Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PLEXUS CORP | cover.htm |

| EX-99.1 - EXHIBIT 99.1 - PLEXUS CORP | plxsq4earningsrelease-ex991.htm |

FISCAL FOURTH QUARTER 2014 FINANCIAL RESULTS October 23, 2014

SAFE HARBOR & FAIR DISCLOSURE STATEMENT 2 Any statements made during our call today and information included in the supporting material that is not historical in nature, such as statements in the future tense and statements that include "believe," "expect," "intend," "plan," "anticipate," and similar terms and concepts, are forward-looking statements. Forward-looking statements are not guarantees since there are inherent difficulties in predicting future results, and actual results could differ materially from those expressed or implied in the forward-looking statements. For a list of factors that could cause actual results to differ materially from those discussed, please refer to the Company’s periodic SEC filings, particularly the risk factors in our Form 10-K filing for the fiscal year ended September 28, 2013, and the Safe Harbor and Fair Disclosure statement in yesterday’s press release. Plexus provides non-GAAP supplemental information such as earnings or margin excluding special items, as well as ROIC and free cash flow. We present information excluding special items because it provides a better indication of core performance for purposes of period-to- period comparisons. ROIC and free cash flow are used for internal management assessments because they provide additional insight into financial performance. In addition, we provide non- GAAP measures because we believe they offer insight into the metrics that are driving management decisions as well as management’s performance under the tests that it sets for itself. For a full reconciliation of non-GAAP supplemental information please refer to yesterday’s press release and our periodic SEC filings.

FISCAL FOURTH QUARTER 2014 3 Q4F14 Sep 27, 2014 Q3F14 Jun 28, 2014 Q4F14 vs. Q3F14 Fiscal 2014 Sept 27 Fiscal 2013 Sept 28 F14 vs. F13 Revenue ($ millions) $666 $621 + 7.4% $2,378 $2,228 + 6.7% Diluted EPS $0.77 $0.71 + 8.5% $2.52 $2.36 + 6.8% ROIC 15.2% 14.6% + 60 bps 15.2% 14.0% + 120 bps • Q4 F14 revenue above mid-point of guidance range ‒ Up 7.4% from prior quarter • Diluted EPS of $0.77 was a strong result • Fiscal 2014 record revenue ‒ Up 6.7% from prior year Second Consecutive Quarter with Record Revenue

