Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Breitling Energy Corp | d820121d8k.htm |

Corporate Presentation

November 2014

Exhibit 99.1 |

The information presented in this presentation may contain

forward-looking statements. All statements, other than

statements of historical facts, included in this presentation that address activities, events or

developments that the Company expects, believes or anticipates will or may

occur in the future are forward-looking statements. These

forward-looking statements are not guarantees of future

performance and are subject to risks and uncertainties that could cause

actual results to differ materially from the results contemplated

by the forward-looking statements. Factors that could cause actual results

to differ materially from the results contemplated by the

forward-looking statements include, but are not limited to, the

risks discussed in the Company's annual report on Form 10-K for the fiscal year ended

December 31, 2013 and its other filings with the Securities and Exchange

Commission. The forward- looking statements in this presentation

are made as of the date of this presentation, and the Company

undertakes no obligation to update any forward-looking statement as a

result of new information, future developments, or otherwise.

Forward Looking Statements

[

1 ] |

[

2 ]

Overview

I.

Who We Are

II.

Our Strategy

III.

E&P Operations

IV.

Asset Management Business

V.

Contact Information |

Who We Are |

[

4 ]

Breitling Energy Corporation is a growing U.S. energy company based in

Dallas, Texas engaged in the exploration and development of

high-probability, lower risk onshore oil and gas properties. The

Company’s dual-focused growth strategy primarily relies on

leveraging management’s technical and operations expertise to

grow through the drill-bit, while also growing its base of non-operating working

interests and royalty interests. Breitling’s oil and gas operations

are focused primarily in the Permian Basin

of

Texas

and

the

Mississippi

oil

window

of

southern

Kansas

and

Northern

Oklahoma,

with

non-

operating investments in Texas, North Dakota, Oklahoma and Mississippi.

Breitling Energy Corporation is traded over the counter under the

ticker symbol: BECC. Additional information is available at

www.breitlingenergy.com.

About Breitling Energy Corporation |

Company Highlights

Divest working interests in BECC wellbores to monetize projects and

reduce risk Leverage industry relationships to place investments

with attractive returns Generates revenue through de-risking

and well upside and covers well costs and provides working capital

Access

to

investment

opportunities

through

established

network

of

operating

companies,

landowners

and

brokers

Target non-operated working interests in lower risk areas operated by

best-in-class E&P producers Acquire diversified royalty

packages with Proved Developed Producing (“PDP”) acreage and ample

undeveloped locations

Entrepreneurial leadership team with unique combination of business

building, value creation and oil and gas experience

Significant experience in the energy industry, analyzing, acquiring and

producing oil & gas properties in multiple basins, with an

emphasis in the Permian Experience developing and marketing oil

& gas investments to qualified investors and institutional investors

Experienced,

disciplined

management team

Focus on proven oilfields for operating and investing opportunities

Currently operating in the Permian Basin of Texas and Mid-Continent

region Significant

supply

of

available

lower-risk

opportunities

in

proven

oilfields

typically

not

of

interest

to

larger

E&P companies

Single-rig, multi-well drilling program in progress on core

Proved Undeveloped Reserves (“PUD”) acreage in Sterling

County, Texas Access to available

operating and non-

operating properties

and royalties

Managed risk profile

through de-risking

projects

Capitalized by

Breitling’s asset

management business

Attractive business model that creates value through E&P activities

and by capitalizing on the demand for oil & gas

interests Leverages legacy business to manage operating risk by

divesting working interests in E&P projects to fund

exploration and production costs, and provides working capital

Drives additional value by developing and placing working interests

through industry relationships [

5 ]

Lower risk U.S. oil

play focused on proven

basins |

[

6 ]

Growing Revenues, Reserves and Metrics

1.

For the six months ended June 30, 2014 (annualized)

2.

Includes operated and non-operated results

3.

As reported on Form 8-K filed April 22, 2014

4.

As reported on Form 10-KT filed March 31, 2014

5.

As of November 6, 2014

6.

