Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IBERIABANK CORP | d799722d8k.htm |

| EX-2.1 - EX-2.1 - IBERIABANK CORP | d799722dex21.htm |

| EX-99.1 - EX-99.1 - IBERIABANK CORP | d799722dex991.htm |

Acquisition of Florida Bank Group, Inc.

October 3, 2014

Exhibit 99.2 |

| Safe

Harbor And Legend 2

Statements contained in this presentation which are not historical facts and which pertain to

future operating results of IBERIABANK Corporation and its subsidiaries constitute

“forward- looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements involve significant risks and

uncertainties. Actual results may differ materially from the results discussed in these

forward-looking statements. Factors that might cause such a difference include, but are not

limited to, those discussed in IBERIABANK Corporation’s periodic filings with the

SEC.

In connection with the proposed merger, IBERIABANK Corporation will file a Registration

Statement on Form S-4 that will contain a proxy statement / prospectus. INVESTORS AND

SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT /

PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE,

BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may

obtain a free copy of the proxy statement / prospectus (when it is available) and other documents

containing information about IBERIABANK Corporation and Florida Bank Group, Inc., without

charge, at the SEC’s website at http://www.sec.gov. Copies of the proxy statement / prospectus

and the SEC filings that will be incorporated by reference in the proxy statement / prospectus

may also be obtained for free from the IBERIABANK Corporation website, www.iberiabank.com,

under the heading “Investor Information”. This

communication is not a solicitation of any vote or approval, is not an offer to purchase shares

of Florida Bank Group, Inc. common stock, nor is it an offer to sell shares of IBERIABANK

Corporation common stock which may be issued in any proposed merger with Florida Bank

Group, Inc. The issuance of IBERIABANK Corporation common stock in any proposed merger

with Florida Bank Group, Inc. would have to be registered under the Securities Act of 1933, as

amended (the “Act”), and such IBERIABANK Corporation common stock would be offered only

by means of a prospectus complying with the Act. |

3

3

3

3

3

3

Transaction Rationale

•

In market and new-market acquisition of a Florida-based commercial

bank based in Tampa, Florida

•

Established and complementary customer profile

•

13 branch

offices

located

in

Florida

–

eight

offices

in

Tampa,

three

in Jacksonville, one in Sarasota and one in Tallahassee

•

Small Business focus with $400 million in deposits and $329

million in gross loans

•

Adds approximately $524 million in assets

•

Neutral to 2015 earnings per share and accretive thereafter

•

Tangible book value dilution of less than 1% excluding one-time

acquisition

and

conversion

related

costs

on

a

pro

forma

basis

at

June

30, 2014

•

Tangible book value breakeven, including one-time acquisition and

conversion related costs, of approximately two years

•

Transaction has limited impact on capital ratios

•

Anticipate internal rate of return in excess of 20%

•

Comprehensive

due

diligence

completed,

including

credit

review

•

Strong credit culture and asset quality

•

Limited loss content expected (2% of gross loans)

•

Conversion and integration experience reduces integration risk

Compelling

Strategic

Rationale

Financially

Attractive

Low Risk |

4

4

4

4

4

4

Transaction Overview

•

Combination cash and common stock with aggregate cash

consideration not to exceed 50% of total consideration

•

$7.81 in cash per Florida Bank Group common share, and

•

Fixed exchange ratio of 0.149 of a share of IBKC common stock for

each Florida Bank Group share within price collars and floating

exchange

ratios

outside

of

the

collars

(1),

•

$87 million

(1)

for common stock outstanding based on IBKC

closing price of $62.61 on October 2, 2014

•

$17.14 per Florida Bank Group share outstanding

(1)

•

$3.5 million in cash liquidation value of options

•

Completed comprehensive due diligence

•

Florida Bank Group shareholder approval

•

Customary regulatory approvals

•

Expected closing in first quarter of 2015

Consideration

Deal Value

Valuation

Multiples

Due Diligence

Required

Approvals

Timing

Common and With All

Other Preferred

Adjustments

(2)

•

Price / Total Book:

142%

126%

•

Price / Tangible Book:

142%

126%

(1)

