified in Item 1A entitled “Risk Factors” beginning on page 43 of this report, as well as those discussed in our other filings with the Securities and Exchange Commission (the “SEC”) and the following:

| ● | our need for, and our ability to obtain, additional funds; | |

| ● | our ability to obtain grants to develop our drug candidates; | |

| ● | uncertainties relating to non-clinical studies, clinical trials and regulatory reviews and approvals; | |

| ● | uncertainties relating to our pre-clinical trials and regulatory reviews and approvals; | |

| ● | uncertainties regarding our ability to successfully advance our Phase I study for Lung-ARS, in light of the clinical hold placed on such study by the FDA on September 22, 2014; | |

| ● | uncertainties regarding whether our compounds could inhibit formation of fibrosis in the lungs. | |

| ● | uncertainties concerning whether we can position our compounds for a pre-EUA application or we can obtain procurements from BARDA following any such application; | |

| ● | our dependence on a limited number of therapeutic compounds; | |

| ● | the early stage of the drug candidates we are developing; | |

| ● | the acceptance of any future products by physicians and patients; | |

| ● | competition with and dependence on collaborative partners; | |

| ● | loss of key consultants, management or scientific personnel; | |

| ● | our ability to obtain adequate intellectual property protection and to enforce these rights; and | |

| ● | our ability to avoid infringement of the intellectual property rights of others. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 1. Business.

General

Overview

Aeolus Pharmaceuticals, Inc. (“we,” “us” or “Aeolus”) is a Southern California-based biopharmaceutical company leveraging significant U.S. Government funding to develop a platform of novel compounds in biodefense, oncology and pulmonary disorders. The platform consists of over 200 compounds licensed from the University of Colorado (“UC”) Duke University (“Duke”) and National Jewish Health (“NJH”).

Our lead compound, AEOL 10150 (“10150”), is being developed under contract with the Biomedical Advanced Research and Development Authority (“BARDA” and the “BARDA Contract”), a division of the U.S. Department of Health and Human Services (“HHS”), as a medical countermeasure (“MCM”) against the pulmonary sub-syndrome of acute radiation syndrome (“Pulmonary Acute Radiation Syndrome” or “Lung-ARS”) and the delayed effects of acute radiation exposure (“DEARE”). Lung-ARS is caused by acute exposure to high levels of radiation due to a nuclear detonation or radiological event.

We are also developing 10150 as a MCM for exposure to chemical vesicants (e.g., chlorine gas, sulfur mustard gas and phosgene gas) and nerve agents (e.g., sarin gas and soman gas) with grant money from the National Institutes of Healh (“NIH”) Countermeasures Against Chemical Threats (“NIH-CounterACT”) program. 10150 previously demonstrated safety and efficacy in animal studies in Lung-ARS, chemical gas exposure and nerve gas exposure and has previously been tested in two Phase I human clinical trials with no drug-related serious adverse events reported.

1

We are also developing 10150 for use in combination with radiation therapy for cancer as a treatment to reduce side effects caused by radiation toxicity and improve local tumor control. A significant portion of the development work funded by the BARDA contract is applicable to the development program for radiation oncology, including safety, toxicology, pharmacokinetics and Chemistry, Manufacturing and Controls (“CMC”). Once we complete our initial Phase I safety study in cancer patients receiving radiotherapy, we plan to initiate studies to demonstrate efficacy in toxic side effects related to radiation therapy. Consistent with our strategy outlined below, we will seek to use non-dilutive capital sources whenever possible to fund this work.

Similarly, we are also developing 10150 for the treatment of lung fibrosis, including idiopathic pulmonary fibrosis (”IPF”) and other fibrotic diseases. This new development program was created based upon the data generated from animal studies in Lung-ARS and chemical gas exposure under the BARDA Contract and NIH grants. After we have completed safety studies, we plan to initiate efficacy studies in patients with fibrosis.

Finally, we have a pipeline of approximately 180 additional compounds. Four of these compounds have demonstrated efficacy as treatments for epilepsy and Parkinson’s Disease. These studies have been funded by Citizens United for Research in Epilepsy (“CURE”) and the Michael J. Fox Foundation (“MJFF”), after initial research funded by Aeolus showed promise in these indications. Consistent with our strategy outlined below, the development of additional compounds in our portfolio is dependent on our finding non-dilutive capital sources to fund the work.

We were incorporated in the State of Delaware in 1994. Our common stock trades on the OTCQB under the symbol “AOLS.” Our principal executive offices are located at 26361 Crown Valley Parkway, Suite 150 Mission Viejo, California 92691, and our phone number at that address is (949) 481-9825. Our website address is www.aolsrx.com. However, the information on, or that can be accessed through our website is not part of this report. We also make available, free of charge through our website, our most recent annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC.

Strategy

Our strategy is to use non-dilutive capital wherever possible to develop our promising platform of broad-spectrum, catalytic antioxidant compounds in important unmet medical indications of clinical and national strategic importance.

To date, we, and/or our research collaborators, have been awarded more than $150 million in non-dilutive U.S. government funding. This includes grants and contracts from federal agencies, such as BARDA, NIH-NIAID and NIH-CounterACT. Additionally, research is currently being conducted on several other compounds with funding from private foundations, such as the MJFF and CURE.

The expected benefit of this strategy is threefold. First, a significant portion of the research to be completed under the government funding mechanisms, particularly the contract with BARDA, is applicable to our 10150 development programs for radiation therapy in cancer patients and lung fibrosis. Specifically, safety, toxicology, pharmacokinetic and CMC data generated from the BARDA Lung-ARS program can be used to support a New Drug Application (“NDA”) for cancer radiation therapy or lung fibrosis.

Second, cost-plus development contracts, like our contract with BARDA, include funds for overhead and profit. These overhead and profit streams have significantly reduced our cash burn rate, which reduces our need to raise capital and incur dilution.

Third, the purpose of the BARDA contract is to fund development of 10150 so it can be procured for the Strategic National Stockpile (“SNS” or the “Stockpile”). Procurements may be made if either the drug meets the requirements for approval by the U.S. Food and Drug Administration (the “FDA”) under the “Animal Rule” or prior to Animal Rule approval following the filing of a pre-Emergency Use Authorization (“EUA”) application. Most of BARDA’s procurements to date have been following the filing of a pre-EUA application.

2

Procurements could generate significant cash and profit that could be re-invested to further develop 10150 for radiation oncology indications (and other compounds for additional indications). The amount of any potential procurement is undisclosed by BARDA at this time and is unknown to us. Based on publicly available information, as well as other procurements made by the agency after pre-EUA applications, we believe the agency may purchase sufficient courses of therapy to treat a minimum of one hundred thousand people, with options to purchase an additional two hundred thousand courses of treatment. If purchases of such volumes occurred, the revenue to the Company could provide funding to advance numerous clinical studies, including potentially large Phase III programs in radiation oncology. This funding could allow us to fund studies with less dependence on collaborative partnering arrangements and future equity offerings, which is consistent with our strategy to deploy non-dilutive capital wherever possible to develop our compounds for unmet medical indications and thereby generate value for our stockholders. In addition, purchases of such volumes of drug could make the Company profitable.

Business Overview

We are developing a new class of broad-spectrum, catalytic antioxidant compounds based on technology discovered and researched at Duke University, the University of Colorado and National Jewish Health, developed by Drs. Irwin Fridovich, Brian Day and others. Dr. Day is our Chief Scientific Officer.