As of December 9, 2013

2014 Reserve Breakdown

Progression of Key Metrics

3P PV-10 Progression Over Time

Current Position

Share Price

(as of Nov. 6, 2014)

$0.57

% Change Since Reverse Merger

375%

Basic Shares Outstanding (mm)

499

Market Capitalization ($mm)

$284

Debt (June 30, 2014) ($mm)

$0

2014

2013

2012

Revenues for the year (in thousands)

$65,886

(1)

$26,651

(4)

$13,408

PV-10 of 3P Reserves (in thousands)

128,865

(2,3)

22,073

(4)

13,407

Net Income (loss) in thousands

$15,106

(1)

($2,522)

($5,685)

Stock Price

$0.57

(5)

$0.08

(6)

Projections included in this presentation are based upon assumptions and

estimates that were developed by management in good faith and are subject to risks, uncertainties or other factors that could cause actual results to differ

materially from those described. Accordingly, management projections

should not be relied upon as a prediction of actual results or regarded as a representation by the Company or its management that the projected results will

be achieved. The total

PV-10 value of the estimated future net revenue are not intended to represent the current market value of the estimated oil and natural gas reserves we

own. Management believes that the presentation of PV-10, while not a

financial measure in accordance with GAAP, provides useful information to investors

because it is widely used by professional analysts and sophisticated

investors in evaluating oil and natural gas companies. Because many factors that are unique

to each individual company impact the amount of future income taxes

estimated to be paid, the use of a pre-tax measure is valuable when comparing companies

based on reserves. PV-10 is not a measure of financial or operating

performance under GAAP. PV-10 should not be considered as an alternative to the

standardized measure as defined under GAAP. PV-10 of probable or

possible reserves represent the present value of estimated future revenues to be generated

from the production of probable or possible reserves, calculated net of

estimated lease operating expenses, production taxes and future development costs, using

costs as of the date of estimation without future escalation and using

12-month average prices, without giving effect to non-property related expenses such as

general and administrative expenses, debt service, and depreciation,

depletion, and amortization, or future income taxes and discounted using an annual

discount rate of 10%. With respect to pre-tax PV-10 amounts for

probable or possible reserves, there do not exist any directly comparable GAAP measures, and

such amounts do not purport to present the fair value of our probable and

possible reserves.

Note: |

Proven Management and Technical Team

Over twelve years of experience working with energy companies

Serves as Chief Operating Officer, General Counsel and Secretary; served

as Chief Compliance Officer and General Counsel of Breitling Oil

and Gas Corporation Previously,

Senior

Vice

President,

General

Counsel

and

Corporate

Secretary

for

Triangle

Petroleum

Corporation;

practiced law as a corporate finance, securities and M&A attorney

with Vinson & Elkins, LLP and with Skadden, Arps, Slate,

Meagher & Flom, LLP in Houston B.B.A in Finance and Economics

(summa cum laude) from Baylor University and J.D. from University of Texas with

Honors

Over ten years of experience in the oil and gas industry in North

America, Europe and the Middle East in roles dealing with project

management, production, facilities, drilling and business development

Drives the long-range economic and energy outlook of the Company,

which serves as the basis for strategic planning as well as

investor relations, short and long-term business strategy and mergers and acquisitions

Serves

as

an

advisor

to

ECF

Asia

Shale

Committee

and

sits

on

the

Board

of

Directors

for

the

North

Texas

Commission

Studied

Biomedical

Engineering

at

Southern

Methodist

University,

Business

Administration

and

Mathematics

at

Baylor

University and Information Systems at the University of North Texas

Over ten years of experience within the oil and gas industry

Serves as Chief Financial Officer since February 2014

Before joining Breitling, was Chief Financial Officer of TransCoastal

Corporation; from March 2011 to September 2012, he served as Chief

Financial Officer for Sun River Energy; from June 2007 to June 2009, served as Controller for Union

Drilling; from December 2004 to March 2007 served as Chief Financial

Officer for Ness Energy International Licensed CPA from the State

of Colorado B.S. from Regis University and Master’s Degree in

Taxation from the University of Colorado in Denver Rick Hoover

Chief Financial Officer

Chris Faulkner

Chief Executive Officer

Jeremy Wagers

COO & General Counsel

Breitling Energy Corporation

[

7 ] |

Proven Management and Technical Team (Continued)

