Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Diamond Foods Inc | Financial_Report.xls |

| EX-32.01 - EXHIBIT - Diamond Foods Inc | dmnd-20141031x10qex3201.htm |

| EX-10.02 - EXHIBIT - Diamond Foods Inc | dmnd-20141031x10qex1002.htm |

| EX-31.01 - EXHIBIT - Diamond Foods Inc | dmnd-20141031x10qex3101.htm |

| EX-10.04 - EXHIBIT - Diamond Foods Inc | dmnd-20141031x10qex1004.htm |

| 10-Q - 10-Q - Diamond Foods Inc | dmnd-20141031x10q.htm |

| EX-31.02 - EXHIBIT - Diamond Foods Inc | dmnd-20141031x10qex3102.htm |

Exhibit 10.03

DIAMOND FOODS, INC.

2005 EQUITY INCENTIVE PLAN

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD AGREEMENT

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD AGREEMENT (this “Agreement”) is made by and between Diamond Foods, Inc., a Delaware corporation (the “Company”), and the Participant (“Participant”) identified on the attached Notice of Grant of Award and Award Agreement (the “Notice”) pursuant to the Company’s 2005 Equity Incentive Plan (the “Plan”). To the extent any capitalized terms used in this Agreement (including Appendix A and Appendix B) are not defined, they shall have the meaning ascribed to them in the Plan. The Award (as defined in Appendix A) and the “Award Units” transferrable thereunder are subject to all the terms and conditions set forth herein, in the attached Appendix A and Appendix B, and in the Plan, the provisions of which are incorporated herein by reference and all references to this Agreement include the Notice.

[For Awards Other than the 2014 Awards: The Award and Award Units are intended to qualify as “qualified performance-based compensation” as described in Section 162(m)(4)(C) of the Code.] The principal features of the Award are an Award Date set forth in the Notice (“Award Date”), Target Number of Award Units, and Maximum Number of Award Units, all as set forth in a participant’s Grant Summary.

The actual number of Award Units that vest pursuant to the terms and conditions of this Award will be between 0% and 200% of the Target Number of Award Units. The Maximum Number of Award Units represents 200% of the Target Number of Award Units. Notwithstanding the above or anything else contained in this Agreement, in no event shall the actual number of Award Units be greater than the amount specified in Section 4 of Appendix B.

PERFORMANCE-BASED VESTING SCHEDULE: Subject to the terms and conditions of the Plan, Appendix A, Appendix B and this paragraph, the number of Award Units that vest on the Final Vest Date for the Measurement Period (as defined in Appendix B) shall be based (after certification by the Committee as described below) on the relative total stockholder return percentile ranking (“Percentile Ranking”) of the Company for each Measurement Period, provided Participant is, and has remained continuously employed by or in continuous service with the Company or a Subsidiary since the Award Date through the Final Vest Date. Participant shall not be considered to have terminated employment for purposes of the vesting requirements during a leave of absence that is protected under local law (which may include, but is not limited to, a maternity, paternity, disability, medical, or military leave), provided that such period shall not exceed the maximum leave of absence period protected by local law. Following the completion of the Measurement Period, the Committee shall determine and certify, on or before the applicable vest date, in accordance with the requirements of Section 162(m) of the Code, the Percentile Ranking for the Measurement Period and the number of Award Units that vest according to the performance terms set forth in Appendix B; provided, however, that the Committee retains discretion to reduce, but not increase the number of Award Units that would otherwise vest as a result of the Company’s Percentile Ranking for each Measurement Period.

PLEASE READ ALL OF THE APPENDIX A AND APPENDIX B WHICH CONTAIN THE SPECIFIC TERMS AND CONDITIONS OF THE AWARD.

1.

2

APPENDIX A

DIAMOND FOODS, INC.

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD

2. Award. Each Award Unit represents the unsecured right to receive one share of Diamond Foods, Inc. common stock (“Common Stock”), subject to certain restrictions and on the terms and conditions contained in this Performance-Based Restricted Stock Unit Award (“Award” or “RSU”), and the Diamond Foods, Inc. 2005 Equity Incentive Plan, as amended (the “Plan”). In the event of any conflict between the terms of the Plan and this Award, including appendices thereto, the terms of the Plan shall govern. Any terms not defined herein or in Appendix B or the Agreement shall have the meaning set forth in the Plan.

