Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

(Mark One)

|

|

|

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended June 30, 2014

|

|

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from __________ to __________

|

|

|

000-53560

|

|

|

Commission File Number

|

|

|

OCTAGON 88 RESOURCES, INC.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

|

26-2793743

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

Hochwachtstrasse 4, Steinhausen CH

|

6312

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

( 41) 79 237-6218

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

n/a

|

n/a

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

|

Common Stock

|

|

Title of class

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

|

Yes

|

[ ]

|

No

|

[X]

|

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes

|

[ ]

|

No

|

[ X ]

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes

|

[ ]

|

No

|

[X]

|

|

The aggregate market value of voting common stock held by non-affiliates of the registrant was approximately $63,002,313 as of December 31, 2013 (the last business day of the registrant’s most recently completed second quarter), calculated as of the closing selling price of $6.37, assuming solely for the purpose of this calculation that all directors, officers and greater than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose.

|

2

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST 5 YEARS:

Indicate by check mark whether the issuer has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

|

Yes

|

[ ]

|

No

|

[ ]

|

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

26,932,342 common shares outstanding as of October 7, 2014

|

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes.

|

None

|

3

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Business

|

5 | |

|

Risk Factors

|

16 | |

|

Unresolved Staff Comments

|

22 | |

|

Properties

|

23 | |

|

Legal Proceedings

|

34 | |

|

Mine Safety Disclosures

|

34 | |

|

PART II

|

||

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

34 | |

|

Selected Financial Data

|

35 | |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

35 | |

|

Quantitative and Qualitative Disclosures About Market Risk

|

38 | |

|

Financial Statements and Supplementary Data

|

38 | |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

39 | |

|

Controls and Procedures

|

39 | |

|

Other Information

|

41 | |

|

PART III

|

||

|

Directors, Executive Officers and Corporate Governance

|

44 | |

|

Executive Compensation

|

44 | |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

46 | |

|

Certain Relationships and Related Transactions, and Director Independence

|

48 | |

|

Principal Accounting Fees and Services

|

50 | |

|

PART IV

|

||

|

Exhibits, Financial Statement Schedules

|

51 | |

|

SIGNATURES

|

52 |

4

PART I

FORWARD-LOOKING INFORMATION

We make forward-looking statements throughout this report. Whenever you read a statement that is not simply a statement of historical fact (such as statements including words like “believe,” “expect,” “anticipate,” “intend,” “will,” “plan,” “seek,” “may,” “estimate,” “could,” “potentially” or similar expressions), you must remember that these are forward-looking statements, and that our expectations may not be correct, even though we believe they are reasonable. The forward-looking information contained in this report is generally located in the material set forth under the headings “Business,” “Risk Factors,” “Properties,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” but may be found in other locations as well. These forward-looking statements generally relate to our plans and objectives for future operations and are based upon our management’s reasonable estimates of future results or trends. The factors that may affect our expectations regarding our operations include, among others, the following:

|

·

|

the availability of capital;

|

|

·

|

our success in development, exploitation and exploration activities;

|

|

·

|

our ability to procure services and equipment for our drilling and completion activities;

|

|

·

|

our ability to make planned capital expenditures;

|

|

·

|

our restrictive debt covenants;

|

|

·

|

political and economic conditions in oil producing countries, especially those in Canada;

|

|

·

|

price and availability of alternative fuels;

|

|

·

|

our acquisition and divestiture activities;

|

|

·

|

weather conditions and events;

|

|

·

|

the proximity, capacity, cost and availability of pipelines and other transportation facilities; and

|

|

·

|

other factors discussed elsewhere in this report.

|

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

5

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this Annual Report, the terms "we," "us," "Company," "our" and "Octagon" mean Octagon 88 Resources, Inc. and its wholly owned subsidiary Octagon 88 Resources (Schweiz) AG, unless otherwise indicated.

Corporate Information and Corporate History

The address of our principal executive office is Hochwachtstrasse 4, Steinhausen, CH 6312. Our telephone number is (41) 79- 237-6218. Our website is www.octagon-88.com.

Our common stock is quoted on the OTCBB (“Over-the-Counter Bulletin-Board”) under the symbol "OCTX".

Octagon 88 Resources Inc. was incorporated in the State of Nevada on June 9, 2008, as a natural resource exploration company.

On August 13, 2010, we underwent a change of control and 8883333333 Holdings Ltd. became the controlling shareholder of the Company, however our there was no change in the Company’s planned business which was, and remains, the acquisition, exploration and development of oil and gas assets.

During April and May 2011, there was a dispute between Mr. Hryhor, our then Chief Executive Officer, and Kenmore International S.A., the then controlling shareholder of 888333333 Holdings Ltd. (“888 Holdings”); which was our major shareholder. On May 27, 2011 Mr. Hryhor reported that on May 26, 2011, Ms. Jacqueline Danforth was removed as a Director of the Company by Consent of the Stockholders in Lieu of Meeting allegedly executed by a majority of the stockholders and that Ms. Jacqueline Danforth was dismissed as our Chief Financial Officer and Secretary Treasurer by a resolution in writing of the Board of the Corporation, making Mr. Hryhor our sole officer and director. However, 888 Holdings did not vote on this motion as it was not controlled or represented by Mr. Hryhor as prior reported and this action required the vote of our controlling shareholder. On May 21, 2011, 888 Holdings and other stockholders holding 83.14% of our issued share capital voted to remove Mr. Hryhor as Director of the Company. On June 22, 2011, our legal counsel filed the definitive Schedule 14C with the Securities and Exchange Commission, which was mailed to all shareholders of record as of May 21, 2011, and reported that on May 21, 2011, the majority shareholders holding 83.14% of our stock had voted to replace Mr. Donald Hryhor, with Mr. Philip Thomann and Ms. Jacqueline Danforth as Directors of the Company. Moreover, Mr. Thomann was named as our Chairman of the Board, Chief Executive Officer and President, Secretary and Treasurer. As required under the rules and regulations of the Securities and Exchange Commission, the change to the Board of Directors appointing Ms. Danforth and Mr. Thomann took place 20 days after June 21, 2011 which was the mailing date of the Definitive 14C.

On May 5, 2012, Philip Thomann resigned as our Chief Executive Officer, President, Secretary, Treasurer, Chief Financial Officer and Director.

On May 9, 2012, the Board of Directors appointed Mr. Moufid Makhoul as our Chief Executive Officer, President, Secretary, Treasurer, Chief Financial Officer and Director.

