Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bristow Group Inc | d803301d8k.htm |

October 10, 2014

Returns Comparison

Exhibit 99.1 |

2

Illustrative comparison of return metrics

•

Bristow believes a good capital deployment strategy includes a

mix of leased assets and owned assets

•

The company uses the metric Bristow Value Added (BVA), which

is a tailored version of the cash flow value added (CFVA) metric

also similar to the economic value added (EVA) metric

BVA is our primary metric for evaluating capital deployment decisions

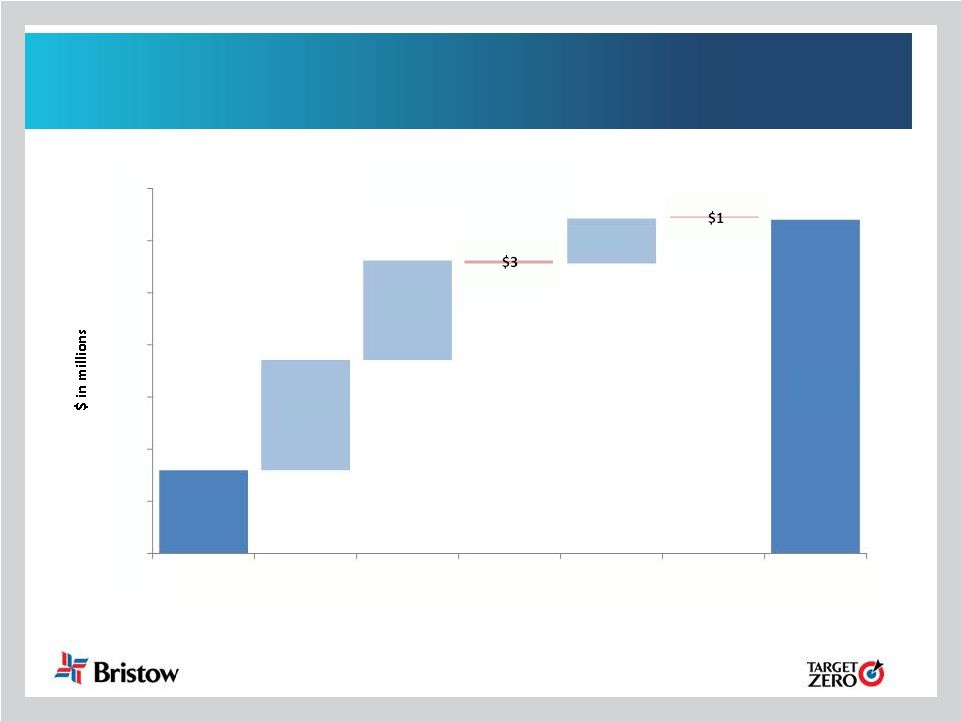

We believe BVA is a superior metric to other off the shelf metrics like return

on capital (ROC) for a company with a mix of leased and owned assets

BVA is the largest component of management incentive bonuses at Bristow

•

We provide the following summary as an illustrative reconciliation

of a traditional ROC calculation to an adjusted ROC calculation

