Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | rf-201411078k.htm |

BancAnalysts Association o of Boston Fall Conference November 7, 2014 David Turner Chief Financial Officer 1 Deron Smithy Treasurer Exhibit 99.1

Agenda • Footprint positioning • Deposit gathering using multiple channels • Retail network strategy • Deposit strategies • Interest rate sensitivity • Liquidity management 2

($ in billions) National Average: 3.5% Source: SNL Financial as of 6/30/14 Note: Core Markets include AL, FL, LA, MS, AR, TN Weighted Average Deposit Market Share in Regions’ Core Markets Rank Name Market Share 1 Bank of America 11.3% 2 Wells Fargo 9.7% 3 Regions 9.0% 4 SunTrust 6.6% 5 JPMorgan Chase 4.5% 6 BB&T 2.5% 7 Capital One 2.2% 8 First Horizon 1.9% 9 Citi 1.8% 10 BBVA 1.7% Footprint positioning Characterized by High Market Share, High Growth Markets 3 1.0% 5.0% 0.6% 2.6% 6.4% 6.4% 2.9% 5.1% 6.2% 1.7% Top MSAs Deposits Market Rank ’14-’19 Population Growth Birmingham, AL $11.5 1 Nashville, TN $6.7 2 Tampa, FL $5.9 4 Memphis, TN $4.4 2 Miami, FL $4.0 12 Atlanta, GA $3.3 6 Jackson, MS $2.8 2 St. Louis, MO $2.7 4 New Orleans, LA $2.6 5 Mobile, AL $2.4 1

Optimizing channel integration to drive deposit convenience 4 › 1,671 locations › Continues to be #1 sales generator › More than 80% of sales occur in a branch › Experimenting with several new designs, technologies and universal banker roles › 37% of customers use mobile technology › Customers using Mobile increased 20% YoY › Capabilities › Remote Deposit Capture › Funds availability uniqueness › New iPad® app › 1,315 currently with 400 more in 2015, completing deployment › Currently 66% of ATM network with 87% at completion › 16% of all customer initiated deposits via ATM › 36% increase in ATM deposit volume YOY › Capabilities › Check cashing › Funds availability options Branch Mobile Deposit Smart ATM® iPad® is a registered trademark of Apple Inc.

Channel activity 5 Channel Integration Total branch outlets Product unit sales by channel (in thousands) 2% Decline since 4Q12 13.6% Increase since 2012 Branch interactions (in millions) 11% Decline since 2012 Mobile banking 166% Increase in interactions since 2012 1117 1141 1262 99 114 96 127 146 167 2012 2013 2014 YTD Annualized Branch Online Contact Center (in millions) (in thousands) 1,711 1,705 1,671 4Q12 4Q13 3Q14 1,343 1,401 1,525 (in thousands) 133 123 119 2012 2013 2014 YTD Annualized 107 171 285 924 1,156 1,222 2012 2013 2014 YTD Annualized Mobile Banking Interactions Mobile Banking Customers

6 Retail network strategy F = Flagship – (8,000 - 10,000 sq feet) • Large, highly visible prime locations • Larger staff, focused highly on sales and customer service • Advanced technology • Full Line of Business compliment N = Neighborhood – (2,500 - 4,000 sq feet) • Commitment to smaller footprint, some Universal Bankers • Implementation of advanced technology as appropriate M = Micro - (1,000 - 2,500 sq feet) • Minimal staff (2 - 3 FTE), Universal Bankers, focused on sales and service • Highly automated with advanced technology, more self-serve functionality U = Unmanned ATM / Kiosk • Fully self-service ATM / Kiosk locations, with vestibules to efficiently and conveniently deliver daily transactions F N N M M U U U