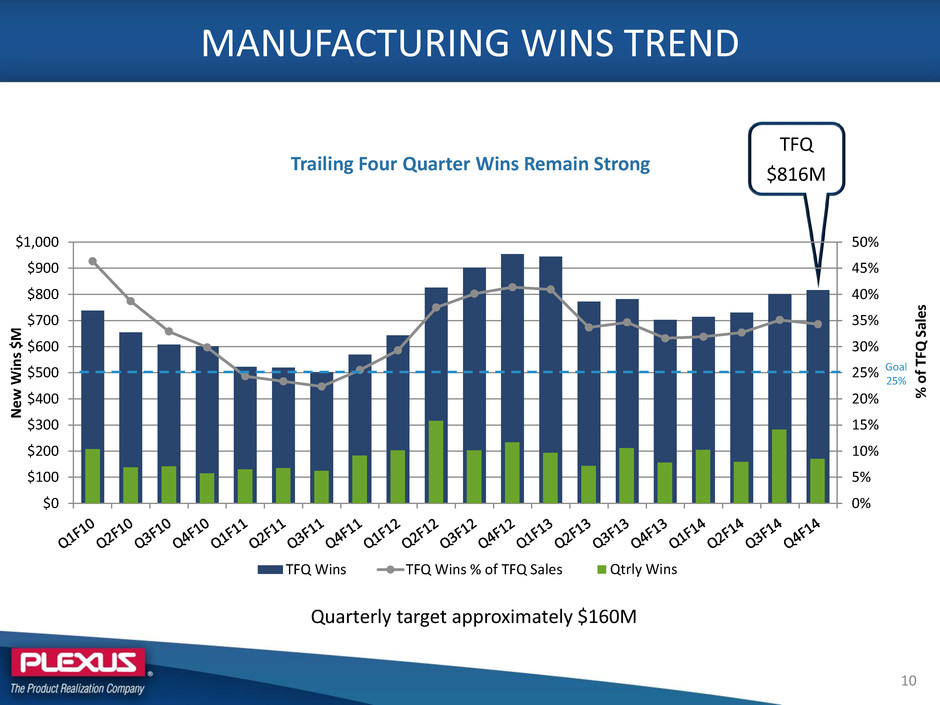

A FEW FISCAL FOURTH QUARTER HIGHLIGHTS • $170M of new Manufacturing Solutions wins; trailing four quarter wins at $816M • $20M of new Engineering Solutions wins; another solid quarter • Q/Q Operating Performance Improvements: ‒ Operating margin: 4.8%; up 10 bps ‒ Cash Cycle: 56 days; 1 day improvement ‒ Free cash flow: $23.8 million ‒ ROIC: 15.2%; up 60 bps and representing an economic return of 4.2% • Completed $30 million share repurchase authorization • Plexus Engineering Solutions achieves AS9100 certification • Accepted as an applicant member to the Electronic Industry Citizenship Coalition (EICC) 4

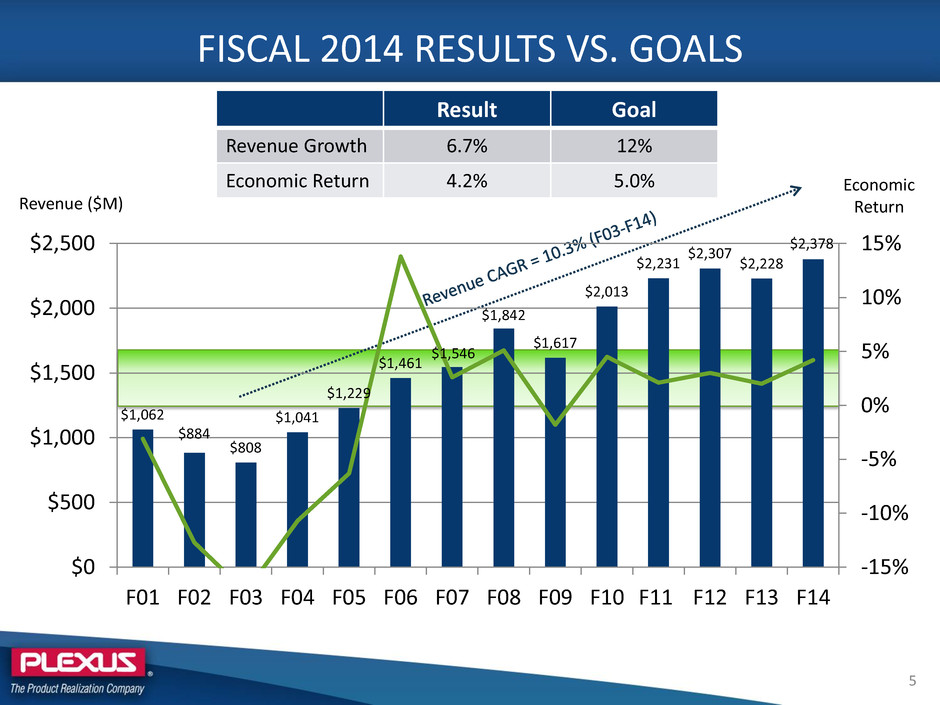

FISCAL 2014 RESULTS VS. GOALS 5 Revenue ($M) Economic Return Result Goal Revenue Growth 6.7% 12% Economic Return 4.2% 5.0% $1,062 $884 $808 $1,041 $1,229 $1,461 $1,546 $1,842 $1,617 $2,013 $2,231 $2,307 $2,228 $2,378 -15% -10% -5% 0% 5% 10% 15% $0 $500 $1,000 $1,500 $2,000 $2,500 F01 F02 F03 F04 F05 F06 F07 F08 F09 F10 F11 F12 F13 F14

