Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Tribune Publishing Co | a20148kitem701.htm |

2014 Wells Fargo Technology, Media and Telecom Conference November 13, 2014

Cautionary Statement Regarding Forward-Looking Statements The statements contained in this presentation include certain forward-looking statements that are based largely on our current expectations and reflect various estimates and assumptions by us. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward- looking statements. Such risks, trends and uncertainties, which in some instances are beyond our control, are described under the heading “Risk Factors” in Tribune Publishing Company’s filings with the Securities and Exchange Commission, and include: competition and other economic conditions including fragmentation of the media landscape and competition from other media alternatives; changes in advertising demand, circulation levels and audience shares; our ability to develop and grow our online businesses; our reliance on revenue from printing and distributing third-party publications; changes in newsprint prices; macroeconomic trends and conditions; our reliance on third party vendors for various services; our ability to adapt to technological changes; adverse results from litigation, governmental investigations or tax-related proceedings or audits; our ability to realize benefits or synergies from acquisitions or divestitures or to operate our businesses effectively following acquisitions or divestitures; our ability to attract and retain employees; our ability to satisfy pension and other postretirement employee benefit obligations; changes in accounting standards; the effect of labor strikes, lock-outs and labor negotiations; regulatory and judicial rulings; our indebtedness and ability to comply with covenants applicable to our debt financing; our adoption of fresh-start reporting which has caused our combined financial statements for periods subsequent to December 31, 2012 to not be comparable to prior periods; our ability to satisfy future capital and liquidity requirements; and our ability to access the credit and capital markets at the times and in the amounts needed and on acceptable terms. The words “believe,” “expect,” “anticipate,” “estimate,” “could,” “should,” “intend,” “may,” “plan,” “seek” and similar expressions generally identify forward-looking statements. Whether or not any such forward-looking statements are in fact achieved will depend on future events, some of which are beyond our control. You are cautioned not to place undue reliance on such forward- looking statements, which are being made as of the date of this presentation. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. 2

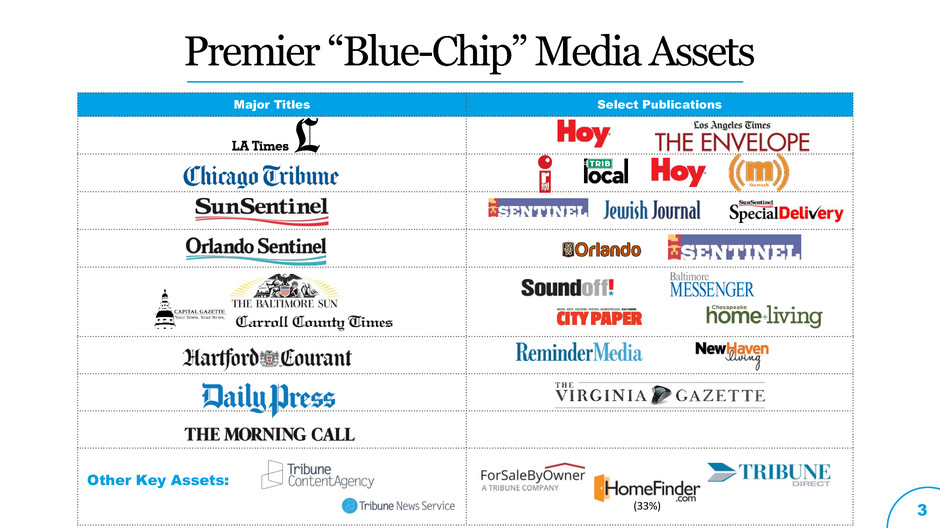

Major Titles Select Publications Other Key Assets: Premier “Blue-Chip” Media Assets 3 (33%) 3