If the weighted average trading price of IBERIABANK common stock were to decline to or go below $56.79

per share, or to reach or exceed $76.83 per share, over a specified period, the value of the

common stock portion of the transaction would become fixed and the exchange ratio would float

(2)

Assumes the impact of cash liquidation for options, reversal of $23.4 million of deferred tax asset

valuation allowance, credit loss assumptions, interest rate adjustments and fair value marks to

facilities |

5

5

5

5

5

5

Pricing Overview

Credit, interest rate and facilities marks are shown net of tax

Dollars in thousands

IBKC

Common

Stock

Price

-

10/02/14

$62.61

Purchase Price Per Share of FBG

$17.14

Amount

($000s)

Common

Equivalent

Shares

Common

Equity per

Share

Purchase

Multiple

Common Equity

36,195

$

2,471,745

14.64

$

117%

Preferred Stock

24,800

2,480,000

10.00

171%

Subtotal Equity

60,995

$

4,951,745

12.32

$

139%

Warrants

100

$

100,000

1.00

$

1714%

Options

-

-

-

-

With Options & Warrants

61,095

$

5,051,745

12.09

$

142%

Deferred Tax Asset

23,395

$

Liquidation of Options

(3,519)

Credit Loss, Net of Allowance

910

Interest Rate Adjustment

(5,590)

With Credit & Interest Marks

76,291

$

5,051,745

15.10

$

113%

Facility FMV Adjustment

(7,475)

$

Total With Facilities FMV

68,816

$

5,051,745

13.62

$

126% |

6

6

6

6

6

6

Enhances Our

Florida Franchise

Deposit Market Share

Source: SNL Financial, June 30, 2013

•

Total Gross Loans: $329 million

•

Total Assets: $524 million

•

Total Deposits: $400 million

•

Total Equity: $36 million common equity

and $25 million in convertible preferred

equity

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

Bank of America Corp.

608

81,494

18.90

2

Wells Fargo & Co.

650

69,468

16.11

3

SunTrust Banks Inc.

510

42,022

9.75

4

Regions Financial Corp.

363

18,609

4.32

5

JPMorgan Chase & Co.

385

18,528

4.30

6

BB&T Corp.

325

16,186

3.75

7

Citigroup Inc.

57

13,932

3.23

8

EverBank Financial

16

13,743

3.19

9

Toronto-Dominion Bank

167

9,373

2.17

10

Fifth Third Bancorp

171

9,219

2.14

21

Pro Forma IBKC

50

2,910

0.67

24

IBERIABANK Corp.

