Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SunCoke Energy, Inc. | d808855d8k.htm |

| EX-99.1 - EX-99.1 - SunCoke Energy, Inc. | d808855dex991.htm |

| EX-99.3 - EX-99.3 - SunCoke Energy, Inc. | d808855dex993.htm |

Exhibit 99.2

|

|

SunCoke Energy, Inc.

Q3 2014 Earnings

Conference Call

October 24, 2014

|

|

Forward-Looking Statements

This slide presentation should be reviewed in conjunction with the Third Quarter 2014 earnings release of SunCoke Energy, Inc. (SXC) and the conference call held on October 24, 2014 at 11:30 a.m. ET.

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SXC or SunCoke Energy Partners, L.P. (SXCP), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words

“believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures.

Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

|

|

Q3 2014 Highlights

SXC Q3 2014 Earnings Call

Operating Highlights

Delivered solid Coke performance across fleet

Achieved best Domestic Coke Adjusted EBITDA per ton since SXC IPO of $67/ton

Indiana Harbor within targeted production range

Benefited from full quarter of Coal Logistics vs. Q3 ‘13

Maintained strong safety performance

Coal Mining Divestiture

Negotiating with prospective buyers; anticipate transaction by year-end

Reflected as Discontinued Operations

Recorded additional pre-tax $16.4M impairment charge

In addition, expect $10M—$15M of exit costs in Q4

Capital Allocation

Initiated first quarterly dividend of $0.0585 per share

Completed $75M Accelerated Share Repurchase Program

(“ASR”) in October

$75M remaining under $150M board authorization

2

|

|

Basis of Presentation

Continuing Operations focus of presentation

Adjusted EBITDA from Continuing Operations excludes Discontinued Operations and Legacy Costs

Prior period comparisons also adjusted to reflect reporting changes

For a definition and reconciliation of Net Income to Adjusted EBITDA from Continuing and Discontinued Operations, please see appendix

Coal business reclassified as Discontinued Operations

Depreciation, depletion and amortization no longer recorded

Corporate costs no longer allocated (~$8M annually)

Certain coal-related assets and liabilities not expected to be part of potential sale moved to Corporate/Other and identified as Legacy Costs

Coal Pension/OPEB, Coal Workers’ Comp., Black Lung and Prep. Plant

4

|

|

Q3 2014 Earnings Overview

(1)

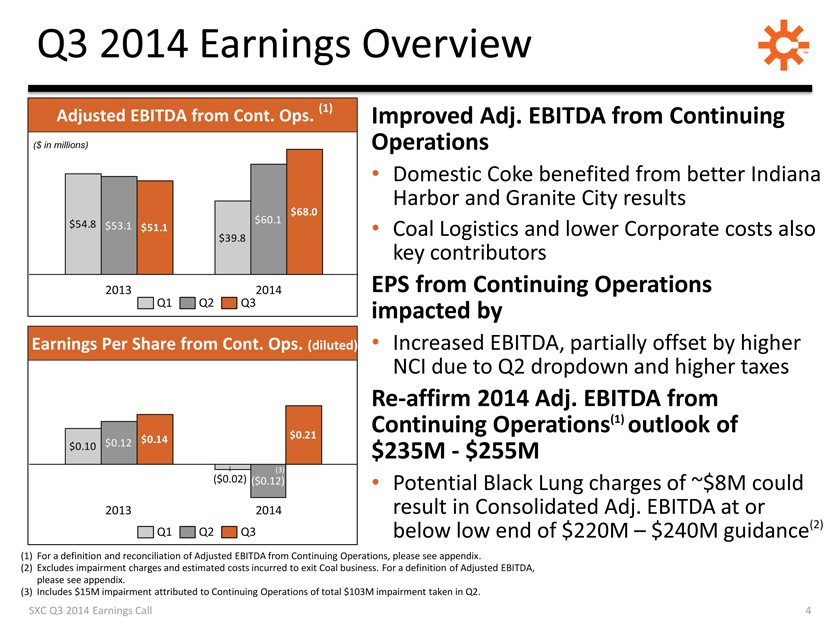

Adjusted EBITDA from Cont. Ops.

($ in millions)

$68.0 $60.1 $54.8 $53.1 $51.1 $39.8

2013 2014 Q1 Q2 Q3

Earnings Per Share from Cont. Ops. (diluted)

$0.21

$0.12 $0.14

$0.10

(3)

($0.02) ($0.12)

2013 2014 Q1 Q2 Q3

Improved Adj. EBITDA from Continuing Operations

Domestic Coke benefited from better Indiana Harbor and Granite City results

Coal Logistics and lower Corporate costs also key contributors

EPS from Continuing Operations impacted by

Increased EBITDA, partially offset by higher NCI due to Q2 dropdown and higher taxes

Re-affirm 2014 Adj. EBITDA from Continuing Operations(1) outlook of $235M—$255M

Potential Black Lung charges of ~$8M could result in Consolidated Adj. EBITDA at or below low end of $220M – $240M guidance(2)

(1) For a definition and reconciliation of Adjusted EBITDA from Continuing Operations, please see appendix.

(2) Excludes impairment charges and estimated costs incurred to exit Coal business. For a definition of Adjusted EBITDA, please see appendix.

(3) Includes $15M impairment attributed to Continuing Operations of total $103M impairment taken in Q2.

SXC Q3 2014 Earnings Call

5

|

|

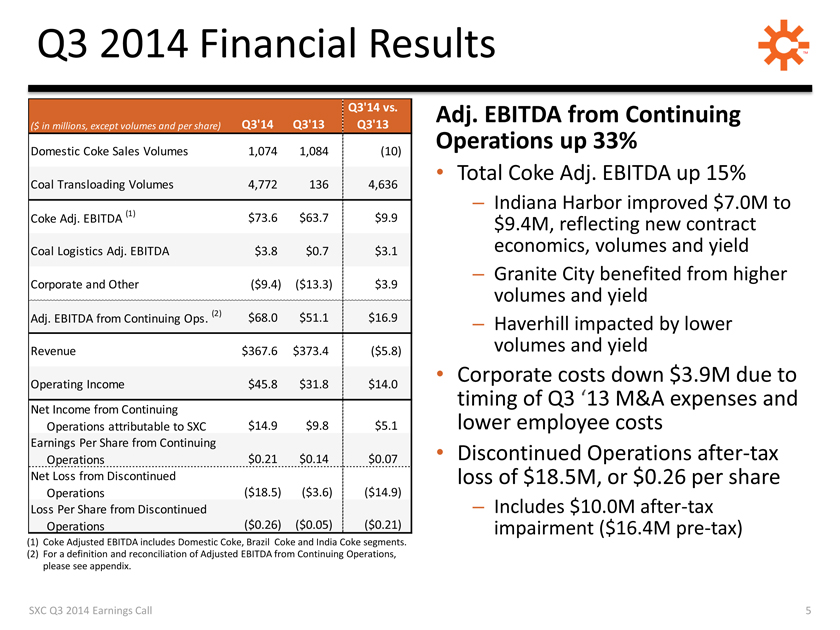

Q3 2014 Financial Results

Q3’14 vs.

