Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WELLS FARGO & COMPANY/MN | d803270d8k.htm |

| EX-99.1 - EX-99.1 - WELLS FARGO & COMPANY/MN | d803270dex991.htm |

3Q14 Quarterly Supplement

October 14, 2014

©

2014 Wells Fargo & Company. All rights reserved.

Exhibit 99.2 |

Wells Fargo

3Q14 Supplement 1

Appendix

-

Non-strategic/liquidating loan portfolio

22

-

Purchased credit-impaired (PCI) portfolios

23

-

Residential mortgage trends

24

-

Real estate 1-4 family first mortgage portfolio

25

-

Real estate 1-4 family junior lien mortgage portfolio

26

-

Consumer credit card portfolio

27

-

Auto portfolios

28

-

Student lending portfolio

29

Common Equity Tier 1 under Basel III (General

Approach)

30

Common Equity Tier 1 under Basel III (Advanced

Approach, fully phased-in)

31

Forward-looking statements and

additional information

32

Table of contents

3Q14 Results

-

3Q14 Highlights

Page 2

-

Year-over-year results

3

-

Strong revenue diversification

4

-

Balance Sheet and credit overview (linked quarter)

5

-

Income Statement overview (linked quarter)

6

-

Loans

7

-

Broad-based, year-over-year loan growth

8

-

Commercial and Industrial diversified loan growth

9

-

Deposits

10

-

Net interest income

11

-

Noninterest income

12

-

Noninterest expense and efficiency ratio

13

-

Community Banking

14

-

Wholesale Banking

15

-

Wealth, Brokerage and Retirement

16

-

Credit quality

17

-

Capital position

18

-

Capital return

19

-

Summary

20

Financial information for certain periods prior to 2014 was revised to reflect our

determination that certain factoring arrangements did not qualify as loans.

Accordingly, we revised our commercial loan balances for year-end 2012 and each of the

quarters in 2013 in order to present the Company’s lending trends on a comparable

basis over this period. This revision, which resulted in a reduction to total commercial loans and a corresponding decrease to other liabilities, did

not impact the Company’s consolidated net income or total cash flows. We reduced our

commercial loans by $3.5 billion, $3.2 billion, $2.1 billion, $1.6 billion, and $1.2

billion at December 31, September 30, June 30, and March 31, 2013, and December 31, 2012, respectively, which represented less than 1% of total

commercial loans and less than 0.5% of our total loan portfolio. Other affected financial

information, including financial guarantees and financial ratios, has been

appropriately revised to reflect this revision.

Pages 21-32 |

Wells Fargo

3Q14 Supplement 2

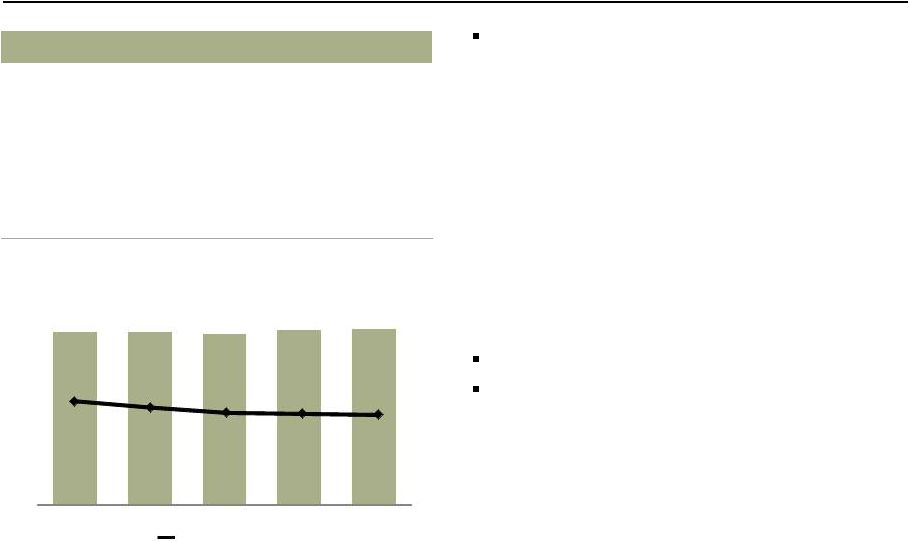

3Q14 Highlights

Strong earnings of $5.7 billion, up $151 million,

or 3% year-over-year (YoY), and stable linked

quarter (LQ)

Diluted earnings per common share of $1.02, up

3% YoY and 1% LQ

Balanced revenue

-

Net interest income up 1% LQ

-

Noninterest income stable LQ

Solid loan and deposit growth, with core loans

(1)

up 2% and deposits up 1% LQ

Pre-tax pre-provision profit (PTPP)

(2)

up 1% LQ

Provision expense up $151 million LQ as lower net

charge-offs were more than offset by a lower

reserve release

Strong capital position and shareholder return

-

Returned $3.6 billion to shareholders through

common stock dividends and net share

repurchases including $1.0 billion forward share

repurchase expected to settle in 4Q14

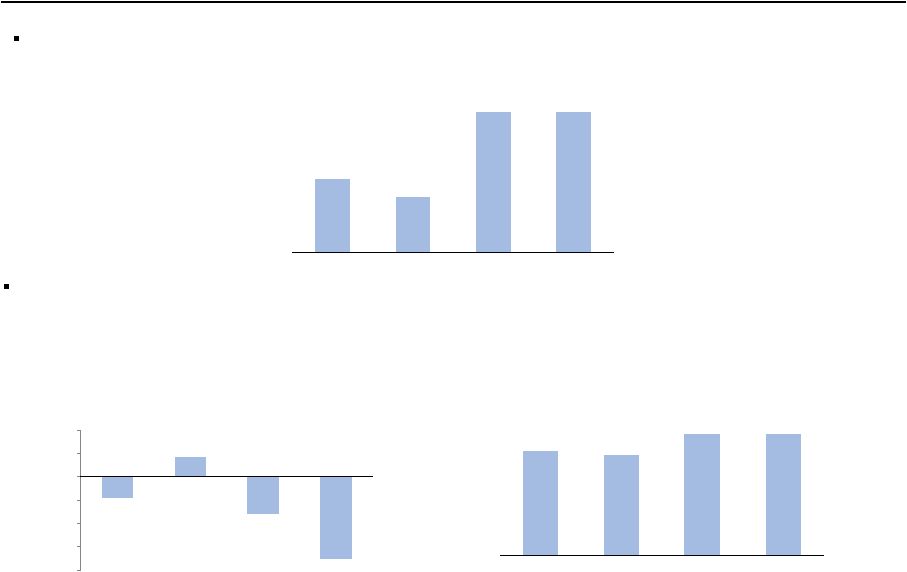

Wells Fargo Net Income

($ in millions)

(1)

Diluted earnings per common share

$0.99

$1.00

$1.05

$1.01

$1.02

5,578

5,610

5,893

5,726

5,729

3Q13

4Q13

1Q14

2Q14

3Q14

(2)

See pages 7 and 22 for additional information regarding core loans and the

non-strategic/liquidating portfolio, which is comprised of Pick-a-Pay, liquidating

home equity, legacy WFF indirect auto, legacy WFF debt consolidation, Education

Finance-government guaranteed, and legacy Wachovia commercial & industrial,

commercial real estate, foreign and other PCI loan portfolios. At the end of 2Q14, $9.7 billion in Education Finance-government guaranteed loans

were transferred to loans held for sale. Pre-tax

pre-provision profit (PTPP) is total revenue less noninterest expense. Management believes PTPP is a useful financial measure because it enables

investors and others to assess the Company’s ability to generate capital to cover credit

