Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d815462d8k.htm |

©

Fifth Third Bank | All Rights Reserved

BancAnalysts Association of Boston

Conference

Tayfun Tuzun

Executive Vice President & Chief Financial Officer

November 6, 2014

Refer to earnings release dated October 16, 2014 for further information

Exhibit 99.1 |

2

©

Fifth Third Bank | All Rights Reserved

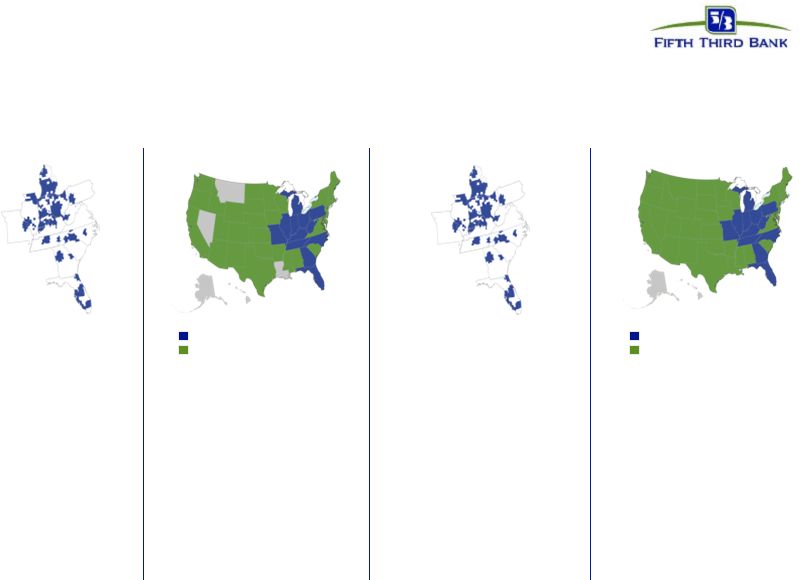

Broad scope of products and services

addressing the needs of wide array of customers

Consumer Lending

Branch Banking

Wealth Management

Wholesale Banking

Retail Bank

Cards

Home Equity

Mortgage

Auto

YTD total revenue of $398MM

YTD average loans of $2.2B

YTD average core deposits of $9.5B

$26B assets under management

$303B assets under care

YTD total revenue of $1.9B

YTD average loans of $51.2B

YTD average core deposits of $34.3B

YTD total revenue of $1.7B

YTD average loans of $16.6B

1,308 banking centers

2,639 ATMs

12 states

YTD total revenue of $470MM

YTD average loans of $20.8B

Private Bank

Retail Brokerage

Institutional Services

Commercial Bank

Footprint

Business

Lines

Highlights

In footprint markets

National consumer lending

In footprint markets

National commercial banking

Diversified financial services company with local orientation and

strong national businesses |

3

©

Fifth Third Bank | All Rights Reserved

•

Earnings per diluted share of $0.39; included impact of negative

valuation adjustment on

Vantiv warrant ($53 million pre-tax, or $0.04 per share)

•

Solid operating results driven by expense discipline and healthy

balance sheet with strong

growth potential

•

Overall good performance in credit trends; total delinquencies and nonperforming

assets remain at low levels

Third quarter 2014 earnings highlights

1

Non-GAAP measure; see Reg. G reconciliation in appendix. Capital ratios

presented under current U.S. capital regulations. The pro forma Basel III Tier 1 common equity ratio is

management’s estimate based upon its current interpretation of recent

prospective regulatory capital requirements approved in July 2013.

•

Affiliate-based commercial banking franchise leveraging specialized expertise in

national businesses

•

Redesigning retail distribution strategy and prioritizing key segments in consumer

bank •

Growing regional wealth management and brokerage services

•

Payments and Commerce Solutions division specializing in developing

commerce-enabled solutions

•

Top 3 deposit market share in 7 of 15 markets, with focus on further improving share

