Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - AXIOM OIL & GAS CORP. | Financial_Report.xls |

| EX-32.1 - AXIOM OIL & GAS CORP. | exhibit32-1.htm |

| EX-31.2 - AXIOM OIL & GAS CORP. | exhibit31-2.htm |

| EX-32.2 - AXIOM OIL & GAS CORP. | exhibit32-2.htm |

| EX-31.1 - AXIOM OIL & GAS CORP. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2014

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-53232

AXIOM OIL AND GAS CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

(State of other jurisdiction of incorporation or organization)

|

27-06864455

(IRS Employer Identification Number)

|

1846 E. Innovation Park Dr. Oro Valley, AZ 85755

(Address of principal executive offices)

(303) 872-7814

(Registrant's telephone number, including area code)

____________

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes xNo

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes xNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. xYes oNo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). oYes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes xNo

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of February 28, 2014: $1,204,338.

State the number of shares outstanding of each of the issuer's classes of common equity, as of December 10, 2014: 18,960,650 shares of common stock.

Documents incorporated by reference. There are no annual reports to security holders, proxy information statements, or any prospectus filed pursuant to Rule 424 of the Securities Act of 1933 incorporated herein by reference.

TABLE OF CONTENTS

|

PART I

|

||

|

Item 1.

|

Business

|

2 |

|

Item 1A.

|

Risk Factors

|

23 |

|

Item 1B.

|

Unresolved Staff Comments

|

34 |

|

Item 2.

|

Properties

|

34 |

|

Item 3.

|

Legal Proceedings

|

34 |

|

Item 4.

|

Mine Safety Disclosures

|

34 |

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

35 |

|

Item 6.

|

Selected Financial Data

|

38 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

38 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

45 |

|

Item 8.

|

Financial Statements and Supplementary Data

|

46 |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

47 |

|

Item 9A.

|

Controls and Procedures

|

47 |

|

Item 9B.

|

Other Information

|

48 |

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers, and Corporate Governance

|

49 |

|

Item 11.

|

Executive Compensation

|

50 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

53 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

54 |

|

Item 14.

|

Principal Accounting Fees and Services

|

55 |

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

56 |

1

PART 1

Forward-Looking Information

This Annual Report of Axiom Oil and Gas Corp. on Form 10-K contains forward-looking statements, particularly those identified with the words, anticipates, believes, expects, plans, intends, objectives and similar expressions. These statements reflect management's best judgment based on factors known at the time of such statements. The reader may find discussions containing such forward-looking statements in the material set forth under “Management's Discussion and Analysis of Financial Condition and Results of Operations”, generally, and specifically therein under the captions “Liquidity and Capital Resources” as well as elsewhere in this Annual Report on Form 10-K. Actual events or results may differ materially from those discussed herein. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. No assurance can be given that any of the assumptions relating to the forward-looking statements specified in the following information are accurate, and we assume no obligation to update any such forward-looking statements.

Item 1. Business

General

The Company was incorporated in the State of Nevada on February 13, 2007. The Company was in the development stage of its business through fiscal 2010 when it abandoned its previous business of providing consulting services to private and public entities seeking assessment, development, and implementation of energy generating solutions. Effective fiscal 2011, we changed our planned business activities to the exploration and development of precious metal properties. As part of our business strategy, we acquired another business, Axiom de Mexico S.A. de C.V. (“Axiom Mexico”). On May 31, 2012, we sold all of our interest in Axiom Mexico to an unrelated third party for $100 releasing us from any liabilities in Axiom Mexico. In August 2012, we acquired additional mineral properties and planned to explore those properties in 2013. We were unable to raise the required funds to explore our mineral properties and in February 2013 we dropped those mineral claims. Subsequent to the year ended August 31, 2013, we effected a 1:25 reverse spilt on our common stock and changed our name to Axiom Oil and Gas Corp. It is our intention to refocus our efforts on acquiring and developing oil and gas assets. On March 18, 2014, we entered into a Lease Purchase Agreement with Alberta Oil and Gas LP (“LP”) to purchase its interest in certain leases. On October 14, 2014, we finalized a Lease Purchase Agreement with Alberta Oil and Gas LP whereby we purchased certain oil and gas leases and the leasehold estates created thereby located in Toole County, Montana totaling 14,916.94 gross acres, 6,170.76 net acres which includes a 23.1% working interest in two oil and gas wells drilled on the leases and a 50% interest in two producing gas wells on the leases (the “Leases”). The purchase price for the Leases was $2,919,211 ($3,269,076 CDN), of which $44,600 ($50,000 CDN) is to be paid in cash from future cash flow or from future financing, $1,339,470 ($1,500,000 CDN) in the form of the assumption of a note secured against the Leases (of which $1,265,100 ($1,416,717 CDN) remains owing) and the remainder in the form of 6,997,876 shares of our common stock valued at $0.23 per share, approximately $1,610,000.

Tanglewood Energy LLC had a part ownership position in some of the leases we own. We believe that it has forfeited its positions, and the gross acreage and net acreages reported above includes acreage that we believe that Tanglewood Energy LLC forfeited and that American Midwest Oil and Gas (a former operator) registered as defaulted in the court registry in Shelby, Montana. For a more complete description of Tanglewood Energy LLC and our position on the defaults and forfeitures, please see “Description of Business – Legal Proceedings” and “Risk Factors – Risk Associated with Our Business”. Some of our leases are shared 50% with Tanglewood Energy LLC who is insolvent and as such has defaulted on its obligations to maintain its interests in the shared leases below. If the forfeitures were to be challenged and proven not to have occurred, our net mineral acreage would be reduced by 1,735.53 acres.

2

This is a related party transaction as one of our directors and largest shareholders, our Chief Executive Officer and our Chief Financial Officer are affiliates of Alberta Oil and Gas LP.

Our wholly owned subsidiary, Toole Oil and Gas Corp. is the registered owner of our interest in the leases.

Our plan of operation is forward looking, and we may not be successful in our operations.

We are in the exploration stage and will continue to be in the exploration stage until we generate significant revenue from our business operations. To date, we have not generated any revenues. We maintain our statutory registered agent's office at 2360 Corporate Circle, Suite 400, Henderson, NV 89074-7722. Our administrative office is located at 1846 E. Innovation Park Dr., Oro Valley, AZ 85755. Our telephone number is (303) 872-7814.

Our Prior Strategy

Originally, our business was to concentrate on providing consulting services to private and public entities seeking assessment, development, and implementation of energy generating solutions. We have abandoned this strategy. We then changed our strategy to explore for precious metal properties. On January 13, 2012, we completed our acquisition of all of the outstanding shares of Axiom Mexico whereby through our wholly owned Mexican subsidiary, Axiom Acquisition Corp, acquired all of the issued and outstanding shares of Axiom Mexico, by the issuance of eighty thousand (80,000) of our common shares. The surviving company was Axiom de Mexico S.A. de C.V., which was our wholly owned Mexican corporation that had options on two mineral concessions in Sonora State, Mexico. On May 31, 2012, we sold all of our interest in Axiom Mexico to an unrelated third party for $100 releasing us from any liabilities in Axiom Mexico. In August 2012, we acquired the 13 Fico claims in the Yukon Territory of Canada. In February 2013 we abandoned the 13 Fico claims. We have abandoned this strategy as well.

