Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Workhorse Group Inc. | fs12014ex23i_ampholding.htm |

As filed with the Securities and Exchange Commission on December 15, 2014.

Registration Statement No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

AMP HOLDING INC.

(Exact name of registrant as specified in its charter)

| Nevada | 3711 | 26-1394771 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

100 Commerce Drive

Loveland, Ohio 45140

513-360-4704

(Address and telephone number of registrant’s principal executive offices)

Stephen S. Burns

Chief Executive Officer

AMP Holding Inc.

100 Commerce Drive

Loveland, Ohio 45140

513-360-4704

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Stephen M. Fleming Fleming PLLC 49 Front Street, Suite 206 Rockville Centre, New York 11570 516-833-5034 |

Ralph V. De Martino Cavas S. Pavri Schiff Hardin LLP 901

K Street NW, Suite 700 202-778-6400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☒ |

The registrant is an “emerging growth company,” as defined in Section 2(a) of the Securities Act. This registration statement complies with the requirements that apply to an issuer that is an emerging growth company.

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee (2) | ||||||||||||

| Units consisting of Common Stock and Series A Warrants | ||||||||||||||||

| Common Stock, par value $0.001 per share, underlying the Units (5) | 66,666,667 shares | $ | 0.15 | $ | 10,000,000 | $ | 1,162.00 | |||||||||

| Series A Warrants consisting of one half share of Common Stock, underlying the Units (3) | 33,333,333 warrants | (3 | ) | (3 | ) | - | ||||||||||

| Common Stock underlying the Series A Warrants (5) | 33,333,333 shares | $ | 0.15 | $ | 5,000,000 | $ | 581.00 | |||||||||

| Representative’s Unit Purchase Option (3) | (3 | ) | (3 | ) | - | |||||||||||

| Common Stock underlying Units included in the Unit Purchase Option (4) | 4,666,667 shares | $ | 0.15 | $ | 700,000 | $ | 81.34 | |||||||||

| Series A Warrants underlying Units included in the Unit Purchase Option | 2,333,334 warrants | (3 | ) | (3 | ) | -- | ||||||||||

| Common Stock underlying Series A Warrants included in the Units included in the Unit Purchase Option | 2,333,334 shares | $ | 0.15 | $ | 350,000 | $ | 40.67 | |||||||||

| Total Registration Fee | - | - | $ | 16,050,000 | $ | 1,865.01 | ||||||||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes offering price of securities that the underwriters have the option to purchase to cover over-allotments, if any.

|

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the registrant.

|

| (3) | No registration fee pursuant to Rule 457(g) under the Securities Act.

|

| (4) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The Representative’s Warrants are exercisable at a per share exercise price equal to 100% of the public offering price. As estimated solely for the purpose of recalculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the Representative’s Warrant is $700,000 (7% of $10,000,000). |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED , 2014 |

Units

Each Unit Consisting of One Share of Common Stock and

One-Half (0.5) of a Series A Warrant to Purchase One-Half (0.5) of a Share of Common Stock

This is a firm commitment initial public offering of the securities of AMP Holding Inc. We are offering shares of common stock and Series A Warrants. Each whole Series A Warrant is exercisable for one share of common stock. We expect that the initial public offering price for one unit consisting of one share and one-half (0.5) Series A Warrant will be between $ and $ . Although issued together, the shares of common stock and Series A Warrants may be transferred separately immediately upon issuance.

Each whole Series A Warrant is exercisable for one share of common stock. A whole Series A Warrants is immediately exercisable upon issuance in this initial public offering at an initial exercise price of 100% of the initial public offering price of one unit in this offering. The Series A Warrants will expire on the fifth anniversary of the date of issuance. The shares of common stock issuable from time to time upon the exercise of the Series A Warrants are also being offered pursuant to this prospectus.

Our common stock is currently traded on the OTC Markets (OTCQB) under the symbol “AMPD”. On December 10, 2014, the last reported sales price of our common stock was $0.15 per share. We intend to change our name to Workhorse Advanced Vehicles Inc. and apply to list our common stock on the Nasdaq Capital Market (Nasdaq) under the symbol “WAV”. The Series A Warrants will not be listed for trading on a securities exchange.

Before investing in our common stock and warrants exercisable for common stock, you should carefully read the discussion of “Risk Factors” beginning on page 7. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit |

Total | |||||||

| Public offering price (1) | $ | $ | ||||||

| Underwriting discounts and commissions (2) | $ | $ | ||||||

| Offering proceeds to us, before expenses | $ | $ |

(1) The price per unit of $______ includes $0.005 for each warrant to purchase 0.5 shares of common stock included in such unit.

(2) Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Dawson James Securities, Inc., the representative of the underwriters, or the issuance of a unit purchase option to acquire 7% of the units sold in this offering. See “Underwriting.”

We have also granted a 45-day option to the representative of the underwriters to purchase up to (i) additional shares of common stock, and (ii) additional Series A Warrants to purchase up to additional shares of common stock solely to cover over-allotments, if any. The over-allotment option may be used to purchase shares of common stock and Series A Warrants, as determined by the underwriters, but such purchases cannot exceed an aggregate of 15% of the number of shares of common stock and Series A Warrants sold in the primary offering.

The underwriters expect to deliver our securities to purchasers in the offering on or about , 2015.

Sole Book Running Manager

Dawson James Securities, Inc.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

AMP’s logo and some of our trademarks, including the Workhorse ® are used in this prospectus. This prospectus also includes trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, our trademarks and trade names referred to in this prospectus appear without the ™ or the ® symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and trade names.

This prospectus contains estimates, projections and other information concerning our industry, our business and the potential markets for our platform, including data regarding the estimated demand in those markets, their projected growth rates, as well as data regarding market research, estimates and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from the same sources, unless otherwise expressly stated or the context otherwise requires.

Unless the context requires otherwise references to “AMP Holding Inc.” “AMP Holding”, “Workhorse”, our “company,” “we,” “us” or “our” refer to AMP Holding Inc., a Nevada corporation, doing business as AMP Holding. We intend to change our name to Workhorse Advanced Vehicles Inc. AMP Holding primarily manages its operations through its two wholly owned subsidiaries, AMP Trucks Inc. (“AMP Trucks”), an Indiana corporation, and AMP Electric Vehicles Inc., an Ohio corporation (“AMP”).

| i |

Note Regarding Reverse Stock Split

As of 2014, our Board intends to approve an amendment to our Articles of Incorporation to effect a reverse split of our common stock that we refer to as the Reverse Stock Split. Under NRS 78.207, the Board of Directors has the authority to reverse split the outstanding and authorized shares of common stock at an identical ratio solely based on the approval of the Board of Directors and without shareholder approval. Our Board is contemplating a Reverse Stock Split, at any time on or before with the final ratio to be determined at the discretion of our Board. Unless we indicate otherwise, the information in this prospectus does not reflect the pro forma impact of the Reverse Stock Split.

| ii |

The following information is a summary of the prospectus and it does not contain all of the information you should consider before investing in our securities. You should read the entire prospectus carefully, including the “Risk Factors” section and our financial statements and the notes relating to the financial statements, before making an investment decision.

