Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFCATION - Vapor Group, Inc. | vpor_ex321.htm |

| EX-31.2 - CERTIFICATION - Vapor Group, Inc. | vpor_ex312.htm |

| EX-31.1 - CERTIFICATION - Vapor Group, Inc. | vpor_ex311.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Vapor Group, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended September 30, 2014

or

¨ Transitional Report under Section 13 or 15(d) of the Securities Exchange Act of 1934

000-27795

(Commission file number)

|

VAPOR GROUP, INC. |

|

(Exact name of registrant as specified in its charter) |

|

Florida |

98-0427526 |

|

|

(State of incorporation) |

(IRS Employer Identification Number) |

| 3901 SW 47TH AVENUE

Suite 415 Davie, Florida 33314 |

|

(Address of principal executive offices) |

| (954) 792-8450 |

|

(Registrant's telephone number) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Not Applicable. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. (Check one):

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller Reporting Company |

x |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date was:

Common Stock, $0.001 par value 429,827,024 shares issued & outstanding on November 13, 2014

Series A Preferred Stock, $0.001 par value, 1,000,000 shares issued & outstanding on November 13, 2014

Series B Preferred Stock, $0.001 par value, 250,000 shares issued & outstanding on November 13, 2014

DOCUMENTS INCORPORATED BY REFERENCE:

None

FORWARD-LOOKING STATEMENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q ("Quarterly Report"), in particular the Management’s Discussion and Analysis of Financial Condition and Results of Operations appearing in Item 2 herein ("MD&A") contains certain "forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give expectations or forecasts of future events. The reader can identify these forward-looking statements by the fact that they do not relate strictly to historical or current facts. They use words such as "believe(s)," "goal(s)," "target(s)," "estimate(s)," "anticipate(s)," "forecast(s)," "project(s)," (plan(s)," "intend(s)," "expect(s)," "might," may" and other words and terms of similar meaning in connection with a discussion of future operating, financial performance or financial condition. Forward-looking statements, in particular, include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends of operations and financial results.

Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this Quarterly Report. These statements are based on current expectations and current the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance; actual results could differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining the Company's actual results and financial condition. The reader should consider the following list of general factors that could affect the Company's future results and financial condition.

Among the general factors that could cause actual results and financial condition to differ materially from estimated results and financial condition are:

|

· |

The success or failure of management's efforts to implement their business strategy |

|

· |

The ability of the Company to raise sufficient capital to meet operating requirements |

|

· |

The uncertainty of consumer demand for our products and services; |

|

· |

The ability of the Company to compete with major established companies; |

|

· |

Heightened competition, including, with respect to pricing, entry of new competitors and the development of new products by new and existing competitors; |

|

· |

Absolute and relative performance of our products and services; |

|

· |

The effect of changing economic conditions; |

|

· |

The ability of the Company to attract and retain quality employees and management; |

|

· |

The current global recession and financial uncertainty; and |

|

· |

Other risks which may be described in future filings with the U.S. Securities and Exchange Commission ("SEC"). |

No assurances can be given that the results contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. We assume no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this Annual Report. The reader is advised, however, to consult any further disclosures we make on related subjects in our filings with the SEC.

|

2

|

VAPOR GROUP, INC.

FORM 10-Q

September 30, 2014

In this Quarterly Report on Form 10-Q, unless the context otherwise requires, the terms “Vapor Group.”, “we,”, “us,” “our” and the “Company” refer to Vapor Group, Inc. and its consolidated, wholly-owned subsidiaries, Total Vapor Inc., Vapor 123 Inc. and Vapor Products, Inc.

TABLE OF CONTENTS

|

PART I – FINANCIAL INFORMATION |

|||||

|

ITEM 1 – |

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

||||

|

Condensed Consolidated Balance Sheets |

|||||

|

Condensed Consolidated Statements of Operations |

|||||

|

Condensed Consolidated Statements of Cash Flows |

|||||

|

Notes to Condensed Consolidated Financial Statements |

|||||

|

ITEM 2 – |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

||||

|

ITEM 3 – |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

||||

|

ITEM 4 – |

CONTROLS AND PROCEDURES |

||||

|

PART II – OTHER INFORMATION |

|||||

|

ITEM 1 – |

LEGAL PROCEEDINGS |

||||

|

ITEM 1A – |

RISK FACTORS |

||||

|

ITEM 2 – |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

||||

|

ITEM 3 – |

DEFAULTS UPON SENIOR SECURITIES |

||||

|

ITEM 4 – |

MINE SAFETY DISCLOSURES |

||||

|

ITEM 5 – |

OTHER INFORMATION |

||||

|

ITEM 6 – |

EXHIBITS |

||||

|

3

|

PART I – FINANCIAL INFORMATION

Item 1 – Condensed, Consolidated Financial Statements

|

VAPOR GROUP, INC. |

||||

|

CONSOLIDATED BALANCE SHEET |

| As of | As of | |||||||

| September 30, | December 31, | |||||||

| 2014 | 2013 | |||||||

|

|

(Unaudited) | (Audited) | ||||||

|

ASSETS |

||||||||

|

CURRENT ASSETS |

||||||||

|

Cash |

$ |

859,058 |

$ |

48,177 |

||||

|

Accounts receivable |

955,085 |

104,856 |

||||||

|

Loan to shareholder |

388,634 |

282,872 |

||||||

|

Inventory |

564,222 |

149,732 |

||||||

|

Other current assets |

788,711 |

358,483 |

||||||

|

Total current assets |

3,555,710 |

944,120 |

||||||

|

PROPERTY AND EQUIPMENT, NET |

18,373 |

16,054 |

||||||

|

OTHER ASSETS |

||||||||

|

Intangible assets, net |

- |

975 |

||||||

|

Deferred expenses |

55,000 |

87,896 |

||||||

|

Total other assets |

55,000 |

88,871 |

||||||

|

TOTAL ASSETS |

$ |

3,629,083 |

$ |

1,049,045 |

||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

||||||||

|

CURRENT LIABILITIES |

||||||||

|

Accounts payable |

$ |

176,295 |

$ |

- |

||||

|

Accrued interest |

218,291 |

88,375 |

||||||

|

Accrued expenses |

115,328 |

- |

||||||

|

Payroll tax liability |

59,433 |

- |

||||||

|

Convertible notes payable |

3,583,423 |

319,527 |

||||||

|

Loans payable |

710 |

437,910 |

||||||

|

Sales tax payable |

9,999 |

9,197 |

||||||

|

TOTAL CURRENT LIABILITIES |

4,163,479 |

855,009 |

||||||

|

TOTAL LIABILITIES |

4,163,479 |

855,009 |

||||||

|

STOCKHOLDERS' DEFICIT |

||||||||

|

Preferred stock, $0.001 par value, 15,000,000 shares authorized, |

||||||||

|

1,250,000 and 1,000,000 issued and outstanding at September 30, 2014 and December 31, 2013, respectively |