Our Current Strategy:

We changed the focus of our Company to the exploration and development of oil and gas leases, mainly in the United States of America. On October 12, 2013 we changed our name to Axiom Oil and Gas Corp. On March 18, 2014, we entered into a Lease Purchase Agreement with Alberta Oil and Gas LP (“LP”) to purchase its interest in the Leases. On October 14, 2014, we finalized a Lease Purchase Agreement with Alberta Oil and Gas LP whereby we purchased certain oil and gas leases and the leasehold estates created thereby located in Toole County, Montana totaling 14,916.94 gross acres, 6,170.76 net acres which includes a 23.1% working interest in two oil and gas wells drilled on the leases and a 50% interest in two producing gas wells on the leases. The purchase price for the leases was $2,919,211 ($3,269,076 CDN), of which $44,600 ($50,000 CDN) is to be paid in cash from future cash flow or from future financing, $1,339,470 ($1,500,000 CDN) is in the form of the assumption of a note secured against the leases (of which $1,265,100 ($1,416,717 CDN) remains owing) and the remainder was paid in the form of 6,997,876 shares of our common stock valued at $0.23 per share.

Tanglewood Energy LLC had a part ownership position in some of the leases we own. We believe that it has forfeited its positions, and the gross acreage and net acreages reported above includes acreage that we believe Tanglewood Energy LLC forfeited and that American Midwest Oil and Gas, Corp. (a former operator) registered as defaulted in the court registry in Shelby, Montana. For a more complete description of Tanglewood Energy LLC and our position on the defaults and forfeitures, please see “Description of Business – Legal Proceedings” and “Risk Factors – Risk Associated with Our Business”. Some of our leases are owned 50% by Tanglewood Energy LLC who is insolvent and as such has defaulted on its obligations to maintain its interests in the leases below. If the forfeitures were to be challenged and proven not to have occurred, our net mineral acreage would be reduced by 1,735.53 acres.

This is a related party transaction as one of our directors and largest shareholders, our Chief Executive Officer and our Chief Financial Officer are affiliates of Alberta Oil and Gas LP.

Our wholly owned subsidiary, Toole Oil and Gas Corp. is the registered owner of our interest in the leases.

3

Glossary of Terms:

Abandon: (1) The proper plugging and abandoning of a well in compliance with all applicable regulations, and the cleaning up of the well site to the satisfaction of any governmental body having jurisdiction and to the reasonable satisfaction of the operator. (2) To cease efforts to find or produce from a well or field. (3) To plug a well completion and salvage material and equipment.

Acreage: An area, measured in acres, which is subject to ownership or control by those holding total or fractional shares of working interests. Acreage is considered developed when development has been completed. A distinction may be made between “gross” acreage and “net” acreage. “Gross Acreage” means all Acreage covered by any working interest, regardless of the percentage of ownership in the interest.

AECO: The AECO “C” spot price, which is the Alberta gas trading price, has become one of North America’s leading price-setting benchmarks for natural gas.

AFE: Authority or authorization for expenditure. A cost estimate of doing something. The AFE of drilling a well is estimated both as a dry hole and as a completed well.

Anhydrite: A salt mineral composed of anhydrous calcium sulfate (CaSO4).

Average BOPD per year for first year: The measure of oil output, represented by the number of barrels of oil produced per day, on average per Well, during the First Year Revenue Period.

Barrel: A unit of volume measurement used for petroleum and its products (~42 U.S. gallons).

Barrel of Oil Equivalent or BOE: A unit of energy based on the approximate energy released by burning one barrel (~42 U.S. gallons) of crude oil.

BOPD: Barrels of Oil Per Day

Borehole: The hole as drilled by the drill bit.

Casing: Steel pipe cemented in the borehole to seal off formation fluids or keep the hole from caving in.

Commercial Well: A well that produces hydrocarbons in commercial quantities (i.e., enough to commence sales to an oil refinery and/or gas pipeline carrier in a profitable way or method).

Completion: The installation of permanent wellhead equipment for the production of oil and gas.

°API Gravity (degree API gravity): A measure of the density of a liquid or a gas. Freshwater is 10. Average weight oil is 25 to 35, heavy oil is below 25, light oil is 35 to 45 and condensate is above 45 °API gravity.

Dolostone: Or dolomite rock, is a sedimentary carbonate rock that contains a high percentage of the mineral dolomite. It forms from the natural chemical alteration of limestone and is often a reservoir rock.

Dry Hole or Non-commercial Well: A well that does not produce hydrocarbons in Commercial Well quantities.

EUR: Estimated Ultimate Recovery; that is, the number of barrels of oil that may be produced during the life span of a well.

Exploration Drilling: Drilling carried out to determine whether hydrocarbons are present in a particular area or structure.

Exploration phase: The phase of operations which covers the search for oil or gas by carrying out detailed geological and geophysical surveys followed up where appropriate by exploratory drilling.

Exploration well: A well drilled in an unproven area. Also known as a "wildcat well".

4

Farm In: When a company acquires an interest in a block by taking over all or part of the financial commitment for drilling an exploration well.

Field: A geographical area under which an oil or gas reservoir lies.

40 Acre Spacing: Area of land containing 1 oil well, generally regulated by State regulations.

Fracking or Hydraulic Fracturing: The fracturing of rock by a pressurized liquid. Some hydraulic fractures form naturally—certain veins or dikes are examples. Induced hydraulic fracturing or hydrofracturing, commonly known as fracking, is a technique in which typically water is mixed with sand and chemicals, and the mixture is injected at high pressure into a wellbore to create small fractures (typically less than 3/8th inches), along which fluids such as gas, petroleum, and brine water may migrate to the well. Hydraulic pressure is removed from the well. Then, small grains of proppant (sand or aluminum oxide) hold these fractures open once the rock achieves equilibrium.

Gas Field: A field containing natural gas but no oil.

Gas Injection: The process whereby separated associated gas is pumped back into a reservoir for conservation purposes or to maintain the reservoir pressure.

Gross Acreage: All Acreage covered by any working interest, regardless of the percentage of ownership in the interest.

HBP: Held by production. Term referring to the ownership of leases that no longer need rental payments as the lease has producing oil and/or gas wells and therefore the mineral rights owner receives royalty payments from production. Typically, the leases are held by production until the well no longer produces commercial hydrocarbons and is abandoned.

Horizontal Drilling: A well that is drilled vertically into the oil bearing zone and then turned and drilled horizontally along the zone. The horizontal wellbores allow for far greater exposure to a formation than a conventional vertical wellbore. This is particularly useful in shale formations which do not have sufficient permeability to produce economically with a vertical well. Such wells when drilled onshore are now usually hydraulically fractured in a number of stages, especially in North America. The type of wellbore completion used will affect how many times the formation is fractured, and at what locations along the horizontal section of the wellbore.

Hydrocarbon: A compound containing only the elements hydrogen and carbon. Hydrocarbons may exist as a solid, a liquid or a gas. The term is mainly used in a catch-all sense for oil, gas and condensate.

Initial Production or IP: The rate at which a well commences initial producing hydrocarbons in Commercial Well quantities.

Lease: The right granted by a landowner to the Company to extract minerals, specifically oil and/or natural gas, from the mineral estate. A lease is a legal document or contract between a landowner (lessor) and a company or individual (lessee) granting exploration and development rights to subsurface oil and gas deposits.

Mud: A mixture of base substance and additives used to lubricate the drill bit and to counteract the natural pressure of the formation allowing the drill bit to drill down into the earth.

