Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SEARS HOLDINGS CORP | Financial_Report.xls |

| EX-32.2 - SECTION 906 CERTIFICATION OF CFO - SEARS HOLDINGS CORP | shldex322q32014.htm |

| EX-32.1 - SECTION 906 CERTIFICATION OF CEO - SEARS HOLDINGS CORP | shldex321q32014.htm |

| EX-31.2 - SECTION 302 CERTIFICATIONS OF CFO - SEARS HOLDINGS CORP | shldex312q32014.htm |

| EX-10.2 - GUARANTY - SEARS HOLDINGS CORP | shldex102q32014.htm |

| 10-Q - 10-Q - SEARS HOLDINGS CORP | shldq32014.htm |

| EX-31.1 - SECTION 302 CERTIFICATIONS OF CEO - SEARS HOLDINGS CORP | shldex311q32014.htm |

EXHIBIT 10.1

LOAN AGREEMENT

Dated as of September 15, 2014

between

SEARS, ROEBUCK AND CO., SEARS DEVELOPMENT CO.

and KMART CORPORATION

collectively, as Borrower,

and

JPP II, LLC and JPP, LLC

collectively, as Lender

collectively, as Lender

LOAN AGREEMENT

This Loan Agreement (this “Agreement”) is dated September 15, 2014 and is between JPP II, LLC and JPP, LLC, each a Delaware limited liability company, as lender (collectively, together with their respective successors and assigns, including any lawful holder of any portion of the Indebtedness, as hereinafter defined, “Lender”), and SEARS, ROEBUCK AND CO., SEARS DEVELOPMENT CO. and KMART CORPORATION, as borrower (individually or collectively, as the context may require, jointly and severally, together with their respective permitted successors and assigns, “Borrower”).

RECITALS

Borrower desires to obtain from Lender the Loan (as hereinafter defined) in connection with the financing of the Properties (as hereinafter defined).

Lender is willing to make the Loan on the terms and subject to the conditions set forth in this Agreement if Borrower joins in the execution and delivery of this Agreement, the Note and the other Loan Documents.

In consideration of the agreements, provisions and covenants contained herein and in the other Loan Documents, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Lender and Borrower agree as follows:

DEFINITIONS

(a) When used in this Agreement, the following capitalized terms have the following meanings:

“Agreement” means this Loan Agreement, as the same may from time to time hereafter be amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Alteration” means any demolition, or any material alteration, installation, improvement or expansion of or to any of the Properties or any portion thereof.

“Appraisal” means, with respect to each Property, an as-is appraisal of such Property that is prepared by a member of the Appraisal Institute selected by Lender, meets the minimum appraisal standards for national banks promulgated by the Comptroller of the Currency pursuant to Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended (FIRREA) and complies with the Uniform Standards of Professional Appraisal Practice (USPAP).

“Assignment” has the meaning set forth in Section 7.7(b).

“Bankruptcy Code” has the meaning set forth in Section 6.1(d).

“Borrower or “Borrowers” has the meaning set forth in the first paragraph of this Agreement.

“Burlington Condition” has the meaning set forth in Section 2.1(c).

“Business Day” means any day other than (i) a Saturday and a Sunday and (ii) a day on which federally insured depository institutions in the State of New York or the state in which the offices of Lender, its trustee, its Servicer or its Servicer’s collection account are located are authorized or obligated by law, governmental decree or executive order to be closed.

“Casualty” means a fire, explosion, flood, collapse, earthquake or other casualty affecting all or any portion of any Property.

“Closing Date” means the date of this Agreement.

“Closing Date Advance” has the meaning set forth in Section 1.1(a).

“Closing Date Advance Amount” means $200,000,000.

“Code” means the Internal Revenue Code of 1986, as amended.

“Collateral” means all assets owned from time to time by Borrower located at and including the Properties and all other tangible and intangible property located at or related to the Properties, in respect of which Lender is expressly granted a Lien under the Loan Documents, and all proceeds thereof.

“Condemnation” means a taking or voluntary conveyance of all or part of any of the Properties or any interest in or right accruing to or use of any of the Properties, as the result of, or in settlement of, any condemnation or other eminent domain proceeding by any Governmental Authority, other than immaterial takings by and/or the granting of immaterial easements or rights of way to a Governmental Authority in the ordinary course of business that do not, in the aggregate, have a Property Material Adverse Effect.

“Contingent Obligation” means, with respect to any Person, any obligation of such Person directly or indirectly guaranteeing any Debt of any other Person in any manner and any contingent obligation to purchase, to provide funds for payment, to supply funds to invest in any other Person or otherwise to assure or indemnify a creditor against loss.

“Damages” to a Person means any and all liabilities, obligations, losses, demands, damages, penalties, assessments, actions, causes of action, judgments, proceedings, suits, claims, costs, expenses and disbursements of any kind or nature whatsoever (including reasonable attorneys’ fees and other costs of defense and/or enforcement whether or not suit is brought), fines, charges, fees, settlement costs and disbursements imposed on, incurred by or asserted against such party, whether based on any federal, state, local or foreign laws, statutes, rules or regulations (including securities and commercial laws, statutes, rules or regulations and Environmental Laws), on common law or equitable cause or on contract or otherwise; provided, however, that “Damages” shall not include special, consequential or punitive damages, except to the extent imposed upon Lender by one or more third parties.

2

“Debt” means, with respect to any Person, without duplication:

(i) all indebtedness of such Person to any other party (regardless of whether such indebtedness is evidenced by a written instrument such as a note, bond or debenture), including indebtedness for borrowed money or for the deferred purchase price of property or services;

(ii) all letters of credit issued for the account of such Person and all unreimbursed amounts drawn thereunder;

(iii) all indebtedness secured by a Lien on any property owned by such Person (whether or not such indebtedness has been assumed) except obligations for impositions that are not yet due and payable;

(iv) all Contingent Obligations of such Person;

(v) all payment obligations of such Person under any interest rate protection agreement (including any interest rate swaps, floors, collars or similar agreements) and similar agreements;

(vi) all contractual indemnity obligations of such Person; and

(vii) any material actual or contingent liability to any Person or Governmental Authority with respect to any employee benefit plan (within the meaning of Section 3(3) of ERISA) subject to Title IV of ERISA, Section 302 of ERISA or Section 412 of the Code.

“Default” means the occurrence of any event that, but for the giving of notice or the passage of time, or both, would be an Event of Default.

“Default Interest” means, during the continuance of an Event of Default, the amount by which interest accrued on the Notes or Note Components at their respective Default Rates exceeds the amount of interest that would have accrued on the Notes or Note Components at their respective Interest Rates.

“Default Rate” means, with respect to any Note or Note Component, the greater of (x) 2.5% per annum in excess of the interest rate otherwise applicable to such Note or Note Component hereunder and (y) 1% per annum in excess of the Prime Rate from time to time; provided that, if the foregoing would result in an interest rate in excess of the maximum rate permitted by applicable law, the Default Rate shall be limited to the maximum rate permitted by applicable law.

“Delayed Advance” has the meaning set forth in Section 1.1(b).

“Delayed Advance Amount” means $200,000,000.

“Engineering Report” means a structural and (and, with respect to the Properties located in California only, seismic engineering) report or reports (including a “probable

3

maximum loss” calculation, if applicable) with respect to each of the Properties prepared by an independent engineer approved by Lender and delivered to Lender in connection with the Loan, and any amendments or supplements thereto delivered to Lender.

“Environmental Claim” means any written notice, claim, proceeding, notice of proceeding, investigation, demand, abatement order or other order or directive by any Person or Governmental Authority alleging or asserting liability with respect to Borrower directly in connection with any Property arising out of, based on, in connection with, or resulting from (i) the actual or alleged presence, Use or Release of any Hazardous Substance, (ii) any actual or alleged violation of any Environmental Law, or (iii) any actual or alleged injury or threat of injury to property, health or safety, natural resources or to the environment caused by Hazardous Substances.

“Environmental Indemnity” means that certain environmental indemnity agreement executed by Borrower and Guarantor as of the Closing Date, as the same may from time to time be amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Environmental Laws” means, with respect to any Properties, any and all present and future federal, state and local laws, statutes, ordinances, orders, rules, regulations and the like, as well as common law, any judicial or administrative orders, decrees or judgments thereunder, and any permits, approvals, licenses, registrations, filings and authorizations, in each case as now or hereafter in effect, relating to (i) the pollution, protection or cleanup of the environment, (ii) the impact of Hazardous Substances on property, health or safety, (iii) the Use or Release of Hazardous Substances, (iv) occupational safety and health, industrial hygiene or the protection of human, plant or animal health or welfare or (v) the liability for or costs of other actual or threatened danger to health or the environment. The term “Environmental Law” includes, but is not limited to, the following statutes, as amended, any successors thereto, and any regulations promulgated pursuant thereto, and any state or local statutes, ordinances, rules, regulations and the like addressing similar issues: the Comprehensive Environmental Response, Compensation and Liability Act; the Emergency Planning and Community Right-to-Know Act; the Hazardous Materials Transportation Act; the Resource Conservation and Recovery Act (including Subtitle I relating to underground storage tanks); the Clean Water Act; the Clean Air Act; the Toxic Substances Control Act; the Safe Drinking Water Act; the Occupational Safety and Health Act; the Federal Water Pollution Control Act; the Federal Insecticide, Fungicide and Rodenticide Act; the Endangered Species Act; the National Environmental Policy Act; and the River and Harbors Appropriation Act. The term “Environmental Law” also includes, but is not limited to, any present and future federal state and local laws, statutes ordinances, rules, regulations and the like, as well as common law, conditioning transfer of property upon a negative declaration or other approval of a Governmental Authority of the environmental condition of a property; or requiring notification or disclosure of Releases of Hazardous Substances or other environmental conditions of a property to any Governmental Authority or other Person, whether or not in connection with transfer of title to or interest in property.