losses through a credit cycle. |

Wells Fargo

3Q14 Supplement 3

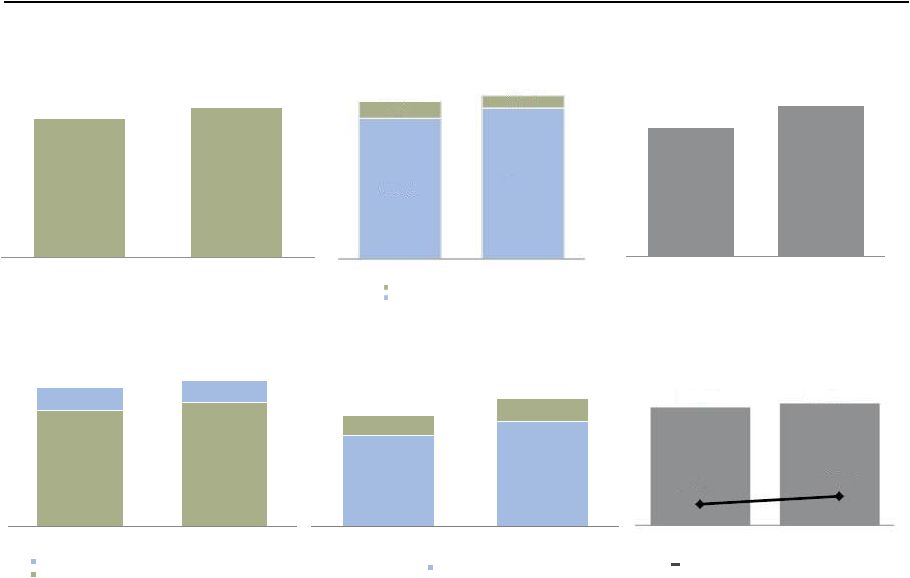

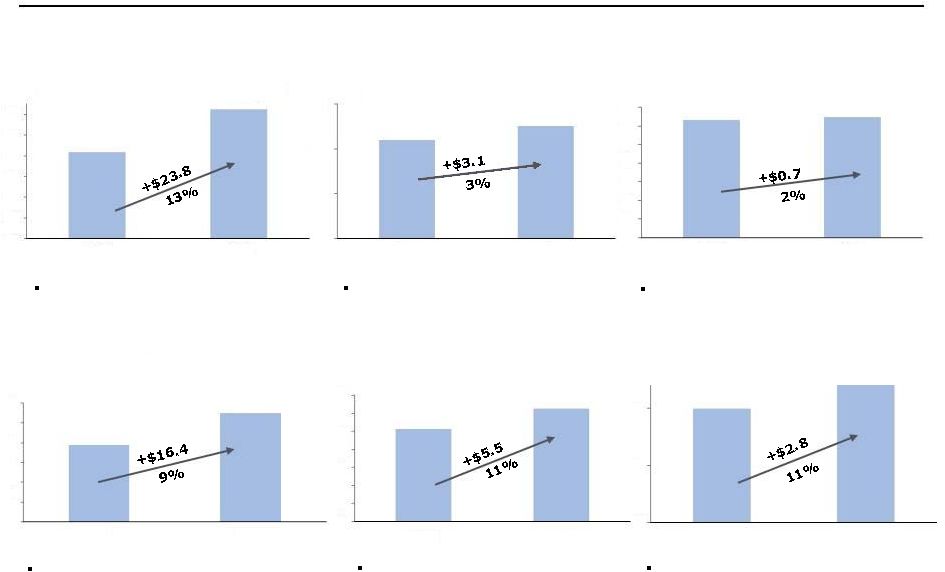

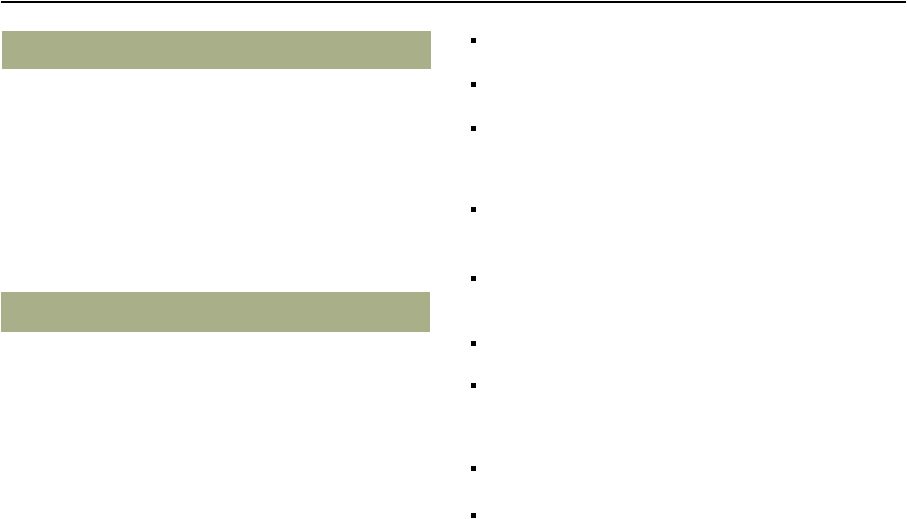

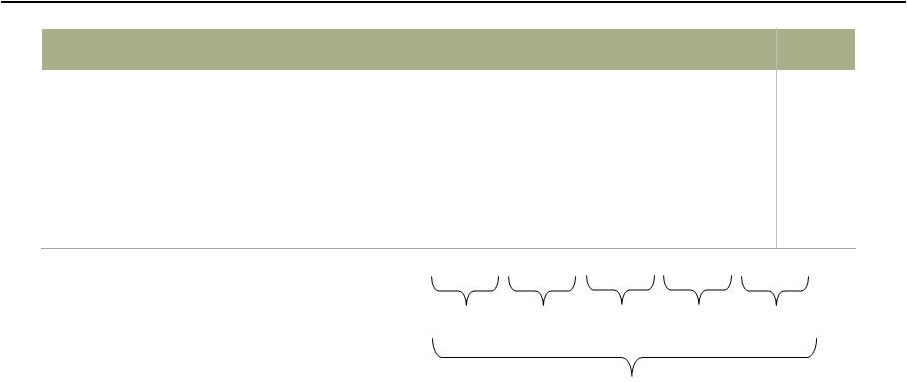

Year-over-year results

Pre-tax Pre-provision Profit

(2)

($ in millions)

Net Income

($ in millions, except EPS)

Diluted earnings per common share

Period-end Loans

(1)

($ in billions)

Net Interest Income

($ in millions)

Noninterest Income

($ in millions)

Period-end Deposits

($ in billions)

(1)

Please see page 1 for information on certain prior period revisions.

(2)

Pre-tax pre-provision profit (PTPP) is total revenue less noninterest expense.

Management believes PTPP is a useful financial measure because it enables investors and

others to assess the Company’s ability to generate capital to cover credit losses through a credit cycle.

Mortgage banking

Noninterest income excluding Mortgage banking

Core Deposits

10,748

10,941

3Q13

3Q14

8,376

8,965

3Q13

3Q14

8,122

8,639

1,608

1,633

9,730

10,272

3Q13

3Q14

947.8

1,016.5

94.1

114.1

1,041.9

1,130.6

3Q13

3Q14

$0.99

$1.02

5,578

5,729

3Q13

3Q14

725.0

775.8

84.1

63.1

809.1

838.9

3Q13

3Q14

Non-strategic/liquidating loans

Core loans |

Wells Fargo

3Q14 Supplement 4

Balanced Spread and

Fee Income

Diversified Fee Generation

Deposit Service Charges

13%

Card Fees

9%

Total Mortgage Banking

16%

Insurance

4%

Net Gains from Trading

2%

All data is for 3Q14.

(1) Other noninterest income includes lease income, life insurance investment income and

all other noninterest income. Strong revenue diversification

Total Trust & Investment Fees 35%

Total Other Fees

10%

Net Gains from Equity Inv.

7%

Net Interest

Income

Noninterest

Income

Other Noninterest Income

(1)

2%

Net Gains on Debt Securities

2%

$21.2

billion

$10.3

billion

Brokerage advisory,

commissions

and

other

Mortgage Orig./

Sales, net

Mortgage Servicing, net

Trust and investment

management

Investment banking

Charges and fees on loans

Merchant processing

1% Cash network

1% CRE brokerage commissions

1% Letters of credit

Card fees

Deposit service charges

Other noninterest income

(1)

Net gains from trading

Insurance

All other fees

Net gains from equity investments

Net gains on debt securities

13%

23%

8%

4%

9%

3%

2%

2%

7%

9%

4%

2%

2%

7%

2%

48%

52% |

Wells Fargo

3Q14 Supplement 5

Balance Sheet and credit overview (linked quarter)

Loans

Core loans

(1)

increased $12.2 billion, or 6% annualized, LQ on broad-based growth

Non-strategic/liquidating portfolio

(1)

decreased $2.2 billion

Short-term investments/

Fed funds sold

Up $23.2 billion primarily due to deposit growth and liquidity-related actions

Investment securities

Up $9.9 billion as gross purchases of ~$25 billion were partially offset by run-off

Deposits

Up $12.0 billion on strong consumer and small business growth and liquidity-related

fundings

Long term debt

Up $16.7 billion including $16.3 billion in liquidity-related issuance

Common stock

repurchases

Common shares outstanding down 34.9 million on net share repurchases

Purchased 48.7 million common shares in the quarter and entered into a $1.0 billion

forward

repurchase

transaction

that

is

expected

to

settle

for

an

estimated

19.8

million shares in 4Q14

Credit

Provision expense of $368 million, up $151 million

-

Net charge-offs of $668 million, or 32 bps, down $49 million

-

$300 million reserve release

(2)

vs. $500 million in 2Q14 on strong credit

performance

Period-end balances. All comparisons are 3Q14 compared with 2Q14.

(1)

See pages 7 and 22 for additional information regarding core loans and the

non-strategic/liquidating portfolio, which is comprised of Pick-a-Pay,

liquidating home equity, legacy WFF indirect auto, legacy WFF debt consolidation, Education

Finance-government guaranteed, and legacy Wachovia commercial & industrial,

commercial real estate, foreign and other PCI loan portfolios. At the end of 2Q14, $9.7 billion in Education

Finance-government guaranteed loans were transferred to loans held for sale. (2) Provision expense minus net charge-offs. |

Wells Fargo

3Q14 Supplement 6

Income Statement overview (linked quarter)

Total revenue

Revenue of $21.2 billion, up $147 million

Net interest income

NII up $150 million driven by growth in earning assets, PCI accretion income and one extra

day in the quarter

NIM down 9 bps to 3.06% reflecting deposit growth and liquidity-related funding

actions Noninterest income

Noninterest income stable

-

Service charges on deposit accounts and card fees each up $28 million

-

Trust and investment fees down $55 million as lower investment banking was partially

offset by higher retail brokerage asset-based fees and trust and investment

management fees

-

Mortgage banking down $90 million as lower servicing income was partially offset by

higher production revenue

-

Market

sensitive

revenue

(1)

up

$231

million

Noncontrolling interest

(Reduces Net Income)

Minority interest up $166 million LQ reflecting strong equity gains from venture capital

businesses

Noninterest expense

Noninterest expense up $54 million

-

Personnel

expense

down

$38

million

as

lower

employee

benefits

expense

(2)

more

than

offset higher salaries expense and higher commission and incentive compensation

-

Operating

losses

up

$53

million

primarily

from

higher

litigation

accruals

-

Outside professional services up $38 million

Income tax

Tax expense down $227 million reflecting tax benefits primarily due to charitable donations

of appreciated securities

All comparisons are 3Q14 compared with 2Q14.