Natural Gas: Mainly Methane Gas but also other flammable gases, occurring naturally and often found in association with crude petroleum.

Net Acreage: Also known as Net Mineral Acres. Net Acreage is Gross Acreage adjusted to reflect the percentage of ownership in the working interest in the Acreage.

Oil: A mixture of liquid hydrocarbons of different molecular weights.

Oil Field: A geographic area under which an oil reservoir lies.

5

Operator: The company that has legal authority to drill wells and undertake the production of hydrocarbons that are found. The Operator is often part of a consortium and acts on behalf of this consortium.

Paleostructure: The geologic structure of a region or sequence of rocks in the geologic past.

Permeability: The property of a formation which quantifies the flow of a fluid through the pore spaces and into the wellbore.

Petroleum: A generic name for hydrocarbons, including crude oil, natural gas liquids, natural gas and their products.

Plug and Abandon (P&A): The final state in any well. Permission to plug and abandon is granted by a government agency and done to specific requirements. A surface cement plug is placed at the surface and cement plugs are placed at specific depths in the well to prevent any pollution. A steel plate is welded to the top of the casing and covered with dirt.

Porosity: The percentage of void in a porous rock compared to the solid formation.

Possible Reserves: Those reserves which at present cannot be regarded as ‘probable’ but are estimated to have a significant but less than 50% chance of being technically and economically producible.

Primary Recovery: Recovery of oil or gas from a reservoir purely by using the natural pressure in the reservoir to force the oil or gas out.

Probable Reserves: Those reserves which are not yet proven but which are estimated to have a better than 50% chance of being technically and economically producible.

Proven Field: An oil and/or gas field whose physical extent and estimated reserves have been determined.

Proven Reserves: Those reserves which on the available evidence are virtually certain to be technically and economically producible (i.e. having a better than 90% chance of being produced).

Recoverable Reserves: That proportion of the oil and/gas in a reservoir that can be removed using currently available techniques.

Reserves: Barrels of Oil per Field. It is calculated by multiplying the Lifespan Average BOPD per well by the number of Wells per Field.

Reservoir: The underground formation where oil and gas has accumulated. It consists of a porous rock to hold the oil or gas, and a cap rock that prevents its escape.

Reservoir Rock: A rock that has porosity and permeability. It can hold and transmit fluids. The most common reservoir rocks are sandstones, limestones and dolomites.

Royalty Payment: The cash or kind paid to the owner of mineral rights from the production of hydrocarbons.

Sabkha Environments: Sabkha environments are supratidal, forming along arid coastlines and are characterized by evaporite-carbonate deposits with some siliciclastics. Sabkhas form subaerial, prograding and shallowing-upward sequences

Secondary Recovery: Recovery of oil or gas from a reservoir by artificially maintaining or enhancing the reservoir pressure by injecting gas, water or other substances into the reservoir rock.

Shut In Well: A well which is capable of producing but is not presently producing. Reasons for a well being shut in may be lack of equipment, market or other.

Surface Location: The location of a well or facility/measurement point.

6

38 Degree API “Light” Oil: An arbitrary scale expressing the gravity or density of liquid petroleum products. The measuring scale is calibrated in terms of degrees API. The higher the API gravity, the lighter the compound. Light crudes generally exceed 38 degrees API and heavy crudes are commonly labeled as all crudes with API gravity of 22 degrees or below. Intermediate crudes fall in the range of 22 degrees to 38 degrees API gravity.

3D Seismic Analysis: Similar to 2D, but uses a dense array of geophones to provide a much more detailed set of seismic information. 3D seismic information allows geologists to see a significantly more reliable view of the underground topography of an area. Denser data and improved computer processing ensures that subsurface features are correctly located and may indicate the presence of hydrocarbons, rather than merely the structural elements, which could possibly contain hydrocarbons. Time-Lapse 3D seismic (also known as 4D) is also used when needed to provide more data in mature fields to identify where new oil has not yet been tapped.

Top Lease: Generally, a top lease grants rights if and when the current lease expires. In some cases, lease holders are paid a bonus before the current lease expires, in others, the company may prefer to pay the bonus after the current lease expires.

Total Production: The cumulative Barrels of Oil or Barrels of Oil Equivalent a field produces during its Lifespan.

Vertical Drilling: The traditional method of completing an oil and gas well which is done by drilling vertically into the earth at a selected location.

Well Interest: The interest in a well held by the Company under the terms of a Lease.

Well Log Data or Well Logging or Drill Logging: The practice of making a detailed record (a well log) of the geologic formations penetrated by a borehole. The log may be based either on visual inspection of samples brought to the surface (geological logs) or on physical measurements made by instruments lowered into the hole (geophysical logs). Well Logging can be done during any phase of a well’s history; drilling, completing, producing and abandoning. Well Logging is performed in boreholes drilled for the oil and gas, groundwater, mineral and geothermal exploration, as well as part of environmental and geotechnical studies.

Wildcat Well: A well drilled in an unproven area. Also known as an exploration well.

Nisku Carbonate Project – Toole County Montana:

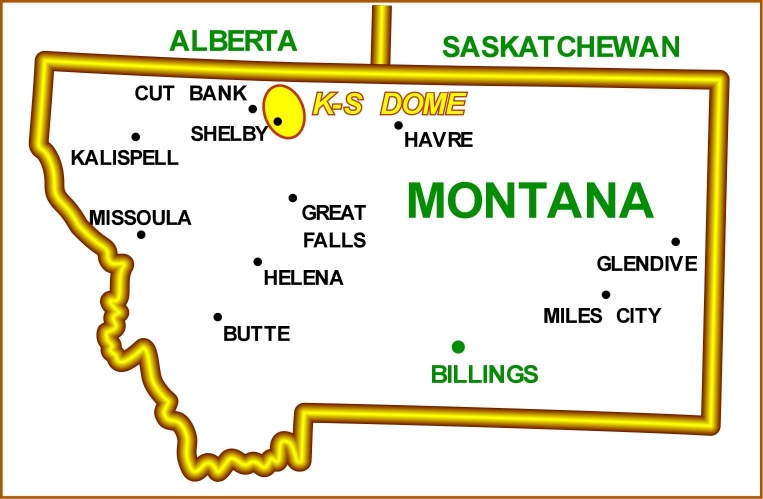

The oil and gas leases owned by us through Toole Oil and Gas Corp. our wholly owned subsidiary, are located in Toole County, in north central Montana, approximately 16 miles south of the Province of Alberta, Canada and U.S. border. According to state production records, Montana, itself, is a prolific producer of oil and natural gas and we believe that Montana has state legislation that supports the oil and gas industry. First year state tax rates on revenues generated by the sale of hydrocarbons are 0.8% in Montana. The tax rate shifts to rates between 6.1% and 9.3% in subsequent years, depending on the hydrocarbon being produced, the year in which wells were drilled and type of well.

7

Map showing location of the Kevin-Sunburst Dome where the leases are generally located.