Our Company

Overview

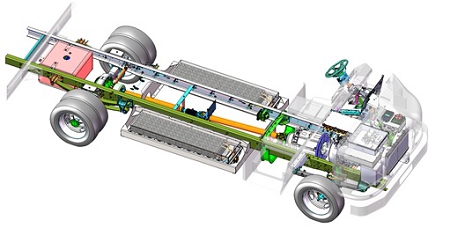

AMP Holding Inc., which is in the process of changing its name to Workhorse Advanced Vehicles Inc., designs and produces high-performance electric vehicles (EVs) specifically engineered to enable our fleet customers to deliver goods and services with minimal environmental impact while reducing costs by 50% as compared to standard gas powered vehicles. Our new vehicles will be assembled at our 270,000 sq. ft. Indiana facility, which has a capacity to produce up to 60,000 complete chassis per year. Our medium duty vehicles come in two models: the Workhorse E-100 all-electric truck and the E-GEN™ electric truck with on board charging. Over the life of the vehicle, the Workhorse E-GEN™ potentially offers a savings of $100,000, with the savings beginning immediately as compared to standard gas delivery vehicles, and a positive return on investment (ROI) by year three based on current gasoline and electricity costs. We believe these electric trucks represent the future of logistics by creating both economic and environmental benefits.

Customers

On June 16, 2014 we received an initial order for two E-GEN vehicles from a major transportation company that operates one of the world’s largest fleets of delivery vehicles. The vehicles will be deployed by February 2015. This initial order was followed by a larger purchase agreement that Workhorse has entered into with this company to supply a total of 18 Workhorse E-100 all-electric walk in vans to be deployed in the Houston-Galveston-Brazonia, Texas area. The U.S. Department of Energy (DOE) National Energy Technology Laboratory awarded a grant to accelerate the introduction of electric vehicles to improve local air quality in the Houston-Galveston-Brazonia area, which is currently designated as a National Ambient Air Quality Non-Attainment Area.

Government Incentives

Our trucks qualify for financial incentives to lower the purchase price of an EV truck in states and cities including New York, California, and Chicago. Without these current incentives, our logistics solutions still offer a 50 % cost advantage as compared to traditional gas vehicles.

Market Size & Distribution Channels

In the market for electric logistics vehicles, we directly address the step van/strip chassis market. The market segments our vehicles serve include package and product delivery companies, uniform and laundry services, food services, utilities, and special-use industries. Companies operating in the space that are potential customers for AMP include UPS, FedEx, Bimbo Bakeries, Aramark, Canada Post, Cintas, Purolator, Peapod, UniFirst, and Frito Lay. We have sold our initial vehicles through our internal sales force but have the ability to sell our Workhorse vehicles through a distribution channel of approximately 440 dealers nationwide.

Vehicles

In addition to building its own chassis, AMP designs and produces two, second-generation, battery-electric drive trains both powered by Panasonic 18650 Li Ion cells. AMP’s E-100 V.2 all electric drive train features a 100 kWh battery pack offering a range of up to 100 miles. AMP’s E-GEN, introduced in 2014, is its newest drive train employing a 2200 nm permanent magnet electric drive motor coupled to a small internal combustion engine (ICE) that drives the electric motor in generator mode to keep the battery pack within the desired level of charge.

Market Entry

Based on market experience, we believe that the duty cycle of the average medium-duty local delivery truck market represents the appropriate entry point to launch electric trucks due to the quick financial payback associated with electrification. To our knowledge, our Workhorse E-GEN™ electric truck, which has an EPA approved on-board internal combustion engine, provides a three-year payback without any government financial incentives. Over the typical 10-year life of a medium-duty delivery truck, our Workhorse E-GEN electric truck is designed to save its owner over $100,000 in fuel and maintenance savings, a projected 75% reduction in costs compared to gas powered vehicles based on current fuel and electricity costs.

| 1 |

Our Workhorse E-GEN electric truck is the first of its kind. Purpose-built for the package delivery vehicle market, it is expected to offer three-times the miles per gallon than typical gasoline-powered vans in use today. The E-GEN power train is unique in that it employs a 2200 nm permanent magnet motor/generator for propulsion plus a 2.4 Liter internal combustion engine that turns the electric motor in generator mode to recharge the battery pack under certain conditions i.e. the battery pack falls below a predetermined level, the vehicle is in park with the key out, and the emergency brake is on. As such, it can be charging while the driver stops the vehicle to make a delivery or pauses for lunch.

We believe the E-GEN will change the economics of EV acquisition by reducing battery costs, which in the past has been an impediment to the mass adoption of commercial EVs. By integrating Panasonic 18650 batteries with our proprietary battery management system, control software, charging innovations, and mechanical packaging, we are able to keep total vehicle cost at an attractive price point. At the same time, AMP is continually assessing battery technology and applications.

HorseFly™

Our unique HorseFly line of drones is designed to be the ‘last mile’ solution in delivery logistics. We worked with the University of Cincinnati to develop the HorseFly to meet the rigors of package delivery and to have eight rotors and redundant systems to ensure safety in the air. Today, we estimate that it costs approximately $1 to move a 20,000-pound diesel-powered truck one mile. While we believe our Workhorse trucks can reduce the standard delivery costs from $1 to less than $0.30 cents per mile based on current costs of fuel, We expect that having drones handle the last leg of delivery could further potentially reduce the cost to about $.03 cents for the last mile. The all weather HorseFly battery-powered drone will carry up to 10 pounds of cargo with a 15-mile range. It is designed to meet the anticipated FAA drone guidelines expected in 2015, of which there is no guarantee, and is differentiated from other drones as it is designed to work in tandem with a Workhorse electric truck. HorseFly will deliver packages, loaded on-route by the truck's driver, to remote locations while the driver continues on the main delivery route. HorseFly will then rejoin the truck at its new location after its delivery is completed, saving the fleet operator much of the time and fuel cost of the last, most expensive, mile. Also while the HorseFly is atop the Workhorse truck, it can quickly charge its batteries from the truck's large battery pack. We believe this implementation is superior to the proposed deployment of other delivery drones wherein the package is loaded at a distant warehouse and the drone must make a round trip flight to the delivery address and back to the warehouse. Other applications for the HorseFly include transmission line inspections and agricultural surveys.

Facilities

In March of 2013, we purchased the former Workhorse Custom Chassis assembly plant in Union City, Indiana from a subsidiary of Navistar International with the goal of transforming the company into the leading producer of electric medium duty trucks in the United States. To our knowledge, Workhorse Advanced Vehicles is the only commercial electric vehicle OEM in the country.

