Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - MERIDIAN BIOSCIENCE INC | d806176dex32.htm |

| EX-21 - EX-21 - MERIDIAN BIOSCIENCE INC | d806176dex21.htm |

| EX-23 - EX-23 - MERIDIAN BIOSCIENCE INC | d806176dex23.htm |

| EX-31.1 - EX-31.1 - MERIDIAN BIOSCIENCE INC | d806176dex311.htm |

| EX-31.2 - EX-31.2 - MERIDIAN BIOSCIENCE INC | d806176dex312.htm |

| EX-10.12 - EX-10.12 - MERIDIAN BIOSCIENCE INC | d806176dex1012.htm |

| EX-10.13 - EX-10.13 - MERIDIAN BIOSCIENCE INC | d806176dex1013.htm |

| EX-10.10 - EX-10.10 - MERIDIAN BIOSCIENCE INC | d806176dex1010.htm |

| EXCEL - IDEA: XBRL DOCUMENT - MERIDIAN BIOSCIENCE INC | Financial_Report.xls |

| 10-K - ANNUAL REPORT - MERIDIAN BIOSCIENCE INC | d806176d10k.htm |

Exhibit 13

Meridian Bioscience, Inc. and Subsidiaries

Selected Financial Data

Income Statement Information (Amounts in thousands, except per share data)

| FY 2014 | FY 2013 | FY 2012 | FY 2011 | FY 2010 | ||||||||||||||||

| Net revenues |

$ | 188,832 | $ | 188,686 | $ | 172,712 | $ | 158,836 | $ | 142,213 | ||||||||||

| Gross profit |

117,243 | 121,044 | 109,048 | 98,411 | 87,909 | |||||||||||||||

| Operating income |

52,392 | 57,314 | 49,296 | 40,033 | 41,138 | |||||||||||||||

| Net earnings |

34,743 | 38,032 | 33,371 | 26,831 | 26,647 | |||||||||||||||

| Basic earnings per share |

$ | 0.84 | $ | 0.92 | $ | 0.81 | $ | 0.66 | $ | 0.66 | ||||||||||

| Diluted earnings per share |

$ | 0.83 | $ | 0.91 | $ | 0.80 | $ | 0.65 | $ | 0.65 | ||||||||||

| Cash dividends declared per share |

$ | 0.79 | $ | 0.76 | $ | 0.76 | $ | 0.76 | $ | 0.74 | ||||||||||

| Book value per share |

$ | 3.87 | $ | 3.73 | $ | 3.46 | $ | 3.36 | $ | 3.38 | ||||||||||

| Balance Sheet Information |

||||||||||||||||||||

| FY 2014 | FY 2013 | FY 2012 | FY 2011 | FY 2010 | ||||||||||||||||

| Current assets |

$ | 112,748 | $ | 114,088 | $ | 96,590 | $ | 90,354 | $ | 95,305 | ||||||||||

| Current liabilities |

13,735 | 19,617 | 16,772 | 13,948 | 13,247 | |||||||||||||||

| Total assets |

176,929 | 176,748 | 161,381 | 155,493 | 154,641 | |||||||||||||||

| Long-term debt obligations |

— | — | — | — | — | |||||||||||||||

| Shareholders’ equity |

161,029 | 155,045 | 142,748 | 138,524 | 137,361 | |||||||||||||||

Forward Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a safe harbor from civil litigation for forward-looking statements accompanied by meaningful cautionary statements. Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, which may be identified by words such as “estimates”, “anticipates”, “projects”, “plans”, “seeks”, “may”, “will”, “expects”, “intends”, “believes”, “should” and similar expressions or the negative versions thereof and which also may be identified by their context. All statements that address operating performance or events or developments that Meridian expects or anticipates will occur in the future, including, but not limited to, statements relating to per share diluted earnings and revenue, are forward-looking statements. Such statements, whether expressed or implied, are based upon current expectations of the Company and speak only as of the date made. Specifically, Meridian’s forward-looking statements are, and will be, based on management’s then-current views and assumptions regarding future events and operating performance. Meridian assumes no obligation to publicly update or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. These statements are subject to various risks, uncertainties and other factors that could cause actual results to differ materially, including, without limitation, the following:

