Attached files

| file | filename |

|---|---|

| 8-K - HUDSON VALLEY HOLDING CORP | s1141408k.htm |

| EX-99.1 - EXHIBIT 99.1 - HUDSON VALLEY HOLDING CORP | ex99_1.htm |

Exhibit 99.2

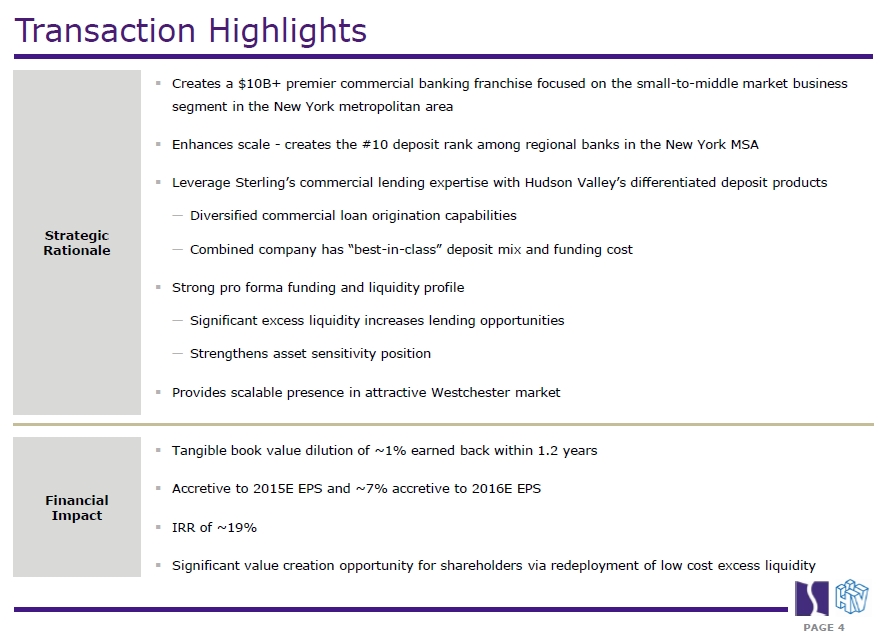

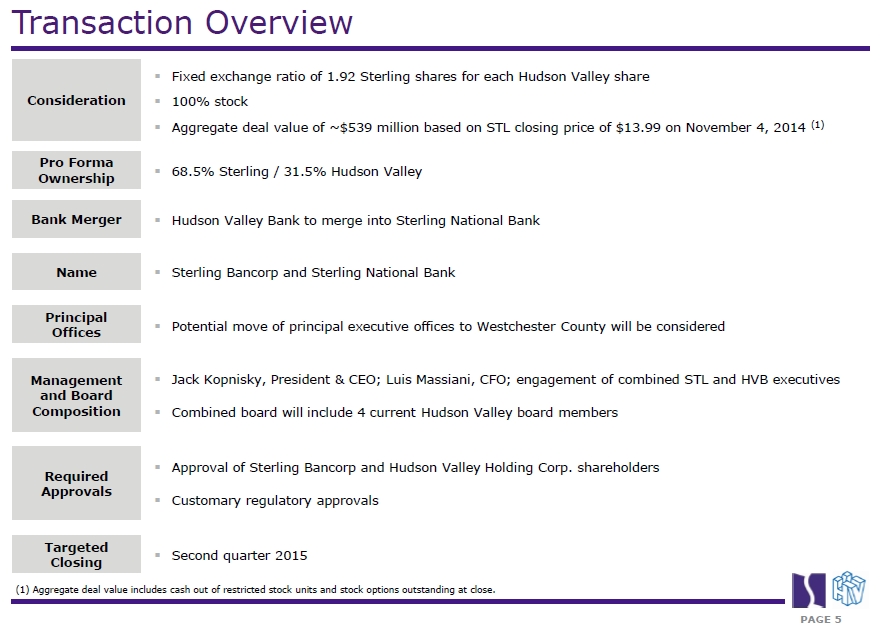

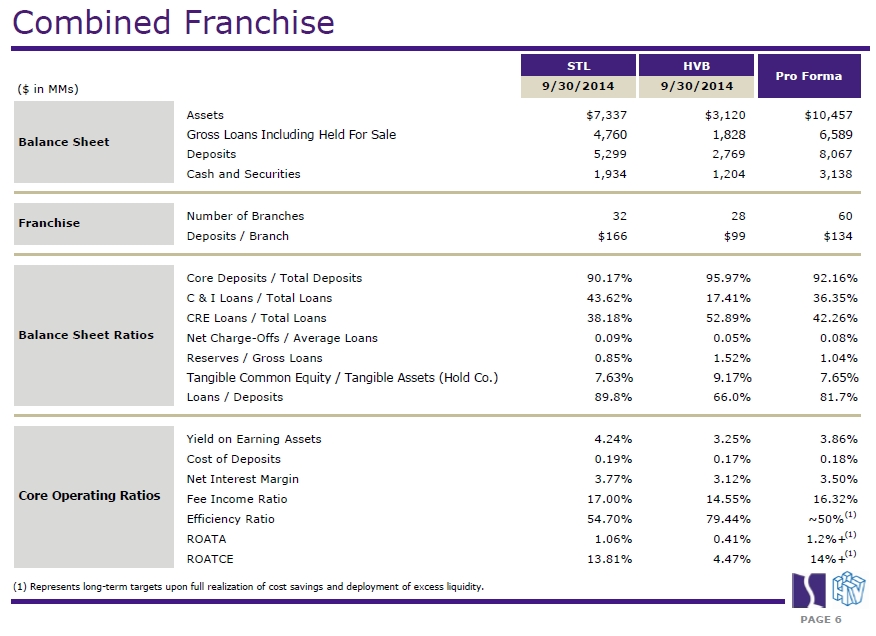

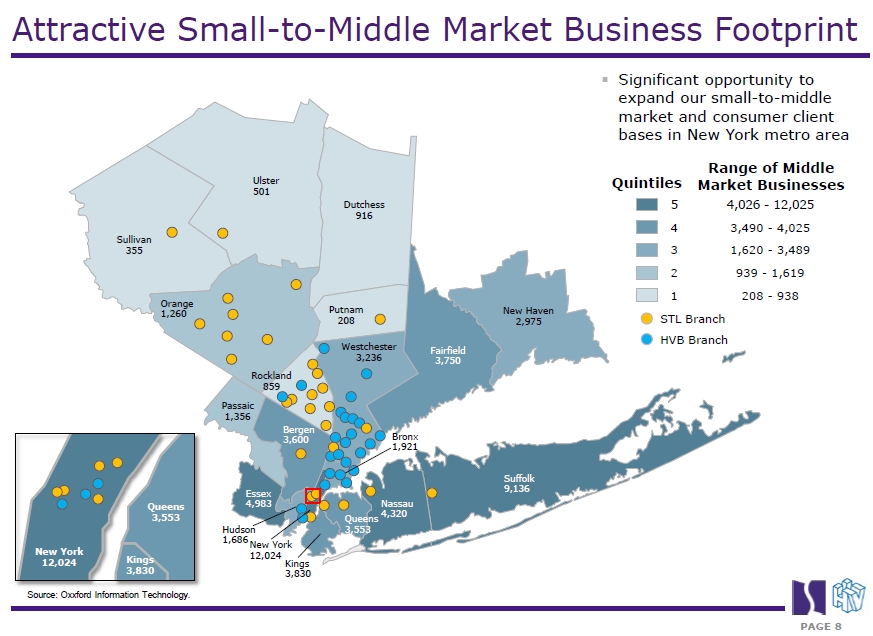

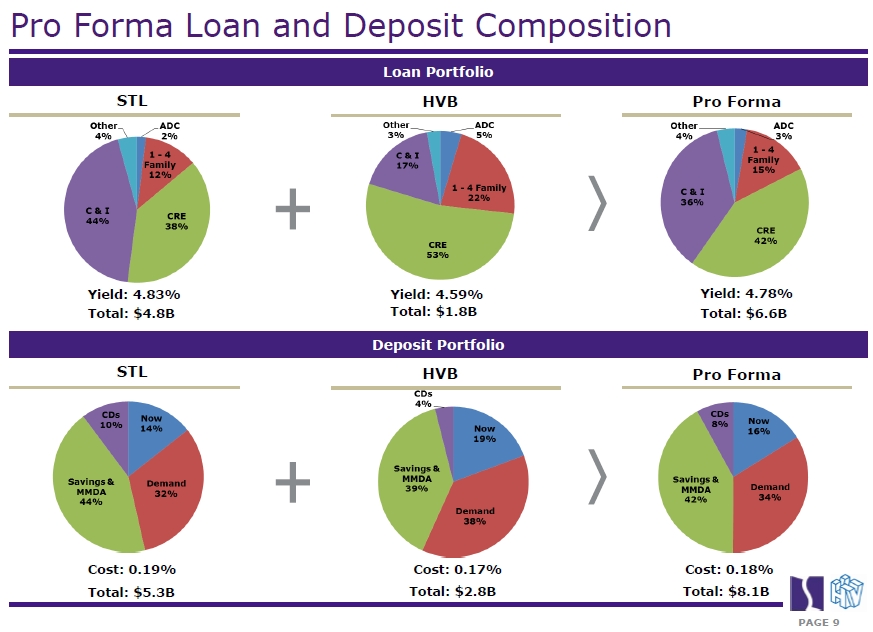

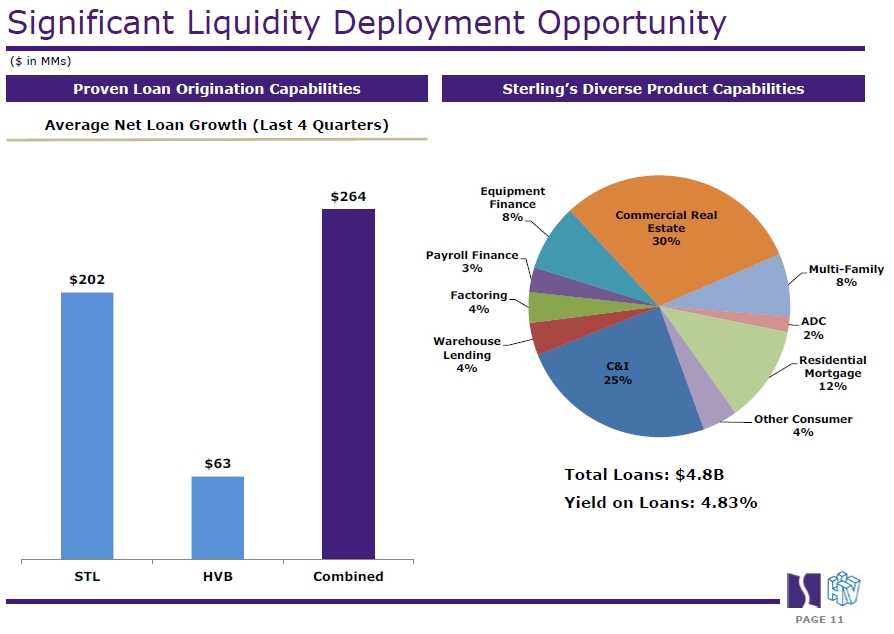

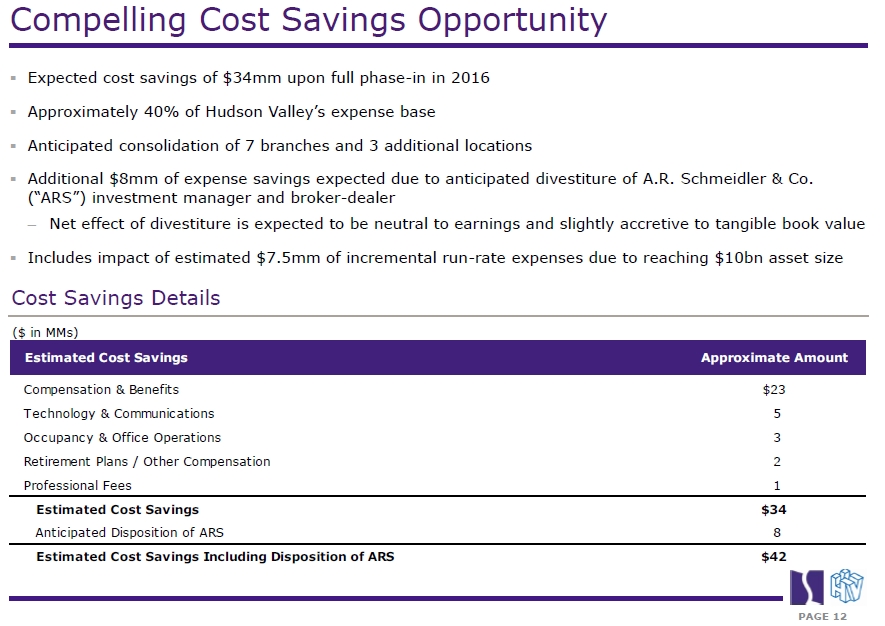

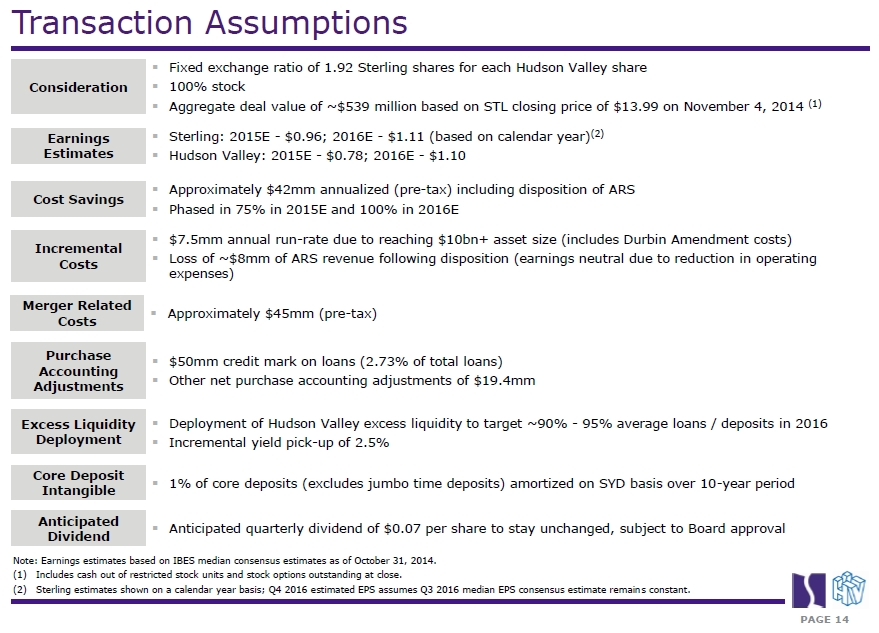

Forward Looking Statements The information presented herein contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 giving Sterling Bancorp (“Sterling” or “STL”) and Hudson Valley Holding Corp. (“Hudson Valley” or “HVB”) expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Sterling and Hudson Valley, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions and other statements that are not historical facts. These forward-looking statements are subject to numerous assumptions, risks and uncertainties which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. In addition to factors previously disclosed in Sterling’s and Hudson Valley’s reports filed with the Securities and Exchange Commission, the following factors among others, could cause actual results to differ materially from forwardlooking statements: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by Sterling and Hudson Valley shareholders, on the expected terms and schedule; delay in closing the merger; difficulties and delays in integrating the Sterling and Hudson Valley businesses or fully realizing cost savings and other benefits; business disruption following the proposed transaction; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; changes in Sterling’s stock price before closing, including as a result of the financial performance of Hudson Valley prior to closing; the reaction to the transaction of the companies’ customers, employees and counterparties; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Additional Information About the Proposed Transaction and Where to Find It Investors and