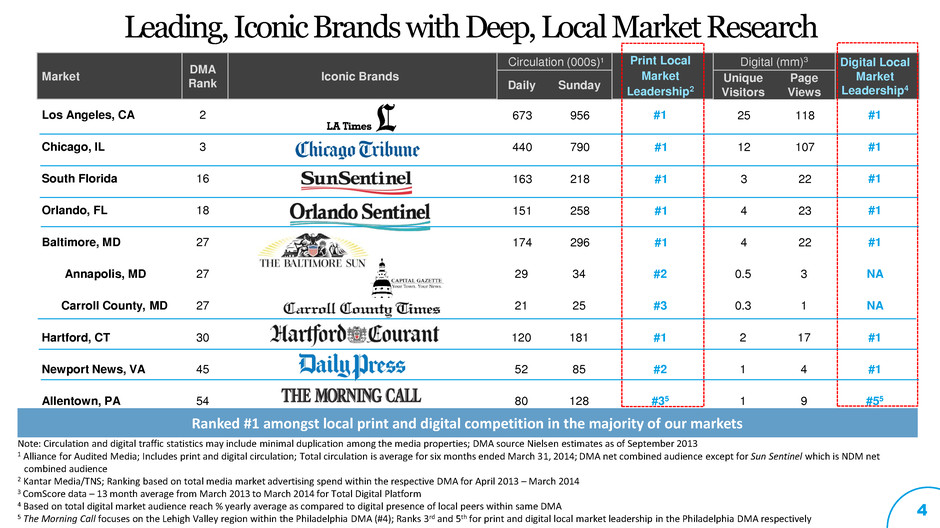

Leading, Iconic Brands with Deep, Local Market Research 4 Market DMA Rank Iconic Brands Circulation (000s)¹ Print Local Market Leadership2 Digital (mm)3 Digital Local Market Leadership4 Daily Sunday Unique Visitors Page Views Los Angeles, CA 2 673 956 #1 25 118 #1 Chicago, IL 3 440 790 #1 12 107 #1 South Florida 16 163 218 #1 3 22 #1 Orlando, FL 18 151 258 #1 4 23 #1 Baltimore, MD 27 174 296 #1 4 22 #1 Annapolis, MD 27 29 34 #2 0.5 3 NA Carroll County, MD 27 21 25 #3 0.3 1 NA Hartford, CT 30 120 181 #1 2 17 #1 Newport News, VA 45 52 85 #2 1 4 #1 Allentown, PA 54 80 128 #35 1 9 #55 Ranked #1 amongst local print and digital competition in the majority of our markets Note: Circulation and digital traffic statistics may include minimal duplication among the media properties; DMA source Nielsen estimates as of September 2013 1 Alliance for Audited Media; Includes print and digital circulation; Total circulation is average for six months ended March 31, 2014; DMA net combined audience except for Sun Sentinel which is NDM net combined audience 2 Kantar Media/TNS; Ranking based on total media market advertising spend within the respective DMA for April 2013 – March 2014 3 ComScore data – 13 month average from March 2013 to March 2014 for Total Digital Platform 4 Based on total digital market audience reach % yearly average as compared to digital presence of local peers within same DMA 5 The Morning Call focuses on the Lehigh Valley region within the Philadelphia DMA (#4); Ranks 3rd and 5th for print and digital local market leadership in the Philadelphia DMA respectively

Strong Cash Flow & Conservative Capital Structure Deep & Experienced Management Team Deep Multi-Platform Audience Engagement Compelling Suite of Advertising Solutions Trusted, Award-Winning Premium Content Key Investment Highlights 5 Diverse Portfolio of Iconic Brands and Products Leader in Multimedia Local News & Information

Our 7 Strategic Principles Build On Our Leading Local Market Presence Strategically Manage Our Core Print Business Accelerate Innovation and the Digital Transition Monetize Our Consumer Content On Digital Platforms Continue Successful Revenue Diversification Leverage Operating Platform for Opportunistic Consolidation Maintain Disciplined Cost Management and Financial Policies 6 1 2 3 4 5 6 7

Our First 90 Days Five-Year Affiliate Agreement with Cars.com Acquisition of Suburban Chicago Titles Secured Long Term Agreement with the Chicago Sun-Times First Quarterly Dividend Declared - 17.5¢ per share Key Leadership Appointments, primarily replacements 7

8 Trusted, award-winning premium content Our content makes us the local print and digital leader in the communities we serve Our readers care about their communities and trust our content Our publishing brands stand for integrity and authority in their markets Average publishing history of over 150 years A tradition of journalistic excellence: 88 total Pulitzer Prizes, 27 since 2000 2013 Pulitzer Prize, Staff Public Service The Sun Sentinel was awarded the prestigious Pulitzer Prize Gold Medal for public service journalism for its investigation of off-duty police officers endangering the lives of citizens by speeding.