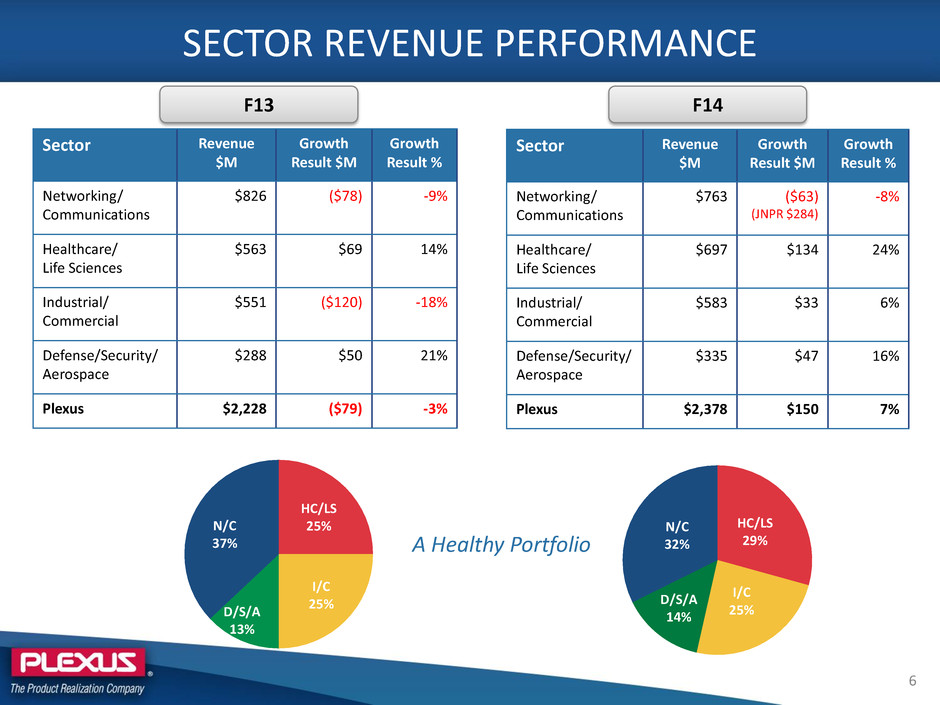

SECTOR REVENUE PERFORMANCE 6 F14 Sector Revenue $M Growth Result $M Growth Result % Networking/ Communications $826 ($78) -9% Healthcare/ Life Sciences $563 $69 14% Industrial/ Commercial $551 ($120) -18% Defense/Security/ Aerospace $288 $50 21% Plexus $2,228 ($79) -3% F13 Sector Revenue $M Growth Result $M Growth Result % Networking/ Communications $763 ($63) (JNPR $284) -8% Healthcare/ Life Sciences $697 $134 24% Industrial/ Commercial $583 $33 6% Defense/Security/ Aerospace $335 $47 16% Plexus $2,378 $150 7% A Healthy Portfolio HC/LS 29% I/C 25% D/S/A 14% N/C 32% HC/LS 25% I/C 25% D/S/A 13% N/C 37%

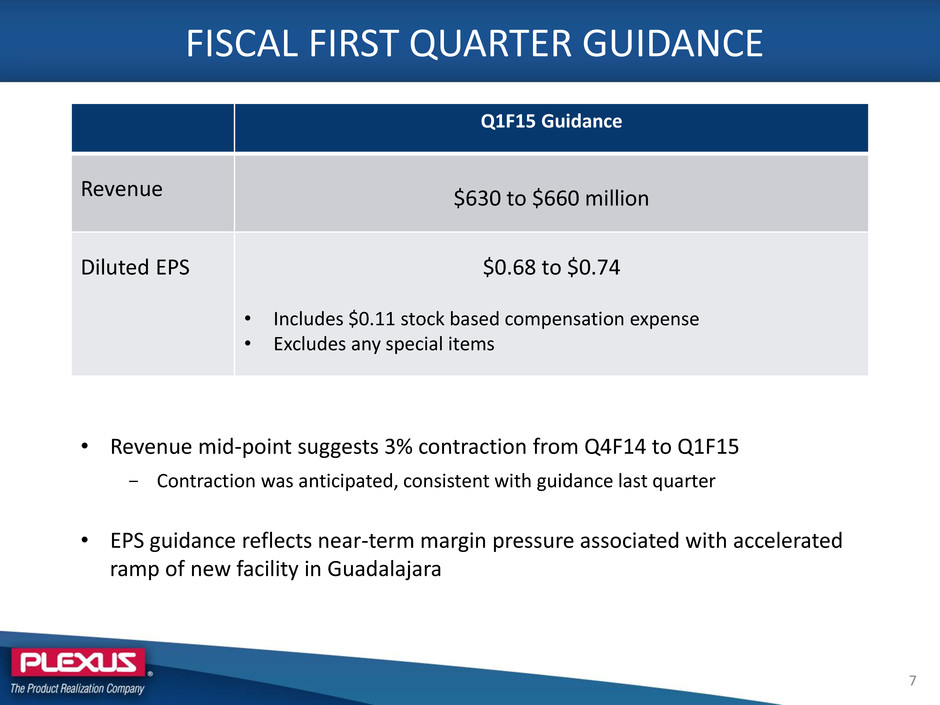

FISCAL FIRST QUARTER GUIDANCE 7 Q1F15 Guidance Revenue $630 to $660 million Diluted EPS $0.68 to $0.74 • Includes $0.11 stock based compensation expense • Excludes any special items • Revenue mid-point suggests 3% contraction from Q4F14 to Q1F15 - Contraction was anticipated, consistent with guidance last quarter • EPS guidance reflects near-term margin pressure associated with accelerated ramp of new facility in Guadalajara