(1) Consists of net gains from trading activities, debt securities and equity

investments. (2) Deferred compensation plan investment results are essentially

P&L neutral as the employee benefits expense is hedged with offsetting trading revenue.

•

Net gains from trading down $214 million on $163 million lower deferred

compensation

plan

investment

results

(2)

(offset

in

employee

benefits

expense) and lower customer accommodation trading results

•

Net gains from debt securities up $182 million

•

Net gains from equity investments up $263 million from venture capital

businesses |

Wells Fargo

3Q14 Supplement 7

Loans

(1)

(1) Please see page 1 for information on certain prior period revisions.

(2) See page 22 for additional information regarding the non-strategic/liquidating

portfolio, which is comprised of Pick-a-Pay, liquidating home equity, legacy WFF

indirect auto, legacy WFF debt consolidation, Education Finance-government guaranteed, and

legacy Wachovia commercial & industrial, commercial real estate, foreign and other

PCI loan portfolios. At the end of 2Q14, $9.7 billion in Education Finance-government guaranteed loans were transferred to loans held for sale.

Period–end Loans Outstanding

($ in billions)

(2)

Total average loan yield

Period-end

-

Commercial loans up $5.1 billion LQ

driven by growth in C&I and real estate construction

-

Consumer loans up $7.1 billion LQ on

growth in nonconforming mortgage, auto and credit

card

Average

-

Excluding the 2Q14 period-end transfer of $9.7 billion in

student loans to held for sale, average loans would have

been up $12.0 billion, or 6% annualized, LQ

-

Core loan yield excluding the non-strategic/

liquidating portfolio was down 3 bps

-

Non-strategic/liquidating portfolio yield

of 5.46%

725.0

741.4

748.4

763.6

775.8

84.1

80.9

78.0

65.3

63.1

809.1

822.3

826.4

828.9

838.9

3Q13

4Q13

1Q14

2Q14

3Q14

Core loans

Non-strategic/liquidating loans

4.42%

4.36%

4.29%

4.28%

4.29%

Core loans grew $50.8 billion, or 7%, YoY and $12.2

billion, or 6% annualized, LQ

Non-strategic/liquidating loans

(2)

down $21.0 billion

YoY and $2.2 billion from 2Q14

Total average loans of $833.2 billion up $31.1 billion

YoY and $2.2 billion LQ

Total average loan yield of 4.29%, up 1 bp LQ |

Wells Fargo

3Q14 Supplement 8

Broad-based, year-over-year loan

growth

Growth in nonconforming mortgage

Strong originations, up 9%

Continued account growth

($ in billions)

Broad-based growth, see page 9 for

additional information

Trade finance growth and 3Q13 U.K.

CRE acquisition

(1)

Please see page 1 for information on certain prior period revisions.

(2)

Please see page 25 for additional information.

New originations

150

160

170

180

190

200

210

3Q13

3Q14

16

21

26

3Q13

3Q14

100

110

120

130

3Q13

3Q14

24

29

34

39

44

49

54

59

3Q13

3Q14

15

20

25

30

35

40

45

50

3Q13

3Q14

150

160

170

180

190

200

210

3Q13

3Q14

Core 1-4 Family First

Mortgage

(2)

Credit Card

Commercial Real Estate

Automobile

Foreign

(1)

Commercial and Industrial

(1) |

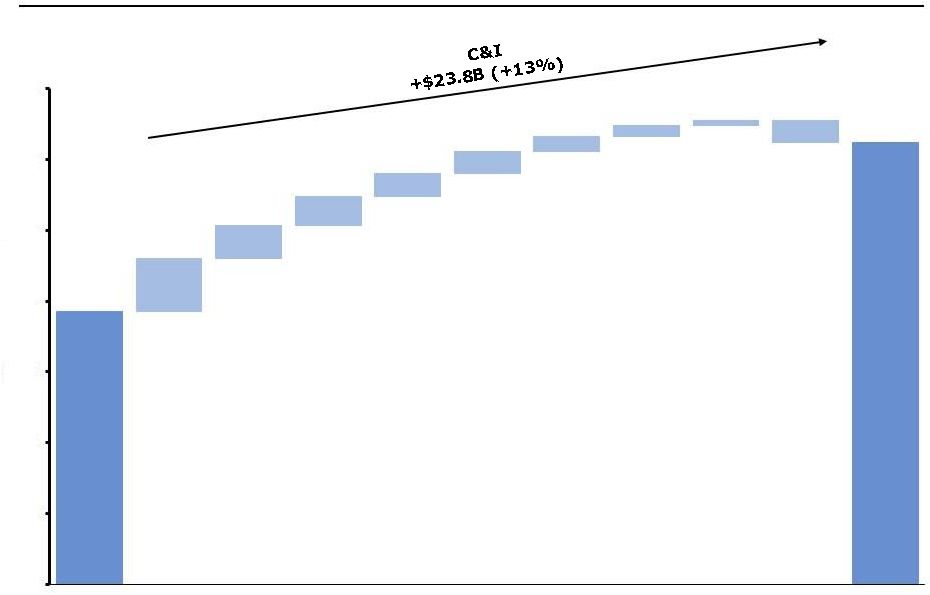

Wells Fargo

3Q14 Supplement 9

3Q13

3Q14

Corporate

Banking

Govt. &

Institutional

Banking

Commercial

Banking

CRE

All

Other

C&I

Commercial and Industrial diversified loan growth

WF

Capital

Finance

Equipment

Finance

Commercial

Dealer

Services

Period-end balances.

$188.6

212.4

$150

$160

$170

$180

$190

$200

$210

$220

Asset

Backed

Finance

$ |

Wells Fargo

3Q14 Supplement 10

Deposits

Average

-

Average retail core deposits up 5% YoY on new

customer account growth and up 2%

annualized, LQ

Average Deposits and Rates

($ in billions)

Average deposit cost

Average Core Deposits

(1)

($ in billions)

Deposits up $101.5 billion, or 10%, YoY and $25.6

billion, or 9% annualized, LQ

Average deposit cost of 10 bps, stable LQ and down 2

bps YoY

Core deposits of $1.0 trillion up $71.9 billion, or 8%,

YoY and up $20.5 billion, or 8% annualized, LQ

Primary consumer checking customers

(2)

up a net

4.9% YoY

Primary small business and business banking checking

customers

(2)

up a net 5.6% YoY

746.4

805.6

819.1

279.2

295.9

308.0

1,025.6

1,101.5

1,127.1

3Q13

2Q14

3Q14

Interest-bearing deposits

Noninterest-bearing deposits

0.12%

0.10%

0.10%

940.3

991.7

1,012.2

3Q13

2Q14

3Q14

Period-end

Total period-end deposits of $1.1 trillion up $88.8

billion, or 9%, YoY and up $12.0 billion, or 4%

annualized, LQ

(1)

Core deposits are noninterest-bearing deposits, interest-bearing checking, savings

certificates, certain market rate and other savings, and certain foreign deposits

(Eurodollar sweep balances). (2)

Data as of August 2014, comparisons with August 2013; customers who actively use their

checking account with transactions such as debit card purchases, online bill payments,

and direct deposits. |

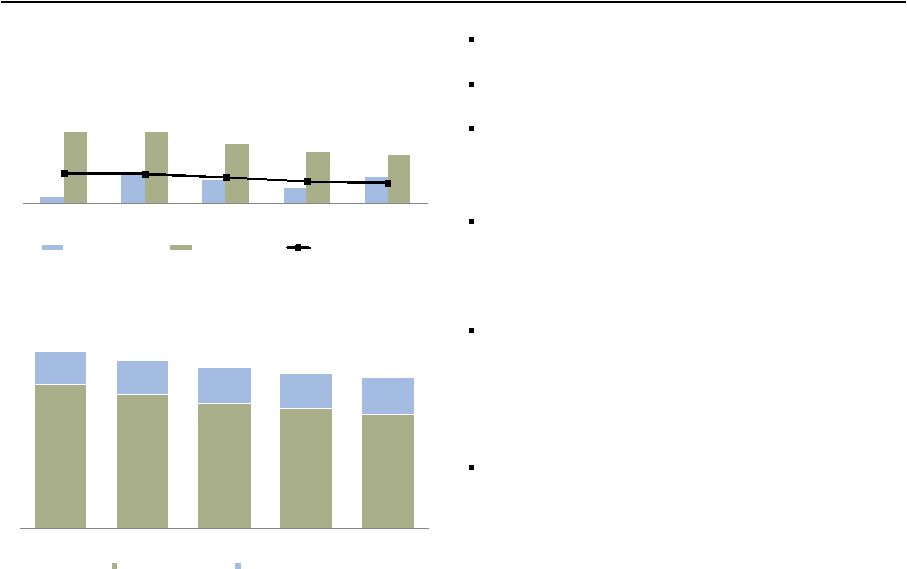

Wells Fargo

3Q14 Supplement 11

Net interest income (TE)