On August 16, 2012, Moufid Makhoul resigned as our Chief Executive Officer, President, Secretary, Treasurer, Chief Financial Officer and Director and the Board of Directors appointed Mr. Feliciano Tighe as our Chief Executive Officer, President, Secretary, Treasurer, Chief Financial Officer and a Director.

6

On October 3, 2012, the Board of Directors of Octagon 88 Resources, Inc. (the “Company”) appointed Dr. Peter Beck as a Director of the Company.

On October 4, 2012, Ms. Danforth resigned as a director and officer of the Company.

On October 11, 2012, Feliciano Tighe resigned as Chief Financial Officer of the Company and on October 12, 2012, the Board of Directors appointed Bryan Leonard Cook as Chief Financial Officer of the Company.

On December 21, 2012, the Company closed an agreement which it had entered into with Zentrum Energie Trust AG (“Zentrum”) which it had entered into on October 15, 2012 and issued a total of 14,000,000 restricted shares of the Company to Zentrum. Pursuant to the agreement the Company’s then controlling shareholder, Kenmore International S.A. returned a total of 31,942,000 shares to treasury for cancellation, thus effecting a change of control of the Company.

On December 24, 2012, the Company acquired a total of 3,100,000 common shares in the capital stock of CEC North Star Energy Ltd., which is referred to herein as CEC or North Star.

On January 22, 2013, the Company entered into an acquisition of mineral rights agreement with Zentrum to acquire the Mineral Rights known as the Trout Properties.

On January 24, 2013, the Company entered into a share purchase agreement with three independent shareholders whereby the Company acquired an additional 1,410,000 common shares in the capital stock of CEC North Star Energy Ltd.

On January 29, 2013, Mr. Feliciano Tighe tendered his resignation as President of the Company and Mr. Guido Hilekes was appointed a director and President of the Company.

On January 29, 2013, Mr. Gordon E. Taylor was appointed a director of the Company.

On March 31, 2013, Mr. Gordon Taylor tendered his resignation as a Director of the Company.

On July 1, 2013, Mr. Richard O. Ebner was appointed a Director of the Company.

On August 4, 2014, Bryan Leonard Cook was dismissed as the Chief Financial Officer of Octagon 88 Resources, Inc. Concurrently Mr. Richard Ebner was appointed the Company’s Chief Financial Officer.

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

We are currently based in Switzerland and we hold oil and gas assets in Canada. We intend to acquire and where warranted operate oil and gas assets in the U.S. and Canada. Some of our assets may be operated by other companies that we either hold an interest in or that are appointed operators based on the determination of management on each project individually acquired and reviewed.

We have one wholly owned subsidiary, Octagon 88 Resources (Schweiz) AG, a company incorporated pursuant to the laws of Switzerland. All of our operations are undertaken by our Swiss subsidiary.

Current Business

We were incorporated as a natural resource exploration company to acquire, explore and develop natural resource assets. We commenced our business operations by acquiring the right to earn a 50% working interest in an Alberta, Canada petroleum and natural gas lease. With a change in management and a review of the project, we allowed the Farm-out agreement to lapse and therefore under the SEC policies we became a shell company.

7

The Company’s intention is to grow shareholder value through mergers and acquisitions opportunities available to the Company. Following the intent of the Company, in late 2012 and early2013, we acquired substantial light and conventional heavy oil assets in Northern Alberta by way of a number of acquisition agreements pursuant to which we acquired certain direct and indirect working interests more particularly described above and throughout this annual report on Form 10-K.

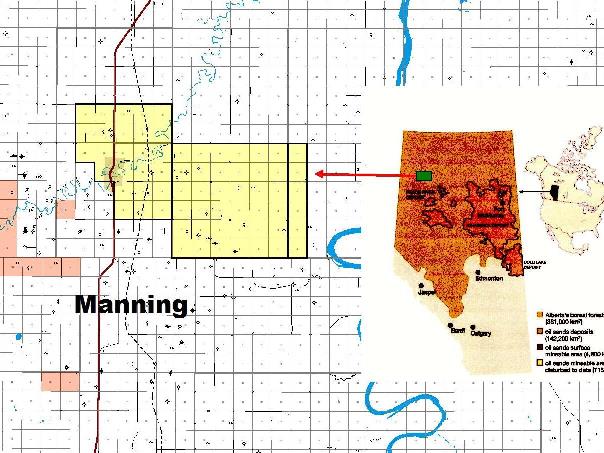

Following the consummation of these acquisitions the Company emerged from shell status. We acquired an indirect working interest in a contiguous land base of 73 sections of oilsands leases in the Province of Alberta through the acquisition of shares in CEC North Star Energy Ltd. and a direct working interest in petroleum and natural gas leases known as the Trout Lake Properties, also located in the Province of Alberta.

