Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UMB FINANCIAL CORP | d812432d8k.htm |

| EX-99.1 - EX-99.1 - UMB FINANCIAL CORP | d812432dex991.htm |

Quality endures.

Third Quarter 2014

UMB Financial

Exhibit 99.2 |

Cautionary Notice about Forward-Looking Statements

2

This presentation contains, and our other communications may contain,

forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements can be identified by the

fact that they do not relate strictly to historical or current facts. All forward-looking

statements

are

subject

to

assumptions,

risks,

and

uncertainties,

which

may

change

over

time

and

many

of

which

are

beyond

our

control.

You

should

not

rely

on

any

forward-looking

statement

as

a

prediction or guarantee about the future. Our actual future objectives, strategies,

plans, prospects, performance, condition, or results may differ materially

from those set forth in any forward-looking statement. Some of the

factors that may cause actual results or other future events, circumstances, or

aspirations to differ from those in forward-looking statements are described in

our Annual Report on Form

10-K

for

the

year

ended

December

31,

2013,

our

subsequent

Quarterly

Reports

on

Form

10-Q

or Current Reports on Form 8-K, or other applicable documents that are filed or

furnished with the Securities and Exchange Commission (SEC). Any

forward-looking statement made by us or on our behalf speaks only as of

the date that it was made. We do not undertake to update any forward-

looking statement to reflect the impact of events, circumstances, or results that

arise after the date that the statement was made. You, however, should

consult further disclosures (including disclosures of a forward-looking

nature) that we may make in any subsequent Quarterly Report on Form 10-Q, Current

Report on Form 8-K, or other applicable document that is filed or furnished

with the SEC. |

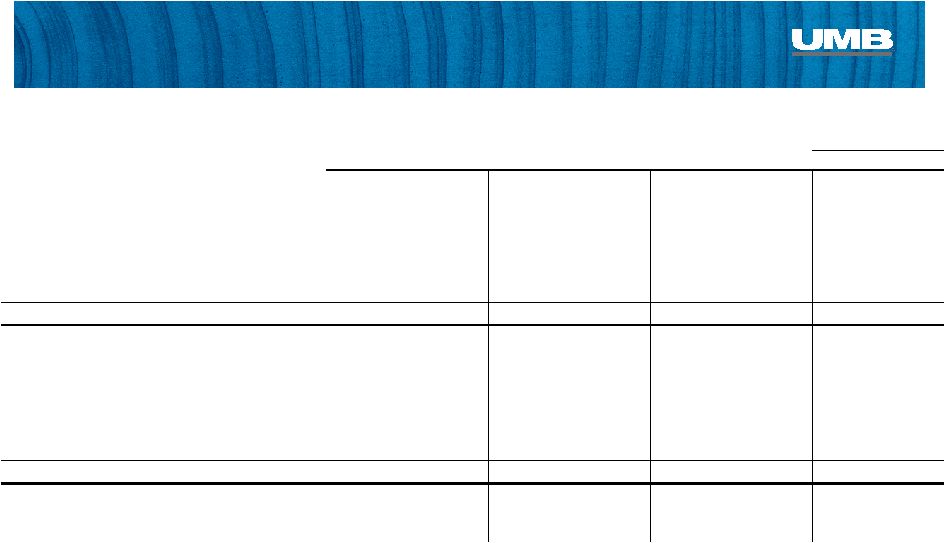

Earnings Summary

$ in thousands, except per-share data; unaudited

3

3Q14

3Q13

2Q14

vs. 3Q13

vs. 2Q14

Net Interest Income

87,526

$

85,545

$

86,170

$

2.3

1.6

Noninterest Income

126,475

121,625

134,001

4.0

(5.6)

Total Revenue

214,001

207,170

220,171

3.3

(2.8)

Noninterest Expense

161,461

153,063

166,511

5.5

(3.0)

Operating Income

52,540

54,107

53,660

(2.9)

(2.1)