of wallet

•

Tier 1 common ratio of 9.6% (Basel III pro forma estimate of

~9.4%)¹ •

Tangible book value per share¹

of $13.95; up 1% sequentially and 7% year-over-year

•

Repurchased $375 million of common shares 3Q14 YTD in conjunction with 2014 CCAR

plan

—

$180MM share repurchase agreement announced in October

|

4

©

Fifth Third Bank | All Rights Reserved

Balance sheet strategy

Achieve appropriate risk-adjusted returns on lending relationships

Manage securities portfolio in a disciplined manner

Position deposit base for a competitive environment

Target long-term efficiency in liquidity management

Proactive balance sheet management based on risk appetite

|

5

©

Fifth Third Bank | All Rights Reserved

•

Loan-to-core deposit ratio better

positioned for rising rates and

liquidity rules

•

97% in 3Q 2014; 106% in 3Q

2004

•

Future growth needs to be

balanced

•

…and to remain above historical

levels

•

Utilization of short-term

borrowings no longer a prudent

permanent funding strategy

•

Stable and diverse funding base

•

Substantially lower reliance on short-

term borrowings

•

Significant available capacity for

market debt issuances and CD growth

Loans and Core Deposits ($B)

Funding profile

Core Deposits Short-term

Borrowing Long-term Borrowing Funding

Mix |

6

©

Fifth Third Bank | All Rights Reserved

Demand Interest Checking

Savings/MMDA Foreign Office

CDs < $100K (Other time) Core Deposit Growth

•

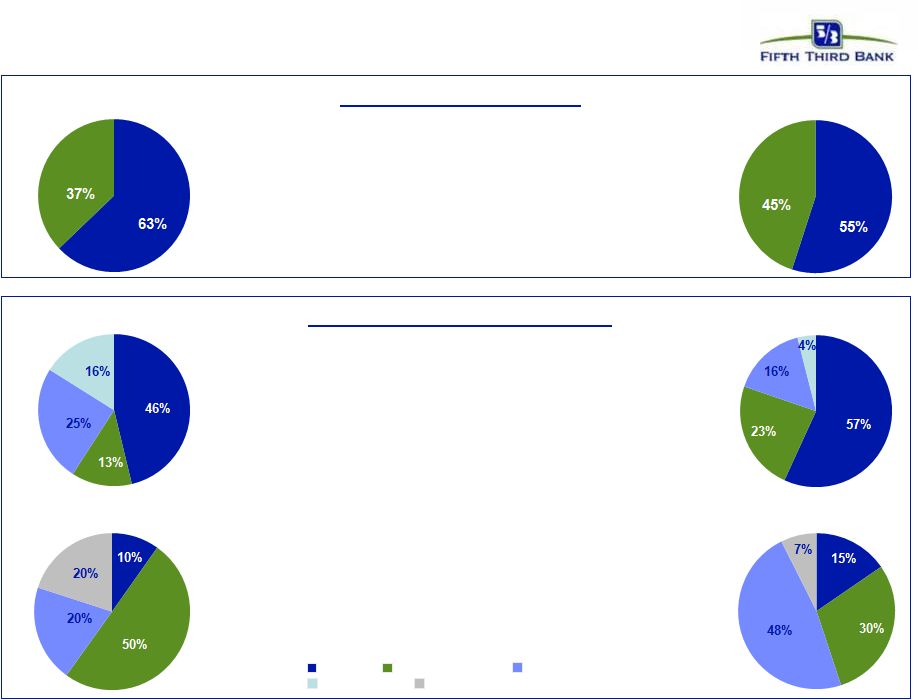

Over the last 10 years, core deposits have grown

72% from $54B to $93B

3Q04 ($54B)

3Q14 ($93B)

Core Deposit Composition

•

Commercial demand balances have increased and

are supported by low earnings credits rates

•

Growth in commercial core deposits reflects

customer acquisition and impact of additional

treasury management solutions

•

Shift in consumer core deposit balances

consistent with expectations from changes to

product offerings and recent focus on growing

money market balances

•

Contraction in CD portfolio reflects current low

interest rate environment

3Q04 Commercial ($20B)

3Q04 Consumer ($34B)

3Q14 Commercial ($42B)

3Q14 Consumer ($51B)

Commercial

Commercial

Consumer

Consumer

Strengthened deposit profile

–

$17B increase in consumer core deposits

–

$22B increase in commercial core deposits |

Long-term industry balance sheet trends

Loan-to-deposit ratios improving for the

industry since the financial crisis

–

Deposit growth is consistent with its

long-term trends

–

Loan growth exceeded nominal GDP

growth pre-crisis and has now stabilized

to match GDP growth

Fifth Third trends similar to industry,

although our recent focus on deposits

reflects steeper growth

Source: FDIC

1

All graphs indexed

7

U.S.

banks

and

Nominal

GDP

1

U.S.