($ in millions, except volumes and per share) Q3’14 Q3’13 Q3’13

Domestic Coke Sales Volumes 1,074 1,084 (10)

Coal Transloading Volumes 4,772 136 4,636

(1) $73.6 $63.7 $9.9 Coke Adj. EBITDA

Coal Logistics Adj. EBITDA $3.8 $0.7 $3.1

Corporate and Other ($9.4) ($13.3) $3.9

(2) $68.0 $51.1 $16.9 Adj. EBITDA from Continuing Ops.

Revenue $367.6 $373.4 ($5.8)

Operating Income $45.8 $31.8 $14.0

Net Income from Continuing

Operations attributable to SXC $14.9 $9.8 $5.1 Earnings Per Share from Continuing Operations $0.21 $0.14 $0.07 Net Loss from Discontinued Operations ($18.5) ($3.6) ($14.9) Loss Per Share from Discontinued Operations ($0.26) ($0.05) ($0.21)

(1) Coke Adjusted EBITDA includes Domestic Coke, Brazil Coke and India Coke segments. (2) For a definition and reconciliation of Adjusted EBITDA from Continuing Operations, please see appendix.

Adj. EBITDA from Continuing Operations up 33%

Total Coke Adj. EBITDA up 15%

– Indiana Harbor improved $7.0M to $9.4M, reflecting new contract economics, volumes and yield

– Granite City benefited from higher volumes and yield

– Haverhill impacted by lower volumes and yield

Corporate costs down $3.9M due to timing of Q3 ‘13 M&A expenses and lower employee costs

Discontinued Operations after-tax loss of $18.5M, or $0.26 per share

– Includes $10.0M after-tax impairment ($16.4M pre-tax)

|

|

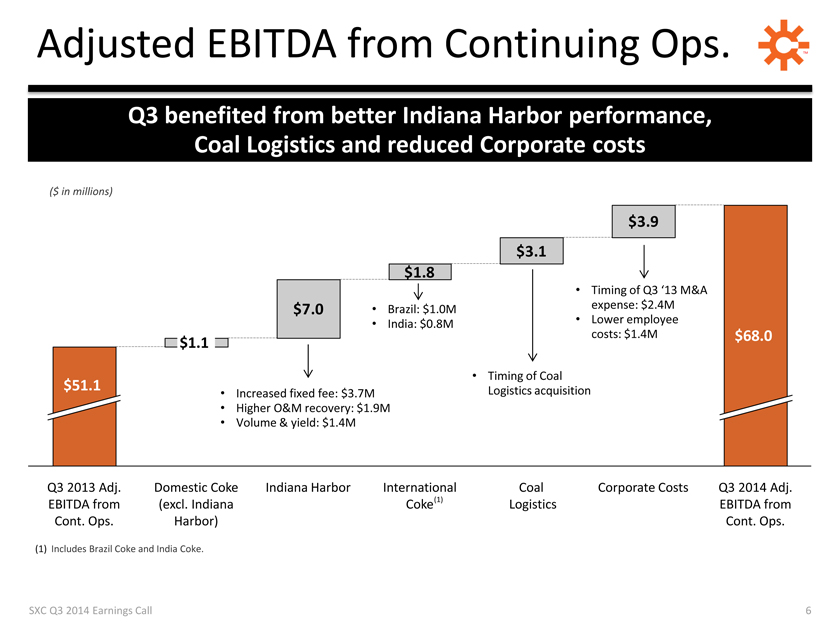

Adjusted EBITDA from Continuing Ops.

Q3 benefited from better Indiana Harbor performance, Coal Logistics and reduced Corporate costs

($ in millions)

$3.9

$3.1 $1.8

Timing of Q3 ‘13 M&A $7.0 Brazil: $1.0M expense: $2.4M

India: $0.8M Lower employee costs: $1.4M $68.0

$1.1

Timing of Coal $51.1 Logistics acquisition

Increased fixed fee: $3.7M

Higher O&M recovery: $1.9M

Volume & yield: $1.4M

Q3 2013 Adj. Domestic Coke Indiana Harbor International Coal Corporate Costs Q3 2014 Adj. EBITDA from (excl. Indiana Coke (1) Logistics EBITDA from Cont. Ops. Harbor) Cont. Ops.

(1) Includes Brazil Coke and India Coke.

SXC Q3 2014 Earnings Call

|

|

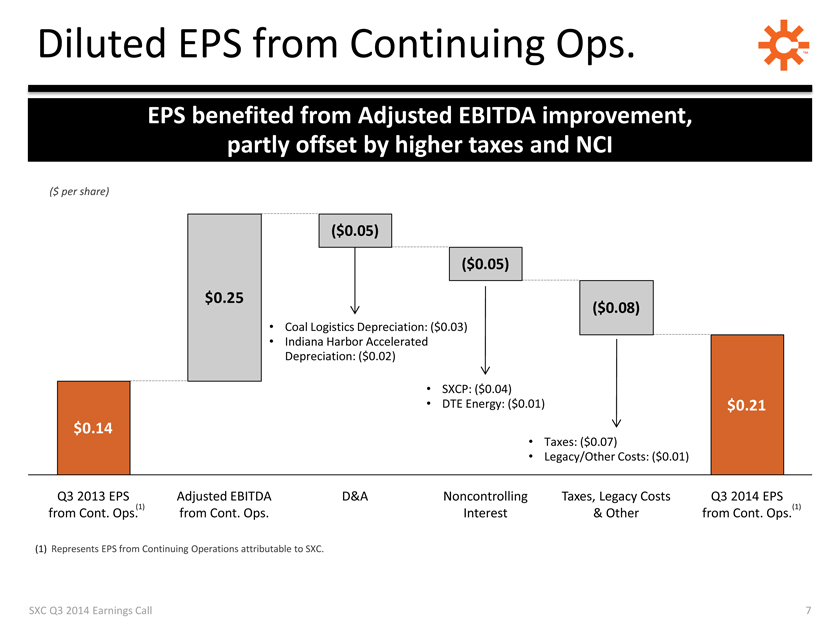

Diluted EPS from Continuing Ops. TM

EPS benefited from Adjusted EBITDA improvement, partly offset by higher taxes and NCI

($ per share)

($0.05)

($0.05)

$0.25

($0.08)

Coal Logistics Depreciation: ($0.03)

Indiana Harbor Accelerated Depreciation: ($0.02)

SXCP: ($0.04)

DTE Energy: ($0.01) $0.21

$0.14

Taxes: ($0.07)

Legacy/Other Costs: ($0.01)

Q3 2013 EPS Adjusted EBITDA D&A Noncontrolling Taxes, Legacy Costs Q3 2014 EPS

(1) (1)

from Cont. Ops. from Cont. Ops. Interest & Other from Cont. Ops.

