Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d834303d8k.htm |

©

Fifth Third Bank | All Rights Reserved

Goldman Sachs

U.S. Financial Services Conference

Tayfun Tuzun

Executive Vice President & Chief Financial Officer

December 9, 2014

Refer to earnings release dated October 16, 2014 and

10-Q dated November 7, 2014 for further information.

Exhibit 99.1 |

2

©

Fifth Third Bank | All Rights Reserved

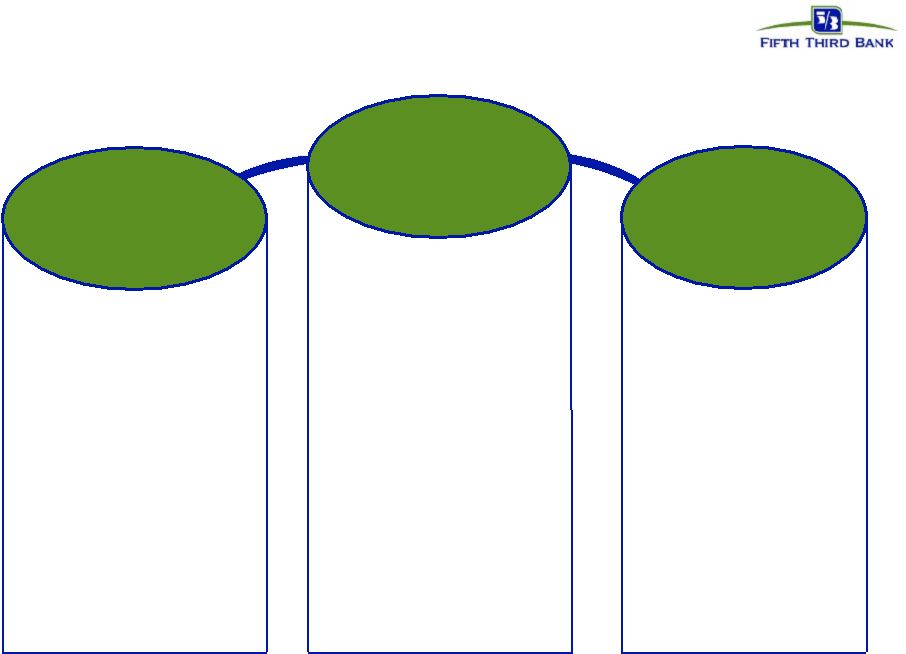

Business composition at Fifth Third

Consumer

Lending

Branch

Banking

Wealth

Management

Commercial

Banking

Retail Bank

Cards

Home Equity

Mortgage

Auto

Private Bank

Retail Brokerage

Institutional Services

Commercial Bank

Footprint

Business

Lines

In footprint markets

National consumer lending

In footprint markets

National commercial banking

37% of

Bancorp net

revenue

10% of

Bancorp net

revenue

9% of

Bancorp net

revenue

42% of

Bancorp net

revenue

1

2014YTD as of September 30. Net revenue represents net interest

income plus noninterest income. General Corporate and Other segment not included

in above disclosure and represents remaining 2% of net revenue.

1

1

1

1 |

3

©

Fifth Third Bank | All Rights Reserved

Overview of our Commercial Bank

•

Approximately 33% of Commercial

revenue driven by National business

and 67% in footprint at 3Q14

–

Compared with approximately 25%

National and 75% in footprint at

1Q11

In footprint markets

National commercial banking

National commercial hub cities

Commercial loan production office

Small Business Business

Banking Middle Market

Mid Corp Large Corp

<$2MM

sales $2-10MM sales $10-500MM

sales $500MM-2B sales >$2B sales

1Q11

Commercial

Loans

Commercial Bank Composition by Segment

3Q14

Commercial

Loans |

4

©

Fifth Third Bank | All Rights Reserved

Strategic direction in commercial banking

Growing

relationships

with larger

companies

Strengthening

vertical

expertise

Increasing

utilization of

non-credit

offerings

Selection of verticals

based on market size,

identified non-credit

product and service

utilization, and growth

expectations

Specialized relationship

managers with better

knowledge of clients’

business

Current verticals:

Healthcare, Energy,

Retail

Alignment of risk appetite

and stronger post-crisis

growth in large and mid-

corporate borrowing

needs

Better credit quality and

need for wider scope of

banking products and

services

Continuing to preserve

relationships in traditional

middle market lending

given market conditions

Areas of historical

expertise such as

Treasury Management

coupled with new

investments in capital

markets capabilities and

advisory services

Competitive advantage

relative to smaller bank

competition |

5

©

Fifth Third Bank | All Rights Reserved

Changing profile of commercial lending

Commercial Loan Portfolio

Cross-sell

ratio

2

Changing credit profile post-crisis directly linked

to change in our risk appetite, indirectly a result of

increased focus on mid-

and large-corporate

relationships

Combination of lower credit spreads and higher

capital ratios require significantly higher

contribution from non-credit business fees to

meet target returns

Although fee income streams may result in higher

potential volatility in revenues compared to pure

interest income, lower credit volatility should

preserve stable earnings

PD

Yield /

Rating

Noninterest Income Composition

3

1

1

5 year BB spread at quarter end.