“Environmental Reports” means “Phase I Environmental Site Assessments” as referred to in the ASTM Standards on Environmental Site Assessments for Commercial Real Estate, E 1527-013 (and, if necessary as determined in such Phase I Environmental Site

4

Assessments, “Phase II Environmental Site Assessments”), prepared by an independent environmental auditor selected by Borrower and reasonably approved by Lender and delivered to Lender in connection with the Loan and any amendments or supplements thereto delivered to Lender, and shall also include any other environmental reports delivered to Lender pursuant to this Agreement and the Environmental Indemnity.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time, and the regulations promulgated thereunder.

“ERISA Affiliate” means, at any time, each trade or business (whether or not incorporated) that would, at the time, be treated together with Borrower as a single employer under Title IV or Section 302 of ERISA or Section 412 of the Code.

“Event of Default” has the meaning set forth in Section 6.1.

“Exception Report” means the report prepared by Borrower and certified to Lender in the Officer’s Certificate, setting forth any exceptions to the representations set forth in Article III.

“Extension Term” has the meaning set forth in Section 1.1(d).

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof and any agreement entered into pursuant to Section 1471(b)(1) of the Code or any legislation adopted pursuant to any intergovernmental agreement entered into in connection with the implementation of such Sections of the Code.

“Form W-8BEN” means Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)) of the Department of Treasury of the United States of America, and any successor form.

“Form W-8BEN-E” means Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)) of the Department of the Treasury of the United States of America, and any successor form.

“Form W-8ECI” means Form W-8ECI (Certificate of Foreign Person’s Claim that Income is Effectively Connected with the Conduct of a Trade or Business in the United States) of the Department of the Treasury of the United States of America, and any successor form.

“Form W-9” means Form W-9 (Request for Taxpayer Identification Number and Certification) of the Department of the Treasury of the United States of America, and any successor form.

“GAAP” means generally accepted accounting principles in the United States of America, consistently applied.

5

“Governmental Authority” means any federal, state, county, regional, local or municipal government, any bureau, department, agency or political subdivision thereof and any Person with jurisdiction exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government (including any court).

“Guarantor” means Sears Holdings Corporation.

“Guaranty” means that certain guaranty, dated as of the Closing Date, executed by Guarantor for the benefit of Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Hazardous Substances” means any and all substances (whether solid, liquid or gas) defined, listed, or otherwise classified as pollutants, hazardous wastes, hazardous substances, hazardous materials, extremely hazardous wastes, toxic substances, toxic pollutants, contaminants, pollutants or words of similar meaning or regulatory effect under any present or future Environmental Laws or the presence of which on, in or under any of the Properties is prohibited or requires monitoring, investigation or remediation under Environmental Law, including petroleum and petroleum by-products, asbestos and asbestos-containing materials, toxic mold, polychlorinated biphenyls, lead and radon, and compounds containing them (including gasoline, diesel fuel, oil and lead-based paint), pesticides and radioactive materials, flammables and explosives and compounds containing them, but excluding those substances commonly used in the operation and maintenance of properties of kind and nature similar to those of the Properties that are used at the Properties in compliance with all Environmental Laws and in a manner that does not result in contamination any of the Properties or in a Property Material Adverse Effect.

“Indebtedness” means the Principal Indebtedness, together with interest and all other obligations and liabilities of Borrower under the Loan Documents, including all transaction costs, late fees and other amounts due or to become due to Lender pursuant to this Agreement, under the Notes or in accordance with any of the other Loan Documents, and all other amounts, sums and expenses reimbursable by Borrower to Lender hereunder or pursuant to the Notes or any of the other Loan Documents.

“Indemnified Parties” has the meaning set forth in Section 7.17.

“Insurance Requirements” means, collectively, (i) all material terms of any insurance policy required pursuant to this Agreement and (ii) all material regulations and then-current standards applicable to or affecting any of the Properties or any portion thereof or any use or condition thereof, which may, at any time, be recommended by the board of fire underwriters, if any, having jurisdiction over any of the Properties, or any other body exercising similar functions.

“Interest Accrual Period” means each period from and including the first day of a calendar month (and, if the Closing Date is not the first day of a calendar month, the Closing Date) through but excluding the first day of the immediately succeeding calendar month (or, if earlier, the Maturity Date). Notwithstanding the foregoing, the first Interest Accrual Period shall commence on and include the Closing Date.

6

“Interest Rate” means 5% per annum.

“Lease” means any leasehold estate, lease, sublease, sub-sublease, license, concession, occupancy agreement or other agreement (written or oral, now or at any time in effect and every modification, amendment or other agreement relating thereto, including every guarantee of the performance and observance of the covenants, conditions and agreements to be performed and observed by the other party thereto) that grant a possessory interest in, or the right to use or occupy, all or any part of the Property, together with all related security and other deposits (together with any and all modifications, renewals, extensions and substitutions of the foregoing), but specifically excluding (a) all Leases under which Borrower is not the landlord, sublandlord or licensor thereunder, (b) Multi-Site Agreements and (c) REA’s that expressly prohibit the encumbrance of Borrower’s interests, rights and obligations thereunder.

“Legal Requirements” means all governmental statutes, laws, rules, orders, regulations, ordinances, judgments, decrees and injunctions of Governmental Authorities (including Environmental Laws and zoning restrictions) affecting Borrower, Guarantor, the Property or any other Collateral or any portion thereof or the construction, ownership, use, alteration or operation thereof, or any portion thereof (whether now or hereafter enacted and in force), and all permits, licenses and authorizations and regulations relating thereto.

“Lender” has the meaning set forth in the first paragraph of this Agreement and in Section 7.7.

“Lien” means any mortgage, lien (statutory or other), pledge, hypothecation, assignment, preference, priority, security interest, restrictive covenant, easement, or any other encumbrance or charge on or affecting any Collateral or any portion thereof, or any interest therein (including any conditional sale or other title retention agreement, any sale-leaseback, any financing lease or similar transaction having substantially the same economic effect as any of the foregoing, the filing of any financing statement or similar instrument under the Uniform Commercial Code or comparable law of any other jurisdiction, domestic or foreign, and mechanics’, materialmen’s and other similar liens and encumbrances, as well as any option to purchase, right of first refusal, right of first offer or similar right).

“Loan” has the meaning set forth in Section 1.1(a).

“Loan Amount” means $400,000,000.

“Loan Documents” means this Agreement, the Note, each of the Mortgages (and related financing statements), the Environmental Indemnity, the Guaranty and all other agreements, instruments, certificates and documents necessary to effectuate the granting to Lender of Liens on the Collateral or otherwise in satisfaction of the requirements of this Agreement or the other documents listed above or hereafter entered into by Lender and Borrower in connection with the Loan, as all of the aforesaid may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance herewith.

“Loss Proceeds” means amounts, awards or payments payable to Borrower or Lender in respect of all or any portion of any of the Properties in connection with a Casualty or Condemnation thereof (after the deduction therefrom and payment to Borrower and Lender,

7

respectively, of any and all reasonable expenses incurred by Borrower and Lender in the recovery thereof, including all attorneys’ fees and disbursements, the fees of insurance experts and adjusters and the costs incurred in any litigation or arbitration with respect to such Casualty or Condemnation), other than any amounts payable to Borrower in connection with the grant of the Redmond Easement.

“Material Adverse Effect” means a material adverse effect upon (i) Borrower’s title to the Properties taken as a whole, (ii) the ability of Borrower and Guarantor, taken as a whole, to perform their obligations under the Loan Documents, (iii) Lender’s ability to enforce and derive the principal benefit of the security intended to be provided by the Mortgage and the other Loan Documents, or (iv) the use or value of the Properties taken as a whole.

“Material Agreements” means each contract and agreement in force and effect relating to the Property a default under which or the termination or cancellation of which could reasonably be expected to result in a Material Adverse Effect, other than (i) Leases (but including REA’s), (ii) Multi-Site Agreements and (iii) any agreement (other than REA’s) set forth on Schedule B of the Title Insurance Policy.

“Material Alteration” means any Alteration to be performed by or on behalf of Borrower at any of the Properties that (i) is reasonably expected to result in a Material Adverse Effect with respect to the applicable Property or (ii) is reasonably expected to permit (or is reasonably likely to induce) any Tenant to terminate its Lease or abate rent.

“Maturity Date” means December 31, 2014, as same may be extended in accordance with Section 1.1(d), or such earlier date as may result from acceleration of the Loan in accordance with this Agreement.