37

2,458

0.57

73

Florida Bank Group

13

452

0.10

Total For Institutions In Market

5,474

431,189

State Of Florida |

7

7

7

7

7

7

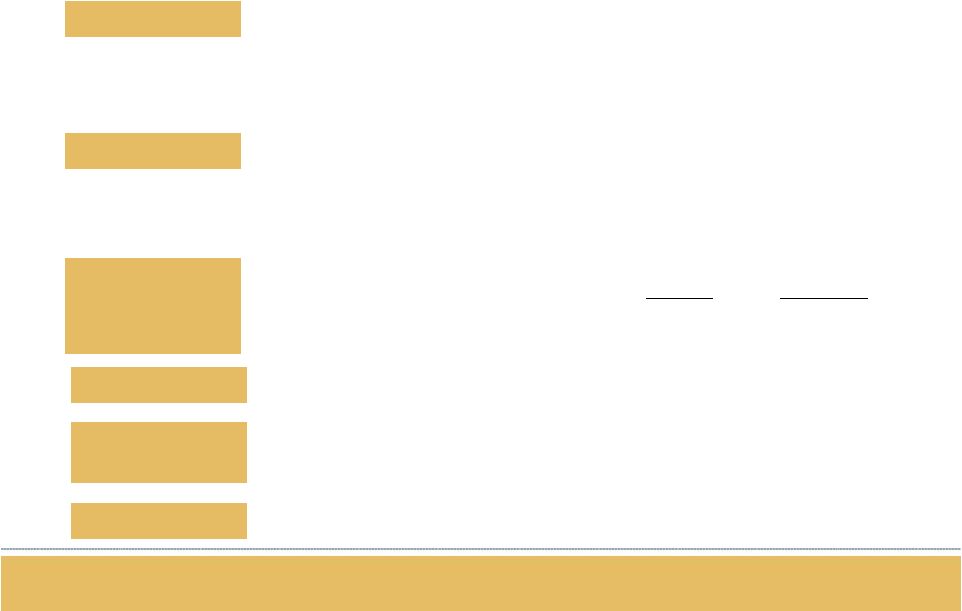

Tampa Market

Source: SNL Financial, June 30, 2013

3000 Cove Bend Drive,

Tampa, $29.5 million

4105 North Himes Ave,

Tampa, $17.3 million

201 North Franklin St,

Tampa, $92.2 million

500

4

St

North,

St Petersburg, $24.9 million

777 Pasadena Ave S,

St. Petersburg, $77.0 million

612 S Dale Mabry,

Tampa, $35.3 million

3065 34 St North

St Petersburg, $20.0 million

•

Eight branches in Tampa-St. Petersburg market

•

Four owned and four leased branches

•

Total market deposits of $316 million

•

Average deposits per branch of $40 million

•

Two IBKC Mortgage office consolidations

3100 Tampa Rd,

Oldsmar, $20.1 million

th

th |

8

8

8

8

8

8

Jacksonville Market

Source: SNL Financial, June 30, 2013

135 West Bay Street

Jacksonville, $26.8 million

4211 San Juan Ave

Jacksonville, $19.4 million

250 Route A1A North

Ponte Vedra Beach, $29.6 million

•

Three

branches

in

Jacksonville

-

two

owned

and

one

leased

•

Total market deposits of $76 million

•

Average deposits per branch of $25 million

•

More favorable locations than IBKC’s previous Jacksonville branches

|

9

9

9

9

9

9

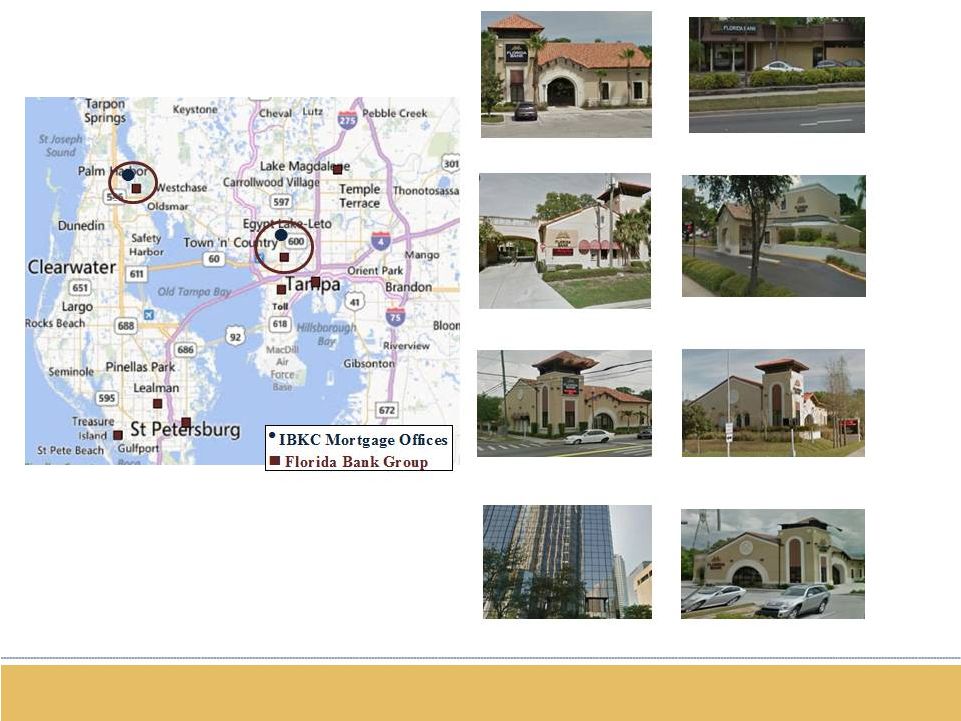

Sarasota

Tallahassee

Source: SNL Financial, June 30, 2013

•

One owned branch in Sarasota

•

Total market deposits of $17 million

•

Consolidate into existing IBKC branch system

•

One owned branch in Tallahassee

•

Total market deposits of $43 million |

10

10

10

10

10

10

Florida MSA Deposit Market Share

Source: SNL Financial, June 30, 2013

Tampa-St. Petersburg-Clearwater, FL

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

Bank of America Corp.