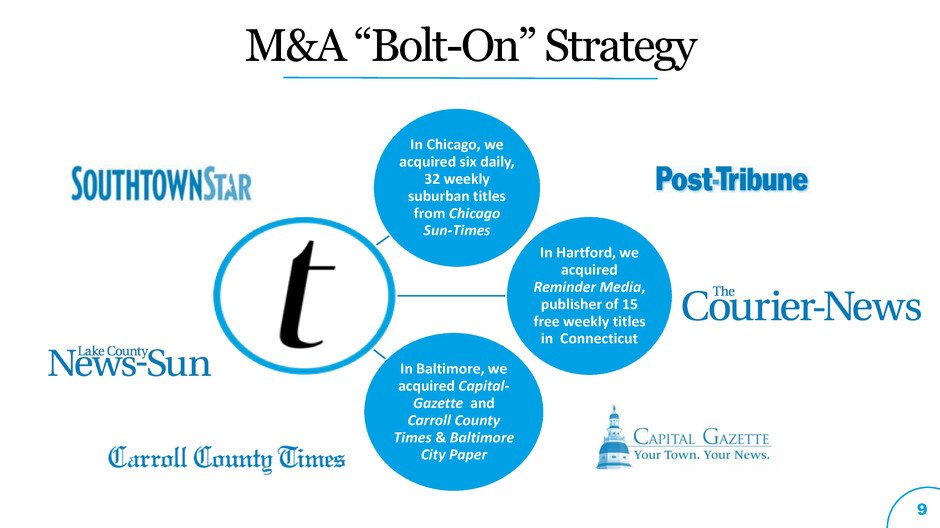

M&A “Bolt-On” Strategy In Chicago, we acquired six daily, 32 weekly suburban titles from Chicago Sun-Times In Hartford, we acquired Reminder Media, publisher of 15 free weekly titles in Connecticut In Baltimore, we acquired Capital- Gazette and Carroll County Times & Baltimore City Paper 9

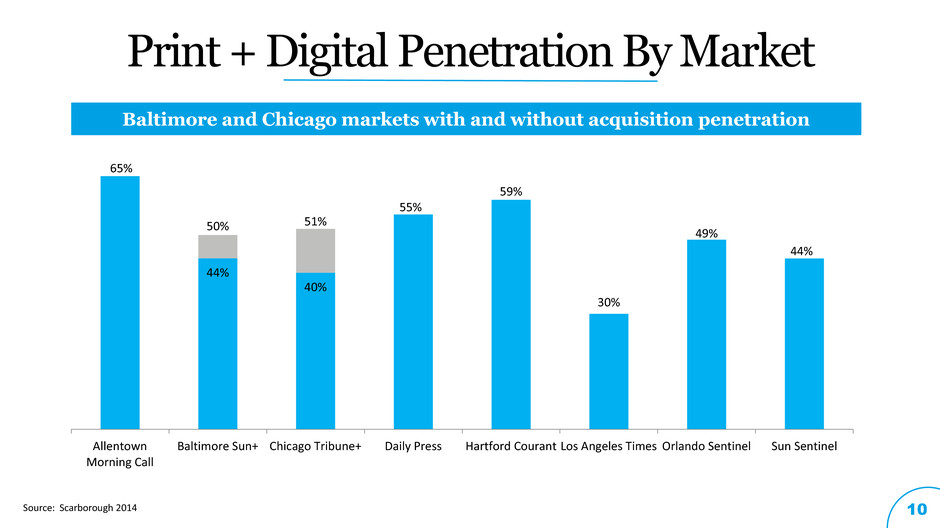

Print + Digital Penetration By Market 10 Source: Scarborough 2014 44% 40% 65% 50% 51% 55% 59% 30% 49% 44% Allentown Morning Call Baltimore Sun+ Chicago Tribune+ Daily Press Hartford Courant Los Angeles Times Orlando Sentinel Sun Sentinel Baltimore and Chicago markets with and without acquisition penetration

Our digital growth initiatives Leverage NGUX: users, engagement & ad revenue Aggressively grow our digital subscription base Grow our digital marketing services businesses Accelerate video production & monetization Optimize our content & products for mobile Grow our Hispanic businesses & platforms Expand our verticals, e.g. ForSaleByOwner, HomeFinder 1 2 3 4 5 11 6 7

