Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIAA FSB Holdings, Inc. | form8-kforeverbankinvestor.htm |

EVERBANK FINANCIAL CORP INVESTOR PRESENTATION November 2014

2 DISCLAIMER THIS PRESENTATION HAS BEEN PREPARED BY EVERBANK FINANCIAL CORP ("EVERBANK" OR THE “COMPANY”) SOLELY FOR INFORMATIONAL PURPOSES BASED ON ITS OWN INFORMATION, AS WELL AS INFORMATION FROM PUBLIC SOURCES. THIS PRESENTATION HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF EVERBANK AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT MAY BE RELEVANT. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF EVERBANK AND THE DATA SET FORTH IN THIS PRESENTATION AND OTHER INFORMATION PROVIDED BY OR ON BEHALF OF EVERBANK. EXCEPT AS OTHERWISE INDICATED, THIS PRESENTATION SPEAKS AS OF THE DATE HEREOF. THE DELIVERY OF THIS PRESENTATION SHALL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE WILL BE NO CHANGE IN THE AFFAIRS OF THE COMPANY AFTER THE DATE HEREOF. CERTAIN OF THE INFORMATION CONTAINED HEREIN MAY BE DERIVED FROM INFORMATION PROVIDED BY INDUSTRY SOURCES. EVERBANK BELIEVES THAT SUCH INFORMATION IS ACCURATE AND THAT THE SOURCES FROM WHICH IT HAS BEEN OBTAINED ARE RELIABLE. EVERBANK CANNOT GUARANTEE THE ACCURACY OF SUCH INFORMATION, HOWEVER, AND HAS NOT INDEPENDENTLY VERIFIED SUCH INFORMATION. THIS PRESENTATION MAY CONTAIN CERTAIN FORWARD-LOOKING STATEMENTS AS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995, AND SUCH STATEMENTS ARE INTENDED TO BE COVERED BY THE SAFE HARBOR PROVIDED BY THE SAME. WORDS SUCH AS “OUTLOOK,” “BELIEVES,” “EXPECTS,” “POTENTIAL,” “CONTINUES,” “MAY,” “WILL,” “COULD,” “SHOULD,” “SEEKS,” “APPROXIMATELY,” “PREDICTS,” “INTENDS,” “PLANS,” “ESTIMATES,” “ANTICIPATES” OR THE NEGATIVE VERSION OF THOSE WORDS OR OTHER COMPARABLE WORDS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS BUT ARE NOT THE EXCLUSIVE MEANS OF IDENTIFYING SUCH STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE NOT HISTORICAL FACTS, AND ARE BASED ON CURRENT EXPECTATIONS, ESTIMATES AND PROJECTIONS ABOUT THE COMPANY’S INDUSTRY, MANAGEMENT’S BELIEFS AND CERTAIN ASSUMPTIONS MADE BY MANAGEMENT, MANY OF WHICH, BY THEIR NATURE, ARE INHERENTLY UNCERTAIN AND BEYOND THE COMPANY’S CONTROL. ACCORDINGLY, YOU ARE CAUTIONED THAT ANY SUCH FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO CERTAIN RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT ARE DIFFICULT TO PREDICT. ALTHOUGH THE COMPANY BELIEVES THAT THE EXPECTATIONS REFLECTED IN SUCH FORWARD-LOOKING STATEMENTS ARE REASONABLE AS OF THE DATE MADE, EXPECTATIONS MAY PROVE TO HAVE BEEN MATERIALLY DIFFERENT FROM THE RESULTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. UNLESS OTHERWISE REQUIRED BY LAW, EVERBANK ALSO DISCLAIMS ANY OBLIGATION TO UPDATE ITS VIEW OF ANY SUCH RISKS OR UNCERTAINTIES OR TO ANNOUNCE PUBLICLY THE RESULT OF ANY REVISIONS TO THE FORWARD-LOOKING STATEMENTS MADE IN THIS PRESENTATION. INTERESTED PARTIES SHOULD NOT PLACE UNDUE RELIANCE ON ANY FORWARD-LOOKING STATEMENT AND SHOULD CONSIDER THE UNCERTAINTIES AND RISKS DISCUSSED UNDER THE HEADINGS “RISK FACTORS” AND “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” IN EVERBANK’S ANNUAL REPORT ON FORM 10-K, QUARTERLY REPORTS ON FORM 10-Q AND IN OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. NOVEMBER INVESTOR PRESENTATION

3 EVERBANK OVERVIEW CORPORATE OVERVIEW • Diversified financial services company headquartered in Jacksonville, FL • Nationwide deposit and lending businesses • Experienced management team • 20 consecutive years of profitability 3Q14 FINANCIAL DATA1 PRICE PERFORMANCE1 (1) Market data and price performance as of 11/3/2014. A reconciliation of non-GAAP financial measures can be found in the appendix. Consumer and Commercial Deposits Residential Lending Commercial Real Estate Lending Commercial Finance Warehouse Finance Other Credit Products SINCE IPO (5/2/2012) ONE YEAR 90% 49% EVER KBW Bank Index 29% 12% EVER KBW Bank Index Assets $20.5bn Loans & Leases $16.5bn Deposits $14.5bn Tangible Common Equity per Common Share $12.36 Stock Price $19.03 Market Cap $2.3bn Ticker (NYSE) EVER NOVEMBER INVESTOR PRESENTATION