Provision for loan losses

4,500

6,500

5,000

(30.8)

(10.0)

Income before Taxes

48,040

47,607

48,660

0.9

(1.3)

Income Tax Expense

12,410

13,175

13,988

(5.8)

(11.3)

Net Income

35,630

$

34,432

$

34,672

$

3.5

2.8

Diluted EPS

0.78

$

0.83

$

0.76

$

(6.0)

2.6

Dividends per share

0.225

0.215

0.225

4.7

0.0

WASO

44,890,309

40,698,700

44,823,370

10.3

0.1

% variance |

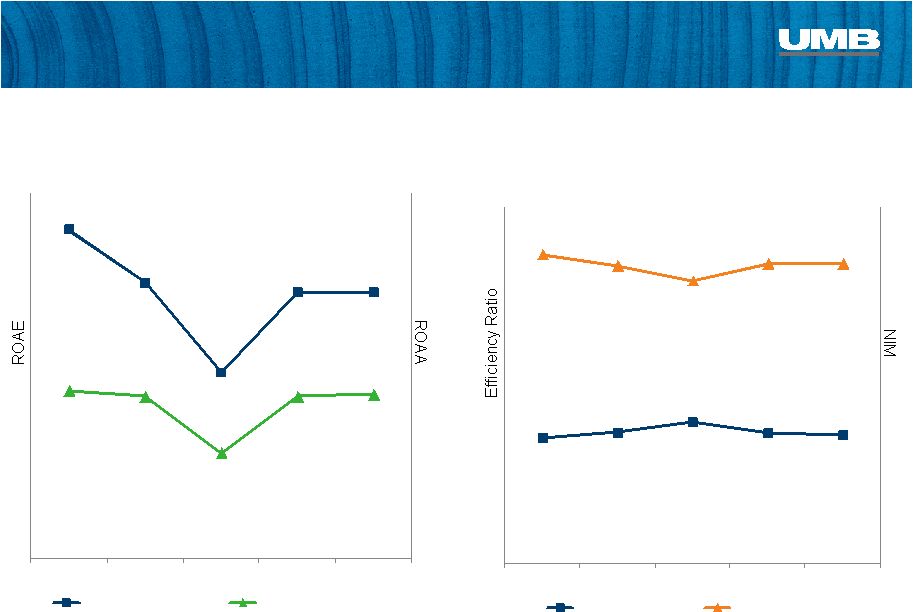

70.77%

73.64%

79.67%

73.32%

72.25%

2.61%

2.51%

2.39%

2.53%

2.53%

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Efficiency Ratio

Net Interest Margin

10.84%

9.08%

6.13%

8.77%

8.77%

0.92%

0.89%

0.58%

0.89%

0.90%

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Return on Avg Equity

Return on Avg Assets

Performance Metrics

ROAE/ROAA

Efficiency Ratio/NIM

4 |

Select Balance Sheet Items

5

$ in thousands, average balances; unaudited

vs. 3Q'13

vs. 2Q'14

Avg. Balance

Avg. Balance

Avg. Balance

Assets

Loans, net of unearned interest

6,996,363

$

3.50

6,418,368

$

3.65

6,897,840

$

3.51

9.0

1.4

Total securities

6,992,618

1.92

6,985,343

1.99

6,940,448

1.97

0.1

0.8

Total earning assets

14,575,849

2.62

13,855,913

2.71

14,526,859

2.63

5.2

0.3

Allowance for loan losses

(77,347)

(72,792)

(75,929)

6.3

1.9

Total assets

15,638,322

$

14,923,769

$

15,618,192

$

4.8

0.1

Liabilities and Shareholders' Equity

Interest-bearing deposits

7,444,093

$

0.16

7,117,927

$

0.17

7,126,614

$

0.17

4.6

4.5

Total interest-bearing liabilities

8,797,486

0.15

8,886,697

0.16

8,725,371

0.17

(1.0)

