Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UMB FINANCIAL CORP | d837997d8k.htm |

| EX-2.1 - EX-2.1 - UMB FINANCIAL CORP | d837997dex21.htm |

| EX-99.1 - EX-99.1 - UMB FINANCIAL CORP | d837997dex991.htm |

Acquisition of Marquette Financial Companies

Strategically Compelling, Financially Attractive

December 15, 2014

UMB Financial Corporation

Exhibit 99.2 |

Cautionary Notice about Forward-Looking Statements

2

This presentation contains, and our other communications may contain,

forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly

to historical or current facts—such as our statements about accretion to

tangible book value per share or earnings per share, post-closing

capital ratios, cost savings, pro forma ownership, deposit share ranking, and the phase-out of high-cost funding.

Forward-looking

statements

often

use

words

such

as

“believe,”

“expect,”

“anticipate,”

“intend,”

“estimate,”

“project,”

“outlook,”

“forecast,”

“target,”

“trend,”

“plan,”

“goal,”

or other words of comparable meaning or future-tense or conditional verbs such

as “may,”

“will,”

“should,”

“would,”

or “could.”

Forward-looking statements convey our expectations, intentions, or forecasts

about future events, circumstances, results, or aspirations.

All forward-looking statements are subject to assumptions, risks, and

uncertainties, which may change over time and many of which are beyond our

control. You should not rely on any forward-looking statement as a prediction or guarantee about the

future. Our actual future objectives, strategies, plans, prospects, performance,

condition, or results may differ materially from those set forth in any

forward-looking statement. Some of the factors that may cause actual results or other future events,

circumstances, or aspirations to differ from those in forward-looking

statements are described in our Annual Report on Form 10-K

for

the

year

ended

December

31,

2013,

our

subsequent

Quarterly

Reports

on

Form 10-Q or Current Reports on Form 8-

K, or other applicable documents that are filed or furnished with the Securities

and Exchange Commission (SEC). Any forward-looking statement made by us

or on our behalf speaks only as of the date that it was made. We do not

undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that

arise after the date that the statement was made. You, however, should consult

further disclosures (including disclosures of a forward-looking

nature)

that

we

may

make

in

any

subsequent

Annual

Report

on

Form

10-K, Quarterly Report on Form 10-Q,

Current Report on Form 8-K, or other applicable document that is filed or

furnished with the SEC. |

Transaction Rationale

Complementary balance sheet combining Marquette Financial Companies’

higher-yielding loans and higher loan-to-deposit ratio with UMB’s

low-cost funding

Enhances UMB’s market share in important Dallas and Phoenix markets

Adds national specialty-lending businesses—asset-based lending and

transportation-focused factoring—and an asset-management

business Expected

to

be

immediately

accretive

to

UMBF

TBV

per

share

at

closing

(1)

Estimated to be accretive to 2016 EPS

Attractively

priced

at

approximately

1.6x

MFC

TBV

(1)

Comprehensive diligence performed

Strong understanding of MFC’s geographies

Compatible banking cultures

Strong post-closing capital ratios anticipated

3

(1)

See pages 13 and 14 for explanation of non-GAAP financial measures. UMBF and

MFC TBV as of 9/30/2014. Pricing based on UMBF 12/12/2014, closing share

price of $53.16. Strategically

Compelling

Strong Transaction

Economics

Low Execution Risk |

Transaction Overview

Approximately $182.5

million, or 3.4 million shares of UMBF (100% stock

consideration),

subject

to

closing

equity

adjustments

and

fill-or-kill

rights

(1)

Customary regulatory approvals

Mid-2015

1.6x MFC TBV, versus a median of 2.1x for recent

Southwest transactions

(1) (2) (3)

4

(2)

Southwest includes Arizona, Colorado, Louisiana, New Mexico, Oklahoma, Texas &

Utah. 2.1x is the median of transactions since 2011 with target assets between

Approximately $14 million (23% of the past twelve months of MFC

noninterest

expense

at

September

30,

2014)

to

be

phased

in

over

2

years

(4)

$23 million

(3)

See pages 13 and 14 for explanation of non-GAAP financial measures. UMBF and

MFC TBV as of 9/30/2014. (1)

Pricing based on UMBF 12/12/2014, closing share price of $53.16.

