Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT - Colfax CORP | q32014earningspressrelease.htm |

| 8-K - 8-K - Colfax CORP | cfx8-kxq32014.htm |

THIRD QUARTER 2014 | EARNINGS CONFERENCE CALL

2 FORWARD-LOOKING STATEMENTS The following information contains forward-looking statements, including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning Colfax's plans, objectives, expectations and intentions and other statements that are not historical or current facts. Forward- looking statements are based on Colfax's current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Factors that could cause Colfax's results to differ materially from current expectations include, but are not limited to, factors detailed in Colfax's reports filed with the U.S. Securities and Exchange Commission including its 2013 Annual Report on Form 10-K under the caption “Risk Factors”. In addition, these statements are based on a number of assumptions that are subject to change. This presentation speaks only as of this date. Colfax disclaims any duty to update the information herein.

Q3 2014 RESULTS

4 Q3 2014 HIGHLIGHTS • Adjusted net income of $71.3 million ($0.57 per share) compared to $64.1 million ($0.56 per share) in Q3 2013 – Q3 2013 included non-cash gains of $0.04 related to adjustments to deferred tax balances • Net sales of $1.16 billion, an increase of 14.8% from Q3 2013 net sales of $1.01 billion (an organic decline of 3.8%) • Adjusted operating income of $127.8 million compared to $112.2 million in Q3 2013 • Third quarter gas- and fluid-handling orders of $539.4 million compared to orders of $533.3 million in Q3 2013, an increase of 1.1% (an organic decline of 8.3%) • Gas- and fluid-handling backlog of $1.5 billion at period end

5 YEAR TO DATE 2014 HIGHLIGHTS • Adjusted net income of $182.5 million ($1.48 per share) compared to $159.7 million ($1.41 per share) in the nine months ended September 27, 2013 • Net sales of $3.42 billion, an increase of 12.6% from the nine months ended September 27, 2013 net sales of $3.04 billion (an organic decline of 1.3%) • Adjusted operating income of $330.9 million compared to $307.0 million in the nine months ended September 27, 2013 • Gas- and fluid-handling orders of $1.72 billion compared to orders of $1.51 billion in the nine months ended September 27, 2013, an increase of 13.4% (flat organically)

GAS AND FLUID HANDLING

7 GAS AND FLUID HANDLING Q3 2014 HIGHLIGHTS • Net sales of $564.7 million compared to net sales of $511.4 million in Q3 2013, an increase of 10.4% (an organic decline of 5.3%) • Adjusted segment operating income of $67.3 million and adjusted segment operating income margin of 11.9% • Third quarter orders of $539.4 million compared to orders of $533.3 million in Q3 2013, an increase of 1.1% (an organic decline of 8.3%) • Backlog of $1.5 billion at period end

8 GAS AND FLUID HANDLING YTD 2014 HIGHLIGHTS • Net sales of $1.71 billion compared to net sales of $1.45 billion in the nine months ended September 27, 2013, an increase of 17.5% (flat organically) • Adjusted segment operating income of $168.9 million and adjusted segment operating income margin of 9.9% • Orders of $1.72 billion compared to orders of $1.51 billion in the nine months ended September 27, 2013, an increase of 13.4% (flat organically)

9 ORDERS AND BACKLOG $533.3 $539.4 $1,513.6 $1,716.6 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 $1,200.0 $1,400.0 $1,600.0 $1,800.0 Q3 2013 Q3 2014 YTD 2013 YTD 2014 - 200.0 400.0 600.0 800.0 1,000.0 1,200.0 1,400.0 1,600.0 1,800.0 ORDERS BACKLOG(1) (1) Backlog data for the periods prior to Q1 2012 are presented on a proforma basis. Note: Dollars in millions (unaudited). $1.45B QTD YTD Existing Businesses (8.3)% (0.7)% Acquisitions 9.3% 14.0% FX Translation 0.1% 0.1% Total Growth 1.1% 13.4% $1.58B $1.51B