These compounds, known as metalloporphyrins, scavenge reactive oxygen species (“ROS”) at the cellular level, mimicking the effect of the body’s own natural antioxidant enzyme, Superoxide Dismutase (“SOD”). While the benefits of antioxidants in reducing oxidative stress are well-known, research with our compounds indicates that metalloporphyrins can be used to affect signaling via ROS at the cellular level. In addition, there is evidence that high-levels of ROS can affect gene expression and this may be modulated through the use of metalloporphyrins. We believe this could have a profound beneficial impact on people who have been exposed, or are about to be exposed, to high-doses of radiation, whether from cancer therapy or a nuclear event. In addition, data generated in animal studies under the BARDA contract indicate that our compounds could inhibit the formation of fibrosis in the lungs, suggesting that treatment with our compounds may be effective in treating fibrotic diseases of the lung.

Our lead compound, 10150, is a metalloporphyrin specifically designed to neutralize reactive oxygen and nitrogen species. The neutralization of these species reduces oxidative stress, inflammation, and subsequent tissue damage-signaling cascades resulting from radiation or chemical exposure. We are developing 10150 as a MCM for national defense and for use in oncology and lung fibrosis.

Our primary development program is the advanced development of 10150 for Lung-ARS and DEARE. On February 11, 2011, we signed a five-year, cost-plus contract with BARDA for the development of 10150 as a MCM against Lung-ARS. BARDA is the government agency responsible for the advanced development and purchase of medical countermeasures for chemical, biological, radiological and nuclear threats. The contract fully funds the advanced development of 10150 through approval by the FDA under 21 CFR Part 314 Subpart I and Part 601 Subpart H (the “Animal Rule.”) The Animal Rule allows for approval of drugs using only animal studies when human clinical trials cannot be conducted ethically. The goal of the BARDA Contract is to obtain FDA approval for 10150 as a MCM for Lung-ARS. In addition, the BARDA Contract is designed to prepare 10150 for potential procurement to the SNS.

Pursuant to the BARDA Contract we were awarded approximately $10.4 million for the base period of the contract (from February 2011 to April 2012). On April 16, 2012, we announced that BARDA had exercised two options under the BARDA Contract worth approximately $9.1 million. On September 17, 2013, we announced that BARDA had exercised $6.0 million in additional contract options. On May 07, 2014, we announced that BARDA had exercised a Contract Modification worth approximately $1.8 million. The Contract Modification allowed Aeolus to reconcile actual costs incurred with billings under the original provisional indirect billing rate. It established a new provisional indirect billing rate and placed a cap on the current and future provisional indirect billing rates. The Contract Modification brings the total contract value exercised as of September 30, 2014 to approximately $27.3 million. We may receive up to an additional $91.1 million in options exercisable over the remaining years of the BARDA Contract. Options are exercised based on the progress of the development program, including the completion of clinical trials or manufacturing tasks under previously exercised options. The final goal of the contract is to achieve FDA approval for 10150 and the development of commercial manufacturing capability. In order to achieve these goals, we believe it will be necessary to exercise the majority of the options in the contract. We also believe that BARDA is likely to continue to exercise options as long as 10150 continues to demonstrate efficacy and safety in animal testing for Lung-ARS. In the event we begin sales to the U.S. government following the filing of a pre-EUA application, we believe that BARDA is likely to exercise the majority of the remaining options under the contract. One of the requirements of an EUA is that the development program continue towards the goal of FDA approval. If all of the options are exercised by BARDA, the total value of the contract would be approximately $118.4 million.

3

There are no existing treatments for Lung-ARS or DEARE and we are not aware of any compounds in development that have shown efficacy when administered after exposure to radiation. 10150 has demonstrated efficacy in two animal models (mouse and non-human primate) when administered after exposure to radiation. The U.S. government’s planning scenario for a radiation incident is a 10 kiloton detonation of a nuclear device in a major American city. It is estimated that several hundred thousand civilians would be exposed to high doses of radiation in this scenario.

The BARDA contract is designed to complete the work necessary for 10150 to be purchased for the US Strategic National Stockpile (the “SNS”). BARDA currently acquires drugs for the SNS through a Special Reserve Fund (the “SRF”) created under Project BioShield and reauthorized under the Pandemic All-Hazards Preparedness Reauthorization Act of 2013. Although the final goal of the contract is full FDA approval under the Animal Rule, BARDA, based on historical purchases from other suppliers, may purchase product prior to FDA approval following the filing of a pre-EUA application. Procurements from BARDA following a pre-EUA application could result in a significant increase in revenues for Aeolus and potential profitability.

Pursuant to the Statement of Work in the BARDA Contract, we planned to provide the data necessary for filing a pre-EUA application in the second half of 2014. In August 2014, we filed an Investigational New Drug (“IND”) application with the Division of Medical Imaging Products of the U.S. Food & Drug Administration (“FDA”) for 10150 as a treatment for Lung-ARS. On September 4, 2014, the Company announced positive results from a study in non-human primates exposed to lethal radiation and treated with 10150. The study demonstrated that administration of 10150 24 hours after exposure to lethal radiation impacted survival at six months post-exposure as follows: survival in the 60 day treatment group was 50%, compared to 25% survival in the radiation only untreated control group. The data from this study, combined with development work completed in manufacturing and human safety data, will form the basis for a pre-EUA application. On September 22, 2014, we received a letter from the FDA placing our proposed Phase I study in healthy normal volunteers for 10150 as a treatment for Lung-ARS on clinical hold. (See - “Future Development Plans” and “Risk Factors - Our commercialization efforts may be adversely impacted by an FDA clinical hold on our Phase I clinical trial in Lung-ARS.”) The FDA provided the Company with specific concerns that need to be addressed in order to allow for the initiation of studies in healthy normal volunteers. In consultation with BARDA, the Company has submitted a mitigation strategy to the FDA for their review and feedback. Although the Phase I safety study is part of the development plan with BARDA, the clinical hold does not prevent progress on the other elements of the Contract related to animal efficacy studies, manufacturing or other areas. Furthermore, the Company plans to file a separate IND for non-small cell lung cancer and for lung fibrosis during the first half of 2015, and then initiate Phase I studies upon clearance from the FDA for these indications. Data from these Phase I studies could provide further support for allowance of the Phase I study in healthy normal volunteers and could also be used to support the human safety requirement for the pre-EUA filing and filing for approval under the Animal Rule.

We also benefit from research funded by grants from the NIH CounterACT program for the development of 10150 as a MCM for the effects of nerve gas (e.g., sarin and soman) and chemical vesicant gasses (e.g., mustard gas, phosgene gas and chlorine gas) exposure. Funding for this indication is provided directly to the research facility and does not flow through our financial statements. Continued funding is generally dependent on continuing evidence of efficacy in animal trials. There are no existing treatments for exposure to chemical vesicants. In October 2011, we announced that National Jewish Health was awarded a $12.5 million grant from NIH CounterACT to continue the development of 10150 as a MCM against chlorine gas exposure. Also included in the grant is support for research in looking at tissue plasminogen activator (“TPA”) and Silabilin, which are not Aeolus assets, as MCMs against sulfur mustard gas exposure. The ultimate objective of the sulfur mustard and chlorine gas work at National Jewish Health will be to complete all work necessary to initiate pivotal efficacy studies in animals for both indications. This would include: running efficacy studies in the rat model for higher doses of sulfur mustard and chlorine gas; establishing endpoints, optimal dosing and duration of treatment for pivotal efficacy studies; and characterizing the natural history from sulfur mustard and chlorine gas damage. We plan to meet with the Division of Pulmonary, Allergy and Rheumatology Products of the FDA in 2015 to discuss filing an investigational new drug application (an “IND”) for the sulfur mustard indication under the Animal Rule and to present the design of a pivotal study in a rat model developed under the NIH CounterACT program. This is the same division that will review our plans for development in lung fibrosis.