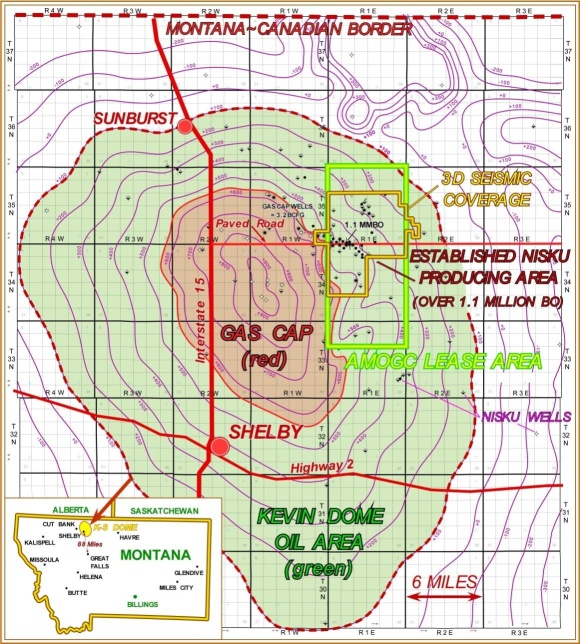

The Kevin-Sunburst Dome is a geological structure in the area in Toole County and covers approximately 1,000 square miles and we believe has 850 feet of structural closure. We believe that intense structural compression by the Montana Thrust Belt produced forces and fractures that dispersed the Bakken oil into many rock formations through-out the area. State production records indicate that some formations are located up to a thousand feet above the Bakken zone (such as the Madison, Swift, Cutbank and Sunburst) and others are located only a few hundred feet below the Bakken (such as the Nisku and Duperow). We believe that the Bakken zone oil migrated through many different rock layers and accumulated to form oil fields wherever the oil encountered porosity (the oil reservoir) and a seal (the oil trap). Geological interpretation by our consulting geologist from drilling in the area is that the Kevin-Sunburst Dome was the focal point for Bakken oil migration from the Southern Alberta Basin to the west. According to state production records, the domal area has produced more than 320 million barrels of oil (MMBO) and 650 billion cubic feet of gas (BCFG) from the Devonian Nisku, Mississippian Madison, Jurassic Swift, Cretaceous Cutbank/Sunburst, and four other formations. The primary formation we intend to target, assuming sufficient capital is raised for drilling, is the conventional Nisku carbonate formation. In Toole County, the Nisku formation is found at a depth of approximately 3,000 to 3,200 feet.

Our leases are located on the eastern slope of the Kevin-Sunburst Dome near the producing fields called the East Kevin Field and the 9 Mile Field. The East Kevin Field, according to state records, has been in production for approximately 29 years. Generally, state records show that the oil produced from the Nisku formation is 38 degree API “light” oil. The state records also show that the Nisku formation does not produce water. Initially, assuming adequate capital is raised, we plan to drill simple vertical wells into the Nisku zone. Drill logs from surrounding wells do not show any hazardous or complex drilling problems, though no assurance can be given that we would not encounter such problems.

8

General location of the leases held and the area covered by the 3D Seismic.

In the Kevin-Sunburst Dome there is multi-zone production from seven shallower formations. If and when we drill on the leases, the drill hole has the potential to drill through these formations. If such formations are indicated on the drill logs, we will have the opportunity, if commercial, to produce from these upper zones. No assurance may be given that any of these zones contain commercial amounts of hydrocarbons.

9

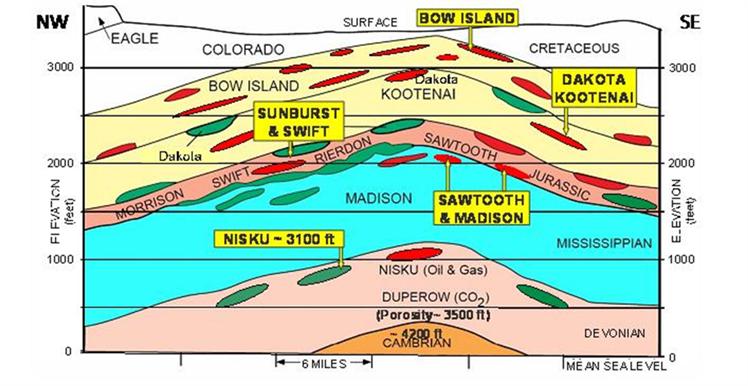

Conceptual Cross section of Kevin-Sunburst Dome illustrating the different formations that have been identified.

Nisku deposition

State records and drill logs show that the Nisku Formation is about 60 to 70 feet thick across the Kevin-Sunburst Dome. Scientific interpretation by our consulting geologist indicates that the formation was deposited as a shallowing-upward carbonate-evaporate sequence on top of marine limestones and shales of the Devonian Duperow Formation. Fine-grained carbonates (wackestones) make up the bottom 20 to 30 feet of strata. That zone is overlain by a 20-ft thick “Middle Layer” containing wave-dominated grainstone deposits that account for the primary Nisku porosity. The Middle Layer grades into 10 to 15 feet of supratidal laminated dolostones and anhydrites, capped by a 12 foot anhydrite layer. We believe that a Sabkha environment prevailed during the next few million years while an additional 150 feet of dolostones and anhydrites accumulated to form the overlying Potlatch Formation.

Nisku porosity and reservoir variability

The Nisku grainstone deposits formed on paleotopographic features (ancestral island shoals and beaches) where wave action left behind the coarser carbonate sand and winnowed away the silt and mud. Primary Nisku porosity developed in the 20-ft thick wave-dominated Middle Layer where skeletal grainstones are preserved. We believe that soon after deposition, the entire Nisku formation was dolomitized. This is a chemical process that enhances the original grainstone porosity present in a limestone reservoir. Records of drill core from surrounding drill holes indicate that the porosity in the Nisku can range from a 0 percent to more than 20 percent.

3D Seismic

3D seismic data was shot across the area during 2007, about 24 years after the East Kevin Field was discovered. The 3D data and the interpretation of the data by our consulting geologist indicate to us, though no assurance can be given, that the Nisku porosity and oil potential are present not only where wells have already been drilled in the East Kevin Field, but also to the north of the field. We have acquired an interest in leases on what we believe are similar geological locations on the north edge of East Kevin Field and on trend to the 9 Mile Field to the north of the East Kevin Field.

The 3D seismic data has been interpreted by our consulting geologist to establish what we feel are the areas of better Nisku porosity. The seismic data interpretation by our consulting geologist has delineate what we believe are paleostructures where grainstone porosity development have most likely occurred. We believe that this structure could have impacted the topography of the overlying Nisku Formation, resulting in better porosity development on the structurally higher areas, though, no assurance can be given to this development. Furthermore, we believe that distinct seismic amplitude variations are associated with the Nisku porosity zone and these have been tied to the porosity in previously drilled wells in the area.

10

Operation

Activities on the properties described below are governed by the Operating Agreement entered into with Young Sanders E&P LLC. The Operating Agreement is the standard American Association of Land Professionals 1989 Standard Operating Agreement (the “AAPL Agreement”) with an additional Section 16 governing forfeitures and participation. The AAPL describes the rights and obligations of the participants and the operator in conducting all activities on the properties including the drilling, production and the abandonment of wells. Exhibits to the Operating Agreement contain, among other things, the standard COPAS Accounting Procedures Joint Operations governing the expenditure of funds and accounting procedures.

DESCRIPTION OF PROPERTY

We do not own any real estate or other tangible property. Our principal office is located at 1846 E. Innovation Park Dr., Oro Valley, AZ 85755, telephone (303) 872-7814. We lease our office space in Tucson, Arizona on a monthly basis at $125 per month. No debt has accrued on account of rent payments owing. Our office space is sufficient for our current needs. However, we may require additional space in the event that our business operations are successful and we hire employees.