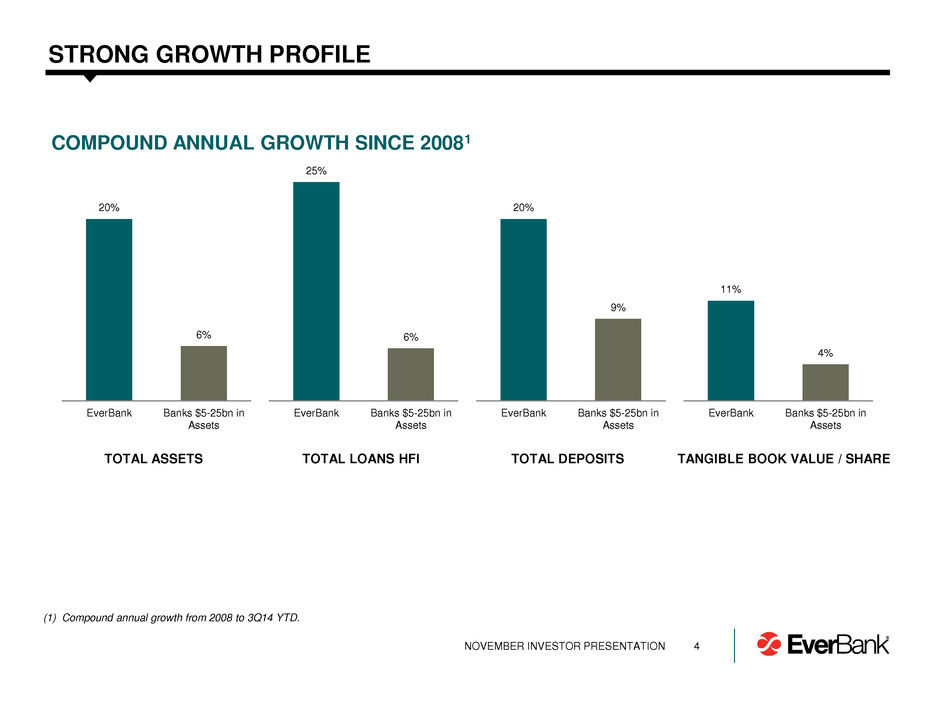

4 STRONG GROWTH PROFILE COMPOUND ANNUAL GROWTH SINCE 20081 TOTAL ASSETS TOTAL LOANS HFI TOTAL DEPOSITS TANGIBLE BOOK VALUE / SHARE (1) Compound annual growth from 2008 to 3Q14 YTD. 20% 9% EverBank Banks $5-25bn in Assets 25% 6% EverBank Banks $5-25bn in Assets 11% 4% EverBank Banks $5-25bn in Assets 20% 6% EverBank Banks $5-25bn in Assets NOVEMBER INVESTOR PRESENTATION

5 STRATEGIC EVOLUTION EverBank is well positioned to execute on core growth strategy 2008 – 2012 Addition of Diversified Asset Generation • Tygris Commercial Finance • Assumed three subsidiaries of Bank of Florida from FDIC • Business Property Lending from GE Capital • Warehouse Finance business from MetLife Bank • Initial Public Offering • Significant investments in corporate governance and infrastructure • Exited wholesale lending business • Realigned commercial lending platforms • Sold non-performing commercial loans and REO • Sold default servicing portfolio and platform • Executed asset rotation strategy • Adjusted reporting segments to align with core strategic initiatives 2013 – 2014 Optimization of Business Platforms NOVEMBER INVESTOR PRESENTATION

6 CORE GROWTH STRATEGY GENERATE ROBUST LOAN GROWTH THROUGH DIVERSIFIED NATIONWIDE CONSUMER AND COMMERCIAL LENDING PLATFORMS LEVERAGE INFRASTRUCTURE AND PLATFORM INVESTMENTS TO DRIVE OPERATING LEVERAGE AND INCREASE EFFICIENCY DEEPEN FULL SERVICE RELATIONSHIPS WITH CORE CONSUMER AND COMMERCIAL CLIENTS 3Q14 YTD Target $4.3bn $4.0 – $5.0bn 3Q14 YTD Target $486mm $650mm RETAINED ASSET GENERATION NONINTEREST EXPENSE Consumer Deposits Consumer Lending Commercial Deposits Commercial Lending CONSUMER COMMERCIAL CROSS-SELL NOVEMBER INVESTOR PRESENTATION

7 DIVERSE AND FLEXIBLE BUSINESS MODEL Residential Lending Consumer Deposits Corporate & Small Business Deposits Commercial Finance & CRE Lending Global Market & Wealth Management CONSUMER BANKING COMMERCIAL BANKING • Originate jumbo and conforming loans through nationwide retail and direct channels • Innovative deposit and investment products attract core clients • Opportunity to deepen client relationship through cross-sell initiatives • Originate CRE loans nationwide through account executives, network of mortgage bankers and other intermediaries • Originate equipment leases and loans through relationship with over 600 equipment manufacturers, distributors and dealers • Provide specialty finance solutions to small businesses • Generate warehouse lending relationships through direct channels TARGET CLIENTS DELIVERY CHANNELS NATIONWIDE NETWORK MOBILE / TABLET ONLINE CONTACT CENTER ATM NOVEMBER INVESTOR PRESENTATION