1,250 |

1,000 |

||||||

|

Common stock, $0.001 par value, 1,000,000,000 shares authorized, |

||||||||

|

429,827,024 and 270,020,145 issued and outstanding at September 30, 2014 and December 31, 2013, respectively, |

429,827 |

270,020 |

||||||

|

Additional paid in capital |

(216,690 |

) |

109,958 |

|||||

|

Accumulated deficit |

(748,783 |

) |

(186,942 |

) |

||||

|

TOTAL STOCKHOLDERS' DEFICIT |

(534,396 |

) |

194,036 |

|||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

$ |

3,629,083 |

$ |

1,049,045 |

||||

|

4

|

| VAPOR GROUP, INC. | ||||||||

| CONSOLIDATED STATEMENT OF OPERATIONS | ||||||||

| (Unaudited) |

| For the three months ended | For the nine months ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| NET REVENUES | $ | 1,307,524 | $ | 760,477 | $ | 3,299,300 | $ | 855,204 | ||||||||

| COST OF REVENUES | 429,987 | 450,202 | 1,267,686 | 450,202 | ||||||||||||

| GROSS PROFIT | 877,537 | 310,275 | 2,031,614 | 405,002 | ||||||||||||

| COST AND EXPENSES | ||||||||||||||||

| Advertising and promotion | 91,013 | 8,182 | 530,379 | 14,261 | ||||||||||||

| Commissions | 23,769 | - | 472,063 | - | ||||||||||||

| Professional fees | 76,644 | 38,717 | 157,109 | 41,956 | ||||||||||||

| General and administrative expenses | 870,094 | 133,708 | 1,498,363 | 183,770 | ||||||||||||

| 1,061,520 | 180,607 | 2,657,914 | 239,987 | |||||||||||||

| (Loss) from continuing operations | (183,983 | ) | 129,668 | (626,300 | ) | 165,015 | ||||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||

| Interest expense | - | - | - | - | ||||||||||||

| Other Income | - | 64,459 | 92,331 | |||||||||||||

| Total other income and (expense) | - | - | 64,459 | 92,331 | ||||||||||||

| Net (Loss) | $ | (183,983 | ) | $ | 129,668 | $ | (561,841 | ) | $ | 257,346 | ||||||

| Earnings (loss) per share | ||||||||||||||||

| - Basic |

$ |

- | $ | 1,297 |

$ |

- | $ | 2,573 | ||||||||

| Weighted average number of shares outstanding | 338,958,893 | 100 | 306,778,265 | 100 | ||||||||||||

|

5

|

| VAPOR GROUP, INC. | |||

| CONSOLIDATED STATEMENT OF CASH FLOWS | |||

| (Unaudited) |

| For the nine months ended | ||||||||

| September 30, | ||||||||

| 2014 | 2013 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (561,841 | ) | $ | 257,346 | |||

| Adjustments to reconcile increase(decrease) in net assets to cash provided by operating activities: | ||||||||

| Depreciation | 2,523 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Inventory | (414,490 | ) | 188,163 | |||||

| Accounts receivable | (850,229 | ) | - | |||||

| Other assets | (430,228 | ) | (201,786 | ) | ||||

| Accounts payables | 176,295 | (77,917 | ) | |||||

| Deferred expenses | 328,596 | |||||||

| Accrued expense | 116,130 | - | ||||||

| Accrued interest | 129,916 | (11,930 | ) | |||||

| Payroll liabilitiy | 59,433 | - | ||||||

| NET CASH USED IN OPERATING ACTIVITIES | (1,443,895 | ) | 153,876 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Payments for property and equipment | (59,943 | ) | - | |||||

| Net cash provided by investing activities | (59,943 | ) | - | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Loan to shareholder | (105,762 | ) | (14,315 | ) | ||||

| Proceeds from convertible notes | 2,857,681 | - | ||||||

| Proceeds from loans payable | - | 26,282 | ||||||

| Payment of loans | (437,200 | ) | - | |||||

| Net cash used in provided by financing activities | 2,314,719 | 11,967 | ||||||

| NET DECREASE IN CASH AND CASH EQUIVALENTS | 810,881 | 165,843 | ||||||

| CASH - BEGINNING OF YEAR | 48,177 | 7,027 | ||||||

| CASH - END OF YEAR | $ | 859,058 | $ | 172,870 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for income taxes |

$ |

- |

$ |

- | ||||

| Cash paid for interest |

$ |

- |

$ |

- | ||||

|

6

|

VAPOR GROUP, INC.

NOTES TO FINANCIAL STATEMENTS

AS OF September 30, 2014

Note 1 – Nature and Description of Business

Company Background

We were originally incorporated under the laws of Canada on January 15, 1990, under the name "Creemore Star Printing, Inc." and changed our name on June 15, 2003 to "Smitten Press: Local Lore and Legends, Inc." We domesticated in the State of Nevada on May 8, 2007, and we were incorporated as SmittenPress: Local Lore and Legends, Inc. On April 30, 2010, our Board of Directors approved a change in our name to DataMill Media Corp., effective at the close of business on June 30, 2010.

We were a management consulting firm that planned to educate and assist small businesses to improve their management, corporate governance, regulatory compliance and other business processes, with a focus on capital market participation. On October 3, 2011, we closed the Share Exchange Agreement, which resulted in Young Aviation, LLC, (“Young Aviation”), becoming a wholly-owned subsidiary. On November 10, 2011, a majority of our shareholders approved a change in our name to AvWorks Aviation Corp. As a result of acquiring Young Aviation, the Company ceased being a "shell company" as that term is defined in Section 12b-2 of the Securities Exchange Act of 1934.

The acquisition of Young Aviation is classified as a reverse merger and resulted in a change in control at the Company and a new focus on the business of Young Aviation. As the result of the slow growth of such operations, in early 2013 the Company decided to seek other business opportunities.

On September 3, 2013, the majority shareholder of the Company and record holder of 165,000,000 shares of restricted common stock of the Company (61.11% of the 270,020,145 shares of common stock issued and outstanding), and Corporate Excellence Consulting, Inc., a Florida corporation, the holder of 1,000,000 shares of the Series A Preferred Stock of the Company (100% of the issued and outstanding shares of preferred stock of the Company), (collectively, the “Sellers), entered into a share purchase agreement (the “Share Purchase Agreement”) with Dror Svorai, an individual, (the “Buyer”), and the future President and CEO of the Company (post-Merger Agreement as hereinafter described). In accordance with the Share Purchase Agreement, the Sellers agreed to sell and transfer over time the 165,000,000 shares of restricted common stock and the 1,000,000 shares of Series A Preferred Stock of the Company to the Buyer for a total purchase price of $115,000. The Share Purchase Agreement provides that the purchase price be paid on or before February 13, 2014 and that as the purchase price is being paid by the Buyer, the shares of common and preferred stock are to be released pro-rata to the Buyer by the Sellers. The Share Purchase Agreement was completed and paid-in-full within its terms, and the sale and transfer of the common stock and Series A Preferred Stock to the Buyer was finalized on February 20, 2014. The sale and purchase of the 165,000,000 shares of common stock of the Company constitutes 49.34% of the total issued and outstanding shares of the Company of 343,536,386 as of April 11, 2014, and the sale and purchases of the 1,000,000 shares of Series A Preferred Stock constitutes 100% of the total issued and outstanding shares of preferred stock which has over 50% voting control of the Company. As a result, Dror Svorai, an individual, is the controlling shareholder of the Company.