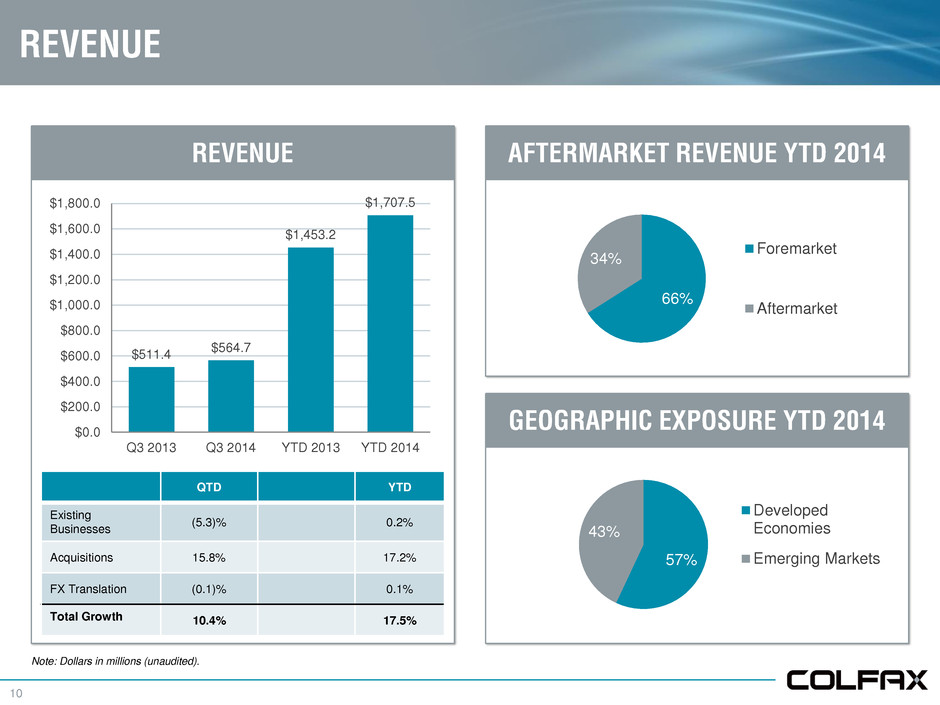

10 GEOGRAPHIC EXPOSURE YTD 2014 REVENUE $511.4 $564.7 $1,453.2 $1,707.5 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 $1,200.0 $1,400.0 $1,600.0 $1,800.0 Q3 2013 Q3 2014 YTD 2013 YTD 2014 66% 34% Foremarket Aftermarket REVENUE AFTERMARKET REVENUE YTD 2014 57% 43% Developed Economies Emerging Markets Note: Dollars in millions (unaudited). QTD YTD Existing Businesses (5.3)% 0.2% Acquisitions 15.8% 17.2% FX Translation (0.1)% 0.1% Total Growth 10.4% 17.5%

11 Q3 2014 SALES AND ORDERS BY END MARKET Power Generation 35% Oil, Gas & Petro-chemical 20% Marine 11% Mining 6% General Industrial and Other 28% SALES: $564.7 Million Total Growth (Decline) Organic (Decline) Growth Power Generation 4.4% (7.5)% Oil, Gas & Petrochemical (4.6)% (11.7)% Marine 0.0% 1.2% Mining 156.2% 71.4% General Industrial & Other 22.0% (7.7)% Total 10.4% (5.3)% Power Generation 32% Oil, Gas & Petro-chemical 21% Marine 13% Mining 4% General Industrial and Other 30% ORDERS: $539.4 Million Total (Decline) Growth Organic (Decline) Growth Power Generation (9.9)% (12.5)% Oil, Gas & Petrochemical 3.9% (8.1)% Marine 15.5% 12.8% Mining (48.4)% (62.0)% General Industrial & Other 25.2% 6.1% Total 1.1% (8.3)%