2

3Q12 not restated for subsequent adjustments reflected in current period

data. 3

Represents National Healthcare business.

2.00

2.50

3.00

3.50

4.00

4.50

3Q12

3Q14

Mid-Corporate

Healthcare

-

-

-

1%

2%

3%

4%

5%

6%

7%

4

5

6

7

8

Weighted-Average PD

Yield

5 Yr Rating BB Spread

27%

17%

16%

16%

14%

4%

4%

1%

1%

BL Fees

Syndication Fees

FX Revenue

Institutional Sales

LOC Fees

Derivative Income

Lease Remarketing

Commodities Revenue

Other

Total Commercial |

6

©

Fifth Third Bank | All Rights Reserved

Changing trajectory of earnings composition

1

Includes FTE Adjustment

2

YTD10, YTD11, and YTD12 have not been restated for changes in the structure of

reporting units that occurred in 1Q14. Net Revenue

1,2

Net Interest Income

1,2

Fees

2

•

In the long-run, focus on non-credit revenue streams and continued upgrade of

portfolio credit profile is likely to favor growth rates in fee items relative

to margin income Growth rates in margin income in the transition to higher

interest rates are expected to improve

•

Overall attractiveness of commercial banking is likely to be high as capital

efficiencies and lower volatility will lead to higher shareholder

returns Our focus on leveraging verticals and relationships with high growth

potential is key to maintaining historically sector-leading growth in

commercial banking Commercial Bank Financial Trends ($MM)

|

7

©

Fifth Third Bank | All Rights Reserved

Conclusion

•

Current capital levels in banking combined with current pricing of credit

risk require shift in corporate lending strategy

Minimum stress scenario capital levels serve as binding constraint

Optimal capital management requires changes in borrower risk profile

Relationship-focused to include contribution from non-credit business

•

Non-credit fee growth provides good balance to lower margins in lending

and improves capital efficiency

•

Our size enables us to compete better with larger banks in capturing

relationships as the SIFI banks are subject to lower leverage limits

Additionally, specialized lending in select sectors deepen expertise and

attract talented relationship managers to service clients at a higher

level

•

Over the long run we expect this approach leads to lower volatility of credit

losses and earnings while driving more stable returns on capital

and

maintaining our strong growth rates in corporate banking

|

8

©

Fifth Third Bank | All Rights Reserved

Cautionary statement

This report contains statements that we believe are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule

3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future

performance or business. They usually can be identified by the use of forward-looking language

such as “will likely result,” “may,” “are expected to,” “is

anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as

“believes,” “plans,” “trend,” “objective,”

“continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,”

“should,” “could,” “might,” “can,” or similar verbs. You

should not place undue reliance on these statements, as they are subject to risks and

uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our

Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should

keep in mind these risks and uncertainties, as well as any cautionary statements we may make.

Moreover, you should treat these statements as speaking only as of the date they are made and

based only on information then actually known to us.

There are a number of important factors that could cause future results to differ materially from

historical performance and these forward- looking statements. Factors that might cause such

a difference include, but are not limited to: (1) general economic conditions and weakening in

the economy, specifically the real estate market, either nationally or in the states in which Fifth Third, one or more acquired

entities and/or the combined company do business, are less favorable than expected; (2) deteriorating

credit quality; (3) political developments, wars or other hostilities may disrupt or increase

volatility in securities markets or other economic conditions; (4) changes in the interest rate

environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan

loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate

sources of funding and liquidity; (7) maintaining capital requirements and adequate sources of

funding and liquidity may limit Fifth Third’s operations and potential growth; (8) changes and

trends in capital markets; (9) problems encountered by larger or similar financial institutions may

adversely affect the banking industry and/or Fifth Third; (10) competitive pressures among

depository institutions increase significantly; (11) effects of critical accounting policies and

judgments; (12) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board

(FASB) or other regulatory agencies; (13) legislative or regulatory changes or actions, or significant

litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined

company or the businesses in which Fifth Third, one or more acquired entities and/or the

combined company are engaged, including the Dodd-Frank Wall Street Reform and Consumer Protection Act; (14) ability to maintain

favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16)

ability to attract and retain key personnel; (17) ability to receive dividends from its

subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth

Third; (19) effects of accounting or financial results of one or more acquired entities; (20)

difficulties from Fifth Third’s investment in, relationship with, and nature of the

operations of Vantiv, LLC; (21) loss of income from any sale or potential sale of businesses that could

have an adverse effect on Fifth Third’s earnings and future growth; (22) ability to secure

confidential information and deliver products and services through the use of computer systems

and telecommunications networks; and (23) the impact of reputational risk created by these

developments on such matters as business generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these forward-looking

statements.

|