“Mortgage” means, with respect to each Property, that certain mortgage, deed of trust or deed to secure debt, as the case may be, assignment of rents and leases, collateral assignment of property rents, security agreement and fixture filing encumbering such Property, executed by Borrower as of the Closing Date, as the same may from time to time be amended, restated, replaced, supplemented or otherwise modified in accordance herewith. Each Mortgage shall secure the entire Indebtedness, provided that in the event that the jurisdiction in which the Property is located imposes a mortgage recording, intangibles or similar Tax and does not permit the allocation of indebtedness for the purpose of determining the amount of such Tax payable, the principal amount secured by such Mortgage shall be equal to 125% of the portion of the Loan Amount allocated to the applicable Property, as reasonably estimated by Lender.

“Multi-Site Agreements” means, collectively, national, multi-site or master leases, licenses, or concession or department agreements with tenants or licensees that operate within and as a part of Borrower’s store, or that operate kiosks, ATM or vending machines or drive –through facilities located on the Property, in each case, solely to the extent any such leases, licenses, concessions or agreements terminate with respect to the Property upon the cessation of Mortgagor’s operations at the Property.

“Note(s)” means that certain promissory note, dated as of the Closing Date, made by Borrower to the order of Lender to evidence the Loan, as such note may be replaced by

8

multiple Notes in accordance with Section 1.1(c) and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note Component” has the meaning set forth in the Note.

“Officer’s Certificate” means the officer’s certificate of Borrower, dated as of the date hereof, delivered to Lender and certifying (i) certain organizational documents of Borrower, (ii) the Properties, (iii) the Substitution Properties, (iv) the Valuations, (v) the Rent Roll, (vi) the Exception Report and (vii) the Redmond Easement.

“Overpaying Borrower” has the meaning set forth in Section 7.28.

“Participation” has the meaning set forth in Section 7.7(b).

“PATRIOT Act” means the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act (Title III of Pub. L. 107-56 (signed into law October 26, 2001), as amended from time to time.

“Payment Date” means (i) the first day of each calendar month immediately following each Interest Accrual Period and (ii) the Maturity Date. Whenever a Payment Date is not a Business Day, the entire amount that would have been due and payable on such Payment Date shall instead be due and payable on the immediately succeeding Business Day.

“Permits” means all licenses, permits, variances and certificates used in connection with the ownership, operation, use or occupancy of each of the Properties (including certificates of occupancy, business licenses, state health department licenses, licenses to conduct business and all such other permits, licenses, consents, approvals and rights, obtained from any Governmental Authority or private Person concerning ownership, operation, use or occupancy of such Property).

“Permitted Debt” means the Indebtedness and any other Debt of Borrower or any affiliate of Borrower that is not secured by a lien on any of the Properties and, to the extent constituting Debt, all obligations secured by Liens constituting Permitted Encumbrances other than Debt for borrowed money secured by a Lien on the Land or the Improvements, each as defined in the Mortgage.

“Permitted Encumbrances” means:

(i) the Liens created by the Loan Documents;

(ii) all (A) Liens and other matters specifically disclosed on Schedule B of the Title Insurance Policies and any matters omitted from any previous title report or commitment that would have appeared on such Schedule B but for such omission, (B) easements, rights-of-way, covenants, conditions, restrictions (including building, fire and safety, land use and development, and zoning regulations and restrictions), declarations, rights of reverter, minor defects or irregularities in title and other similar charges or encumbrances, whether or not of record, in each case and (C) matters which a physical inspection or accurate survey of the Properties would disclose, in each case of (B) and

9

(C), solely to the extent the same do not, in the aggregate, result in a Material Adverse Effect;

(iii) the Redmond Easement;

(iv) Liens, if any, for Taxes not yet delinquent and Liens for delinquent taxes or impositions if being diligently contested in good faith and by appropriate proceedings, provided that, with respect to delinquent taxes or impositions, either (a) each such Lien is released or discharged of record or fully insured over by the title insurance company issuing the applicable Title Insurance Policy (including be subsequent endorsement) within 60 days of its creation, or (b) Borrower deposits with Lender, by the expiration of such 60-day period, an amount equal to 125% of the dollar amount of such Lien or a bond in the aforementioned amount from such surety, and upon such terms and conditions, as is reasonably satisfactory to Lender, as security for the payment or release of such Lien;

(v) mechanics’, materialmen’s, environmental or similar Liens or other Liens created by operation of law and judgment liens or lis pendens, in each case securing obligations that are not overdue for a period of more than 30 days or that are being diligently contested in good faith and by appropriate proceedings, provided that no such Lien is in imminent danger of foreclosure and provided further that either (a) each such Lien is released or discharged of record or fully insured over by the title insurance company issuing the applicable Title Insurance Policy (including by subsequent endorsement) within 30 days of its creation, or (b) Borrower deposits with Lender, by the expiration of such 30-day period, an amount equal to 125% of the dollar amount of such Lien or a bond in the aforementioned amount from such surety, and upon such terms and conditions, as is reasonably satisfactory to Lender, as security for the payment or release of such Lien;

(vi) all Leases and all Multi-Site Agreements, and all rights of existing and future Tenants as tenants only (including the rights of any subtenant or licensee deriving rights through any such Tenant) pursuant to written Leases, and all rights of existing and future occupants under all Multi-Site Agreements;

(vii) any interest or title of a lessor under any lease with respect to assets other than the Land or Improvements as defined in the Mortgage (including without limitation, leases of furniture, furnishings, fixtures, equipment and other personal property) entered into by a Borrower in the ordinary course of business and covering only the assets so leased;

(viii) all other Liens on personal property Collateral existing as of the date hereof or hereafter incurred in connection with the acquisition thereof;

(ix) all bonds, deposits and security instruments or other Liens required or imposed by any Governmental Authority in connection with the use, occupancy or operation of the Property in the ordinary course of business of a Borrower, so long as

10

such Liens do not arise from the failure of Borrower to pay taxes or other amounts payable with respect to the Properties;

(x) all Material Agreements and all other agreements and licenses in connection the ordinary use and operation of the Properties, in each case, solely to the extent the same do not grant a Lien on the Land or the Improvements (as defined in the Mortgage) for the purpose of securing Debt; and

(xi) any financing of a Tenant’s leasehold interest under its Lease.

“Person” means any natural person, corporation, limited liability company, partnership, joint venture, estate, trust, unincorporated association or Governmental Authority and any fiduciary acting in such capacity on behalf of any of the foregoing.

“Plan Assets” means assets of any (i) employee benefit plan (as defined in Section 3(3) of ERISA) subject to Title I of ERISA, (ii) plan (as defined in Section 4975(e)(1) of the Code) subject to Section 4975 of the Code, or (iii) governmental plan (as defined in Section 3(32) of ERISA) subject to federal, state or local laws, rules or regulations substantially similar to Title I of ERISA or Section 4975 of the Code.