Toole Oil and Gas Corp. our wholly owned subsidiary, also maintains its office at 1846 E. Innovation Park Dr., Oro Valley, AZ 85755, telephone (303) 872-7814.

The following chart is a detailed list of leases held by our wholly owned subsidiary, Toole Oil and Gas Corp.

Toole Oil = Toole Oil and Gas Corp.

TWP = Township

RGE = Range

SEC = Section

|

Toole Oil Lease No.

|

Lease Expiry Date:

|

Gross Acres

|

Toole Oil Net Acres

|

Royalty Rate

|

Twp

|

Rge

|

Sec

|

Description

|

||

|

Acres Acquired by Forfeiture

|

Total Toole Oil Net Acres

|

|||||||||

|

1

|

2/22/2016

|

120

|

30

|

-

|

30

|

15.00%

|

35 North

|

1 East

|

1

|

S2NE, SESW, NWSE, S2SE

|

|

1

|

2/22/2016

|

80

|

20

|

-

|

20

|

15.00%

|

35 North

|

1 East

|

1

|

SWSW, NESE

|

|

1

|

2/22/2016

|

40

|

10

|

-

|

10

|

15.00%

|

35 North

|

1 East

|

12

|

N2NE

|

|

1

|

2/22/2016

|

460

|

115

|

-

|

115

|

15.00%

|

35 North

|

1 East

|

12

|

E2SWNE, SENE, W2, N2SE

|

|

2

|

3/9/2016

|

120

|

30

|

-

|

30

|

15.00%

|

35 North

|

1 East

|

1

|

S2NE, SESW, NWSE, S2SE

|

|

2

|

3/9/2016

|

40

|

10

|

-

|

10

|

15.00%

|

35 North

|

1 East

|

12

|

N2NE

|

|

3

|

2/15/2016

|

20

|

5

|

-

|

5

|

15.00%

|

35 North

|

1 East

|

12

|

W2SWNE

|

|

4

|

3/16/2016

|

160.02

|

40.01

|

-

|

40.01

|

15.00%

|

35 North

|

1 East

|

1

|

Lots 1(40.00), 2(40.01), 3(40.01), 4(40.02), S2NW, N2SW

|

11

|

5

|

3/16/2016

|

160.02

|

40

|

-

|

40

|

15.00%

|

35 North

|

1 East

|

1

|

Lots 1(40.00), 2(40.01), 3(40.01), 4(40.02), S2NW, N2SW

|

|

6

|

10/31/2016

|

320

|

80

|

-

|

80

|

15.00%

|

35 North

|

1 East

|

13

|

E2

|

|

7

|

2/2/2016

|

320

|

80

|

-

|

80

|

15.00%

|

34 North

|

1 East

|

30

|

E2

|

|

8

|

3/1/2021

|

480

|

120

|

120

|

240

|

16.67%

|

35 North

|

1 East

|

24

|

N2, SE

|

|

9

|

3/1/2021

|

160

|

40

|

40

|

80

|

16.67%

|

35 North

|

1 East

|

25

|

NE

|

|

10

|

11/17/2017

|

320

|

160

|

-

|

160

|

15.00%

|

33 North

|

1 East

|

11

|

N2

|

|

10

|

11/17/2017

|

160

|

80

|

-

|

80

|

15.00%

|

33 North

|

1 East

|

11

|

S2

|

|

12

|

2/6/2017

|

25.9

|

12.95

|

-

|

12.95

|

15.00%

|

33 North

|

1 East

|

6

|

Lots 3(39.88), 4(37.34), 5(37.61), 6(37.85), 7(38.08), SENW, E2SW

|

|

13

|

2/6/2017

|

12.95

|

6.47

|

-

|

6.47

|

15.00%

|

33 North

|

1 East

|

6

|

Lots 3(39.88), 4(37.34), 5(37.61), 6(37.85), 7(38.08), SENW, E2SW

|

|

14

|

2/6/2017

|

12.95

|

6.47

|

-

|

6.47

|

15.00%

|

33 North

|

1 East

|

6

|

Lots 3(39.88), 4(37.34), 5(37.61), 6(37.85), 7(38.08), SENW, E2SW

|

|

15

|

2/6/2017

|

25.9

|

12.95

|

-

|

12.95

|

15.00%

|

33 North

|

1 East

|

6

|

Lots 3(39.88), 4(37.34), 5(37.61), 6(37.85), 7(38.08), SENW, E2SW

|

|

16

|

5/12/2015

|

80

|

40

|

-

|

40

|

16.66%

|

33 North

|

1 East

|

4

|

SW4

|

|

17

|

5/12/2015

|

80

|

40

|

-

|

40

|

16.66%

|

33 North

|

1 East

|

5

|

SE4

|

|

18

|

5/12/2015

|

159.78

|

79.898

|

-

|

79.898

|

16.66%

|

33 North

|

1 East

|

3

|

Lots 3(39.79), 4(39.77), S2NW, SW

|

|

25

|

HBP

|

53.33

|

21.33

|

-

|

21.33

|

12.50%

|

33 North

|

1 East

|

13

|

N2

|

|

26

|

HBP

|

120

|

48

|

-

|

48

|

12.50%

|

33 North

|

1 East

|

13

|

N2

|

|

27

|

HBP

|

8.89

|

10.66

|

-

|

10.66

|

12.50%

|

33 North

|

1 East

|

13

|

N2

|

|

28

|

HBP

|

120

|

48

|

-

|

48

|

12.50%

|

33 North

|

1 East

|

13

|

N2

|

12

|

29

|

HBP

|

120

|

48

|

-

|

48

|

12.50%

|

33 North

|

1 East

|

13

|

S2

|

|

30

|

HBP

|

120

|

48

|

-

|

48

|

12.50%

|

33 North

|

1 East

|

13

|

S2

|

|

31

|

HBP

|

80

|

32

|

-

|

32

|

12.50%

|

33 North

|

1 East

|

13

|

S2

|

|

32

|

SHUT-IN

|

40

|

4

|

-

|

4

|

15.00%

|

33 North

|

1 East

|

1

|

SE4

|

|

32

|

SHUT-IN

|

40

|

4

|

-

|

4

|

15.00%

|

33 North

|

1 East

|

12

|

NE4

|

|

33

|

SHUT-IN

|

40

|

4

|

-

|

4

|

15.00%

|

33 North

|

1 East

|

1

|

SE4

|

|

33

|

SHUT-IN

|

40

|

4

|

-

|

4

|

15.00%

|

33 North

|

1 East

|

12

|

NE4

|

|

34

|

SHUT-IN

|

160

|

28.8

|

-

|

28.8

|

15.00%

|

33 North

|

1 East

|

12

|

S2

|

|

35

|

12/6/2015

|

79.8

|

39.9

|

-

|

39.9

|

16.66%

|

33 North

|

1 East

|

6

|

Lot 2(39.80), SWNE

|

|

39

|

7/10/2017

|

320

|

160

|

-

|

160

|

16.66%

|

33 North

|

1 East

|

9

|

W2

|

|

42

|

7/22/2017

|

146.34

|

36.585

|

36.585

|

73.17

|

12.50%

|

34 North

|

1 East

|

7

|

Lots 3(35.07), 4(35.17), S2NE, E2SW, SE4

|

|

42

|

7/22/2017

|

45

|

11.25

|

11.25

|

22.5

|

12.50%

|

34 North

|

1 East

|

8

|

S2NW, SWNE

|

|

43

|

7/22/2017

|

68.29

|

17.07

|

17.07

|

34.14

|

12.50%

|

34 North

|

1 East

|

7

|

Lots 3(35.07), 4(35.17), S2NE, E2SW, SE4

|

|

43

|

7/22/2017

|

21

|

5.25

|

5.25

|

10.5

|

12.50%

|

34 North

|

1 East

|

8

|

S2NW, SWNE

|

|

54

|

Top lease

|

-

|

-

|

-

|

0

|

12.50%

|

34 North

|

1 East

|

18

|

Lots 3, 4, E2SW, SE4

|

|

54

|

HBP

|

155.69

|

155.69

|

-

|

155.69

|

12.50%

|

34 North

|

1 East

|

18

|

Lots 3(35.61), 4(35.76), E2SW, SE4

|

|

55

|

HBP

|

77.84

|

77.84

|

-

|

77.84

|

15.00%

|

34 North

|

1 East

|

18

|

Lots 3, 4, E2SW, SE4

|

|

56

|

HBP

|

77.84

|

38.92

|

-

|

38.92

|

15.00%

|

34 North

|