On November 11, 2013, The Board of Directors and stockholders owning or having voting authority for 165,000,000 shares of issued and outstanding Common Stock of the then 270,020,145 shares issued and outstanding, or 61.11% of the voting common stock of the Company, and 1,000,000 shares of Series A Preferred Stock, representing all of the issued and outstanding shares of preferred stock of the Company, voted in favor of an amendment to our Articles of Incorporation to affect a reverse stock split of all of the outstanding shares of Common Stock, at a ratio of one-for-thirty. The reverse split which was pending and would have become effective once FINRA completes its review of the Company’s filings related to this corporate action, was subsequently cancelled by the Board of Directors on March 13, 2014, as filed on Form 8-K on March 18, 2014.

|

7

|

On January 22, 2014, the Company entered into an Agreement of Merger and Plan of Reorganization ("Merger Agreement") by and among the Company and the Vapor Group, Inc., a Florida corporation ("Vapor Group") and the shareholders of Vapor Group (the “Vapor Group Shareholders”), pursuant to which the Company will acquire 100% of the issued and outstanding shares of Vapor Group from the Vapor Group Shareholders in return for the issuance of 750,000,000 shares of its common stock. As a condition to be met prior to the closing of the Merger Agreement, the Company was required to increase its authorized shares of common stock to 2,000,000,000 from 500,000,000, which it did by filing an amendment to its Articles of Incorporation with the State of Florida on January 10, 2014, which amendment was accepted by the State of Florida on January 15, 2014 thereby increasing its authorized shares. The Merger Agreement subsequently became effective as of January 27, 2014 with its filing in the State of Florida.

As a result of the Merger Agreement: (i) the Vapor Group assumed management control of the Company and established its business model and operations as the primary business operations of the Company; (ii) prior management resigned as the sole officer and director of the Company; (iii) Dror Svorai consented to act as a member of the Board of Directors, Chairman of the Board of Directors and as the President/Chief Executive Officer, and Treasurer of the Company; (iv) Yaniv Nahon consented to act as a member of the Board of Directors and as a Vice President/Chief Operating Officer, and Secretary of the Company; and (v) Jorge Schcolnik consented to act as a member of the Board of Directors and Vice President/Chief Financial Officer of the Company. Mr. Eccles did not resign as a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

The “Agreement of Merger and Plan of Reorganization”, dated January 22, 2014, is considered a reverse merger, and resulted in a change in control at the Company and new management decided to abandon the former aviation business and focus solely on the business of Vapor Group.

On October 28, 2014 the Company amended its Articles of Incorporation to increase the total quantity of authorized common stock to 2,500,000,000 shares.

About Vapor Group, Inc.

The business of Vapor Group, Inc., (www.vaporgroup.com), is the designing, developing, manufacturing and marketing high quality, vaporizers and e-cigarette brands which use state-of-the-art electronic technology and specially formulated, “Made in the USA” e-liquids, which may or may not contain nicotine. It offers a range of products with unique e-liquid flavors that is unmatched in our industry. Its products are marketed under the Vapor Group, Total Vapor, Vapor 123, and Vapor Products brands which it sells nationwide through distributors, wholesalers and directly to consumers through its own websites and direct response advertising. Total Vapor Inc., Vapor 123 Inc. and Vapor Products, Inc., each a Florida corporation, are each a wholly-owned subsidiary of Vapor Group, Inc.

Vapor Group is committed to providing e-cigarettes that are convenient and economical to use, safer and healthier than traditional smoking, and which provide a flavorful, enjoyable smoking experience, in addition Vapor Group designs, manufactures and distributes a line of proprietary vaporizers and accessories designed for use with liquids, waxes and dry herbs.

We believe that we produce the highest quality e-liquids for e-cigarettes in the world. Our e-liquids are unsurpassed by any competitor in terms of their purity, high quality, and the steps that we take to protect our customers. All our e-liquids are formulated and mixed exclusively in the U.S. by an FDA registered laboratory by degreed professionals, in accordance with cGMP guidelines (21 CFR part 111). All our e-liquid ingredients are quarantined before use, and must pass an independent, third party laboratory test for purity. All our key ingredients are United States Pharmacopeia (“USP”) grade and kosher. Our lab carefully tests each batch of our e-liquid by high pressure liquid chromatograph to verify that we have the right levels of ingredients. Our high quality is a fundamental pillar of our competitive advantage.

|

8

|

Vapor Group, Inc. is committed to responsible business policies and practices, including, but not limited to, the marketing of our products only to persons eighteen years of age or older, not making or avoiding claims about our products’ health benefits, and fulfilling the requirements of all applicable municipal, state and federal laws and regulations.

As of September 30, 2014, the following table shows individuals and legal entities with an equity interest greater than 20 percent and the amount of their equity interest:

|

Shareholder/owner |

Ownership percentage | |||

|

Cede & Co. |

64.872 |

% |

||

|

Dror Svorai |

23.009 |

% |

||

|

Total |

87.88 |

% |

||

Dror Svorai, President and CEO, is also the holder of 1,000,000 shares of Series A Preferred Stock that has voting rights in any election of the shareholders held for any purpose, wherein each share of Series A Preferred Stock has ten thousand (10,000) votes. The Series A Preferred Stock is non-convertible.

In addition Dror Svorai is the holder of 187,500 shares of convertible Series B Preferred Stock, and Yaniv Nahon, the Company’s COO, is the holder of 62,500 shares of convertible Series B Preferred Stock, such that Dror Svorai and Yaniv Nahon hold 100% of all the issued and outstanding shares of Series B Preferred Stock. Each share of Series B Preferred Stock has voting rights equivalent to 100 shares of common stock.

The Company's business activity is with customers located throughout the United States through retailers and web-based sales as well.

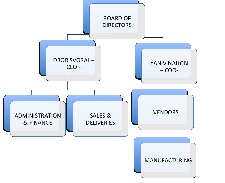

Organizational Structure

|

9

|

Board of Directors at the Balance Sheet Date:

| Board of Directors |

Position |

|

Name |

|

|

|

Chairman & CEO |

|

Dror Svorai |

|

|

Vice-Chairman & COO |

|

Yaniv Nahon |

||

|

Chief Financial Officer |

|

Jorge Schcolnik |

Note 2 – Going Concern

As reflected in the accompanying consolidated financial statements, the Company had a net loss of $561,841 and an accumulated deficit of $748,783 as of September 30, 2014. In addition, the Company had a working capital deficit of $ 607,769 at September 30, 2014. These matters raise concern about the Company's ability to continue as a going concern, which is dependent on the Company's ability to raise additional capital, further implement its business plan and to generate additional revenues.