0.8

Noninterest-bearing demand deposits

5,060,662

4,669,742

5,152,980

8.4

(1.8)

Shareholders' Equity

1,612,470

1,260,330

1,585,612

27.9

1.7

Total liabilities and shareholders' equity

15,638,322

$

14,923,769

$

15,618,192

$

4.8

0.1

Net interest spread

2.47

2.55

2.46

Net interest margin

2.53

2.61

2.53

% variance

3Q'14

3Q'13

2Q'14

Avg Yield

/ Rate %

Avg Yield

/ Rate %

Avg Yield

/ Rate % |

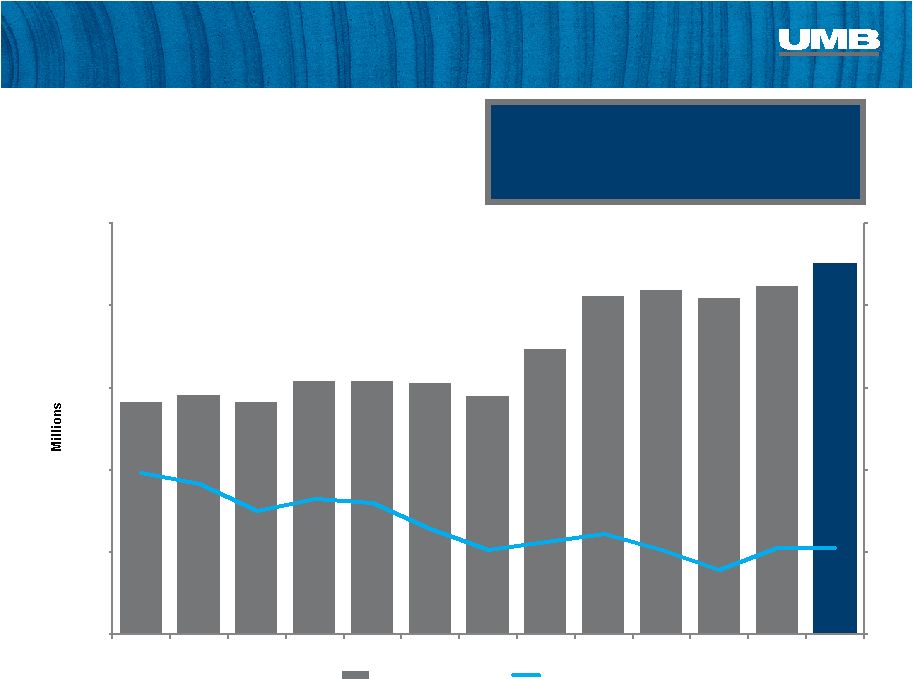

Consistent Loan Growth

5 Year

CAGR

9.9%

6

Average Net Loans & Loan Yields

$4.6

$4.8

$5.3

$6.4

$7.0

4.92%

3.50%

3.0%

3.5%

4.0%

4.5%

5.0%

5.5%

6.0%

6.5%

7.0%

Average Net Loans

Average Loan Yield |

Credit Quality Metrics

Net Charge-Offs

$ thousands

Nonperforming Loans

$ thousands

7

$3,209

$4,187

$3,737

$3,713

$3,985

0.20%

0.26%

0.23%

0.22%

0.23%

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Net Charge-offs

NCOs/Avg Loans

$31,260

$30,706

$30,153

$27,175

$32,662

0.48%

0.47%

0.45%

0.39%

0.46%

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Nonperforming Loans

NPLs/Loans |

Net

Interest Income 8

+2.3%

Net Interest Income 3Q’14 vs. 3Q’13

•

Increased loan balances

$79.1

$79.5

$79.1

$80.4

$80.4

$80.2

$79.5

$82.3

$85.5

$85.9

$85.4

$86.2

$87.5

2.98%

2.91%

2.75%

2.82%

2.80%

2.64%

2.51%

2.56%

2.61%

2.51%

2.39%

2.53%

2.53%

$65.0

$70.0

$75.0

$80.0

$85.0

$90.0

3Q'11

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

1Q'13

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Net Interest Income

NIM% |

58.6%

17.1%

13.5%

3.0%

2.6%

2.5%

2.0%

0.7%

0.02%

Bankcard Fees

Noninterest Income Highlights

5 Year

CAGR

17.8%

Trust & Securities Processing Composition:

