Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - UIL HOLDINGS CORP | ex99_1.htm |

| 8-K - UIL HOLDINGS CORPORATION 8-K 11-4-2014 - UIL HOLDINGS CORP | form8k.htm |

3Q ‘14 Earnings PresentationNovember 5, 2014 Exhibit 99.2

Note to Investors Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future. Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and uncertainties include, but are not limited to, general economic conditions, conditions in the debt and equity markets (particularly as they affect the terms on which we can issue equity securities or incur borrowings in connection with the pending acquisition of the operating assets and certain liabilities of Philadelphia Gas Works), legislative and regulatory changes, changes in demand for electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or guidelines, the expected timing and likelihood of completion of the pending acquisition, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending acquisition that could reduce anticipated benefits or cause the parties to abandon the transaction, the allocation of personnel and resources to the pending acquisition during this time period, as well as the ability to successfully integrate the businesses, and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and services of our subsidiaries. All such factors are difficult to predict, contain uncertainties that may materially affect our actual results and are beyond our control. You should not place undue reliance on the forward-looking statements, each speaks only as of the date hereof and we undertake no obligation to revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances. New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. The foregoing and other factors are discussed and should be reviewed in our Annual Report on Form 10-K for the year ended December 31, 2013, as amended, and other subsequent filings with the Securities and Exchange Commission. 2 Visit our website at www.UIL.com James TorgersonPresident and Chief Executive OfficerRichard NicholasExecutive Vice President and Chief Financial Officer

3Q & YTD ‘14 Earnings Summary Consolidated net income of $12.5M, or $0.22 per diluted share, for the 3Q ’14, compared to $5.1M, or $0.10 per diluted share, for the 3Q ‘13Consolidated net income was $77.3M, or $1.35 per diluted share, YTD ’14, compared to $74.9M, or $1.46 per diluted share, for the same period in ‘13 Consolidated earnings for the 3Q & YTD ’14 and ‘13 reflect non-recurring after-tax expenses, including:Acquisition-related expenses recorded in 2014 associated with the proposed acquisition of PGWReserves recorded in 2014 and 2013 related to the transmission ROE proceedings pending at the FERCElectric Distribution rate case disallowances recorded in 2013Excluding the non-recurring expenses, adjusted consolidated net income for 3Q ’14 was $16.6M, or $0.30 per diluted share, compared to $17.1M, or $0.34 per diluted share, in 3Q ’13YTD ’14 consolidated net income, excluding the non-recurring expenses, was $93.3M, or $1.63 per diluted share, compared to $86.9M, or $1.70 per diluted share, YTD ‘13 3

Strategic Initiatives Growth – through investment in electric and gas infrastructures Growth – through addition of new natural gas heating customers – extension of mainsSupported by CT state legislationPursuing investment opportunities in Renewable Generation, LNG and other projectsConstruction on Renewables project is expected to begin in late ’14PGW acquisition 4

PGW Acquisition Update Reports by independent consultant, Concentric, are complete and have been publicly released On October 27th, City Council announced it would not endorse the sale of PGW to UILOn October 28th, we responded that we would make a determination whether to exercise our right to terminate the agreement and make a determination on future actions within two weeksUIL has had the right to terminate the agreement since July 16thIf the ordinance is not approved by the City Council by December 31, 2014, the asset purchase agreement will automatically terminate 5

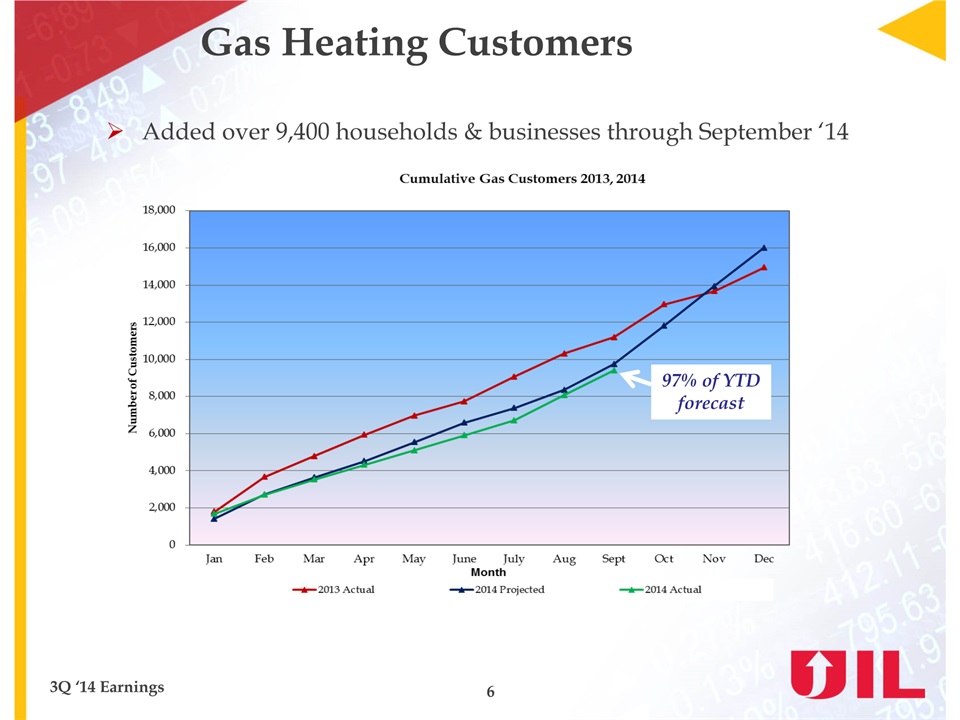

Gas Heating Customers Added over 9,400 households & businesses through September ‘14 6 97% of YTD forecast