3. Award Date. The Award Date shall be the date on which the Committee makes the determination to grant such Award, unless otherwise specified by the Committee.

4. Forfeiture Upon Termination of Employment.

(a) Except as otherwise provided in Section 3(b) hereof, in the event that Participant’s employment or service is Terminated for any reason, any unvested Award Units that are not yet vested as of Participant’s Termination Date shall be forfeited immediately upon such Termination Date.

(b) In the event of the death or Disability of Participant during the Measurement Period, Participant shall vest in a pro-rata portion of the Award Units on the Final Vest Date, the Two-Year Vest Date or, if applicable, the Change in Control Vest Date (as defined below), with such number of Award Units vesting to be determined (i) on the Final Vest Date, based upon the actual Percentile Ranking for the Measurement Period, as set forth in Appendix B, (ii) on the Two-Year Vest Date based on the number of Award Units that would otherwise vest on such date, and (iii) on the Change in Control Vest Date, based on the Target Number of Award Units, in each case based upon the following pro-ration formula:

Number of Award Units determined to vest on the Final Vest Date, the Two-Year Vest Date or, if applicable, the Change in Control Vest Date multiplied by the number of calendar months worked by Participant from (i) the Award Date through the Termination Date due to the death or Disability (ii) divided by thirty-six (36).

Participant shall be deemed to have worked a full calendar month if Participant has worked any portion of that month. The Committee’s determination of vested Award Units shall be in whole Award Units only and will be binding on Participant. [NTD: The time-based RSU does not have this provision – it can be retained or eliminated.]

5. Forfeiture Upon Termination of Measurement Period. Any Award Units that do not vest on the Final Vest Date shall be forfeited.

6. Change of Control. Upon a Change of Control occurring prior to the expiration of the Performance Period, the Target Number of Award Units shall vest on the date of the Change in

A-1

Control (the “Change in Control Vest Date”); provided that if the Change of Control Vest Date occurs prior to the first anniversary of the Award Date, the number of Award Units that shall vest shall be multiplied by the number of calendar months worked by Participant from (i) the Award Date through the Change of Control Vest Date (ii) divided by thirty six (36). Participant shall be deemed to have worked a full calendar month if Participant has worked any portion of that month. Any Award Units that do not vest on the Change in Control Vest Date shall be forfeited.

7. Section 280G Provision. If Participant, upon taking into account the benefit provided under this Award and all other payments that would be deemed to be “parachute payments” within the meaning of Section 280G of the Code (collectively, the “280G Payments”), would be subject to the excise tax under Section 4999 of the Code, notwithstanding any provision of this Award to the contrary, Participant's benefit under this Award shall be reduced to an amount equal to (i) 2.99 times Participant's “base amount” (within the meaning of Section 280G of the Code), (ii) minus the value of all other payments that would be deemed to be “parachute payments” within the meaning of Section 280G of the Code (but not below zero); provided, however, that the reduction provided by this sentence shall not be made if it would result in a smaller aggregate after-tax payment to Participant (taking into account all applicable federal, state and local taxes including the excise tax under Section 4999 of the Code). Unless the Company and Participant otherwise agree in writing, all determinations required to be made under this Section 6, and the assumptions to be used in arriving at such determinations, shall be made in writing in good faith by the accounting firm serving as the Company's independent public accountants immediately prior to the events giving rise to the payment of such benefits (the “Accountants”). For the purposes of making the calculations required under this Section 6, the Accountants may make reasonable assumptions and approximations concerning the application of Sections 280G and 4999 of the Code. The Company shall bear all costs the Accountants may reasonably incur in connection with any calculations contemplated by this Section 6.