Over 20 years of diversified energy experience in operations, finance and

land Participates in acquisition, business development and land

management for Breitling Previously, served as the Director of

Operations of a public water transfer and salt water disposal well company and

Land Manager of a regional, private E&P company focused on East

Texas Studied Business Administration and Management at Eastern New

Mexico University Scott Cox

VP of Land

Jim Hiza

Chief Investment

Officer

15 years of asset management as a registered investment advisor

Participates in Breitling’s economic valuation, sales and marketing

of oil & gas investments Serves as Chief Investment Officer for

Breitling joint ventures Previously was a CPA with Bank of

America B.S. in Accounting from the University of North Carolina at

Charlotte ~40 years of experience generating, evaluating and

drilling oil and gas prospects In 1986, was responsible for

generating some of the first horizontal drilling ventures in the Pearsall and Giddings Austin

Chalk Fields

Managed more than 675 wells in Texas, New Mexico, Oklahoma, Louisiana,

Mississippi, Michigan, Arkansas, Wyoming, the Gulf of Mexico and

on the North Island of New Zealand 37 year member of the American

Association of Petroleum Geologists and 20 year member of the Society of Petroleum

Engineers

B.S. in Geology with a minor in Petroleum Engineering from the University

of Texas at Austin Joseph Simo

SVP of Exploration

Breitling Energy Corporation

[

8 ] |

Jeremy Wagers

COO, GC, Director

Strong Board of Directors

Chris Faulkner

CEO, Director

Jonathan Huberman

Director

Richard Mourglia

Director

[

9 ] Currently serves as General Counsel and Senior Vice President-Land of

Dune Energy, Inc.

From 1990 until joining Dune in 2008, was in private practice with major

national and international law firms where his practice focused on

a variety of oil and gas/energy transactional matters Began his career in 1980 as a petroleum landman, including heading his

own petroleum land services company from 1984 to 1990

Served on the board and as an officer of the General Counsel Forum and

the board of the Texas Association of Bank Counsel

BA in Finance from The University of Texas at Austin and a JD (cum laude)

from South Texas College of Law

Currently serves as President and CEO of Tiburon, Inc., a software

provider for the public safety industry

From 2012 until 2013, Managing Director at the Gores Group,

Tiburon’s primary investor. From 2008 to 2012, President of the Consumer

and Small Business Product Division at EMC Corp. and was responsible for

the company’s China growth initiatives. Prior to that, CEO

of Iomega Corp. and continued his responsibilities following EMC’s

acquisition of Iomega in 2008. Before joining Iomega, was Managing

Director and co-founder of aAd Capital, a hedge fund focused on

investing in small to mid-sized public companies

Experience working at Idanta Partners, a Private Equity affiliate of the

Bass family, Boston Consulting Group and Cray Research. He also

served as Special Advisor to the Director of DARPA B.A. in Computer Science from Princeton University and an MBA from The

Wharton School at the University of Pennsylvania

Over twelve years of experience working with energy companies Serves as Chief Operating Officer , General Counsel and Secretary; served

as Chief Compliance Officer and General Counsel of Breitling Oil

and Gas Corporation Previously, Senior Vice President, General Counsel and Corporate

Secretary for Triangle Petroleum Corporation; practiced law as a corporate

finance, securities and M&A attorney with Vinson & Elkins, LLP

and with Skadden, Arps, Slate, Meagher & Flom, LLP in Houston

B.B.A in Finance and Economics (summa cum laude) from Baylor University

and J.D. from University of Texas with Honors

Over ten years of experience in the oil & gas industry in North

America, Europe and the Middle East in roles dealing with project

management, production, facilities, drilling and business development Drives the long-range economic and energy outlook of the Company,

which serves as the basis for strategic planning as well as investor

relations, short and long-term business strategy and mergers and

acquisitions Serves as an advisor to ECF Asia Shale Committee and sits on the

Board of Directors for the North Texas Commission

Studied Biomedical Engineering at Southern Methodist University, Business

Administration and Mathematics at Baylor University and

Information Systems at the University of North Texas |

Breitling Corporate History

2009

Participates in

first horizontal

well

Begins execution of

“buying in front of

the bit”

strategy to

target large

publicly-traded

operators

2011

2013

Divests

management

of legacy retail

investor

network

Forms asset

management

business,

begins

fundraising

2012

Enters

Bakken/Three

Forks play

Enters Mid-

Continent

region

Launches

proven oilfield

development

non-operated

strategy

Acquires $20

million royalty

package

Executes reverse

merger with Bering

Exploration, Inc.