(1) Represents EPS from Continuing Operations attributable to SXC.

SXC Q3 2014 Earnings Call

|

|

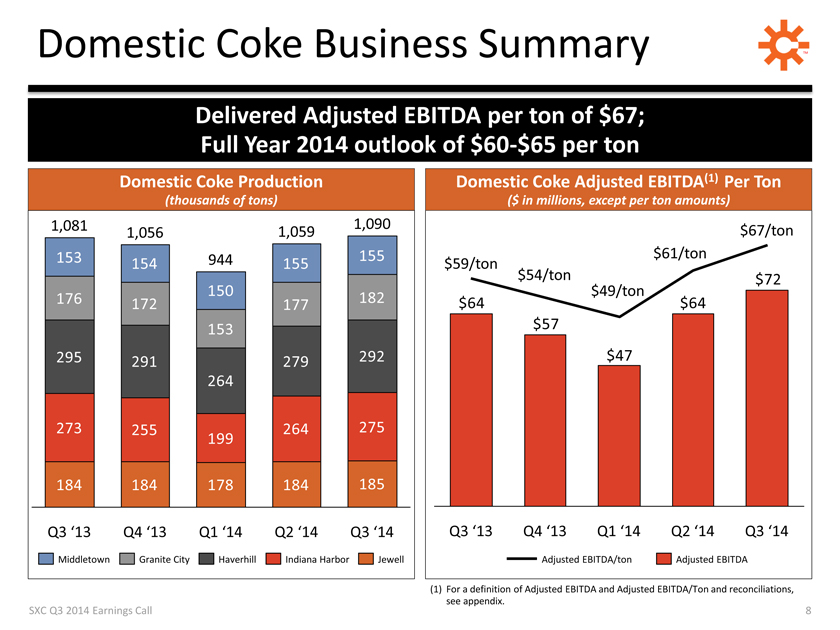

Domestic Coke Business Summary

Delivered Adjusted EBITDA per ton of $67; Full Year 2014 outlook of $60-$65 per ton

Domestic Coke Production

(thousands of tons)

1,081 1,090 1,056 1,059

153 944 155 154 155 150 176 172 182 177 153 295 291 279 292 264

273 255 264 275 199

184 184 178 184 185

Q3 ‘13 Q4 ‘13 Q1 ‘14 Q2 ‘14 Q3 ‘14

Middletown Granite City Haverhill Indiana Harbor Jewell

Domestic Coke Adjusted EBITDA(1)Per Ton

($ in millions, except per ton amounts)

$67/ton

$61/ton $59/ton

$54/ton $72 $49/ton $64 $64

$57

$47

Q3 ‘13 Q4 ‘13 Q1 ‘14 Q2 ‘14 Q3 ‘14

Adjusted EBITDA/ton Adjusted EBITDA

(1) For a definition of Adjusted EBITDA and Adjusted EBITDA/Ton and reconciliations, see appendix.

SXC Q3 2014 Earnings Call

|

|

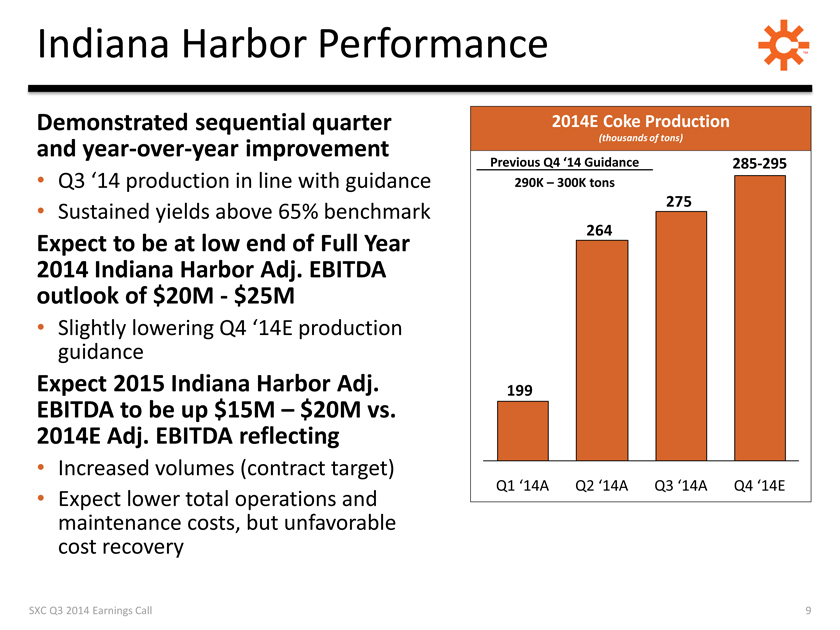

Indiana Harbor Performance

Demonstrated sequential quarter and year-over-year improvement

Q3 ‘14 production in line with guidance

Sustained yields above 65% benchmark

Expect to be at low end of Full Year 2014 Indiana Harbor Adj. EBITDA outlook of $20M—$25M

Slightly lowering Q4 ‘14E production guidance

Expect 2015 Indiana Harbor Adj. EBITDA to be up $15M – $20M vs. 2014E Adj. EBITDA reflecting

Increased volumes (contract target)

Expect lower total operations and maintenance costs, but unfavorable cost recovery

2014E Coke Production

(thousands of tons)