Exploration Activities

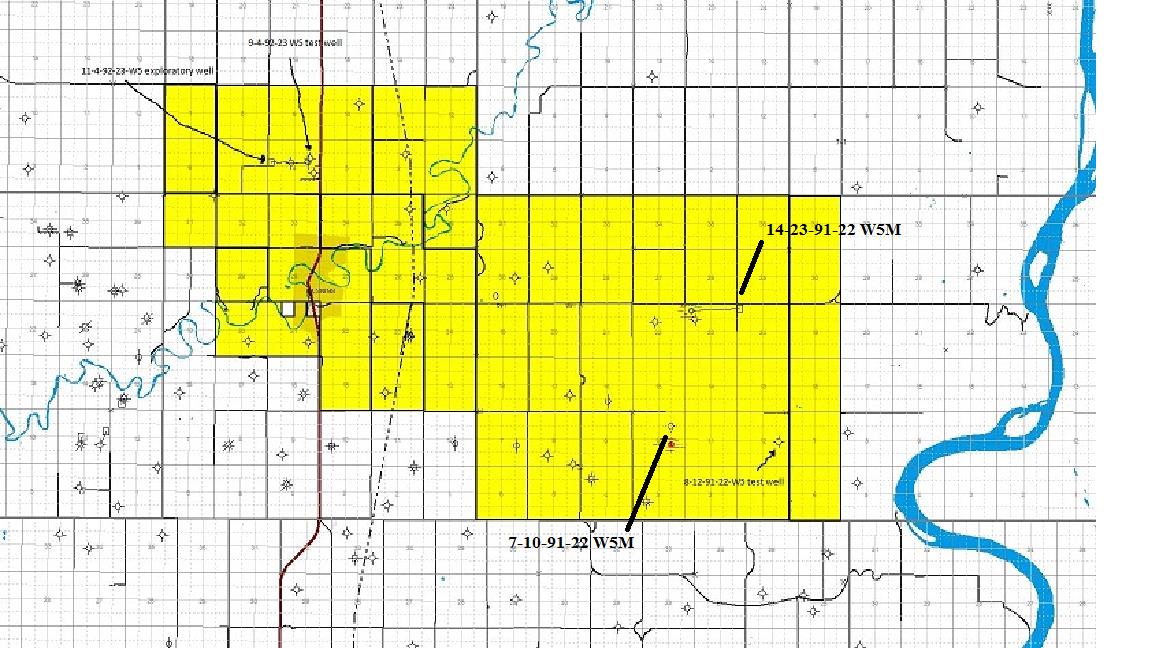

In late 2012, North Star performed an in-house extensive geological review of 25 historical wells drilled relying on available public information. North Star then purchased additional 2D seismic prior to drilling two exploratory delineation wells in March 2013 targeting heavy oil in the Elkton formation (11-4-92-23W5) and the Bluesky formation (8-12-0-91-22W5) and undertaking a number of independent third party evaluations in order to obtain further information from the drilling. Further in spring and summer of 2014 North Star completed the drilling of one production test well to the Bluesky formations, as well as a development horizontal well which is expected to be put on production in the term.

|

·

|

CEC Deadwood 11-4-92-23-W5

|

In March 2013, North Star drilled the discovery well for the Elkton oil pool at Manning. The objective of this well was to core and delineate the Elkton formation. Drilling and coring were completed in five days. The core was sent to AGAT Laboratories, or AGAT, a third party independent laboratory, for porosity, permeability, oil saturation, oil viscosity and API oil gravity analysis. Following the drilling and coring of this well, the well was logged by Baker Hughes. This well was the first drilled in the Manning Area to test the heavy oil potential of the Elkton erosional edge play.

|

·

|

CEC Deadwood 8-12-91-22W5

|

In March 2013, the Bluesky test delineation well or stratigraphic test well (drilled for purposes of obtaining core data and subsequently abandoned, and surface immediately reclaimed) was drilled based on a positive seismic signature that suggested a deep valley fill cut and a thick sandstone deposit. The objective of this well was to core and delineate the Bluesky formation. Drilling and coring were completed in five days twenty-two meters of core were recovered. The core was sent to AGAT for porosity, permeability, oil saturation, oil viscosity and oil API gravity analysis. Following the drilling and coring of this well, the well was logged by Baker Hughes.

The cores from the two well coring programs on both the Elkton and the Bluesky wells described above were analyzed by AGAT’s, Calgary, Alberta offices. In addition, a heavy oil feasibility study was prepared by Schlumberger Canada Ltd. dated June 2013 and an independent evaluation of oil potentially in place was prepared for North Star by GLJ Petroleum Consultants. Our management believes that, based on the information contained in the reports provided by these independent consultants, the Manning Project has substantial merit and value. Based on the information provided in the reports, the Company decided to drill a production test well at 9-4-92-23W5 prior to December 31, 2013.

|

·

|

CEC Deadwood 9-4-92-23 W5

|

In October 2013, North Star completed a production test well to the Elkton formation. The well was drilled vertically to a depth of 480 meters, cored and plugged back. Subsequently the well was drilled horizontally to a total measured depth of 1517.97 meters. Further the well tested drilling technology in Carbonate formations for the Peace River. The well was put on production test until cold weather made operations difficult. The well was left suspended. Core was provided to Perm Inc for ongoing stimulation testing.

|

·

|

Seismic

|

A 4 mi sq 3D seismic program was shot during the winter of 2013/2014 on the Bluesky trend with analysis completed in January 2014. As a result 5 drill targets were identified.

8

|

·

|

CEC Deadwood 7-10-91-22 W5M

|

In March 2014, CEC completed a production test well to the Bluesky formation. The well was drilled vertically to a depth of 500 m, cored and completed to two Bluesky zones. Production tests were undertaken during the subsequent months. After some initial production the well sanded off and the testing was terminated. The well was abandoned in July 2014 and the surface reclaimed. Core, and oil/water/gas analysis obtained from the production tests were sent to AGAT for analysis.

|

·

|

CEC Deadwood 14-23-91-22 W5M

|

Based on the results of the Bluesky test on 7-10-91-22 W5M and the 3D seismic obtained in the winter of 2013/2014, in July 2014 CEC drilled a vertical well a depth of 477 meters, cored and plugged back, drilling horizontal leg to a total measured depth of 1603 meters with the intent of putting the well on production. As at the date of this report the well has produced for about 4 weeks before the pump failed due to solids content in the fluid and a work over was required. A new pump has been installed and the well has been put back on pump.

As of October 7, 2014, the Company does not have any reportable reserves. It is expected that once production has been ongoing for a minimum of 6 to 9 months initial reserve evaluations may be completed.

Our current plan of development entails working with North Star, the operator of these properties, to bring on production and cash flow through the Company’s direct working interests in Trout Lake and its indirect interests in the Manning Project, which are held by virtue of the Company’s percentage ownership in North Star.

Notable Acquisitions

On December 24, 2012, we exchanged 14,000,000 shares of the Company with Zentrum Energie Trust AG (“Zentrum”) for approximately 3,100,000 shares of CEC North Star Energy Ltd. (“North Star”) and on January 23, 2013, we exchanged a further 1,410,000 shares of North Star with three independent stockholders of North Star for 5,310,000 shares of the Company bringing our ownership interest in North Star to 31.4% and making the Company the largest single stockholder of North Star. Certain of the officers and directors and shareholders of North Star, Zentrum and the Company are related parties as further described herein under “Related Party Transactions.”

On January 22, 2013, the Company entered into an acquisition of mineral rights agreement (the “Mineral Rights Agreement”). Under the terms of the Mineral Rights Agreement, the Company has the right to acquire the Mineral Rights known as the Trout Properties by undertaking certain exploration activities on the properties acquired. The acquisition was made between Zentrum and the Company. Certain of the officer and directors and shareholder of Zentrum and the Company are related parties as further described herein under “Related Party Transactions.”

About North Star

Incorporated in Alberta in 2012, North Star was established by a group of international financial and oil and gas experts to build a major oil and gas company targeting conventional heavy crude oilsands opportunities in northwestern Alberta, Canada.

Since its inception, North Star has acquired and consolidated an extensive contiguous land base of 73 sections, from which they have:

|

·

|

developed a geological model for the resources in the area and specifically for the lands held;

|

|

·

|

drilled wells, conducted cores and seismic tests;

|

|

·

|

acquired more land on the trend; and

|

|

·

|

obtained third party reviews of the projects and geological models relating to such resources.

|

9

Manning Project – Phased Development Model focusing on primary recovery of the “Elkton Erosional Edge”

A plan of development (POD) has been compiled that proposes a combined phased development of the “Manning Project” that is located in the Peace River block of northwestern Alberta, Canada. The Manning Project comprises the following targets:

(1) EOR recovery of oil in the Elkton Erosional Edge formation;

(2) EOR recovery of oil in the Debolt Erosional Edge Formation;

(3) Multiple Bluesky/Gething primary recovery projects; and

(4) Down-dip from Erosional Edge Elkton and Debolt formations exploration and development.