(similar to a BVA return calculation) which we believe is a more

meaningful return calculation for our capital structure

|

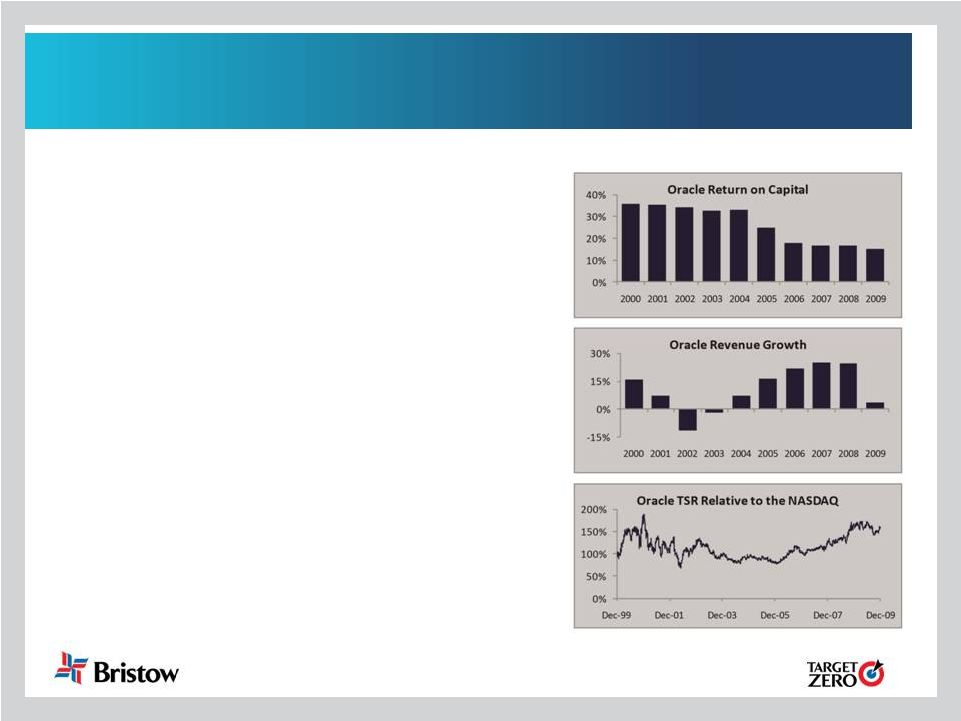

TSR

requires a growth and return balance Return alone only measures quality and

not quantity •

Don’t Be Too Preoccupied with Return

on

Capital

Gregory

V.

Milano,

Fortuna

Advisors (May 19, 2010)

•

Study was based on the 1000 Largest Non-

Financial US Companies as of 12/31/2009,

excluding those not public for the entire 10-yr

period of the study, yielding 765 companies.

“…sacrificing returns to achieve higher

revenue growth worked for most

companies…

14% of the companies had

higher revenue growth and lower return on

capital in the second half of the decade, 57%

of these higher-growth lower-return

companies generated TSR above the

median. Among these were well-known

companies including Oracle, PepsiCo, CVS

Caremark and Procter & Gamble.”