(1)

up $147 million LQ on

growth in earning assets, PCI accretion and one

additional day in the quarter

Average earning assets up $50.7 billion, or

4%, LQ

-

Short-term investments/fed funds sold up

$23.4 billion

-

Mortgages and loans held for sale up $12.0

billion

(3)

-

Investment securities up $9.8 billion

-

Trading assets up $3.1 billion

-

Loans up $2.2 billion

NIM of 3.06% down 9 bps from 2Q14 on:

-

Customer-driven deposit growth = (4) bps

-

Liquidity-related activity = (4) bps

-

Balance sheet repricing, growth and mix = (1) bp

-

Variable income = 0 bps

Net interest income

Net Interest Income (TE)

(1)

($ in millions)

Net Interest Margin (NIM)

(2)

10,949

11,022

10,832

11,016

11,163

3.39%

3.27%

3.20%

3.15%

3.06%

3Q13

4Q13

1Q14

2Q14

3Q14

(1)

Tax-equivalent net interest income is based on the federal statutory rate of 35% for the

periods presented. Net interest income was $10,748 million, $10,803 million, $10,615

million, $10,791 million and $10,941 million for 3Q13, 4Q13, 1Q14, 2Q14 and 3Q14

respectively.

(2)

Please see page 1 for information on certain prior period revisions. (3)

At the end of 2Q14, $9.7 billion in Education Finance-government guaranteed

loans were transferred to loans held for sale. |

Wells Fargo

3Q14 Supplement 12

Noninterest income

Deposit service charges up $28 million LQ

Trust and investment fees down $55 million, or 2%,

LQ as higher retail brokerage asset-based fees and

trust and investment management fees were more

than offset by lower investment banking

Card fees up $28 million on higher transaction

volumes reflecting new customer growth

Other fees up $2 million as higher CRE brokerage

commissions were offset by the impact of the exit of

the direct deposit advance product

Mortgage banking down $90 million

Insurance down $65 million reflecting the impact of

the 2Q14 sale of insurance offices and seasonally

lower crop insurance

Trading gains down $214 million on $163 million

lower deferred compensation investment income (P&L

neutral) (($53) million in 3Q14 vs. $110 million in

2Q14) and lower customer accommodation trading

Debt gains up $182 million

Equity gains up $263 million from venture capital

businesses

Other income down $95 million from 2Q14 gain on

sale of 40 insurance offices

vs

vs

($ in millions)

3Q14

2Q14

3Q13

Noninterest income

Service charges on deposit accounts

$

1,311

2

%

3

Trust and investment fees

Brokerage advisory, commissions

and other fees

2,327

2

13

Trust and investment management

856

2

6

Investment banking

371

(24)

(7)

Card fees

875

3

8

Other fees

1,090

-

(1)

Mortgage banking

1,633

(5)

2

Insurance

388

(14)

(6)

Net gains from trading activities

168

(56)

(58)

Net gains on debt securities

253

n.m.

n.m.

Net gains from equity investments

712

59

42

Lease income

137

6

(14)

Life insurance investment income

143

4

(7)

Other

8

(92)

(78)

Total noninterest income

$

10,272

-

%

6

-

Gain on sale revenue up $266 million reflecting

higher gain on sale margin and higher repurchase

reserve releases

-

Net servicing income down $356 million reflecting

higher unreimbursed direct servicing costs and lower

net MSR hedge results

8,122

8,292

8,500

8,552

8,639

1,608

1,570

1,510

1,723

1,633

9,730

9,862

10,010

10,275

10,272

3Q13

4Q13

1Q14

2Q14

3Q14

Mortgage banking

Noninterest income excluding Mortgage banking |

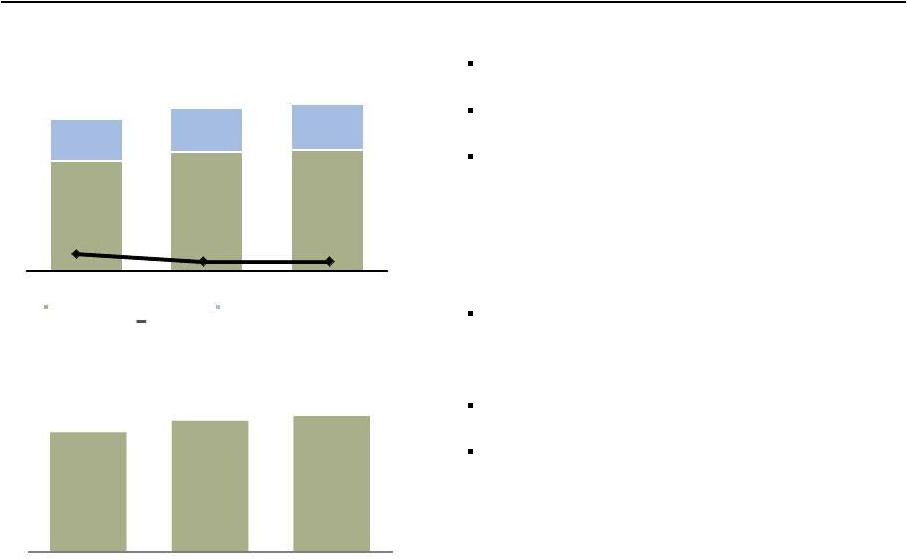

Wells Fargo

3Q14 Supplement 13

Noninterest expense and efficiency ratio

(1)

Noninterest expense up $54 million LQ

-

Personnel expense down $38 million

•

Salaries up $119 million reflecting one extra

day in the quarter and higher staffing levels

•

Commission and incentive compensation up

$82 million and included $45 million higher

revenue-based incentive compensation

•

Employee benefits expense down $239 million

and included $163 million lower deferred

compensation expense (($47) million vs.

$116 million in 2Q14)

-

Outside professional services

(2)

up $38 million

-

Other expense

(2)

up $36 million

•

Operating losses up $53 million on higher

litigation accruals

•

Foreclosed asset expense up $27 million

•

Insurance down $43 million on crop insurance

seasonality

Efficiency ratio improved LQ to 57.7%

Expect to operate within targeted efficiency ratio

range of 55%-59% in 4Q14

12,102

12,085

11,948

12,194

12,248

3Q13

4Q13

1Q14

2Q14

3Q14

59.1%

58.5%

57.9%

57.9%

57.7%

Efficiency Ratio

(1)

Efficiency ratio defined as noninterest expense divided by total revenue (net interest income

plus noninterest income). Noninterest expense and our efficiency ratio may be affected

by a variety of factors, including business and economic cyclicality, seasonality, changes in our business composition and operating environment,

growth in our business and/or acquisitions, and unexpected expenses relating to, among other

things, litigation and regulatory matters.

(2)

The sum of Outside professional services expense and Other expense ties to Other noninterest

expense in the Consolidated Statement of Income, pages 19 and 20 of the press release.

vs

vs

($ in millions)

3Q14

2Q14

3Q13

Noninterest expense

Salaries

$

3,914

3

%

-

Commission and incentive compensation

2,527

3

5

Employee benefits

931

(20)

(21)

Equipment

457

3

(3)

Net occupancy

731

1

-

Core deposit and other intangibles

342

(2)

(9)

FDIC and other deposit assessments

229

2

7

684

6

10

Other

(2)

2,433

2

10

Total noninterest expense

$

12,248

-

%

1

Outside professional services

(2) |

Wells Fargo

3Q14 Supplement 14

Community Banking

Net income of $3.5 billion, up 4% YoY and 1% LQ

reflecting growth in both net interest income and

noninterest income

Regional Banking

(1)

Primary consumer checking customers

(2)

up a

net 4.9% YoY

Primary business checking customers

(2)

up a net

5.6% YoY

Retail bank cross-sell of 6.15 products per

household; strong net household growth

Consumer Lending

Credit card penetration

(1) (3)

rose to 39.7%, up

from 39.0% in 2Q14 and 36.0% in 3Q13

Consumer auto originations of $7.6 billion, down

3% LQ and up 9% YoY

Mortgage originations of $48 billion, up 2% LQ

-

70% of originations were purchases, up from 59% in

3Q13

-

1.82% gain on sale margin

vs

vs

($ in millions)

3Q14

2Q14

3Q13

Net interest income

$

7,472

1

%

3

Noninterest income

5,356

3

7

Provision for credit losses

465

67

94

Noninterest expense

7,051

-

-

Income tax expense

1,609

(12)

7

Segment net income

$

3,470

1

%

4

($ in billions)

Avg loans, net

$

498.6

(1)

-

Avg core deposits

646.9

1

5

3Q14

2Q14

3Q13

Regional Banking

Primary consumer checking customers

(1)(2)

4.9

%

4.6

3.9

Primary business checking customers

(1)(2)

5.6

5.2

3.6

Retail Bank household cross-sell

(1)

6.15

6.17

6.15

vs

vs

($ in billions)

3Q14

2Q14

3Q13

Consumer Lending

Credit card payment volumes (POS)

$

15.9

3

%

16

Credit card penetration

(1)(3)

39.7

70

bps

367

Home Lending

Applications

$

64

(11)