4

We are also funded by grant money from the NIH CounterACT program and the National Institute of Neurological Disorders and Stroke (“NINDS”) for the development of 10150 as a MCM for the effects of nerve gas (e.g., sarin and soman) exposure. NIH-CounterACT awarded a contract on September 24, 2011 worth approximately $735,000, to the University of Colorado to develop 10150 as a MCM against nerve agents. Work performed with this initial funding has demonstrated that 10150 significantly improved survival when administered with current treatment in a pilocarpine model for nerve gas exposure. In September 2013, we announced that Dr. Manisha Patel at the University of Colorado had been awarded a $4.3 million grant from NINDS to develop as a MCM for exposure to sarin gas and other nerve agents.

Until February 2011, the Lung-ARS program was principally funded by the Company and the work was performed at Duke University and the University of Maryland. Since February 11, 2011, substantially all of the costs for the Lung-ARS program have been funded by the BARDA Contract. To date, the chlorine, phosgene, mustard gas and nerve agent programs have been funded by NIH-CounterACT and NINDS through programs at National Jewish Health, the University of Colorado, and the United States Army Medical Research Institute for Chemical Defense (“USAMRICD”).

We are also developing 10150 for use in oncology where it would be used in combination with radiation and chemotherapy as both a therapeutic and prophylactic drug. Pre-clinical studies at Duke University have demonstrated that 10150 does not interfere with the benefit of radiation therapy or chemotherapy in prostate and lung cancer. These studies also demonstrated that 10150 displays anti-tumor activity.

We plan to file an additional IND for 10150 with the oncology division of the FDA in the first quarter of 2015, then initiate a Phase I study in non-small cell lung cancer patients receiving radiation and chemotherapy upon approval of the IND. Upon the successful completion of the Phase I study, we expect to begin Phase II studies in cancer radiation therapy patients. The Company is considering several potential indications, including prostate cancer, esophagial cancer, head and neck cancer and non-small cell lung cancer.

10150 has been tested in two human Phase I safety studies where it was well-tolerated and no adverse events were observed. Efficacy has been demonstrated in validated animal models for Lung-ARS, chlorine gas exposure, phosgene gas exposure, sulfur mustard gas exposure (lungs and skin) and nerve gas exposure. In both mouse and non-human primate (“NHP”) studies for Lung-ARS, 10150 treated groups showed significantly reduced weight loss, inflammation, oxidative stress, lung damage, and most importantly, mortality. Therapeutic efficacy has been demonstrated when 10150 is administered 24 hours after exposure to radiation, a requirement for consideration as a radiation MCM for the SNS.

Following the events at the Fukushima nuclear plant in Japan in 2011, we ran murine studies at the request of Japanese researchers to demonstrate the alternative effects of administering leukocyte growth factors (“LGF”) used to treat the hematopoietic or bone marrow syndrome of ARS (“H-ARS”). Data showed that 10150 does not interfere with the efficacy of LGF (in this case Amgen’s Neupogen®). Additionally, the study demonstrated that administration of Neupogen®, the current standard of care for H-ARS, increased damage to the lungs. When 10150 was administered with Neupogen® this damage was significantly reduced. We believe that this finding may have important implications for the potential procurement of 10150 for the SNS. In September 2013, BARDA announced that it had entered into a procurement and inventory management agreement with Amgen to provide Neupogen® for the SNS.

5

We have an active Investigational New Drug Application (“IND”) on file with the FDA for AEOL 10150 as a potential treatment for amyotrophic lateral sclerosis (“ALS”). At this time, we do not have any plans to continue development of 10150 for ALS.

We have already completed two Phase I safety studies in 50 humans (39 receiving drug and 13 control) demonstrating that 10150 is safe and well tolerated. CMC work has been completed, pilot lots have been prepared and production is being scaled up under the BARDA Contract.

We have two programs underway for the development of several other drug candidates, AEOL 11207, AEOL 1114B and AEOL 11203, for the treatment of epilepsy and Parkinson’s Disease. These programs are being funded, in part, by private foundations, including the Michael J. Fox Foundation, CURE and government grants. In February 2012, data was published in the Journal Neurobiology of Disease from the CURE study indicating AEOL 11207 significantly reduced both the frequency and duration of spontaneous seizures in a pre-clinical epilepsy model. Additionally, the study showed an increase in average life span, protection against neuronal death and no difference in seizure severity.

Aeolus’ Catalytic Antioxidant Program

We established our research and development program to explore and exploit the therapeutic potential of small molecule catalytic antioxidants. We have achieved our initial research objectives and begun to extend our preclinical accomplishments into non-clinical studies, clinical trials and drug development programs.

Our catalytic antioxidant program is designed to:

|

·

|

Retain the catalytic mechanism and high antioxidant efficiency of the natural enzymes, and

|

|

·

|

Create and develop stable and small molecule antioxidants without the limitations of SOD so that they:

|

|

o

|

Have broader antioxidant activity,

|

|

o

|

Have better tissue penetration,

|

|

o

|

Have a longer life in the body, and

|

|

o

|

Are not proteins, which are more difficult and expensive to manufacture.

|

We created a class of small molecules that consume reactive oxygen and nitrogen species catalytically; that is, these molecules are not themselves consumed in the reaction. Our class of compounds is a group of manganoporphyrins (an anti-oxidant containing manganese) that retain the benefits of antioxidant enzymes, are active in animal models of disease and, unlike the body’s own enzymes, have properties that make them suitable drug development candidates.

Our most advanced compound, 10150 (Figure 1), is a small molecule, broad-based, catalytic antioxidant that has shown the ability to scavenge a broad range of reactive oxygen species, or free radicals. As a catalytic antioxidant, 10150 mimics, and thereby amplifies, the body’s natural enzymatic systems for eliminating these damaging compounds. Because oxygen- and nitrogen-derived reactive species are believed to have an important role in the pathogenesis of many diseases, we believe that our catalytic antioxidants and 10150 may have a broad range of potential therapeutic uses.

Figure 1

|

AEOL 10150 Overview

|

|

|

Product Type

|

√ Catalytic antioxidants (manganoporphyrin) |

| Administration Route |

√ Subcutaneous administration; self-injection possible

|

| √ Oncology | |

| √ Pulmonary Fibrosis | |

| Indications in Development |

√ Pulmonary ARS/DEARE

|

|

√ Sulfur Mustard; Chlorine Gas; Nerve Gas

|

|

| Technical Readiness Level (TRL) | √ TRL 7/8 for Pulmonary Effects of ARS/DEARE |

|

Regulatory Status

|

√ Active IND (IND-67741) Phase I (3 studies, 50 patients total 39 treated, 13 placebo) |

|

√ IND on Clinical Hold (IND-

|

|

6

AEOL 10150 has shown efficacy in a variety of animal models as a protectant against radiation injury, sulfur mustard gas exposure, nerve gas exposure, ALS, stroke, pulmonary diseases, and diabetes. We filed an IND for AEOL 10150 in April 2004, under which human safety trials in ALS patients were conducted as more fully described below under the heading “10150 Clinical Program to Date.” For a more detailed description of antioxidants see the section below under the heading “Background on Antioxidants.”