security holders are urged to carefully review and consider each of Sterling Bancorp’s and Hudson Valley Holding Corp.’s public filings with the SEC, including but not limited to their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their Quarterly Reports on Form 10-Q. The documents filed by Sterling Bancorp with the Securities and Exchange Commission (the “SEC”) may be obtained free of charge at Sterling Bancorp’s website at www.sterlingbancorp.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Sterling Bancorp by requesting them in writing to Sterling Bancorp, 400 Rella Boulevard, Montebello, New York 10901 Attention: Investor Relations, or by telephone at (845) 369-8040. The documents filed by Hudson Valley Holding Corp. with the SEC may be obtained free of charge at Hudson Valley Holding Corp.’s website at www.hudsonvalleybank.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Hudson Valley Holding Corp. by requesting them in writing to Hudson Valley Holding Corp., c/o Hudson Valley Bank, 21 Scarsdale Road, Yonkers, New York 10707; Attention: Investor Relations, or by telephone at (914) 961-6100. In connection with the proposed transaction, Sterling Bancorp intends to file a registration statement on Form S-4 with the SEC which will include a joint proxy statement of Hudson Valley Holding Corp. and Sterling Bancorp and a prospectus of Sterling Bancorp, and each party will file other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, investors and security holders of Hudson Valley Holding Corp. and Sterling Bancorp are urged to carefully read the entire registration statement and joint proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents and any other relevant documents filed with the SEC, because they will contain important information about the proposed transaction. A definitive joint proxy statement/prospectus will be sent to the stockholders of each institution seeking the required stockholder approvals. Investors and security holders will be able to obtain the registration statement and the joint proxy statement/prospectus free of charge from the SEC’s