Equity Earnings/Alternatives

Trading & Investment Banking

Other

Deposit Service Charges

Trust & Securities Processing

Brokerage Fees

Gains on Sale of Securities

($ millions)

Insurance Fees

9

Source of income:

3Q'14

3Q'13

Institutional Investment Mgmt.

$33.7

$32.9

Asset Servicing

$22.6

$20.3

Bank (inst. & personal asset mgmt.

$17.7

$15.2

$74.1

$68.5

$32.6

$39.8

$51.9

$56.3

$68.5

$74.1

Trust & Securities Processing Revenue |

Non-Int

Expense

5yr

CAGR

7.0%

0%

20%

40%

60%

80%

100%

$40

$60

$80

$100

$120

$140

$160

$180

Salary/Benefit Expense

Noninterest Income

Total Noninterest Expense

Coverage Ratio*

Noninterest Expense

Noninterest expense increased 5.5% to $161.5 million vs. 3Q’13

•

Salary and benefit expense increased $6.3 million or 7.5% compared to

3Q’13 •

Expense

for

contingent

consideration

liabilities

on

acquisitions

was

$2.2

million

in

3Q’14

compared

to

$1.1

million a year ago

Salary

5yr

CAGR

8.4%

Non-Int

Income

5yr

CAGR

9.5%

Managed FTE Costs; Growing Noninterest Income

10

* Noninterest Income/Noninterest Expense

Demonstrating Operating

Leverage |

Average Balance, AFS:

$6.7 billion

Average Yield:

1.86%

Investment Mix

Securities Available for Sale,

At September 30, 2014

Agencies

High Quality Investment Portfolio

11

CDs & Corporates

Municipals

Mortgage-Backed Securities

Treasuries

AFS Portfolio Statistics

46.8%

29.1%

14.6%

2.0%

7.5%

Securities Gains

$ in thousands

3Q13

1,140

$

4Q13

(10)

$

1Q14

1,470

$

2Q14

2,569

$

3Q14

26

$

Roll off

Purchased

($ millions)

Yield

($ millions)

Yield

4Q'13

$308

2.04%

$355

0.64%

1Q'14

$528

1.53%

$618

1.26%

2Q'14

$275

2.23%

$560

1.35%

3Q'14

$244

1.98%

$311

1.45%

Scheduled Cash Flow

4Q'14

$272

2.08%

Next 12 months

$1,071

1.98%

Duration/Life

(in months)