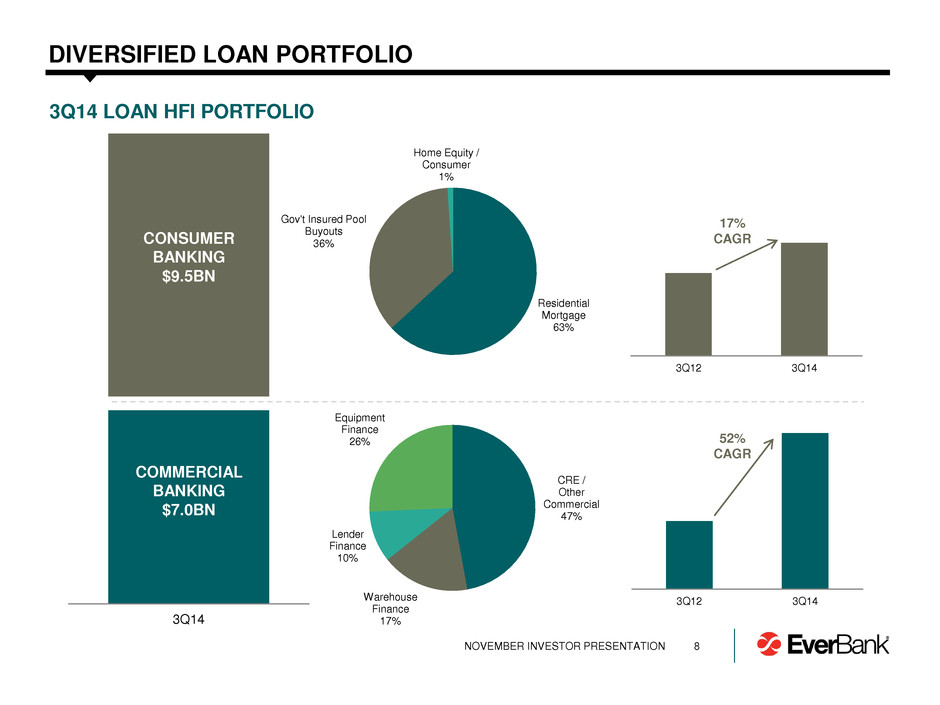

CRE / Other Commercial 47% Warehouse Finance 17% Lender Finance 10% Equipment Finance 26% 8 DIVERSIFIED LOAN PORTFOLIO 3Q14 LOAN HFI PORTFOLIO 3Q14 CONSUMER BANKING $9.5BN COMMERCIAL BANKING $7.0BN Residential Mortgage 63% Gov't Insured Pool Buyouts 36% Home Equity / Consumer 1% 3Q12 3Q14 52% CAGR 3Q12 3Q14 17% CAGR NOVEMBER INVESTOR PRESENTATION

Equipment Finance 55% Commercial Real Estate 26% Warehouse / Lender Finance 19% 9 STRONG RETAINED ORIGINATION VOLUMES 3Q14 YTD RETAINED ORIGINATIONS 3Q14 YTD RESIDENTIAL $2,573MM COMMERCIAL $1,764MM $4.3BN Jumbo 50% Conforming 50% C O N S U M E R B A N K IN G C O M M E R C IA L B A N K IN G 3Q14 YTD ORIGINATIONS BY PRODUCT 3Q14 YTD ORIGINATIONS BY BUSINESS • Retained 100% of originations • Warehouse and lender finance originations represent volume from new relationships • Originated $6.2bn of residential loans 3Q14 YTD • Retained volume consists of Jumbo originations NOVEMBER INVESTOR PRESENTATION

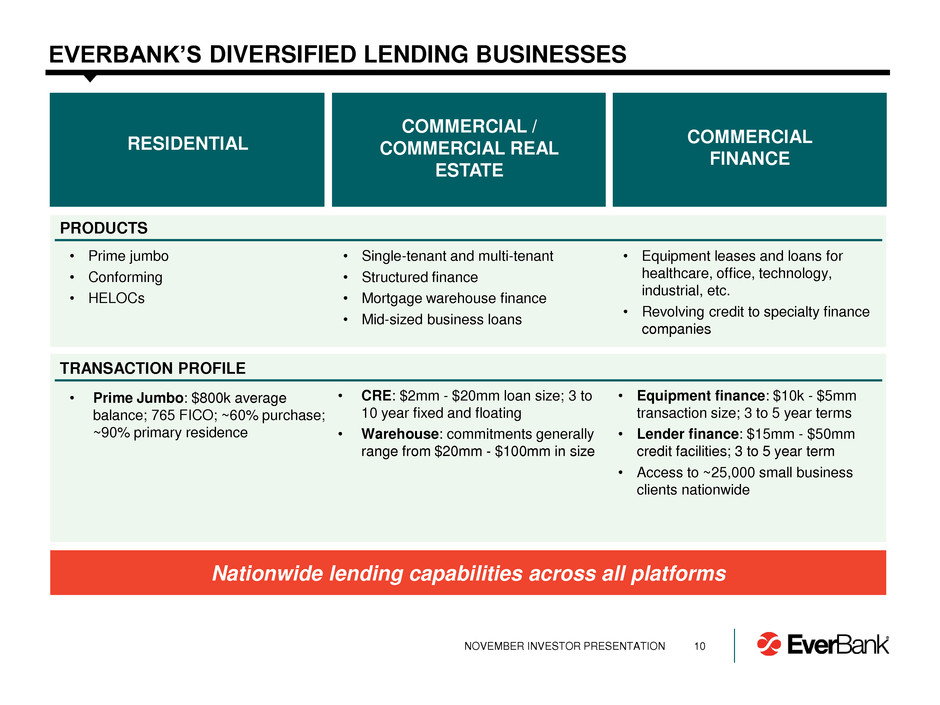

10 EVERBANK’S DIVERSIFIED LENDING BUSINESSES RESIDENTIAL COMMERCIAL / COMMERCIAL REAL ESTATE COMMERCIAL FINANCE Nationwide lending capabilities across all platforms • Prime jumbo • Conforming • HELOCs • Single-tenant and multi-tenant • Structured finance • Mortgage warehouse finance • Mid-sized business loans • Equipment leases and loans for healthcare, office, technology, industrial, etc. • Revolving credit to specialty finance companies PRODUCTS TRANSACTION PROFILE • CRE: $2mm - $20mm loan size; 3 to 10 year fixed and floating • Warehouse: commitments generally range from $20mm - $100mm in size • Equipment finance: $10k - $5mm transaction size; 3 to 5 year terms • Lender finance: $15mm - $50mm credit facilities; 3 to 5 year term • Access to ~25,000 small business clients nationwide • Prime Jumbo: $800k average balance; 765 FICO; ~60% purchase; ~90% primary residence NOVEMBER INVESTOR PRESENTATION