and changes name

to Breitling Energy

Corporation (BECC)

Acquires two

$18 million

royalty

packages

2014

Announces

successful

results of its

first Permian

Basin farmout

well, the

Parramore #1

Asset

management

business

executes $12.5

million

transaction

with

institutional

investor

Announces

results of the

Buresh 17-

#1HM well in

the Mid-Con

Announces

spudding of

Hoppe 63 #1

well in Sterling

County, Texas

(Permian)

Announces

first

production on

the Teaff #1

operated well

in the Permian

Basin Eastern

Shelf

[

10 ]

Timeline events prior to December 9, 2013 are Breitling Oil and Gas

Corporation and Breitling Royalties Corporation |

Our Strategy |

Portfolio Management

Oil & Gas Management

Overview of Breitling Business Strategy

E&P Operations

[

12 ]

Asset Management

Generates revenue from production

and strategic divestment

De-risking projects and maintaining

upside through strategic divestment

of working interests

Growing scale with acquisition of

lower-risk properties

Focuses on proven oilfields primarily in

the Permian Basin & Mid-Continent

Generates ongoing revenue thru

carried interests and fees

Earns carried interests on investments

Maintains distribution network of

institutional and qualified investors

Manages BECC portfolios of royalty

and non-op working interests

Generates revenue through carried

interests and BECC wellbore

monetization

Earns carried interests on investments

Sells to strategic industry relationships

Monetizes and de-risks BECC projects

Places BECC and third-party royalties

and non-operating working interests |

E&P Operations |

Breitling E&P Acquisition / Development Strategy

E&P strategy focused on developing projects in proven oilfields

leveraging new oilfield technologies to enhance returns and reduce

risk Lower-risk development drilling

Operating in established basins with long production histories

Using proven operational and technical enhancements to optimize well

performance and drive drilling efficiencies

Targeting high-probability, lower risk opportunities held by private

operators motivated to begin drilling

Existing relationships with private operators facilitates an ongoing flow

of investment opportunities

[

14 ]

E&P Operations – Proven Oilfield Development Recent

pullback in oil prices represents significant opportunity to target assets from distressed