%

(26)

Application pipeline

25

(17)

(29)

Originations

48

2

(40)

Gain on sale margin

1.82

41

bps

40

(1)

Metrics reported on a one-month lag from reported quarter-end; for example 3Q14 data

as of August 2014 compared with August 2013. (2)

Customers who actively use their checking account with transactions such as debit card

purchases, online bill payments, and direct deposit. (3)

Household penetration as of August 2014 and defined as the percentage of retail

bank households that have a credit card with Wells Fargo. |

Wells Fargo

3Q14 Supplement 15

Wholesale Banking

Net income of $1.9 billion, down 3% YoY and

2% LQ

Net interest income up 2% LQ reflecting average

loan growth of 3%

Noninterest income down 3% LQ on lower

investment banking and sales and trading, as well

as lower insurance (2Q14 sale of offices and

seasonality)

Noninterest expense up 1% LQ on higher

personnel expense

Cross-sell

Cross-sell of 7.2 products per relationship

(2)

up

from 7.0 in 3Q13

Treasury Management

Commercial card spend volume of $5.7 billion up

2% LQ and 15% YoY

Wholesale treasury management revenue up 1%

LQ and 9% YoY reflecting new product sales and

repricing

Investment Banking

U.S. investment banking market share

of 4.5%

(3)

Asset Management

Total AUM up $9 billion YoY, including an $11

billion increase in equity AUM reflecting higher

market valuations and net equity inflows

-

Equity AUM as a % of total AUM = 29%, up from

28% in 3Q13

(1) Please see page 1 for information on certain prior period revisions.

(2) Cross-sell reported on a one-quarter lag.

(3) Source: Dealogic U.S. investment banking fee market share.

vs

vs

($ in millions)

3Q14

2Q14

3Q13

Net interest income

$

3,007

2

%

(2)

Noninterest income

2,895

(3)

3

Reversal of provision for

credit losses

(85)

73

(41)

Noninterest expense

3,250

1

5

Income tax expense

824

(2)

(13)

Segment net income

$

1,920

(2)

%

(3)

($ in billions)

Avg loans, net

(1)

$

316.5

3

10

Avg core deposits

278.4

5

18

vs

vs

($ in billions)

3Q14

2Q14

3Q13

Key Metrics:

Cross-sell

(2)

7.2

-

%

3

Commercial card spend

volume

$

5.7

2

15

U.S. investment banking

market share %

(3)

4.5

-

bps

(120)

Total AUM

$

483.9

(1)

%

2

Advantage Funds AUM

233.7

(1)

(1)

|

Wells Fargo

3Q14 Supplement 16

Wealth, Brokerage and Retirement

Net income up 22% YoY and 1% LQ

Net interest income up 2% LQ; average loans

up 3%

Noninterest income flat LQ as higher asset-based

fees were partially offset by lower deferred

compensation gains and lower brokerage

transaction revenue

-

Brokerage managed account asset fees priced

at beginning of quarter, reflecting 6/30/2014

market valuations

Noninterest expense flat LQ as increased broker

commissions and non-personnel expenses were

partially offset by lower deferred compensation

plan expense

Retail Brokerage

Managed account assets of $409 billion, flat LQ;

up 17% YoY driven by market performance and

net flows

Wealth Management

Wealth Management client assets

down 1% LQ

and up 7% YoY

Retirement

IRA assets down 1% LQ and up 8% YoY

Institutional Retirement plan assets down 2% LQ

and up 6% YoY

(1) Includes deposits.

(2) Data as of August 2014.

vs

vs

($ in millions)

3Q14

2Q14

3Q13

Net interest income

$

790

2

%

5

Noninterest income

2,763

-

8

Reversal of provision for

credit losses

(25)

-

(34)

Noninterest expense

2,690

-

3

Income tax expense

338

1

23

Segment net income

$

550

1

%

22

($ in billions)

Avg loans, net

$

52.6

3

13

Avg core deposits

153.6

-

2

vs

vs

($ in billions, except where noted)

3Q14

2Q14

3Q13

Key Metrics:

WBR Client Assets

(1)

($ in trillions)

$

1.6

(1)

%

8

Cross-sell

(2)

10.44

-

-

Retail Brokerage

Financial Advisors

15,163

-

(1)

Managed account assets

$

409

-

17

Client assets

(1)

($ in trillions)

1.4

(1)

8

Wealth Management

Client assets

(1)

219

(1)

7

Retirement

IRA Assets

354

(1)

8

Institutional Retirement

Plan Assets

314

(2)

6 |

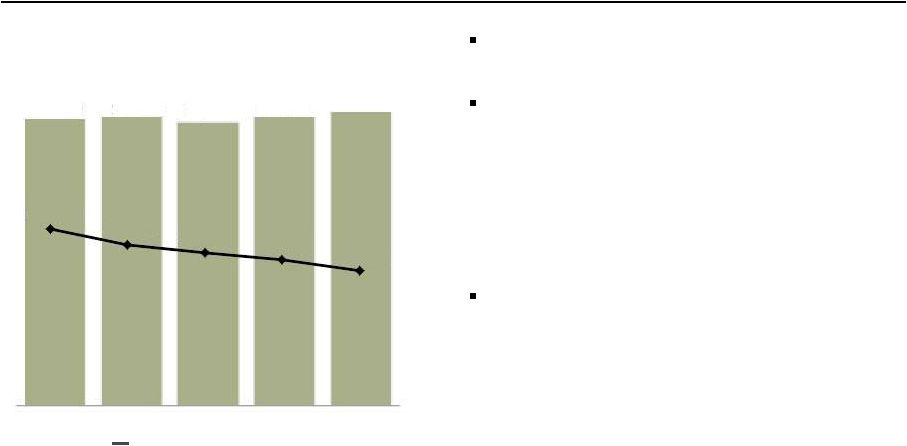

Wells Fargo

3Q14 Supplement 17

0.1

0.4

0.3

0.2

0.4

1.0

1.0

0.8

0.7

0.7

0.48%

0.47%

0.41%

0.35%

0.32%

3Q13

4Q13

1Q14

2Q14

3Q14

Provision Expense

Net Charge-offs

Net charge-off rate

16.9

15.7

14.7

14.0

13.4

3.8

3.9

4.1

4.1

4.3

20.7

19.6

18.8

18.1

17.7

3Q13

4Q13

1Q14

2Q14

3Q14

Nonaccrual loans

Foreclosed assets

Credit quality

Provision expense of $368 million, up $151 million

from 2Q14

Net charge-offs of $668 million, down $49 million,

or 7%, LQ

0.32% net charge-off rate

-

Commercial net recoveries of 2 bps, improved

5 bps LQ

-

Consumer losses of 0.62%, stable LQ

NPAs declined $406 million LQ

-

$607 million decline in nonaccrual loans

-

$201 million increase in foreclosed assets due to

growth in government insured/guaranteed

properties primarily in judicial states

Reserve release

(3)

of $300 million, down $200

million LQ

-

Continue to expect future reserve releases absent

significant deterioration in the economy, but

expect a lower level of future releases as the rate

of improvement in credit slows and the loan

portfolio continues to grow

Allowance for credit losses = $13.5 billion

-

Allowance covered 5.1x annualized 3Q14

net charge-offs

(1) Please see page 1 for information on certain prior period revisions.

(2) 30-89 days and 90 days or more past due and still accruing, and nonperforming

loans, include held for sale loans reported on Balance Sheet. (3) Provision

expense minus net charge-offs. Provision Expense and Net Charge-offs

($ in billions)

Nonperforming Assets

(2)

($ in billions)

(1) |

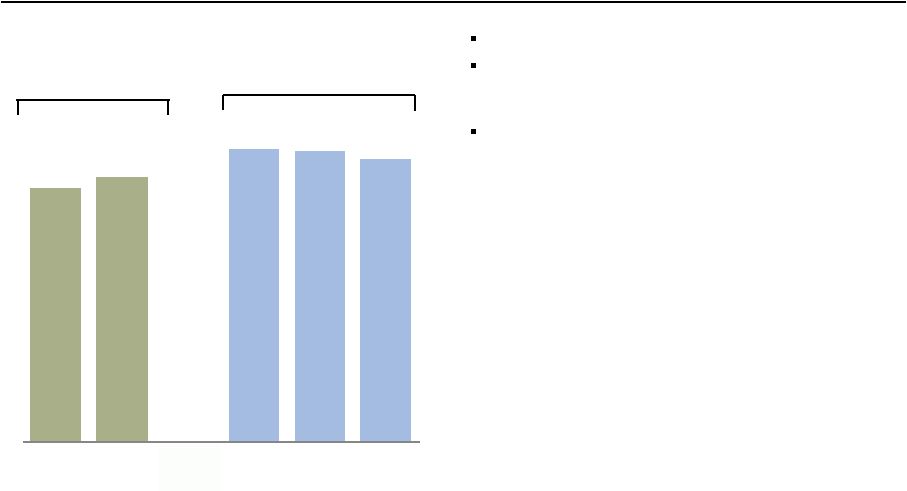

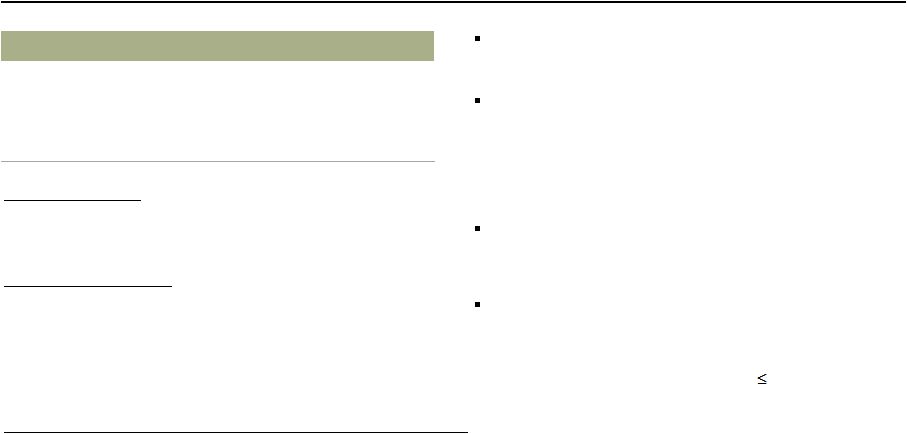

Wells Fargo

3Q14 Supplement 18

Capital remained strong

Common Equity Tier 1 ratio under Basel III

(General Approach) of 11.16%, largely due to

balance sheet growth

Common Equity Tier 1 ratio under Basel III

(Advanced Approach, fully phased-in) of

10.46% at 9/30/14

(1)