AEOL 10150 Medical Countermeasure Development Program

We and our research partners have been awarded in excess of $143 million for the development of 10150 as a dual-use, broad spectrum medical countermeasure. The table below details the indications currently under development and the sources of funding from the US Government.

|

Indication

|

Funding Source

|

Amount of

Grant/Contract |

Research Partners

|

|

Lung-ARS

|

BARDA

|

Up to $118.4

million |

University of Maryland

|

|

Chlorine Gas

|

NIH

CounterACT |

$20.3 million

|

National Jewish Health

|

|

Mustard Gas

|

NIH

CounterACT |

Part of the NIH-

CounterACT grant above |

National Jewish Health

University of Colorado

|

|

Nerve Agents

|

NIH

CounterACT |

$5 million

|

University of Colorado

|

10150 as a potential medical countermeasure against the effects of Pulmonary Acute Radiation Syndrome

Overview

The U.S Government’s current planning scenario for a nuclear attack is a 10 kiloton detonation in a major American city. For purposes of comparison, the yield of the bomb dropped on Hiroshima in World War II was approximately 16 kilotons. Such an attack would potentially expose hundreds of thousands of citizens to acute, high dose, ionizing radiation and the lethal effects of Acute Radiation Syndrome (“ARS”).

ARS is not a single disease, but a series of sub-syndromes that follow exposure to ionizing radiation. BARDA is pursuing separate development plans for each sub-syndrome. 10150 is the only compound in advanced development with BARDA for Lung-ARS.

Immediately after exposure, the first syndromes of ARS typically experienced by those exposed are the acute hematopoietic (bone marrow) syndrome (“H-ARS”) and early-onset GI-ARS, both of which can be lethal. However, depending on the level and location of radiation exposure, the lethal effects of both H-ARS and early-onset GI-ARS may be reduced with proper treatment, including supportive care (fluids and antibiotics) and LGFs like Amgen’s Neupogen®.

In September 2013, BARDA announced that it had entered into a vendor-managed supply agreement with Amgen to supply its LGF, Neupogen®, to the SNS as a treatment for H-ARS. Although Neupogen® is an FDA-approved drug for neutropenia, it is not approved for H-ARS and would be used under a pre-EUA application. The procurement of Neupogen® for the SNS is significant for 10150 and its potential role in the treatment of ARS. A 2011 murine study conducted at Indiana University at the request of Japanese researchers confirmed that 10150 does not interfere with the positive effects of Neupogen® in H-ARS and the two products in combination were safe and well-tolerated. More importantly, this study also demonstrated that treatment of H-ARS with Neupogen® exacerbates radiation damage to the lung, even at sub-lethal doses of radiation. Treatment with Neupogen® in combination with 10150 significantly reduced the lung damage. We believe that the use of Neupogen® in treating H-ARS makes the use of 10150 crucial in managing the lung effects of acute radiation exposure.

When patients survive H-ARS and GI-ARS, respiratory failure becomes the major cause of death. Research has shown that damage associated with the exposure to upper half body irradiation or total body irradiation is an acute, but delayed, onset of radiation pneumonitis (inflammation of lung tissue) followed by lung fibrosis (scarring caused by inflammation).The incidence of radiation pneumonitis rises very steeply at relatively low radiation doses. This is Lung-ARS, the syndrome that 10150 is being developed to treat.

7

We believe it is in the government’s interest in to provide care not only for survival from the short-term effects of radiation exposure following an event (e.g., H-ARS and GI-ARS), but also to provide care for the delayed effects of radiation exposure, such as Lung-ARS. There are no current FDA-approved or EUA-approved therapies for Lung-ARS. We believe 10150 is the only drug in advanced development with BARDA for Lung-ARS.

Pre-clinical studies

In a 2013 study run under the BARDA contract at the University of Maryland at Baltimore, a total of 120, CBA/J mice were exposed to 14.6 Gray of whole thorax irradiation (“WTLI”). Four cohorts of animals were treated with daily doses of 5mg, 10 mg, 25 mg or 40 mg/kg of 10150 beginning 24 hours after exposure for a total for 28 days. The results are shown in the table below. Survival at six months post-exposure in the optimal treatment group of 25mg/kg of 10150 improved to 40 percent, compared to 10 percent survival in the radiation only group. In addition, animals receiving 10150 showed significant protection of the lungs as measured by differences in wet lung weights and breathing frequency. This study confirms previous studies in animals that demonstrate 10150’s protection of the lungs from radiation exposure.

|

Treatment

|

Survival

|

Number of Animals

|

|||||

|

Radiation Only

|

10% | 20 | |||||

|

Radiation + 5 mg/kg AEOL 10150

|

16% | 19 | |||||

|

Radiation + 10 mg/kg AEOL 10150

|

16% | 19 | |||||

|

Radiation + 25 mg/kg AEOL 10150

|

40% | 20 | |||||

|

Radiation + 40 mg/kg AEOL 10150

|

30% | 20 | |||||

A number of other preclinical studies by researchers at the University of Indiana, the University of Maryland and Duke University have demonstrated the efficacy of 10150 in radioprotection of normal tissue.

In 2011, we announced positive results from study of 10150 and Neupogen® as combination therapy for treatment of ARS. The study was conducted by Christie Orschell, PhD of Indiana University. The primary endpoint of the study was to determine drug-drug interactions between Neupogen® and 10150, as well as to monitor safety and tolerability of the two treatments given simultaneously. Results of the study confirmed that 10150 does not interfere with the positive effects of Neupogen® on the hematopoietic, or bone marrow, syndrome of Acute Radiation Syndrome (“ARS”), and the two products in combination were safe and well tolerated. In 2012, we announced further data from this study, which demonstrated that treatment of the hematopoetic sub-syndrome of acute radiation syndrome (“Heme-ARS”) with Neupogen® exacerbates radiation damage to the lung. The study also confirmed that treatment with 10150 in combination with Neupogen® significantly reduced the lung damage.

The study entitled “Pilot Study to Test the Effects of Aeolus 10150 on Neupogen®-Induced ANC Recovery in Sub-Lethally Irradiated C57Bl/6 Mice” was initiated at the request of Shigetaka Asano, MD of Waseda University and Arinobu Tojo, MD, PhD and Tokiko Nagamura, MD at the Institute of Medical Science at the University of Tokyo to determine whether there would be any interference with the demonstrated efficacy of Neupogen® as a medical countermeasure against the hematopoietic complications of radiation exposure. In previous treatment of radiation accident victims at Tokai-mura, Dr. Asano and others were able to use Granulocyte Colony Stimulating Factor (“G-CSF”) and supportive care to enable victims of 8 to 12 Gy exposure to survive the hematopoietic (“heme”) syndrome. Unfortunately, these patients later died due to lung and multi-organ complications. As 10150 has shown separate efficacy against lung and GI complications in mice and in Lung-ARS in non-human primates, this study was undertaken to evaluate whether the Neupogen® and Aeolus 10150 compounds would be beneficial if used in tandem.

The use of Neupogen® or other G-CSFs or Neulasta® or other Granulocyte-Macrophage Colony Stimulating Factor (“GM-CSF”) products is recommended by the Radiation Emergency Assistance Center/Training Site (REAC/TS) at radiation exposures greater than 2 to 3 Gy to mitigate damage to the hematopoietic system. REAC/TS is a response asset of the U.S. Department of Energy and provides treatment capabilities and consultation assistance nationally and internationally. In animal studies G-CSF's have been shown to be effective in increasing survival at levels up to 7.5 Gy due to their positive effects on the hematopoietic damage created by radiation exposure. BARDA began procuring Neupogen® and Sanofi-Aventis’ drug Leukine® for the Strategic National Stockpile in September 2013.