website or from Sterling Bancorp or Hudson Valley Holding Corp. by writing to the addresses provided for each company set forth in the paragraphs above. Sterling Bancorp, Hudson Valley Holding Corp., their directors, executive officers and certain other persons may be deemed participants in the solicitation of proxies from Sterling Bancorp and Hudson Valley Holding Corp. stockholders in connection with the proposed transaction. Information about the directors and executive officers of Sterling Bancorp and their ownership of Sterling Bancorp common stock is set forth in the definitive proxy statement for Sterling Bancorp’s 2014 annual meeting of stockholders, as previously filed with the SEC on January 10, 2014. Information about the directors and executive officers of Hudson Valley Holding Corp. and their ownership of Hudson Valley Holding Corp. common stock is set forth in the definitive proxy statement for Hudson Valley Holding Corp.’s 2014 annual meeting of stockholders, as previously filed with the SEC on April 9, 2014. Stockholders may obtain additional information regarding the interests of such participants by reading the registration statement and the joint proxy statement/prospectus when they become available. Free copies of the registration statement and joint proxy statement/prospectus may be obtained as described in the paragraphs above. Transaction Highlights Strategic Rationale * Creates a $10B+ premier commercial banking franchise focused on the small-to-middle market business segment in the New York metropolitan area * Enhances scale - creates the #10 deposit rank among regional banks in the New York MSA * Leverage Sterling’s commercial lending expertise with Hudson Valley’s differentiated deposit products ? Diversified commercial loan origination capabilities ? Combined company has “best-in-class” deposit mix and funding cost * Strong pro forma funding and liquidity profile ? Significant excess liquidity increases lending opportunities ? Strengthens asset sensitivity position * Provides scalable presence in attractive Westchester market Financial Impact * Tangible