1 East

|

18

|

Lots 3, 4, E2SW, SE4

|

|

56

|

Top lease

|

0

|

0

|

-

|

0

|

15.00%

|

34 North

|

1 East

|

18

|

Lots 3, 4, E2SW, SE4

|

|

57

|

5/22/2017

|

40

|

10

|

-

|

10

|

12.50%

|

34 North

|

1 East

|

17

|

SE4

|

|

58

|

5/22/2017

|

40

|

10

|

-

|

10

|

12.50%

|

34 North

|

1 East

|

17

|

SE4

|

|

59

|

8/15/2017

|

13.33

|

3.33

|

-

|

3.33

|

12.50%

|

34 North

|

1 East

|

17

|

SE4

|

|

60

|

8/15/2017

|

13.33

|

3.33

|

-

|

3.33

|

12.50%

|

34 North

|

1 East

|

17

|

SE4

|

|

61

|

8/15/2017

|

13.33

|

3.33

|

-

|

3.33

|

12.50%

|

34 North

|

1 East

|

17

|

SE4

|

|

65

|

7/8/2017

|

80

|

40

|

-

|

40

|

15.00%

|

34 North

|

1 East

|

17

|

N2NE

|

|

66

|

9/3/2017

|

10

|

2.5

|

-

|

2.5

|

34 North

|

1 East

|

1

|

SW4

|

13

|

66

|

9/3/2017

|

10

|

2.5

|

-

|

2.5

|

34 North

|

1 East

|

12

|

NW4

|

|

|

68

|

3/8/2017

|

10

|

2.5

|

-

|

2.5

|

15.00%

|

34 North

|

1 East

|

1

|

SW4

|

|

68

|

3/8/2017

|

10

|

2.5

|

-

|

2.5

|

15.00%

|

34 North

|

1 East

|

12

|

NW4

|

|

69

|

9/3/2017

|

20

|

5

|

-

|

5

|

15.00%

|

34 North

|

1 East

|

1

|

SW4

|

|

69

|

9/3/2017

|

20

|

5

|

-

|

5

|

15.00%

|

34 North

|

1 East

|

12

|

NW4

|

|

70

|

12/6/2016

|

65.07

|

16.27

|

16.27

|

32.54

|

12.50%

|

34 North

|

1 East

|

23

|

S2

|

|

70

|

12/6/2016

|

65.07

|

16.27

|

16.27

|

32.54

|

12.50%

|

34 North

|

1 East

|

27

|

N2

|

|

70

|

12/6/2016

|

65.07

|

16.27

|

16.27

|

32.54

|

12.50%

|

34 North

|

1 East

|

28

|

S2

|

|

71

|

11/18/2017

|

65.07

|

16.27

|

16.27

|

32.54

|

12.50%

|

34 North

|

1 East

|

23

|

S2

|

|

71

|

11/18/2017

|

65.07

|

16.27

|

16.27

|

32.54

|

12.50%

|

34 North

|

1 East

|

27

|

N2

|

|

71

|

11/18/2017

|

65.07

|

16.27

|

16.27

|

32.54

|

12.50%

|

34 North

|

1 East

|

28

|

S2

|

|

98

|

11/22/2015

|

160

|

40

|

40

|

80

|

17.00%

|

34 North

|

1 East

|

34

|

E2

|

|

99

|

4/3/2016

|

320

|

80

|

80

|

160

|

12.50%

|

34 North

|

1 East

|

3

|

S2N2, SE4

|

|

100

|

HBP

|

317

|

158.5

|

-

|

158.5

|

15.00%

|

34 North

|

1 East

|

19

|

E2 Less 3 Acres in NENE

|

|

101

|

4/25/2017

|

8

|

2

|

-

|

2

|

12.50%

|

34 North

|

1 East

|

20

|

NE4

|

|

102

|

4/25/2017

|

8

|

2

|

-

|

2

|

12.50%

|

34 North

|

1 East

|

20

|

NE4

|

|

103

|

4/25/2017

|

20

|

5

|

-

|

5

|

12.50%

|

34 North

|

1 East

|

20

|

NE4

|

|

104

|

4/25/2017

|

8

|

2

|

-

|

2

|

12.50%

|

34 North

|

1 East

|

20

|

NE4

|

|

105

|

4/25/2017

|

20

|

5

|

-

|

5

|

12.50%

|

34 North

|

1 East

|

20

|

NE4

|

|

106

|

4/25/2017

|

20

|

5

|

-

|

5

|

12.50%

|

34 North

|

1 East

|

20

|

NE4

|

|

107

|

4/25/2017

|

20

|

5

|

-

|

5

|

12.50%

|

34 North

|

1 East

|

20

|

NE

|

|

108

|

4/25/2017

|

40

|

10

|

-

|

10

|

12.50%

|

34 North

|

1 East

|

20

|

NE4

|

|

109

|

10/10/2017

|

8

|

2

|

-

|

2

|

12.50%

|

34 North

|

1 East

|

20

|

NE4

|

|

110

|

9/24/2016

|

160

|

40

|

40

|

80

|

12.50%

|

34 North

|

1 East

|

10

|

SW4

|

|

110

|

9/24/2016

|

160

|

40

|

40

|

80

|

12.50%

|

34 North

|

1 East

|

17

|

SW4

|

|

110

|

9/24/2016

|

480

|

120

|

120

|

240

|

12.50%

|

34 North

|

1 East

|

20

|

SE4, W2

|

|

111

|

6/21/2017

|

80

|

20

|

20

|

40

|

15.00%

|

35 North

|

1 East

|

28

|

S2

|

14

|

111

|

6/21/2017

|

146

|

36.5

|

36.5

|

73

|

15.00%

|

35 North

|

1 East

|

29

|

SE4

|

|

112

|

6/21/2017

|

80

|

20

|

20

|

40

|

15.00%

|

35 North

|

1 East

|

28

|

S2

|

|

112

|

6/21/2017

|

156

|

39

|

39

|

78

|

15.00%

|

35 North

|

1 East

|

33

|

SW4

|

|

117

|

2/4/2016

|

438.56

|

109.64

|

-

|

109.64

|

15.00%

|

35 North

|

1 East

|

5

|

Lots 1(39.40), 2(39.16), S2NE, SE, N2SW, SESW

|

|

120

|

11/22/2015

|

80

|

20

|

20

|

40

|

17.00%

|

35 North

|

1 East

|

24

|

SW4

|

|

121

|

HBP

|

320

|

19.2

|

19.2

|

35 North

|

1 East

|

14

|

E2

|

||

|

121A

|

HBP

|

640

|

320

|

-

|

320

|

12.50%

|

35 North

|

1 East

|

16

|

All

|

|

122

|

7/1/2017

|

640

|

160

|

160

|

320

|

15.00%

|

35 North

|

1 East

|

17

|

All

|

|

122

|

7/1/2017

|

160

|

40

|

40

|

80

|

35 North

|

1 East

|

18

|

E2SW, SE4

|

|

|

123

|

7/28/2017

|

60

|

15

|

15

|

30

|

15.00%

|

35 North

|

1 East

|

18

|

E2SW, SE4

|

|

123

|

7/28/2017

|

20

|

5

|

5

|

10

|

15.00%

|

35 North

|

1 East

|

19

|

E2NE

|

|

123

|

7/28/2017

|

80

|

20

|

20

|

40

|

15.00%

|

35 North

|

1 East

|

20

|

N2

|

|

124

|

7/31/2017

|

20

|

5

|

-

|

5

|

15.00%

|

35 North

|

1 East

|

18

|

E2SW, SE

|

|

124

|

7/31/2017

|

6.67

|

1.66

|

-

|

1.66

|

15.00%

|

35 North

|

1 East

|

19

|

E2NE

|

|

124

|

7/31/2017

|

26.67

|

6.66

|

-

|

6.66

|

15.00%

|

35 North

|

1 East

|

20

|

N2

|

|

125

|

7/1/2017

|

53.33

|

13.3325

|

13.3325

|

26.665

|

15.00%

|

35 North

|

1 East

|

19

|

E2NE

|

|

125

|

7/1/2017

|

213.33

|

53.3325

|

53.3325

|

106.665

|

15.00%

|

35 North

|

1 East

|

20

|

N2

|

|

126

|

7/23/2017

|

34.06

|

8.515

|

8.515

|

17.03

|

15.00%

|

35 North

|

1 East

|

18

|

Lots 3(34.01), 4(34.11)