7 Retail network strategy F = Flagship – (8,000 - 10,000 sq feet) • Large, highly visible prime locations • Larger staff, focused highly on sales and customer service • Advanced technology • Full Line of Business compliment N = Neighborhood – (2,500 - 4,000 sq feet) • Commitment to smaller footprint, some Universal Bankers • Implementation of advanced technology as appropriate M = Micro - (1,000 - 2,500 sq feet) • Minimal staff (2 - 3 FTE), Universal Bankers, focused on sales and service • Highly automated with advanced technology, more self-serve functionality U = Unmanned ATM / Kiosk • Fully self-service ATM / Kiosk locations, with vestibules to efficiently and conveniently deliver daily transactions F N N M M U U U

8 Retail network strategy F = Flagship – (8,000 - 10,000 sq feet) • Large, highly visible prime locations • Larger staff, focused highly on sales and customer service • Advanced technology • Full Line of Business compliment N = Neighborhood – (2,500 - 4,000 sq feet) • Commitment to smaller footprint, some Universal Bankers • Implementation of advanced technology as appropriate M = Micro - (1,000 - 2,500 sq feet) • Minimal staff (2 - 3 FTE), Universal Bankers, focused on sales and service • Highly automated with advanced technology, more self-serve functionality U = Unmanned ATM / Kiosk • Fully self-service ATM / Kiosk locations, with vestibules to efficiently and conveniently deliver daily transactions F N N M M U U U

9 Retail network strategy F = Flagship – (8,000 - 10,000 sq feet) • Large, highly visible prime locations • Larger staff, focused highly on sales and customer service • Advanced technology • Full Line of Business compliment N = Neighborhood – (2,500 - 4,000 sq feet) • Commitment to smaller footprint, some Universal Bankers • Implementation of advanced technology as appropriate M = Micro - (1,000 - 2,500 sq feet) • Minimal staff (2 - 3 FTE), Universal Bankers, focused on sales and service • Highly automated with advanced technology, more self-serve functionality U = Unmanned ATM / Kiosk • Fully self-service ATM / Kiosk locations, with vestibules to efficiently and conveniently deliver daily transactions F N N M M U U U

Video Teller Machine (VTM) • Overview • VTM provides customer convenience and extended hours • Links a customer to a Contact Center banker via video • Banker can complete nearly all the transactions offered at a branch including non-card transactions/activities • Easily deployed throughout the footprint without building a fully staffed branch while minimizing the potential costs of maintaining a traditional branch • Transactions • Personal and small business • Most traditional teller transactions can be completed • Maintenance and Inquiry transactions can be completed 10

Continued focus on growing non-interest revenue and managing expenses Non-interest revenue • Growing checking accounts and quality households • Continued expansion of Now Banking® • Focused on growing Wealth Management • Increasing opportunities within the Corporate Bank Non-interest expense • Expense management fundamental to the company • One of the lowest NIE / Avg. Assets among peer group • Anticipate that adjusted 2014 expenses will be lower than 2013 adjusted expenses 11 Regions is committed to driving long-term growth while improving efficiency across organization