With the purchase we acquired a 220,000 sq. ft. factory, a 50,000 sq. ft. engineering facility, all the intellectual property and patents, and access to the 440 Workhorse dealers across the U.S., and established a supply agreement with its parts supplier UpTime parts. The mechanical, electrical and software design and engineering is done at our Cincinnati, Ohio headquarters. Ownership of this plant enables us to build new chassis with gross vehicle weight capacities of between 10,000 and 26,000 pounds and offer them with four different fuel variants—electric, gas, propane (LPG) and compressed natural gas (CNG).

Intellectual Property

We have six issued patents and two pending in the U.S. We also plan to pursue appropriate foreign patent protection. AMP also has five pending trademark applications and two issued trademark registrations in the U.S. with intent to pursue foreign trademark registration as well.

Competitive Landscape

We believe our ability to meet fleet performance specifications and reduce vehicle lifecycle costs affords us significant advantages over competing EVs. Other companies currently competing in the EV fleet logistics market include Ford Motor Company, Freightliner, Smith Electric Vehicles, and Electric Vehicles International. Batteries are the most expensive part of an EV. Workhorse uses Panasonic LI batteries; therefore our E-GEN battery packs are under $20,000 since they can be recharged from the ICE, as compared to the industry’s average battery pack cost of $72,000. Competing EV trucks have limited range because they are electric only. Our EPA-approved E-GEN emergency range electric, medium-duty truck offers greater range since the truck can recharge when parked. As an OEM, our manufacturing costs are lower as compared to competitors that are installing their drive trains into chassis from another manufacturer.

| 2 |

Management Team

Our executive team has deep experience in the automotive industry, engineering field, and public company management. Our Chairman has 34 years of automotive and engineering management experience and was CEO of Hummer and General Manager of Cadillac. Our Founder and CEO is a veteran entrepreneur who has founded several successful start-ups, while our CFO has 35 years of financial management experience at several public companies. Our engineering executives are from Navistar, Autocar LLC, Procter and Gamble, and the United States Naval Research Lab.

Convertible Note Offering

From November 2014 through December 2014, we entered into Subscription Agreements with several accredited investors (the “2014 Investors”) providing for the sale by us to the 2014 Investors of 14% Unsecured Convertible Promissory Notes in the aggregate amount of $900,000 (the "2014 Notes"). In addition to the 2014 Notes, the 2014 Investors also received common stock purchase warrants (the “2014 Warrants”) to acquire 3,214,286 shares of common stock. The 2014 Warrants are exercisable for five years at an exercise price of $0.14. Dawson James acted as placement agent.

The 2014 Notes mature one year from their respective effective dates (the "Maturity Dates") and interest associated with the 2014 Notes is 14% per annum, which is payable on the Maturity Dates. The 2014 Notes are convertible into shares of common stock of the Company, at the 2014 Investors’ option, at a conversion price of $0.14. However, the 2014 Notes convert automatically upon our increasing our authorized shares of common stock to 500,000,000 shares of common stock or such other amount that would allow for the full conversion of the 2014 Notes. The 2014 Notes and the 2014 Warrants carry standard anti-dilution provisions and price protection provisions for a period of six months.

Our Corporate Information

We are a Nevada corporation headquartered in Loveland, Ohio that does business as AMP Holding Inc. utilizing the Workhorse ® brand. Our manufacturing facility is located in Union City, Indiana. We were originally incorporated as Title Starts Online Inc. on November 13, 2007. On December 28, 2009, we entered into and closed a Share Exchange Agreement with the shareholders of AMP Electric Vehicles, Inc. pursuant to which we acquired 100% of the outstanding securities of AMP in exchange for 14,890,904 shares of our common stock. We formally changed our name to AMP Holding Inc. on May 24, 2010. On March 4, 2013, AMP Trucks Inc. (“AMP Trucks”), an Indiana corporation and a wholly-owned subsidiary of AMP Holding, entered into an Asset Purchase Agreement with Workhorse Custom Chassis, LLC (“Workhorse”), an Illinois limited liability company and a wholly-owned affiliate of Navistar International Corporation, to purchase certain assets including the Workhorse ® brand, logo, intellectual property, patents and approximately 250,000 sq. ft. of facilities on 48 acres of land in Union City, Indiana (the “Workhorse Assets”). On March 13, 2013, AMP Trucks closed the acquisition of the Assets from Workhorse for a purchase price of $5,000,000 of which $2,750,000 was paid in cash and the delivery of a Secured Debenture (the “Workhorse Debenture”) in the principal amount of $2,250,000. The Workhorse Debenture is secured pursuant to a Security Agreement (the “Workhorse Security Agreement”) and a Mortgage, Security Agreement, Assignment of Rents and Fixture Filing (the “Workhorse Mortgage”) entered between AMP Trucks and Workhorse. Pursuant to the Security Agreement, AMP Trucks granted Workhorse a security interest in all of the assets of AMP Trucks in order to secure the prompt payment, performance and discharge in full of all of obligations of AMP Trucks under the Workhorse Debenture. Pursuant to the Workhorse Mortgage, the Workhorse Debenture is secured by the real estate and related assets of the plant located in Union City, Indiana. The Workhorse Debenture matures three years from its effective date of March 13, 2013 (the " Workhorse Maturity Date") and interest associated with the Debenture is 10% per annum, which is payable on the Maturity Date. AMP Trucks may prepay outstanding principal and interest of the Workhorse Debenture in full at any time. In the event AMP Trucks prepays outstanding principal and interest, it shall pay an amount equal to all outstanding principal and interest multiplied by 105%. AMP Holding and AMP guaranteed the payment of the Workhorse Debenture.

Our fiscal year ends December 31 of each year. Our principal executive offices are located at 100 Commerce Drive, Loveland, Ohio 45140. Our telephone number is 513-360-4704. Our website address is www.ampelectricvehicles.com. The information contained on, or that can be accessed through, our website is not incorporated by reference in this prospectus and should not be considered a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

| 3 |

| Securities we are offering | units, with each unit consisting of one share of common stock and one-half (0.5) Series A Warrant to purchase one-half (0.5) share of common stock. The units will not be certificated and the shares of common stock and Series A Warrants may be transferred separately immediately upon issuance.

Each Series A Warrant is exercisable for one-half share of common stock. A whole Series A Warrants is immediately exercisable upon issuance in this initial public offering at an initial exercise price of 100% of the initial public offering price of one unit in this offering. The Series A Warrants will expire on the fifth anniversary of the date of issuance.

