Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Discover Financial Services | d815899d8k.htm |

2014 BancAnalysts Association of Boston Conference

©2014 DISCOVER FINANCIAL SERVICES

Mark Graf

EVP & Chief Financial Officer

November 7, 2014

Exhibit 99.1 |

2

Notice

The following slides are part of a presentation by Discover Financial Services (the "Company")

and are intended to be viewed as part of that presentation. No representation is made

that the information in these slides is complete. The presentation contains forward-looking statements. You are cautioned not to place undue

reliance on forward-looking statements, which speak only as of the date on which they are

made, which reflect management’s estimates, projections, expectations or beliefs at that

time, and which are subject to risks and uncertainties that may cause actual results to differ

materially. For a discussion of certain risks and uncertainties that may affect the future results of

the Company, please see "Special Note Regarding Forward-Looking Statements,"

"Risk Factors," "Business – Competition," "Business – Supervision and

Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results

of Operations" in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2013 and "Management’s Discussion and Analysis of Financial Condition and

Results of Operations" in the Company's Quarterly Reports on Form 10-Q for the quarters ended March 31, 2014,

June 30, 2014 and September 30, 2014, which are available on the Company’s website and the

SEC’s website. The Company does not undertake to update or revise forward-looking

statements as more information becomes available. We own or have rights to use the trademarks, trade names and service marks that we use in conjunction

with the operation of our business, including, but not limited to: Discover

®

, PULSE

®

, Cashback Bonus

®

, Discover Cashback Checking

Discover it

®

, Discover

®

Network and Diners Club International ®

. All other trademarks, trade names and service marks included

in this presentation are the property of their respective owners.

Throughout these materials, direct-to-consumer deposits are referred to as DTC deposits.

DTC deposits include deposit products that we offer to customers through direct marketing,

internet origination and affinity relationships. DTC deposits include certificates of

deposits, money market accounts, online savings and checking accounts, and IRA certificates of deposit.

SM

, |

3

Positioning to be the leading direct bank

U.S. Card

Issuing

•

$54Bn in card receivables

•

Leading cash rewards

program

•

1 in 4 U.S. households

Deposits and

Lending

•

$29Bn direct-to-consumer

deposits

•

$13Bn personal loans and

private student loans

•

$2.5Bn home loan

originations

•

Home equity installment

loans

Direct Banking Strategy

•

Discover to become the leading direct

bank by leveraging our unique assets

and capabilities to grow credit card

market share and pursue other high-

return direct consumer banking

opportunities in the U.S.

Direct Banking Segment

(97% of DFS Pre-Tax Profit)

Note(s):

Balances as of September 30, 2014; direct mortgage originations and pre-tax

profit based on the trailing four quarters ending 3Q14 Consumer Strategic

Shift Today:

"My favorite credit card”

Near

Term:

“My

favorite

provider

of

credit

cards and other financial services”

Ultimately:

"My bank" |

4

Discover

Milestones:

U.S. Deposit Growth vs. Fed Funds Rate

Today -

uncharted environment

Source:

Federal

Reserve

Board

Flow

of

Funds

and

Fed

Funds

rate

reported

annually

$28Bn

DTC

(1)

$13Bn

DTC

(1)

DFS

Spin

Note(s):

1.