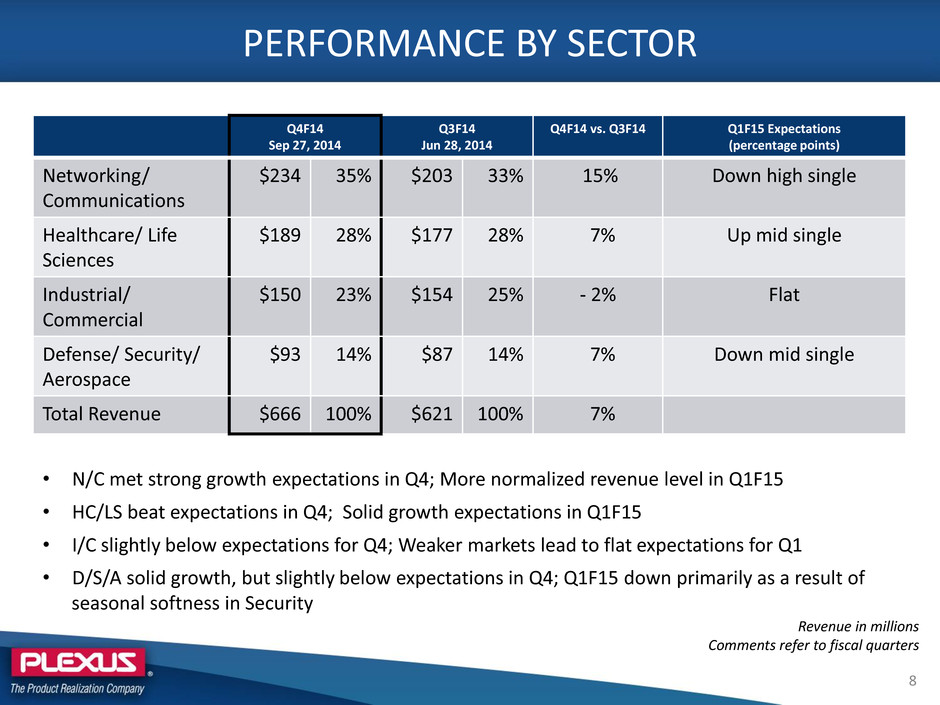

PERFORMANCE BY SECTOR 8 Q4F14 Sep 27, 2014 Q3F14 Jun 28, 2014 Q4F14 vs. Q3F14 Q1F15 Expectations (percentage points) Networking/ Communications $234 35% $203 33% 15% Down high single Healthcare/ Life Sciences $189 28% $177 28% 7% Up mid single Industrial/ Commercial $150 23% $154 25% - 2% Flat Defense/ Security/ Aerospace $93 14% $87 14% 7% Down mid single Total Revenue $666 100% $621 100% 7% Revenue in millions Comments refer to fiscal quarters • N/C met strong growth expectations in Q4; More normalized revenue level in Q1F15 • HC/LS beat expectations in Q4; Solid growth expectations in Q1F15 • I/C slightly below expectations for Q4; Weaker markets lead to flat expectations for Q1 • D/S/A solid growth, but slightly below expectations in Q4; Q1F15 down primarily as a result of seasonal softness in Security