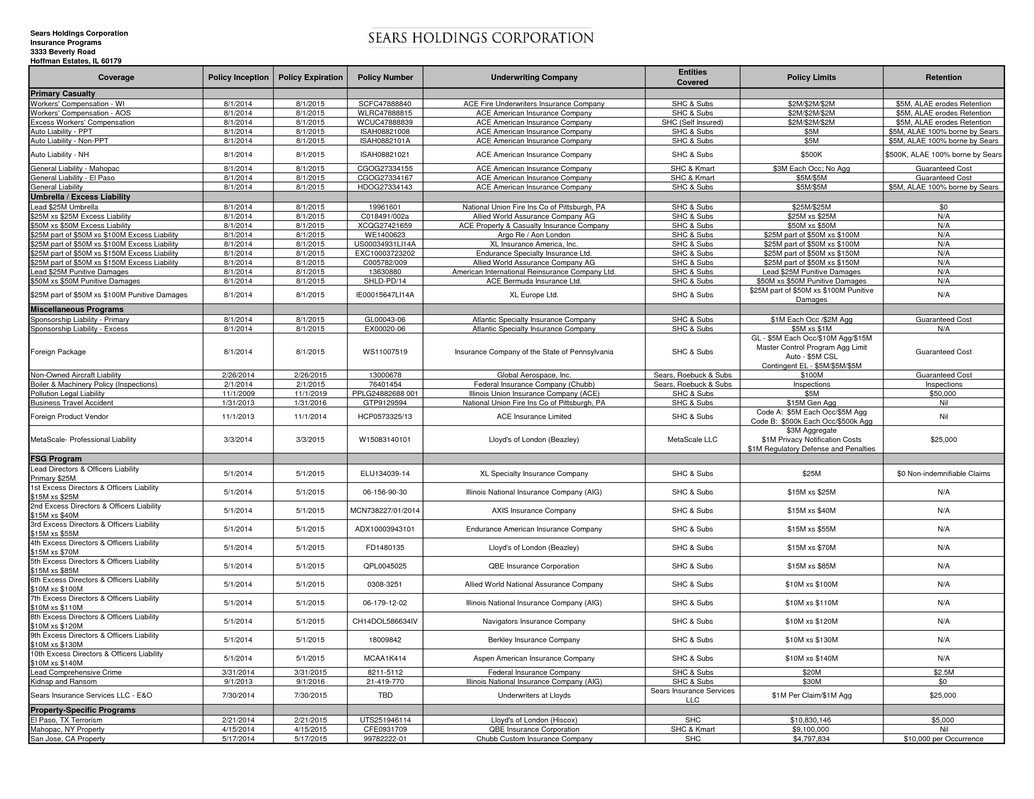

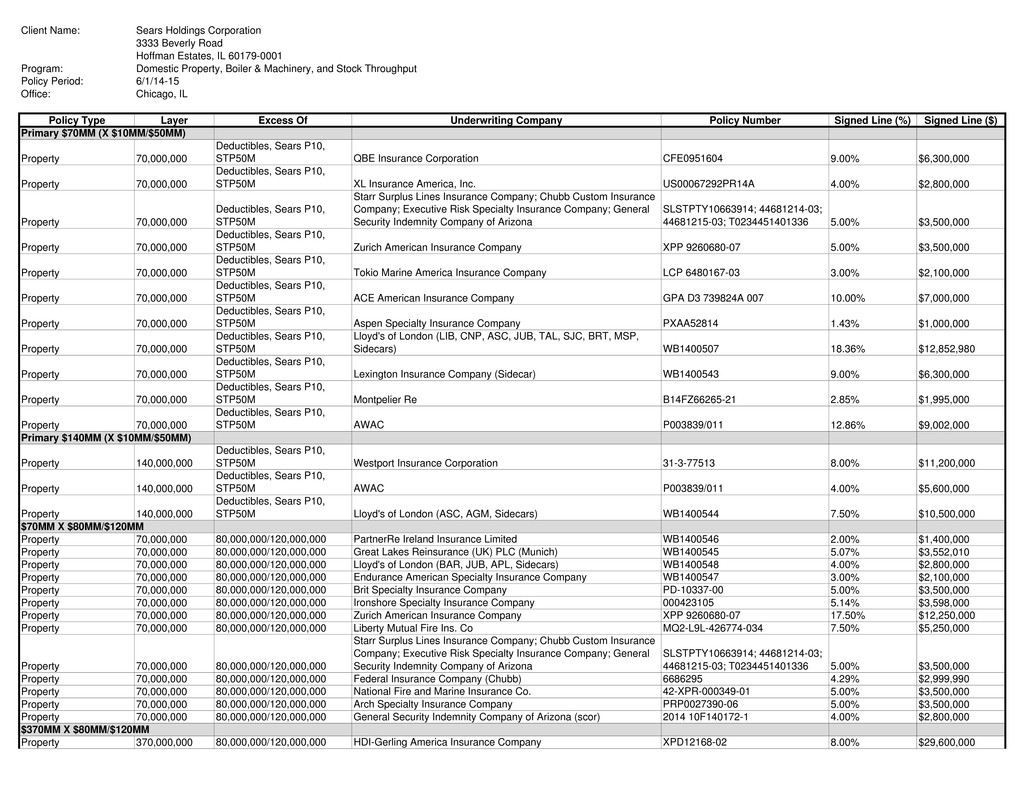

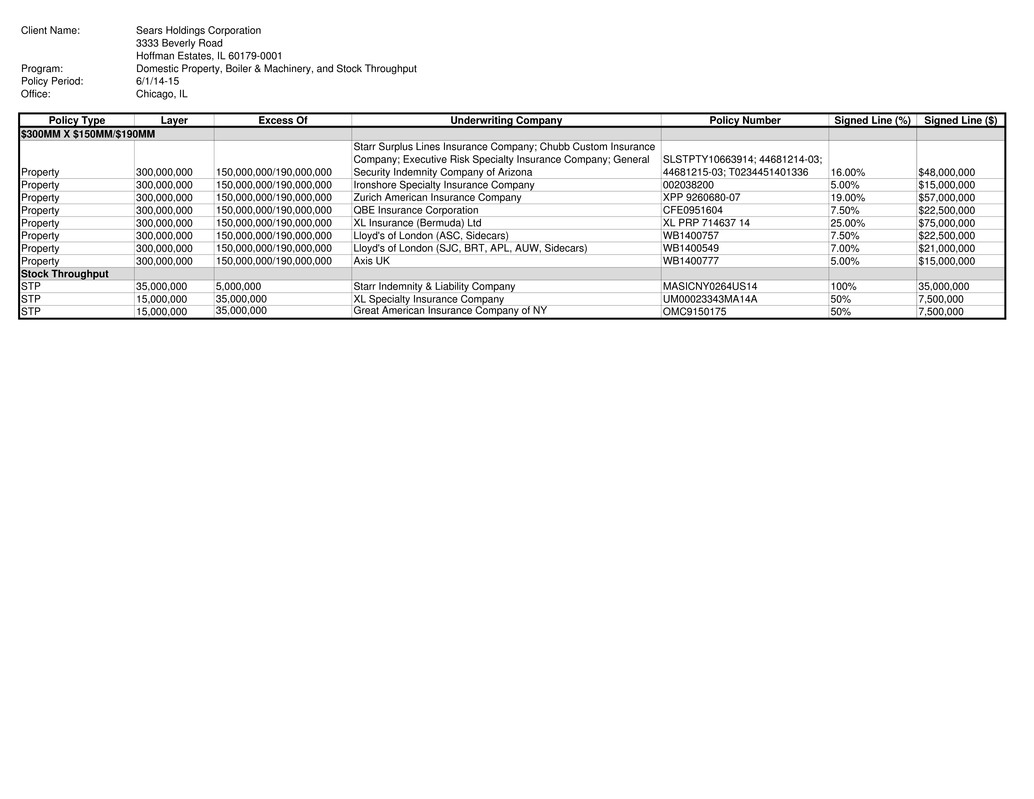

“Policies” means each insurance policy covering any of the Properties as more particularly described on Schedule A.

“Post-Closing Items” means the items described in Section 2.2 hereof that have not been delivered as of the Closing Date.

“Prime Rate” means the “prime rate” published in the “Money Rates” section of The Wall Street Journal. If The Wall Street Journal ceases to publish the “prime rate,” then Lender shall select an equivalent publication that publishes such “prime rate,” and if such “prime rate” is no longer generally published or is limited, regulated or administered by a governmental or quasi-governmental body, then Lender shall reasonably select a comparable interest rate index.

“Principal Indebtedness” means the principal balance of the Loan outstanding from time to time, including any Delayed Advance actually advanced to Borrower.

“Prohibited Change of Control” means the failure of each Borrower to be, directly or indirectly, wholly owned by Guarantor.

“Properties” means the real property on the list of properties certified to Lender in the Officer’s Certificate (other than any such property that is replaced pursuant to Section 2.1(b)), together with any Substitution Property encumbered by a Mortgage, in each case, as described in greater detail under the applicable Mortgage, together with all buildings and other improvements thereon (other than leasehold improvements that are the property of a Tenant under a Lease at a Property) and all personal property owned by Borrower and encumbered by the Mortgages, together with all rights pertaining to such property; and “Property” means an individual property included in the Properties or all Properties collectively, as the context may require.

11

“Property Material Adverse Effect” means a material adverse effect upon (i) Borrower’s title to any individual Property, (ii) Lender’s ability to enforce and derive the principal benefit of the security intended to be provided by any Mortgage and/or the other Loan Documents, or (iii) the use or value of any individual Property.

“Proportional Amount” has the meaning set forth in Section 7.28.

“REA” means any reciprocal access, easement, construction and/or operating or similar agreements with respect to the individual Properties in effect as of the Closing Date.

“Redmond Easement” means the easement to be granted with respect to the real property identified as Store 1069 located in Redmond, Washington, as depicted on the site plan certified to Lender in the Officer’s Certificate

“Release” with respect to any Hazardous Substance means any release, deposit, discharge, emission, leaking, leaching, spilling, seeping, migrating, injecting, pumping, pouring, emptying, escaping, dumping, disposing or other movement of Hazardous Substances into the indoor or outdoor environment (including the movement of Hazardous Substances through ambient air, soil, surface water, ground water, wetlands, land or subsurface strata), and “Released” has the meaning correlative thereto.

“Rent Roll” means the rent roll certified to Lender in the Officer’s Certificate.

“Replacement Qualifications” has the meaning set forth in Section 2.1(b).

“Representative Borrower” has the meaning set forth in Section 7.04(a).

“SAC Conditions” means, collectively, the visible or surface level presence of materials and/or the existence of hydraulic lifts, oil and fluid separators, underground storage tanks and all other machinery and equipment, in each case, solely to the extent related to, used in or incidental to the operation of a Sears Auto Center facility.

“Service” means the Internal Revenue Service or any successor agency thereto.

“Servicer” means the entity or entities (if any) appointed by Lender from time to time to serve as servicer and/or special servicer of the Loan. If at any time no entity is so appointed, the term “Servicer” shall be deemed to refer to Lender.

“Severed Loan Documents” has the meaning set forth in Section 6.2(g).

“Substitution Properties” means the real property on the list of substitution properties certified to Lender in the Officer’s Certificate, together with all buildings and other improvements thereon (other than leasehold improvements that are the property of a Tenant under a Lease at a Property); and “Substitution Property” means an individual property included in the Substitution Properties or all Substitution Properties collectively, as the context may require; provided, however, in the event there is an insufficient number of Substitution Properties on such list to satisfy the replacements required hereunder (or if the value of such Substitution Properties based on the Valuations is not sufficient to satisfy the Replacement Qualifications),

12

Borrower and Lender shall agree on such additional properties owned by Borrower as necessary to provide such replacements.

“Survey” means, with respect to each Property, a current land title survey thereof, certified to Borrower, the title company issuing the applicable Title Insurance Policy and Lender and their respective successors and assigns, in form and substance reasonably satisfactory to Lender.