Direct-to-consumer deposits (DTC); see Notice for complete definition

|

5

Deposits strategy –

Great service and good pricing

•

Segment: Savvy, value-oriented consumers

•

Value Proposition

Outstanding service and convenience

Consistently good rates

•

Execution Path

Expand product breadth with distinctive offerings over time

Enhance product features and functionality

Integrate brands across platforms to drive cross-sell

|

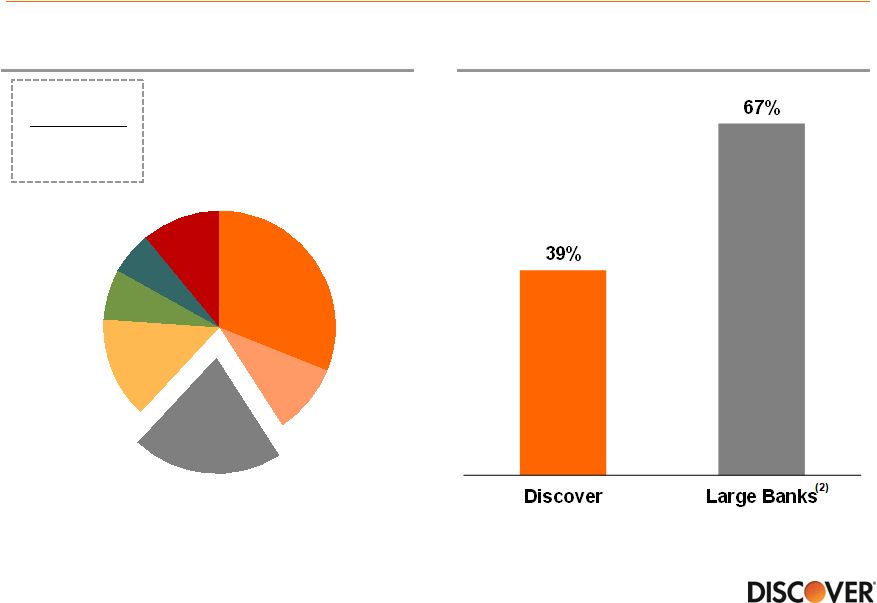

6

2013 Efficiency Ratio

Preference for direct channels has grown among

consumers

Preferred Banking Channel

Source:

American

Bankers

Association

Survey

2014

Branch

Preference

2008: 34%

2014: 21%

Source:

SNL

Note(s):

1.

Total operating expenses divided by revenue net of interest expense

2.

Bank holding companies participating in the 2014 Comprehensive Capital Analysis and

Review (CCAR); excludes Discover (1)

Internet,

31%

Mobile,

10%

Branch,

21%

ATM,

14%

Phone,

7%

Mail, 6%

NA, 11% |

7

Funding asset growth with deposits

Direct-to-Consumer

Deposits ($Bn)

(1)

Funding Mix

(1)

Note(s):

1.

Includes affinity deposits

Senior Bank Notes

ABS and Other

Brokered Deposits

Direct Deposits

$3

$7

$13

$21

$27

$28

$28

$29

2007

2008

2009

2010

2011

2012

2013

3Q14 |

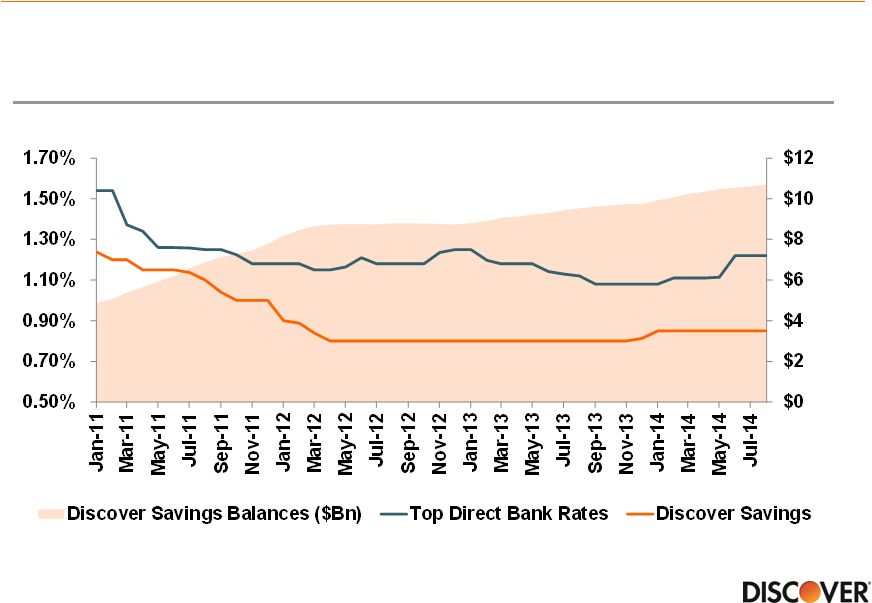

8

Pricing to balance growth and stability of book

Discover

Savings

Rate

vs.