Previous Q4 ‘14 Guidance 285-295

290K – 300K tons

275

264

199

Q1 ‘14A Q2 ‘14A Q3 ‘14A Q4 ‘14E

SXC Q3 2014 Earnings Call

|

|

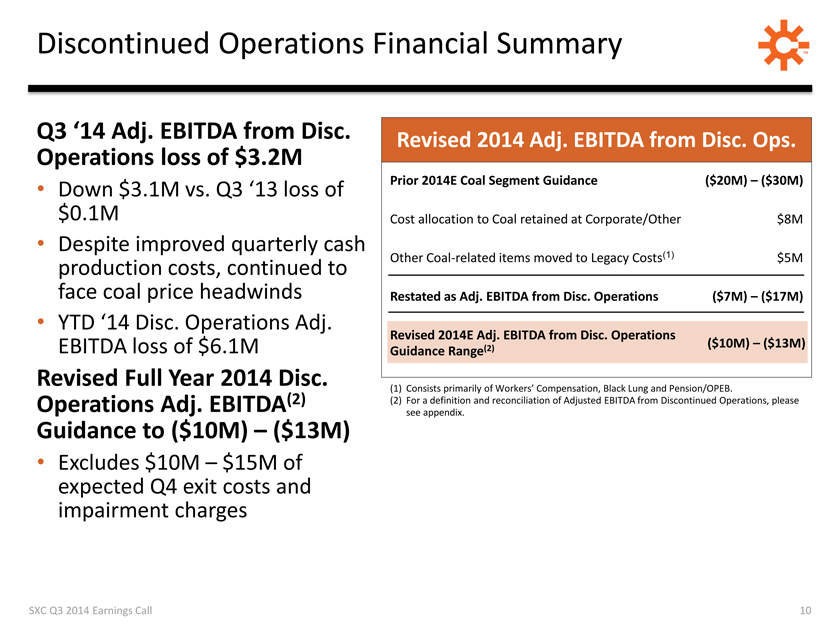

Discontinued Operations Financial Summary

Q3 ‘14 Adj. EBITDA from Disc.

Operations loss of $3.2M

Down $3.1M vs. Q3 ‘13 loss of $0.1M

Despite improved quarterly cash production costs, continued to face coal price headwinds

YTD ‘14 Disc. Operations Adj.

EBITDA loss of $6.1M

Revised Full Year 2014 Disc. Operations Adj. EBITDA(2) Guidance to ($10M) – ($13M)

Excludes $10M – $15M of expected Q4 exit costs and impairment charges

Revised 2014 Adj. EBITDA from Disc. Ops.

Prior 2014E Coal Segment Guidance ($20M) – ($30M)

Cost allocation to Coal retained at Corporate/Other $8M

Other Coal-related items moved to Legacy Costs(1) $5M

Restated as Adj. EBITDA from Disc. Operations ($7M) – ($17M)

Revised 2014E Adj. EBITDA from Disc. Operations

Guidance Range(2) ($10M) – ($13M)

(1) Consists primarily of Workers’ Compensation, Black Lung and Pension/OPEB.

(2) For a definition and reconciliation of Adjusted EBITDA from Discontinued Operations, please

see appendix.

SXC Q3 2014 Earnings Call

|

|

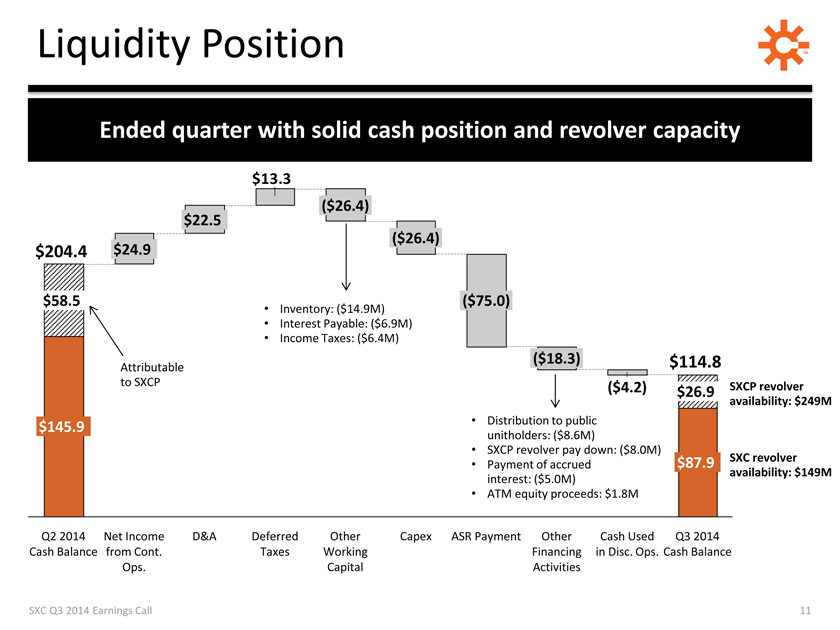

Liquidity Position TM

Ended quarter with solid cash position and revolver capacity

$13.3

($26.4)

$22.5

($26.4)

$204.4 $24.9

$58.5 ($75.0)

Inventory: ($14.9M)

Interest Payable: ($6.9M)

Income Taxes: ($6.4M)

($18.3) $114.8

Attributable

to SXCP

($4.2) $26.9 SXCP revolver

availability: $249M

$145.9 • Distribution to public

unitholders: ($8.6M)

SXCP revolver pay down: ($8.0M)

$87.9 SXC revolver

Payment of accrued

availability: $149M

interest: ($5.0M)