The shares of common stock issuable from time to time upon the exercise of the Series A Warrants are also being offered pursuant to this prospectus. | |

| Public offering price | $ (the midpoint of the range set forth on the cover page of this prospectus) per unit. | |

| Common stock outstanding before this offering | 149,667,926 shares | |

|

Common stock included in the securities we are offering |

(i) shares, which assumes no exercise of the Series A Warrants; or (ii) shares, which assumes the full exercise of the Series A Warrants. | |

| Common stock to be outstanding immediately after this offering | shares, which assumes no exercise of the Series A Warrants. | |

| Over-allotment option | We have granted a 45-day option to the representative of the underwriters to purchase up to (i) additional shares of common stock, and (ii) additional Series A Warrants, solely to cover over-allotments, if any. Such purchases cannot exceed an aggregate of 15% of the number of shares and Series A Warrants sold in the primary offering. | |

| Use of proceeds | We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, at an assumed initial public offering price of $ per unit, (the midpoint of the range set forth on the cover page of this prospectus), after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering as follows: (i) approximately $ million for developing our sales and service organization, (ii) approximately $ million for research and development, (iii) approximately $ million to finance capital expenditures, and (iv) the remaining proceeds, if any, will be used for general corporate purposes, including working capital. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. | |

| Risk Factors | Investing in our securities involves substantial risks. You should read the “Risk Factors” section starting on page for a discussion of factors to consider carefully before deciding to invest in our securities. | |

| Symbol | Our common stock is currently traded on the OTC Markets (OTCQB) under the symbol “AMPD”. On December 10, 2014, the last reported sales price of our common stock was $0.15 per share. We intend to change our name to Workhorse Advanced Vehicles Inc. and apply to list our common stock on the Nasdaq Capital Market (Nasdaq) under the symbol “WAV”. The Series A Warrants will not be listed for trading on a securities exchange. | |

| 4 |

The number of shares of our common stock outstanding before and after this offering, as set forth in the table above, is based on 149,667,926 shares outstanding as of November 20, 2014 and excludes as of that date:

| ● | up to shares of common stock issuable upon the full exercise of the Series A Warrants offered hereby; | |

| ● | 53,417,613 shares of common stock issuable upon the full exercise of warrants to purchase shares of common stock; | |

| ● | 23,560,565 Options to purchase shares of our common stock issued under our 2010 Stock Incentive Plan, 2011 Stock Incentive Plan, 2012 Stock Incentive Plan, the 2013 Stock Incentive Plan and the 2014 Stock Incentive Plan. | |

| ● | 5,104,750 shares of our common stock reserved for future issuance under our 2010 Stock Incentive Plan, 2011 Stock Incentive Plan, 2012 Stock Incentive Plan, the 2013 Stock Incentive Plan and the 2014 Stock Incentive Plan; | |

| ● | 6,428,571 shares of common stock issuable upon exercise of the 14% unsecured convertible notes issued in November 2014 through December 2014; | |

| ● | shares of our common stock underlying the warrants to be issued to the representative of the underwriters in connection with this offering, plus up to shares of our common stock if the over-allotment option to purchase shares of common stock is exercised in full; and | |

| ● | the pro forma impact of the proposed Reverse Stock Split. |

Unless otherwise indicated, all information in this prospectus:

| ● | assumes no exercise of the representative’s warrants described above; | |

| ● | assumes no exercise of any outstanding options or warrants to purchase common stock; | |

| ● | assumes no exercise by the representative of the underwriters of its option to purchase up to units consisting of (i) additional shares of common stock, and (ii) additional Series A Warrants to cover over-allotments, if any; | |

| ● | does not reflect the pro forma impact of the proposed Reverse Stock Split. | |

| 5 |

The summary financial data set forth below should be read in conjunction with our financial statements and the related notes, “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

We derived the statement of operations data for the fiscal years ended December 31, 2012 and 2013 from our audited financial statements appearing elsewhere in this prospectus. We derived the statement of operations data for the nine months ended September 30, 2013 and 2014 and balance sheet data as of September 30, 2014 from our unaudited financial statements appearing elsewhere in this prospectus.

| Years Ended December 31, | Nine Months Ended September 30, | |||||||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||||||

| Consolidated Statements of Operations Data: | ||||||||||||||||

| Sales | $ | 272,098 | $ | 177,500 | $ | 177,500 | $ | 177,459 | ||||||||

| Operating Expenses | ||||||||||||||||

| Selling, general and administrative | 2,329,398 | 3,137,288 | 2,504,110 | 2,521,695 | ||||||||||||

| Research and development | 1,984,302 | 2,892,505 | 2,285,637 | 2,364,686 | ||||||||||||

| Total operating expenses | 4,313,700 | 6,029,793 | 4,789,746 | 4,886,381 | ||||||||||||

| Interest expense, net | 230,887 | 258,261 | 179,029 | 92,218 | ||||||||||||

| Net loss during the development stage | $ | (4,272,489 | ) | $ | (6,110,554 | ) | $ | (4,791,275 | ) | $ | (4,801,140 | ) | ||||

| Basic and diluted loss per share | $ | (0.10 | ) | $ | (0.08 | ) | $ | (0.07 | ) | $ | (0.03 | ) | ||||

| Weighted average number of common shares outstanding | 44,915,220 | 75,710,613 | 73,164,046 | 149,057,350 | ||||||||||||

| As of December 31, | As of September 30, 2014 | |||||||||||||||||||

| 2012 | 2013 | Actual | Pro Forma | Pro Forma as Adjusted (1) | ||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Consolidated Balance Sheet Data: | ||||||||||||||||||||

| Cash and cash equivalents | 39,819 | 7,019 | 833,834 | |||||||||||||||||

| Property plant and equipment, net | 126,847 | 4,407,261 | 4,112,685 | |||||||||||||||||

| Working capital | (2,344,694 | ) | (4,020,842 | ) | (462,847 | ) | ||||||||||||||

| Total assets | 220,693 | 4,850,997 | 5,410,234 | |||||||||||||||||

| Long term debt, less current portion | 362,186 | 2,292,890 | 2,495,244 | |||||||||||||||||

| Common stock | 55,955 | 82,712 | 149,051 | |||||||||||||||||

| Additional paid in capital | 14,956,547 | 20,321,536 | 26,992,044 | |||||||||||||||||

| Stock based compensation | 3,778,723 | 5,171,093 | 6,456,211 | |||||||||||||||||

| Total stockholders' deficit | (21,371,258 | ) | (27,481,812 | ) | (32,442,712 | ) | ||||||||||||||

| (1) | The pro forma as adjusted balance sheet data above reflects the issuance of shares of our common stock upon the completion of this offering at an assumed initial public offering price of $ per share (the mid-point of the price range on the front cover of this prospectus) after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| 6 |

An investment in our securities involves a high degree of risk. Before you invest in our securities, you should give careful consideration to the following risk factors, in addition to the other information included in this prospectus, including our financial statements and related notes, before deciding whether to invest in our securities. The occurrence of any of the adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

Our results of operations have not resulted in profitability and we may not be able to achieve profitability going forward.

We have incurred net losses amounting to $32.4 million for the period from inception (February 20, 2007) through September 30, 2014. In addition, as of September 30, 2014, we had a working capital deficiency of $462,000. We have had net losses in each quarter since our inception. We expect that we will continue to incur net losses for the foreseeable future. We may incur significant losses in the future for a number of reasons, including the other risks described in this prospectus, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown events. Accordingly, we may not be able to achieve or maintain profitability. Our management is developing plans to alleviate the negative trends and conditions described above and there is no guarantee that such plans will be successfully implemented. Our business plan has changed from concentrating on the electric passenger vehicle market to the electric medium duty trucks, but is still unproven. There is no assurance that even if we successfully implement our business plan, that we will be able to curtail our losses. Further, as we are a development stage enterprise, we expect that net losses and the working capital deficiency will continue. If we incur additional significant operating losses, our stock price may decline, perhaps significantly.