Top

Direct

Bank

Rates

(1)

Note(s):

1.

Data set through August 2014; Top Direct Bank Rates reflects monthly average of top

three rates posted online weekly by banks without a traditional branch

network Source:

Internal

data

&

Informa

Research

Services

(1) |

9

Optimizing product mix to manage rate sensitivity

Indeterminate Balances Acquired at

10%+

Above

Competitor

Rates

(1,2)

Indeterminate Balances as a % of

Deposits

Portfolio

(1)

(3)

(3)

Note(s):

1. Indeterminate Balances defined as savings and money

market balances 2.

Competitor

Rates

reflects

monthly

average

of

rates

posted

online

by

peer

banks,

which

include

banks

without

a

traditional

branch

network

3.

2014 YTD is as of 9/30/2014

48%

49%

54%

57%

2011

2012

2013

2014 YTD

39%

39%

33%

30%

2011

2012

2013

2014 YTD |

10

Optimizing customer mix to manage rate sensitivity

Note(s):

1.2014 YTD is as of 9/30/2014

Deposits from

Card or Affinity Customers

(% of Total)

New Deposit Accounts Opened by

Card or Affinity Customers

(% of Total)

(1)

(1)

66%

69%

78%

84%

2011

2012

2013

2014 YTD

54%

56%

60%

62%

2011

2012

2013

2014 YTD |

11

Positive trends in depositor behavior

DTC Balances by Life of

Relationship

CD Retention Rates

(1)

$21Bn

$29Bn

(2)

Note(s):

1. CD retention rates based on direct-to-consumer

CDs; excludes brokered CDs 2.

2014 YTD is as of 9/30/2014

(2)

78%

82%

2010

2014 YTD

9%

44%

16%

33%

75%

23%

2010

2014 YTD

Less than 2 Years

2 to 4 Years

Over 4 Years |

12

Our beta will be higher than a “traditional”

bank but

not “1”

DFS vs. Traditional Bank

Illustrative

Betas

(1)

•

Similar to “traditional”

bank, strong

synergy between right and left hand

side of balance sheet

62% of current accounts have a loan

product relationship with DFS

78% of new accounts have a loan

product relationship with DFS

•

Different from “traditional”

bank…

Checking deposits are still relatively

small (<1% of DFS funding)

Funding stack relies on ABS, DTC

and Brokered Deposits

Note(s):

1.

Defined as the ratio of expected change in deposit pricing relative to Fed

increases in short term interest rates 0.0

0.5

1.0

Traditional

Bank Deposit

Pricing

Discover DTC

Deposit

Pricing

Brokered CD

Pricing |

13

•

Achieves cost of funds benefit in a

rising rate environment

•

Deepens customer relationships

given transactional nature of product

•

Delivers richer product features and

better value given lower direct

banking cost structure

•

Leverages Discover and PULSE

networks

Establish core banking presence and lower long term cost

of funds with checking product

Strategic Rationale

Note(s):

Checking

product

currently

limited

to

existing

deposit

and

card

customers;

Broad

market

launch

expected

in

2015 |

14

Strong digital presence with great customer service is key

|

15

Summary

•

Utilizing all current funding channels

•

Focusing on funding that is favorable in terms of cost, beta, liquidity and

term •

Committed to DTC funding channel as a large percentage of funding mix

•

Focusing on product mix and customer retention to prepare for rising rate

environment |