(4)

Source: MFC financial reports.

Approximately

7%

of

UMBF

shares

to

be

owned

by

the

Pohlad

family

(1)

Required Approvals

Anticipated Closing

Pro Forma Ownership

Transaction Costs

Cost Savings

Pricing

Consideration

$750mm - $5.0bn and NPAs / Assets <5.0%. Source: SNL

Financial. |

Overview of Marquette Financial Companies

$1.3 billion in assets, $1.0 billion in loans & leases, $1.0 billion in

deposits Original bank formed 36 years ago in Phoenix

Privately owned by the Pohlad family

Assets under management of $716 million

5 branches and $318 million of loans and $378 million of deposits in Dallas

8 branches and $322 million of loans and $574 million of deposits in Phoenix

Commercially focused, with C&I and owner-occupied CRE comprising 57%

of loans

Middle-market ABL with $230 million in loans outstanding

Factoring business with $102 million in loans outstanding

Attractive risk-adjusted loan yields

Significant deposit and wholesale-funding synergistic opportunities

High loan-to-deposit ratio and net interest margin

Overall

Attractive Community

Banking Franchise

High Quality National

Specialty Lending

Complementary

Balance Sheet

5

Note: Financial data as of 9/30/2014. Source: MFC financial reports and regulatory

filings. |

Arizona and Texas Franchises

Meridian Bank, N.A.

Meridian Bank Texas

Phoenix

ranked

as

the

3

rd

fastest-growing

large

metro

market in the U.S.

Favorable competitive dynamics to grow UMB model

Will expand UMB branches from 2 to 10

Will add $322 million of in-market loans and $574

million of deposits

Platform for delivering enhanced banking services

Will increase UMB’s FDIC deposit share ranking to 12

from 28

Dallas/Fort Worth ranked as the 4

th

fastest-growing

large metro market in the U.S.

Will expand UMB branches from 2 to 7

Will add $318 million of in-market loans and $378

million of deposits

Will complement existing loan-production team

Will increase UMB’s FDIC deposit share ranking to

41 from 146

6

Note: Financial data as of 9/30/2014. Source: UMBF public filings and MFC

regulatory reports. Maps from SNL Financial. (1)

Source: Forbes’

“America's 20 Fastest-Growing

Cities,”

2/14/2014; ranked on growth in population and jobs, gross metro product

growth, unemployment and median salaries for college-educated

workers. (1)

(1)

UMBF

MFC

: 8 Branches

UMBF

MFC

: 5 Branches |

Financial Summary

2011

2012

2013

YTD

9/30/14

Gross Loans ($000s)

213,038

185,335

226,840

229,898

Yield on Earning Asset

8.44%

7.66%

7.80%

7.84%

NPAs/Assets

2.11%

1.08%

0.11%

0.21%

NCOs/Average Loans

-0.74%

0.42%

0.06%

0.00%

National Specialty-Lending Businesses

Middle-Market Asset-Based Lending

Factoring Business

$230 million in loans outstanding

ABL providing $1 -

$15 million in credit

Secured lines of credit against A/R, inventory,

machinery and equipment, real estate loans, cash-

flow-supported term loans

7.84%

earning-asset

yield

in

3

rd

quarter

2014

Low historical charge-offs

Key Data

National lender with industry-focused solutions for

transportation businesses

$102 million in loans outstanding

Financing on average $120 million per month

Lines of credit from $0.2 to $15 million

14.40%

earning-asset

yield

in

3

rd

quarter

2014

Low historical charge-offs

Key Data

7

Note: Financial data as of 9/30/2014. Source: MFC financial reports.