12 YTD 2014 SALES AND ORDERS BY END MARKET Power Generation 36% Oil, Gas & Petro-chemical 20% Marine 10% Mining 5% General Industrial and Other 29% SALES: $1.71 Billion Total Growth Organic Growth (Decline) Power Generation 10.9% 1.2% Oil, Gas & Petrochemical 5.9% (7.4)% Marine 3.8% 2.2% Mining 36.8% 1.7% General Industrial & Other 41.9% 4.4% Total 17.5% 0.2% Power Generation 34% Oil, Gas & Petro-chemical 18% Marine 14% Mining 5% General Industrial and Other 29% ORDERS: $1.72 Billion Total Growth (Decline) Organic (Decline) Growth Power Generation 2.0% (3.9)% Oil, Gas & Petrochemical (10.1)% (26.5)% Marine 38.5% 33.9% Mining (2.4)% (18.9)% General Industrial & Other 49.1% 18.5% Total 13.4% (0.7)%

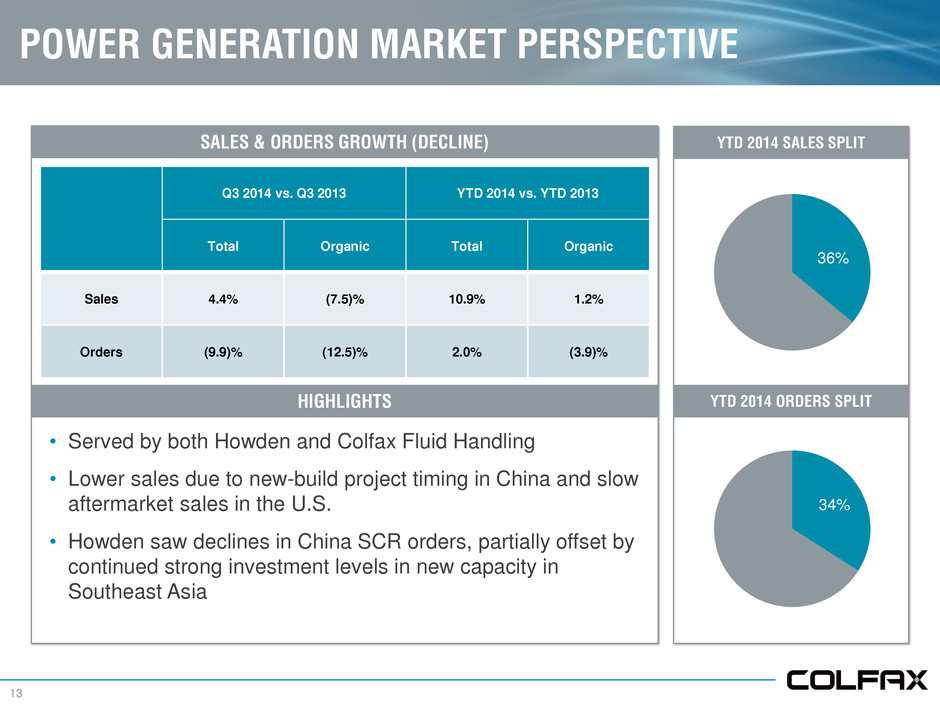

13 POWER GENERATION MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) 34% • Served by both Howden and Colfax Fluid Handling • Lower sales due to new-build project timing in China and slow aftermarket sales in the U.S. • Howden saw declines in China SCR orders, partially offset by continued strong investment levels in new capacity in Southeast Asia YTD 2014 SALES SPLIT YTD 2014 ORDERS SPLIT 36% HIGHLIGHTS Q3 2014 vs. Q3 2013 YTD 2014 vs. YTD 2013 Total Organic Total Organic Sales 4.4% (7.5)% 10.9% 1.2% Orders (9.9)% (12.5)% 2.0% (3.9)%