The main focus of the Plan of Development is expected to be the primary recovery of 11-13 API heavy oil in the Bluesky Channels with EOR programs for the Elkton/Debolt oilsands. Current plans for the upcoming 12 months for the Elkton include additional well core and lab/simulation work for fall 2014 working to a field test of preferred EOR program for the second quarter of 2015 and a pilot project application to be completed immediately thereafter. North Star is licensing additional multi leg horizontal wells on the Bluesky Channels with subsequent 3D seismic programs. Additionally, North Star engaged Weatherford Labs for simulation work and Kade Reservoir to define the simulations and subsequent modeling. In addition design has started for construction of an oil battery for production and treating and subsequent sales.

Trout Property

On January 22, 2013, the Company entered into an acquisition of mineral rights agreement with Zentrum (the “Mineral Rights Agreement”). Under the terms of the Mineral Rights Agreement the Company has the right to acquire a 100% interest in the Mineral Rights known as the Trout Properties for consideration as follows:

|

·

|

An 8% Royalty of Gross Monthly Production to be paid to Zentrum;

|

|

|

·

|

On or before December 31, 2013, the Company shall have drilled a minimum of one (1) exploratory well to contract depth at locations to be provided by Zentrum and agreed to by the Company on Section 9 89 R3W5 of the Trout Property;

|

|

·

|

On or before June 30, 2014, unless otherwise mutually agreed to, the Company shall perform a 3D seismic program on Sections 4, 5, 6 89 R3W5 of the Trout Property. A copy and rights to the seismic data shall be provided to Zentrum within 60 days of the completion of the project;

|

|

|

·

|

On or before December 31, 2014, unless otherwise mutually agreed to, the Company shall have drilled a minimum of one (1) exploratory well at a location to be mutually determined based on the 3D seismic above;

|

|

·

|

Any default in the terms above will terminate the Mineral Rights Agreement and the Company shall return the Trout Property to Zentrum.

|

10

The Trout Property is comprised of certain oil and gas leases as detailed below:

|

Legal Description

|

Title Document

|

Expiry

|

Pre Farm-out Working Interest

|

Encumbrances

|

|

Sec 4-89-3 W5M All Petroleum and Natural Gas

|

Alberta PNG 0511080381

Dated August 25, 2011

|

August 25, 2016

|

100%

|

Crown S/S Lessor

GORR 8% BPO;

3% APO

|

|

Sec 5-89-3 W5M All Petroleum and Natural Gas

|

Alberta PNG 0511080382

Dated August 25, 2011

|

August 25, 2016

|

100%

|

Crown S/S Lessor

GORR 8% BPO;

3% APO

|

|

Sec 6-89-3 W5M All Petroleum and Natural Gas

|

Alberta PNG 0511080383

Dated August 25, 2011

|

August 25, 2016

|

100%

|

Crown S/S Lessor

GORR 8% BPO;

3% APO

|

|

Sec 9-89-3 W5M All Petroleum and Natural Gas

|

Alberta PNG 0510070305

Dated July 8, 2010

|

July 8, 2015

|

100%

|

Crown S/S Lessor

GORR 8% BPO;

3% APO

|

On February 13, 2014, Company and Zentrum entered into a further letter agreement amending and restating the terms of the original Mineral Rights Agreement of January 22, 2013, adopting the following terms and conditions:

|

·

|

Octagon and Zentrum will enter into a formal Farm-out and Operating Agreement;

|

|

·

|

Octagon will have the right to earn a fifty percent (50%) working interest in the Trout Properties;

|

|

·

|

A 3% Royalty of Gross Monthly Production to be paid to Zentrum;

|

|

·

|

Octagon will pay fifty percent (50%) of the drilling and completion costs of the first production well to be drilled on the Trout Properties at such location as may be agreed between the parties (the "Well");

|

|

·

|

Within six months of the successful completion and production of the Well, Octagon will pay to Zentrum a cash payment in the amount of$1,250,000.

|

In May 2014 the Company received the first draft of the Farm-out and Operating Agreements together with a cash call for its 50% share of the drilling costs for the first well to be drilled at 7-9-89-3 W5M in the total amount of CAD$998,647 (USD $935,869). Concurrent with the draft Farm-out and Operating Agreements, Zentrum advised the Company of its agreement to Farm-out 42.5% of its remaining 50% working interest. Assuming all parties are successful in earning their respective working interests, Zentrum will maintain a 7.5% working interest, other partners have acquired a total of 22.5% working interest and North Star has farmed in to earn a 20% working interest.

As at the date of this report joint venture partners including Zentrum and CEC, holding the right to earn a 42.5% working interest have completed certain geological and geophysical work to identify the bottom hole target and have conducted extensive field work to locate an appropriate surface location with reasonable access for a directional drilling rig. Further the joint venture partners have obtained an environmental assessment for the drilling application and obtained project approval for the drilling from the Peerless/Trout First Nations Band. The site has also been made ready for drilling and has been secured with gates on access roads as required. The drilling license will remain in place for a year, expiring April 2015, by which time the well must be drilled and completed. Mineral rights on this lease targeted for drilling expire in July 2015 and any work will need to be reclaimed if the project does not proceed.

The Company has not yet returned the signed Farm–out and Operating Agreements, nor has the cash call been funded as at the date of this filing. The joint venture partners have advised the Company they will not spud the well until such documents and required funding have been provided. It is anticipated management will complete its review of the pending agreements no later than October 31, 2014.

11

Regulation of Oil and Gas Activities

The exploration, production and transportation of all types of hydrocarbons are subject to significant governmental regulations. Our properties will be affected from time to time in varying degrees by political developments and provincial and local laws and regulations. In particular, oil and gas production operations and economics are, or in the past have been, affected by industry specific price controls, taxes, conservation, safety, environmental and other laws relating to the petroleum industry, and by changes in such laws and by periodically changing administrative regulations.

Provincial and local laws and regulations govern oil and gas activities. Operators of oil and gas properties are required to have a number of permits in order to operate such properties, including operator permits and permits to dispose of salt water. The operator, North Star, possesses all material requisite permits required by the provinces and other local authorities in which they operate properties based on their activity at the time of the respective operation.