3

, |

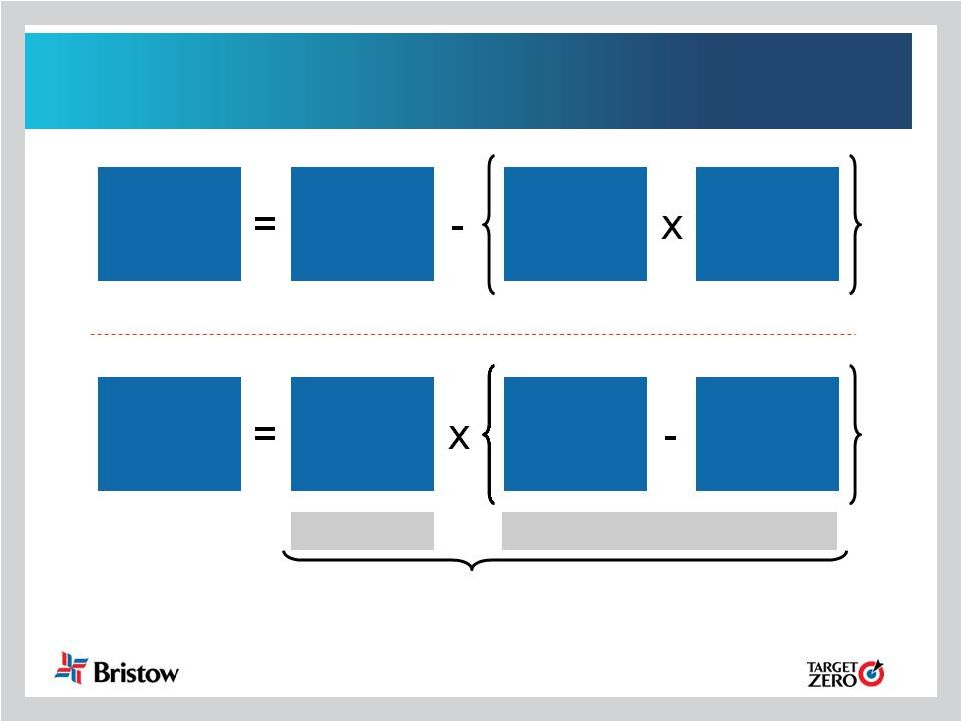

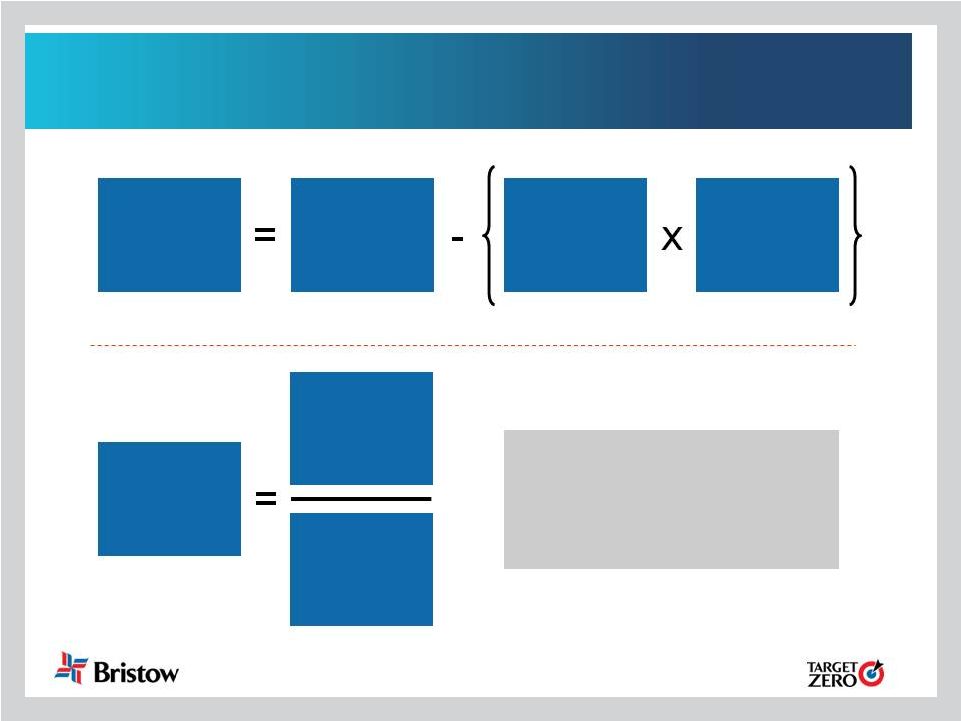

BVA

balances growth and return Two equivalent ways to calculate BVA

BVA

Gross

Cash Flow

Gross

Operating

Assets

Required

Return

(10.5%)

BVA

Gross

Operating

Assets

Gross

Cash Flow

Return

Required

Return

(10.5%)