|

|

126

|

7/23/2017

|

77.13

|

19.2825

|

19.2825

|

38.565

|

15.00%

|

35 North

|

1 East

|

19

|

Lot 1(34.26), W2NE, NENW

|

|

127

|

7/23/2017

|

34.06

|

8.515

|

8.515

|

17.03

|

15.00%

|

35 North

|

1 East

|

18

|

Lots 3, 4

|

|

127

|

7/23/2017

|

77.13

|

19.2825

|

19.2825

|

38.565

|

15.00%

|

35 North

|

1 East

|

19

|

Lot 1, W2NE, NENW

|

|

128

|

10/20/2017

|

303.98

|

75.99

|

-

|

75.99

|

12.50%

|

35 North

|

1 East

|

19

|

Lots 2, 3, 4, SENW, E2SW, W2SE

|

|

129

|

7/24/2017

|

40

|

10

|

10

|

20

|

12.50%

|

35 North

|

1 East

|

20

|

S2

|

|

130

|

7/24/2017

|

160

|

40

|

40

|

80

|

12.50%

|

35 North

|

1 East

|

20

|

S2

|

|

131

|

7/24/2017

|

40

|

10

|

10

|

20

|

12.50%

|

35 North

|

1 East

|

20

|

S2

|

|

132

|

2/1/2018

|

40

|

10

|

10

|

12.50%

|

35 North

|

1 East

|

20

|

S2

|

15

|

133

|

7/24/2017

|

40

|

10

|

10

|

20

|

12.50%

|

35 North

|

1 East

|

20

|

S2

|

|

136

|

8/23/2017

|

8.94

|

2.28

|

-

|

2.28

|

15.00%

|

35 North

|

1 East

|

23

|

S2SWNW, West 450' of SWSENW

|

|

137

|

8/23/2017

|

320

|

80

|

80

|

160

|

15.00%

|

35 North

|

1 East

|

25

|

W2

|

|

138

|

12/29/2015

|

160

|

40

|

40

|

80

|

12.50%

|

35 North

|

1 East

|

25

|

SE4

|

|

139

|

6/20/2017

|

80

|

20

|

20

|

40

|

15.00%

|

35 North

|

1 East

|

26

|

W2SW

|

|

140

|

8/23/2017

|

320

|

80

|

80

|

160

|

15.00%

|

35 North

|

1 East

|

26

|

E2

|

|

141

|

8/5/2017

|

240

|

60

|

60

|

120

|

15.00%

|

35 North

|

1 East

|

26

|

E2SW, NW4

|

|

142

|

8/5/2017

|

80

|

20

|

20

|

40

|

15.00%

|

35 North

|

1 East

|

27

|

E2NE

|

|

143

|

6/20/2017

|

240

|

60

|

60

|

120

|

15.00%

|

35 North

|

1 East

|

27

|

E2SW, SE4

|

|

144

|

7/3/2017

|

80

|

20

|

-

|

20

|

12.50%

|

35 North

|

1 East

|

27

|

W2NE, NW4, W2SW

|

|

145

|

7/9/2017

|

80

|

20

|

-

|

20

|

12.50%

|

35 North

|

1 East

|

27

|

W2NE, NW4, W2SW

|

|

146

|

7/3/2017

|

80

|

20

|

-

|

20

|

35 North

|

1 East

|

27

|

W2NE, NW4, W2SW

|

|

|

147

|

7/3/2017

|

80

|

20

|

-

|

20

|

12.50%

|

35 North

|

1 East

|

27

|

W2NE, NW4, W2SW

|

|

148

|

6/10/2018

|

320

|

80

|

80

|

160

|

16.66%

|

35 North

|

1 East

|

35

|

W2E2, E2NW, SESE, NESW

|

|

149

|

HBP

|

3

|

1.5

|

-

|

1.5

|

12.50%

|

34 North

|

1 East

|

19

|

A 3.00 acre tract of land located in the NENE

|

|

150

|

10/11/2016

|

60.82

|

15.21

|

-

|

15.21

|

15.00%

|

34 North

|

1 East

|

19

|

Lots 1, 2, 3, 4, E2W2

|

|

151

|

1/2/2017

|

8.89

|

2.22

|

-

|

2.22

|

16.00%

|

34 North

|

1 East

|

15

|

SW

|

|

151

|

1/2/2017

|

8.89

|

2.22

|

-

|

2.22

|

16.00%

|

34 North

|

1 East

|

22

|

NW

|

|

151

|

1/2/2017

|

13.33

|

3.38

|

-

|

3.38

|

16.00%

|

34 North

|

1 East

|

23

|

N2

|

|

151

|

1/2/2017

|

6.67

|

3.16

|

-

|

3.16

|

16.00%

|

34 North

|

1 East

|

24

|

NE

|

|

152

|

1/2/2017

|

8.89

|

2.22

|

-

|

2.22

|

16.00%

|

34 North

|

1 East

|

15

|

SW

|

|

152

|

1/2/2017

|

8.89

|

2.22

|

-

|

2.22

|

16.00%

|

34 North

|

1 East

|

22

|

NW

|

|

152

|

1/2/2017

|

13.33

|

3.38

|

-

|

3.38

|

16.00%

|

34 North

|

1 East

|

23

|

N2

|

16

|

152

|

1/2/2017

|

6.67

|

1.16

|

-

|

1.16

|

16.00%

|

34 North

|

1 East

|

24

|

NE

|

|

153

|

1/2/2017

|

8.89

|

2.22

|

-

|

2.22

|

16.00%

|

34 North

|

1 East

|

15

|

SW

|

|

153

|

1/2/2017

|

8.89

|

2.22

|

-

|

2.22

|

16.00%

|

34 North

|

1 East

|

22

|

NW

|

|

153

|

1/2/2017

|

13.33

|

3.38

|

-

|

3.38

|

16.00%

|

34 North

|

1 East

|

23

|

N2

|

|

153

|

1/2/2017

|

6.67

|

1.16

|

-

|

1.16

|

16.00%

|

34 North

|

1 East

|

24

|

NE

|

|

154

|

1/10/2017

|

4.44

|

1.11

|

-

|

1.11

|

16.00%

|

34 North

|

1 East

|

15

|

SW

|

|

154

|

1/10/2017

|

4.44

|

1.11

|

-

|

1.11

|

16.00%

|

34 North

|

1 East

|

22

|

NW

|

|

154

|

1/10/2017

|

6.67

|

1.16

|

-

|

1.16

|

16.00%

|

34 North

|

1 East

|

23

|

N2

|

|

154

|

1/10/2017

|

3.33

|

0.83

|

-

|

0.83

|

16.00%

|

34 North

|

1 East

|

24

|

NE

|

|

155

|

3/6/2017

|

4.44

|

1.11

|

-

|

1.11

|

16.00%

|

34 North

|

1 East

|

15

|

SW

|

|

155

|

3/6/2017

|

4.44

|

1.11

|

-

|

1.11

|

16.00%

|

34 North

|

1 East

|

22

|

NW

|

|

155

|

3/6/2017

|

6.67

|

1.16

|

-

|

1.16

|

16.00%

|

34 North

|

1 East

|

23

|

N2

|

|

155

|

3/6/2017

|

3.33

|

0.83

|

-

|

0.83

|

16.00%

|

34 North

|

1 East

|

24

|

NE

|

|

156

|

1/11/2017

|

160

|

40

|

40

|

80

|

15.00%

|

35 North

|

1 East

|

32

|

NENE, S2NE, SENW

|

|

156

|

1/11/2017

|

160

|

40

|

40

|

80

|

15.00%

|

35 North

|

1 East

|

33

|

NW

|

|

157

|

1/12/2017

|

320

|

8

|

-

|

8

|

16.67%

|

34 North

|

1 East

|

11

|

E2

|

|

Total

|

14916.94

|

4435.223

|

1735.535

|

6170.758

|

2. RESERVES REPORTED TO OTHER AGENCIES

We have no reserve reports at this time. Save and except the two gas wells, our acreage is undeveloped.

3. PRODUCTION

A. As part of the acquisition of the lease interests, we have acquired a 50% working interest in two producing gas wells.

i) The average sales price of the production per thousand btus for the 12 month period ending June 30, 2014 is $3.577808. The average sales price of the production per thousand btus for the 2 month period ending August 31, 2014 is $3.998000

