UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 13, 2013

|

UNITED STATES ANTIMONY CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Montana

|

33-00215

|

81-0305822

|

||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

P.O. Box 643

Thompson Falls, Montana

|

59873

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (406) 827-3523

|

Not Applicable

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.07 Submission of Matters to a Vote of Security Holders.

On December 13, 2014, the Registrant held its Annual Meeting. As of the record date for the Annual Meeting, there were 65,933,564 shares entitled to vote on all matters presented to the Registrant’s shareholders at the Annual Meeting. At the Annual Meeting, there were 34,823,822 votes cast, representing approximately 53% of the combined voting power of the Registrant’s common stock, Series B preferred stock, Series C preferred stock and Series D preferred stock were present in person or represented by proxy.

The following are the voting results on each matter submitted to the Registrant’s shareholders at the Annual Meeting. The proposals below are described in detail in the Proxy Statement. At the Annual Meeting, the five nominees for directors were elected to the Registrant’s Board of Directors (Proposal 1 below). In addition, a management proposal regarding ratification of the appointment of DeCoria, Maichel & Teague P.S. as the Registrant’s independent registered public accounting firm for 2014 (Proposal 2 below) was approved.

|

Proposal #1 – Election of Directors

|

Voted For

|

Withheld

|

Non Vote

|

|||||||||

| The election of the Nominees to the Company’s Board to serve until the Company’s 2014 Annual Meeting of Shareholders or until successors are duly elected and qualified: | ||||||||||||

|

John C. Lawrence

|

34,823,822 | 681,506 | 30,248,236 | |||||||||

|

Gary D. Babbitt

|

32,439,101 | 3,066,227 | 30,428,236 | |||||||||

|

Harmut W. Baitis

|

32,439,101 | 3,066,227 | 30,428,236 | |||||||||

|

Russell C. Lawrence

|

33,581,178 | 1,924,150 | 30,428,236 | |||||||||

|

Whitney H. Ferer

|

32,439,101 | 3,066,227 | 30,428,236 | |||||||||

|

Proposal #2

|

For

|

Against

|

Abstain

|

Non Vote

|

||||||||||||

|

To ratify the appointment of the Company’s Independent Registered Public Accounting Firm for the 2014 fiscal year

|

||||||||||||||||

| 35,327,913 | 10,460 | 167,065 | 30,248,126 | |||||||||||||

Proxies were solicited under the proxy statement filed with the Securities and Exchange Commission on October 20, 2014. All nominees for director were elected. The proposal to ratify the appointment of the Company’s Independent Registered Public Accounting Firm for the 2014 fiscal year was approved.

2

Item 2.02 Results of Operations and Financial Condition.

SUMMARY ANNUAL MEETING 13 DECEMBER 2014

John C. Lawrence, President of the Company, told shareholders at the 2014 Annual Meeting, that USAC’s mission is to capture 50% of the domestic market for antimony which is approximately 55,000,000 pounds per year. The Company’s strategy, he said, has been to control the source of raw materials. “Historically, Bolivia, Mexico, and China controlled the raw material sources. Bolivia and Mexico became dormant due to low prices, and China assumed more than 90% of the world supply. Our strategy was to gain control of the significant Mexican antimony mines, construct two mills, and increase our smelting capacity in Mexico,” Lawrence said.

Lawrence reported that the Company achieved an all time 9-month record production of 1,358,518 pounds and expects to produce more than 1,800,000 pounds during 2014. From Q2 until Q3of 2014, the Company’s antimony sales increased approximately 60%, he said. “Four new furnaces were added to the Mexican smelter by early Q4 at a cost of $600,000,” Lawrence said. “They will increase our Mexican production by 50%. The natural gas line at the Mexican smelter was connected during the latter part of Q3 at a cost of approximately $1,800,000. This will reduce our Mexican costs by approximately $.70 per pound and company-wide costs by$.25 per pound.”

Lawrence reported that USAC has entered into an agreement with Hillgrove Mines of Australia to purchase, process and sell 200 tons per month of a 60% antimony concentrate that contains 20 grams of gold per ton. There is a provision in the contract, Lawrence said, that would allow Hillgrove to triple their off-take to the Company. He noted that USAC has developed a leach process to make a high recovery of the silver and gold from Los Juarez concentrates. The leaching plant is expected to be permitted, installed and operating by the second half of 2015 Lawrence said.

During 2015, Lawrence reported, the Company is expecting to produce 4,500,000 to 5,000,000 pounds of antimony, while a Canadian off-take agreement should provide approximately 1,200,000 pounds. “Mexican production should provide 1,000,000 pounds per year and is growing fast,” Lawrence said. “Hillgrove production should start in the first quarter of 2015 and reach an annualized production of 3,000,000 pounds of antimony with 1,500 ounces of gold.”

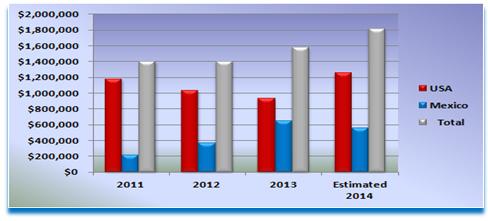

At the Annual Meeting, Lawrence displayed the following information in graph form:

| Antimony Sales in pounds | 2011 | 2012 | 2013 | Estimated 2014 | ||||||||||||

| USA | 1,179,973 | 1,031,164 | 931,789 | 1,255,007 | ||||||||||||

| Mexico | 221,450 | 372,046 | 647,393 | 561,469 | ||||||||||||

| Total | 1,401,423 | 1,403,212 | 1,579,182 | 1,816,476 | ||||||||||||

| Total Sales in Dollars | $ | 10,406,636 | $ | 8,753,449 | $ | 8,375,158 | $ | 8,159,198 | ||||||||

| Average price per pound | $ | 7.43 | $ | 6.24 | $ | 5.30 | $ | 4.49 | ||||||||

3

Finally, Lawrence reported that Bear River Zeolite Company, or BRZ, the Company’s subsidiary that is mining and producing zeolite in southwestern Idaho, is expected to double production in 2015 by making sales to the oil and gas industry.

| Zeolite Production | 2011 | 2012 | 2013 | Estimated 2014 | ||||||||||||

| Tons Shipped | 12,105 | 12,189 | 11,182 | 10,817 | ||||||||||||

| Average Price per Ton | $ | 168.83 | $ | 216.73 | $ | 196.96 | $ | 197.32 | ||||||||

| Gross Revenues | $ | 2,043,641 | $ | 2,641,699 | $ | 2,202,414 | $ | 2,134,400 | ||||||||

| Gross Profit | $ | 118,185 | $ | 313,442 | $ | 404,454 | $ | 225,000 | ||||||||

4

Forward Looking Statements:

The foregoing disclosure contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are based upon current expectations or beliefs, as well as a number of assumptions about future events, including matters related to the Company's operations, pending contracts and future revenues, ability to execute on its increased production and installation schedules for planned capital expenditures and the size of forecasted deposits. Although the Company believes that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, it can give no assurance that such expectations and assumptions will prove to have been correct. Undue reliance should not be placed on these forward-looking statements, as these statements are subject to numerous factors and uncertainties. In addition, other factors that could cause actual results to differ materially are discussed in the Company's most recent filings, including Form 10-KSB with the Securities and Exchange Commission.

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

UNITED STATES ANTIMONY CORPORATION

|

|||

|

Date: December 13, 2014

|

By:

|

/s/ John C. Lawrence | |

|

John C. Lawrence

|

|||

|

President, Director and Principal Executive Office

|

|||

6