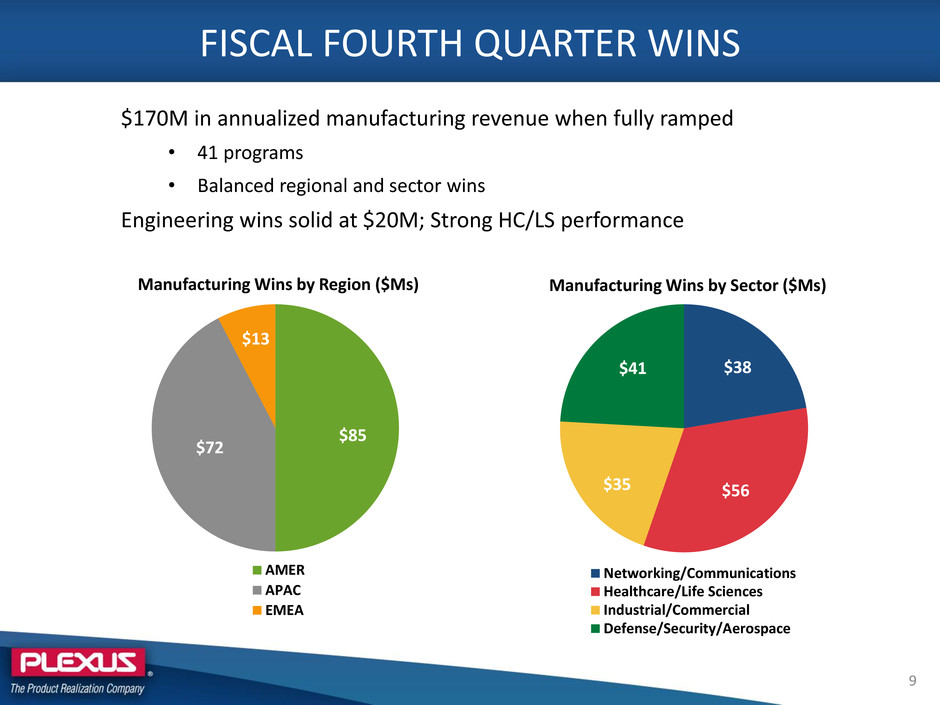

FISCAL FOURTH QUARTER WINS 9 $38 $56 $35 $41 Manufacturing Wins by Sector ($Ms) Networking/Communications Healthcare/Life Sciences Industrial/Commercial Defense/Security/Aerospace $85 $72 $13 Manufacturing Wins by Region ($Ms) AMER APAC EMEA $170M in annualized manufacturing revenue when fully ramped • 41 programs • Balanced regional and sector wins Engineering wins solid at $20M; Strong HC/LS performance

MANUFACTURING WINS TREND 10 TFQ $816M 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 % o f TF Q S al es Ne w W in s $ M TFQ Wins TFQ Wins % of TFQ Sales Qtrly Wins Goal 25% Trailing Four Quarter Wins Remain Strong Quarterly target approximately $160M

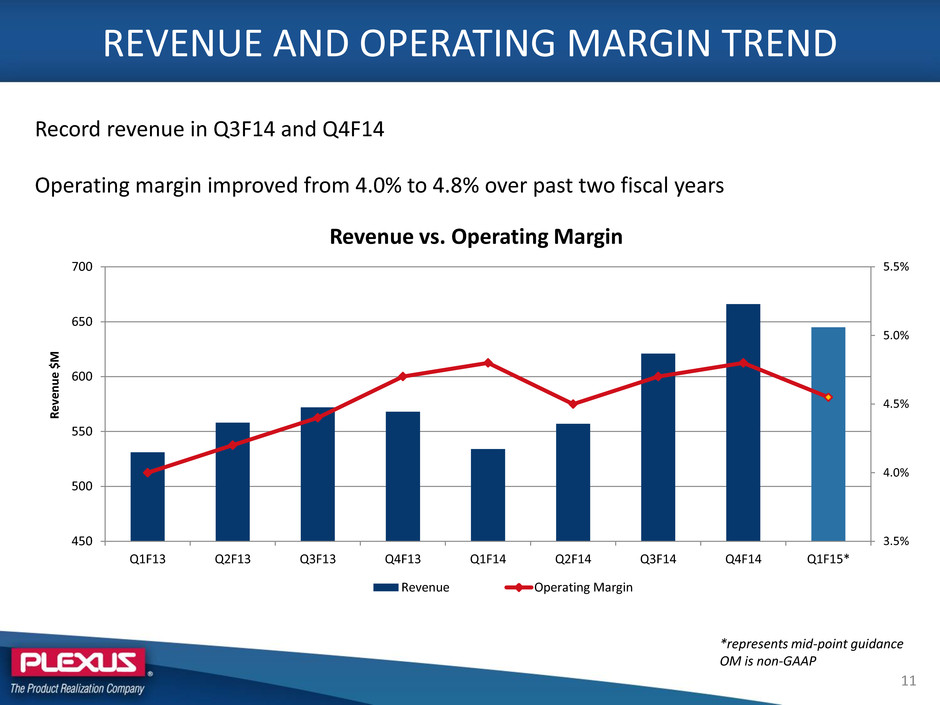

REVENUE AND OPERATING MARGIN TREND Record revenue in Q3F14 and Q4F14 Operating margin improved from 4.0% to 4.8% over past two fiscal years *represents mid-point guidance OM is non-GAAP 3.5% 4.0% 4.5% 5.0% 5.5% 450 500 550 600 650 700 Q1F13 Q2F13 Q3F13 Q4F13 Q1F14 Q2F14 Q3F14 Q4F14 Q1F15* R e ve n u e $ M Revenue vs. Operating Margin Revenue Operating Margin 11