Quality

Quantity

BVA captures quantity and quality

which return measures do not

4 |

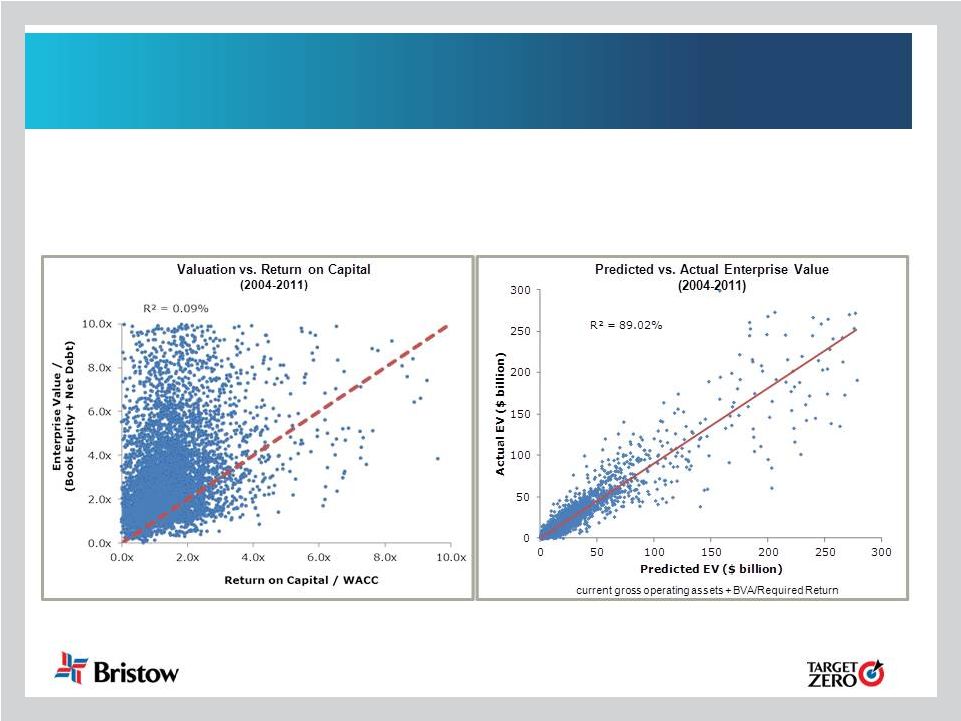

5

BVA is a superior valuation metric

•

When used in valuation (current gross operating assets + NPV of future BVA), BVA

predicts enterprise values quite well even when future BVA is assumed

constant. •

The approach helps solve the apparent disconnect between market valuation and

traditional measures of performance such as the ROC/WACC relationship.

Note: Right chart employs Fortuna Advisor’s standard proprietary framework for BVA-like

measures. See “Postmodern Corporate Finance” in the Spring 2010 issue of the

Journal of Applied Corporate Finance

|

6

ROC misses important performance aspects

BVA treatment:

•

•

•

•

•

Leases

Remove

rent

to

get

EBITDAR

and

capitalize

the

present

value

of leases as a debt equivalent

Depreciation:

Remove

depreciation

to

get

EBITDAR

and

add

back

accumulated depreciation to capital

Cash

Remove

from

capital

–

reflects

negative

debt

•

Líder

Remove

equity

accounting

and

replace

with

proportional

consolidation

Goodwill

Remove

to

reflect

operating

returns

but

adjust

BVA

incentive goals to target enough BVA improvement to justify the

required return on the goodwill over five years

:

:

:

: |

7

Gross cash flow return (GCFR)

A BVA-like return measure

BVA

Gross

Cash Flow

Gross

Operating

Assets

Required

Return

(10.5%)

Gross

Cash Flow

Return

The numerator and denominator

in Gross Cash Flow Return are

the very same Gross Cash Flow

and Gross Operating Assets

used in calculating BVA.