11 RESIDENTIAL LENDING BUSINESS OVERVIEW • Originate high quality residential loans nationwide • Retail footprint/presence targets top 50 markets nationwide with emphasis on purchase money transactions • Flexibility to generate jumbo hybrid ARM loans for bank portfolio or fixed-rate jumbo loans for capital markets execution based on product demand in the market • Jumbo volume of $3.4bn in 2013 • Jumbo volume of $3.1bn through 3Q14 YTD PREFERRED BORROWER PROFILE1 PREFERRED ORIGINATIONS2 (1) 3Q14 YTD borrower profile. (2) 3Q14 YTD originations by location. Loan Size $ 801,653 LTV 69 % FICO 764 Debt-to-income 33 % Primary residence 90 % Purchase % 62 % NOVEMBER INVESTOR PRESENTATION

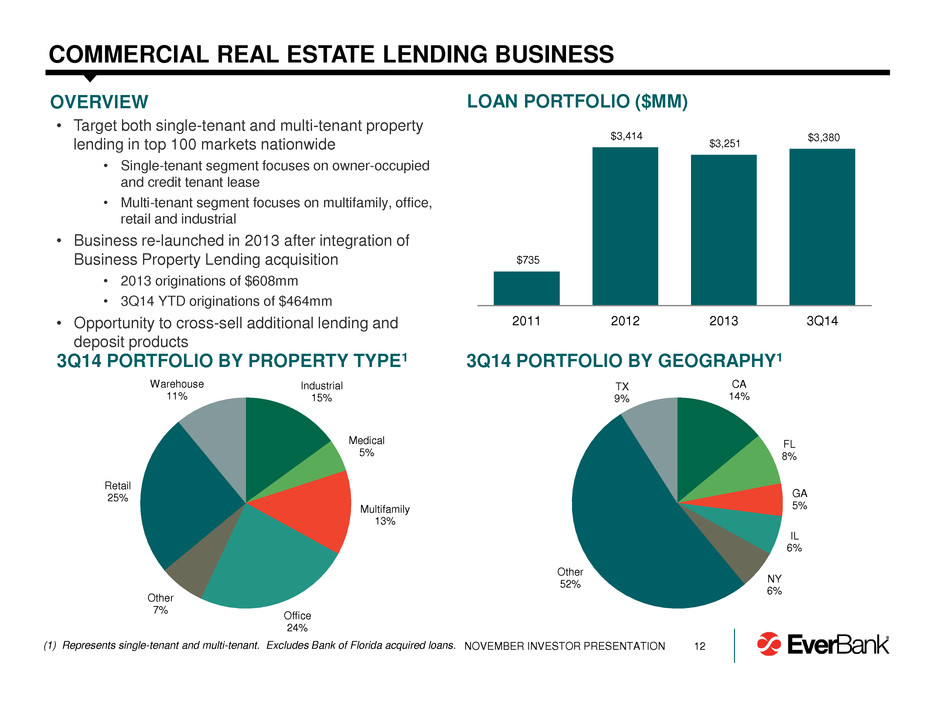

• Target both single-tenant and multi-tenant property lending in top 100 markets nationwide • Single-tenant segment focuses on owner-occupied and credit tenant lease • Multi-tenant segment focuses on multifamily, office, retail and industrial • Business re-launched in 2013 after integration of Business Property Lending acquisition • 2013 originations of $608mm • 3Q14 YTD originations of $464mm • Opportunity to cross-sell additional lending and deposit products 12 COMMERCIAL REAL ESTATE LENDING BUSINESS 3Q14 PORTFOLIO BY PROPERTY TYPE1 3Q14 PORTFOLIO BY GEOGRAPHY1 OVERVIEW Industrial 15% Medical 5% Multifamily 13% Office 24% Other 7% Retail 25% Warehouse 11% CA 14% FL 8% GA 5% IL 6% NY 6% Other 52% TX 9% LOAN PORTFOLIO ($MM) $735 $3,414 $3,251 $3,380 2011 2012 2013 3Q14 (1) Represents single-tenant and multi-tenant. Excludes Bank of Florida acquired loans. NOVEMBER INVESTOR PRESENTATION

CA 12% TX 11% FL 9% NY 7% NJ 6% Other 55% 13 COMMERCIAL FINANCE BUSINESS • Commercial finance business originates lease financing receivables in addition to lending facilities to specialty finance lenders • Robust origination volume and balance sheet growth as business repositioned post acquisition in 2010 • 2013 originations of $1.1bn • 3Q14 YTD originations of $1.1bn • Core leasing platforms include office products, healthcare, IT / telecom and industrial equipment • Opportunity to generate significant ancillary fee income and business deposits LEASE / LOAN PORTFOLIO ($MM) 3Q14 LEASE PORTFOLIO BY GEOGRAPHY OVERVIEW $589 $837 $1,238 $1,839 2011 2012 2013 3Q14 Leases Other 3Q14 LEASE PORTFOLIO BY PRODUCT Healthcare 28% Office Products 23% Industrial 24% Info Tech and Telecom 13% Other 12% $671 $1,197 $1,831 $2,517 NOVEMBER INVESTOR PRESENTATION

OVERVIEW • Direct banking platform supplemented by highly productive financial centers in Florida • Generate core, mass-affluent consumer clients nationwide who utilize transaction-oriented features such as online bill pay and direct deposit • Commercial balance growth driven by attractive value proposition • Proven ability to tailor deposit growth to current and forecasted asset growth assumptions SCALABLE DEPOSIT PLATFORM 14 NATIONWIDE CLIENT REACH 3Q14 DEPOSIT COMPOSITION 3Q14 DEPOSITS BY SEGMENT 8% 20% 6% 36% 30% Noninterest bearing demand Interest bearing demand Global markets Savings & MMA Time, excluding global markets 84% 16% Consumer deposits Commercial deposits NOVEMBER INVESTOR PRESENTATION