14 OIL, GAS & PETROCHEMICAL MARKET PERSPECTIVE SALES & ORDERS (DECLINE) GROWTH 18% • Served by both Howden and Colfax Fluid Handling • Period over period comparisons are difficult due to the timing of large projects • Revenue declines due to softening order book; received $20 million turbo fan order for mechanical vapor compression in a Canadian oil sands project YTD 2014 SALES SPLIT YTD 2014 ORDERS SPLIT 20% HIGHLIGHTS Q3 2014 vs. Q3 2013 YTD 2014 vs. YTD 2013 Total Organic Total Organic Sales (4.6)% (11.7)% 5.9% (7.4)% Orders 3.9% (8.1)% (10.1)% (26.5)%

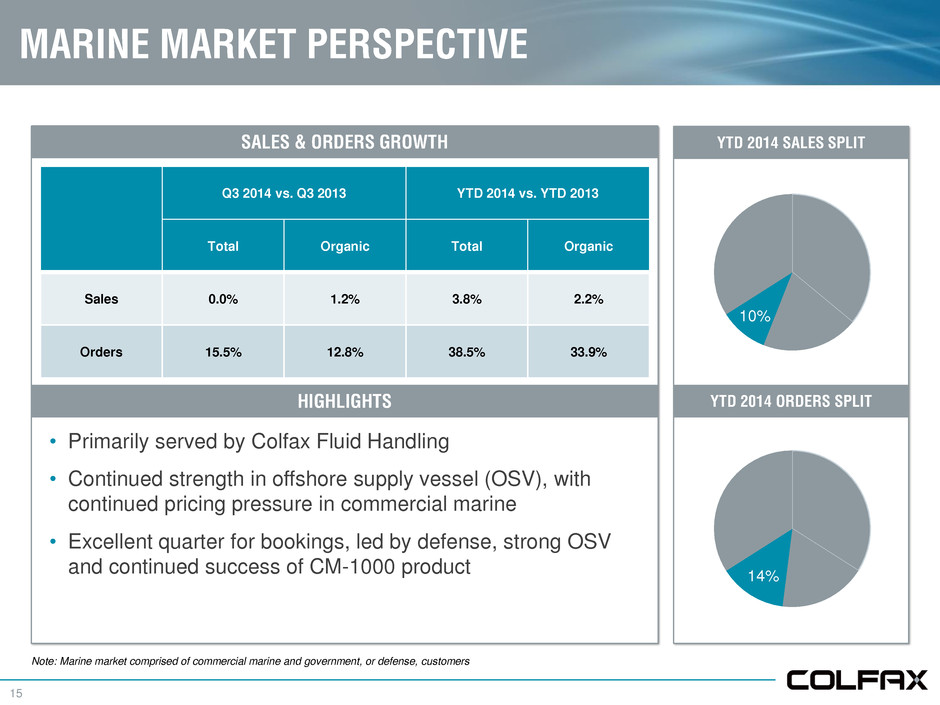

15 MARINE MARKET PERSPECTIVE SALES & ORDERS GROWTH 14% • Primarily served by Colfax Fluid Handling • Continued strength in offshore supply vessel (OSV), with continued pricing pressure in commercial marine • Excellent quarter for bookings, led by defense, strong OSV and continued success of CM-1000 product YTD 2014 SALES SPLIT YTD 2014 ORDERS SPLIT 10% HIGHLIGHTS Note: Marine market comprised of commercial marine and government, or defense, customers Q3 2014 vs. Q3 2013 YTD 2014 vs. YTD 2013 Total Organic Total Organic Sales 0.0% 1.2% 3.8% 2.2% Orders 15.5% 12.8% 38.5% 33.9%