We have yet to achieve positive cash flow and, given our projected funding needs, our ability to generate positive cash flow is uncertain.

We have had negative cash flow from operating activities of $2.7 million and $2.2 million for the years ended December 31, 2013 and 2012 and $2.9 million for the nine months ended September 30, 2014. We anticipate that we will continue to have negative cash flow from operating and investing activities for the foreseeable future as we expect to incur increased research and development, sales and marketing, and general and administrative expenses and make significant capital expenditures in our efforts to increase sales and commence operations at our Union City facility. Our business also will at times require significant amounts of working capital to support our growth, particularly as we acquire inventory to support our anticipated increase in production. An inability to generate positive cash flow for the foreseeable future may adversely affect our ability to raise needed capital for our business on reasonable terms, diminish supplier or customer willingness to enter into transactions with us, and have other adverse effects that may decrease our long-term viability. There can be no assurance we will achieve positive cash flow in the foreseeable future.

We may need access to additional financing, which may not be available to us on acceptable terms or at all. For the year ended December 31, 2013, our independent registered public accounting firm issued a report on our 2013 financial statements that contains an explanatory paragraph stating that the lack of sales, negative working capital and stockholders’ deficit, raise substantial doubt about our ability to continue as a going concern. If we cannot access additional financing when we need it and on acceptable terms, our business, prospects, financial condition, operating results and ability to continue as a going concern could be adversely affected.

Our growth-oriented business plan to design, produce, sell and service commercial electric vehicles through our Union City facility will require continued capital investment. Our research and development activities will require continued investment. For the year ended December 31, 2013, our independent registered public accounting firm issued a report on our 2013 financial statements that contains an explanatory paragraph stating that the lack of sales, negative working capital and stockholders’ deficit, raise substantial doubt about our ability to continue as a going concern. Assuming this offering does not close, we expect that our cash and cash equivalent balances, will be sufficient to fund our operating activities through January 31, 2015, which will not allow us to implement our business plan in any meaningful way. Based on an operating plan that assumes we receive net proceeds from this offering, we expect that our cash and cash equivalent balances and our anticipated cash from operating activities, will be sufficient to fund our operating activities, including the implementation of our business plan through 2016. However, if our operating costs exceed our expectations or if we incur any significant unplanned expenses, we may need to raise additional funds through the issuance of equity, equity-related or debt securities or by obtaining credit from government or financial institutions. This capital will be necessary to fund our ongoing operations, continue research, development and design efforts, open our sales, service and assembly facilities, improve infrastructure and introduce new or improve existing vehicle models. We cannot be certain that additional financing will be available to us on favorable terms when required, or at all, particularly given that we do not now have a committed credit facility with any government or financial institution. If we cannot obtain additional financing when we need it and on terms acceptable to us, our business, prospects, financial condition, operating results and ability to continue as a going concern could be adversely affected.

| 7 |

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We have basically been a research and development company since beginning operations in February 2007. We have a limited operating history and have generated limited revenue. As we move more toward a manufacturing environment it is difficult, if not impossible, to forecast our future results based upon our historical data. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable or incur losses, which may result in a decline in our stock price.

Failure to successfully integrate the Workhorse ® brand, logo, intellectual property, patents and assembly plant in Union City, Indiana into our operations could adversely affect our business and results of operations.

As part of our strategy to become an OEM, in March 2013, we acquired Workhorse and the Workhorse Assets including the Workhorse ® brand, logo, intellectual property, patents and assembly plant in Union City, Indiana. The Workhorse acquisition may expose us to operational challenges and risks, including the diversion of management’s attention from our existing business, the failure to retain key Workhorse dealers and our ability to commence operations at the plant in Union City, Indiana. Our ability to sustain our growth and maintain our competitive position may be affected by our ability to successfully integrate the Workhorse Assets.

Our business, prospects, financial condition and operating results will be adversely affected if we cannot reduce and adequately control the costs and expenses associated with operating our business, including our material and production costs.

We incur significant costs and expenses related to procuring the materials, components and services required to develop and produce our electric vehicles. We have secured supply agreements for our critical components including our batteries. However, these are dependent on volume to ensure that they are available at a competitive price. As a result, our current cost projections are considerably higher than the projected revenue stream that such vehicles will produce. As a result we are continually working on initiatives to reduce our cost structure so that we may effectively compete. If we do not properly manage our costs and expenses our net losses will continue which will negatively impact our stock price.

If we are unable to pay off the outstanding amount owed under the debenture in the principal amount of $2,250,000 that is secured against all of the assets of AMP Trucks including the Workhorse brand and the Union City facility and such lien holder were to take possession of such assets, our operations would be severely negatively impacted if not curtailed.

On March 4, 2013, AMP Trucks entered into an Asset Purchase Agreement with Workhorse Custom Chassis, LLC (“WCC”), an Illinois limited liability company and a wholly-owned affiliate of Navistar International Corporation, to purchase certain assets including the Workhorse ® brand, logo, intellectual property, patents and approximately 250,000 sq. ft. of facilities on 48 acres of land in Union City, Indiana (the “Assets”). On March 13, 2013, AMP Trucks closed the acquisition of the Assets from WCC for a purchase price of $5,000,000 of which $2,750,000 was paid in cash and the delivery of a Secured Debenture (the “Debenture”) in the principal amount of $2,250,000. The Debenture is secured pursuant to a Security Agreement (the “Security Agreement”) and a Mortgage, Security Agreement, Assignment of Rents and Fixture Filing (the “Mortgage”) entered between AMP Trucks and WCC. Pursuant to the Security Agreement, AMP Trucks granted WCC a security interest in all of the assets of AMP Trucks in order to secure the prompt payment, performance and discharge in full of all of obligations of AMP Trucks under the Debenture. Pursuant to the Mortgage, the Debenture is secured by the real estate and related assets of the plant located in Union City, Indiana. The Debenture matures three years from its effective date of March 13, 2013 (the "Maturity Date") and interest associated with the Debenture is 10% per annum, which is payable on the Maturity Date. AMP Trucks may prepay outstanding principal and interest of the Debenture in full at any time. In the event AMP Trucks prepays outstanding principal and interest, it shall pay an amount equal to all outstanding principal and interest multiplied by 105%. AMP Holding and AMP guaranteed the payment of the Debenture.

Our future growth is dependent upon the willingness of operators of commercial vehicle fleets to adopt electric vehicles and on our ability to produce, sell and service vehicles that meet their needs. If the market for commercial electric vehicles does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be adversely affected.