“Taxes” means all real estate and personal property taxes, assessments, fees, taxes on rents or rentals, water rates or sewer rents, facilities and other governmental, municipal and utility district charges or other similar taxes or assessments now or hereafter levied or assessed or imposed against the Properties or Borrower with respect to the Properties or rents therefrom or that may become Liens upon any of the Properties, without deduction for any amounts reimbursable to Borrower by third parties.

“Tenant” means any Person liable by contract or otherwise to pay monies (including a percentage of gross income, revenue or profits) pursuant to a Lease.

“Threshold Amount” means, with respect to each Property, $1,000,000.

“Third-Party Lease” means any Lease that covers all or any portion of any Property with a Tenant that is not an affiliate of Borrower.

“Title Insurance Policy” means, with respect to each Property, an American Land Title Association lender’s title insurance policy or a comparable form of lender’s title insurance policy approved for use in the applicable jurisdiction, in form and substance reasonably satisfactory to Lender (taking into account any endorsements or other modifications to the any such policy to made upon the subsequent delivery of the Surveys and zoning reports required to be delivered pursuant to this Agreement).

“Transaction” means, collectively, the transactions contemplated and/or financed by the Loan Documents.

“Transfer” means the sale or other whole or partial conveyance of all or any portion of any of the Collateral or any direct or indirect interest therein to a third party, including any grant made after the Closing Date of any purchase options, rights of first refusal, rights of first offer or similar rights in respect of any portion of the Collateral or the subjecting of any portion of the Collateral to restrictions on transfer; except that the conveyance (including assignment and subleasing) of a space lease at such Property by a Borrower in accordance herewith or by a Tenant or subtenant or licensee in accordance with the terms and conditions of any Lease shall not constitute a Transfer.

“Use” means, with respect to any Hazardous Substance, the generation, manufacture, processing, distribution, handling, possession, use, discharge, placement, treatment, disposal, disposition, removal, abatement, recycling or storage of such Hazardous Substance or transportation of such Hazardous Substance.

13

“Valuations” means the valuations of the Properties and the Substitution Properties certified to Lender in the Officer’s Certificate.

“Waste” means any intentional and material abuse or destructive use (whether by action or inaction) of any Property.

(b) Rules of Construction. Unless otherwise specified, (i) all references to sections, schedules and exhibits are to sections, schedules and exhibits in or to this Agreement, (ii) all meanings attributed to defined terms in this Agreement shall be equally applicable to both the singular and plural forms of the terms so defined, (iii) “including” means “including, but not limited to”, (iv) “mortgage” means a mortgage, deed of trust, deed to secure debt or similar instrument, as applicable, and “mortgagee” means the secured party under a mortgage, deed of trust, deed to secure debt or similar instrument, (v) the words “hereof,” “herein,” “hereby,” “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision, article, section or other subdivision of this Agreement, (vi) unless otherwise indicated, all references to “this Section” shall refer to the Section of this Agreement in which such reference appears in its entirety and not to any particular clause or subsection or such Section, (vii) terms used herein and defined by cross-reference to another agreement or document shall have the meaning set forth in such other agreement or document as of the Closing Date, notwithstanding any subsequent amendment or restatement of or modification to such other agreement or document. Except as otherwise indicated, all accounting terms not specifically defined in this Agreement shall be construed in accordance with GAAP, as the same may be modified in this Agreement and (viii) all references to “foreclosure’ herein shall include acceptance of a deed-in-lieu of foreclosure.

ARTICLE I

GENERAL TERMS

GENERAL TERMS

Section 1.1. The Loan; Term.

(a) On the Closing Date, subject to the terms and conditions of this Agreement, Lender shall make an advance (the “Closing Date Advance”) to Borrower in an amount equal to the Closing Date Advance Amount. The Loan shall initially be represented by a single Note that shall bear interest as described in this Agreement at a per annum rate equal to the Interest Rate. Interest payable hereunder shall be computed on the basis of a 360-day year and the actual number of days elapsed in the related Interest Accrual Period.

(b) Provided no Event of Default is continuing, Lender shall make a single delayed advance (“Delayed Advance”) to Borrower on September 30, 2014 (or such other date as Lender and Borrower shall agree) in the amount of the Delayed Advance Amount, which Delayed Advance shall be conditioned on the delivery of Title Insurance Policies reasonably acceptable to Lender for each of the Properties. Interest on the Delayed Advance shall begin to accrue on the date that the Delayed Advance is made to Borrower. The Delayed Advance is not in the nature of a revolving credit facility, and amounts borrowed and repaid hereunder may not be re-borrowed.

14

(c) The Closing Date Advance together with the Delayed Advance is referred to herein as the “Loan”. The Loan shall be secured by the Collateral pursuant to the Mortgage and the other Loan Documents.

(d) Borrower shall have a single option to extend the scheduled Maturity Date of the Loan to February 28, 2015 (the period of such extension, an “Extension Term”), provided that, as a condition to such Extension Term (i) Borrower shall deliver to Lender written notice of such extension at least 10 Business Days prior to December 31, 2014; (ii) no Event of Default shall be continuing on either the date of such notice or on December 31, 2014; (iii) Borrower shall have paid an extension fee in respect of such Extension Term in an amount equal to 0.5% of the Principal Indebtedness and (iv) Borrower shall have paid all reasonable out-of-pocket expenses incurred by Lender in connection with such extension. If Borrower fails to exercise any extension option in accordance with the provisions of this Agreement, such extension option will automatically cease and terminate

Section 1.2. Interest and Principal.

(a) On each Payment Date, Borrower shall pay to Lender interest in arrears on each Note for the applicable Interest Accrual Period at the applicable Interest Rate (except that in each case, interest shall be payable on the Indebtedness, including due but unpaid interest, at the Default Rate with respect to any portion of such Interest Accrual Period falling during the continuance of an Event of Default).

(b) The Loan may be prepaid in whole or in part on any Business Day; provided that any prepayment hereunder shall be accompanied by all interest accrued on the amount prepaid through and including the date of such prepayment, plus all other amounts then due under the Loan Documents. The entire outstanding principal balance of the Loan, together with interest through the Maturity Date and all other amounts then due under the Loan Documents, shall be due and payable by Borrower to Lender on the Maturity Date. Interest will cease to accrue on any portion of the Principal Indebtedness that has been repaid to Lender.

(c) Any payments of interest and/or principal not paid when due hereunder shall bear interest at the applicable Default Rate.

(d) Any and all payments by or on account of any obligation of Borrower hereunder shall be made without deduction or withholding for any taxes, except as required by law; provided that to the extent any deduction or withholding is so required by law, Borrower shall be entitled to so deduct or withhold the amounts required to be withheld or deducted from any such payment.

Section 1.3. Method and Place of Payment. Except as otherwise specifically provided in this Agreement, all payments and prepayments under this Agreement and the Notes shall be made to Lender not later than 1:00 p.m., New York City time, on the date when due and shall be made in lawful money of the United States of America by wire transfer in federal or other immediately available funds to the account specified from time to time by Lender. Any funds received by Lender after such time shall be deemed to have been paid on the next succeeding Business Day. Lender shall notify Borrower in writing of any changes in the account

15

to which payments are to be made. If the amount received from Borrower is less than the sum of all amounts then due and payable hereunder, such amount shall be applied, at Lender’s sole discretion, either toward the components of the Indebtedness (e.g., interest, principal and other amounts payable hereunder) and the Notes and Note Components, in such sequence as Lender shall elect in its sole discretion, or toward the payment of Property expenses.

Section 1.4. Taxes; Regulatory Change. Borrower shall indemnify Lender and hold Lender harmless from and against any present or future stamp, documentary or other similar taxes or charges now or hereafter imposed, levied, collected, withheld or assessed by any Governmental Authority solely by reason of the execution and delivery of the Loan Documents and any consents, waivers, amendments and enforcement of rights under the Loan Documents, other than any such taxes or charges imposed as a result of a present or former connection between Lender and the jurisdiction imposing such tax or charges (other than connections arising from the Lender having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in the Loan or any Loan Document).

Section 1.5. Release. Upon payment of the Indebtedness in full, or in connection with the replacement of a Property with a Substitution Property pursuant to Section 2.1, Lender shall execute instruments prepared by Borrower and reasonably satisfactory to Lender, which, at Borrower’s election and at Borrower’s sole cost and expense: either, (a) in the case of a repayment of the indebtedness in full (i) release and discharge all Liens on all Collateral securing payment of the Indebtedness (subject to Borrower’s obligation to pay any associated fees and expenses), or (ii) assign such Liens (and the Loan Documents) to a new lender designated by Borrower; or (b) in the case of the replacement of a Property with a Substitution Property, release and discharge the Lien of the applicable Mortgage on the Property being so replaced. All Liens on Collateral constituting personal property (but expressly excluding the Land and Improvements as defined in the Loan Agreement) shall be automatically released upon any transfer of such Collateral permitted under Section 5.2. Any release or assignment provided by Lender pursuant to this Section shall be without recourse, representation or warranty of any kind.

ARTICLE II

CLOSING DELIVERIES; SUBSTITUTION PROPERTIES

CLOSING DELIVERIES; SUBSTITUTION PROPERTIES

Section 2.1. Post-Closing Deliveries.