Banks

and

Nominal

GDP

1

Fifth

Third

and

Nominal

GDP

1

©

Fifth Third Bank | All Rights Reserved |

Deposit composition trends

Deposit mix has been impacted by

prolonged low rates

Longer term trend of slowly

declining proportion of non-interest

bearing balances reversed in 2008

—

Future reversion to mean will

be a function of the rate

environment

Fifth Third trends have been similar

to overall industry trends:

—

Strong commercial DDA

growth partly due to growth in

Treasury Management

—

Contraction in the consumer

CD portfolio offset by growth

in non-maturity deposits

Fifth Third’s DDA modeling

assumptions are consistent with the

expectation of migration from non-

interest bearing into interest bearing

accounts

Source: FDIC

1

All graphs indexed

8

Industry Deposit Composition vs. Nominal

FITB Deposit Composition vs. Nominal

©

Fifth Third Bank | All Rights Reserved

GDP

1

GDP

1 |

Value

of retail deposits Retail deposits are the foundation of

our balance sheet funding strategy:

—

Provide more stable source of

liquidity

—

Relative price advantage

–

40% beta during the last

Fed tightening cycle while

commercial deposits had a

67% beta

—

Favorable regulatory treatment

Expectation of more intense

competition reflected in interest rate

risk modeling

—

Commercial deposit beta

assumption of 85%

—

Consumer deposit beta

assumption of 62%

CDs represent a significant source of

potential liquidity

—

2009 consumer CD balances

~35% of consumer interest-

bearing deposits vs 9% in 3Q14

—

Flexible rate risk management

tool in a rising rate environment

Source: FDIC and Federal Reserve

1

Indexed; Excludes all Maturity deposits. C/D new production assumes a 100% Beta to

the like term on the yield curve. 2

Interest-bearing deposits; Yearly-weighted average balances

Consumer

Deposit

Pricing

Sensitivity

1

9

Consumer

Deposit

Composition

2

©

Fifth Third Bank | All Rights Reserved

5.25% |

10

©

Fifth Third Bank | All Rights Reserved

Deposit offerings drive value contribution

Cross Sell Ratio

Single Service Households

Accounts Paying a Maintenance Fee

•

Broader and deeper banking relationships with Fifth

Third earn better rates and lower costs

•

Favorable execution trends contributing to stronger

revenue

•

Could see additional benefit from higher average

account balances when rates rise

Note: Retail cross sell service set includes Checking, Savings, CD, Home Equity,

Direct/Indirect Loan, Mortgage (incl EHR), Credit Card, Annuity, Brokerage, Insurance,