at 09/30/14

at 06/30/14

Avg. Life Total

45.15

46.93

Duration Total

40.20

42.55 |

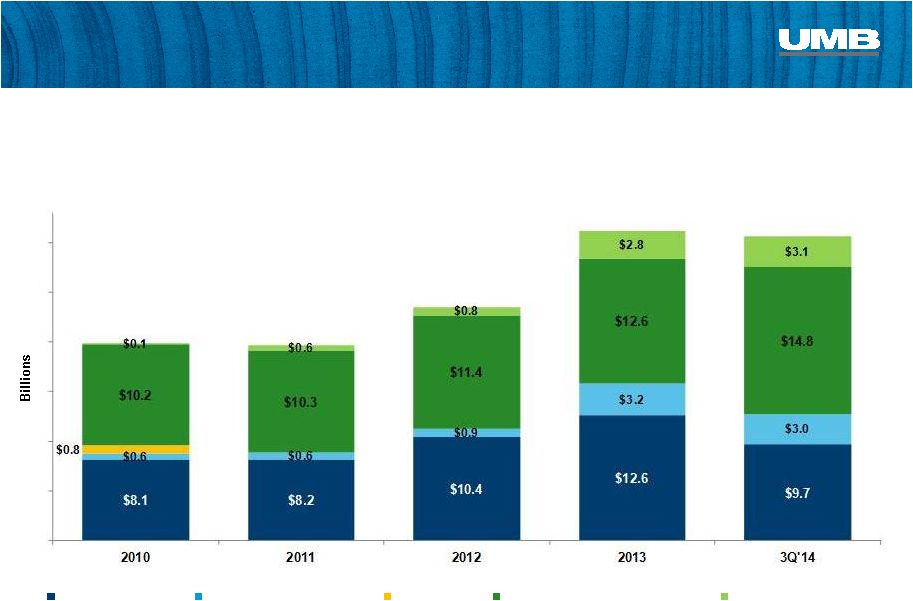

Deposit Growth

Deposits & % of Free Funds

$ billions

3Q’14

Cost of Funds 0.15%

Including DDA 0.09%

12

$9.4

$13.0

$10.6

$12.8

38.5%

41.6%

43.2%

42.9%

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

Interest Bearing

Non-Interest Bearing |

12.45

12.20

11.92

14.43

14.51

11.30

11.20

11.05

13.61

13.72

6.56

6.71

6.81

8.41

8.90

2010

2011

2012

2013

3Q14

Total Risk-Based Capital

Tier 1 Capital

Tier 1 Leverage

Strong Capital Position

Tier 1 Capital Ratio vs. Industry

3Q 2014

13

Average Equity

($ billions)

5 yr

CAGR

9.8%

Capital Ratio Trends

Industry Median as of 2Q14; Source: SNL Financial |

Business Segment Updates |

$8.3

$9.5

$10.4

$11.8

$12.5

32.7%

37.1%

40.4%

39.6%

40.5%

3Q'10

3Q'11

3Q'12

3Q'13

3Q'14

Interest Bearing

Non-Interest Bearing

$4.6

$4.8

$5.3

$6.4

$7.0

3Q'10

3Q'11

3Q'12

3Q'13

3Q'14

Bank

15

Average Net Loans

$ in billions

5 yr

CAGR

9.9%

5 yr

CAGR

10.9%

Average Deposits

$ in billions

Net loans grew for the 18 consecutive

quarter, increasing by 9.2% year-over-

year to $7.1 billion

Private Wealth managed AUM increased

13.5% totaling $7.6 billion in 3Q’14

compared to 3Q’13

Private Banking average loans increased

26.7% to $386.7 million vs. 3Q’13

3 Quarter 2014 Highlights

rd

th

Bank Operating Results

$ in 000s, unaudited

3 mos Ended

June 30,

Y/Y

LQ

2014

2013

2014

Net interest income

72,906

$

73,419

$

72,481

$

-0.7%

0.6%

Provision for loan losses

2,446

1,833

2,686

33.4%

-8.9%

Noninterest income

48,385

48,945

56,006

-1.1%

-13.6%

Noninterest expense

99,307

93,150

100,928

6.6%

-1.6%

NI before taxes

19,538

27,381

24,873

-28.6%

-21.4%

Income tax expense

5,081

6,922

7,211

-26.6%

-29.5%

Net income

14,457

$

20,459

$

17,662

$

-29.3%

-18.1%

pre-tax profit margin

16.1%

22.4%

19.4%

3 mos Ended

% Change

September 30, |

Bank -

Lending

16

Diverse Loan Book

(Actual Loan Balances at September 30)

46.6%

53.8%

28.2%

25.4%

10.7%

$5.4B

$7.1B

8.9%

8.9%

$6.5B

6.1%

4.0%

4.5%

1.6%

$4.8B

1.3%

3Q'11

3Q'12

3Q'13

3Q'14

Commercial & Industrial*

Commercial Real Estate

Home Equity

Credit Card

Consumer Real Estate

Consumer -

Other

*includes C&I, real estate construction and leases

|

Bank -

Deposits

Diverse Sources of Deposits

(Average Deposits for Three Months Ended September 30)