ATM equity proceeds: $1.8M

Q2 2014 Net Income D&A Deferred Other Capex ASR Payment Other Cash Used Q3 2014

Cash Balance from Cont. Taxes Working Financing in Disc. Ops. Cash Balance

Ops. Capital Activities

SXC Q3 2014 Earnings Call

|

|

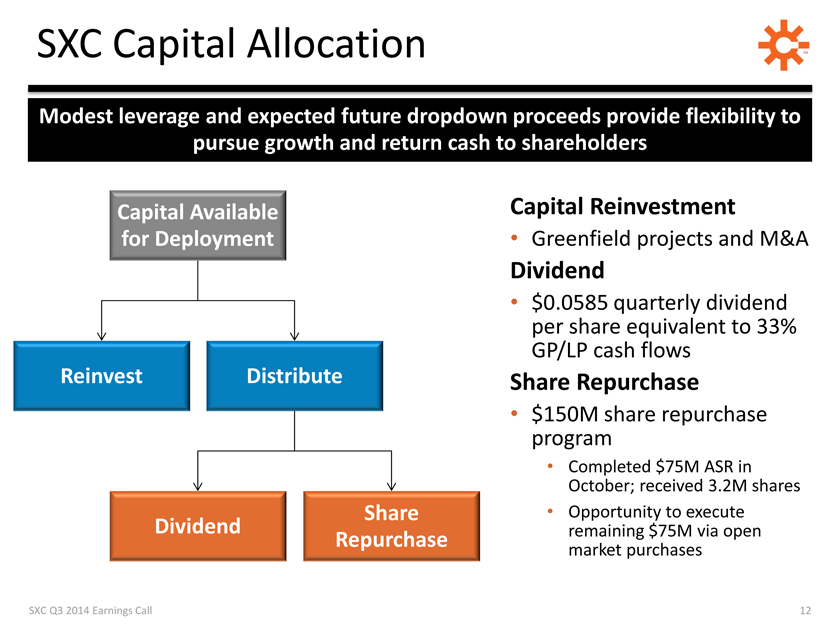

SXC Capital Allocation

Modest leverage and expected future dropdown proceeds provide flexibility to

pursue growth and return cash to shareholders

Capital Available Capital Reinvestment

for Deployment • Greenfield projects and M&A

Dividend

$0.0585 quarterly dividend

per share equivalent to 33%

GP/LP cash flows

Reinvest Distribute Share Repurchase

$150M share repurchase

program

Completed $75M ASR in

October; received 3.2M shares

Share • Opportunity to execute

Dividend Share remaining $75M via open

Repurchase

market purchases

SXC Q3 2014 Earnings Call

|

|

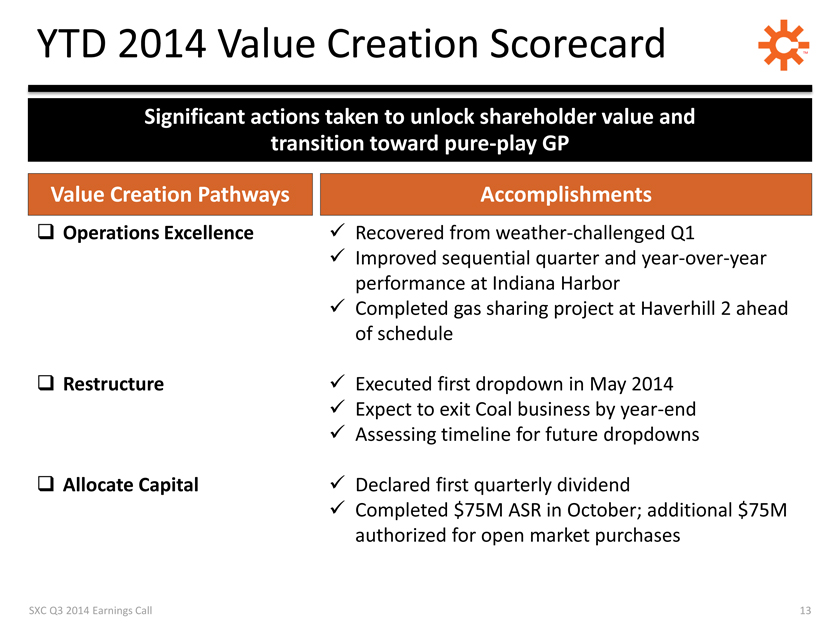

YTD 2014 Value Creation Scorecard

Significant actions taken to unlock shareholder value and transition toward pure-play GP

Value Creation Pathways Accomplishments

Operations Excellence Recovered from weather-challenged Q1

Improved sequential quarter and year-over-year performance at Indiana Harbor Completed gas sharing project at Haverhill 2 ahead of schedule

Restructure Executed first dropdown in May 2014 Expect to exit Coal business by year-end Assessing timeline for future dropdowns

Allocate Capital Declared first quarterly dividend

Completed $75M ASR in October; additional $75M authorized for open market purchases

SXC Q3 2014 Earnings Call

|

|

QUESTIONS

|

|

Investor Relations

630-824-1907 www.suncoke.com

SXC Q3 2014 Earnings Call

|

|

APPENDIX

SXC Q3 2014 Earnings Call

|

|

Definitions

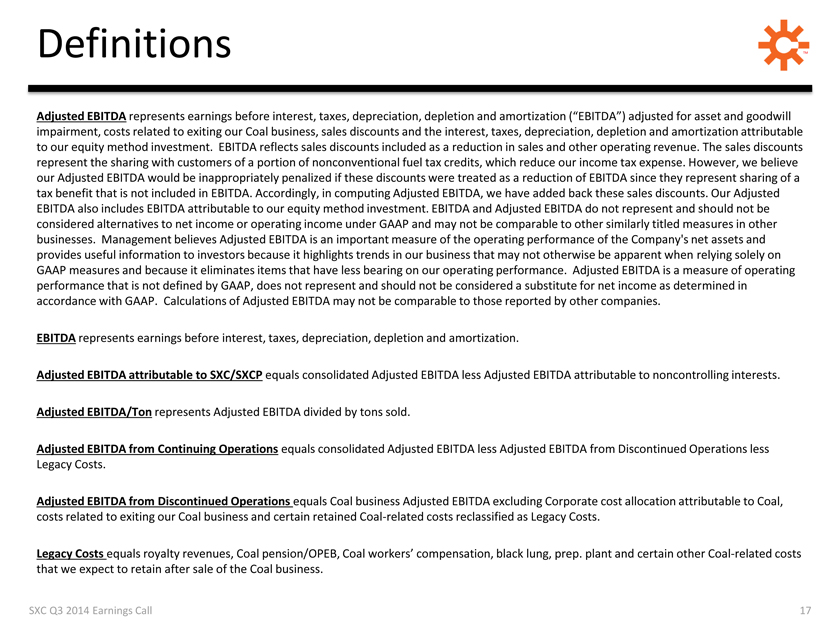

Adjusted EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization (“EBITDA”) adjusted for asset and goodwill impairment, costs related to exiting our Coal business, sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to our equity method investment. EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance of the Company’s net assets and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP, does not represent and should not be considered a substitute for net income as determined in accordance with GAAP. Calculations of Adjusted EBITDA may not be comparable to those reported by other companies.

EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization.

Adjusted EBITDA attributable to SXC/SXCP equals consolidated Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold.

Adjusted EBITDA from Continuing Operations equals consolidated Adjusted EBITDA less Adjusted EBITDA from Discontinued Operations less Legacy Costs.

Adjusted EBITDA from Discontinued Operations equals Coal business Adjusted EBITDA excluding Corporate cost allocation attributable to Coal, costs related to exiting our Coal business and certain retained Coal-related costs reclassified as Legacy Costs.