Gas Heating Customer Additions Comprehensive Energy Strategy (CES) & Berkshire Plan’10–’13 UIL Actuals ’14 UIL Target ‘15–’23 CES & Berkshire Projections 7

Transmission ROE Proceeding Initial Complaint – Commission issued order 10/16/14 10.57% base ROE applicable to refund period Oct ’11 – Dec ’1210.57% base ROE 10/16/14 and forward (subject to Second and Third Complaints)11.74% cap on total company transmission ROERehearing requests related to initial complaint pendingSecond Complaint filed 12/27/12 – refund period Jan '13 - Mar '14 FERC settlement procedures terminatedNo evidentiary record yet establishedHearings to begin in June ’15Initial decision expected by end of Oct ’15Third Complaint filed 7/31/14 Requests refund period Aug '14 – Oct '15 Requests determination that financial markets have changed, and ROE should be reducedTOs requested consolidating with Second Complaint 8 Challenge to Transmission (T) Base ROE: “206” complaints filed at the FERC claiming that current approved base ROE of 11.14% on T investments is not just and reasonable UI recorded a reserve of $3.2M, after-tax, in 3Q ’14, in addition to the $1.5M, after-tax, reserve recorded in 3Q ‘13

Regulatory Update Gas Distribution Rate Case – CNGFinal decision issued on 1/22/14 ordered a private letter ruling (PLR) request on 338 (h)(10) issue CT OCC filed an appeal of PURA’s rate case decision, including the PLRAt PURA’s request, CNG and CT OCC entered into settlement discussions, which are ongoingCT’s Comprehensive Energy Strategy -- Regulatory SettlementSettlement agreement filed with PURA on 10/23/14A portion of non-firm margin credits will be used to offset CIACCustomer aggregation methodology defined by proposing a two-mile radius to group customers into potential gas expansion projectsStreamlines certain reporting requirementsGeneration Service Charge – UIDraft decision* issued on 10/2/14 - disallowed partial recovery of certain expenses, primarily carrying charges, relating to the period from ’04-’13Written exceptions have been filedOral arguments scheduled for 11/5/14 9 * If draft decision were adopted without change as final, a pre-tax write-off of approx. $3.1M would be recorded in 4Q ‘14

3Q & YTD ‘14 Financial Results by Segment 10

11 3Q & YTD ‘14 Financial Results - Details Electric distribution & Other3Q & YTD ’13 earnings reflect after-tax rate case disallowances of $10.5M, or $0.21 per diluted shareExcluding these disallowance3Q increase primarily due to start of second year of rate increaseYTD decrease was primarily due to increased uncollectible expense of $1.4MAverage D ROE as of 9/30/14: 9.51% (excl. ‘13 regulatory reconsideration adjustment)Note: Average D ROE as of 9/30/14: 10.92% (incl. ‘13 regulatory reconsideration adjustment)

12 3Q & YTD ‘14 Financial Results - Details Electric transmissionEarnings reflect after-tax reserves recorded regarding the transmission ROE proceedings pending at the FERC -- $3.2M, or $0.06 per diluted share, for 3Q & YTD ’14 and $1.5M, or $0.03 per diluted share,for 3Q & YTD ’13Excluding these reserves Net income was flat quarter over quarter and year over yearOverall actual weighted-average T ROE as of 9/30/14: 12.1% (excl. reserve recorded in ’14 )Note: Average T ROE as of 9/30/14: 11.73% (incl. reserve recorded in ’14)

Gas distributionIncreased loss primarily due to increased uncollectible expense of $0.4MYTD increase primarily due to colder weather, increased customer growth and increased normalized usage per customer, partially offset by increased uncollectible expense of $1.6M3Q & YTD ‘14 weighted average heating degree days compared to normal & same periods in ‘13 13 3Q & YTD ‘14 Financial Results - Details

14 3Q & YTD ‘14 Financial Results - Details Gas distribution - cont.Impact of weather, normalized usage per customer and customer growth – 3Q & YTD ‘14 compared to the same periods in ’13Preliminary avg. ROEs* as of 9/30/14: SCG 9.21-9.41%, CNG 10.17-10.37%Preliminary avg. weather normalized ROEs* as of 9/30/14: SCG 8.21-8.41%, CNG 9.65-9.85% * Including impact of 338(h)(10)

15 3Q & YTD ‘14 Financial Results - Details CorporateCorporate costs include after-tax acquisition-related expenses of $0.9M, or $0.02 per diluted share and $12.8M, or $0.22 per diluted share, for the 3Q & YTD ’14, respectivelyExcluding these acquisition-related expenses Increase in costs primarily due to a partial reversal of an interim tax benefit recognized in 1Q ’14, which adjusted tax expense to the projected, annualized consolidated income tax rateDecrease in costs was primarily due to an increase in the return on shared capital assets of $1.1M

Revised 2014 Earnings Guidance 16

Questions