94

10,559

19.31

2

Wells Fargo & Co.

87

10,176

18.61

3

SunTrust Banks Inc. (GA)

97

7,765

14.20

4

Regions Financial Corp.

79

5,415

9.90

5

Fifth Third Bancorp

44

3,019

5.52

6

BB&T Corp.

47

2,619

4.79

7

USAmeriBancorp Inc.

13

1,383

2.53

8

JPMorgan Chase & Co.

56

1,280

2.34

9

Tampa Bay Banking Co.

10

1,133

2.07

10

TFS Financial Corp (MHC)

5

1,131

2.07

21

Florida Bank Group

8

316

0.58

Total For Institutions In Market

767

54,683

Jacksonville, FL

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

Bank of America Corp.

35

20,164

42.12

2

EverBank Financial

6

12,061

25.20

3

Wells Fargo & Co.

62

5,560

11.61

4

SunTrust Banks Inc.

27

2,049

4.28

5

BBVA

25

1,646

3.44

6

Regions Financial Corp. (AL)

24

1,165

2.43

7

BB&T Corp. (NC)

14

556

1.16

8

Ameris Bancorp

10

507

1.06

9

Toronto-Dominion Bank

8

507

1.06

10

Jacksonville Bancorp Inc.

9

451

0.94

24

Florida Bank Group

3

76

0.16

Total For Institutions In Market

316

47,868

Tallahassee, FL

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

Capital City Bank Group Inc.

19

929

18.22

2

SunTrust Banks Inc.

9

823

16.14

3

Wells Fargo & Co.

8

590

11.58

4

Bank of America Corp.

7

511

10.03

5

Home BancShares Inc.

9

466

9.14

6

FMB Banking Corp.

5

306

6.01

7

BB&T Corp.

3

261

5.13

8

Synovus Financial Corp.

4

241

4.72

9

Regions Financial Corp.

5

231

4.53

10

Hancock Holding Co.

4

205

4.02

16

Florida Bank Group

1

43

0.85

Total For Institutions In Market

88

5,097

North Port-Sarasota-Bradenton, FL

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

Bank of America Corp.

35

3,118

18.69

2

Wells Fargo & Co.

30

2,559

15.34

3

SunTrust Banks Inc.

31

2,151

12.89

4

BB&T Corp.

20

1,152

6.91

5

Fifth Third Bancorp

16

740

4.44

Pro Forma IBKC

9

638

3.82

6

IBERIABANK Corp.

8

621

3.72

7

JPMorgan Chase & Co.

19

601

3.61

8

Northern Trust Corp.

3

518

3.11

9

Regions Financial Corp.

16

502

3.01

10

Bank of Montreal

11

474

2.84

39

Florida Bank Group

1

17

0.10

Total For Institutions In Market

302

16,680 |

11

11

11

11

11

11

Credit Summary

Source: SNL Financial and Company documents

Data as of June 30, 2014

Diligence Scope

•

Approximately 90 people involved in due diligence

process; credit team included 25 associates

performing both on-site credit file and off-site credit

portfolio reviews

•

Reviewed 99% of outstanding loan balances and

nearly 99% of total number of loans

•

Approximately one-third of the loans were reviewed

on-site with the remainder analyzed by off-site

portfolio review

Loan Portfolio Comments

•

Majority are in-market loans

•

Primarily focused on real estate and small business

lending

•

Good asset quality metrics:

•

NPA / assets = 0.55%

•

Nonaccrual loans / loans = 0.56%

•

Allowance for loan losses of $8.0 million

•

Credit mark of approximately $6.6 million on a pre-tax

basis

Loan Portfolio Composition

Loan Type

Balance

($ millions)