Gross

Operating

Assets

Gross

Cash Flow |

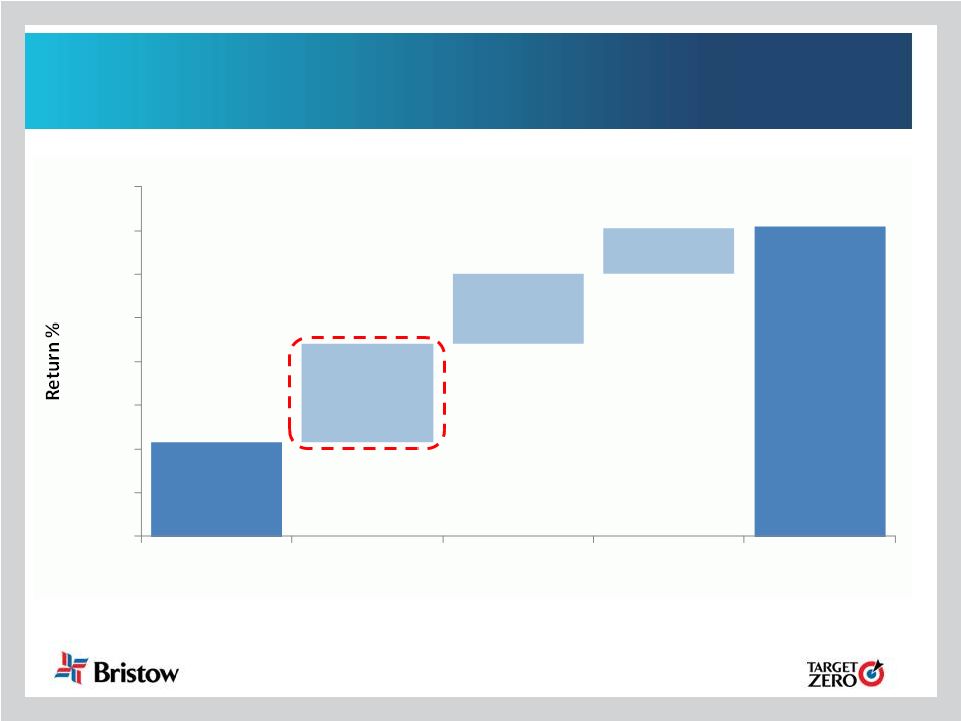

8

Bridge ROC to GCFR: FY13

Gross cash flow return numerator and denominator from BVA

NOTE: For illustrative purposes only

7.2%

10.7%

1.5%

2.0%

0.4%

0.4%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

12.0%

13.0%

ROC

Leases

D&A

Líder

Other

GCFR

FY13 |

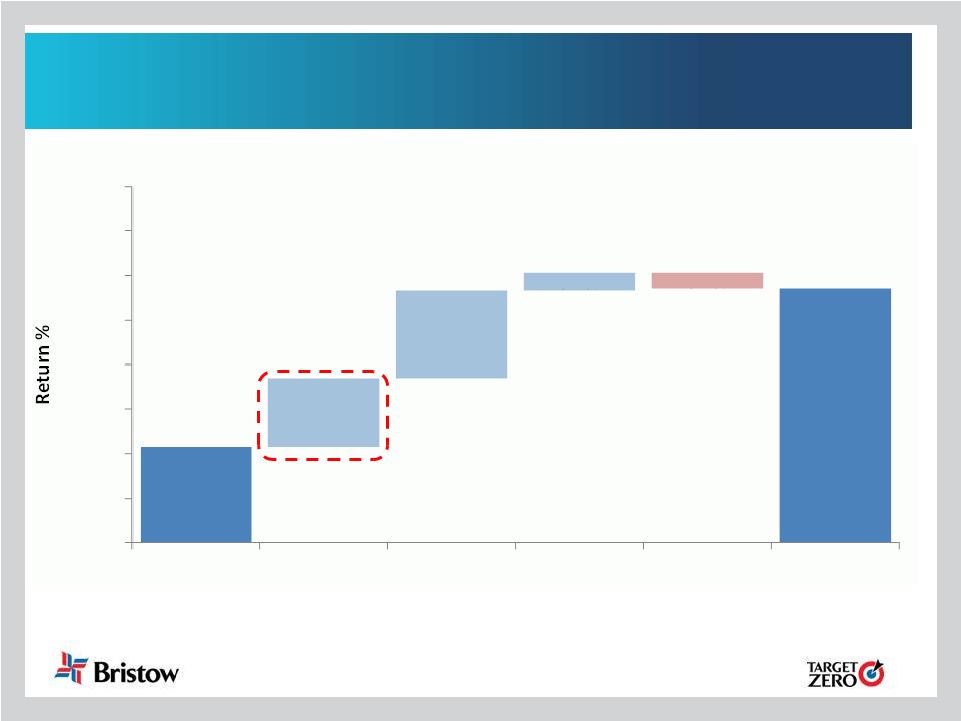

9

Bridge ROC to GCFR: FY14

Gross cash flow return numerator and denominator from BVA

NOTE: For illustrative purposes only

7.2%

12.1%

2.3%

1.6%

1.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

12.0%

13.0%

ROC

Leases

D&A

Líder

GCFR

FY14 |

10

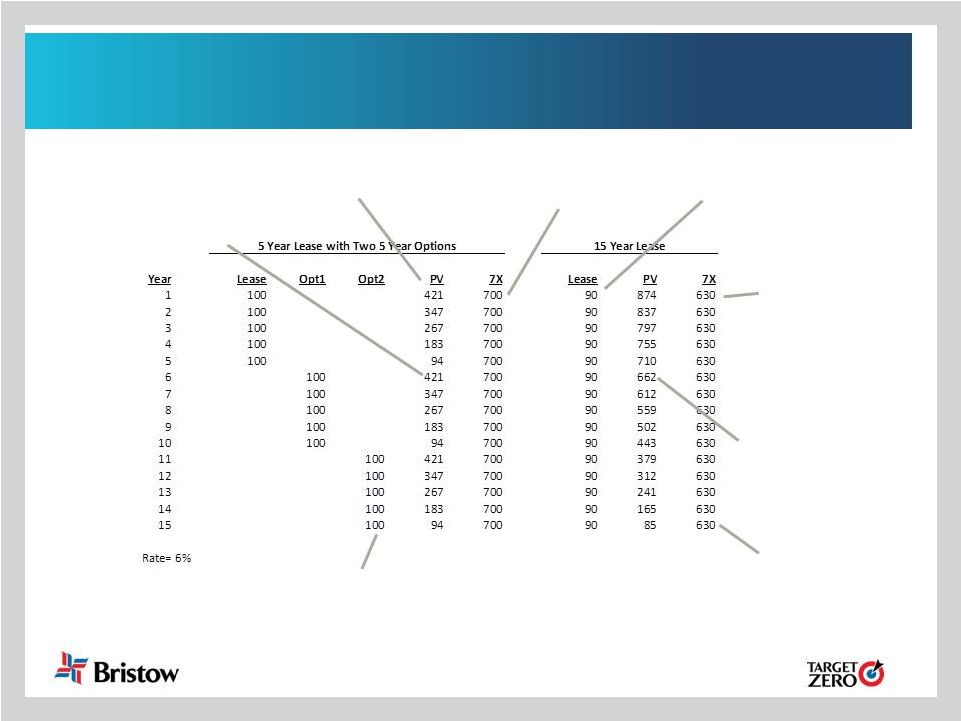

Treatment of leases in BVA and GCFR

•

In BVA and GCFR, the present value of lease commitments is added

to gross

operating assets

Equivalent to taking out a level payment loan to finance making a one time

payment to purchase the rights to the asset over the lease term.

The hypothetical loan value (i.e. capital) would be the present value of the

principal and interest payments (same as the rent)

Encourages risk reduction by managing lease commitments which can be helpful

in the next industry downturn (easier to not renew a lease than to sell an

owned asset during a downturn)

•

In BVA and GCFR, lease expense (i.e. rent) is removed from gross

cash flow

Consistent with ignoring principal and interest payments on the hypothetical loan