Financial Summary

2011

2012

2013

YTD

9/30/14

Gross Loans ($000s)

90,908

101,786

112,107

101,765

Yield on Earning Asset

13.12%

13.13%

13.97%

14.40%

NPAs/Assets

0.55%

0.00%

0.03%

0.17%

NCOs/Average Loans

0.89%

0.04%

-0.08%

0.15% |

Loan

Composition UMB Financial

MFC

Pro Forma

(1)

MFC Loans by Business Unit

Key Takeaways

Gross Loans: $7.1 billion

Avg. Yield: 3.50%

Gross Loans: $1.0 billion

Avg. Yield: 7.00%

Gross Loans: $8.1 billion

Avg. Yield: 3.92%

Asset-Based

Lending

Arizona Bank

Texas Bank

8

Portfolio exhibiting favorable growth trends

National specialty-lending businesses further diversify and enhance

UMB’s strong commercial-loan portfolio and provide opportunities for

growth across the UMB footprint

Strong yield principally driven by attractive risk-adjusted returns from

ABL and factoring businesses

(1)

Pro forma is defined as 9/30/2014 financials for both UMBF and MFC combined.

Includes no growth projections or purchase-accounting adjustments. Note:

Financial data as of 9/30/2014. Source: UMBF public filings and MFC financial reports and regulatory filings. Avg. yield for 3Q 2014.

33%

33%

24%

10%

C&I

47%

Owner

-

Occupied

CRE

16%

Investor

CRE

6%

1-4 Family

14%

Other

17%

C&I

46%

Owner-

Occupied

CRE

11%

Investor

CRE

15%

1-4 Family

16%

Other

12%

C&I

47%

Owner-

Occupied

CRE

16%

Investor

CRE

5%

1-4 Family

13%

Other

19%

Factoring |

MFC

UMB

Deposit and Funding Composition

Cost of Funds

Pro Forma

(1)

Total Deposits: $12.8 billion

Avg. Cost of Deposits: 0.10%

Total Deposits: $1.0 billion

Avg. Cost of Deposits: 0.56%

9

Total Deposits: $13.7 billion

Avg. Cost of Deposits: 0.13%

Key Takeaways

MFC average cost of deposits of 0.56%

Offer clients UMB’s enhanced deposit services

High-cost funding expected to be phased out

Credit lines paid off at closing

FHLB borrowing runoff based on maturity schedule

Brokered deposits and jumbo CDs runoff based on

maturity schedule

(1)

Pro forma is defined as 9/30/2014 financials for both UMBF and MFC combined.

Includes no growth projections or purchase-accounting adjustments.

Note:

Financial

data

as

of

9/30/2014.

Source:

UMBF

public

filings

and

MFC

regulatory

filings.

MFC

cost

of

funds

from

SNL

Financial.

Avg.

cost

of

deposits

for

3Q

2014.