Our growth is dependent upon the adoption of electric vehicles by operators of commercial vehicle fleets and on our ability to produce, sell and service vehicles that meet their needs. The entry of commercial electric vehicles into the medium-duty commercial vehicle market is a relatively new development, particularly in the United States, and is characterized by rapidly changing technologies and evolving government regulation, industry standards and customer views of the merits of using electric vehicles in their businesses. This process has been slow as without including the impact of government or other subsidies and incentives, the purchase prices for our commercial electric vehicles currently is higher than the purchase prices for diesel-fueled vehicles. As part of our sales efforts, we must educate fleet managers as to the economical savings during the life of the vehicle. As such, we believe that operators of commercial vehicle fleets consider a number of factors when deciding whether to purchase our commercial electric vehicles (or commercial electric vehicles generally) or vehicles powered by internal combustion engines, particularly diesel-fueled or natural gas-fueled vehicles. We believe these factors include:

| ● | the difference in the initial purchase prices of commercial electric vehicles and vehicles with comparable GVWs powered by internal combustion engines, both including and excluding the impact of government and other subsidies and incentives designed to promote the purchase of electric vehicles; |

| 8 |

| ● | the total cost of ownership of the vehicle over its expected life, which includes the initial purchase price and ongoing operating and maintenance costs; |

| ● | the availability and terms of financing options for purchases of vehicles and, for commercial electric vehicles, financing options for battery systems; |

| ● | the availability of tax and other governmental incentives to purchase and operate electric vehicles and future regulations requiring increased use of nonpolluting vehicles; |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; |

| ● | fuel prices, including volatility in the cost of diesel; |

| ● | the cost and availability of other alternatives to diesel fueled vehicles, such as vehicles powered by natural gas; |

| ● | corporate sustainability initiatives; |

| ● | commercial electric vehicle quality, performance and safety (particularly with respect to lithium-ion battery packs); |

| ● | the quality and availability of service for the vehicle, including the availability of replacement parts; |

| ● | the limited range over which commercial electric vehicles may be driven on a single battery charge; |

| ● | access to charging stations and related infrastructure costs, and standardization of electric vehicle charging systems; |

| ● | electric grid capacity and reliability; and |

| ● | macroeconomic factors. |

If, in weighing these factors, operators of commercial vehicle fleets determine that there is not a compelling business justification for purchasing commercial electric vehicles, particularly those that we produce and sell, then the market for commercial electric vehicles may not develop as we expect or may develop more slowly than we expect, which would adversely affect our business, prospects, financial condition and operating results.

If our customers are unable to efficiently and effectively integrate our electric vehicles into their existing commercial fleets our sales may suffer and our business, prospects, financial condition and operating results may be adversely affected.

Our sales strategy involves a comprehensive plan for the pilot and roll-out of our electric vehicles, as well as the ongoing replacement of existing commercial vehicles with our electric vehicles, that is tailored to the individual needs of our customers. If we are unable to develop and execute fleet integration strategies or fleet management support services that meet our customers' unique circumstances with minimal disruption to their businesses, our customers may not realize the economic benefits they expect from our electric vehicles. If this were to occur, our customers may not order additional vehicles from us, which could adversely affect our business, prospects, financial condition and operating results.

We currently do not have long-term supply contracts with guaranteed pricing which exposes us to fluctuations in component, materials and equipment prices. Substantial increases in these prices would increase our operating costs and could adversely affect our business, prospects, financial condition and operating results.

Because we currently do not have long-term supply contracts with guaranteed pricing, we are subject to fluctuations in the prices of the raw materials, parts and components and equipment we use in the production of our vehicles. Substantial increases in the prices for such raw materials, components and equipment would increase our operating costs and could reduce our margins if we cannot recoup the increased costs through increased vehicle prices. Any attempts to increase the announced or expected prices of our vehicles in response to increased costs could be viewed negatively by our customers and could adversely affect our business, prospects, financial condition and operating results.

If we are unable to scale our operations at our Union City facility in an expedited manner from our limited low volume production to high volume production, our business, prospects, financial condition and operating results could be adversely affected.

We are currently assembling our orders at our Union City facility which is acceptable for our existing orders. In order to satisfy increased demand, we will need to quickly scale operations in our Union City facility as well as scale our supply chain including access to batteries. Our business, prospects, financial condition and operating results could be adversely affected if we experience disruptions in our supply chain, if we cannot obtain materials of sufficient quality at reasonable prices or if we are unable to scale our Union City facility.

| 9 |

We depend upon key personnel and need additional personnel.

Our success depends on the continuing services of James E. Taylor, Chairman of the Board, Stephen Burns, CEO, and Martin J. Rucidlo, President. On December 8, 2010, we entered into an employment agreement with Mr. Burns for a term of two years which automatically renews for one year periods unless either of the parties elects to not renew for such period. We entered into a letter agreement in August 2012 with Mr. Taylor whereby Mr. Taylor agreed to serve as the Chairman of the Board of Directors. Mr. Taylor may resign as a director any anytime. Mr. Rucidlo is not engaged under a long-term employment agreement. The loss of any of these individuals could have a material and adverse effect on our business operations. Additionally, the success of our operations will largely depend upon its ability to successfully attract and maintain competent and qualified key management personnel. As with any company with limited resources, there can be no guarantee that we will be able to attract such individuals or that the presence of such individuals will necessarily translate into profitability for our company. Our inability to attract and retain key personnel may materially and adversely affect our business operations. Any failure by our management to effectively anticipate, implement, and manage the changes required to sustain our growth would have a material adverse effect on our business, financial condition, and results of operations.

Our business requires substantial capital, and if we are unable to maintain adequate financing sources our profitability and financial condition will suffer and jeopardize our ability to continue operations.

We require substantial capital to support our operations. In order to fully implement our business plan, we expect that we will need approximately $20,000,000 in capital through 2016. If we are unable to maintain adequate financing, or other sources of capital are not available, we could be forced to suspend, curtail or reduce our operations, which could harm our revenues, ability to achieve profitability, financial condition and business prospects.

We face competition. A few of our competitors have greater financial or other resources, longer operating histories and greater name recognition than we do and one or more of these competitors could use their greater resources and/or name recognition to gain market share at our expense or could make it very difficult for us to establish market share.

Companies currently competing in the fleet logistics market offering alternative fuel medium duty trucks include Ford Motor Company and Freightliner. In the electric medium duty truck market in the United States, we compete with a few other manufacturers, including Electric Vehicles International and Smith Electric Vehicles. Ford and Freightliner have more significant financial resources, established market positions, long-standing relationships with customers and dealers, and who have more significant name recognition, technical, marketing, sales, financial and other resources than we do. Ford and Freightliner are currently selling alternative fuel fleet vehicles including hybrids. The resources available to our competitors to develop new products and introduce them into the marketplace exceed the resources currently available to us. As a result, our competitors may be able to compete more aggressively and sustain that competition over a longer period of time that we can. This intense competitive environment may require us to make changes in our products, pricing, licensing, services, distribution, or marketing to develop a market position. Each of these competitors has the potential to capture market share in our target markets which could have an adverse effect on our position in our industry and on our business and operating results.

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position.