-

Advanced approach is more risk-sensitive

than the general approach, and is our

constraining factor

-

Ratio improvement reflects strong capital

generation, better credit quality and data

refinements

Capital position

See pages 30-31 for additional information regarding common equity ratios.

3Q14 capital ratios are preliminary estimates.

Common Equity Tier 1 Ratio

Under Basel I

Basel III

(General Approach)

(1)

Estimated based on final rules adopted July 2, 2013, by the Federal Reserve Board establishing

a new comprehensive capital framework for U.S. banking organizations that would

implement the Basel III capital framework and certain provisions of the Dodd-Frank Act.

10.60%

10.82%

11.36%

11.31%

11.16%

3Q13

4Q13

1Q14

2Q14

3Q14 |

Wells Fargo

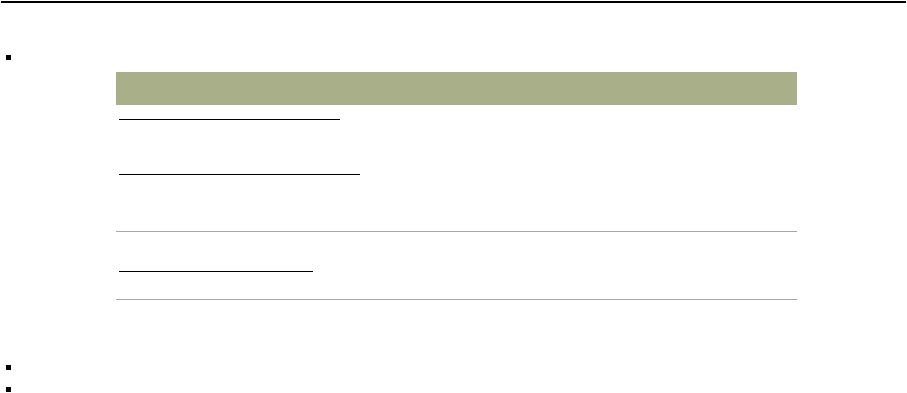

3Q14 Supplement 19

Our

strong

capital

levels

have

allowed

us

to

return

more

capital

to

shareholders

-

Returned $3.6 billion to shareholders in 3Q14

Capital return

(1)

Net payout ratio means the ratio of (i) common stock dividends and share repurchases less

issuances and stock compensation-related items, divided by (ii) net income

applicable to common stock. (2)

Dividends declared per common share as a percentage of diluted earnings per common share.

34%

26%

66%

66%

2013

1Q14

2Q14

3Q14

Net Payout Ratio

(1)

(9)

9

(16)

(35)

(40)

(30)

(20)

(10)

-

10

20

2013

1Q14

2Q14

3Q14

Net Change in Ending Common

Shares Outstanding

(shares in millions)

Period-end common shares outstanding down 34.9 million LQ

-

Purchased 48.7 million common shares

-

Issued 13.8 million common shares

-

Entered

into

a

$1.0

billion

forward

repurchase

transaction

which

is

expected

to

settle

in

4Q14

for

an

estimated 19.8 million shares

29%

28%

34%

34%

2013

1Q14

2Q14

3Q14

Dividend Payout Ratio

(2) |

Wells Fargo

3Q14 Supplement 20

Summary

3Q14

-

Diluted EPS of $1.02, up 3%

-

ROA = 1.40%

-

ROE = 13.10%

-

Loans

(1)

up $29.7 billion, or 4%, with core loans up $50.8 billion, or 7%, on broad-based

growth -

Deposits up $88.7 billion, or 9%

-

Loan portfolio is balanced, diversified and high quality

•

Credit quality improved with net charge-offs of 0.32% (annualized), down 16 bps

-

Strengthened capital levels while returning more capital to shareholders

•

Returned $3.6 billion to shareholders through common stock dividends and net share

repurchases including $1.0 billion forward repurchase transaction expected to settle

in 4Q14 •

Net payout ratio

(2)

of 66%

-

Strong liquidity; significant amount of cash available to be deployed into high quality liquid

assets Strong earnings of $5.7 billion, up $151 million, or 3% from 3Q13

PTPP up 7% reflecting diversified business model

Solid returns

Strong loan and deposit growth

Balance sheet has never been stronger

Well positioned for the future

All comparisons are 3Q14 compared with 3Q13.

(1) Please see page 1 for information on certain prior period

revisions. (2) Net payout ratio means the ratio of (i) common stock dividends and share repurchases

less issuances and stock compensation-related items, divided by (ii) net income

applicable to common stock. |

Appendix |

Wells Fargo

3Q14 Supplement 22

(1) Net of purchase accounting adjustments.

(2) At the end of 2Q14, $9.7 billion in Education Finance-government guaranteed

loans were transferred to loans held for sale. -$106.7

Non-strategic/liquidating loan portfolio

-$3.2

-$127.7

-$2.9

-$12.7

-$2.2

($ in billions)

3Q14

2Q14

1Q14

4Q13

3Q13

4Q08

Pick-a-Pay mortgage

(1)

$

46.4

48.0

49.5

51.0

52.8

95.3

Liquidating home equity

3.1

3.3

3.5

3.7

3.9

10.3

Legacy WFF indirect auto

0.1

0.1

0.1

0.2

0.3

18.2

Legacy WFF debt consolidation

11.8

12.2

12.6

12.9

13.3

25.3

Education Finance - gov't guaranteed

(2)

-

-

10.2

10.7

11.1

20.5

Legacy WB C&I, CRE and foreign PCI loans

(1)

1.5

1.5

1.7

2.0

2.3

18.7

Legacy WB other PCI loans

(1)

0.2

0.2

0.4

0.4

0.4

2.5

Total

$

63.1

65.3

78.0

80.9

84.1

190.8

|

Wells Fargo

3Q14 Supplement 23

Purchased credit-impaired (PCI) portfolios

Nonaccretable difference

Accretable yield

•

3Q14 accretable yield percentage of 6.15% increased from 4.98% LQ on the 2Q14

reclassification from nonaccretable difference to accretable yield

-

Commercial accretable yield balance of $345 million; weighted average life of portfolio is 1.9

years -

Pick-a-Pay accretable yield balance of $17.3 billion; weighted average life of 11.9

years $3.1 billion remains to absorb losses on PCI loans

$446 million accreted into interest income in 3Q14 vs. $362 million in 2Q14

$18.0 billion expected to accrete to income over the remaining life of the underlying

loans (1)

Includes write-downs taken on loans where severe delinquency (normally 180 days) or other

indications of severe borrower financial stress exist that indicate there will be a loss

of contractually due amounts upon final resolution of the loan. (2)

Reflects releases of $1.9 billion for loan resolutions and $8.4 billion from the

reclassification of nonaccretable difference to the accretable yield, which will result

in increasing income over the remaining life of the loan or pool of loans.