0.09%

1.01%

0.17%

UMBF

MFC

Pro Forma

MMDA &

Savings

70%

Transaction

23%

Jumbo CDs

4%

Retail CDs

3%

MMDA &

Savings

42%

Transaction

17%

Jumbo CDs

29%

Retail CDs

12%

MMDA &

Savings

68%

Transaction

22%

Jumbo CDs

6%

Retail CDs

4% |

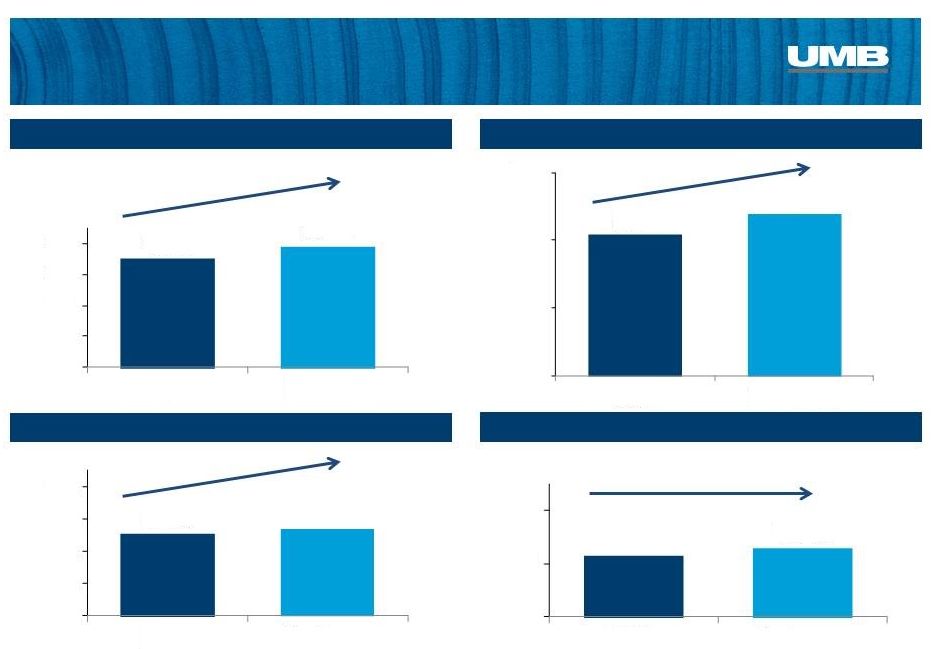

Average Yield on Loans

Key Pro Forma Performance Metrics

Average Loans / Deposits

Nonperforming Loans/Total Loans

Net Interest Margin

10

(1)

Pro forma is defined as 9/30/2014 financials for both UMBF and MFC combined.

Includes no growth projections or purchase-accounting adjustments.

(1)

(1)

(1)

(1)

Note: Financial data as of 9/30/2014. Source: UMBF public filings and MFC

regulatory filings. Avg. yield for 3Q 2014. 3.50%

3.92%

0.0%

1.0%

2.0%

3.0%

4.0%

UMBF

Pro Forma

55.95%

58.86%

35.0%

45.0%

55.0%

65.0%

UMBF

Pro Forma

2.53%

2.70%

0.0%

1.0%

2.0%

3.0%

4.0%

UMBF

Pro Forma

0.46%

0.52%

0.0%

0.4%

0.8%

UMBF

Pro Forma |

Summary

Strategically Compelling

Financially Attractive

Low Execution Risk

Complementary balance sheet

Enhances share in two important markets

Adds national lending businesses and asset-

management firm

Expected to be accretive to TBV per share

Estimated to be accretive to EPS

Strong understanding of company, business

model, and markets

Similar cultures

11 |

Appendix

December 15, 2014

UMB Financial Corporation |

Non-GAAP Reconciliation

13

Tangible Book Value Per Share of UMBF at September 30, 2014

GAAP

Total

Shareholders’

Equity

$1,615,349

Deduct:

Goodwill

and

Other

Intangibles

($256,724)

Tangible

Book

Value

$1,358,625

UMBF

Shares

Outstanding

45,485

Tangible

Book

Value

Per

Share

$29.87

GAAP

Total

Shareholders’

Equity

Per

Share

$35.51

In this presentation, we provide information using the tangible book value (TBV)

per share of UMBF and the TBV of MFC. This information supplements the

results that are reported according to generally accepted accounting

principles (GAAP) and should not be viewed in isolation from, or as a

substitute for, GAAP results. The difference between each of the TBV per share of UMBF and the

TBV of MFC, as applicable on the one hand, and the comparable GAAP measure, on the

other hand, is reconciled in this and the following slide. We believe that

this information and the reconciliations

may

be

useful

to

investors

because

TBV

per

share

and

TBV

are

commonly

used

by

investors as an additional measure of a company’s total value and the strength

and adequacy of its capital-management strategies.

Note: Unaudited. Values in thousands except per share data.

Source: UMBF Public Filings |

Non-GAAP Reconciliation

Price to MFC Tangible Book Value at September 30, 2014

GAAP

Total

Shareholders’

Equity

$123,681

Deduct: Goodwill and Other Intangibles

($7,658)

Tangible Book Value

$116,023

Total

Expected

Consideration

(1)

$182,522

Price to Tangible Book Value

157%

Price

to

GAAP

Total

Shareholders’

Equity

148%

Note: Unaudited. Values in thousands except per share data.

Source: MFC regulatory filings.

14

(1)

Based on UMBF 12/12/2014 closing share price of $53.16 and consideration of 3.4

million shares of UMBF stock. |

Estimated Transaction Costs

(1)

Total includes $20.0 million of direct expense and $3.0 million of capitalized

costs. 15

(Dollars in millions)

HR Costs

$7.2

Technology Integration

$6.8

Professional Fees

$3.5

Other Integration Fees

$5.5

Total Estimated Transaction Costs

(1)

$23.0 |