17

31.4%

32.5%

35.3%

25.1%

6.1%

7.8%

7.3%

6.9%

8.3%

6.3%

3.1%

6.5%

4.6%

3.4%

9.8%

4.8%

$9.5B

$10.4B

$11.8B

$12.5B

0.5%

0.3%

3Q'11

3Q'12

3Q'13

3Q'14

Commercial/Treasury Mgmt

Consumer Banking

Asset Servicing

Private Wealth Mgmt

Institutional Asset Mgmt

Healthcare Svcs

Small Business Banking

Inst. Banking & Investor Services

Other |

Bank –

Commercial Banking

High Growth Regions

3Q’14 vs. 3Q’13

Commercial Loans By Region

Loan Balances

$ in billions, Average C&I and CRE Loan Balances for Three Months Ended

September 30 5 yr

CAGR

11.1%

18

48.0%

45.9%

44.1%

42.3%

42.2%

0%

50%

100%

3Q'10

3Q'11

3Q'12

3Q'13

3Q'14

KC

CO

STL

Greater MO

KS

OK

AZ

NE

TX

$3.57

$3.79

$4.23

$5.28

$5.75

3Q'10

3Q'11

3Q'12

3Q'13

3Q'14

•

Texas

+649.8%

•

Arizona

+37.4%

•

Kansas

+10.4% |

Bank –

Private Wealth Mgmt. & Consumer Banking

19

$473

$512

$564

$573

$629

$470

$524

$604

$652

$733

50.1%

49.4%

48.3%

46.8%

46.2%

3Q '10

3Q '11

3Q '12

3Q '13

3Q '14

Balances

Unused Commitments

Utilization

Home Equity Lines of Credit

$ in millions

$0.94B

$1.04B

$1.17B

$1.23B

$1.36B

$5,366

$6,390

$7,044

$7,376

$7,565

$7,562

$2,035

$2,219

$2,853

$3,195

$3,326

$3,515

$188

$226

$351

$364

$393

$394

2011

2012

2013

1Q'14

2Q'14

3Q'14

Private Wealth & Institutional Asset Mgmt

Prairie Capital Management

Brokerage Assets

Assets Under Management

$ in millions

$8.8B

$10.2B

$10.9B

$11.3B

$11.5B

$7.6B |

$29.3

$31.2

$32.2

$32.4

$30.6

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Institutional Investment Management

20

Total Scout Assets Under Management

$ in billions

AUM increased 4.5% to $30.6

billion compared to 3Q’13

Extended employment

agreements with key principals of

Reams and look forward to

continued growth with one of the

industry’s most respected fixed

income teams

3 Quarter 2014 Highlights

rd

Institutional Investment Management Operating Results

$ in 000s, unaudited

3 mos Ended

June 30,

Y/Y

LQ

2014

2013

2014

Net Interest income

-

$

(11)

$

(1)

$

100.0%

100.0%

Noninterest income

33,919

33,842

33,999

0.2%

-0.2%

Noninterest expense

20,910

21,054

22,111

-0.7%

-5.4%

NI before taxes

13,009

12,777

11,887

1.8%

9.4%

Income tax expense

3,350

3,506

3,375

-4.4%

-0.7%

Net income

9,659

$

9,271

$

8,512

$

4.2%

13.5%

pre-tax profit margin

38.4%

37.8%

35.0%

September 30,

% Change

3 mos Ended |

AUM

Drivers $ in millions

$230.7

$996.1

Total Change

($millions)

$32,394.3

$32,163.5

Total AUM

($millions)

Institutional Investment Management

21

$2,994.8

$29,308.9

$1,858.5

$31,167.4

($1,767.0)