Legacy Costs equals royalty revenues, Coal pension/OPEB, Coal workers’ compensation, black lung, prep. plant and certain other Coal-related costs that we expect to retain after sale of the Coal business.

SXC Q3 2014 Earnings Call

|

|

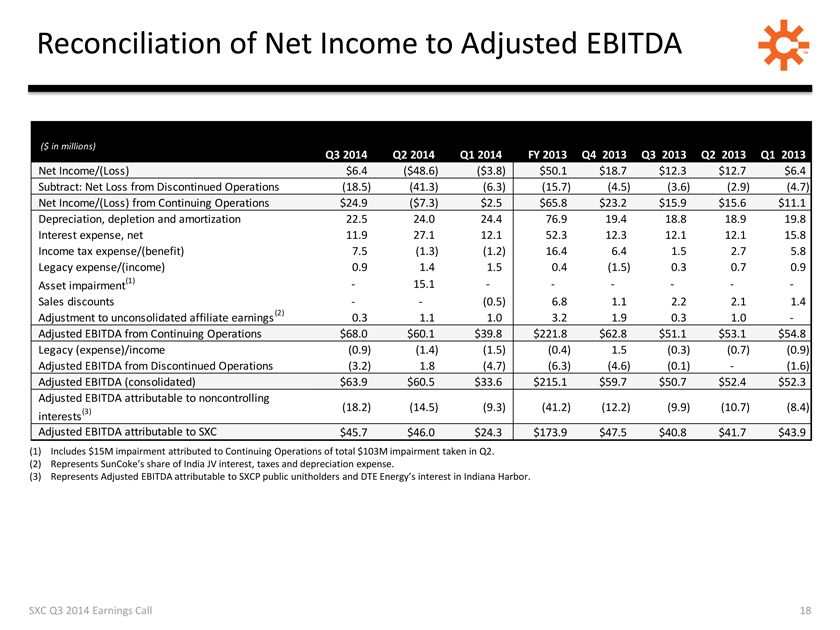

Reconciliation of Net Income to Adjusted EBITDA

($ in millions) Q3 2014 Q2 2014 Q1 2014 FY 2013 Q4 2013 Q3 2013 Q2 2013 Q1 2013

Net Income/(Loss) $6.4 ($48.6) ($3.8) $50.1 $18.7 $12.3 $12.7 $6.4

Subtract: Net Loss from Discontinued Operations (18.5) (41.3) (6.3) (15.7) (4.5) (3.6) (2.9) (4.7)

Net Income/(Loss) from Continuing Operations $24.9 ($7.3) $2.5 $65.8 $23.2 $15.9 $15.6 $11.1

Depreciation, depletion and amortization 22.5 24.0 24.4 76.9 19.4 18.8 18.9 19.8

Interest expense, net 11.9 27.1 12.1 52.3 12.3 12.1 12.1 15.8

Income tax expense/(benefit) 7.5 (1.3) (1.2) 16.4 6.4 1.5 2.7 5.8

Legacy expense/(income) 0.9 1.4 1.5 0.4 (1.5) 0.3 0.7 0.9

(1) — 15.1 — — — — — -

Asset impairment

Sales discounts — — (0.5) 6.8 1.1 2.2 2.1 1.4

(2)

Adjustment to unconsolidated affiliate earnings 0.3 1.1 1.0 3.2 1.9 0.3 1.0 -

Adjusted EBITDA from Continuing Operations $68.0 $60.1 $39.8 $221.8 $62.8 $51.1 $53.1 $54.8

Legacy (expense)/income (0.9) (1.4) (1.5) (0.4) 1.5 (0.3) (0.7) (0.9)

Adjusted EBITDA from Discontinued Operations (3.2) 1.8 (4.7) (6.3) (4.6) (0.1) — (1.6)

Adjusted EBITDA (consolidated) $63.9 $60.5 $33.6 $215.1 $59.7 $50.7 $52.4 $52.3

Adjusted EBITDA attributable to noncontrolling (18.2) (14.5) (9.3) (41.2) (12.2) (9.9) (10.7) (8.4)

Interests (3)

Adjusted EBITDA attributable to SXC $45.7 $46.0 $24.3 $173.9 $47.5 $40.8 $41.7 $43.9

(1) Includes $15M impairment attributed to Continuing Operations of total $103M impairment taken in Q2.

(2) Represents SunCoke’s share of India JV interest, taxes and depreciation expense.

(3) Represents Adjusted EBITDA attributable to SXCP public unitholders and DTE Energy’s interest in Indiana Harbor.

SXC Q3 2014 Earnings Call

|

|

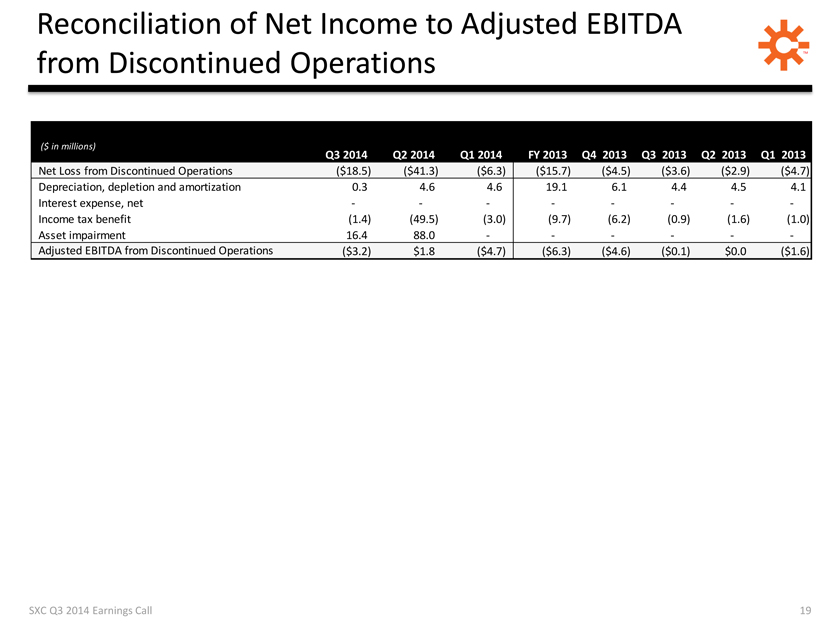

Reconciliation of Net Income to Adjusted EBITDA from Discontinued Operations

($ in millions) Q3 2014 Q2 2014 Q1 2014 FY 2013 Q4 2013 Q3 2013 Q2 2013 Q1 2013

Net Loss from Discontinued Operations ($18.5) ($41.3) ($6.3) ($15.7) ($4.5) ($3.6) ($2.9) ($4.7)