book value dilution of ~1% earned back within 1.2 years * Accretive to 2015E EPS and ~7% accretive to 2016E EPS * IRR of ~19% * Significant value creation opportunity for shareholders via redeployment of low cost excess liquidity Transaction Overview * Fixed exchange ratio of 1.92 Sterling shares for each Hudson Valley share Consideration ??100% stock * Aggregate deal value of ~$539 million based on STL closing price of $13.99 on November 4, 2014 (1) Pro Forma ??68.5% Sterling / 31.5% Hudson Valley Ownership Bank Merger ??Hudson Valley Bank to merge into Sterling National Bank Name ??Sterling Bancorp and Sterling National Bank Principal Offices ??Potential move of principal executive offices to Westchester County will be considered Management ??Jack Kopnisky, President & CEO; Luis Massiani, CFO; engagement of combined STL and HVB executives and Board Composition ??Combined board will include 4 current Hudson Valley board members * Approval of Sterling Bancorp and Hudson Valley Holding Corp. shareholders Required Approvals * Customary regulatory approvals Targeted ??Second quarter 2015 Closing (1) Aggregate deal value includes cash out of restricted stock units and stock options outstanding at close. Combined Franchise STL HVB Pro Forma 9/30/2014 9/30/2014 ($ in MMs) Balance Sheet Assets $7,337 $3,120 $10,457 Gross Loans Including Held For Sale 4,760 1,828 6,589 Deposits 5,299 2,769 8,067 Cash and Securities 1,934 1,204 3,138 Franchise Number of Branches 32 28 60 Deposits / Branch $166 $99 $134 Balance Sheet Ratios Core Deposits / Total Deposits 90.17% 95.97% 92.16% C & I Loans / Total Loans 43.62% 17.41% 36.35% CRE Loans / Total Loans 38.18% 52.89% 42.26% Net Charge-Offs / Average Loans 0.09% 0.05% 0.08% Reserves / Gross Loans 0.85% 1.52% 1.04% Tangible Common Equity / Tangible Assets (Hold Co.) 7.63% 9.17% 7.65% Loans / Deposits 89.8% 66.0% 81.7% Core Operating Ratios Yield on Earning Assets 4.24% 3.25% 3.86% Cost of Deposits 0.19% 0.17% 0.18% Net Interest Margin 3.77% 3.12% 3.50% Fee Income Ratio 17.00% 14.55% 16.32% Efficiency Ratio 54.70% 79.44% ~50%(1) ROATA 1.06% 0.41% 