The AER D56 requirements for licensing, notification and obtaining approval applies to the development of the Manning Project. A full directive of the requirements can be found at;

http://aer.ca/documents/directives/Directive056.pdf

North Star was required to apply and be granted permits for the drilling of the two exploratory wells discussed herein as well as for the drilling of the production well which commenced drilling in October 2013. For the ongoing drilling operations, our operator will be required to apply for and secure permits for the planned operations as detailed in the above noted directive.

In addition, under federal and provincial law, operators of oil and gas properties are required to possess certain certificates and permits in order to operate such properties such as hazardous materials certificates, which we intent to obtain as required.

Development and Production

The operations of our properties are subject to various types of regulation at the federal, provincial, and local levels. These types of regulation include requiring the operator of oil and gas properties to possess permits for the drilling and development of wells, post bonds in connection with various types of activities, and file reports concerning operations. The jurisdiction in which we operate regulates the following:

|

●

|

the location of wells;

|

|

●

|

the method of drilling and casing wells;

|

|

●

|

the method of completing and fracture stimulating wells;

|

|

●

|

the surface use and restoration of properties upon which wells are drilled;

|

|

●

|

the plugging and abandoning of wells; and

|

|

●

|

the notice to surface owners and other third parties.

|

The failure to comply with these rules and regulations can result in substantial penalties, including lease suspension or termination in the case of federal or provincial leases. The regulatory burden on the oil and gas industry increases our cost of doing business and, consequently, affects our profitability. Our competitors in the oil and gas industry are subject to the same regulatory requirements and restrictions that affect us.

12

Title to Interests

As is customary in our industry, a preliminary review of title records, which may include opinions or reports of appropriate professionals or counsel, is made at the time we acquire properties. We believe that our title to all of the various interests set forth above is satisfactory and consistent with the standards generally accepted in the oil and gas industry, subject only to immaterial exceptions that do not detract substantially from the value of the interests or materially interfere with their use in our operations. The interests owned by us may be subject to one or more royalty, overriding royalty, or other outstanding interests (including disputes related to such interests) customary in the industry. The interests may additionally be subject to obligations or duties under applicable laws, ordinances, rules, regulations, and orders of arbitral or governmental authorities. In addition, the interests may be subject to burdens such as production payments, net profits interests, liens incident to operating agreements and current taxes, development obligations under oil and gas leases, and other encumbrances, easements, and restrictions, none of which detract substantially from the value of the interests or materially interfere with their use in our operations.

Competition

We operate in a highly competitive environment. The principal resources necessary for the exploration and production of oil and gas are leasehold prospects under which oil and gas reserves may be discovered, drilling rigs and related equipment and services to explore for such reserves and knowledgeable personnel to conduct all phases of oil and gas operations. We must compete for such resources with both major oil and gas companies and independent operators. Many of these competitors have financial and other resources substantially greater than ours. Although we believe our current operating and financial resources are adequate to preclude any significant disruption of our near term operations; however we cannot assure you that such materials and resources will be available to us in the future.

The Company’s business is subject to regulations generally established by government legislation and governmental agencies. The regulations are summarized in the following paragraphs.

The Industry in Canada

The crude oil and natural gas industry in Canada operates under government legislation and regulations, which govern exploration, development, production, refining, marketing, transportation, prevention of waste and other activities.

The Company’s Canadian properties are located in Alberta. Most of these properties are held under leases/licences obtained from the respective provincial or federal governments, which give the holder the right to explore for and produce crude oil and natural gas. The remainder of the properties are held under freehold (private ownership) lands. The leases held by North Star are a 100% working interest in oilsands leases granted by the Government of Alberta. The Trout Lake properties are 100% petroleum and natural gas leases granted by the Government of Alberta, on which Octagon 88 has the right to earn a 50% working interest.

Conventional petroleum and natural gas leases issued by the Province of Alberta have a primary term from two to five years. Those portions of the leases that are producing or are capable of producing at the end of the primary term will “continue” for the productive life of the lease.

An Alberta oilsands permit and oilsands primary lease is issued for five and fifteen years respectively. If the minimum level of evaluation of an oilsands permit is attained, a primary oilsands lease will be issued. A primary oilsands lease is continued based on the minimum level of evaluation attained on such lease. Continued primary oilsands leases that are designated as “producing” will continue for their productive lives and are not subject to escalating rentals while those designated as “non-producing” can be continued by payment of escalating rentals.

The provincial governments regulate the production of crude oil and natural gas as well as the removal of natural gas and NGLs from their respective province. Government royalties are payable on crude oil, NGLs and natural gas production from leases owned by the province. The royalties are determined by regulation and are generally calculated as a percentage of production varied by a number of different factors including selling prices, production levels, recovery methods, transportation and processing costs, location and date of discovery.

The Alberta government implemented changes to the Alberta Royalty Framework (“ARF”) effective January 1, 2009. The ARF includes a number of changes to royalty rates for natural gas, crude oil, and oilsands production. Under the ARF, royalties payable vary according to commodity prices and the productivity of wells. Initial changes to the Alberta royalty regime under the ARF included the implementation of a sliding scale for oilsands royalties ranging from 1% to 9% on a gross revenue basis pre-payout and 25% to 40% on a net revenue basis post-payout, depending on benchmark crude oil pricing.

13

During 2010, the Government of Alberta modified the crude oil and natural gas royalty rates. These changes included:

|

·

|

Effective May 1, 2010, an extension of the period subject to the 5% maximum royalty rate for CBM and shale gas wells to the first 36 months after start of production, subject to volume limits of 750 MMcfe for CBM and no volume limits for shale gas.

|

|

·

|

Effective May 1, 2010, an extension of the period subject to the 5% maximum royalty rate for horizontal natural gas and crude oil wells. The period for horizontal natural gas wells is extended to the first 18 months after start of production, and volumes of 500 MMcfe. Limits on production months and volumes for crude oil will be set according to the measured depth of the wells.

|

|

·

|

Effective January 1, 2011, a reduction in the maximum royalty rate to 5% on new natural gas and crude oil wells for the first 12 months after the start of production, subject to volume limits of 500 MMcfe and 50,000 BOE respectively.

|

|

·

|

Effective January 1, 2011, a reduction in the maximum royalty rate for crude oil from 50% to 40% and a reduction in the maximum royalty rate for conventional and unconventional natural gas from 50% to 36%.

|

Modifications were also made to the natural gas deep drilling program, including changes to depth requirements. The Government of Alberta also announced changes to the price components of oil and gas royalty formulas to reduce the royalty rate at prices higher than $85.00 per bbl and $5.25 per GJ respectively.