Depreciation, depletion and amortization 0.3 4.6 4.6 19.1 6.1 4.4 4.5 4.1

Interest expense, net — — — — — — — -

Income tax benefit (1.4) (49.5) (3.0) (9.7) (6.2) (0.9) (1.6) (1.0)

Asset impairment 16.4 88.0 — — — — — -

Adjusted EBITDA from Discontinued Operations ($3.2) $1.8 ($4.7) ($6.3) ($4.6) ($0.1) $0.0 ($1.6)

SXC Q3 2014 Earnings Call

|

|

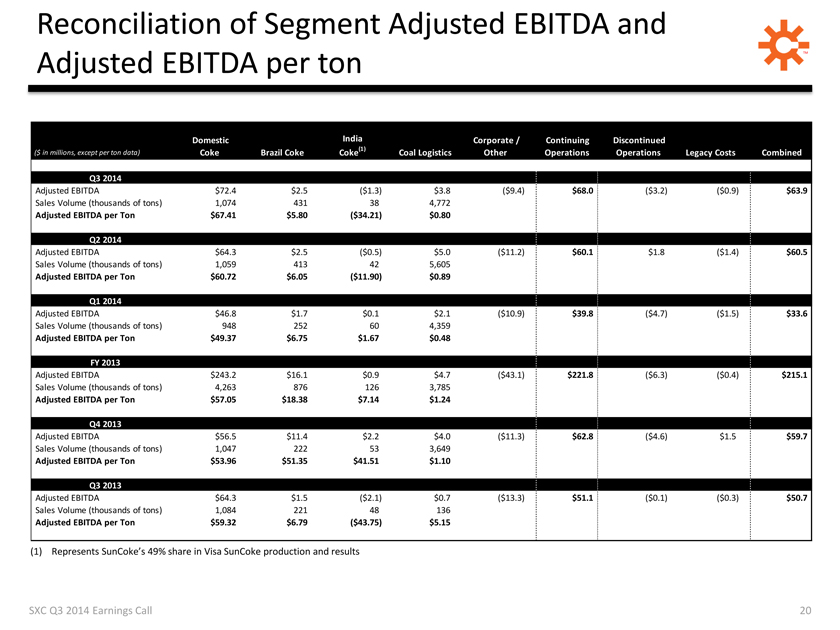

Reconciliation of Segment Adjusted EBITDA and

Adjusted EBITDA per ton

Domestic India Corporate / Continuing Discontinued

(1)

($ in millions, except per ton data) Coke Brazil Coke Coke Coal Logistics Other Operations Operations Legacy Costs Combined

Q3 2014

Adjusted EBITDA $72.4 $2.5 ($1.3) $3.8 ($9.4) $68.0 ($3.2) ($0.9) $63.9

Sales Volume (thousands of tons) 1,074 431 38 4,772

Adjusted EBITDA per Ton $67.41 $5.80 ($34.21) $0.80

Q2 2014

Adjusted EBITDA $64.3 $2.5 ($0.5) $5.0 ($11.2) $60.1 $1.8 ($1.4) $60.5

Sales Volume (thousands of tons) 1,059 413 42 5,605

Adjusted EBITDA per Ton $60.72 $6.05 ($11.90) $0.89

Q1 2014

Adjusted EBITDA $46.8 $1.7 $0.1 $2.1 ($10.9) $39.8 ($4.7) ($1.5) $33.6

Sales Volume (thousands of tons) 948 252 60 4,359

Adjusted EBITDA per Ton $49.37 $6.75 $1.67 $0.48

FY 2013

Adjusted EBITDA $243.2 $16.1 $0.9 $4.7 ($43.1) $221.8 ($6.3) ($0.4) $215.1

Sales Volume (thousands of tons) 4,263 876 126 3,785

Adjusted EBITDA per Ton $57.05 $18.38 $7.14 $1.24

Q4 2013

Adjusted EBITDA $56.5 $11.4 $2.2 $4.0 ($11.3) $62.8 ($4.6) $1.5 $59.7

Sales Volume (thousands of tons) 1,047 222 53 3,649

Adjusted EBITDA per Ton $53.96 $51.35 $41.51 $1.10

Q3 2013

Adjusted EBITDA $64.3 $1.5 ($2.1) $0.7 ($13.3) $51.1 ($0.1) ($0.3) $50.7

Sales Volume (thousands of tons) 1,084 221 48 136

Adjusted EBITDA per Ton $59.32 $6.79 ($43.75) $5.15

(1) Represents SunCoke’s 49% share in Visa SunCoke production and results

SXC Q3 2014 Earnings Call

|

|

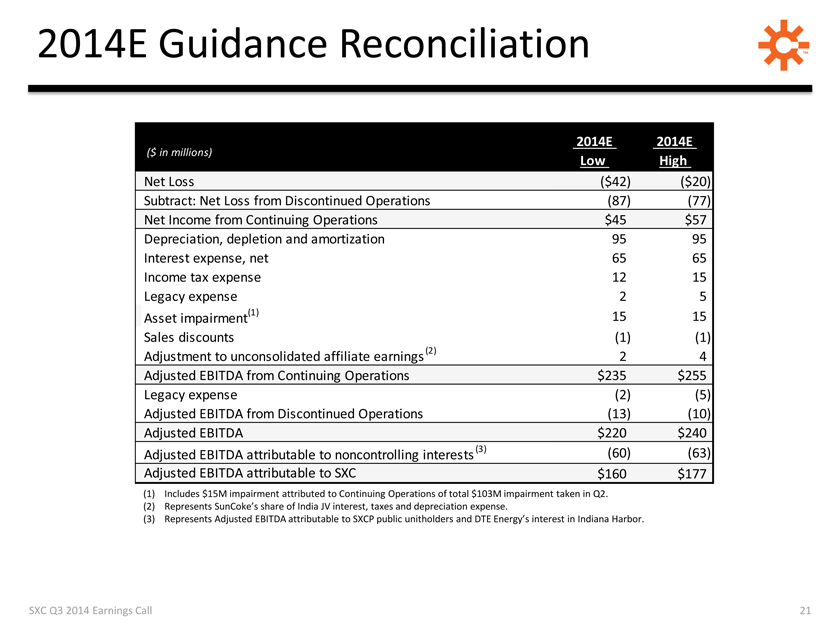

2014E Guidance Reconciliation

2014E 2014E

($ in millions)

Low High

Net Loss ($42) ($20)

Subtract: Net Loss from Discontinued Operations (87) (77)

Net Income from Continuing Operations $45 $57

Depreciation, depletion and amortization 95 95

Interest expense, net 65 65

Income tax expense 12 15

Legacy expense 2 5

(1) 15 15

Asset impairment

Sales discounts (1) (1)

(2)

Adjustment to unconsolidated affiliate earnings 2 4

Adjusted EBITDA from Continuing Operations $235 $255

Legacy expense (2) (5)

Adjusted EBITDA from Discontinued Operations (13) (10)

Adjusted EBITDA $220 $240

(3) (60) (63)

Adjusted EBITDA attributable to noncontrolling interests

Adjusted EBITDA attributable to SXC $160 $177

(1) Includes $15M impairment attributed to Continuing Operations of total $103M impairment taken in Q2.