ii) The average lifting price per thousand btus for the 12 month period ending June 30, 2014 is $1.257781. The average lifting price per thousand btus for the 2 month period ending August 31, 2014 is $1.299800.

4. PRODUCTIVE WELLS AND ACREAGE

As of October 14, 2014, we own 2 gas wells (gross) and 1 gas well net. The total productive area of the two gross wells is 80 acres and the net productive area is 40 acres.

5. UNDEVELOPED ACREAGE

As of October 14, 2014, we own 14,916.94 gross acres and 6,170.76 net acres (which includes 1,735.53 acres forfeited by Tanglewood Energy, LLC).

17

6. DRILLING ACTIVITY

In December 2012, drilling of two oil wells we acquired commenced. The two wells are awaiting fracking in order to determine whether either or both of such wells should be placed in production or abandoned.

7. PRESENT ACTIVITIES

As of October 15, 2014, we have two oil wells being drilled.

8. DELIVERY COMMITMENTS

American Midwest Oil and Gas Ltd., (“AMOG”) the 50% owner of our two producing gas wells is the operator of these two wells. AMOG has a contract with Ranck Oil Company to sell to them all of the gas produced from these two wells. The gas is sold based on the AECO monthly price minus $1.00 for gathering and is effective until June 30, 2015.

Principal Products

Our principal product is the exploration for and development of oil and natural gas. Because our properties are in the development stage, there is no guarantee that any hydrocarbons will be found or extracted.

Employees

We are an exploration stage company and currently have two full time employees; Michael Altman, our current President, who is also our CEO, works full time on behalf of our Company. Robert Knight, a director, works full time on behalf of our Company. Currently, we have no other full time employees. Frank Lamendola, our Chief Financial Officer, works for us on a part time basis. Our President and our Chief Financial Officer do not have compensation agreements with us.

All oil and gas exploration and operations will be contracted out to third parties. In the event that our exploration projects are successful and warrant putting any of our leases into production, such operations may also be contracted out to third parties. We rely on management to handle all matters related to business development and business operations.

Insurance

We do not maintain any general insurance, but we plan to implement standard insurance policies for our company. We do not have directors’ and officers’ liability insurance. Our ability to acquire a general insurance policy relies upon us having the necessary funds to do so. We do not have the necessary funds to implement such insurance policies. Because we do not have any insurance, if we are made a party to a liability action, we may not have sufficient funds to defend the litigation. If that occurs, a judgment could be rendered against us that could cause us to cease operations.

The current operator of our leases, Young Sanders E&P LLC, does carry liability insurance that would cover us against any action pertaining to the leases we hold.

Offices

Our administrative offices are currently located at 1846 E. Innovation Park Dr. Oro Valley, AZ 85755. Our telephone number is (303) 872-7814.

Governmental Regulations - Environmental and Occupational Health and Safety Matters

18

General

Our operations are subject to stringent and complex federal, regional, state and local laws and regulations governing occupational health and safety, the discharge of materials into the environment or otherwise relating to environmental protection. Compliance with these laws and regulations may require the acquisition of permits before drilling or other related activity commences, restrict the type, quantities and concentration of various substances that can be released into the environment in connection with drilling and production activities, limit or prohibit drilling and production activities on certain lands lying within wilderness, wetlands and other protected areas, impose specific health and safety criteria addressing worker protection, and impose substantial liabilities for pollution arising from drilling and production operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations, and the issuance of injunctions that may limit or prohibit some or all of our operations.

These laws and regulations may also restrict the rate of oil and natural gas production below the rate that would otherwise be possible. The regulatory burden on the oil and natural gas industry increases the cost of doing business in the industry and consequently affects profitability. Additionally, the trend in environmental regulation has been to place more restrictions and limitations on activities that may affect the environment, and, any changes in environmental laws and regulations that result in more stringent and costly well construction, drilling, waste management or completion activities or waste handling, storage, transport, disposal or remediation requirements could have a material adverse effect on our business. While we believe that we are in substantial compliance with current applicable federal and state environmental laws and regulations and that continued compliance with existing requirements will not have a material adverse impact on our operations or financial condition, there is no assurance that we will be able to remain in compliance in the future with such existing or any new laws and regulations or that such future compliance will not have a material adverse effect on our business and operating results.

The following is a summary of the more significant existing environmental laws to which our business operations are subject and with which compliance may have a material adverse effect on our capital expenditures, earnings or competitive position.

Hazardous Substances and Wastes