Meridian’s continued growth depends, in part, on its ability to introduce into the marketplace enhancements of existing products or new products that incorporate technological advances, meet customer requirements and respond to products developed by Meridian’s competition, and its ability to effectively sell such products. While Meridian has introduced a number of internally developed products, there can be no assurance that it will be successful in the future in introducing such products on a timely basis. Meridian relies on proprietary, patented and licensed technologies, and the Company’s ability to protect its intellectual property rights, as well as the potential for intellectual property litigation, would impact its results. Ongoing consolidations of reference laboratories and formation of multi-hospital alliances may cause adverse changes to pricing and distribution. Recessionary pressures on the economy and the markets in which our customers operate, as well as adverse trends in buying patterns from customers can change expected results. Costs and difficulties in complying with laws and regulations, including those administered by the United States Food and Drug Administration, can result in unanticipated expenses and delays and interruptions to the sale of new and existing products. The international scope of Meridian’s operations, including changes in the relative strength or weakness of the U.S. dollar and general economic conditions in foreign countries, can impact results and make them difficult to predict. One of Meridian’s growth strategies is the acquisition of companies and product lines. There can be no assurance that additional acquisitions will be consummated or that, if consummated, will be successful and the acquired businesses will be successfully integrated into Meridian’s operations. There may be risks that acquisitions may disrupt operations and may pose potential difficulties in employee retention and there may be additional risks with respect to Meridian’s ability to recognize the benefits of acquisitions, including potential synergies and cost savings or the failure of acquisitions to achieve their plans and objectives. Meridian cannot predict the possible impact of U.S. health care legislation enacted in 2010 - the Patient Protection and Affordable Care Act, as amended by the Health Care Education Reconcilliation Act - and any modification or repeal of any of the provisions thereof, and any similar initiatives in other countries on its results of operations. Efforts to reduce the U.S. federal deficit, breaches of Meridian’s information technology systems and natural disasters and other events could have a materially adverse effect on Meridian’s results of operations and revenues. In addition to the factors described in this paragraph, Part I, Item 1A Risk Factors of our Form 10-K contains a list and description of uncertainties, risks and other matters that may affect the Company.

CORPORATE PROFILE

Meridian is a fully integrated life science company that develops, manufactures, markets and distributes a broad range of innovative diagnostic test kits, purified reagents and related products and offers biopharmaceutical-enabling technologies. Utilizing a variety of methods, these products and diagnostic tests provide accuracy, simplicity and speed in the early diagnosis and treatment of common medical conditions, such as gastrointestinal, viral and respiratory infections. Meridian’s diagnostic products are used outside of the human body and require little or no special equipment. The Company’s products are designed to enhance patient well-being while reducing the total outcome costs of health care. Meridian has strong market positions in the areas of gastrointestinal and upper respiratory infections, serology, parasitology and fungal disease diagnosis. In addition, Meridian is a supplier of rare reagents, specialty biologicals and related technologies used by biopharmaceutical companies engaged in research for new drugs and vaccines. The Company markets its products and technologies to hospitals, reference laboratories, research centers, diagnostics manufacturers and biotech companies in more than 60 countries around the world. The Company’s shares are traded on the NASDAQ Global Select Market, symbol VIVO. Meridian’s website address is www.meridianbioscience.com.

MERIDIAN BIOSCIENCE, INC. 1

Meridian Bioscience, Inc. and Subsidiaries

Corporate Data

| Corporate Headquarters 3471 River Hills Drive Cincinnati, Ohio 45244 (513) 271-3700

Legal Counsel Keating Muething & Klekamp PLL Cincinnati, Ohio |

Annual Meeting

The annual meeting of the shareholders will be held on Thursday, January 22, 2015 at 2:00 p.m. Eastern Time at the Holiday Inn Eastgate, 4501 Eastgate Boulevard, Cincinnati, OH 45245. Directions to the Holiday Inn Eastgate can be found on our website: www.meridianbioscience.com. |

Independent Public Accountants

Grant Thornton LLP

Cincinnati, Ohio

Transfer Agent, Registrar and Dividend Reinvestment Administration

Shareholders requiring a change of name, address or ownership of stock, as well as information about shareholder records, lost or stolen

certificates, dividend checks, dividend direct deposit, and dividend reinvestment should contact: Computershare, P. O. Box 30170, College Station, TX 77842-3170; (800) 884-4225 or (781) 575-3120 (International holders only); or submit your inquiries

online through

https://www-us.computershare.com/investor/contact.