ALL-ACCESS MODEL Growing digital consumer revenue 12 #1 Print Platforms Award-winning NGUX Mobile & Apps

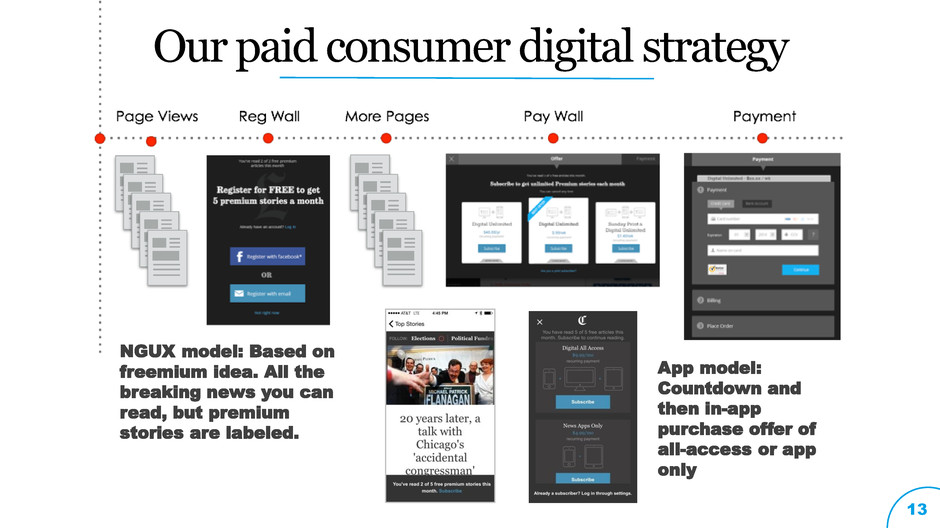

Our paid consumer digital strategy 13 App model: Countdown and then in-app purchase offer of all-access or app only NGUX model: Based on freemium idea. All the breaking news you can read, but premium stories are labeled.

2014: A year of building and transition 14 Award-winning NGUX Mobile & Apps

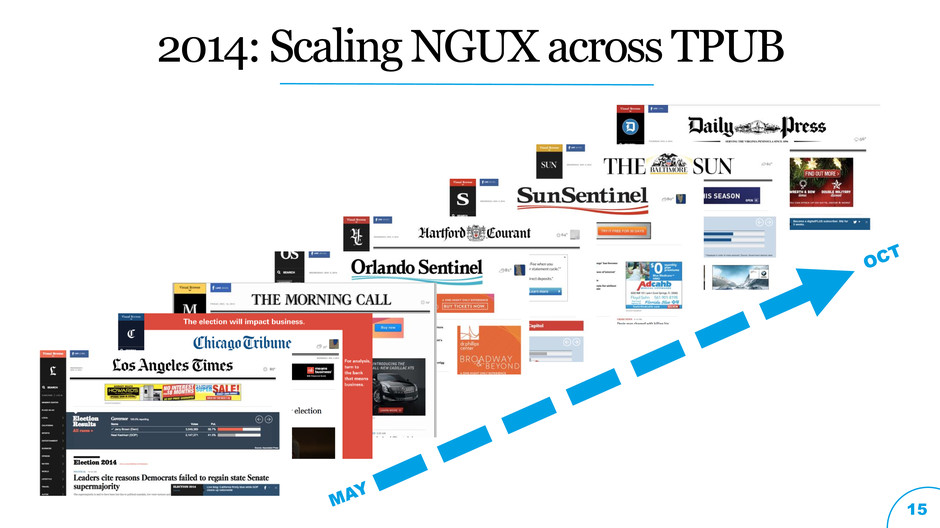

2014: Scaling NGUX across TPUB 15

Example: Digital Vertical 16 Sources: Information from ForSaleByOwner.com Consumer Sentiment Survey, September 2014 and unique visitors based on September 2014 ComScore. A leading ‘For Sale by Owner’ website Sold 9,000 homes valued at $2.3B and owners saved over $70M in commissions in 2013 Homes sold by owners represent 17% of all U.S. home sales 1.5 million unique visitors per month