$30,627.3 |

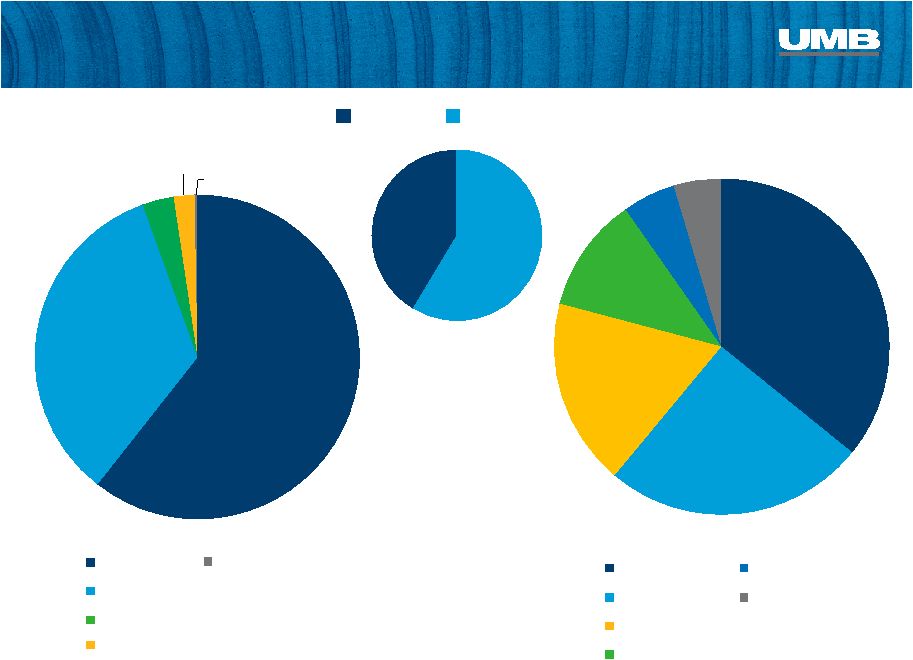

Total AUM

$30.6B

$19.9B

$19.7B

Institutional Investment Management

22

$23.5B

$31.2B

Equity Mutual Funds

Equity Institutional & Other

Money Market

Fixed Income Institutional & Other

Fixed Income Mutual Funds |

35.9%

25.2%

18.1%

11.1%

5.1%

4.6%

AUM by Strategy –

As of 3Q’14

Equity Strategies

International

Mid Cap

International ADR

Emerging Markets

Global

Small Cap

Other:

23

Fixed Income Strategies

Core Plus

Low Duration

Long Duration

Core

Intermediate

Unconstrained

Unconstrained UCITS

Real Return

Equity

Fixed Income

59%

41%

60.6%

33.9%

3.2%

2.0%

0.3%

Other:

Large Cap

Equity Opportunity

Global Aggregate |

$1.06

$1.08

$1.31

$1.36

$1.29

$1.26

$1.58

$1.48

$1.37

$1.38

$1.79

$1.72

$1.64

$1.63

$2.10

$2.18

$2.11

$14.3

$16.3

$15.4

$16.4

$18.6

Purchase Volume ($ billions)

Interchange ($ millions)

Payment Solutions

Total Card Purchase Volume

& Interchange Revenue

24

Durbin

effective

Credit and debit card purchase

volume increased 28.5% vs.