(2) Represents SunCoke’s share of India JV interest, taxes and depreciation expense.

(3) Represents Adjusted EBITDA attributable to SXCP public unitholders and DTE Energy’s interest in Indiana Harbor.

SXC Q3 2014 Earnings Call

|

|

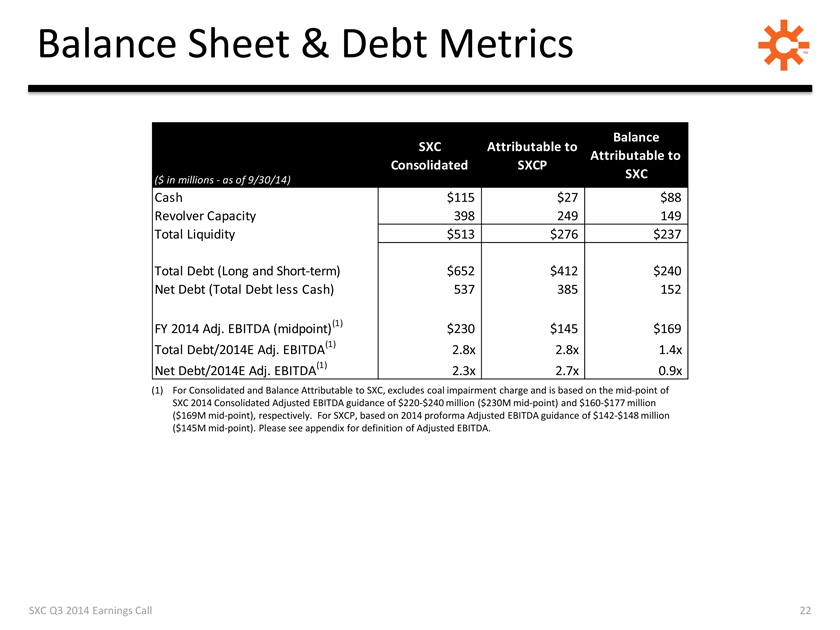

Balance Sheet & Debt Metrics

Balance

SXC Attributable to

Attributable to

Consolidated SXCP

SXC

($ in millions—as of 9/30/14)

Cash $115 $27 $88

Revolver Capacity 398 249 149

Total Liquidity $513 $276 $237

Total Debt (Long and Short-term) $652 $412 $240

Net Debt (Total Debt less Cash) 537 385 152

(1)

FY 2014 Adj. EBITDA (midpoint) $230 $145 $169

(1)

Total Debt/2014E Adj. EBITDA 2.8x 2.8x 1.4x

(1)

Net Debt/2014E Adj. EBITDA 2.3x 2.7x 0.9x

(1) For Consolidated and Balance Attributable to SXC, excludes coal impairment charge and is based on the mid-point of

SXC 2014 Consolidated Adjusted EBITDA guidance of $220-$240 million ($230M mid-point) and $160-$177 million

($169M mid-point), respectively. For SXCP, based on 2014 proforma Adjusted EBITDA guidance of $142-$148 million

($145M mid-point). Please see appendix for definition of Adjusted EBITDA.

SXC Q3 2014 Earnings Call

|

|

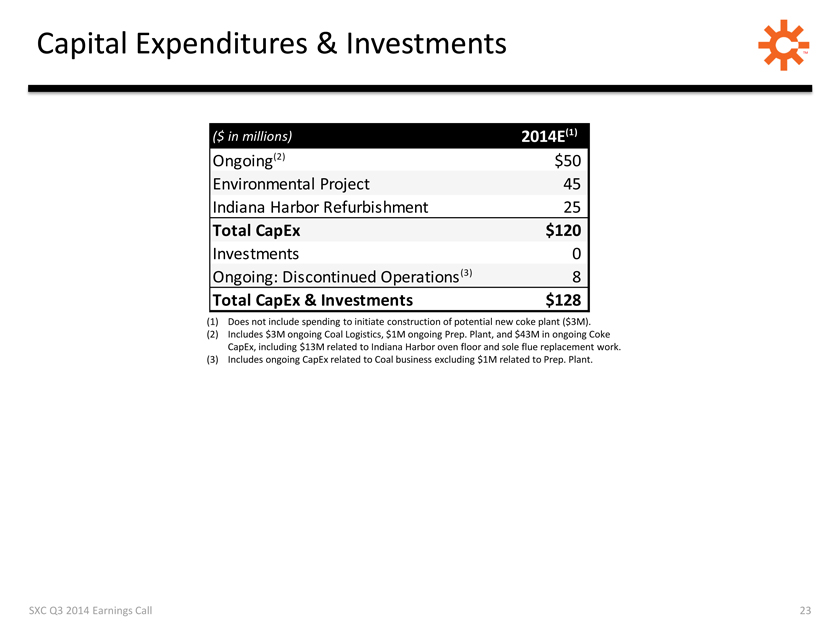

Capital Expenditures & Investments

($ in millions) 2014E(1)

Ongoing(2) $50

Environmental Project 45

Indiana Harbor Refurbishment 25

Total CapEx $120

Investments 0

Ongoing: Discontinued Operations (3) 8

Total CapEx & Investments $128

(1) Does not include spending to initiate construction of potential new coke plant ($3M).

(2) Includes $3M ongoing Coal Logistics, $1M ongoing Prep. Plant, and $43M in ongoing Coke

CapEx, including $13M related to Indiana Harbor oven floor and sole flue replacement work.

(3) Includes ongoing CapEx related to Coal business excluding $1M related to Prep. Plant.

SXC Q3 2014 Earnings Call