4.7% - 5.0% Goal = 5.0% 4.4% - 4.7% 4.7% - 5.0% Goal = 5.0% 0.40%* 0.10%* 0.15%* (0.25%)* (0.15%)* (0.10%)* (0.25%)* Operating Margin Q4F14 JRZ Close GDL Ramp Q1F15 GDL Accelerated Ramp Q1F15 Aerospace CoE Ramp (Neenah) Operating Margin Q1F15 Seasonal Costs Guadalajara Ramp Recovery Aerospace CoE Ramp Recovery (Neenah) F15 EMEA Growth Operating Margin OPERATING MARGIN *Value is +/- 0.05% Q2F15 – Late F15 Q4F14 – Q1F15 12

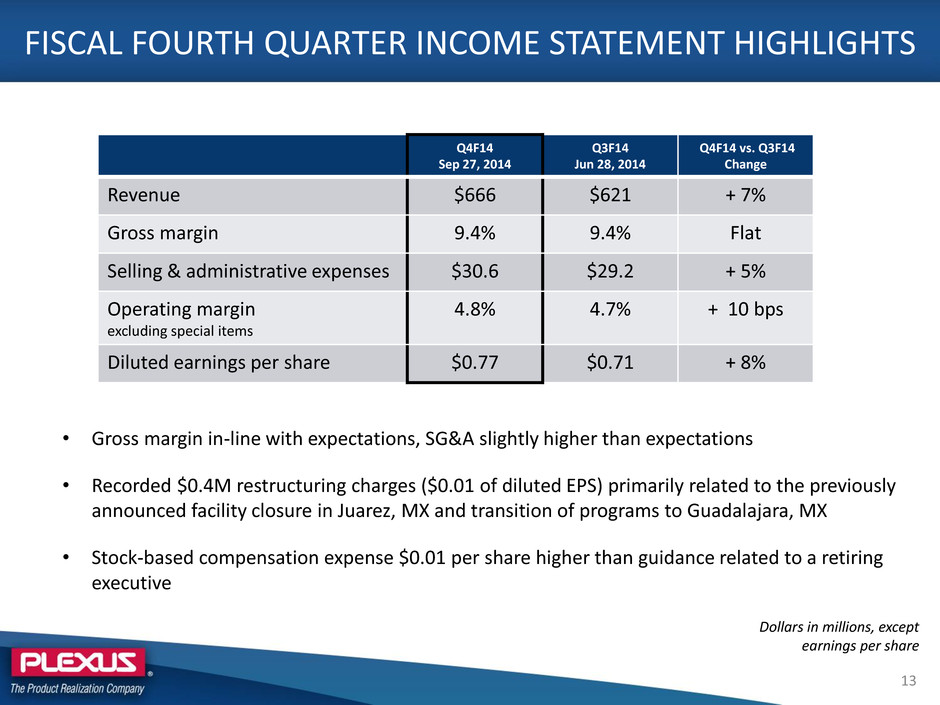

FISCAL FOURTH QUARTER INCOME STATEMENT HIGHLIGHTS 13 Q4F14 Sep 27, 2014 Q3F14 Jun 28, 2014 Q4F14 vs. Q3F14 Change Revenue $666 $621 + 7% Gross margin 9.4% 9.4% Flat Selling & administrative expenses $30.6 $29.2 + 5% Operating margin excluding special items 4.8% 4.7% + 10 bps Diluted earnings per share $0.77 $0.71 + 8% Dollars in millions, except earnings per share • Gross margin in-line with expectations, SG&A slightly higher than expectations • Recorded $0.4M restructuring charges ($0.01 of diluted EPS) primarily related to the previously announced facility closure in Juarez, MX and transition of programs to Guadalajara, MX • Stock-based compensation expense $0.01 per share higher than guidance related to a retiring executive