(a) As a material inducement to Lender making the Loan, Borrower agrees that it shall deliver Title Insurance Policies for each of the Properties on or before September 30, 2014 and use commercially reasonable efforts to satisfy all other Post-Closing Items to Lender’s reasonable satisfaction by October 15, 2014; provided, however, that in any event Borrower shall satisfy all such Post-Closing Items to Lender’s reasonable satisfaction by October 30, 2014, or such later date as to which Lender may grant its consent, not to be unreasonably withheld, delayed or conditioned (so long as Borrower is diligently pursuing the satisfaction of the applicable Post-Closing Items). Post-Closing Items with respect to any Substitution Property shall be delivered no later than the date that is 45 days following the selection of the Substitution Property, or such later date as to which Lender may grant its consent, not to be unreasonably

16

withheld, delayed or conditioned (so long as Borrower is diligently pursuing the satisfaction of the applicable Post-Closing Items). For the avoidance of doubt, notwithstanding the foregoing, the making of the Delayed Advance shall be conditioned on Lender’s receipt of reasonably acceptable Title Insurance Policies for each of the Properties.

(b) In the event that information received by Lender in connection with the satisfaction of any Post-Closing Item (whether with respect to a Property or a Substitution Property) shall result in the determination by Lender in its sole but reasonable discretion that (i) any material representation in this Agreement with respect to any Property or Substitution Property is untrue, provided that, solely for the purposes of this clause (i), any reference to the term “Material Adverse Effect” in any representation in this Agreement shall be deemed to be replaced with “Property Material Adverse Effect”, (ii) any Property or Substitution Property does not constitute acceptable Collateral for the Loan (other than solely by virtue of the existence of SAC Conditions), including by reason of anything contained in any Lease or Material Agreement heretofore delivered to Lender or the results of any searches with respect to the Borrower or the Properties received by Lender, or (iii) subject to clause (A) of the last sentence of Section 2.1(c), if Borrower does not provide a Phase II Environmental Report with respect to any Property or Substitution Property following a request by Lender to provide such Phase II Environmental Report (if obtaining such a Phase II Environmental Report is indicated by a Phase I Environmental Report with respect to such Property or Substitution Property for any reason other than the existence of SAC Conditions), then, in each such case, Lender shall have the right, in its sole discretion, to require that the applicable Property or Substitution Property be replaced by a Substitution Property, which Substitution Property may be selected by Borrower (but subject to Lender’s reasonable approval under the circumstances set forth in the last sentence of Section 2.1(c)) so long as (1) such Substitution Property has a value no less than the value of the Property being replaced, as determined by reference to the Valuations and (2) Borrower shall certify that each of the representations in Article III hereof are true with respect to the applicable Substitution Property (collectively, the “Replacement Qualifications”), subject to any exceptions to such representations contained in any such certification (which exceptions shall be deemed to be a part of the Exception Report); provided, however, the Replacement Qualifications shall not be deemed satisfied if Lender shall reasonably determine that such exceptions to such representations are not acceptable. In addition, in connection with the disposition of any Property by Borrower to a Person that is not an affiliate of Borrower or Guarantor, the Property so disposed shall be replaced with a Substitution Property selected by Lender. In connection with any such replacement by a Substitution Property, (w) Borrower shall certify that the representations contained in Article III hereof are true and correct with respect to such Substitution Property, subject to any exceptions to such representations contained in any such certification (which exceptions shall be deemed to be a part of the Exception Report); provided, however, this clause (w) shall not be deemed satisfied if Lender shall reasonably determine that such exceptions to such representations are not acceptable, (x) Borrower shall cooperate with Lender in executing and recording a Mortgage securing the applicable Substitution Property and shall provide to Lender such other then-existing information and documentation in Borrower’s possession or control with respect to such Substitution Property as was provided to Lender in connection with the other Properties, together with all documentation and information necessary to satisfy each of the items in Section 2.2 and (y) upon the recordation of a Mortgage securing such Substitution Property, Lender shall fully release of record the Property being so replaced from the Lien of the applicable Mortgage in accordance with Section 1.5. In the case of clause

17

(i) of the first sentence of this paragraph, such replacement shall constitute the sole remedy of Lender for such misrepresentation, so long as Borrower did not intentionally cause such misrepresentation to occur. Notwithstanding anything to the contrary contained herein, if Borrower is required to replace one or more Properties pursuant to this Section 2.1 (A) any individual Property may be replaced by multiple Substitution Properties, so long as the aggregate value of such Substitution Properties is no less than the value of the individual Property so replaced (in each case, based on the Valuations) and (B) up to two Properties may be replaced by a single Substitution Property, so long as the value of such Substitution Properties is no less than the aggregate value of the Properties so replaced (in each case, based on the Valuations).

(c) If Lender shall receive comments to any Mortgage from local counsel in connection with the delivery of the opinions delivered pursuant to Section 2.2(b), or from the title company issuing the Title Insurance Policies, in each case, regarding the enforceability, validity, effectiveness or insurability of such Mortgage, Borrower shall cooperate with Lender in the preparation, execution and recording of any amendments to such Mortgages necessitated by such comments and the delivery of an appropriate mortgage modification endorsement to the applicable Title Insurance Policy, all at Borrower’s sole cost and expense. In addition, Lender and Borrower acknowledge and agree that the legal descriptions attached to the Mortgages delivered as of the Closing Date may not be up to date, and such legal descriptions shall be amended as necessary to conform to the legal descriptions in the Title Insurance Policies as and when delivered. In such event, an amendment or modification of the respective affected Mortgages shall be executed, acknowledged and recorded by the parties to substitute the amended legal description as contained in the Title Insurance Policies and an appropriate mortgage modification endorsement to the applicable Title Insurance Policy shall be obtained, all at the sole cost and expense of Borrower. In addition, if any Environmental Report delivered to Lender shall recommend the performance of a Phase II Environmental Report other than by virtue of the existence of SAC Conditions, at Lender’s request, Borrower shall promptly obtain such assessment with respect to the applicable Property if (1) Lender has requested a Phase II Environmental Report with respect to the applicable Property, (2) no then-identified Substitution Property or Substitution Properties have a value equal to or greater than the value of the Property for which such request has been made, as determined by reference to the Valuations, and (3) either (x) Borrower has not proposed one or more Substitution Properties to be added to the list of Substitution Properties (pursuant to the proviso of the definition of “Substitution Properties”) that have a value equal to or greater than the value of the Property for which such request has been made or (y) Borrower has made such a proposal and Lender has reasonably rejected the same; provided, however, (A) Lender shall not have the right to require a Phase II Environmental Report for the Property located at 1100 Middlesex Turnpike in Burlington, Massachusetts, unless Borrower shall receive from a Governmental Authority written notification that Borrower is responsible for the remediation of the condition (the “Burlington Condition”) referenced in that certain letter to Borrower, dated as of September 18, 2001, from the Massachusetts Executive Office of Environmental Affairs Department of Environmental Protection and (B) if Lender shall have the right to require the delivery of a Phase II Environmental Report with respect to any Property pursuant to this sentence, to the extent practicable based on the recommendations of a reputable environmental engineer, any investigation of the Property in connection with the creation of such report shall be limited only to the portions of the Property as may be reasonably necessary to address the recommendations contained in the related Phase I Environmental Report, other than recommendations related to SAC Conditions.

18

Section 2.2. Deliverables. Borrower shall satisfy the following requirements within the time periods set forth in Section 2.1(a):

(a) Title. Lender shall have received a marked, signed commitment to issue, or a signed pro-forma version of, a Title Insurance Policy in respect of each Property, listing only such exceptions as are reasonably satisfactory to Lender, subject to all Permitted Encumbrances (with the exception of clause (ii)(A) thereof). If any Title Insurance Policy is to be issued by, or if disbursement of the proceeds of the Loan are to be made through, an agent of the actual insurer under such Title Insurance Policy (as opposed to the insurer itself), the actual insurer shall have issued to Lender for Lender’s benefit a so-called “Insured Closing Letter.”

(b) Opinion of Local Counsel. Lender shall have received, in form and substance reasonably satisfactory to Lender, a legal opinion as to the enforceability of each Mortgage under the laws of the state in which the applicable individual Property is located, the good standing, foreign qualification, valid existence or other comparable concept under applicable law of the applicable Borrower in such state and the other matters described in the form local counsel opinion delivered to Borrower as of the Closing Date (it being understood that the formulation of such opinions shall be subject to the policies of the counsel providing such opinions and qualifications required by the various jurisdictions in which the Properties are located).

(c) Lien Search Reports. Lender shall have received satisfactory reports of Uniform Commercial Code, tax lien, bankruptcy and judgment searches (subject to all Permitted Encumbrances) conducted by a search firm acceptable to Lender with respect to the Property, Guarantor and each Borrower, such searches to be conducted in such locations as Lender shall have requested.

(d) Zoning. Lender shall have received zoning report for each Property indicating that it is in material compliance with all applicable zoning requirements (taking into account all grandfathering provisions thereof).

(e) Engineering Report. Lender shall have received a current Engineering Report with respect to each Property, which report shall be in form and substance reasonably satisfactory to Lender. No such report shall be deemed unsatisfactory solely by reason of the location of such Property in a seismic zone or in area which may be prone to or affected by seismic events.

(f) Environmental Report. Lender shall have received an Environmental Report (not more than six months old) with respect to each Property that discloses no material environmental contingencies with respect to the Properties. In addition, Lender shall have received all Phase II Environmental Reports relating to the Properties in the possession of Borrower.