Management believes that the actions presently being taken provide the opportunity for the Company to continue as a going concern. The consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Note 3 – Summary of Significant Accounting Policies

This summary of significant accounting policies is provided to assist the reader in understanding the Company's financial statements. The financial statements and notes thereto are representations of the Company's management. The Company's management is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States of America and have been consistently applied in the preparation of the financial statements.

Basis of Presentation - The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for complete financial statements.

Use of estimates - In preparing financial statements, management is required to make estimates and assumptions that effect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and revenues and expenses during the periods presented. Actual results may differ from these estimates.

The Company’s financial statements have been prepared as of the balance sheet date, September 30, 2014. The financial statements were prepared on October 30, 2014.

Tangible and Intangible Fixed Assets

Fixed assets include assets with an estimated useful life greater than one year and an acquisition cost greater than one thousand ($1,000) in respect of tangible assets, five thousands ($5,000) in respect of start-up costs, and one thousand ($1,000) in respect of other intangible assets, on an individual basis.

Purchased tangible and intangible fixed assets are stated at cost less accumulated depreciation and provisions, if any.

The cost of fixed asset improvements exceeding one thousand ($1,000) for individual tangible assets for the taxation period, and one thousand ($1,000) for individual intangible assets for the taxation period, increases the acquisition cost of the related fixed asset.

Depreciation is charged so as to write off the cost of tangible and intangible fixed assets, other than land and assets under construction, over their estimated useful lives, using the straight line method.

|

10

|

Inventory

Purchased inventory is valued at acquisition cost. Acquisition costs doesn’t include the purchase cost and indirect acquisition costs such as customs fees, freight costs and storage fees, commissions, insurance charges and discounts, which are recorded as general and administrative expenses or other income as the case may be.

Internally developed inventory is stated at cost of direct materials, direct labour costs and other direct expenses are recorded as general and administrative expenses.

As of September 30, 2014, inventory totals equalled $564,222.

Receivables

Upon origination, receivables are stated at their nominal value. At this time no provisions has been established due to the non-significant amount delinquency accounts.

Receivables as of September 30, 2014 totalled $955,085.

Payables

Payables are stated at their nominal value. Payables as of September 30, 2014 totalled $176,295.

Loans

Loans are stated at their nominal value. The portion of loans maturing within one year from the balance sheet date is included in Current Liabilities. For other specific financial liabilities, please see Note 6 below.

Borrowing Costs

Borrowing costs arising from loans attributable to the acquisition, construction or production of fixed assets are added to the cost of those assets. All other borrowing costs are recognised in the profit and loss account in the period in which they are incurred.

Note 4 – Deferred Expenses

There were no Deferred Expenses as of September 30, 2014.

|

11

|

Note 5 – Property & Equipment

Depreciation expense for the period ended September 30, 2014 was $1,324 and accumulated as of September 30, 2014 was $12,097.

| DEPRECIATION | RESIDUAL VALUE | |||||||||||||||||||||||

|

|

2014-3Q | AS OF | ACCUM AS 0F | |||||||||||||||||||||

|

ITEM |

BASE VALUE | % | USD | 2014-2Q | 2014-3Q | 30-Sep-14 | ||||||||||||||||||

|

Formulas |

15,000 |

15 |

% |

(563 |

) |

(6,470 |

) |

(7,033 |

) |

7,967 |

||||||||||||||

|

Furniture and Equipment |

6,353 |

20 |

% |

(289 |

) |

(2,490 |

) |

(2,779 |

) |

3,574 |

||||||||||||||

|

Property Plant and Equipment |

2,768 |

20 |

% |

(138 |

) |

(1,194 |

) |

(1,332 |

) |

1,435 |

||||||||||||||

|

Warehouse Equipment |

305 |

20 |

% |

(15 |

) |

(132 |

) |

(147 |

) |

158 |

||||||||||||||

|

Trademarks |

1,300.00 |

25 |

% |

(81 |

) |

(488 |

) |

(569 |

) |

731 |

||||||||||||||

|

Computer Equipment |

2,015.67 |

20 |

% |

(101 |

) |

(101 |

) |

1,915 |

||||||||||||||||

|

Furniture Stores |

2,728.00 |

20 |

% |

(136 |

) |

(136 |

) |

2,592 |

||||||||||||||||

|

TOTAL: |

30,469 |

(1,324 |

) |

(10,773 |

) |

(12,097 |

) |

18,373 |

||||||||||||||||

Note 6 – Notes Payable

The Company had notes payable totaling $4,488,423 face value as of September 30, 2014 and funds pending $905,000 making a net of $ 3,583,423, and the accrued interest thereon is $218,290 as September 30, 2014.

|

12

|

|

NOTE DISCLOSURE |

FACE VALUE | ACCRUED INTEREST | ||||||

|

|

|

|

||||||

|

Investment Firm: $150,000 Note issued on May 22, 2014, a corporation loaned the Company $150,000 in exchange for a Promissory Note bearing interest at 8%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

150,000 |

4,307 |

||||||

|

|

|

|

||||||

|

Investment Firm: $6,000 Note issued on November 22, 2011. A corporation loaned the Company $6,000 in exchange for a Promissory Note bearing interest at 10%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

6,000 |

1,715 |

||||||

|

|

|

|

||||||

|

Investment Firm: $50,000 Note issued on March 12, 2014. This corporation loaned the Company $50,000 in exchange for a Promissory Note bearing interest at 10%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

50,000 |

2,767 |

||||||

|

|

|

|

||||||

|

Investment Firm: $150,000 including $4,882.19 Renewal Fee, Note issued on March 18, 2014. This corporation loaned the Company $150,000 in exchange for a Promissory Note bearing interest at 18%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

154,882 |

15,714 |

||||||

|

|

|

|

||||||

|

Investment Firm: $11,027.10 Note issued on February 7, 2014. This corporation loaned the Company $11,027.10 in exchange for a Promissory Note bearing interest at 18%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

11,027 |

4,980 |

||||||

|

|

|

|

||||||

|

Investment Firm: $40,000 Note issued on April 30, 2014. This corporation loaned the Company $40,000 in exchange for a Promissory Note bearing interest at 18%. The Lender and is allowed to convert the promissory note into Company common shares, based on which, Lender converted on January 28, 2014 $9,000 of the note . The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

31,000 |

9,020 |

||||||

|

13

|

|

Investment Firm: On April 29, 2014 Notes issued: $21,739.13, $364,130.43, $434,782.61 and $521,739.00. This corporation loaned the Company $1,342,391.17 in exchange for a Promissory Note bearing interest at 8%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