1.2%+(1) ROATCE 13.81% 4.47% 14%+(1) (1) Represents long-term targets upon full realization of cost savings and deployment of excess liquidity. Strategic Extension of Deposit Footprint Regional Banks in New York MSA Rank Bank Deposits Market Share Branches M&T Bank $24,854 1.72% 176 New York Community 21,559 1.49 202 Signature Bank 19,759 1.37 27 PNC Financial 18,581 1.28 236 Banco Santander 16,838 1.16 197 Valley National Bancorp 11,356 0.78 206Investors Bancorp 10,610 0.73 101 Apple Financial 10,433 0.72 77 Astoria Financial 9,851 0.68 85 Pro Forma STL / HVB 7,802 0.54 58First Republic Bank 6,207 0.43 8 Provident Financial 5,302 0.37 82 Israel Discount Bank 5,014 0.35 4 Sterling Bancorp 4,941 0.34 30 New York Pvt. B&T 4,696 0.32 5 Ridgewood Savings 3,990 0.28 37 SNBNY Holdings Ltd. 3,743 0.26 1 Flushing Financial 3,258 0.23 18 Mizuho Financial Group 3,221 0.22 3 People's United 3,041 0.21 93 Hudson Valley 2,861 0.2 28 Source: SNL Financial. Attractive Small-to-Middle Market Business Footprint ??Significant opportunity to Source: Oxxford Information Technology. Pro Forma Loan and Deposit Composition Loan Portfolio Yield: 4.83% Yield: 4.59% Yield: 4.78% Total: $4.8B Total: $1.8B Total: $6.6B Deposit Portfolio Superior Deposit Franchise with Excess Liquidity Hudson Valley Has a Stable Base of Low Cost Deposits ($ in MMs) Loans/Deposits at 9/30/2014 = 66% Excess Liquidity at 92.5% Loans /Deposits Target = $733mm 2010 2011 2012 2013 9/30/2014 Cost of Deposits % of Core Deposits 0.53% 94% 0.36% 95% 0.24% 96% 0.19% 97% (1) 0.17% 96% (1) For the nine months ended 9/30/2014. Significant Liquidity Deployment Opportunity ($ in MMs) Proven Loan Origination Capabilities Sterling’s Diverse Product Capabilities Average Net Loan Growth (Last 4 Quarters) ADC 2% 12% Total Loans: $4.8B Yield on Loans: 4.83% Compelling Cost Savings Opportunity * Expected cost savings of $34mm upon full phase-in in 2016 * Approximately 40% of Hudson Valley’s expense base * Anticipated consolidation of 7 branches and 3 additional locations * Additional $8mm of expense savings expected due to anticipated divestiture of