During 2007, the Canadian federal government enacted income tax rate changes which decreased the federal corporate income tax rate over a five year period. The federal income tax rate in 2012 was 15%.

During 2011, the Canadian federal government enacted legislation to implement several taxation changes. These changes include a requirement that, beginning in 2012, partnership income must be included in the taxable income of each corporate partner based on the tax year of the partner, rather than the fiscal year of the partnership. The legislation includes a five year transition provision and has no impact on net earnings.

In addition to government royalties, the Company is subject to federal and provincial income taxes in Canada at a combined rate of approximately 25.1% after allowable deductions for 2012.

Further Effects of Existing or Probable Governmental Regulations on the Business

In Canada, producers of oil negotiate sales contracts directly with oil purchasers, with the result that the market determines the price of oil. The price depends in part on oil quality, prices of competing fuels, distance to market, the value of refined products and the balance of supply and demand for oil. Oil exports may be made pursuant to export contracts with terms not exceeding 1 year in the case of light crude, and not exceeding 2 years in the case of heavy crude, provided that an order approving any such export has been obtained from the National Energy Board of Canada (“NEB”). Any oil export to be made pursuant to a contract of longer duration (to a maximum of twenty-five (25) years) requires an exporter to obtain an export license from the NEB and the issuance of such a license requires the approval of the Governor in Council.

In Canada, the price of natural gas sold in interprovincial and international trade is determined by negotiation between buyers and sellers. Natural gas exported from Canada is subject to regulation by the NEB and the Government of Canada. Exporters are free to negotiate prices and other terms with purchasers, provided that the export contracts continue to meet certain criteria prescribed by the NEB and the Government of Canada. Natural gas exports for a term of less than two years or for a term of 2 to 20 years (in quantities no greater than 30,000 m3/day) must be made pursuant to an NEB order. Any natural gas export to be made pursuant to a contract of longer duration (to a maximum of 25 years) or of a larger quantity requires an exporter to obtain an export license from the NEB and the issuance of such a license requires the approval of the Governor in Council.

The Government of Alberta also regulates the volume of natural gas which may be removed from the province for consumption elsewhere based on such factors as reserve availability, transportation arrangements and market considerations.

The Government of Alberta regulates the royalty percent from Crown mineral leases for petroleum, natural gas and hydrocarbon by-products.

14

Principal Products or Services and Their Markets

Our principal products are intended to be petroleum and natural gas and any related saleable by-products. Our initial market will be the Province of Alberta. We currently do not have any oil and gas production or products.

Distribution Methods of the Products or Services

Once we have oil and gas production, we will rely on the operator of our oil and gas wells to distribute any oil and gas and saleable by-products. We do not know at this time whether we will be the operator of the oil and gas assets we may acquire, but we do anticipate that we may undertake operations on some of the oil and gas assets.

Need for any Governmental Approval of Principal Products or Services

We do not currently have any production, however, our operator is required to have government approvals for all drilling and production activities undertaken in the respective jurisdictions where we may acquire assets and thus, we will be required to ensure that all approvals are granted and complied with. Should we progress further in our development, we will become subject to all governmental approval requirements to which oil and gas producers are subject.

Smaller Reporting Company

We are currently subject to the reporting requirements of Section 13 of the Exchange Act, and we are subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports that we file with the Securities and Exchange Commission, or SEC, are available at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding reporting companies.

Employees

We presently have no employees. We hire consultants as required and rely on present management, being our directors and officers, to direct our business. As we grow through acquisitions we will require employees with significant expertise in the oil and gas industry who will manage our operations and we may require accounting and administrative staff to manage revenues and expenditures, in addition to the consultants we currently engage to undertake this work. We intend to hire these employees as we raise capital and complete acquisitions requiring these employees. Should we find an oil and gas property or properties of merit which would require an operator and we determine to undertake the role of operator, we would need to hire additional staff for operations.

15

The following risks and uncertainties, along with other information contained in this Form 10-K, should be carefully considered by anyone considering an investment in our securities. The occurrence of any of the following risks could negatively affect our business, financial condition and operating results.

RISKS RELATED TO OUR BUSINESS

Our financial condition raises substantial doubt about our ability to continue as a going concern.

During the period from our inception of June 9, 2008 to our year end at June 30, 2014, we have an accumulated deficit of $8,783,128, of which approximately $6,500,000 relates to stock based compensation expenses incurred in fiscal 2014. Our auditors have issued a going concern opinion indicating that our operating losses, working capital deficit and inability to generate any revenues, cause substantial doubt about our ability to continue as a going concern, and that there is uncertainty as to whether we have the capability to continue our operations without additional funding. Accordingly, we anticipate that we will need additional funding during the next 12 months, which we plan to seek through public or private equity financing, bank debt financing, or from other sources; however, adequate funds may not be available when needed, and even if we raise additional funds through sales of our equity securities, existing stockholder interests will be diluted.

We lack an operating history in our current business plan, which makes it difficult to evaluate whether we will be able to continue our operations or ever be profitable.

In June 2008, we began our current business plan of acquiring, exploring and developing oil and gas assets. Our short operating history has consisted of preliminary acquisition and exploration activities and non-income-producing activities. Accordingly, we have no adequate operating history to evaluate our future success or failure.

Because we are an exploration stage company, we currently have no significant operations, and our future operations are subject to substantial risks, we may be unsuccessful in conducting our operations.

We are an early stage oil exploration company and have not commenced oil production. We will be unable to generate revenues or make profits, unless we actually commence significant production.

We are subject to substantial regulation of our business, including requirements to obtain numerous licenses and permits in the operation of our business; if we are denied needed government licenses and permits or otherwise fail to comply with federal and state requirements, we may be subject to increased compliance costs and fines or penalties.