1,342,391 |

45,310 |

||||||

|

|

|

|

||||||

|

Investment Firm: $20,000.00 Note issued on August 15, 2011. A corporation loaned the Company $20,000 in exchange for a Promissory Note bearing interest at 5%. The Lender is allowed to convert the promissory note into Company common shares, based on which the Note's buyer, Subsequently the note transferred to a non-affiliated second investment firm, which has converted $7,720.58. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014 |

12,279 |

1,921 |

||||||

|

|

|

|

||||||

|

Investment Firm: $150,000.00 funded $75,000 on July 1, 2014 and $75,000 on September 3, 2014. Note issued on May 28, 2014. This corporation agreed to loan the Company $521,739.00 over time in exchange for a Promissory Note bearing no interest for the first three months. The Lender is allowed to convert the promissory note into Company common shares. No accrued interest payable due to the grace period already mentioned. Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014 |

150,000 |

2,910 |

||||||

|

|

|

|

||||||

|

Private Investor: $40,000.00 Note issued on June 1, 2012. This individual loaned the Company $40,000 in exchange for a Promissory Note bearing interest at 8%. The Lender is allowed to convert the promissory note into Company common shares, The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

40,000 |

7,461 |

||||||

|

|

|

|||||||

|

Investment Firm: $60,000 Note issued on May 28, 2014. This corporation loaned the Company $60,000 in exchange for a Promissory Note bearing interest at 8%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

60,000 |

1,644 |

||||||

|

|

|

|||||||

|

Investment Firm: $150,000 Note issued on May 22, 2014. This corporation loaned the Company $150,000 in exchange for a Promissory Note bearing interest at 8%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

150,000 |

4,307 |

|

14

|

|

Private Investor: $50,000.00 Note issued on December 5, 2011. This individual loaned the Company $50,000 in exchange for a Promissory Note bearing interest at 8%. In May, 2012, $28,000 was paid on the Note. The Lender is allowed to convert the promissory note into Company common shares, The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

22,000 |

8,947 |

||||||

|

|

|

|

||||||

|

Investment Firm: $5,000 Note issued on January 18, 2013, $5,000 Note issued on February 4, 2013, $1,500 Note issued on August 14, 2013; $15,000 Note issued on May 21, 2012, $7,000 Note issued on May 30, 2012, $20,000 Note issued on July 24, 2012, $17,000 Note issued on October 10, 2013, $13,000 Note issued on January 16, 2013, $6,000 Note issued on July 24, 2012, $20,000 Note issued on March 6, 2014 and $10,000 Note issued on August 9, 2012 . This corporation loaned the Company $112,500 in exchange for a Promissory Note bearing interest at 18%. The Lender is allowed to convert the promissory note into Company common shares, based on which converted $20,384.34 from Face Value and $67,615.66 from Accrued Interests. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

91,966 |

11,258 |

||||||

|

|

|

|

||||||

|

Investment Firm: $8,877 Note issued on June 25, 2012. This individual loaned the Company $8,877 in exchange for a Promissory Note bearing interest at 8%. The Lender is allowed to convert the promissory note into Company common shares, The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

8,877 |

1,609 |

||||||

|

|

|

|

||||||

|

Investment Firm: $100,000 Note issued on May 29, 2014. This corporation loaned the Company $95,000 in exchange for a Promissory Note bearing interest at 8%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet was as of September 30, 2014. |

100,000 |

2,718 |

||||||

|

|

|

|

||||||

|

Investment Firm $75,000 Note issued on August 29 and 30, 2012. This corporation loaned the Company $75,000 in exchange for a Promissory Note bearing interest at 18%, $1,500 is pending for funding. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $24.043 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

73,500 |

27,184 |

|

15

|

|

Investment Firm $250,000 Note: on June 24, 2014. Funded $50,000 on July 1, 2014, this entity loaned the Company $250,000 in exchange for a Promissory Note bearing interest at 12% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $1,495.89 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

50,000 |

1,496 |

||||||

|

|

|

|

||||||

|

Investment Firm $555,000 Note: on June 27, 2014 and funded $200,000 on July 2, 2014 this entity loaned the Company $225,000 in exchange for a Promissory Note bearing interest at 10% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $4,931.51 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

200,000 |

4,932 |

||||||

|

|

|

|

||||||

|

Investment Firm $100,000 Note: on July 17, 2014 this entity loaned the Company $100,000 in exchange for a Promissory Note bearing interest at 12% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $2,465.75 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

100,000 |

2,466 |

||||||

|

|

|

|

||||||

|

Investment Firm $110,000 Note: on July 18, 2014 this entity loaned the Company $110,000 in exchange for a Promissory Note bearing interest at 8% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $1,748.11 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

110,000 |

1,784 |

||||||

|

|

|

|

||||||

|

Investment Firm $110,000 Note: on July 29, 2014 this entity loaned the Company $110,000 in exchange for a Promissory Note bearing interest at 8% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $1,518.90 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

110,000 |

1,519 |

||||||

|

|

|

|

||||||

|

Investment Firm $105,000 Note: on August 22, 2014 this entity loaned the Company $105,000 in exchange for a Promissory Note bearing interest at 10% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $1,121.92 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

105,000 |

1,122 |

||||||

|

|

|

|

||||||

|

Investment Firm $80,000 Note: on April 20, 2014 this entity loaned the Company $80,000 in exchange for a Promissory Note bearing interest at 18% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $7,425.28 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

80,000 |

7,425 |

|

16

|

|

Individual $69,000 Note: on May 1, 2014 this entity loaned the Company $69,000 in exchange for a Promissory Note bearing interest at 18% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $6,267.09 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

69,000 |

6,267 |

||||||

|

|

|

|

||||||

|

Investment Firm $250,000 Note: on April 24, 2014 this entity loaned the Company $250,000 in exchange for a Promissory Note bearing interest at 18% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $20,386.54 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

250,000 |

20,387 |

||||||

|

|

|

|

||||||

|

Private Investor $44,000.00 Note issued on November 15 and December 20, 2012, an individual loaned the Company $44,000 000 in exchange for a Promissory Note bearing interest at 18%. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $12,692 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

44,000 |

14,278 |

||||||

|

|

|

|

||||||

|

Investment Firm $11,500 Note: on May 23, 2013 this entity loaned the Company $11,500 in exchange for a Promissory Note bearing interest at 18% for a term of one year renewable. The Lender is allowed to convert the promissory note into Company common shares. The accrued interest payable balance on this note was $2,317 as of September 30, 2014, and is included in the Convertible Promissory Notes – Accrued Interest Section of the Company’s balance sheet. |

11,500 |

2,847 |

||||||

|

|

|

|

||||||

|

TOTAL: |

3,583,423 |

218,290 |

All of the above notes are uncollateralized.