operators

Technical and operating team led by Joseph Simo, a ~40-year

industry veteran who has overseen the drilling of more than 675

wells – many in the Permian Basin, Breitling’s primary

area of focus |

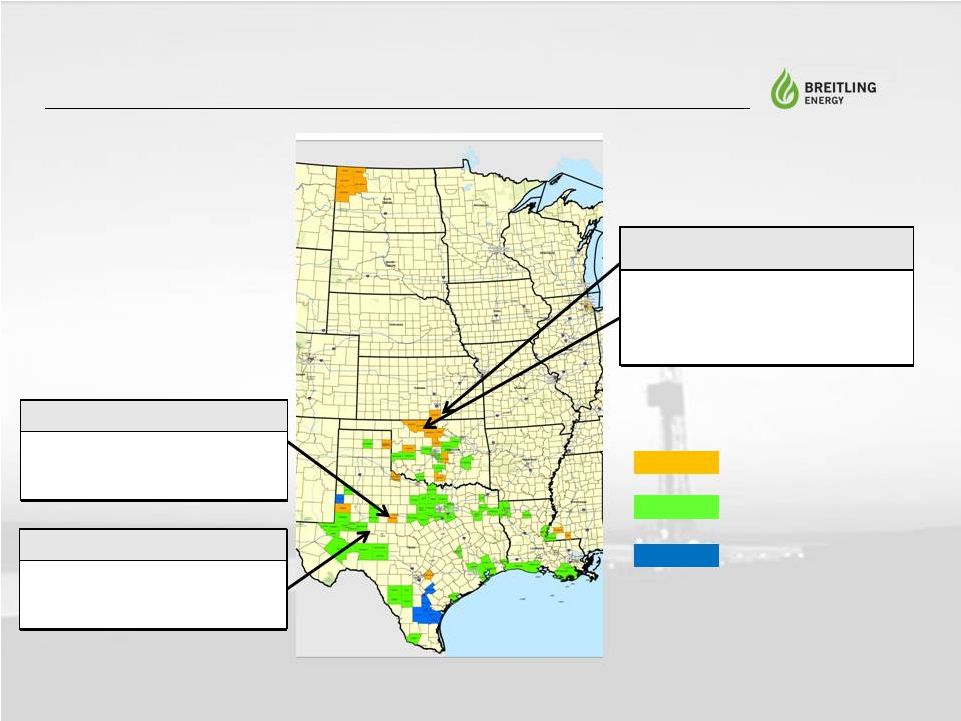

Working Interest Only

Royalty Interest Only

Working and Royalty Interest

Map of Key Focus Areas

[

15 ]

Permian Basin –

Midland Basin

Sterling County, TX

Parramore #1 well producing

Hoppe ’63’

#1 well awaiting completion

Mid-Continent

Sumner County, KS and Garfield County, OK

Buresh 17 -

#1HM well -

Sumner County

Currently producing with offset to successful wells

Woodring

#1

well

-

Garfield

County

Currently producing with offset to successful wells

Permian Basin Eastern Shelf

Taylor County, TX

Teaff #1 currently producing

Infill drilling opportunities; fit for BECC’s

proven oilfield development strategy |

Existing Permian Basin Operations

Sterling County, Texas Farmout

Parramore #1 well

#1 Hoppe ’63’

well

[

16 ]

Vertical well

Total depth ~9,200

Three-stage slickwater frack

Main target three Wolfcamp zones

Began production in June 2014

Well currently cleaning up after secondary completion

BECC earns full section with each well

drilled and entire acreage by drilling eight

wells

First well, the Parramore #1, was completed

in June and the second, Hoppe 63 #1, is

awaiting completion

#1 Hoppe ’63’

Overview:

Vertical well

Total depth ~8600 feet

Minimum five stage frack

Encountered the same productive zones from the

Wolfcamp formation as Parramore #1

Currently awaiting completion

Primary focus of BECC current development

Acquired approximately 3,680 acres in a

farmout agreement in early 2014

Multiple pay zone potential, including

Wolfcamp, Canyon Sand, Mississippian

Lime, Fusselman and Ellenburger

Perfect fit for the proven oilfield

development strategy

Parramore #1 Overview: |

Existing Permian Basin Operations

Eastern Shelf -

Taylor County, Texas

Teaff #1 well

[

17 ]

Recently acquired acreage

Teaff #1 Overview:

Vertical well

Total depth ~2,600 feet

Hope Lime producer

Began production in February 2014

Potential for at least two offsets based on 3-D seismic

BECC recently acquired a ~205-acre lease with multiple

shallow well opportunities

Water disposal planned to increase efficiency and

enable full production |

Existing Mid-Continent Operations

Sumner County, Kansas

Buresh 17 -

#1HM Overview:

Horizontal well producing from the Mississippian

formation

Total vertical depth ~4,270

Total measured depth ~6,844

Began producing in September 2014

SandRidge is drilling multiple horizontal

Mississippian wells approximately three miles

west of the Buresh location and has ~20 wells

permitted in Sumner County

Buresh 17 -

#1HM well

Source: Seeking Alpha –

“The Mississippian Lime: America’s Next Big Resource”

for description in map

1.