8. Tax Withholding. Prior to delivery of Shares of Common Stock upon the vesting of the Award Units (“Award Shares”), Participant must pay or make adequate arrangements satisfactory to the Company and/or Participant's employer to satisfy all withholding obligations of the Company and/or Participant's employer. In this regard, Participant authorizes the Company and/or Participant's employer, at their discretion and if permissible under local law, to satisfy its withholding obligations by one or a combination of the following:

(i) withholding Shares from the delivery of the Award Shares, provided that the Company only withholds a number of Shares with a Fair Market Value equal to or below the minimum withholding amount, provided, however, that in order to avoid issuing fractional Shares, the Company may round up to the next nearest number of whole Shares, as long as the Company issues no more than a single whole Share in excess of the minimum withholding obligation. The Company or Participant’s employer will remit the total amount withhold for Tax Items to the appropriate tax authorities; or

(ii) withholding from Participant’s wages or other base compensation paid to Participant by the Company and/or Participant’s employer; or

(iii) selling or arranging for the sale of Award Shares.

A-2

9. No Deferral of Compensation. Payments made pursuant to this Plan and Award are intended to qualify for the “short-term deferral” exemption from Section 409A of the Code. The Company reserves the right, to the extent the Company deems necessary or advisable in its sole discretion, to unilaterally amend or modify the Plan and/or this Award agreement to ensure that all Awards are made in a manner that qualifies for exemption from or complies with Section 409A of the Code, provided however, that the Company makes no representations that the Award will be exempt from Section 409A of the Code and makes no undertaking to preclude Section 409A of the Code from applying to this Award.

10. Settlement. Settlement of vested RSUs shall occur within 30 days of the applicable vest date. Settlement of vested RSUs shall be in Shares.

11. No Stockholder Rights. Unless and until such time as Shares are issued in settlement of vested RSUs, the Participant shall have no ownership of the Shares allocated to the RSUs and shall have no right to vote such Shares, subject to the terms, conditions and restrictions described in the Plan and herein.

12. No Transfer. The RSUs and any interest therein: (i) shall not be sold, assigned, transferred, pledged, hypothecated, or otherwise disposed of, and (ii) shall, if the Participant’s continuous employment or service with the Company or any Parent or Subsidiary shall terminate for any reason (except as otherwise provided in the Plan or herein), be forfeited to the Company forthwith, and all the rights of the Participant to such RSUs shall immediately terminate.

13. Acknowledgement. By their signatures on the Agreement, the Company and the Participant agree that the RSUs are granted under and governed by this Agreement and by the provisions of the Plan (incorporated herein by reference). The Participant: (i) acknowledges receipt of a copy of the Plan and the Plan prospectus, (ii) represents that the Participant has carefully read and is familiar with their provisions, and (iii) hereby accepts the Award and any RSUs granted thereunder subject to all of the terms and conditions set forth herein and those set forth in the Plan.

14. Compliance with Laws and Regulations. The issuance of Shares will be subject to and conditioned upon compliance by the Company and Participant with all applicable state and federal laws and regulations and with all applicable requirements of any stock exchange or automated quotation system on which the Company's Common Stock may be listed or quoted at the time of such issuance or transfer.

15. Successors and Assigns. The Company may assign any of its rights under this Agreement. This Agreement shall be binding upon and inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer herein set forth, this Agreement will be binding upon Participant and Participant's heirs, executors, administrators, legal representatives, successors and assigns.

16. Governing Law; Severability. This Agreement shall be governed by and construed in accordance with the internal laws of the State of California as such laws are applied to agreements between California residents entered into and to be performed entirely within

A-3

California, excluding that body of laws pertaining to conflict of laws. If any provision of this Agreement is determined by a court of law to be illegal or unenforceable, then such provision will be enforced to the maximum extent possible and the other provisions will remain fully effective and enforceable.

17. Notices. Any notice required to be given or delivered to the Company shall be in writing and addressed to the Corporate Secretary of the Company at its principal corporate offices. Any notice required to be given or delivered to Participant shall be in writing and addressed to Participant at the address indicated above or to such other address as Participant may designate in writing from time to time to the Company. All notices shall be deemed effectively given upon personal delivery, (i) three (3) days after deposit in the United States mail by certified or registered mail (return receipt requested), (ii) one (1) business day after its deposit with any return receipt express courier (prepaid), or (iii) one (1) business day after transmission by rapifax or telecopier.