As a result of the above, the balance of the notes payable is $4,488,423 face value as of September 30, 2014 and funds pending $905,000 making a net of $ 3,583,423, and the accrued interest thereon is $218,290 as September 30, 2014.

|

17

|

Note 7 – Stock

Preferred Stock

The Company is authorized to issue 15,000,000 shares at a par value $0.001. 1,250,000 and 1,000,000 shares are issued as of September 30, 2014 and December 31st 2013.Each share of Series A Preferred Stock that has voting rights in any election of the shareholders held for any purpose, wherein each share of Series A Preferred Stock has ten thousand (10,000) votes. On August 28, 2014, the Company amended its Articles of Incorporation such that the Series A Preferred Stock is non-convertible, and the Series B Preferred Stock has voting rights equivalent to 1,800 shares of common stock, and each share of Series B Preferred Stock is convertible into 1,800 shares of common stock.

Common Stock

As the result of an amendment to its Articles of Incorporation filed on July 22, 2014, the Company reduced the number of shares of its common stock that it was authorized to issue to 1,000,000,000 shares, with a par value per share of $0.001. Therefore, for the quarter ending September 30, 2014 the Company was authorized to issue 1,000,000,000 shares of its common stock. On October 28, 2014 the Company amended its Articles of Incorporation to increase the total quantity of authorized common stock to 2,500,000,000 shares.

The Company had issued 429,827,024 shares of common stock as of September 30, 2014.

Note 8 – Legal Matters

The Company is not aware of any pending or threatened legal matters that would have a material impact on our financial condition.

Note 9 – Income Tax

Deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

|

18

|

Net deferred tax assets consist of the following components as of September 30, 2014 and December 31, 2013:

| September 30, 2014 |

December 31, 2013 |

|||||||

|

Deferred Tax Assets – Non-current: |

||||||||

|

NOL Carryover |

$ |

0 |

18,135 |

|||||

|

Less valuation allowance |

0 |

(18,135 |

) |

|||||

|

Deferred tax assets, net of valuation allowance |

$ |

- |

$ |

- |

||||

At December 31, 2013, the Company had no net operating loss carry forwards that may be offset against future taxable income from the year 2014 to 2034. No tax benefit has been reported in the September 30, 2014 financial statements since the potential tax benefit is offset by a valuation allowance of the same amount.

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards for Federal Income tax reporting purposes are subject to annual limitations. Should a change in ownership occur, net operating loss carry forwards may be limited as to use in future years.

Note 10 – Subsequent Events

On October 28, 2014 the Company amended its Articles of Incorporation to increase the total quantity of authorized common stock to 2,500,000,000 shares.

As reported in a Current Report on Form 8-K, filed by the Company with the U.S. Securities Exchange Commission on October 28, 2014:

On April 29, 2014, the Company closed a private placement whereby it entered into a securities purchase agreement, dated April 29, 2014 (the “Purchase Agreement”), with Magna Equities II, LLC (formerly Hanover Holdings I, LLC) (“Magna”), an affiliate of Magna Group. Pursuant to the Purchase Agreement, the Company sold Magna four (4) 8% senior convertible promissory notes in aggregate principal amount of $1,342,391.17 million (collectively, the “Convertible Notes”, or individually, a “Convertible Note”) due twelve months from the date of the Convertible Notes’ issuance. The Convertible Notes were purchased by Magna for $1,235,000. A copy of the Purchase Agreement and the Convertible Notes are attached as Exhibits to the Current Report on Form 8-K, filed by the Company with the U.S. Securities Exchange Commission on May 6, 2014.

On October 24, 2014, the Company made a prepayment (the “Prepayment”) to Magna to be applied against the Convertible Notes.

On October 27, 2014, the Company entered into a Side Letter Agreement (the “Agreement”), dated October 27, 2014, with Magna. Pursuant to the Side Letter Agreement, the Company and Magna agreed to allocate the Prepayment towards the principal amount due under the Convertible Note with a $480,000 purchase price. As such, the outstanding principle amount due under the Convertible Note with a Purchase Price of $480,000 was reduced accordingly. Further, the Agreement provides that the fixed conversion price under each of the Convertible Notes will be amended to reflect that the conversion price will be equal to a 30% discount from the lowest trading price in the five (5) trading days prior to conversion, subject to adjustment. The Agreement also makes various modifications to the Convertible Notes, including, without limitation, the removal of the clause in Section 3.19 of each Convertible Note, which stated: “Trading Below Premium. If, at any time after one hundred and eighty (180) calendar days after the Issue Date, the stock is trading below $0.18, the Company will be considered in default.”

|

19

|

Additionally, the Agreement provides for the issuance of a new 8% senior convertible promissory note was by the Company to Magna in the principle amount of $35,760.95, for a purchase price of $38,870.69 (the “New Note”). The New Note was issued in accordance with the terms and conditions of the Purchase Agreement, contains substantially the same terms and conditions as the Convertible Notes, and has a maturity date of October 27, 2015.

Finally, the Agreement provides that except as otherwise expressly provided therein, the Purchase Agreement, the Convertibles Notes, and the related Escrow Agreement, dated April 29, 2014, are, and shall continue to be, in full force and effect and are thereby ratified and confirmed in all respects, including, without limitation, all representations and warranties made by each of the Company and Magna.

The issuance of the New Note to Magna was exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated under the Securities Act (“Regulation D”). The Company made this determination based on the representations of Magna in the Purchase Agreement that Magna is an “accredited investor” within the meaning of Rule 501 of Regulation D and has access to information about its investment and about the Company.

Management has evaluated subsequent events pursuant to the requirements of ASC Topic 855 and has determined that no other material subsequent events exist.

|

20

|

Item 2 – Management's Discussion and Analysis of Financial Condition and Results of Operations

The following “Management’s Discussion and Analysis of Financial Condition and Results of Operations” should be read in conjunction with our consolidated financial statements and their related notes included elsewhere in this report.

General

Executive Overview

Vapor Group, Inc. is in the business of designing, developing, manufacturing and marketing high quality, vaporizers and related items for liquid, wax and dry herb use, and e-cigarette brands which use state-of-the-art electronic technology and specially formulated, “Made in the USA” e-liquids, which may or may not contain nicotine. It offers a range of products with unique e-liquid flavors that is unmatched in our industry. Its products are marketed under the Vapor Group, Total Vapor, Vapor 123 and Vapor Products brands. It sells nationwide through distributors, wholesalers and directly to consumers, eighteen years of age or older, through its own websites and direct response advertising. Total Vapor Inc., Vapor 123 Inc. and Vapor Products, Inc., each a Florida corporation, are each a wholly-owned subsidiary of Vapor Group, Inc.

We believe that we produce the highest quality e-liquids in the world. Our e-liquids are unsurpassed by any competitor in terms of their purity, high quality, and the steps that we take to protect our customers. All our e-liquids, whether containing nicotine or not, are formulated and mixed exclusively in the U.S. by an FDA registered laboratory by degreed professionals, in accordance with cGMP guidelines (21 CFR part 111). All our e-liquid ingredients are quarantined before use, and must pass an independent, third party laboratory test for purity. All our key ingredients are United States Pharmacopeia (“USP”) grade and kosher. Our lab carefully tests each batch of our e-liquid by high pressure liquid chromatograph to verify that we have the right levels of ingredients. Our high quality is a fundamental pillar of our competitive advantage.