Our operations are subject to various types of regulation at federal, state, provincial, territorial and local levels. These types of regulations may include requiring permits for the drilling of wells, drilling bonds and reports concerning operations. Most provinces, states, territories and some municipalities in which we operate also regulate one or more of the following:

|

·

|

the location of wells;

|

|

|

·

|

the method of drilling and casing wells;

|

|

|

·

|

the surface use and restoration of properties upon which wells are drilled;

|

|

|

·

|

the plugging and abandoning of wells; and

|

|

|

·

|

notice to surface owners and other third parties.

|

16

Our future exploration activities will require licenses, permits, or compliance with other state and federal requirements, including:

|

·

|

Acquiring permits before commencing drilling;

|

|

|

·

|

Restricting substances that can be released into the environment with drilling and production activities;

|

|

|

·

|

Limiting or prohibiting drilling activities on protected areas such as wetlands or wilderness areas;

|

|

|

·

|

Requiring that reclamation measures be taken to prevent pollution from former operations;

|

|

|

·

|

Requiring remedial measures to mitigate pollution from former operations, such as plugging abandoned wells and remediation of contaminated soil and groundwater; and

|

|

|

·

|

Requiring remedial measures to be taken with respect to property designated as a contaminated site.

|

Additionally, we could be liable for personal injury, clean-up costs and other environmental and property damages, as well as administrative, civil and criminal penalties. Although we maintain limited insurance coverage for sudden and accidental environmental damages as well as environmental damage that occurs over time, we have not obtained coverage for the full potential liability of environmental damages since we do not believe that we can obtain insurance coverage for the full potential liability of environmental damages is available at a reasonable cost. Accordingly, we could be liable, or could be required to cease production on properties, if environmental damage occurs. Delays or failures to acquire required licenses or permits or successfully comply with the pertinent federal and state regulations will negatively impact our operations.

Although the regulatory burden on the oil and gas industry increases our cost of doing business and, consequently, affects our profitability, these burdens generally do not affect us any differently or to any greater or lesser extent than they affect other companies in the industry with similar types, quantities and locations of production.

The successful implementation of our plan of operations is subject to risks inherent in the oil and gas business.

Our oil and gas operations are subject to the economic risks associated with exploration, development and production activities, including substantial expenditures to locate and acquire properties and to drill exploratory wells. Additionally, the cost and timing of drilling, completing and operating wells may be uncertain. The presence of unanticipated pressure or irregularities in formations, miscalculations or accidents may cause our exploration, development and production activities to be delayed or unsuccessful, and may result in the total loss of our investment in a particular property. North Star is presently developing a technology for enhanced oil recovery with Perm labs, an independent third party company based in the Province of Alberta, that helps develop and evaluate enhanced oil recovery schemes for the oil and gas industry. The technology required to economically produce the Manning Project, or any project requiring an enhanced oil recovery technology, is not well developed at this time, and thus additional time and costs may be incurred to fully develop the technology to an economic stage. While we can use conventional production methods such as SAGD or Cyclic Steam, which is in extensive use by many producers, we believe that if we can successfully finalize the development and implementation of the North Star technology that we will have the opportunity for enhanced recovery for our project. There can be no assurance that North Star will be successful in developing this technology.

17

Our ability to produce sufficient quantities of oil and gas from our properties may be adversely affected by factors outside of our control.

We are an early stage oil exploration company and have not commenced significant oil production. We will be unable to generate revenues or make profits, unless we actually commence significant oil production. Drilling, exploring and producing oil and gas involves various substantial risks beyond our control, including:

|

·

|

unproductive wells;

|

|

|

·

|

productive wells that are unable to produce oil or gas in economically feasible quantities;

|

|

|

·

|

hazards, such as unusual or unexpected geological formations, pressures, fires, blowouts, loss of circulation of drilling fluids or other conditions that may substantially delay or prevent completion of any well;

|

|

|

·

|

adverse weather conditions hindering drilling operations;

|

|

|

·

|

a productive well becoming uneconomic due to pressure depletion, water encroachment, mechanical difficulties, or other factors, which impair or prevent the production of oil and/or gas from the well;

|

|

|

·

|

operations being adversely affected by the proximity and capacity of oil and gas pipelines and processing equipment;

|

|

|

·

|

market fluctuations of taxes, royalties, land tenure; and

|

|

|

·

|

allowable production and environmental protection.

|

Government and Environmental Regulation

Our business is governed by numerous laws and regulations at various levels of government. These laws and regulations govern the operation and maintenance of our facilities, the discharge of materials into the environment and other environmental protection issues. The laws and regulations may, among other potential consequences, require that we acquire permits before commencing drilling, restrict the substances that can be released into the environment with drilling and production activities, limit or prohibit drilling activities on protected areas such as wetlands or wilderness areas, require that reclamation measures be taken to prevent pollution from former operations, require remedial measures to mitigate pollution from former operations, such as plugging abandoned wells and remediation of contaminated soil and groundwater, and require remedial measures to be taken with respect to property designated as a contaminated site.

Under these laws and regulations, we could be liable for personal injury, clean-up costs and other environmental and property damages, as well as administrative, civil and criminal penalties. We maintain limited insurance coverage for sudden and accidental environmental damages as well as environmental damage that occurs over time. However, we do not believe that insurance coverage for the full potential liability of environmental damages is available at a reasonable cost. Accordingly, we could be liable, or could be required to cease production on properties, if environmental damage occurs.

The costs of complying with environmental laws and regulations in the future may harm our business. Furthermore, future changes in environmental laws and regulations could occur that may result in stricter standards and enforcement, larger fines and liability, and increased capital expenditures and operating costs, any of which could have a material adverse effect on our financial condition or results of operations.

We rely upon third parties in our business which could adversely affect our business.

We rely upon third parties, including: (a) those that assist us in identifying desirable oil and gas prospects to acquire and to provide us with technical assistance and services; (b) the services of geologists, geophysicists, chemists, engineers and other scientists to explore and analyze oil prospects to determine a method in which the oil prospects may be developed in a cost-effective manner; and (c) owners and operators of oil drilling equipment to drill and develop our prospects to production. Although we have developed relationships with a number of third-party service providers, we cannot assure that we will be able to continue to rely on such persons. If any of these relationships with third-party service providers are terminated or are unavailable on commercially acceptable terms, we may be unable to execute our operational plan.

18

Market fluctuations in the prices of oil & gas could adversely affect our business.

Prices for oil and natural gas tend to fluctuate significantly in response to factors beyond our control, including:

|

·

|

actions of the Organization of Petroleum Exporting Countries and its production constraints;

|

|

|

·

|

United States and global economic environment;

|

|

|

·

|

weather conditions;

|

|

|

·

|

availability of alternate fuel sources;

|

|

|

·

|

transportation interruption;

|

|

|

·

|

the impact of drilling levels on crude oil and natural gas supply; and

|

|

|

·

|

the environmental and access issues that could limit future drilling activities industry wide.

|

Additionally, changes in commodity prices affect our capital resources, liquidity and expected operating results. Price changes directly affect revenues and can indirectly impact expected production by changing the amount of funds available to reinvest in exploration and development activities. Reductions in oil and gas prices not only reduce revenues and profits, but could also reduce the quantities of reserves that are commercially recoverable. Significant declines in prices could result in charges to earnings due to impairment. Changes in commodity prices may also significantly affect our ability to estimate the value of producing properties for acquisition and divestiture, and often cause disruption in the market for oil producing properties, as buyers and sellers have difficulty agreeing on the value of the properties. Price volatility also makes it difficult to budget for and project the return on acquisitions, development and exploitation of projects. We expect that commodity prices will continue to fluctuate significantly in the future.