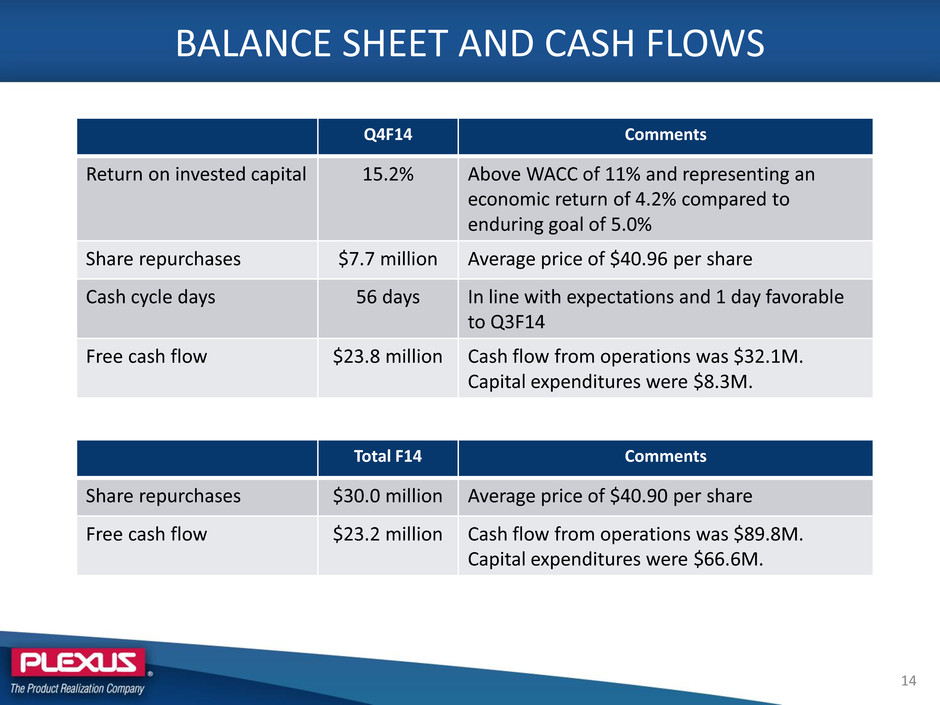

BALANCE SHEET AND CASH FLOWS 14 Q4F14 Comments Return on invested capital 15.2% Above WACC of 11% and representing an economic return of 4.2% compared to enduring goal of 5.0% Share repurchases $7.7 million Average price of $40.96 per share Cash cycle days 56 days In line with expectations and 1 day favorable to Q3F14 Free cash flow $23.8 million Cash flow from operations was $32.1M. Capital expenditures were $8.3M. Total F14 Comments Share repurchases $30.0 million Average price of $40.90 per share Free cash flow $23.2 million Cash flow from operations was $89.8M. Capital expenditures were $66.6M.