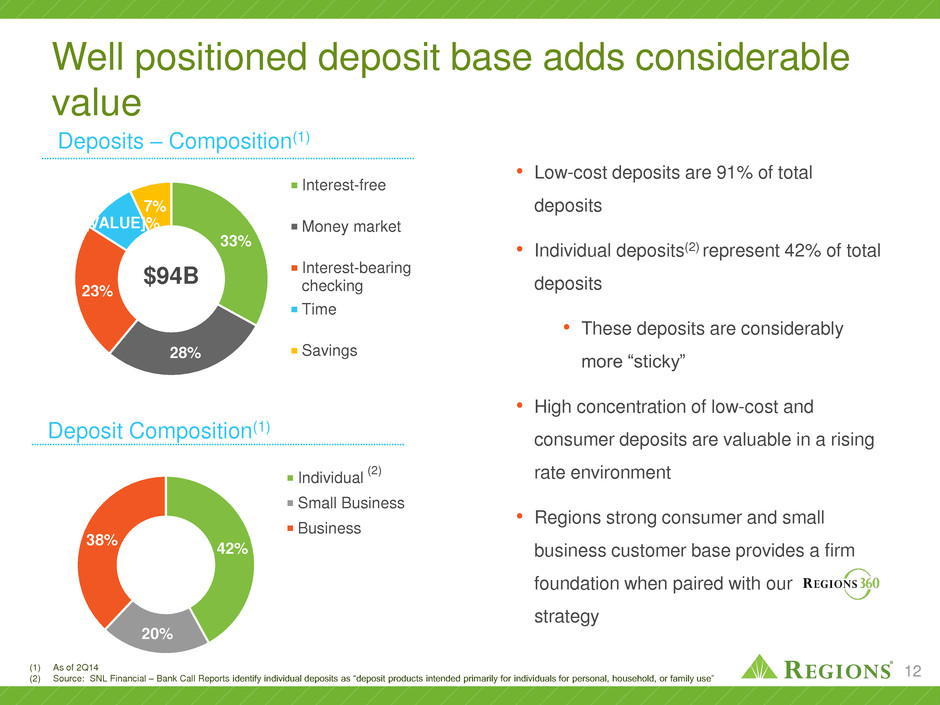

Well positioned deposit base adds considerable value 12 33% 28% 23% [VALUE]% 7% $94B Interest-free Money market Interest-bearing checking Time Savings Deposits – Composition(1) 42% 20% 38% Individual Small Business Business Deposit Composition(1) (1) As of 2Q14 (2) Source: SNL Financial – Bank Call Reports identify individual deposits as “deposit products intended primarily for individuals for personal, household, or family use” • Low-cost deposits are 91% of total deposits • Individual deposits(2) represent 42% of total deposits • These deposits are considerably more “sticky” • High concentration of low-cost and consumer deposits are valuable in a rising rate environment • Regions strong consumer and small business customer base provides a firm foundation when paired with our strategy (2)

Deposit mix vs. peers(1) 0% 10% 20% 30% 40% 50% Peer #1 Peer #2 Peer #3 Peer #4 RF Peer #5 Peer #6 Peer #7 Peer #8 Peer #9 Peer #10 Peer #11 • Regions’ comparative concentration in non- interest bearing deposit categories indicate a relatively less interest sensitive funding base • Regions' deposits are substantially consumer based, thus supporting a more modest pace of disintermediation as rates rise, providing stable and profitable funding for loan growth 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% Peer #1 Peer #2 RF Peer #3 Peer #4 Peer #5 Peer #6 Peer #7 Peer #8 Peer #9 Peer #10 Peer #11 (1) As of 6/30/2014 (2) Source: SNL Financial (3) Source: SNL Financial – Bank Call Reports identify individual deposits as “deposit products intended primarily for individuals for personal, household, or family use” Note: Peer banks include BBT, CMA, FHN, FITB, HBAN, KEY, MTB, PNC, STI, USB, WFC Noninterest bearing deposits / total assets(2) Peer Average = 24% Individual deposits(3) / total deposits Peer Average = 39%

Net interest margin (NIM) summary • NIM has remained stable despite the impacts of a low-rate environment due largely to efficiencies in deposit and funding costs • However, further continuation of rates at current levels will put moderate pressure on NIM over time • Naturally asset sensitive position allows for outperformance in a rising rate scenario, and only gradual pressure on NIM if rates remain low 4.07% 3.91% 4.11% 3.86% 3Q13 4Q13 1Q14 2Q14 3Q14 Regions Peer Average Loan yield vs. peers Net interest margin vs. peers 3.24% 3.18% 3.29% 3.06% 3Q13 4Q13 1Q14 2Q14 3Q14 Regions Peer Average Note: Peer banks include BBT, CMA, FHN, FITB, HBAN, KEY, MTB, PNC, STI, USB, WFC, ZION Source: SNL Financial 14