There are companies in the electric vehicle industry that have developed or are developing vehicles and technologies that compete or will compete with our vehicles. We cannot assure that our competitors will not be able to duplicate our technology or provide products and services similar to ours more efficiently. If for any reason we are unable to keep pace with changes in electric vehicle technology, particularly battery technology, our competitive position may be adversely affected. We plan to upgrade or adapt our vehicles and introduce new models in order to continue to provide electric vehicles that incorporate the latest technology. However, there is no assurance that our research and development efforts will keep pace with those of our competitors.

Our electric vehicles compete for market share with vehicles powered by other vehicle technologies that may prove to be more attractive than ours.

Our target market currently is serviced by manufacturers with existing customers and suppliers using proven and widely accepted fuel technologies. Additionally, our competitors are working on developing technologies that may be introduced in our target market. If any of these alternative technology vehicles can provide lower fuel costs, greater efficiencies, greater reliability or otherwise benefit from other factors resulting in an overall lower total cost of ownership, this may negatively affect the commercial success of our vehicles or make our vehicles uncompetitive or obsolete.

| 10 |

We currently have a limited number of customers, with whom we do not have long-term agreements, and expect that a significant portion of our future sales will be from a limited number of customers and the loss of any of these high volume customers could materially harm our business.

A significant portion of our projected future revenue, if any, is generated from a limited number of vehicle customers. Additionally, much of our business model is focused on building relationships with large customers. Currently we have no contracts with customers that include long-term commitments or minimum volumes that ensure future sales of vehicles. As such, a customer may take actions that affect us for reasons that we cannot anticipate or control, such as reasons related to the customer’s financial condition, changes in the customer’s business strategy or operations or as the result of the perceived performance or cost-effectiveness of our vehicles. The loss of or a reduction in sales or anticipated sales to our most significant customers could have an adverse effect on our business, prospects, financial condition and operating results.

Changes in the market for electric vehicles could cause our products to become obsolete or lose popularity.

The modern electric vehicle industry is in its infancy and has experienced substantial change in the last few years. To date, demand for and interest in electric vehicles has been slower than forecasted by industry experts. As a result, growth in the electric vehicle industry depends on many factors, including, but not limited to:

● |

continued development of product technology, especially batteries | |

| ● | the environmental consciousness of customers | |

| ● | the ability of electric vehicles to successfully compete with vehicles powered by internal combustion engines | |

| ● | limitation of widespread electricity shortages; and | |

| ● | whether future regulation and legislation requiring increased use of non-polluting vehicles is enacted |

We cannot assume that growth in the electric vehicle industry will continue. Our business may suffer if the electric vehicle industry does not grow or grows more slowly than it has in recent years or if we are unable to maintain the pace of industry demands.

The unavailability, reduction, elimination or adverse application of government subsidies, incentives and regulations could have an adverse effect on our business, prospects, financial condition and operating results.

We believe that, currently, the availability of government subsidies and incentives including those available in New York, California and Chicago is an important factor considered by our customers when purchasing our vehicles, and that our growth depends in part on the availability and amounts of these subsidies and incentives. Any reduction, elimination or discriminatory application of government subsidies and incentives because of budgetary challenges, policy changes, the reduced need for such subsidies and incentives due to the perceived success of electric vehicles or other reasons may result in the diminished price competitiveness of the alternative fuel vehicle industry.

We may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in our competitive position.

Our current products are designed for use with, and are dependent upon, existing electric vehicle technology. As technologies change, we plan to upgrade or adapt our products in order to continue to provide products with the latest technology. However, our products may become obsolete or our research and development efforts may not be sufficient to adapt to changes in or to create the necessary technology. As a result, our potential inability to adapt and develop the necessary technology may harm our competitive position.

The failure of certain key suppliers to provide us with components could have a severe and negative impact upon our business.

We have secured supply agreements for our critical components including our batteries. However, these are dependent on volume to ensure that they are available at a competitive price. Further, we rely on a small group of suppliers to provide us with components for our products. If these suppliers become unwilling or unable to provide components or if we are unable to meet certain volume requirements in our existing supply agreements, there are a limited number of alternative suppliers who could provide them. Changes in business conditions, wars, governmental changes, and other factors beyond our control or which we do not presently anticipate could affect our ability to receive components from our suppliers. Further, it could be difficult to find replacement components if our current suppliers fail to provide the parts needed for these products. A failure by our major suppliers to provide these components could severely restrict our ability to manufacture our products and prevent us from fulfilling customer orders in a timely fashion.

Product liability or other claims could have a material adverse effect on our business.

The risk of product liability claims, product recalls, and associated adverse publicity is inherent in the manufacturing, marketing, and sale of electrical vehicles. Although we have product liability insurance for our consumer and commercial products, that insurance may be inadequate to cover all potential product claims. We also carry liability insurance on our products. Any product recall or lawsuit seeking significant monetary damages either in excess of our coverage, or outside of our coverage, may have a material adverse effect on our business and financial condition. We may not be able to secure additional product liability insurance coverage on acceptable terms or at reasonable costs when needed. A successful product liability claim against us could require us to pay a substantial monetary award. Moreover, a product recall could generate substantial negative publicity about our products and business and inhibit or prevent commercialization of other future product candidates. We cannot provide assurance that such claims and/or recalls will not be made in the future.

| 11 |

We may have to devote substantial resources to implementing a retail product distribution network.

Dealers are often hesitant to provide their own financing to contribute to our product distribution network. As a result, we anticipate that we may have to provide financing or other consignment sale arrangements for dealers. A capital investment such as this presents many risks, foremost among them being that we may not realize a significant return on our investment if the network is not profitable. Our inability to collect receivables from dealers could cause us to suffer losses. Lastly, the amount of time that our management will need to devote to this project may divert them from performing other functions necessary to assure the success of our business.

Regulatory requirements may have a negative impact upon our business.

While our vehicles are subject to substantial regulation under federal, state, and local laws, we believe that our vehicles are or will be materially in compliance with all applicable laws. However, to the extent the laws change, or if we introduce new vehicles in the future, some or all of our vehicles may not comply with applicable federal, state, or local laws. Further, certain federal, state, and local laws and industrial standards currently regulate electrical and electronics equipment. Although standards for electric vehicles are not yet generally available or accepted as industry standards, our products may become subject to federal, state, and local regulation in the future. Compliance with these regulations could be burdensome, time consuming, and expensive.

Our products are subject to environmental and safety compliance with various federal and state regulations, including regulations promulgated by the EPA, NHTSA, and various state boards, and compliance certification is required for each new model year. The cost of these compliance activities and the delays and risks associated with obtaining approval can be substantial. The risks, delays, and expenses incurred in connection with such compliance could be substantial.

Our success may be dependent on protecting our intellectual property rights.

We rely on trade secret protections to protect our proprietary technology as well as several registered patents and one patent application. Our patents relate to the vehicle chassis assembly, vehicle header and drive module and manifold for electric motor drive assembly. Our existing patent application relates to the onboard generator drive system for electric vehicles. Our success will, in part, depend on our ability to obtain additional trademarks and patents. We are working on obtaining patents and trademarks registered with the United States Patent and Trademark Office but have not finalized any as of this date. Although we have entered into confidentiality agreements with our employees and consultants, we cannot be certain that others will not gain access to these trade secrets. Others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets.