($ in billions)

Adjusted

unpaid

principal

balance

(1)

December 31, 2008

$

29.2

62.5

6.5

98.2

September 30,2014

2.2

26.9

0.7

29.8

Nonaccretable

difference

rollforward

12/31/08 Nonaccretable difference

$

10.4

26.5

4.0

40.9

Addition of nonaccretable difference due to acquisitions

0.2

-

-

0.2

Losses from loan resolutions and write-downs

(6.9)

(17.9)

(2.9)

(27.7)

Release of nonaccretable difference since merger

(3.6)

(5.8)

(0.9)

(10.3)

(2)

9/30/14 Remaining nonaccretable difference

0.1

2.8

0.2

3.1

Life-to-date

net

performance

Additional provision since 2008 merger

$

(1.6)

-

(0.1)

(1.7)

Release of nonaccretable difference since 2008 merger

3.6

5.8

0.9

10.3

(2)

Net performance

2.0

5.8

0.8

8.6

Commercial

Pick-a-Pay

Other

consumer

Total |

Wells Fargo 3Q14

Supplement 24

Residential mortgage trends

Mortgage production

-

70% of originations were purchases, compared with 74% in 2Q14

Mortgage repurchase liability

-

Total provision for repurchases losses: $81 million net reduction in 3Q14; primarily

reflecting release of $93 million for change in estimate vs. $26 million net reduction

in 2Q14, primarily reflecting release of $38 million for change in estimate

-

Outstanding repurchase demands (dollars) down 25% LQ

Servicing portfolio

-

(1) Net gains on mortgage loan origination/or sales activities less repurchase reserve

build/release divided by total originations. Residential mortgage production trends

($ in billions)

3Q14

2Q14

1Q14

4Q13

3Q13

Applications

$

64

72

60

65

87

Pipeline

25

30

27

25

35

Originations

48

47

36

50

80

Refinance %

30

%

26

34

32

41

Purchase %

70

74

66

68

59

Gain on Sale

(1)

1.82

1.41

1.61

1.77

1.42

$48 billion of mortgage originations, up 2% LQ

$669 million balance

Residential servicing portfolio of $1.8 trillion

Wells Fargo servicing portfolio’s total delinquency and foreclosure ratio for 3Q14 was

5.80%, up 16 bps LQ and down 53 bps YoY |

Wells Fargo

3Q14 Supplement 25

Real estate 1-4 family first mortgage portfolio

First lien mortgage loans up 1% as growth in core

first lien mortgage was partially offset by continued

run-off in the liquidating portfolio

Core first lien up $5.2 billion, or 3%, reflecting

nonconforming mortgage originations

-

Nonconforming mortgages increased $8.5 billion

to $104.0 billion

(3)

-

First lien home equity lines and loans of $17.3

billion, down $258 million

Strong core first lien credit performance

-

Nonaccrual loans down $63 million LQ

-

Net charge-offs down $7 million LQ to 7 bps

Pick-a-Pay non-PCI portfolio

-

Loans down 4% LQ driven by loans paid-in-full

-

87% of portfolio current

-

79% of portfolio with LTV

(4)

80%, up from 72%

in 2Q14 as a result of improving home values

-

Nonaccrual loans decreased $160 million,

or 5%, LQ

-

Net charge-offs of $12 million down $7 million LQ

on improved portfolio performance and lower

severities

($ in millions)

3Q14

2Q14

Total real estate 1-4 family first mortgage

$

263,326

260,104

Less consumer non-strategic/liquidating portfolios:

Pick-a-Pay

non-PCI

first

lien

mortgage

(1)

24,332

25,301

PCI first lien mortgage

(1)

22,271

22,888

Debt consolidation first mortgage portfolio

11,558

11,930

Liquidating first lien home equity lines and loans

134

144

Core first lien mortgage

205,031

199,841

Nonaccrual loans

$

3,819

3,864

as % of loans

1.86 %

1.93

Net charge-offs

$

37

43

as % of loans

0.07 %

0.09

Non-PCI loans

Nonaccrual loans

2,953

3,113

as % of loans

12.13 %

12.30

Net charge-offs

$

12

19

as % of average loans

0.19 %

0.30

90+ days past due as % of loans

8.17

8.29

PCI loans carrying value

(1)

22,057

22,664

Nonaccrual loans

$

2,032

2,049

Net charge-offs

$

65

75

as % of loans

2.22 %

2.49

Legacy

WFF

debt

consolidation

first

mortgage

and

liquidating

first

lien

HE

lines

and

loans

(2)

Pick-a-Pay first lien mortgage

Core first lien mortgage

(1)

The carrying value, which does not reflect the allowance for loan losses, includes purchase

accounting adjustments, which, for PCI loans, are the nonaccretable difference and the

accretable yield, and for all other loans, an adjustment to mark the loans to a market yield at date of merger less any subsequent charge-offs.

(2)

Ratios on Legacy WFF debt consolidation first mortgage loan portfolio only.

(3)

Nonconforming mortgages originated post February 2009.

(4)

Current LTV calculated as net carrying value divided by collateral value.

|

Wells Fargo

3Q14 Supplement 26

Real estate 1-4 family junior lien mortgage portfolio

Outstandings

down

3%

LQ

-

High quality new originations with weighted

average CLTV of 66%, 775 FICO and 33% total

debt service ratio

Net charge-offs down $20 million, or 12 bps, LQ

2+ delinquencies increased $28 million, or 11 bps

Delinquency rate for loans with a CLTV >100%

decreased 4 bps

49% in junior lien position behind WFC owned or

serviced

1

lien

-

Current

1

lien,

Current

junior

lien

=

96.8%

-

Current

1

lien,

Delinquent

junior

lien

=

1.0%

-

Delinquent

1

lien,

Current

junior

lien

=

0.9%

-

Delinquent

1

lien,

Delinquent

junior

lien

=

1.3%

51%

in

junior

lien

position

behind

third

party

1

lien

(1)

CLTV is calculated based on outstanding balance plus unused lines of credit divided by

estimated home value. Estimated home values are determined predominantly based on

automated valuation models updated through August 2014. (2)

Unsecured balances, representing the percentage of outstanding balances above

the most recent home value. ($ in millions)

3Q14

2Q14

Outstandings

$

60,844

62,455

Net charge-offs

140

160

as % of avg loans

0.90

%

1.02

2+ payments past due

$

1,517

1,489

as % of loans

2.50

%

2.39

% CLTV > 100%

(1)

20

24

2+ payments past due

3.08

%

2.79

% Unsecured balances

(2)

8

11

st

st

st

st

st

st |

Wells Fargo

3Q14 Supplement 27

Consumer credit card portfolio

Credit card outstandings up 4% LQ and 11% YoY

reflecting continued new account growth

-

Credit card household penetration

(2)

of 39.7%,

up 70 bps LQ and 367 bps YoY

-

Purchase dollar volume up 3% LQ and 16% YoY

reflecting growth in the account base

-

POS transactions up 4% LQ and 16% YoY

Net charge-offs down $10 million, or 33 bps, LQ

(1)

Consumer credit card new account openings, excludes private label.

(2)

Household penetration as of August 2014 and defined as the percentage of retail banking

deposit households that have a credit card with Wells Fargo. ($ in millions)

3Q14

2Q14

Credit card outstandings

$

28,270

27,215

Net charge-offs

201

211

as % of avg loans

2.87

%

3.20

Key Metrics:

Purchase volume

$

15,858

15,388

POS transactions (millions)

224

215

New accounts

(1)

546,640

601,631

Penetration

(2)

39.7

%

39.0 |

Wells Fargo

3Q14 Supplement 28

Auto portfolios

(1)

Consumer Portfolio

Auto outstandings of $55.2 billion up 2% LQ and

11% YoY

3Q14 originations of $7.6 billion down 3% LQ

on seasonality and up 9% YoY

Nonaccrual loans declined $7 million LQ and $45

million YoY

Net charge-offs were up $66 million LQ reflecting

seasonality, and up $34 million YoY on portfolio

growth

September Manheim index of 121.4 down 2%

LQ and 1% YoY

30+ days past due increased $147 million, or 23

bps, LQ reflecting seasonality and increased

$286 million, or 35 bps, YoY on portfolio mix and

aging

Commercial Portfolio

Loans of $8.5 billion down 3% LQ and up

13% YoY

(1)

The consumer auto portfolio includes the liquidating legacy Wells Fargo Financial indirect

portfolio of $54 million. ($ in millions)

3Q14

2Q14

Auto outstandings

$

52,245

51,345

Nonaccrual loans

136

142

as % of loans

0.26

%

0.28

Net charge-offs

$

110

46

as % of avg loans

0.84

%

0.36

30+ days past due

$

1,090

944

as % of loans

2.09

%

1.84

Auto outstandings

$

2,997

2,750

Nonaccrual loans

7

8

as % of loans

0.23

%

0.29

Net charge-offs

$

2

-

as % of avg loans

0.28

%

0.05

30+ days past due

$

11

10

as % of loans

0.37

%

0.36

Commercial

Auto outstandings

$

8,470

8,705

Nonaccrual loans

18

18

as % of loans

0.21

%

0.21

Net charge-offs

$

-

-

as % of avg loans

n.m.

%

n.m.