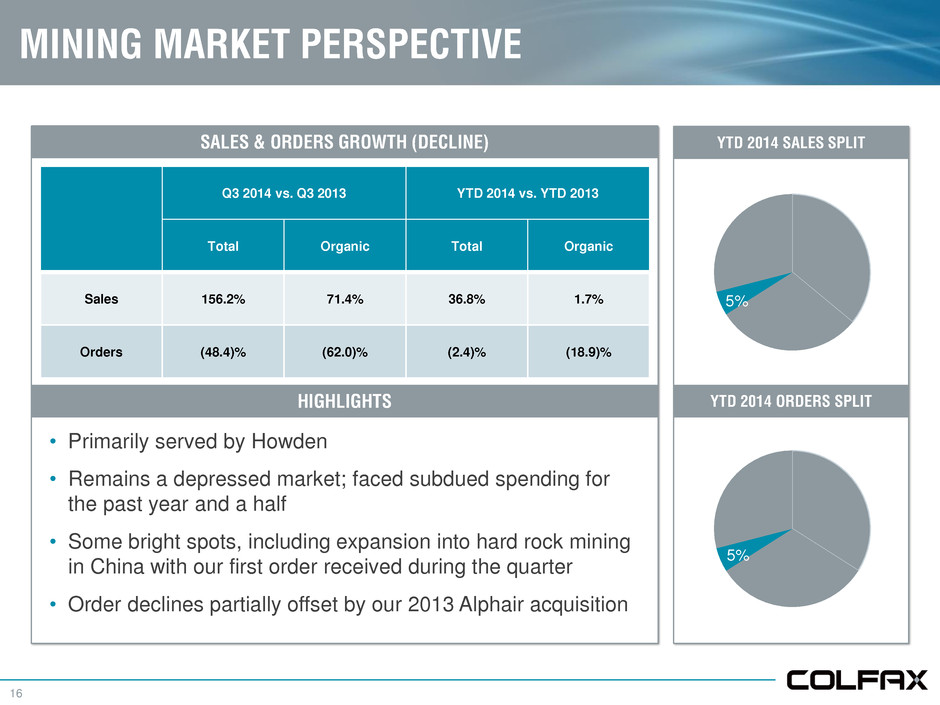

16 MINING MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) 5% • Primarily served by Howden • Remains a depressed market; faced subdued spending for the past year and a half • Some bright spots, including expansion into hard rock mining in China with our first order received during the quarter • Order declines partially offset by our 2013 Alphair acquisition YTD 2014 SALES SPLIT YTD 2014 ORDERS SPLIT 5% HIGHLIGHTS Q3 2014 vs. Q3 2013 YTD 2014 vs. YTD 2013 Total Organic Total Organic Sales 156.2% 71.4% 36.8% 1.7% Orders (48.4)% (62.0)% (2.4)% (18.9)%

17 GENERAL INDUSTRIAL & OTHER MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) 29% • Includes both Howden and Colfax Fluid Handling • Volatile quarter to quarter due to large orders • Near term opportunities for fans and large gas-gas heaters in China for steel plants to be fitted with flue-gas desulfurization capabilities YTD 2014 SALES SPLIT YTD 2014 ORDERS SPLIT 29% HIGHLIGHTS Q3 2014 vs. Q3 2013 YTD 2014 vs. YTD 2013 Total Organic Total Organic Sales 22.0% (7.7)% 41.9% 4.4% Orders 25.2% 6.1% 49.1% 18.5%

FABRICATION TECHNOLOGY

19 FABRICATION TECHNOLOGY Q3 2014 HIGHLIGHTS • Net sales of $599.8 million compared to net sales of $503.2 million in Q3 2013, an increase of 19.2% (an organic decline of 2.3%) • Adjusted segment operating income of $72.2 million and adjusted segment operating income margin of 12.0% – Improvement over Q3 2013 of 60 basis points