(g) Survey. Lender shall have received a Survey with respect to each Property in form and substance reasonably satisfactory to Lender.

19

ARTICLE III

REPRESENTATIONS

REPRESENTATIONS

Each individual Borrower represents to Lender with respect to itself and each other Borrower that, as of the Closing Date, except as set forth in the Exception Report:

Section 3.1. Organization.

(a) Each Borrower is duly organized, validly existing and in good standing under the laws of the of its jurisdiction of organization, and is in good standing in each other jurisdiction where ownership of the Properties requires it to be so, and each Borrower has all power and authority under such laws and its organizational documents and all material governmental licenses, authorizations, consents and approvals required to carry on its business as now conducted at the Properties.

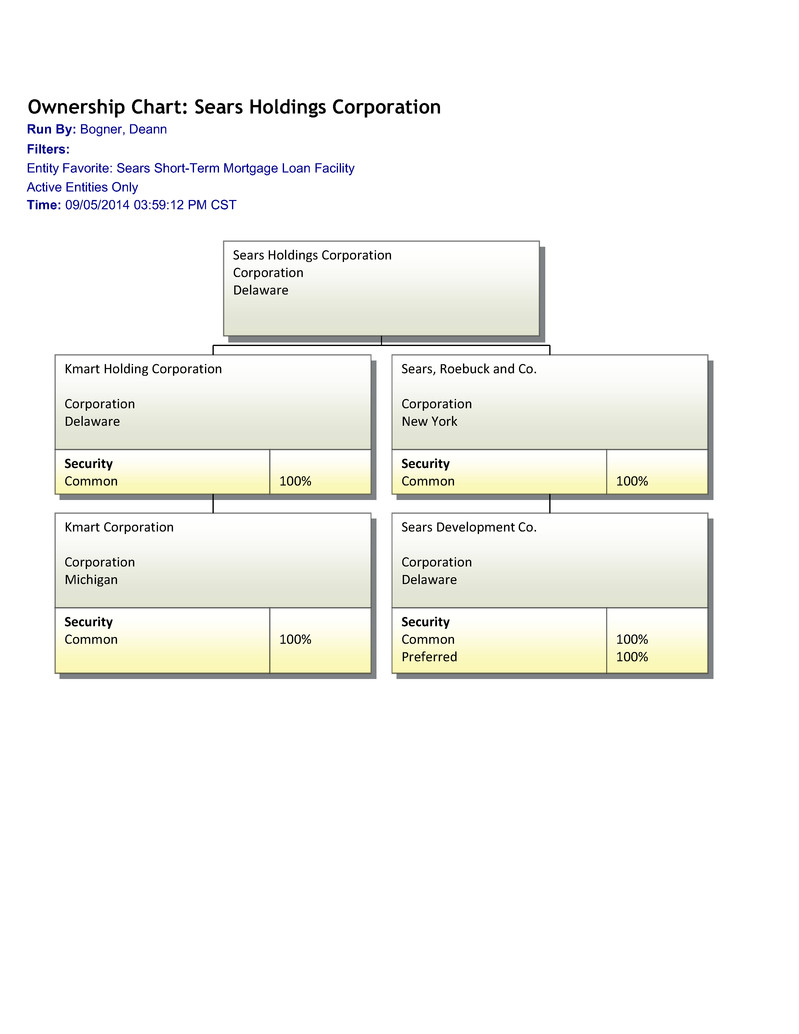

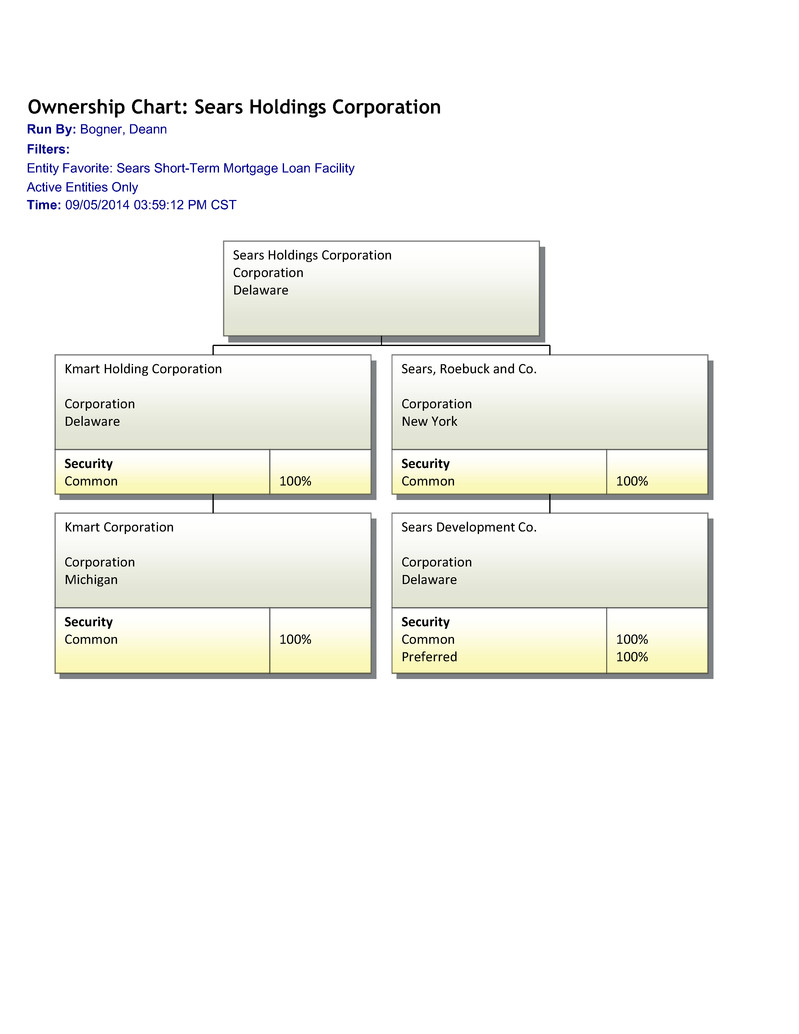

(b) The organizational chart contained in Exhibit A is true and correct as of the date hereof.

Section 3.2. Authorization. Borrower has the power and authority to enter into this Agreement and the other Loan Documents, to perform its obligations hereunder and thereunder and to consummate the transactions contemplated by the Loan Documents and has by proper action duly authorized the execution and delivery of the Loan Documents.

Section 3.3. No Conflicts. Neither the execution and delivery of the Loan Documents, nor the consummation of the transactions contemplated therein, nor performance of and compliance with the terms and provisions thereof will (i) violate or conflict with any provision of its formation and governance documents, (ii) violate any Legal Requirement, regulation (including Regulation U, Regulation X or Regulation T), order, writ, judgment, injunction, decree or permit applicable to it where, except in the case of Regulation U, Regulation X or Regulation T, such violation is not reasonably be expected to result in a Material Adverse Effect, (iii) violate or conflict with contractual provisions of, or cause an event of default under, any indenture, loan agreement, mortgage, contract or other Material Agreement to which Guarantor, any of its direct or indirect subsidiaries or any Borrower is a party or may be bound except where such violation or conflict is not reasonably be expected to result in a Material Adverse Effect, or (iv) result in or require the creation of any Lien or other charge or encumbrance upon or with respect to the Collateral in favor of any Person other than Lender. No reciprocal easement agreement or similar agreement to which any of the Properties are subject requires Borrower to obtain the consent of any party thereto in connection with the making of the Loan or the recording of the Mortgages.

Section 3.4. Consents. No consent, approval, authorization or order of, or qualification with, any court or Governmental Authority is required in connection with the execution, delivery or performance by Borrower of this Agreement or the other Loan Documents, except for any of the foregoing that have already been obtained and for the filings to perfect any security interest granted to Lender or its agents or representatives under the Loan Documents.

20

Section 3.5. Enforceable Obligations. This Agreement and the other Loan Documents have been duly executed and delivered by Borrower and constitute Borrower’s legal, valid and binding obligations, enforceable in accordance with their respective terms, subject to bankruptcy, insolvency and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles (whether enforcement is sought by proceedings in equity or at law), and further subject to any requirements in the various jurisdictions in which the Properties are located with respect to the order of and requirements for the realization on security, including any applicable so-called “security first” and “one-action” or similar rules, requirements or limitations. The Loan Documents to which Guarantor is a party have been duly executed and delivered by Guarantor and constitute Guarantor’s legal, valid and binding obligations, enforceable in accordance with their respective terms, subject to bankruptcy, insolvency and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles (whether enforcement is sought by proceedings in equity or at law), and further subject to any requirements in the various jurisdictions in which the Properties are located with respect to the order of and requirements for the realization on security, including any applicable so-called “security first” and “one-action” or similar rules, requirements or limitations. The Loan Documents are not subject to any right of rescission, offset, abatement, counterclaim or defense by Borrower or Guarantor, including the defense of usury or fraud

Section 3.6. No Default. No Default or Event of Default will exist immediately following the making of the Loan.

Section 3.7. Payment of Taxes. Borrower has filed, or caused to be filed, all material tax returns (federal, state, local and foreign) required to be filed (taking into account any applicable extensions) and paid all material amounts of taxes due (including interest and penalties) except for taxes that are not yet delinquent and taxes the amount or validity of which are currently being contested in good faith by appropriate proceedings and has paid all other taxes, fees, assessments and other governmental charges (including mortgage recording taxes, documentary stamp taxes and intangible taxes) owing by it necessary to preserve the Liens in favor of Lender.