% of Total

CRE - Owner Occupied

$87.7

26.7%

CRE - Non Owner Occupied

70.2

21.4%

1-4 Family Residential

67.6

20.6%

HELOC

36.4

11.1%

Commercial & Industrial

26.9

8.2%

C&D

20.0

6.1%

Multifamily Loans

11.5

3.5%

Consumer & Other

4.2

1.3%

Other

3.9

1.2%

Total Loans

$328.6

100.0% |

12

12

12

12

12

12

Costs and Synergies

Merger Considerations

•

No corporate or bank board seats

•

Florida Bank Group board members

invited to join IBKC’s local Advisory

Boards

•

One employment contract

•

Savings equate to approximately

31% compared to Florida Bank

Group’s total expenses

•

Branch and office consolidations

anticipated

•

One branch consolidation in

Sarasota

•

Consolidate operations center

•

Consolidate mortgage offices with

existing IBKC mortgage

Approximately $20 million in pre-tax costs:

•

$6.4 million in lease terminations

•

$5.6 million in contract terminations

•

$2.7 million in severance/retention payments

•

$1.1 million in system conversions

•

$0.6 million in marketing/communications

•

$3.6 million in other merger-related expense

Merger-Related Costs

DTA Allowance Reversal

•

Reversal of Deferred Tax Asset Allowance

and utilization of prior NOL carryforwards

of approximately $24 million |

13

13

13

13

13

13

Financial Assumptions & Impact

Conservative

Financial

Assumptions

Attractive

Financial

Impact

Other Marks:

Cost Savings:

Merger Related Costs:

•

Gross loss estimate of $6.6 million on a pre-tax basis

(2% of gross loan portfolio)

•

Loss estimate is less than current allowance for loan

losses of $8.0 million

•

Aggregate negative $1.2 million in other marks, including

securities portfolio, loan rate, allowance for loss reversal,

OREO, fixed assets, FHLB marks

•

Annual run-rate cost savings of approximately $5 million

on a pre-tax basis

•

Represents approximately of 31% of Florida

Bank’s anticipated 2014 non-interest expenses

•

Savings expected to be achieved within six months

of closing

•

Approximately $20 million on a pre-tax basis

•

Neutral to 2015 EPS and accretive thereafter

•

Tangible book value dilution of less than 1% excluding one-time acquisition

and conversion related costs on a pro forma basis at June 30, 2014

•

Tangible book value breakeven, including one-time acquisition and

conversion related costs, in approximately two years

•

Strong pro forma capital ratios:

•

Tangible common equity ratio = 8.4%

•

Total risk based capital ratio = 12.6%

•

Internal rate of return over 20%; well in excess of our cost of capital

Credit Mark: |

Appendix |

15

15

15

15

15

15

Management/Board of Directors

Susan

"Susie"

Martinez

-

President

and

Chief

Executive

Officer

of

Florida

Bank

Group,

Inc.

Served as Senior Executive Vice President and Florida Regional President of Regions

Financial Corporation until December 2007. Prior to the merger with Regions

in 2006, Ms. Martinez served as the head of the Florida Banking

Group

at

AmSouth

Bank.

Prior

to

joining

AmSouth

in

1998,

Ms.

Martinez

spent

more

than

25

years

with

Barnett

Bank

and

First

Florida

Bank,

and

held

various

positions,

including

Executive

Vice

President

and

Senior

Retail Executive for the Tampa, Florida market.

Board of Directors:

Robert Rothman

Chairman of the Board of Florida Bank Group, Inc. since January 2002.

Served as Chairman and CEO of Consolidated International Group, a

multinational financial services company, from 1987 to 1999

N. Troy Fowler

Director since 2004. Director of Triad Foundation, Inc.

Thomas E. Gibbs

Director since 2002. Founding partner of Dewey & LeBoeuf’s Florida

office. Lewis S. Lee, Jr.