20 FABRICATION TECHNOLOGY YTD 2014 HIGHLIGHTS • Net sales of $1.71 billion compared to net sales of $1.58 billion in the nine months ended September 27, 2013, an increase of 8.1% (an organic decline of 2.6%) • Adjusted segment operating income of $203.1 million and adjusted segment operating income margin of 11.9% – Improvement over the nine months ended September 27, 2013 of 170 basis points

21 GEOGRAPHIC EXPOSURE YTD 2014 REVENUE $503.2 $599.8 $1,582.6 $1,710.6 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 $1,200.0 $1,400.0 $1,600.0 $1,800.0 Q3 2013 Q3 2014 YTD 2013 YTD 2014 74% 26% Consumables Equipment REVENUE REVENUE YTD 2014 48% 52% Developed Economies Emerging Markets Note: Dollars in millions (unaudited). QTD YTD Volume (5.5)% (4.5)% Price/ Mix 3.2% 1.9% Acquisitions 24.0% 14.5% FX Translation (2.5)% (3.8)% Total Growth 19.2% 8.1%

RESULTS OF OPERATIONS

23 INCOME STATEMENT SUMMARY (unaudited) Refer to Appendix for Non-GAAP reconciliation and footnotes. Note: Dollars in millions, except per share amounts. September 26, 2014 September 27, 2013 September 26, 2014 September 27, 2013 Net sales 1,164.5$ 1,014.6$ 3,418.1$ 3,035.8$ Gross profit 373.2$ 320.3$ 1,087.0$ 948.8$ % of sales 32.0 % 31.6 % 31.8 % 31.3 % SG&A expense 245.4$ 208.8$ 756.1$ 644.6$ % of sales 21.1 % 20.6 % 22.1 % 21.2 % Adjusted operating income 127.8$ 112.2$ 330.9$ 307.0$ % of sales 11.0 % 11.1 % 9.7 % 10.1 % Adjusted net income 71.3$ 64.1$ 182.5$ 159.7$ % of sales 6.1 % 6.3 % 5.3 % 5.3 % Adjusted net income per share 0.57$ 0.56$ 1.48$ 1.41$ Three Months Ended Nine Months Ended

APPENDIX

25 DISCLAIMER Colfax has provided financial information that has not been prepared in accordance with GAAP. These non-GAAP financial measures are projected adjusted net income, projected adjusted net income per share, adjusted net income, adjusted net income per share, adjusted operating income, organic sales growth (decline) and organic order growth (decline). Projected adjusted net income, projected adjusted net income per share, adjusted net income, adjusted net income per share and adjusted operating income exclude restructuring and other related charges and, for the 2013 periods presented, asbestos coverage litigation expense. Projected adjusted net income, projected adjusted net income per share, adjusted net income and adjusted net income per share for the nine months ended September 26, 2014, exclude the preferred stock conversion inducement payment. The effective tax rates used to calculate adjusted net income and adjusted net income per share are 29.8% and 29.3% for the third quarter and nine months ended September 26, 2014, respectively, and 21.7% and 26.2% for the third quarter and nine months ended September 27, 2013. Organic sales growth (decline) and organic order growth (decline) exclude the impact of acquisitions and foreign exchange rate fluctuations. These non-GAAP financial measures assist Colfax in comparing its operating performance on a consistent basis because, among other things, they remove the impact of asbestos insurance coverage issues, restructuring and other related charges and preferred stock conversion inducement payment. Sales and order information by end market are estimates. We periodically update our customer groupings order to refine these estimates.