8

LGFs as a class have not demonstrated an effect on the two other major sub-syndromes -- GI and Lung. 10150 has demonstrated efficacy in treating the GI sub-syndrome in pilot studies conducted by NIH-NIAID, by protecting crypt cells and reducing diarrhea. More extensive studies of the drug in treating the pulmonary effects of radiation at Duke University and the University of Maryland have shown improved survival and enhanced lung function and improved histology at exposures up to 15 Gy in mice and 11.5 Gy in non-human primates. These exposure levels caused death in 100 percent of animals that were not treated with 10150. Studies at Duke University have also shown a significant survival advantage for animals treated with 10150 after 15 Gy upper half body irradiation, which causes lethal damage to both the GI tract and the lungs.

In summary, 10150 has consistently shown a survival advantage and protective effect against the lung and delayed effects of acute radiation exposure when administered 24 hours or more after exposure. Additionally, the current standard of care for the acute ARS syndromes, LGF administration, exacerbates damage to the lungs and 10150 has demonstrated efficacy in reducing that damage.

Non-clinical studies

In a 2014 study run under the BARDA contract at the University of Maryland at Baltimore, a total of 80 rhesus macaque monkeys were exposed to 10.74 Gray of WTLI. Three cohorts of animals were treated with 25 mg/kg of 10150 beginning 24 hours after exposure. The three cohorts then received daily doses of 10150 for 28 days, 60 days or 28 days followed by a pause of 32 days and then an additional 28 days of treatment. Survival at six months post-exposure in the 60 day treatment group was 50%, compared to 25% survival in the radiation-only untreated control group. This study confirms previous studies in non-human primate and mouse models that demonstrate 10150’s protection of the lungs from radiation exposure. We plan to publish the detailed results of the study with our research collaborators as soon as possible.

In 2010, we initiated a study to confirm the efficacy of 10150 as an MCM to nuclear and radiological exposure in non-human primates (“NHPs”). The study was designed to test the efficacy of 10150 as a treatment for Lung-ARS and to begin establishing an animal model that can be validated and could be utilized by the FDA for approval of an MCM for Pulmonary Acute Radiation Syndrome under the “Animal Rule”. The FDA “Animal Rule” enumerates criteria whereby the FDA can rely on animal efficacy data when “evidence is needed to demonstrate efficacy of new drugs against lethal or permanently disabling toxic substances when efficacy studies in humans, ethically cannot be conducted.” The criteria are discussed below.

Results from the study were published in the journal Health Physics, Volume 106, Number 1 (January 2014) under the title “A Pilot Study in Rhesus Macaques to Assess the Treatment Efficacy of A Small Molecular Weight Catalytic Metalloporphyrin Antioxidant (AEOL 10150) in Mitigating Radiation-induced Lung Damage." The primary objective of the study was to determine if 10150 could mitigate radiation-induced lung injury and enhance survival in rhesus macaques exposed to whole thorax lung irradiation (“WTLI”) and administered supportive care. Two cohorts of NHPs were exposed to 11.5Gy LINAC-derived photon radiation in the WTLI protocol. The control cohort had n=6 and 10150-treated cohort was n=7.This model showed 100% incidence of severe radiation-induced lung damage. 10150 was administered subcutaneously at 5mg/kg beginning at day 1 post WTLI and continued as a single, daily injection for 28 consecutive days. The final results were presented at the 14th International Congress of Radiation Research in Warsaw, Poland in September 2011. Key findings in the study include:

|

|

1.

|

Exposure of the whole thorax to 11.5 Gy resulted in radiation-induced lung injury in all NHPs in the study and proved 100% fatal in the control animals, despite supportive care including dexamethasone. 11.5 Gy is, therefore, equal to or greater than the LD100/180dose for the WTLI model.

|

|

|

2.

|

10150, as administered in this pilot study (daily for 28 days at a dose of 5mg/kg subcutaneously), demonstrated potential efficacy in mitigating against fatal radiation-induced lung injury. Treatment with the drug resulted in 28.6% survival following exposure to a radiation dose that proved to be 100% fatal in the untreated control group.

|

9

|

|

3.

|

Serial CT scans demonstrated less quantitative radiographic injury (pneumonitis, fibrosis, effusions) in the 10150-treated cohort, suggesting that the drug reduces the severity of the radiographically detectable lung injury.

|

|

|

4.

|

Dexamethasone administration yielded a transient benefit on both clinical and radiographic evidence of pneumonitis. The 10150 treated cohort required 1/3 less dexamethasone support due to reduced pulmonary injury in the 10150 treated group, resulting in less frequent clinical “triggers” (respiratory rate≥80) to treat with dexamethasone.

|

|

|

5.

|

The results of this pilot study are encouraging and suggest that treatment with 10150 results in reduced clinical, radiographic and anatomic evidence of radiation-induced lung injury, which also results in improved survival. 10150 merits further study as a post-exposure MCM against radiation-induced lung injury.

|

In rodents, non-human primates and humans, radiation of the lungs can cause reduced breathing capacity, pneumonitis, fibrosis, weight loss and death and is characterized by oxidative stress, inflammation and elevated macrophage counts. 10150 has proven to be an effective countermeasure to radiation exposure of the lungs in mice and rats in published studies such as Rabbani et al Int J Rad Oncol Biol Phys 67:573-80, 2007, Rabbani et al Free Rad Res 41:1273-82, 2007 and Gridley et al Anticancer Res 27:3101-9, 2007.

Future Development Plans

Our objective is to develop 10150 as an MCM against Lung-ARS via the FDA’s “Animal Rule”. This development pathway requires demonstration of the key study efficacy parameter of 10150 treatment in two animal models relevant to the human radiation response and its treatment, demonstration of safety in humans, demonstration of relevant dosing and administration in humans, and clear identification of the mechanism of radiation-induced damage to the lung and its amelioration by the drug candidate.

10150 has several distinct advantages as an MCM, including the following:

|

·

|

Demonstrated survival increase in animal studies of lung ARS when administered 24 hours after exposure,

|

|

·

|

Demonstrated reduction in lung fibrosis in animal studies up to 24 hours post exposure,

|

|

·

|

Demonstrated histological improvement in lung tissue post-radiation exposure,

|

|

·

|

Addresses an unmet medical need as an MCM to Lung-ARS,

|

|

·

|

Established safety profile in both clinical and pre-clinical studies,

|

|

·

|

Subcutaneous self-administration possible by exposed individuals during emergency,

|

|

·

|

Rapid administration, allowing large numbers of patients to be treated quickly,

|

|

·

|

Original formulation stable for up to 4½ years at 0–8°C and 1 year at room temperature,

|

|

·

|

New formulation stability tested in bulk drug for 2 years at room temperature (25°C) and refrigerated conditions (2-8°C); stability testing in bulk drug will continue to three years,

|

|

·

|

New formulation stability tested in final drug product to 18 months under room temperature (25°C), accelerated conditions (40°C) and refrigerated conditions (2-8°C);

stability testing in final drug product will continue to 5 years,

|

|

·

|

Requires no non-standard storage conditions (i.e., not photosensitive),

|

|

·

|

Currently in development as an adjunct to radiation therapy and lung fibrosis; if approved will provide a pre-existing distribution and stockpile resource at oncology

centers in the event of a radiological emergency,

|

|

·

|

Demonstrated advantage when used in combination with Neupogen®,

|

|

·

|

Demonstrated potential as both a therapeutic and prophylactic,

|

|

·

|

Demonstrated efficacy against sulfur mustard gas, phosgene gas, chlorine gas and nerve agent exposures,

|

|

·

|

Potential dual use as an adjunct treatment for cancer patients receiving radiation therapy and treatment of pulmonary fibrosis, subject to separate FDA approvals for these indications.

|

We believe that in order to receive approval from the FDA for Lung-ARS with the FDA, we will need to demonstrate efficacy in animal models and demonstrate product safety. We also plan to request Fast Track status for this indication. If the FDA accepts our Fast Track request, a rolling NDA submission process is enabled, a key step in achieving Priority Review. The FDA determines within 45 days of a company’s request, made once the complete NDA is submitted, whether a Priority or Standard Review designation will be assigned.