15 Interest rate risk management Assumption sensitivity analysis (1) As of 3Q14 (2) 12 month NII sensitivity to gradual, parallel changes in interest rates over six months versus a market forward rate scenario (3) Assumes reinvestment into wholesale funding Standard shock scenario + 200bps(2) $242 $117 ( $43 ) ( $38 ) ( $23 ) ( $21 ) Increased interest bearing deposit beta (5%) Additional decline in deposit balances ($3B)(3) Additional deposit remixing ($3B, all-in total $6.5B) Increased loan spread compression (10 bps) Stressed shock scenario Loan Portfolio Composition(1) • Regions’ naturally asset sensitive position supported with mostly floating rate loans and a large proportion of low-rate deposits • Though model assumptions are largely informed by historical observations, asset sensitive position maintains even under more conservative assumptions (See appendix for more detail) • Projected interest bearing deposit beta ~55% - 65% • Deposit remixing of $3.5B from non- interest bearing to interest bearing 36% 64% $77B Fixed Floating ($ in millions)

Note: Data as of 6/30/14 Peer banks include BBT, CMA, FHN, FITB, HBAN, KEY, MTB, PBCT, PNC, STI, USB, WFC, ZION Source: Form 10-Q filings Favorable liquidity and funding mix 16 16 Peer #1 Peer #2 Peer #3 Peer #4 Peer #5 Peer #6 Peer #7 Peer #8 Peer #9 Peer #10 Peer #11 Peer #12 Peer #13 68% 73% 78% 83% 88% 93% 98% 103% 108% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% L o ans/Dep o sit s Funded Debt/Avg. Earning Assets Liquidity position vs. peers

Well positioned for the liquidity coverage ratio without significant balance sheet changes • Low loan to deposit ratio (81%) and low funded debt/earning assets (4.1%) provides greater flexibility to fund future loan growth • Lower reliance on market rate funding supports favorable LCR and interest rate sensitivity profile • Regions will likely have a reduced appetite for products that receive unfavorable LCR (e.g., unfunded liquidity facilities to financial entities) • Regions expects terms of credit and liquidity facilities to be more explicit on the subject of intended use • The current size and mix of the investment portfolio is favorable from an LCR perspective 17

18

Appendix 19

Standard shock scenario model assumptions 20 Category Assumption Interest rates 200 bps gradual ramp (parallel increase over 6 months above market forward rates) Loan balances Moderate increase Deposit balances Moderate increase in aggregate balances, rate shock includes rate-related shift in deposit mix ($3.5B NIB to CD over 12 months) Loan spreads Moderate continued compression Deposit pricing Moderately more conservative than historical observations (Projected interest bearing deposit beta ~55% - 65%) Securities portfolio Held at current levels MBS prepayments Vary with interest rate levels Hedging (swaps) No new transactions assumed 12 month NII sensitivity to gradual, parallel changes in interest rates over six months versus a market forward rate scenario

Forward-looking statements The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors" of Regions' Annual Report on Form 10-K for the year ended December 31, 2013, as filed with the Securities and Exchange Commission. The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time. This presentation may include forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward- looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below: 21 • Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and potential reduction of economic growth. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook. • Possible changes in market interest rates. • Any impairment of our goodwill or other intangibles, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations of the reporting unit, or other factors. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments. • Our ability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner. • Changes in laws and regulations affecting our businesses, including changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self- regulatory agencies. • Our ability to obtain regulatory approval (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or issue or redeem preferred stock or other regulatory capital instruments. • Our ability to comply with applicable capital and liquidity requirements (including finalized Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms. • The costs and other effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party. • Any adverse change to our ability to collect interchange fees in a profitable manner, whether such change is the result of regulation, litigation, legislation, or other governmental action. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers. • The inability of our internal disclosure controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts and terrorist attacks. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes and environmental damage. • Our ability to keep pace with technological changes. • Our ability to identify and address cyber-security risks such as data security breaches, “denial of service” attacks, “hacking” and identity theft. • Possible downgrades in our credit ratings or outlook. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally. • The effects of the failure of any component of our business infrastructure which is provided by a third party. • Our ability to receive dividends from our subsidiaries. • Changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies. • The effects of any damage to our reputation resulting from developments related to any of the items identified above.