18. Further Instruments. The parties agree to execute such further instruments and to take such further action as may be reasonably necessary to carry out the purposes and intent of this Agreement.

19. Headings. The captions and headings of this Agreement are included for ease of reference only and are to be disregarded in interpreting or construing this Agreement.

20. Entire Agreement. The Plan and this Agreement (including Appendix A and Appendix B) constitute the entire agreement and understanding of the parties with respect to the subject matter herein and supersede all prior understandings and agreements, whether oral or written, between the parties hereto with respect to the specific subject matter hereof.

A-4

APPENDIX B

DIAMOND FOODS, INC.

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD

Performance Vesting Terms

1. Performance Period. The performance period for the Award Units shall be August 1, 2014 through July 31, 2017 (the “Performance Period”). During the Performance Period there will be a measurement period of the Company's Relative TSR (a “Measurement Period”). The Measurement Period has a corresponding vest date (the “Final Vest Date”) on which Award Units will vest.

The Start Date, End Date and Final Vest Date are:

Performance Period | |

Start Date | August 1, 2014 |

End Date | July 31, 2017 |

Final Vest Date | October 7, 2017 |

2. Target Number of Award Units. The Target Number of Award Units for the Measurement Period is as set forth in the Notice.

3. Performance Measure. The performance measure for the Performance Period is Relative TSR, as defined below. The number of Award Units that may vest for each Measurement Period will be determined by multiplying the Target Number of Award Units by the Maximum Vest Percentage that corresponds to the Company’s Relative TSR Percentile Ranking according to the following schedule and subject to the Maximum Value limitation described below:

Relative TSR Maximum Vest

Percentile Ranking Percentage

>85th percentile = 200%

75th to 85th percentile = 150% plus 5% for each percentile > 75th

75th percentile = 150%

50th to 75th percentile = 100% plus 2% for each percentile > 50th

TARGET 50th percentile = 100%

25th to 50th percentile = 100% minus 3% for each percentile > 25th

25th percentile = 25%

≤ 25 percentile = 0%

For October 2014 Grant Only: Notwithstanding the foregoing, if the Relative TSR Percentile Ranking for the period ending on the second anniversary of the Start Date is at or above the 50th percentile, 40% of the Award Units shall vest on the second anniversary of the Award Date (the “Two-Year Vest Date”), with vesting of the remainder of the Award Units to be determined on the

B-1

Final Vest Date after taking account of any prior vesting pursuant to this sentence. For example, if 40% of the Award Units vest on the Two -Year Vest Date pursuant to the preceding sentence, and the Company’s Relative TSR Percentile Ranking is 50th on the Final Vest Date, the remaining 60% of the Award Units shall vest on the Final Vest Date.

4. Maximum Number of Award Units. The number of Award Units that vest will be between 0% and 200% of the Target Number of Award Units for the Measurement Period; provided that, under no circumstances will the monetary value of the actual number of Award Units that vest exceed four (4) times the monetary value of the Target Number of Award Units on the Award Date (the “Maximum Value”). For purposes of this Award Agreement “monetary value” refers to the value of a share of Company stock as determined on any specified date by the Company's closing stock price for that date. The Maximum Value for the Measurement Period is determined by multiplying the Target Number of Award Units by the closing price of the Company's stock on the Award Date and then multiplying that product by four (4). Accordingly, the maximum number of Award Units that may vest for the Measurement Period shall not exceed the lesser of:

(i) the number of Award Units determined by multiplying the Target Number of Award Units for each Measurement Period by the Maximum Vest Percentage corresponding to the Relative TSR percentile ranking of the Company for that Measurement Period; or

(ii) the number of Award Units determined not to exceed the Maximum Value (with such number of Award Units calculated by dividing the Maximum Value by the closing price of the Company's stock on the End Date of each Measurement Period.)