Early Access, Debt Protection, ID Alert, Debit Card, Access 360,

Online Bill Pay, Direct Deposit, Mobile Banking and Internet Banking. Households

with Access 360 only are not included. |

11

©

Fifth Third Bank | All Rights Reserved

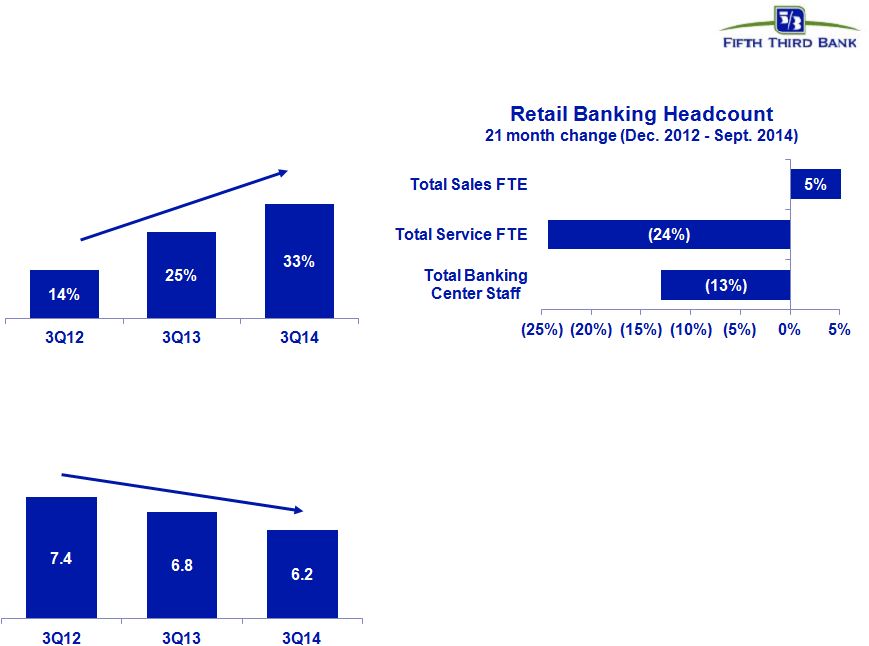

Enhancing retail bank platform

Consumer deposit activity

Transaction volume by ATM and Mobile channels

•

Remote deposit capture launched in 2012

•

All ATMs image-enabled and ~50 Smart ATMs

deployed with additional consumer-friendly

upgrades

–

Touch-screen and dual screen interface

–

Ability to split deposits into two accounts

–

Small denomination withdrawals

•

Testing technology-focused, smaller branch

formats with lower staffing requirements

•

Redefining roles of branch personnel and testing

hybrid roles

Branch transactions

Average monthly teller trans. in millions |

12

©

Fifth Third Bank | All Rights Reserved

Deposit momentum delivering franchise value

Naples

Source: FDIC, SNL Financial.

Note: Branches included are full service retail / brick and mortar; data excludes

headquarters branches with over $250 million in deposits ($500MM for Chicago CBSA).

Cincinnati affiliate

#1 market share (23% or $11.0B

of FITB footprint deposits) and

Fifth Third’s largest affiliate

market; home of Fifth Third’s

corporate headquarters

Western Michigan and Northwestern Ohio affiliates

#1 market shares (17% and 19% of FITB footprint deposits,

respectively); incl. Grand Rapids, MI and Toledo, OH

Chicago affiliate

Fifth Third’s second largest affiliate market;

6.9% increase in deposits vs. 2013

•

Deposit growth in all 15

affiliates

•

Deposit market share

growth in 13 of 15 affiliates

–

Top 3 deposit share in 7

affiliates

–

Deposit growth

outperforming market in

13 affiliates

Strong market share in mature Midwest markets;

Southeast markets remain key focus area and source of growth.

North Carolina affiliate

#4 market share in Charlotte;

8.0% increase in deposits vs.

2013

Florida region

10.3% increase in deposits vs. 2013;

one of the strongest regional growth

markets |

13

©

Fifth Third Bank | All Rights Reserved

Conclusion

Actively

managing

balance sheet

based on risk

appetite

Creating

shareholder

value with long-

term focus while

optimizing our

current

opportunities

Continuously

improving

business

platforms in

response to

changing

environment

Managing

expenses with

focus on

improved

efficiency |

14

©

Fifth Third Bank | All Rights Reserved

Cautionary statement

This report contains statements that we believe are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6

promulgated thereunder. These statements relate to our financial condition, results of operations,

plans, objectives, future performance or business. They usually can be identified by the use of

forward-looking language such as “will likely result,” “may,” “are expected to,” “is

anticipated,” “estimate,” “forecast,” “projected,” “intends

to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,”

“objective,” “continue,” “remain,” or similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or

similar verbs. You should not place undue reliance on these statements, as they are subject to risks

and uncertainties, including but not limited to the risk factors set forth in our most recent

Annual Report on Form 10-K. When considering these forward-looking statements, you should keep in

mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you

should treat these statements as speaking only as of the date they are made and based only on

information then actually known to us. There are a number of important factors that

could cause future results to differ materially from historical performance and these forward-looking

statements. Factors that might cause such a difference include, but are not limited to: (1) general

economic conditions and weakening in the economy, specifically the real estate market, either

nationally or in the states in which Fifth Third, one or more acquired entities and/or the

combined company do business, are less favorable than expected; (2) deteriorating credit quality; (3)

political developments, wars or other hostilities may disrupt or increase volatility in

securities markets or other economic conditions; (4) changes in the interest rate environment reduce

interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan

loss provisions; (6) Fifth Third’s ability to maintain required capital levels and

adequate sources of funding and liquidity; (7) maintaining capital requirements may limit Fifth Third’s

operations and potential growth; (8) changes and trends in capital markets; (9) problems encountered

by larger or similar financial institutions may adversely affect the banking industry and/or

Fifth Third; (10) competitive pressures among depository institutions increase significantly; (11) effect

of critical accounting policies and judgments; (12) changes in accounting policies or procedures as

may be required by the Financial Accounting Standards Board (FASB) or other regulatory

agencies; (13) legislative or regulatory changes or actions, or significant litigation, adversely affect

Fifth Third, one or more acquired entities and/or the combined company or the businesses in which