Oil and Natural Gas Properties

We believe that we have satisfactory title to our producing properties in accordance with standards generally accepted in the oil and natural gas industry and specific to the jurisdiction that the properties reside.

Although title to these properties is subject to encumbrances, in some cases, such as customary interests generally retained in connection with the acquisition of real property, customary royalty interests and contract terms and restrictions, liens under operating agreements, liens related to environmental liabilities associated with historical operations, liens for current taxes and other burdens, easements, restrictions and minor encumbrances customary in the oil and natural gas industry; we believe that none of these liens, restrictions, easements, burdens and encumbrances will materially detract from the value of these properties or from our interest in these properties or will materially interfere with our use in the operation of our business. In some cases, lands over which leases have been obtained may be subject to prior liens that have not been subordinated to the leases. In addition, we believe we have obtained sufficient rights-of-way grants and permits from public authorities and private parties for us to operate our business in all material respects.

Our President devotes less than full time to our business, which may negatively impact our operations.

Guido Hilekes, our President, does not devote a set of amount of time to our business and devotes some of his time to other business activities. Because our President may be unable to devote the time necessary to our business, we may be unsuccessful in implementing our operational plan.

19

The services of our President, Chairman of the Board and other Board Members are essential to the success of our business; the loss of any of these personnel will adversely affect our business.

Our business depends upon the continued involvement of our President, Chairman of the Board, and other board members. The loss, individually or cumulatively, of these personnel would adversely affect our business, prospects, and our ability to successfully conduct our exploration activities. Before you decide whether to invest in our common stock, you should carefully consider that the loss of their expertise, may negatively impact your investment in our common stock.

Certain of our officers and directors and advisors may be conflicted due to their positions with other companies with which we share related management or directorship.

Our President and Director, Mr. Guido Hilekes is a member of the Board of Directors of both North Star and our controlling stockholder, Zentrum, and Feliciano Tighe, our Secretary and a member of our Board of Directors is an administrative consultant to North Star. The CEO of North Star is an advisor to Zentrum, and Zentrum provides financing for both our Company and North Star. Therefore conflicts may arise in the provision of management and directorship to the Company. While our officers and directors have advised they will act in the best interests of the Company and abstain from voting when conflicts arise, we cannot say for certainty this will occur and decisions made could impact unfavorably on our intended operations.

Capital markets are highly competitive in the sector of the industry within which we intend to operate.

In Canada particularly, and we anticipate therefore internationally, the capital for start-up thermal projects is highly competitive and very limited. Hence, capital may not be readily available to us if and when required which may mean that we will be unable to effect our business plan or a timely basis or at all until funding becomes available.

RISKS RELATING TO AN INVESTMENT IN OUR SECURITIES

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Any failure of these controls could also prevent us from maintaining accurate accounting records and discovering accounting errors and financial frauds. Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting. The standards that must be met for management to assess the internal control over financial reporting as effective are complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting. If we cannot assess our internal control over financial reporting as effective, investor confidence and share value may be negatively impacted.

In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting, or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. For example, on January 30, 2009, the SEC adopted rules requiring companies to provide their financial statements in interactive data format using the eXtensible Business Reporting Language, or XBRL. We currently have to comply with these rules. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

20

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We have not generated any revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon our ability to market the products developed under our licensing agreement and to source other acquisitions in the industry we have chosen either additional technologies or exploration projects. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

We may, in the future, issue additional common shares that would reduce investors’ percent of ownership and may dilute our share value.

The future issuance of common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the common shares held by our investors, and might have an adverse effect on any trading market for our common shares.

The Market for Penny Stock has suffered in recent years from patterns of fraud and abuse

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include: (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; (iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and, (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses.

Our common shares are subject to the “Penny Stock” Rules of the SEC, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted regulations that generally define a "penny stock" to be any equity security other than a security excluded from such definition by Rule 3a51-1 under the Securities Exchange Act of 1934, as amended. For the purposes relevant to our Company, it is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

Our common shares are currently regarded as a “penny stock”, since our shares are not listed on a national stock exchange or quoted on the NASDAQ Market within the United States, to the extent the market price for its shares is less than $5.00 per share. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide a customer with additional information including current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer's account, and to make a special written determination that the penny stock is a suitable investment for the purchaser, and receive the purchaser's written agreement to the transaction. To the extent these requirements may be applicable; they will reduce the level of trading activity in the secondary market for the common shares and may severely and adversely affect the ability of broker-dealers to sell the common shares.

FINRA sales practice requirements may also limit a stockholders ability to buy and sell our stock.

In addition to the penny stock rules promulgated by the SEC, which are discussed in the immediately preceding risk factor, FINRA rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the ability to buy and sell our stock and have an adverse effect on the market value for our shares.

21

Our common stock may experience extreme rises or declines in price, and you may not be able to sell your shares at or above the price paid.

Our common stock may be highly volatile and could be subject to extreme fluctuations in response to various factors, many of which are beyond our control, including (but not necessarily limited to): (i) the trading volume of our shares; (ii) the number of securities analysts, market-makers and brokers following our common stock; (iii) changes in, or failure to achieve, financial estimates by securities analysts; (iv) actual or anticipated variations in quarterly operating results; (v) conditions or trends in our business industries; (vi) announcements by us of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; (vii) additions or departures of key personnel; (viii) sales of our common stock; and (ix) general stock market price and volume fluctuations of publicly-trading and particularly, microcap companies.

Investors may have difficulty reselling shares of our common stock, either at or above the price they paid for our stock, or even at fair market value. The stock markets often experience significant price and volume changes that are not related to the operating performance of individual companies, and because our common stock is thinly traded it is particularly susceptible to such changes. These broad market changes may cause the market price of our common stock to decline regardless of how well we perform as a company. In addition, there is a history of securities class action litigation following periods of volatility in the market price of a company’s securities. Although there is no such shareholder litigation currently pending or threatened against the Company, such a suit against us could result in the incursion of substantial legal fees, potential liabilities and the diversion of management’s attention and resources from our business. Moreover, and as noted below, our shares are currently traded on the OTC-BB and, further, are subject to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to manipulation by market-makers, short-sellers and option traders.

We have not and do not intend to pay any cash dividends on our common shares and, consequently, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We have not, and do not, anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

A decline in the price of our common stock could affect our ability to raise further working capital, it may adversely impact our ability to continue operations and we may go out of business.