Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InvenTrust Properties Corp. | d825368d8k.htm |

Exhibit 99.1

PORTFOLIO SUMMARY

| Total Assets Undepreciated |

$ | 9.6 billion | ||

| Total Assets after Depreciation |

$ | 8.3 billion | ||

| Total Cash |

$ | 349 million | ||

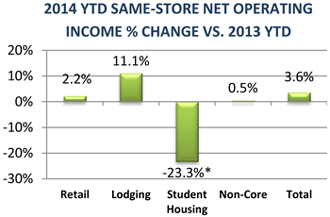

| YTD Same-Store NOI over 2013(a) |

up 3.6 | % | ||

| Cash Flow from Operations |

$ | 324 million | ||

| YTD FFO(b) |

$ | 388 million | ||

| YTD FFO per share |

$ | 0.44 | ||

| Annualized Distribution Rate |

$ | 0.50 a share | ||

| Number of Properties(a) |

203 | |||

| Debt |

$ | 4.1 billion | ||

| Weighted Average Interest Rate |

4.83 | % | ||

| Leverage Ratio |

44 | %* | ||

| Mortgage Payable Breakdown |

||||

| • Fixed Rate |

73% of mortgage debt | |||

| • Variable Rate |

27% of mortgage debt | |||

| * | Based on line of credit covenants. |

| (a) | Q3 results do not include any properties included in the select service transaction. |

| (b) | FFO is a non-GAAP financial measure. Please review our recently filed 10Q for a reconciliation of the most direct comparable GAAP measure. |

INLAND AMERICAN UPDATE

Xenia Hotels & Resorts Spin-Off Update

| • | On October 9th, Xenia Hotels & Resorts, Inc. (“Xenia”) filed an amendment to the Form 10 with the SEC related to its potential spin-off into a standalone, publicly traded lodging REIT. This amendment is the next step in the process for the listing of Xenia on the New York Stock Exchange. We currently anticipate that the spin-off will occur in the first half of 2015. |

New Estimated Share Value

| • | Each year Inland American publishes an estimated share value to assist broker dealers in complying with the account statement reporting rules published by the Financial Industry Regulatory Authority. With the announced potential spin-off of Xenia by Inland American, the timing of Inland American’s new estimated share value is uncertain. |

| • | If the spin-off is consummated, we currently plan to publish a new estimated share value in closer proximity to the Xenia spin-off date. Regardless of the timing, once the new estimated share value is determined, we will communicate it to our stockholders. |

$1.1 Billion Select Service Hotel Transaction

| • | On November 17th, we closed on the sale of our select service hotel portfolio to a joint venture formed by affiliates of Northstar Realty Finance Corp. and Chatham Lodging Trust for approximately $1.1 billion. |

| • | The select service hotel portfolio includes 52 select service hotels with 6,976 rooms, and was previously managed by Xenia Hotels & Resorts. The sale of the portfolio is aligned with both Inland American’s long-term strategy, as well as Xenia’s strategy of investing primarily in premium full service, lifestyle and urban upscale hotels, with a focus on the top 25 U.S. lodging markets as well as key leisure destinations throughout the United States. |

| • | We realized approximately $480 million of net proceeds at the closing of the transaction. We plan to use the net proceeds to advance the growth strategy of our student housing and retail portfolios. We also will use the proceeds for other general corporate purposes, which may include, among other things, debt reduction. |

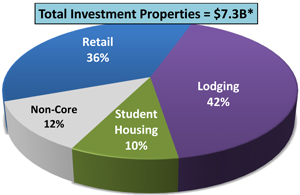

| * | Chart based on undepreciated (total investment) asset values and does not include select service or other properties held for sale |

RETAIL PROPERTY OVERVIEW

| • | 180 comparable leases renewed YTD with a 4.85% increase in rent over prior contract rent. |

| • | Economic occupancy equals 93% for the portfolio. |

LODGING PROPERTY OVERVIEW(a)

47 Properties — 12,797 Rooms

| • | YTD same-store average daily rate increased to $166, up 4.4% over the first nine months of 2013. |

| • | YTD same-store revenue per available room increased to $127, up 8.5% over the first nine months of 2013. |

| • | Occupancy increased to 78%, up from 74% in September 2013. |

STUDENT HOUSING PROPERTY OVERVIEW

14 Properties — 8,318 Beds

| • | Rent per bed for our entire student housing portfolio increased 4.6% to $743 over YTD in 2013. |

| • | Five properties in development, one opens in Q2 2015, two with Q3 2015 open dates and two others with 2016 open dates. |

NON-CORE PROPERTY OVERVIEW

28 Properties — 7.2 Million Square Feet

| • | Same-Store portfolio is 92% occupied. |

| • | Portfolio consists of 14 industrial properties, nine office and five single-tenant retail. |

| (a) | Q3 results do not include any properties included in the select service transaction. |

| * | Our student housing same-store net operating income decreased $4.5 million, or 23.3% due to a one-time major project at one of the properties, of which $5.1 million was incurred year-to-date. Overall, student housing revenues are holding steady. |

Forward-looking statements in this document, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about our plans, strategies and future events, including the anticipated net cash proceeds from the sale of the select service hotels, the spin-off of our subsidiary Xenia Hotels & Resorts, Inc. (“Xenia”) and the listing of Xenia’s shares on the New York Stock Exchange, the anticipated timing to close the spin-off, our ability to successfully execute on our growth strategy and strategic transactions and provide liquidity events to our stockholders, among other things, each of which involve known and unknown risks that are difficult to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, purchase price adjustments in accordance with the terms of the select service purchase agreement, indemnification obligations, if the SEC fails to declare Xenia’s preliminary registration statement on Form 10 effective in a timely manner or at all; if the NYSE fails to authorize the listing of Xenia’s common stock in a timely manner or at all; our current expectations with respect to the timing of the potential spin-off and/or the potential failure to satisfy certain closing conditions; Inland American’s board of directors may determine that the completion of the spin-off is not in our best interests and determine not to consummate the spin-off; other risks as described in the preliminary registration statement on Form 10; and other risks described in our filings with the SEC. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this press release. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. This letter shall not constitute an offer to sell or the solicitation of an offer to buy any securities.

InvenTrust Properties Corp. Reports

- 03/16/2010 - 10-K

- 03/18/2016 - 10-K

- 03/17/2017 - 10-K

- 03/07/2018 - 10-K

- 02/21/2020 - 10-K

- 02/19/2021 - 10-K

- 11/12/2009 - 10-Q

- 05/14/2010 - 10-Q

- 08/13/2010 - 10-Q

- 11/12/2010 - 10-Q

- 05/13/2011 - 10-Q

- 08/14/2014 - 10-Q

- 11/07/2014 - 10-Q

- 05/14/2015 - 10-Q

- 08/07/2015 - 10-Q

- 11/12/2015 - 10-Q

- 05/10/2016 - 10-Q

- 11/14/2016 - 10-Q

- 05/12/2017 - 10-Q

- 08/10/2017 - 10-Q

- 11/09/2017 - 10-Q

- 05/15/2018 - 10-Q

- 08/09/2018 - 10-Q

- 11/06/2018 - 10-Q

- 05/08/2020 - 10-Q

- 08/07/2020 - 10-Q

- 11/06/2020 - 10-Q

- 05/07/2021 - 10-Q

- 08/06/2021 - 10-Q