26 NON-GAAP RECONCILIATION (unaudited) _____________________ Note: Dollars in thousands. Corporate and Other Corporate and Other Net sales -$ Operating income (loss) 65,182 11.5 % 65,283 10.9 % (11,659) 118,806 10.2 % 64,135 12.5 % 52,124 10.4 % (13,461) 102,798 10.1 % Restructuring and other related charges 2,079 6,869 - 8,948 3,278 5,459 - 8,737 Asbestos coverage litigation expense - - - - 627 - - 627 Adjusted operating income (loss) 67,261$ 11.9 % 72,152$ 12.0 % (11,659)$ 127,754$ 11.0 % 68,040$ 13.3 % 57,583$ 11.4 % (13,461)$ 112,162$ 11.1 % 503,210$ 1,014,570$ 564,650$ 599,803$ -$ 1,164,453$ 511,360$ Q3 2014 Q3 2013 Gas and Fluid Handling Fabrication Technology Total Colfax Corporation Gas and Fluid Handling Fabrication Technology Total Colfax Corporation Corporate and Other Corporate and Other Net sales -$ -$ Operating income (loss) 157,332 9.2 % 185,986 10.9 % (41,106) 302,212 8.8 % 174,597 12.0 % 148,794 9.4 % (36,614) 286,777 9.4 % Restructuring and other related charges 11,617 17,117 - 28,734 4,744 12,684 - 17,428 Asbestos coverage litigation expense - - - - 2,801 - - 2,801 Adjusted operating income (loss) 168,949$ 9.9 % 203,103$ 11.9 % (41,106)$ 330,946$ 9.7 % 182,142$ 12.5 % 161,478$ 10.2 % (36,614)$ 307,006$ 10.1 % Nine Months Ended September 26, 2014 Nine Months Ended September 27, 2013 Gas and Fluid Handling Fabrication Technology Total Colfax Corporation Gas and Fluid Handling Fabrication Technology Total Colfax Corporation 3,035,831$ 1,707,539$ 1,710,581$ 3,418,120$ 1,453,228$ 1,582,603$

27 NON-GAAP RECONCILIATION (unaudited) (1) The effective tax rates used to calculate adjusted net income and adjusted net income per share are 29.8% and 29.3% for the third quarter and nine months ended September 26, 2014, respectively, and 21.7% and 26.2% for the third quarter and nine months ended September 27, 2013, respectively. (2) Adjusted net income per share for periods prior to April 23, 2013 were calculated consistently with the two-class method in accordance with GAAP as the Series A preferred stock were considered participating securities. Subsequent to April 23, 2013, adjusted net income per share was calculated consistently with the if-converted method in accordance with GAAP as the Series A preferred stock were no longer participating securities. Adjusted net income per share for the nine months ended September 27, 2013 excludes the impact of 12,173,291 common stock equivalent shares as their inclusion would be anti-dilutive. On February 12, 2014, the Series A Perpetual Convertible Preferred Stock were converted to common stock and the Company paid a $19.6 million conversion inducement to the holders of the Series A Perpetual Convertible Preferred Stock. _____________________ Note: Dollars in thousands, except per share amounts. September 26, 2014 September 27, 2013 September 26, 2014 September 27, 2013 Adjusted Net Income Net income attributable to Colfax Corporation 73,389$ 55,475$ 311,964$ 141,502$ Restructuring and other related charges 8,948 8,737 28,734 17,428 Asbestos coverage litigation expense - 627 - 2,801 Tax adjustment (1) (11,032) (714) (158,154) (2,068) Adjusted net income 71,305$ 64,125$ 182,544$ 159,663$ Adjusted net income margin 6.1 % 6.3 % 5.3 % 5.3 % Adjusted Net Income Per Share Net income available to Colfax Corporation common shareholders 73,389$ 50,389$ 290,051$ 126,248$ Restructuring and other related charges 8,948 8,737 28,734 17,428 Asbestos coverage litigation expense - 627 - 2,801 Preferred stock conversion inducement payment - - 19,565 - Tax adjustment (1) (11,032) (714) (158,154) (2,068) Adjusted net income available to Colfax Corporation common shareholders 71,305 59,039 180,196 144,409 Dividends on preferred stock - 5,086 2,348 - Less: adjusted net income attributable to participating securities (2) - - - 4,571 71,305$ 64,125$ 182,544$ 139,838$ Weighted-average shares outstanding - diluted 125,380,566 115,384,669 123,624,735 99,281,670 Adjusted net income per share 0.57$ 0.56$ 1.48$ 1.41$ Net income per share — diluted (in accordance with GAAP) 0.59$ 0.48$ 2.38$ 1.23$ Three Months Ended Nine Months Ended