when calculating EBITDA or EBITDAR

Alternatively can be viewed as consistent with removal of depreciation and

interest when calculating EBITDAR on owned assets

•

Bristow has limits on the volume of lease commitments to avoid excessive

fixed charges, and manages lease durations as a balanced portfolio

|

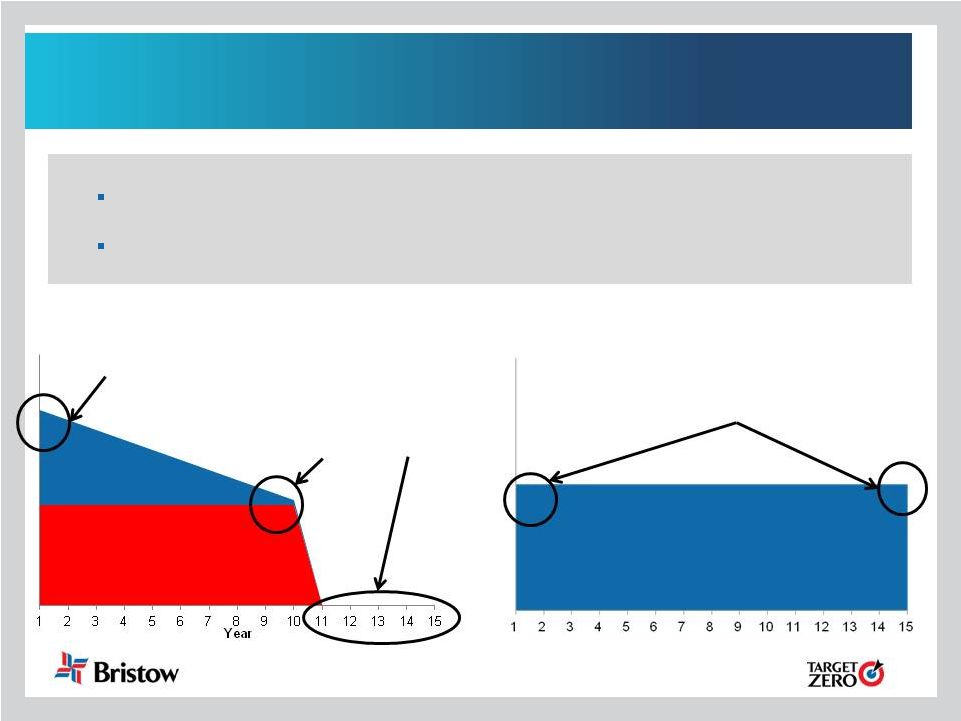

11

Illustration of PV approach to leases

Assume 10%

discount for longer

commitment

Shorter commitment

implies less capital

Optionality: only

renew if needed

Stuck if not needed

Overstates the

commitment

Understates the

commitment

Ultimately pay more in total if used

all 15 years –

that’s the cost of

unexercised option

Motivates signing the

longest lease possible

to get annual rent low

even if unnecessary |

12

Treatment of depreciation in BVA and GCFR

•

Using gross assets treats old assets the same as new assets

A net asset framework gives misleading signals as older businesses with

depreciated assets look better than newer businesses with

un-depreciated assets A

gross

measure

removes

this

distortion

by

smoothing

the

capital

charge

over

the

entire

life

of

the asset

Typical economic profit measures

BVA (&GCFR)

New investments look

prohibitively expensive….

…while older assets look

‘cheap’…or ‘free’

Balanced view

of new vs. old assets –

encouraging more growth into profitable

opportunities

Capital

Charge

Depreciation

Required

Return |

13

Cash is removed

•

Cash is removed from gross operating assets in BVA and

gross cash flow return

•

In most valuations, cash is treated as a negative debt (i.e.

subtract cash from debt to get net debt to subtract from

enterprise value to get equity value).

BVA treats cash the same way

•

Cash is expected to earn its own risk adjusted return which is

much lower than the required return so it would be penalizing

in BVA for a company to carry any cash.

•

Removing cash encourages management to streamline

inventory, receivables and other assets to convert them to

cash and immediately see the benefit in higher BVA. |

14

Treatment of Lider in BVA and GCFR

•

Earnings from unconsolidated entities removed from

gross cash flow

•

Investment in unconsolidated entities removed from

gross operating assets

•

Proportional consolidation of pro rata share of Lider BVA

added in to improve accuracy over using equity

accounting; this is only done for ‘major’

investments (i.e.