3Q’13 to $2.11 billion

HSA deposits and assets grew by

nearly 40% vs. 3Q’13 to $892.6

million

Healthcare payer-to-provider

purchase volume surpassed $1

billion YTD during the 3 quarter

3 Quarter 2014 Highlights

rd

rd

Payment Solutions Operating Results

$ in 000s, unaudited

3 mos Ended

June 30,

Y/Y

LQ

2014

2013

2014

Net interest income

13,442

$

11,587

$

12,390

$

16.0%

8.5%

Provision for loan losses

2,054

4,667

2,314

-56.0%

-11.2%

Noninterest income

21,579

18,409

21,219

17.2%

1.7%

Noninterest expense

22,056

21,658

24,603

1.8%

-10.4%

NI before taxes

10,911

3,671

6,692

197.2%

63.0%

Income tax expense

2,795

1,283

1,910

117.8%

46.3%

Net income

8,116

$

2,388

$

4,782

$

239.9%

69.7%

pre-tax profit margin

31.2%

12.2%

19.9%

% Change

September 30,

3 mos Ended |

Payment Solutions

25

Healthcare Purchase Volume Trends

$millions

* Interchange revenue from Healthcare cards divided by purchase volume on

Healthcare cards 6.8%

8.9%

16.9%

23.4%

22.7%

32.5%

37.7%

$261.5

$252.3

$512.2

$461.2

$393.8

$350.0

$682.2

$536.4

$448.0

$421.4

$881.3

$748.6

$680.2

$649.1

$1,150.0

$1,152.1

$1,082.9

0.44%

0.38%

0.39%

0.34%

0.31%

0.20%

0.25%

0.30%

0.35%

0.40%

0.45%

Payer-to-Provider Volume

Other Healthcare Volume

Effective Interchange Rate * |

$84.2

$125.1

$169.8

$255.2

$298.5

$399.6

$595.0

$824.8

$16.7

$15.4

$20.9

$24.7

$24.9

$30.9

$47.4

$67.8

2005

2006

2007

2008

2009

2010

2011

2012

2013

3Q '14

HSA Deposits

HSA Assets

Payment Solutions

26

Healthcare Deposits and Assets

$millions

$36.6M

$65.8M

$100.8M

$140.5M

$190.7M

$279.9M

$323.3M

$430.5M

$642.4M

$892.6M

Healthcare

provided

6.5% of Total

Avg. Deposits

in 3Q’14 |

Asset Servicing

27

Assets Under Administration

$billions

Investment Managers Series Trust

assets increased 6.6% in 3Q’14 and

>50% YTD

46 new fund accounting & administration

clients have been added during the past

12 months, increasing AUA in that

business by 22.6%

3 Quarter 2014 Highlights

rd

Asset Servicing Operating Results

$ in 000s, unaudited

3 mos Ended

June 30,

Y/Y

LQ

2014

2013

2014

Net interest income

1,178

$

550

$

1,300

$

114.2%

-9.4%

Noninterest income

22,592

20,429

22,777

10.6%

-0.8%

Noninterest expense

19,188

17,201

18,869

11.6%

1.7%

NI before taxes

4,582

3,778

5,208

21.3%

-12.0%

Income tax expense

1,184

1,464

1,492

-19.1%

-20.6%

Net income

3,398

$

2,314

$

3,716

$

46.8%

-8.6%

pre-tax profit margin

19.3%

18.0%

21.6%

% Change

September 30,

3 mos Ended |

Asset Servicing

Fund Accounting & Administration

Alternative Asset Servicing

Custody

Transfer Agency

28

$35.9

$44.1

$48.4

$52.1

$58.2

$63.0

$66.8

$71.4

$71.4

160

179

181

182

196

219

229

238

242

2011

2012

1Q'13

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Assets Under Administration

# of Funds Serviced

$24.7

$26.3

$27.9

$28.3

$29.3

$27.9

$27.1

$31.3

$31.0

467

532

543

549

551

514

512

592

583

2011

2012

1Q'13

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Assets Under Administration

# of Funds Serviced

802.4

946.8

1,058.7

1,213.8

1,208.0

1,280.1

1,122.6

1,195.8

1,037.0

256

270

275

284

303

301

313

318

327

2011

2012

1Q'13

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

# of Shareholders

# of Funds Serviced

$115.6

$54.9

$58.5

$56.2

$62.9

$68.0

$65.6

$70.5

$61.8

499

443

432

400

416

411

432

438

443

2011

2012

1Q'13

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

3Q'14

Assets Under Administration

# of Custody Accounts |

Building a company

for the next 100 years.

UMB Financial

Third Quarter 2014 |