15 SOLID LONG TERM EARNINGS GROWTH ADJUSTED EARNINGS PER SHARE1 $0.42 $0.53 $0.63 $0.74 $0.66 $0.41 $0.78 $1.28 $1.11 $1.27 $1.11 $0.82 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 3Q14 YTD (1) Represents adjusted diluted earnings per common share from continuing operations for 2007-2013; 2003-2006 and 3Q14 YTD represents GAAP basic earnings per common share from continuing operations Calculated using adjusted net income attributable to the Company from continuing operations for 2010-2013; No material items gave rise to material adjustments prior to the year ended December 31, 2010; 2012 adjusted EPS calculation includes $4.5mm and $1.1mm cash dividends paid to Series A and Series B Preferred shareholders in Q1 and Q2, respectively; a reconciliation of non-GAAP financial measures can be found in the appendix. (2) Represents tangible common equity per share including other comprehensive loss. A reconciliation of non-GAAP financial measures can be found in the appendix. (3) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans and foreclosed property accounted for under ASC 310-30 because we expect to fully collect the carrying value of such loans and foreclosed property. A reconciliation of non-GAAP financial measures can be found in the appendix. TANGIBLE COMMON EQUITY PER SHARE2 $3.10 $3.60 $4.08 $4.81 $5.39 $6.96 $8.54 $10.65 $10.12 $10.30 $11.57 $12.36 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 3Q14 14.3% 15.4% 16.3% 16.5% 13.1% 7.4% 11.5% 14.0% 10.7% 12.4% 9.9% 9.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 3Q14 YTDEverBank Banks $5-25bn in Assets ADJUSTED RETURN ON AVERAGE EQUITY ADJUSTED NPA / TOTAL ASSETS3 0.66% 2.01% 2.73% 2.11% 1.86% 1.08% 0.65% 0.50% 2007 2008 2009 2010 2011 2012 2013 3Q14 NOVEMBER INVESTOR PRESENTATION

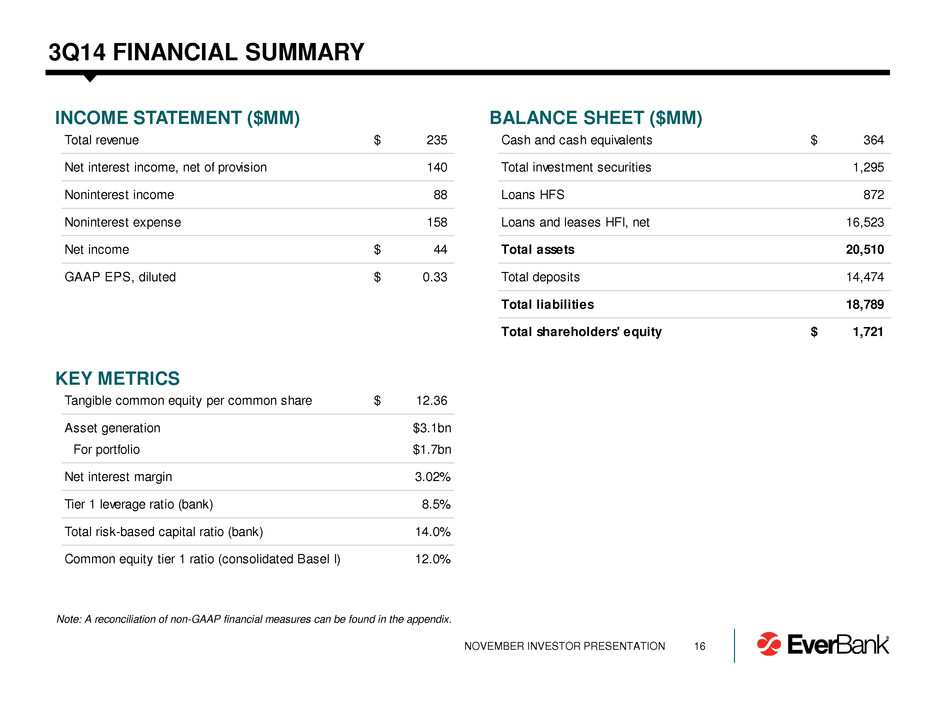

16 3Q14 FINANCIAL SUMMARY Note: A reconciliation of non-GAAP financial measures can be found in the appendix. BALANCE SHEET ($MM) INCOME STATEMENT ($MM) KEY METRICS Total revenue 235$ Net interest income, net of provision 140 Noninterest income 88 Noninterest expense 158 Net income 44$ GAAP EPS, diluted 0.33$ Tangible common equity per common share 12.36$ Asset generation $3.1bn For portfolio $1.7bn Net interest margin 3.02% Tier 1 leverage ratio (bank) 8.5% Total risk-based capital ratio (bank) 14.0% Common equity tier 1 ratio (consolidated Basel I) 12.0% Cash and cash equivalents 364$ Total investment securities 1,295 Loans HFS 872 Loans and leases HFI, net 16,523 Total assets 20,510 Total deposits 14,474 Total liabilities 18,789 Total shareholders' equity 1,721$ NOVEMBER INVESTOR PRESENTATION

17 INVESTMENT HIGHLIGHTS NATIONWIDE BANKING FRANCHISE UNIQUE, DIVERSIFIED BUSINESS MODEL ROBUST ASSET GENERATION CAPABILITIES EMBEDDED OPERATING LEVERAGE THROUGH SCALABLE PLATFORM DISCIPLINED RISK MANAGEMENT COHESIVE, LONG TENURED MANAGEMENT TEAM NOVEMBER INVESTOR PRESENTATION