Líder) |

15

Goodwill is excluded from BVA

•

We aimed for a framework that would simultaneously encourage

investments and hold management accountable for delivering returns.

Incentives focus on year to year changes in BVA to encourage a constant

pursuit of growth and return that more than covers the required return on all

new investments.

•

Goodwill is excluded to facilitate operating performance comparisons

and to avoid discouraging acquisitive investments

Acquisitions

often

do

not

cover

the

cost

of

capital

on

the

total

investment

for

a few years and we would not want to be discouraged from making good

long term investments.

•

The

incentive

plan

is

adjusted

whenever

new

goodwill

is

acquired

to

step

up

the

required

improvements

in

BVA

to

deliver

a

required

return

on

the

goodwill so if management doesn’t earn an adequate return over time

bonuses will suffer. |

16

Appendix |

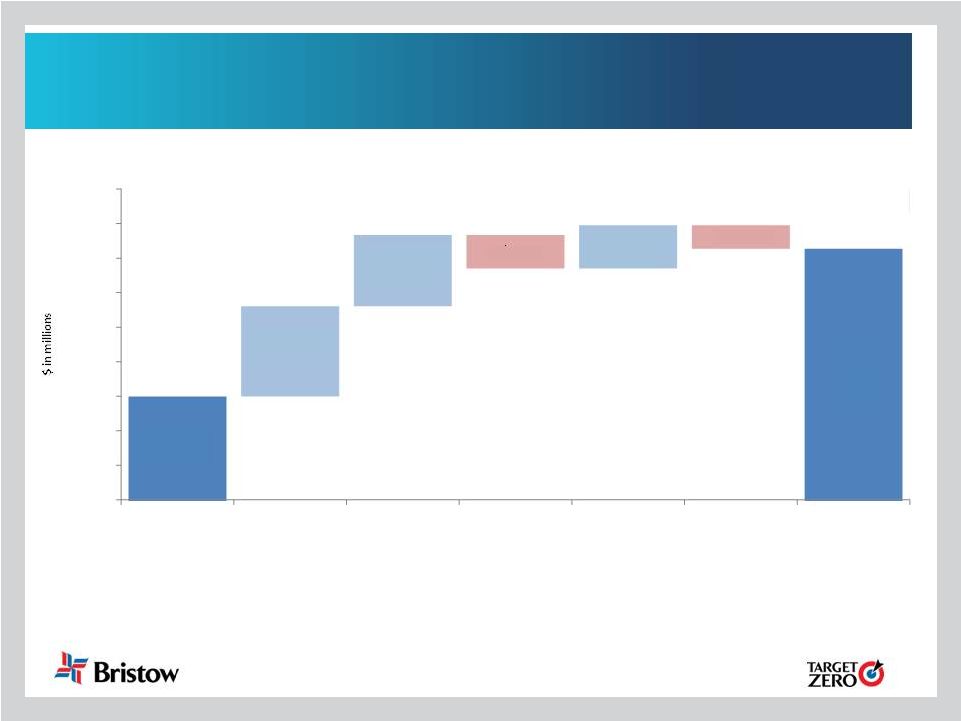

17

FY14 bridge to gross cash flow

NOTE: For illustrative purposes only

$180

$420

$106

$95

$43

$100

$150

$200

$250

$300

$350

$400

$450

NOPAT

Rent

D&A

Líder equity

earnings

Líder

proportional

Other

GCF

FY14 NOPAT to GCF |

18

FY14 bridge to gross operating assets

NOTE: For illustrative purposes only

$2,598

$3,455

$523

$412

$250

$193

$135

$2,000

$2,200

$2,400

$2,600

$2,800

$3,000

$3,200

$3,400

$3,600

$3,800

Invested Capital

(LT + ST Debt +

Equity)

Accumulated

depreciation

NPV of leases

Líder equity

investment

balance

Líder

proportional GCF

Other

GOA

FY14 Invested Capital to GOA |