10

In August 2014, the Company filed an IND for 10150 for Lung-ARS with the Division of Medical Imaging Products (“DMIP”) at FDA. On September 22, 2014, the Company received a letter from FDA placing the proposed Phase I study in healthy normal volunteers on clinical hold. The FDA clinical hold was based on two main areas of concern. First, the FDA requested that the Company use a different pre-clinical in-vivo model to test for genotoxicity. The Company plans to run this additional model as requested. Second, the FDA and the Company differed on the calculation of human equivalent dose (“HED”) for determining efficacy and therapeutic ratio. Therapeutic ratio is the ratio between the dose at which toxicity has appeared in pre-clinical studies and the projected efficacious dose to be used in humans. The Company has requested a meeting to have further discussions with the DMIP regarding an agreeable therapeutic ratio for the study and will also run additional toxicity studies designed to further increase the therapeutic window. In this regard, we plan to initiate studies in patients with cancer and/or lung fibrosis, and will use this data together with the existing data we have in patients with Amyotrophic Lateral Sclerosis (“ALS”) to respond to the DMIP’s concerns. As discussed above, we also plan to file a separate 10150 IND with the Oncology division of the FDA in the first quarter of 2015 and initiate a Phase I study in patients receiving radiation therapy for cancer upon FDA approval of the IND. We also believe that this is the most efficient way to generate the safety data required for a pre-EUA application for Lung-ARS.

The FDA’s “Animal Rule” enumerates criteria whereby the FDA can rely on animal efficacy data when evidence is needed to demonstrate efficacy of new drugs against lethal or permanently disabling toxic substances when efficacy studies in humans cannot be ethically conducted. The criteria are as follows:

|

·

|

Knowledge of the mechanism of radiation-induced damage to the lung and its amelioration by the candidate drug.

|

|

·

|

Pharmacokinetic and pharmacodynamic analysis to provide information on relevant dose and administration schedule.

|

|

·

|

Direct correlation of key study parameters (e.g., survival or major morbidity) with the desired clinical benefit in humans.

|

|

·

|

Collection of efficacy data in two species relevant to the human radiation response and its treatment unless otherwise justified under GLP-compliant conditions.

|

|

·

|

A Phase I safety trial using the same product and formulation as used in the pivotal trial(s) is required.

|

Demonstrate Efficacy in Animal Models

Under the BARDA contract, we have developed and validated mouse and NHP models for Lung-ARS. We have also presented these models to the FDA and they have concurred with our design and our development plan for demonstrating efficacy. We believe that the efficacy data produced in pivotal studies using validated models will provide the data required to demonstrate efficacy of 10150 at the dose and schedule proposed for licensure

Demonstrate Product Safety

For product approval under the “Animal Rule”, we will also demonstrate product safety using the same product and formulation used in the animal efficacy trials and proposed for use in humans. Demonstration of safety includes preclinical demonstration of safety via the standard pre-clinical studies and analyses methods and Phase I safety trials sufficient to demonstrate product safety in the target patient population. We believe our safety studies completed as a therapy for ALS may be utilized to demonstrate safety for this indication. We also plan to conduct additional Phase I clinical safety studies, which are included in the BARDA Contract.

Competition

Currently there are no FDA-approved drugs for the treatment of Lung-ARS. We are also not aware of any other drug candidates that have demonstrated the ability to protect the lungs from radiation when administered after exposure, which we believe is a critical aspect of the development of an MCM against the effects of acute radiation syndrome. We are also not aware of any drugs with large advanced development funding from BARDA for Lung-ARS.

11

However, in general, we face significant competition for U.S. government funding for both development and procurements of an MCM for biological, chemical and nuclear threats, diagnostic testing systems and other emergency preparedness countermeasures. The U.S. federal government has currently allocated a significant amount of research funding to the development of countermeasures against the effects of radiation exposure. As a result, there are many drug candidates under development as a possible countermeasure against the various effects and sub-syndromes of radiation exposure.

Funding and Funding Options

On February 11, 2011, we signed a five-year, cost-plus contract with BARDA for the development of 10150 as a MCM against Lung-ARS (the “BARDA Contract”). BARDA is the government agency responsible for the advanced development and purchase of medical countermeasures for chemical, biological, radiological and nuclear threats. The contract funds the advanced development of 10150 through approval by the United States Food & Drug Administration (“FDA”) under the “Animal Rule.” The Animal Rule allows for approval of drugs using only animal studies when human clinical trials cannot be conducted ethically.

Pursuant to the BARDA Contract we were awarded approximately $10.4 million for the base period of the contract (from February 2011 to April 2012). On April 16, 2012, we announced that BARDA had exercised two options under the BARDA Contract worth approximately $9.1 million. On September 17, 2013, we announced that BARDA had exercised $6.0 million in additional contract options. On May 07, 2014, we announced that BARDA had exercised a Contract Modification worth approximately $1.8 million. The Contract Modification brings the total contract value exercised as of September 30, 2014 to approximately $27.3 million. We may receive up to an additional $91.1 million in options exercisable over the remaining years of the contract. Options are exercised based on the progress of the development program, including the completion of clinical trials or manufacturing tasks under previously exercised options. The final goal of the contract is to achieve FDA approval for 10150 and the development of commercial manufacturing capability. In order to achieve these goals, we believe it will be necessary to exercise the majority of the options in the contract. We also believe that BARDA is likely to continue to exercise options as long as 10150 continues to demonstrate efficacy and safety in testing for Lung-ARS. In the event we begin sales to the U.S. government under an EUA, we believe that BARDA is likely to exercise the majority of the remaining options under the contract. One of the requirements of an EUA is that the development program continue towards the goal of FDA approval. If all of the options are exercised by BARDA, the total value of the contract would be approximately $118.4 million.

Since we have been awarded the BARDA Contract, substantially all of the costs associated with the research and development of 10150 as a MCM for Lung-ARS have been covered by the BARDA Contract and we expect such costs to continue to be covered by the BARDA Contract. We believe that continued funding under the BARDA contract is primarily dependent on continued positive results with 10150 in animal studies and the general risks of doing business with the government. See Risk Factors – “Risks Related to Our Dependence on U.S. Government Grants and Contracts.”

10150 as a potential medical countermeasure against the effects of mustard gas

Overview

Sulfur mustards, of which sulfur mustard gas (“SM”) is a member, are a class of related cytotoxic, vesicant chemical warfare agents with the ability to form large blisters on exposed skin and cause pneumonitis and fibrosis in the lungs. In their pure form most sulfur mustards are colorless, odorless, viscous liquids at room temperature. When used as warfare agents they are usually yellow-brown in color and have an odor resembling mustard plants, garlic or horseradish. Mustard agents, including sulfur mustard, are regulated under the 1993 Chemical Weapons Convention. Three classes of chemicals are monitored under this Convention, with sulfur and nitrogen mustard grouped in the highest risk class, “schedule 1.” However, concerns about its use in a terrorist attack have led to resurgence in research to develop a protectant against exposure.