APPENDIX

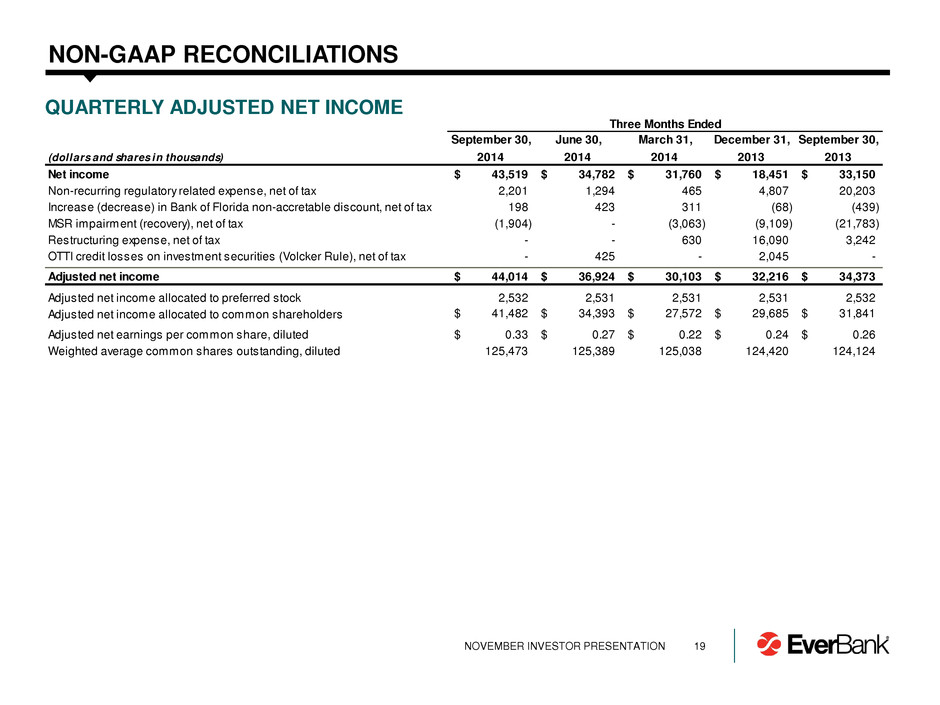

19 NON-GAAP RECONCILIATIONS QUARTERLY ADJUSTED NET INCOME September 30, June 30, March 31, December 31, September 30, (dollars and shares in thousands) 2014 2014 2014 2013 2013 Net income 43,519$ 34,782$ 31,760$ 18,451$ 33,150$ Non-recurring regulatory related expense, net of tax 2,201 1,294 465 4,807 20,203 Increase (decrease) in Bank of Florida non-accretable discount, net of tax 198 423 311 (68) (439) MSR impairment (recovery), net of tax (1,904) - (3,063) (9,109) (21,783) Restructuring expense, net of tax - - 630 16,090 3,242 OTTI credit losses on investment securities (Volcker Rule), net of tax - 425 - 2,045 - Adjusted net income 44,014$ 36,924$ 30,103$ 32,216$ 34,373$ Adjusted net income allocated to preferred stock 2,532 2,531 2,531 2,531 2,532 Adjusted net income allocated to common shareholders 41,482$ 34,393$ 27,572$ 29,685$ 31,841$ Adjusted net earnings per common share, diluted 0.33$ 0.27$ 0.22$ 0.24$ 0.26$ Weighted average common shares outstanding, diluted 125,473 125,389 125,038 124,420 124,124 Three Months Ended NOVEMBER INVESTOR PRESENTATION

20 NON-GAAP RECONCILIATIONS ANNUAL ADJUSTED NET INCOME1 (1) No material items gave rise to adjustments prior to the year ended December 31, 2010. (dollars and shares in thousands) 2013 2012 2011 2010 GAAP net income from continuing operations $ 136,740 $ 74,042 $ 52,729 $ 188,900 Bargain purchase gain on Tygris transaction, net of tax - - - (68,056) Gain on sale of investment securities due to portfolio repositioning, net of tax - - - (12,337) Gain on repuchase of trust preferred securities, net of tax - - (2,910) (3,556) Transaction expense, net of tax - 5,355 9,006 5,984 Non-recurring regulatory related expense, net of tax 48,477 17,733 7,825 - Loss on early extinguishment of acquired debt, net of tax - - - 6,411 Decrease in fair value of Tygris indemnification asset, net of tax - - 5,382 13,654 Increase in Bank of Florida non-accretable discount, net of tax (95) 3,195 3,007 3,837 Impact of change in ALLL methodology, net of tax - - 1,178 - Adoption of TDR guidance and policy change, net of tax - 3,709 6,225 - MSR impairment, net of tax (58,870) 39,375 24,462 - Tax expense (benefit) related to revaluation of ygris NUBILS, net of tax - - 691 (7,840) Restructuring cost, net of tax 19,332 - - - OTTI credit losses on investment securities (Volcker Rule), net of tax 2,045 - - - Adjusted net income 147,629$ 143,409$ 107,595$ 126,997$ Adjusted net earnings per common share, diluted 1.11$ 1.27$ 1.11$ 1.28$ Weighted average common shares outstanding, diluted 123,949 105,951 77,506 74,589 NOVEMBER INVESTOR PRESENTATION