Vapor Group, Inc. is committed to responsible business policies and practices, including, but not limited to, the marketing of our products only to adults (that is, persons eighteen years of age or older), not making and avoiding claims about our products’ health benefits, and fulfilling the requirements of all applicable municipal, state and federal laws and regulations.

The Company competes in a highly fragmented and competitive market that is still emerging and evolving. Participants include several small competitors as well as entrants owned or financially backed by large tobacco or consumer products companies, all of whom foresee a marketplace that it rapidly growing at the expense of traditional consumer tobacco products. The market in which we compete for e-cigarettes, vaporizers and related accessories is in its infancy. Going forward we anticipate continued intense competition and look forward to continued success as represented by increases in distribution, market share and revenue.

|

21

|

RESULTS OF OPERATIONS

NINE MONTHS ENDED SEPTEMBER 30, 2014 COMPARED TO THE NINE MONTHS ENDED SEPTEMBER 30, 2013

NET REVENUES – Net revenues for the nine months ended September 30, 2014 increased by $2,444,096 or approximately 286% to $3,299,300 from $855,204 in the comparable period in 2013.

COST OF SALES – Cost of sales for the nine months ended September 30, 2014 were $1,267,686 an increase of $817,484 from $450,202 in the comparable period in 2013.e

GENERAL AND ADMINISTRATIVE – General and administrative costs for the nine months ended September 30, 2014 increased by $1,314,593 or 715% to $1,498,363 from 183,770 in the comparable period in 2013.

DEPRECIATION – Depreciation for the nine months ended September 30, 2014 was $2,523 from $0 in the comparable period in 2013.

INTEREST, NET OF INTEREST INCOME – Interest expense for the nine months ended September 30, 2014 increased by $0 or approximately 0% to $0 from $0 in the comparable period in 2013.

NET INCOME – Net income for the nine months ended September 30, 2014 was $(561,841) compared to $27,346 for the comparable period in 2013.

LIQUIDITY AND CAPITAL RESOURCES

At September 30, 2014, we had approximately $859,058 in cash and total current assets of $3,555,710 as of the same date we had approximately $4,163,479 of current liabilities and a working capital deficit of approximately $607,769.

Our ability to continue our business activities as a going concern including continuation of our existing business service lines and funding our strategic growth plans will depend upon, among other things, raising capital from third parties or receiving net cash flows from our existing business operations.

The Company plans to meet its financial obligations and commitments for the next 12 months by increasing its revenues and gross margin and simultaneously raising additional capital in the form of debt or equity instruments in order to continue to increase inventories and accelerate our turn on inventory. We are uncertain whether we will be able to obtain additional financing, or if we are able to obtain financing that it will be on commercially favorable terms to us. There can be no assurance that we will be able to obtain financing on terms that are economically viable to us.

|

22

|

To the extent that we raise additional capital through the sale of equity or convertible debt securities, dilution of the interests of existing shareholders may occur. If we raise additional funds through the issuance of debt securities, these securities may have rights, preferences and privileges senior to holders of common stock and the terms of such debt could impose restrictions on our operations. Regardless of whether our assets prove to be adequate to meet our operational needs, we may seek to compensate providers of services by issuance of stock in lieu of cash, which may also result in dilution to existing shareholders.

Item 3 – Quantitative and Qualitative Disclosures about Market Risk

Not applicable.

Item 4 – Controls and Procedures

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this Quarterly Report, our President and Treasurer (the "Certifying Officer") conducted evaluations of our disclosure controls and procedures. As defined under Sections 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, (the “1934 Act”), the term "disclosure controls and procedures" means controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the 1934 Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer's management, including the Certifying Officer, to allow timely decisions regarding required disclosure. Based on this evaluation, the Certifying Officer has concluded that our disclosure controls and procedures are not effective to ensure that all material information is recorded, processed, summarized and reported by our management on a timely basis in order to comply with our disclosure obligations under the 1934 Act, and the rules and regulations promulgated there-under.

Based upon this evaluation the Certifying Officer has concluded that there were no material weaknesses in our disclosure controls and procedures that existed as of the end of the period covered by this quarterly report:

Management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting for the Company as defined in Rule 13a-15(f) under the 1934 Act. The Company's internal control over financial reporting is designed to provide reasonable assurance to the Company's management and board of directors regarding the preparation and fair presentation of published financial statements and the reliability of financial reporting. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Management assessed the effectiveness of the Company's internal control over financial reporting as of June 30, 2014. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") in Internal Control - Integrated Framework. Based on our assessment, we believe that, as of June 30, 2014, the Company's internal control over financial reporting are effective based on those criteria. This quarterly report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this quarterly report. Further, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

|

23

|

PART II – OTHER INFORMATION

ITEM 1 – LEGAL PROCEEDINGS

In the ordinary course of business, we may from time to time be involved in various threatened or actual legal proceedings which the company will vigorously defend. The litigation process is inherently uncertain and it is possible that the outcome of such matters may result in a material adverse effect on the financial condition and/or results of operations of the Company. In the opinion of the management, matters currently pending or threatened against the Company are not expected to result in a material adverse effect on our financial position or result of operations.

ITEM 1A – RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

WE RELY UPON KEY MEMBERS OF OUR MANAGEMENT TEAM AND OTHER KEY PERSONNEL AND A LOSS OF KEY PERSONNEL COULD PREVENT OR SIGNIFICANTLY DELAY THE ACHIEVEMENT OF OUR GOALS.

Our success will depend to a large extent on the abilities and continued services of key members of our management team including our President and CEO, and Vice President and COO, as well as other key personnel. The loss of these key members of our management team or other key personnel could prevent or significantly delay the implementation of our business plan, research and development and marketing efforts. If we continue to grow, we will need to add additional management and other personnel. Our success will depend on our ability to attract and retain highly skilled personnel and our efforts to obtain or retain such personnel may not be successful.

WE HAVE LIMITED RESOURCES AND WILL NEED ADDITIONAL FINANCING IN ORDER TO EXECUTE OUR BUSINESS PLAN AND CONTINUE AS A GOING CONCERN.

We have limited resources and our cash on hand may not be sufficient to satisfy our cash requirements during the next twelve months. The financial statements included in this annual report do not include any adjustment to asset values or recorded amounts of liability that might be necessary in the event we are unable to continue as a going concern. If we are in fact unable to continue as a going concern, shareholders may lose their entire investment in our common stock.

|

24

|

IF WE ARE UNABLE TO MANAGE ANY FUTURE GROWTH EFFECTIVELY, OUR PROFITABILITY AND LIQUIDITY COULD BE ADVERSELY AFFECTED.

Our growth is expected to place significant strain on our limited research and development, sales and marketing, operational and administrative resources. To manage any future growth, we must continue to improve our operational and financial systems and expand, train and manage our employee base. We also need to improve our supply chain management and quality control operations and hire and train new employees, including sales and customer service representatives and operations managers. If we are unable to manage our growth effectively, our profitability and liquidity could be adversely affected.