Indirect Consumer

Direct Consumer |

Wells Fargo

3Q14 Supplement 29

Student lending portfolio

Private Portfolio

$11.9 billion private loan outstandings up 2%

LQ and 5% YoY

Average FICO of 753 and 80% of the total

outstandings have been co-signed

Net charge-offs down $3 million LQ

30+ days past due increased $35 million LQ

on seasonality

Government Portfolio

Transferred to held for sale at the end of 2Q14

($ in millions)

3Q14

2Q14

Private Portfolio

Private outstandings

$

11,916

11,633

Net charge-offs

30

33

as % of avg loans

1.03

%

1.14

30 days past due

$

230

195

as % of loans

1.93

%

1.68

|

Wells Fargo

3Q14 Supplement 30

Common Equity Tier 1 under Basel III (General

Approach) Wells Fargo & Company

FIVE QUARTER RISK-BASED CAPITAL COMPONENTS

Sept. 30,

June 30,

Mar. 31,

Dec. 31,

Sept 30,

2014

2014

2014

2013

2013

$

183.0

181.5

176.5

171.0

168.8

(0.5)

(0.6)

(0.8)

(0.9)

(1.6)

182.5

180.9

175.7

170.1

167.2

(18.0)

(17.2)

(15.2)

(15.2)

(14.3)

(2.5)

(3.2)

(2.2)

(1.4)

(2.2)

(25.5)

(25.6)

(25.6)

(29.6)

(29.8)

-

(0.1)

-

(0.4)

(0.6)

(A)

136.5

134.8

132.7

123.5

120.3

18.0

17.2

15.2

15.2

14.3

-

-

-

2.0

2.9

(0.4)

(0.3)

(0.3)

-

-

154.1

151.7

147.6

140.7

137.5

23.7

24.0

21.7

20.5

18.9

13.5

13.8

14.1

14.3

14.3

(0.2)

-

0.2

0.7

0.6

37.0

37.8

36.0

35.5

33.8

(B)

$

191.1

189.5

183.6

176.2

171.3

$

1,171.7

1,145.7

1,120.3

51.3

46.8

48.1

1,105.2

1,099.2

36.3

35.9

(C)

$

1,223.0

1,192.5

1,168.4

1,141.5

1,135.1

(A)/(C)

11.16 %

11.31

11.36

10.82

10.60

(B)/(C)

15.63

15.89

15.71

15.43

15.09

(1)

(2)

(3)

(4)

(5)

(6)

(in billions)

Under Basel III

(General Approach) (1)

Under Basel I

Other

Total equity

Noncontrolling interests

Total Wells Fargo stockholders' equity

Adjustments:

Preferred stock

Cumulative other comprehensive income (2)

Goodwill and other intangible assets (2)(3)

Investment in certain subsidiaries and other

Common Equity Tier 1 (1)(4)

Preferred stock

Qualifying hybrid securities and noncontrolling interests

Market risk

Total Tier 1 capital

Long-term debt and other instruments qualifying as Tier 2

Qualifying allowance for credit losses

Other

Total Tier 2 capital

Total qualifying capital

Basel III Risk-Weighted Assets (RWAs) (5)(6):

Credit risk

Market risk

Basel I RWAs (5)(6):

Credit risk

Total Basel III / Basel I RWAs

Capital Ratios (6):

Common Equity Tier 1 to total RWAs

Total capital to total RWAs

Basel III revises the definition of capital, increases minimum capital ratios, and introduces a minimum

Common Equity Tier 1 (CET1) ratio. These changes are being fully phased in effective January 1,

2014 through the end of 2021 and the capital ratios will be determined using Basel III (General Approach) RWAs during 2014.

Under transition provisions to Basel III, cumulative other comprehensive income (previously deducted

under Basel I) is included in CET1 over a specified phase-in period. In addition, certain

intangible assets includable in CET1 are phased out over a specified period. Goodwill and other

intangible assets are net of any associated deferred tax liabilities. CET1 (formerly Tier 1

common equity under Basel I) is a non-GAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position

of financial services companies. Management reviews CET1 along with other measures of capital as part

of its financial analyses and has included this non-GAAP financial information, and the

corresponding reconciliation to total equity, because of current interest in such information on the part of market participants.

Under the regulatory guidelines for risk-based capital, on-balance sheet assets and credit

equivalent amounts of derivatives and off-balance sheet items are assigned to one of several

broad risk categories according to the obligor, or, if relevant, the guarantor or the nature of any collateral. The aggregate dollar amount in each risk category is then

multiplied

by

the

risk

weight

associated

with

that

category.

The

resulting

weighted

values

from

each

of

the

risk

categories

are

aggregated

for

determining

total

RWAs.

The Company's September 30, 2014, RWAs and capital ratios are preliminary.

|

Wells Fargo

3Q14 Supplement 31

Common Equity Tier 1 under Basel III (Advanced Approach, fully

phased-in) Wells Fargo &

Company COMMON EQUITY TIER 1 UNDER BASEL III (ADVANCED APPROACH, FULLY PHASED-IN)

(1)(2) Sept. 30, 2014

$

136.5

2.5

(2.5)

-

Common Equity Tier 1 (fully phased-in) under Basel III

(C) $

136.5

(D) $

1,305.7

Common Equity Tier 1 to total RWAs anticipated under Basel III (Advanced Approach, fully

phased-in) (C)/(D)

10.46

%

(1)

(2)

(3)

(4)

Common Equity Tier 1 (transition amount) under Basel III

(in billions)

CET1 is a non-GAAP financial measure that is used by investors, analysts and bank regulatory

agencies to assess the capital position of financial services companies. Management reviews CET1

along with other measures of capital as part of its financial analyses and has included this non-GAAP financial information, and the corresponding

reconciliation to total equity, because of current interest in such information on the part of market

participants. The Basel III CET1 and RWA are estimated based on the Basel III capital rules

adopted July 2, 2013, by the FRB. The rules establish a new comprehensive capital framework for

U.S. banking organizations that implement the Basel III capital framework and certain provisions of the

Dodd-Frank Act. The rules are being phased in effective January 1, 2014 through the end of

2021. Assumes

cumulative

other

comprehensive

income

is

fully

phased

in

and

certain

other

intangible

assets

are

fully

phased

out

under

Basel

III

capital

rules.

The

final

Basel

III

capital

rules

provide

for

two

capital

frameworks:

the

Standardized

Approach

intended

to

replace

Basel

I,

and

the

Advanced

Approach

applicable

to

certain

institutions. Under the final rules, we will be subject to the lower of our CET1 ratio calculated under

the Standardized Approach and under the Advanced Approach in the assessment of our capital

adequacy. While the amount of RWAs determined under the Standardized and Advanced Approaches has been converging, management’s estimate

of RWAs as of September 30, 2014, is based on the Advanced Approach, which is currently estimated to be

higher than RWAs under the Standardized Approach, resulting in a lower CET1 compared with the

Standardized Approach. Basel III capital rules adopted by the Federal Reserve Board incorporate different classification of assets, with risk weights

based on Wells Fargo's internal models, along with adjustments to address a combination of

credit/counterparty, operational and market risks, and other Basel III elements.

Adjustments from transition amount to fully phased-in under Basel III (3):

Cumulative other comprehensive income

Other

Total adjustments

Total RWAs anticipated under Basel III (4) |

| Wells Fargo

3Q14 Supplement 32

Forward-looking statements and additional information

Forward-looking statements:

This document contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, we

may make forward-looking statements in our other documents filed or furnished with

the SEC, and our management may make forward-looking statements orally to analysts,

investors, representatives of the media and others. Forward-looking statements can

be identified by words such as “anticipates,”

“intends,”

“plans,”

“seeks,”

“believes,”

“estimates,”

“expects,”

“target,”

“projects,”

“outlook,”

“forecast,”

“will,”

“may,”

“could,”

“should,”

“can”

and similar references to future periods. In particular, forward-looking statements

include, but are not limited to, statements we make about:

(i)

the

future

operating

or

financial

performance

of

the

Company,

including

our

outlook

for

future

growth;

(ii)

our

noninterest

expense

and efficiency ratio; (iii) future credit quality and performance, including our expectations

regarding future loan losses and allowance releases; (iv) the appropriateness of the

allowance for credit losses; (v) our expectations regarding net interest income and net interest margin; (vi) loan growth

or the reduction or mitigation of risk in our loan portfolios; (vii) future capital levels and

our estimated Common Equity Tier 1 ratio under Basel III capital standards; (viii) the

performance of our mortgage business and any related exposures; (ix) the expected outcome and impact of legal,

regulatory and legislative developments, as well as our expectations regarding compliance

therewith; (x) future common stock dividends, common share repurchases and other uses

of capital; (xi) our targeted range for return on assets and return on equity; (xii) the outcome of contingencies,

such as legal proceedings; and (xiii) the Company’s plans, objectives and strategies.

Forward-looking statements are not based on historical facts but instead represent

our current expectations and assumptions regarding our business, the economy and other future conditions. Investors are

urged to not unduly rely on forward-looking statements as actual results could differ

materially from expectations. Forward-looking statements speak only as of the date

made, and we do not undertake to update them to reflect changes or events that occur after that date. For more

information about factors that could cause actual results to differ materially from

expectations, refer to the “Forward-Looking Statements” discussion in

Wells Fargo’s press release announcing our third quarter 2014 results and in our

most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other

reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors”

in our Annual

Report on Form 10-K for the year ended December 31, 2013.

Purchased credit-impaired loan portfolio:

In certain cases, the purchased credit-impaired loans may affect portfolio credit ratios

and trends. Management believes that the presentation of information adjusted to

exclude the purchased credit-impaired loans provides useful disclosure regarding the credit quality of the non-impaired loan

portfolio. Accordingly, certain of the loan balances and credit ratios in this document have

been adjusted to exclude the purchased credit-impaired loans. References in this

document to impaired loans mean the purchased credit-impaired loans. Please see pages 32-34 of the press release

announcing our 3Q14 results for additional information regarding

the purchased credit-impaired loans.

Loans that were acquired from Wachovia that were considered credit impaired were written down

at acquisition date in purchase accounting to an amount estimated to be collectible and

the related allowance for loan losses was not carried over to Wells Fargo’s

allowance. In addition, such purchased credit-impaired loans are not classified as

nonaccrual or nonperforming, and are not included in loans that were contractually 90+

days past due and still accruing. Any losses on such loans are charged against the nonaccretable

difference established in purchase accounting and are not reported as charge-offs (until

such difference is fully utilized). As a result of accounting for purchased loans with

evidence of credit deterioration, certain ratios of the combined company are not comparable to a

portfolio that does not include purchased credit-impaired loans. |