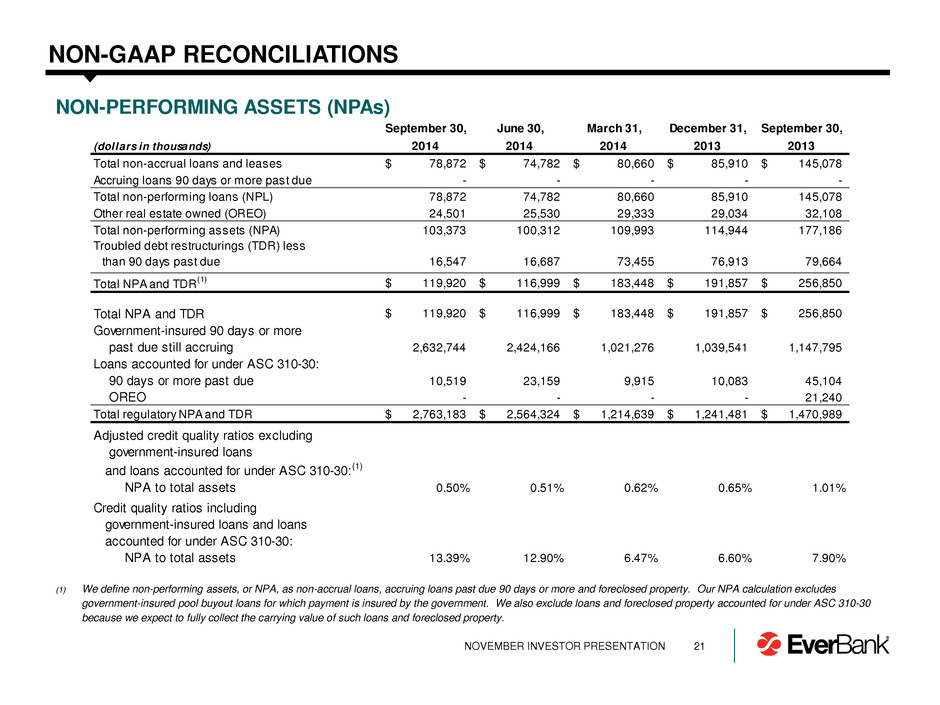

21 NON-GAAP RECONCILIATIONS NON-PERFORMING ASSETS (NPAs) (1) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans and foreclosed property accounted for under ASC 310-30 because we expect to fully collect the carrying value of such loans and foreclosed property. September 30, June 30, March 31, December 31, September 30, (dollars in thousands) 2014 2014 2014 2013 2013 Total non-accrual loans and leases 78,872$ 74,782$ 80,660$ 85,910$ 145,078$ Accruing loans 90 days or more past due - - - - - Total non-performing loans (NPL) 78,872 74,782 80,660 85,910 145,078 Other real estate owned (OREO) 24,501 25,530 29,333 29,034 32,108 Total non-performing assets (NPA) 103,373 100,312 109,993 114,944 177,186 Troubled debt restructurings (TDR) less than 90 days past due 16,547 16,687 73,455 76,913 79,664 Total NPA and TDR (1) 119,920$ 116,999$ 183,448$ 191,857$ 256,850$ Total NPA and TDR 119,920$ 116,999$ 183,448$ 191,857$ 256,850$ Government-insured 90 days or more past due still accruing 2,632,744 2,424,166 1,021,276 1,039,541 1,147,795 Loans accounted for under ASC 310-30: 90 days or more past due 10,519 23,159 9,915 10,083 45,104 OREO - - - - 21,240 Total regulatory NPA and TDR 2,763,183$ 2,564,324$ 1,214,639$ 1,241,481$ 1,470,989$ Adjusted credit quality ratios excluding government-insured loans and loans accounted for under ASC 310-30: (1) NPA to total assets 0.50% 0.51% 0.62% 0.65% 1.01% Credit quality ratios including government-insured loans and loans accounted for under ASC 310-30: NPA to total assets 13.39% 12.90% 6.47% 6.60% 7.90% NOVEMBER INVESTOR PRESENTATION