IF OUR DEVELOPED TECHNOLOGY OR TECHNOLOGY UNDER DEVELOPMENT DOES NOT ACHIEVE MARKET ACCEPTANCE, PROSPECTS FOR OUR GROWTH AND PROFITABILITY WOULD BE LIMITED.

Our future success depends on market acceptance of the technology used in our products and our technology currently under development. Although adoption of e-cigarettes has grown in recent years, adoption of such products has only recently begun, is still limited and faces significant challenges. Potential customers may be reluctant to adopt e-cigarette products as an alternative to traditional smoking because of its higher initial cost or perceived risks relating to its novelty, reliability, usefulness, quality and cost-effectiveness when compared to other established smoking products on the market. Changes in economic and market conditions may also affect the marketability of e-cigarette products. Even if e-cigarette products continue to achieve performance improvements and cost reductions, limited customer awareness of their benefits, lack of widely accepted standards governing them and customer unwillingness to adopt their use in favor of entrenched solutions could significantly limit the demand for such products and adversely impact our results of operations.

E-CIGARETTE PRODUCTS ARE SUBJECT TO RAPID TECHNOLOGICAL CHANGES. IF WE FAIL TO ACCURATELY ANTICIPATE AND ADAPT TO THESE CHANGES, THE PRODUCTS WE SELL WILL BECOME OBSOLETE, CAUSING A DECLINE IN OUR SALES AND PROFITABILITY.

E-cigarette products are subject to rapid technological changes that often cause product obsolescence. Companies within the e-cigarette industry are continuously developing new products with heightened performance and functionality. This puts pricing pressure on existing products and constantly threatens to make them, or causes them to be, obsolete. If we fail to accurately anticipate the introduction of new technologies, we may possess significant amounts of obsolete inventory that can only be sold at substantially lower prices and profit margins than we anticipated. In addition, if we fail to accurately anticipate the introduction of new technologies or are unable to develop the planned new technologies, we may be unable to compete effectively due to our failure to offer products most demanded by the marketplace. If any of these failures occur, our sales, profit margins and profitability will be adversely affected.

WE MAY BE SUBJECT IN THE FUTURE TO BURDENSOME GOVERNMENTAL REGULATION.

The e-cigarette industry is relatively new and the manufacture and distribution of its products is not currently subject to consistent or significant amounts of governmental regulation. Over time, we may become subject to burdensome and costly governmental regulation at the municipal, state and federal levels. The cost of compliance with such regulation may be costly, and may negatively impact our future revenues, profits, and the manner in which we distribute and market our products.

|

25

|

IF WE ARE UNABLE TO INCREASE PRODUCTION CAPACITY FOR OUR PRODUCTS IN A COST EFFECTIVE AND TIMELY MANNER, WE MAY INCUR DELAYS IN SHIPMENT AND OUR REVENUES AND REPUTATION IN THE MARKETPLACE COULD BE HARMED.

An important part of our business plan is the expansion of production capacity for our products. In order to fulfill anticipated demand for our products, we invest in capacity in advance of actual customer orders, typically based on preliminary, non-binding indications of future demand. As customer demand for our products changes, we must be able to adjust our production capacity to meet demand while keeping costs down. Uncertainty is inherent within our facility and capacity expansion, and unforeseen circumstances could offset the anticipated benefits, disrupt our ability to provide products to our customers and impact product quality.

Our ability to successfully increase production capacity in a cost effective and timely manner will depend on a number of factors, including the following: (i) our ability to transition production in our manufacturing facility; (ii) the ability of contract manufacturers to allocate more of their existing capacity to us or their ability to add new capacity quickly; (iii) the ability of any future contract manufacturers to successfully implement our manufacturing processes; (iv) the availability of critical components and subsystems used in the manufacture of our products; (v) our ability to effectively establish adequate management information systems, financial controls and supply chain management and quality control procedures; and (vi) the occurrence of equipment failures, power outages, environmental risks or variations in the manufacturing process.

If we are unable to increase production capacity for our products in a cost effective and timely manner while maintaining adequate quality, we may incur delays in shipment or be unable to meet increased demand for our products which could harm our revenues and operating margins and damage our reputation and our relationships with current and prospective customers. Conversely, due to the proportionately high fixed cost nature of our business (such as facility expansion costs), if demand does not increase at the rate forecasted, we may not be able to reduce manufacturing expenses or overhead costs at the same rate as demand decreases, which could also result in lower margins and adversely impact our business and results of operations.

WE INTEND TO ASSEMBLE AND MANUFACTURE CERTAIN OF OUR PRODUCTS AND OUR SALES, RESULTS OF OPERATIONS AND REPUTATION COULD BE MATERIALLY ADVERSELY AFFECTED IF THERE IS A DISRUPTION AT OUR ASSEMBLY AND MANUFACTURING FACILITY.

Our assembly and manufacturing operations for our products is based in Davie, Florida. The operation of this facility involves many risks, including equipment failures, natural disasters, industrial accidents, power outages and other business interruptions. We could incur significant costs to maintain compliance with, or due to liabilities under, environmental laws and regulations, the violation of which could lead to significant fines and penalties. Although we intend to carry business interruption insurance and third-party liability insurance to cover certain claims in respect of personal injury or property or environmental damage arising from accidents on our properties or relating to our operations, any existing insurance coverage may not be sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations. Additionally, any interruption in our ability to assemble, manufacture or distribute our products could result in lost sales, limited revenue growth and damage to our reputation in the market, all of which would adversely affect our business.

|

26

|

Additionally, we intend to rely on arrangements with independent shipping companies, such as United Parcel Service, Inc. and Federal Express Corp., for the delivery of certain components and subsystems from vendors and products to our customers in both the United States and abroad. The failure or inability of these shipping companies to deliver components, subsystems or products timely, or the unavailability of their shipping services, even temporarily, could have a material adverse effect on our business. We may also be adversely affected by an increase in freight surcharges due to rising fuel costs or added security.

WE MAY UTILIZE A CONTRACT MANUFACTURER TO MANUFACTURE CERTAIN OF OUR PRODUCTS AND ANY DISRUPTION IN THIS RELATIONSHIP MAY CAUSE US TO FAIL TO MEET OUR CUSTOMERS’ DEMANDS AND MAY DAMAGE OUR CUSTOMER RELATIONSHIPS.

Although we intend to assemble and manufacture certain of our products, we may depend on a third party contract manufacturer to manufacture a portion of our products elsewhere. This manufacturer will need to provide the necessary facilities and labor to manufacture these products, which may be primarily high volume products. Our reliance on a contract manufacturer involves certain risks, including the following: (i) lack of direct control over production capacity and delivery schedules; (ii) risk of equipment failures, natural disasters, industrial accidents, power outages and other business interruptions; (iii) lack of direct control over quality assurance and manufacturing yield; and (iv) risk of loss of inventory while in transit.