Common Stock Information

NASDAQ Global Select Market Symbol: “VIVO.” Approximate number of beneficial holders: 17,500. Approximate number of record holders: 850.

The following table sets forth by calendar quarter the high and low sales prices of the Common Stock on the NASDAQ Global Select Market.

| Years Ended September 30, | 2014 | 2013 | ||||||||||||||

| Quarter ended: |

High | Low | High | Low | ||||||||||||

| December 31 |

26.65 | 22.61 | 20.82 | 18.65 | ||||||||||||

| March 31 |

27.72 | 20.27 | 23.04 | 20.27 | ||||||||||||

| June 30 |

23.13 | 19.14 | 23.05 | 19.15 | ||||||||||||

| September 30 |

21.22 | 17.52 | 25.10 | 21.59 | ||||||||||||

Directors and Officers

| Directors | Officers and Executives | |||||

| John A. Kraeutler Chairman of the Board and Chief Executive Officer

Robert J. Ready Chairman of the Board, LSI Industries Inc.

David C. Phillips Co-founder, Cincinnati Works, Inc. |

James M. Anderson Retired President and Chief Executive Officer, Cincinnati Children’s Hospital Medical Center

Dwight E. Ellingwood Senior Vice President, Strategy, Communications and Public Affairs, TriHealth |

John A. Kraeutler Chairman of the Board and Chief Executive Officer

Lawrence J. Baldini Executive Vice President, Operations and Information Systems

Marco G. Calzavara President and Managing Director, Meridian Bioscience Europe

Richard L. Eberly Executive Vice President, President, Meridian Life Science |

Vecheslav A. Elagin Executive Vice President, Research and Development

Marviette D. Johnson Vice President, Human Resources

Melissa A. Lueke Executive Vice President, Chief Financial Officer and Secretary

Susan D. Rolih Executive Vice President, Regulatory and Quality Systems

Michael C. Shaughnessy Executive Vice President, President, Meridian Diagnostics | |||

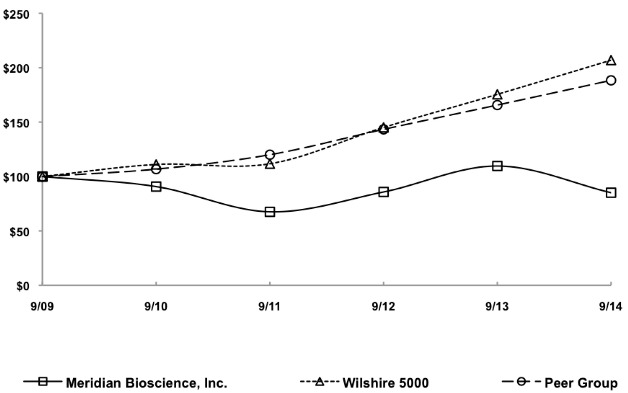

PERFORMANCE GRAPH

The following graph shows the yearly percentage change in Meridian’s cumulative total shareholder return on its Common Stock as measured by dividing the sum of (A) the cumulative amount of dividends, assuming dividend reinvestment during the periods presented and (B) the difference between Meridian’s share price at the end and the beginning of the periods presented; by the share price at the beginning of the periods presented with the Wilshire 5000 Equity Index and a Peer Group Index. The Peer Group consists of Alere Inc., Cepheid, IDEXX Laboratories, Inc., Neogen Corporation, Orasure Technologies Inc., Quidel Corporation and Trinity Biotech Plc.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Meridian Bioscience, Inc., the Wilshire 5000 Index, and a Peer Group

| * | $100 invested on 9/30/09 in stock or index, including reinvestment of dividends. |

Fiscal year ending September 30.