12

Mustard gas is a strong vesicant (blister-causing agent). Due to its alkylating properties, it is also strongly mutagenic (causing damage to the DNA of exposed cells) and carcinogenic (cancer causing). Those exposed usually suffer no immediate symptoms. Within 4 to 24 hours the exposure develops into deep, itching or burning blisters wherever the mustard contacted the skin; the eyes (if exposed) become sore and the eyelids swollen, possibly leading to conjunctivitis and blindness. At very high concentrations, if inhaled, it causes bleeding and blistering within the respiratory system, damaging the mucous membrane and causing pulmonary edema. Blister agent exposure over more than 50% body surface area is usually fatal.

The NIH awarded a five-year, $7.8 million Center of Excellence grant to National Jewish Health and the University of Colorado Health Sciences Center, both in Denver, Colorado. This Center of Excellence was developed to focus on sulfur mustard toxicity in the lung and skin with the long-term goal to develop an effective treatment for mustard gas induced injury in lung and skin.10150 has been identified by the National Jewish Health Center of Excellence as a lead compound for its center, and research work there has been focused on further testing and studies of 10150.

Research in the area of mustard gas-mediated lung injury has provided experimental evidence that the mechanisms of these injuries are directly linked to the formation of reactive oxygen and nitrogen species and that superoxide dismutase and catalase can improve injury responses. This theory has led to the hypothesis that the administration of catalytic antioxidant therapy can protect against mustard gas-induced acute lung and dermal injury.

Non-clinical studies

In July 2013, we announced that four separate studies conducted at USAMRICD using 85 rats and comparing 2 different 10150 dosing regimens conclusively demonstrated that 10150 improves survival against an LD60-70 sulfur mustard gas exposure. 10150 improved sulfur mustard gas survival up to 82% over 48 hours. The improvement in survival seen with 10150 treated animals after sulfur mustard gas exposure correlated with improvements in clinical scores, blood oxygenation and airway obstruction. The best improvements in survival and lung function occurred with the 10150 dosing regimen of 5 mg/kg body weight given every 4 hours by subcutaneous injection (p < 0.0004).

The primary endpoints in these studies were survival and blood oxygen saturation. Secondary endpoints included clinical scores, blood gas and histopathology for cast formations. 10150 or placebo was given to rats one hour after sulfur mustard vapor exposure and repeated every 4 or 8 hours. Forty-eight hours after exposure, lung edema was assessed by changes in the bronchoalveolar lavage (BAL) protein levels. At euthanasia, 48 hours after exposure, 10150 significantly improved (p < 0.0001) pulse oximetry, and 10150 treated rats had improved blood oxygenation throughout the study period. Treatment with 10150 also restored blood gas parameters to near normal levels, including: pO2 (p < 0.001), pCO2 (p < 0.0016) and pH (p < 0.0006). Finally, 10150 treatment reduced airway cast formation by 50% at 24 hours (p < 0.017).

In prior studies 10150 reduced lung edema (p < 0.05), decreased SM-induced increases in macrophages (p < 0.05) and epithelial cells in BAL fluid (p < 0.05). In all three measurements 10150 provided approximately 100 percent protection -- with levels approximating that of the control animals in the study. These results indicate that 10150 significantly improves survival and attenuates lung injury from mustard gas exposure and may provide an effective countermeasure against mustard gas-induced lung injury.

The first whole mustard gas study was completed in October 2009. In June 2010, National Jewish Health and Lovelace Respiratory Research Institute reported results from a second whole mustard study confirming that 10150 protects lungs from whole mustard gas exposure in rats. The two studies demonstrated that10150 protects lungs from whole mustard gas exposure in rats. The primary objective of the study was to determine whether administration of 10150, after exposure, reduces the severity of acute lung injury induced by mustard gas. 10150 was given to rats one hour after sulfur mustard exposure and repeated every 6 hours. Twenty-four hours after exposure, lung edema was assessed by changes in the BAL protein levels. 10150 significantly reduced (p<0.05) mustard gas-induced lung edema as measured by BAL protein levels. In addition, 10150 decreased SM-induced increase in the numbers of BAL neutrophils. These results indicate that 10150 can attenuate lung injury from mustard gas exposure and may provide an effective countermeasure against mustard gas-induced lung injury.

13

Future Development Plans

We plan to meet with the FDA in 2015 to discuss a pivotal rat study and a second animal model for this indication. We expect to file an IND for the sulfur mustard in 2015. We also seek to launch the two pivotal efficacy studies required for approval by the FDA under the “Animal Rule” as well as complete the necessary safety studies as further described under the heading “10150 as a potential medical countermeasure against the effects of Pulmonary Acute Radiation Syndrome – Future Development Plans – Demonstrate Product Safety.”

Competition

There are currently no effective treatments for mustard gas exposure.

However, in general, we face significant competition for U.S. government funding for both development and procurements of medical countermeasures for biological, chemical and nuclear threats, diagnostic testing systems and other emergency preparedness countermeasures. The U.S. federal government has currently allocated a significant amount of research funding to the development of countermeasures against bioterrorism. As a result, there are many drug candidates under development as a possible countermeasure against chemical threat agents.

Funding Options

This development program to date has been funded under the NIH-CounterACT Program and we expect that future efficacy studies necessary for approval by the FDA, including the pivotal rat study and second animal model described above, will be funded by the NIH-CounterACT program.

10150 as a potential medical countermeasure against the effects of chlorine gas.

Overview

Chlorine gas is a toxic gas that inflicts airway injury through primary oxidative stress and secondary inflammation. Chlorine inhalation was recently used in terrorist/insurgent attacks on military and civilian populations and has caused numerous industrial, transportation, swimming pool, and household accidents, as well as deaths to members of the U.S. military in the past. Chlorine gas, also known as bertholite, was first used as a weapon in World War I. Chlorine gas was also used against the local population and coalition forces in the first Iraq War in the form of chlorine bombs.

One of the primary goals of the NIH-CounterACT program is to assist in the development of safe and effective medical countermeasures designed to prevent, diagnose, and treat the conditions caused by potential and existing chemical agents of terrorism and which can be added to the SNS. The SNS is maintained by the Centers for Disease Control and Prevention (“CDC”). The SNS now includes CHEMPACKS that are forward-deployed in secure, environmentally controlled areas throughout the United States available for rapid distribution in case of emergency. CHEMPACKS were developed for threats like chemical and nerve gas where treatment must be administered in less than 24 hours and shipment of MCMs from SNS warehouse locations is not practicable. The CDC has established a diagnostic response network for the detection of nerve agents, mustard, cyanide and toxic metals.

Worldwide, independent of warfare and chemical terrorism, chlorine is the greatest single cause of major toxic release incidents (16.Davis DS, Dewolf GB, Ferland KA, et al. Accidental Release of Air Toxins. Park Ridge, New Jersey: NDC; 1989:6-9.). In the U.S., there are about 5-6,000 exposures per year resulting in, on average, about one death, 10 major, 400-500 moderate, and 3-4,000 minor adverse outcomes. Chlorine gas causes damage to upper and lower respiratory tracts. While chlorine is an irritant, its intermediate water solubility may delay emergence of upper airway symptoms for several minutes. No specific beneficial therapies are available. 10150 has demonstrated a decrease in airway injury, inflammation, oxidative damage, hyperreactivity and cell proliferation after acute chlorine gas inhalation in mice, and therefore could be a possible beneficial therapy for chlorine gas inhalation injury to the airways.

