Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VECTOR GROUP LTD | a1107148k_factsheet.htm |

| EX-99.1 - EXHIBIT 99.1 - VECTOR GROUP LTD | ex991_non-gaap.htm |

| EX-99.2 - EX 99.2 VGR INVEST PRESENT - VECTOR GROUP LTD | vgrinvestorpres110114.htm |

| EX-99.3 - EX 99.3 VGR FACT SHEET - VECTOR GROUP LTD | vectorgroupfactsheet1101.htm |

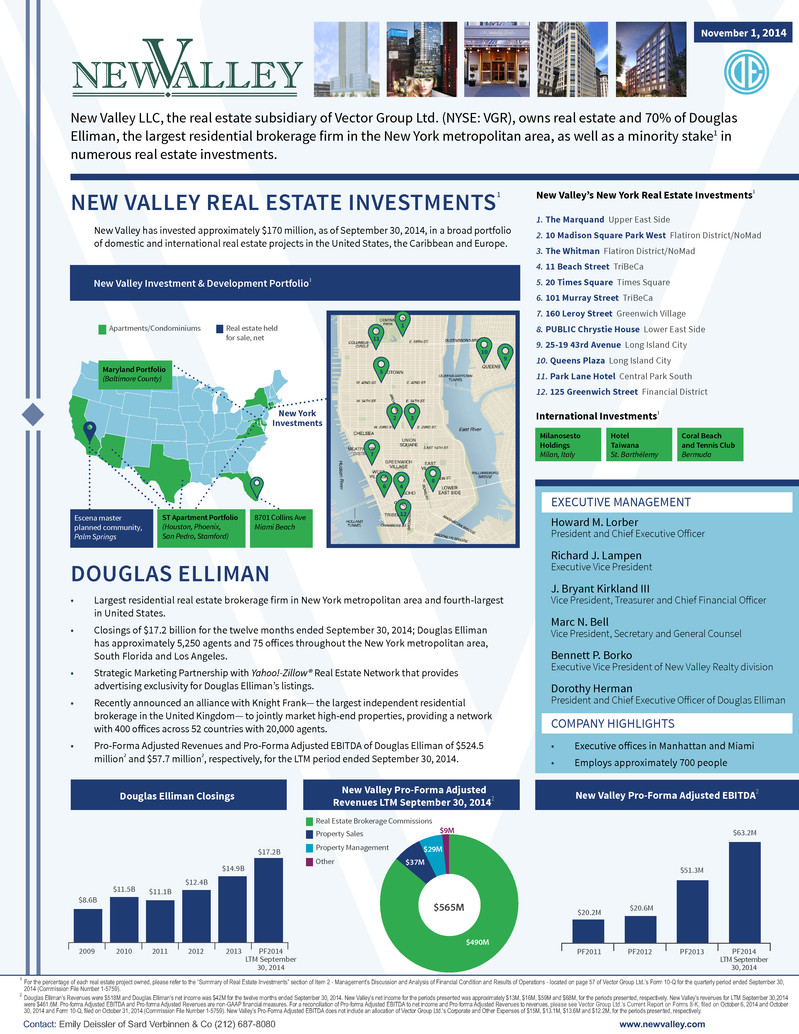

New Valley LLC, the real estate subsidiary of Vector Group Ltd. (NYSE: VGR), owns real estate and 70% of Douglas Elliman, the largest residential brokerage firm in the New York metropolitan area, as well as a minority stake1 in numerous real estate investments. New Valley has invested approximately $170 million, as of September 30, 2014, in a broad portfolio of domestic and international real estate projects in the United States, the Caribbean and Europe. NEW VALLEY REAL ESTATE INVESTMENTS1 November 1, 2014 DOUGLAS ELLIMAN • Largest residential real estate brokerage firm in New York metropolitan area and fourth-largest in United States. • Closings of $17.2 billion for the twelve months ended September 30, 2014; Douglas Elliman has approximately 5,250 agents and 75 offices throughout the New York metropolitan area, South Florida and Los Angeles. • Strategic Marketing Partnership with Yahoo!-Zillow® Real Estate Network that provides advertising exclusivity for Douglas Elliman’s listings. • Recently announced an alliance with Knight Frank— the largest independent residential brokerage in the United Kingdom— to jointly market high-end properties, providing a network with 400 offices across 52 countries with 20,000 agents. • Pro-Forma Adjusted Revenues and Pro-Forma Adjusted EBITDA of Douglas Elliman of $524.5 million2 and $57.7 million2, respectively, for the LTM period ended September 30, 2014. COMPANY HIGHLIGHTS • Executive offices in Manhattan and Miami • Employs approximately 700 people Douglas Elliman’s Revenues were $518M and Douglas Elliman’s net income was $42M for the twelve months ended September 30, 2014. New Valley’s net income for the periods presented was approximately $13M, $16M, $59M and $68M, for the periods presented, respectively. New Valley’s revenues for LTM September 30,2014 were $461.6M. Pro-forma Adjusted EBITDA and Pro-forma Adjusted Revenues are non-GAAP financial measures. For a reconciliation of Pro-forma Adjusted EBITDA to net income and Pro-forma Adjusted Revenues to