Section 3.8. Compliance with Law. To the knowledge of Borrower, Borrower, each Property and the uses thereof comply in all material respects with all applicable material Insurance Requirements and Legal Requirements, including building and zoning ordinances and codes (taking into account all grandfathering provisions thereof). Borrower is not in default or violation of any order, writ, injunction, decree or demand of any Governmental Authority with respect to any Property the violation of which could result in a Material Adverse Effect. There has not been committed by or on behalf of Borrower or, to Borrower’s knowledge, any other person in occupancy of or involved with the operation or use of any Property, any act or omission affording any federal Governmental Authority or any state or local Governmental Authority the right of forfeiture as against any Property or any portion thereof or any monies paid in performance of its obligations under any of the Loan Documents. Neither Borrower nor Guarantor has purchased any portion of the Properties with proceeds of any illegal activity.

Section 3.9. ERISA. Except as would not be otherwise expect to result in a Material Adverse Effect, neither Borrower nor any ERISA Affiliate of Borrower (a) has incurred any liability under Title IV of ERISA other than the payment of premiums to the Pension Benefit

21

Guaranty Corporation, none of which are overdue, or (b) failed to satisfy the requirements of Section 302(a) of ERISA and Section 412(a) of the Code with respect to any employee benefit plan (as defined in Section 3(3) of ERISA) subject to Title IV or Section 302 of ERISA or Section 412 of the Code The consummation of the transactions contemplated by this Agreement will not constitute or result in any non-exempt prohibited transaction under Section 406 of ERISA, Section 4975 of the Code or substantially similar provisions under federal, state or local laws, rules or regulations, assuming that the source of funds used by Lender for the Loan does not constitute Plan Assets.

Section 3.10. Investment Company Act. Borrower is not an “investment company”, or a company “controlled” by an “investment company”, registered or required to be registered under the Investment Company Act of 1940, as amended.

Section 3.11. [Reserved].

Section 3.12. Other Debt. Borrower does not have outstanding any Debt other than Permitted Debt.

Section 3.13. Litigation. There are no actions, suits, proceedings, arbitrations or governmental investigations by or before any Governmental Authority or other court or agency now filed or otherwise pending, and to Borrower’s knowledge there are no such actions, suits, proceedings, arbitrations or governmental investigations threatened in writing against Borrower, Guarantor or any of the Collateral, in each case, (a) with respect to any of the Loan Documents or any of the transactions contemplated hereby or thereby or (b) that would reasonably be expected to have a Material Adverse Effect.

Section 3.14. Leases; Material Agreements.

(a) Borrower has delivered to Lender true and complete copies of all Leases pursuant to which any Borrower is the lessor at any of the Properties, including all modifications and amendments thereto, which are in Borrower’s possession. Except for Borrower or affiliates of Borrower occupying all or any part of any Property, no person has any possessory interest in any of the Properties or right to occupy the same except under and pursuant to the provisions of the Leases or Permitted Encumbrances. The Rent Roll is accurate and complete in all material respects as of the Closing Date, and the applicable Borrower that owns the Property covered by each Lease on the Rent Roll is the lessor under such Lease. Except as indicated on the Rent Roll or Exception Report, no security deposits are being held by Borrower (including bonds or letters of credit being held in lieu of cash security deposits) and no Tenant or other party has any option, right of first refusal or similar preferential right to purchase all or any portion of any Property. Subject to the provisions of Section 4.7(a), upon foreclosure on any Property, with respect to each Lease at such Property either (i) Lender shall automatically succeed to the rights and obligations of the landlord under such Leases (ii) or such Leases shall automatically terminate. No material amounts are payable by Borrower to any Tenant under a Lease (other than in connection with common area maintenance and other routine reconciliations) and no Tenant has the right to require Borrower to perform or finance any Material Alterations or improvements to the space covered by its Lease. Notwithstanding any provision contained in this Agreement to the contrary, Leases may contain (and the same shall be expressly permitted hereunder without

22

notice to or the consent of Lender, except to the extent required pursuant to Section 4.7(b)) the rights of tenants to receive reimbursement, contribution or allowance by landlord for tenant improvements or rent concessions or abatements, in each case as set forth in the Exception Report.

(b) There are no Material Agreements except as described in Schedule B. Borrower has made available to Lender true and complete copies of all Material Agreements. Each Material Agreement has been entered into at arm’s length in the ordinary course of business by or on behalf of Borrower. The Material Agreements are in full force and effect and there are no defaults thereunder by Borrower or, to Borrower’s knowledge, any other party thereto. Borrower is not in default in any material respect in the performance, observance or fulfillment of any of the obligations, covenants or conditions contained in any Permitted Encumbrance.

Section 3.15. Full and Accurate Disclosure. No statement of fact heretofore delivered by Guarantor or Borrower to Lender in writing with respect to the Properties or the Loan contains any untrue statement of a material fact or omits to state any material fact necessary to make statements contained therein not misleading unless subsequently corrected (except that the foregoing representation, as it relates to any Environmental Report, Engineering Report, Title Insurance Policy and zoning report delivered to Lender in connection with the closing of the Loan, shall be limited to Borrower’s actual knowledge). To Borrower’s actual knowledge, there is no fact, event or circumstance presently known to Borrower that has intentionally not been disclosed to Lender that has had or could reasonably be expected to result in a Material Adverse Effect.

Section 3.16. Use of Loan Proceeds. No part of the proceeds of the Loan will be used for the purpose of purchasing or acquiring any “margin stock” within the meaning of Regulations T, U or X of the Board of Governors of the Federal Reserve System or for any other purpose that would be inconsistent with such Regulations T, U or X or any other Regulations of such Board of Governors, or for any purpose prohibited by Legal Requirements or by the terms and conditions of the Loan Documents. The Loan is solely for the general corporate purposes of Borrower, Guarantor and the subsidiaries and no portion thereof shall be used for personal, consumer, household or similar purposes.

Section 3.17. [Reserved]

Section 3.18. [Reserved]Title. Borrower owns good, valid and insurable title to the Properties and good, valid and transferrable title to any other Collateral, in each case free and clear of all Liens whatsoever except the Permitted Encumbrances. No Property is subject to a Lien that secures Debt for borrowed money (expressly excluding all leases of furnishings, fixtures, equipment and other personal property). The Mortgages, when properly recorded in the appropriate records, together with any Uniform Commercial Code financing statements required to be filed in connection therewith, will create (i) valid, perfected first priority Liens on the Properties, enforceable as such against creditors of and purchasers from Borrower and subject only to Permitted Encumbrances any requirements in the various jurisdictions in which the Properties are located with respect to the order of and requirements for the realization on security, including any applicable so-called “security first” and “one-action” or similar rules,

23

requirements or limitations and (ii) perfected Liens in and to all personalty constituting Collateral, all in accordance with the terms thereof, in each case subject only to any applicable Permitted Encumbrances any requirements in the various jurisdictions in which the Properties are located with respect to the order of and requirements for the realization on security, including any applicable so-called “security first” and “one-action” or similar rules, requirements or limitations. The Permitted Encumbrances do not, individually or in the aggregate, result in a Material Adverse Effect. Subject to clause (v) of the definition of Permitted Encumbrances, there are no claims for payment for work, labor or materials affecting the Properties that are or may become a Lien prior to, or of equal priority with, the Liens created by the Loan Documents.

Section 3.20. No Encroachments. Except as set forth on the Surveys, all of the improvements on each Property lie wholly within the boundaries and building restriction lines of the such Property, and no improvements on adjoining property encroach upon any Property, and no easements or other encumbrances upon any Property encroach upon any of the improvements, except to the extent the same is not reasonably be expected to result in a Material Adverse Effect.

Section 3.21. Physical Condition.

(a) Except as would not reasonably be expected to result in a Material Adverse Effect, each Property and all building systems (including sidewalks, storm drainage system, roof, plumbing system, HVAC system, fire protection system, electrical system, equipment, elevators, exterior sidings and doors, irrigation system and all structural components) are free of all material damage and are in good condition, order and repair in all respects material to such Property’s use, operation and value, subject to ordinary wear and tear and any maintenance, restoration, repairs and/or replacements that are diligently being prosecuted to completion in accordance with Borrower’s ordinary course of business.

(b) Except as would not reasonably be expected to result in a Material Adverse Effect, Borrower is not aware of any material structural or other material defect or damages in any of the Properties, whether latent or otherwise.

(c) Borrower has not received written notice, and has not received written notice that any Tenant has received written notice from any insurance company or bonding company of any defects or inadequacies in any of the Properties that would, alone or in the aggregate, adversely affect in any material respect the insurability of the same or cause the imposition of extraordinary premiums or charges thereon or of any termination or threatened termination of any policy of insurance or bond.

Section 3.22. Reserved.

Section 3.23. Management. No property management agreements to which Borrower or any affiliate is a party are in effect with respect to the Properties.

Section 3.24. Condemnation. No Condemnation has been commenced or, to Borrower’s knowledge, is contemplated or threatened with respect to all or any portion of any of the Properties or for the relocation of roadways providing access to any of the Properties to the extent that such Condemnation would reasonably be expected to cause a Material Adverse Effect.

24