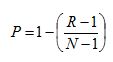

5. Determination of Relative TSR. “Relative TSR” means the Company's Total Stockholder Return relative to the Total Stockholder Returns of the other companies in the Comparator Group. During the Performance Period, Relative TSR will be determined by ranking the Comparator Group from the highest to lowest according to their respective Total Stockholder Return, then calculating the Relative TSR Percentile Ranking of the Company relative to the other Comparator Group as follows:

Where:

“P” represents the Relative TSR Percentile Ranking rounded to the nearest whole percentile

“R” represents the Company's ranking among the Comparator Group

“N” represents the number of Comparator Group

“Total Stockholder Return” means the number calculated by dividing (i) the Closing Average Share Value minus the Opening Average Share Value (in each case adjusted to take into

B-2

consideration the cumulative amount of dividends per share for the Measurement Period, assuming reinvestment, as of the of applicable ex-dividend date, of all cash dividends and other cash distributions (excluding cash distributions resulting from share repurchases or redemptions by the Company) paid to stockholders) by (ii) the Opening Average Share Value.

“Opening Average Share Value” means the average of the daily closing prices per share of a Comparator Group's stock as reported on the NASDAQ for all Trading Days in the 30 calendar days immediately prior to and including the Start Date.

“Closing Average Share Value” means the average of the daily closing prices per share of a Comparator Group's stock as reported on the NASDAQ for all Trading Days in the Closing Average Period.

“Closing Average Period” means (i) in the absence of a Change of Control of the Company, the 30 trading days immediately prior to and including the End Date; or (ii) in the event of a Change of Control, the 30 trading days immediately prior to and including the effective date of the Change of Control.

“Comparator Group” means those companies listed in the Packaged Food & Meat Companies in the Russell 3000 (currently 41 companies):

(iii) In the event of a merger, acquisition or business combination transaction of a company in the Comparator Group with or by another company in the Comparator Group, the surviving entity shall remain in the Comparator Group;

(iv) In the event of a merger, acquisition, or business combination transaction of a company in the Comparator Group with or by another company that is not in the Comparator Group, or “going private transaction” where the company in the Comparator Group is not the surviving entity or is otherwise no longer publicly traded, the company that was previously in the Comparator Group shall no longer be a Comparator Group; and

(v) In the event of a bankruptcy of a company in the Comparator Group, such company shall remain in the Comparator Group and its stock price will continue to be tracked for purposes of the Relative TSR calculation. If the company liquidates, it will remain in the Comparator Group and its stock price will be reduced to zero for the remaining portion of the Measurement Periods.

6. Award Vesting. The Committee will certify the Relative TSR Percentile Ranking of the Company after the End Date of the Measurement Period and determine the actual number of Award Units that vest for the Measurement Period on or before the Final Vest Date.

7. Adjustment of Award. The Comparator Group, the Relative TSR Percentile Ranking or the Award may be adjusted by the Committee from time to time, in its sole discretion, to the extent necessary in order to reflect a change in corporate capitalization, such as a stock split or dividend, or a corporate transaction, such as any merger, consolidation, separation (including a spinoff or other distribution of stock or property by the Company), reorganization, or any partial

B-3

or complete liquidation by the Company, as provided by Sections 10(b) or 10(c) of the Plan, to take account of events such as mergers, consolidations, dispositions, separations (including any spinoffs or other distributions of stock or property), reorganizations, bankruptcies, any partial or complete liquidations, changes in corporate capitalization (such as stock splits or dividends) and other significant business changes affecting any member of the Comparator Group, or to take account of any other terms described in the Plan[For Awards Other Than the 2014 Awards:; provided, however, that to the extent that any such adjustments affect awards to “covered employees” (as such term is defined in Section 162(m) of the Code), they shall be prescribed in a manner that strives to meet the requirements of Section 162(m) of the Code. Any adjustment to the Relative RSR Percentile Ranking to account for changes in the Comparator Group, including changes in the capitalization of Comparator Group companies (due to stock splits, mergers, spin-offs, etc. of the Comparator Group companies), will be made at the sole discretion of the Committee].

B-4