We may be exposed to liability for infringing upon the intellectual property rights of other companies.

Our success will, in part, depend on our ability to operate without infringing on the proprietary rights of others. Although we have conducted searches and are not aware of any patents and trademarks which our products or their use might infringe, we cannot be certain that infringement has not or will not occur. We could incur substantial costs, in addition to the great amount of time lost, in defending any patent or trademark infringement suits or in asserting any patent or trademark rights, in a suit with another party.

Our electric vehicles make use of lithium-ion battery cells, which, if not appropriately managed and controlled, on rare occasions have been observed to catch fire or vent smoke and flames. If such events occur in our electric vehicles, we could face liability for damage or injury, adverse publicity and a potential safety recall, any of which could adversely affect our business, prospects, financial condition and operating results.

The battery packs in our electric vehicles use lithium-ion cells, which have been used for years in laptop computers and cell phones. On rare occasions, if not appropriately managed and controlled, lithium-ion cells can rapidly release the energy they contain by venting smoke and flames in a manner that can ignite nearby materials.

Our facilities could be damaged or adversely affected as a result of disasters or other unpredictable events. Any prolonged disruption in the operations of our facility would adversely affect our business, prospects, financial condition and operating results.

We engineer and assemble our electric vehicles in a facility in Loveland, Ohio and we intend to locate the assembly function to our facility in Union City. Any prolonged disruption in the operations of our facility, whether due to technical, information systems, communication networks, accidents, weather conditions or other natural disaster, or otherwise, whether short or long-term, would adversely affect our business, prospects, financial condition and operating results .

| 12 |

Risks Relating to Our Financial Position and Need for Additional Capital

Risks Related to Owning our Common Stock

An active trading market for our common stock may not develop, and you may not be able to sell your common stock at or above the initial public offering price.

Prior to the completion of this offering, there has been a limited public market for our common stock. Our common stock is currently traded on the OTC Markets (OTCQB) under the symbol “AMPD”. On December 10, 2014, the last reported sales price of our common stock was $0.15 per share. We intend to change our name to Workhorse Advanced Vehicles Inc. and apply to list our common stock on the Nasdaq Capital Market (Nasdaq) under the symbol “WAV”. The Series A Warrants will not be listed for trading on a securities exchange. An active trading market for shares of our common stock may never develop or be sustained following this offering. If an active trading market does not develop, you may have difficulty selling your shares of common stock at an attractive price, or at all. The price for our common stock in this offering will be determined by negotiations among us and the underwriters, and it may not be indicative of prices that will prevail in the open market following this offering. Consequently, you may not be able to sell your common stock at or above the initial public offering price or at any other price or at the time that you would like to sell. An inactive market may also impair our ability to raise capital by selling our common stock, and it may impair our ability to attract and motivate our employees through equity incentive awards and our ability to acquire other companies, products or technologies by using our common stock as consideration.

The price of our common stock may fluctuate substantially.

You should consider an investment in our common stock to be risky, and you should invest in our common stock only if you can withstand a significant loss and wide fluctuations in the market value of your investment. Some factors that may cause the market price of our common stock to fluctuate, in addition to the other risks mentioned in this “Risk Factors” section and elsewhere in this prospectus, are:

| ● | sales of our common stock by our stockholders, executives, and directors; |

| ● | volatility and limitations in trading volumes of our shares of common stock; |

| ● | fluctuations in our results of operations; |

| ● | our ability to develop significant sales; |

| ● | actual or un-anticipated fluctuations in our annual and quarterly financial results; |

| ● | our ability to obtain financings to continue and expand our commercial activities, commence our manufacturing operations at our Union City facility, maintain our competitive technological position and other business activities; |

| ● | our ability to secure resources and the necessary personnel to continue and expand our commercial activities; |

| ● | changes in our capital structure or dividend policy, including as a result of future issuances of securities and sales of large blocks of common stock by our stockholders; |

| ● | our cash position; |

| ● | announcements and events surrounding financing efforts, including debt and equity securities; |

| ● | reputational issues including issues relating to use of our vehicles by our customers; |

●

|

competition from traditional manufacturers utilizing diesel based engines and alternative fuels including electric or others that may emerge in the future; | ||

| ● | the absence of the development of a charging infrastructure; |

| ● | announcements of acquisitions, partnerships, collaborations, joint ventures, new diagnostic tests, capital commitments, or other events by us or our competitors; |

| ● | changes in general economic, political and market conditions in the United States; |

| ● | changes in industry conditions or perceptions; |

| ● | changes in valuations of similar companies or groups of companies; |

| ● | analyst research reports, recommendations and changes in recommendations, price targets and withdrawals of coverage; |

| ● | departures and additions of key personnel; |

| 13 |

| ● | disputes and litigations related to intellectual properties, proprietary rights and contractual obligations; |

| ● | changes in applicable laws, rules, regulations, or accounting practices and other dynamics; |

| ● | release or expiry of lockup or other transfer restrictions on our outstanding common shares; |

| ● | announcements or actions taken by our principal stockholders; and |

| ● | other events or factors, many of which may be out of our control. |

In addition, if the market for stocks in our industry or industries related to our industry, or the stock market in general, experiences a loss of investor confidence, the trading price of our common stock could decline for reasons unrelated to our business, financial condition and results of operations. If any of the foregoing occurs, it could cause our stock price to fall and may expose us to lawsuits that, even if unsuccessful, could be costly to defend and a distraction to management.

An effective registration statement may not be in place when an investor desires to exercise warrants, thus precluding such investor from being able to exercise his, her or its warrants at that time.

No warrant held by an investor will be exercisable and we will not be obligated to issue common stock unless at the time such holder seeks to exercise such warrant, a prospectus relating to the common stock issuable upon exercise of the warrant is current (or an exemption from registration is available) and the common stock has been registered or qualified or deemed to be exempt under the securities laws of the state of residence of the holder of the warrants. We cannot assure you that we will be able to maintain a current prospectus relating to the common stock issuable upon exercise of the warrants until the expiration of the warrants, and if we do not maintain a current prospectus related to the common stock issuable upon exercise of the warrants (and an exemption from registration is not available), holders will be unable to exercise their warrants and we will not be required to net cash settle any such warrant exercise. If we are unable to issue the shares upon exercise of the warrants by an investor because there is no current prospectus relating to the common stock issuable upon exercise of the warrant (and an exemption from registration is not available) or the common stock has not been registered or qualified or deemed to be exempt under the securities laws of the state of residence of the holder of the warrants, the warrants will not expire until ten days after the date we are first able to issue the shares. Nevertheless, because an investor may not be able to exercise the warrants at the most advantageous time, the warrants held by an investor may have no value, the market for such warrants may be limited and such warrants may expire worthless.