DrillingInfo [

18 ]

1 |

Asset Management Business |

Breitling Asset Management Operations

Oil and Gas Non-Operated Working Interests and Royalty Interests

in Proven Onshore U.S. Basins

Portfolio Management

[

20 ]

Divests BECC working interests in its well bores to de-risk and

monetize such working interests in each project

Proceeds fund well development and provide working capital

Generates

revenue

through

the

monetization

of

wellbores,

revenue

from

carried

interests and the returns on third-party interests placed with

industry relationships Oil & Gas Management

BECC’s technical team identifies and analyzes royalty and

non-operated working interest opportunities

through

an

established

network

of

operating

companies,

landowners

and

brokers

motivated to develop acreage

Targets liquid rich plays alongside best-in-class operators and

owners motivated to develop properties

Acquires

and

develops

interests

and

distributes

to

institutional

and

qualified

investors

BECC participates in the upside of wells through earned carried interests

Realizes ongoing revenue thru carried interests and fees

associated with these interests |

Awards and Notoriety

[

21 ]

Excellence in Social Responsibility - 2014

Breitling Energy Corporation

-

Southwest Region Oil and Gas Awards

Named to 2014 World Finance 100

Breitling Energy Corporation

-

World Finance Magazine

Best Company for Leadership in Oil & Gas Extraction - 2014

Breitling Energy Corporation

-

IAIR Awards

Best Independent Oil and Gas Company – North America - 2011, 2012

& 2013

Breitling Oil and Gas Corporation

-

World Finance Magazine

Oil Executive of the Year, 2013

Chris Faulkner

-

American Energy Research Group

Aggreko Award for Excellence in Environmental Stewardship – Gulf Coast

Region - 2013 Breitling Oil and Gas Corporation

-

Oil and Gas Awards

E&P Company of the Year - Southwest Region - 2013

Breitling Oil and Gas Corporation

-

Oil and Gas Awards

Industry Leader of the Year - Southwest Region - 2013

Chris Faulkner

-

Oil and Gas Awards

4 Fastest Growing Privately Held Dallas Company

- 2013

Breitling Oil and Gas Corporation

-

Dallas 100 Entrepreneur Awards

Dallas Who’s Who in Energy - 2012, 2013 , 2014

Chris Faulkner

-

Dallas Business Journal

th |

Company Highlights

Divest working interests in BECC wellbores to monetize projects and

reduce risk Leverage industry relationships to place investments

with attractive returns Generates revenue through de-risking

and well upside and covers well costs and provides working capital

Access

to

investment

opportunities

through

established

network

of

operating

companies,

landowners

and

brokers

Target non-operated working interests in lower risk areas operated by

best-in-class E&P producers Acquire diversified royalty

packages with Proved Developed Producing (“PDP”) acreage and ample

undeveloped locations

Entrepreneurial leadership team with unique combination of business

building, value creation and oil and gas experience

Significant experience in the energy industry, analyzing, acquiring and

producing oil & gas properties in multiple basins, with an

emphasis in the Permian Experience developing and marketing oil

& gas investments to qualified investors and institutional investors

Experienced,

disciplined

management team

Focus on proven oilfields for operating and investing opportunities

Currently operating in the Permian Basin of Texas and Mid-Continent

region Significant

supply

of

available

lower-risk

opportunities

in

proven

oilfields

typically

not

of

interest

to

larger

E&P companies

Single-rig, multi-well drilling program in progress on core

Proved Undeveloped Reserves (“PUD”) acreage in Sterling

County, Texas Access to available

operating and non-

operating properties

and royalties

Managed risk profile

through de-risking

projects

Lower risk U.S. oil

play focused on proven

basins

Capitalized by

Breitling’s asset

management business

Attractive business model that creates value through E&P activities

and by capitalizing on the demand for oil & gas

interests Leverages legacy business to manage operating risk by

divesting working interests in E&P projects to fund

exploration and production costs, and provides working capital

Drives additional value by developing and placing working interests

through industry relationships [

22 ] |

Contact Information |

Breitling Contact Information

Please contact the Breitling representatives below for further

information: Jeremy Wagers

Chief Operating Officer and

General Counsel

214.716.2030

jwagers@breitlingenergy.com

Gilbert Steedley

Vice President of Capital Markets

214.716.2060

gsteedley@breitlingenergy.com

[

24 ] |