Fifth Third, one or more acquired entities and/or the combined company are engaged, including

the Dodd-Frank Wall Street Reform and Consumer Protection Act; (14) ability to maintain

favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16)

ability to attract and retain key personnel; (17) ability to receive dividends from its

subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth Third; (19)

effects of accounting or financial results of one or more acquired entities; (20) difficulties from

Fifth Third’s investment in, relationship with, and nature of the operations of Vantiv,

LLC; (21) loss of income from any sale or potential sale of businesses that could have an adverse effect on Fifth

Third’s earnings and future growth; (22) ability to secure confidential information and deliver

products and services through the use of computer systems and telecommunications networks; and

(23) the impact of reputational risk created by these developments on such matters as business

generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these forward-looking statements.

|

15

©

Fifth Third Bank | All Rights Reserved

Appendix |

16

©

Fifth Third Bank | All Rights Reserved

Interest rate risk management

1

Repricing

percentage

or

“beta”

is

the

estimated

change

in

yield

over

12

months

as

a

result

of

a

shock

or

ramp

100

bps

parallel

shift

in

the

yield

curve.

2

Actual results may vary from these simulated results due to timing, magnitude, and

frequency of interest rate changes, as well as changes in market conditions and management strategies.

Strategically

positioned

balance

sheet

to

limit

risk

to

downside

rate

scenarios

•

Balance sheet is well positioned for a rising rate environment

—

62% of total loans are floating rate (80% of commercial and 35% of consumer)

—

Investment portfolio duration of approximately 5 years

—

Short-term wholesale funding represents only 4% of total funding

—

$14.1B in funding will reprice beyond 1 year

•

Interest rate sensitivities are based on conservative deposit assumptions

—

Weighted-average deposit beta of 70% (2004 –

2006 cycle betas ~50%)

1

—

No modeled lag in deposit repricing

—

Modeled DDA runoff of approximately $2.5B (approximately 8%) for

each 100 bps increase in rates

—

For every $1B of incremental DDA runoff beyond what is modeled, asset sensitivity

decreases: -

15 bps in year 1 and 28 bps in year 2 in a 100 bps ramp

-

35 bps in both year 1 and year 2 in a 100 bps shock

•

Forecasted balances represent our current

expectations regarding balance sheet trends

•

Static balances assume current composition of

balance sheet remains constant

•

In ramp scenarios, rate changes occur evenly over

the first four quarters

•

In shock scenarios, rate changes are instantaneous

+100 bps

+200 bps

(2.0%)

(4.4%)

EVE at Risk

+100 bps

+200 bps

+100 bps

+200 bps

NII-Asset Sensitivity

Forecast Balances

Static Balances

Year 1

0.9%

1.7%

0.9%

1.7%

Year 2

4.0%

6.7%

4.5%

7.6%

Year 1

2.1%

4.0%

2.1%

3.8%

Year 2

4.9%

8.4%

5.5%

9.3%

2 |

17

©

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

September

June

March

December

September

2014

2014

2014

2013

2013

Income before income taxes (U.S. GAAP)

464

606

438

561

604

Add:

Provision expense (U.S. GAAP)

71

76

69

53

51

Pre-provision net revenue

535

682

507

614

655

Net income available to common shareholders (U.S. GAAP)

328

416

309

383

421

Add:

Intangible amortization, net of tax

1

1

1

1

1

Tangible net income available to common shareholders

329

417

310

384

422

Tangible net income available to common shareholders (annualized) (a)

1,305

1,673

1,257

1,523

1,674

Average Bancorp shareholders' equity (U.S. GAAP)

15,486

15,157

14,862

14,757

14,440

Less:

Average preferred stock

(1,331)

(1,119)

(1,034)

(703)

(593)

Average goodwill

(2,416)

(2,416)

(2,416)

(2,416)

(2,416)

Average intangible assets

(16)

(17)

(19)

(20)

(22)

Average tangible common equity

(b) 11,723

11,605

11,393

11,618

11,409

Total Bancorp shareholders' equity (U.S. GAAP)

15,404

15,469

14,826

14,589

14,641

Less:

Preferred stock

(1,331)

(1,331)

(1,034)

(1,034)

(593)

Goodwill

(2,416)

(2,416)

(2,416)

(2,416)

(2,416)

Intangible assets

(16)

(17)

(18)

(19)

(21)

Tangible common equity, including

unrealized gains / losses (c) 11,641

11,705

11,358

11,120

11,611

Less: Accumulated other comprehensive income

(301)