Director since September 2007. President of Estabrook Capital

Management LLC

Stanley Calderon

D. Scott Lutrell

Founder, Chairman and Chief Investment Officer of LCM Group, Inc. from

1988 until 2011

Lisa Smithson

Director since 2009. Managing Partner of IS and Company, a Tampa Bay,

Florida based accounting firm

Charles B. Tomm

Director since 2007. CEO of Brumos Automotive |

16

16

16

16

16

16

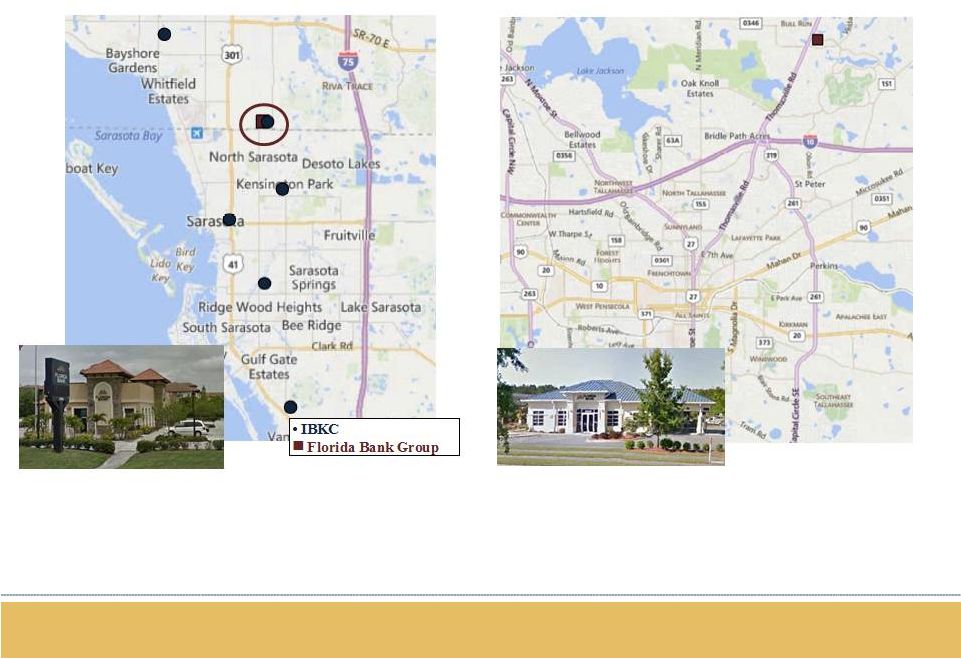

Tampa Market

•

Economy in Tampa-St. Petersburg-Clearwater progressing towards full

recovery •

Jobless

rate

of

6.4%

with

workers

entering

job

market

as

fast

as

jobs

are

being

created

•

Household employment has surpassed pre-recession peak

•

Financial services capital of Florida

•

Low tax burden and office rents

•

University

of

South

Florida

draws

high-skilled

workers

and

research

and

development

firms

•

Strong demographic trends

•

Expanding port

Source: Moody’s Analytics, July 2014 |

17

17

17

17

17

17

Tampa Market

Source: Moody’s Analytics, July 2014

$ in thousands

000’s

000’s |

18

18

18

18

18

18

Tampa Market

Home Price Change

Home values for Tampa-

St. Petersburg-Clearwater

are forecast to

increase by 10 percent over the next 12 months. Nationally, prices are

forecast to increase by 7.3 percent. In the second and third year, prices

are forecast to increase 7% and 7%, respectively

Home Price Change

Home prices in this market peaked in Q4 2006 at $259,646. Since their

peak, prices have fallen by 32%. In the last 12 months, prices have gone up

by 10 percent. The average home price in this market is currently $176,535.

Job Growth In the past 12 months, jobs in this market have grown

by 1.8 percent. This compares to a national increase of 1.9 percent.

Job Growth

Unemployment

The Unemployment Rate in July 2014 was 6.8% versus 7.3% last year.

Source: Local Market Monitor |

19

19

19

19

19

19

Tampa Market

Population Growth

The population in this market grew 0.6% in 2012, while the US population

grew 0.7%.

Rent Per Month

We forecast rents to increase 17 percent over the next three years in this

market, to an average of $1246 per month, partly due to higher inflation

Total housing permits in July 2014 were up 83 percent from last year.

Single family permits were up 43 percent.

Housing Permits

Employment By Industry

Source: Local Market Monitor |

|