A.R. Schmeidler & Co. (“ARS”) investment manager and broker-dealer – Net effect of divestiture is expected to be neutral to earnings and slightly accretive to tangible book value * Includes impact of estimated $7.5mm of incremental run-rate expenses due to reaching $10bn asset size Cost Savings Details ($ in MMs)Estimated Cost Savings Approximate Amount Compensation & Benefits $23 Technology & Communications 5 Occupancy & Office Operations 3 Retirement Plans / Other Compensation 2 Professional Fees 1 Estimated Cost Savings $34 Anticipated Disposition of ARS 8 Estimated Cost Savings Including Disposition of ARS $42 Due Diligence & Credit Review * Credit risk due diligence on Hudson Valley portfolio ? Review process conducted mainly by senior credit executives of Sterling with geographic and functional area expertise (CRE, C&I, ABL, Equipment Finance) ? Portfolio review of >70% of outstanding commercial loans ? Review concluded that a 2.73% mark is appropriate * Operational due diligence on Hudson Valley ? High quality operations with effective risk management and controls ? HVB management has made a significant investment in upgrading risk management capabilities in recent years ? Validation of projected operational efficiencies upon completion of the merger Transaction Assumptions * Fixed exchange ratio of 1.92 Sterling shares for each Hudson Valley share Consideration ??100% stock * Aggregate deal value of ~$539 million based on STL closing price of $13.99 on November 4, 2014 (1) Earnings ??Sterling: 2015E - $0.96; 2016E - $1.11 (based on calendar year)(2) Estimates ??Hudson Valley: 2015E - $0.78; 2016E - $1.10 * Approximately $42mm annualized (pre-tax) including disposition of ARS Cost Savings * Phased in 75% in 2015E and 100% in 2016E * $7.5mm annual run-rate due to reaching $10bn+ asset size (includes Durbin Amendment costs) Incremental ? Costs Loss of ~$8mm of ARS revenue following disposition (earnings neutral due to reduction in operating expenses) Merger Related ??Approximately $45mm (pre-tax) Costs Purchase ??