(382)

(196)

(82)

(218)

Tangible common equity, excluding unrealized gains /

losses (d) 11,340

11,323

11,162

11,038

11,393

Total assets (U.S. GAAP)

134,188

132,562

129,654

130,443

125,673

Less:

Goodwill

(2,416)

(2,416)

(2,416)

(2,416)

(2,416)

Intangible assets

(16)

(17)

(18)

(19)

(21)

Tangible assets, including

unrealized gains / losses (e) 131,756

130,129

127,220

128,008

123,236

Less: Accumulated other comprehensive income / loss, before tax

(463)

(588)

(302)

(126)

(335)

Tangible assets, excluding unrealized gains / losses

(f) 131,293

129,541

126,918

127,882

122,901

Common shares outstanding (g)

834

844

848

855

887

Ratios:

Return on average tangible common equity (a) / (b)

11.1%

14.4%

11.0%

13.1%

14.7%

Tangible common equity (excluding unrealized gains/losses) (d) / (f)

8.64%

8.74%

8.79%

8.63%

9.27%

Tangible common equity (including unrealized gains/losses) (c) / (e)

8.84%

9.00%

8.93%

8.69%

9.42%

Tangible book value per share (c) / (g)

$13.95

$13.86

$13.40

$13.00

$13.09

For the Three Months Ended |

18

©

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

September

June

March

December

September

2014

2014

2014

2013

2013

Total Bancorp shareholders' equity (U.S. GAAP)

15,404

15,469

14,826

14,589

14,641

Goodwill and certain other intangibles

(2,484)

(2,484)

(2,490)

(2,492)

(2,492)

Unrealized gains

(301)

(382)

(196)

(82)

(218)

Qualifying trust preferred securities

60

60

60

60

810

Other

(18)

(19)

(18)

19

21

Tier I capital

12,661

12,644

12,182

12,094

12,762

Less:

Preferred stock

(1,331)

(1,331)

(1,034)

(1,034)

(593)

Qualifying trust preferred securities

(60)

(60)

(60)

(60)

(810)

Qualifying noncontrolling interest in consolidated

subsidiaries (1)

(1)

(1)

(37)

(39)

Tier I common equity (a)

11,269

11,252

11,087

10,963

11,320

Risk-weighted assets, determined in accordance with

prescribed regulatory requirements (b)

116,920

117,117

116,622

115,969

113,801

Ratio:

Tier I common equity (a) / (b)

9.64%

9.61%

9.51%

9.45%

9.95%

Basel III - Estimated Tier 1 common equity ratio

September

June

March

December

September

2014

2014

2014

2013

2013

Tier 1 common equity (Basel I)

11,269

11,252

11,087

10,963

11,320

Add:

Adjustment related to capital components

99

96

99

82

88

Estimated Tier 1 common equity under final Basel III rules without AOCI (opt out)(c)

11,368

11,348

11,186

11,045

11,408

Add:

Adjustment related to AOCI

301

382

196

82

218

Estimated Tier 1 common equity under final Basel III rules with AOCI (non opt out)(d)

11,669

11,730

11,382

11,127

11,626

Estimated risk-weighted assets under final Basel III rules (e)

121,068

122,465

122,659

122,074

120,447

Estimated Tier 1 common equity ratio under final Basel III rules (opt out) (c) / (e)

9.39%

9.27%

9.12%

9.05%

9.47%

Estimated Tier 1 common equity ratio under final Basel III rules (non opt out) (d) / (e)

9.64%

9.58%

9.28%

9.12%

9.65%

(c), (d)

(e)

Under the final Basel III rules, non-advanced approach banks are permitted to make a one-time

election to opt out of the requirement to include AOCI in Tier 1 common equity. Other adjustments

include mortgage servicing rights and deferred tax assets subject to threshold limitations and

deferred tax liabilities related to intangible assets. Key differences under Basel III in the

calculation of risk-weighted assets compared to Basel I include: (1) Risk weighting for commitments under 1 year; (2) Higher risk weighting for exposures to

securitizations, past due loans, foreign banks and certain commercial real estate; (3) Higher risk

weighting for mortgage servicing rights and deferred tax assets that are under certain thresholds as

a percent of Tier 1 capital; and (4) Derivatives are differentiated between exchange clearing and

over-the-counter and the 50% risk-weight cap is removed. For the Three Months

Ended |