28 SALES & ORDERS GROWTH (unaudited) _____________________ Note: Dollars in millions. (1) Represents the incremental sales, orders and order backlog as a result of our acquisitions of Clarus Fluid Intelligence, LLC, CKD Kompressory a.s., the global industrial and industry division of Flakt Woods Group, TLT-Babcock Inc., Alphair Ventilating Systems Inc., and Sistemas Centrales de Lubrication S.A. de C.V., and incremental sales as a result of our acquisition of Victor Technologies Holdings, Inc. $ % $ % For the three months ended September 27, 2013 1,014.6$ 533.3$ Components of Change: Existing Businesses (38.9) (3.8)% (44.3) (8.3)% Acquisitions (1) 201.8 19.9 % 49.6 9.3 % Foreign Currency Translation (13.0) (1.3)% 0.8 0.1 % Total 149.9 14.8 % 6.1 1.1 % For the three months ended September 26, 2014 1,164.5$ 539.4$ $ % $ % $ % As of and for the nine months ended September 27, 2013 3,035.8$ 1,513.6$ 1,446.9$ Components of Change: Existing Businesses (38.9) (1.3)% (11.0) (0.7)% (94.0) (6.5)% Acquisitions (1) 479.2 15.8 % 211.2 14.0 % 211.1 14.6 % Foreign Currency Translation (58.0) (1.9)% 2.8 0.1 % (57.5) (4.0)% Total 382.3 12.6 % 203.0 13.4 % 59.6 4.1 % As of and for the nine months ended September 26, 2014 3,418.1$ 1,716.6$ 1,506.5$ Net Sales Orders Net Sales Orders Backlog at Period End

29 2014 OUTLOOK SUMMARY (October Update) _____________________ Note: Guidance as of October 23, 2014. Revenue Range 2014 Total $4.675 billion To $4.725 billion EPS and Adjusted Net Income Range 2014 Net income per share $2.24 To $2.35 Adjusted net income $262 million To $270 million 2014 Adjusted net income per share (1) $2.11 To $2.18 Assumptions Restructuring costs $50 million Euro – full year/Q4 $1.33/$1.26 Tax rate - adjusted basis/GAAP 29-30% Outstanding shares (if converted) – full year/Q4 124 million/125 million Depreciation $89 million Amortization $77 million Interest expense (based on LIBOR and EURIBOR = 25 bps) $56 million (1) Excludes impact of restructuring charges, preferred stock conversion and gain on reversal of tax valuation allowances. (See Non-GAAP Reconciliation included in this slide deck)

30 2014 OUTLOOK SUMMARY (October Update) _____________________ Note: Guidance as of October 23, 2014. (1) Includes $10 million of transaction costs and year-one fair value adjustments. In thousands, except per share data LOW HIGH Revenue 4,675,000$ 4,725,000$ Adjusted Operating Profit 468,000 478,000 Interest (56,000) (56,000) Taxes (120,000) (122,000) Noncontrolling interest (30,000) (30,000) Adjusted Net Income- Colfax 262,000 270,000 Adjusted EPS 2.11$ 2.18$ 2014

31 NON-GAAP RECONCILIATION (October Update) _____________________ Note: Guidance as of October 23, 2014. (1) Reflects the impact of the preferred stock conversion for GAAP EPS due to the anti-dilution of the if-converted method. LOW HIGH Projected net income per share - diluted 2.24$ 2.35$ Restructuring costs 0.41 0.41 Preferred stock conversion(1) 0.18 0.18 Tax adjustment (0.72) (0.76) - Projected adjusted net income per share - diluted 2.11$ 2.18$