14

Pre-clinical studies

Under a grant from NIH CounterACT, researchers from National Jewish Health and McGill University have completed a series of preliminary studies demonstrating that 10150 protects lungs from chlorine gas exposure in mice and rats. The primary objective of these studies was to determine whether administration of 10150, after exposure, reduces the severity of acute lung injury and asthma-like symptoms induced by chlorine gas. In 2010, 10150 was given to mice at a 5 mg/kg subcutaneous dose one hour after chlorine gas exposure (100 ppm for 5 minutes) and repeated every 6 hours. Twenty-four hours after exposure, lung inflammation was assessed by changes in bronchoalveolar lavage (“BAL”) cellularity and neutrophil influx. 10150 significantly reduced (p<0.05, n=6/group) chlorine gas-induced lung inflammation as measured by BAL fluid cellularity levels by 40% that appeared to be due to limiting neutrophil influx. 10150 also significantly attenuated (p<0.05, n=6) the degree of asthma-like airway reactivity induced by chlorine gas exposure by 40%. These results indicate that 10150 can attenuate lung injury and asthma-like symptoms from chlorine gas exposure and may provide an effective countermeasure against chlorine gas-induced lung injury. The data from this study was published in December 2010 as AEOL10150: A novel therapeutic for rescue treatment after toxic gas lung injury by Toby McGovern, Brian J. Day, Carl W. White, William S. Powell and James G. Martin in the journal Free Radical Biology and Medicine.

National Jewish Health replicated the mice studies previously conducted by McGill University in rats to determine whether 10150 mitigates lung damage due to chlorine gas exposure in multiple studies between 2011 and 2013. In these studies, 10150 significantly reduced protein, white blood cell, red blood cell, macrophage and neutrophil counts in Broncho-alveolar lavage fluid. Additional studies are ongoing at National Jewish Health.

Future Development Plans

We plan to develop a second animal model and to launch the two pivotal efficacy studies required for approval by the FDA under the “Animal Rule.” We believe that the safety and CMC work being done under the BARDA Lung-ARS further described under the heading “10150 as a potential medical countermeasure against the effects of Pulmonary Acute Radiation Syndrome – Future Development Plans” will be sufficient to satisfy the safety and CMC requirements for an NDA filing.

Competition

There are currently no effective treatments for chlorine gas exposure.

However, in general, we face significant competition for U.S. government funding for both development and procurements of MCMs for biological, chemical and nuclear threats, diagnostic testing systems and other emergency preparedness countermeasures. The U.S. federal government has currently allocated a significant amount of research funding to the development of countermeasures against bioterrorism. As a result, there are many drug candidates under development as a possible countermeasure against chemical threat agents.

Funding Options

This development program to date has been funded under the NIH-CounterACT Program and we expect that future efficacy studies necessary for approval by the FDA will be funded by the NIH-CounterACT program.

AEOL 10150 as a potential medical countermeasure against the effects of nerve gas

Overview

Nerve agents, such as sarin gas, have been used in Syria, Iraq and Japan and pose a threat to civilian and military personnel. Sarin gas exposure can cause pain, weakness, vomiting, diarrhea and changes in heart rate within minutes to 18 hours after exposure. High levels of exposure can cause convulsions, paralysis, breathing problems and death. BARDA classifies nerve agents as a priority threat.

10150 is the focus of a sponsored research grant awarded by the National Institutes of Health (NIH), National Institute of Neurological Disorders and Stroke (NINDS) and Office of the Director (OD) to the University of Colorado to test its potential efficacy as a MCM against nerve agents.

15

Pre-clinical studies

In September 2013, we announced that researchers, led by Dr. Manisha Patel at the University of Colorado, completed a pilot study demonstrating that 10150 provides neuroprotection, decreases oxidative stress, and significantly improves survival in rats exposed to pilocarpine – a surrogate for the nerve agents soman and sarin gas. These data were presented at the 6th Annual CounterACT Countermeasures Against Chemical Threats Network Research Symposium in Washington, D.C.

The current standard of care for nerve agent exposure is Atropine® and benzodiazepines. In this study 10150 significantly improved the survival of animals exposed to pilocarpine. Injection of 10150 sixty minutes after pilocarpine in the presence of standard therapy resulted in 100% survival and near complete inhibition of oxidative stress indices in the hippocampus.

Future Development Plans

On September 10th 2013, NIH-NINDS notified Dr. Patel that a total of $4.3 million had been awarded for her project titled “Neuroprotective Effects of AEOL 10150 against organophosphate toxicity.” The research work is being conducted in Dr. Patel’s lab at the University of Colorado, National Jewish Health as well as at the USAMRICD. Funding for this research has been awarded under a grant supported by the CounterACT Program, National Institutes of Health Office of the Director (NIH OD), and the NINDS

Competition

The current standard of care for nerve agent exposure is Atropine® and benzodiazepines. 10150 would be added to current standard of care to improve outcomes. We believe that other companies are developing potential treatments for nerve gas, although it is difficult to evaluate their success unless data is announced publicly

However, in general, we face significant competition for U.S. government funding for both development and procurements of medical countermeasures for biological, chemical and nuclear threats, diagnostic testing systems and other emergency preparedness countermeasures. The U.S. federal government has currently allocated a significant amount of research funding to the development of countermeasures against bioterrorism. As a result, there are many drug candidates under development as a possible countermeasure against chemical threat agents.

Funding Options

This development program to date has been funded under the NIH-CounterACT Program and NINDS and we expect that future efficacy studies necessary for approval by the FDA will also be funded by the $4.3 million grant to Dr. Patel.

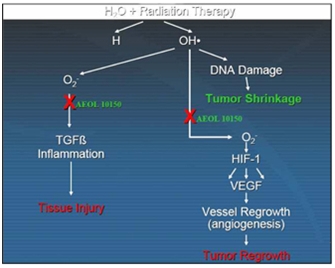

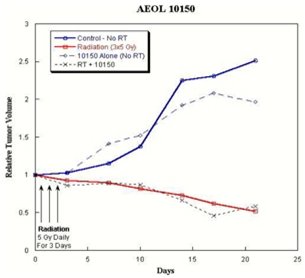

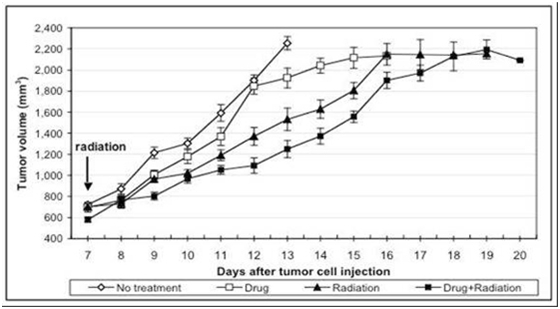

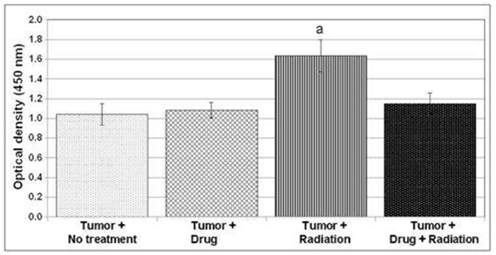

AEOL 10150 in Radiation Therapy

Overview

According to the American Cancer Society, cancer is the second leading cause of death by disease, representing one out of every four deaths in the United States. Approximately 572,000 Americans were expected to die of cancer in 2011. In 2012, about 1.6 million new cancer cases were expected to be diagnosed in the United States. According to the Radiological Society of North America, about 50 to 60 percent of cancer patients are treated with radiation at some time during their disease.