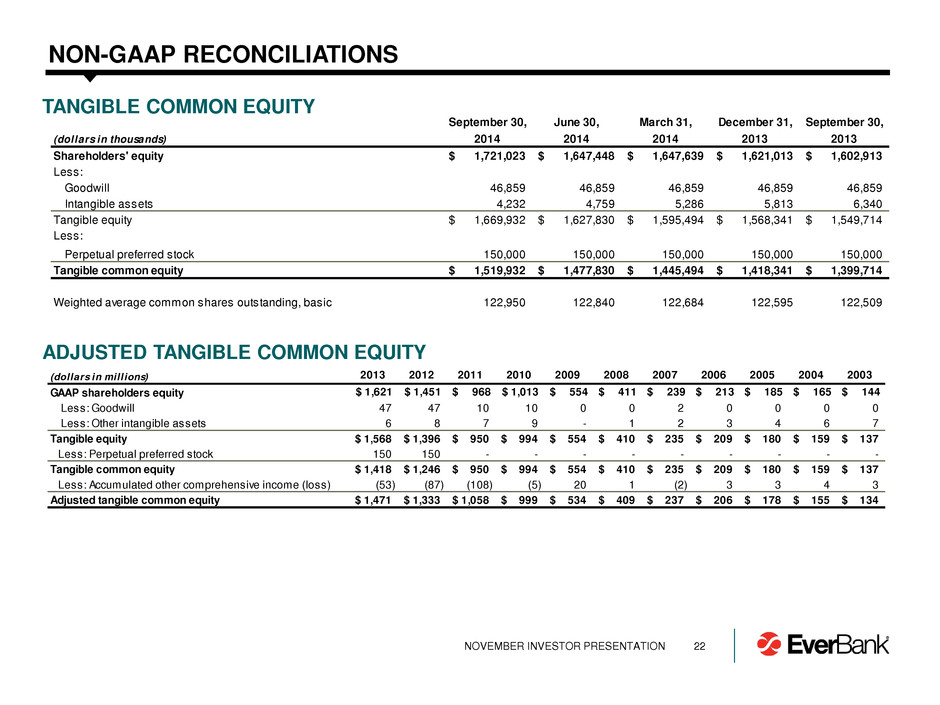

22 NON-GAAP RECONCILIATIONS ADJUSTED TANGIBLE COMMON EQUITY (dollars in millions) 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 GAAP shareholders equity $ 1,621 $ 1,451 $ 968 $ 1,013 $ 554 $ 411 $ 239 $ 213 $ 185 $ 165 $ 144 Less: Goodwill 47 47 10 10 0 0 2 0 0 0 0 Less: Other intangible assets 6 8 7 9 - 1 2 3 4 6 7 Tangible equity 1,568$ 1,396$ 950$ 994$ 554$ 410$ 235$ 209$ 180$ 159$ 137$ Less: Perpetual preferred stock 150 150 - - - - - - - - - Tangible common equity 1,418$ 1,246$ 950$ 994$ 554$ 410$ 235$ 209$ 180$ 159$ 137$ Less: Accumulated other comprehensive income (loss) (53) (87) (108) (5) 20 1 (2) 3 3 4 3 Adjusted tangible common equity 1,471$ 1,333$ 1,058$ 999$ 534$ 409$ 237$ 206$ 178$ 155$ 134$ TANGIBLE COMMON EQUITY September 30, June 30, March 31, December 31, September 30, (dollars in thousands) 2014 2014 2014 2013 2013 Shareholders' equity 1,721,023$ 1,647,448$ 1,647,639$ 1,621,013$ 1,602,913$ Less: Goodwill 46,859 46,859 46,859 46,859 46,859 Intangible assets 4,232 4,759 5,286 5,813 6,340 Tangible equity 1,669,932$ 1,627,830$ 1,595,494$ 1,568,341$ 1,549,714$ Less: Perpetual preferred stock 150,000 150,000 150,000 150,000 150,000 Tangible common equity 1,519,932$ 1,477,830$ 1,445,494$ 1,418,341$ 1,399,714$ Weighted average common shares outstanding, basic 122,950 1 2,840 122,684 22,595 122,509 NOVEMBER INVESTOR PRESENTATION

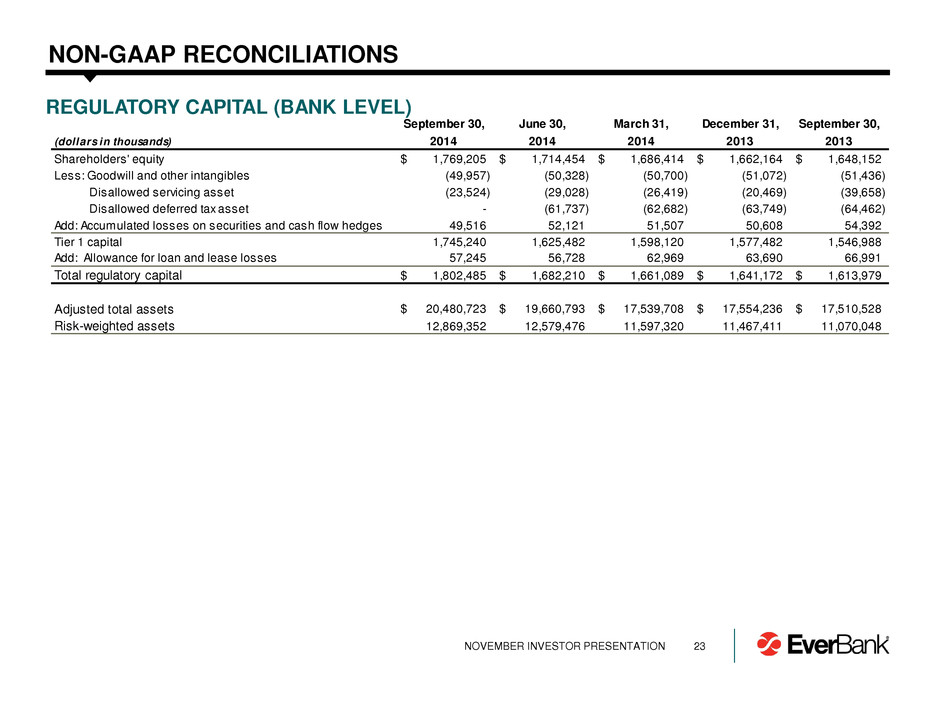

23 NON-GAAP RECONCILIATIONS REGULATORY CAPITAL (BANK LEVEL) September 30, June 30, March 31, December 31, September 30, (dollars in thousands) 2014 2014 2014 2013 2013 Shareholders' equity 1,769,205$ 1,714,454$ 1,686,414$ 1,662,164$ 1,648,152$ Less: Goodwill and other intangibles (49,957) (50,328) (50,700) (51,072) (51,436) Disallowed servicing asset (23,524) (29,028) (26,419) (20,469) (39,658) Disallowed deferred tax asset - (61,737) (62,682) (63,749) (64,462) Add: Accumulated losses on securities and cash flow hedges 49,516 52,121 51,507 50,608 54,392 Tier 1 capital 1,745,240 1,625,482 1,598,120 1,577,482 1,546,988 Add: Allowance for loan and lease losses 57,245 56,728 62,969 63,690 66,991 Total regulatory capital 1,802,485$ 1,682,210$ 1,661,089$ 1,641,172$ 1,613,979$ Adjusted total assets 20,480,723$ 19,660,793$ 17,539,708$ 17,554,236$ 17,510,528$ Risk-weighted assets 12,869,352 12,579,476 11,597,320 11,467,411 11,070,048 NOVEMBER INVESTOR PRESENTATION