revenues, please see Vector Group Ltd.’s Current Report on Forms 8-K, filed on October 6, 2014 and October 30, 2014 and Form 10-Q, filed on October 31, 2014 (Commission File Number 1-5759). New Valley’s Pro-Forma Adjusted EBITDA does not include an allocation of Vector Group Ltd.’s Corporate and Other Expenses of $15M, $13.1M, $13.6M and $12.2M, for the periods presented, respectively. 2 PF2011 PF2012 PF2013 PF2014 LTM September 30, 2014 $20.2M $20.6M $51.3M $63.2M New Valley Pro-Forma Adjusted EBITDA2 2 3 4 11 6 7 8 9 10 1 5 ST Apartment Portfolio (Houston, Phoenix, San Pedro, Stamford) Maryland Portfolio (Baltimore County) New Valley Investment & Development Portfolio1 New Valley’s New York Real Estate Investments1 1. The Marquand Upper East Side 2. 10 Madison Square Park West Flatiron District/NoMad 3. The Whitman Flatiron District/NoMad 4. 11 Beach Street TriBeCa 5. 20 Times Square Times Square 6. 101 Murray Street TriBeCa 7. 160 Leroy Street Greenwich Village 8. PUBLIC Chrystie House Lower East Side 9. 25-19 43rd Avenue Long Island City 10. Queens Plaza Long Island City 11. Park Lane Hotel Central Park South 12. 125 Greenwich Street Financial District Hotel Taiwana St. Barthélemy Milanosesto Holdings Milan, Italy Coral Beach and Tennis Club Bermuda International Investments1 Apartments/Condominiums Real estate held for sale, net 8701 Collins Ave Miami Beach www.newvalley.comContact: Emily Deissler of Sard Verbinnen & Co (212) 687-8080 Escena master planned community, Palm Springs Douglas Elliman Closings 2009 $8.6B 2010 2011 2012 2013 $11.5B $11.1B $12.4B $14.9B $17.2B PF2014 LTM September 30, 2014 EXECUTIVE MANAGEMENT Howard M. Lorber President and Chief Executive Officer Richard J. Lampen Executive Vice President J. Bryant Kirkland III Vice President, Treasurer and Chief Financial Officer Marc N. Bell Vice President, Secretary and General Counsel Bennett P. Borko Executive Vice President of New Valley Realty division Dorothy Herman President and Chief Executive Officer of Douglas Elliman New York Investments For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations - located on page 57 of Vector Group Ltd.’s Form 10-Q for the quarterly period ended September 30, 2014 (Commission File Number 1-5759). 1 New Valley Pro-Forma Adjusted Revenues LTM September 30, 20142 Other Real Estate Brokerage Commissions Property Management Property Sales $565M $490M $29M $37M $9M 12