$50mm credit mark on loans (2.73% of total loans) Accounting * Other net purchase accounting adjustments of $19.4mm Adjustments Excess Liquidity ??Deployment of Hudson Valley excess liquidity to target ~90% - 95% average loans / deposits in 2016 Deployment ??Incremental yield pick-up of 2.5% Core Deposit Intangible * 1% of core deposits (excludes jumbo time deposits) amortized on SYD basis over 10-year period Anticipated ??Anticipated quarterly dividend of $0.07 per share to stay unchanged, subject to Board approval Dividend Note: Earnings estimates based on IBES median consensus estimates as of October 31, 2014. (1) Includes cash out of restricted stock units and stock options outstanding at close. (2) Sterling estimates shown on a calendar year basis; Q4 2016 estimated EPS assumes Q3 2016 median EPS consensus estimate remains constant. Pro Forma Financial Impact Transaction Accretion and Returns 2015E EPS Accretion Accretive 2016E EPS Accretion ~7% IRR ~19% Tangible Book Value Earn-back Period(1) ~1.2 years Tangible Book Value Dilution (at close) ~1% Expected Capital Position(2) Hudson Sterling Pro Forma Valley TCE / TA 7.9% 9.2% 7.9% Tier 1 Leverage Ratio 8.3% 8.9% 8.0% Tier 1 Risk-based Ratio 10.6% 14.1% 10.9% Total Risk-based Capital Ratio 11.4% 15.4% 11.4% (1) Based on tangible book value earn-back using “cross-over” method. (2) Capitalization data estimated as of June 30, 2015. Transaction Summary * Creates a $10B+ premier franchise focused on the small-to-middle market business segment in the New York metropolitan area * Enhances scale - creates the #10 deposit rank among regional banks in the New York MSA * Leverage Sterling’s commercial lending expertise with Hudson Valley’s differentiated deposit products ? Diversified commercial loan origination capabilities ? Combined company has “best-in-class” deposit mix and funding cost * Strong pro forma funding and liquidity profile ? Significant excess liquidity increases lending opportunities ? Strengthens asset sensitivity position * Provides scalable presence in attractive Westchester market * Financially attractive — accretive to earnings, attractive IRR, fast recovery of TBV dilution