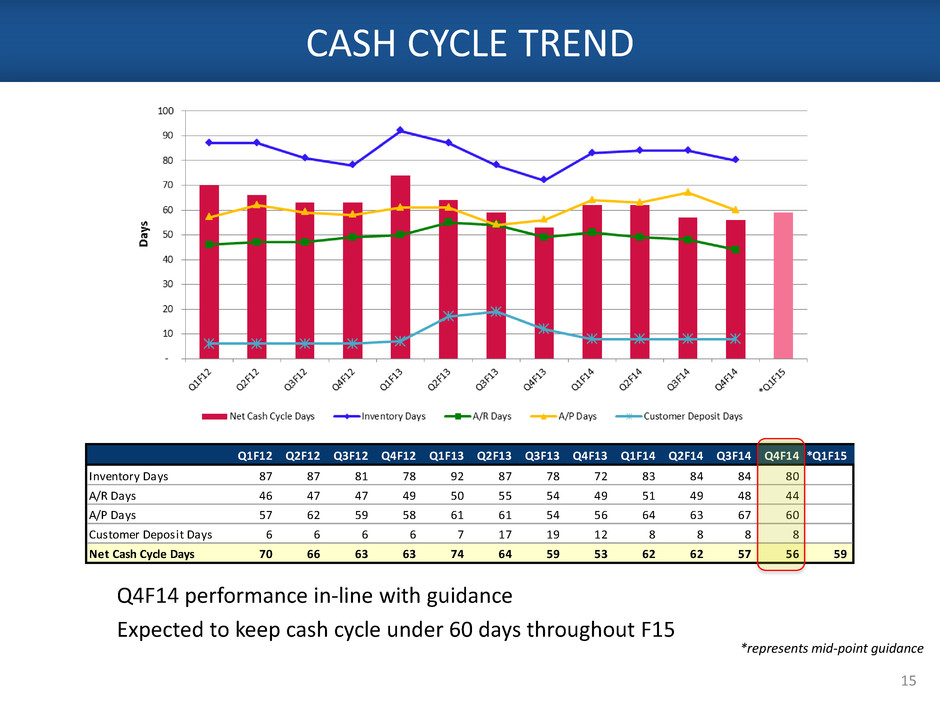

Q1F12 Q2F12 Q3F12 Q4F12 Q1F13 Q2F13 Q3F13 Q4F13 Q1F14 Q2F14 Q3F14 Q4F14 *Q1F15 Inventory Days 87 87 81 78 92 87 78 72 83 84 84 80 A/R Days 46 47 47 49 50 55 54 49 51 49 48 44 A/P Days 57 62 59 58 61 61 54 56 64 63 67 60 Customer Deposit Days 6 6 6 6 7 17 19 12 8 8 8 8 Net Cash Cycle Days 70 66 63 63 74 64 59 53 62 62 57 56 59 CASH CYCLE TREND 15 Q4F14 performance in-line with guidance Expected to keep cash cycle under 60 days throughout F15 *represents mid-point guidance

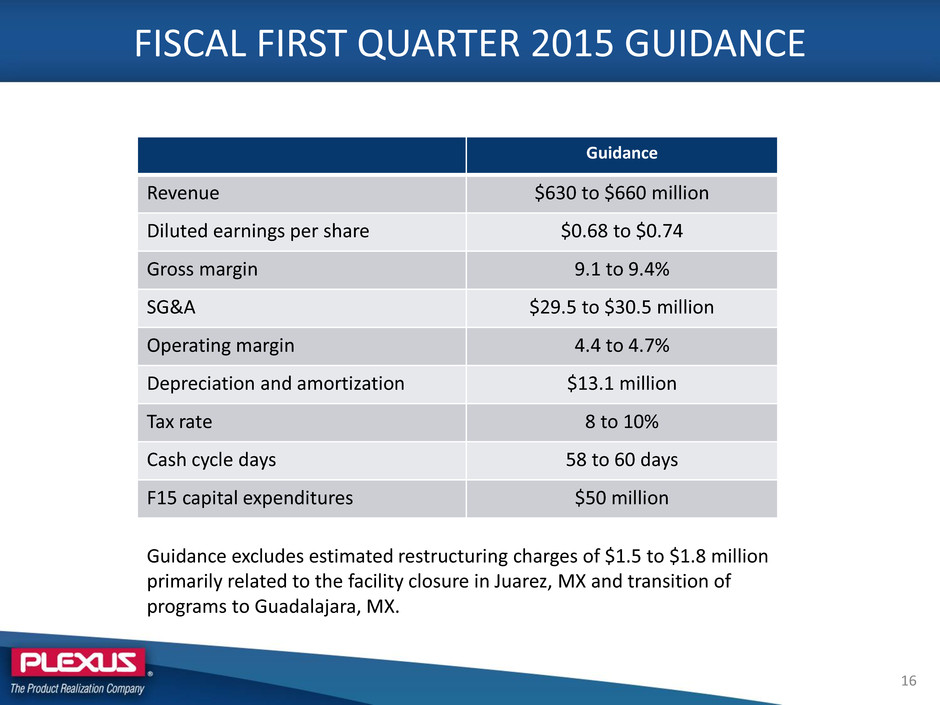

FISCAL FIRST QUARTER 2015 GUIDANCE 16 Guidance Revenue $630 to $660 million Diluted earnings per share $0.68 to $0.74 Gross margin 9.1 to 9.4% SG&A $29.5 to $30.5 million Operating margin 4.4 to 4.7% Depreciation and amortization $13.1 million Tax rate 8 to 10% Cash cycle days 58 to 60 days F15 capital expenditures $50 million Guidance excludes estimated restructuring charges of $1.5 to $1.8 million primarily related to the facility closure in Juarez, MX and transition of programs to Guadalajara, MX.

A FEW THOUGHTS ON FISCAL 2015 Reality Check Uncertainty abounds (macroeconomic, geopolitical, others) • Risks appear to be reflected in longer-term customer forecasts; currently muted • Apparently, customers see little incentive in driving optimistic forecasts Cause for Optimism Revenues • Strong trailing four quarter new business wins heading into the year • Healthy sector mix and customer portfolio Platform for growth with lower capital spending EMEA: Value proposition attracting new business—anticipate profitability Q3 F15 AMER: Aggressive revenue ramp in Guadalajara, Mexico—anticipate profitability Q3 F15 APAC: Ample capacity for growth Investing in higher margin Value Stream solutions • Engineering Solutions (7 locations), Aftermarket Services, Micro Electronics Capital allocation • $30 million share repurchase authorization 17

Q&A ANALYSTS PLEASE CONFORM TO: ONE QUESTION ONE FOLLOW-UP THANKS